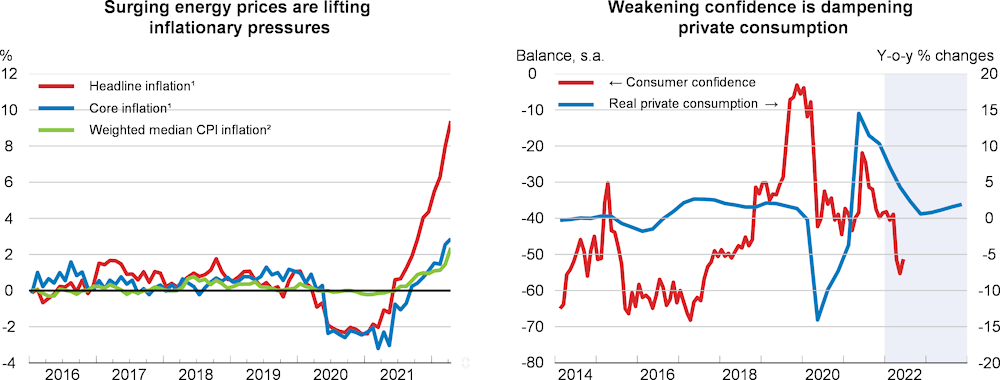

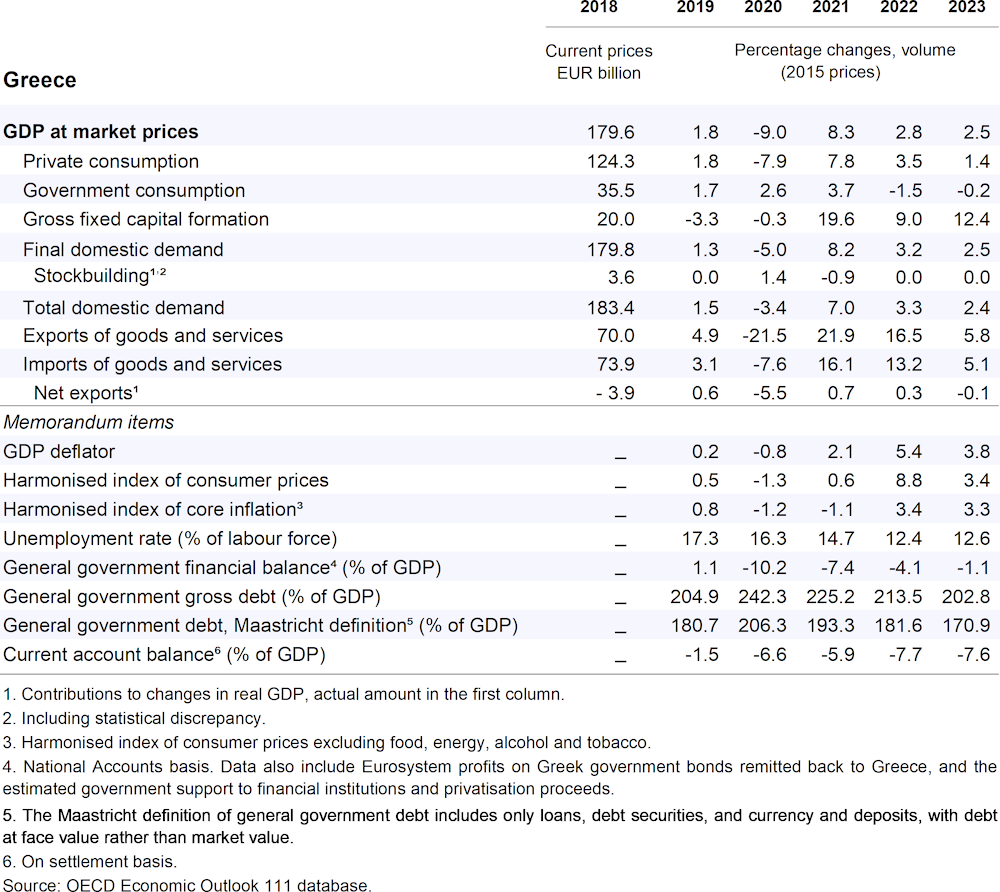

The recovery is expected to slow in 2022. Surging global prices, heightened uncertainty and tightening monetary conditions will be partly offset by disbursements of Greece’s recovery and resilience plan, fiscal support to households and firms, and rising exports and investment. Employment growth is expected to pause temporarily as employers face higher uncertainty, difficulties in hiring workers with relevant skills and rising wages. While supply pressures have risen, remaining spare capacity will dampen price pressures.

Revenues buoyed by rising prices and the recovery will help the government return the budget to a primary surplus in 2023. Using unplanned revenues and savings to rebuild the fiscal surplus, and ensuring support measures are temporary and targeted towards vulnerable households’ income rather than subsidising prices, would further improve fiscal sustainability. Greater fiscal sustainability, along with resolving banks’ remaining non-performing loans, would support Greece achieving an investment-grade sovereign debt rating, improving access to finance. While Greece is shifting its energy supply from Russia, improving energy efficiency and developing renewable sources would support long-term energy security and sustainability.