The 2023 edition of Corporate Tax Statistics contains a further two years of anonymised and aggregated country-by-country reporting (CbCR) statistics covering fiscal years (FY) 2019 and 2020.

Fifty-two jurisdictions out of a potential ninety-three submitted CbCR statistics to the OECD detailing the financial and business activities of almost 7 000 multinational enterprises (MNEs).

Data for FY2019 and 2020 continues to show a misalignment between the location where profits are reported and the location where economic activities occur. Revenues and profits per employee tend to be higher in investment hubs. For example, the data show that the median value of revenues per employee in investment hubs is USD 1 630 000 as compared to just USD 290 000 for all other jurisdictions.

The data includes a jurisdiction-by-jurisdiction breakdown of low-taxed profit of MNEs (defined as profit taxed at an effective tax rate below 15%) headquartered in some jurisdictions. This data highlights the presence of low-taxed profit in low-tax and high-tax jurisdictions alike, with more than half of the low-taxed profit in the new data located in jurisdictions with average ETRs above 15%.

In FY 2019 and 2020 there is a large decrease in overall total profits of the MNEs covered which can be seen as a direct symptom of the COVID-19 pandemic.

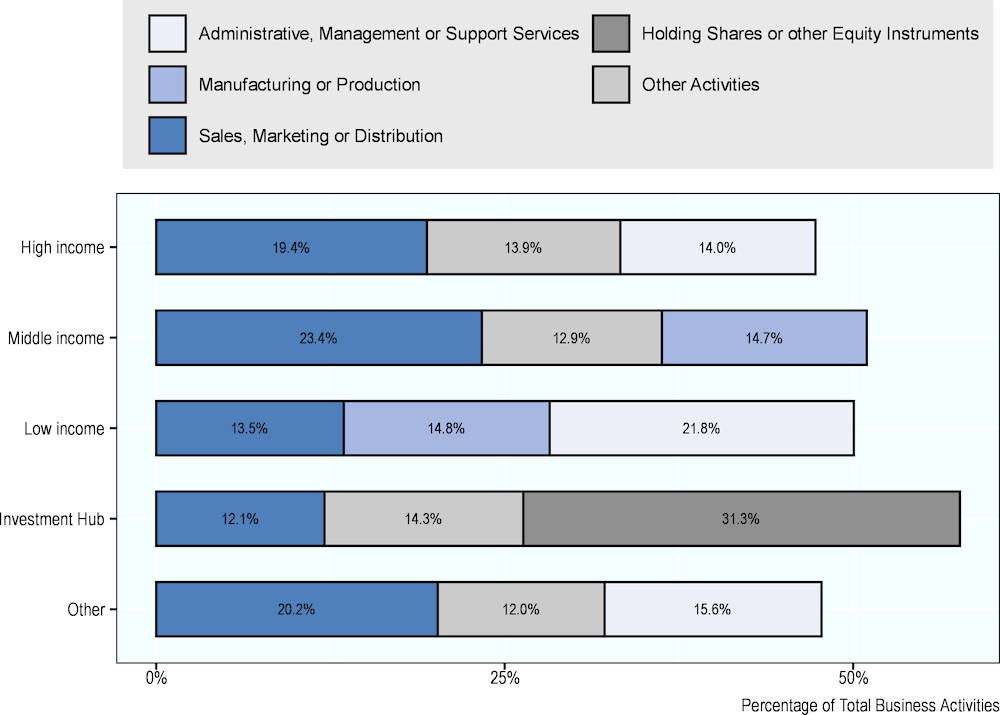

The composition of business activity differs across jurisdiction groups. The most predominant activity in investment hubs is “holding shares” which also includes other equity instruments.

Corporate Tax Statistics 2023

5. Country-by-country reporting statistics

Key insights

Country-by-country reporting was implemented as part of Action 13 of the OECD/G20 BEPS Project to support jurisdictions in combating base erosion and profit shifting (BEPS). Under BEPS Action 13, all large MNEs are required to prepare a country-by-country (CbC) report with aggregate data on the global allocation of income, profit, taxes paid and economic activity among tax jurisdictions in which it operates. This CbC report is shared with tax administrations in these jurisdictions, for use in high level transfer pricing and BEPS risk assessments.

While the main purpose of country-by-country reports is to support tax administrations in the high-level detection and assessment of transfer pricing and other BEPS-related risks, data collected from CbCRs can also play a role in supporting the economic and statistical analysis of BEPS activity and of multinational enterprises in general. Under Action 11 of the BEPS Project (OECD, 2015[1]), acknowledging the need for additional sources of data on MNEs, jurisdictions agreed to regularly publish anonymised and aggregated CbCR statistics to support the ongoing economic and statistical analysis of MNEs and BEPS. This section outlines progress on the implementation of Action 13, as well as the country-by-country reporting statistics published by the OECD under Action 11.

Action 13 implementation

BEPS Action 13 is part of the transparency pillar of the OECD/G20 BEPS project, supporting jurisdictions in combating BEPS. In many cases, jurisdictions already have rules in place to deal with BEPS risks posed by MNE groups but may not previously have had access to information to identify cases where these risks arise. BEPS Action 13 helps to address this by providing new information for use by tax administrations in high-level transfer pricing risk assessment and the assessment of other BEPS-related risks.

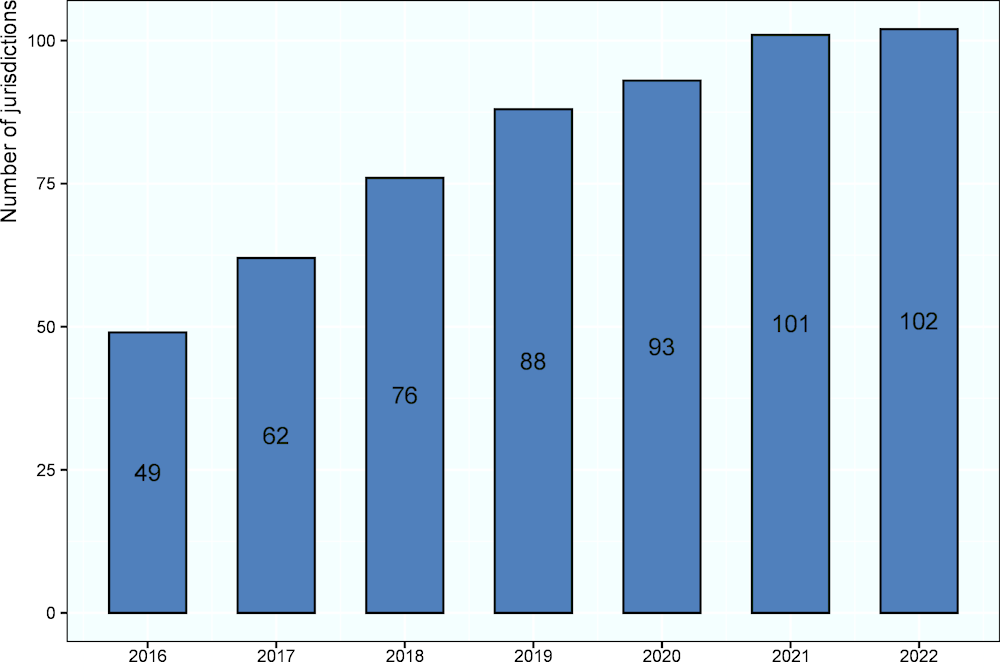

For the fiscal year 2020, 93 jurisdictions required mandatory filing of Country-by-Country Reports for 2020. To date, more than 100 jurisdictions have laws in place introducing a reporting obligation in relation to CbCRs (Figure 5.1).

Feedback from tax administrations indicates that they are using CbCRs to combat BEPS, in combination with other tools: (i) to help identify MNE groups for possible audit, (ii) to help identify MNE groups that do not need to be audited (de-selection), and (iii) to help plan audits or other enquiries. The specific approaches adopted vary depending upon each tax administration’s general approach to risk assessment. Two important points to note on the role of CbCRs include:

CbCRs may only be used in a high-level risk assessment of an MNE. CbCRs may not be used as evidence that BEPS exists or as a substitute for substantive enquiries and should be used alongside other information available to tax administrations. It is unlikely that success in particular cases will be able to be attributed to CbCRs specifically.

There may be a significant time delay between a CbCR being filed and the outcomes of a transfer pricing audit. CbCRs may be used for the purposes of a high-level risk assessment and in planning a tax audit, but it will only be determined whether an MNE group is in fact engaged in BEPS once further enquiries are completed, which may take a number of years.

While CbCRs are an important tool, tax administrations are using them in concert with a range of other tools in their efforts to combat BEPS. The OECD has developed several tools to support tax administrations in using CbCRs and, in particular, in undertaking multilateral activity to risk assess MNE groups. These include regular CbCR risk assessment workshops; the CbCR Tax Risk Evaluation and Assessment Tool (TREAT) for tax administrations; a Tax Risk Assessment Questionnaire (TRAQ), which is used in the International Compliance Assurance Programme (ICAP) provided by a tax administration to an MNE group with an invitation to explain key indicators of possible risk; and the CbCR Effective Risk Assessment Handbook, released in 2017.

