This chapter looks at the tax assessment function, which includes all activities related to processing tax returns and payments. It examines the use of e-channels for filing and paying, outlines administrations’ efforts to provide pre-filled returns, and discusses the level of on-time return filing and payment. It also provides examples of the impact of technology in assessment processes.

Tax Administration 2023

4. Assessment

Abstract

Introduction

The tax assessment function includes all activities related to processing tax returns, including issuing assessments, refunds, notices and statements. It also includes the processing and banking of payments. These activities continue to be an area of significant change and focus as administrations look to take costs out of high-volume processes.

As reported in previous editions of this series, the widespread enabling of electronic filing and payment by taxpayers has helped administrations to reduce their costs and improve the services they provide. This trend has continued with an increasing range of supporting services and options now also being made available.

Tax administrations are also managing an expanding range of data that administrations are collecting electronically, including from a growing number of third-party organisations. This is facilitating a shift towards more intelligent use of data, and more complete pre-filled returns, increasingly driven by the use of artificial intelligence and machine learning. This is also helping to create more upstream compliance approaches that can minimise or prevent errors in returns. As well as updating information on the channels used for filing and paying, this chapter will outline:

Administrations’ efforts to provide pre-filled returns for individual and corporate taxpayers, including the expansion of this approach by some into “no-return regimes”;

The levels of on-time return filing and payment; and

Examples of how technology and the application of data sciences have improved filing, payment and refund processes.

Use of e-channels for filing and paying

With digitalisation continuing to transform everyday life, it is unsurprising that the uptake in the use of e‑filing and payment channels continues to grow. Table 4.1. provides average e-filing rates from jurisdictions that provided details of channels used by taxpayers to file for the years 2018 to 2021. Over that period, around 95% business taxpayers filed their returns electronically. For personal income tax return filers this figure is above 85%. Also, it should be noted that for a significant number of administrations a 100% e‑filing rate is the reality across the three main tax types (see Table D.23.).

Table 4.1. Average e-filing rates (in percent) by tax type, 2018-2021

|

Tax type |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|

|

Personal income tax (50 jurisdictions) |

81.1 |

83.4 |

86.6 |

87.2 |

|

Corporate income tax (52 jurisdictions) |

92.4 |

93.5 |

94.2 |

94.9 |

|

Value added tax (46 jurisdictions) |

94.4 |

96.0 |

97.1 |

97.5 |

Note: The table shows the average e-filing rates for those jurisdictions that were able to provide the information for the years 2018 to 2021. The number of jurisdictions for which data was available is shown in parenthesis.

Source: Table D.23.

Looking at the evolution of e-filing rates over the period 2014 to 2021 shown in Table 4.2., it is clear that e-filing rates have increased significantly – between 17 and 21 percentage points – across the three main tax types. (It should be noted that the table only takes into account information from jurisdictions for which data was available for both years 2014 and 2021, which explains the differences in 2021 averages shown in Tables 4.1. and 4.2.)

Table 4.2. Evolution of e-filing rates (in percent) between 2014 and 2021 by tax type

|

Tax type |

2014 |

2021 |

Difference in percentage points |

|---|---|---|---|

|

Personal income tax (33 jurisdictions) |

65.0 |

85.1 |

+20.1 |

|

Corporate income tax (35 jurisdictions) |

77.2 |

95.3 |

+18.1 |

|

Value added tax (32 jurisdictions) |

81.4 |

98.7 |

+17.3 |

Note: The table shows the average e-filing rates for those jurisdictions that were able to provide the information for the years 2014 and 2021. The number of jurisdictions for which data was available is shown in parenthesis.

Sources: Table D.23. and OECD (2017), Tax Administration 2017: Comparative Information on OECD and Other Advanced and Emerging Economies, Table A.8., https://doi.org/10.1787/tax_admin-2017-en.

As for electronic payments rates, as can be seen in Table 4.3., around 90% of payments, measured by number and value, were made electronically in 2021. This represents a significant increase since 2018. The percentage of e-payments by value is slightly higher than the percentage of e-payments made by number, suggesting that particularly larger taxpayers make use of this payment channel. (Due to a change in the definition of the underlying survey question, it is not possible to look at the evolution of e-payment rates since 2014.)

Table 4.3. Average e-payment rates (in percent) by number and value of payments, 2018-2021

|

Measurement type |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|

|

Percentage by number of payments (47 jurisdictions) |

79.9 |

82.1 |

86.3 |

88.5 |

|

Percentage by value of payments (47 jurisdictions) |

84.4 |

85.8 |

88.4 |

90.2 |

Note: The table shows the average e-payment rates for those jurisdictions that were able to provide the information for the years 2018 to 2021. The number of jurisdictions for which data was available is shown in parenthesis.

Source: Table D.32.

There remain a number of jurisdictions where the volume of returns filed using paper as well as payments through non-electronic means remains high. Among those jurisdictions that provided data, more than 57 million returns (for PIT, CIT and VAT) were still filed on paper (see Tables A.83., A.85. and A.87.). However, this is a significant reduction compared to the years prior to the COVID-19 pandemic.

