The chapter analyses the state of Africa’s development financing in the face of the COVID-19 global crisis and highlights key policy areas to ensure its sustainability. The first section presents recent trends and dynamics of Africa’s main sources of development finance before COVID-19 hit in 2020. The second section discusses the global economic impact of the coronavirus pandemic on domestic resource mobilisation and highlights the opportunities for digitalisation to improve Africa’s tax revenues. The third section analyses the risks of declining external financial flows on African economies. It also identifies policy priorities to relaunch remittances, foreign direct investment and official development assistance to Africa. The last section examines both the urgent need for debt restructuring to free up critical development financing and reforms in debt management to ensure future debt sustainability.

Africa’s Development Dynamics 2021

Chapter 8. Financing development in Africa

Abstract

In brief

Africa’s major sources of finance were decreasing before the COVID-19 health and economic crisis hit in 2020. Domestic financing, such as gross private savings and taxes, is the most important source of development finance in Africa and is likely to suffer due to the plunge in global and domestic economic activity. However, African governments can unlock the potential of digitalisation to mobilise domestic resources in the medium and long terms.

The global economic crisis is reducing Africa’s external financial inflows. Lowering the cost of sending remittances is vital at a time when remittances are set to drop at an unprecedented rate. The global investment slowdown is affecting Africa’s larger and less diversified economies, but policies can help capture new opportunities that arise from the reorganisation of global value chains. International co-operation is key to sustaining official development assistance flows and supporting recovery, particularly in low-income countries.

African governments urgently need debt restructuring, with private creditor participation, to free up resources for development financing and return to a growth trajectory. On average, African governments are spending more on debt servicing than on combatting the health and economic crisis. Reforms in debt and public finance management are necessary to maintain access to commercial credit and also to ensure long-term debt sustainability.

Financing development in Africa

Indicators of financing development in Africa

Table 8.1. Sources of finance for development in Africa

|

Source of revenues |

Financial flows by year |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

In billions of USD |

As a percentage of GDP |

|||||||||

|

2014 |

2015 |

2016 |

2017 |

2018 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

|

Inward foreign direct investment |

53.9 |

56.9 |

46.5 |

41.4 |

45.9 |

2.1% |

2.5% |

2.1% |

1.9% |

2.0% |

|

Portfolio investments |

30.4 |

22.2 |

6.2 |

57.1 |

36.5 |

1.2% |

1.0% |

0.3% |

2.6% |

1.6% |

|

Remittances |

71.8 |

71.4 |

67.5 |

77.6 |

84.2 |

2.9% |

3.2% |

3.2% |

3.6% |

3.7% |

|

Official development assistance (net total) |

54.1 |

50.1 |

50.4 |

53.8 |

55.3 |

2.1% |

2.2% |

2.3% |

2.4% |

2.4% |

|

Total foreign inflows |

210.1 |

200.5 |

170.5 |

229.8 |

221.8 |

8.4% |

8.8% |

7.9% |

10.6% |

9.7% |

|

Public revenues (no grants) |

524.7 |

438.2 |

394.2 |

425.9 |

483.6 |

20.7% |

18.9% |

18.0% |

19.2% |

20.7% |

|

Private savings |

507.0 |

419.6 |

408.2 |

415.6 |

427.8 |

20.4% |

18.5% |

19.1% |

19.3% |

18.9% |

Sources: Authors’ calculations based on data from IMF (2020a), World Economic Outlook (database) www.imf.org/external/pubs/ft/weo/2020/01/weodata/index.aspx; OECD-DAC (2020a), International Development Statistics (database) www.oecd.org/dac/stats/idsonline.htm; OECD-DAC (2020b), Country Programmable Aid (database) www.oecd.org/dac/financing-sustainable-development/development-finance-standards/cpa.htm; UNCTAD (2020a), World Investment Report 2020 and World Bank (2020a), KNOMAD Remittances Data (database) www.knomad.org/data/remittances.

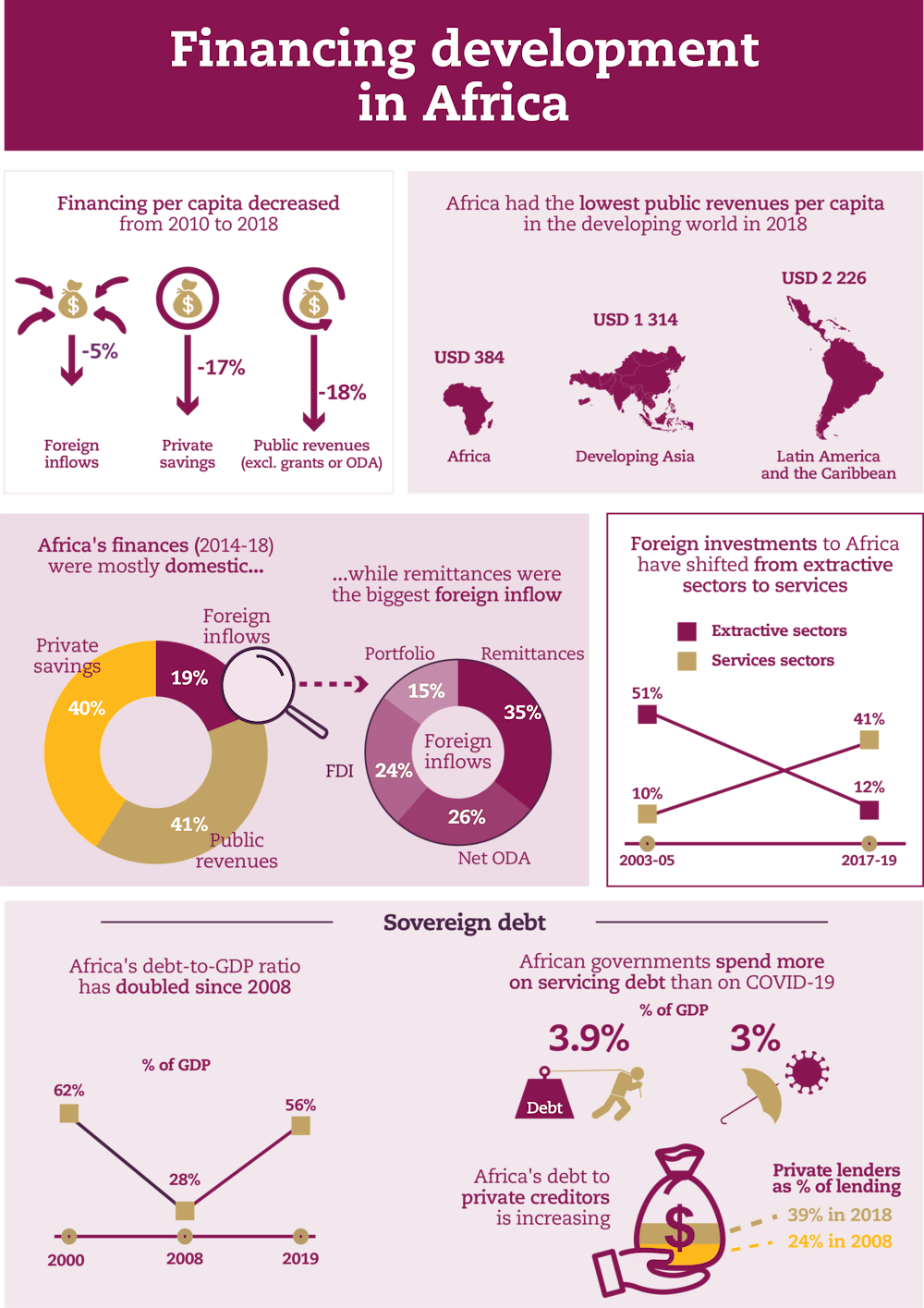

Figure 8.1. Real change in development financing per capita for Africa (2010 = 100)

Sources: Authors’ calculations based on data from IMF (2020a), World Economic Outlook (database) www.imf.org/external/pubs/ft/weo/2020/01/weodata/index.aspx; OECD-DAC (2020a), International DevelopmentStatistics (database) www.oecd.org/dac/stats/idsonline.htm; OECD-DAC (2020b), Country Programmable Aid (database) www.oecd.org/dac/financing-sustainable-development/development-finance-standards/cpa.htm; UNCTAD (2020a), World Investment Report 2020 and World Bank (2020a), KNOMAD Remittances Data (database) www.knomad.org/data/remittances.

African finances were already weakening before the health and economic crisis of 2020

The financial resources available per capita for development in Africa have dropped since 2010 (Figure 8.1). The amount of financing per capita decreased during the period 2010-18 for both domestic revenues and external financial flows, by 18% and 5% respectively. Since 2016, when commodity prices dropped sharply and financing hit its lowest point, domestic revenues have remained stagnant, and only external inflows have recovered to previous levels. In 2018, African governments averaged revenues of USD 384 per capita, compared with USD 2 226 for Latin American and Caribbean countries, USD 1 314 for developing countries in Asia and over USD 15 000 for European and other high-income countries. Not only do Africans have fewer sources of financing, but these sources are also volatile, often due to the dependence of many African economies on global commodity markets and external financial inflows.

