In Andalusia, greenhouse gas (GHG) emissions increased from 42 015 kt CO2 eq. in 1990 to 54 416 kt CO2 eq. in 2019 (Instituto de Estadistica y Cartografia de Andalucia, 2020[1]). Hydrocarbons still represent the largest share in the energy mix of Andalusia compared to Spain and EU average, especially driven by the transport sector (Junta de Andalucia, 2020[2]). In 2020, transport represented 41.3% of CO2 emissions (41.2% in 2019), the largest emitters, followed by generation (25.6% vs 31.1% in 2019) and industry (12.8% vs 11.8% in 2019) (Table 2.1) (Agencia Andaluza de la Energia, 2020[3]).1 Andalusia has a high potential for renewable energy as there is a high availability of renewable energy sources, which is judged capable of meeting the energy demand of the autonomous community (Junta de Andalucia, 2020[2]). The gross electricity production of renewables as compared to final electricity consumption sharply grew from 7.2% in 2005 to 44.6% in 2020 (Instituto de Estadistica y Cartografia de Andalucia, 2020[1]). Regarding the transport sector, the number of vehicles per 100 inhabitants increased from around 64 in 2010 to 71 in 2020, of which 0.57 per thousand vehicles were electric, hybrid or used biofuels in 2020 (Instituto de Estadistica y Cartografia de Andalucia, 2020[1]).

Environmental Tax Policy Review of Andalusia

2. Legal stocktake: GHG emissions and air pollution

Table 2.1. CO2 emissions by sector in Andalusia from 2010 to 2020 (million tonnes of CO2)

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Generation |

16 494.9 |

17 191.1 |

18 234.9 |

14 820.2 |

14 361.2 |

18 093.0 |

14 333.8 |

17 129.3 |

16 723.7 |

11 584.3 |

7 166.0 |

|

Transport |

14 547.7 |

13 094.2 |

12 234.2 |

12 361.3 |

12 707.9 |

13 242.9 |

13 305.7 |

14 537.7 |

14 975.5 |

15 361.8 |

11 551.6 |

|

Industry |

4 353.3 |

4 347.2 |

3 859.9 |

3 711.4 |

3 809.9 |

3 705.9 |

4 069.8 |

4 697.9 |

4 320.5 |

4 398.0 |

3 578.3 |

|

Primary sector |

2 839.0 |

2 717.1 |

2 477.0 |

2 316.3 |

2 230.4 |

2 221.1 |

2 269.3 |

2 281.9 |

2 310.7 |

2 373.3 |

2 383.5 |

|

Services |

313.3 |

431.4 |

313.3 |

262.9 |

271.9 |

390.3 |

410.1 |

378.5 |

395.2 |

497.1 |

463.0 |

|

Residence |

1 557.1 |

1 408.0 |

1 462.6 |

1 391.9 |

1 273.8 |

1 331.6 |

1 257.5 |

1 179.4 |

1 199.2 |

1 162.7 |

1 009.3 |

|

Energy |

2 152.5 |

2 069.4 |

2 103.4 |

2 125.9 |

2 323.8 |

2 179.8 |

2 079.0 |

2 074.6 |

2 170.7 |

1 903.0 |

1 816.5 |

|

Total |

42 257.7 |

41 258.4 |

40 685.3 |

36 989.9 |

36 979.0 |

41 164.7 |

37 725.1 |

42 279.3 |

42 095.5 |

37 280.2 |

27 968.2 |

Note: the energy sector includes emissions associated with the consumption of fossil fuels for the development of the activities of extraction, production, transformation and distribution of energy.

Source: Author’s own elaboration based on Agencia Andaluza de la Energia (2020[3]).

In addition to carbon emissions, small particulate matter (PM2.5) remains one of the largest cause of human mortality induced by air pollution (OECD, 2021[4]). Air pollution also amplifies infectious disease, such as COVID-19, and affects children the most. In most autonomous communities in Spain, at least 25% of the population was exposed to PM2.5 above the World Health Organisation (WHO) threshold in 2019 (OECD, 2021[4]).

Policies to reduce GHG emissions and air pollution are therefore a key priority in Andalusia. This chapter proposes possible opportunities for reform to Andalusia’s existing environmental tax system governing GHG emissions and air pollution for both stationary2 and non-stationary sources.3 While the discussion on stationary sources will focus on industrial and electricity generation facilities, non-stationary sources will focus on personal vehicles. The proposed possibilities are derived from two sequential analyses. First, an analysis of the legal and policy framework governing GHG emissions and air pollution at the EU, national, and regional government levels; second, an analysis on the distribution of responsibilities in policy areas relevant to reducing GHG emissions and air pollution, between the different levels of government (EU, national, regional and local). The key possibilities will be assessed against environmental tax policy principles in the economic analysis.

2.1. Legal Framework on Greenhouse Gas Emissions and Air Pollution

This section outlines the legal and policy instruments governing GHG emissions and air pollution at the EU, national, and regional levels. In doing so, it provides context on the policies, targets, and strategies in place for these two environmental domains which serves as the basis for the subsequent section on the responsibilities across levels of government in these two domains.

2.1.1. At the EU level

The EU Green Deal: a legally binding objective of climate neutrality by 2050

The EU established the EU Green Deal as the core of its policies to fight against climate change (Box 2.1). The objective of the EU Green Deal is to achieve climate neutrality in Europe by 2050, which means net zero GHG emissions for EU countries as a whole. This objective implies the involvement of all sectors of the economy, including industry, energy and transport, and a global response, in line with the UN Framework Convention of Climate Change (UNFCCC) and the Paris Agreement4.

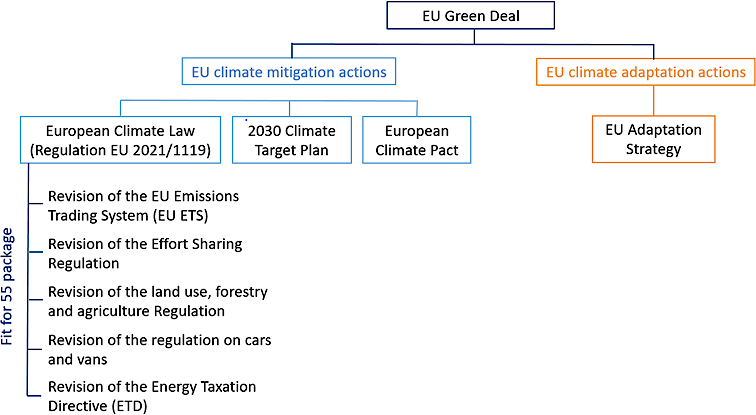

Box 2.1. The EU Green Deal

The EU Green Deal comprises an ambitious package of measures to achieve carbon neutrality by 2050, including cutting GHG emissions, investing in green technologies and protecting Europe’s natural environment. The measures comprise climate mitigation actions, of which the European Climate Law, the 2030 Climate Target Plan and the European Climate Pact. They also comprise climate adaptation measures, under the new EU Adaptation Strategy, to confront the adverse impacts of climate change (Figure 2.1). A third of the EUR 1.8 trillion from the NextGenerationEU Recovery Plan and the EU 2021-2027 budget will finance the European Green Deal.

Figure 2.1. Climate mitigation and adaptation measures under the EU Green Deal

Note: Climate mitigation measures are depicted in blue; climate adaptation measures are depicted in orange. The “Fit for 55” package is a series of legislative proposals to revise current EU legislation aiming to mitigate climate change. The list of proposals is not exhaustive but focuses on the relevant domains for the report.

Source: Author’s own elaboration.

To make the objective of carbon neutrality by 2050 legally binding, the European Commission enshrined it in the EU law with the implementation of the European Climate Law on 29 July 2021 (Regulation EU 2021/1119) (European Commission, 2021[5]). Based on a comprehensive impact assessment, the law also sets an intermediary target of reducing net GHG emissions by at least 55% by 2030 compared to 1990 levels. It also includes a process for establishing an EU-wide climate target by 2040, based on an indicative GHG budget for 2030-2050, and a commitment for negative GHG emissions after 2050. In addition, the law provides the creation of a European Scientific Advisory Board on Climate Change for independent scientific advice and a commitment to prepare sector-specific roadmaps towards carbon neutrality. The law also grants coherence across EU policies on carbon neutrality.

The emission objectives of 2030 and 2050 set within the European Climate law are immediately applicable to all Member States, of which Spain and its autonomous communities, since EU regulation is a legally binding instrument that overrules national laws.5 The law comprises measures for Member States to keep track record of their progress based on national climate and energy plans (see below) and to adjust actions accordingly. Progress is reviewed every five years. A series of legislative proposals (“Fit for 55”) have been implemented on 14 July 2021 in order to deliver the above-mentioned emission targets of 2030 and 2050, as set within the 2030 Climate Target Plan and in the European Climate Law. Several EU climate legislations have been revised accordingly, including the EU Emissions Trading System (EU ETS) (Box 2.2), the Effort Sharing Regulation, transport and land use laws.

