This chapter describes market developments and medium-term projections for world biofuel markets for the period 2023-32. Projections cover consumption, production, trade and prices for ethanol and biodiesel. The chapter concludes with a discussion of key risks and uncertainties which could have implications for world biofuel markets over the next decade.

OECD-FAO Agricultural Outlook 2023-2032

9. Biofuels

Copy link to 9. BiofuelsAbstract

9.1. Projection highlights

Copy link to 9.1. Projection highlightsPolicies and global transport fuel are key drivers in biofuel markets

Biofuel use will continue to be largely driven by transport fuel demand and domestic support policies. Global transport fuel use in this Outlook is based on the IEA World Energy Outlook which foresees a reduction in many high-income countries, while increasing in low-income countries. Middle-income countries are predicted to take the lead in biofuel market expansion through the implementation of blending mandates and availability of subsidies for domestic production and blended fuel use.

Global biofuel use is projected to expand substantially over the next decade (Figure 9.1). In the United States, the largest biofuel producer, biofuel demand is expected to remain strong thanks to the Renewable Fuel Standard (RFS) regime. While ethanol consumption is anticipated to remain relatively flat over the projection period, biodiesel (including renewable diesel) is expected to be the major contributor to global growth, due to the increasing targets for state and federal renewable fuel programs and biomass-based diesel tax credits, which have been extended through 2024 under the Inflation Reduction Act of 2022. In the European Union, the RED II (Renewable Energy Directive) has classified palm oil-based biodiesel as a high ILUC (Indirect Land Use Change) risk category and as a result the use of palm oil-based biodiesel is expected to decrease slightly reducing total biodiesel use in the European Union. Nevertheless, the share of biodiesel in total diesel use is expected to grow over the coming decade. The Clean Fuel Regulations in Canada are projected to lead to biofuel consumption in the country being twice as high in 2032 compared to today.

Transport fuel consumption is expected to expand in Brazil, Argentina, Colombia and Paraguay over the coming years, with ethanol and biodiesel usage projected to increase accordingly. Indonesia's blending rate is assumed to stay above 30% (B30), while diesel and biodiesel use is set to rise. In South and Southeast Asian nations, biodiesel is expected to become more popular due to the growth in transport fuel demand and industrial use. In India sugarcane-based ethanol is projected to contribute significantly towards the goal of achieving an ethanol blend rate of 16% by 2025, whereas the E20 target would be met by 2032.

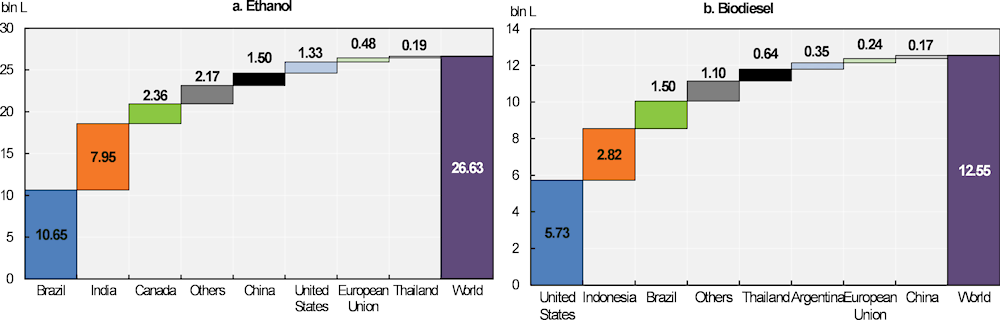

Figure 9.1. Regional contribution of growth in biofuel consumption

Copy link to Figure 9.1. Regional contribution of growth in biofuel consumption2032 to base period

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The production of biofuel is expected to remain largely reliant on first generation feedstocks such as maize and sugarcane to produce ethanol and vegetable oil for biodiesel. Used cooking oil (UCO) based biodiesel production is projected to gain importance in the European Union, United States, and Singapore. Governments have implemented policies mainly designed to reduce the national carbon footprint, decrease the dependency on fossil fuels, and support domestic agricultural producers. Production support and mandated use usually result in self-sufficient domestic markets, leaving only a small international market. The Outlook projects that by 2032, the amount of biodiesel traded internationally will decrease from 13% to 11% of total production, while the amount of ethanol traded internationally will drop slightly to 7% of total production.

