This chapter presents estimates of the transport infrastructure investment needs for the Current Ambition and High Ambition scenarios. It outlines the differences in investment profiles between transport modes based on projected transport demand. It also explores the potential investment needs associated with installing electric vehicle charging networks to support the policies of the High Ambition scenario. Finally, it considers the corresponding impact of electrification on fuel tax revenues.

ITF Transport Outlook 2023

6. Investing in the future: The financial implications of decarbonising transport

Abstract

In Brief

Transport competes for investment with other essential services and networks, such as healthcare, energy and water. Conversations about decarbonisation in all sectors often focus on funding or financing needs for the transition to net-zero. Where money is tight, benchmarking the investment needs for a net-zero scenario against those for a business-as-usual approach to infrastructure investment can yield important evidence to support important strategic decisions and set priorities.

In the case of transport, comparing investment needs under the Current Ambition scenario with the High Ambition scenario reveals that a strong push for decarbonising transport is in fact not more expensive: the total capital investment needs of core infrastructure for road, rail, airports and ports are 5% lower with ambitious policies in place than carrying on with business as usual.

The “decide and provide” approach is one example of an ambitious investment policy. Instead of providing infrastructure as a reaction to predicted demand (“predict and provide”), this approach involves investing in infrastructure in a vision-led way, with a view to achieving certain public policy objectives. In a transport decarbonisation context, this means investing in public transport infrastructure and policies that support the move to transport modes with higher occupancy or load factors, and more compact cities. Taking such an approach in a low-carbon future could potentially save governments from spending USD 4 trillion globally on road maintenance and investment (excluding investment in adaptation).

Nevertheless, transport decarbonisation requires significant investment in support infrastructure. The charging-point network, for example, is critical for the electrification of vehicle fleets. Under the High Ambition scenario, this network will require additional investments equaling roughly 0.4% of global gross domestic product over the period 2019 to 2050.

Transport decarbonisation also has an impact on revenues from fuel taxes. This revenue stream has already begun to diminish in many countries as internal combustion engines are becoming more efficient and electric vehicles increase their share of the passenger car fleet. The rate of this decline in revenue accelerates under the High Ambition scenario, as the uptake of zero-emission vehicles accelerates. Because of this, governments will lose income and the behavioural policy lever of taxing car use through fuel consumption.

Therefore, fuel tax regimes need reform. Distance-based pricing gives policy makers a stronger lever for encouraging sustainable travel choices. In addition, maintaining fuel taxes while vehicles with internal combustion engines remain on the roads helps phase out polluting vehicles. That said, policy makers need to design pricing regimes carefully to avoid perpetuating inequities.

Policy recommendations

Adopt a vision-led “decide and provide” approach to infrastructure planning instead of a reactive “predict and provide” approach.

Account for the significant additional investment needed for electric vehicle charging infrastructure.

Reform the current method of taxing car use through fuel excise duty and introduce more distance-based pricing.

Policy decisions to decarbonise transport are made within the context of available budgets and competing priorities. Furthermore, infrastructure investments made now will shape transport choices, access to opportunities and communities for years to come. As highlighted at the ITF 2022 Summit, future transport infrastructure will compete for available budget resources with other essential services and utilities (e.g. sanitation). This is especially relevant in emerging economies, where all sectors will grow simultaneously (Cunha Linke, 2022[1]).

This chapter identifies the elements of infrastructure investment and tax revenue that will most likely be affected when transitioning from the Current Ambition scenario to the High Ambition scenario. The available funding for future infrastructure investments is also critical. Decarbonising the vehicle fleet will diminish revenue from vehicle taxes (including acquisition, ownership and use taxes) based on fuel consumption and carbon dioxide (CO2) emissions. This will be true under both the Current Ambition and High Ambition scenarios.

Approaches to vehicle taxation vary worldwide; some regimes will be more susceptible than others to changes in the vehicle fleet. However, under the High Ambition scenario, all regions will see concerted efforts to reduce trip lengths and the use of motorised (or at least private motorised) modes. In this context, advance planning for future tax reform will be necessary.

Investing in cleaner transport: Will decarbonisation cost more?

Under the High Ambition scenario described in this edition of the Outlook, public transport modes would receive greater investment. However, any discussion of investing in cleaner transport should include an analysis of the network investments required under a business-as-usual approach.

This section presents the infrastructure investments required under the Current Ambition and High Ambition scenarios. It considers the scale of changes to supply core immovable infrastructure based on projected demand and associated costs of maintenance of existing and future infrastructure networks.

It is important to note that these estimates do not include additional infrastructure costs for new alternative fuels at ports and airports. They also do not include potential transport infrastructure adaptation costs to increase resilience to future climate change impacts.

Infrastructure needs will vary by country and region

Comprehensive data on infrastructure investment is difficult to come by. Investment and planning decisions are made at different levels of government and in various departments, meaning that there is often no single office responsible for collating and processing this information (Fay et al., 2019[2]). In addition, data on private assets and maintenance is not in the public domain. Furthermore, the lack of data at a per-kilometre level across different transport modes makes it difficult to estimate future spending.

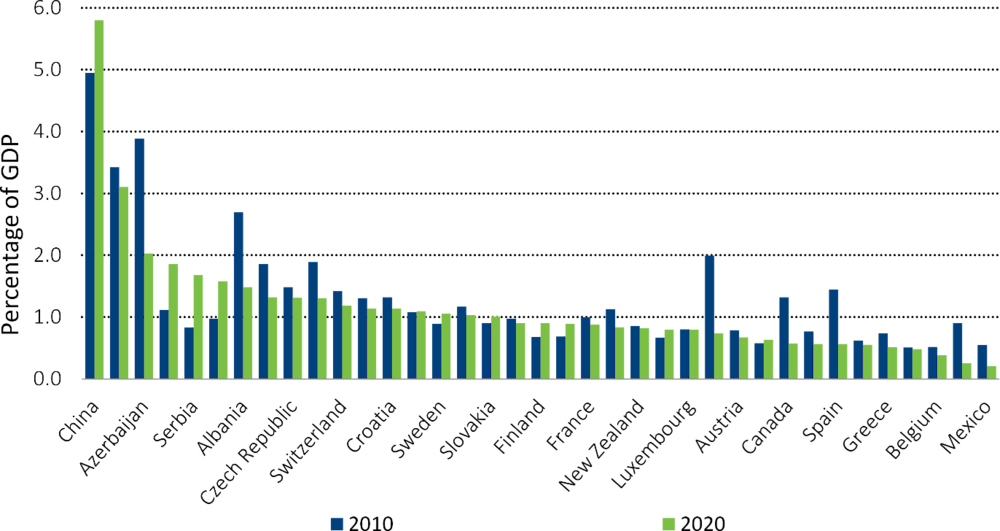

Nevertheless, several sources provide insights into overall average spending on transport infrastructure (see Box 6.1). Figure 6.1 presents data on infrastructure investments reported to the ITF for inland infrastructure spending in 2010 and 2020. The World Bank has also conducted comprehensive assessments of infrastructure spending (Rosenberg and Fay, 2018[3]; Foster, Rana and Gorgulu, 2022[4]; Fay et al., 2019[2]) while also acknowledging the difficulty of compiling accurate and detailed infrastructure spending data.

Infrastructure needs will vary by region and country. For example, low- and middle-income countries may need to pave existing roads while emerging regions seek to grow connectivity linked to economic growth. On top of this, global profiles of investment decisions are changing towards more sustainable modes. Infrastructure development will be crucial to the delivery of the Sustainable Development Goals (SDGs) as well as the economic growth of emerging economies, (OECD, 2018[5]).

Box 6.1. Estimating infrastructure costs for the two policy scenarios

The infrastructure cost calculations under the Current Ambition and High Ambition scenarios discussed in this chapter were sourced from a mix of nationally reported data, individual projects and case studies. Most transport network investment data come from the OECD database (OECD, n.d.[6]). Data for urban transportation modes, including bus rapid transit and light-rail transit projects, came from the Institute for Transportation and Development Policy (ITDP, n.d.[7]). City-specific projects were evaluated and broken down per unit to serve as proxies for countries with less-developed public transport systems.

For airports, information on the costs of recent infrastructure projects reflects total investment, capacity and mode share for passengers and freight. The Centre for Aviation analyses major airline projects globally, capturing corresponding timelines, funding sources and capacities (CAPA, n.d.[8]). Port cost estimates come from the UN Economic Commission for Latin America and the Caribbean, government agencies and regional news services (CAAR, 2022[9]; Energy, Capital and Power, 2022[10]; UN ECLAC, 2012[11]; Liang, 2019[12]). Urban road systems underwent a similar analysis, using data from national economic agencies and the Asian Infrastructure Investment Bank.

The UK government and the European Cycling Federation collect data on the respective costs of cycleway scheme types, which form the basis of calculations of cycleway-related infrastructure (Taylor and Hiblin, 2017[13]; ECF, 2021[14]). Tax rates related to car circulation and acquisition come from reported values published by the International Council on Clean Transportation (Chen, Yang and Wappelhorst, 2022[15]), the OECD and academic studies (OECD, n.d.[16]; Zahedi and Cremades, 2012[17]; PwC, 2019[18]).

The overall availability of data varied, with specific categories of infrastructure seeing a wide value spread and others remaining reasonably consistent. A proxy based on region was applied to account for countries with data gaps after calculating investment costs for economically and geographically similar states. Ranges of values depended on the level of existing infrastructure, the size of current and potential investments, demographic and geographic composition, and economic development. Limited data is currently available for certain types of investment (e.g. pipelines and waterways).

Generally speaking, developed countries spend less on infrastructure, given their well-established networks, although this can mean they are underspending (OECD/ITF, 2013[19]). An assessment of global transport infrastructure investment needs by Oxford Economics (2017[20]) estimated that transport (road, rail, airports and ports) would require approximately 1.9% of global GDP between 2016 and 2040. The figure is lower in developed economies than in emerging economies. However, the gap between current spending levels and future needs in Europe and the United States, for example, still amounts to 0.3% and 0.6% of gross domestic product (GDP), respectively (Oxford Economics, 2017[20]).

Low-income countries start from a lower level of infrastructure stock and a lower overall available budget, meaning essential infrastructure investment would typically be expected to consume a higher proportion of available funds. Even so, some estimates put the current rate of spending – particularly on roads – below the level needed (Foster, Rana and Gorgulu, 2022[4]). Rozenberg and Fay (2018[3]) estimate that the annual infrastructure investment needs for low- and middle-income countries would fall into the range of 0.9‑3.3% of GDP between 2015 and 2030, depending on the modes chosen for investment. The Inter-American Development Bank estimates that the Latin America and the Caribbean (LAC) region needs to spend 1.4% of GDP through to 2030 on capital investments in roads, public transport and airports (Brichetti et al., 2021[21]).