It is to be expected that this figure will further decline over time as more administrations take steps to encourage more taxpayers to use electronic platforms where possible. This will not only lower administration costs but could also reduce the administrative burden on taxpayers over time.

Box 4.1. Examples – E-filing

Hungary – Supporting flat-rate taxation

One of the goals of the National Tax and Customs Administration (NTCA) of Hungary is to reduce the administrative burden from tax returns, and one of the first steps towards this is the development of the Flat Rate Tax Wizard Web Application. Flat-rate taxation can be chosen by self-employed entrepreneurs in Hungary fulfilling specific conditions.

The Flat Rate Tax Wizard helps taxpayers submit their monthly tax and social security contribution returns via an application that communicates with the taxpayer in the form of questions and answers.

The advantage compared to filling a traditional form-based return is that it can be used even without tax knowledge, since the calculations required for the return do not have to be performed by the taxpayer. The tax return is pre-filled with data content based on answers given to questions and the data in the registers of the NTCA relevant for the taxpayer’s tax and social contribution returns. In addition to easier fulfilment of obligations, the platform also helps to determine the quarterly personal income tax in advance. The NTCA is now investigating the addition of this service to additional target taxpayer groups.

See Annex 4.A. for supporting material.

Japan – Tax withholding slip automatic entry function via smartphone camera

Thanks to filing assistance provided via the National Tax Agency (NTA) website, when a taxpayer enters the necessary information, income and tax amounts are automatically calculated and the filing data can be transmitted via the “filing through online (e-Tax)” application. During the 2021 filing period, the number of people having filed income tax returns using the filing assistance on the NTA website reached 11.71 million, including those prepared via computers set up at tax office consultation sites. This comprised about 51% of all taxpayers who filed returns and was around 17 times higher than the filings for 2004, when this online filing assistance service was first provided, reflecting steady growth in user numbers.

In addition, among the 11.71 million cases prepared using the filing assistance on the NTA website, about 2.56 million were prepared via smartphone. The NTA is working towards a smartphone-dedicated site for taxpayers. As part of this, a new function has been introduced to the filing assistance on the NTA website, allowing items to be entered automatically, such as amount of earnings from employment, withholding tax and names and address simply by using a smartphone camera to take a photo.

Sources: Hungary (2023) and Japan (2023).

Pre-filled returns

One of the significant innovations in tax return process design over the last two decades has been the development of pre-filled tax returns, often for personal income taxpayers. The pre-filled approach involves administrations “pre-populating” the taxpayer’s return or on-line account with information from third parties. The pre-filled return can be reviewed by the taxpayer and either filed electronically or in paper form. (Table 4.4. shows that an increasing number of administrations is pre-filling PIT returns.)

As the extent of pre-population is generally determined by the range of electronic data sources available to the administration, it is critical to this approach that the legislative framework provides for extensive and timely third-party reporting covering as much relevant taxpayer information as possible. The complexities of the legal frameworks governing tax can be a barrier to more automated tax calculations, and to help overcome this some tax administrations are exploring the use of machine-readable legislation which can help automate the calculation process through the use of algorithms. This is leading to reduced errors and reduced burdens for taxpayers.

Table 4.4. Evolution of pre-filling of PIT returns, 2018-2021

Percent of administrations that pre-fill PIT returns

|

2018 |

2019 |

2020 |

2021 |

Difference in percentage points (2018-2021) |

|---|---|---|---|---|

|

77.6 |

79.3 |

82.8 |

87.9 |

+10.3 |

Source: Table A.79.

