This chapter introduces the policy assumptions for the two modelling scenarios in the ITF Transport Outlook 2023. The Current Ambition scenario takes into account existing policies and forthcoming policy commitments, while the High Ambition scenario imagines a policy pathway with accelerated implementation timelines, or increased scale. The chapter then gives an overview of the projections for passenger and freight transport demand, and their associated carbon emissions, under the Current Ambition and High Ambition scenarios.

ITF Transport Outlook 2023

2. Decarbonising transport: Scenarios for the future

Abstract

In Brief

The transport sector is a significant part of the global economy. It provides access to opportunities that contribute to countries’ and individuals’ economic and social well-being. But transport faces a critical challenge: how to meet increasing demand while reducing carbon dioxide (CO2) emissions. Tackling poor air quality, reducing congestion and improving equity are equally important tasks for the sector globally.

The transport sector accounts for 23% of the world’s energy-related CO2 emissions. Transport also indirectly contributes to increased demand for energy. Transport infrastructure construction, vehicle manufacturing and fuel production generate greenhouse gas emissions. And the sector locks in future emissions because of the longevity of vehicle fleets and infrastructure.

This edition of the ITF Transport Outlook models two scenarios for future transport policies and their potential impacts on demand and emissions through to 2050. The Current Ambition scenario represents the business-as-usual approach. It projects the potential effects of existing commitments, including Nationally Determined Contributions made under the Paris Agreement.

In contrast, the High Ambition scenario assumes policy makers take accelerated action to decarbonise transport. This scenario models the impact of specific policy objectives, including providing alternatives to private motorised vehicles, enhancing public transport services, improving walking and cycling facilities, and improving the efficiency of the movement of goods.

Some regions’ current efforts will make a difference over time and overall transport CO2 emissions will fall slightly by 2050. However, a business-as-usual approach will not make enough difference to deliver against the Paris Agreement goals. The projections also show that the carbon-intensity of passenger activity falls faster than freight’s under the Current Ambition scenario.

Without decisive action, the transport sector will continue to contribute significantly to the world’s CO2 emissions. The need to break the link between emissions and transport activities is increasingly urgent. Achieving decarbonisation in the transport sector will require increased policy ambition and international co-operation. But solutions for specific transport types, and economic and geographic contexts, will vary.

Key takeaways

Transport is central to economic development and social opportunity, but it also contributes significantly to the world’s CO2 emissions.

This report models two scenarios for the future transport demand and CO2 emissions to 2050, one informed by announced or existing policies (Current Ambition scenario), the other assuming more ambitious decarbonisation measures (High Ambition scenario).

Overall, the scenarios show that current policies will begin make a difference over time at a global level, with transport CO2 emissions falling slightly by 2050.

However, continuing on the current path will not make enough of a difference for the transport sector’s CO2 emissions to deliver against the Paris Agreement goals.

The urgent need to break the link between transport activities and emissions requires increased ambition and more international co-operation.

Every two years, the International Transport Forum (ITF) provides an overview of current trends and future prospects for the global transport sector based on its in-house transport models. The ITF Outlook 2023 presents long-term projections for freight and passenger transport demand. It also quantifies the transport sector’s projected carbon dioxide (CO2) emissions using two alternative policy scenarios: a Current Ambition and a High Ambition scenario.

The ITF’s modelling makes it possible to assess changes in freight and passenger flows under these two scenarios. The modelling also accounts for externalities caused by disruptions and policy interventions. For each policy scenario, the Outlook examines the impact of GDP patterns, changing populations and population centres on transport demand. It also outlines the potential roles different policy levers could play in decarbonising transport.

This chapter outlines the actions assumed by the ITF’s modelling under the Current Ambition and High Ambition scenarios. It then provides a high-level summary of this edition’s findings on passenger and freight transport demand and emissions.

Raising policy ambition: Transport’s central role

Transport is crucial to the three pillars of sustainable development: the economy, the environment and society. Transport provides access to opportunities, services and social life; it enables the movement of goods and people. The transport sector’s centrality to the core areas of human life makes it especially vulnerable to global crises. The restrictions on travel and movement throughout the Coronavirus (Covid-19) pandemic have directly affected the sector, while the current world energy crisis is causing massive increases in fuel costs (see Chapter 1).

Since the last Outlook was published in 2021, the world has experienced more extreme weather events, including devastating floods, record high temperatures, and extensive wildfires. As well as the catastrophic loss of life, livelihoods and habitats, these events, also have devastating economic impacts, underlining the urgency of taking action. Transport is responsible for roughly 23% of the world's energy-related CO2 emissions (IEA, n.d.[1]), making it a critical focus area for decarbonisation. The results in this Outlook show that the transport sector is still not on track to decarbonise, but actions can be taken to put this right.

Trends in population, economic growth and land use influence transport activity. But these trends are often beyond the scope of transport policy measures. In the case of economic growth, for example, higher gross domestic product (GDP) represents a positive trend for many governments, independent of its impact on emissions. Therefore, it is necessary to identify transport policy pathways and levers that recognise wider goals, alongside decarbonising the associated transport activity, and accounting for the needs of different regions.

Decarbonising the transport sector also represents a significant shift away from a “business-as-usual” mindset and offers opportunities to reimagine transport systems and reconsider the wider benefits of cleaner air, reduced oil dependency, and more liveable cities. Achieving the transition to greener, cleaner and more resilient transport systems needs to include affordable, safe and inclusive services. The UN predicts that 68% of the world’s population will live in cities by 2050 (UN DESA, 2019[2]).

Transport tailpipe emissions were responsible for ~385,000 premature deaths in 2015 (Anenberg et al., 2019[3]). Transport has the highest reliance on fossil fuels of any sector (IEA, n.d.[4]). Decarbonisation of the transport sector will require an energy transition of the vehicle fleet away from fossil fuels. The transition to zero-emission cars and vans was estimated to avoid nearly 1.7m barrels of oil a day in 2022 (BloombergNEF, 2022[5]). Planning for low-carbon transport systems that shift away from technologies that emit harmful pollutants also helps ensure cities become more liveable as urban populations grow.

Decarbonising transport: Two scenarios for the future

This edition of the ITF Transport Outlook focuses on how the global transport sector can meet the ambition to reduce CO2 emissions in line with the Paris Agreement between now and 2050. Using the ITF’s in-house global transport models (see Box 2.1), it projects the potential effects of two specific policy scenarios: a Current Ambition scenario and a High Ambition scenario.

The Current Ambition scenario provides insights into how transport demand and emissions could evolve over the coming decades if transport policy continues along its current path. The High Ambition scenario, by contrast, looks at the impact of adopting more ambitious policies to decarbonise the transport sector.

This report models the projected effects of the Current Ambition and High Ambition scenarios across four main sectors: urban passenger demand and mode choice, non-urban passenger demand and mode choice, freight demand and mode choice and the transition to cleaner vehicle fleets. The following sections describe the two scenarios in detail. Chapters 3-6 examine how these two scenarios could play out in different world regions between now and 2050, as well as some of the co-benefits arising from the reduction of CO2 emissions from transport.

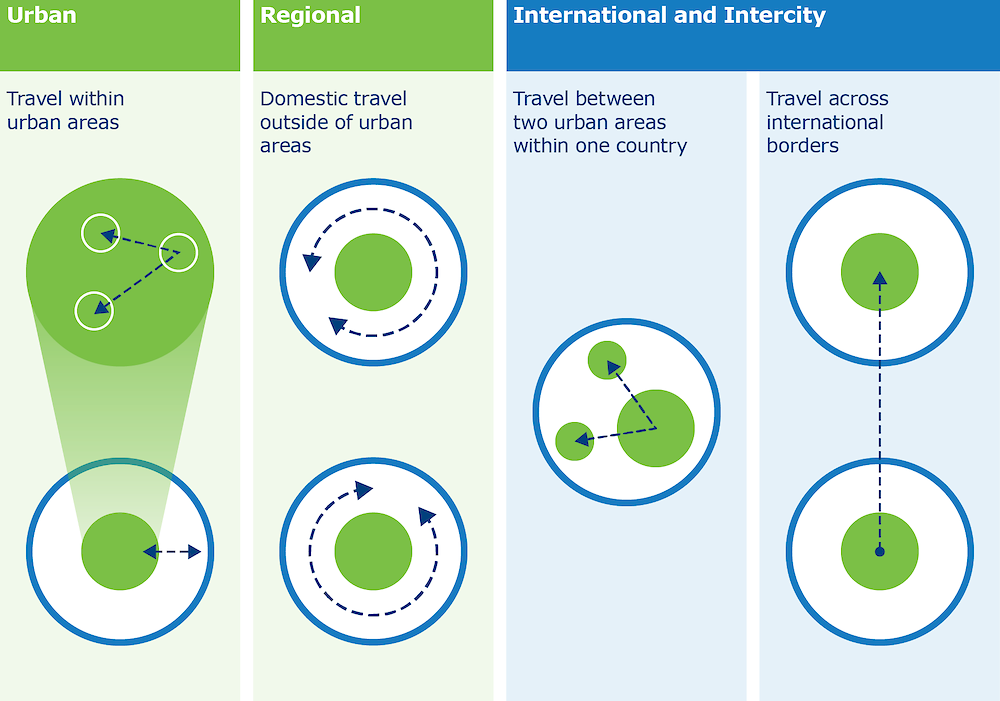

For passenger activity, the demand is grouped into three activity types: 1) urban, denoting activity within urban areas, 2) regional, denoting domestic travel outside of urban areas and 3) international and intercity, denoting travel across international borders, or domestically between two cities (see Infographic 1). For freight activity, there is a similar split: 1) urban, denoting activity within urban areas, 2) domestic, denoting activity outside urban areas but within national borders and 3) international, denoting activity across international borders).