Figure 6.1. Investment in inland transport infrastructure, 2010 and 2020

According to the World Bank, more than 80% of infrastructure investment in emerging economies comes from the public sector, either directly from the government or via specially established public-sector bodies (World Bank, 2017[23]). This is a trend mirrored in the provision of climate finance. The OECD reports that 82% of the financing mobilised as part of the pledge to raise USD 100 billion per year for decarbonisation in emerging economies comes from public sources, including multilateral development banks (OECD, 2022[24]). The private sector is more likely to be involved in upper-middle-income regions and is almost invisible in Africa (OECD, 2018[5]).

The split between public and private is also visible across transport modes. Private investment making up the majority of development investments in roads airports and ports in emerging economies. Meanwhile, long-distance rail projects have tended to attract funding from the multilateral development banks, or state enterprises. For example, Chinese state-owned enterprises have provided funding in Africa as part of the Belt and Road initiative. Helping to create a more “enabling environment” for private investment in transport in emerging economies has been identified as one of the ways development partners can help these regions, in addition to actions the governments themselves need to take (OECD, 2018[5]). However, given the lifespan of most infrastructure, private investment in infrastructure must be well-managed to avoid governments finding themselves locked into unfavourable arrangements (ITF, 2018[25]). How this can best be achieved in the context of emerging economies is an area for further investigation.

Investment needs for core infrastructure are lower under the High Ambition scenario

At a global level, the investment needed for core infrastructure is 5.2% less under the High Ambition scenario than under the Current Ambition scenario. This reduction is mainly due to an overall decrease in the amount needed for investments in road infrastructure capacity. While the investment needs of other transport modes increase under the High Ambition scenario, even cumulatively, they do not reach this scale of spending.

This underlines the importance of adopting demand-management and mode-shift measures (see Chapter 3) in conjunction with technology and energy transition measures (see Chapter 4). This combination of measures reduces vehicle-kilometres and associated road-capacity needs for private motorised vehicles, and accelerates the move towards higher-occupancy modes and shorter urban trip distances.

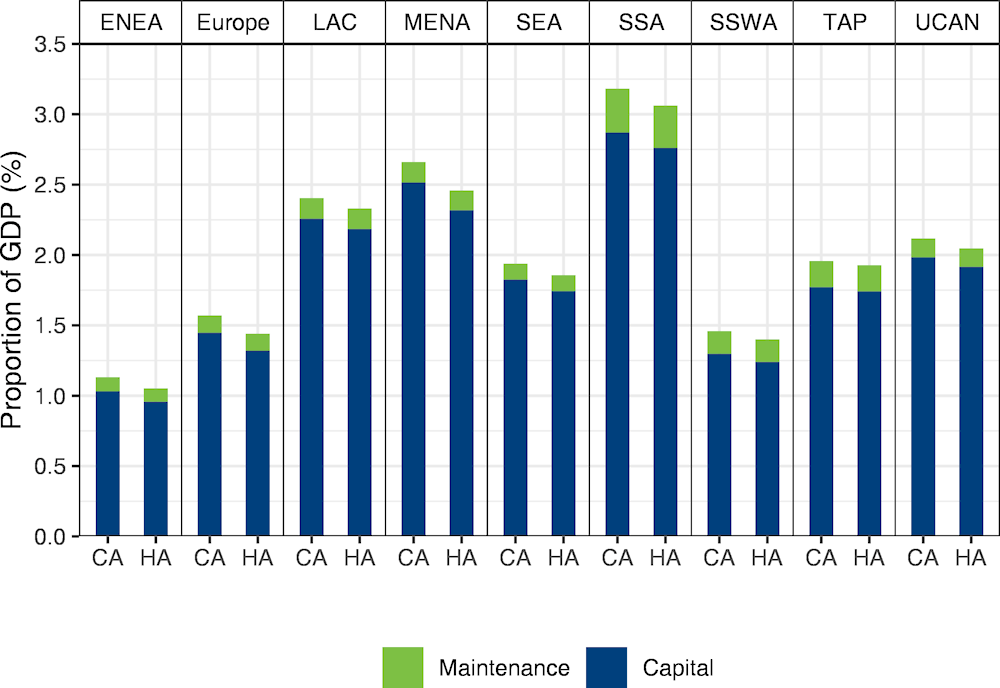

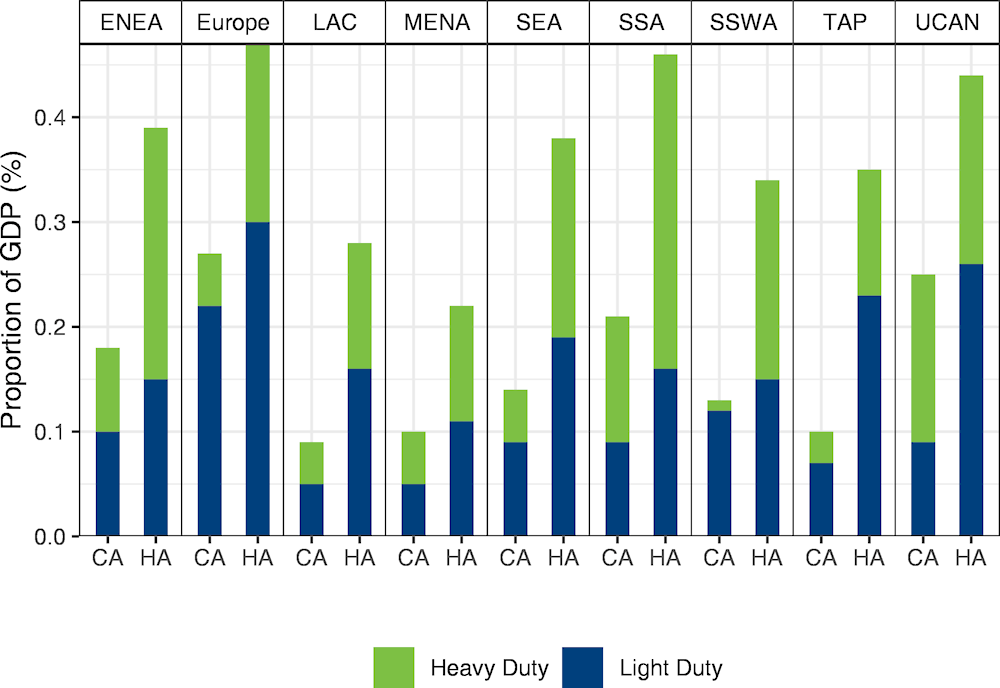

Figure 6.2 provides a regional breakdown of operational and capital investments in transport infrastructure. The shares of GDP represent the average infrastructure spend across the whole of the period 2019‑50. However, in most regions, costs are concentrated in the 2020s, when a higher share of GDP is needed under both policy scenarios. On average, most regions’ investment requirements under the High Ambition scenario will be about 0.1% of GDP lower than under the Current Ambition scenario. The exceptions are the Middle East and North Africa (MENA) region, where the expected reduction would be around 0.2% of GDP, and the Transition economies and other Asia Pacific (TAP) countries, where the reduction would be close to zero as a share of GDP.

Figure 6.2. Average core infrastructure investment under the Current Ambition and High Ambition scenarios as a proportion of gross domestic product, over the period 2019-50

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. ENEA: East and Northeast Asia. LAC: Latin America and the Caribbean. MENA: Middle East and North Africa. SEA: Southeast Asia. SSA: Sub-Saharan Africa. SSWA: South and Southwest Asia. TAP: Transition economies and other Asia-Pacific countries. UCAN: United States, Canada, Australia and New Zealand.

Source: GDP data based on the OECD ENV Linkages model, http://www.oecd.org/environment/indicators-modelling-outlooks/modelling.htm.

The estimates presented here consider the projected changes in new infrastructure and assets required to service the projected demand by mode under the two policy scenarios. It also accounts for the estimated maintenance costs of existing and new core infrastructure. In this Outlook, heavy infrastructure includes active travel infrastructure, airports, buses, bus rapid transit (BRT), intercity rail, light rail and metro (urban rail), ports, roads and waterways.

“Decide and provide”: A new approach to infrastructure planning and investment

A series of ITF reports over the past several years has recommended that governments adopt a “decide and provide” approach to infrastructure provision (ITF, 2021[26]; ITF, 2023[27]). This approach involves planning for desired future sustainable transport systems, rather than providing infrastructure in response to existing or projected demand (Lyons et al., n.d.[28]). Continuing to build infrastructure based on projections of growth in existing demand patterns (the “predict and provide” approach) will only perpetuate the problems car-led planning has engendered. These include environmental costs as well as negative impacts on accessibility and equity.

Decision makers can also come under pressure to make decisions on transport infrastructure based on short-term gains or political cycles. This pressure can result in disjointed choices that impact transport systems for decades (Rosenberg and Fay, 2018[3]). Aside from the environmental benefits, the “decide and provide” approach, guided by a vision of the outcome rather than following forecasts based on current transport patterns, can support effective decision making, even in times of uncertainty (ITF, 2021[26]; ITF, 2023[27]).

Evaluating the Current and High Ambition scenarios on the same cost basis suggests there is only a small difference between the total cost of the two. However, this finding assumes that governments begin implementing the measures included in the High Ambition scenario (see Chapter 2) in the 2020s. In other words, transport planners must decide now on the sustainable transport systems they want in the future. They then need to make strategically aligned investment decisions about the modes for which they need to build infrastructure.

O’Broin and Guivarch (2017[29]) found that restricting the development of capacity for carbon-intensive modes resulted in a greater reduction in emissions than allowing the development to go ahead but introducing measures such as carbon pricing. Restricting development also had a less detrimental impact on GDP and would avoid the carbon dioxide (CO2) emissions inherent in constructing excess capacity (O’Broin and Guivarch, 2017[29]).

Infrastructure investment profiles: Where will the money go?

