This chapter examines how public policies can leverage digitalisation to accelerate productive transformation and provide solutions to youth unemployment in 15 countries in West Africa. The first two sections provide an assessment of labour market and digital development in the region and highlight opportunities and challenges that countries face in leveraging digitalisation. The third section explores the main channels through which West African countries can make the most of the digital transformation to tackle youth unemployment and fulfill the Agenda 2063. Finally, based on these assessments, the last section highlights strategies and policy interventions that can help West African countries build an integrated digital economy.

Africa’s Development Dynamics 2021

Chapter 7. Digital transformation for youth employment and Agenda 2063 in West Africa

Abstract

In brief

Digital transformation can improve youth employment in West Africa, which is a crucial issue for the future, with under 24-year-olds accounting for 65% of a total population of 420 million. The new digital era holds great promise for the region, in terms of the emergence of start-ups and local ecosystems. The advent of digital finance (Fintech), for instance, has already strongly stimulated entrepreneurship and self-employment in a region with a significant informal sector (92% of jobs) and in a context of underemployment and high youth unemployment. In the region, the mobile ecosystem already employs 200 000 people formally and 800 000 informally, particularly in the sale and distribution of mobile services and devices, and contributes 3.5% to gross domestic product (GDP). In addition to those directly employed in the sector, there are 600 000 indirect jobs. Nonetheless, significant challenges remain in the region, including a lack of adequate communications infrastructure, skills or regulation. Policy makers will need to address these issues through strategic policy responses.

The region can actively support and accelerate the digital transformation to tackle employment challenges by targeting four impactful policy areas: (i) strengthening government support of technology parks and start-up incubators, and monitoring progress; (ii) strengthening regulatory frameworks and supportive measures to expand the adoption of fintech products; (iii) supporting SMEs and small producers to use digital technologies and strengthen their integration into local, regional and global value chains; and (iv) investing in skills development and digital-related technical and vocational education and training (TVET) initiatives for youth.

West Africa

West Africa regional profile

Table 7.1. Selected indicators on digital transformation in West Africa

|

|

|

|

West Africa (5 years ago) |

West Africa (latest year) |

Source |

Latest year |

|---|---|---|---|---|---|---|

|

Digital sector |

Communications infrastructure |

Percentage of the population with a cell phone |

15.2 |

40.1 |

ITU |

2018 |

|

|

|

Percentage of the population with 4G coverage |

14.5 |

62.7 |

GSMA |

2020 |

|

|

|

International Internet bandwidth per Internet user (kilobits/second) |

5 310.4 |

16 518.0 |

ITU |

2018 |

|

|

Telecommunication sector |

Total capital expenditure (as a percentage of total revenue) |

27.4 |

21.5 |

GSMA |

2018-20 |

|

|

|

Earnings before interest, taxes, depreciation and amortisation (as a percentage of total revenue) |

52.0 |

34.0 |

GSMA |

2018-20 |

|

|

|

Total employed headcount within the telecom companies (head account full-time equivalent) |

24 803 |

27 531 |

GSMA |

2016-17 |

|

Digital economy |

Start-up development |

Number of active start-ups that raised at least USD 100 000 |

22 |

129 |

Crunchbase |

2011-20 |

|

|

Digital services |

E-Commerce sales (in USD million) |

409.7 |

892.4 |

UNCTAD |

2014-18 |

|

|

|

Export of professional and IT services delivered electronically (in USD million) |

1 476.8 |

7 032.0 |

UNCTAD |

2014-18 |

|

Digitalised economy |

Internet use among people |

Percentage of the population that use mobile phones regularly |

72.8 |

74.6 |

Gallup |

2018 |

|

|

|

Percentage of women with Internet access |

13.0 |

29.0 |

Gallup |

2018 |

|

|

|

Percentage of the poorest 40% with Internet access |

11.1 |

24.1 |

Gallup |

2018 |

|

|

|

Percentage of rural inhabitants with Internet access |

11.9 |

26.3 |

Gallup |

2018 |

|

|

Digital-enabled businesses |

Percentage of firms having their own website |

13.9 |

26.1 |

World Bank |

2018* |

|

|

|

Percentage of firms using e-mail to interact with clients/suppliers |

42.3 |

56.4 |

World Bank |

2018* |

|

|

|

Percentage of goods vulnerable to automation that are exported to OECD countries |

n.a. |

11.7 |

World Bank |

2020 |

|

|

Access to finance |

Percentage of the population with a mobile money account |

7.0 |

69.3 |

Demirgüç- Kunt et al. |

2017 |

Note: *Data for 2018 or the latest available. Chapter 1 provides the definitions of a digital and a digitalised economy. n.a. – not available, ITU – Information Technology Union, GSMA – Global system for Mobile communication Association, UNCTAD – United Nations Conference on Trade and Development.

Sources: Authors’ calculations based on data from Crunchbase (2020), Crunchbase Pro (database); Demirgüç-Kunt et al. (2018), The Global Findex Database 2017 (database); Gallup (2019), Gallup World Poll (database accessed on 1 February 2020); GSMA (2020a), GSMA Intelligence (dataset); ITU (2020), World Telecommunication/ICT Indicators (database); UNCTAD (2020a), UNCTADSTAT (database); World Bank (2019a), World Bank Enterprise Surveys (database); World Bank (2020a), World Development Report 2020.

The West African labour market remains dominated by informal employment

Digital transformation represents a real opportunity for youth employment, especially of the most qualified young people, and has the potential to accelerate West African countries’ achievement of the goals set out under Agenda 2063, adopted by the African Union (AU).1 This jobs dividend can be realised by shifting activity to the formal economy to create stable and decent jobs. Digital transformation also offers an opportunity to remove the barriers facing companies when they start the formalisation process.

Accounting for more than 92.4% of total employment in West Africa (ILO, 2019a), the informal sector is a major obstacle to the achievement of the Sustainable Development Goals (SDGs)2 and Goal 4 of the African Union’s Agenda 2063 to build transformed economies able to create jobs. For example, SDG 8 on stable and decent employment was only 16% achieved in 2019, and West Africa’s performance on this goal remains low (12%). Although the informal sector enables a large proportion of the population to participate in economic activity and facilitates labour market flexibility, it also increases workers’ vulnerability. The in-work poverty rate remains very high in most countries, especially in the most informal economies: 61.7% in Guinea-Bissau, 47.9% in Mali and 44.8% in Benin (ILO, 2019b).

Young people are most at risk of unemployment in West Africa, with average unemployment rates twice as high as among people aged over 25, according to African Development Bank (AfDB) figures. In Senegal, 63% of unemployed people are aged 15-34, with unemployment particularly high among the 20-29 year old age group (18.8% of 20-24 year olds and 16.3% of 25-29 year olds) and graduates, with 22.8% unemployed among those with two years of higher education (ANSD, 2018). At around 9% in Ghana, youth unemployment goes hand in hand with widespread underemployment, where young graduates work in small businesses in the informal sector. In Nigeria, youth unemployment (15-24 year olds) stands at 36.5% (NBS, 2018). Moreover, political crises and post-conflict situations have an impact on youth unemployment, which peaked at 18% in Mali in 2015 and settled at around 15% in 2019 (ILO, 2019b).

The predominance of informal employment is partly explained by the difficulty of accessing credit, as well as the often prohibitive procedures for setting up or formalising a company, due to administrative delays. Indeed, the business climate remains unattractive, as illustrated by the World Bank’s Doing Business 2020 report. Togo, placed 97th out of 190 countries, is the highest ranked West African country, followed by Côte d’Ivoire (110th). The boom in digital tools could present an opportunity to facilitate access to credit, formalisation procedures and tax payment.

Byfacilitating companies’ shift to the formal sector, digital transformation could act as a lever for stable and secure jobs. Formalisation improves corporate governance and enables companies to increase their profits by an average of 20% (Investisseurs & Partenaires, 2019). It gives them easier access to financing and provides a positive signal to markets about their credibility and the reliability of their products. Moreover, formal companies offer a safer working environment, retain workers (especially if they are skilled), and support their development.

Informality is exacerbated by the predominance of jobs in precarious sectors, increasing the vulnerability of workers in West Africa. Between 2000 and 2020, 42% of jobs were in the agricultural sector and 41% in services. The employment landscape is dominated by self-employment and jobs in family businesses (over 80%), while salaried positions account for only 16% of the total (ILO, 2019b). The employment landscape and its sectoral distribution favour both informality and precariousness. Self-employment is often informal and occurs in the agricultural or service sector. Ultimately, digital transformation offers a valuable opportunity to create more stable jobs in the primary and tertiary sectors.

There is a severe lack of major innovative entrepreneurs in West Africa able to employ unskilled workers who turn to self-employment due the dearth of job opportunities. Employers accounted for only 1.84% of employment on average in 2020. The employment model in West Africa, based on individual entrepreneurship supported by microfinance institutions, is in question: while it has helped to limit extreme poverty, it has not facilitated stable jobs that enable workers to escape from poverty.