Remittances have become the largest and most stable source of external financial flows to Africa. This money sent home by the African diaspora has increased almost every year since 2010, from USD 54.9 billion in 2010 to 84.2 billion in 2018. Egypt and Nigeria accounted for 60% of Africa’s remittance inflows in 2019, while remittances as a share of gross domestic product (GDP) exceeded 5% in 15 countries. Remittances have often been counter-cyclical, playing a vital role in risk-mitigating and helping provide food security and other immediate livelihood needs to African households for which they served as a key source of income. According to the Afrobarometer (2019), about 22% of surveyed households in Africa declare being at least “a little bit” dependant on remittances from relatives or friends living in other countries. Remittances also serve as a macro-economic stabiliser, accounting for a significant fraction of foreign exchange in many African countries.

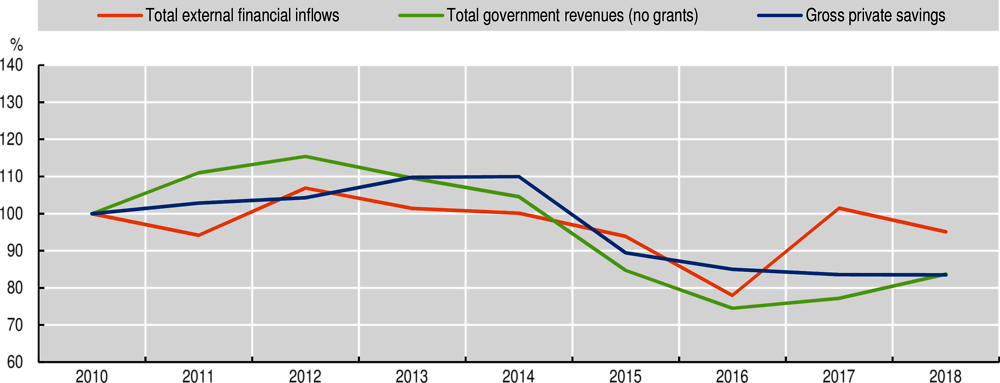

Before 2020, Africa was attracting increasing amounts of foreign direct investment (FDI), although overall FDI inflows remained much lower than in other world regions. Between 2000 and 2019, FDI flows to Africa increased fourfold, with a compound annual growth rate of 8.5%. This was due to growing demand for certain commodities, as well as sustained investments in services. In 2019, Africa received USD 45.4 billion of FDI flows. However, these amounts remained too small by international comparison. In 2017-19, Africa attracted only 2.9% of global FDI flows, compared to Asia (31.1%) and Latin America and the Caribbean (LAC) (9.9%) (Figure 8.2).

Figure 8.2. Global foreign direct investment inflows by world region, 1990-2019 (USD billion)

Source: Authors’ calculations based on UNCTAD (2020a), World Investment Report 2020, Statistical annex tables, https://unctad.org/en/Pages/DIAE/World%20Investment%20Report/Annex-Tables.aspx.

Official development assistance (ODA) to Africa has increased in recent years but has not met international commitments. ODA inflows to Africa saw massive spikes in the early 2000s through the Heavily Indebted Poor Countries (HIPC) initiative and stabilised at around USD 53 billion per year between 2014 and 2018. With the growing African population, however, ODA inflows per capita dropped from USD 52 in 2013 to USD 44 in 2018. In addition, most donors of the OECD Development Assistance Committee (DAC), with the exception of Denmark, Luxembourg, Norway, Sweden and the United Kingdom (UK), failed to match the collective ambition of 0.7% ODA to gross national income (GNI) set by the 2030 Agenda for Sustainable Development and reiterated in the 2015 Addis Ababa Action Agenda (OECD, 2020a).

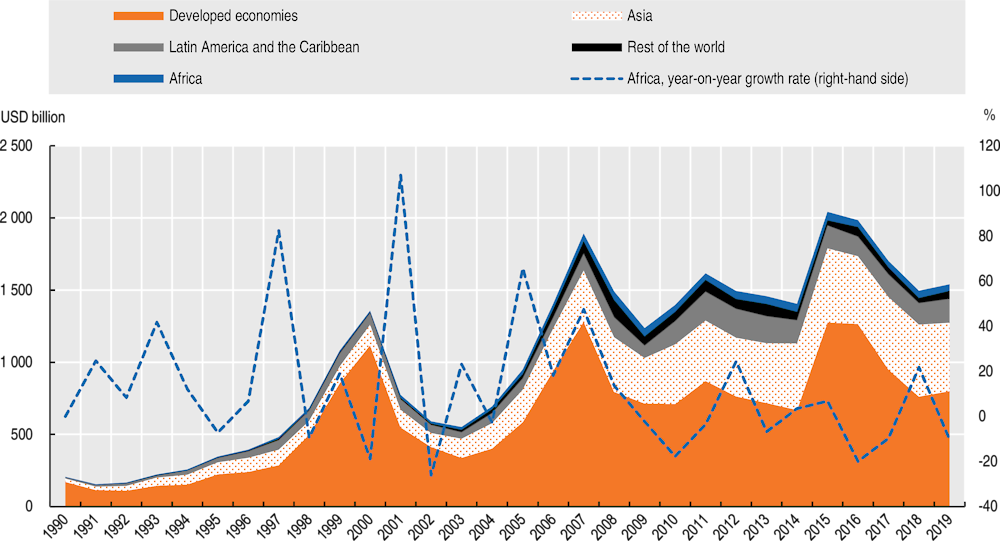

Africa is facing the COVID-19 pandemic with a limited fiscal space

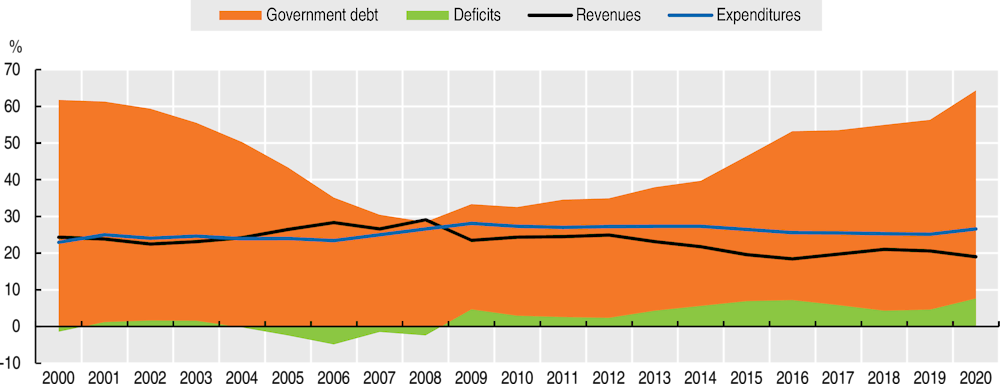

Going into 2020, African governments had increased their debt level to the highest since 2002. In 2008, Africa’s sovereign debt, public debt and debt publicly guaranteed by national governments reached a low of 28% of GDP, after declining in the early 2000s due to a combination of high GDP growth, debt relief and restraint on borrowing. By 2019, the sovereign debt had doubled to 56% of GDP, following a period in which total general government debt nearly tripled. Thus, in 2019, the total African debt as a percentage of Africa’s GDP approached that of 2000 (Figure 8.3). Today, annual revenues, which before 2008 exceeded expenditures, now regularly fall short of them.

The increased debt level since 2008 reflects both greater confidence in African economies and favourable global conditions. Africa’s sovereign debt markets gained the confidence of investors thanks to their relatively high yields, improved macroeconomic management and larger fiscal space following the HIPC Initiative. At the same time, global conditions for international bond issuances have been positive: there has been a strong demand from investors and a lower gap in perceived risks between emerging and developed markets, indicating their “search for yield” (Calderón and Zeufack, 2020). The acceleration in debt accumulation since 2015 reflects this favourable context for borrowers, as well as the growing fiscal deficit in oil-rich countries due to the sustained low prices for hydrocarbons. Total expenditures in oil-rich countries exceeded revenues by 8.7 percentage points of GDP in 2016, a reversal of ten years earlier when revenues exceeded expenditures by 13 percentage points of GDP.

Figure 8.3. African total general government debt, deficits, revenues and expenditures as a percentage of gross domestic product, 2000-20

Source: Authors’ calculations based on data from IMF (2020a), World Economic Outlook (database), www.imf.org/external/pubs/ft/weo/2020/01/weodata/index.aspx.

A number of middle-income African countries issued debts denominated in a foreign currency. The total amount of foreign currency-denominated debt nearly doubled between 2008 and 2018, from 11% of GDP to 20%, introducing new risks. Over the past few years, Eurobonds have risen in importance in Africa, surpassing USD 100 billion in value in 2019 after increasing by USD 27.1 billion in the previous year. Some countries are borrowing syndicated loans. However, borrowing in foreign currency debts places the exchange rate risks with the debtor countries – which requires sound monetary and fiscal policy frameworks to prevent the feedback loop between currency devaluations and capital outflows during a financial downturn.