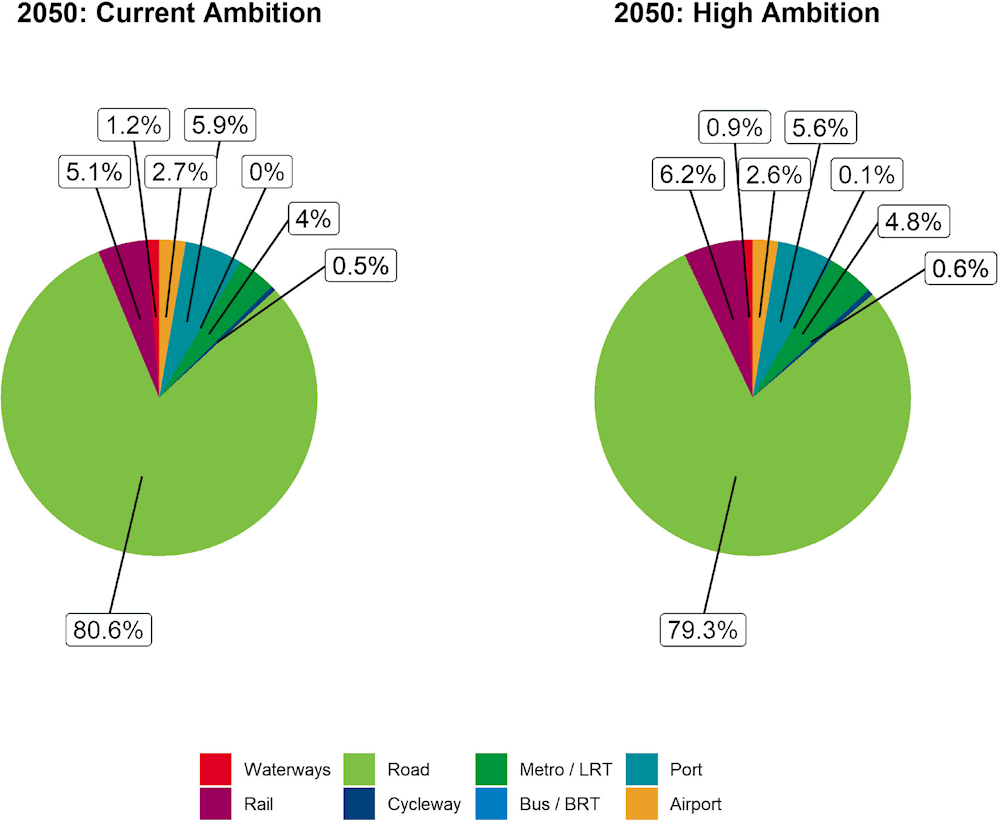

Globally, road investment represents the largest proportion, by far, of infrastructure investment in the Current Ambition scenario (see Figure 6.3), and this will also be true under the High Ambition scenario. The combined maintenance and global capital investments in road infrastructure still exceed USD 60 trillion over the next three decades, even under the High Ambition scenario. Rail will attract the second-largest share of investment under both the Current and High Ambition scenarios.

Given the long planning timelines required for infrastructure and its expected life span, the infrastructure investment decisions made today will influence the options available in the future, potentially locking-in private car use (Fisch-Romito and Guivarch, 2019[30]), especially if short-term decisions are made in the face of growing demand. It is important to reflect here that the changes in investment refer only to the investment required to serve the projected demand for the different modes under the two policy pathways. These numbers would not reflect a decision to build or maintain a railway line, road or other link to improve connectivity (rather than satisfy demand).

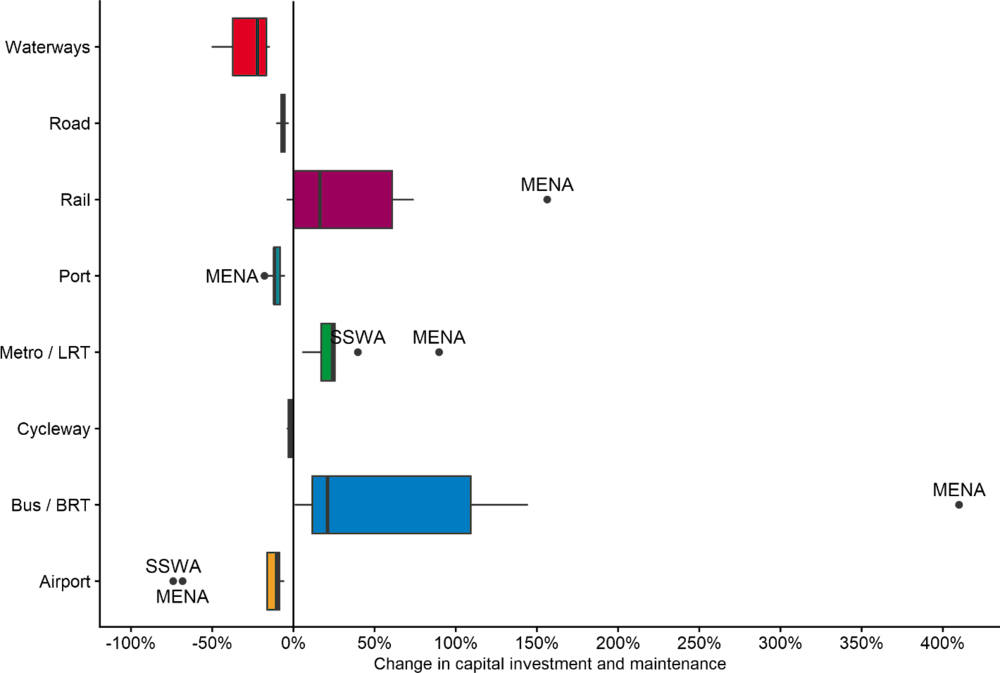

Figure 6.3. Investment anticipated by 2050 under the Current Ambition and High Ambition scenarios

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. BRT: bus rapid transit. LRT: Light rail transit.

A “decide and provide” approach would base long-term transport strategies on a vision of the future transport system rather than reacting to demand projections. It would support infrastructure investment decision making by providing foresight on how future mode shares and demand could evolve under a High Ambition scenario. New investments may need to move away from traditional modal hierarchies and historical transport planning priorities in different regions. Long-term strategies based on this approach can help ensure all investments contribute towards the same goals and support effective investment decisions.

Over time, the changes in passenger and freight demand seen under the High Ambition scenario for different modes suggest there could be a corresponding change in the investment required (see Figure 6.4). For example, road investment would be 6.5% less under the High Ambition scenario as a proportion of the spending required under the Current Ambition scenario. This equates to more than USD 4 trillion in avoided investment between 2020 and 2050 due to lower demand for road modes under the High Ambition scenario.

This reduction comes from a combination of sources. For freight transport, higher-capacity vehicles, high costs and a change in commodity types (particularly the reduction in fossil fuels) result in lower tonne-kilometres under the High Ambition scenario in 2050, and fewer road-based vehicle-kilometres. For passengers, the reduction comes from reduced demand, and the shift to higher-occupancy vehicles and modes. This is particularly the case for buses and rail-based modes, and an increase in active modes. BRT investment is classed as a separate type of infrastructure to road infrastructure in this chapter. However, urban roads will also need investment as part of supporting buses and shared-vehicle fleets.

This Outlook assumes priority measures for buses are operational investments, while road investments cover the associated capital costs. Investment in public or mass-transit modes is greater. Bus lanes and BRT lines, urban rail – including metro and light rapid transit (LRT) – and intercity rail all see higher investments under the High Ambition scenario due to greater expected demand. Buses and BRT see the greatest change, with expected investment being 33.6% (USD 10.4 billion) higher over the three decades to 2050. For rail, expected investments total more than USD 1 trillion across all rail types. Both urban and non-urban rail-based modes see increased investments of around 15.5% and 14.8%, respectively.

Figure 6.4. Difference in infrastructure investments under the High Ambition compared to the Current Ambition scenario

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. BRT: bus rapid transit. LRT: Light rail transit.

Box 6.2. Decarbonisation and climate change risks to port infrastructure

The scale of ambition for decarbonisation is a crucial piece of information for long-term port infrastructure planning for three reasons. First, the degree of decarbonisation determines the amount and composition of future maritime trade flows. As such, it influences decisions about where new port infrastructure is needed and the type of terminals required. Second, decarbonisation, and its subsequent implications for the severity of climate change, affect the physical climate risks faced by ports.

These risks are relevant to existing infrastructure and any new infrastructure required to cope with future demand. Third, the decarbonisation of maritime transport will determine infrastructure planning, particularly fuel bunkering facilities and charging infrastructure.

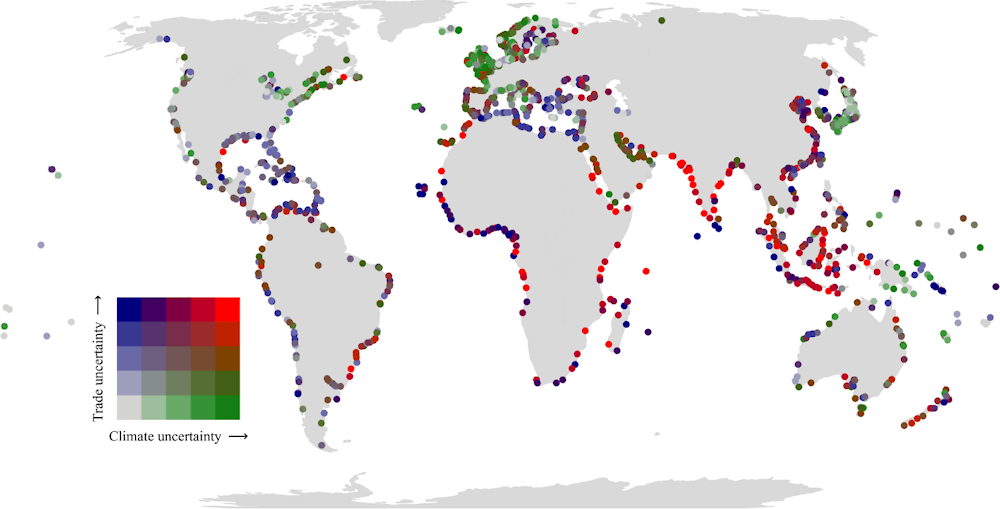

In 2022, researchers from the ITF and the University of Oxford explored the first two links between decarbonisation and port infrastructure planning as part of a joint study. They constructed 14 trade scenarios and fed them into a port planning and cost model to determine the terminal area and investments needed to meet the demand for trade in 2050. They also modelled physical climate risks to port infrastructure under three decarbonisation scenarios.

The results from the study indicate that strong decarbonisation leads to considerable benefits for society. More sustainability-focused scenarios lower the need for future trade, reducing the potential investment gap, particularly in developing economies. For example, under the most sustainable scenarios, investments would only be 40% of what would be required under less sustainable scenarios.

In addition, stronger decarbonisation moderates any increases in physical climate risks. In a decarbonisation scenario that assumes ~2 degrees Celsius (°C) warming by 2100, future climate risk increases by 74%. Meanwhile, under a scenario assuming ~5°C warming by 2100, this risk increases by 118%. If the demand for future trade is considered (implying that more new infrastructure would potentially be at-risk), the gap widens further. More sustainable scenarios entail a risk increase of 155‑190%, while under unsustainable scenarios, the equivalent risk increase would be 270‑470%.

As such, the degree of decarbonisation results in uncertainties about the long-term planning of future port expansions. Uncertainty regarding the trade scenario means that new terminals experience over- or under-capacity, while uncertainty in terms of climate change scenario means that terminals are over- or under-designed. Figure 6.5 shows the relative degree of trade and climate uncertainty faced.

Some ports (e.g. in Japan, North America and Western Europe) face planning uncertainties because they are sensitive to the future climate change scenario. Others (including ports in Chile, the Gulf of Mexico and the Mediterranean Sea) are more sensitive to the future trade scenario. In some areas (particularly parts of India, Southeast Asia and Sub-Saharan Africa), these two planning uncertainties come together, posing financial risks to new investments.