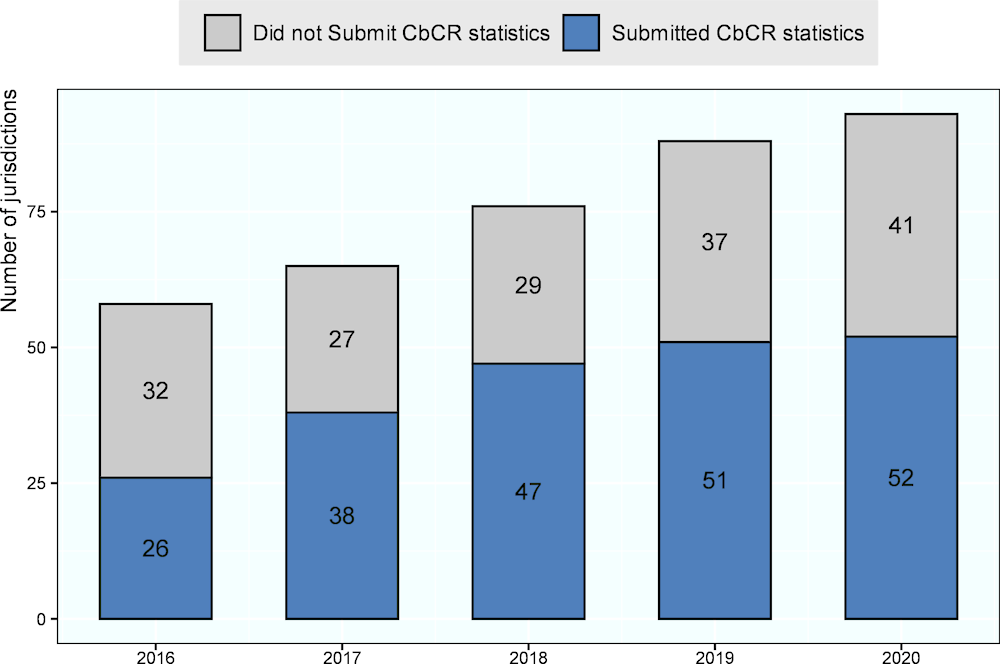

The number of jurisdictions providing CbCR statistics has increased yearly since their introduction in 2016. Figure 5.2 shows that the total number of jurisdictions that could potentially provide CbCR statistics to the OECD increased from 58 in 2016 to 93 in 2020. This total is calculated as the number of jurisdictions that have implemented mandatory CbCR filing along with those that accepted voluntary filing in the specific year. For example, in 2016, 49 jurisdictions implemented mandatory filing while a further 9 accepted voluntary filing. The number of jurisdictions that provided CbCR statistics increased from 26 to 52 over the same period. Despite the large increase in the number of jurisdictions that could potentially submit CbCR statistics the number of jurisdictions that did not provide CbCR statistics to the OECD has only increased from 32 to 41. Many jurisdictions receive too few CbCRs to be able to provide the statistics under their confidentiality standards.

Figure 5.1. Number of jurisdictions implementing mandatory CbCR filing

Figure 5.2. The evolution of CbCR coverage

Source: Anonymised and Aggregated CbCR statistics and OECD Country-by-Country Reporting Requirements.

General CbCR data characteristics

Jurisdictions have provided the OECD with anonymised and aggregated tabulations of the Country by Country Reporting information described below. Aggregation is performed at the sub-group level according to certain sub-group or group characteristics and reported according to these different criteria in several tables (see Box 5.1). Table 5.1 provides an overview of the tables submitted to the OECD as part of the CbCR statistics, a brief description of their content and the number of individual jurisdictions that submitted each table in 2018.

The aggregated CbCR data are subject to a number of limitations that need to be borne in mind when carrying out any economic or statistical analysis (see Box 5.2). Nonetheless, the data provide important information on MNEs and their activities relative to previously existing data sources:

The CbCR data provide global information on MNEs’ activities, with more granular information than is available in other data sources such as consolidated financial accounts.1

The CbCR data include information on number of CbCRs, number of sub-groups, number of entities, total unrelated and related party revenues (and their sum, total revenues), profit or loss before income tax, income tax paid (on a cash basis), current year income tax accrued, stated capital, accumulated earnings, number of employees, tangible assets other than cash and cash equivalents, and the main business activity (or activities) of each constituent entity.

The data ensure inclusion of all global activities of included MNEs.

At a minimum, the data allows for the domestic and foreign activities of MNEs to be separately identified.2 Depending on the reporting jurisdiction, it allows for an analysis of MNEs’ activities in investment hubs and developing jurisdictions thanks to a detailed geographical disaggregation.

Information is reported by jurisdiction of tax residence and not jurisdiction of incorporation.

The CbCR data provide cross-country information on MNEs’ business activities (e.g., manufacturing, intellectual property (IP) holding, sales) in different jurisdictions, allowing researchers to relate financial outcomes to these functions for the first time.

The CbCR data thus provide governments and researchers with important new information to analyse MNE behaviour, particularly in relation to tax, allowing for the construction of a more complete view of the global activities of the largest MNEs than is possible using existing sources.

The anonymised and aggregated CbCR statistics are constructed in two main steps. First, all large MNEs (i.e., with consolidated revenues of at least EUR 750 million) file CbCRs, typically with the tax administration in the jurisdiction of their ultimate parent entity (UPE). An MNE group is usually required to file its CbCR one year after the closing date of its fiscal year. Second, in each jurisdiction, tax administrations or other government bodies compile the different CbCR filings into a single dataset according to their specific confidentiality standards. This results in a single anonymised and aggregated dataset covering all the jurisdiction’s MNEs subject to the filing requirement, which is shared with the OECD.

Box 5.1. MNE group structure

An MNE group is a collection of enterprises related through ownership or control such that the group is either required to prepare consolidated financial statements for financial reporting purposes under applicable accounting principles or would be so required if equity interests in any of the enterprises were traded on a public securities exchange.

An entity is any separate business unit of an MNE group that is included in the consolidated financial statements of the MNE group for financial reporting purposes.

The UPE directly or indirectly owns a sufficient interest in one or more other entities of the MNE group such that it is required to prepare consolidated Financial Statements.

A sub-group is formed by the combined entities of an MNE group operating in one tax jurisdiction.

Table 5.1. Content of anonymised and aggregated CbCR statistics

|

CbCR table |

Content |

Description |

|---|---|---|

|

Table 1A |

Aggregate totals of all variables by jurisdiction |

Reports variable totals for all sub-groups, obtained by aggregating sub-group variables according to their jurisdiction of tax residence (or jurisdiction groups, depending on confidentiality). The tables include three panels aggregating all sub-groups, sub-groups with positive profits and sub-groups with negative profits. |

|

Table 1B |

Interquartile mean values of all variables by jurisdiction |

Same structure as Table 1A but with interquartile mean figures based on the number of CbCR sub-groups. |

|

Table 4 |

Aggregate totals of all variables by effective tax rate of MNE groups |

Data is provided by effective tax rate of the MNE group and by tax jurisdiction. The level of disaggregation varies across jurisdictions, depending on confidentiality. |

|

Table 5 |

Aggregate totals of all variables by effective tax rate of MNE sub-groups |

Data is provided by the effective tax rate of the MNE sub-group. The level of disaggregation varies across jurisdictions, depending on confidentiality. |

|

Table 6 |

Distribution points of MNE group size |

Provides distribution points of MNE group size, as measured by unrelated party revenues, number of employees and tangible assets. The total size of an MNE group is determined by summing the relevant variables across all of its sub-groups. |

Note: The collection of Tables 2 and 3, where the data is aggregated according to the MNEs sector and size, has been postponed. The Inclusive Framework will consider whether to expand the dataset to include these tables in future years. The effective tax rate (ETR) of the MNE group and sub-group in Tables 4 and 5 should not be directly compared to the effective tax rates mentioned in the chapter on corporate effective tax rates.

Coverage of CbCR statistics

While there are 141 members of the Inclusive Framework, only 93 have implemented mandatory reporting for the fiscal year 2020 (see above). The 2023 edition of Corporate Tax Statistics includes CbCR statistics on CbCRs filed in 52 jurisdictions, covering almost 7 600 MNE groups (see Table 5.2). This dataset contains a vast array of information on the global financial and economic activities of MNEs.

Anonymised and aggregated CbCR data provide an overview of where large MNE groups are headquartered. Table 5.2 shows that, across the jurisdictions that submitted data, the United States and Japan host almost 40% of the headquarters of MNEs included in the sample. The number of reported MNEs varies considerably among jurisdictions, ranging from a minimum of two in Macau, China to 1,759 in the United States. The median number of reported MNEs per jurisdiction is 64.

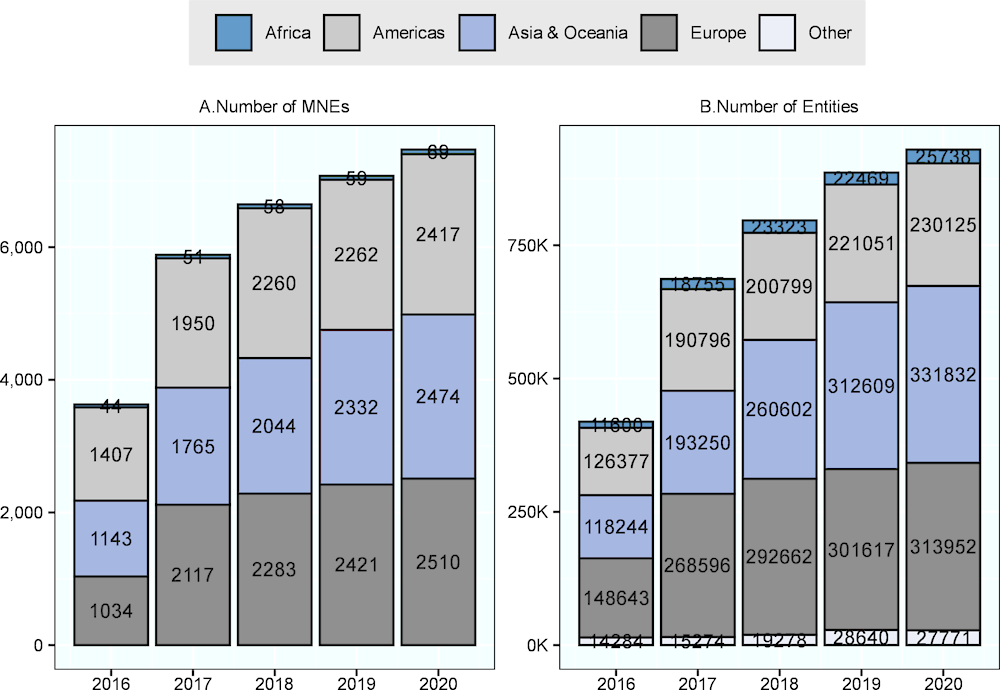

The number of MNEs covered in the CbCR statistics has increased over time, from 3,722 in 2016 to 7,583 in 2020. Panel A of Figure 5.3 shows the breakdown of MNE headquarters by regional grouping. There is a fairly even split of headquarter locations between the Americas, Asia & Oceania and Europe across the sample. However, Panel B of Figure 5.3 shows that in general, MNEs in Asia & Oceania comprise more business entities than in the other regional groupings.

