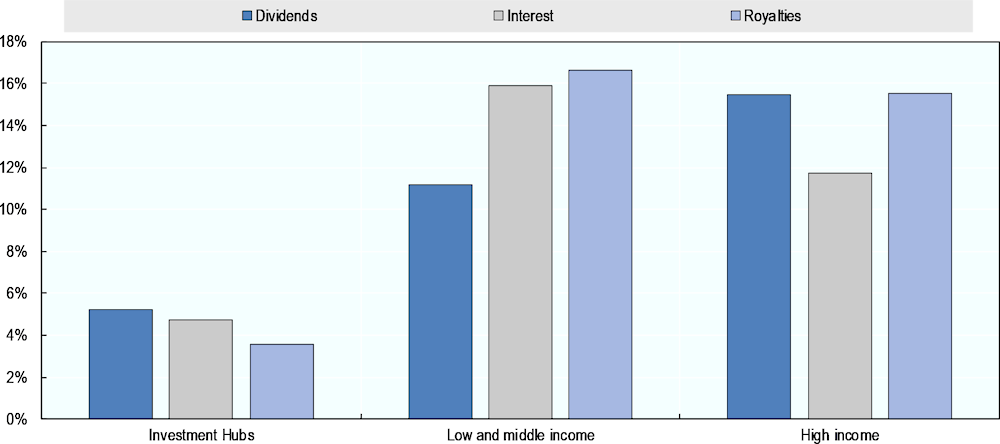

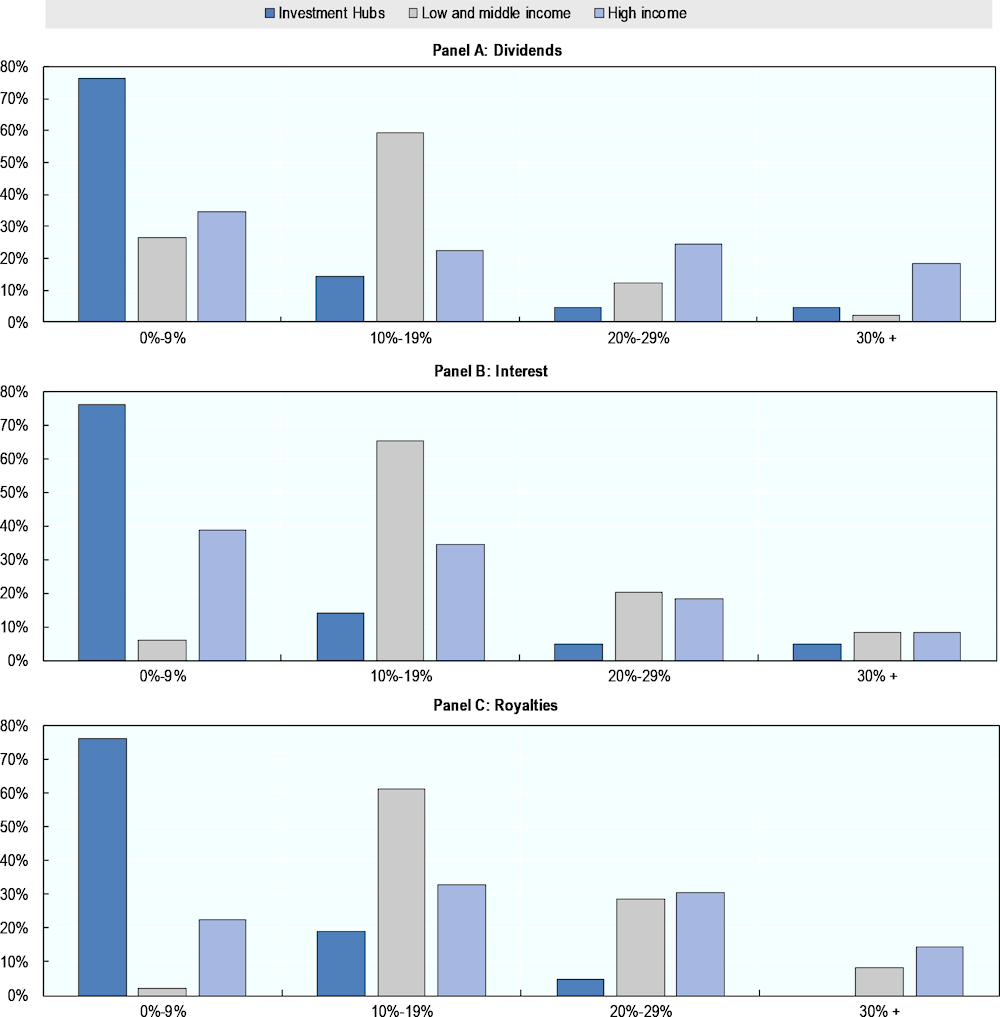

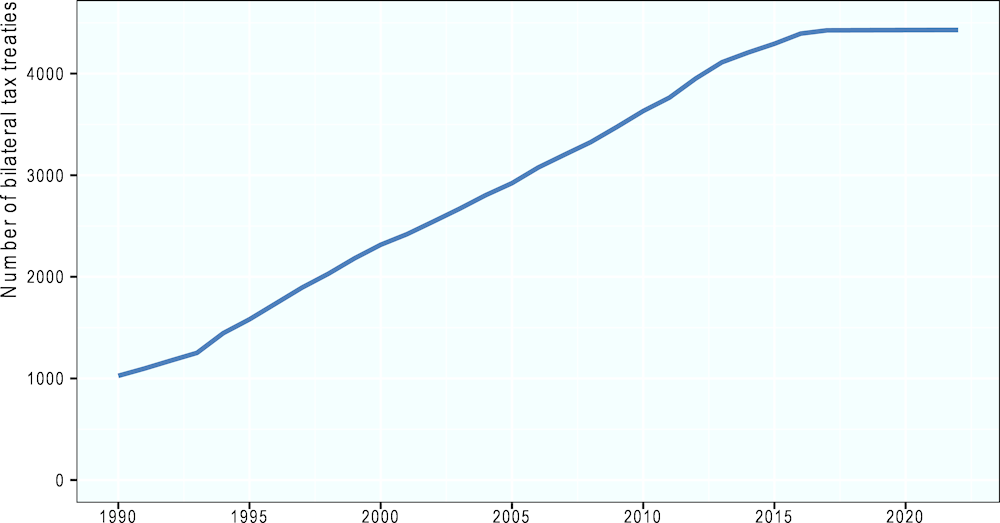

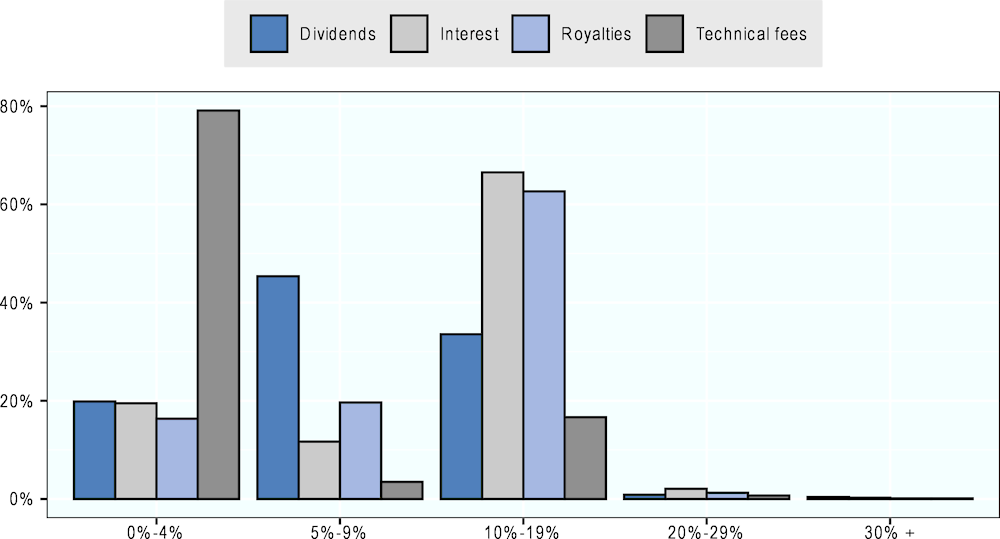

Withholding taxes (WHTs) are levied on businesses when they make payments to other foreign or domestic business entities or individuals, e.g., in the form of dividends, interest, and royalties. Governments collect these taxes based on statutory or preferential treaty-based tax rates requiring businesses to withhold a fraction of cross-border payments in scope of the WHT.

Data on withholding taxes can be used to improve understanding of multinational enterprise (MNE) decisions about investment, repatriation, finance and organisational structures among other tax policy issues. For example:

WHTs increase the cost of repatriating profits earned in foreign jurisdictions thereby potentially discouraging MNEs’ investment decisions at the extensive margin (i.e., discrete investment decisions between two or more alternative projects);

differences in WHT rates between interest and dividend payments, both within and across locations, could affect MNEs’ financing decisions;

taxes levied on cross-border payments increase the cost of capital and could thus affect investments at the intensive margin (i.e., the incentive to expand existing investments given a fixed location). (Auerbach, Devereux and Simpson, 2008[1])

Importantly, WHT data can also potentially provide insights on certain base erosion and profit shifting (BEPS) strategies such as treaty shopping or the strategic location of debt and intangible assets. The publication of WHT rates in Corporate Tax Statistics was envisaged in the 2015 BEPS Action 11 Report (OECD, 2015[2]).