The results show that infrastructure planners need to account for decarbonisation uncertainties in long-term infrastructure planning. Plans need to be flexible to allow for a change of course if future scenarios change. But they must also be robust to ensure planning decisions perform well under multiple scenarios. For example, the Port of Rotterdam adapts its Maasvlakte 2 project Master Plan yearly based on new information. It can also transform terminals designed for containers to handle other cargo types.

Figure 6.5. Relative climate and trade uncertainties for ports worldwide in 2050 relative to 2015

Note: Based on data for 1 380 ports and 14 combined trade and climate-change scenarios. Uncertainty refers to the differences between the maximum and minimum future scenario relative to the present-day values. Trade uncertainty reflects changes in port throughput, while climate uncertainty reflects changes in physical climate risks.

Source: Verschuur et al (forthcoming[31]).

The reduction in spending for cycleways under the High Ambition scenario seems counterintuitive. However, it reflects the assumption of increasingly dense cities and a corresponding reduction of urban sprawl. This reduction in urban footprints means that while more people will cycle under the High Ambition scenario, urban trip distances and infrastructure kilometres required will both decrease. Maintenance costs for wear and tear due to cycling passenger-kilometres under this scenario would also be lower than for other modes, given that bicycles are much lighter than other vehicle types.

The investment required for airports under the High Ambition scenario declines by 9.8% compared to the Current Ambition scenario. This reduction is due to drops in both passenger and freight transport demand. The decrease in air freight reflects an increase in carbon pricing under the High Ambition scenario. It also results from changes in the types of commodities transported and greater trade regionalisation, which supports land-based modes.

These projections only reflect the investment needed to meet demand. They do not include investment in airports to support transitions to alternative fuels or reduce emissions caused by airport activity. However, the projections suggest that some costs could be offset against the costs of further expansion and corresponding maintenance if planned over the long term.

Investment in ports drops by 9.9% under the High Ambition scenario. This reduction stems from efficiency improvements, including greater asset sharing and corresponding reductions in vehicle movements. It also reflects changes in trade volumes for certain commodities. Transport activity associated with fossil fuel extraction and distribution reduces, in line with a reduction in demand for these fuels. Similar to airports, however, this reduction in investment does not include new infrastructure for alternative fuels or investment in port upgrades and digitalisation.

The decline in fossil fuel demand volumes also reduces tonne-kilometres carried by river, which has a corresponding impact on the investment required to serve demand on waterways. A critical cost omitted in these estimates is adaptation of infrastructure for climate resilience. Box 6.2 presents an overview of work on this topic for ports.

Priority modes for investment vary by region

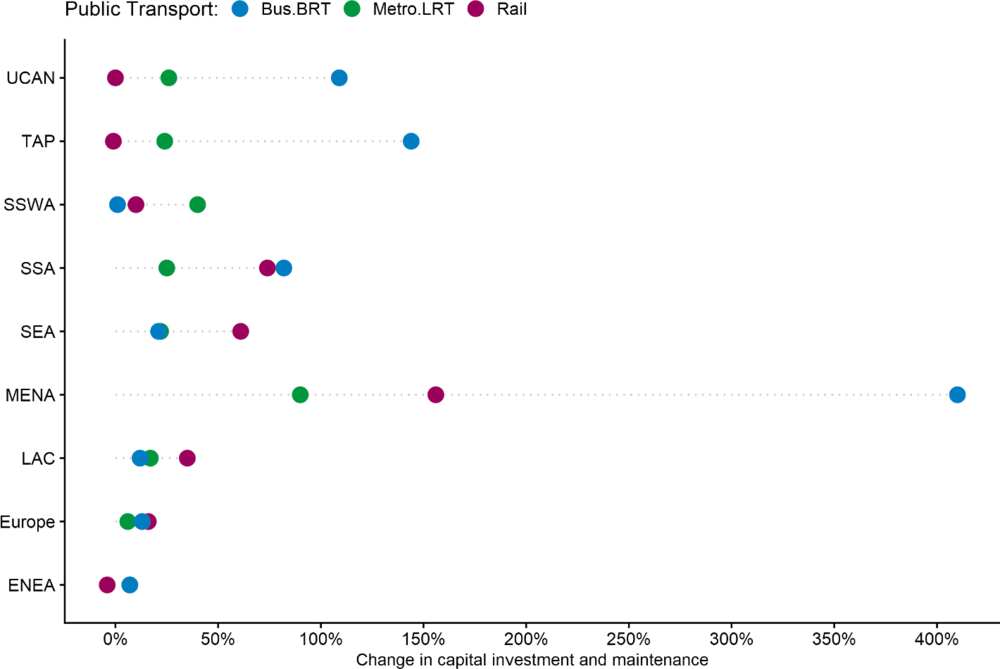

While the overall investment envelopes for the Current Ambition and High Ambition scenarios are similar, (see Figure 6.6), investments in the various transport modes change considerably between scenarios and among regions. For passenger transport, these changes often reflect a new approach to transport planning – namely, removing private cars from the top of the hierarchy. However, road building still attracts the highest investment in all regions under both the Current Ambition and High Ambition scenarios.

Figure 6.6. Regional changes in capital investment and maintenance costs under the High Ambition scenario as a proportion of the Current Ambition scenario

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. ENEA: East and Northeast Asia. LAC: Latin America and the Caribbean. MENA: Middle East and North Africa. SEA: Southeast Asia. SSA: Sub-Saharan Africa. SSWA: South and Southwest Asia. TAP: Transition economies and other Asia-Pacific countries. UCAN: United States, Canada, Australia and New Zealand. BRT: bus rapid transit. LRT: Light rail transit. Boxplots are a way to show a five-number summary in a chart. The box shows the middle of data (i.e. the interquartile range). The ends of the box show the limits of the first (25%) and third (75%) quartiles. The median is shown by the vertical line in the box. Outliers are defined as any value beyond 1.5 times the interquartile range (the size of the box) and are drawn as points and labelled.

For freight, connectivity continues to be essential for economic growth; reductions in investment for the relevant modes reflect a combination of a changing commodities mix and mode shift. In developed economies, the changes in priority will be about getting people to change their mode choices. Meanwhile, in regions with quickly developing urban areas and populations, the strategy should be to pre-empt car dependence in the first place by planning for sustainable transport by default.

In all regions, investment in urban public transport is expected to be higher under the High Ambition scenario than the Current Ambition scenario (see Figure 6.7). The most dramatic changes in several regions come from bus or BRT investment. Investment in buses and BRT would more than double in the United States, Canada, Australia and New Zealand (UCAN) and TAP countries, nearly double in Sub-Saharan Africa (SSA), and grow by over 400% in MENA.

Metro and LRT investment also grows considerably under the High Ambition scenario. In Latin America and the Caribbean (LAC), Southeast Asia (SEA), and SSA, metro and LRT grows by 17.2%, 22.1% and 24.7%, respectively. In South and Southwest Asia (SSWA), investment in urban rail would be 39.7% higher under the High Ambition scenario. In MENA, urban rail investment grows by 89.8% under the High Ambition scenario compared to the Current Ambition scenario. In East and Northeast Asia (ENEA), metro and LRT, and bus and BRT are the only categories with higher investment under the High Ambition scenario.

The high growth in investment in urban public transport, particularly in MENA and SSA, reflects the sustainable urban mobility policies in the High Ambition scenario that can contribute to sustainable and liveable cities (see Chapter 5). Such investment will be important as the region’s populations urbanise to avoid urban sprawl and car dependency (Stucki, 2015[32]; ICA et al., 2016[33]). In SEA, the investment would also be expected to support more sustainable urban population growth.

Cities in these regions already suffer from some of the worst levels of congestion in the world (ITF, 2022[34]; ITF, 2022[35]). Investment in urban public transport under the High Ambition scenario would support accessibility for existing populations and the development of sustainable travel habits as urban populations grow (ITF, 2022[35]; ITF, 2022[34]).

In LAC, while existing access to public transport is of reasonable quality, the attractiveness of those services in some cities could be hindered by poor “frequency, safety and reliability” (Brichetti et al., 2021[21]). Investment is also needed to improve public transport travel times, which are slower for comparable trips in LAC than in developed economies. Investment in transport infrastructure in LAC is also crucial to achieving the SDGs, particularly SDG 9 (Industry, Innovation and Infrastructure) and SDG 11 (Sustainable cities and communities) (Brichetti et al., 2021[21]).

In UCAN, investment in BRT grows by 109% under the High Ambition scenario, reflecting the increased demand for bus-based modes. However, it also reflects a greater investment in infrastructure – in other words, investment in dedicated bus lanes and BRT services in addition to the investment in bus services that run in normal traffic. Such investments are needed to ensure that bus-based modes are reliable and attractive alternatives to private cars.

These modes offer greater flexibility than rail for sprawling, lower-density cities. Investment in sprawling cities is more focussed on providing sustainable alternatives to the private car that can be retrofitted to developed, lower-density cities where a metro would be unfeasible. Increased investment in metro also shows the need to support sustainable travel with appealing, high-frequency options where the population density can sustain them.

Figure 6.7. Change in investment needs for public transport modes by region under the High Ambition scenario compared to the Current Ambition scenario

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. BRT: bus rapid transit. LRT: Light rail transit. ENEA: East and Northeast Asia. LAC: Latin America and the Caribbean. MENA: Middle East and North Africa. SEA: Southeast Asia. SSA: Sub-Saharan Africa. SSWA: South and Southwest Asia. TAP: Transition economies and other Asia-Pacific countries. UCAN: United States, Canada, Australia and New Zealand.

Road construction outside of cities receives the highest tranche of funding in every region. However, in LAC, SSWA and TAP countries, non-urban rail accounts for the second-largest levels of investment after roads under the Current Ambition scenario. Under the High Ambition scenario, this investment grows further in LAC and SSWA, while in TAP countries, it drops slightly. Rail also becomes the second largest capital investment in SSA. In LAC and SSWA, investment in rail grows by 35% and 10%, respectively. In SSA, inter-urban rail investment is 74% higher under the High Ambition scenario than under the Current Ambition scenario, while urban rail investment in MENA grows by over 156%.

In emerging regions, improving connectivity is an economic imperative, and investment in infrastructure networks is a priority (OECD, 2018[5]). In addition to urban public transport, road and rail connectivity investment will be needed to decarbonise transport activity (Rosenberg and Fay, 2018[3]). The lack of quality transport infrastructure in Africa is a barrier to industrialisation and potential competitiveness (ADB, 2018[36]).

The United Nations Economic and Social Commission for Asia and the Pacific has identified the region’s transport system as integral to its development (ESCAP, n.d.[37]), highlighting investment in road, rail and, for freight, dry ports for transhipment. Asian sub-regions will benefit from planned investments in the Trans-Asia Highway and in Rail Networks, which will increase the number of links and the quality of existing links (ESCAP, 2021[38]). Cross-border facilitation and bilateral and multilateral trade agreements are crucial to improving connectivity in Asia. They also provide a means to support measures that mitigate increases in freight movements, such as vehicle fuel efficiency standards (ITF, 2022[35]; ITF, 2022[34]; ITF, 2022[39]).