The agriculture and service sectors, the largest reservoirs of jobs in West Africa, lack large companies capable of raising significant financial resources and mobilising innovative technologies to achieve economies of scale and productivity gains. Such large companies could efficiently and effectively employ workers who are often low-skilled and in most cases only able to succeed through individual entrepreneurship. The aim of organising productive activities in this way is to provide stable employment and ensure a level of pay that keeps workers above the poverty line.

Digital transformation has accelerated in the region, but the infrastructure and skills gaps expose stark inequalities

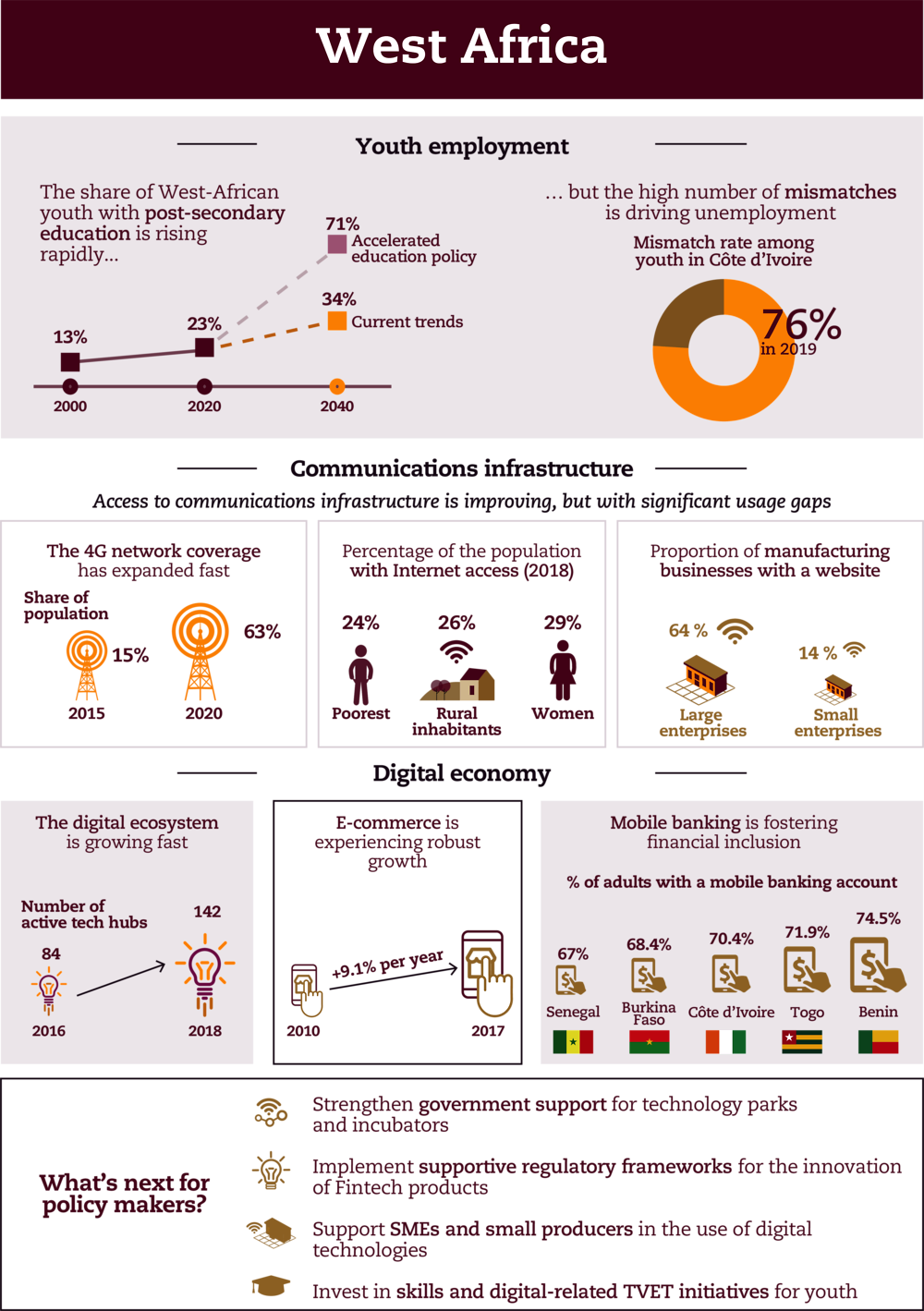

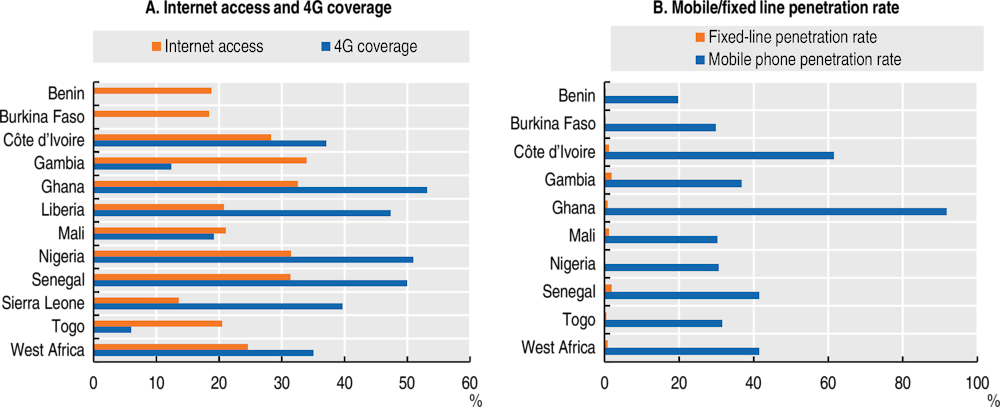

Digital transformation in West Africa presents a real opportunity to address the challenges of employment and financial inclusion. Beyond creating direct jobs, the digital ecosystem improves productivity in many sectors. Furthermore, the COVID-19 health crisis has shown that digital transformation will provide innovative solutions in many vital sectors. Access to communications infrastructure is assessed using the telephone penetration rate and Internet and 4G coverage rate (Figure 7.1).

Figure 7.1. Access to the digital transformation in West Africa (percentage of the population, 2018)

Source: Authors’ calculations based on ITU (2020), World Telecommunication/ICT Indicators Database, www.itu.int; GSMA (2020a), GSMA Intelligence (database), www.gsmaintelligence.com/; Gallup (2019), Gallup World Poll (database), www.gallup.com/analytics/213617/gallup-analytics.aspx.

Despite the number of mobile subscribers continuing to grow, West Africa’s digital connectivity is still weak. Overall, in 2018, less than half the population (41.5%) had access to a mobile network, while more than a third (35.1%) had 4G coverage. Only one in four people have Internet access. These figures clearly show that West Africa does not yet have sufficient access to communications infrastructure to draw upon for growth and job creation.

The digital transformation of West African countries has been stimulated by the development of communications infrastructure, particularly submarine cables. In 2019, sub-Saharan Africa was connected to the global telecommunications network via 18 active multilateral submarine cables3 (excluding bilateral submarine cables), including eight on the west coast. This expansion has led to a 3-5% increase in the Internet penetration rates in West Africa compared with the rest of the continent (Cariolle, 2020).

Access to communications infrastructure remains uneven across the subregion, dampening the benefits not only at the country level, but also at the regional level, due to the difficulty of ensuring digital interconnectivity. Some countries such as Ghana, Côte d’Ivoire, Senegal and to some extent Nigeria have coverage rates above the regional average, but major efforts are yet to be made in Benin, Burkina Faso and Togo. Small countries often face challenges in achieving economies of scale, due to the level of investment required to connect the whole territory.

In addition to the poor digital coverage of many West African countries, the quality of coverage is weak (telephone network, Internet access), leading to suboptimal use. In most countries, mobile phones have replaced fixed-line phones, which have a penetration rate of less than 1%. This situation reduces the potential for asymmetric digital subscriber line (ADSL) connections. Ongoing investments by individual countries and mobile operators to adopt fibre and accelerate the migration to 4G will ensure that Internet speeds are reasonable over the coming years. For example, in 2019, the Orange Group announced the creation of an international fibre optic network, called the “BAFO” (African fibre optic backbone), which will link eight West African countries where the operator is active, including major regional capitals (Dakar, Bamako, Abidjan, Accra, etc.). Despite difficulties around access, many companies are using digital tools to increase their visibility by creating websites, to communicate with their customers and to conduct business transactions via online platforms.

High Internet connection costs also discourage the use of applications or technologies that require a continuous connection. Twenty gigabytes (GB) of mobile data cost EUR 30 in Côte d’Ivoire, while the same provider sells packages that include free phone calls and SMS with 100 GB of mobile data for EUR 19.99 throughout Europe (Kouamé, 2019). This high cost is attributable to the lack of communications infrastructure and two types of vulnerability: the risk of submarine cable breakage and “digital isolation” (Cariolle and Goujon, 2019). The multiplicity of stakeholders, competition with incumbent operators, the question of ownership of transactional data and the lack of communications infrastructure in rural areas remain major challenges (World Bank, 2019a).