Several African countries were already having difficulty in meeting their debt commitments prior to the COVID-19 crisis. As of 30 November 2019, according to the International Monetary Fund (IMF), 8 African countries were in debt distress, and 11 were at high risk of being in debt distress. In March 2020, after South Africa’s credit rating was downgraded at the end of 2019, only Botswana, Mauritius and Morocco had investment-grade credit ratings (Reuters, 2020). African governments have also been drawing from their reserve assets, which dropped from a high of 22% of GDP in 2009 to 14% in 2018.

African countries are mobilising fewer domestic resources, yet the digital transformation accelerated by COVID-19 offers new opportunities to increase tax revenues

Domestic resource mobilisation is likely to suffer due to less economic activity and lower commodity prices

The COVID-19 pandemic has been highly disruptive to domestic tax revenues in Africa since the beginning of 2020. According to the IMF (2020b), tax revenues in 22 sub-Saharan African countries are projected to decrease on average by 1.3 percentage points of GDP, or 10%, between 2019 and 2020. By comparison, between 2007 and 2010 due to the global financial crisis, the average tax-to-GDP ratio dropped by 0.8 percentage points, or 5%, in the 26 African countries where data is available (OECD, 2020b).

The plunge in domestic economic activity and international trade and the halt on tourism are suppressing major sources of tax revenues for the majority of African countries. In June 2020, the IMF (2020c) forecast that real GDP will contract by 3.2% in sub-Saharan Africa in 2020. Global trade is projected to drop between 12.9% and 31.9%, according to the World Trade Organization (WTO, 2020), and thus reduce customs and import duties for African governments, which accounted for 10.7% of public revenues in 2018. The International Air Transport Association (IATA, 2020) estimates that Africa’s air transport industry normally contributes USD 55.8 billion to the economy, or 2.6% of the continent’s GDP, supporting 6.2 million jobs. However, in the first three months of 2020, African airlines lost USD 4.4 billion in revenue due to reduced international flights and tourism.

The crisis is also having an impact on non-tax revenues by lowering demand for commodities, which translates into lower rents for resource-exporting countries. In a continent where oil rents were 4.5% of GDP in 2017, the oil price shock in the first half of 2020 is affecting the fiscal position of oil exporters. The United Nations Economic Commission for Africa estimates the losses linked to the collapse of oil prices at USD 65 billion for Africa as a whole (UNECA, 2020a). The previous time when commodity prices fell so quickly, in 2014 and 2015, 26 African countries recorded a decrease in their non-tax revenues equivalent to an average of 1.4 percentage points of GDP (OECD/ATAF/AUC, 2019). While lower prices for oil can be positive for net oil-importing African countries by reducing the import bill, these countries are harmed by lower prices on other commodities, and the overall global economic plunge.

African governments also actively deployed fiscal measures to encourage economic recovery at the expense of lower public revenues and higher spending. The OECD Centre for Tax Policy and Administration tracked 58 short-term fiscal policy measures in response to COVID-19 in 13 African countries, nearly all of them involving policies such as decreases in tax rates or delayed tax payments (see Table 8.2). However, due to the uncertainty around the depth and persistence of the COVID-19-related economic downturn, there is a high risk that both the amount of tax forgone and the cost of COVID-19 expenditures to African public finances will be higher than anticipated.

Table 8.2. Numbers of tax-related policy measures in response to the COVID-19 pandemic, 2020

|

Tax policy measures |

March |

April |

May |

|---|---|---|---|

|

Change in value-added tax rate |

1 |

0 |

0 |

|

Tax waiver |

1 |

0 |

1 |

|

Personal income tax rate reduction |

1 |

0 |

0 |

|

Corporate income tax rate reduction |

2 |

0 |

0 |

|

Tax payment deferral |

4 |

7 |

6 |

|

Tax filing extension |

0 |

1 |

0 |

|

Tax filing extension combined with tax payment deferral |

0 |

1 |

0 |

|

More flexible tax debt repayments |

1 |

2 |

0 |

|

Enhanced or extended eligibility for unemployment benefits |

0 |

1 |

0 |

|

Enhanced tax refunds |

2 |

1 |

0 |

|

Cash transfers for households |

1 |

2 |

0 |

|

Wage subsidy paid to employers |

2 |

1 |

0 |

|

Loan or guarantee scheme |

0 |

1 |

0 |

|

Other |

6 |

8 |

5 |

|

Total measures |

21 |

25 |

12 |

Source: OECD-CTP (2020), Overview of Country Tax Policy Measures in Response to COVID-19 Crisis (database), www.oecd.org/tax/covid-19-tax-policy-and-other-measures.xlsm.

The COVID-19 pandemic is disrupting private savings in Africa. In the short run, existing evidence suggests that the decreases in African incomes will be severe enough to force Africans to dip into their savings (Jordà, Singh and Taylor, 2020). In April 2020, the IMF forecast that total national savings for African countries would drop 17.8% between 2019 and 2020, after having previously forecast an increase of 7.7%. In the longer run, however, exogenous shocks such as this pandemic could increase household savings due to precautionary savings behaviour.

Box 8.1. The African Union’s leadership in combatting illicit financial flows in Africa

Illicit financial flows (IFFs) continue to drain large amounts of financial resources from the continent, with severe impacts on Africa’s development agenda. As a result, Africa is unable to recover or repatriate assets consigned to foreign jurisdictions.

The Africa Union (AU) has played an important role in the fight against financial corruption and stem IFFs from Africa. For example, it adopted (i) the recommendations of the Report of the High-Level Panel on Illicit Financial Flows, (ii) the outcomes of its 2018 theme “Winning the Fight Against Corruption – A Sustainable Path to Africa’s Transformation” and (iii) the Nouakchott Declaration on Anti-Corruption taken at the 31st Ordinary Session of the African Union, 1-2 July 2018 (African Union, 2018). In February 2020, the African Union Advisory Board on Corruption and other partners developed the Common African Position on Asset Recovery to tackle internal and external obstacles to recovering stolen assets.

With contributions from member states and other international actors such as the OECD Development Centre and the IMF, the African Union Commission (AUC) published a report on domestic resource mobilisation and the fight against IFFs and corruption (AUC, 2019). The report provides recommendations for a continental strategy, with guidelines for developing and enhancing national strategies. The AUC also works closely with the African Tax Administration Forum (ATAF) in building and strengthening the capacities of AU member states, especially in the area of reforming tax policies, digitalising the tax systems and exchanging information for tax purposes.

Furthermore, the AUC produces an annual publication with the Global Forum for Tax Transparency to combat corruption, tax evasion, money laundering, fraud, and illicit enrichment. The 2020 edition of “Tax Transparency in Africa” shows that progress has been made through the exchange of cross-border information via bilateral relationships between African countries. The number of these relationships has expanded to 3 263, compared to 2 523 in 2018. This increase has translated into significant additional tax revenues for countries. More African countries can now use the cross-border exchange of information in their tax investigations.

African governments can improve tax revenues by adapting to the digital transformation

The digital transformation has accelerated during the pandemic, offering new opportunities to mobilise public revenues in Africa in the medium and long terms.Chapter 1 provides an in-depth discussion on the various ways that digitalisation is improving the resilience of countries. Digital technologies both allow for social distancing, limiting the spread of COVID-19, and permit some workers to remain productive and to bank online, reducing the economic costs of containment. Many young and entrepreneurial Africans are ready to adopt opportunities arising from the digital transformation. Digitalisation is changing African tax bases and changing how taxes are collected and administered. However, taxing the profits of the digital economy is more challenging than taxing digital consumption and requires international co-operation.

Digitalisation is changing African tax bases and tax collection

Digitalisation offers both opportunities and challenges for public finances in Africa. The opportunities are most obvious in tax administration, where digitalisation can potentially improve both compliance and enforcement as well as reduce burdens. Digitalisation can also increase transparency and accountability of the tax system, which can help build trust in the system and hence compliance. At the same time, there are a number of challenges related to tax policy. Governments need to adapt their tax bases to economies where an increasing number of goods and services are bought and/or consumed virtually and where companies no longer have to be physically present in a country to be part of the local market.

Addressing these opportunities and challenges will require a combination of responses at both the domestic and international levels. Taxes are largely a domestic matter, and putting in place effective domestic laws and capacity will remain a cornerstone of taxation in the digital age. The laws must also promote human rights, including the freedom of speech, in line with the African Charter on Human and Peoples’ Rights. The international dimension of taxes will increase, however; in tax administration, sharing experiences and best practices can help ensure that the gains of digitalisation are realised quickly. International co-operation is vital in tax policy to efficiently tax highly digitalised companies.

