[4] Agenzia delle Entrate (2020), Norme generali e aliquote, https://www.agenziaentrate.gov.it/portale/web/guest/iva-regole-generali-aliquote-esenzioni-pagamento/norme-generali-e-aliquote (accessed on 16 August 2023).

[12] Benzarti, Y. and D. Carloni (2019), “Who Really Benefits from Consumption Tax Cuts? Evidence from a Large VAT Reform in France”, American Economic Journal: Economic Policy, Vol. 11/1, pp. 38–63., https://www.jstor.org/stable/26641348.

[5] Berardi, D. and F. Bersanetti (2014), Verso la riforma dell’Iva: tra esigenze di gettito, fedeltà fiscale e semplificazione, GS1 Italy | Indicod-Ecr & REF Ricerche.

[23] Boschmeier, E. (2022), Identified market needs for recycled fibres. SCIRT D1.3., https://scirt.eu/wp-content/uploads/2022/06/SCIRT-D1.3-Identified_market_needs_for_recycled_fibres.pdf.

[11] Burnod, F. (2022), Rapport particulier n°1 - Le cadre juridique de la taxe sur la valeur ajoutée, Conseil des Prélèvements Obligatoires.

[16] Conseil des Prélevements Obligatoires (2023), La taxe sur la valeur ajoutée (TVA), un impot à recentrer sur son objectif de rendement pour les finances publiques.

[15] Copenhagen Economics (2007), Study on reduced VAT applied to goods and services in the Member States of the European Union, Final Report DG TAXUD.

[18] Copenhagen Economics (2007), Study on reduced VAT applied to goods and services in the Member States of the European Union. Part B – Appendices.

[9] Corte dei Conti (2023), AUDIZIONE NELL’AMBITO DELL’INDAGINE CONOSCITIVA SUGLI STRUMENTI DI INCENTIVAZIONE FISCALE CON PARTICOLARE RIFERIMENTO AI CREDITI D’IMPOSTA. Marzo 2023., https://www.corteconti.it/Download?id=78dd13e4-7f3e-4e35-8284-dd69d157c8ce.

[20] European Commission (2003), Experimental application of a reduced rate of VAT to certain labour-intensive services, COM/2003/309.

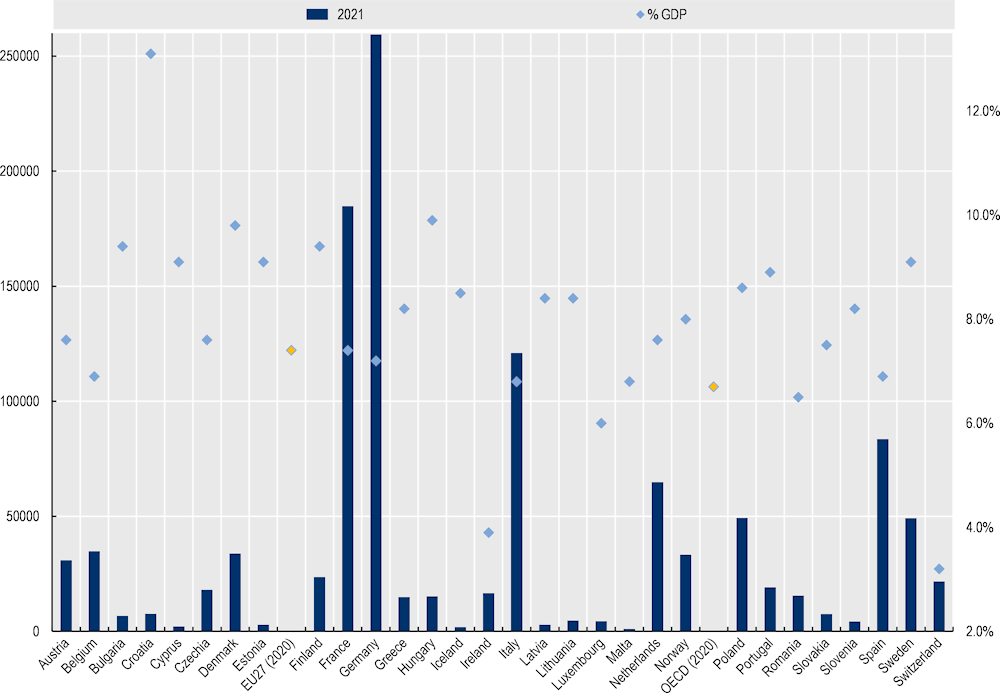

[7] European Commission - Directorate-General for Taxation and Customs Union (DG TAXUD) (2023), Tax revenue by type of tax: VAT.