Although having a website is now essential for running and managing a company, this tool is still underutilised in West Africa (Table 7.2). Only 24% of companies have a website, despite its benefits in terms of marketing and access to a very large customer base. This proportion is even lower among small businesses (14%). Moreover, 36% of large companies do not have a website, reflecting low digital coverage and the dominance of the informal sector, especially in small countries with few communications infrastructure, such as Sierra Leone, Liberia and Guinea-Bissau.

Table 7.2. Proportion of businesses with a website in West Africa

|

Country |

Large companies |

Medium companies |

Small companies |

All companies |

|---|---|---|---|---|

|

Benin |

94 |

58 |

3 |

38 |

|

Burkina Faso |

44 |

30 |

9 |

17 |

|

Côte d’Ivoire |

54 |

36 |

8 |

18 |

|

Cabo Verde |

47 |

17 |

18 |

19 |

|

Ghana |

75 |

48 |

22 |

33 |

|

Guinea |

77 |

21 |

16 |

19 |

|

Gambia |

100 |

43 |

14 |

22 |

|

Guinea-Bissau |

31 |

5 |

9 |

|

|

Liberia |

16 |

25 |

7 |

13 |

|

Mali |

72 |

43 |

36 |

42 |

|

Niger |

78 |

52 |

17 |

33 |

|

Nigeria |

70 |

48 |

15 |

22 |

|

Senegal |

83 |

59 |

16 |

35 |

|

Sierra Leone |

41 |

28 |

3 |

7 |

|

Togo |

49 |

40 |

20 |

30 |

|

West Africa |

64 |

39 |

14 |

24 |

Note: Data are for different years due to availability: 2009 (Burkina Faso, Cabo Verde), 2013 (Ghana), 2014 (Senegal, Sierra Leone), 2016 (Benin, Côte d’Ivoire, Guinea, Niger), 2017 (Liberia, Mali, Nigeria, Togo), 2018 (Guinea-Bissau).

Source: Authors’ calculations based on World Bank (2019a), World Bank Enterprise Survey, www.enterprisesurveys.org/en/survey-datasets.

The low number of websites among West African businesses is linked to the low proportion of households with access to a computer, the scarcity of innovative start-ups and the limited digital skills of workers. In contrast to the mobile phone penetration rate (41.5%), less than 5% of households have a computer (OIF, 2018). Moreover, the education system places little emphasis on digital education, leading to workers having low levels of IT skills. For example, in Benin, 53.6% of graduates in 2015 were in social, information and business sciences, compared with 4.7% in engineering and 8.7% in natural sciences, mathematics and statistics (OIF, 2018). Moreover, of those companies that have a website, very few update it. As such, website management – one of the first manifestations of digital transformation – has not yet been mastered in West Africa.

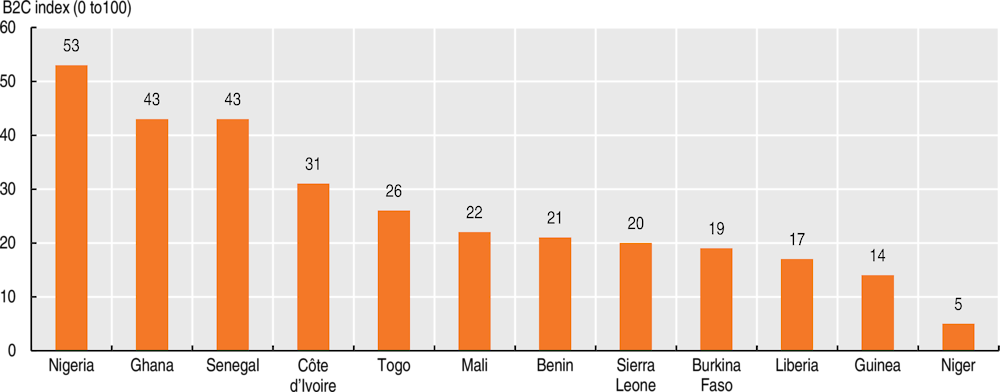

The Business-to-Consumer (B2C) Index, which measures countries’ ability to conduct e-commerce, is still low (Figure 7.2). In Africa, the highest B2C Index scores are 68.4 in Mauritius and 54.4 in South Africa. Nigeria, Ghana and Senegal have the highest scores in the region due to their dynamic economies and digital infrastructure potential. Consequently, investments are needed to improve not only Internet coverage, but also the logistics services between buyers and sellers.

Figure 7.2. Business-to-Consumer (B2C) Index, 2019

Notes: The B2C Index is based on four indicators strongly linked to e-commerce: (i) account ownership at a financial institution or with a mobile-money-service provider (percentage of the population aged 15 and over); (ii) individuals using the Internet (percentage of the population); (iii) Postal Reliability Index; and (iv) secure Internet servers (per 1 million people).

Source: Authors’ calculations based on (UNCTAD, 2020b), “UNCTAD B2C E-commerce index 2019”, UNCTAD Technical Notes on ICT for Development No. 14, https://unctad.org/en/PublicationsLibrary/tn_unctad_ict4d14_en.pdf.

Despite the gap in communications infrastructure, e-commerce has been driven by both specialised and generalist websites.Table 7.3 presents the top five e-commerce sites in the four most dynamic economies, based on their traffic. The e-commerce market in West Africa is dominated by Jumia, a Nigerian platform present in many countries, followed by Afrimarket.

Table 7.3. Top five e-commerce sites in the most dynamic economies of West Africa

|

Country |

Côte d’Ivoire |

Ghana |

Senegal |

Nigeria |

|---|---|---|---|---|

|

Website |

Jumia.ci |

Afriyie Electroworld Limited |

Jumia.sn |

Jumia.com.ng |

|

Afrimarket.ci |

CediBasket |

Afrimarket.sn |

Konga.com |

|

|

Vendito.ci |

Shopingh.com |

Food.jumia.sn |

Slot.ng |

|

|

Kaym.ci |

Ugodeal |

Promo.sn |

OLX.com.ng |

|

|

Shop.pdastoreci.com |

Zewnic |

Africashop.sn |

Dealdey.com |

Source: Authors’ own elaboration.

E-commerce faces challenges related to postal addresses and transport. When orders are placed on line, poor road links between cities and the remoteness of some rural populations make delivery difficult. According to the Boston Consulting Group (BCG), some sites report that between 30% and 40% of products ordered are returned because the delivery service has failed to find the destination address (Ecofin Agency, 2020). Poorly co-ordinated distribution networks compound this situation. The goods delivery sector in West Africa needs to be properly organised to make it a reliable source of jobs and capable of supporting the development of e-commerce.

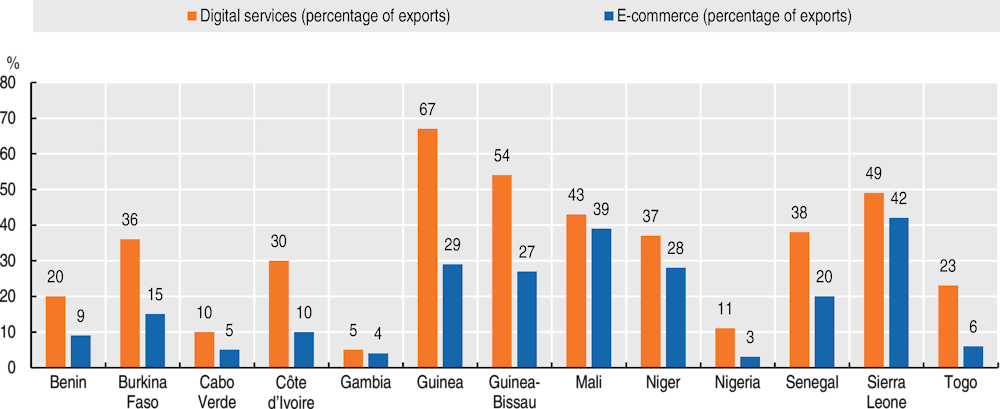

Despite constraints around communications infrastructure and the low proportion of companies with a website, e-commerce is experiencing robust growth at 9.1% per year, while digital services (up 21.2% per year) are expanding in cities. Between 2010 and 2017, the share of e-commerce in exports was still low (around 19%, compared with 33% for digital services), but its contribution was higher in small countries, despite relatively low turnover (Figure 7.3).

E-commerce and digital services can support new job-creation initiatives targeting young graduates. The countries best placed to benefit from this jobs dividend are Senegal, Côte d’Ivoire and Nigeria, due to the high turnover recorded in e-commerce and digital services, linked to the offshoring of hotlines and call centres from developed countries.

