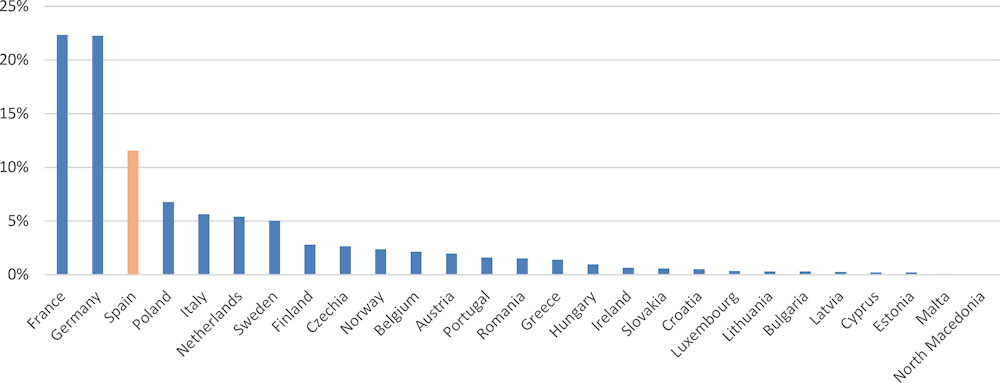

While tourist taxes exist in several European countries, there is currently no specific tax on tourists in Andalusia The tourism industry is one of the major economic sectors in the Andalusian economy, contributing to 13% of the region’s GDP and to 14% of employment (Villegas, Del Carmen Delgado and Cardenete, 2022[1]). There currently is no specific tax on tourist stays in the region. Taxes on tourist stays exist in several European countries at the regional, local or city-level, such as in Switzerland, or in the cities of Amsterdam or Lisbon (Responsible Travel, 2022[2]). In Spain, the Autonomous Communities of Catalonia and the Balearic Islands have established tourist taxes (see Annex 12.A). In most of the cases, such taxes cannot be considered environmental taxes as their main goal is not to account for the environmental impact of tourism, but rather to raise funds for municipal expenses. Typically, these taxes do not incorporate environmental considerations explicitly but are fixed charges per night ranging from EUR 0.50 to EUR 5 or charged as a percentage of the price of the accommodation (up to 7% in Amsterdam). Whilst several tourist taxes use revenues to relieve some of the (environmental) pressures caused by tourism, there are few cases in Europe where the tax rate itself varies with explicit environmental criteria. This is the case of the Balearic Islands Tourist Tax (see Box 12.1 and Annex 12.A).

This chapter lines out few dimensions that may need to be considered in reflections on tourist taxes, without providing concrete recommendations on their implementation or design. Additional research on the actual extent of the problem and potential policy approaches to resolve them, reflections and discussions would need to be conducted (e.g. on the impact of specific design and management features), which is not in the focus of this report.