High-speed passenger rail is also of interest in Europe. The European Commission (EC), in its Sustainable and Smart Mobility Strategy, includes targets for high-speed rail use to double by 2030 and triple by 2035 (EC, 2020[40]). Recent research commissioned by Europe Rail has examined the possibility of developing a master plan for high-speed rail “connecting all EU capitals and major cities” (Ernst and Young, 2023[41]).

The research estimates that the network would require approximately EUR 550 billion. This amount is roughly the same as the non-urban rail investment in Europe under the Outlook’s High Ambition scenario (although the latter includes all rail investment, not just passenger rail). It also estimates a net social benefit of around EUR 750 billion, representing a positive return on investment (Ernst and Young, 2023[41]). The EC’s Sustainable and Smart Mobility Strategy also aims to double rail freight by 2035 (EC, 2020[40]).

Electric vehicle chargers: Essential new networks for decarbonisation

In a departure from historical network investments, electric vehicle (EV) chargers consume a significant proportion of infrastructure investment in the two scenarios explored in this edition of the Outlook. This is because under both scenarios EVs will play a fundamental role in reducing emissions due to road transport. Investments in EV charging networks represent approximately 9.8% and 19% of total infrastructure investments under the Current Ambition scenario and the High Ambition scenario, respectively.

Crucially, these estimates do not account for the historical costs of building fuel stations over previous decades. Therefore, they do not include a comparison between what it cost to achieve the network of support infrastructure needed for the existing system based on internal combustion engine (ICE) vehicles and what is required to build an equivalent system for EVs.

This section is based on the assumption that the clean vehicle fleets of the future will be predominantly electric and reflects expert knowledge at the time of writing. However, even if future vehicle fleets use alternative fuels, investment in support infrastructure will still be required.

Networks for heavy duty vehicles need to be accelerated while roll-out for passenger vehicles continues

The investment needs associated with installing EV charging networks under the High Ambition scenario amount to between 0.1 than 0.3% of GDP, depending on the region, more than the investment needed under the Current Ambition scenario (see Figure 6.8). In the LAC, SEA and SSA regions, the investments needed under the High Ambition scenario are 0.3% of GDP higher than under the Current Ambition scenario.

Figure 6.8. Regional investment needs for electric vehicle chargers as a proportion of gross domestic product over the period 2019-50

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. ENEA: East and Northeast Asia. LAC: Latin America and the Caribbean. MENA: Middle East and North Africa. SEA: Southeast Asia. SSA: Sub-Saharan Africa. SSWA: South and Southwest Asia. TAP: Transition economies and other Asia-Pacific countries. UCAN: United States, Canada, Australia and New Zealand.

It is important to account for different power levels when estimating the infrastructure costs of EV chargers. Common household and public wall chargers use alternating current (AC) and range between 3.7 and 22 kilowatts (kW). These chargers take 4‑10 hours to charge a battery-electric passenger car and 1‑2 hours to charge a plug-in hybrid electric vehicle (PHEV). Increasingly, direct current (DC) fast 50‑60 kW chargers are being deployed for passenger cars in public charging stations (e.g. on motorways). These enable rapid charging for battery-electric vehicles in 20 minutes to one hour (US DoT, 2022[42]).

Heavier vehicles, such as trucks, will require significantly larger batteries than passenger cars but must be recharged within similar timeframes. Therefore, heavy-duty vehicles (HDVs) will need even higher-powered chargers. For example, the EC’s Alternative Fuels Infrastructure Regulation sets binding targets for HDV charging infrastructure on Europe’s main road network, with minimum power requirements of 350 kW (EC, 2021[43]). Technical standards are also being developed for 1-megawatt (MW) charging systems (Charin, n.d.[44]).

Estimates of the cost of chargers vary greatly. Home and workplace chargers require less electricity grid capacity and materials and can cost as little as USD 2 000. Conversely, 50 kW DC fast chargers cost around USD 50 000 (Hecht, Figgener and Sauer, 2022[45]) and 350 kW fast chargers can cost over USD 200 000 (Basma, Saboori and Rodriguez, 2021[46]) due to more expensive equipment and higher grid connection costs. For this edition of the Outlook, the ITF’s in-house models have been enhanced with specially developed modules to assess infrastructure costs. Estimates of public EV charging infrastructure costs are based on projected EV demand in different regions, the number of chargers needed to support that demand, and the power capacities of chargers.

The difference between the Current Ambition and High Ambition scenarios is especially dramatic for HDVs (including heavy-duty freight and bus fleets) in emerging economies. In these regions, zero-emission road freight would not be expected to start to pick up until towards the end of the 2040s under the Current Ambition scenario but begins to grow in the 2030s under the High Ambition scenario. In high-income regions, where the existing rate of private motorised vehicle ownership is higher and the transition to EVs is already advancing, greater investment in charging networks for passenger cars is expected.

The scale of the ambition for emerging regions should be considered in the context of the already high investment needs required for core infrastructure (see Figure 6.2) and for the delivery of the SDGs. For example, of the roughly 770 million people in the world who lack access to electricity, three-quarters live in SSA (IEA, n.d.[47]). The cost of improving the electricity grid – which the International Energy Agency has estimated will require USD 35 billion per year through to 2030 – will be in addition to the cost of installing EV chargers.

In 2018, the OECD estimated that, accounting for core infrastructure of roads, rail, airports and ports, the funding gap to deliver the SDGs by 2030 was USD 440 million. In this context, the additional scale of investment needed in the supply of EV charger infrastructure in these countries raises a note of caution regarding the timelines for achieving the High Ambition scenario. Further work is needed on the most viable models for rolling out networks of supporting infrastructure in developing contexts if the ambitious timelines are to be feasible.

Policy approaches to growing electric-vehicle charging networks vary

EV charging infrastructure roll-out is the potential weakness in ambitions to increase the number of zero-emission vehicles (ZEVs). Publicly accessible EV charging networks will be needed to encourage and support this roll-out, but a wide-spread residential and work-place network will also be crucial. Jurisdictions worldwide have taken varying policy approaches to expanding the EV charging network, often adopting a combination of policy measures. In some cases, there is direct public-sector investment in installing the charging assets to kick-start the charging network and provide confidence and leadership.

Some countries have introduced tax credits or subsidies to stimulate and support the installation of chargers by private entities and individuals, or to establish high-quality commercial charging services. Regulations have also set binding targets and establish minimum standards for the installation of EV chargers in new developments, or set out EV-readiness requirements to make future installation simpler (ITF, 2021[48]; IEA, 2022[49]). For HDVs, a greater emphasis on the roll-out of depot charging will be needed (ITF, 2022[50]).

In the United States, the federal government has set the goal of installing 500 000 publicly accessible EV chargers by 2030. The US Department of Transportation (DoT), through the Federal Highway Administration (FHWA), provides a combination of direct state funding and grants for projects to increase the EV charger network (US DoT FHWA, 2022[51]; US DoT FHWA, 2022[52]). A budget of USD 7.5 billion has been provisioned for this goal under the Bipartisan Infrastructure Law (US DoT FHWA, 2022[52]). However, the FHWA also encourages US states to bring private funding on board: “Many of [the DoT’s] programs are oversubscribed, and EV charging infrastructure competes with many other types of eligible projects” (US DoT FHWA, 2022[51]). The US government also offers tax credit schemes to encourage private investment in charging infrastructure in “low-income and non-urban” areas (CleanEnergy.gov, 2022[53]; US DoE, n.d.[54]).

In Europe, the European Union is adopting regulations to advance the EV charging network. It is proposing binding targets on governments to extend the charging network, with the aim of reaching a goal of 3 million installed chargers by 2030 (EPRS, 2022[55]; EPRS, 2021[56]; IEA, 2022[49]). The EU is also revising its directives covering building regulations to require minimum levels of charging infrastructure in some buildings and mandate EV-readiness in others. At the EU level, EUR 1.5 billion in funding has been made available for the Trans-European Transport Network (TEN-T), although this is for both EV chargers and hydrogen refuelling. Several EU member states have also opted to supplement their networks by directly drawing on funding from the EU (IEA, 2022[49]).

The United Kingdom is deploying a combination of incentives to progress domestic and public charging infrastructure. The EV chargepoint grant provides funding for up to 75% of the cost of installing domestic EV charging infrastructure. Landlords, property owners and tenants are eligible for the grant (UK Office for Zero Emission Vehicles, n.d.[57]). Additionally, the UK government provides funding for local authorities to install street-side public EV chargers for PHEVs. In 2022, it launched an EV-charger installation pilot in nine local authorities, with over 1 000 chargers to be installed. This involved a public-private collaboration to deliver around GBP 20 million in investment, of which the government provided GBP 10 million, the private sector GBP 9 million and local public authorities GBP 1.9 million (UK Competition and Markets Authority, 2021[58]).

The People’s Republic of China also combines directly funded networks with subsidies to encourage EV-charger installation. The subsidies can target the capital costs involved in installation, or at the operational costs of providing a high-quality service. As in the United States, rural networks are also of particular interest in China. It is also trialling battery-swapping programmes (IEA, 2022[49]).

Commercial providers could also potentially provide EV charging infrastructure and services if a viable business model was identified. This could be particularly relevant to oil companies beginning to move into the charging market to future-proof aspects of their business. Nevertheless, the prevalence of private EV-charging solutions is still expected to negatively impact these companies (BloombergNEF, 2022[59]).

Fuel tax: Avoiding shortfalls through reform

Many countries, including the majority of OECD member countries, tax the acquisition, ownership and use of vehicles. While the scale of these taxes varies, they nevertheless represent an important revenue stream for governments. Vehicle taxation has also become a policy lever to affect change in consumer and travel behaviour (OECD, 2022[60]). An important element of this is fuel excise duties on petrol, gasoline or diesel used in ICE vehicles.

In most countries, fuel taxes account for the largest share of the revenue from road transport (ITF, 2022[61]). They can be considered reasonably equitable compared to other flat taxes, as they reflect the “user pays” principle to internalise the external costs of car use (ITF, 2018[62]). Excise duties also often incorporate environmental taxes. For example, in Austria and Colombia, the tax rate is different for fuels that include a share of drop-in biofuels (OECD, 2022[60]).

However, revenue from fuel taxes is already on a downward trend due to the growing share of EVs in vehicle fleets and improvements in fuel efficiency standards for ICE vehicles (ITF, 2022[61]). For example, the UK government estimates that its current policy pathway and tax regime are “likely to result in zero revenue for the Government from motoring taxation by 2040” (HM Treasury, 2021[63]). Using other taxes to offset these losses would likely require politically difficult rate increases. In the United Kingdom, value-added tax (VAT) would need to grow by an estimated 4% (Lord and Palmou, 2021[64]) to make up for lost revenue.

