Key insights

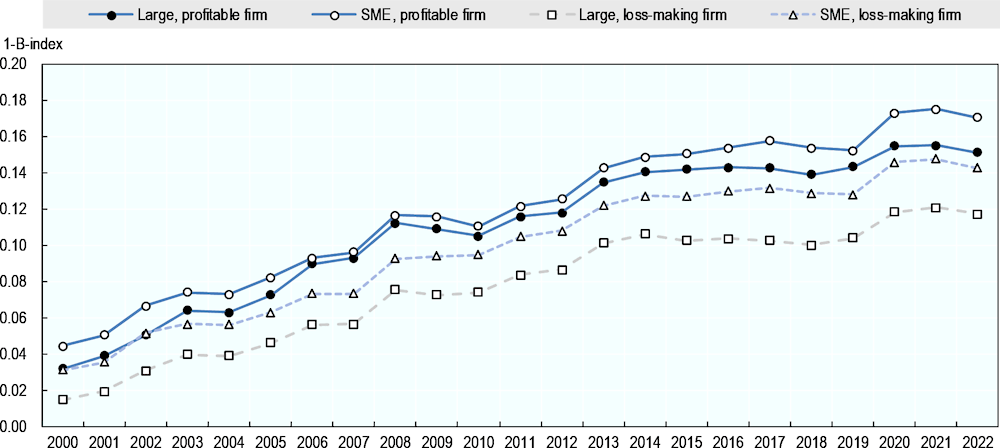

Tax incentives for research and development (R&D) are increasingly used to promote business R&D with 33 out of the 38 OECD jurisdictions offering tax relief on R&D expenditures in 2021, compared to 19 in 2000.

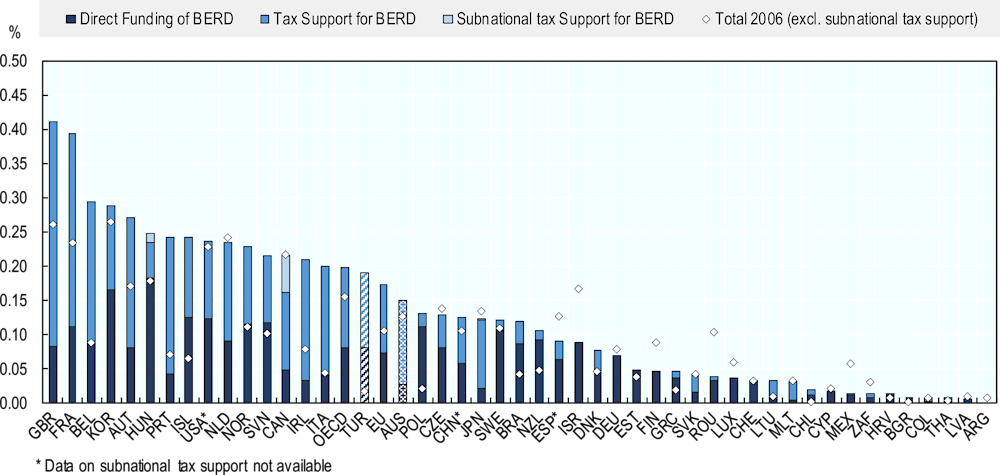

Most jurisdictions use a combination of direct support and tax relief to support business R&D, but the policy mix varies. Over time, there has been a shift towards a more intensive use of R&D tax incentives to deliver financial support for business R&D.