Rapidly expanding e-commerce is a significant potential base for value added taxes (VAT). VAT is the largest single source of tax revenue in Africa, providing 29.4% of revenues in 2017 (OECD/ATAF/AUC, 2019). Effective VAT collection on e-commerce will be important to ensuring the competitiveness of the VAT system and the sustainability of VAT revenues. The African e-commerce market is already worth USD 27 billion and is expected to grow by over 14% a year, to reach USD 47 billion by 2024 (Statista, 2020). While much of this will be new consumption from Africa’s growing middle class, there will also be a shift from physical commerce to e-commerce as seen elsewhere in the world. Collecting VAT on online sales is therefore important to generate revenues from the new activity and to preserve revenues from current activity that will move online in the future. African countries can learn from recent international experiences on tax collection on e-commerce to compensate for lost VAT revenues.

There are a number of challenges to securing VAT on e-commerce, especially when the supplier is based in another jurisdiction. Traditional VAT rules make it difficult and complex to organise, administer and enforce VAT on online sales of digital products and services (e.g. applications, on-demand television), particularly to private consumers from suppliers abroad. In many countries, the laws and procedures are not in place to collect VAT on sales made by suppliers that are not physically present in the consumer’s country. The volume of imports of low-value goods purchased online continues to rise. This presents VAT collection challenges under the traditional customs procedures and can lead to considerable VAT revenue losses. It can also create unfair competitive pressure on domestic businesses that are required to charge VAT on their sales, while low-value imports are often exempt from VAT. In addition, higher value items are vulnerable to fraudulent undervaluation and miscategorisation by foreign suppliers.

Internationally agreed OECD standards provide examples of solutions for African countries for the effective collection of VAT on e-commerce. The OECD Global Forum on VAT (comprising over 100 countries) has developed standards to address the VAT challenges linked to the digitalisation of the economy; they have been implemented or are being implemented worldwide (OECD, 2019a; OECD, 2017a).1 South Africa is one of over 50 countries that have implemented the standards on cross-border supplies of digital services, raising significant revenues (South Africa raised over ZAR 5 billion − approximately USD 276 million − between June 2014 and September 2019). Recognising that online marketplace platforms facilitate a large proportion of online sales, the OECD recommends involving them in the VAT collection process. African countries can benefit from others’ experiences in implementing these standards. Most of the major platforms (responsible for the majority of online sales) have already developed systems and processes to comply with the standards.

The digital economy in Africa demands new tax policies and international co-operation

Taxing the profits of the digital economy is complex and requires international co-operation. As the global economy has become digitalised, some people have raised concerns that the traditional rules do not adequately reflect substance and value-creation. These rules base taxing rights on physical presence in a jurisdiction and allocate profits according to the “arm’s length principle”. Highly digitalised businesses that can operate remotely and those which rely heavily on interactions with markets or with users and their data are therefore not affected by traditional rules. Addressing these concerns will require significant changes to the existing approach to taxing multinational enterprises. International agreements will be necessary to avoid a proliferation of unilateral measures that would inevitably lead to an increase in disputes, double taxation and a lack of certainty for businesses.

The Inclusive Framework on Base Erosion and Profit Shifting (BEPS) is bringing together over 135 countries and jurisdictions, including 23 African countries, to develop solutions on taxing the digitalising economy. Negotiations, with all members on an equal footing, are ongoing in 2020. These negotiations focus on two pillars. The first would create a new taxing right for market jurisdictions, while simplifying the taxation of the profits from certain routine functions of multinational enterprises (OECD, 2020c). The second pillar would ensure the profits on multinational enterprises are subject to a minimum rate of tax to reduce the incentive for companies to adopt aggressive tax avoidance strategies. Both of these pillars offer potential gains for Africa. While the impacts are difficult to predict accurately before the exact policies are known, early estimates suggest that, in relative terms, low-income countries would benefit from both pillars (OECD, 2020d).

Some African countries are experimenting with other approaches to taxing key parts of the digital economy. For instance, as mobile money and mobile communications have expanded dramatically in Africa, a number of countries have proposed or implemented specific taxes to attempt to capture some of the value. Examples include taxes on mobile money transactions and on the use of specific Internet communication applications. On average, sub-Saharan Africa has the highest sector-specific taxes and fees in the mobile telecoms sector (ODI, 2020). Some of these taxes have been controversial. Taxes on mobile money have been accused of slowing progress on financial inclusion, and taxes on Internet communication have been suspected of being a cover for restrictions on free speech (Brookings, 2019; Ratcliffe and Samuel, 2019). Moreover, these taxes often end up falling on consumers, rather than digital companies, which can make them politically unpopular and prevent them from achieving their stated policy objectives.

African countries will have to balance the trade-offs in tax policy between raising revenues for short-term benefits and encouraging faster and broader digitalisation for longer-term benefits. African governments will need to tax the digital economy for several reasons: (i) from a financial perspective, to mobilise much needed domestic resources, as an ever-increasing part of the economy becomes digitalised; (ii) from an equity perspective, to ensure a level playing field between businesses; and (iii) from a political perspective, to respond to citizens’ questions over foreign companies making profits from their personal data. However, governments need to carefully consider how to impose taxes so as not to negatively affect consumers, particularly the poorest, or to risk impeding innovation or the spread of the benefits of digitalisation. While these trade-offs are universal, they could be more keenly felt in Africa. It will be important to identify the new sectors of the digital economy where the highest profits are being made, competition being distorted, or loopholes in the existing tax system are being exploited and to target these. Continued engagement at the international level can help African countries both learn from others and ensure that new international standards reflect the needs of African countries.

Digital technologies are bringing improvements to tax collection and administration

While digitalisation poses a number of challenges to tax policy, it offers significant opportunities in tax administration. Many tax administrations are increasing their efficiency and effectiveness by moving to e-administration and using new technology tools both to enhance compliance and to reduce burdens for taxpayers by improving services (OECD, 2019b) The new digital options and the availability of off-the-shelf software can offer African countries opportunities to make swift gains.

Some African countries are making significant advances in digitalising their tax administrations, though many others have yet to realise the full benefits. Online return filing is fast becoming the norm in countries across the globe, including in some African countries. For the 2017 fiscal year, the International Survey on Revenue Administration showed six African countries reporting online filing rates of 70% and above for corporate income tax and VAT and five reporting online filing rates above 50% for personal income tax.2 The data indicated that most African countries had some provision for e-filing but that around 25% had none. More broadly, most African countries have yet to make full use of digital tools to help with tax compliance, with only half providing online tools and calculators and 20% offering mobile applications (OECD, 2019b).

A number of challenges can prevent African governments from making the most of the digital transformation in tax administration. These include the reliability of the Internet, the availability of resources for investing in information and communications technology (ICT) in tax administration, and taxpayers’ understanding of and access to e-services (especially in rural areas with skills shortages) (Wilton Park, 2017). Providing access to reliable Internet connections requires a broad response, while other challenges ultimately relate to strategy and the management of digitalisation.

Peer learning across tax administrations can help address some of these challenges. Learning from other countries’ successes and failures can provide valuable assistance in areas such as matching digital solutions to the digital maturity of taxpayers, ensuring budgets are set for the medium term, providing for technology maintenance and upgrades, and undertaking cost-benefit analyses to determine whether to develop solutions in-house or to outsource tax software development. The ATAF provides a regional network for 38 African tax administrations, offering training, guidance and research on all aspects of tax administration, including digitalisation. African countries can also learn from countries on other continents that have already digitalised, to help increase the speed and effectiveness of digitalising their own tax administrations.

Public policies and international co-operation can help mitigate the expected drop in external financial inflows due to COVID-19

Reducing the cost of sending remittances is vital at a time when remittances inflows to Africa are set to plunge

Remittances to Africa may not prove as resilient during the COVID-19 crisis as in past crises. Africans who work on other continents have been particularly vulnerable to a loss of income. Due to the confinement policies related to COVID-19 (Guermond and Kavita, 2020; Morris, 2020), income available for remittances has been limited. For example, 36% of remittances to Africa in 2017 came from the European Union, where many countries were locked down for part of 2020. Furthermore, North Africa receives a large share of remittances from the Middle East, which was severely hit by the slump in oil prices. The World Bank (2020b) expects remittances inflows to sub-Saharan Africa to drop by 23.1%, to USD 37 billion, in 2020 – the lowest level since 2016.

Reducing the costs of sending remittances will be crucial both during the COVID crisis and after it. In the first quarter of 2020, sending a remittance of USD 200 to sub-Saharan Africa cost on average 8.9% of the remittance amount, compared to 5% for South Asia and 6% for LAC. For some intra-African corridors, the transaction cost was 20%, the highest in the world (World Bank, 2020b). By contrast, Sustainable Development Goal 10.c calls for reducing remittance costs to below 3% and eliminating remittance corridors with costs above 5%. Reducing the costs could increase remittance flows to recipient countries and save around USD 14 billion a year (Ratha et al., 2016). The World Bank estimates that, in the next decade, the amount of money that Africa’s diaspora sends home could grow to USD 200 billion a year, if remittance costs decrease.