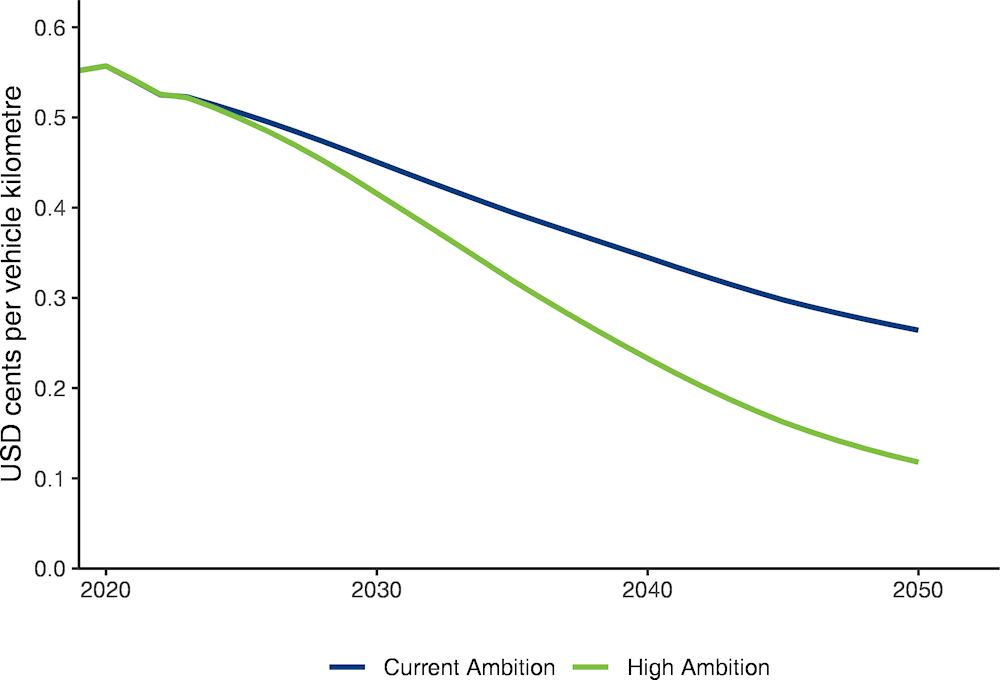

Figure 6.9. Global fuel tax revenues under the Current Ambition and High Ambition scenarios

Note: Figure depicts ITF modelled estimates based on estimates of fuel tax rates derived from OECD and Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) figures. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport.

Sources: OECD (2022[60]); GIZ (2021[65]); OECD (n.d.[16]).

This downward trajectory for fuel tax would continue under both scenarios explored in this edition of the Outlook (see Figure 6.9). But revenue will decline faster under the High Ambition scenario, as this pathway includes more ambitious targets on new vehicle sales.

As the share of ZEVs in vehicle fleets increases, the lack of a replacement for fuel taxes raises the issue of fairness. As things stand, in the absence of a charge specifically targeted at ZEV purchasers, or some form of road-user charging, EV owners will not contribute to the costs of maintaining the infrastructure they use. Participants in a recent ITF Roundtable (ITF, 2022[61]) discussed the various policy options available to governments seeking to reform vehicle taxation. The analysis in this section explores the outputs of the Current Ambition and High Ambition scenarios in the context of these discussions.

Approaches to vehicle taxation vary significantly among regions

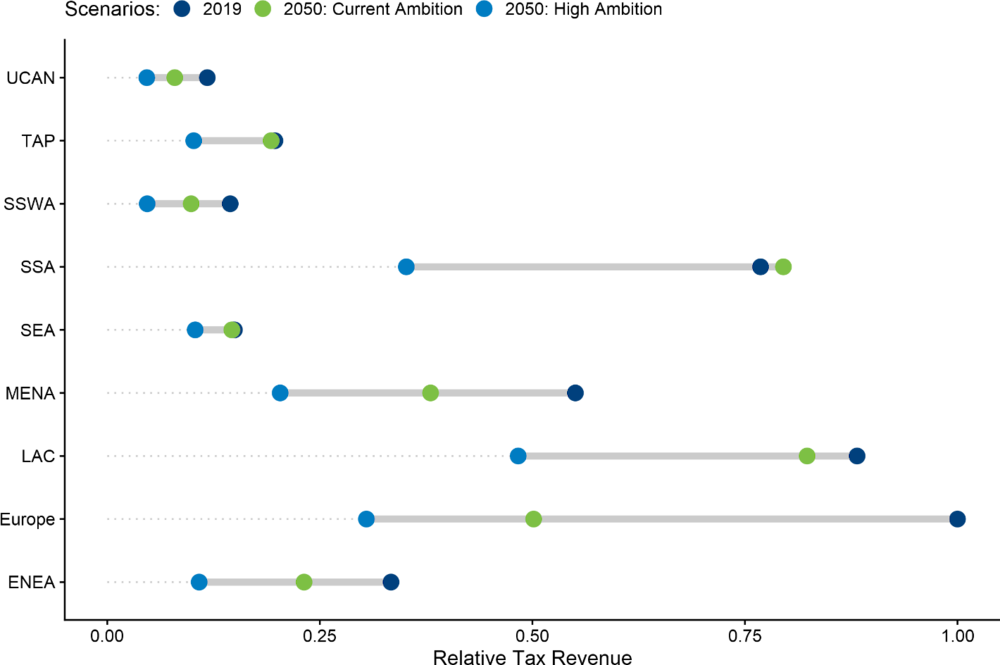

Figure 6.10 shows the total level of vehicle taxation (accounting for taxes on vehicle acquisition, ownership and use) in the different world regions under the Current and High Ambition scenarios. It compares vehicle taxation in these regions per vehicle-kilometre and accounts for approximate fleet sizes based on ITF estimates. Because the vehicle taxation rates in Europe are higher, the other reporting regions are shown relative to that region. For this analysis, fuel taxes were compared using the OECD’s Consumption Tax Database (OECD, 2022[60]), a Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) report for the Sustainable Urban Transport Project (GIZ, 2021[65]) and the OECD’s 2019 data on taxation on premium-unleaded gasoline (OECD, n.d.[16]).

Figure 6.10. Relative change in vehicle tax on private vehicles between 2019 and 2050 under the Current Ambition and High Ambition scenarios

Note: Comparison is normalised by fleet size. The fleet includes two- and three-wheelers, passenger cars, buses, LCVs, lorries and road tractors. Figure depicts ITF modelled estimates and modelled changes to the vehicle fleet from the ITF in-house models. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. ENEA: East and Northeast Asia. LAC: Latin America and the Caribbean. MENA: Middle East and North Africa. SEA: Southeast Asia. SSA: Sub-Saharan Africa. SSWA: South and Southwest Asia. TAP: Transition economies and other Asia-Pacific countries. UCAN: the United States, Canada, Australia and New Zealand. Vehicle taxation rates in Europe are highest and so the other reporting regions are shown relative to that region.

Sources: Estimates of tax rates derived from figures in OECD (2022[60]), GIZ (2021[65]), OECD (n.d.[16]), Zahedi and Cremades (2012[17]), PWC (2019[18]) and Chen et al. (2022[15]).

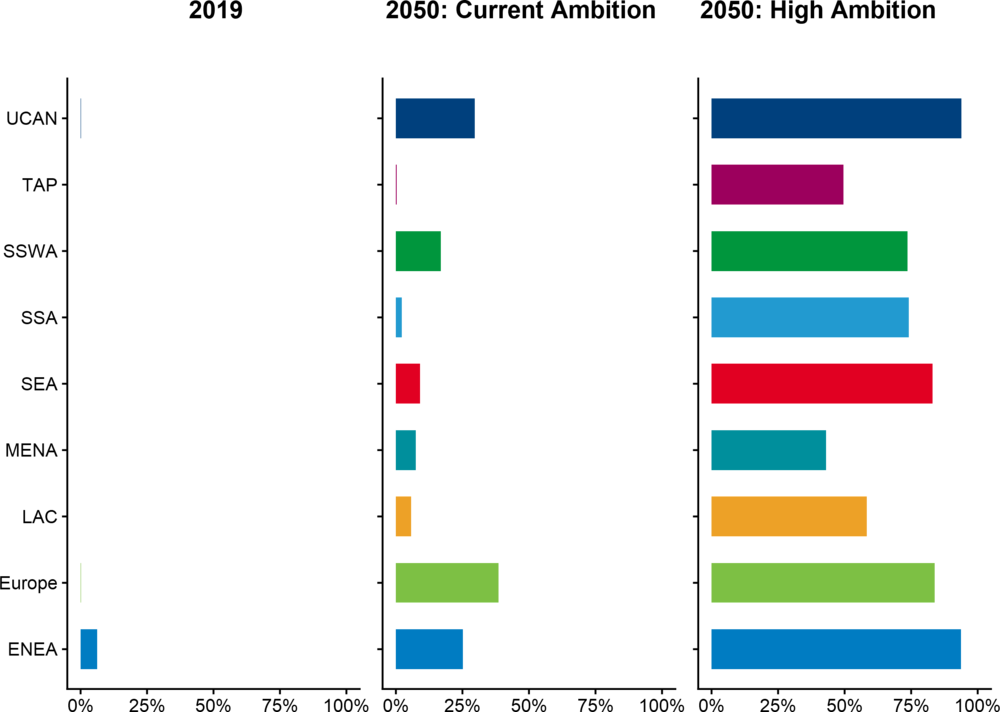

According to ITF estimates, in 2019 Europe generated the largest total tax revenue from vehicle ownership and use, standardised by fleet size (see Figure 6.10). If the tax regimes in these countries were to continue as they are now, their future tax revenue from vehicle ownership and use would nearly halve by 2050 under the Current Ambition scenario and reduce by more than two-thirds under the High Ambition scenario. These figures assume that countries in this reporting region do not apply additional charges to ZEVs at the same rates. In 2019, in all regions except ENEA, the vehicles comprising the tax bases were almost exclusively conventional ICE vehicles (see Figure 6.11).

The High Ambition scenario assumes a faster uptake rate for ZEVs than the Current Ambition scenario, which would reduce the share of ICE vehicles in the fleet to generate fuel-tax revenue. Countries in LAC and SSA received the second- and third-highest total amounts of tax revenue from vehicle use in 2019, respectively. The UCAN countries have the lowest tax rates, generating roughly 12% of the revenue per vehicle of the equivalent taxes in the Europe. It is worth noting that regional-level estimates can disguise considerable differences between countries.

For several regions, under the Current Ambition scenario, vehicle tax revenues would fall considerably by 2050. The exceptions are SEA, SSA and TAP. This result is mostly a reflection of the anticipated growth in transport demand coupled with a slower rate of decarbonisation. In contrast, under the High Ambition scenario, every region will have lower revenue from vehicle use taxes in 2050.