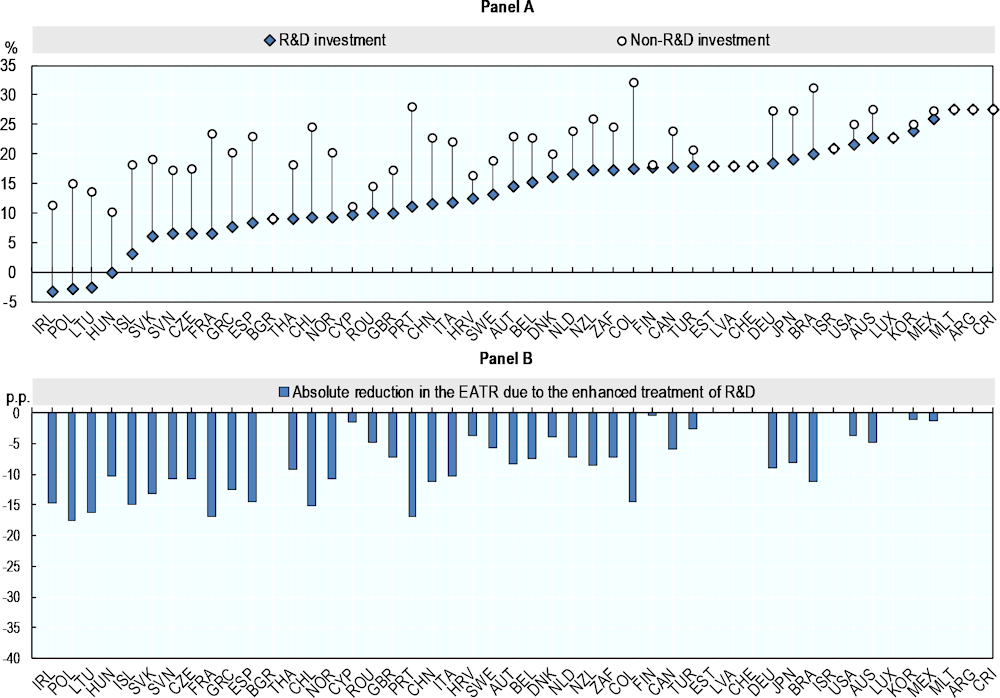

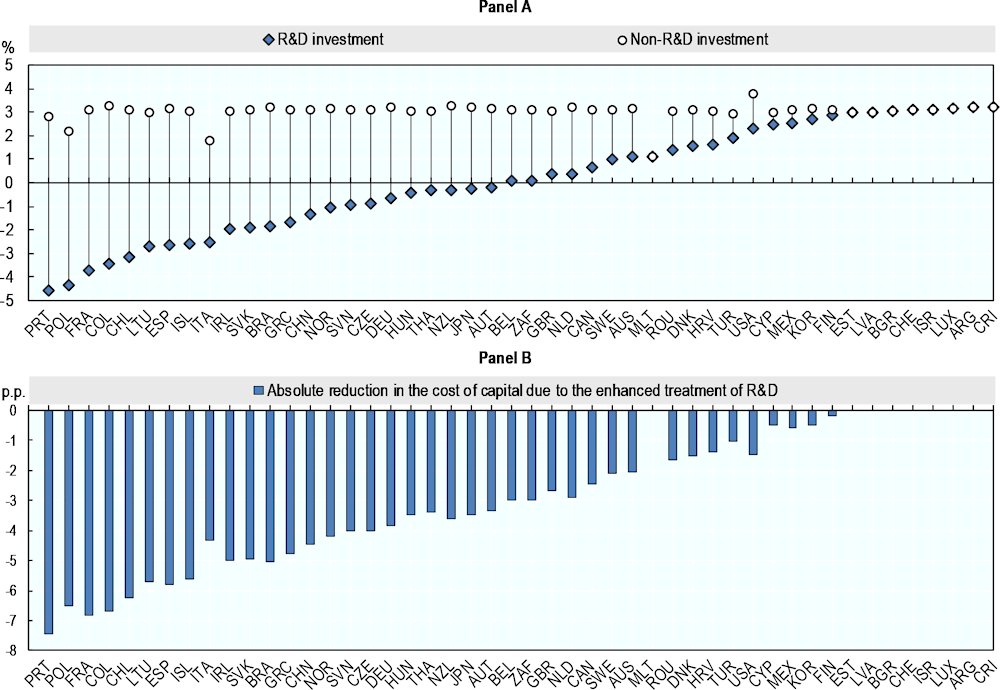

The effective average tax rate (EATR) for R&D in 2022 was lowest in Ireland, Poland and Lithuania, providing greater tax incentives for firms to locate R&D investment in these jurisdictions.

The cost of capital for R&D in 2022 was lowest in Portugal, Poland and France where these jurisdictions provide greater tax incentives for firms to increase their R&D investment.

Isolating the impact of R&D tax incentives, the largest preferential tax treatment for profitable and marginal R&D investments was offered in Portugal, France and Poland in 2022.