The outlook for international biofuel prices expects an adjustment period of two years in which prices return from their peaks in 2022 back to normal levels. Thereafter, a rise in nominal terms throughout the forecast period is expected, with a slight decline in real terms for ethanol and a slight increase for biodiesel. Prices of biofuels continue to be determined by a mix of fundamental factors, such as feedstock costs, crude oil prices, distribution costs, and government policies, such as production subsidies, consumer tax credits, and blending regulations.

The policy context, largely determined by energy and environmental issues, is an important source of uncertainty in the projections for the transportation sector. The Outlook does not anticipate a significant increase in advanced biofuels, such as cellulose-based ethanol or HVO-based biodiesel, over the outlook period. Renewable diesel and Sustainable Aviation Fuel (SAF) production could potentially rise stronger than anticipated in this Outlook in the long run, yet its success depends on technological progress, mandated use, and the availability of sustainable feedstock. A long-run uncertainty is the global electric vehicle (EV) stock that has many underlying factors, including consumer preferences, technology, resource availability, policy or indirect fuel market effects. The use of these vehicles has been growing since the mid-2000s. To date, more than 20 countries have announced plans to gradually eliminate internal combustion engine (ICE) vehicle sales in the next 10-30 years. Numerous countries have introduced targets for EV deployment, as well as other initiatives to boost EV utilisation and research and development. In addition, the current instability in the energy and oil sectors is causing governments to prioritize self-sufficiency in energy supply, with biofuels seen as a key component to reduce vulnerability to global markets. As a result, uncertainty in the projections is influenced by the assumptions made about future developments in the transportation sector. Unexpected improvements in technology, together with potential changes in government regulations, could result in substantial variations from the current market projections for biofuels.

9.2. Current market trends

Copy link to 9.2. Current market trendsBiofuels (bioethanol and biodiesel1) are fuels produced from biomass. The Outlook defines biodiesel to also include renewable diesel SAF. Currently, about 60% of ethanol is produced from maize, 23% from sugarcane, 7% from molasses, 3% from wheat, and the remainder from other grains, cassava or sugar beets. About 70% of biodiesel is based on vegetable oils (14% rapeseed oil, 23% soybean oil, and 29% palm oil) and used cooking oils (25%). More advanced technologies based on cellulosic feedstock (e.g. crop residues, dedicated energy crops, or woody biomass) account for small shares of total biofuel production. International biofuel sectors are strongly influenced by national policies that have three major goals: farmer support, reduced GHG emissions, and/or increased energy supply and independence.

In 2022, biofuels consumption increased, offsetting the decrease caused by the drop of global transport fuel use during the COVID-19 pandemic, which brought restrictions on people's movements, as well as disruptions in trade logistics all over the world. The ethanol market nearly came back to levels observed in 2019. The biodiesel market was less affected by the pandemic, due to the higher blending requirements, tax credits, direct subsidies and decarbonisation initiatives which made up for the lower total diesel consumption. While biofuels world prices increased owing to higher cost of production through higher costs of feedstock (vegetable oil, maize, sugarcane, and molasses) and labour, oil price increases exceeded those witnessed in the biofuels markets, thus sustaining the incentives to continue and even expand the use of biofuels.