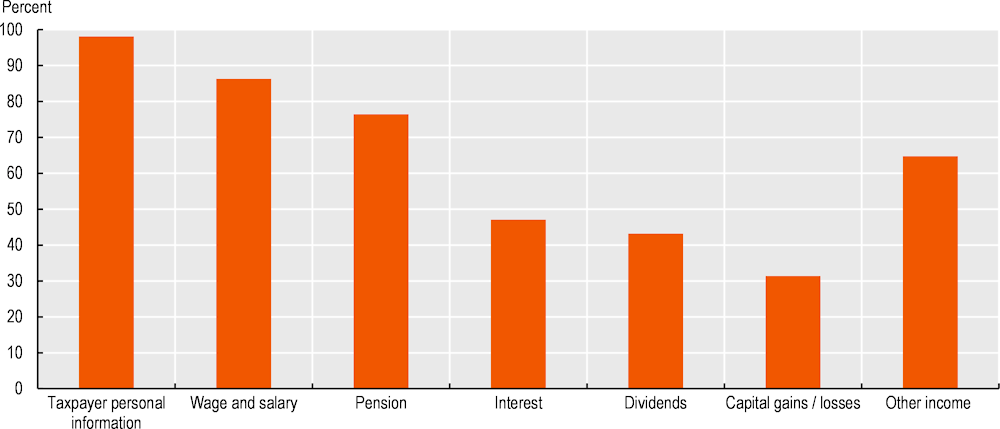

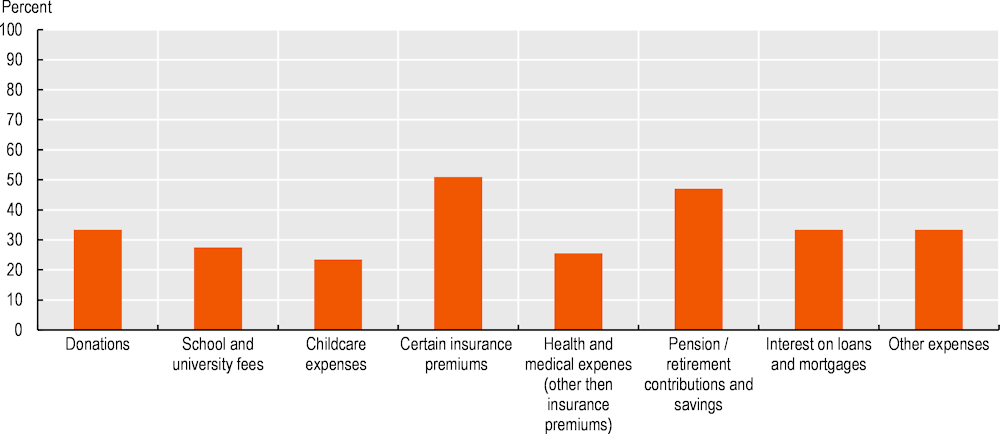

Advocates of pre-filling initially encouraged its use with individual tax regimes that allowed relatively few deductions and credits, and where they could be verified with third party data sources. Advances in rules-based technologies, information-reporting requirements and the application of data science techniques mean that the approach can now be considered more widely. For example, survey responses show that in many jurisdictions PIT returns are pre-filled with different income information and deductible expenses such as donations, school and university fees and insurance premiums (see Figures 4.1. and 4.2.).

Figure 4.1. Categories of third-party income information used to pre-fill PIT returns or assessments, 2021

Figure 4.2. Categories of tax deductible expenses used to pre-fill PIT returns or assessments, 2021

In a growing number of jurisdictions, this concept now goes as far as totally pre-filling PIT returns, which the taxpayer then has to either agree (which may be by deemed agreement after a certain period of elapsed time) or provide further information which may lead to an upwards or downwards adjustment (see Table A.84.). In their most advanced form, complete pre-filled returns are being generated for large proportions of the individual tax base. In addition, the availability of technology solutions and approaches, such as electronic invoicing systems, allows tax administrations to start to go beyond PIT returns and pre-fill corporate income tax (CIT) and value-added tax (VAT) returns (see Tables A.82. and A.86.).

The latest pre-filling developments in some jurisdictions are described in Box 4.2.

Box 4.2. Examples – Pre-filling

Australia – Enhanced prefill

In 2022, the Australian Taxation Office (ATO) introduced enhanced prefill to the individual tax return. Whilst the ATO has prefilled returns for more than 20 years there was a taxpayer behaviour of deleting or changing the prefill information requiring compliance follow up with clients after the return was lodged to resolve the discrepancy. The ATO has piloted the use of its current risk models to prevent taxpayers from changing prefilled Bank Interest information at lodgement unless the client can provide evidence why the amount should change. This has resulted in a 74% decrease in compliance activities after lodgement compared to the previous year. The ATO plans on expanding this approach over the coming years.

See Annex 4.A. for supporting material.

Czech Republic – Real Estate Tax prefilling

In 2021, the Czech Tax Office introduced the „MOJE daně“ (“My Taxes”) project which delivered a significant step forward in the simplification and extension of electronic services available for taxpayers. The efforts to make tax return filing even easier have continued and, in 2022, this lead to a significant advance in the area of real estate tax.

Taxpayers are required to report real estate on their tax return when there are any changes such as purchasing or selling a property. However, the tax return must contain all information about all properties owned by the taxpayer and not just the one where there is a change. Now if the taxpayer uses the “My Taxes” portal, they can have a pre-filled tax return using the data from the previous period.

Another online service which taxpayers can make use of is a cross checking of the data filled in on the tax return with data from the Register of Real Estate. This tool can check for example whether a plot area or a size of share in case of joint ownership declared in tax return is the same as in the Register of Real Estate.

Mexico – Pre-filling of business tax returns

In 2004, the Mexican Tax Administration Service (SAT) established the legal framework for the CFD (acronym in Spanish for Digital Fiscal Receipt). Later, in 2010, a new invoicing scheme was introduced: the CFDI (acronym in Spanish for Digital Fiscal Receipt through Internet), which requires invoices to be sent via the internet to PACs (Authorized Certification Providers acronym in Spanish) - who are entities authorised by SAT -, for validation prior to being received within SAT’s infrastructure. CFDI replaced paper invoices, and by 2014, their use became mandatory for electronic accounting throughout Mexico. Nowadays, CFDI are utilised in 100% of economic transactions. The information derived from CFDI undergoes analysis and automatically populates the taxpayer's tax return for the corresponding period. To ensure accuracy, taxpayers have the option to review and modify the statement via the services provided on the tax administration portal. The implementation of this system yielded significant benefits. The declared tax base has seen a substantial increase of 150%. Moreover, between 2010 and 2016, it effectively reduced tax evasion from 35.7% to 16.1%. Furthermore, there has been a noteworthy rise in general tax revenue and social security contributions, achieving a 95% increase in revenue compared to the tax period of 2010. Notably, smaller companies are now obliged to utilise electronic invoicing, meaning micro-enterprises are entering the formal economy. This integration grants SAT real-time access to transactional information of registered taxpayers, thereby enhancing the collection and auditing process.