Figure 7.3. E-commerce and digital services deliverable using ICT (average 2010-18)

Source: Authors’ calculations based on UNCTAD (2020a), UNCTADSTAT (database), https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=158359

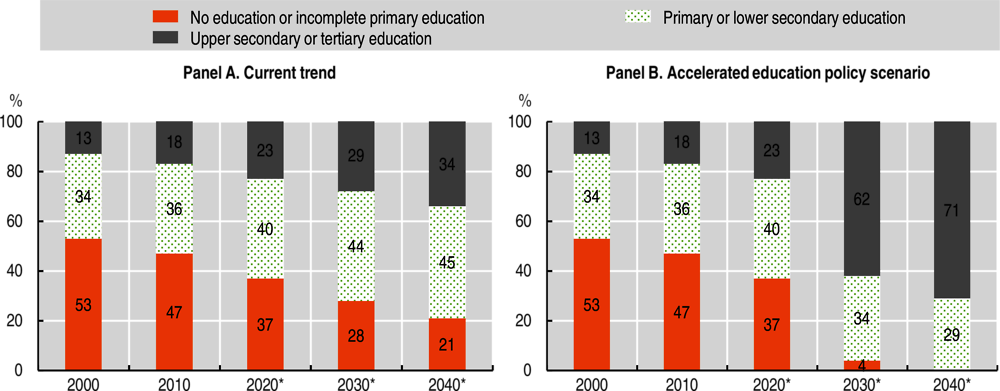

To better capitalise on digital transformation, employees’ technical and vocational skills must be developed through education. The education system in West Africa is not yet in a position to equip all young graduates with the digital skills they need. Indeed, training in computer science and basic software is accessible to only a few privileged learners, due to equipment costs and the predominance of the humanities. In West Africa, 37% of young people have not attended or completed primary education, with a similar share (40%) having completed primary school and moved on to lower secondary school. Only 23% of young people have attended high school (the upper level of secondary education), which is crucial if they are to learn digital skills (WCHC, 2020). Students need strong science, technology, engineering and mathematics (STEM) skills, as well as digital skills. These need to be combined with management and marketing skills to enable students to adapt to the challenges of the labour market.

Young people’s low level of digital skills and the mismatch between curricula and market requirements could lead to division in the labour market. Indeed, the impact of digital transformation is linked to workers’ skill level. While employment opportunities will improve for skilled young people, the 54% without the required skills will see their chances of entering the labour market fall and find themselves unable to turn to self-employment using digital technologies. Likewise, low-skilled workers are at high risk of losing their job. Reskilling, upgrading and vocational training are essential to reduce the digital divide in the labour market.

Box 7.1. Digital transformation and job creation in West Africa

In the wake of Gordon’s (2012) paper on the impact of the third industrial revolution (computers, telephones and the Internet) on labour productivity and employment in the United States, a vast literature highlighting the benefits and risks of digital transformation, particularly in developing countries, has developed. One of the authors’ main arguments is that the ICT boom favours skilled employment in the short term at the expense of unskilled employment, thus supporting the Schumpeterian process of creative destruction associated with digital transformation.

On a theoretical level, the impact of digital transformation on employment can be divided into two schools of thought: “leapfrogging” proposed by Brezis et al. (1993) and “skill-biased technological change” developed by Michaels et al. (2014), Akerman et al. (2015), and Acemoglu and Restrepo (2017). The first school of thought argues that countries lagging behind technologically are encouraged to adopt new technology that can boost productivity and employment. The lagging behind of West African countries has therefore stimulated their adoption of innovative services that generate employment. Conversely, the second school of thought highlights the fact that digital transformation polarises the labour market, increasing the demand for skilled workers at the expense of unskilled workers, and thereby increasing inequality.

Few studies have actually assessed the contribution of ICTs to job creation in developing countries. Hjort and Poulsen (2017) set out three channels through which better Internet access positively affects employment: productivity, business creation and increased exports. Using a sample of 50 000 companies in 117 developing and emerging countries, Paunov and Rollo (2016) also show that businesses’ use of the Internet improves labour productivity. Similar results obtained by Cariolle et al. (2017) based on a sample of more than 30 000 companies in 60 countries corroborated the skill-biased technological change thesis.

In the West African subregion, by 2018 the mobile ecosystem already employed 200 000 people formally and 800 000 informally, particularly in the sale and distribution of mobile services and devices, and contributed 3.5% to GDP. In addition to those directly employed in the sector, there are 600 000 indirect jobs. If the indirect effects of productivity improvements in other sectors are taken into account, this contribution is estimated to be 8.7% of GDP (GSMA, 2020b). This dynamic of direct and indirect employment, in relation to the mobile ecosystem, shows that the “leapfrogging” effect outweighs the potential adverse effects associated with the “skill-biased technological change” effect in West Africa.

Source: Authors’ compilation based on literature review.

Digital transformation presents many employment opportunities in the region but requires the adoption of complementary policies

By improving labour productivity and efficiency through the development of new innovative services, digital transformation is a plentiful source of employment in West Africa. Mobile phone and messaging services reduce unproductive travel by enabling employees and companies to communicate effectively. Likewise, 3G and 4G coverage allows data to be accessed and transferred quickly, facilitating decision-making.

The digital transformation of administrative procedures (e-government) is a powerful tool for public efficiency that can also provide an enabling environment for business to create jobs. For example, the digital transformation of tax returns and payments makes collecting tax revenues more efficient. It simplifies procedures for companies, saves time and helps improve the allocation of human resources by companies and the government.

E-government is an innovative tool that helps boost public revenues, streamline expenditure and tackle corruption by reducing human involvement in public service administration. In Benin, medium-sized enterprises have been obliged, since 2019, to declare and pay their taxes on line. Large companies have been subject to this requirement since 2018. Furthermore, since January 2020, the Directorate General of Taxes has developed an application that allows motorists to pay their vehicle taxes by mobile phone. The roll-out of the remote procedure for filing salary taxes and social security contributions is understood to have brought in an additional XOF 1 billion after just one month. Similarly, Ghanaians can now pay their taxes on line on the Ghana.GOV platform.

E-government can extend to all areas of administration and generate significant productivity gains. It can cover a range of areas, from port operations to immigration and visa procedures, or from e-justice to the interoperability of government databases. In March 2019, the government of Ghana launched “E-Justice”, an electronic platform for recording court cases, accessing legal services and paying fines. The platform also automatically assigns cases to courts and judges, thereby reducing the risk of corruption and conflicts of interest.

Beyond facilitating formalisation processes, digital transformation can increase the activity, opportunities and visibility of informal actors, while encouraging them to formalise, with a view to creating more stable jobs. In the informal sector, digital transformation must rely on basic technologies (Unstructured Supplementary Service Data) and universal applications (WhatsApp or Facebook) to collaborate with different stakeholders and promote products. Digital transformation will also make it possible to build trust between buyers and sellers by using branding to guarantee the credibility and quality of products and making customer feedback visible to all stakeholders. Digital transformation can support the SDGs by deploying network infrastructure, improving connectivity and making relevant digital services (health, finance, education) available.

In terms of health, digital transformation contributes to the achievement of SDG 3, through prevention and remote consultations, especially in areas without health centres. In terms of awareness-raising, My Healthline, an SMS information service on contraception, sexuality, HIV/AIDS and sexually transmitted infections provided by Orange, sends regular prevention messages to pregnant women and young mothers in Mali. In Ghana, the mPedigree application uses an SMS code to enable people to check whether their medicines are counterfeit (Gonzales and Dechanet, 2015). Meanwhile in Benin, the KEA Medicals hospital information system provides a universal medical identity for all patients using a label with a QR code, enabling medical data to be communicated between doctors and different hospitals.

Digital transformation also facilitates access to education (SDG 4), especially university education, which is hampered by the lack of infrastructure and teachers. In the absence of massive investment in the education sector, digital transformation remains the best solution for maintaining any significant level of education. It enables learners and educators to connect across a global knowledge-sharing network. In 2014, the Orange Foundation launched the Digital Schools programme for the most disadvantaged children, to provide free digital content to primary and secondary school pupils in countries where Orange operates, including Côte d’Ivoire, Niger, Senegal, Mali and Guinea.

The agricultural sector, which employs 42% of the workforce, can also mobilise digital tools to increase its output. Information on new cultivation techniques or pesticide combinations, crop conditions, weather and product prices, disseminated through ICT, can reduce production costs and improve yields. Digital transformation minimises geographical and seasonal disparities in the price of perishable goods (Aker and Fafchamps, 2015), reduces transport and transaction costs, builds trust in businesses and their reputation, and expands professional networks (Overa, 2006). Moreover, producers benefit from reliable and practical signals on which to act in a less uncertain environment and in turn improve their production, investment and sales decisions.

However, the digital revolution can give rise to a new form of crime, particularly in some West African countries: more than 10 000 cyberattacks were identified in Nigeria, Côte d’Ivoire and Senegal in 2015 (Gonzales and Dechanet, 2015). These cyberattacks can involve fraudulent use of bank data, hacking bank accounts or disseminating confidential and strategic information. According to McAfee (2014), cybercrime costs Nigeria 0.08% of its GDP each year, while losses are estimated at EUR 3.8 million for Côte d’Ivoire in 2013 and EUR 2.2 million for Senegal (Gonzales and Dechanet, 2015).