Table 9.1. Biofuel production ranking and major feedstock

Copy link to Table 9.1. Biofuel production ranking and major feedstock|

|

Production ranking (base period) |

Major feedstock |

||

|---|---|---|---|---|

|

|

Ethanol |

Biodiesel |

Ethanol |

Biodiesel |

|

United States |

1 (46.4%) |

2 (18.3%) |

Maize |

Used cooking oils, soybean oil |

|

European Union |

4 (5.3%) |

1 (32.2%) |

Sugar beet / wheat / maize |

Rapeseed oil /Palm oil/ used cooking oils |

|

Brazil |

2 (25.2%) |

4 (12.3%) |

Sugarcane / maize |

Soybean oil |

|

China |

3 (7.9%) |

5 (3.6%) |

Maize / cassava |

Used cooking oils |

|

India |

5 (4.3%) |

15 (0.4%) |

Molasses / sugarcane / maize / wheat / rice |

Used cooking oils |

|

Canada |

6 (1.6%) |

12 (0.7%) |

Maize / wheat |

Canola oil / used cooking oil/soybean oil |

|

Indonesia |

18 (0.1%) |

3 (17.6%) |

Molasses |

Palm oil |

|

Argentina |

8 (1%) |

6 (3.3%) |

Maize / sugarcane/ molasses |

Soybean oil |

|

Thailand |

7 (1.4%) |

7 (3.0%) |

Molasses / cassava/ sugarcane |

Palm oil |

|

Colombia |

13 (0.4%) |

10 (1.2%) |

Sugarcane |

Palm oil |

|

Paraguay |

10 (0.5%) |

17 (0.02%) |

Maize/ sugarcane |

Soybean oil |

1. Numbers refer to country ranking in global production; percentages refer to the production share of countries in the base period.

2. In the OECD-FAO Agricultural Outlook 2023-2032, biodiesel includes renewable diesel (also known as Hydrotreated Vegetable Oil or HVO), although these are different products.

Source: OECD/FAO (2022), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

9.3. Market projections

Copy link to 9.3. Market projections9.3.1. Consumption and Production

Asian countries are driving biofuel supply and demand

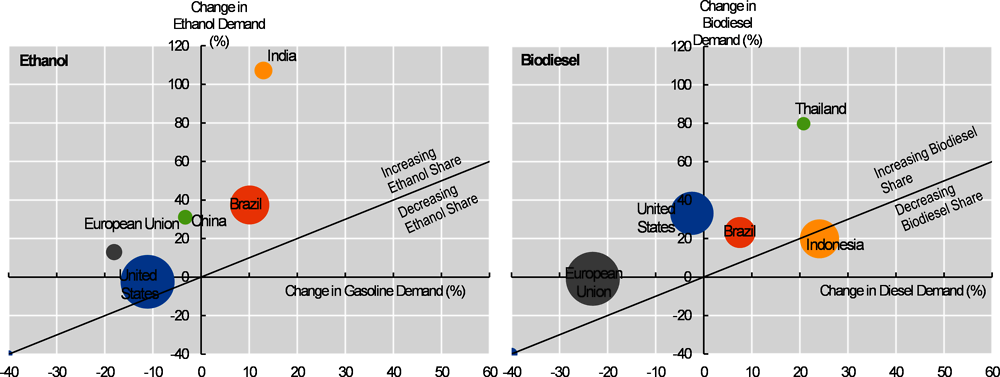

Globally, the Outlook expects biofuel consumption and production to increase at a much slower pace (1.3% p.a.) during the projection period than in previous decades primarily as result of policies not increasing support in developed countries. This slowdown is particularly significant for biodiesel consumption which grew by more than 7% p.a. over the past decade. Nonetheless, demand for biofuels is expected to increase due to developments in transportation fleets in some countries where total fuel consumption is still projected to increase and domestic policies that favour higher blends. Figure 9.2 shows that the share of biofuels in total transport fuels increases almost for all major producers except for biodiesel in Indonesia where it remains stagnant.

Five countries account for 80% to the increase in global biofuel consumption. For biodiesel, those are the United States, Indonesia, and Brazil, and for ethanol they are Brazil, India and Canada (Figure 1.1)

Figure 9.2. Biofuel demand trends in major regions

Copy link to Figure 9.2. Biofuel demand trends in major regions

Note: Shares calculated on demand quantities expressed in volume. The size of each bubble relates to the consumption volume of the respective biofuel in 2022.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global ethanol and biodiesel production is projected to increase to 150.9 bln L and 66.9 bln L, respectively, by 2032 and will continue to be dominated by traditional feedstocks despite the increasing sensitivity to the sustainability of biofuel production observed in many countries (Figure 9.3).

Note: Traditional feedstocks are here defined as food and feed crop based biofuels. Values in Petajoules = 1015 Joules.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

United States

In the United States, biofuels are expected to be sustained by the Renewable Fuel Standard (RFS) regime administered by the EPA at recently announced levels in volume terms while a decrease in the use of transportation fuel is projected. Most of gasoline will continue to be used for 10% ethanol blend (E10). Some growth is projected in 15% ethanol blend (E15), but infrastructure, technology and other constrains limit the mid-high-level blending. The ethanol blend rate limit is projected to increase to 11% by 2032.

