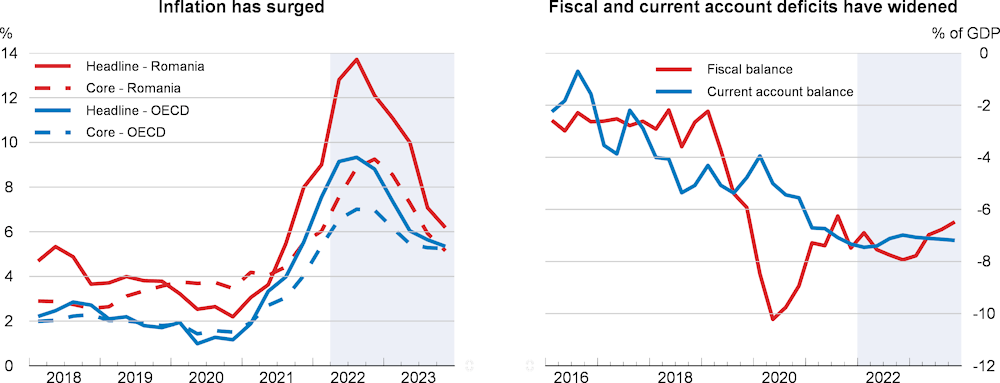

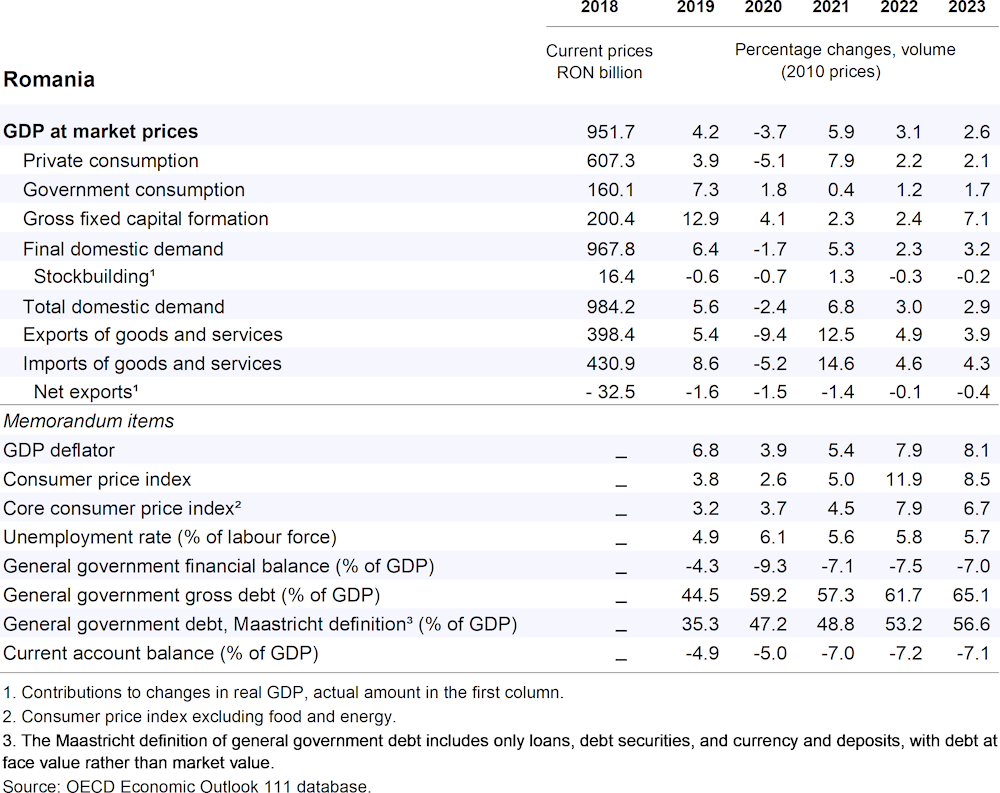

Following a 5.9% rebound in 2021, GDP growth is projected to decelerate to 3.1% in 2022 and 2.6% in 2023 due to high uncertainty, commodity prices and supply shortages. Domestic demand will remain the main growth driver supported by the absorption of EU funds and a resilient labour market. By contrast, the trade deficit is set to remain large, contributing to relatively high risk premia in financial markets. Inflation is expected to reach 11.9% in 2022 and 8.5% in 2023, despite tightening monetary policy and a cap on electricity and gas prices.

Monetary policy should ensure inflation expectations remain anchored. Fiscal support should target the most vulnerable households and firms, as fiscal space is limited. If the recovery resumes as projected from end-2022, fiscal consolidation should start in 2023. Expanding the tax base will be key, as room to reduce public spending is low. Greening the energy mix and achieving energy savings, notably in housing, is a priority for sustainable growth.