Digital transformation has enabled terrorist groups present in West Africa to establish a communication strategy and assert themselves. These groups use the Internet, videos and multimedia for propaganda, to claim responsibility for attacks, and so on. They also use the Tor network, which allows people to connect anonymously, and video game chat rooms to talk to each other or recruit people. In such a context, making the Internet safe remains a significant challenge.

The protection of private data remains challenging in the context of rapid digital transformation. Indeed, personal data collected by mobile operators must be stored within a regulatory framework that guarantees data security and prevents data being used for unlawful purposes.

Public policies to support and accelerate digital transformation in West Africa

Digital transformation can accelerate productive transformation and provide solutions to youth unemployment through four channels: (i) developing a dynamic digital environment conducive to the creation of digital start-ups and direct employment; (ii) promoting innovative financing for SMEs thanks to the emergence of fintech; (iii) integrating SMEs and informal workers into regional and global value chains contributing to indirect job creation; and (iv) developing skills aligned with future market requirements. Public policies play an essential role in the transition process through these different channels.

Public authorities can actively contribute to the emergence of a dynamic digital ecosystem

Through the creation of technology hubs or “tech hubs” and partnerships with the private sector

The new digital era holds great promise for the region, in terms of start-up creation, private sector development and stronger trade relations. Although West Africa has begun its digital transformation with e-commerce platforms such as the Jumia group, policies must be integrated into an overarching approach to development, particularly in terms of investment in fibre optic cables and efforts to facilitate Internet access for the greatest number of people (Cariolle and Goujon, 2019). This would help SMEs to discover digital innovations that could facilitate their move upmarket. New dynamic sectors have emerged, such as Nollywood in Nigeria (Box 7.2).

Box 7.2. Nollywood: successful integration into global value chains

Nigeria’s Nollywood has overcome the obstacles it faced in its early days to become a fully-fledged film industry, largely due to the Internet and smartphones. With 89.6% of its revenues coming from its online presence, it ranks second in the world behind Bollywood (India) in terms of the number of films produced and third after Hollywood and Bollywood in terms of revenues. Worth about USD 3 billion, or 1.42% of Nigeria’s GDP, Nollywood employs more than a million people directly or indirectly, making it the country’s second largest source of employment after agriculture. According to a report by PricewaterhouseCoopers (2018), a compound annual growth rate (CAGR)1 of 21.5% is forecast until 2022, with revenues expected to reach USD 9.9 billion. Despite the challenges of piracy, Nollywood remains a promising source of revenue for the sector’s stakeholders, with its online presence being the main driver of revenue growth. Growing interest among foreign companies and the credit line opened by the Central Bank of Nigeria (CBN) are other factors for success.

1. The compound annual growth rate (CAGR) in finance measures the average annual growth rate over several years.

Source: Agence de presse africaine (APA), 28 July 2019.

Given the weak position of formal employment in the economy, providing support to local entrepreneurs could contribute to job creation. Digital transformation has been a strong stimulus for entrepreneurship and self-employment in West African countries with high rates of underemployment. As the salaried labour market cannot keep pace with population growth, more and more young people are turning to (mostly informal) entrepreneurship, especially in the digital sector. To support these young people, several tech hubs have been created, backed by public authorities and/or operators working in the digital sector (Table 7.4). Good examples include Yabacon Valley and the Ekovolt system in Nigeria (Box 7.3), the Information Technology and Biotechnology Village (VITIB in French) in Côte d’Ivoire and the Meltwater Entrepreneurial School of Technology (MEST) in Ghana. Between 2016 and 2018, the number of active tech hubs increased from 84 to 142, predominantly in Nigeria. According to the 2017 edition of the MyAfrican Startup 100 honours list, 40 of the top 100 African start-ups are from West Africa, including 17 from Nigeria, five from Côte d’Ivoire and four from Ghana. Private stakeholders are active in the emergence of these start-ups in West Africa, including the SmartUp Digital Youth Foundation and the CGECI Academy in Côte d’Ivoire – an initiative of the General Confederation of Enterprises of Côte d’Ivoire – in addition to large companies like Microsoft or Seedstars, among others.

Table 7.4. Examples of digital start-up incubators in West Africa

|

Name |

Date created |

Country |

Features |

|---|---|---|---|

|

Jokkolabs |

2010 |

Senegal, Côte d’Ivoire, Mali, Burkina Faso, Benin, Gambia |

Launched in 2010 in Senegal, it offers shared workspaces as well as a community of entrepreneurs working on new technologies. Since its inception, the initiative has grown into a network of 12 innovation spaces across nine countries. |

|

Co-Creation Hub (CcHUB) |

2011 |

Nigeria |

This incubator offers digital skills programmes for entrepreneurs and students, start-up incubation and an investment portfolio through its venture capital fund and partnerships with large private groups (Facebook, Google, MTN, etc.). In 2019, it acquired Nairobi’s iHub, boosting its global visibility and network of digital start-ups. |

|

Ghana Innovation Hub |

2018 |

Ghana |

This hub provides start-up incubation and acceleration programmes. Its partnership with coLABS helps connect entrepreneurs with relevant investment opportunities. Moreover, coLABS has committed to invest USD 5 million over the next three years in young entrepreneurs. |

|

Djanta Tech Hub |

2018 |

Togo |

This tech hub has three objectives for 2025: to develop a network of Togolese start-ups (with more than 50 start-ups going through its incubation programme, of which at least ten raise more than EUR 100 000, and 200 new start-ups joining its network), to train 1 000 digital talents each year and to attract innovative international technology companies (at least 15 new companies). |

Source: Authors’ compilation.

While the emergence of tech hubs is encouraging, many of them are still struggling to operate effectively. The Biotechnology and ICT Free Trade Zone (ZBTIC in French) operated by VITIB in Côte d’Ivoire is struggling to get off the ground. Nevertheless, VITIB expects to provide more than 2 500 jobs five years after its launch. In 2011, West Africa had 11 free trade zones, mostly in low value-added and low-skilled labour-intensive sectors (Bost, 2011). The poor performance of these tech hubs is likely to be the result of a lack of government monitoring and support, which hinders their development. Similarly, without adequate infrastructure, these businesses are forced to invest more than their competitors. Companies in the Nigerian cluster Nnewi have had to invest in roads and water and electricity supplies themselves. This increase in overhead costs reduces their capacity to invest in research, development or improving skills and techniques (Kaplinsky and Morris, 2015). These major obstacles can only be overcome with the support of public bodies, which can create the right conditions for businesses to yield convincing results. Better public policies and a more stable political, economic and social environment would attract private sector stakeholders and investors, making it possible to stimulate technological innovation in the short and medium term that would benefit the countries’ economies.

Box 7.3. A successful example of a technology hub: Yabacon Valley

Yabacon Valley, the nickname given to a tech hub located in Yaba, on the outskirts of Lagos, was created in partnership with local start-ups. According to Voice of America (VOA) Africa, this technology ecosystem is a first step towards cultivating the tech community. This initiative is the result of successful collaboration between local and international stakeholders. Some provide the talent, market knowledge and entrepreneurial spirit, while others provide the financing that is still lacking on the ground. Yabacon Valley received more than 20% of the capital raised in Africa in 2017, i.e. USD 115 million. Although below the flows attracted by developed markets, this volume of capital is evidence of very real interest from venture capital funds. The country’s growing middle class is the preferred target group, as are traditional marketplaces and e-finance and e-retail companies.

Several less conventional initiatives are emerging, such as a crowdfunding platform for farmers (Farmcrowdy) and an application to facilitate blood donation (LifeBank). Yabacon Valley is home to several incubators including the Co-Creation Hub (CcHUB), which is sponsored by major technology companies (MTN Nigeria, Google, Nokia and MainOne), and Start Innovation Hub, which targets start-ups in education, energy, agriculture and health. The Yabacon Valley ecosystem has grown to include major e-commerce start-ups such as Jumia and Konga.

Source: Le Temps, 18 November 2018; Voice of America (VOA) Africa, 15 July 2018.

Through adequate funding for start-ups

While the emergence of start-ups represents an opportunity for all economic operators in the region, technical and financial support often fails to meet their needs as it tends to target companies in less risky sectors. To break the vicious cycle that SMEs face when seeking funding, the EIC Corporation platform has been launched to create a bridge between the diaspora and the African continent through its Diaspora Angel Investors (DAI) fund. This digital platform is present in all West African countries. This initiative should be strengthened and supported by tailored public policies to better direct remittances from African migrants towards productive investments. This could involve lowering the cost of sending remittances to countries in the region, which ranks second in Africa for migrant remittances after North Africa. Better SME funding also requires tailored public policies on tax waivers, public guarantee schemes to promote bank financing for creditworthy projects, and direct public funding for youth projects with positive knock-on effects. Many of the region’s countries have policies to support youth entrepreneurship and these should be strengthened and promoted. Moreover, the development of fintech firms appears to be another effective way of fostering inclusive and innovative financing in the economy.