Box 5.2. Limitations of the CbCR data and actions to improve the quality of the data

The aggregated CbCR data are subject to a number of limitations that need to be borne in mind when carrying out any economic or statistical analysis. Some limitations include that:

Much of the data is too aggregated to allow detailed investigation of specific BEPS channels (e.g., there is no distinction between royalties and interest in related party payments, and no information on intangible assets).

Often but not always, CbCRs are based on financial accounting data.3 Due to differences between financial and other permitted accounting rules and tax reporting rules, CbCR data might not accurately represent how items are reported for tax purposes. Differences in accounting rules could affect the comparability of CbCR data across jurisdictions.

There are a number of data deficiencies described in the disclaimer accompanying the data, which is available at http://www.oecd.org/tax/tax-policy/anonymised-and-aggregated-cbcr-statistics-disclaimer.pdf. In the absence of specific guidance, MNEs may have included intra-company dividends in profit figures, meaning that profit figures could be subject to double counting.

While the inclusion of dividends in the profit figure is normal in separate financial accounting, in the context of corporate income tax analysis it can lead to biased results. For example, the tax treatment of repatriated dividends can differ across jurisdictions. As a distribution of post-tax profits, dividends are often lightly taxed or tax exempt.4 To evaluate the potential magnitude of included dividends, some jurisdictions have carried out their own independent analyses of this question.5

In the case of stateless entities, the inclusion of transparent entities such as partnerships may give rise to double counting of revenue and profit. On the other hand, the data may imply that stateless profit are untaxed, since this income is generally taxed at the level of the owner.

Corporate income tax (CIT) exempt companies such as pension funds or university hospitals are required to file CbCRs and as such are included in aggregated statistics, unless otherwise specified. The inclusion of these companies could distort the relationship between profits and taxes.

Some of the data limitations have already been addressed through revised guidance. For example, with respect to the double-counting of dividends, the guidance on CbCR implementation was updated in November 2019 to specify that intra-company dividends should be excluded from profit figures. However, because of the time lag in the revision of instructions with jurisdictions and in reporting, it is expected to take several years before these actions lead to improvements in data quality. Other issues, e.g., the treatment of stateless entities, are the subject of ongoing discussion, including through the review of Country-by-Country Reporting (BEPS Action 13)6 that could lead to the collection of more detailed information through CbCR reports in the future. The OECD continues to work with members of the Inclusive Framework and other stakeholders to improve the quality and consistency of the data across jurisdictions. In light of these potential improvements, it is expected that the value and importance of the dataset in providing researchers and the public with a valuable tool for better understanding the global activities of MNEs and BEPS will continue to increase over time.

In addition to the limitations mentioned above, caution needs to be exercised when attempting to draw conclusions from the data for several reasons:

Changes and potential trends in BEPS behaviour cannot be detected with a single year of data.

In the short term, comparability between the 2016 and the 2017 and 2018 samples is limited, e.g., because of the move from voluntary to mandatory filing and differences in fiscal year coverage.7 In the longer term, changes to guidance will lead to changing treatment of some variables such as profits, also limiting the comparison of these variables over time.

Even with additional years of data, a number of other events that affect the data may make it difficult to identify the effect of BEPS-related policies (e.g., COVID-19, and the United States’ 2017 Tax Cuts and Jobs Act).

Implementing BEPS measures takes time, and the effects of these measures may not become evident until a few years after implementation.

