Since the publication of the latest Action 14 Peer Review Report Slovenia has made efforts to make the following two tax Treaties in line with the Action 14 Minimum Standard: tax treaty between Slovenia and Thailand (entry into force of the MLI for the tax treaty) and tax treaty between Slovenia and Sweden (entry into force of the new tax treaty replacing the existing tax treaty). Furthermore, additional action is currently ongoing to make the tax treaty between Slovenia and Switzerland (signature of the protocol to the tax treaty on 30 May 2023) in line with the Action 14 Minimum Standard.

Making Dispute Resolution Mechanisms More Effective – Consolidated Information on Mutual Agreement Procedures 2023

Slovenia

Recent developments relating to MAP in Slovenia prior to 15 August 2023

Developments relating to MAP in the tax treaty network

Other developments relating to MAP

Since the publication of the latest Action 14 Peer Review Report an amendment to the provisions of the Tax Procedure Act relating to MAP was adopted in 2022 (available in Slovenian only: Zakon o spremembah in dopolnitvah Zakona o davčnem postopku - ZDavP-2N).

Latest Action 14 Peer Review report

25 May 2021 - https://doi.org/10.1787/27a608bc-en

Tax treaty network of Slovenia

61 treaties (60 of which are in force), applicable to 62 jurisdictions (covering all treaties signed, although not necessarily in force)

status of MLI: in force.

Table 1. State of play of Slovenia's tax treaty network

|

Treaties in line with the Action 14 Minimum Standard following MLI impact |

Treaties where actions are ongoing to make them in line with the Action 14 Minimum Standard |

Following impact/actions, remaining treaties that are not in line with Action 14 Minimum Standard |

|---|---|---|

|

59 |

1 |

1 |

Source: OECD

Slovenia's MAP programme

Organisation of competent authority function

Ministry of Finance of the Republic of Slovenia (competent authority for all cases apart from attribution/allocation cases):

three persons:

one head of unit

two persons working on MAP cases (all of which work on other tasks as well).

The Financial Administration of the Republic of Slovenia (competent authority for attribution/allocation cases):

four persons:

one head of unit

three persons working on MAP cases (among which two persons work on other tasks as well).

contacts for MAP requests:

competent authority for all cases apart from attribution/allocation cases:

Ministry of Finance of the Republic of Slovenia, Tax, Customs and Other Public Revenue Systems Directorate, Income and Property Taxation System Division, Župančičeva 3, 1001 Ljubljana, Slovenia

Phone: (+386) 1/369 6710 | Fax: (+386) 1/369 6719 | E-mail: gp.mf@gov.si.

competent authority for attribution/allocation cases:

Financial Administration of the Republic of Slovenia, General Financial Office - Tax Department, Division for International Taxation and Exchange of Information, Šmartinska cesta 55, 1000 Ljubljana, Slovenia

Phone: +386 1/478 38 00 | E-mail: gfu.fu@gov.si.

Figure 1. Competent Authority Organisational Structure

Source: OECD

Table 2. Guidance on the MAP process

|

MAP guidance |

Postopek skupnega dogovarjanja po mednarodnih pogodbah o izogibanju dvojnega obdavčevanja, April 2018 |

https://www.gov.si/assets/ministrstva/MF/Davcni-direktorat/DOKUMENTI/Postopek-skupnega-dogovarjanja-po-mednarodnih-pogodbah-o-izogibanju-dvojnega-obdavcevanja.pdf (Section 2.1.6. to be referred to for form and content of a MAP request, including information requirements) |

|

MAP profile |

5 November 2020 |

https://www.oecd.org/tax/dispute/slovenia-dispute-resolution-profile.pdf |

Overview of Slovenia's MAP Statistics for 2022

Please refer to https://www.oecd.org/tax/dispute/map-statistics-slovenia.pdf for details with respect to Slovenia's MAP Statistics.

Figure 2. Cases Closed in 2022

Source: OECD

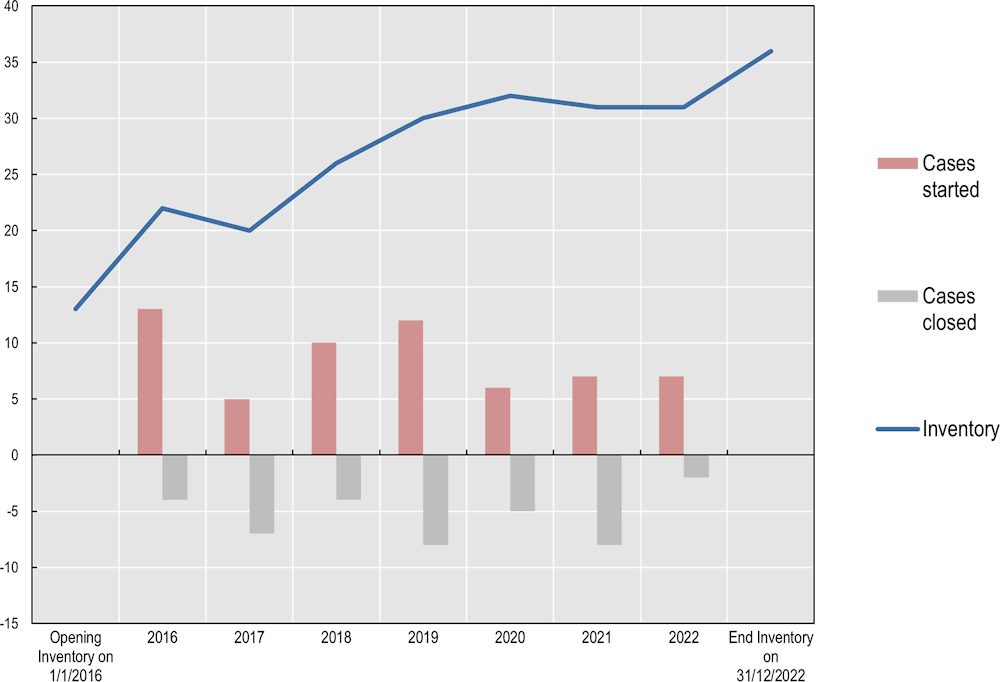

Figure 3. Evolution of Slovenia's MAP caseload (2016-22)

Source: OECD

Table 3. Overview of Slovenia’s MAP caseload for 2022

|

Inventory for year 2022 |

Opening Inventory 1/1/2022 |

Cases started |

Cases Closed |

End Inventory 31/12/2022 |

|---|---|---|---|---|

|

Attribution/allocation cases |

11 |

4 |

2 |

13 |

|

Other cases |

20 |

3 |

0 |

23 |

|

Total |

31 |

7 |

2 |

36 |

Source: OECD

Table 4. Slovenia’s average time to resolve MAP cases in 2022

|

Cases resolved in year 2022 |

Pre-2016 cases |

Post-2015 cases |

All |

|||

|---|---|---|---|---|---|---|

|

Number of cases |

Average time |

Number of cases |

Average time |

Number of cases |

Average time |

|

|

Start to End |

||||||

|

Attribution / Allocation cases |

0 |

N/A |

2 |

63.06 |

2 |

63.06 |

|

Other cases |

0 |

N/A |

0 |

N/A |

0 |

N/A |

|

All cases |

0 |

N/A |

2 |

63.06 |

2 |

63.06 |

Source: OECD