Non-urban passenger travel represents a greater variety of trip types than urban travel. There are international and intercity trips, which would potentially have high volumes of people travelling between the same start and end points. Then there are regional trips, which have a more dispersed pattern and could have lower densities of people for every origin and destination. On average, non-urban trips also tend to cover longer distances. This combination of different travel patterns and greater distances means non-urban travel has proven harder to abate than its urban counterpart.

Box 2.1. The ITF modelling framework

The ITF has developed a set of modelling tools to build its own forward-looking scenarios of transport activity. Covering all modes of transport, as well as freight and passenger activity, the tools are unified under a single framework to test the impacts of policies and technology trends on transport activity and carbon dioxide (CO2) emissions.

Urban passenger transport model

This model combines data from various sources, forming an extensive database on global city mobility to account for 18 modes. It produces estimates on urban passenger trip numbers, travel distances, modal splits, modal trip shares, passenger- and vehicle-kilometres (pkm, vkm) and related CO2 and pollutant emissions, as well as indicators for accessibility, space consumption and crash risk.

Non-urban passenger transport model

This model provides estimates for passenger trip numbers, pkm and related CO2 emissions for all modes available for travel between urban areas (both intercity and international travel) and locally in non-urban areas (regional travel), accounting for multimodal passenger activity.

Urban freight transport model

This model produces estimates on urban freight trip numbers, travel distances, modal splits, tonne-kilometres (tkm), vkm and cargo weights and their related CO2 and pollutant emissions. It applies innovative methods to overcome the general lack of data describing urban freight movements.

Non-urban freight transport model

This network model assigns freight flows of all major transport modes to specific routes and network links. It combines data on national freight transport activity (in tkm) with trade projections from the OECD ENV-Linkages trade model to provide estimates on tkm and vkm by mode and commodity type.

Fleet model

This model, newly developed for the ITF Transport Outlook 2023, combines data on the age and technologies of vehicle fleets around the world with forecasts of vkm from the ITF passenger and freight models for every vehicle type and region. It uses these to estimate how vehicle fleets will evolve over time using scrappage probabilities. Projected future fleets are combined with scenarios on technology adoption and energy efficiencies to estimate CO2 and pollutant emissions.

Infographic 1. ITF Transport Outlook classification of passenger activity types

Note: Each green dot represents a functional urban area. Solid blue lines represent national borders. Arrows and dotted lines represent specific trip types.

The Current Ambition scenario: Projecting the impact of existing commitments

The Current Ambition scenario reflects a general recognition that the transport sector needs to decarbonise. It takes into account existing policies and forthcoming policy commitments in national and regional governance directives, government strategies and laws. It incorporates assumptions about current global political and economic conditions. It also reflects the reality that many decarbonisation plans are progressing slowly and will be even slower in terms of worldwide implementation.

The Current Ambition scenario accounts for the early actions that have been taken to translate existing ambitions into action. However, the scale of these actions varies greatly from region to region.

The measures in the Current Ambition scenario include policies or technological developments aimed at replacing internal combustion engine (ICE) vehicles; demand management and encouraging mode shift; investment in attractive and sustainable alternatives to the private car; and improving efficiency and operations to reduce carbon intensity. The following subsections and the accompanying tables outline the policy pathway assumed under the Current Ambition scenario over the next three decades.

Urban passenger demand and mode choice under the Current Ambition scenario

The Current Ambition policy scenario for urban passenger demand (see Table 2.1) assumes that governments and other actors gradually introduce economic instruments, transport infrastructure enhancements, transport service improvements, and regulatory and other measures to decarbonise the transport sector. All of these actions reflect current policy commitments, and the scenario assumes that they are fulfilled.

Under the Current Ambition scenario, urban policies include several pricing-based measures, including congestion pricing, parking pricing and carbon pricing. Access restrictions to urban spaces and parking for private motorised vehicles are also introduced in many regions along with investments in expanding bicycle and pedestrian infrastructure. Authorities are expected to enforce existing and new regulatory measures (e.g. speed limits, and parking and urban vehicle restrictions) more strongly as 2050 approaches.

Land-use planning, and transit-oriented design, begin to be introduced gradually in some regions with population density increasing. In some emerging economies, however, where urban populations are expected to grow rapidly, the absence of these measures would result in lower population densities in the 2030s and 2040s. Some increase in teleworking is expected to continue after the trend shifts observed during the Covid-19 pandemic. This is especially visible in high-income countries with industries that lend themselves to remote working.

Authorities also introduce improvements to transport infrastructure gradually under this scenario. Investments in public transit systems also increase, but at a more modest scale. Some expansion of express bus lanes occurs and integrated ticketing in some regions contributes to reduced fares for public transport use.

Public transport operators, authorities and regulators make moderate improvements to public transport coverage, routing and frequency to match demand to service levels. However, in some regions, a lack of policies to improve public transport actually sees service levels decline over the coming decades. While shared vehicles become more common, carpooling leads to only slightly higher occupancy rates.

Non-urban passenger demand and mode choice under the Current Ambition scenario

The Current Ambition policy scenario for non-urban passenger demand (see Table 2.3) assumes that governments and other actors will go some way towards decarbonising this hard-to-abate activity. The policy scenario focuses on investments in rail infrastructure, carbon pricing for non-urban travel modes, air travel ticket pricing and the eventual implementation of short-haul flight bans.

Under the Current Ambition scenario, investment in non-urban rail networks begins in the 2030s, with some high-income countries investing in important service improvements where the business case exists and in electrification of their rail services. By the 2040s, some middle-income countries have followed suit. While plans for better rail in high-income countries progress, there is no equivalent push to incentivise shared and collective non-urban passenger modes.

Governments in all regions implement carbon-pricing policies in the 2020s, with the introduction of carbon taxes within the range of USD 15-35 per tonne of carbon dioxide (CO2). The price of carbon then rises to a maximum of USD 100 per tonne of CO2 in the 2030s, and up to USD 200 per tonne of CO2 in the 2040s. Over the same timeframe, ticket taxes begin to apply to air travel, starting at 2.5% of the value of a ticket in the 2020s, and reaching up to 15% by the 2040s.

Freight demand and mode choice under the Current Ambition scenario

The Current Ambition policy scenario for freight demand (see Table 2.5) assumes that governments implement a variety of sustainable urban logistic measures for urban freight deliveries. Measures aimed at decarbonising urban freight are already in place, with more pick-up and drop-off locations for parcels, the emergence of restricted access zones and an explosion in the use of electric cargo bikes for last-mile distribution. By the 2040s, these new modes and measures have become embedded in the urban logistics space.

For non-urban freight, measures to improve efficiency and reduce the carbon intensity of freight activity, along with transport network improvement plans, are rolled out gradually over the next three decades.

Distance-based pricing of road transport, another measure that can be used to encourage greater efficiency in freight transport, is already the subject of policy discussions in the 2020s but is not introduced until the 2030s. Carbon pricing is not introduced in the freight sector until the 2030s, and even then with prices set at varying levels in different regions. By the 2040s, carbon pricing continues to vary by region, and between sea-based transport modes and other modes. The price of carbon in 2050 is projected to range between USD 150-250 per tonne of CO2.

Slow steaming and smart steaming are two examples of measures that reduce emissions in the shipping sector. In the 2020s, under the Current Ambition scenario, governments begin to provide incentives for operators to switch to these lower-emitting practices. By the 2030s, overall reductions in the speed of vessels produce a 5% improvement in efficiency. By the 2040s, this efficiency improvement has risen to 10%, compared to the baseline of 2019.

In the 2020s, digital solutions emerge for the management of journeys that use more than one mode. This leads to a reduction in transfer times between modes, particularly for rail and waterways. While intermodal solutions become more viable, improvements under this scenario in the 2030s and 2040s are not sufficient. Concurrently, transport network improvement plans for rail, waterways and port infrastructure begin to be phased in and funded.