Greater competition between money transfer operators (MTOs) could reduce remittance costs. Three MTOs – MoneyGram, Ria and Western Union – make up 25% of the global market and much more of some bilateral remittance flows (IFAD, 2017). Regulators can increase market competition by discouraging exclusivity conditions and promoting fair and equitable access to the market infrastructure. Likewise, non-discriminatory access for MTOs to infrastructure for payment systems, as well as to mobile network platforms, can improve the efficiency of money transfers and result in better quality services available to consumers (World Bank, 2018). After Ghana and Morocco encouraged banks, foreign exchange markets and post offices to partner with more than one MTO, remittance costs declined, and consumers in both the sending and receiving countries benefited from increased service options.

New digital technologies, such as mobile money and blockchain, are lowering the costs of sending remittances. According to the World Bank, digitalised transactions had already reduced the global average cost of sending remittances to 3.3%, and the GSMA expects the average cost to reach as low as 1.7% thanks to mobile money (World Bank, 2020c; GSMA, 2018). Numerous financial technology (fintech) models now provide remittance services on the continent. In Ghana, Zeepay aims to reach more than 150 million mobile money users across 20 African countries and recently began collaborating with MoneyGram. In Nigeria, Sure Remit charges 0-2% for non-cash remittances. In place of cash, recipients are given blockchain-based tokens. These can be used for a variety of purposes, such as to purchase and send vouchers, acquire airtime, pay bills and buy groceries.

Channelling remittances towards longer-term productive investments is also essential. As remittances come from individual savings, the recipients tend to use the money more for household consumption than to invest it. But remittances could become a source of capital for small and home-based businesses or serve as seed money for start-ups, if African governments create policies that encourage African diaspora to support them. Evidence from a 2017 OECD survey shows that remittance recipients in Côte d’Ivoire and Morocco were significantly more likely to invest in agricultural assets and to own an off-farm business (OECD, 2017b). In Senegal, the probability of a household having a loan increased by 11.8 percentage points when it received remittances (Mbaye, 2015). Increasing financial literacy and entrepreneurial skills, especially for women in communities with high emigration rates, will be important to ensure that these remittances can be used in the most efficient way. In Morocco, for instance, 42% of households receiving remittances are female-headed compared to 12% for non-recipient households (OECD, 2017b).

Diaspora bonds can create a pool of funds to finance major projects, but their issuance requires careful design to attract investors. Since 2000, only five countries − Ethiopia, Ghana, Kenya, Nigeria and Rwanda − representing 12% of total African migrants, have issued diaspora bonds, i.e. bonds specifically targeting untapped savings from their diaspora, with mostly disappointing results.3 Going forward, the persistently low interest rates in high-income markets could increase the attractiveness of such products. To successfully issue diaspora bonds requires careful planning, regulatory approval in key high-income jurisdictions where large migrant populations live and competitive pricing. Following these principles, Nigeria managed to raise USD 300 million in 2017 to finance a range of infrastructure projects. Investor’s confidence in Nigeria’s economy and the innovative structure of its five-year bond, which targeted both diaspora and non-diaspora investors, led to its oversubscription, by 130%, despite a low interest rate of 5.6%. To encourage African diaspora to purchase the bond, the government designed it as a retail instrument denominated in United States (US) dollars to avoid concerns related to exchange rate risks. Nigeria also registered the bond in the UK and US jurisdictions (Rustomjee, 2018). International institutions could support African countries’ issuance of diaspora bonds by helping to assess diaspora savings and investment potential and developing new risk-mitigating instruments (Rustomjee, 2018).

The global investment slowdown is affecting Africa’s economies, but the reorganisation of value chains offers new opportunities

Africa’s least diversified economies will be hit the hardest by the global investment slowdown caused by COVID-19

The decline in global FDI flows due to the COVID-19 pandemic will have the most adverse effects on Africa’s least diversified economies. FDI flows to Africa are expected to drop by 25% to 40% in 2020 due to the COVID-19 global crisis. A similar decline is projected in Asia, while investment flows to Latin America and the Caribbean are expected to halve in 2020 (UNCTAD, 2020b). The three largest African economies (Egypt, Nigeria and South Africa) were among Africa’s top five recipients of FDI in 2017-19, at 18%, 10% and 9% respectively. A low sectoral diversification of FDI exposes countries to declining investment flows. For example, in Egypt, FDI flows registered the largest drop in Africa4 between 2007 and 2009, during the global financial crisis (UNCTAD, 2020a). On the other hand, FDI in South Africa is more diversified than in Egypt, with about two-thirds in manufacturing and services (e.g. finance and transportation services) at the end of 2018, and could thus rebound more quickly from the downturn caused by COVID-19 (South African Reserve Bank, 2020). The Republic of the Congo and Mozambique depend on FDI for more than 20% of their GDPs5 mainly invested in oil and mining and are thus among the most vulnerable African countries to a sharp decline in oil prices and a prolonged halt on investment activity.

Investment support and trade facilitation policies can help mitigate the investment slowdown brought about by the 2020 global recession. Priorities for the short term should be mitigating supply chain disruptions with financial or fiscal support for domestic suppliers, ensuring investment aftercare that supports existing investors during the crisis and facilitating industrial reconversions.6 Trade facilitation policies are also important because foreign companies could be affected by export bans that many countries adopt for public health and national security reasons. The Southern African Development Community has proposed a number of trade facilitation initiatives, including prioritising the clearance and transportation of essential goods and services, automating the submission and approval of trade documents, and accelerating the use of online platforms for the submission of applications, renewals for licences, etc. (World Bank, 2020c).

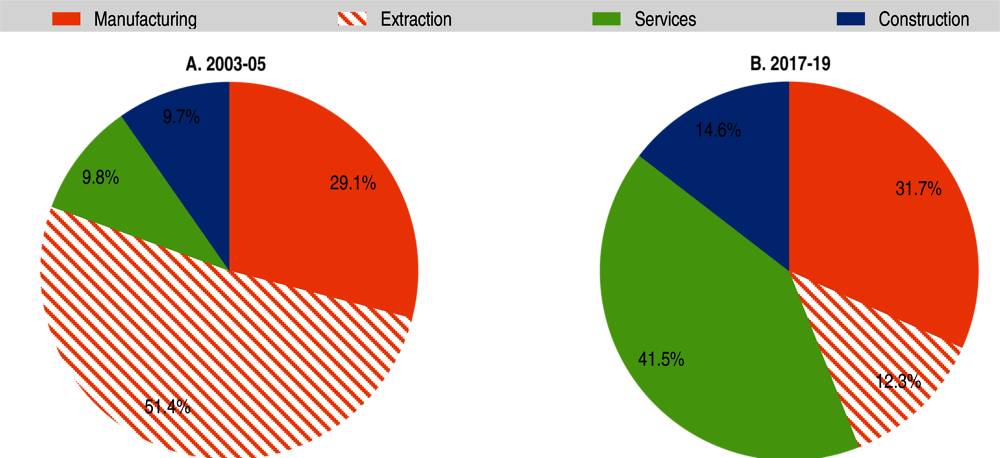

FDI in Africa is shifting from the extractive sector to services, while the share in manufacturing generally has remained stable. FDI in the extractive sectors decreased from 51.4% in 2003-05 to 12.3% in 2017-19. It increased in the services sectors from 9.8% to 41.5% over the same period (Figure 8.4). In recent years, the emergence of new technologies and the booming domestic consumption markets attracted new market-seeking FDI in Africa in retail, ICT, financial services and other consumer services. An increasing numbers of investors wished to gain proximity to growing African markets and to relocate their activities to increase efficiency in these sectors. In contrast, investment in manufacturing failed to take off, mainly due to high tariffs and costs of doing business and production as well as insufficient business infrastructure (UNCTAD, 2016a). A noteworthy exception remains Ethiopia, where FDI has been increasingly concentrated in manufacturing sectors, such as textiles, largely due to investment attracted by the country’s industrial parks (EIC, 2019).

Figure 8.4. Foreign direct investment capital expenditures in Africa by economic activity

Note: Percentage of total FDI capital expenditures; average over the period.

Source: Authors’ calculations based on FDI Markets (2020), fDi Markets (database), www.fdimarkets.com.

New investment opportunities could arise from the reorganisation of global value chains

Multinational enterprises are likely to adjust the geographic and sectoral allocation of their foreign operations following the COVID-19 pandemic. The COVID-19 crisis has pushed companies to give more consideration to resilience with respect to global and local shocks (e.g. pandemics, climate change) in their decisions about production locations (Seric et al., 2020). In a recent World Economic Forum survey of senior supply executives of global multinational enterprises across all industries, “increasing visibility”, “improving risk assessments” and “increasing flexibility to a changing demand” were consistently ranked as the top three priorities once the crisis is over (WEF, 2020). Meanwhile, leading government politicians in advanced economies have called for companies to consider moving certain production activities in key sectors back to home countries.7

African economies could benefit from attracting new FDI following the reorganisation of global value chain structures. Coming out of the supply shock induced by the coronavirus, some multinational enterprises may wish to diversify their global supplier networks to increase resilience to location-specific shocks. At the same time, the reorganisation of global production networks, induced by the COVID-19 pandemic, could lead multinationals to shorten supply chains in developing economies, adversely affecting the industrialisation of least developed countries. The creation of a single African market, cost competitiveness and a growing working-age population could potentially make Africa an attractive investment destination for multinationals looking to diversify away from China-centric production chains (Paterson, 2020). However, local suppliers in Africa will need support to upgrade their productivity and capability in order to make meaningful linkages with the lead multinationals and facilitate the transfer of technology.

