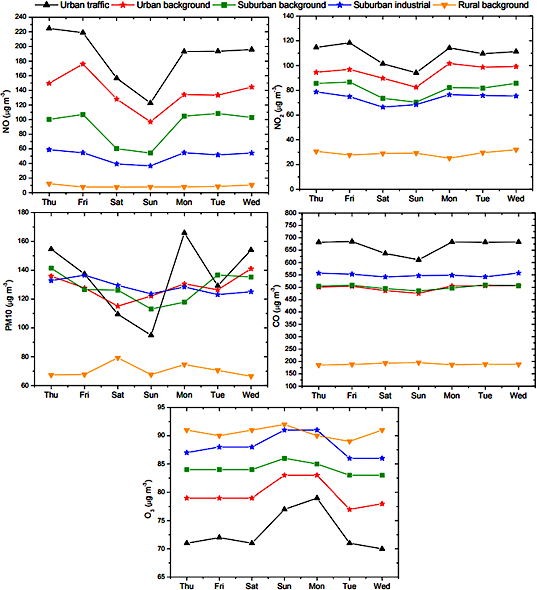

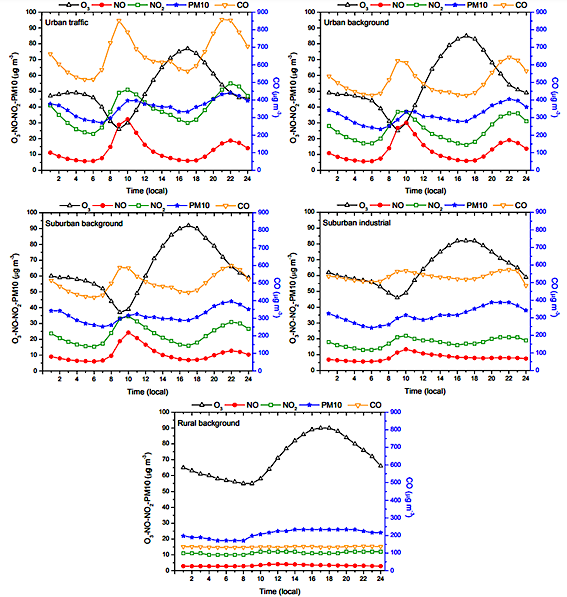

[7] Adame, J. et al. (2014), “Weekend-Weekday Effect Assessment for O3, NOx, CO and PM10 in Andalusia, Spain (2003–2008)”, Aerosol and Air Quality Research, Vol. 14, pp. 1862-1874, https://doi.org/10.4209/aaqr.2014.02.0026.

[43] Agencia Tributaria de Catalunya (2022), Base imponible, cuota tributaria y bonificación.

[74] Albalate, D., M. Borsati and A. Gragera (2022), Preliminary results of the impact of massive discounts in public transport on air quality, https://nadaesgratis.es/admin/resultados-preliminares-del-impacto-de-los-descuentos-masivos-en-transporte-publico-sobre-la-calidad-del-aire.

[32] Alonso-Epelde, E. et al. (2022), Modelling the direct socio-economic impacts of the New Energy Taxation Directive (ETD) and the extension of the ETS on transport and building sectors, OTEA (Observatorio de la Transición Energética y la Acción Climática), https://api.otea.info/storage/2022/06/06/ff2c5dc97f2cda8d3ea2812cb0e34e576100920a.pdf.

[61] Bento, A. et al. (2009), “Distributional and Efficiency Impacts of Increased US Gasoline Taxes”, American Economic Review, Vol. 99/3, pp. 667-699, https://doi.org/10.1257/aer.99.3.667.

[34] Borenstein, S. and L. Davis (2016), “The Distributional Effects of US Clean Energy Tax Credits”, ax Policy and the Economy, Vol. 30, pp. 191-234, https://doi.org/10.1086/685597.