Box 2.2. The European Union Emissions Trading System (EU ETS)

Established in 2005 through Directive 2003/87/EC of the European Parliament and the Council of the EU, the system is currently active in EU Member States and in Switzerland. The system works on the “cap and trade principle”, meaning that a cap is set on the total amount of certain GHGs that are emitted by the installations covered by the system. The cap decreases over time as the total amount of emissions fall. Within the cap, installations can trade their emission allowances amongst each other. At the end of the year, an installation must surrender enough emissions to cover the entirety of its emissions, otherwise fines apply. The EU ETS works in trading phases and is now within its fourth phase (2021-2030). It covers the following sectors and gases:

Carbon dioxide (CO2) from electricity and heat generation, energy-intensive industry sectors (e.g. oil refineries, steel works, iron, aluminium, metals, cement, lime, glass, ceramics, pulp, paper, cardboard, acids, and bulk organic chemicals) and commercial aviation within the European Economic Area.

Nitrous oxide (N2O) from nitric, adipic and glyoxylic acids and glyoxal production.

Perfluorocarbons (PFCs) from the production of aluminium.

The participation of companies in these sectors is mandatory. However, in some sectors, only installations above a certain size are included. Small installations may be excluded if central governments implement fiscal or other measures cutting their emissions by an equivalent amount. The EU ETS has been revised several times to remain in line with the EU climate policy objectives.

Source: (European Commission, 2003[6]).

EU legislation in the area of GHG emissions

The EU ETS is the centrepiece of the EU climate policy package. It has been proposed to be revised to become more ambitious under the “Fit for 55” package. Accordingly, the proposed emission reduction target for the sectors covered by the system will be increased from 43% to 61% by 2030 compared to 2005 levels (European Commission, 2021[7]). The distribution of freely allocated emissions allowances has also been proposed to be revised with the aim to further incentivise the development of low-carbon technologies:

the Market Stability Reserve (i.e. the system that addresses the excess of allowances since 2009) will be strengthened; and

the emission trading system will be extended to new sectors (i.e. maritime activities for ships above 5 000 gross tonnage travelling within the EU or at berth in EU ports) and a separate trading system will be established from 2026 to cover emissions from fuels in road transports and buildings (cost paid by fuel suppliers rather than households and car drivers). In addition, flights between EU outermost regions and international flights between EU outermost regions and the European Economic Area will be included in the EU ETS. The number of free allowances allocated to aircraft operators will be also reduced gradually to reach full auctioning by 2027.

The European Commission also proposed the introduction of a Carbon Border Adjustment Mechanism (CBAM) as part of its “Fit for 55” package (European Commission, 2021[8]). This new mechanism aims to price the carbon content of imports on specific products in order to address competitive concerns of industries that pay a high carbon price and to avoid “carbon leakage”. The Commission proposed that CBAM starts in 2026, following a transitional period from 2023-2025 with reporting requirements on EU importers.

As part of the “Fit for 55 package”, the European Commission also proposed to revise the Effort Sharing Regulation (EU) 2018/842. The Regulation establishes binding annual GHG emission targets for Member States between 2021 and 2030 for the sectors that are not covered by the EU ETS, which accounts for around two-thirds of total domestic EU emissions (European Commission, 2021[9]). The European Commission proposed to increase the EU emission reduction target from 30% to 40% by 2030 compared to 2005 levels to be in line with the objectives of the EU Green Deal. To ensure fairness among Member States, targets are based on GDP per capita. They also reflect cost-efficiency for countries with GDP per capita above the average to avoid too highly costs for them. The European Commission’s proposal increases GHG emission reduction target for Spain from 26% to 37.7% in 2030 compared to 2005 levels (European Commission, 2021[9]).

The legislative package also includes a proposed revision of the Energy Taxation Directive (ETD) (No 2003/96/EC) to align it with the objectives set within the EU Green Deal (European Commission, 2021[10]). The ETD has been implemented in 2003 and laid down minimum excise duty rates for the taxation of energy products used as motor and heating fuels and electricity. Member States are free to set their own rates within the minimum limits set by the law. The Commission has suggested to introduce a new structure of minimum tax rates based on the energy content and environmental performance of the fuels and electricity. It also proposed to broaden the tax base by including more products (e.g. mineralogical processes) and by removing some of the exemptions (e.g. kerosene used as fuel in aviation and heavy oil used in the maritime sector) and reductions. Nevertheless, certain reductions of the rates will remain possible (e.g. electricity or advanced energy products from renewables, primary sector such as farming).

The land use and transport laws has also been proposed to be revised as part of the EU “Fit for 55” legislative package. The LULUCF Regulation (EU) 2018/841 provides that all sectors, including land use, shall contribute to the EU’s 2030 emission reduction target (European Commission, 2018[11]). Accordingly, GHG emissions from land use, agriculture or forestry must be balanced by at least an equivalent level of CO2 removal from the atmosphere between 2021 and 2030. The Commission has proposed to increase the carbon removal to -310 million of tonnes CO2 by 2030 and to introduce the objective of carbon neutrality in land use, agriculture and forestry by 2035 in the EU (European Commission, 2021[12]).

Regarding transport, the Regulation (EU) 2019/631 sets EU fleet-wide CO2 emission performance standards for new passenger cars and new light commercial vehicles (vans) registered in the EU (European Commission, 2021[13]). The Commission has proposed to increase the targets as follows: (i) by 55% for cars and 50% for vans from 1 January 2030; and (ii) fully for both cars and vans from 1 January 2035. Targets are set annually for manufacturers. Additionally, the Alternative Fuels Infrastructure Regulation will aim to ensure the availability of the recharging and refuelling infrastructure for zero-emission vehicles (European Commission, 2021[14]).

Overall, the Regulation (EU) 2018/1999 on the governance of the Energy Union and climate action aims to ensure that the EU’s Energy Union Strategy on energy, decarbonisation, research, innovation and competitiveness is implemented in a coherent and co-ordinated manner (European Commission, 2018[15]). From 2021 to 2030, the law requires Member States to produce integrated national energy and climate plans (NECPs), which includes consultation processes, regional co-operation, progress reports, policies and requirements for national and EU inventory systems for GHG emissions. The plans shall address energy efficiency, renewables, GHG emissions reduction, interconnections, research and innovation.

EU legislation in the area of air pollution

In addition to GHG emissions, the Commission adopted the Directive (EU) 2016/2284 on 17 December 2016 on the reduction of national emissions of certain atmospheric pollutants, amending the Directive 2003/35/EC and repealing the Directive 2001/81/EC on national emission ceilings (NEC directive). The Directive extends the period of the NEC Directive from 2020 to 2030. The directive does not only focus on GHG emission reduction but aims to improve national air quality by establishing national emission reduction targets for several pollutants, of which sulphur dioxide (SO2), nitrogen oxides (NOx), non-methane volatile organic compounds (NMVOC), ammonia (NH3) and fine particulate matter (PM2,5) (European Commission, 2016[16]). As a Directive, Member States have to transpose it into their national legislation and to achieve the objectives specified. For Spain, the Directive provides the thresholds listed in its Annex II (Table 2.2).

Table 2.2. Emission reduction commitments for Spain under the Directive (EU) 2016/2284 on the reduction of national emissions of certain atmospheric pollutants (compared to 2005 levels)

|

SO2 reduction |

NOx reduction |

NMVOC reduction |

NH3 reduction |

PM2,5 reduction |

|

|---|---|---|---|---|---|

|

From 2020 to 2029 |

67% |

41% |

22% |

3% |

15% |

|

From 2030 |

88% |

62% |

39% |

16% |

50% |

Note: Reductions are based on 2005 levels.

Source: Author’s own elaboration based on European Commission (2016[16]).

2.1.2. At the national level

The Spanish Climate Change and Energy Transition Law: a general legislative framework to address climate change in Spain

Spain established its first climate change law on 21 May 2021 with the implementation of the Climate Change and Energy Transition (Law 7/2021). The law provides a general legislative framework to address climate change with the objective to achieve carbon neutrality by 2050 in Spain (Gobierno de Espana, 2021[17]), in line with EU regulations (of which the European Climate Law) and the Paris agreement. The law also establishes intermediary GHG emission reduction targets of 23% by 2030 compared to 1990s levels.

The law comprises both climate mitigation and adaptation measures. It focuses on several environmental domains, ranging from renewable energies and energy efficiency (including electricity generation), fuel transition and low-emission transports (road, maritime and ports). Article 3 specifies an objective of at least 42% renewables in final energy consumption and at least 74% renewable electricity generation by 2030, as well as a reduction of primary energy consumption by at least 39.5% compared to the baseline under EU legislation. These objectives may be increased periodically as of 2023.

