In 2020, the share of corporate tax revenues in total tax revenues was 15.1% on average across the 116 jurisdictions for which corporate tax revenues are available in the database, and the share of these revenues as a percentage of gross domestic product (GDP) was 3.0% on average.

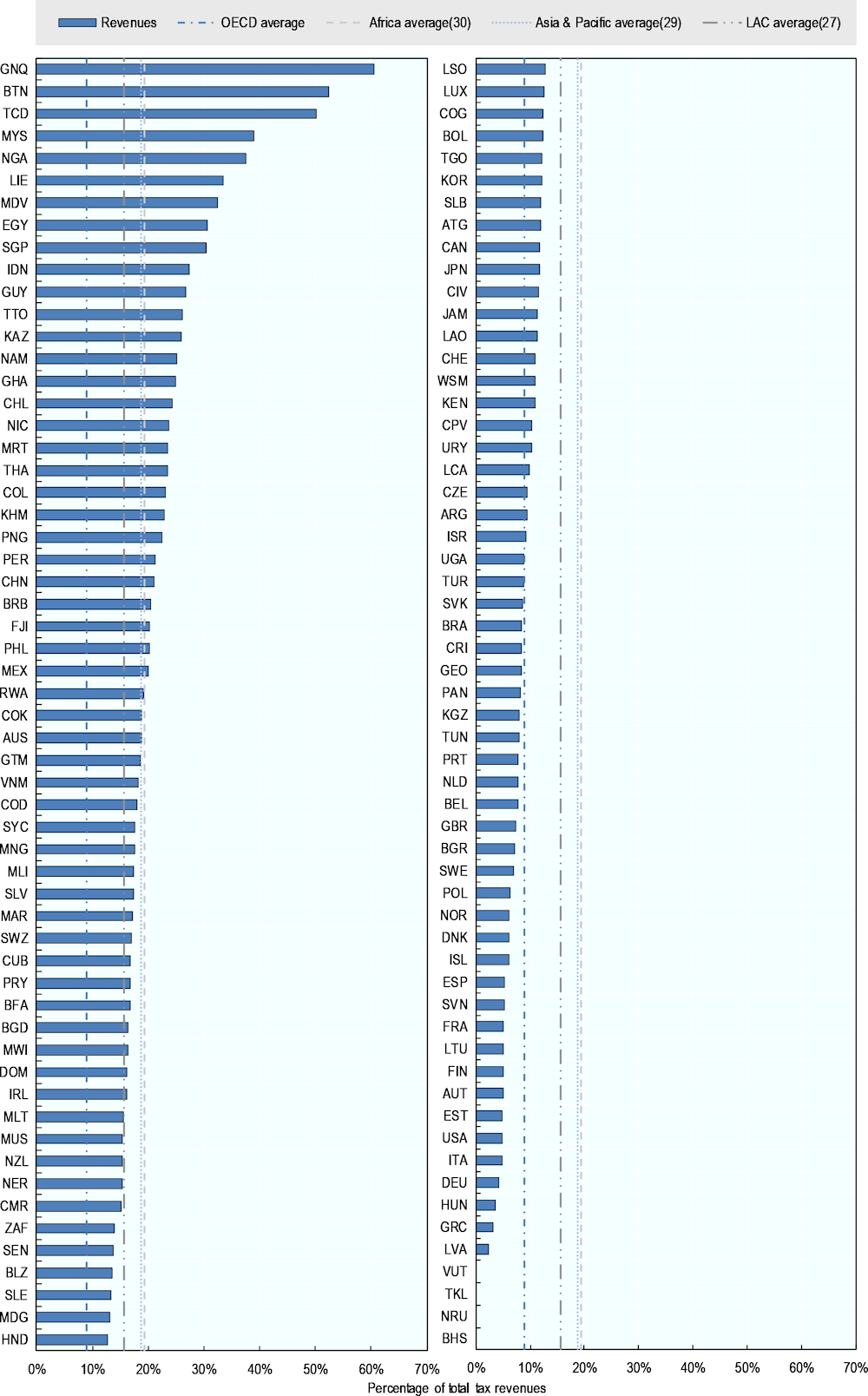

The size of corporate tax revenues relative to total tax revenues and relative to GDP varies by groupings of jurisdictions. In 2020, corporate tax revenues were a larger share of total tax revenues on average in Africa (19.3% in the 30 jurisdictions), Asia and Pacific (18.8% in the 29 jurisdictions) and Latin American and The Caribbean (LAC) (15.6% in the 27 jurisdictions) than the OECD (9.0%). The average of corporate tax revenues as a share of GDP was the largest in LAC (3.4% in the 27 jurisdictions), followed by Asia and Pacific (3.1% in the 29 jurisdictions), Africa (3.1% in the 30 jurisdictions) and the OECD (2.8%).