[60] Bruzz (2022), Consultation committee not even about SmartMove, but ’road pricing not buried’.

[29] Bureau, B. (2011), “Distributional effects of a carbon tax on car fuels in France”, Energy Economics, Vol. 33/1, pp. 121-130, https://doi.org/10.1016/j.eneco.2010.07.011.

[18] Comité de personas expertas (2022), Libro Blanco Sobre la Reforma Tributaria.

[2] Crawford, I. and S. Smith (1995), “Fiscal Instruments for Air Pollution Abatement in Road Transport”, Journal of Transport Economics and Policy, Vol. 29/1, pp. pp. 33-51, https://www.jstor.org/stable/20053059.

[20] D’Arcangelo, F. et al. (2022), “Estimating the CO2 emission and revenue effects of carbon pricing: New evidence from a large cross-country dataset”, OECD Economics Department Working Papers, No. 1732, OECD Publishing, Paris, https://doi.org/10.1787/39aa16d4-en.

[22] D’Haultfœuille, X., P. Givord and X. Boutin (2014), “The Environmental Effect of Green Taxation: The Case of the French Bonus/Malus”, The Economic Journal, Vol. 124/578, pp. F444–F480, https://doi.org/10.1111/ecoj.12089.

[62] Douenne, T. (2018), “The vertical and horizontal distributive effects of energy taxes: A case study of a French policy”, FAERE Working Paper, No. 2018.10, http://faere.fr/pub/WorkingPapers/Douenne_FAERE_WP2018.10.pdf.

[21] Durrmeyer, I. (2022), “Winners and Losers: The Distributional Effects of the French Feebate on the Automobile Market”, The Economic Journal, Vol. 132/644, pp. 1414–1448., https://doi.org/10.1093/ej/ueab084.

[53] Elbil (2022), Norwegian EV policy.

[65] European Commission (2022), Commission proposes new Euro 7 standards to reduce pollutant emissions from vehicles and improve air quality [press release], https://ec.europa.eu/commission/presscorner/detail/en/IP_22_6495.

[66] European Parliament (2022), Deal confirms zero-emissions target for new cars and vans in 2035 [press release], https://www.europarl.europa.eu/news/en/press-room/20221024IPR45734/deal-confirms-zero-emissions-target-for-new-cars-and-vans-in-2035.

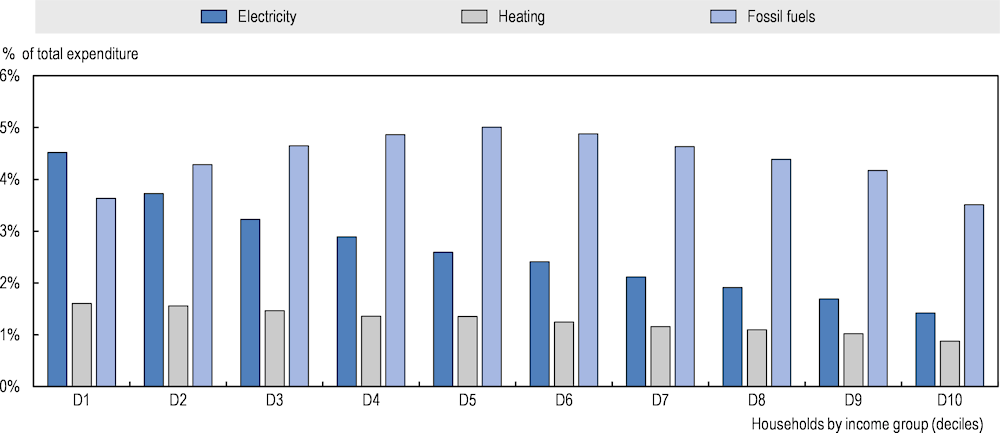

[28] Flues, F. and A. Thomas (2015), “The distributional effects of energy taxes”, OECD Taxation Working Papers, No. 23, OECD Publishing, Paris, https://doi.org/10.1787/5js1qwkqqrbv-en.