In line with the Regulation (EU) 2018/1999 on the European climate change governance mechanism (see above), the Spanish climate law provides that the central government, the autonomous communities and local governments must achieve the objectives set by the law through co-operation and collaboration among them (art. 1). It also stipulates that climate plans from the autonomous communities must be submitted to the central government to secure policy coordination and compliance with the existing responsibilities distribution (Gobierno de Espana, 2021[17]). Ahead of the COP26 in November 2021, only three autonomous communities had climate change laws in place (Balearic Islands, Catalonia, and Andalusia) and seven others had started to elaborate theirs.

To foster coherence and coordination among Spanish climate policies, the law has established the Integrated National Energy and Climate Plan (PNIEC), which is the national strategic planning tool on energy and climate policies, reflecting Spain’s contribution to the achievement of the objectives set by EU regulations (art. 4). The plan covers the period 2021-2030. It contains the objectives and quantitative contributions at the national and sectoral levels for the reduction of GHG emissions and removals by sinks, renewable energies and energy efficiency for all sectors of the economy, as well as the policies and measures to achieve these objectives.

Spanish legislation on GHG emissions

Regarding GHG emissions, the law 1/2005 on the trading of GHG emission rights scheme, adopted on 9 March 2005, transposed the Directive 2003/87/EC (see above) into national legislation and introduced the EU ETS at the national level for GHG emissions (Gobireno de Espana, 2005[18]). In 2021, the Spanish Climate Change and Energy Transition law also prohibited new explorations for hydrocarbon research and for exploitation concessions (art. 9), while it promoted the use of renewable gases (e.g. biogas, biomethane, hydrogen and other renewable fuels) (art. 12) (Gobierno de Espana, 2021[17]). On electricity, the Spanish Electric Sector law (law 54/1997, later consolidated in law 24/2013) provides the basic regulation of electricity in Spain (Gobierno de Espana, 1997[19]; Gobierno de Espana, 2013[20]). It aims to ensure efficient electricity supply, economic and financial sustainability of the electric system and effective competition. The law has been complemented by the Spanish Climate Change law, which promotes the use of reversible hydroelectric power plants, as well as the use of electricity generation for urban water supply and sanitation systems (art. 7) (see below on water).

Article 14 of the Spanish Climate Change and Energy Transition law also provides that the central government, the autonomous communities and local governments, within the scope of their responsibilities, must achieve the objective of a fleet of passenger cars and light commercial vehicles with zero GHG emission by 2050, in line with EU regulations (Gobierno de Espana, 2021[17]). To this end, the PNIEC sets targets for the share of zero or low-emission vehicles in the car fleet to reach by 2030. In addition, the sales of new passenger cars and light commercial vehicles emitting GHG emissions, not intended for commercial purposes, will be prohibited by 2040, in accordance with EU regulations. Large municipalities with more than 50 000 inhabitants shall also adopt sustainable urban mobility plans by 2023 with the aim to reduce emissions from mobility. This includes the development of low-emission zones6 by 2023, the improvement of the public transport network (e.g. multimodal integration) and its electrification, the promotion of private electric transport (including charging points), the integration of last-mile electrification plans with low-emission zones and the establishment of criteria to improve air quality around schools, health or sensitive areas, in accordance with air quality regulation (see below). Article 15 provides for the installation of electric charging points in facilities that supply fuels.

The law also includes the objective of zero emission by 2050 for ships, vessels and naval devices in ports and the development of sustainable logistic chains with origin or destination in ports (art. 16) (Gobierno de Espana, 2021[17]). After agreement with the autonomous communities in their domain of responsibilities, the central government shall support the supply of electric or alternative sources on docked ships and rail transport from/to ports and establish objectives to reduce energy consumption in ports based on their activity.

In order to help the autonomous communities and cities to promote electric mobility, in the realm of the EU Recovery and Resilience Facility,7 the central government launched the Moves III Plan on 13 April 2021 through the Royal Decree 266/2021 (Gobierno de Espana, 2021[21]). The Plan is coordinated by the national Institute for the Diversification and Saving of Energy (IDAE) and managed by the autonomous communities and cities. It is endowed with initial EUR 400 million, which may be extended to EUR 800 million, provided that there is adequate budget execution and budget availability. The funds are distributed from IDAE to the autonomous communities and cities, based on population criteria, to encourage the purchase of electric vehicles and to finance the deployment of charging facilities for these vehicles. The autonomous communities and cities are responsible for the calls within their territory to subsidy citizens for the purchase of efficient vehicles (e.g. electric, extended-range or plug-in hybrid cars). Subsidies may amount up to EUR 7 000 for passenger cars and EUR 9 000 for light commercial cars. This program provides continuity to the previous Efficient Vehicle Incentive Program and the Renewal Plans, which provided financial support to drivers exchanging their cars for the ones respecting tighter environmental and social criteria.

In addition, es.movilidad, the Safe, Sustainable and Connected Mobility Strategy 2030 was approved by the Spanish Council of Ministers on 10 December 2021 (Ministerio de Transportes Movilidad y Agenda Urbana, 2021[22]). The strategy will serve as a guide to the actions of the Spanish Ministry of Transport, Mobility and Urban Agenda (MITMA) in the areas of mobility, infrastructure and transport for the next 10 years. It is made up of 150 measures, structured around 40 lines of action and 9 strategic axes, of which (i) mobility for all, (ii) new investment policy, (iii) safe mobility, (iv) low emission mobility, (v) smart mobility, (vi) smart intermodal logistics chains, (vii) connectivity, (viii) social and labour aspects, and (ix) evolution of the MITMA. The fourth axis aims to develop sustainable energy sources for transport (e.g. electrification, hydrogen) and low-emission technologies, to decrease the age of the vehicle fleet and to support the sustainability of transport facilities (e.g. terminals). The Strategy will also promote administrative co-operation and co-ordination, as well as public participation (e.g. the Open Mobility Dialogue in 2020, territorial workshops, surveys). The Strategy is based on the Sustainable Mobility Law, whose the bill has been approved by the Council of Ministers on 13 December 2022 (Ministerio de Transportes Movilidad y Agenda Urbana, 2022[23]), and is financed under the Recovery, Transformation and Resilience Plan.

Spanish legislation on air pollution

Spain also targets other atmospheric pollutants to fight against air pollution. The Spanish National Program on Atmospheric Pollution Control, which transposed the Directive EU 2016/2284 (see above) into national legislation through Royal Decree 818/2018, sets sectoral measures to achieve the emissions reduction targets of several pollutants (Table 2.2). The Program gives continuity to the previous Spanish Air Plans with the objective to improve national air quality.

2.1.3. At the regional level

The urgency of combatting climate change and reaching environmental protection objectives has led the region to take action since the early 2000s. In 2002, the region passed the Andalusian Climate Change Strategy, the first Spanish autonomous region to develop a strategy of measures and actions. In 2007, it published its first Climate Action Plan (PAAC) (Junta de Andalucia, 2007[24]). In 2018, the region passed a law entitled “Measures against climate change and for the transition towards a new Andalusian energy model”, calling for the creation of a new PAAC to act as a general strategy/planning instrument for climate change action in the region in the short, medium, and long-term. The law also called for the creation of municipal climate action plans (PMCC). Following this law, Andalusia implemented a new PAAC in 2021 with three new programs to fight against climate change.

The 2002 Andalusian Strategy on Climate Change and 2007 Andalusian Climate Action Plan

Andalusia established the Andalusian Strategy on Climate Change on 3 September 2002. The initiative was the first in Spain. The document presented a set of measures to reduce regional emissions of GHGs. It provided the ground for the 2007-2012 PAAC, which was structured around three Action Programs.

Mitigation program (approved on 5 June 2007): the program aimed to reduce GHG emissions of 19% by 2012 compared to 2004 and from 8 tonnes of CO2 per capita to 6.5 tonnes per capita in Andalusia, as well as to promote carbon sequestration by enhancing the carbon sink capacity of ecosystems (Junta de Andalucia, 2007[25]). The objectives were met by 2012, with 21% reduction of GHG emissions and 6.1 tonnes of CO2 per capita (Junta de Andalucia, 2015[26]). The development of environmental taxation to reduce GHG effect was underlined as part of the measures of the program (M.138 under “Development of new intervention tools”).

Adaptation program (approved on 13 August 2010): the program aimed to reduce the vulnerability of the autonomous community to climate change by increasing its adaptation capacity through planning instruments (Junta de Andalucia, 2010[27]). The program comprised four subprograms, of which measures for immediate actions, sectoral analysis of the effects of climate change, sectoral measures of adaptation, and continuous development of knowledge and governance.

Communication program (approved on 21 January 2012): the program aimed to promote knowledge, raise awareness and increase participation of citizens in climate action (Junta de Andalucia, 2012[28]).

The Plan is still at the core of Andalusia’s climate policy and the climate component of the Andalusian Sustainable Development Strategy 2030 (Estrategia Andaluza de Desarrollo Sostenible 2030; EADS), adopted on 5 June 2018 (Junta de Andalucia, 2018[29]).