Netherlands – Prefilling profit tax return directly from commercial bookkeeping software

Self-employed find the process of keeping books and records together with tax return filing difficult and burdensome. This target group of SME’s makes more unintended errors in filling out a tax return than the bigger enterprises. To make return filing for the self-employed easier and less labour intensive, the Netherlands Tax Administration started working together with developers of bookkeeping software to build a module which automates the transformation from the digital bookkeeping to a prefilled profit tax return. The module provides wizards in plain language, so transformation is easy to perform. This module makes manual actions unnecessary and reduces unintended errors. The aim of the module is to reduce the administrative burden and stimulate compliance.

The module is based on a standard ledger and can be integrated in the commercial bookkeeping software. The module is offered as a service to all software developers. It checks the numbers on the balance sheet and the profit and loss account and will generate (‘prefills’) the profit tax return automatically with the help of a wizard.

In 2022, the module has been integrated in two commercial bookkeeping software products and has been used by a few hundred taxpayers. An evaluation has been planned and the results are expected to be presented in the second quarter of 2023.

Sources: Australia (2023), Czech Republic (2023), Mexico (2023) and Netherlands (2023).

As the levels of data available to support pre-filling grows, tax administrations are able to develop predictive techniques that can spot errors that taxpayers make as they finalise their return, and also prevent non-compliance. Examples of this have been included in previous editions. See, for example, Box 4.3. in Tax Administration 2022 (OECD, 2022[1]). These can be combined with techniques to prompt action, creating whole new approaches to compliance which are bringing the compliance work ‘upstream’ into tax administration processes, as Box 4.3. highlights.

Box 4.3. Examples – Preventing non-compliance activity

Argentina – Warnings prior to non-compliance

The Argentinian tax administration (AFIP) is rolling out a communication project that aims to provide vulnerable taxpayers with personalised alerts of potential non-compliance across a range of contact channels. When a tax obligation is due, and prior to becoming a fiscal debt, a specific, systematized communicational strategy is planned to help taxpayer comply with their obligations:

Prior to due date, messages highlight the need to comply with their obligations and the necessary requirements to do so.

5 days after the due date an electronic message is sent with a link to access information on the debt, payment options and the consequences of being in arrears.

15 days after the due date there is an automatic outgoing telephone call /contact by Chatbot.

25 days after the due date there is an outgoing telephone call from an AFIP employee.

Spain – Predictive model for non-filers

Every year, the Spanish Tax Agency (AEAT) receives a lot of information from different sources related to personal income allocations. Based on this information, and in accordance with current regulations, the set of taxpayers who are required to submit a personal income tax return is determined. Unfortunately, every year, some of these taxpayers do not file the return, leading to a campaign for non-filers, the first step being sending a request to all those taxpayers who have not filed and whose calculated tax amount exceeds a certain threshold.

To improve the efficiency of filing AEAT is implementing an innovative project based on predictive models to identify and contact those taxpayers who are considered most likely not to submit their PIT return on time.

Through this project AEAT aims to:

Improve taxpayer assistance, through contact during the voluntary filing period, to achieve an increase in the percentage of personal income tax returns filed on time.

Reduce the number of sanctions and surcharges applied to those taxpayers who do not file a return on time.

Increase the efficiency of AEAT systems by reducing the amount of non-filers which aims to decrease the number of request to be issued as well as subsequent audit actions.

See Annex 4.A. for supporting material.

Sources: Argentina (2023) and Spain (2023).

On-time return filing

Even allowing for changes occurring because of pre-filled or no-return regimes, the filing of a tax return is still the principal means by which a tax liability is established and becomes payable. As a result, the on-time filing rate is seen as an effective measure of the health of the tax system as well as the performance of the tax administration itself.

Table 4.4. summarises on-time return filing for those administrations able to supply information by tax type. Apart from CIT, the rates are around 85%. The lower rates for CIT may be explained through more complexity in the corporate income tax system and the preparation of financial statements and year-end reports.

Table 4.5. Average on-time filing rates (in percent) by tax type, 2018-2021

|

Tax type |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|

|

Personal income tax (37 jurisdictions) |

85.6 |

85.1 |

85.5 |

85.5 |

|

Corporate income tax (40 jurisdictions) |

78.3 |

79.2 |

78.2 |

76.2 |

|

Employer withholding (28 jurisdictions) |

89.0 |

88.6 |

87.1 |

88.1 |

|

Value added tax (42 jurisdictions) |

87.1 |

86.3 |

86.0 |

85.7 |

Note: The table shows the average on-time filing rates for those jurisdictions that were able to provide the information for the years 2018 to 2021. The number of jurisdictions for which data was available is shown in parenthesis.

