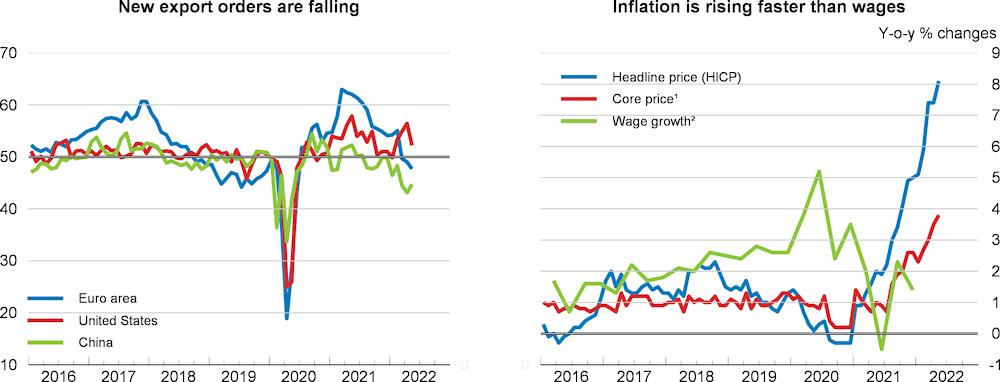

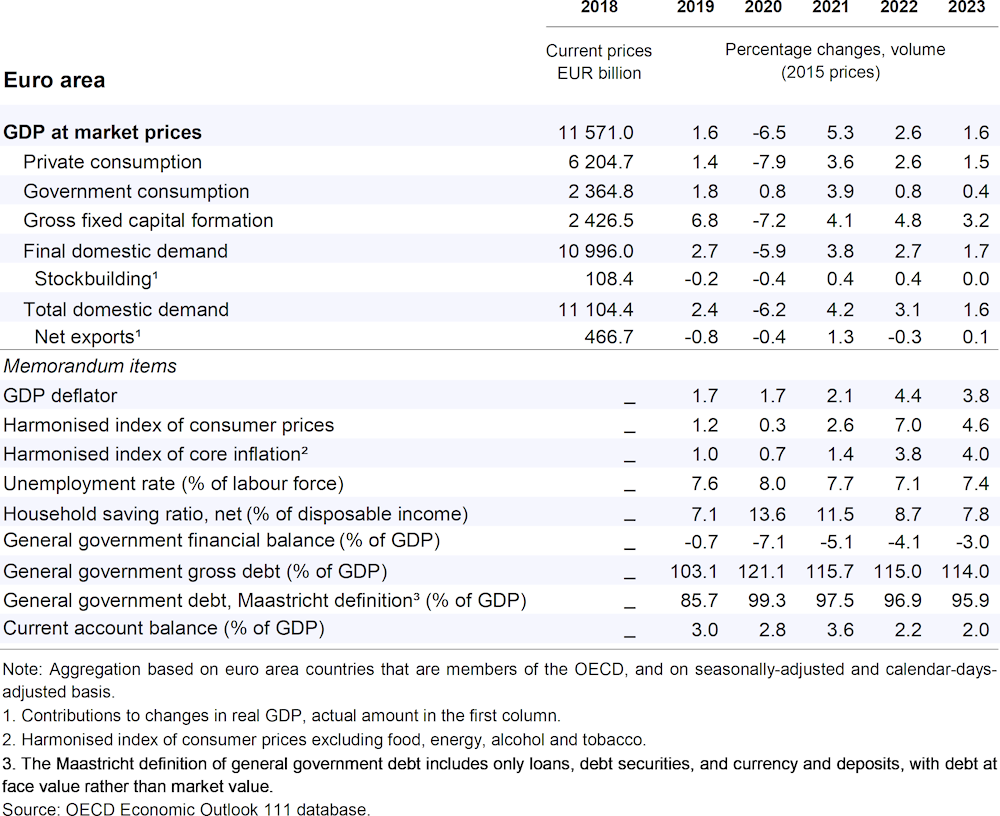

After a strong rebound in 2021, real GDP is projected to grow by 2.6% in 2022 and 1.6% in 2023. Growth is set to be significantly damped in the first half of 2022 by the war in Ukraine and the lockdowns in China. These factors are also pushing inflation up further, to a projected 7% this year. This is weighing on households’ consumption and increasing uncertainty. With the Russian oil embargo from 2023 pushing oil prices up, growth is expected to remain subdued in 2023 and inflation is set to decline only gradually. Risks to economic activity remain tilted to the downside: severe disruptions in energy, notably gas, supply would hit growth in Europe while pushing inflation further up.

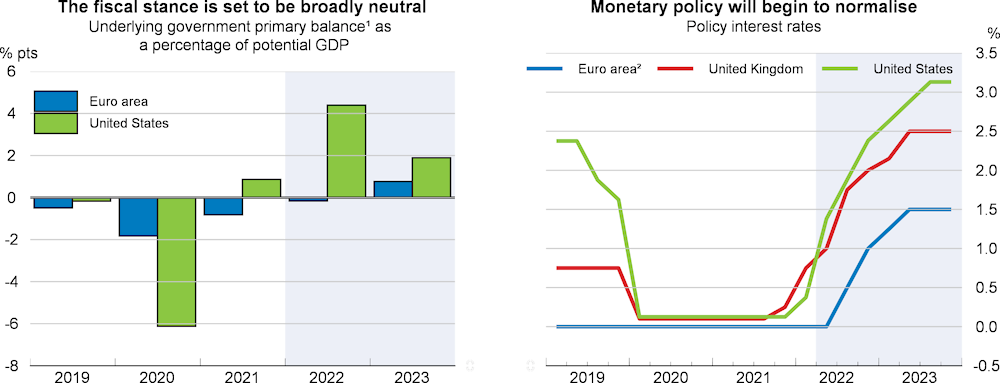

High uncertainty around the evolution of the war and its economic ramifications requires careful policy actions. Recovery and Resilience Facility funds need to be used effectively to support growth. Support to limit the effects of rising energy and food prices on consumers and businesses, while welcome, should be well targeted and avoid distorting price signals. As enacted during the pandemic, some common borrowing to strengthen energy security in Europe could be considered. While the case for removing monetary policy accommodation is strong given inflationary developments, this should be done carefully and be mindful of the evolution of the war to reduce risks of financial fragmentation.