Vehicle tax revenues in emerging economies may also be higher than in high-income countries relative to per-capita GDP (Benitez, 2021[66]), meaning that national budgets in emerging countries are more dependent on fuel tax revenue (ITF, 2022[61]). This finding is particularly relevant in light of the accelerated rate of deployment of ZEVs (especially EVs) and greater investments in public transport under the High Ambition scenario, which will in turn contribute to reducing the tax base.

Figure 6.11. Share of zero-emission vehicles in the fleet by region

Note: Figure depicts ITF modelled estimates. The fleet includes two- and three-wheelers, passenger cars, buses, light commercial vehicles, lorries and road tractors. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. ENEA: East and Northeast Asia. LAC: Latin America and the Caribbean. MENA: Middle East and North Africa. SEA: Southeast Asia. SSA: Sub-Saharan Africa. SSWA: South and Southwest Asia. TAP: Transition economies and other Asia-Pacific countries. UCAN: United States, Canada, Australia and New Zealand.

Governments will need to include tax reforms in their decarbonisation strategies

A strategic approach is needed to avoid the expected shortfalls in tax revenue in future years (OECD/ITF, 2019[67]). The accelerated uptake of low-emission vehicles and ZEVs under the High Ambition scenario will reduce governments’ time to react to the expected changes in their tax bases. Markets in which larger, heavier vehicles (e.g. sports utility vehicles) dominate could potentially see an even more pronounced drop in tax revenue if a strategy to manage the transition is not implemented far enough in advance (ITF, 2021[48]).

In addition, in the absence of additional taxes, reducing the marginal cost of vehicle use over time could contribute to continued rises in private-car use. This would undermine the modal shift objectives central to sustainable mobility policies by making the private car more cost-competitive against mass transit and active mobility options.

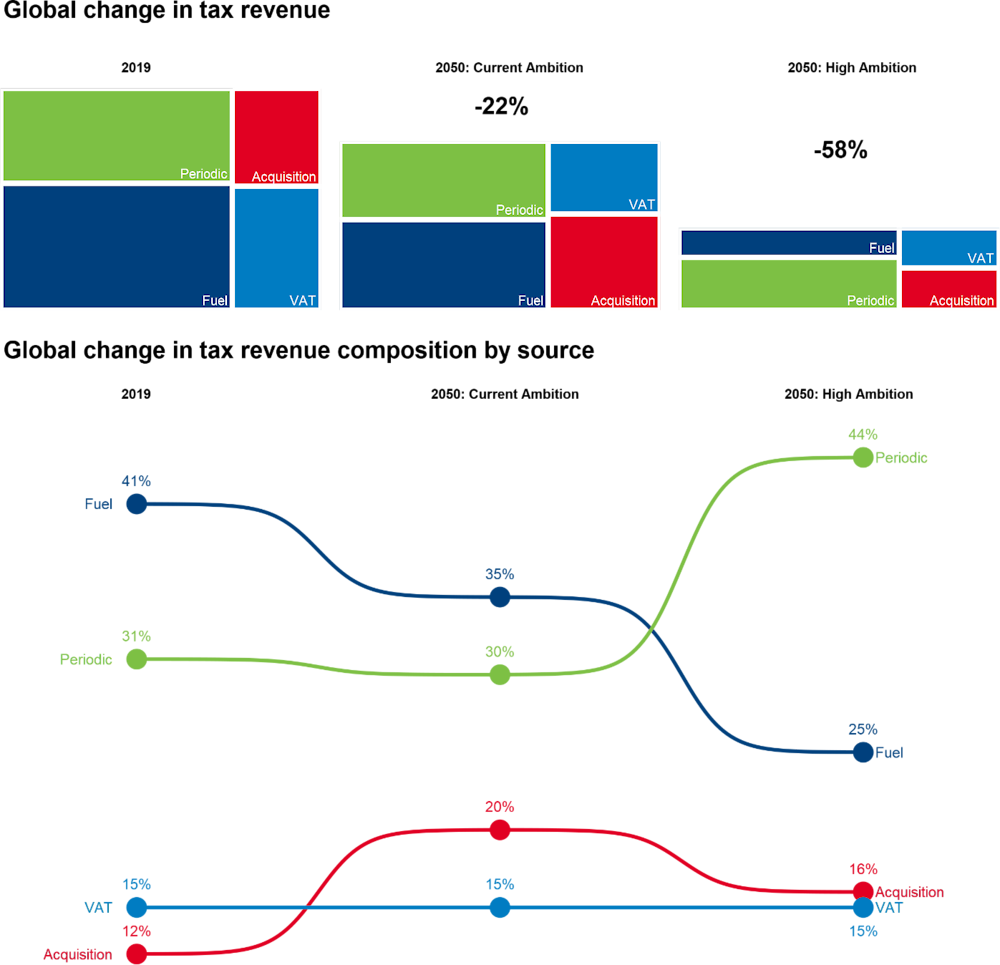

Figure 6.12 shows an estimation of the change in tax revenue from vehicle ownership and use between 2019 and 2050 under the Current Ambition and High Ambition scenarios. In addition to fuel tax, the figure shows the relative changes in revenue shares due to VAT or sales tax (on all aspects of car purchase and use, which average out at a consistent share across both scenarios), specific one-off acquisition taxes (excluding VAT or sales tax), and periodic taxes (such as annual road tax or monthly motor vehicle tax).

Looking at the breakdown of tax revenue globally (see Figure 6.12), fuel taxes and periodic taxes for vehicle ownership and use account for the majority of tax revenue associated. Fuel taxes can include excise duty (i.e. a tax on the production and sale of the good) and a carbon tax element (OECD, 2022[60]; Van Dender, 2019[68]; OECD/ITF, 2019[67]). While carbon taxes directly target the CO2 emissions of the fuel, there is evidence that governments also use excise duties as a lever for behaviour change among the populace.

In the case of fuel, excise duties can be considered “an implicit form of carbon pricing” (OECD, 2022[60]). The diminishing CO2 emissions from road vehicles under all future policy scenarios will lead to a rapid erosion of this tax base. Fuel taxes also capture the external costs associated with CO2 emissions. However, they are less effective at capturing other external costs (e.g. congestion), which are estimated to be higher than those of CO2 emissions in congested urban areas (ITF, 2022[61]).

Taxing electricity at the same rates as current fuel tax is not expected to be a viable solution. Electricity is used in many sectors, meaning there would be wider impacts than just on transport, and it would also further exacerbate potential equity issues by affecting affordability for lower-income households. Additionally, as EVs are more efficient than conventional ICE vehicles, the tax revenues would still be lower than those on fossil fuels (ITF, 2021[48]).

Many European and UCAN countries have also introduced acquisition or periodic tax structures designed to encourage low-emission vehicles or ZEVs by varying the tax paid based on fuel consumption or CO2 emissions. Several explicitly offer bonuses, discounts or reduced tax rates for ZEVs or fully electric vehicles (OECD, 2022[60]). This approach to acquisition or periodic taxes is less prevalent in other regions.

Among the Asian sub-regions, emissions-based acquisition and periodic taxes are less common. ITF estimates suggest that ENEA has a stronger share of tax revenue based on periodic taxes than other regions in the long term. A 2022 study by the International Council for Clean Transportation (ICCT) found that among the countries in the ENEA region, only Japan based its acquisition or periodic taxes on CO2 emissions or fuel consumption.

In SEA, Thailand and Singapore are the only countries to reflect environmental considerations in their acquisition and periodic taxes. However, at the time of writing, China, Japan, Korea and Singapore (as well as India in SSWA) all also offered some form of subsidy or rebate for electric or hybrid vehicles (Chen, Yang and Wappelhorst, 2022[15]), meaning the transition of the fleet would still have an impact on their tax revenue overall.

While the focus of this section is the reform of fuel tax, the results for acquisition taxes shown in Figure 6.12 also highlight the need to consider the lifespan of incentives for the purchase of ZEVs. The projections here assume that existing tax regimes carry forwards, and so existing exemptions in acquisition taxes for low- or zero-emission vehicles also carry forwards. When designing such incentives, the triggers or timing for phasing them out should also be considered.

Figure 6.12. Share of tax revenue by vehicle type and tax family in 2050

Note: Comparison is normalised by fleet size. The fleet includes two and three wheelers, passenger cars, buses, LCVs, lorries and road tractors. Figure depicts ITF modelled estimates and modelled changes to the vehicle fleet from the ITF in-house models. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport.

Sources: Estimates of tax rates derived from OECD (2022[60]), GIZ (2021[65]), OECD (n.d.[16]), Zahedi and Cremades (2012[17]), PWC (2019[18]) and Chen et al. (2022[15]).

New taxes can address falling revenue and support climate action investments

Decisions on the future of taxation for vehicle ownership and use must consider all relevant externalities. Fuel tax has been effective for CO2 emissions, but it is a blunt tool when seeking to account for congestion or safety risks. The EC views congestion and road crashes as the two largest external costs of private car use (EC, 2019[69]). Even as transport decarbonises, these two external costs will remain. However, they vary by time of day and location and are estimated to be higher in urban settings than rural ones (Proost, 2022[70]).

According to EC cost estimates, the externalities from EVs in uncongested rural settings are quite low relative to ICE vehicles or any car in congested conditions (EC, 2019[69]). This data suggests that undifferentiated road-user charging could be implemented in the short term so that all drivers contribute to the costs of the infrastructure. Additional pricing measures, such as congestion charges, could be implemented in congested urban settings to properly capture the external costs imposed by car use in that locality (ITF, 2022[61]). More sophisticated, differentiated road-user charges could then be introduced in the longer term. Urban pricing measures are discussed further in Chapter 3.

Of the UCAN countries, Australia, New Zealand and the United States have already taken action to move away from fuel taxes, adopting distance-based pricing at the national or subnational level. In Australia and New Zealand, distance-based pricing schemes exist based on odometer readings. The US states of Oregon, Utah and Virginia have adopted schemes that allow users to choose between an annual fee or a per-mile charge, depending on which is cheaper based on their usage level (ITF, 2022[61]). New Zealand’s scheme has been in place since 1978, but in Australia and the United States, the schemes have been introduced to mitigate the impact of the changing fleet on fuel tax revenue.

However, fuel tax is not entirely obsolete: it is a largely effective and equitable means to capture the external costs of CO2 emissions and encourage migration to cleaner vehicles. Fuel taxes should be retained as long as ICE vehicles form a significant part of the fleet, and rationalised so they fully internalise the relevant external costs of fuel use (e.g. climate costs and air pollution) for all fuel types. This also implies a relative increase in diesel taxes to account for diesel’s greater air-pollution impacts (ITF, 2022[61]).

A recent ITF Roundtable on the pricing of road transport (ITF, 2022[61]) discussed introducing distance-based pricing for EVs while retaining fuel taxes for as long as ICE vehicles remain a part of the fleet. A combination of fuel taxes on ICE vehicles, distance-based road-user charges on EVs and locally adopted congestion charges should effectively capture the costs to society of road vehicle use and ensure a significant and proportionate user contribution to the costs of road infrastructure. In this way, vehicle use charges retain an element of leverage for governments to encourage mode shift and behaviour change.

