Croatia updated its MAP guidelines and introduced a documented bilateral notification process. Accordingly, Croatia applies its notification process for future cases in which its competent authority considered the objection raised in a MAP request not to be justified and when the tax treaty concerned does not contain Article 25(1) of the OECD Model Tax Convention as amended by the Action 14 final report. Accordingly, Croatia is introducing, in its newly negotiated treaties, an alternative provision on bilateral notification process.

Making Dispute Resolution Mechanisms More Effective – Consolidated Information on Mutual Agreement Procedures 2023

Croatia

Recent developments relating to MAP in Croatia prior to 15 August 2023

Developments relating to MAP in the tax treaty network

Other developments relating to MAP

Croatia updated its MAP guidelines in 2022.

Latest Action 14 Peer Review report

26 July 2021 - https://doi.org/10.1787/7a89e6e4-en

Tax treaty network of Croatia

65 treaties, applicable to 66 jurisdictions (covering all treaties signed, although not necessarily in force)

status of MLI: in force.

Table 1. State of play of Croatia's tax treaty network

|

Treaties in line with the Action 14 Minimum Standard following MLI impact |

Treaties where actions are ongoing to make them in line with the Action 14 Minimum Standard |

Following impact/actions, remaining treaties that are not in line with Action 14 Minimum Standard |

|---|---|---|

|

60 |

3 |

2 |

Source: OECD

Croatia's MAP programme

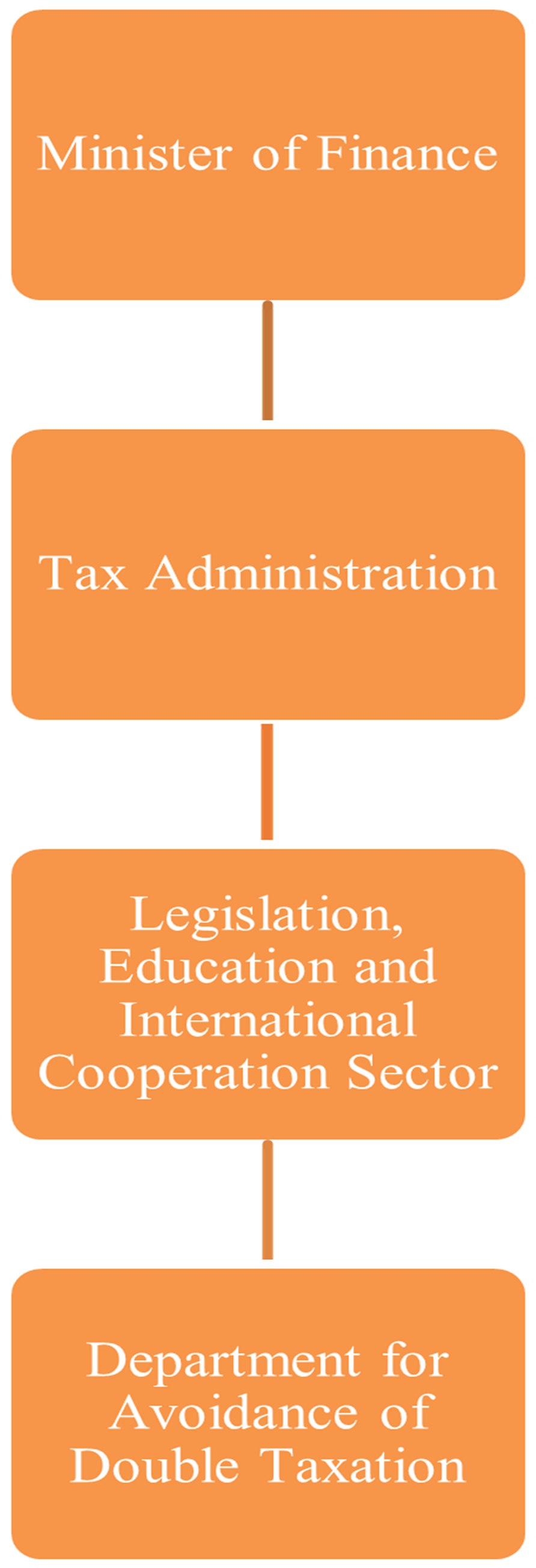

Organisation of competent authority function

two persons working on MAP cases

One head of unit

Two persons working on MAP cases (all of which work on other tasks as well)

One person works on attribution/allocation cases and one person works on other cases

contact persons for MAP requests:

Republic of Croatia, Ministry of Finance, Croatian Tax Administration, Central office, Boskoviceva 5, 10 000 Zagreb, Croatia Phone: +385 1 4809 000 / Fax: +385 1 4809 129 / Email: su_pis@porezna-uprava.hr.

Figure 1. Competent Authority Organisational Structure

Source: OECD

Table 2. Guidance on the MAP process

|

MAP guidance |

Smjernice za postupak zajedničkog dogovaranja, ažurirano 2022. (Guidelines for MAP, updated 2022) |

https://www.porezna-uprava.hr/Dokumenti%20vijesti/Postupak%20zajedni%C4%8Dkog%20dogovaranja%20.pdf (Section 4.1.2. to be referred to for form and content of a MAP request, including information requirements) |

|

MAP profile |

15 September 2023 |

https://www.oecd.org/tax/dispute/croatia-dispute-resolution-profile.pdf |

Overview of Croatia's MAP Statistics for 2022

Please refer to https://www.oecd.org/tax/dispute/map-statistics-croatia.pdf for details with respect to Croatia's MAP Statistics.