The growing momentum in the health and fintech sectors could make Africa more appealing to FDI. Africa relies on external suppliers for more than 90% of its medications. Manufacturing pharmaceuticals locally and improving healthcare could attract new market-seeking foreign investors who may be more likely to integrate into domestic economies. For example, in Senegal, DiaTropix is rapidly developing COVID-19 diagnostic kits with the support of a UK firm (Mologic); their joint manufacturing process could be scaled up to meet demand from the entire continent (UNCTAD, 2020c). Africa’s e-commerce giant, Jumia, declared a surge in the demand for medical supplies due to COVID-19 restrictions and has offered for African governments to use its last-mile delivery network for distribution to healthcare facilities and workers (Bright, 2020). The health crisis is likely to accelerate the trend to invest in fintech as more people stay at home and manage their finances digitally (African Business, 2020).

Implementing complementary policies can help to guide post-COVID foreign direct investment towards development goals

African governments, development partners and multinationals can co-ordinate an investment policy response to the crisis. The response should focus on the most strategic sectors for building future resilience (e.g. healthcare, pharmaceuticals, education, ICT) as well as industries with a strong export potential (e.g. agri-business, automotives, textiles). Developing multi-stakeholder platforms involving the private sector, African governments, civil society and international partners could contribute to co-ordinating FDI and other financial flows across sectors and African countries.

The African Union and its member states could immediately introduce trade facilitation measures on essential goods in reaction to the pandemic while accelerating the African Continental Free Trade Agreement (AfCFTA). The Brookings Institution (Brookings, 2020) estimates that the immediate implementation of the AfCFTA (i.e. the removal of 90% of intra-African tariffs) coupled with a 10% reduction in trade costs among African countries would reduce the anticipated decline in GDP during the COVID-19 crisis by 3.6 percentage points. The elimination of tariffs under the Agreement could support market-seeking FDI, as foreign investors tap into a larger and increasingly integrated market. In particular, higher trade integration could boost intra-regional greenfield FDI, currently at only 7% of investment flows to Africa compared to 50% in Asia and 14% in LAC (AUC/OECD, 2019).

The COVID-19 crisis has accelerated initiatives in certain sectors such as those related to mobile payments,digital health and e-education. Central banks have allowed zero fees on digital payments to encourage the use of mobile money over cash, while free e-learning platforms have surged across Africa with the support of governments working with telecom companies (Reiter, 2020).8 Public-private partnerships and new investment opportunities should now be established to scale up these initiatives and increase digital inclusion in essential services.

Stronger international co-operation will be crucial to maintain official development assistance

Safeguarding ODA will be vital to weather the challenges presented by the COVID-19 crisis. In the past, ODA budgets have proven resilient in the face of recessions; for example, they increased in 2009 and 2010 despite the global financial crisis of 2008. Bilateral ODA to Africa reached USD 27 billion in 2009 (29.3 billion in 2010), representing an increase of 3% in real terms over 2008 (and 3.6% over 2009) (OECD, 2010; OECD, 2011). In April 2020, the OECD-DAC members pledged to protect ODA budgets, to promote other financial flows to support governments and communities in partner countries, and to invite development co-operation partners to do the same (OECD-DAC, 2020b). The pandemic’s negative effect of donors’ budget constraints on ODA could be postponed since many 2020 budgets were already finalised before the crisis hit (OECD, 2020b).

ODA represents a crucial source of finance for many African countries, especially the least developed. Indeed, the least developed countries (LDCs) have few financing alternatives to ODA. In 2018, for instance, ODA represented 52.6% of total external financial inflows for all of Africa’s LDCs and more than 10% of GDP for 13 of them. For countries in fragile contexts, like the Central African Republic, Somalia and South Sudan, ODA represented over 25% of their GDPs the same year. In contrast, ODA accounted for only 11% of total financial inflows for middle-income countries, yet 41% of total net ODA inflow targeted these countries. In light of the COVID-19 crisis, donors will need to ensure that ODA reaches the neediest countries.

In light of the current crisis, development finance institutions (DFIs) could provide alternative strategies to reducing the perceived riskiness of private investment in Africa. For instance, blended concessional finance (i.e. combining concessional funds from DFIs with commercial financing from the private sector) could be used to attract investments to the hardest-hit sectors, such as agriculture, health, water and sanitation, or to projects with strong developmental impacts, such as infrastructure. In 2018, DFIs used USD 1.1 billion in concessional funds to unlock more than USD 8.7 billion of private sector projects in developing countries (IFC, 2019). In the medium to long term, reassessing existing blended finance models will be key to increasing support for sustainable development, given the large pool of private finance that could be leveraged. Enabling financial regulations could unlock an estimated USD 12 trillion of commercially viable market opportunities and significantly contribute to achieving the Sustainable Development Goals (Business and Sustainable Development Commission, 2017).

Co-operation with new donors could change considerably following the COVID-19 crisis. Certain new donors such as the Gulf states and India could face budget difficulties due to the impact of low commodity prices and the COVID-19 pandemic. In recent years, China’s role, in particular in Africa, has increased. China’s global Belt and Road Initiative (BRI) involves no less than 44 African states. The country’s foreign direct investments in Africa reached a high of USD 5.4 billion in 2018, surpassing its investments in LAC (USD 1.9 billion) and the Middle East (USD 2 billion) (The Economist, 2020). Along with this increase, criticism arose in the international community. Lin and Wang (2017), for instance, cited lack of transparency, wide use of tied aid, few local employment opportunities created, and weak labour and environmental standards surrounding China’s investments. In the future, using these financing opportunities to their full potential will require strategic planning and a co-ordinated approach from African governments to ensure that Africans are not bound to long-term commitments that run against their national interests (Calabrese, 2019; Calabrese and Xiaoyang, 2020).

Debt restructuring and reforms are necessary to free up critical development financing in the short term and ensure future debt sustainability

Debt restructuring is needed to allow the fiscal space for African governments to respond to the health and economic impacts of COVID-19

African governments face an immediate twin challenge of financing the health policy responses to the COVID-19 pandemic and of mitigating the economic crisis and supporting people’s livelihoods. The recovery may take years, given the global scope and long duration of the pandemic; the resulting dislocation of people, capital and supply chains; and the potential for international travel and other trade restrictions to remain in place for long periods (Hughes, 2020).

Deteriorating financial conditions, reduced fiscal space and lower external demand following the COVID-19 crisis will constrain governments’ ability to mitigate the economic impact of the crisis. The IMF projects that the fiscal deficit in sub-Saharan Africa will almost double from 4.4% of GDP in 2019 to 7.6% of GDP in 2020, because of lower tax revenues combined with new public spending to face the effects of the crisis. Both oil-exporting and oil-importing countries will suffer from this widening fiscal deficit (IMF, 2020c). In addition, the pandemic brought external private demand for African debt to a halt. Private investments stopped, certain foreign investors withdrew their investments at the beginning of 2020 and yields on African bonds rose. Lockdowns in major economies halted activity in global value chains, eliminating the demand for African raw materials and putting major investment projects on hold.

In the short term, debt restructuring is critical because many countries are spending more on repaying their debt obligations (i.e. servicing their debts) than on mitigating the crisis. In June 2020, African governments announced fiscal packages with an average size of 3% of GDP, a quarter of which is dedicated to health spending. In contrast, African countries spent an average of 3.9% of GDP on debt services in 2018. In that year, at least 15 African countries had government debt service costs that amounted to over a quarter of their revenues (Figure 8.5). That same year, the governments of Angola and South Sudan paid more debt service costs than they received in revenues. Furthermore, recent currency devaluations in the wake of the COVID-19 crisis make servicing the foreign currency-denominated debts more difficult. International co-operation to relieve governments of such financial duties is critical to ensuring that they have the resources necessary to respond to the immediate health and economic crisis.

Figure 8.5. General government gross debt as a percentage of gross domestic product and government debt service as a percentage of revenues, 2018

Source: Authors’ calculations based on data from IMF (2020a), World Economic Outlook (database) www.imf.org/external/pubs/ft/weo/2020/01/weodata/index.aspx.

Timely debt restructuring is necessary to ensuring debt sustainability, i.e. the ability of African countries to meet their debt service obligations. The average debt-to-GDP ratio in sub-Saharan African countries is expected to increase by 7.3 percentage points in 2020, to reach 64.8% of GDP; this is due to the larger fiscal deficits, currency devaluations and GDP contractions in most countries (IMF, 2020c). If African countries were to implement the same fiscal policy measures that the largest economies in the European Union (EU) have applied in the crisis up until March 2020, “all other conditions remaining equal, Africa’s government debt-to-GDP ratio would increase to about 85%” (OECD, 2020e). A swift restructuring could prevent debt-distressed countries from increasing their debts to the point of being unable to repay them due to disrupted access to finance and to capital flights. Furthermore, decisive and timely policy actions would help to contain the impact of the health and economic crisis to enable a faster recovery – which would allow countries to repay the debts more quickly.