The forthcoming report from the Roundtable recommends that, in the medium term, governments should develop the technical capacity to enable the adoption of differentiated pricing schemes, which can reap greater efficiency gains. In all cases, the policies must be well considered, and the reasoning behind them communicated to the general public to support political acceptability and smoother implementation. The acceptability of road pricing also needs to be considered. Such considerations may well imply congestion taxes need to be levied and spent locally, for example on improving urban public transport (ITF, 2022[61]).

As discussed in Chapter 3, the revenue generated from congestion or road pricing could be put towards improvements in public transport, so that it is attractive as an alternative to the private car. The design of any long-term road-pricing scheme must also consider the feasibility of implementation. This will include planning for the equity and affordability impacts of distance-based charges, especially in areas where the poorest communities may live on the peripheries.

Any scheme will likely require new technological solutions and administrative processes. Privacy concerns will also need to be addressed whenever the Global Positioning System (GPS) is used to estimate distance travelled. Future pricing policies should also contribute to wider policy goals, such as managing the potential for the continued risk of congestion if EVs simply replace ICE vehicles.

Policy recommendations

Adopt a vision-led “decide and provide” approach to infrastructure planning instead of a reactive “predict and provide” approach

Deciding now on the sustainable transport system of the future and investing in infrastructure accordingly can play a crucial role in decarbonising transport. If the High Ambition scenario is adopted, a “decide and provide” approach to core infrastructure will have lower investment needs than existing policy pathways. A long-term strategic vision will also encourage the integration of land-use and transport planning policies, supporting more liveable cities and greater access to – and use of – sustainable transport modes.

In the coming years, developing and growing cities will have opportunities to avoid car-dependent urban developments – if they act now to promote integrated land use and adopt a vision-led approach to their transport systems. Meanwhile, established cities in developed regions will need to prioritise sustainable modes over private motorised vehicles. The High Ambition scenario can still be delivered in these regions for lower core infrastructure costs than the Current Ambition scenario. In all regions, greater investment in public transport modes and inter-urban rail will be needed, while investment in roads will reduce, although it will still take the lion’s share of investments.

This is the first time the ITF Transport Outlook has included costs for the infrastructure required to service the demand projections of the policy scenarios considered in the modelling exercise. While subject to limitations, as all modelling exercises are, this work demonstrates that, when assessed using the same assumptions, the two scenarios cost nearly the same in infrastructure requirements.

Infrastructure investment data remains difficult to collect at such a scale, in large part due to so many different bodies, public and commercial, being responsible for transport infrastructure projects. In most cases, no single office collates this information across all infrastructure types and governance levels. Tackling the data gap would be an important step towards developing better estimates in the future. If the data can be refined, costing exercises such as this can add important clarity to discussions of different pathways.

Account for the significant additional investment needed for electric vehicle charging infrastructure

The EV charging infrastructure needed to support the delivery of the High Ambition scenario represents a new and significant need for infrastructure investment. The investment required globally is estimated at 0.2% of global GDP per year in 2050 under the Current Ambition scenario and 0.4% under the High Ambition scenario, on average. This assumes a network comprising publicly accessible and domestic or workplace (or depot) charging. Several regions have developed policy packages to support and stimulate the installation of publicly accessible chargers while also using regulations and tax exemptions to drive domestic and workplace installations.

The extra investment needs for EV chargers in emerging regions, in particular, warrant consideration. Several already have greater investment needs for their core infrastructure than developed regions. Under the Current Ambition scenario, these regions will also experience the slowest “natural” uptake of ZEVs – meaning that the increase under the High Ambition scenario will be greater than in other regions. Crucially, emerging regions’ electricity needs must be met before the EV charging network becomes relevant.

Charging networks for HDVs, in particular, will require increased planning. Currently, these networks represent the largest share of required investment under the High Ambition scenario. The development of depot-based charging infrastructure needs to be accelerated. Policy makers must now focus as diligently on planning for the transition of HGVs as they did to encourage the uptake of passenger light-duty vehicles in the past.

Reform the current method of taxing car use through fuel excise duty and introduce more distance-based pricing

Well-designed road-user pricing can help address declining fuel tax revenue and internalise the external costs of vehicle use. The climate and pollution costs of road use will decline significantly with electrification. But without significant policy change, congestion costs will continue to increase. Fuel taxes should be retained for as long as ICE vehicles form a significant part of the fleet and rationalised so that they fully internalise the relevant external fuel use costs.

Undifferentiated distance-based charges can form a useful substitute for fuel taxes in the short term. Congestion charges should also be adopted where warranted and levied locally. When road-user charges internalise all relevant external costs, they help encourage the necessary modal shifts that are an important part of transport decarbonisation. Any additional revenues can help improve public transport and develop better infrastructure for active mobility and micromobility.

Governments should work towards adopting a more sophisticated and differentiated distance-charging system in the medium term. Given the substantial efficiency and equity benefits that charging systems differentiated by time and place can achieve, governments should develop the technical capacity to adopt these systems and the legal frameworks to respond to privacy concerns. Governments should also ensure they communicate their road pricing policies effectively, to ensure public understanding and acceptance of these charges.

References

[36] ADB (2018), African Economic Outlook 2018, African Development Bank, Abidjan, https://www.afdb.org/en/documents/document/african-economic-outlook-aoe-2018-99877.

[46] Basma, H., A. Saboori and F. Rodriguez (2021), Total cost of ownership for tractor-trailers in Europe: battery electric versus diesel, International Council on Clean Transportation, Washington, DC, https://theicct.org/publication/total-cost-of-ownership-for-tractor-trailers-in-europe-battery-electric-versus-diesel/.

[66] Benitez (2021), Financing low carbon transport solutions in developing countries, https://openknowledge.worldbank.org/bitstream/handle/10986/36610/Carbon-Transport-Solutions-in-Developing-Countries-Discussion-Paper.pdf?sequence=1.

[59] BloombergNEF (2022), Electric Vehicle Outlook 2022, Bloomberg, New York City, https://about.bnef.com/electric-vehicle-outlook/.

[21] Brichetti, J. et al. (2021), The Infrastructure Gap in Latin America and the Caribbean, Inter-American Development Bank, Washington, DC, https://doi.org/10.18235/0003759.

[9] CAAR (2022), “Update on Port of Oshawa expansion”, Canadian Association of Agri-Retailers Communicator, https://caar.org/the-communicator/october-2022/1662-update-on-port-of-oshawa-expansion.

[8] CAPA (n.d.), Airport Construction and Investment Review 2022, Part 1: Asia Pacific and Europe, https://centreforaviation.com/analysis/reports/airport-construction-and-investment-review-2022-part-1---asia-pacific-and-europe-601186 (accessed on 1 December 2022).

[44] Charin (n.d.), Megawatt Charging System (MCS), https://www.charin.global/technology/mcs/ (accessed on 16 December 2022).

[15] Chen, Z., Z. Yang and S. Wappelhorst (2022), Overview of Asian and Asia-Pacific passenger vehicle taxation policies and their potential to drive low-emission vehicle purchases, International Council on Clean Transportation, Washington, DC, https://theicct.org/publication/asia-vehicle-taxation-jan22/.

[53] CleanEnergy.gov (2022), Building a Clean Energy Economy: A guidebook to the Inflation Reduction Act’s investments in clean energy and climate action, The White House, Washington, DC, https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook/.

[1] Cunha Linke, C. (2022), ITF in Focus: ITF Transport Outlook 2023, https://www.youtube.com/watch?v=8uQlvnDNF6U.

[43] EC (2021), Proposal for a Regulation of the European Parliament and of the Council on the deployment of alternative fuels infrastructure, European Commission, Brussels, https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX%3A52021PC0559.

[40] EC (2020), Sustainable and Smart Mobility Strategy: Putting European transport on track for the future, European Commission, Brussels, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020DC0789.

[69] EC (2019), Handbook on the external costs of transport, European Commission, Directorate-General for Mobility and Transport, Essen, https://data.europa.eu/doi/10.2832/51388.

[14] ECF (2021), The Costs of Cycling Infrastructure, European Cycling Federation, https://ecf.com/system/files/The_Costs_of_Cycling_Infrastructure_Factsheet.pdf.

[10] Energy, Capital and Power (2022), “Top 5 Port Projects in Africa by Investment”, https://energycapitalpower.com/top-5-port-projects-in-africa-by-investment/.

[55] EPRS (2022), Alternative fuels in transport: Targets for deployment of recharging and refuelling infrastructure, European Parlimentary Research Service, Brussels, https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI(2022)729433.

[56] EPRS (2021), Deployment of alternative fuels infrastructure: Fit for 55 package, European Parliamentary Research Service, Brussels, https://www.europarl.europa.eu/thinktank/en/document/EPRS_ATA(2022)733688.

[41] Ernst and Young (2023), Smart and affordable rail services in the EU: a socio-economic and environmental study for High-Speed in 2030 and 2050, https://rail-research.europa.eu/publications/smart-and-affordable-rail-services-in-the-eu-a-socio-economic-and-environmental-study-for-high-speed-in-2030-and-2050/.

[38] ESCAP (2021), Study on efficient operations of international passenger trains along the Trans-Asian railway network, UN Economic and Social Commission for Asia and the Pacific, Bangkok, https://hdl.handle.net/20.500.12870/3684.

[37] ESCAP (n.d.), Our work: Transport, https://www.unescap.org/our-work/transport (accessed on 23 March 2023).

[2] Fay, M. et al. (2019), Hitting the Trillion Mark: A look at how much countries are spending on Infrastructure, World Bank Group, Washington, DC, https://doi.org/10.1596/1813-9450-8730.

[30] Fisch-Romito, V. and C. Guivarch (2019), “Transportation infrastructures in a low carbon world: An evaluation of investment needs and their determinants”, Transportation Research, Part D, Vol. 72, pp. 203-219, https://doi.org/10.1016/j.trd.2019.04.014.

[4] Foster, V., A. Rana and N. Gorgulu (2022), Understanding Public Spending Trends for Infrastructure in Developing Countries, World Bank Group, Washington, DC, https://doi.org/10.1596/1813-9450-9903.

[65] GIZ (2021), International Fuel Prices, Deutsche Gesellschaft für Internationale Zusammenarbeit, Eschborn, https://sutp.org/publications/international-fuel-prices-report/.

[45] Hecht, C., J. Figgener and D. Sauer (2022), “Analysis of electric vehicle charging station usage and profitability in Germany based on empirical data”, iScience, Vol. 25/12, https://doi.org/10.1016/j.isci.2022.105634.

[63] HM Treasury (2021), Net Zero Review Final Report, UK Government, London, https://www.gov.uk/government/publications/net-zero-review-final-report.