Figure 5.3. Distribution of MNEs and entities by region

Table 5.2. Sample composition and average values for key financial variables

|

|

Reporting Jurisdiction |

Level of data disaggregation |

Number of CbCRs |

Unrelated party revenues |

Tangible assets (other than cash) |

Income tax accrued |

Number of employees |

|---|---|---|---|---|---|---|---|

|

1 |

Argentina |

16 individual jurisdictions |

30 |

1 539 |

3 160 |

27 |

7 361 |

|

2 |

Australia |

92 individual jurisdictions |

148 |

4 055 |

3 710 |

117 |

11 240 |

|

3 |

Austria |

Continents |

100 |

3 851 |

2 576 |

38 |

12 477 |

|

4 |

Belgium |

22 individual jurisdictions |

69 |

4 147 |

2 997 |

77 |

12 175 |

|

5 |

Bermuda |

96 individual jurisdictions |

71 |

4 472 |

4 888 |

63 |

12 291 |

|

6 |

Brazil |

33 individual jurisdictions |

82 |

8 789 |

7 680 |

134 |

22 641 |

|

7 |

Bulgaria |

4 individual jurisdictions |

3 |

1 792 |

3 829 |

19 |

9 716 |

|

8 |

Canada |

9 individual jurisdictions |

230 |

5 664 |

6 085 |

112 |

14 080 |

|

9 |

Cayman Islands |

138 individual jurisdictions |

135 |

7 776 |

8 466 |

211 |

25 249 |

|

10 |

Chile |

12 individual jurisdictions |

31 |

3 796 |

3 844 |

56 |

20 707 |

|

11 |

China |

133 individual jurisdictions |

691 |

13 755 |

12 535 |

285 |

39 014 |

|

12 |

Czechia |

All foreign jurisdictions combined |

|||||

|

13 |

Denmark |

101 individual jurisdictions |

73 |

5 044 |

3 505 |

115 |

16 877 |

|

14 |

Finland |

Continents |

52 |

5 296 |

1 979 |

65 |

11 323 |

|

15 |

France |

88 individual jurisdictions |

235 |

10 269 |

5 730 |

217 |

36 748 |

|

16 |

Germany |

162 individual jurisdictions |

419 |

8 316 |

5 276 |

113 |

22 961 |

|

17 |

Greece |

68 individual jurisdictions |

17 |

3 559 |

2 882 |

39 |

10 083 |

|

18 |

Hong Kong, China |

138 individual jurisdictions |

231 |

5 013 |

8 289 |

148 |

18 425 |

|

19 |

Hungary |

All foreign jurisdictions combined |

8 |

4 373 |

2 174 |

44 |

13 842 |

|

20 |

India |

83 individual jurisdictions |

144 |

5 129 |

6 608 |

109 |

32 861 |

|

21 |

Indonesia |

71 individual jurisdictions |

27 |

4 764 |

11 587 |

89 |

22 326 |

|

22 |

Ireland |

All foreign jurisdictions combined |

63 |

6 085 |

3 021 |

109 |

29 150 |

|

23 |

Isle Of Man |

Continents |

6 |

1 509 |

954 |

7 |

4 217 |

|

24 |

Italy |

103 individual jurisdictions |

143 |

5 163 |

3 087 |

75 |

12 326 |

|

25 |

Japan |

135 individual jurisdictions |

904 |

7 546 |

4 229 |

135 |

19 433 |

|

26 |

Korea |

Continents |

247 |

7 393 |

5 604 |

127 |

15 039 |

|

27 |

Latvia |

10 individual jurisdictions |

3 |

217 |

1 315 |

9 |

2 520 |

|

28 |

Lithuania |

4 individual jurisdictions |

4 |

1 392 |

1 324 |

12 |

6 806 |

|

29 |

Luxembourg |

98 individual jurisdictions |

155 |

3 924 |

2 118 |

20 |

11 324 |

|

30 |

Macau, China |

All foreign jurisdictions combined |

2 |

1 162 |

6 620 |

9 |

14 946 |

|

31 |

Malaysia |

26 individual jurisdictions |

62 |

4 022 |

13 904 |

88 |

18 548 |

|

32 |

Mauritius |

Continents |

8 |

4 978 |

2 971 |

26 |

5 080 |

|

33 |

Mexico |

91 individual jurisdictions |

64 |

19 798 |

13 653 |

206 |

32 479 |

|

34 |

Netherlands |

5 individual jurisdictions |

162 |

22 852 |

7 656 |

231 |

22 199 |

|

35 |

New Zealand |

All foreign jurisdictions combined |

23 |

2 915 |

2 384 |

29 |

6 499 |

|

36 |

Norway |

59 individual jurisdictions |

66 |

3 471 |

3 409 |

70 |

6 606 |

|

37 |

Panama |

48 individual jurisdictions |

5 |

3 891 |

4 637 |

12 |

37 823 |

|

38 |

Peru |

13 individual jurisdictions |

10 |

2 443 |

1 809 |

48 |

6 233 |

|

39 |

Poland |

5 individual jurisdictions |

28 |

4 791 |

3 459 |

85 |

16 463 |

|

40 |

Portugal |

48 individual jurisdictions |

23 |

3 324 |

1 195 |

25 |

11 893 |

|

41 |

Romania |

146 individual jurisdictions |

4 |

34 185 |

12 848 |

329 |

63 982 |

|

42 |

Saudi Arabia |

96 individual jurisdictions |

35 |

9 712 |

17 509 |

1 394 |

14 202 |

|

43 |

Singapore |

27 individual jurisdictions |

73 |

6 425 |

5 097 |

85 |

11 995 |

|

44 |

Slovenia |

5 individual jurisdictions |

6 |

2 303 |

961 |

17 |

5 341 |

|

45 |

South Africa |

38 individual jurisdictions |

58 |

3 613 |

2 838 |

82 |

32 973 |

|

46 |

Spain |

106 individual jurisdictions |

139 |

5 066 |

3 776 |

64 |

18 961 |

|

47 |

Sweden |

Continents |

117 |

4 097 |

2 004 |

89 |

14 594 |

|

48 |

Switzerland |

139 individual jurisdictions |

159 |

7 799 |

5 068 |

138 |

18 859 |

|

49 |

Tunisia |

9 individual jurisdictions |

3 |

2 137 |

2 447 |

28 |

10 873 |

|

50 |

Turkey |

45 individual jurisdictions |

57 |

5 263 |

2 333 |

86 |

17 432 |

|

51 |

United Kingdom |

Continents |

399 |

7 363 |

4 690 |

145 |

21 150 |

|

52 |

United States |

139 individual jurisdictions |

1 759 |

9 254 |

4 888 |

164 |

22 395 |

Note: Currency values (all values except the number of CbCRs and number of employees) are reported in millions of USD. Level of data disaggregation provided depends on data confidentiality standards applicable in each reporting jurisdiction. Average values have not been calculated for Czechia as the number of CbCRs has not been supplied for confidentiality reasons.

Source: Anonymised and Aggregated CbCR statistics.

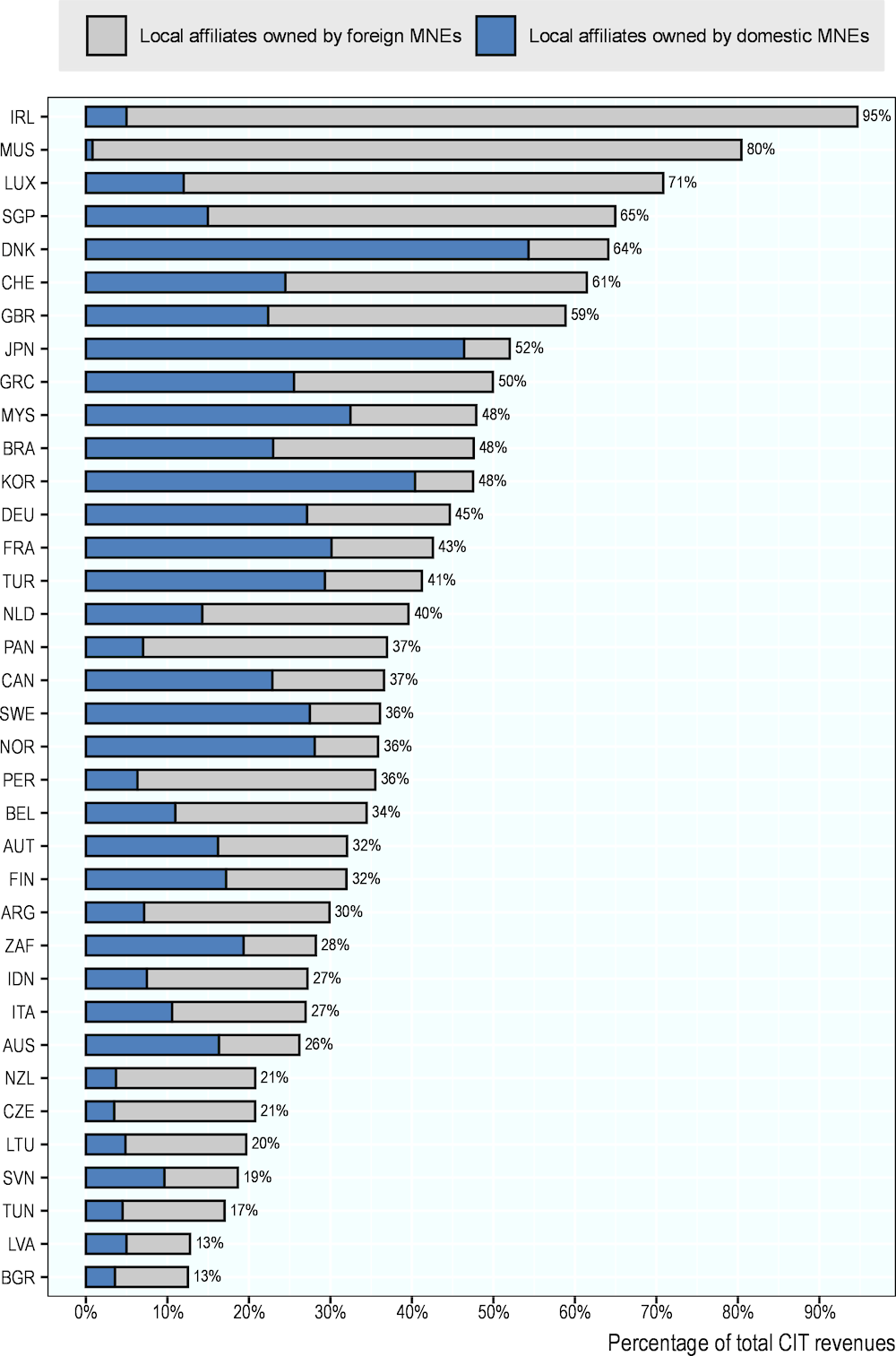

Foreign and domestic MNEs account for significant shares of CIT revenues in several jurisdictions. For a selection of countries, Figure 5.4 reports total tax accrued based on CbCR statistics, as a fraction of the total national CIT revenues, taken from the OECD’s Global Revenue Statistics Database. The figure allows an examination of the relative importance of foreign and domestic MNE contributions as covered in the 2020 data.8

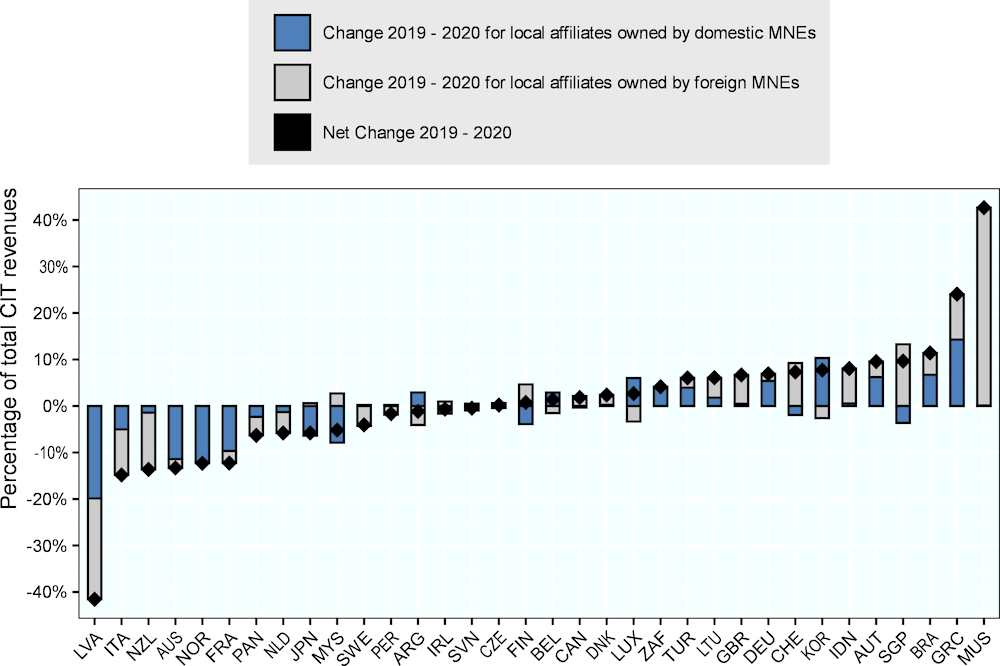

Figure 5.5 shows the variation of MNEs contribution to total CIT revenues as compared to 2019. Twenty jurisdictions saw a net increase in the contribution of MNEs to their total CIT revenues. The percentage contribution by Greek and Mauritian MNEs increased by over 20 p.p. in 2020. On the other hand, six jurisdictions saw a decrease of more than 10 p.p. between 2019 and 2020.