The nature of the COVID-19 crisis means that there is no risk of moral hazard for a debt restructuring. Through the Addis Ababa Action Agenda in 2015, Africa and its development partners committed to debt rescheduling, cancellation and other measures for debt restructuring following severe shocks such as pandemics and natural disasters. Due to the highly exceptional and exogenous nature of the COVID-19 pandemic, any debt restructuring does not constitute a moral hazard of African governments’ not repaying their debts. This idea relates to the doctrine of necessity in international law that applies in very specific, extreme circumstances, where the urgent needs of the population may take precedence over certain legal obligations (Bolton et al., 2020).

Africa would benefit from presenting a unified voice in any debt restructuring. The smaller African countries have little economic clout in debt restructuring discussions, but at 2-3% of global GDP, Africa as a continent might. In April 2020, the African Union appointed five special envoys to negotiate debt cancellation with the G20, IMF, World Bank, EU and other international organisations in response to the pandemic. In a bid to relieve the pressure on the continent’s fiscal and monetary authorities, African ministers of finance called for a waiver of interest payments on all public debt and sovereign bonds in 2020 (UNECA, 2020b). The complexity and high cost of sovereign debt restructuring contributed to the need for African countries to combine resources.9 The important yet opaque role of legal and financial sovereign advisors calls for a careful selection process based on public procurement measures (UNCTAD, 2019). It also requires strengthening the capacity of African governments and organisations to develop their own legal and financial expertise to ensure competitive bidding.

Debt restructuring must include private and non-traditional creditors

Private creditors are behind an important share of Africa’s sovereign debt, as several of the continent’s middle-income countries have raised funds through the international commercial debt markets. Private lenders accounted for 39% of lending to African governments in 2018, up from 24% in 2008. Increased private credit has generally gone to middle-income countries. South Africa’s total private external debt declined from a high of 57% in 2010 to 41% in 2018, as lower-middle-income countries such as Côte d’Ivoire, Senegal and Zambia increased their share of borrowing from private sources. In contrast, low-income countries continued to rely mostly on official and concessional loans (World Bank, 2020d).

All creditors, including private ones, need to be included in debt relief programmes in order to avoid free-riding and perverse incentives. Without private creditors’ participation, this financial assistance could end up servicing sovereign government commercial debt, rather than social and medical needs, thus undermining the justification for the programmes. Private creditors would free-ride on the official creditors’ support in this case. In addition, if some creditors do not participate in these programs, each debt relief measure provided by one participant could increase the ability of the debtor country to repay its remaining debts, thereby increasing the financial incentive for creditors to hold out for full repayment (the hold-out problem).

Obtaining private sector participation in restructuring debts depends on the veto power that individual or minority creditors have over proposed negotiations. In general, creditors tend to hold out longer for smaller outstanding amounts and when they hold bonds without collective action clauses (CACs) or older type of CACs10 that are less favourable to the debtor country (Fang, Schumacher and Trebesch, 2020).

African governments can use the new CACs to avoid holdouts. Newer bonds tend to enable a qualified majority of holders of a specific bond issuance (typically 75%) to bind the minority to the terms of a restructuring. Of the USD 62.3 billion worth of international sovereign bond issued by African countries since October 2014, all but USD 1 billion worth (issued by Côte d’Ivoire) are covered by this kind of enhanced CAC (Fang, Schumacher and Trebesch, 2020). Countries should not be discouraged from activating this type of clause. Recent research highlights that private investors prefer the more orderly and efficient debt resolution process brought out about by CACs (IMF, 2019).

Inaddition, African countries have a number of instruments they can use to encourage creditor participation in debt restructuring.Table 8.3 highlights several incentives and threats that can serve this purpose. For example, Vallée and Pointier (2020) suggest that countries can offer for private debtors to exchange their existing shares for new credit at a lower rate and with a longer maturity period. The private debtors should be guaranteed by a highly esteemed development institution or group of institutions.

Table 8.3. Examples of incentives and threats to encourage foreign creditor participation

|

Instrument |

Description |

Example |

|---|---|---|

|

Incentives |

||

|

Cash or equivalent |

Cash or highly liquid assets used to pay down the outstanding principal, to reimburse accrued but unpaid interest, or to pay participation fees to the creditors joining the restructuring |

Russia (2000): Replaced debt owed by a state-owned bank with Eurobonds owed directly by the Russian government and issued under foreign law |

|

Value recovery instruments |

Instruments to recover some portion of the financial sacrifice that private creditors will have endured in the debt |

Nigeria (1980s): Offered warrants indexed on oil prices to creditors using Brady bonds to restructure their debts |

|

Parity of treatment undertakings |

A covenant promising that other lenders will not be given preferential treatment |

HIPC Initiative (1989-present): Required that the discount applied to commercial creditors be comparable to that offered by bilateral creditors (average discount price of 8.3 cents on the US dollar) |

|

Principal reinstatement features |

Features that allow lenders to renegotiate their original claims if a debtor country seeks another round of restructuring of the debts that led to the previous debt crisis |

Seychelles (2010): Agreed to restore the principal to its creditors if it failed to implement its IMF programme |

|

Credit enhancement |

An enhancement in the value of restructured bonds through a partial guarantee of amounts due under bonds or collateral securities issued by a creditworthy third party or the borrowing government |

Seychelles (2010): Provided a partial guarantee to its new restructured bonds issued by the African Development Bank |

|

Contractual improvements |

An instrument allowing the correction of legal protections attached to the original debt instrument that is being restructured |

Greece (2012): Offered participating holders new bonds governed by English law instead of local law |

|

Threats |

||

|

Collective action clauses |

Clauses that enable a qualified majority of bondholders of a specific bond issuance (typically 75%) to bind the minority of the same issuance to the terms of a restructuring |

Uruguay (2003): Permitted, through an aggregated CAC, all holders of all affected instruments to vote on a proposed restructuring, while preserving a vote in each bond issuance, albeit with a lower voting threshold (66.6% rather than 75%, provided that 85% of all affected issuances approved the exchange) |

|

Trust structures |

Centralisation of enforcement powers in the hands of a trustee |

Global: Issuance of most international sovereign bonds under either fiscal agency agreements or trust structures |

|

Protection of assets |

Protection from the seizure of a country’s assets by judgment creditors |

Iraq (2003): Benefitted from a UN Security Council resolution immunising all Iraqi oil sales, as well as the cash proceeds from the sale of that oil, from any form of attachment, garnishment or execution |

Source: Adapted from Buchheit et al. (2019), “How to restructure sovereign debt: Lessons from four decades”.

Non-traditional official creditors also must be involved in the negotiations. Lending from non-traditional creditors, such as China, India, Saudi Arabia, the Islamic Development Bank and other financial institutions in the Gulf, has increased sharply in recent years. According to data from the China Africa Research Initiative, China accounts for an estimated 22% of sovereign debt stock and 29% of debt service for 22 low-income African countries. In Angola, Cameroon, Djibouti, the Republic of the Congo, Ethiopia, Kenya and Zambia, lending from China represents more than a quarter of their publicly-guaranteed debt (CARI, 2020). Recent research demonstrates that China’s loans tend to have shorter grace periods and maturities and higher interest rates than loans from the World Bank; this could make the borrowing countries more vulnerable to debt distress due to short-term economic volatility (Morris, Parks and Gardner, 2020). As of 10 July 2020, China agreed to take part in the G20 debt relief initiative, suspending debt service until the end of 2020. The country also pledged to provide USD 2 billion, mostly to developing countries and presumably in the form of foreign aid, over the next two years to help with the COVID-19 response and with economic and social development in the affected countries, especially developing countries (Brookings, 2020).

Reforms in debt and public finance management are vital for long-term debt sustainability

African countries would benefit from improving their debt management and transparency

African governments need to strengthen their capacity to manage their debts. According to the World Bank’s Debt Management Performance Assessment, less than half of the 22 African countries assessed fulfil the minimum requirements for sound international standards in the legal framework for debt management. So far, the lack of comparable data and transparency hinders the debt sustainability analysis and the assessment of fiscal risks, thus increasing the probability of debt vulnerability. In this context, international financial institutions such as the World Bank and the IMF could provide technical assistance and develop tools to build African countries’ capacity to record, monitor and report their debts.

Debt transparency is necessary to reduce fraud and corruption, and help African authorities assess their debt sustainability. Recent cases of hidden debts in the Republic of the Congo, Mozambique and Togo highlight weaknesses in legal frameworks, debt reporting and monitoring processes. Horn, Reinhart and Trebesch (2020) estimate that certain African countries did not declare to the IMF or World Bank 50% of their debts to China. As the characteristics of debts are changing rapidly (e.g. non-Paris club official and private lenders are on the rise, and the use of complex collateralised loans is increasing), debt management authorities need to better assess the full costs and risks of debts.