In fifteen jurisdictions – Bhutan, Chad, Egypt, Equatorial Guinea, Ghana, Guyana, Indonesia, Kazakhstan, Liechtenstein, Malaysia, Maldives, Namibia, Nigeria, Singapore and Trinidad and Tobago – corporate tax revenues made up more than one-quarter of total tax revenues in 2020.

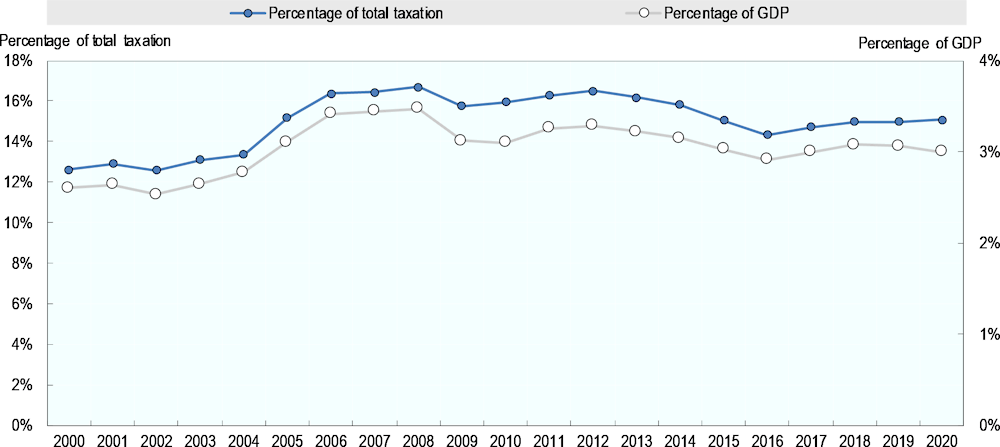

Corporate tax revenues are driven by the economic cycle. For the period 2000-20, average corporate tax revenues as a percentage of GDP reached their peak in 2008 (3.5%) and declined in 2009 and 2010 (3.1% and 3.1% respectively), reflecting the impact of the 2008 global financial and economic crisis.

Corporate Tax Statistics 2023

1. Corporate tax revenues

Key insights

Data on corporate tax revenues can be used for comparison across jurisdictions and to track trends over time. The data in the Corporate Tax Statistics database is drawn from the OECD’s Global Revenue Statistics Database and allows for the comparison of individual jurisdictions as well as average corporate tax revenues across OECD, LAC, African, and Asian and Pacific jurisdictions.1

The Corporate Tax Statistics database contains four corporate tax revenue indicators:

the level of corporate tax revenues in national currency;

the level of corporate tax revenues in USD;

corporate tax revenues as a percentage of total tax revenue;

corporate tax revenues as a percentage of gross domestic product (GDP).

The data are from the OECD’s Global Revenue Statistics Database, which presents detailed, internationally comparable data on tax revenues. The classification of taxes and methodology is described in detail in the OECD’s Revenue Statistics Interpretative Guide.

Trends in corporate tax revenues

Data from the OECD’s Corporate Tax Statistics database show that there was a slight increase in both the average of corporate income tax (CIT) revenues as a share of total tax revenues and as a share of GDP between 2000 and 2019 across the 116 jurisdictions for which data are available.2 Average corporate tax revenues as a share of total tax revenues increased from 12.6% in 2000 to 15.1% in 2020, and average CIT revenues as a percentage of GDP increased from 2.6% in 2000 to 3.0% in 2020.

Between 2000 and 2019, the trend for both indicators is very similar (Figure 1.1). When measured both as a percentage of total tax revenues and as a percentage of GDP, corporate tax revenues reached their peak in 2008 and then dipped in 2009 and 2010, reflecting the impact of the global financial and economic crisis. While average CIT revenues recovered after 2010, the unweighted averages declined in 2014, 2015 and 2016 across all 116 jurisdictions for which data are available. The unweighted averages recovered slightly in 2017 and 2018 as a result of increases across a wide range of jurisdictions. This two-year period of increases was followed by a slight decline in 2019 in both indicators, however in 2020, average CIT revenues as a share of total tax revenues increased slightly while average CIT as a share of GDP continued to decline slightly.