Beyond transport policy, the Current Ambition scenario also assumes a decrease in the 2020s in the trade in (and consumption of) oil- and coal-based commodities. This reduction is projected to have a direct impact on the demand for fossil fuels in freight transport and on trade-associated freight activity. Over the 2030s and 2040s, however, the trade in oil and coal grows, albeit to a lesser extent than the trade in other commodities.

The transition to cleaner vehicle fleets under the Current Ambition scenario

The Current Ambition policy scenario for the transition to cleaner vehicle fleets (see Table 2.7) assumes governments enact a series of measures to encourage the switch to zero-emission vehicles (ZEVs). The rate of change reflects historical trends in the turnover of vehicle fleets and existing progress and policies in innovations in alternative fuel sources, including biofuels and sustainable aviation fuels (SAFs).

Vehicle fleets in the 2020s continue to turn over in line with past trends, meaning that ZEVs will make up a growing proportion of the world’s vehicle fleets. By the 2030s, countries have begun to meet their own aspirational ZEV targets, with some even reaching 100% ZEV sales. This trend continues into the 2040s.

In contrast, when it comes to medium- and heavy-duty vehicles (i.e. freight fleets), progress is slower. It is not until the 2030s that signatories to a global memorandum of understanding designed to encourage the shift to ZEVs in this sector begin to meet their targets. Even then, only 30% of vehicles in this sector are ZEVs by the end of the decade, while the 100% sales target is expected to be met some time in the 2040s.

Meanwhile, in the 2020s a number of countries set targets to encourage the uptake of road fuels containing biofuel, which produce fewer emissions and are becoming increasingly economically viable. For aviation, in the 2020s, the EU and the United States enact mandates for the use of sustainable aviation fuel (SAF), which become more successful over time. By 2050, SAFs make up 85% of aviation fuels in Europe and 100% of aviation fuels in the United States.

The High Ambition scenario: The necessary pathway to decarbonisation

The High Ambition scenario takes the Current Ambition policies and imagines a policy pathway with accelerated implementation timelines, or increased scales. It factors in the impacts of bolder policies aimed at encouraging more sustainable developments and travel behaviour. It also takes into account the scale of ambition set by the goals of the 2030 Breakthroughs for the global transport sector (UNFCCC, 2021[6]).

The 2030 Breakthroughs include ambitious targets for ending new sales of ICE vehicles for both passenger and freight road fleets, the rollout of sustainable aviation fuels and the uptake of zero-emission fuels for maritime shipping. The following subsections and the accompanying tables outline the projected impact of the policy pathway assumed under the High Ambition scenario over the next three decades.

Urban passenger demand and mode choice under the High Ambition scenario

The High Ambition policy scenario for urban passenger demand (see Table 2.2) assumes that comprehensive urban mobility strategies are put in place to ensure that the most sustainable mode, and cleanest vehicles, are used. Of all the policy measures considered in this edition of the Outlook, urban passenger travel has the greatest number of measures aimed at achieving mode shift and demand management, in addition to those for encouraging the uptake of ZEVs.

This scenario assumes that authorities gradually introduce economic instruments, transport infrastructure enhancements, transport service improvements, and regulatory and other measures to decarbonise the transport sector. In contrast to the Current Ambition scenario, however, these actions and measures accelerate as the 2030s and 2040s progress.

Under the High Ambition scenario, urban authorities are assumed to introduce congestion charging and parking pricing. Carbon pricing is also introduced to encourage the use of cleaner vehicles. Restrictions on access for private motorised vehicles are introduced, along with a reduction in parking capacity within the urban area. These measures are aimed at reducing the dominance of cars in urban settings and addressing some of the external costs of car use. The pricing measures could also represent an important source of revenue to fund improvements to public transport and active mobility infrastructure. Authorities ramp up regulatory measures aimed at increasing urban safety and liveability under this scenario and by the 2040s, speed limits have been reduced by one-third.

At the same time, the alternatives to private motorised vehicles are improved to make them more appealing. Public transport networks and services are enhanced, including increased frequency, the introduction of express lanes for buses, integrated ticketing and the expansion of infrastructure for active modes, bus rapid transit (BRT) and rail-based modes. The High Ambition scenario sees a much higher level of investment in bicycle and pedestrian infrastructure compared to the Current Ambition and a significantly higher spend on public transport systems.

Importantly, the High Ambition scenario assumes long-term systemic changes to urban planning. This sees integrated land-use and transport planning introduced, to ensure a greater availability of social and employment opportunities, as well as public transport stops and stations, available in greater proximity for urban dwellers. These measures see an increase in urban population density and changes to the land-use mix. In regions where the prevailing industries support it, teleworking also increases.

Non-urban passenger demand and mode choice under the High Ambition scenario

The High Ambition policy scenario for non-urban passenger demand (see Table 2.4) assumes that governments and other actors make greater efforts to decarbonise this type of travel. There is a greater focus on investments in rail infrastructure shared and collective modes (including coaches), carbon pricing, air-travel ticket taxes and the implementation of short-haul flight bans.

In high-income countries, rail investment is accelerated compared to the Current Ambition scenario, with these countries taking action in the 2020s to invest in the improvement and electrification of networks. This leads to improvements in the frequency and speed of non-urban rail services, and lower CO2 emissions from rail travel. Over the 2030s and 2040s, rail investment grows worldwide, with planning for high-speed rail taking shape in some countries.

In tandem with these accelerated rail investments, short-haul flight bans are brought in a decade earlier than in the Current Ambition scenario for direct air links shorter than 500 kilometres where there is an adequate rail alternative. As in the Current Ambition scenario, governments also begin to apply ticket taxes to air travel in the 2020s. However, under the High Ambition scenario the tax rate increases more dramatically, starting at 5% of the value of a ticket in some regions in the 2020s, and reaching up to between 5% and 30% of the value of a ticket bought by a single passenger by the 2040s.

The net for alternatives to private motorised vehicles is also cast more widely under the High Ambition scenario. Incentives are introduced to encourage the use of other collective modes (e.g. coaches and ridesharing) for regional and intercity travel. Additionally, widespread implementation of carbon-pricing schemes occurs in the 2030s, with higher initial prices than under the Current Ambition scenario but an equivalent price ceiling of up to USD 200 per tonne of CO2 in the 2040s.

Freight demand and mode choice under the High Ambition scenario

The High Ambition policy scenario for freight demand (see Table 2.6) assumes that governments implement the measures outlined in the Current Ambition scenario for this sector according to a more accelerated timeframe, with correspondingly faster results. Furthermore, the High Ambition scenario assumes the trade in and use of fossil-fuel commodities will decrease more rapidly, and the price on carbon, while not uniform across regions, will be higher than under the Current Ambition scenario.

Under the High Ambition scenario, measures designed to decarbonise urban freight are introduced faster and at a greater scale. This leads to cargo bikes and asset sharing doubling the growth seen in the Current Ambition scenario, and a corresponding 60% higher use of pick-up and drop-off locations for parcels. By the 2040s, electric vehicles are three times as likely to be used to transport goods in cities.

Non-urban freight includes several hard-to-abate sectors: road freight, aviation and shipping. With mode choice being heavily reliant on cost and commodity type. The trip lengths involved limit the number of viable mode shift options. Demand management measures could also be sensitive as freight activity is closely linked with economic growth. The High Ambition scenario aims to decrease the carbon intensity of freight activity through improved efficiencies and ensuring the most sustainable mode is always chosen.

To support and encourage this, the High Ambition scenario assumes that high-capacity vehicles are introduced, along with improved intelligent transport systems that support asset sharing. Distance-based pricing is encouraged from the 2020s and expands in the 2030s, with rates increasing in the 2040s. As with the Current Ambition scenario, carbon pricing is introduced in the 2030s, with prices varying by region. Under the High Ambition scenario, the maximum price of carbon in the 2040s rises to up to USD 500 per tonne of CO2 –that is, double the maximum price assumed under the Current Ambition scenario.

Incentives designed to encourage slow steaming and smart steaming in the maritime shipping sector come on track under both scenarios in the 2020s, but achieve greater efficiencies under the High Ambition scenario. Improved digital systems, with better data, support improved efficiencies too, making the interface between modes smoother and reducing dwell times. In the 2030s, intermodal solutions become increasingly attractive. By 2050, truck-to-port, truck-to-rail and rail-to-port dwell times each decrease by 45%, and inland waterways dwell times decrease by 25%.

In terms of exogenous factors, the High Ambition scenario assumes that a low-carbon policy position is also adopted for energy supplies, reducing the trade in and consumption of petroleum- and coal-based commodities. Both scenarios assume this trade will decrease in the 2020s but the High Ambition scenario then assumes an annual decrease in demand for oil- and coal-based products from the 2030s onwards. This decrease amounts to 50% yearly in the 2040s.

