Since the approval of its MAP Peer Review Report of Stage 2 (11 December 2019), Italy has signed new tax treaties with Kosovo (June 2021) and Liechtenstein (July 2023), which include provisions on MAP procedure in line with Action 14 Minimum Standard. In addition, the treaty with Liechtenstein provides for an arbitration procedure in line with Part VI of MLI. The treaties signed with Colombia, Jamaica, Mongolia and Uruguay have entered into force.

Making Dispute Resolution Mechanisms More Effective – Consolidated Information on Mutual Agreement Procedures 2023

Italy

Recent developments relating to MAP in Italy prior to 15 August 2023

Developments relating to MAP in the tax treaty network

Other developments relating to MAP

Italy has implemented the Council Directive (EU) 2017/1852 of 10 October 2017 on tax dispute resolution mechanisms in the European Union in its domestic legislation via Legislative Decree no.49 of 10 June 2020 (entered into force on 25 June 2020, applicable to MAP requests as per 1 July 2019).

On 16 December 2020 the Italian Revenue Agency issued guidance on modalities and operational procedures for the implementation of provisions of Legislative Decree no.49 of 10 June 2020 transposing the Directive (https://www.agenziaentrate.gov.it/portale/web/guest/-/provvedimento-del-16-12-2020).

Latest Action 14 Peer Review report

9 April 2020 - https://doi.org/10.1787/08a4369e-en

Tax treaty network of Italy

106 treaties, applicable to 110 jurisdictions (covering all treaties signed, although not necessarily in force)

status of MLI: signed.

Table 1. State of play of Italy's tax treaty network

|

Treaties in line with the Action 14 Minimum Standard following MLI impact |

Treaties where actions are ongoing to make them in line with the Action 14 Minimum Standard |

Following impact/actions, remaining treaties that are not in line with Action 14 Minimum Standard |