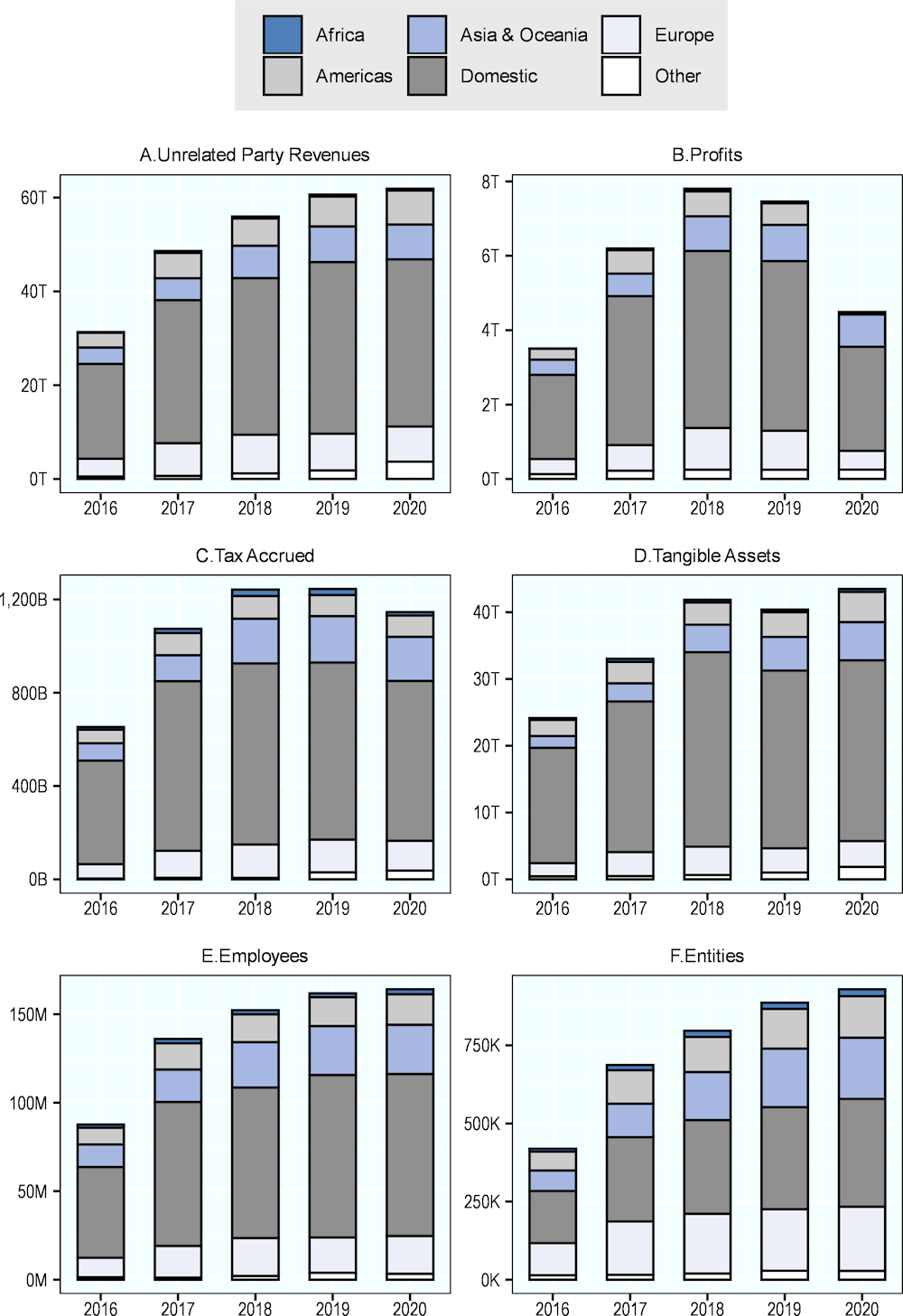

MNEs operate both within their domestic jurisdiction where the UPE is located and in foreign jurisdictions where their foreign entities are located. Figure 5.6 provides detailed information about the distribution of MNE activities between domestic and foreign jurisdictions where activities operated abroad are disaggregated into regional groupings. The upward trend across most panels is associated in line with the increasing coverage in MNEs as depicted in Figure 5.3, however, the large decrease in total profits can be seen as a symptom of the COVID-19 pandemic.

Panels A-D shows the location of selected financial activities, ranging from unrelated party revenues (UPR) in panel A to assets in panel D. The distribution of panel A shows that 20 out of 31 and 36 out of 62 USD trillions in UPR were located domestically in 2016 and 2020, respectively. This entails that in the years for which data is available, the majority of the activity in question takes place domestically. This trend is identical in panels B-D as well as in panel E which depicts the distribution of employees. Panel F, which captures the distribution of entities, is an exception in this respect. The figure shows that the share of domestic entities was around one third across the years 2016 to 2020. The available data thereby suggests that when MNEs set up an entity, in most cases the entity is based in a foreign jurisdiction in comparison with the location of the UPE.

Figure 5.4. MNEs’ contribution to total CIT Revenues, 2020

Note: The percentages above are calculated by dividing the amount of total tax accrued reported in CbCR statistics by total CIT revenues as reported in the OECD’s Global Revenue Statistics Database. The figure shows total revenues of both domestic and foreign MNEs as a percentage of total CIT revenues, with jurisdictions ranked according to the total contribution of MNEs to CIT revenues. As there might be some timing differences in recording tax payments between tax accrued reported in CbCR data and CIT revenues reported in Global Revenue Statistics, percentages should be considered as indicative. Revenues from foreign MNEs are calculated as the sum of tax accrued reported in the jurisdiction by MNEs headquartered in other jurisdictions. Foreign MNEs’ tax revenues should be considered as a lower bound as they can be reported exclusively where the geographical disaggregation is available at the jurisdiction level. Data for missing jurisdictions are not included because these jurisdictions are not covered in the 2020 OECD Global Revenue Statistics data. The US ratio of MNE tax revenues to total tax revenues is not presented in this chart due to a one-time transition tax imposed as part of the 2017 Tax Cuts and Jobs Act, which created a mismatch between the numerator and denominator of this ratio. MNEs generally report this transition tax as part of income taxes accrued and income taxes paid on the CbCR. However, the US Bureau of Economic Analysis does not classify this transition tax as CIT revenue (https://www.bea.gov/help/faq/1293). Therefore, the ratio of income tax accrued in CbCR data to US CIT revenues would be significantly upward biased and not indicative of the amount of CIT revenue contributed by MNEs in 2020. This mismatch is likely to persist for a number of years as taxpayers can elect to pay the tax over several years.

Source: 2020 Anonymised and Aggregated CbCR statistics and the OECD Global Revenue Statistics Database.

Figure 5.5. 2020 MNEs’ contribution to total CIT Revenues compared to 2019

Source: Anonymised and Aggregated CbCR statistics and the OECD Global Revenue Statistics Database.

Figure 5.6. Domestic and foreign activities

Note: T = trillions, B = billions, M = millions, K = thousands

Source: Anonymised and Aggregated CbCR statistics. These data are based on Table 1A of the CbCR statistics.

General observations from CbCR tables

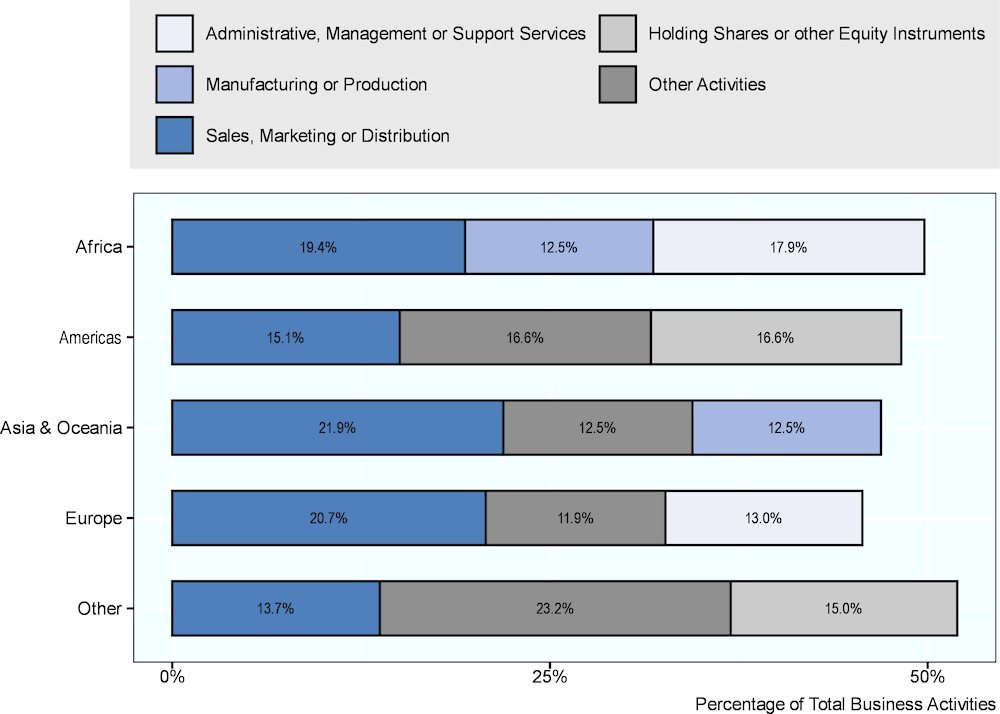

The presence and prevalence of different types of business activities may vary across regions for different reasons, including among others, the level of development, the demographic structure, trade patterns, or macroeconomic conditions. The existence of BEPS practices may also alter such prevalence in a given region. Figure 5.7 provides an overview of the top three business activities disaggregated into five regional groups for the most recent year for which data is available (2018).

Sales, marketing and distribution accounts for around one fifth of total business activity in four of the five regional groupings (all except “Other”). In regions with a relatively high share of low- and middle-income countries such as Africa and Asia and Oceania, manufacturing or production is also a common business activity, accounting for around 13% of the total number of activities in each region. Europe is the only region where administrative, management, or support services is included in the top three (13.0%). Holding shares or other equity instruments and holding or managing intellectual property are the business activities that reach the top three only in the Other regional grouping which includes Stateless entities and those that were not disaggregated. This may be indicative of tax planning structures but could also be the result of genuine commercial activity.

Figure 5.7. Top three business activities by region

Source: 2020 Anonymised and Aggregated CbCR statistics. These data are based on the business activities data in Table 1A of the CbCR data.

