This chapter provides an overview of existing approaches to transition finance and financial instruments commonly associated with transition finance, notably, sustainability-linked bonds and loans, and transition bonds. Within existing approaches, this chapter first identifies those that do not explicitly rely on corporate transition plans and are predominantly based on specific tools like national or regional taxonomies or national sectoral pathways and roadmaps. The chapter then separately identifies the growing field of transition finance approaches that revolve around corporate transition plans, including initiatives by non-governmental organisations and industry, the public sector, as well as transnational bodies. As set out in Chapter 1, in the context of this Guidance, transition finance is understood as finance raised or deployed by corporates to implement their net-zero transition, in line with the temperature goal of the Paris Agreement and based on a credible corporate climate transition plan.

OECD Guidance on Transition Finance

2. What is transition finance?

Abstract

2.1. State-of-play: Existing approaches to transition finance

The exact details of the net-zero transition will be a function of each country’s specific domestic context. Resource endowment, economic structure, socio-economic priorities, fiscal capacity, current emission levels, mitigation costs and potentials, as well as the socio-political acceptability of potential climate and environmental policies will impact the shape and ambition of the transition. This concretely means that activities and sectors considered as ‘supporting the transition’ may vary from jurisdiction to jurisdiction, as well as over time, including depending on the capacities of different countries.

In this context, delineating ‘transition investments’ has been an increasing focus of various national and regional public authorities, industry associations, investors, and civil society. The OECD’s 2021 review of transition finance-related approaches suggests that, under existing approaches, transition finance has been generally understood as being intended to decarbonise entities or economic activities that: (i) are emissions-intensive,1 (ii) may not currently have a low- or zero-emission substitute that is economically available or credible in all relevant contexts,2 but (iii) are important for future socio-economic development. However, to date there is neither a consensus definition of transition finance, nor a set of technical criteria or qualifying sectors or technologies that are commonly agreed upon (Tandon, 2021[1]). Responses to the OECD industry survey on transition finance further corroborate the plurality of views in this area. Almost three quarters of respondents indicated that transition finance represents an opportunity for them to transition towards net zero across an organisation’s entire investment portfolio or business model and 30% of respondents consider that transition finance presents such an opportunity for specific asset classes or business lines. Moreover, over half of respondents reported that for them, transition finance is a way to reduce exposure to transition risk (policy and legal risks, technology risks, market risk and reputational risk), while 17% indicated that transition finance could be a source of greenwashing risk (see Figure 2.1 below).

Figure 2.1. For most market actors, transition finance represents an opportunity

Note: The number of respondents for this survey question was 178; multiple answers per respondent were possible.

Source: 2022 OECD Industry Survey on Transition Finance.

Different jurisdictions are pursuing a spectrum of approaches to identify and designate investments that align with their domestic priorities, while contributing to the net-zero transition. Table A A.1 in Annex A provides an overview and comparison of transition finance approaches that do not focus on corporate transition plans but are based on other selected tools, and sometimes a combination of those tools to guide investment selection at activity–, or entity-level, or both. They include, notably, taxonomies, Nationally-Determined Contributions (NDCs), pathways, sectoral roadmaps, high-level guidelines and principles. For example, Japan has put in place guidelines that include dedicated sectoral roadmaps, while Malaysia has put forward a principles-based taxonomy, and Singapore a taxonomy based on a traffic light system. The ASEAN Taxonomy takes a hybrid approach, putting forward a multi-tiered framework that considers differences among ASEAN Member States and allows them to choose between using a principles-based approach, quantitative thresholds, or a combination thereof. The European Union (EU), on the other hand, has proposed a list of eligible activities, qualitative criteria, and thresholds to define which economic activities qualify for the EU Taxonomy. In 2021, multilateral development banks (MDBs) revised their Common Principles for Climate Mitigation Finance Tracking comprising eligibility criteria for climate mitigation finance, which, after a two-year roll-out period, will be adjusted to focus also on criteria for transitional and enabling activities (EIB, 2021[2]) (see Chapter 4 for further insights on taxonomies).