Ethanol production and consumption are expected to increase slightly relative to the base period (Figure 1.1). Maize is assumed to remain the main feedstock for ethanol production, accounting for 99% of production in 2032. Cellulosic ethanol production capacity is assumed to increase, albeit from a still low initial level. Although the United States should maintain its position as the world’s largest ethanol producer, its share of global production should decrease from 46% to 40%. Biodiesel production is projected to increase by 2.7% p.a. in the coming decade. This is driven by increased renewable diesel consumption due to the higher targets for state and federal renewable fuel programs and biomass-based diesel tax credits, which have been extended through 2024 under the Inflation Reduction Act of 2022. The United States is projected to increase its share in global biodiesel production from 18% in the base period to 24% in 2032. This is also sustained by import demand for renewable diesel from Canada to comply with their clean fuel targets.

European Union

Since 2010, EU legislation related to biofuel support has been based on the 2009 Renewable Energy Directive (RED), which required that at least 10% of transport energy use in EU Member States should be based on renewables by 2020. In 2018, agreement was reached to increase the transport sector target to 14%, with national caps on food and feed crop-based biofuels at 1 percentage point above 2020 levels, but not exceeding 7%. A new framework was adopted under Directive 2018/2001. RED II entered into force in 2021 to be implemented by 2030.2 RED II set a new overall renewable energy target of 32% by 2030. It classified palm oil-based biodiesel under a high ILUC risk category and thus consumption of this source as biodiesel feedstock is expected to decline.

For the European Union, total fuel transport use projections are taken from the EU Agricultural Outlook 2022-32 where fuel use is projected to decrease for both diesel and gasoline. However, this downward trend is not expected for biofuel consumption. Biodiesel use is assumed to remain at similar levels as in the base year and ethanol consumption is expected to increase. This implies that the share of biodiesel in total diesel increases from 10% in 2022 to 13% and the share of ethanol in gasoline use would reach 8.7% compared to 6.3% in 2022. As to consumption, biodiesel production remains overall stable, although the share that is produced from palm oil, in view of sustainability considerations, will decrease from 21% to 8% in 2032. Biodiesel production from used cooking oils is projected to increase by 1.5% p.a., albeit a much slower rate than the past decade given availability constraints of this feedstock. Responding to the demand projections for the biodiesel sector, the European Union is expected to remain the world’s largest biodiesel producing region in 2032 although global production shares are expected to decrease from 32% to 26%.

Brazil

Brazil has a large fleet of flex-fuel vehicles that can run on either gasohol (a mix of gasoline and anhydrous ethanol, also called gasoline C) or on pure hydrous ethanol. For gasohol, the ethanol blend rate ranges between 18% and 27%, depending on the price relationship between domestic sugar and ethanol. The current percentage requirement for ethanol is legislated at 27%. Due to the fuel tax exemptions in 2022 as well as easing gasoline prices in the second half of the year, consumers have purchased more gasoline at the pump, benefiting anhydrous inclusion, but to the detriment of hydrous ethanol. The biodiesel blending target is 15% but has been reduced to 10% since 2021. For 2023 Brazil's National Energy Policy Council announced its gradual return to 15% by 2026, which the Outlook assumes to be maintained until 2032.

For the coming decade it is assumed that Brazilian ethanol consumption will increase by 2.5% p.a., sustained by the RenovaBio programme.3 This programme, signed in January 2018, is intended to reduce the emissions intensity of the Brazilian transport sector in line with the country’s commitments under COP21. Brazilian ethanol production is projected to increase with a similar pace as consumption. While the Outlook assumes that sugarcane will remain the main feedstock for ethanol, maize, which increased over the past five years from below 0.3 bln L to over 4.4 bln L, is assumed to gain greater shares in the feedstock mix and reach almost 7 bln L by 2032.

In contrast to the United States and the European Union, total fuel consumption of gasoline and diesel in Brazil is projected to increase over the coming decade, underpinning the potential growth of blending biofuels to gasoline and diesel. Consequently, the Outlook projects ethanol and biodiesel consumption increasing respectively by 2.5% p.a. and 1.6% p.a. in Brazil.