Source: Tables D.21 and D.22.

Table 4.5. shows the evolution of on-time filing rates. On average, this has remained broadly static between 2014 and 2021, although the underlying data for on-time filing shows significant variation in the evolution of on-time filing rates between jurisdictions. In relation to the recent years 2020 and 2021, this may also be a reflection of the different responses that jurisdictions had to the pandemic. The 2020 report Tax Administration Responses to COVID-19: Measures Taken to Support Taxpayers highlighted how some jurisdictions may have required on-time filing, for example to pay out refunds or to provide other government benefits, but allowed delayed payment, while some may have relaxed penalties for late filing (CIAT/IOTA/OECD, 2020[2]).

Overall, it is encouraging that despite the impact of the pandemic on-time filing rates remained stable (except for a few jurisdictions, see Tables D.21. and D.22.). It should be noted that the table only takes into account information from jurisdictions that were able to provide data for both years 2014 and 2021, which explains the differences in 2021 averages shown in Tables 4.4. and 4.5.

Table 4.6. Evolution of on-time filing rates (in percent) between 2014 and 2021 by tax type

|

Tax type |

2014 |

2021 |

Difference in percentage points |

No. of jurisdictions with a decreasing on‑time filing rate |

No. of jurisdictions with an increasing on‑time filing rate |

|---|---|---|---|---|---|

|

Personal income tax (36 jurisdictions) |

85.6 |

86.4 |

+0.8 |

13 |

23 |

|

Corporate income tax (36 jurisdictions) |

80.0 |

78.5 |

-1.5 |

18 |

18 |

|

Employer withholding (18 jurisdictions) |

86.7 |

89.8 |

+3.1 |

11 |

7 |

|

Value added tax (37 jurisdictions) |

86.0 (2016) |

84.8 |

-1.2 |

18 |

19 |

Note: The table shows the average on-time filing rates for those jurisdictions that were able to provide the information for the years 2014 and 2021. The number of jurisdictions for which data was available is shown in parenthesis. For VAT, the table compares information for the years 2016 and 2021, as the underlying question was changed with ISORA 2018.

Sources: Tables D.21. and D.22., OECD (2017), Tax Administration 2017: Comparative Information on OECD and Other Advanced and Emerging Economies, Table A.6., https://doi.org/10.1787/tax_admin-2017-en and OECD (2019), Tax Administration 2019: Comparative Information on OECD and Other Advanced and Emerging Economies, Table D.12., https://doi.org/10.1787/74d162b6-en.

Box 4.4. Behavioural insight to improve filing

Brazil – Improving communications

Simplification can be considered the most basic “nudge” of all: making something simpler and easier to carry out has a very important effect on people deciding to adopt a certain action. However, as common to many tax administrations, communications from the Federal Revenue of Brazil (RFB) to taxpayers use quite a complex language: legal texts, acronyms and jargon, and long paragraphs that cause a great difficulty in understanding.

The need for simple and clear communication is a major challenge for public management, especially when in Brazil according to the last Functional Literacy Indicator Survey (2018), about 30% of Brazilians between 15 and 64 years-old are functionally illiterate and only 12% understand complex texts. In addition, a 2018 report showed only 2% of 15 year-old students in Brazil were top performers in reading, meaning that they can understand lengthy texts and deal with abstract concepts.

In order to face this problem, the Behavioural Economics National Centre (Cecom) developed a Guide (“Simplify in 7 Notes”) with seven basic rules for the use of Plain Language in RFB, each one associated with one of the seven musical notes (as a way of facilitating memorization). Based on this Guide, Cecom has been providing workshops for various teams inside RFB. In these hands-on workshops, each team receives training in Plain Language and reviews their own real communications, making them more effective in promoting compliance. From what is experienced in the workshop, those that prepare the communication are able to change their mindset, understanding the importance of a more transparent interaction with society.

Slovak Republic – Real estate sales: Behaviourally oriented letter campaign

A significant proportion of property sales produce a high net profit, but with no declared income on the side of a seller. A private individual is obliged to declare income when selling a property within five years from its acquisition. However, based on analysis of data from Slovak Real Estate database, only a third of identified sellers was tax compliant before an intervention. A campaign was developed based on a behavioural experiment focused on improving awareness of real estate sales taxation and the collection of personal income tax.

Letters were sent in 2021, just before the due date for filling tax return for the tax year 2020 and two groups of sellers were identified. First, non-declaring taxpayers who sold a property in 2016 – 2019. These were matched with tax revenue data and classified as “overdue”. Second, potential taxpayers, who sold a property in 2020 and were expected to declare income of this sale in March 2021. A control group was established and those in the test received personalised communication notifying them of the obligation to declare income of real estate sales. Different letter texts were tested to measure the effect of letter itself and also the different approaches.

The results show the rate of declared income increased by 27 percentage points (p.p.) for non-declaring taxpayers and 14 p.p. for potential taxpayers (in comparison with taxpayers with no letter received). The overall impact of the campaign is additional EUR 2.5 million for the state budget and a 16 p.p. increase in the observed tax compliance at minimal costs for the tax administration. This approach will continue in future years.