The 2018 Andalusian Law on Measures against Climate Change and the Transition towards a New Energy Model

On 8 October 2018, the Andalusian Parliament approved the Andalusian Law on Measures against Climate Change and the Transition Towards a New Energy Model in Andalusia (Andalusian law 8/2018), which aimed to reduce GHG emissions, to limit fossil fuel consumption and to increase cities’ adaptation to climate change (Junta de Andalucia, 2018[30]). The law also provided for the creation of an Interdepartmental Climate Change Commission, as a transversal commission responsible for climate planning, and of the Andalusian Climate Change Office, the administrative unit in charge of managing mitigation, adaptation and communication policies.

In line with the Regulation (EU) 2018/1999 and the Spanish Climate Change and Energy Transition law, chapter II of the law provided for the co-ordination of Andalusia with the other levels of government on climate policies. Municipalities must elaborate municipal plans against climate change, within the scope of their responsibilities laid down in law 5/2010 (law on local autonomy in Andalusia) and within the framework of the PAAC (art. 15) (Junta de Andalucia, 2010[31]; Junta de Andalucia, 2018[30]). Municipal plans shall include an analysis and evaluation of GHG emissions within their territory, objectives and strategies for mitigation and adaptation to climate change, actions to reduce emissions, actions to promote research and innovation, actions for awareness on climate change, actions for progressive replacement of fossil fuels with renewable energies, actions to rehabilitate municipal buildings, actions to optimise public lighting, actions to promote energy transition within urban mobility plans, and temporary planning of the actions. Municipal plans shall be reviewed along with the revision of the PAAC to align objectives. They shall approve a report on the degree of compliance with their plans every two years. Provinces may provide support to municipalities for the preparation of their plans, within their scope of responsibilities.

The Autonomous Community of Andalusia shall approve economic resources allocated to the plans of the municipalities within its territory, as per art. 25 of the law 5/20108 (Junta de Andalucia, 2010[31]). Art. 16 of the Andalusian law 8/2018 provides that the autonomous community must collaborate with the central government, within the scope of its responsibilities, to promote mitigation, adaptation and communication measures established in the PAAC through specific instruments (Junta de Andalucia, 2018[30]).

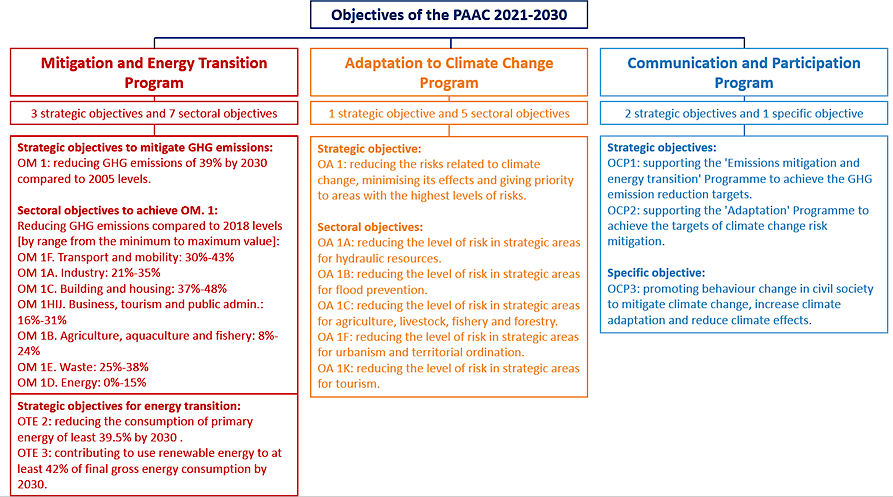

The 2021 Andalusian Climate Action Plan

The Andalusian law 8/2018 prepared the ground for the new PAAC, approved on 13 October 2021 and published by the Andalusian Decree 234/2021 (Junta de Andalucia, 2021[32]). The 2021 PAAC is the general strategic planning instrument to fight against climate change in Andalusia. It aims to integrate climate change into regional and local planning and align them with the central government’s plans, the European Green Deal and the Paris Agreement, to achieve the Sustainable Development Goals set by the 2030 Agenda of the United Nations. The 2021 PAAC comprises six strategic objectives, 12 sectoral objectives and more than 137 lines of actions, structured under three programs:

the Mitigation and Energy Transition Program,

the Adaptation to Climate Change Program, and

the Communication and Participation Program (Figure 2.2).

The main objective of the Plan, under its Mitigation and Energy Transition Program, is to achieve a reduction of 39% of GHG emissions in Andalusia by 2030 compared to 2005 levels through emission reductions in strategic sectors listed in (Figure 2.2).

Figure 2.2. Objectives under the Programs of the PAAC 2021-2030 in Andalusia

Andalusia has also established the Andalusian Energy Strategy (EEA) 2020, which is in line with the objectives set in the PAAC for 2030 and 2050. The EEA Strategy follows the previous energy plans of the autonomous community, of which the Andalusian Plan for Sustainable Energy 2007-2013 (Plan Andaluz de Sostenibilidad Energetica 2007-2013; PASENER). It aims to foster renewable energy generation projects, to increase buildings' energy efficiency, to optimise energy consumption, promote bioeconomy, to decarbonise transport, to prepare the workforce to adapt to technological changes and to enhance private investment in renewable energy projects (Junta de Andalucia, 2020[33]).

On June 7, 2022, in line with the Andalusian law 8/2018 and the PAAC of the region, the government council of Andalusia approved the Andalusia Energy Strategy 2030 (Junta de Andalucia, 2022[34]). This strategy contains six objectives and 12 strategic lines, each with action programs, to support the use of renewable energy and the development of sustainable energy networks. It aims to (i) supporting the decarbonisation of energy consumption, (ii) reducing energy consumption, (iii) reducing the dependence on petroleum derivatives in transport; (iv) having the necessary infrastructure to harness renewable resources and provide quality supply, (v) improving the effectiveness and efficiency of the administration as a facilitator of the transition and decarbonise its energy consumption, and (vi) strengthening the Andalusian energy business and industrial base.

Regarding transportation, Andalusia has also approved the Transport and Mobility Plan of Andalusia for 2021-2030 (PITMA 2030) on 2 February 2021 (replacing 2021-2027) (Junta de Andalucia, 2021[35]). The Plan contains several objectives with indicators to be achieved by 2030, such as (i) improving research and innovation for mobility and transport infrastructure (e.g. share of expenditure on innovation over turnover of 1.65 by 2030 in vehicle manufacturing companies compared to 0.46 in 2018), (ii) supporting mobility services through digitalisation (e.g. 1 500 000 users of new digital mobility services and applications by 2030), (iii) promoting energy efficiency, climate change mitigation and adaptation (e.g. 7.6% of electricity in transport sector energy consumption by 2030 compared to 0.4% in 2019), (iv) developing a good and sustainable network of transport infrastructure to meet demand for mobility (e.g. only 20% of roads with very deteriorated or somewhat deteriorated pavement by 2030 compared to 39.6% in 2019), (v) achieving sustainable regional mobility (e.g. 10% of freight transport over land transport by 2030 compared to 0.77% in 2018), and (vi) developing sustainable multimodal urban and metropolitan mobility (5.5 kt eq. CO2 emitted by road traffic in all Andalusian cities with more than 10 000 inhabitants by 2030 compared to 9.1 kt eq. CO2 in 2018) (Junta de Andalucia, 2022[36]). In line with the PITMA and the PAAC, which are the main regional instruments for designing policies in mobility, transport and climate change, the Governing Council of Andalusia has also approved the formulation of the Andalusian Strategy for Sustainable Mobility and Transport 2030 on 12 January 2021 (Junta de Andalucia, 2021[37]). This Strategy will guide the region to achieve its GHG emissions reduction target that ranges between 30% and 43% by 2030 compared to 2008 levels for transport and mobility sector.

The Andalusian Strategy for Air Quality

Regarding air pollution, Andalusia adopted the law 7/2007 on the integrated management of atmospheric quality and its development to encompass the three dimensions of sustainable development (i.e. environmental, social and economic). In accordance with the Spanish Air Plans, of which the Spanish National Program on Atmospheric Pollution Control (Royal Decree 818/2018) and the Directive (EU) 2016/2284, Andalusia also established its Andalusian Strategy for Air Quality (Estrategia Andaluza de Calidad del Aire; EACA), approved on 22 September 2020 (Junta de Andalucia, 2020[38]). This Strategy is a framework instrument to facilitate the preparation of air quality improvement plans by local governments in Andalusia. It is based on a comprehensive assessment of air quality at the local level between 2017 and 2019. All atmospheric pollutants that are required to be assessed are included in the analysis and compared with national legislation, EU regulations and the Air Quality Guide of the WHO. The main pollutants emitted by sectors are provided in the Table 2.3. The objectives of the future air quality improvement plans are to remain below the limit values set by these regulations (Junta de Andalucia, 2020[2]). Currently no specific reduction targets for these pollutants exist at the regional level (Table 2.2 shows targets at the national level).