Figure 1.1. Average corporate tax revenues as a percentage of total tax and as a percentage of GDP

The averages mask considerable differences across jurisdictions (Figure 1.2). In 2020, jurisdictions differed considerably in the portion of total tax revenues raised by the CIT. In Bhutan, Chad, Egypt, Equatorial Guinea, Ghana, Guyana, Indonesia, Kazakhstan, Liechtenstein, Malaysia, Maldives, Namibia, Nigeria, Singapore and Trinidad and Tobago, CIT revenue accounted for more than 25% of total tax revenue. In Bhutan, Chad and Equatorial Guinea, it accounted for more than 40%. In contrast, some jurisdictions – such as the Bahamas, Estonia, Germany, Greece, Hungary, Italy, Latvia, Nauru, Tokelau, the United States and Vanuatu3 – raised less than 5% of total tax revenue from the CIT. In most jurisdictions, the difference in the level of corporate taxes as a share of total tax revenues reflects differences in the levels of other taxes raised.

The average revenue share of corporate tax in 2020 also varied across the OECD and the regional groupings (LAC, Asia and Pacific and Africa). In 2020, the OECD average was the lowest, at 9.0%, followed by the LAC average (15.6% in 27 jurisdictions), the Asian and Pacific average (18.8% in 29 jurisdictions) and the African average (19.3% in 30 jurisdictions).

Some of the variation in the share of CIT in total tax revenues results from differences in statutory corporate tax rates, which also vary considerably across jurisdictions. In addition, this variation can be explained by institutional and jurisdiction-specific factors, including:

the degree to which firms in a jurisdiction are incorporated;

the breadth of the CIT base;

the current stage of the economic cycle and the degree of cyclicality of the corporate tax system (for example, from the generosity of loss offset provisions);

the extent of reliance on other types of taxation, such as taxes on personal income and on consumption;

the extent of reliance on tax revenues from the exploitation of natural resources;

other instruments that postpone the taxation of earned profits.

Generally, differences in corporate tax revenues as a share of total tax revenues should not be interpreted as being related to base erosion and profit shifting (BEPS) behaviour, since many other factors are likely to be more significant, although profit shifting may have some effects at the margin.

