The OECD created an industry survey to collect views on the topic of transition finance of different stakeholders, including financial institutions, non-financial corporates, academia, data and service providers, public finance institutions (such as central banks and development banks), and non‑governmental organisations and other relevant actors. The purpose of the survey was to gather insights on the perceived barriers and enabling factors to accessing transition finance, the most important elements to a credible corporate transition plan, as well as the market’s perspective on current developments.

The survey consisted of 17 questions to ask market participants about different elements of transition finance, financial and environmental credibility, and a few questions on the background of the respondent. A branching method was used to present only relevant questions to different respondents, based on stakeholder type. This enabled to tailor questions on financial risk management practices to only financial institutions, for example, and gather results from only relevant stakeholders on each question.

The survey was sent to a broad range of market participants, mainly through the networks of the International Capital Markets Association, the Principles for Responsible Investment, the European Chemical Industry Council, and the network of the OECD’s Centre for Green Finance and Investment to gather a diverse range of views from relevant stakeholders. Respondents were given two weeks to submit their responses, which amounted to 178 in total. Analysis of the survey results informed the OECD Guidance on Transition Finance.

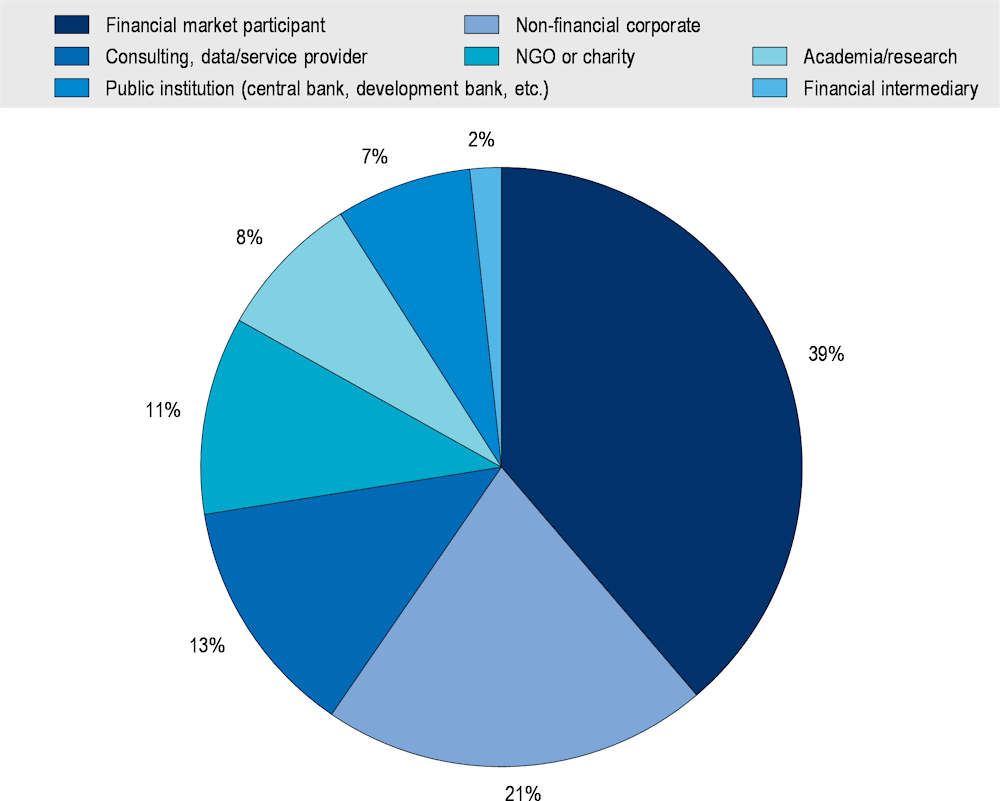

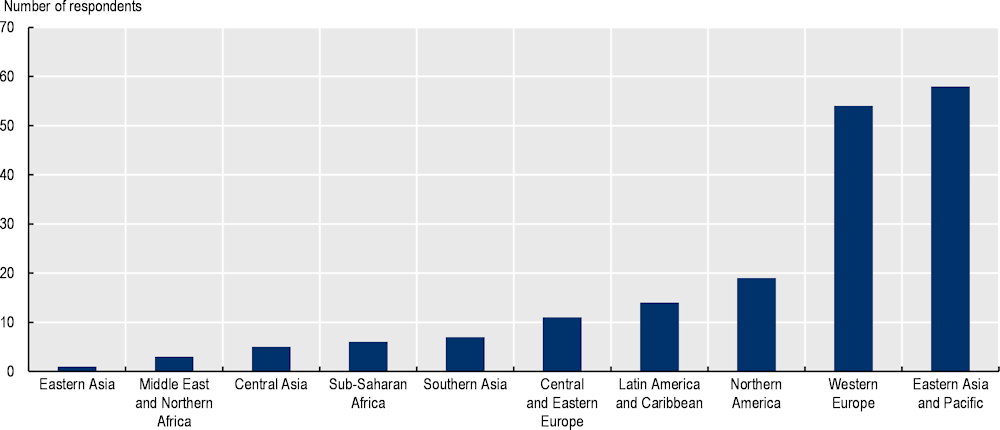

The OECD received a diverse range of responses, with financial institutions and non-financial corporates making up the largest proportions, with 39% and 21%, respectively. In terms of geographical breakdown, this is heavily tilted towards East Asia and the Pacific and Western Europe, with over 100 respondents headquartered in either of these regions. This might be reflective of where the most attention to transition finance is taking place. The two figures below illustrate the breakdown of respondents by stakeholder groups and region of organisations’ headquarters.