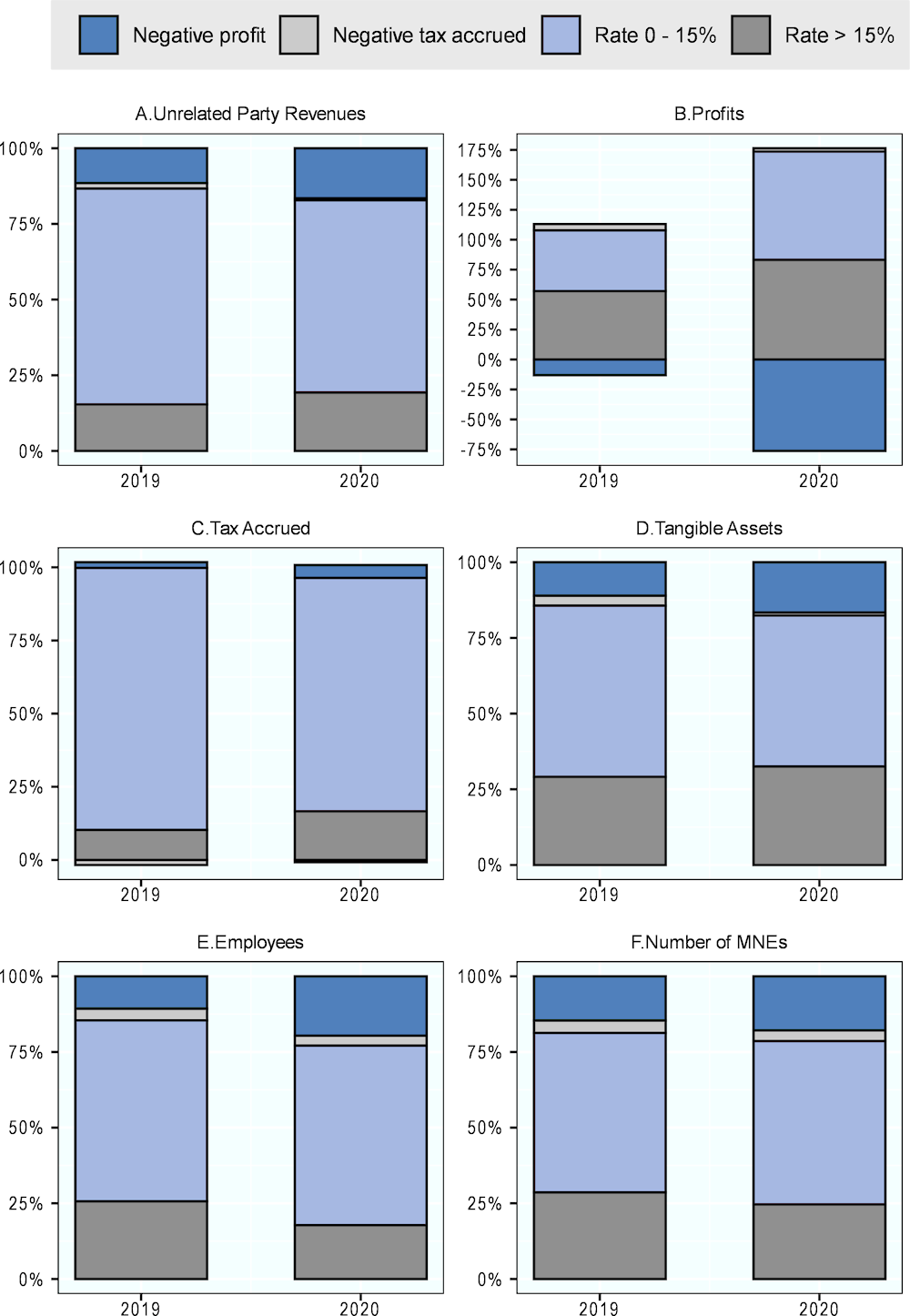

Figure 5.8. Data disaggregated by the ETR of MNE Group

Source: 2019 and 2020 Anonymised and Aggregated CbCR statistics. These data are based on Table 4 of the CbCR statistics.

Figure 5.8 shows the share of different activities operated by MNEs disaggregated into four groups including MNEs for which the total profit was negative, the total tax accrued was negative, located in a jurisdiction with an ETR between 0 and 15%, and located in a jurisdiction with an ETR equal to or above 15%. The six available panels capture different statistics, including the number of MNEs (panel F), the number of employees (panel E), and selected financial variables (panels A-D).

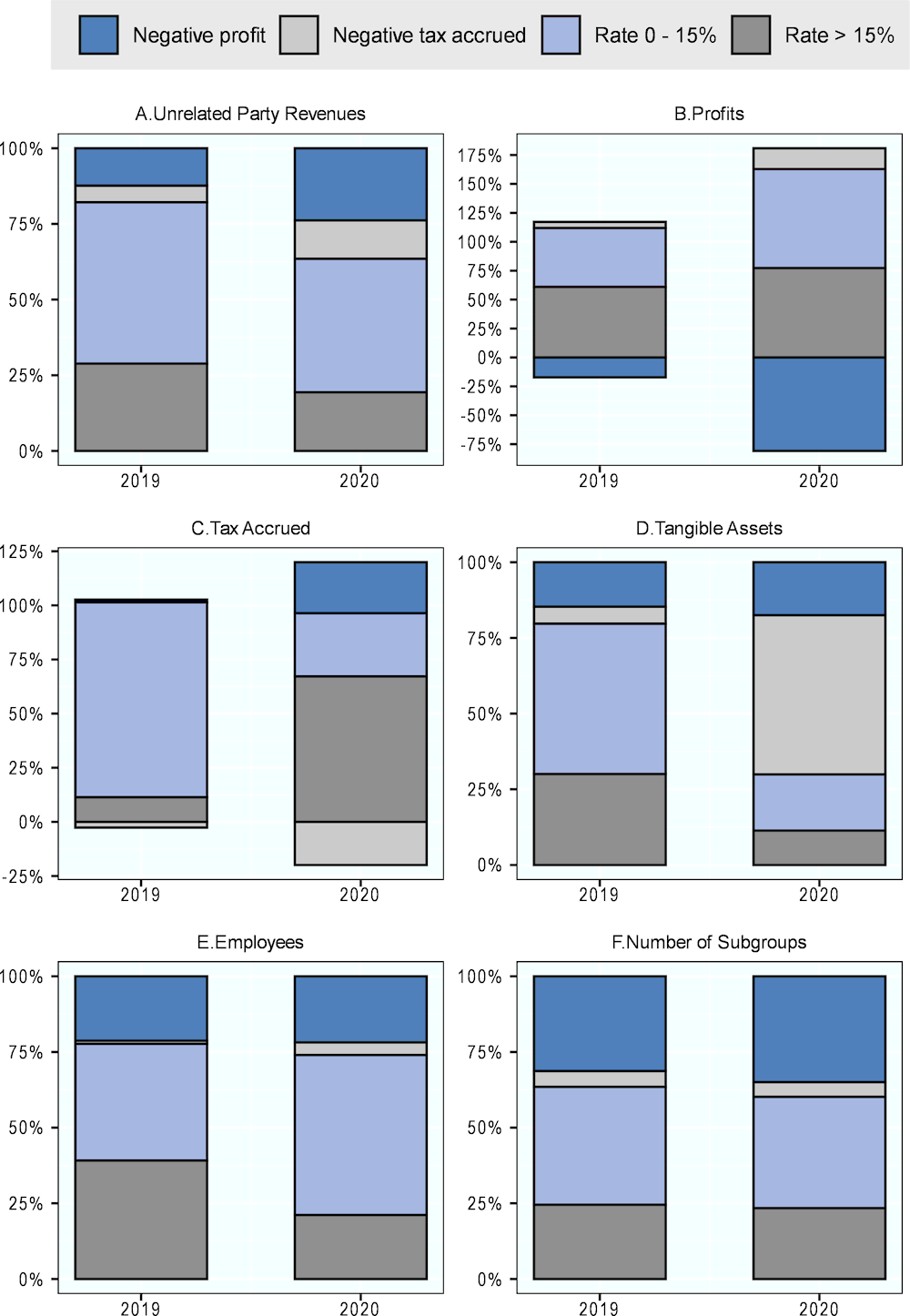

The information shown in Figure 5.9 is the same as the one presented in Figure 5.8 except that the disaggregation into four groups is based on subgroup characteristics. In addition, panel F now represents the number of subgroups instead of the number of MNEs (as depicted in panel A above).

Figure 5.9 shows the share of different activities operated by MNE sub-groups disaggregated into four groups including MNEs for which the total profit was negative, the total tax accrued was negative, located in a jurisdiction where the ETR of the sub-group was between 0 and 15%, and located in a jurisdiction where the ETR of the sub-group was equal to or above 15%. The six available panels capture different statistics, including the number of subgroups (panel F), the number of employees (panel E), and selected financial variables (panels A-D).