The transition to cleaner vehicle fleets under the High Ambition scenario

The High Ambition policy scenario for the transition to cleaner vehicle fleets (see Table 2.8) assumes governments enact far more ambitious measures to encourage the switch to ZEVs. Innovations in biofuels and SAFs are also introduced far more rapidly, achieving a more significant market share by 2050 than under the Current Ambition. All new trains in leading markets are zero emission by 2050.

Passenger vehicle fleets in the 2020s continue to turn over in line with past trends. Unlike the Current Ambition scenario, the High Ambition scenario assumes that by 2050 almost all new passenger cars, buses and heavy-duty vehicles in the world are ZEVs. This achievement is not evenly distributed, however, with emerging regions meeting 100% ZEV sales targets 10-15 years later than high-income regions. This is an acceleration of policies that are already making a difference, even under the Current Ambition scenario.

The High Ambition scenario also assumes that ambitious policies are also extended to medium- and heavy-duty vehicles (i.e. freight fleets) and progress is somewhat faster than under the Current Ambition scenario. Under both scenarios, signatories to a global memorandum of understanding designed to encourage the shift to ZEVs in this sector achieve sales targets of 30% in the 2030s and 100% by 2040. But under the High Ambition scenario, even non-signatories have also reached the 100% sales target by 2050.

Finally, while SAFs begin to emerge in Europe and the United States in the 2020s under both scenarios, the High Ambition scenario assumes that this roll-out spreads to all other world regions in the 2030s and that alternative fuels begin to come down in price. Electric aircraft also begin to replace conventionally powered aircraft on short routes. By the 2050s, SAFs make up 85% of aviation fuels worldwide. Similarly, by 2050, 100% of shipping fuels are zero-emission.

While the advances in cleaning the road fleet represent an acceleration of existing policy pathways, the rate of acceleration for shipping and aviation fuels development and uptake in the High Ambition scenario should be considered even more ambitious relative to existing policy dialogues.

Table 2.1. The Current Ambition policy scenario specification for urban passenger demand and mode choice

|

2020s |

2030s |

2040s |

|---|---|---|

|

Economic instruments including carbon pricing, road pricing and parking pricing are gradually set up or enhanced worldwide. |

Carbon pricing is implemented, and the carbon price reaches USD 35-100 per tonne of carbon dioxide (CO2). When implemented, road pricing can increase non-energy-related car-use costs by up to 2.5%. Parking prices are expected to increase by up to 20%. |

Carbon pricing is implemented, and the carbon price reaches USD 65-200 per tonne of CO2. When implemented, road pricing can increase non-energy-related car-use costs by up to 5%. Meanwhile, parking prices are expected to increase further, by up to 40%. |

|

Transport infrastructure enhancements, including the expansion of bicycle and pedestrian networks, the development and expansion of public transport systems, and express lanes for buses, are set up or enhanced worldwide. |

Bicycle and pedestrian infrastructure networks increase by 6-100%, while public transport systems expand by up to 34%. Meanwhile, express or priority lanes comprise up to 14% of bus networks and public transport fares decrease by 0.5‑2.5%, thanks to integrated ticketing. |

Bicycle and pedestrian infrastructure networks increase by 13‑200%, while public transport systems expand by up to 67%. Meanwhile, express or priority lanes comprise up to 27% of bus networks and public transport fares decrease by 1‑5%, thanks to integrated ticketing. |

|

Transport service improvements, including public transport service optimisation, shared mobility incentives, carpooling policies and support for Mobility as a Service (MaaS) systems, are set up or enhanced worldwide. |

Public transport service levels change by between -4% and 10%. The number of shared vehicles per capita is boosted by 0‑67%. The average private vehicle occupancy rate grows by 1.1‑2.8%. Meanwhile, MaaS systems decrease fares for public transport and shared mobility by 0.3‑3.4%. |

Public transport service levels change by between -7% and 20%. The number of shared vehicles per capita is boosted by 0‑134%. The average private vehicle occupancy rate grows by 2.3‑5.6%. Meanwhile, MaaS systems decrease fares for public transport and shared mobility by 0.6‑6.7%. |

|

An extensive set of regulatory measures, including speed limitations, parking restrictions, and urban vehicle-restriction schemes, are gradually enforced more strongly. |

Speed limits decrease by 0.6‑10%. Between 1.6 and 17% of urban surface areas are subject to parking constraints. Car ownership decreases by 5.9%. |

Speed limits decrease by 1.3‑20%. Between 3.3 and 34% of urban surface areas are subject to parking constraints. Car ownership decreases by 11.7%. |

|

Additional measures, including land-use policies and transit-oriented development, are gradually improved. Exogenous changes such as teleworking are maintained after the pandemic. |

The average population density ranges between -3.4% and 6.7%. There is a 1.7% increase in the land-use mix. Exogenous changes such as teleworking are maintained after the pandemic. Between 0.8% and 6.7% of the active population teleworks regularly. |

The average population density ranges between -6.7% and 13.4%. There is a 3.3% increase in the land-use mix. Exogenous changes such as teleworking are maintained after the pandemic. Between 1.6% and 13.4% of the active population teleworks regularly. |

Table 2.2. The High Ambition policy scenario specification for urban passenger demand and mode choice

|

2020s |

2030s |

2040s |

|---|---|---|

|

Economic instruments including carbon pricing, road pricing and parking pricing are gradually set up or enhanced worldwide. |

Carbon pricing is implemented and the carbon price reaches USD 65-150 per tonne of carbon dioxide (CO2). Road pricing increases non-energy-related car-use costs by 0.8‑9%, while parking prices increase by 6‑50%. |

Carbon pricing is implemented and the carbon price reaches USD 130‑200 per tonne of CO2. Road pricing increases non-energy-related car-use costs by 1.8‑18%, while parking prices increase by 13‑100%. |

|

Transport infrastructure enhancements, including the expansion of bicycle and pedestrian networks, the development and expansion of public transport systems, and express lanes, are set up or enhanced worldwide. |

Bike and pedestrian infrastructure networks increase by 13‑167%, while public transport systems expand by up to 67%. Meanwhile, between 3% and 20% of bus networks are prioritised and public transport fares decrease by 0.5‑4.2%, thanks to integrated ticketing. |

Bike and pedestrian infrastructure networks increase by 26‑334%, while public transport systems expand by up to 134%. Meanwhile, 6‑40% of the bus networks are prioritised and public transport fares decrease by 1‑8.4%, thanks to integrated ticketing. |

|

Transport service improvements, including public transport service optimisation, shared mobility incentives, carpooling policies and support for Mobility as a Service (MaaS) systems are set up or enhanced worldwide. |

Public transport service levels increase by between 3% and 17%. The number of shared vehicles per capita is boosted by 1‑100%. The average private vehicle occupancy rate grows by 2.5‑5.6%. Meanwhile, MaaS systems decrease fares for public transport and shared mobility by 0.6‑6.7%. |

Public transport service levels increase by between 6% and 34%. The number of shared vehicles per capita is boosted by 3‑200%. The average private vehicle occupancy rate grows by 5.1‑11.2%. Meanwhile, MaaS systems decrease fares for public transport and shared mobility by 1.3‑13.4%. |

|

An extensive set of regulatory measures, including speed limitations, parking restrictions, and urban vehicle-restriction schemes, are gradually enforced more strongly. |

Speed limits decrease by 1.6‑16.7%. Between 2.3% and 25% of urban surface areas are subject to parking constraints. Car ownership decreases by between 1.1% and 8.4%. |

Speed limits decrease by 3.3‑33.4%. Between 4.6% and 50% of urban surface areas are subject to parking constraints. Car ownership decreases by between 2.3% and 16.7%. |

|

Additional measures, including land-use policies, transit-oriented development and teleworking-promotion policies, are gradually improved. |

The average population density increases by up to 13.4%. There is a 2.5% increase in the land-use mix. Between 1.1% and 10% of the active population teleworks regularly. |

The average population density increases by up to 26.7%. There is a 5% increase in the land-use mix. Between 2.3% and 20% of the active population teleworks regularly. |

Table 2.3. The Current Ambition policy scenario specification for non-urban passenger demand and mode choice

|

2020s |

2030s |

2040s |

|---|---|---|

|

Outside of urban areas in most high-income countries, there is investment in rail and electrification of rail networks, leading to frequency and speed improvements. Some high-income countries make plans to develop high-speed rail connections. |

Outside of urban areas in most high-income countries and some middle-income countries, there is investment in rail and electrification of rail networks, leading to frequency and speed improvements. Some high-income countries make plans to develop high-speed rail connections. |

|

|

No targeted action to encourage coaches or shared modes outside of urban areas. |

No targeted action to encourage coaches or shared modes outside of urban areas. |

No targeted action to encourage coaches or shared modes outside of urban areas. |

|

Carbon-pricing policies are implemented via a carbon tax of USD 15‑35 per tonne of carbon dioxide (CO2) across all regions. |