Corporate tax revenues as a share of GDP

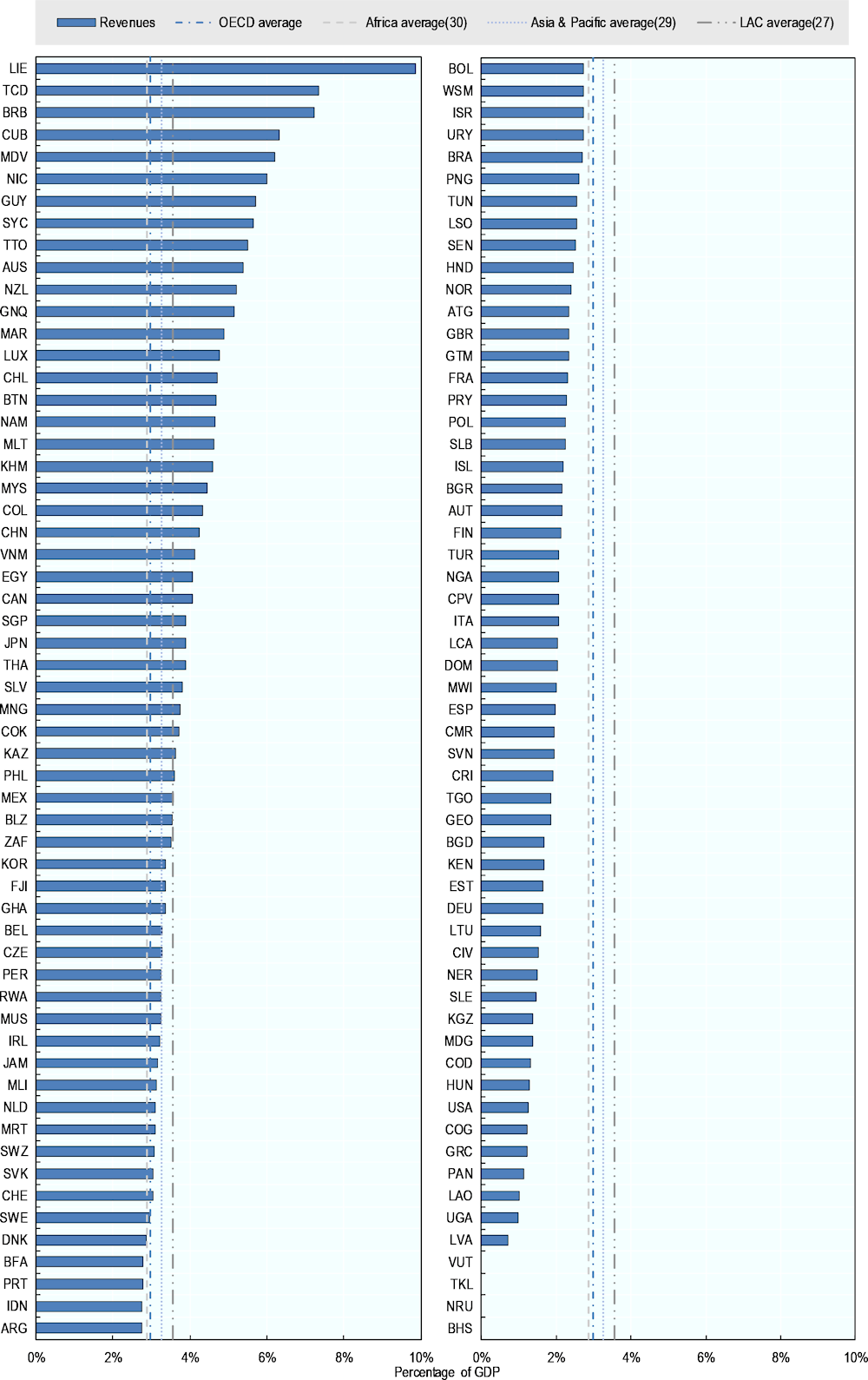

Corporate tax revenues as a percentage of GDP also vary across jurisdictions. In 2020, the ratio of corporate tax revenues to GDP were between 2% and 5% of GDP for a majority of the 116 jurisdictions covered (Figure 1.3). For a few jurisdictions, corporate tax revenues accounted for a larger percentage of GDP; they were more than 5% of GDP in 12 jurisdictions. In contrast, they were less than 2% of GDP in 29 jurisdictions.

In 2020, the OECD and Africa (30 jurisdictions) averages were similar, at 2.9% and 2.8% of GDP respectively, whereas the Asia and Pacific (29 jurisdictions) and LAC (27 jurisdictions) averages were higher (3.1% and 3.4%).

The reasons for the variation across jurisdictions in corporate tax revenues as a percentage of GDP are similar to those that explain why the corporate tax revenue share of total tax revenue differs, such as differences in statutory corporate tax rates and differences in the degree to which firms in a given jurisdiction are incorporated. In addition, the total level of taxation as a share of GDP plays a role. For example, for the 30 African jurisdictions, the relatively high average revenue share of CIT compared to the relatively low average of CIT as a percentage of GDP reflects the low amount of total tax raised as a percentage of GDP (average of 16.0%). Total tax revenue as a percentage of GDP is somewhat higher for the 27 LAC jurisdictions (average of 20.9%), the 29 Asian and Pacific jurisdictions (average of 19.1%) and for the OECD jurisdictions (average of 33.6%). Across jurisdictions in the database, low tax-to-GDP ratios may reflect policy choices as well as other challenges associated with domestic resource mobilisation (e.g., administrative capacity and levels of compliance).

Figure 1.2. Corporate tax revenues as a percentage of total tax revenues, 2020

Figure 1.3. Corporate tax revenue as a percentage of GDP, 2020

Notes

← 1. The Global Revenue Statistics Database covers 120 jurisdictions as of October 2023. Data on corporate tax revenues is available for 116of these jurisdictions. In addition to the OECD, the Global Revenue Statistics Database also contains data on 29 Asian and Pacific jurisdictions, 27 Latin America and Caribbean jurisdictions, and 30 African jurisdictions, and averages for the LAC, African, and Asian and Pacific regions.

← 2. The latest tax revenue data available across all jurisdictions in the database are for 2020, although there are 2021 data available for some jurisdictions in the Global Revenue Statistics database.

← 3. The Bahamas, Nauru, Tokelau and Vanuatu do not levy a corporate income tax.