Some countries, such as Chile in Latin America and Botswana, have implemented fiscal and debt rules that commit policy makers to work against the fluctuations of economic cycles, but the effectiveness of these rules depends on the context. Chile bases its spending decisions on smoothed revenue forecasts to avoid temporary commodity price shocks having an undue influence on its economy (Konuki and Villafuerte, 2016). Botswana adopted a rule stating that only non-mineral revenues can be used to fund current expenditures and that the more volatile mineral revenues fund investments go into a savings fund (called the Pula Fund) which the central bank manages. Such rules, however, require both political commitment by officials and buy-in from political factions and institutions, which depend on relationships of trust and the alignment of all parties’ interests.

Over the longer term, African countries would benefit from moving from debt management to balance-sheet management of the public sector to monitor government assets and non-debt liabilities. Better management of public assets and non-debt liabilities (e.g. pensions) would have several advantages. First, it would significantly improve fiscal policy making and strengthen the efficiency of public investment, as countries could anticipate future fiscal pressures and risks. In the context of the COVID-19 crisis, for instance, financial obligations of state-owned enterprises could migrate to the central government balance sheets as contingent liabilities and add to the debt burden. Second, countries with stronger balance sheets would enjoy lower borrowing costs. Indeed, recent evidence demonstrates that financial markets consider government assets along with debt levels to determine borrowing costs (Hadzi-Vaskov and Ricci, 2016; Henao-Arbelaez and Sobrinho, 2017). Nonetheless, improving balance sheet management will only be possible if quality data and the right methodology to assess the value public asset are available and if governments accept the increased scrutiny of the value of public assets.

Maintaining access to the commercial debt market in the medium term requires a co-ordinated strategy

Access to international financial markets comes with several benefits to bond-issuing countries, especially when interest rates in high-income countries are expected to remain low in the medium term. For example, it increases their ability to raise large volumes of capital in a short time span and provides a diverse investor base. It also helps African economies build a credit history in international financial markets. Going forward, the search for yields in emerging markets is expected to continue, as high-income countries are likely to maintain low interest rates.

African countries need to address other structural factors that raise the risk premiums of African sovereign debts.11 In addition to stronger debt management and transparency, African countries can maintain investor confidence post-COVID-19 in several ways:

Designing bonds with strong legal language, including enhanced collective action clauses, that sets out an orderly and efficient debt resolution process. This will command higher prices on financial markets thanks to lower downside risks when the debtor’s ability to pay sours deteriorates (Chung and Papaioannou, 2019).

Matching loan maturity dates to project life cycles so that loans do not lead to cashflow problems when repayments are due.

Restricting loans to those for growth-enhancing investments, such as in infrastructure, health and education, so that loans do not end up having a net-negative effect on the country’s wealth over the long run.

Strengthening the management of infrastructure investments is important to ensuring the sustainability of infrastructure-linked debts. These debts account for a large share of commercial debt in Africa. Adopting the PIDA (Programme for Infrastructure Development in Africa) Model Law for Infrastructure Investment presented at the African Union Summit in January 2018 can help create a more favourable environment and policy certainty for private and institutional investors (Ashiagbor et al., 2018). Policy makers can further improve the quality of the investments by selecting a pipeline of growth-enhancing infrastructure projects and supporting public sector capacity in planning, allocating and implementing public infrastructure development.

African governments can work with credit rating agencies to better assess the continent’s sovereign credit risks and protect investors. Countries can actively encourage ratings agencies to have a stronger field presence; Standard & Poor, for example, currently has only one office in Africa. Better credit assessments can help dissipate investors’ negative biases associated with credit risks in the continent. In fact, the annual assessment of project finance loans by Moody’s Investors Service documents the superior performance of African project finance loans. African infrastructure projects from 1983 to 2017 averaged 5.5%, a lower default rate than Latin America (12.9%), Asia (8.8%), Eastern Europe (8.6%), North America (7.6%), and Western Europe (5.9%) (Moody’s Investor Service, 2019; quoted in OECD/ACET, 2020, page 42). However, regulations might be necessary to increase the transparency of ratings, reduce conflicts of interests and improve the quality of the rating process. The financial crisis in 2008 highlighted how rating agencies can fail to correctly assess market risks. In 2011, in response to that crisis, the European Commission created its own regulatory framework through the European Securities and Markets Authority. The objective was to enhance the integrity and quality of credit rating activities by registering and monitoring all credit rating agencies operating within the European Union. Finally, measures such as assessing rating methodologies and reviewing complaints received from market participants can help to ensure high levels of investor protection in Africa.

African governments can gradually develop markets for local currency sovereign bonds

African countries would benefit from developing local currency bond markets. Local currency bonds would give countries a way to borrow that is protected from risks such as inflation, exchange rate shocks or currency depreciations. During the latter, debt-to-GDP ratios tend to grow less rapidly in countries with higher shares of domestic currency debt (Panizza and Taddei, 2020). Local currency bonds also mitigate currency mismatches for the borrowers. These bonds are critical for the development of a national financial system: they provide collateral for financial transactions and serve as a baseline for other financial instruments.

Establishing local currency debt markets may require proactive interventions by public actors. Countries wishing to attract foreign investors must maintain a stable macroeconomic environment and carefully liberalise capital accounts. To do so, governments need to pursue standard market practices, improve hard and soft market infrastructure, establish hedging markets, strengthen market liquidity and pursue inclusion of their bonds in global indices. Furthermore, a system for effectively monitoring foreign investor flows and holdings, including by amounts and maturity dates, is important (IMF and World Bank, 2020; UNCTAD, 2016b). International organisations can provide financial and technical assistance in the development of local domestic markets. For instance, the African Development Bank and MCB Capital Markets helped create the African Domestic Bond Fund in 2018, the first multijurisdictional sovereign fixed-income exchange-traded fund. This fund has increased price discovery (where buyers and sellers set their prices) and has enhanced transparency in several fixed-income markets in Africa (IMF/World Bank, 2020).

In recent years, Africa’s local currency-denominated debt has increased rapidly. The median is now 29% of GDP. Local currency-denominated debt has risen at a faster pace than foreign currency-denominated debt (10 percentage points and 7 percentage points, respectively, for the 2013-18 period). Most of this increase can be attributed to middle-income and oil-producing countries tapping their local markets to offset the fiscal ramifications of the decline in oil prices (Calderón and Zeufack, 2020).

Borrowing in local currency has not completely insulated emerging market economies from the sharp currency depreciations and capital outflows caused by the COVID-19 crisis. As both domestic and external financial revenue sources dried up following the outbreak of the virus, government bond yields in both local and foreign currencies spiked in Egypt, Nigeria and South Africa. This rise in bond yields in secondary markets has not affected the cost of servicing existing debts, but it does indicate higher costs for governments to raise new funding in the current debt market.

Central banks may need to expand their range of instruments to rebalance the economy due to the unprecedented scale of COVID-19. African central banks may act as “lenders of last resort” to help offset the large stock adjustments needed in domestic bond markets. Beyond using conventional macroprudential tools and drawing from their exchange reserves, central banks can help inject targeted liquidity, intervene in the repo market or purchase domestic bonds (Hofmann, Shim and Shin, 2020). While the US Federal Reserve and the European Central Bank have successfully taken similar actions, the results could differ for countries with unstable currencies, small monetary bases, weak governance or strong dependence on the use of foreign currencies for domestic transactions. Nonetheless, the scale of the COVID-19 challenges has prompted central banks in developing countries such as Colombia, Indonesia, Philippines, and South Africa to launch bond purchase programmes. The Bank of Thailand also introduced a mutual fund liquidity facility. Depending on the specific local context, such a programme may not necessarily trigger a spike in inflation rates. However, a continued increase in money supply could lead to a higher inflation rate when growth resumes and therefore must be handled with care. Such instruments might be less available to low-income countries that would rely on international financial institutions to assist them if they are to shift a reasonable portion of their international borrowing to local currencies (ODI, 2020).

The participation of domestic pension funds and insurance in the local currency bond markets can be encouraged to increase the demands for such products. For example, non-banking domestic investors now account for 45% of the bonds in local currency in Kenya (UNCTAD, 2016b). However, the share of African assets under management by these institutions remains low, as shown by the 5% Agenda campaign. This campaign, initiated by the New Partnership for Africa’s Development, aims to increase to 5% the allocations that African asset owners pay towards African infrastructure from its low base of approximately 1.5% (NEPAD, 2018; OECD/ACET, 2020).

References

African Union (2018), Assembly of the Union, Thirty-first Ordinary Session, Assembly / AU / Decl.1 (XXXI), 1-2 July 2018, Nouakchott, https://au.int/sites/default/files/decisions/36130-assembly_au_dec_690_-_712_xxxi_e.pdf (accessed 11 August 2020).

African Business (2020), “Where to invest in Africa in the face of COVID-19”, African Business Magazine, https://africanbusinessmagazine.com/sectors/technology/where-to-invest-in-africa-in-the-face-of-covid-19/ (accessed 9 July 2020).

Afrobarometer (2019), Afrobarometer (database), www.afrobarometer.org/ (accessed 10 July 2020).