Existing approaches differ in their level of prescriptiveness, with criteria and thresholds-based taxonomies on the one hand, and principles or guidance on the other. They also differ when it comes to their degree of environmental ambition, with some considering alignment with Nationally Determined Contributions (NDCs) to be sufficient, while others do not rely on NDCs since these are often insufficient to meet the Paris Agreement temperature goal (Tandon, 2021[1]). Similarly, eligible investments vary across jurisdictions depending on their emissions contribution and economic significance. Some approaches also underline the need to direct capital towards new technologies (METI, 2020[3]) and cover a wider portion of the value chain (Platform on Sustainable Finance, 2021[4]). Moreover, while almost all approaches feature the ‘do no significant harm’ principle, only a few set out specific criteria on how to assess it. To date, as indicated by respondents to the OECD Industry Survey on Transition Finance, when identifying transition finance opportunities, market actors mainly use the International Capital Markets Association’s (ICMA) Principles and Handbook, Climate Bonds Initiative’s (CBI) frameworks, the EU Taxonomy or frameworks developed internally.

2.2. Taking stock of transition-related financial instruments

The OECD’s 2021 review analysed a sample of financial instruments that are explicitly labelled, marketed, or based on literature review generally believed to provide transition financing. The analysis showed that transition finance is currently extended mainly through fixed-income instruments and notably, sustainability-linked bonds and loans (Tandon, 2021[1]) (see Glossary in Annex E for the definitions of these instruments). However, the debt market alone will not be sufficient to mobilise enough capital for the net-zero transition. Other types of general-purpose finance, such as equity investments, will also be needed. In particular, private equity and venture capital could play a much more prominent role, for example to finance breakthrough low-emission innovations. Greater use of hybrid instruments such as convertible bonds combining features of KPI-linked instruments, could also be considered (OECD, 2021[5]). Beyond the type of financial instrument deployed to raise transition finance, it is also important to note that financing terms need to reflect the specific needs of corporates seeking transition finance, for instance in terms of duration, currency, risk profile, domicile, etc.