Despite the development of the sector and of dynamic start-ups, the digital economy will fail to create enough direct jobs to meet demand. However, digital transformation could stimulate indirect job creation by providing innovative sources of financing via financial technologies or by facilitating SMEs’ and informal workers’ integration into regional and global value chains.

The emergence of fintech firms could provide an innovative source of financing for the private sector, but the regulatory framework will have to be adapted accordingly

Fintech in West Africa

Fintech firms4 respond to the needs of SMEs and are the new drivers of financing in West Africa. They facilitate the transfer of funds anywhere in the world and are able to harness blockchain – the data storage and transfer technology. Fintech firms leverage digital finance through mobile money/banking, especially for unbanked stakeholders (including those in the informal sector). This is particularly useful in places with poor access to banking services. Fintech’s success lies in money transfer technologies, an extensive innovation which has developed from simple transfer activities to the creation of electronic wallets that make online shopping, tax payment and more possible.

Over recent years, the rise in fintech firms has been characterised by the widespread use of electronic financial services in West Africa. In its annual report on access to financial services via mobile phones published in 2017, the Central Bank of West African States (BCEAO) found that there were 36.5 million subscribers to mobile money services in the Union. Approximately 2 million transactions were processed per day on average in 2017, amounting to XOF 11 500 billion. Service providers include operators such as INTOUCH, m-Louma, Matontine, Wallet, Jokko santé, PayDunya and SudPay in Senegal, JULAYA and Janngo in Côte d’Ivoire, and Bizao and Moneywave in Nigeria.

Financing opportunities

To capitalise on the high level of mobile coverage, phone operators and banks have implemented co-operation agreements to increase access to financial services through mobile phones and promote financial inclusion. For instance, the Ecobank Group (whose mobile portfolio includes Xpress Account by BNP Paribas, Yup by Société Générale and the Banque internationale pour l’Afrique de l’Ouest) has joined forces with Orange, MTN, Airtel and Etisalat through its West African subsidiaries. Even microfinance institutions are exploring whether they can use mobile technologies to bring their services closer to their clients by using tablets to serve savings groups. Moreover, partnerships between microfinance institutions and e-money issuers have been set up to use mobile phones to digitise savings collection and loan repayment. This is the case for Caurie-MicroFinance and Microcred in Senegal, Alide in Benin and Advans Microfinance in Côte d’Ivoire. Reaching 57.1% of people in the West African Economic and Monetary Union (WAEMU) area in 2018 (BCEAO, 2019), mobile banking has fostered financial inclusion, with remarkable rates in some countries: Benin (74.5%), Togo (71.9%), Côte d’Ivoire (70.4%), Burkina Faso (68.4%) and Senegal (67%). Many countries have implemented fintech programmes, such as the Bali programme in Senegal, launched in October 2018 with the support of the World Bank and the International Monetary Fund (IMF),5 and the use of blockchain technology to solve land tenure problems in Ghana.6

Priorities to use fintech for innovative financing

Public policies on fintech should be part of an overarching approach to promote the digital economy. The institutional framework must therefore be clarified. At present, payment service providers are not regulated under a single separate category. These entities are neither microfinance institutions nor electronic money institutions, and the absence of harmonised regulation hinders their growth. The stark differences between countries give rise to additional costs for companies operating in the fintech sector. Likewise, despite the availability of human resources skilled in software development, there is a shortage of the specific skills required for innovation (cloud, big data, digital security).

National policies do not sufficiently support the development of fintech firms. The lack of support for and monitoring of these young companies affects their survival, regardless of the quality of the solutions they offer. The absence of a support strategy for tech companies deprives young entrepreneurs in the sector of access to adequate administrative, legal and financial assistance to make their businesses sustainable. National policies devote only a small share of investment to infrastructure to support the growth of fintech. One recommendation to mitigate these constraints would be to create a Fintech Lab with Côte d’Ivoire as a regional hub (Gonnet, 2018). The objectives would be to detect emerging technologies developed by fintech start-ups, to improve products, services and internal processes and to identify the talents of tomorrow (in IT or marketing). The next step would be to strengthen relationships with start-ups, build a pipeline of young companies in which to invest and encourage the development of the local fintech ecosystem by participating in efforts to innovate. Finally, the ambition would be to promote innovation in related sectors (e-health, e-transport, e-administration, etc.), accelerate the territorial and economic development of Abidjan, the region and other territories by increasing their attractiveness through investments and new foreign partners and, above all, to encourage companies to move out of the informal sector.

For fintech firms to contribute effectively to the region’s development, a permanent framework for dialogue between the various stakeholders of the financing ecosystem is necessary. With this in mind, the World Bank and the BCEAO organised an international conference in October 2019 on financial technology companies, bringing together all stakeholders involved in the financing of the West African economy. This conference brought together the governors of the various West African central banks, the regional stock exchanges, representatives of the WAEMU states’ ministries of finance, banking and microfinance institutions’ professional associations and the Alliance for Financial Inclusion. Beyond this meeting, a permanent framework for dialogue was established to enable effective financing policies to be developed. Such policies include the interoperability platform7 in Ghana and the granting of a licence by the Central Bank of Nigeria to Yello Digital Financial Services Limited, a subsidiary of MTN Nigeria, to provide financial services.

Digital transformation can also improve the spatial distribution of jobs by helping small producers integrate into regional value chains

In a context of accelerated globalisation, digital transformation can help West African countries to better capitalise on their complementarity. Regional value chains could be developed as an alternative to the global value chain, thereby enabling West African countries to strengthen their comparative advantage (AUC/OECD, 2019). Indeed, some countries in the Economic Community of West African States (ECOWAS) have high levels of complementarity in terms of trade relations: Côte d’Ivoire with Senegal and Burkina Faso; Senegal with Mali, Ghana, Togo and Nigeria; and Gambia with Niger. Similarly, several countries manufacture the same goods, such as shea butter (produced by seven countries), cocoa (whose two major global producers are Côte d’Ivoire and Ghana) and gold, iron, copper, nickel and oil (produced in Ghana, Burkina Faso, Mali, Guinea, Liberia and Senegal). As such, integrated Special Economic Zones could present real opportunities. It is therefore essential that local transformation policies are based around carefully selected areas of activity with a strong knock-on effect on employment and the rest of the economy. To further strengthen regional integration, there should be a focus on strengthening trade relations by improving the transport infrastructure that connects the region’s different countries, with a view to harnessing digital transformation.

The agro-industry sectors in Côte d’Ivoire, Ghana and Nigeria are linked to global value chains, but these countries have made little progress in terms of regional value chains. Regional industrialisation and private sector development initiatives are still in their infancy and focus on competitiveness and institutional barriers, particularly non-tariff barriers, political and economic fragility (OECD/AfDB/UNDP, 2014). Global value chains offer the opportunity to create new productive activities and new quality jobs, which are necessary for the structural transformation of economies. Countries can join a value chain without first having to establish all the other links in the chain. Thanks to technological and digital development, it is possible to join an international production network without having all the upstream capacity. In West Africa, agro-industrial value chains offer significant opportunities for expansion. Digital tools can help SMEs to better seize the massive opportunities offered by the regional and African market. By providing strong support to associations of small farmers and SMEs, public authorities and technical and financial partners can help a country to better capitalise on regional and global value chains, as Janngo in Côte d’Ivoire demonstrates (Box 7.4).

Box 7.4. Janngo, a digital solution for integrating SMEs into value chains

Based in Côte d’Ivoire, the company Janngo launched its digital platform Jexport (www.jexport.ci) in 2018. It aims to address issues around the competitiveness of SMEs to accelerate their integration into regional and global value chains. Janngo seeks to provide a holistic solution to the challenges that SMEs face when they try to access markets and capital, as well as capacity building. The Jexport tool seeks to help them export their goods around the world at the best price, while also helping freight forwarders and transport companies to bulk up their volumes, reduce their costs and optimise their transport capacity on key corridors. The platform provides end-to-end digital services and a turnkey tool for managing legal and compliance obligations. Jexport brings together freight forwarders, transport companies and other logistics professionals and gives them the opportunity to optimise their transport capacity and maximise their volumes on existing corridors, while increasing their capacity on new corridors.

Source: Ze-AfricaNews, 11 June 2020.

By using digital technology to facilitate producers’ access to new markets, as well as that of other local stakeholders along the agricultural chain, greater integration into value chains can increase these stakeholders’ income, improve their working conditions and create new jobs (PEJEDEC, n.d). Many of the region’s countries primarily export agricultural products. The food economy accounts for 39% of West Africa’s GDP and will continue to be a source of employment for the region’s young people (Allen, T., P. Heinrigs and I. Heo, 2018). Yet the value chains for these products are controlled by multinationals that process and distribute them. Public authorities must work to ensure that local stakeholders are properly integrated into agricultural value chains. Indeed, value chain development interventions seek to move beyond traditional markets, which are often characterised by low added value. Accessing new markets via digital tools often requires compliance with specific quality and quantity standards. Moreover, the prospect of serving new customers with higher purchasing power and more diversified consumption needs opens up opportunities for processing primary products, thereby adding more value. Meeting higher standards and adding value can increase the income of stakeholders along the value chain and create new jobs. These jobs could be in processing, mechanisation services, distribution and transport, and require a variety of skills, opening up economic opportunities for a larger population. SMEs involved in the agricultural and agro-industrial sectors should be encouraged and supported through various mechanisms.