Indonesia

The implementation of B30 (Biodiesel 30% blend) aims at reducing the country’s dependency on imported fossil fuels, stabilising palm oil prices, reducing GHG emissions and sustaining the domestic economy as it accounts for nearly half a million jobs in the country. In recent years, biodiesel production has steadily increased due to a national biodiesel programme, which provides support to biodiesel producers, and it is financed by the crude palm oil (CPO) fund which is fed by the levy imposed on CPO exports. In 2021, the CPO fund revenue stood at around USD 4.9 billion of which about USD 3.5 billion was allocated to subsidize biodiesel. Nonetheless, owing to external factors such as the economic crisis related to COVID-19, the government set rules restricting CPO exports aiming at alleviating domestic food price inflation. In the second half of 2022, such restrictions were lifted as CPO inventories were accumulating. To stimulate exports, the export levy was set up temporally at zero with a view to increase it once the reference price exceeds USD 800 per metric tonne. The Outlook assumes producer prices to stay above the reference price over the projection period, thus allowing the replenishment of the CPO fund that will not only allow to continue subsidizing domestic biodiesel production but to increase the blend at 35%. At the same time, the level of the subsidy relies to some extent on the cost of fossil fuels and oil prices increasing over the projection period will help to reduce the subsidy per unit of biodiesel.

Based on these assumptions, biodiesel production in Indonesia is projected to increase to 12.4 bln L by 2032. However, in view of the EU environmental regulation and declining use of diesel in high-income countries, exports are projected to remain negligible over the outlook period.

India

India has accelerated ethanol production aiming to achieve the ambitious target of E20 (Ethanol 20% blend) by 2025 rather than 2030. However, the Outlook foresees limitations on feedstock supplies being able to increase biofuel production to reach the target levels over the outlook period. While the Outlook assumes molasses and sugar cane juice would remain as the primarily feedstocks, other crops such as rice, wheat and other coarse grains will help to accelerate domestic production. Sugar mills are investing and developing the capacity to produce ethanol from sugarcane juice as sugar cane is aided by soft loans. In 2022, it is estimated that about 25% of ethanol was produced by sugar cane, and this share could increase to nearly 55% by 2032. However, given accelerating gasoline demand, the blending rate could reach 16% in 2025 and 20% in 2032. Ethanol production is expected to be 13 bln L in 2032. The limited supply of vegetable oils, for which India is a net importer, in combination with high international prices will remain the main constrains to significantly increase biodiesel production.

China

The biofuel policies of the People’s Republic of China (hereafter “China”) have been volatile in the past years, which constrained significant consumption growth. Despite President Xi's pledge to achieve a peak in carbon dioxide emissions by 2030, no mention has been made of the role of biofuels in this context. The Outlook assumes that the ethanol blending rate which was around 1.2% in recent years will increase to 1.7% in 2032. This increase compensates for the projected decrease of total gasoline use sustaining an ethanol consumption growth of 1.1% p.a. over the next decade. Similarly, biodiesel consumption is projected to increase 2% p.a. The Outlook assumes most of the ethanol demand will be produced from domestic feedstock.

Argentina

In 2022, biodiesel production recovered further after the COVID-19 pandemic caused a decrease in diesel demand, with domestic utilization more than making up for decreases in exports to the European Union. There were no announcements made for new investments in biofuel capacities in 2022. However, in June 2022, the government resolved to increase the biodiesel mandate from B5 to B7.5 but allowing it to be temporarily increased as high as B12.5 to be able to respond to diesel shortages. The Outlook assumes B7.5 as blending target and with limited additional export possibilities, biodiesel production is projected to increase only marginally over the next decade.

Ethanol blending has been maintained at 12% despite a push from bioethanol producers to have the blending target increased to 15%. The Outlook assumes the rate to remain at this12% target and with total gasoline use projected to increase, ethanol fuel use is projected to increase 0.8% p.a.

Thailand

In spite of the targets set in the Alternative Energy Development Plan (AEDP) for sugar cane (and indirectly molasses) and cassava, limited domestic availability is expected to constrain biofuels production. In addition, stagnating demand for fossil fuels will limit increasing demand for ethanol. On average, blending is expected to reach 14% over the outlook period and production is projected to increase marginally to 2 bln L in 2032. Biodiesel demand is expected to be supported by mandatory blending. However, palm oil supply and high vegetable oil prices will constrain both domestic supply and demand to an increase of 2.2 bln L by 2032.