Carbon pricing policies are implemented via a carbon tax of USD 35‑100 per tonne of CO2 across all regions. |

Carbon pricing policies are implemented via a carbon tax of USD 65‑200 per tonne of CO2 across all regions. |

|

Air travel ticket taxes, applied as a percentage of the airfare, ranges from 0% to 2.5% across all regions. |

Air travel ticket taxes, applied as a percentage of the airfare, ranges from 1% to 7.5% across all regions. |

Air travel ticket taxes, applied as a percentage of the airfare, ranges from 2% to 15% across all regions. |

|

In high-income regions, a ban on short-haul flights (i.e. for distances less than 500 kilometres) is introduced to encourage the uptake of rail where good-quality connections exist. |

Table 2.4. The High Ambition policy scenario specification for non-urban passenger demand and mode choice

|

2020s |

2030s |

2040s |

|---|---|---|

|

Outside of urban areas in most high-income countries, there is greater investment in rail and electrification of rail networks, leading to frequency and speed improvements. |

Greater investment in rail and electrification of rail networks becomes a priority in all world regions. Rail transport becomes a more competitive alternative, with increased frequency and speed. Ambitious plans to develop high-speed rail connections in some countries. |

Outside of urban areas, continued investment in rail sees a growth in viable transport links that qualify for the short-haul flight ban. Rail electrification and improvements in frequency and speed persist, and new high-speed rail connections continue to be deployed. |

|

Incentives are introduced to encourage the use of collective modes such as coaches and ridesharing for regional and intercity travel. |

Incentives to encourage the use of collective modes such as coaches and ridesharing remain in place for regional and intercity travel. |

Incentives to encourage the use of collective modes such as coaches and ridesharing remain in place for regional and intercity travel. |

|

Carbon-pricing policies are implemented via a carbon tax of USD 35‑50 per tonne of carbon dioxide (CO2) across all regions. |

Carbon-pricing policies are implemented via a carbon tax of USD 65‑150 per tonne of CO2 across all regions. |

Carbon-pricing policies are implemented via a carbon tax of USD 130‑200 per tonne of CO2 across all regions. |

|

Air travel ticket taxes, applied as a percentage of the airfare, ranges from 0% to 5% across all regions. |

Air travel ticket taxes, applied as a percentage of the airfare, ranges from 3% to 15% across all regions. |

Air travel ticket taxes, applied as a percentage of the airfare, ranges from 5% to 30% across all regions. |

|

In high-income regions, a ban on short-haul flights (i.e. for distances less than 500 kilometres) is introduced to encourage the uptake of rail where good-quality connections exist. |

A ban on short-haul flights is introduced for journeys shorter than 500km where an alternative rail connection of adequate quality is available. This is to encourage the uptake of rail where good-quality connections exist. |

Table 2.5. The Current Ambition policy scenario specification for freight demand and mode choice

|

2020s |

2030s |

2040s |

|---|---|---|

|

Decarbonisation measures for urban freight are slowly introduced. The uptake of pick-up and drop-off locations for parcels, and asset sharing, increase linearly. Restricted access zones also start to become more widely implemented. Meanwhile, the use of electric cargo bikes for last-mile distribution of various commodities grows exponentially. |

The uptake of cargo bikes keeps growing exponentially until 2035, when this growth slows but continues to progress linearly. Restricted access zones expand at a linear rate half of what was observed in the 2020s. The use of pick-up and drop-off locations for parcels, and asset sharing, continue to increase at the same rate. |

All of the developments from the 2020s and 2030s have cemented their place in the urban logistics system. All measures continue to expand their share at the same rate. |

|

Incentives for high-capacity vehicles (road tractors) encourage a transition in interurban freight. By 2025, there is a 10% increase in the average load utilisation (load factor) of road freight. |

Road tractors begin to have a larger impact, increasing the truck loads and decreasing the cost per tonne-kilometre. |

Load factors continue to increase, ending up 25% higher in 2050, compared to 2019. |

|

Distance-based charges are encouraged for road transport and introduced in policy discussions. |

Distance-based charges are introduced in 2030 and begin to grow continuously. |

Distance-based charges rise further in the 2040s. |

|

Slow and smart steaming are incentivised in the shipping sector to reduce emissions. |

Vessel speed reductions lead to a 5% improvement in efficiency. |

Vessel speed reductions lead to a 10% improvement in efficiency compared to the baseline (2019). |

|

Digital transformation strategies leveraging near-real-time data are used to reduce intermodal dwell times in journeys with sections undertaken by rail or on waterways. |

Improvements in travel times make intermodal solutions more attractive but do not improve to the same extent as under the High Ambition scenario. |

Travel times for intermodal solutions continue to reduce at a slower rate than under the High Ambition scenario. |

|

Transport network improvement plans for rail, waterways and port infrastructure begin to be phased in and funded. |

||

|

Carbon pricing is introduced but with prices set at varying levels in different regions. |

Carbon pricing continues to vary by region, and between sea-based transport modes and other modes. The price of carbon ranges between USD 150‑250 per tonne of carbon dioxide (CO2). |

|

|

The trade in and consumption of petroleum- and coal-based commodities begins to decrease, directly impacting freight transport demand for fossil fuels and the freight activity associated with the trade of these commodities. |

While the trade in other commodities continues to increase, the trade in oil and coal grows to a lesser extent. |

While the trade in other commodities continues to increase, the trade in oil and coal grows to a lesser extent. |

Table 2.6. The High Ambition policy scenario specification for freight demand and mode choice

|

2020s |

2030s |

2040s |

|---|---|---|

|

Sustainable urban logistics measures are implemented more widely than under the Current Ambition scenario. Cargo bikes and asset-sharing double the growth observed in the Current Ambition scenario. The use of pick-up and drop-off locations for parcels is 60% higher than in the Current Ambition scenario. Restricted access zones are stricter, increasing by a factor of three the likelihood that electric vehicles are used to transport goods in cities. |

||

|

Incentives for high-capacity vehicles (road tractors) encourage a transition in interurban freight. By 2025, there is a 10% increase in the average load utilisation (load factor) of road freight. |

Road tractors begin to have a larger impact, increasing the truck loads and decreasing the cost per tonne-kilometre. |

Load factors continue to increase, ending up 25% higher in 2050, compared to 2019. |

|

Distance-based charges are encouraged for road transport and introduced in policy discussions. |

Distance-based charges are introduced in 2030 and begin to grow continuously. |

Distance-based charges rise further in the 2040s. |

|

Slow and smart steaming are incentivised in the shipping sector to reduce emissions. |

Vessel speed reductions lead to an average 10% improvement in efficiency which reduces dwell times and environmental impacts. |

Vessel speed reductions lead to a 25% improvement in efficiency compared to the baseline (2019). |

|

By 2025, digital transformation strategies leveraging near-real time data cause truck-to-port and truck-to-rail dwell times to decrease by 20%. Meanwhile, rail-to-port dwell times decrease by 15% by 2025. Inland waterways dwell times decrease by 5%. |

Reductions in dwell times across road, rail and inland waterways result in a reduction in travel times associated with intermodal trips, making intermodal solutions more attractive. The improvements continue to increase. |

Travel times for intermodal solutions continue to reduce. Truck-to-port and truck-to-rail dwell times decrease by 45% by 2050. Rail-to-port dwell times decrease by 45% by 2050. Inland waterways dwell times decrease by 25%. |

|

The acceleration and expansion of investments in transport network improvement plans is greater than under the Current Ambition scenario. |

||

|

Carbon pricing is introduced but with prices set at varying levels in different regions. |

Carbon pricing continues to vary by region but at higher values than under the Current Ambition scenario. The price of carbon ranges between USD 300‑500 per tonne of carbon dioxide (CO2). |

|

|

The trade in and consumption of petroleum- and coal-based commodities begins to decrease, directly impacting freight transport demand for fossil fuels and the freight activity associated with the trade of these commodities. |

While the trade in other commodities continues to increase, there is a yearly decrease in demand for coal and petroleum. |

There is a 50% yearly decrease in demand for coal and petroleum. |

Table 2.7. The Current Ambition policy scenario specification for the transition to cleaner vehicle fleets

|

2020s |

2030s |

2040s |

|---|---|---|

|

The turnover of vehicle fleets continues in line with historical trends. New vehicle efficiency improvements continue, driven by existing fuel economy standards and in line with historical trends. |

Mandatory and aspirational zero-emission vehicle (ZEV) sales targets are met. European Union member states and signatories to the COP26 Accelerating to Zero Coalition declaration reach 100% ZEV sales by 2035. |

Mandatory and aspirational ZEV sales targets are met in countries and regions with stated targets. |

|

Signatories to the Global Memorandum of Understanding (MOU) on Zero-Emission Medium- and Heavy-Duty Vehicles reach the target of 30% ZEV sales for heavy-goods vehicles (HGVs) in 2030. |