Table 2.3. The main atmospheric pollutants by sector under the Andalusian Strategy for Air Quality

|

Sectors |

Main atmospheric pollutants |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

PM10 |

NO2/NOx |

SO2 |

CO2 |

Pb |

As |

Cd |

Ni |

Benceno |

Benzo(a)pireno |

||

|

Transport |

x |

x |

x |

x |

|||||||

|

Construction, demolition |

x |

||||||||||

|

Maritime transport |

x |

x |

x |

||||||||

|

Airport |

x |

x |

|||||||||

|

Agriculture sector |

x |

x |

|||||||||

|

Industry |

x |

x |

x |

x |

x |

x |

x |

x |

|||

|

Residence, business and administration |

x |

||||||||||

Source: Author’s own elaboration based on (Junta de Andalucia, 2020[2]).

2.2. Responsibilities Related to Greenhouse Gas Emissions and Air Pollution across Levels of Government

This section details the responsibilities related to GHG emissions and air pollution across the levels of government in Spain and maps where Andalusia has the power to set, manage, or implement taxes in these environmental domains.

In line with the analysis carried out in Activity 1.3 of the project, emissions are separated into stationary source emissions and non-stationary source emissions (see definitions above). For stationary sources, the analysis will focus on industry and electricity, as they represent a key source of GHG emission and air pollution. For non-stationary sources, the analysis concentrates on personal vehicles (i.e. vehicles for individuals with no commercial purpose), that are large emitters of pollutants into the atmosphere. Stationary sources: industry and electricity

This section maps the responsibilities of each level of government regarding emissions from stationary sources in the industrial and electricity sectors. These are identified by examining the environment, climate change, and the energy sector responsibilities of each level of government.

2.2.1. At the EU level

The EU responsibilities related to environment and energy are both shared responsibilities between the EU and Member States (art. 4) (European Union, 2012[39]). Regarding environment, art. 11 and art. 191 to 193 of the TFEU set that the EU has responsibilities in all domains of environmental policy, such as air and water pollution, waste management and climate change, to promote sustainable development (European Union, 2012[39]). Its scope for action is, however, limited by the principle of subsidiarity (see Part I) and the requirement of unanimity in the Council for fiscal matters, urban and country planning, land use, quantitative water resource management, choice of energy source and structure of energy supply (art. 192) (European Union, 2012[39]). Under art. 191, the preparation of EU environmental policies shall be based on scientific and technical data, the environmental conditions of the regions in the EU, the benefits and costs of action and the economic and social development of the EU as a whole. They shall pursue the following objectives: (i) preserving and protecting the environment, (ii) protecting human health and (iii) promoting the prudent use of natural resources (art. 191). The fight against climate change is also set as an explicit objective of the EU environmental policy (art.191) (European Union, 2012[39]). In addition, Member States may adopt more stringent protective measures on environment that those set in EU environmental policies, provided that they are compatible with the Treaty and are notified to the Commission (art. 193).

Regarding energy, art. 194 of the TFEU stipulates that EU energy policy shall aim to: (i) ensure the functioning of the Energy Union, (ii) ensure the energy supply in the Union, (iii) promote energy efficiency and the development of renewable energy and (iv) promote the interconnection of energy networks (European Union, 2012[39]). The measures to achieve these objectives shall be adopted after consultation with the Economic and Social Committee and the Committee of the Regions (art. 194). As stipulated under art. 192 of the TFEU, EU energy policy shall not affect Member State’s right to determine their energy sources and the general structure of their energy supply. It is also limited by the requirement of unanimity in the Council regarding any fiscal matters (art. 194) (European Union, 2012[39]).

2.2.2. At the national, regional and local levels

The distribution of responsibilities across the levels of governments in Spain, including environment and energy, are described in the Constitution, the Statute of Autonomy of Andalusia and the LBRL. The responsibilities related to environment and climate change and to energy are described in Table 2.4.

The Spanish Constitution provides that the autonomous communities may assume responsibilities related to the management of environment protection (art. 148) (Gobierno de Espana, 1978[40]). Accordingly, the Statute of Andalusia requires that the autonomous community shall adopt measures and strategies to mitigate climate change, which includes the rational use of energy resources (Junta de Andalucia, 2007[41]). In addition, art. 149 of the Constitution stipulates that the autonomous communities may establish additional rules on environmental protection. This has been reflected in art. 57 of the Statute and in art. 49, which grants shared responsibilities to Andalusia over the facilities of production, distribution and transport of energy, when this transport remains within its territory (Junta de Andalucia, 2007[41]). The responsibilities of municipalities are set within the LBRL (Junta de Andalucia, 2010[31]), while provinces are responsible for ensuring the co-ordination and provision of municipal services (Table 2.4).

Table 2.4. Distribution of environmental and energy sector responsibilities across levels of government in Spain

|

Matters |

Central government |

Andalusia |

Provinces |

Municipalities |

|---|---|---|---|---|

|

Environment |

Exclusive responsibilities: Basic legislation on environmental protection, without prejudice to the responsibilities of autonomous communities to establish additional protection norms (149.1.23). |

Exclusive responsibilities: Forestry, exploitation, utilisation and forest services; marshes and lagoons, and aquatic ecosystems; pastures and special treatment of mountain areas; delimitation, regulation, planning and comprehensive management of protected natural spaces; environmental prevention (57.1 AS). Shared responsibilities: Establishment and regulation of environmental planning instruments and the procedure for processing and approving these instruments; the establishment and regulation of environmental sustainability and research measures; the regulation of natural resources; the regulation of the atmospheric environment and the different types of contamination of the same; the regulation of the system of authorisations and monitoring of GHG emissions; the establishment and regulation of ecological taxation measures; and the prevention, restoration and repair of damage to the environment, as well as the corresponding sanctioning regime over (57.3 AS). |

Responsibilities: Securing co-ordination and provision of municipal services. |

Responsibilities: Urban environmental protection (25.2.bLBLR). Cooperation with other public administrations to promote, defend, and protect the environment and public health (92 AS). Municipalities with more than 50.000 inhabitants are obliged to provide urban environmental services (26.1.dLBLR). |

|

Energy |

Exclusive responsibilities: Bases of the organisation of mining and energy (149.1.25) The authorisation of electrical facilities when their use affects another autonomous community or the transport of energy exceeds its territorial scope (149.1.22). Establish the basic regulation of activities aimed at supplying electricity (3.1 ESL). Establish the remuneration system (3.3 ESL). Regulate the organisation and operation of the market (3.9 ESL). |

Shared responsibilities: Facilities for the production, distribution and transport of energy, when this transport runs entirely through the territory of Andalusia and its use does not affect another territory (49.1 AS). Promotion and management of renewable energies and energy efficiency (49.1 AS). Energy and mines, without prejudice to the provisions of article 149.1.25 of the Spanish Constitution (49.2 AS). Regulation of energy production, storage and transportation activities, as well as their authorisation and inspection and control, establishing, where appropriate, the quality standards for supply services (49.2 AS). |

Responsibilities: Securing co-ordination and provision of municipal services. |

Responsibilities: Public lighting (LBLR). Municipalities can approve ordinances for the use of renewable energy in buildings and facilities (Court ruling 2339/2015). |

Note: ELS: Electricity Sector Legislation; AS: Andalusian Statute; LBLR: Regulatory Law of the Bases of the Local Regime.

Source: Author’s own elaboration based on (Gobierno de Espana, 1978[40]; Junta de Andalucia, 2007[41]; Junta de Andalucia, 2010[31]).

Nevertheless, Table 2.4 shows that the responsibilities of the autonomous communities and local governments in energy remain limited. They are mainly centralised, with the central government being responsible for establishing regulations and economic instruments on electricity production. The Constitutional Court Decision 87/2019 on the Catalonian Climate Change Act also underlines the limited room for the autonomous communities to implement energy sector reforms (Box 2.3).

Box 2.3. The Constitutional Court Decision 87/2019 in Catalonia

In 2019, the Constitutional Court Decision 87/2019 declared unconstitutional 15 articles of the Climate Change Act in Catalonia (law 16/2017), some of which related to energy (Generalitat de Catalunya, 2017[42]). The decision outlined that “autonomous communities cannot establish quantitative, measurable, and time-bound emission reduction, renewable energy and energy efficiency objectives”, on the ground that it is contrary to basic national legislation and in breach of the responsibilities of the central government. On 16 November 2019, Catalonia approved the Decree-law 16/2019 on urgent measures to deal with the climate emergency and the promotion of renewable energies and, on 30 December 2019, the law 9/2019, amending the law 16/2017, on climate change was published (Generalitat de Catalunya, 2019[43]). The Decree-law 33/2020 on urgent measures in the field of the tax on GHG emissions from mechanical traction vehicles and the tax on stays in tourist establishments (Generalitat de Catalunya, 2020[44]) and the Decree-law 24/2021 on the acceleration of the development of renewable energy (Generalitat de Catalunya, 2021[45]) also amend the law 16/2017.