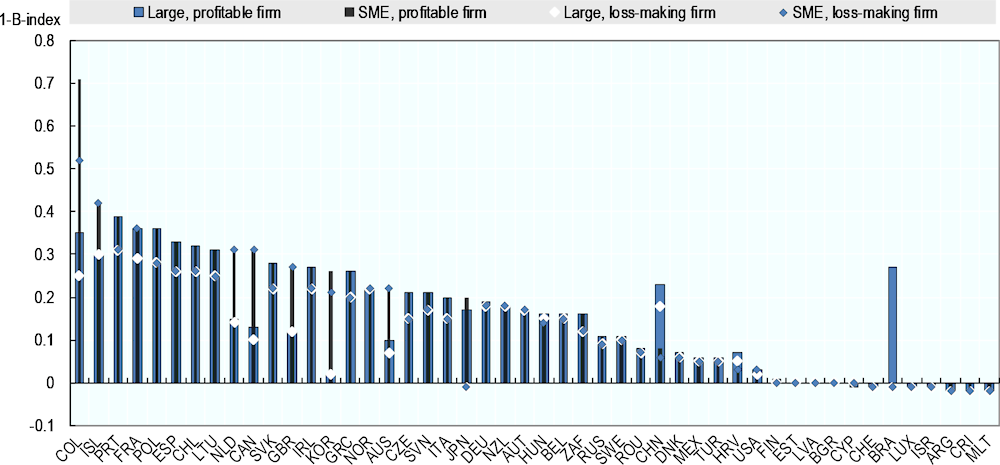

For profitable small and medium-sized enterprises (SMEs), implied marginal R&D tax subsidy rates were highest in Colombia, Iceland and Portugal in 2022.

In 2022, 21 out of the 33 OECD countries that offer tax incentives offer refundable (payable) tax credits or equivalent incentives. Such provisions explicitly target SMEs and young firms compared to large enterprises in Australia, Canada and France.

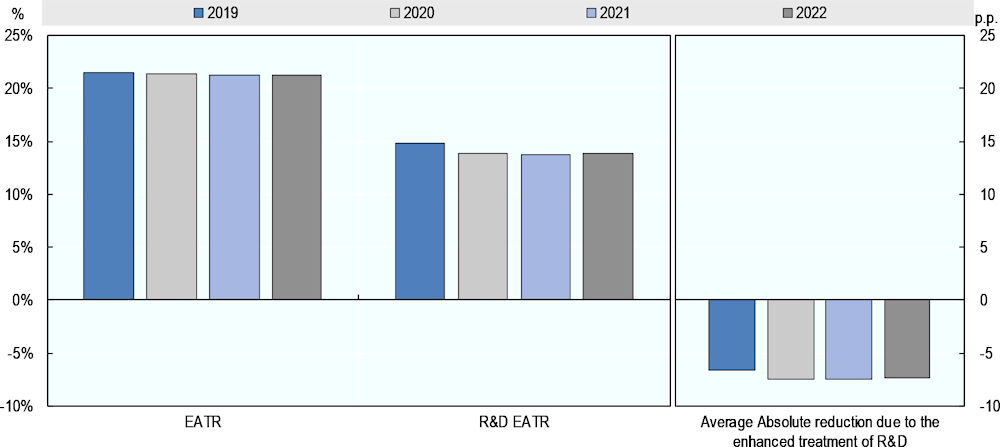

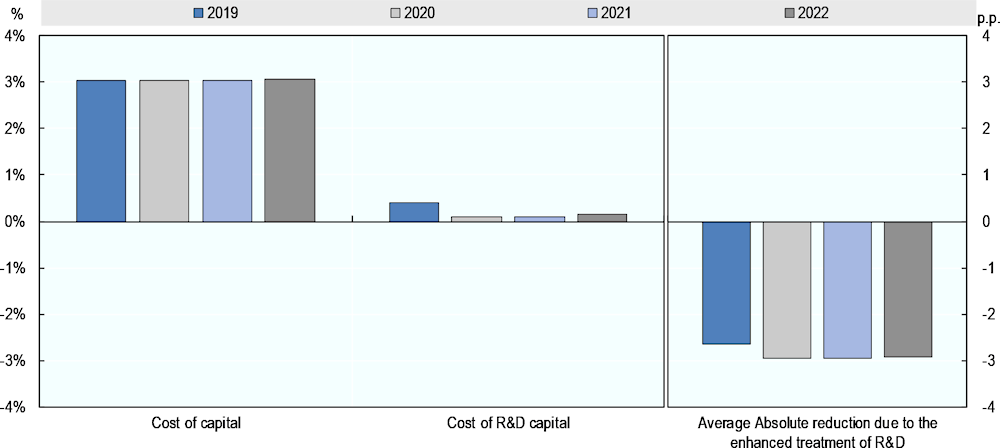

R&D tax incentives have become more generous, on average, over time. This is due to the higher uptake and increased generosity of R&D tax relief provisions. While this trend stabilised between 2013 and 2019, an increase is again observed from 2020 and maintained through to 2022.