The Multilateral Instrument entered into force for Mexico on July 1st, 2023.

As of 4 August 2023, Mexico has 61signed DTT. Of these 61 DTT, 48 are in line with Action 14 Minimum Standard following MLI impact. Out of the remaining 13 DTT, Mexico has taken actions to make 8 of them in line with the Action 14 Minimum Standard: with Germany (Protocol will enter into force on August 6th, 2023), Brazil (communications underway to have a Protocol), Austria (currently negotiating a Protocol), Malta (currently negotiating a Protocol), Indonesia (we have sent them communications in order to make first sentence of paragraph 2 of the MAP Article in line with the minimum standard), Jamaica (we have sent them communications in order to make second sentence of paragraph 2 of the MAP Article in line with the minimum standard), Slovak Republic (we have sent them communications in order to make second sentence of paragraph 2 of the MAP Article in line with the minimum standard) and Italy (communications have taken place to have a Memorandum of Understanding to make the first sentence, of paragraph 1, of the MAP Article in line with the minimum standard). Also, there are 5 remaining DTT that will not be in line with the minimum standard following MLI impact and actions: with Ecuador (not signed the MLI, but we have sent them communications to explore the possibility of updating the MAP Article), Guatemala (not signed the MLI, DTT not yet in force), Philippines (not signed the MLI, but we have sent them communications to explore the possibility of updating the MAP Article), United States (not signed the MLI) and Ukraine (no recent communications).

Making Dispute Resolution Mechanisms More Effective – Consolidated Information on Mutual Agreement Procedures 2023

Mexico

Recent developments relating to MAP in Mexico prior to 15 August 2023

Developments relating to MAP in the tax treaty network

Other developments relating to MAP

Update of the MAP profile.

Update of the MAP Guidance.

Latest Action 14 Peer Review report

15 April 2021 - https://doi.org/10.1787/26bc3948-en

Tax treaty network of Mexico

61 treaties, applicable to 61 jurisdictions (covering all treaties signed, although not necessarily in force)

status of MLI: in force.

Table 1. State of play of Mexico's tax treaty network

|

Treaties in line with the Action 14 Minimum Standard following MLI impact |

Treaties where actions are ongoing to make them in line with the Action 14 Minimum Standard |

Following impact/actions, remaining treaties that are not in line with Action 14 Minimum Standard |

|---|---|---|

|

48 |

8 |

5 |

Source: OECD

Mexico's MAP programme

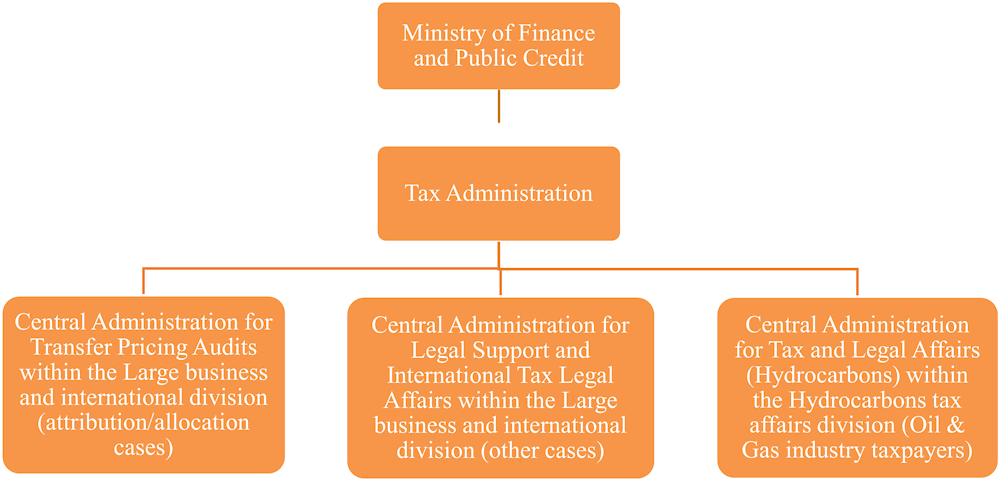

Organisation of competent authority function

26 persons:

2 head(s) of unit

24 persons working on MAP cases (among which 9 persons work on other tasks as well)

15 persons work on attribution/allocation cases and 9 persons work on other cases

Contact persons for MAP requests:

For large taxpayers and taxpayers in the upstream, midstream or downstream Oil & Gas industry (MAP & MAP APA) Mr. Armando Ramírez Sánchez, General Administrator for Large Taxpayers (i.e. Head of the Large Business & International Division) Av. Hidalgo 77, Módulo III, Piso 1, Col. Guerrero, Alcaldía Cuauhtémoc, Ciudad de México, 06300

For large taxpayers, not dealing or related to upstream, midstream or downstream Oil & Gas industry (MAP)