Although the targeted legislation was the Catalonian Climate Change Act, there are similarities between the Catalonian Climate Change Act and the Andalusian Climate and Energy Transition law (Table 2.5). However, no ruling on the Andalusian Climate and Energy Transition law has been identified at the time of writing.

Table 2.5. Comparison between Catalonian and Andalusian climate legislation

|

Catalonian Act excerpt ruled unconstitutional |

Justification |

Andalusian Law excerpt |

|---|---|---|

|

“The goal of reducing greenhouse gas emissions for the year 2030 is 40% compared to the base year (1990), 65% for 2040 and 100% for 2050.” |

“… Violate the basic legislation of the State on polluting emissions, in the same terms as art. 7.3 also appealed (and already declared unconstitutional and null in the preceding legal basis 8). These sections directly indicate binding, specific, measurable and term objectives for the reduction of polluting emissions that are irreconcilable with the possibility and the right to emit greenhouse gases recognised by the State in the Law mentioned above 1/2005 and in Law 34/2007. and Royal Legislative Decree 1/2016, also cited, with no other condition than requesting the mandatory authorisation, paying for it, complying with the corresponding formal obligations and not exceeding the emission limit values and the air quality objectives, as we have already explained more above. Consequently, they must be declared unconstitutional and null”. |

“The objective for Andalusia for the year 2030 is to reduce at least 18% of diffuse greenhouse gas emissions per inhabitant concerning 2005.” |

|

“1. The measures adopted in the field of energy must be aimed at the energy transition towards a one hundred per cent renewable, denuclearised and decarbonised model, neutral in greenhouse gas emissions, which reduces the vulnerability of the Catalan energy system and guarantees the right of access to energy as a common good, and specifically they must be aimed at: |

“Pursuing “the energy transition towards a one hundred per cent renewable, denuclearised, decarbonised model [and] neutral in greenhouse gas emissions” (art. 19, first and second paragraphs) is nothing more than a constitutionally legitimate programmatic guideline, protected by the arts. 45 CE and 27 and 46 EAC (right to an adequate environment and sustainable development) that by itself does not violate central government responsibilities. However, this art. 19 goes beyond this guideline and imposes specific, detailed, term, measurable and therefore binding objectives, such as those already mentioned to close nuclear power plants in 2027 "ensuring the preservation of direct jobs", reduce consumption of energy by 2% per year “to reach at least 27% in 2030” and the consumption of fossil fuels at 50% in 2030 and zero in 2050.” |

“1. The measures adopted as a development of this law or Law 2/2007, of 27 March, on the promotion of renewable energies and energy-saving and efficiency in Andalusia, must be aimed at the energy transition towards a renewable and decarbonised energy model, neutral in greenhouse gas emissions, that reduces the vulnerability of the Andalusian energy system and guarantees the right of access to energy as a common good. In particular, they should focus on: a) Promote energy saving and efficiency policies, to reduce the trend consumption of primary energy in the year 2030, by at least 30%, excluding non-energy uses. b) Promote renewable energies and an energy model in which the consumption of fossil fuels tends to be zero so that by 2030 renewable energies can contribute at least 35% of gross final energy consumption.” |

Source: Author’s own elaboration based on Constitutional Court Ruling 87/2019.

2.2.3. Non-stationary sources: personal vehicles

The analysis for non-stationary source emissions focuses on transport and personal vehicles in particular. Findings from the analysis on environment and energy above may also apply to emissions from and energy used in vehicles.

At the EU level

Transport is a shared responsibility between the EU and Member States according to art. 4 of the TFEU. The EU responsibilities on transport by rail, road and inland waterway are regulated by Title VI of the TFEU, which encompasses art. 90 to art. 100. According to art. 90, the EU has the power to establish a common transport policy. This policy shall include common rules applicable to international transport or transport from one or several Member States, the conditions under which non-EU resident carriers may operate transport services within a Member State, measures to improve transport safety and any other appropriate provisions (art. 91). Regarding transport within the EU, discrimination based on different rates and conditions for the carriage of the same goods over the same transports shall be prohibited (art. 95). In addition, charges or fees related to the crossing of frontiers shall not exceed a reasonable level compared to the costs (art. 97).

At the national, regional and local levels

The Constitution, the Statute of Andalusia and the LBRL provide a more balanced distribution of transport responsibilities across levels of government (Table 2.6). The Constitution grants the central government exclusive responsibility over maritime, air, railway and road transport that passes through the territory of multiple autonomous communities (art. 149). By contrast, it allocates responsibilities to the autonomous communities regarding these forms of transports as long as they fall exclusively within the territory of the autonomous community and they do not pursue any commercial activity (art. 148) (Gobierno de Espana, 1978[40]). This is reflected in art. 64 of the Statute (Junta de Andalucia, 2007[41]). Local level responsibilities relies on urban and rural public roads, as well as on the provision of public transport services for large municipalities (Junta de Andalucia, 2010[31]).

Table 2.6. Distribution of responsibilities in transport across levels of government in Spain

|

Matter |

Central government |

Andalusia |

Provinces |

Municipalities |

|---|---|---|---|---|

|

Transport |

Exclusive responsibilities: Merchant marine, ports and airports of general interest and control, air transport traffic (149.1.20). Railways and land transport passing through the territory of more than one autonomous community; traffic and circulation of motor vehicles (149.1.20). |

Exclusive responsibilities: Regional railway and road networks lying exclusively within their territories, regional and recreational ports and airports with no commercial activities (148.1.5); Andalusian road network, made up of railways, highways and roads; maritime and river transport of people and merchandise that takes place entirely within the waters of Andalusia; ports and airports and other transport infrastructure in the territory of Andalusia (64.1 AS). |

Responsibilities: Securing co-ordination and provision of municipal services. |

Responsibilities: Provision of public transport; conservation of urban and rural public roads; management of mobility and accessibility of people and vehicles on urban roads (92.1 AS). Vehicle parking and mobility (25.2.g). Municipalities with more than 50 000 inhabitants are obliged to provide public transport services (26.1.d LBLR). |

Note: AS: Andalusian Statute; LBLR: Regulatory Law of the Bases of the Local Regime.

Source: Author’s own elaboration based on (Gobierno de Espana, 1978[40]; Junta de Andalucia, 2007[41]; Junta de Andalucia, 2010[31]).

2.3. Current Levies Related to Greenhouse Gas Emissions and Air Pollution across Levels of Government in Spain

This section provides the existing levies on GHG emissions and on air pollution that apply to emitting sources in Andalusia. As for the previous section, emissions are separated between stationary sources and non-stationary sources.

2.3.1. Stationary sources: industry and electricity

Table 2.7. Current levies applicable to stationary sources of GHG emissions and air pollution in Spain and Andalusia

|

Current levies |

Competence |

|

EU ETS |

EU |

|

Tax on fluorinated GHGs |

National |

|

Hydrocarbon tax |

National |

|

Value Added Tax |

National |

|

Hydroelectric development fee |

National |

|

Electricity production tax |

National |

|

Electricity tax |

National |

|

Tax on gas emissions into the atmosphere |

Regional |

|

Charge for administrative services in industrial, energy and mining matters |

Regional |

Source: Author’s own elaboration.

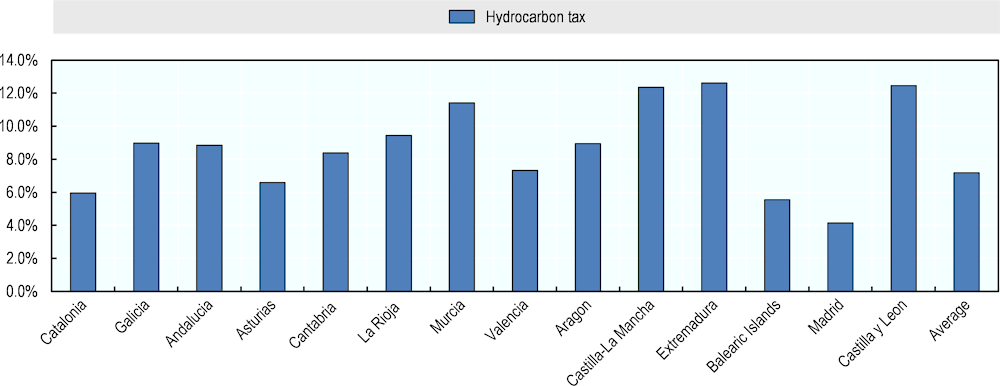

At the national level, there is the hydrocarbon tax, which is regulated under the law 38/1992 on special taxes (Gobierno de Espana, 1992[46]), amended in 2019 to harmonise regional tax rates into a national hydrocarbon tax system. The law has been established in the context of the EU ETD, which set minimum tax rates, and is currently under revision (see above). The tax is levied on hydrocarbons (e.g. petrol, diesel, natural gas, oil, and biofuels) that are used as fuel. Some exemptions apply, of which (i) natural gas used for purposes other than fuel, (ii) fuel supply in air and sea navigation, (iii) rail transport, (iv) construction and maintenance of vessels and aircrafts, and (v) pilot projects of less polluting products. Since 2018, natural gas and biogas used to produce electricity and heat or self-consumption are tax-exempted. Total and partial refunds also apply depending on the fuel use. The tax represented 8.9% of Andalusia’s tax revenue in 2020, above the average of the autonomous communities (7.2%, excluding the Basque country, Navarra and the Canary Islands) (Ministerio de Hacienda y Funcion Publica, 2022[47]). The regions of Catalonia and Andalusia receive the largest receipts from the hydrocarbon tax in absolute terms, although it does not represent the highest shares in tax revenue among the autonomous communities (Figure 2.3).