See Annex 4.A. for supporting material.

Source: Brazil (2023) and Slovak Republic (2023).

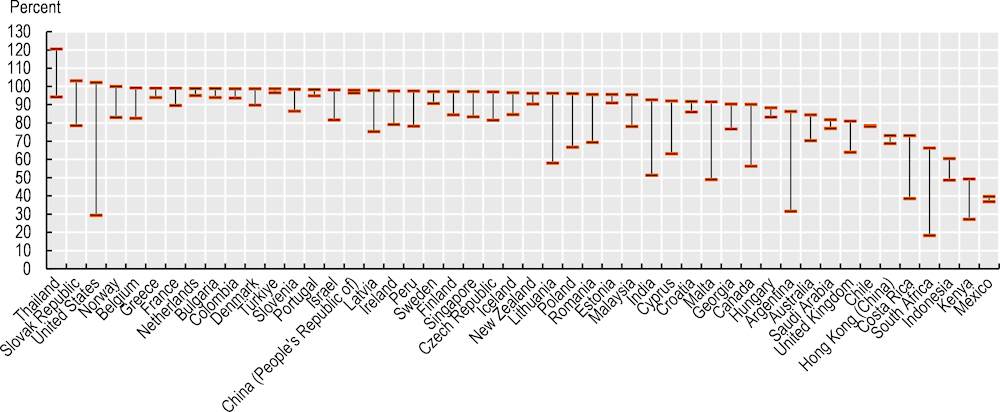

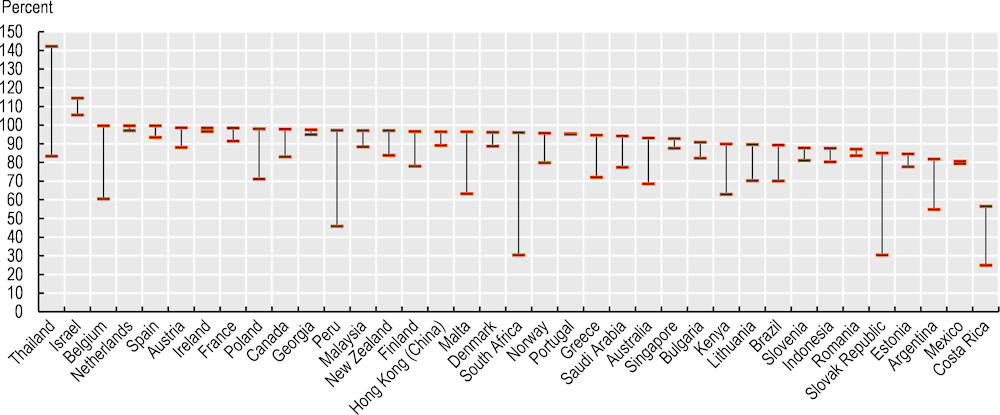

The variation of on-time filing rates by jurisdiction are also visible in Figure 4.3. which shows the range of on-time filing rates across major tax types. For a number of jurisdictions this range is significant.

Given the impact on compliance rates, many tax administrations are turning to behavioural insight techniques to try and encourage more timely and accurate filing. This is seeing promising results, with tax administrations reporting that ‘nudges’ at key points in the filing process can increase the timeliness of filing. Not only is this improving compliance rates but it is also freeing up resources that can be used elsewhere.

Figure 4.3. Range in on-time filing performance across major tax types, 2021

Note: On-time filing performance is expressed as a percentage of returns expected and can therefore be above 100%. The figure shows for each jurisdiction the range in on-time filing performances in 2021 across the four tax types: PIT, CIT, Employer WHT and VAT (where applicable). It only includes jurisdictions for which information was available for at least two tax types.

Sources: Tables D.21. and D.22.

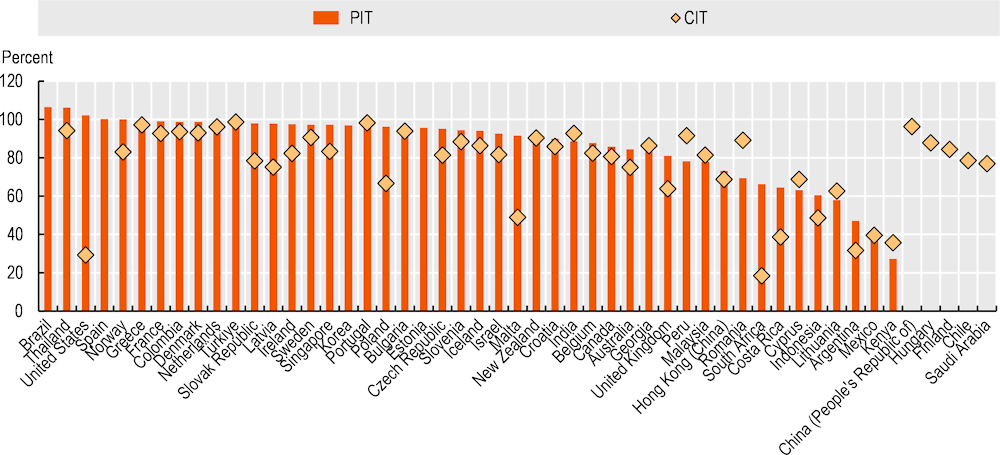

Figure 4.4. PIT and CIT on-time filing rates, 2021

Note: On-time filing performance is expressed as a percentage of returns expected and can therefore be above 100%.