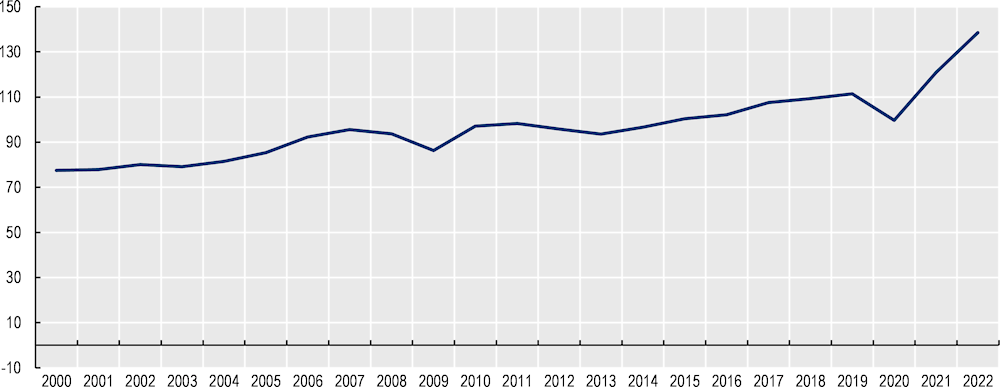

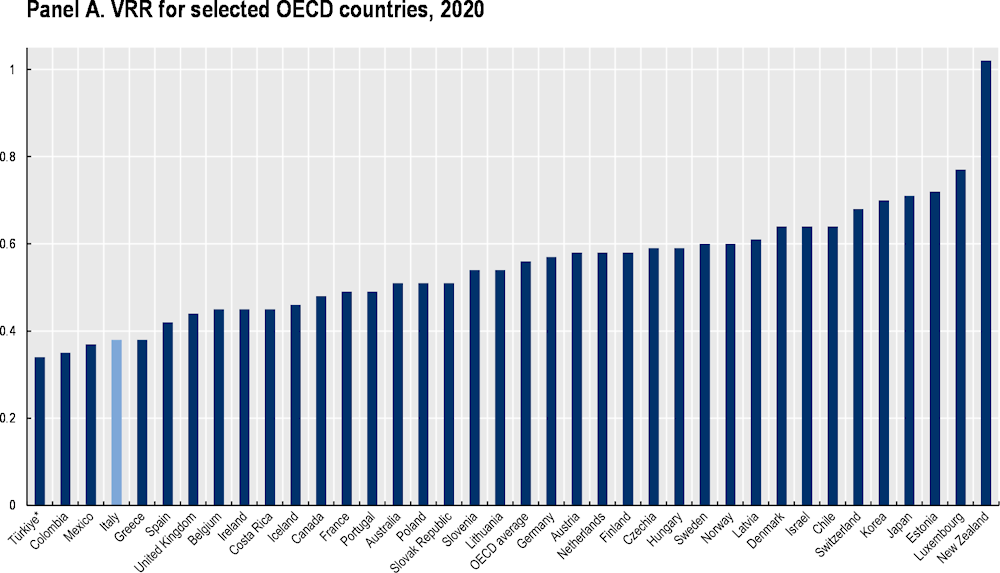

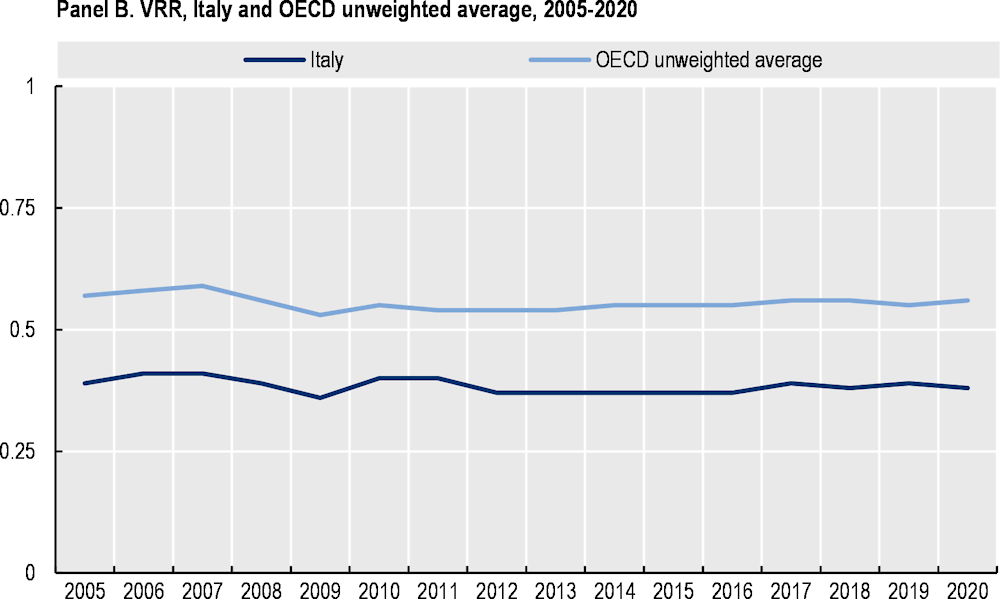

[8] European Commission, DG TAXUD (2023), Poniatowski, G., Bonch-Osmolovskiy, M., Śmietanka, A. et al., VAT gap in the EU – 2023 report, Publications Office of the European Union, https://data.europa.eu/doi/10.2778/911.