[24] Forum Ökologisch-Soziale Marktwirtschaft and Green Budget Europe (2018), Loss of revenues in passenger car taxation due to incorrect CO2 values in 11 EU states, A report commissioned by the Greens/EFA group in the European Parliament, http://www.foes.de/pdf/2018-03-10_FOES_Taxation_loss_due_incorrect_CO2_values.pdf.

[44] Generalidad de Cataluna (2020), Decreto Lay 33/2020, de 30 de septiembre, de medidas urgentes en el ámbito del impuesto sobre las emisiones de dióxido de carbono de los vehículos de tracción mecánica y del impuesto sobre las estancias en establecimientos turísticos, y en el ámbito presupuestario y administrativo.

[63] Gillingham, K. and A. Munk-Nielsen (2019), “A Tale of Two Tails: Commuting and the Fuel Price Response in Driving”, Journal of Urban Economics, Vol. 109, pp. 27-40, https://doi.org/10.1016/j.jue.2018.09.007.

[72] Gobierno de Espana (2022), Royal Decree-Law 20/2022 of 27 December on measures in response to the economic and social consequences of the war in Ukraine and in support of the reconstruction of the island of La Palma and other situations of vulnerability, provided in Articles 1 and 72 for changes in VAT and equivalence surcharge rates..

[33] Gore, T. (2022), Can Polluter Pays policies in the buildings and transport sectors be progressive? Assessing the distributional impacts on households of the proposed reform of the Energy, Research report, Institute for European Environmental Policy, https://ieep.eu/uploads/articles/attachments/7a9ac44a-fa75-4caf-9db5-76d55110217c/Can%20polluter%20pays%20policies%20in%20buildings%20and%20transport%20be%20progressive_IEEP%20(2022).pdf?v=63813977582.

[64] Graham, D. and S. Glaister (2002), “The Demand for Automobile Fuel: A Survey of Elasticities”, Journal of Transport Economics and Policy, Vol. 36/1, pp. 1-25, https://www.jstor.org/stable/20053890.

[11] Harding, M. (2014), “Personal Tax Treatment of Company Cars and Commuting Expenses: Estimating the Fiscal and Environmental Costs”, OECD Taxation Working Papers, Vol. 14/OECD Publishing, Paris, https://doi.org/10.1787/5jz14cg1s7vl-en.

[3] Held, M. et al. (2021), “Lifespans of passenger cars in Europe: empirical modelling of fleet turnover dynamics”, European Transport Research Review, Vol. 13/9, https://doi.org/10.1186/s12544-020-00464-0.

[70] ICCT (2022), Incentivising zero- and low-emission vehicles: the magic of feebate programs (blog post), https://theicct.org/magic-of-feebate-programs-jun22/.

[1] Junta de Andalucia (2022), Parque distribuido por tipo de vehículo, carburante y año de matriculación..

[71] Junta de Andalucia (2022), Statistics on levels of emission into the atmosphere of pollutants in Andalusia, https://www.juntadeandalucia.es/medioambiente/portal/landing-page-%C3%ADndice/-/asset_publisher/zX2ouZa4r1Rf/content/estad-c3-adstica-de-niveles-de-emisi-c3-b3n-a-la-atm-c3-b3sfera-de-contaminantes-en-andaluc-c3-ada/20151?categoryVal=.

[40] Kassirer (2020), France’s Feebate for Fuel Efficient Vehicles.

[16] Kirk, R. and M. Levinson (2016), Mileage-Based Road User Charges, Congressional Research Service, https://fas.org/sgp/crs/misc/R44540.pdf.

[73] Labandeira, X. (2022), Taxation and Ecological Transition during Climate and Energy Crises: the Main Conclusions of the 2022 Spanish White Book on Tax Reform, Real Instituto Elcano WP 09-2022, https://www.realinstitutoelcano.org/en/work-document/taxation-and-ecological-transition-during-climate-and-energy-crises/.