Signatories to the Global MOU on Zero-Emission Medium- and Heavy-Duty Vehicles reach the target of 100% ZEV sales for HGVs in 2040. |

|

|

Biofuel blending targets for road fuels are met in countries with defined targets, including Finland, India, Indonesia and the United Kingdom. |

Biofuel blending targets for road fuels are met in countries with defined targets, including Argentina, Finland, India, Indonesia and the United Kingdom. |

|

|

Sustainable aviation fuel (SAF) mandates are introduced in the EU and the United States according to the ambitions set out in the ReFuel EU and SAF Grand Challenge initiatives, respectively (see note). |

Mandates for SAFs increase in Europe and the United States. |

By 2050, SAFs make up 85% of aviation fuels in Europe and 100% in the United States. |

Table 2.8. The High Ambition policy scenario specification for the transition to cleaner vehicle fleets

|

2020s |

2030s |

2040s |

|---|---|---|

|

The turnover of vehicle fleets continues in line with historical trends and to meet travel demand. New vehicle efficiency improvements for road vehicles double from historical trends, driven by more stringent fuel economy standards. Meanwhile, aviation efficiency improvements increase to 3% per year. |

By 2035, 100% of sales of new passenger vehicles and vans in East and Northeast Asia (ENEA), Europe, and in the United States, Canada, Australia and New Zealand (UCAN) are zero-emission vehicles (ZEVs). This is in line with the Global Fuel Economy Initiative (GFEI) ZERO Pathway. By 2030, 100% of new bus sales in high-income regions (ENEA, Europe and UCAN) are ZEVs. Meanwhile, by 2035, 100% of new two- and three-wheelers in all regions are ZEVs. |

By mid-decade, 100% of sales of new passenger vehicles and vans in emerging markets are ZEVs, in line with the GFEI’s ZERO Pathway. By 2040, 100% of new bus sales in the remaining markets are ZEVs. Also by 2040, 100% of sales of new heavy-duty vehicles in high-income regions are ZEVs. Meanwhile, emerging markets will reach this 100% target by the end of the decade. |

|

Signatories to the Global Memorandum of Understanding (MOU) on Zero-Emission Medium- and Heavy-Duty Vehicles reach the target of 30% ZEV sales for heavy-goods vehicles (HGVs) in 2030. |

Signatories to the Global MOU on Zero-Emission Medium- and Heavy-Duty Vehicles reach the target of 100% ZEV sales for HGVs in 2040. Non-signatories reach the target of 30% of ZEV sales for HGVs in 2040 and 100% in 2050. |

|

|

By 2040, all new trains in high-income regions (UCAN, ENEA, and Europe) are zero-emission. The remaining markets reach this target by 2050. |

||

|

Sustainable aviation fuel (SAF) mandates are introduced in the EU and the United States according to the ambitions set out in the ReFuel EU and SAF Grand Challenge initiatives, respectively (see note). |

The roll-out of SAF mandates continues and alternatives to conventional fuels begin to come down in price. SAF mandates also expand to other regions. Aircraft with electric powertrains become available and begin to take share for short-haul flights with low passenger capacities. |

Commercial applications of electric aircraft emerge in niche sectors. SAFs make up 85% of aviation fuels globally by 2050 (see note). |

|

Initial deployment of zero-emission shipping fuels occurs in green corridors. |

By 2050, zero-emission fuels make up 100% of shipping fuels. Also by 2050, the electrification of short sea shipping routes occurs (see note). |

Breaking the link: Increased activity with fewer emissions?

The transport sector will continue to contribute significantly to the world’s CO2 emissions without decisive action to decarbonise. Achieving decarbonisation in the sector will require international co-operation and increased ambition on the part of policy makers. It will also require cross-sector collaboration to shift away from its dependence on fossil fuels. Chapters 3-6 of this edition of the ITF Transport Outlook present the policy pathways that will be needed to transition to greener, cleaner and more resilient transport systems.

This section presents the projected passenger and freight emissions for both the Current and High Ambition scenarios. It outlines the main trends in demand and emissions from both the passenger and freight sectors. It also examines regional trends, as well as differences in demand and emissions in different settings, or activity types. These are defined based on their potential applicability for different policy measures.

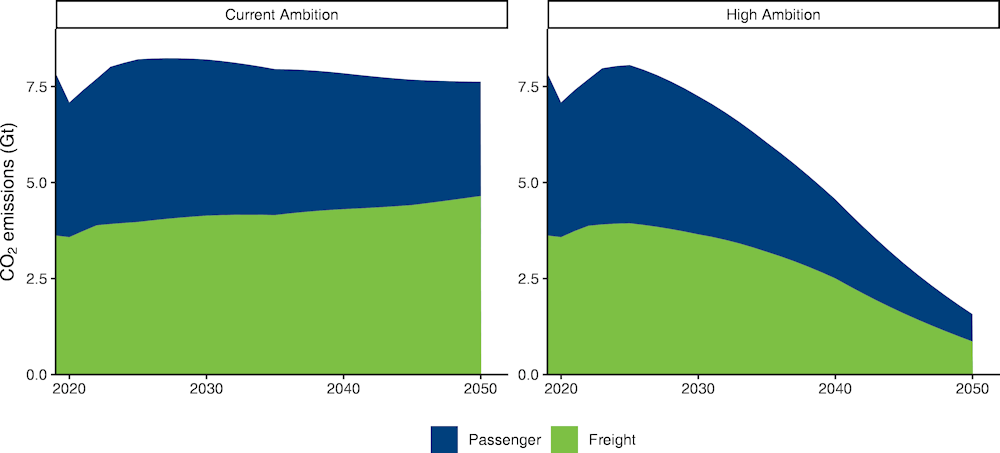

Emissions are nearly evenly split between passenger (54%) and freight (46%) in 2019, although the two sectors decarbonise at different rates over time (see Figure 2.1), with passenger activity already decarbonising under the Current Ambition scenario. By 2030, the two sectors contribute equally to transport’s CO2 emissions. By 2050, under the Current Ambition scenario, freight emissions are higher than they were in 2019, reaching a 61% share, while passenger have achieved some decarbonisation. Under the High Ambition scenario, by 2050 total emissions are only 20% of what they were in 2019, although freight emissions still account for a larger share than passenger emissions.

Figure 2.1. Passenger and freight emissions under the Current and High Ambition scenarios, 2019-50

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport.

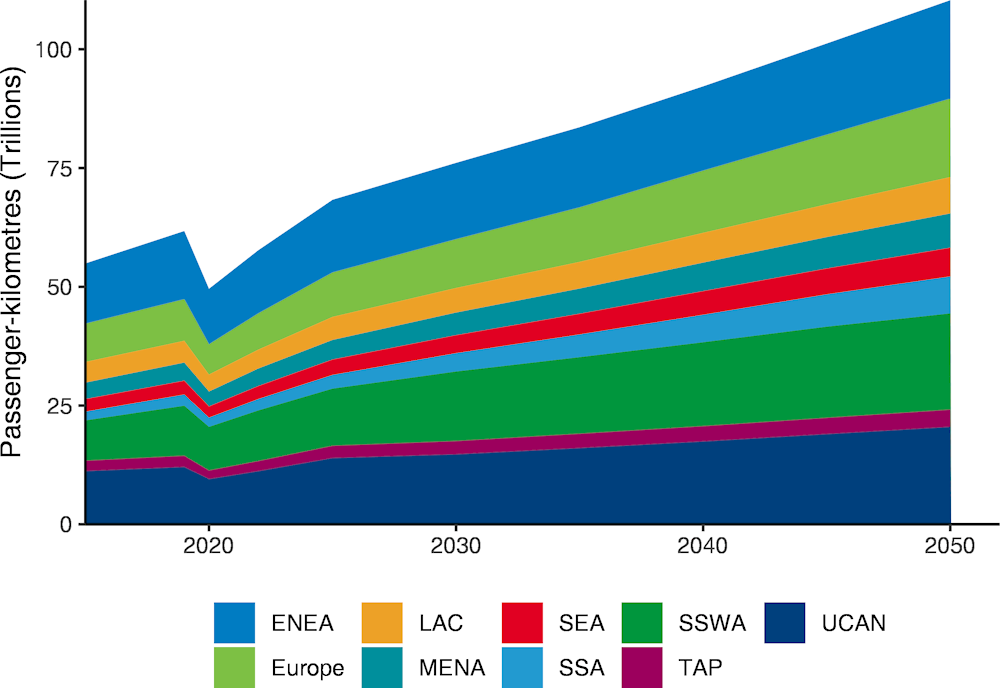

Passenger demand will continue to grow

Demand is set to keep growing, for both passenger and freight transport, increasing the challenge for strategies aimed at CO2 mitigation. Passenger transport demand will increase by 79% by 2050 compared to 2019, under the Current Ambition scenario (see Figure 2.2) and by 65% under the High Ambition scenarios. Global passenger-kilometres will increase under the Current Ambition scenario from around 61 trillion in 2019 to about 110 trillion in 2050. Under the High Ambition scenario, global passenger-kilometres in 2050 will be lower than under the Current Ambition scenario, at approximately 102 trillion.