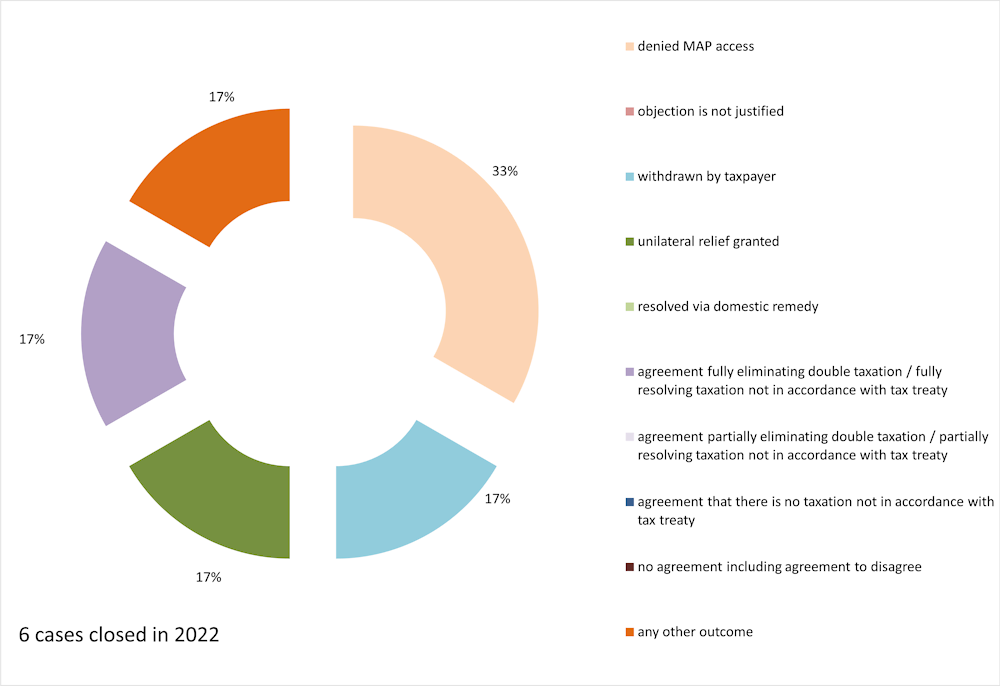

Figure 2. Cases closed in 2022

Source: OECD

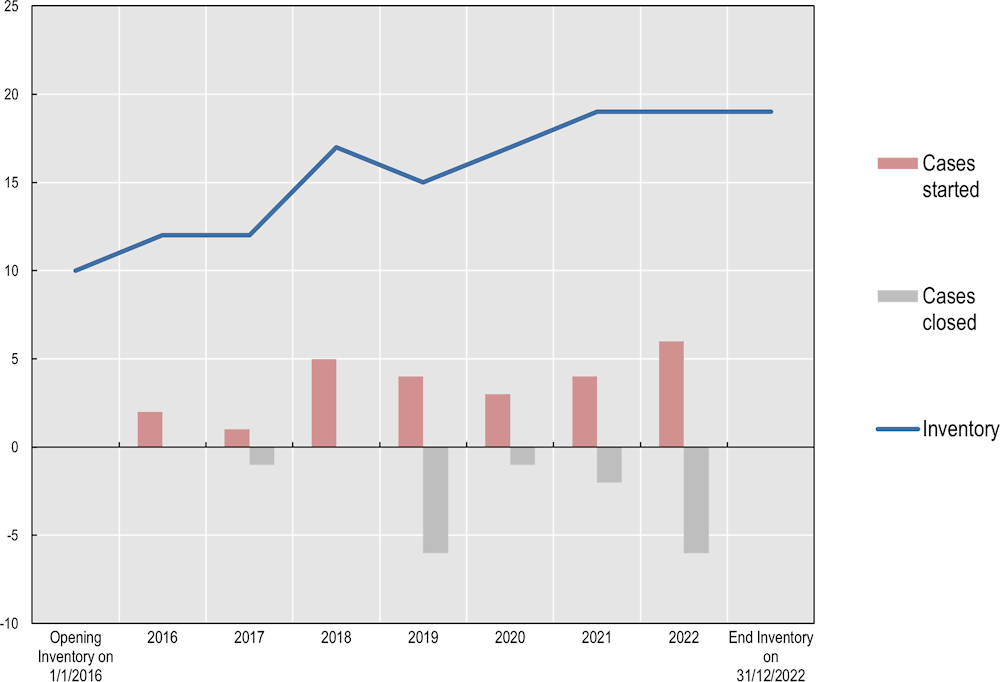

Figure 3. Evolution of Croatia's MAP caseload (2016-22)

Source: OECD

Table 3. Overview of Croatia’s MAP caseload for 2022

|

Inventory for year 2022 |

Opening Inventory 1/1/2022 |

Cases started |

Cases Closed |

End Inventory 31/12/2022 |

|---|---|---|---|---|

|

Attribution/allocation cases |

6 |

4 |

2 |

8 |

|

Other cases |

13 |

2 |

4 |

11 |

|

Total |

19 |

6 |

6 |

19 |

Source: OECD

Table 4. Croatia’s average time to resolve MAP cases in 2022

|

Cases resolved in year 2022 |

Pre-2016 cases |

Post-2015 cases |

All |

|||

|---|---|---|---|---|---|---|

|

Number of cases |

Average time |

Number of cases |

Average time |

Number of cases |

Average time |

|

|

Start to End |

||||||

|

Attribution / Allocation cases |

0 |

N/A |

2 |

23.61 |

2 |

23.61 |

|

Other cases |

1 |

53.00 |

3 |

16.07 |

4 |

25.30 |

|

All cases |

1 |

53.00 |

5 |

19.08 |

6 |

24.74 |

Source: OECD