[19] Labandeira, X., J. Labeaga and X. López-Otero (2017), “A meta-analysis on the price elasticity of energy demand”, Energy Policy, Vol. 102, pp. 549-568, https://doi.org/10.1016/j.enpol.2017.01.002.

[17] Langer, A., V. Maheshri and C. Winston (2017), “From gallons to miles: A disaggregate analysis of automobile travel and externality taxes”, Journal of Public Economics, Vol. 152, pp. 34-46, https://doi.org/10.1016/j.jpubeco.2017.05.003.

[69] L’Echo (2022), L’application SmartMove démarre sa phase de test (press article), https://www.lecho.be/economie-politique/belgique/bruxelles/l-application-smartmove-demarre-sa-phase-de-test/10409083.html.

[41] Legifrance (2018), Articles D251-7 to D251-13.

[36] Leroutier, M. and P. Quirion (2022), “Air pollution and CO2 from daily mobility: Who emits and Why? Evidence from Paris”, Energy Economics, Vol. 109, https://doi.org/10.1016/j.eneco.2022.105941.

[31] Levinson, D. (2010), “Equity Effects of Road Pricing: A Review”, Transport Reviews, Vol. 30/1, pp. 33-57, https://doi.org/10.1080/01441640903189304.

[5] Mottershead, D. et al. (2021), Green taxation and other economic instruments. Internalising environmental costs to make the polluter pay, European Commission, Directorate-General for Environment, Brussels, https://environment.ec.europa.eu/publications/green-taxation-and-other-economic-instruments-internalising-environmental-costs-make-polluter-pay_en.

[35] Muehlegger, E. and D. Rapson (2018), “Subsidizing Mass Adoption of Electric Vehicles: Quasi-Experimental Evidence from California”, NBER Working Papers, No. 25359, National Bureau of Economic Research, https://www.nber.org/papers/w25359.

[51] Norwegian Ministry of Transport and Communications (2017), National Transport Plan 2018–2029.

[9] OECD (2022), Consumption Tax Trends 2022: VAT/GST and Excise, Core Design Features and Trends, OECD Publishing, Paris, https://doi.org/10.1787/6525a942-en.

[55] OECD (2022), OECD Environmental Performance Reviews: Norway 2022, OECD Environmental Performance Reviews, OECD Publishing, Paris, https://doi.org/10.1787/59e71c13-en.

[8] OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/e9778969-en.

[54] OECD (2022), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, OECD Series on Carbon Pricing and Energy Taxation, OECD Publishing, Paris, https://doi.org/10.1787/e9778969-en.

[26] OECD (2022), Tax Policy Reforms 2022: OECD and Selected Partner Economies, OECD Publishing, Paris, https://doi.org/10.1787/067c593d-en.

[25] OECD (2022), “Why governments should target support amidst high energy prices”, OECD Policy Responses on the Impacts of the War in Ukraine, https://www.oecd.org/ukraine-hub/policy-responses/why-governments-should-target-support-amidst-high-energy-prices-40f44f78/.

[14] OECD (2020), Accelerating Climate Action in Israel: Refocusing Mitigation Policies for the Electricity, Residential and Transport Sectors, OECD Publishing, Paris, https://doi.org/10.1787/fb32aabd-en.

[46] OECD (2020), Accelerating Climate Action in Israel: Refocusing Mitigation Policies for the Electricity, Residential and Transport Sectors, OECD Publishing, Paris, https://doi.org/10.1787/fb32aabd-en.

[56] OECD (2020), Consumption Tax Trends 2020: VAT/GST and Excise Rates, Trends and Policy Issues, OECD Publishing, Paris, https://doi.org/10.1787/152def2d-en.

[37] OECD (2019), Taxing Energy Use 2019: Using Taxes for Climate Action, OECD Publishing, Paris, https://doi.org/10.1787/058ca239-en.