[3] Eurostat (2023), Tax revenue by type of tax (TAX_TYPE), https://webgate.ec.europa.eu/taxation_customs/redisstat/databrowser/view/TAX_TYPE/default/table?lang=en&category=TAX_REVENUE (accessed on 30 August 2023).

[28] Gupta, S. and D. Ogden (2006), THE ATTITUDE - BEHAVIOR GAP IN ENVIRONMENTAL CONSUMERISM, https://api.semanticscholar.org/CorpusID:167617632.

[13] IFS et al. (2011), A Retrospective Evaluation of Elements of the EU VAT system, FInal report TAXUD/2010/DE/328.

[17] Institute for Fiscal Studies (2014), Using a temporary indirect tax cut as a fiscal stimulus: evidence from the UK. IFS Working Paper W14/16.

[25] IPPR (n.d.), Istituto per la Promozione delle Plastiche da Riciclo - Plastica Seconda Vita, https://www.ippr.it/en/plastica-seconda-vita-plastic-second-life/.

[22] ISTAT (2023), La struttura produttiva e la competitività delle imprese appartenenti alla filiera della moda, https://www.istat.it/it/files//2023/05/IWP-3-2023.pdf.

[6] ISTAT (2022), Conto annuale.

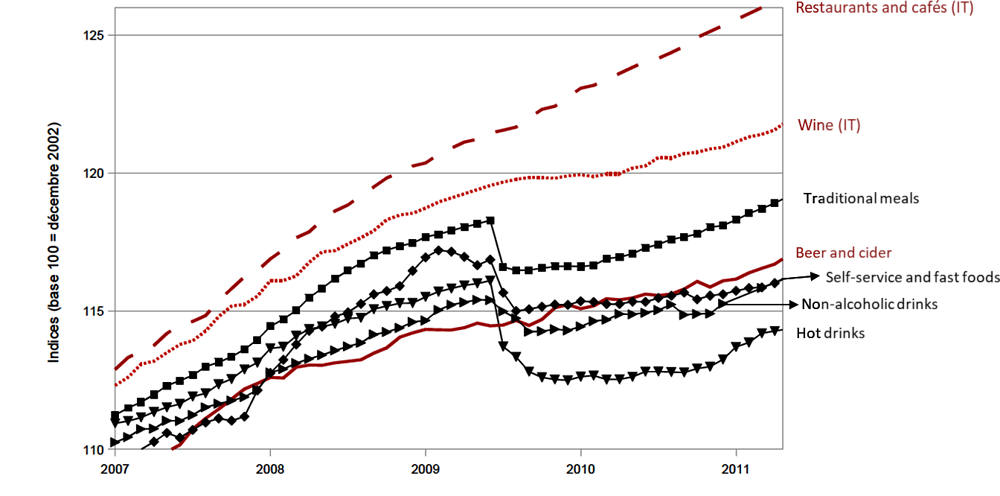

[19] Lafféter, Q. and P. Sillard (2014), L’addition est-elle moins salée? La réponse des prix à la baisse de TVA dans la restauration en France, N° F1404. Direction des Statistiques Démographiques et Sociales.

[24] Laubinger, F. et al. (2021), “Modulated fees for Extended Producer Responsibility schemes (EPR)”, OECD Environment Working Papers, No. 184, OECD Publishing, Paris, https://doi.org/10.1787/2a42f54b-en.

[27] McKinsey & Company (2020), Survey: Consumer sentiment on sustainability in fashion, https://www.mckinsey.com/industries/retail/our-insights/survey-consumer-sentiment-on-sustainability-in-fashion (accessed on 29 August 2023).

[21] MiTE (2022), Strategia nazionale per l’economia circolare.

[2] OECD (2022), Consumption Tax Trends 2022: VAT/GST and Excise, Core Design Features and Trends, OECD Publishing, Paris, https://doi.org/10.1787/6525a942-en.

[10] OECD (2020), Consumption Tax Trends 2020: VAT/GST and Excise Rates, Trends and Policy Issues, OECD Publishing, Paris, https://doi.org/10.1787/152def2d-en.

[1] OECD (2017), International VAT/GST Guidelines, OECD Publishing, Paris, https://doi.org/10.1787/9789264271401-en.

[14] OECD/KIPF (2014), The Distributional Effects of Consumption Taxes in OECD Countries, OECD Tax Policy Studies, No. 22, OECD Publishing, Paris, https://doi.org/10.1787/9789264224520-en.

[26] Remade in Italy (n.d.), Remade in Italy, https://www.remadeinitaly.it/.