Central Administration for Legal Support and International Tax Legal Affairs Av. Hidalgo 77, Módulo III, Planta Baja, Col. Guerrero, Alcaldía Cuauhtémoc, Ciudad de México, 06300 t. +52 (55) 5802 2082 / mapsmexico@sat.gob.mx

For large taxpayers, not dealing or related to upstream, midstream or downstream Oil & Gas industry (MAP APA) Mr. Carlos Eduardo González Gamero, Central Administrator for Transfer Pricing Audits Av. Hidalgo 77, Módulo III, Piso 1, Col. Guerrero, Alcaldía Cuauhtémoc, Ciudad de México, 06300 t. +52 (55) 5802 2384, 5802 0000 ext. 42384 carlos.gamero@sat.gob.mx / acfpt@sat.gob.mx

For taxpayers in the upstream, midstream or downstream Oil & Gas industry (MAP & MAP APA) Central Administration for Tax and Legal Affairs (Hydrocarbons) Av. Hidalgo 77, Módulo III, Piso 1, Col. Guerrero, Alcaldía Cuauhtémoc, Ciudad de México, 06300 t. +52 (55) 5802 2082 / mapsmexico@sat.gob.mx

Figure 1. Competent Authority Organisational Structure

Source: OECD

Table 2. Guidance on the MAP process

|

MAP guidance |

Información relativa a procedimientos amistosos, August 2023 |

https://www.sat.gob.mx/normatividad/98105/tratados-en-materia-fiscal-y-cuestiones-relacionadastratados-en-materia-fiscal-y-cuestiones-relacionadas (Sections 1. to 6. to be referred to for form and content of a MAP request, including information requirements) |

|

Administrative rule 2.1.30. |

http://omawww.sat.gob.mx/normatividad_RMF_RGCE/Paginas/documentos/rmf/rmf/RMF_2023-27122022.pdf (p. 41) |

|

|

Procedure form 244/CFF |

||

|

MAP profile |

29 June 2023 |

https://www.oecd.org/tax/dispute/mexico-dispute-resolution-profile.pdf |

Overview of Mexico's MAP Statistics for 2022

Please refer to https://www.oecd.org/tax/dispute/map-statistics-mexico.pdf for details with respect to Mexico's MAP Statistics.

Figure 2. Cases closed in 2022

Source: OECD

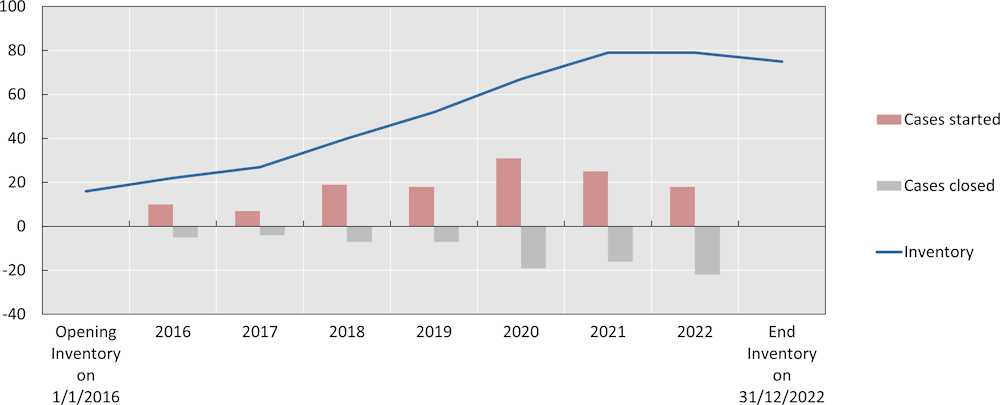

Figure 3. Evolution of Mexico's MAP caseload (2016-22)

Source: OECD

Table 3. Overview of Mexico’s MAP caseload for 2022

|

Inventory for year 2022 |

Opening Inventory 1/1/2022 |

Cases started |

Cases Closed |

End Inventory 31/12/2022 |

|---|---|---|---|---|

|

Attribution/allocation cases |

62 |

17 |

18 |

61 |

|

Other cases |

17 |

1 |

4 |

14 |

|

Total |

79 |

18 |

22 |

75 |

Source: OECD

Table 4. Mexico’s average time to resolve MAP cases in 2022

|

Cases resolved in year 2022 |

Pre-2016 cases |

Post-2015 cases |

All |

|||

|---|---|---|---|---|---|---|

|

Number of cases |

Average time |

Number of cases |

Average time |

Number of cases |

Average time |

|

|

Start to End |

||||||

|

Attribution / Allocation cases |

1 |

127.04 |

17 |

29.06 |

18 |

34.51 |

|

Other cases |

0 |

N/A |

4 |

42.64 |

4 |

42.64 |

|

All cases |

1 |

127.04 |

21 |

31.65 |

22 |

35.99 |

Source: OECD