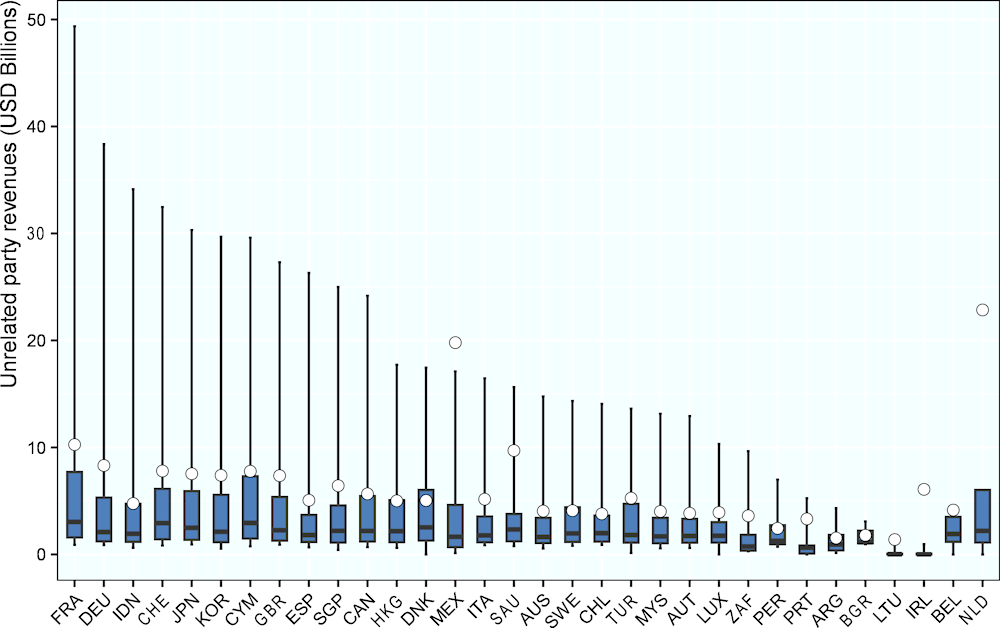

The size of MNE groups varies across the sample and includes a small number of relatively large MNE groups. Figure 5.10 shows the distribution points of unrelated party revenues of MNE groups headquartered in each reporting jurisdiction. A common feature across all jurisdictions is that the mean MNE size in terms of unrelated party revenues is considerably larger than the median size, indicating that the underlying sample includes a small number of relatively large MNE groups.

Key insights on BEPS from CbCR data

This release of anonymised and aggregated CbCR data (FY 2020) provides some insights on BEPS.

Due to the limitations of the CbCR data, considerable caution needs to be exercised when attempting to draw conclusions about BEPS from the data. This is especially the case given that this is only the fifth year for which anonymised and aggregated data have been provided. Five years of data can give only limited insights on changes and potential trends in BEPS behaviour. In addition, the comparability between the 2016 sample and the samples for 2017 to 2020 is limited due to the move from voluntary to mandatory filing in some countries and differences in fiscal year coverage (see Box 5.2). Taking these caveats into account, the 2023 release of CbCR statistics suggests some insights on BEPS:

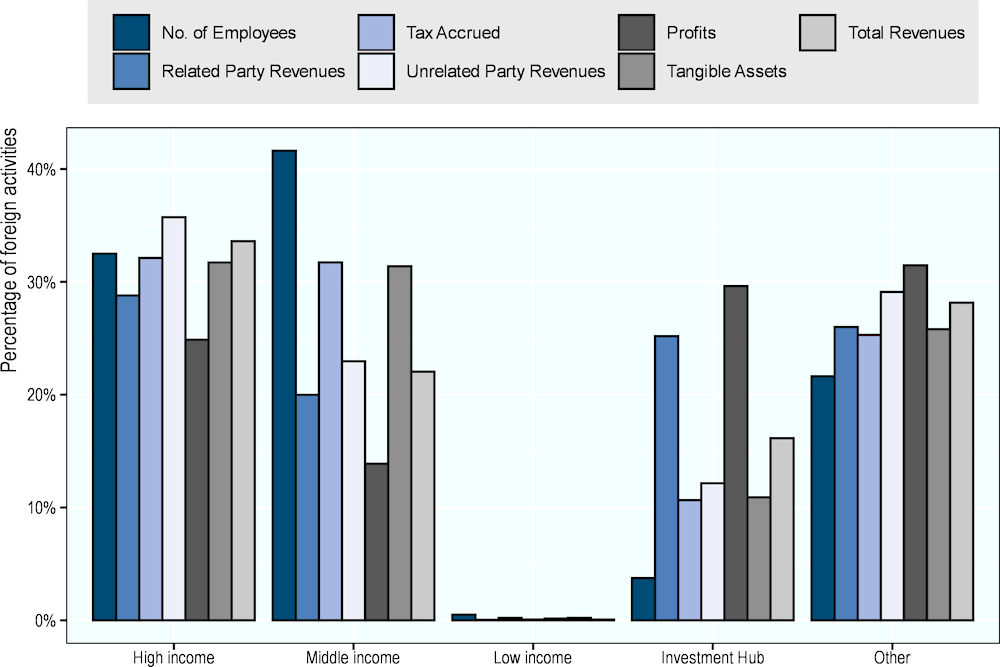

There is evidence of misalignment between the location where profits are reported and the location where economic activities occur. The data show continuing differences in the distribution across jurisdiction groups of employees, tangible assets, and profits.9 Figure 5.11 presents the distribution of MNEs’ foreign activities across jurisdiction groups.10 For example, high and middle income jurisdictions account for a higher share of total employees (respectively 32% and 42%) and total tangible assets (respectively 32% and 32%) than of profits (respectively 25% and 14%). On the other hand, in investment hubs, on average, MNEs report a relatively high share of profits (30%) compared to their share of employees (4%) and tangible assets (11%). High income jurisdictions, middle income jurisdictions, and investment hubs account for 32%, 32%, and 10% of tax accrued, respectively.11

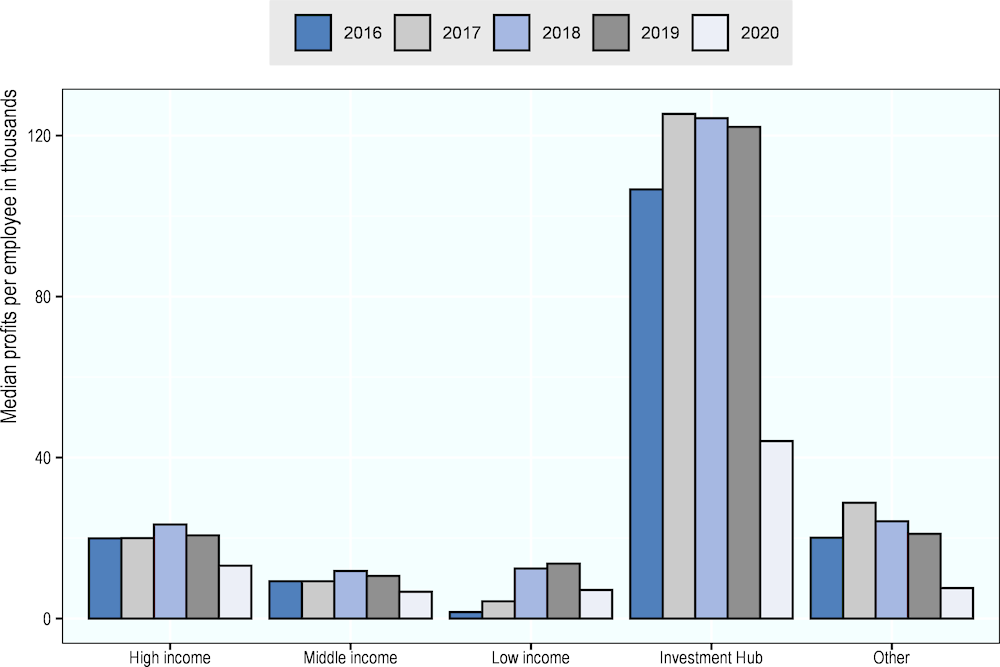

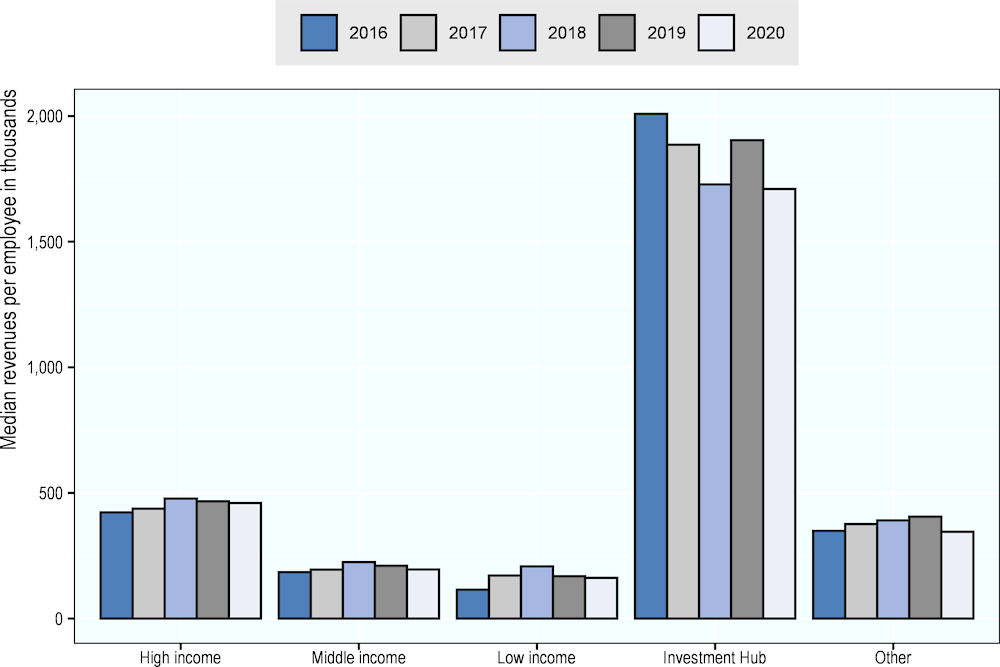

Revenues and profits per employee tend to be higher in investment hubs. Figure 5.12 and Figure 5.13 shows how the ratio of total revenues and profits to the number of employees is higher in investment hubs. In investment hubs, median revenues per employee are USD 1 710 000 while in high-, middle- and low-income jurisdictions median revenues per employee are USD 460 000, USD 195 000 and USD 160 000 respectively. While this may reflect differences in capital intensity or in worker productivity, it is likely also at least partially an indicator of BEPS.