Emerging economies will see the greatest growth in passenger demand over the coming three decades. By 2050, passenger transport demand in Sub-Saharan Africa (SSA) will more than triple compared to 2019. Demand will also more than double in Southeast Asia (SEA). Meanwhile, passenger demand will grow by 89% in the Middle East and Northern Africa (MENA), 92% in South and Southwest Asia (SSWA), 67% in Latin America and the Caribbean (LAC) and 54% in Transition economies and other Asia-Pacific (TAP) countries.

Among high-income economies, Europe has the highest growth (89%), followed by the United States, Canada, Australia and New Zealand (grouped in this report as the UCAN countries) with 70%. East and Northeast Asia (ENEA) and Europe will have the lowest growth of all regions, increasing by 44% under the Current Ambition scenario.

Figure 2.2. Passenger transport demand by region under the Current Ambition scenario, 2019-50

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. ENEA: East and Northeast Asia. LAC: Latin America and the Caribbean. MENA: Middle East and North Africa. SEA: Southeast Asia. SSA: Sub-Saharan Africa. SSWA: South and Southwest Asia. TAP: Transition economies and other Asia-Pacific countries. UCAN: United States, Canada, Australia and New Zealand.

Table 2.9 Share of passenger transport demand by activity type, 2050, Current Ambition and High Ambition scenarios

|

2019 |

2050 |

||

|---|---|---|---|

|

Activity type |

Baseline |

Current Ambition scenario |

High Ambition scenario |

|

International and Intercity |

29% |

44% |

44% |

|

Regional |

35% |

21% |

22% |

|

Urban |

36% |

35% |

34% |

Note: Table depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport.

Between 2019 and 2020, global passenger-kilometres decreased by 20% due to the Covid-19 pandemic. The pandemic hit non-urban travel especially hard, with demand decreasing by 24% between 2019 and 2020, compared to a decrease of about 13% in urban settings.

However, the post-pandemic recovery period has seen passenger-kilometres increase by around 8% year-on-year in 2021 and 2022. In 2019, the largest segment of passenger activity was urban travel (36%) very closely followed by regional travel (35%). However, over time, international and intercity travel grows rapidly to reach 44% of passenger activity by 2050 under both policy scenarios (see Table 2.9).

Passenger emissions will not grow at the same pace as demand

Passenger transport carbon intensity will decrease over the coming years, even if transport policy stays on its current path, but this is not enough. While increased recognition of decarbonising transport in national and regional policies have some effect under the Current Ambition scenario, emissions due to passenger activity will fall by 30%.

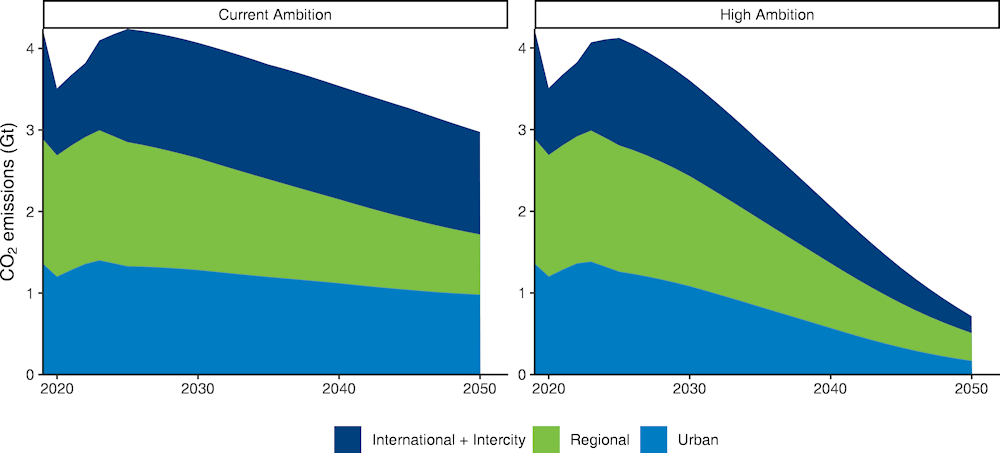

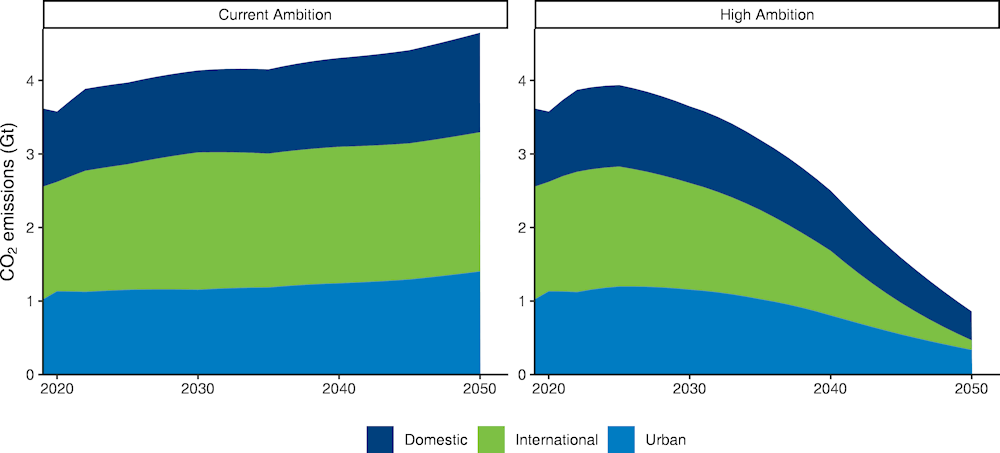

Urban transport activity accounts for roughly one-third of emissions due to passenger travel, varying by year and scenario (see Figure 2.3). Under the High Ambition scenario, emissions fall by 1 190 trillion tonnes of CO2 between 2019 and 2050, compared to a drop of only 379 trillion tonnes of CO2 under the Current Ambition scenario. Non-urban passenger emissions will reduce in both scenarios, driven by a decrease in emissions in regional trips in high-income countries.

Emissions due to regional travel account for the highest share of emissions (36%) for a single segment in 2019. This share falls to 25% under the Current Ambition scenario, as regional demand falls and international and intercity activity increases. However, under the High Ambition scenario, the urban and international and intercity segments decarbonise faster and regional travel ends up with the highest share of emissions in 2050.

Emissions from international and intercity travel reduce by 7% between 2019 and 2050 under the Current Ambition scenario. This reduction occurs in the context of demand nearly tripling, meaning that even on the current policy pathway, the carbon intensity of these trips is reducing. By contrast, under the High Ambition scenario, emissions due to these trips could reduce by 85% while demand still grows by a factor of 2.5.

Figure 2.3. Total passenger transport emissions, 2019-50, under the Current Ambition and High Ambition scenarios

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. International+Intercity: travel across national borders; Regional: non-urban travel within national borders.

Freight demand increases with economic growth

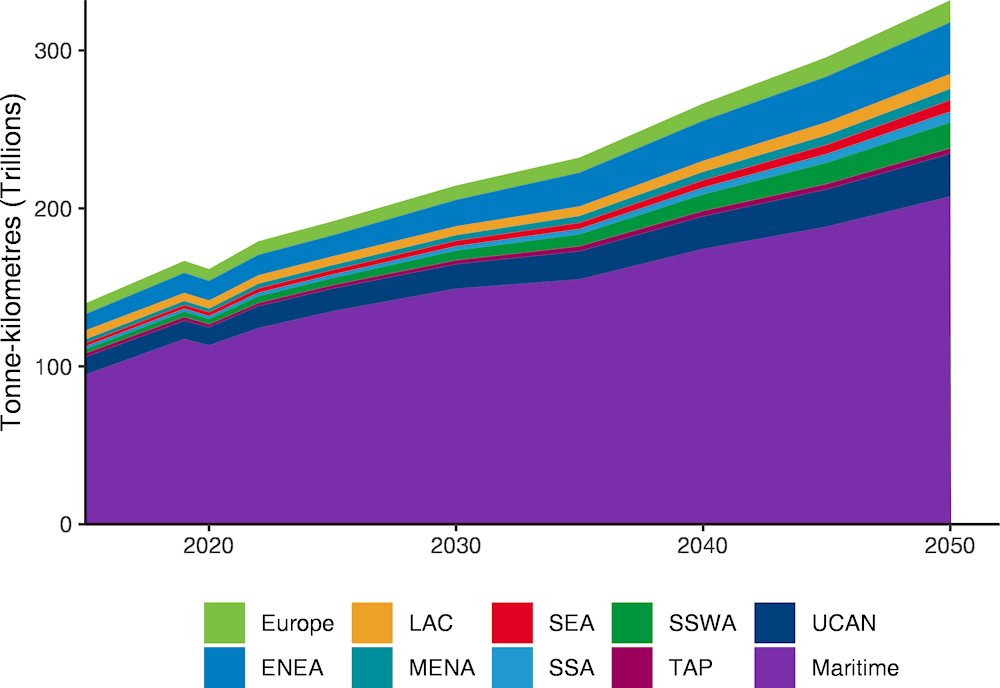

Freight activity also grows in every region under the Current Ambition scenario, with worldwide tonne-kilometres nearly doubling between 2019 and 2050 (see Figure 2.4). Under the High Ambition scenario, demand grows by 59% globally over the same period. The reduction in tonne-kilometres is not entirely linked to the transport policies in the High Ambition scenario, with changes in trade and the commodities being transported around the world also having an impact.