Colombia

Ethanol demand is projected to increase over the outlook period in line with the recovery of gasoline demand. Due to local supply shortages, the government decreased the ethanol blend rate to 4% between April and September 2021, with the average blending rate in 2022 about 8%. Over the medium term, the blending rate is projected to return to 10%. The Outlook assumes sugarcane to continue as the main feedstock. In 2032 biofuels use will account for about 35% of sugarcane production from 22% in the base period, thus consolidating ethanol as an important element in sustaining the Colombian sugarcane industry. Biodiesel demand was subdued in 2019 and 2020 due to a decline in diesel demand, but in 2021 and 2022 the blending rate reached 12%. The Outlook assumes this level will continue and production is projected to reach 0.9 bln L by 2032.

Other countries

Other relatively important producers of ethanol include Paraguay, the Philippines, and Peru, where production could reach 0.8 bln L, 0.6 bln L and 0.3 bln L, respectively by 2032; the blending rate in these three countries is assumed to remain stable at around 30%, 10% and 7%, respectively. Malaysia, the Philippines and Peru are also major biodiesel producers, where production could reach 1.7 bln L, 0.3 bln L and 0.3 bln L, respectively, by 2032. In Malaysia, blending is projected to remain around 10%, whereas in Peru and the Philippines it will be around 5% and 4%, respectively. Other Asian countries, in particular Singapore, would increase production to reach around 1.4 bln L of biodiesel from used cooking oil in 2032. Unlike most countries where biofuels are domestically used to reduce GHG emissions and to reduce national dependency on imported oil, production of biodiesel in Singapore is largely exported.

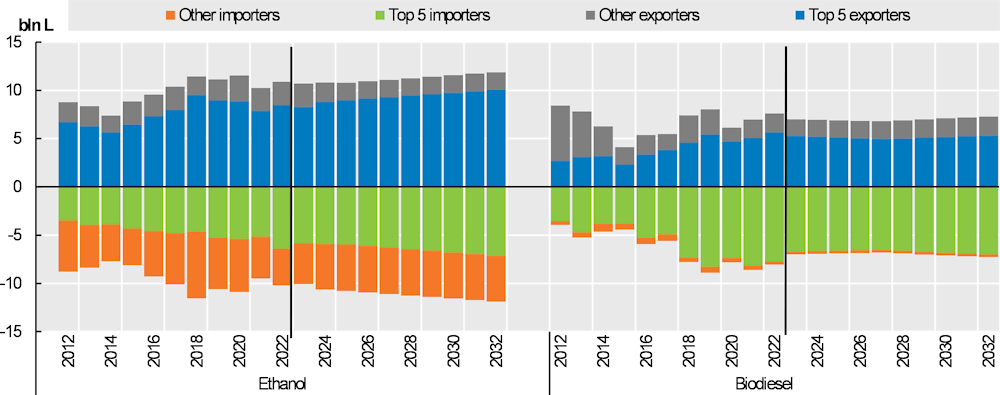

9.3.2. Trade

Global Biofuel trade is stagnating

World ethanol trade is projected to increase from 10 bln L in the base period to 12 bln L in 2032, while the total share of production will remain constant at 8%. The United States and Brazil are expected to remain the main exporters of maize- and sugarcane-based ethanol. The export share of both countries together is expected to remain at about 70%, but the United States will gain some export shares from Brazil where increases in domestic biofuel use hamper export growth.

Globally, biodiesel trade accounts for 13% of production and is projected to decrease from 7.6 bln L to 7.3 bln L by 2032 with its share in production falling to 11%. Indonesian biodiesel exports fell dramatically in 2020 and have since remained low. Reflecting high domestic demand, the Outlook does not expect Indonesia to return with biodiesel exports to international markets. The top 5 exporters of biodiesel, China, the European Union, Argentina, the United States and Malaysia, are projected to decrease their market share from 75% in the base period to 73% in 2032, with Argentina taking over second position from the European Union.

