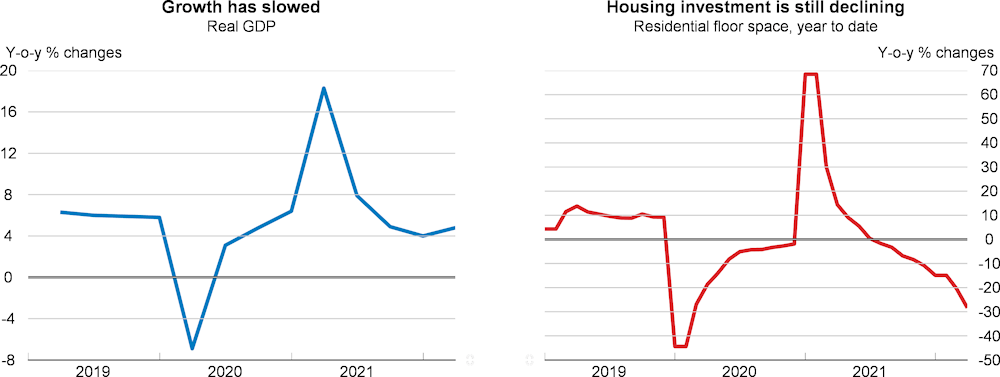

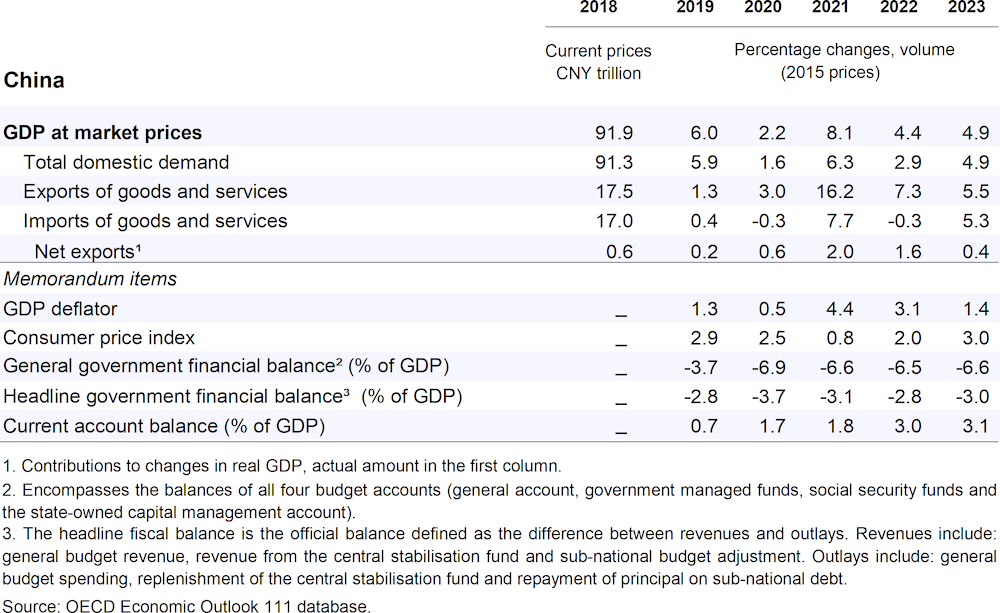

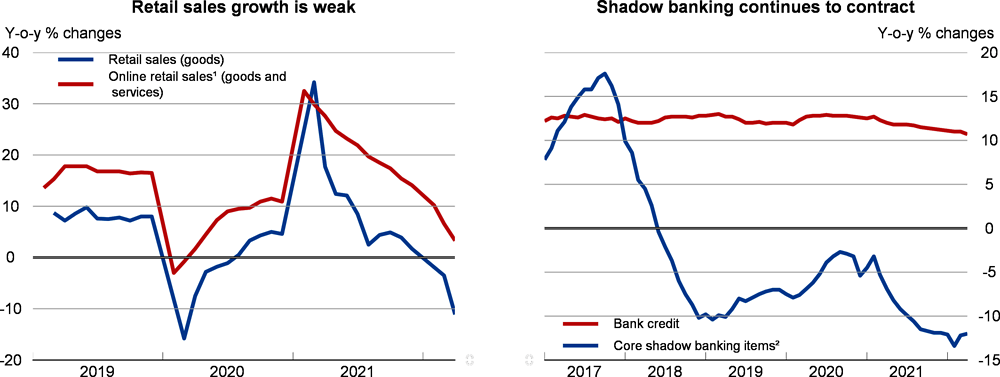

Economic growth will slide to 4.4% in 2022 and rebound to 4.9% in 2023. Amid mounting headwinds, growth will be supported by investment in the climate transition and the frontloading of infrastructure projects. Real estate investment will remain weak due to the continuing defaults across developers and falling price expectations. Exports will remain relatively strong as companies continue to raise their market shares. Adverse confidence effects related to continuing lockdowns coupled with inadequate social protection will weigh on consumption. China’s large oil and grain reserves will mitigate the impact of rising global energy and food prices.

Monetary policy has become more supportive with a series of interest rate and reserve requirement rate cuts, but will refrain from significant easing. Fiscal policy will become more supportive as the composition of spending shifts towards infrastructure, though the use of fiscal reserves will mean the headline deficit will shrink. Fiscal measures should focus more on renewables investment and the energy transition to achieve climate mitigation objectives. Recent measures to create a single domestic market are welcome and the phasing out of administrative monopolies should be accelerated.