Demand grows most strongly in emerging regions, where the greatest economic growth is expected over the next three decades. Demand more than triples under both policy scenarios between 2019 and 2050 in Southeast Asia (SEA) and Sub-Saharan Africa (SSA), and grows by a factor of 4.9 in South and Southwest Asia (SSWA) over that time.

In East and Northeast Asia (ENEA) and the Middle East and North Africa (MENA), freight activity will also more than double under both scenarios through to 2050. The United States, Canada, Australia and New Zealand (grouped in this report as the UCAN countries), and Europe both see increased activity, although it grows at a more sedate pace.

The Transition economies and other Asia-Pacific (TAP) countries will see the lowest growth in tonne-kilometres under both scenarios, increasing by 47% under the Current Ambition scenario and by 34% under the High Ambition scenario.

Figure 2.4. Freight activity by region under the Current Ambition scenario, 2019-50

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) refers to one of the two policy scenarios modelled, which represent two levels of ambition for decarbonising transport. ENEA: East and Northeast Asia. LAC: Latin America and the Caribbean. MENA: Middle East and North Africa. SEA: Southeast Asia. SSA: Sub-Saharan Africa. SSWA: South and Southwest Asia. TAP: Transition economies and other Asia-Pacific countries. UCAN: United States, Canada, Australia and New Zealand. Maritime: International waters and inland waterways.

The majority of global freight is carried by sea (see Table 2.10). This will remain the case over time and under both scenarios. Road modes account for 22% of the mode share in 2019, growing to 27% in 2050 under the Current Ambition scenario and 31% under the High Ambition scenario (although tonne-kilometres are lower under the latter).

Table 2.10. Shares of tonne-kilometres by transport mode in 2050 under the Current Ambition and High Ambition scenarios

|

2019 |

2050 |

||

|---|---|---|---|

|

Vehicle type |

Baseline |

Current Ambition scenario |

High Ambition scenario |

|

Aircraft |

Less than 1% |

Less than 1% |

Less than 1% |

|

Ships |

70% |

62.5% |

56.0% |

|

Rail |

7% |

10% |

13% |

|

Road |

22% |

27% |

31% |

|

Non-motorised |

Less than 1% |

Less than 1% |

Less than 1% |

Note: Table depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport.

Road modes also grow at a greater rate than maritime, with tonne-kilometres carried by road more than doubling between 2019 and 2050, under both scenarios. Among the main modes – road, rail, air and maritime – rail grows most strongly over the three decades. Tonne-kilometres carried by rail in 2050 are roughly 2.7 times the amount in 2019, under both scenarios.

Given their much lower starting points (so small they are not visible at the global scale), non-motorised modes are the fastest-growing mode. Non-motorised urban freight solutions are projected to carry 8.9 times as much in 2050 compared to 2019 under the Current Ambition scenario, and 20.5 times as much under the High Ambition scenario.

Freight emissions will grow, particularly in urban areas

International freight activity dominates freight emissions, but domestic and urban freight are growing faster (see Table 2.11). Non-urban freight accounts for both domestic and international freight flows, while urban freight accounts for freight activity within urban areas.

International freight activity accounts for 42% of total freight emissions, and nearly three-quarters of total freight tonne-kilometres. Domestic activity accounts for 35% of emissions and 21% of tonne-kilometres. Finally, urban freight accounts for 28% of emissions and only 5% of tonne-kilometres. Under the Current Ambition scenario in 2050, urban freight emissions grow significantly (a 37% increase) as cities grow in emerging economies.

Under the High ambition Scenario, international freight activity will account for the lowest share of freight emissions, domestic the highest, followed by urban. This is a result of decarbonisation efforts and changes in trade flows (see Chapter 3).

By 2050, total freight emissions are expected to grow by 28% in the Current Ambition scenario, compared to a 76% decrease in the High Ambition scenario (see Figure 2.5). International freight emissions are expected to decrease by 92% under the High Ambition scenario, the most significant decrease of the three activity types. Domestic freight emissions are expected to decrease by 63%, and urban emissions by 67%.

Table 2.11. Share of freight emission by activity type, 2050, Current Ambition and High Ambition scenarios

|

2019 |

2050 |

||

|---|---|---|---|

|

Activity type |

Baseline |

Current Ambition scenario |

High Ambition scenario |

|

International |

42% |

41% |

15% |

|

Domestic |

29% |

29% |

46% |

|

Urban |

28% |

30% |

39% |

Note: Table depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. International: between national borders; Domestic: non-urban, within national borders.

Figure 2.5. Total emissions in freight transport by activity type, 2019-50, Current Ambition versus High Ambition scenario

Note: Figure depicts ITF modelled estimates. Current Ambition (CA) and High Ambition (HA) refer to the two main policy scenarios modelled, which represent two levels of ambition for decarbonising transport. International: between national borders; Domestic: non-urban, within national borders.

Key takeaways

Transport is central to economic development and social opportunity, but it also contributes significantly to the world’s CO2 emissions.

This report models two scenarios for the future transport demand and CO2 emissions to 2050, one informed by announced or existing policies (Current Ambition scenario), the other assuming more ambitious decarbonisation measures (High Ambition scenario).

Overall, the scenarios show that current policies will begin make a difference over time at a global level, with transport CO2 emissions falling slightly by 2050.

However, continuing on the current path will not make enough of a difference for the transport sector’s CO2 emissions to deliver against the Paris Agreement goals.

The urgent need to break the link between transport activities and emissions requires increased ambition and more international co-operation.

References

[3] Anenberg, S. et al. (2019), A Global Snapshot of the Air Pollution-Related Health Impacts of Transportation Sector Emissions in 2010 and 2015, International Council on Clean Transportation, Washington, DC, https://theicct.org/publication/a-global-snapshot-of-the-air-pollution-related-health-impacts-of-transportation-sector-emissions-in-2010-and-2015/.

[5] BloombergNEF (2022), “Zero-emission vehicle adoption is accelerating, but stronger push is needed to stay on track”, BloombergNEF Blog, https://about.bnef.com/blog/zero-emission-vehicle-adoption-is-accelerating-but-stronger-push-is-needed-to-stay-on-track-for-net-zero/ (accessed on 9 January 2023).

[1] IEA (n.d.), Global energy-related CO2 emissions by sector, https://www.iea.org/data-and-statistics/charts/global-energy-related-co2-emissions-by-sector (accessed on 19 April 2023).

[4] IEA (n.d.), Transport, https://www.iea.org/topics/transport (accessed on 17 November 2022).

[9] Kersey, J., N. Popovich and A. Phadke (2022), “Rapid battery cost declines accelerate the prospects of all-electric interregional container shipping”, Nature Energy, Vol. 7, pp. 664-674, https://doi.org/10.1038/s41560-022-01065-y.

[8] Ueckert, F. et al. (2021), “Potential and risks of hydrogen-based e-fuels in climate change mitigation”, Nature Climate Change, Vol. 11, pp. 384–393, https://doi.org/10.1038/s41558-021-01032-7.

[2] UN DESA (2019), World Urbanization Prospects: The 2018 Revision, UN Department of Economic and Social Affairs, Population Division, New York, https://population.un.org/wup/.

[6] UNFCCC (2021), Upgrading Our Systems Together: A global challenge to accelerate sector breakthroughs for COP26 - and beyond, https://racetozero.unfccc.int/wp-content/uploads/2021/09/2030-breakthroughs-upgrading-our-systems-together.pdf.

[7] Yoo, E., U. Lee and M. Wang (2022), “Life-cycle greenhouse gas emissions of sustainable aviation fuel through a net-zero carbon biofuel plant design”, ACS Sustainable Chemistry & Engineering, Vol. 10/7, pp. 8725-8732, https://doi.org/10.1021/acssuschemeng.2c00977.