Digital tools for financing value chains in West Africa can improve market opportunities. One option is digitising payments to small farmers in value chains. This method has been tested in Ghana by the rice producer Global Agri-Development Company Ghana Limited (GADCO) and the Agropay platform. GADCO, in partnership with mobile network operators, has provided digital payment services to small farmers, while the Agropay platform connects small farmers with major financial intermediaries so they can sell their goods directly and then provide lenders with a financial statement. Small farmers’ practices and the seasonal nature of their financial flows have inspired myAgro in Mali and Senegal. It aims to collect prepayments for quality seeds using mobile money, to deliver the seeds and to provide technical support on how to use them. To reduce the imbalance in information between small farmers and lightweight tractor suppliers, Hello Tractor has developed a mobile application to risk-assess short-term equipment leasing finance or rental in Nigeria, Senegal, Mozambique, Tanzania and South Africa. Tailored support provided through well-targeted public policies using these methods is a godsend for traditional small farmers.

Digital transformation can improve the spatial distribution of jobs and improve the integration of SMEs and entrepreneurs into value chains in West Africa. In this region, the bulk of the employment generated by economic growth is confined to the economic and political capitals and, to a lesser extent, to urban areas more generally. The emergence of start-ups in employment areas outside economic and political capitals can enhance the effective use of local skills. Regardless of their sector, companies that use the Internet have grown twice as fast as those without an online presence (McKinsey, 2012). The impact of email on the productivity and turnover of firms in secondary cities is high (Cariolle et al., 2019). The growth of start-ups at the local level due to the expansion of incubators to the different regions of West African countries is helping to consolidate economic growth through job creation at the local level, in particular through better use of local skills. This could lead to a drop in migration between secondary cities and economic capitals, which can increase urban poverty. Finally, enhancing the regional economic potential of West African countries via digital technology helps to optimise the use of local skills and improve the spatial distribution of jobs, the success of which depends on integrating SMEs from different countries into regional and global value chains.

To better integrate SMEs and entrepreneurs into value chains, public authorities should support skills upgrading and help businesses to increase their productive capacity. Despite the existence of several hubs, it is crucial that West African start-ups are supported to enable them to successfully integrate into value chains. For example, Meltwater Entrepreneurial School of Technology, established in Ghana in 2008, offers an intensive 12-month programme for aspiring African entrepreneurs and is working to break into Côte d’Ivoire to support start-ups in the region. Candidates selected each year receive a comprehensive MBA-style education covering a full range of skills required to build a technology company, including computer programming, software development, product management, finance, marketing, sales and leadership best practices. MEST is accepting applicants from Côte d’Ivoire, Ghana, Kenya, Nigeria and South Africa who want to participate in the intensive entrepreneurship training programme, launch their own digital start-up and receive start-up financing from the Meltwater Foundation. However, to improve the specific skills required by industries and value chains, basic education will need to be supplemented with technical and vocational training.

The region must invest in human capital to meet the growing demand for technical and soft skills

Although West Africa has great potential conducive to harnessing the demographic dividend (almost 44% of its population is aged under 15), its serious skills gap acts as a barrier to innovation. The region’s countries have low levels of human capital. Ghana and Senegal take the lead with the highest score of 0.42, compared with 0.35 in Côte d’Ivoire and 0.34 in Nigeria (World Bank, 2017). Despite significant investment in training, sub-Saharan Africa still suffers from skills shortages (AUC/OECD, 2019). The global competitiveness indicators for higher education and training show that West Africa is lagging behind, particularly with regard to the quality of mathematics and science education (3.7), the availability of research and training services (3.9), and the level of staff training (3.7). The indicators are even more concerning for countries such as Mali and Niger. The low rate of enrolment in science and technology (22.2% compared with 38.8% in East Asia) translates into a severe skills shortage in the labour market. The number of technical specialists per 1 000 workers in 2007 peaked at 0.63 in sub-Saharan Africa, compared with 42.81 in China, while sub-Saharan Africa had 0.99 researchers per 1 000 workers compared with China’s 4.76 (UNESCO Institute for Statistics, 2010). This gap negatively affects private sector development. In the agricultural sector, the skills shortage hampers development, modernisation and productivity improvements, despite the high export potential.

Despite gradual improvement, inadequate education remains a major obstacle, contributing to the digital divide. In an optimistic scenario, where the region manages to make progress on education at a rate similar to Korea, everyone would be guaranteed primary education by 2040. This would present an opportunity for digital technology to expand. However, this overly optimistic scenario seems unrealistic. States’ education systems often perform poorly, despite their efforts to make adequate budgetary allocations. In a less optimistic scenario that follows the current trend, the proportion of young people with no or incomplete primary education in West Africa would still be very high by 2040, at more than 20% (Figure 7.4). Countries such as Niger and Mali would still have high rates of low educational attainment, ranging from 56% to 60% for the no or incomplete primary segment. This situation is a barrier to the smooth integration of economic actors into regional and global value chains in those countries lagging behind in education and is likely to inhibit opportunities for the creation of quality jobs. Conversely, countries like Ghana, Nigeria and Cabo Verde will be able to take full advantage of digital transformation, with education levels increasing significantly: with 42%, 55% and 29% of youth achieving tertiary education.

Given the high mobile penetration rate in the region, public policies should promote national digital skills development programmes, especially among disadvantaged groups. Digital transformation facilitates the integration of populations living in remote areas (including rural areas). However, SMEs in West Africa are slow to capitalise on this opportunity. Many small enterprises operate in the informal sector and employ staff whose low level of human capital hinders the effective use of IT tools. Furthermore, the main barrier faced by African SMEs is the shortage of technical skills, given that employees are often unfamiliar with digital tools. In this context, public social policies should prioritise the development of digital skills among vulnerable populations to narrow the digital divide. More than 230 million jobs in sub-Saharan Africa will require digital skills by 2030, with Ghana alone likely to have 9 million digital jobs, which could potentially generate revenue of USD 4 billion by 2030 (IFC, 2019).

Figure 7.4. Projections for youth educational attainment in West Africa, 2000–40

Note: * are for projections. Owing to data availability, the figures reported are for the population aged 15-29.

Source: Authors’ calculations based on data from the Wittgenstein Centre for Demography and Global Human Capital (database). Accessed from the website: http://dataexplorer.wittgensteincentre.org/wcde-v2/.

Given the changing labour market, the digital transformation should be harnessed to update skills and reduce the skill mismatch. The high rate of unemployment among graduates is partly explained by the mismatch between skills and jobs, with graduate profiles rarely corresponding to what businesses are looking for in the labour market. In Côte d’Ivoire, for example, the mismatch rate is estimated at 75.87%, with the most common types being over-education (61.38%) and under-skilling (59.19%), in particular over-enrolment in arts and humanities (Kouakou and Yapo, 2019). Technology transfers suffer, as does the ability of countries to attract foreign direct investment (FDI) that could help restructure their economies. Public policies on education should make every effort to improve access to and the quality of secondary and tertiary education, especially in the technology streams (STEM), to develop the talent of tomorrow, ready for the fourth industrial revolution (4IR). Early awareness of the use of new ICT should be advocated in the digital age. An in-depth reform of teaching and learning systems should be planned, starting with the introduction of digital technology into training systems.

To reduce graduate unemployment, public authorities should develop mechanisms to facilitate the transition into the labour market, such as partnerships with the private sector and technical and vocational education and training programmes (TVET) (Table 7.5). The most effective way of matching supply with demand in the labour market is to strengthen the ties between general and vocational education, particularly at the secondary level. ICTs should be presented as tools for improving system governance, a learning objective, a pedagogical support tool and a vehicle for increased access to training and job creation. Structuring learning around ICTs provides the skills required to use production technologies. The ability to use business applications improves young people’s employability. Through ICT, new forms of training have emerged, such as distance learning – a significant lever for increased accessibility if well-designed educational material is built around this tool. Retraining and apprenticeships for unemployed young people must also be supported and public-private partnerships (PPPs) developed for the validation of the skills acquired. Countries such as Côte d’Ivoire have initiated reforms to enable schools and businesses to partner up to improve the quality of the technical and vocational education and training system. For this to be a success, it would be appropriate to revive career guidance services and, above all, to provide goal-oriented training that considers the structure of the economy.