Figure 9.4. Biofuel trade dominated by a few global players

Copy link to Figure 9.4. Biofuel trade dominated by a few global players

Note: Top five ethanol exporters in 2032: United States, Brazil, Pakistan, European Union, Paraguay. Top five ethanol importers in 2032: Canada, Japan, European Union, United Kingdom, India. Top five biodiesel exporters in 2032: China, Argentina, United States, European Union, Malaysia. Top five biodiesel importers in 2032: European Union, United States, United Kingdom, Canada, China. Classification of biofuels by domestic policies can result in simultaneous exports and imports of biofuels in several countries.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

9.3.3. Prices

Prices in real terms are expected to decrease

Nominal biodiesel and ethanol prices reached historical high levels in 2021 and in 2022 increased further. Following the prices for feedstock commodities as well as the oil price, nominal and real biofuel prices are assumed to decrease in 2023 and 2024, but thereafter nominal prices are projected to slowly increase through to 2032. In real terms, both ethanol and biodiesel prices are expected to decrease over the coming decade.

Figure 9.5. The evolution of biofuel prices and biofuel feedstock prices

Copy link to Figure 9.5. The evolution of biofuel prices and biofuel feedstock pricesNote: Ethanol: wholesale price, US, Omaha; Biodiesel: Producer price, Germany, net of biodiesel tariff and energy tax. Real prices are nominal world prices deflated by the US GDP deflator (2022=1). As proxy for the biodiesel feedstock price, the world vegetable oil price is used and for ethanol a weighted average between raw sugar and maize is applied.

Source: OECD/FAO (2023), ''OECD-FAO Agricultural Outlook'', OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

9.4. Risks and uncertainties

Copy link to 9.4. Risks and uncertaintiesEvolution of policies and relative prices are key risks

The major risks and uncertainties for the future development of the biofuels sector are largely related to the policy environment, feedstock, and oil prices. Policy uncertainty concerns changes in mandate levels, enforcement mechanisms, investment in non-traditional biofuel feedstock, tax exemptions and subsidies for biofuels and fossil fuels, and policies promoting EV and SAF technology.

The policy environment will remain uncertain because it crucially depends on agricultural feedstock and oil prices developments. Fossil fuel prices affect biofuel competitiveness and are thus linked to subsidies allocated to the biofuel sector. Oil markets have been very volatile in recent years and this tendency was further accentuated by the Russian Federation’s war against Ukraine. Such extreme price swings in the energy markets have affected the structure of the biofuels market and could have a long-lasting effect. Another uncertainty arises from feedstuff supply. Traditionally, countries sought to use surplus commodities for biofuels so to not reduce food availability and threaten food security. As biofuels compete with food use and may require extra crop land, countries are cautious on expanding biofuel production at a faster pace. Nevertheless, blending mandates are expected to lead to more biofuel production in some emerging economies.

Recent price spikes in the cereal and vegetable oil markets have revived the discussion around the ethics of fuel versus food, while some people struggle to obtain enough food. One possibility would be to use biofuel policies as a buffer in food price crises by, for example, reducing mandates for a period of time. The effectiveness of such an approach is yet to be proven but, even if implemented, would not alter the linear projections from the baseline.

The global EV stock has been increasing since the mid-2000s. More than 20 countries have announced the complete phasing out of ICE vehicle sales and eight countries plus the European Union have announced net-zero emission vehicle pledges over the next 10-30 years.4 Many countries have introduced EV deployment targets, purchase incentives and other supporting programmes for increasing EV utilisation and promoting R&D for EV. However, recent events showed that policies supporting EV can be revoked or suspended. For example, China removed the effective subsidy for EV in January 2023. SAF consumption and production could increase in the long term but its success relies on technological advancements, ambitious policies and securing sustainable feedstock. Advances in technology and potential changes in the regulatory framework of the transport sector could result in substantial deviations from current market projections for biofuels. Countries are expected to adopt policies to advance the implementation of new technologies to cut greenhouse emissions, via blending mandates, subsidies, and tax reductions. All these measures transfer uncertainty in energy to agricultural markets and as a consequence, future biofuel demand is related to the response of the private sector to these measures. Industries currently investing in EV and SAF could, depending on the uptake of this technology and the policies supporting its adoption, considerably alter the use of biofuels over the next decade and beyond.

Notes

Copy link to Notes← 1. Biodiesel includes renewable diesel (also known as Hydrotreated Vegetable Oil or HVO), although these are different products.