[13] OECD (2016), “Israel’s Green Tax on Cars: Lessons in Environmental Policy Reform”, OECD Environmental Policy Paper, No 5, OECD Publishing, Paris,, https://doi.org/10.1787/5jlv5rmnq9wg-en.

[45] OECD (2016), “Israel’s Green Tax on Cars: Lessons in Environmental Policy Reform”, OECD Environment Policy Papers, No. 5, OECD Publishing, Paris, https://doi.org/10.1787/5jlv5rmnq9wg-en.

[10] OECD/ITF (2019), Tax Revenue Implications of Decarbonising Road Transport: Scenarios for Slovenia, OECD Publishing, https://doi.org/10.1787/87b39a2f-en.

[15] Parry, I. and K. Small (2005), “Does Britain or the United States Have the Right Gasoline Tax”, The American Economic Review, Vol. 95/4, pp. 1276-1289, https://www.jstor.org/stable/4132715.

[57] Politico (2020), Plan to charge Brussels motorists per kilometer driven.

[52] Regjeringen (2021), Norway is electric.

[58] Reveal (2020), Smart Move: A Breath of Fresh Air for Brussels.

[49] Road Traffic (2020), Stockholm Congestion Charge.

[12] Roshal, V. and A. Tovias (2016), Car purchase tax: green tax reform in Israel, OECD, Paris, https://www.oecd.org/israel/OECDWorkingPaper-Green-Tax-Reform-in-Israel.pdf.

[68] SmartMove (2022), SmartMove sets Brussels on the right track, https://smartmove.brussels/en.

[30] Spiller, E., H. Stephens and Y. Chen (2017), “Understanding the heterogeneous effects of gasoline taxes across income and location”, Resource and Energy Economics, Vol. 50, pp. 74-90, https://doi.org/10.1016/j.reseneeco.2017.07.002.

[27] Sterner, T. (2012), Fuel Taxes and the Poor: The Distributional Effects of Gasoline Taxation and Their Implications for Climate Policy, RFF Press, New York, https://doi.org/10.4324/9781936331925.

[23] Teusch, J. and N. Braathen (2019), “Are environmental tax policies beneficial?: Learning from programme evaluation studies”, OECD Environment Working Papers, No. 150, OECD Publishing, Paris, https://doi.org/10.1787/218df62b-en.

[38] Teusch, J. and N. Braathen (2019), “Are environmental tax policies beneficial?: Learning from programme evaluation studies”, OECD Environment Working Papers, No. 150, OECD Publishing, Paris, https://doi.org/10.1787/218df62b-en.

[59] The Brussels Times (2020), Brussels eyes half a billion euros per year with new toll plan.

[50] Time (2022), “What Norway Can Teach the World About Switching to Electric Vehicles”.

[48] Tools of Change (2014), Stockholm’s Congestion Pricing.

[47] Transport Styrelsen (2021), Hours and amounts in Stockholm.

[4] Van Dender, K. (2019), “Taxing vehicles, fuels, and road use: Opportunities for improving transport tax practice”, OECD Taxation Working Papers, No 44, OECD Publishing, Paris, https://doi.org/10.1787/e7f1d771-en.

[39] Wappelhorst (2022), “Incentivizing zero- and low-emission vehicles: the magic of feebate programs”.

[6] WHO (2005), Health effects of transport-related air pollution, World Health Organization Regional Office for Europe, https://www.euro.who.int/__data/assets/pdf_file/0006/74715/E86650.pdf.

[67] Wilson, S. (2020), Brussels Government to introduce road pricing across the Brussels region (blog post), http://roadpricing.blogspot.com/2020/12/brussels-government-to-introduce-road.html.

[42] Yang (2018), Practical lessons in vehicle efficiency policy: The 10-year evolution of France’s CO2-based bonus-malus (feebate) system.