|---|---|---|

|

12 |

73 |

21 |

Source: OECD

Italy's MAP programme

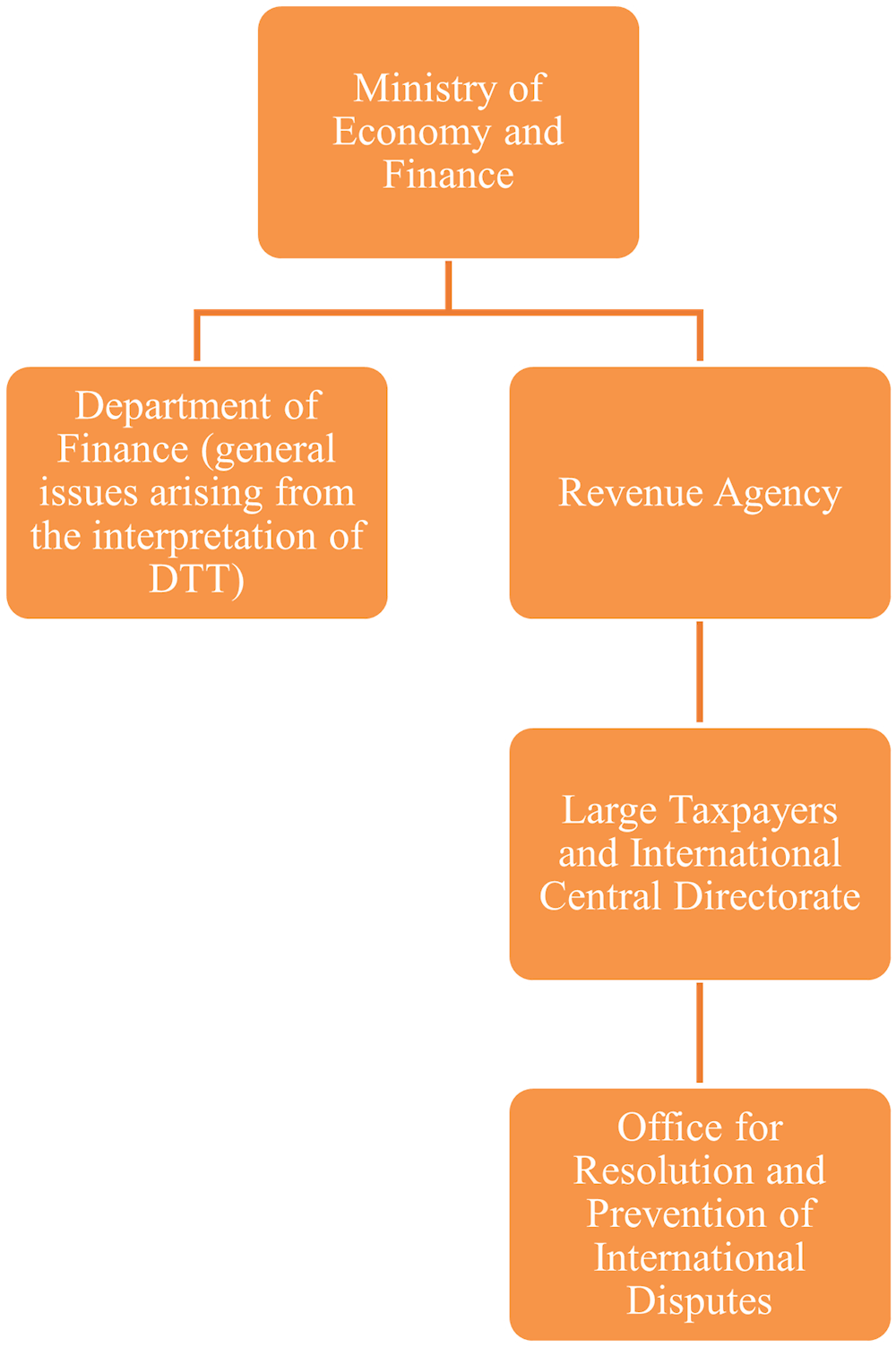

Organisation of competent authority function

24 persons:

two heads of unit

22 persons working on MAP cases (among which two persons work on other tasks as well).

contact persons for MAP requests:

for general issues arising from the interpretation of DTT: Ministero dell'Economia e delle Finanze

Dipartimento delle Finanze, Direzione rapporti fiscali europei e internazionali

Via dei Normanni, 5 – 00184 Roma, e-mail: df.dri.segreteria@finanze.it

for all MAP cases concerning specific taxpayers: Agenzia delle entrate, Divisione Contribuenti, Direzione Centrale Grandi Contribuenti e Internazionale, Settore Controllo, Ufficio Risoluzione e prevenzione controversie internazionali

Via Giorgione 106 - 00147 Roma

Figure 1. Competent Authority Organisational Structure

Source: OECD

Table 2. Guidance on the MAP process

|

MAP guidance |

Settlement of International Tax Disputes. The Mutual Agreement Procedures, 5 June 2012 |

https://www.agenziaentrate.gov.it/portale/documents/180690/1186205/Circular+letter+n.+21E+05062012_circularletter21.pdf/02726080-7856-86b4-b530-aa6b6ac775e3 (Section 4.2.4. to be referred to for form and content of a MAP request, including information requirements) |

|

Web page |

||

|

MAP profile |

14 September 2023 |

https://www.oecd.org/tax/dispute/Italy-Dispute-Resolution-Profile.pdf |

Overview of Italy's MAP Statistics for 2022

Please refer to https://www.oecd.org/tax/dispute/map-statistics-italy.pdf for details with respect to Italy's MAP Statistics.

Figure 2. Cases closed in 2022

Source: OECD

Figure 3. Evolution of Italy's MAP caseload (2016-22)

Source: OECD

Table 3. Overview of Italy’s MAP caseload for 2022

|

Inventory for year 2022 |

Opening Inventory 1/1/2022 |

Cases started |

Cases Closed |

End Inventory 31/12/2022 |

|---|---|---|---|---|

|

Attribution/allocation cases |

668 |

309 |

270 |

707 |

|

Other cases |

256 |

69 |

90 |

235 |

|

Total |

924 |

378 |

360 |

942 |

Source: OECD

Table 4. Italy’s average time to resolve MAP cases in 2022

|

Cases resolved in year 2022 |

Pre-2016 cases |

Post-2015 cases |

All |

|||

|---|---|---|---|---|---|---|

|

Number of cases |

Average time |

Number of cases |

Average time |

Number of cases |

Average time |

|

|

Start to End |

||||||

|

Attribution / Allocation cases |

14 |

94.16 |

256 |

25.47 |

270 |

29.03 |

|

Other cases |

21 |

112.88 |

69 |

29.44 |

90 |

48.91 |

|

All cases |

35 |

105.39 |

325 |

26.31 |

360 |

34 |

Source: OECD