Table 7.5. Digital-skills-related TVET initiatives in West Africa

|

Name |

Short description |

Country |

|---|---|---|

|

Women in Digital Skills |

Enables women in the informal sector to acquire computer skills in demand in the labour market to help them find a new job or start their own businesses. More than 200 volunteer mentors have trained over 5 800 women across eight regions of Ghana. |

Ghana |

|

Women’s Technology Empowerment Centre (W.TEC) |

Organises technology camps and mentoring and research activities, dedicated to women tech entrepreneurs. In 2019, W.TEC reached 27 000 girls and women, 86% of whom have pursued a career in STEM. A total of 1 800 women have started a business thanks to W.TEC support. |

Nigeria |

|

Sonatel Academy |

A free TVET platform, launched in 2017, that aims to increase youth employment by providing digital skills training for six to seven months. Over the 2017-20 period, 350 students, 30% of whom were women, obtained medium to high-level qualifications. |

Senegal |

|

Orange and OpenClassrooms |

A partnership to provide access to free training for unemployed people in Togo and Benin (among other African countries), through online courses via the mobile network and the creation of training centres for digital professions with a “guaranteed job” commitment. |

Togo, Benin |

|

Meltwater Entrepreneurial School of Technology (MEST) |

Offers a 12-month full-time programme in which students – called “entrepreneurs-in-training” – take a higher education-level course in software development, business and communications. |

Ghana, Nigeria, Côte d’Ivoire |

Source: Authors’ compilation.

Current regional strategies and priorities to harness digital transformation in West Africa

It is possible for West African countries to take full advantage of the benefits of digital transformation. To achieve this, the region must overcome major challenges including access to electricity, quality communications infrastructure, digital security risks, harmonising training systems and improving the legal and regulatory framework.

The monopolistic nature of the electricity sector hinders the advancement of digital solutions. An electricity supply is an essential prerequisite for the digital transformation of economies. In West Africa, the rate of access to electricity is 52% on average, with power outages that can reach 80 hours per month (World Bank, 2018). Moreover, electricity continues to be very expensive in the region and costs twice the global average. This leads to low domestic demand that is unable to attract investments in large projects that could achieve economies of scale. The region’s countries are generally dependent on small, very expensive oil-fired power plants. A lack of planning means that countries are forced to rent power plants, which further increases bills. It is therefore essential that countries work together to provide more reliable access to electricity in West Africa (Cole et al., 2018). This is the objective of the West African Power Pool (WAPP), an ECOWAS institution that brings together all its member countries except Cabo Verde and 27 national electricity companies, which are working together to establish a single regional electricity market. Barriers to entry must also be removed to increase supply, reduce the current deficit and enable more innovative operators – particularly in renewable energies (solar, wind, etc.) – to offer cheaper, higher quality alternatives that emit less CO2. The Akon Lighting project, which has brought solar lighting to millions of people across several African countries, bears witness to the value of such measures (Ahouangansi, 2019). At the national level, some countries, such as Nigeria in 2013, have seen a marked increase in their level of electrification following the liberalisation of the electricity sector, making it possible to offer digital solutions in areas that were previously cut off.

To improve the capacity of countries in the region to capitalise on the digital transformation, massive investment in communications infrastructure will be required.Alper and Miktus (2019) estimate that the region will need to invest USD 3.1 billion to achieve full 4G coverage by 2025. However, between 2014 and 2018, only 5% of regional and national government infrastructure financing budgets was allocated to ICT development, i.e. USD 1.25 billion (ICA, 2018). Of the six countries in the region ranked by the Enabling Digitalization Index,8 Senegal, Guinea and Liberia show huge gaps in connectivity, infrastructure and market size. Countries therefore need to overcome the infrastructure gaps that make access to the Internet and IT solutions expensive. For example, in Niger the average cost of a 128 kbps ADSL Internet connection is XOF 60 000, twice the average salary (Ahouangansi, 2019). Expanding the terrestrial wired infrastructure (backbone), including Internet exchange points, data centres and submarine cables, remains an important lever for closing the digital divide. Many projects are currently being implemented, such as: (i) the Priority Telecommunications Programme which seeks to roll out modern and reliable regional broadband infrastructure including the INTELCOM II Programme, alternative broadband infrastructure, submarine cables and the creation of a single liberalised telecommunications market; (ii) the project to modernise the information and communication infrastructure network, which has enabled Voice over Internet Protocol to be rolled out; (iii) the project to connect the global network to the 32 international links that have been installed to serve as a regional backbone supported by the development of a database management system (SIGTEL).

Promoting a regional approach to digital security could limit the risks and losses associated with ICT adoption. Progress has been achieved at the national level in recent years through the adoption of regulations in most countries. However, according to UNCTAD’s Global Cyberlaw Tracker, which tracks the status of legislation in the areas of electronic transactions, consumer protection, data and privacy, and cybercrime prevention, only six countries in the region (Benin, Niger, Ghana, Côte d’Ivoire, Senegal and Gambia) have laws covering all of these areas (UNCTAD, 2020c). Taking a collective approach by, for example, organising inter-country consultations could help make such legislation more effective. In 2020, with the support of the European Union, ECOWAS adopted a joint digital security strategy to address the growing threat posed by digital security incidents and to enable the development of digital economies (ECOWAS, 2020).

A major remaining challenge to address is strengthening and harmonising training systems. According to the International Telecommunication Union (ITU, 2017), as a region Africa is last globally in terms of ICT skills level and below the global average. Therefore, strengthening human capital remains a priority if African countries are to harness the digital and productive technologies within their grasp. This underscores the relevance of improving education systems and research facilities in the region, as well as the teaching of mathematics, science and technology. Access to mobile phones can increase individual returns on education by facilitating communication through social networks (Aker et al., 2012) as well as learning during and after school. From this perspective, applying tax exemptions to smartphones and improving connectivity are of paramount importance. The region should also harmonise its education system, which differs from country to country. A harmonisation process is indeed under way in the WAEMU at the higher education level, through the Licence Master Doctorat (LMD) system, which is achieving mixed results. ECOWAS, in partnership with the African Development Bank and the Government of Japan, took the positive step of commissioning a diagnostic study in April 2020 with a view to developing a coherent and holistic human capital strategy for West Africa.

The business environment and regulation also provide channels for the transmission of digital technologies. The aim here is to create the necessary conditions for trust and co-operation between stakeholders. In this respect, and building on the success of the Organization for the Harmonization of Business Law in Africa (OHADA), adopting the Pan-African Investment Code would be another positive step. ECOWAS has already adopted two protocols that directly concern foreign investment: one in 1984 on community enterprises and the other in 1979 on the free movement of persons, the right of residence and establishment. Given the dynamics of the integration programme in West Africa, this aspect could be accelerated and encourage massive investment in the region.

References

Acemoglu, D. and P. Restrepo (2016), “The Race Between Machine and Man: Implications of Technology for Growth, Factor Shares and Employment”, Working Paper No. W22252, National Bureau of Economic Research, Department of Economy, MIT, Cambridge, Massachusetts, http://ide.mit.edu/sites/default/files/publications/aer.20160696.pdf.

AfDB (2020), African Economic Outlook 2020: Developing Africa’s Workforce for the Future, African Development Bank, Abidjan, www.afdb.org/en/documents/african-economic-outlook-2020.

Ahouangansi M. (2019), “Les quatre piliers de la révolutions digitale” [The four pillars of the digital revolution], Counterpoints, 5 September 2019, www.contrepoints.org/2019/09/05/352903-les-4-piliers-de-la-revolution-digitale-en-afrique.

Aker, J.C., C. Ksoll and J.T. Lybbert (2012), “Can Mobile Phones Improve Learning? Evidence from a Field Experiment in Niger”, American Economic Journal, Vol. 4, No. 4, pp. 94-120, American Economic Association, Nashville, Tennessee, http://dx.doi.org/10.1257/app.4.4.94.

Aker, J.C. and M.Fafchamps (2015), “Mobile Phone Coverage and Producer Markets: Evidence from West Africa”, The World Bank Economic Review, Vol. 29, No. 2, pp. 262–292, World Bank, Washington, DC, https://elibrary.worldbank.org/doi/abs/10.1093/wber/lhu006.

Aker, J.C. and C. Ksoll (2016), “Can Mobile Phones Improve Agricultural Outcomes? Evidence from a Randomized Experiment in Niger”, Food Policy, Vol. 60, pp. 44–51, Elsevier, Amsterdam, doi.org/10.1016/j.foodpol.2015.03.006.

Aker, J.C. and C. Ksoll (2019), “Call Me Educated: Evidence from a Mobile Phone Experiment in Niger”, Economics of Education Review, Vol. 72, pp. 238–257, Elsevier, Amsterdam, www.sciencedirect.com/science/article/abs/pii/S0272775718305697.

Akerman, A., I. Gaarder, and M. Mogstad (2015), “The Skill Complementarity of Broadband Internet”, The Quarterly Journal of Economics, Vol. 130, pp. 1781-1824, MIT Press, Cambridge, Massachusetts, http://hdl.handle.net/10.1093/qje/qjv028.