Source: Table D.21.

On-time payment

Payment of tax constitutes one of the most common interactions between taxpayers and tax administrations, especially for businesses that are typically required to regularly remit a variety of payments covering both their own tax liabilities and those of their employees. Administrations continue to make progress in increasing the range of e-payment options available to taxpayers and to increase their use. This progress not only lowers the cost to the administration, it can also increase on-time payments and reduce the number of payment arrears cases by providing improved access and a better payment experience. One significant development is the growth of payment facilities being built into the natural systems of taxpayers. This is making payment more seamless for taxpayers as they can use their existing banking or accounting software to make payments.

Table 4.7. Average on-time payment rates (in percent) by tax type, 2018-2021

|

Tax type |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|

|

Personal income tax (30 jurisdictions) |

81.5 |

81.2 |

81.0 |

77.2 |

|

Corporate income tax (33 jurisdictions) |

84.6 |

85.1 |

82.5 |

83.5 |

|

Employer withholding (29 jurisdictions) |

94.5 |

94.3 |

91.6 |

91.4 |

|

Value added tax (33 jurisdictions) |

87.9 |

88.0 |

87.0 |

86.9 |

Note: The table shows the average on-time payment rates for those jurisdictions that were able to provide the information for the years 2018 to 2021. The number of jurisdictions for which data was available is shown in parenthesis.

Source: Tables D.30 and D.31.

On-time payment rates for those administrations able to supply information by tax type are summarised in Tables 4.6. and 4.7. Table 4.6 shows that in 2020 and 2021 on-time payment rates have fallen when compared with years 2018 and 2019. The range of on-time payment depicted in Figure 4.5. shows a significant gap in on-time payment across the main tax types for a number of jurisdictions, in some cases above 50 percentage points.

This reduction in on-time payment rates is almost certainly an impact of the pandemic, reflecting the cash flow challenges businesses and individuals may have had. It may also reflect the numerous easements some tax administrations gave on payment timeliness to assist with the challenges of the pandemic, for example where taxpayers may have been required to file on time but had longer time to pay.

Table 4.8. Evolution of on-time payment rates (in percent) between 2014 and 2021 by tax type

|

Tax type |

2014 |

2021 |

Difference in percentage points |

No. of jurisdictions with a decreasing on‑time payment rate |

No. of jurisdictions with an increasing on‑time payment rate |

|---|---|---|---|---|---|

|

Personal income tax (16 jurisdictions) |

80.7 |

80.3 |

-0.4 |

9 |

7 |

|

Corporate income tax (16 jurisdictions) |

90.1 |

86.9 |

-3.2 |

8 |

8 |

|

Employer withholding (13 jurisdictions) |

92.8 |

93.4 |

+0.6 |

5 |

8 |

|

Value added tax (18 jurisdictions) |

88.8 |

88.7 |

-0.1 |

8 |

10 |

Note: The table shows the average on-time filing rates for those jurisdictions that were able to provide the information for the years 2014 and 2021. The number of jurisdictions for which data was available is shown in parenthesis. Data for Costa Rica has been excluded from the calculations as it would distort the average ratios.

Sources: Tables D.30 and D.31, and OECD (2017), Tax Administration 2017: Comparative Information on OECD and Other Advanced and Emerging Economies, Table A.9, https://doi.org/10.1787/tax_admin-2017-en.

Figure 4.5. Range in on-time payment performance, 2021

Note: On-time payments are expressed as a percentage of estimated payments expected by due date and can therefore be above 100%. The figure shows for each jurisdiction the range in on-time payment performances in 2020 across the four tax types: PIT, CIT, Employer WHT and VAT (where applicable). It only includes jurisdictions for which information was available for at least two tax types.

Source: Tables D.30. and D.31.

Future editions of this report will continue to track these trends, and recovering and increasing on-time payment rates should remain an area of focus for administrations given the amounts of revenue involved. This is why some tax administrations report investing resources in this area, to make payments easier and more in real time as can be seen in the example in Box 4.5.

Box 4.5. United Kingdom - VAT Split Payments

The UK Government has announced its intention to further explore the concept of VAT Split Payment, an alternative method of VAT collection which would involve the tax element of a digital payment being taken out and paid directly to His Majesty’s Revenue and Customs (HMRC).

Modernising tax collection in this way would tackle the issue of lost tax revenue resulting from overseas traders’ VAT non-compliance. Losses happen where online sellers do not account to HMRC for VAT due on the sales of goods or services to UK consumers, which also allows them to undercut and place VAT compliant sellers at a disadvantage.

HMRC has already worked with academia and FinTech collaborators on a payment data carriage technique that does not rely on payment messaging standards. This could allow new data about a payment intervention to be transmitted to a tax authority (for taxpayer reconciliation purposes) outside of existing payments processing channels.