Figure 2.3. The hydrocarbon tax as a share of total tax revenue in autonomous communities in 2020

Note: The Basque country, Navarra and the Canary Islands are not presented in the above figure as they have a specific financing system.

Source: Author’s own elaboration based on Ministerio de Hacienda y Funcion Publica (2022).

The tax on fluorinated GHGs is regulated under the law 16/2013 of 29 October (Gobierno de Espana, 2012[48]). It is an indirect tax levied on the consumption of certain fluorinated gases used as refrigerants or solvents based on their global warming potential. It includes hydrofluocarbons (HFCs), perfluorocarbons (PFCs), sulphur hexafluoride (SF6), regenerated and recycled gases, etc. The taxable matter is the first sale or delivery of fluorinated gases after production, import or acquisition. The tax base is the weight of the products, measured in kilograms. Several exemptions apply to the first sale or delivery when they aim to be: (i) resale only (i.e. no use of fluorinated gases in the production process), (ii) exported, (iii) used to chemical transformations that alter its composition, (iv) incorporated for the first time into new equipment and devices, (v) used to produce, import or acquire medical aerosols for inhalation, (vi) imported or acquired in new equipment and devices. A 90% exemption applies when the first sale or delivery is used to fire extinguishing equipment. Reductions are possible for waste management, destruction, recycling or reclamation of waste in accordance with sectoral waste legislation (Gobierno de Espana, 2012[48]).

Regarding electricity, the majority of levies are established and regulated by the central government. They apply to electricity generation, transmission and consumption. They include:

The Value Added Tax (Royal Decree 1624/1992): national tax on consumption of goods and services (Gobierno de Espana, 1992[49]; Gobierno de Espana, 1992[46]). General VAT is levied at 21% on most products and services in Spain. Since June 2021, under the Royal Decree-law 12/2021, electricity falls under the category of “products and services eligible for reduced VAT” (Gobierno de Espagna, 2021[50]). A reduced rate of 10% applies since then for consumers with contracted power of less than 10kW. The Decree-law 6/2022, adopted in response to the economic and social consequences of the war in Ukraine, set that reduced VAT shall be maintained as long as the price in the market is higher than EUR 45 per MWh and extended until 30 June 2022 (Gobierno de Espana, 2022[51]). With effect from 27 June 2022, the rate of VAT on electricity consumption was reduced to 5% due to rising inflation under the Royal Decree-law 11/2022. Recently, this reduced tax rate was extended to 31 December 2023 under the Royal Decree-law 20/2022 (Gobierno de Espana, 2022[52]).

The hydroelectric development fee (art. 112 to Royal Decree 1/2001): national fee on the public hydraulic domain for hydroelectric development purposes (Gobierno de Espana, 2001[53]). The taxable matter is the use of the dams of the reservoirs or the channels built with funds from public administrations for the purposes of hydroelectric exploitation. The tax base is determined by the competent river basin authority (see Box 6.2) based on the economic value of the hydroelectric energy produced.

The electricity production tax (art. 1 to 11 Law 15/2012): national tax levied on the production of electricity and its incorporation in the electrical system. The tax applies to economic capacity of electricity producers whose facilities give rise to significant investments in the transmission and distribution. It is calculated based on the gross revenue generated during the production of electricity and its inclusion in the electrical system received by the taxpayer. The rate is at 7%. Under the Royal Decree-law 12/2021, this tax has been suspended temporarily in 2021 (Gobierno de Espagna, 2021[50]). The suspension was extended to 31 December 2022 under the Royal Decree-law 11/2022 (Gobierno de Espana, 2022[51]) and recently to 31 December 2023 under the Royal Decree-law 20/2022 (Gobierno de Espana, 2022[52]).

The electricity tax (art. 89 to 104 Law 38/1992): special national ad valorem tax levied on the supply of electricity to a person for its own consumption at a rate of 5.113% of the total consumption and power charge, which is the applicable tax base for VAT. Since the Royal Decree-law 12/2021, the tax rate has been reduced to 0.5% (Gobierno de Espagna, 2021[50]), which has been extended to 31 December 2022 (Gobierno de Espana, 2022[51]). The reduced tax rate was extended to 31 December 2023 under the Royal Decree-law 20/2022 (Gobierno de Espana, 2022[52]). The electricity tax represented 1.3% of Andalusia’s tax revenue in 2020, in line with the average of the autonomous communities (1.2%, excluding the Basque country, Navarra and the Canary Islands) (Ministerio de Hacienda y Funcion Publica, 2022[47]).

At the regional level, the main tax on GHG emissions and air pollution is the tax on gas emissions into the atmosphere in Andalusia. The tax is regulated by the law 18/2003 (art. 21 to 28) (Junta de Andalucia, 2003[54]). It is levied on industries that emit carbon dioxide (CO2), nitrogen oxides (NOx) and sulphur oxides (SOx) above a certain threshold during their production processes (Box 2.4). The industries subject to this tax are listed in Annex 1 of Law 16/2002. They include energy production, oil processing, steelmaking and chemical industries. Emissions from landfills, facilities for intensive rearing of animals and those from the combustion of biomass and biofuel are exempt. Deductions apply to industries investing in emission reduction. The tax represented a negligible amount of revenue in Andalusia in 2020. Similar taxes on air pollution or gas emissions exist in other autonomous communities (Table 2.8).

Table 2.8. Taxes on air pollution and gas emissions applicable in other autonomous communities

|

Andalusia |

Cataluna |

Galicia |

Murcia |

Valencia |

Aragon |

Castilla-La-Mancha |

|

|---|---|---|---|---|---|---|---|

|

Instrument |

Tax on gas emissions into the atmosphere (Impuesto sobre las emisiones de gases a la atmosfera) |

Tax on industrial emission of gases and particles into the atmosphere (Impuesto sobre la emisión de gases y partículas a la atmósfera producida por la industria) |

Air pollution tax (Impuesto sobre la contaminación atmosférica) |

Tax on emission of pollutants into the atmosphere (Impuesto sobre emisiones de gases contaminantes a la atmósfera) |

Tax on activities that affect the environment (Impuesto sobre actividades que inciden en el medio ambiente) |

Environmental tax on the emission of pollutants into the atmosphere (Impuesto mediomabiental sobre la emisión de contaminantes a la atmósfera) |

Tax on certain activities that affect the environment (Impuesto sobre determinadas actividades que inciden en el medio ambiente) |

|

Tax base |

Annual CO2, NOx and SOx emissions expressed in polluting units above a certain threshold (3 polluting units) |

Annual NOx, SO2, particulate matter and total organic carbon emissions above a certain threshold (SO2: 150 tonnes; NOx: 100 tonnes; Particulate matter: 50 tonnes; Total organic carbon: 150) |

Annual NOx and SOx emissions |

Annual SO2, NOx, volatile organic compounds and ammonia emissions expressed in polluting units above a certain threshold (3 polluting units) |

Annual NOx (expressed in NO2 eq.) and SO2 emissions above a certain threshold (150 metric tonnes) |

Annual SOx, NOx and CO2 emissions above a certain threshold (SOx: 150 tonnes; NOx:100 tonnes; CO2: 100,000 tonnes) |

Annual SOx and NOx emissions |

|

Tax rate |

Rate in EUR per polluting unit: ≤ 10: 5,000 10 and ≤ 20:8,000 20 and ≤ 30:10,000 30 and ≤ 50:12,000 50: 14,000 The polluting units are obtained by dividing the total amount of each substance emitted by a reference value |

Rate in EUR per pollutant tonne: SOX: 45 NOX: 75 Particulate matter: 60 Total organic carbon: 45 |

Rate in EUR per tonne: ≤ 100:0 > 100 and ≤ 1 000:36 > 1,000 and ≤ 3,000:50 > 3,000 and ≤ 7,000:70 > 7,000 and ≤ 15,000:95 > 15,000 and ≤ 40,000:120 > 40,000 and ≤ 80,000:150 > 80:200 |