Figure 5.9. Data disaggregated by the ETR of MNE sub-group

Source: Source: 2019 and 2020 Anonymised and Aggregated CbCR statistics. These data are based on Table 5 of the CbCR statistics.

Figure 5.10. Distribution of MNE unrelated party revenues by ultimate parent jurisdiction

Note: The white dot represents the average value (obtained by dividing totals by the number of CbCRs), the blue boxes are delimited by the 25th and 75th percentiles, thus representing 50% of the sample within each jurisdiction. The horizontal black bar shows the median (50th percentile). The two whiskers indicate the 5th and 95th percentiles. Jurisdictions are ranked with respect to the 95th percentile where available. Country coverage reflects data availability in Table 6 of the CbCR data.

Source: 2020 Anonymised and Aggregated CbCR statistics.

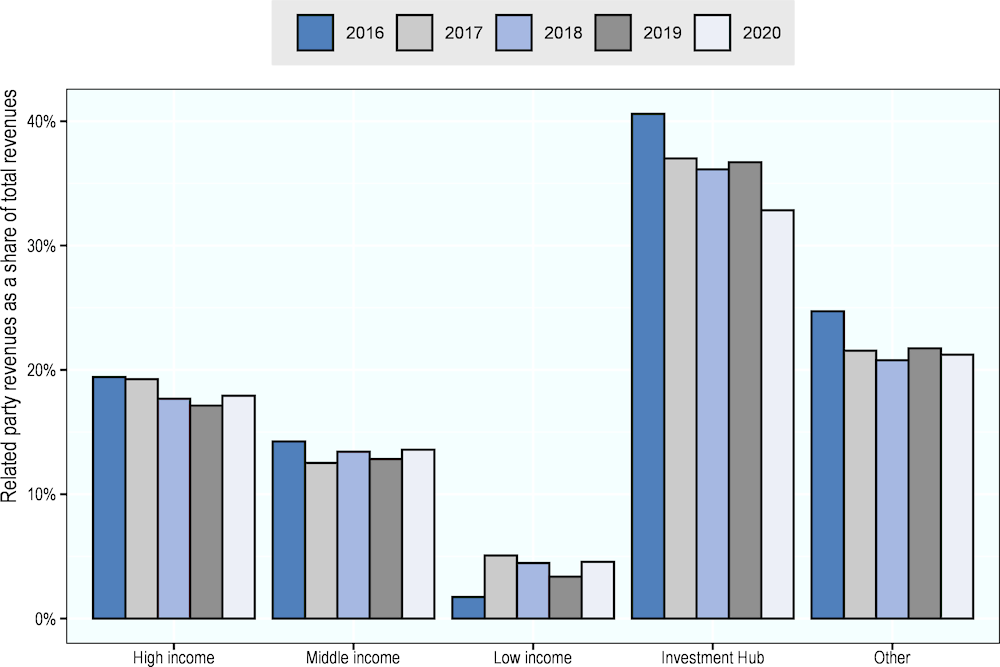

On average, the share of related party revenues in total revenues is higher for MNEs in certain jurisdictions. Figure 5.14 plots the distribution of related party revenues as a share of total revenues, by jurisdiction group. On average, the share of related party revenues in total revenues is higher in investment hubs than in high-, middle- and low-income jurisdictions. In investment hubs, related party revenues account for over 30% of total revenues, whereas the median share of related party revenues in high-, and middle-income jurisdictions is 18% and 13% respectively. The median share of related party revenues in low-income jurisdictions is much lower at just 5%. While high levels of related party revenues may be commercially motivated, they are also a high-level risk assessment factor and could be evidence of tax planning.

The composition of business activity differs across jurisdiction groups. Figure 5.15 shows the share of main business activities in each jurisdiction group. In high-, middle- and low-income jurisdictions, sales, manufacturing, and services are the most prevalent activities, while in investment hubs the predominant activity is “holding shares” which also includes other equity instruments. A concentration of holding companies is a risk assessment factor and could be indicative of certain tax planning structures. However, as with related party revenues, this observation may also relate to genuine commercial arrangements.

Figure 5.11. Jurisdiction groups’ shares of foreign MNEs’ activities

Note: The profit variable could include intracompany dividends in several instances and therefore be upward biased. The bars represent jurisdiction groups’ shares of different variables (e.g., profit in group x/total profits booked in foreign jurisdictions) across all jurisdictions included in the CbCR sample. The percentages are calculated using Table 1A Panel A (all subgroups). “Other” reflects aggregate geographic groupings and Stateless entities.

Source: 2020 Anonymised and Aggregated CbCR statistics.

Figure 5.12. Median profits per employee: distribution within jurisdiction groups

Note: “Other” reflects aggregate geographic groupings and Stateless entities.

Source: Anonymised and Aggregated CbCR statistics.

Figure 5.13. Median total revenues per employee: Distribution within jurisdiction groups

Note: “Other” reflects aggregate geographic groupings and Stateless entities.

Source: 2020 Anonymised and Aggregated CbCR statistics.

Figure 5.14. Median related party revenues shares: Distribution within jurisdiction groups

Note: The chart displays the distribution of related party revenues as a share of total revenues within each jurisdiction group. “Other” reflects aggregate geographic groupings and Stateless entities.

Source: 2020 Anonymised and Aggregated CbCR statistics.

Figure 5.15. Top three business activities performed in jurisdiction groups

Note: The ratios are calculated by dividing the number of the activities performed in a jurisdiction group by the total number of all activities performed in this jurisdiction group where data is available. For example, 20% of all activities performed in high income jurisdictions are in the “sales” category. Entities could be attributed to one or more of the following activities: research and development; holding or managing intellectual property; purchasing or procurement; manufacturing or production (manufacturing); sales, marketing or distribution (sales); administrative, management or support services; provision of services to unrelated parties (services); internal group finance; regulated financial services; insurance; holding shares or other equity instruments (holding shares); dormant; other activities. For the United States, other activities also include holding or managing intellectual property; insurance; internal group finance; and research and development.

Source: 2020 Anonymised and Aggregated CbCR statistics

References

[1] OECD (2015), Measuring and Monitoring BEPS, Action 11 - 2015 Final Report, OECD/G20 Base Erosion and Profit Shifting Project, OECD Publishing, Paris, https://doi.org/10.1787/9789264241343-en.

Notes

← 1. In the case of the United States, CbCR data are less granular than Inland Revenue Service (IRS) Form 5471, 8865, and 8858 data.

← 2. With the exception of stateless income, which could relate to either domestic or foreign activities.

← 3. Reporting MNEs may choose to use data from consolidation reporting packages, from separate entity statutory financial statements, regulatory financial statements, or internal management accounts. In some jurisdictions, taxpayers are permitted to use financial statements or records maintained for tax reporting purposes.

← 4. In the European Union, the Council directive 2011/96/EU limits the ability of EU Member States to tax received dividends in order to exempt dividends and other profit distributions paid by subsidiary companies to their parent companies from withholding taxes and to eliminate double taxation of such income at the level of the parent company.

← 5. Country specific analysis undertaken by Ireland, Italy, the Netherlands, Sweden and the United Kingdom are available at: Ireland: https://oe.cd/3Kn; Italy: https://oe.cd/3Ko; Netherlands: https://oe.cd/3Kp; Sweden: https://oe.cd/3Kq; United Kingdom: https://oe.cd/3Kr.

← 6. The BEPS Action 13 report (http://www.oecd.org/tax/transfer-pricing-documentation-and-country-by-country-reporting-action-13-2015-final-report-9789264241480-en.htm) included a requirement that a review of the CbCR minimum standard be completed (the 2020 review). A public consultation meeting on the 2020 review of BEPS Action 13 was held virtually on 12-13 May 2020, where external stakeholders had the opportunity to provide input on the ongoing work.

← 7. The 2017 data and future releases cover fiscal years ending between 1 January and 31 December of the respective year while the 2016 data contains CbCRs for fiscal years starting between 1 January and 1 July 2016.

← 8. Foreign MNEs’ contributions might be understated for two main reasons: first, some jurisdictions provided limited geographical disaggregation; second, the contributions of MNEs with parents headquartered in jurisdictions that did not provide data are missing.

← 9. As indicated in Box 5.2, and described in greater detail at http://www.oecd.org/tax/tax-policy/anonymised-and-aggregated-cbcr-statistics-disclaimer.pdf, profits may be overestimated due to the inclusion of intra-company dividends. To evaluate the potential magnitude of included dividends country specific analyses are available at: Netherlands: https://oe.cd/3Kp; Ireland: https://oe.cd/3Kn; Italy: https://oe.cd/3Ko; Sweden: https://oe.cd/3Kq; United Kingdom: https://oe.cd/3Kr.

← 10. Jurisdiction groups (high, middle and low income) are based on the World Bank classification resulting in 61 high income jurisdictions, 104 middle income jurisdictions, and 29 low-income jurisdictions. Investment hubs are defined as jurisdictions with a total inward Foreign Direct Investment (FDI) position above 150% of gross domestic product (GDP).

← 11. Tax accrued depends on both effective tax rates and taxable profits in a jurisdiction.