Going forward, HMRC intends using the payments sector and FinTech companies to seek to prove the conceptual viability of taking VAT from a payment in real-time before the money leaves the UK’s authority, whilst remaining within the rules set by various payment networks. This paves the way for real-time tax collection, reducing the need for extra administration.

The ambition is to tackle the tax gap driven by overseas non-compliance and ensure more fairness for VAT compliant sellers.

Source: United Kingdom (2023).

Refunds and credits

Given the underlying design of the major taxes administered (i.e. PIT, CIT and VAT), some element of over-payment by a proportion of taxpayers is unavoidable. Excess tax payments represent a cost to taxpayers in terms of “the opportunity cost”, which is particularly critical to businesses that are operating with tight margins where cash flow is paramount. Any delays in refunding legitimately overpaid taxes may therefore result in significant “costs” to taxpayers.

Table 4.8. shows the different treatment of VAT refunds, and highlights that the majority of administrations pay out refunds immediately. This is helpful to business but tax administrations need to continue to be cognisant of fraud risks. Tax regimes with a high incidence of tax refunds are particularly attractive to fraudsters (especially via organised criminal attacks) necessitating effective risk-based approaches for identifying potentially fraudulent refund claims.

During the COVID-19 crisis, the importance of paying out refunds quickly was a key issue for many governments, as a significant number of taxpayers were facing severe cash-flow problems. Tax administrations responded to this by prioritising refund applications or adapting refund processes, in some cases fully automating them. (CIAT/IOTA/OECD, 2020[2])

Table 4.9. Treatment of VAT refunds, 2021

|

Percent of jurisdictions were … |

|||

|---|---|---|---|

|

VAT refunds are automatically paid out immediately |

VAT refunds are paid out immediately subject to the availability of funds |

VAT refund are established as a ‘credit’ in the taxpayer’s account, until such time as the taxpayer may legally request the refund |

VAT refund are established as a ‘credit’ in the taxpayer’s account, until such time as the taxpayer may legally request the refund, subject to the availability of funds |

|

60 |

5 |

35 |

0 |

Source: Table A.53.

The learning from both the pandemic and previous approaches is now being combined with advances in technology, and the growth of data science to provide tax administrations with new options to mitigate risks and simplify processes. This can lead to reduced administrative and compliance burdens, and the creation of new innovative approaches which can be seen in Box 4.6.

Box 4.6. Netherlands - Selection model for VAT refunds

Refunding VAT is a large process within the Netherlands Tax Administration (NTA). Annually some 2.5 million requests for a VAT refund are submitted. Resource restrictions do not permit manual inspection of this large flow. Even a quick manual scan is practically impossible with this amount of requests.

In 2015, the NTA started to build software that is able to make a selection for manual inspection. The software supports the review of this vast amount of VAT refunds to a significant extent, and simultaneously doubles the effectiveness of the selection, according to an investigation published by the Netherlands Court of Audit in 2019. The software implements business rules as well as several (relatively) simple statistical procedures. Both these rules and statistical procedures were developed in close cooperation with experts from the shop floor. The software includes a Workflow Management System to assist the manual inspection by auditors. A component is included as well that blocks payments for the duration of the inspection.

The latest developments include a focus on clarity of explanation, modernising the selection process, an extension of the software to include foreign businesses that request a VAT refund in the Netherlands, and a tour around the country to collect fresh ideas for improvements from the end-users.

Source: Netherlands (2023).

References

[2] CIAT/IOTA/OECD (2020), “Tax administration responses to COVID-19: Measures taken to support taxpayers”, OECD Policy Responses to Coronavirus (COVID-19), OECD Publishing, Paris, https://doi.org/10.1787/adc84188-en.

[1] OECD (2022), Tax Administration 2022: Comparative Information on OECD and other Advanced and Emerging Economies, OECD Publishing, Paris, https://doi.org/10.1787/1e797131-en.

[3] OECD (2019), Tax Administration 2019: Comparative Information on OECD and other Advanced and Emerging Economies, OECD Publishing, Paris, https://doi.org/10.1787/74d162b6-en.

[4] OECD (2017), Tax Administration 2017: Comparative Information on OECD and Other Advanced and Emerging Economies, OECD Publishing, Paris, https://doi.org/10.1787/tax_admin-2017-en.

Annex 4.A. Links to supporting material (accessed on 26 May 2023)

Box 4.1. – Hungary: Link to a video providing more detail on the Flat Rate Tax Wizard Web Application: https://youtu.be/hSaKYhponBY

Box 4.2. – Australia: Link to further information on the enhanced prefill solution: https://www.oecd.org/tax/forum-on-tax-administration/database/b.4.2-australia-enhanced-prefill.pdf

Box 4.3. – Spain: Link to a presentation on the predictive model for non-filers: https://www.oecd.org/tax/forum-on-tax-administration/database/b.4.3-spain-predictive-model-for-non-filers.pdf

Box 4.4. – Slovak Republic: Link to further information on the behavioural insights letter campaign: https://www.oecd.org/tax/forum-on-tax-administration/database/b.4.4-slovak-republic-real-estate-letters.pdf