Rate in EUR per polluting unit: ≤ 10: 5,000 > 10 and ≤ 20:8,000 > 20 and ≤ 30:10,000 > 30 and ≤ 50:12,000 > 50: 14,000 The polluting units are obtained by dividing the total amount of each substance emitted by a reference value. |

Rate in EUR per tonne: ≤ 1,000: 9 > 1,000 and ≤ 3,000:12 > 3,000 and ≤ 7,000:18 > 7,000 and ≤ 15,000:24 > 15,000 and ≤ 40,000:30 > 40,000 and ≤ 80,000:38 > 80,000:50 Sum of NOX emissions in tonnes of NO2 multiplied by 1.5 and SO2 emissions in tonnes. |

Rate in EUR per pollutant tonne: SOX: 50 NOX: 50 CO2: 0.2 |

Rate in EUR per tonne: ≤ 500: 0 > 501 and ≤ 5,000:34 > 5,000 and ≤ 10,000:60 > 10,000 and ≤ 15,000:80 > 15,000:100 Sum of NOX and SO2 emissions weighted by 1 and 1.5, respectively. |

Source: Author’s own elaboration based on (Junta de Andalucia, 2003[54]; Generalidad de Cataluna, 2014[55]; Comunidad Autonoma de Galicia, 1995[56]; Comunidad Autónoma de la Región de Murcia, 2005[57]; Comunidad Autonoma Valenciana, 2012[58]; Comunidad Autónoma de Aragón, 2007[59]; Comunidad Autónoma de Castilla-La Mancha, 2005[60]).

The tax on gas emissions into the atmosphere is complemented by the charge for administrative services in industrial, energy and mining matters in Andalusia, which is regulated under the law 10/2021 (art. 42 to 46). It is levied on the provision of services and performance of administrative activities concerning the planning of industrial, energy and mining activities.

Box 2.4. The tax on gas emissions into the atmosphere in Andalusia

Key features of the tax on gas emissions into the atmosphere in Andalusia are:

Tax base: the pollutant load of different pollutants emitted from the same industrial plant. The pollutant load is determined by the sum of the polluting units of all the substances emitted from the same industrial facility. The polluting units are obtained by dividing the total amount of each substance emitted yearly divided by a reference value.

A direct estimation of the tax base can only be carried out when the industrial installations have the respective monitoring system in place and when the percentage of monitored data meets the requirements laid down in the rules.

In the case where industrial installations have no monitoring devices or when the percentage of monitored data does not meet the requirements of the standard, the tax base is calculated as the sum of the quantities of substances emitted, by applying specific coefficients depending on the industrial activity carried out in each installation according to an equation.

Indirect estimation is possible in the cases provided for in Law 58/2003 General Tax Law.

Tax rate: This tax is progressive and consists of five brackets whose taxable base varies between 5 000 and 14 000 euros per polluting unit. Thus, the more gases are emitted into the atmosphere, the more expensive the polluting unit becomes.

Source: Author’s own elaboration based on (Junta de Andalucia, 2003[54]).

2.3.2. Non-stationary sources: personal vehicles

The different levies applicable to personal vehicles in Spain and Andalusia are presented in the Table 2.9. The EU ETS does not currently cover fuels from transport, but an extension to transport is being discussed (see above). Regarding air pollution, the Directive (EU) 2016/2284 on 17 December 2016 on the reduction of national emissions of certain atmospheric pollutants also establishes national emission reduction targets for several pollutants, of which sulphur dioxide (SO2), nitrogen oxides (NOx), non-methane volatile organic compounds (NMVOC), ammonia (NH3) and fine particulate matter (PM2,5), as described above.

Table 2.9. Current levies applicable to personal vehicles in Spain and Andalusia

|

Current levies |

Competence |

|---|---|

|

Hydrocarbon tax |

National |

|

Vehicle registration tax |

National |

|

Road tolls (in discussion) |

National |

|

PIT deductions for the purchase of electric vehicles |

Regional |

|

Circulation tax |

Municipal |

Source: Author’s own elaboration.

At the national level, there is the hydrocarbon tax levied on fuels amongst those fuels used in transport (described above) and the vehicle registration tax. The latter is regulated by the law 38/1992 (art. 65 to 74) (Gobierno de Espana, 1992[61]). It is a national tax on the first registration of motorised vehicles (including cars, boats and airplanes). The tax base is the vehicle market price and the tax rate progressively increases as a function of the vehicles CO2 emissions. Exemptions and reductions apply. Exemptions include, for instance, two-seat vehicles used exclusively for industrial, commercial, agricultural, clinic or scientific use, three-wheel motorbikes, vehicles for disabled people, vehicles used by the public administration. The tax revenue has been assigned to the autonomous communities since 2002. It represented a small share of tax revenue in Andalusia in 2020 (0.3%), close to the average of the autonomous communities (0.4%) (Ministerio de Hacienda y Funcion Publica, 2022[47]).

As part of the Spanish recovery plan under the European Recovery and Resilience Facility, Spain also announced in 2021 that road tolls would be implemented in all national roads starting in 2024. This proposal is currently under discussion.

There is no levy implemented specifically on personal vehicles at the regional level in Andalusia. However, in order to incentive the purchase of electric vehicles, the autonomous communities have the competency to establish tax deductions from the PIT, which is a partially assigned tax (see Part I, Section 1). For example, the Autonomous Community of La Rioja established it under the law 10/2017 (art. 32) of 27 October (Comunidad Autónoma de La Rioja, 2017[62]). Under this law, deduction of 15% of the PIT applies for the acquisition of new electric vehicles, provided that it corresponds to the conditions set by the law. Among these conditions: (i) the vehicle must not be for professional or business activities, (ii) its amount shall not exceed EUR 50 000euros, and (iii) they must belong to the categories defined by the Directive 2007/46/EC (i.e. M1 passenger cars, N1 vans or light trucks, mopeds L1e, L2e tricycles, L6e light quadricycles, heavy quadricycles L7e, L3e motorcycles, category L5e and pedal-assisted bicycles with electric motor). For the passenger cars and vans or light trucks, electric vehicles must be: (i) powered by internal combustion engines that can use approved alternative fossil fuels such as LPG/Autogas, Compressed Natural Gas (CNG), Liquefied Natural Gas (LNG) or bi-fuel gasoline-gas., (ii) pure electric, or (iii) extended range electric vehicles, propelled entirely by electric motors.

At the municipal level, there is a circulation tax, regulated by the central government under the Royal Decree 2/2004 (art. 92 to 99) (Junta de Andalucia, 2003[54]). The tax is paid annually for the right of circulating on public roads. Amounts to be paid depend on multiple criteria, such as the vehicle category, the horsepower and the number of seats. There is no explicit environmental aspects considered. Exemptions and reductions apply. Exemptions include vehicles for disabled and personal vehicles used by the public administration.

2.4. Possibilities for Improvement on Taxation Related to Greenhouse Gas Emissions and Air Pollution in Andalusia

This section identifies some opportunities to reform the environmental taxation on GHG emissions and air pollution in Andalusia. It also includes opportunities at the national and municipal levels, which may improve environmental outcomes in Andalusia. Opportunities are based on the legal framework, the responsibilities mapping and the existing levies as discussed in the previous section. A selection of these opportunities will be further analysed in Activity 1.3 of the report, with an emphasis on their alignment with good environmental tax policy principles: notably opportunities in the area of the current tax on gas emissions into the atmosphere, vehicle taxation and distance-based charging. Case studies on the use of such instruments in other countries and Spanish regions will also be included. Where relevant this discussion looks at related aspects such as distributional consequences and health. As for the previous sections, emissions are separated between stationary sources, focusing on industry and electricity, and non-stationary sources, focusing on personal vehicles.

2.4.1. Stationary sources: industry and electricity

GHG emissions and air pollutants are already taxed in Andalusia under the tax on gas emissions into the atmosphere (Junta de Andalucia, 2003[54]). The main possibilities pertain to amending the current tax to broaden its scope, either by expanding the taxable matter or the tax base. The tax may also need to be updated with the current regulatory framework at the national level. In addition, the establishment of a national tax on emissions into the atmosphere is currently being discussed, which, in case of implementation, would repeal the Andalusian tax on gas emissions into the atmosphere due to double-taxation issue and would lead to compensation from the central government to Andalusia. The White Book for Tax Reform in Spain also made a recommendation to harmonise this tax across the autonomous communities (Box 2.5).

Possibility 1 (regional): improving the current tax on gas emissions into the atmosphere

Currently, the taxable matter is restricted to emissions of CO2, NOX and SOX. There is an opportunity to extend the taxable matters to other kinds of emissions, such as particulate emissions (e.g. Catalonia) or ammonia (NH3) and organic compounds (e.g. Murcia). To this end, it would be sufficient to amend article 23 of the current Andalusian law.