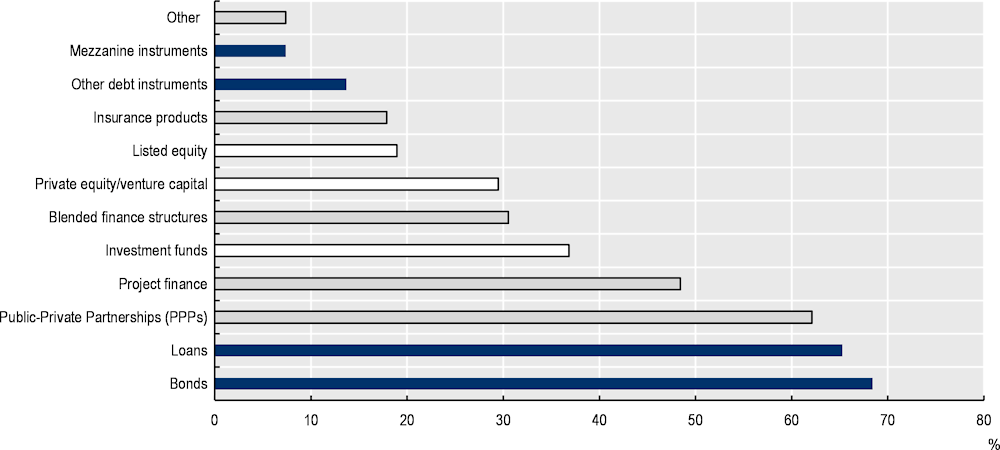

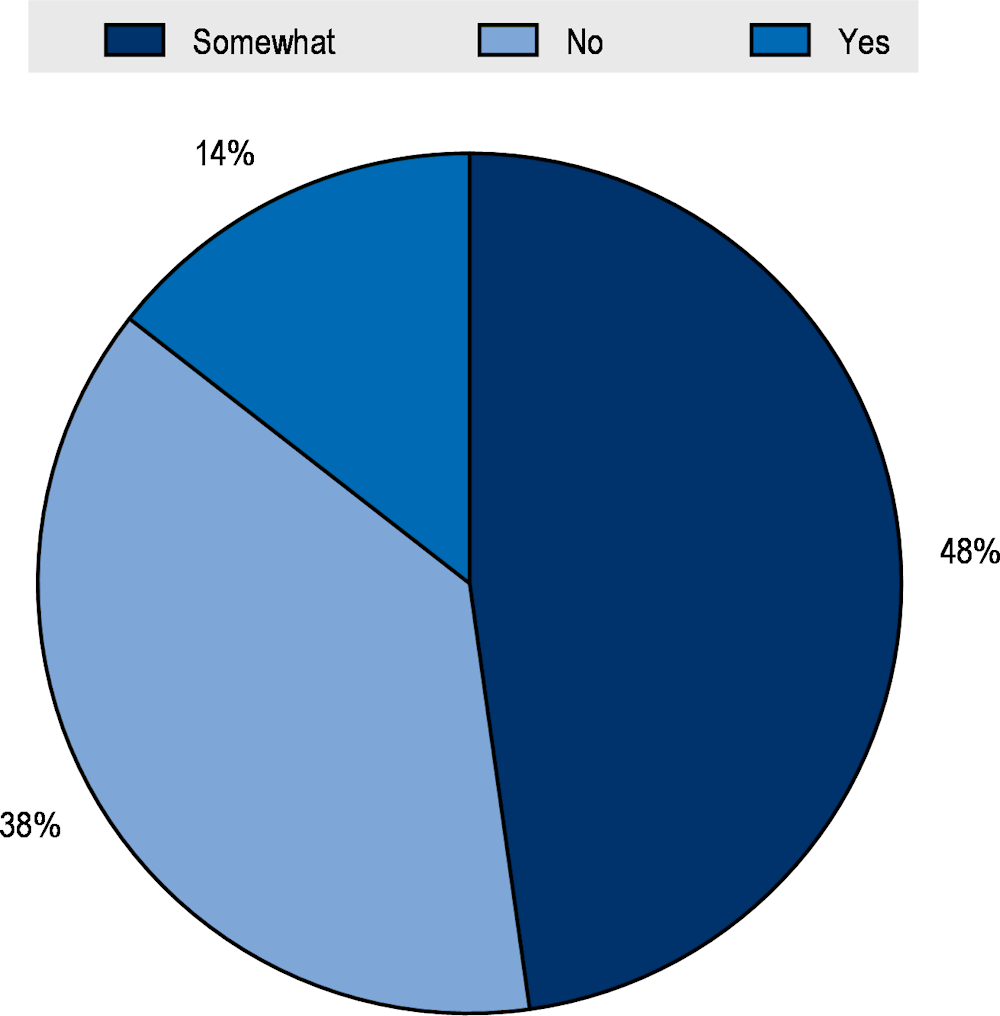

Responses to the OECD Industry Survey on Transition Finance indicated that there is no consensus on the role that individual financial instruments do and will play in transition finance-related transactions. However, many respondents identify debt-related instruments to play the most prominent role. Over half of survey responses pointed to bonds, loans, blended finance or public-private partnerships as those mostly used (with no significant difference, in terms of preferences, across the three sets of instruments), followed by project finance (selected by 13% of responses) and investment funds (10%). Equity instruments were reported to be relevant by only 13% of responses, with 8% indicating private equity and venture capital will be most deployed and 5% selecting listed equity. Insurance products were selected by merely 5% of responses (see Figure 2.2 below). The focus on debt-related instruments stands in contrast to views on current debt-to-equity ratios, where 62% of respondents see these as at least somewhat a material barrier to transition financing (see Figure 2.3 below). Hence, a corporate’s debt levels may become a pronounced constraint to their ability to finance their low-carbon transition.

Figure 2.2. Market actors consider that debt-related instruments will be deployed over equity in transition finance-related transactions

Note: Which financial instruments or mechanisms will be most deployed for transition finance-related transitions, in your view? Debt-related instruments highlighted in blue, equity-related instruments in white, other instruments shown in grey. The number of respondents for this survey question was 95; multiple answers per respondent were possible.

Source: 2022 OECD Industry Survey on Transition Finance.

Figure 2.3. Market actors view debt-to-equity ratios as a somewhat material barrier for transition financing

Note: The number of respondents for this survey question was 90.

Source: OECD Industry Survey on Transition Finance.

The growth of debt capital market instruments that are explicitly labelled, marketed, or generally believed to provide transition financing has been spurred by the publication of the ICMA Climate Transition Finance Handbook in 2020. The Handbook provides guidance to issuers on the “practices, actions, and disclosures to be made available when raising funds in debt markets for climate transition-related purposes, whether this be in the format of (i) use-of-proceeds instruments (green, social or sustainability bonds); or (ii) general corporate purpose instruments (sustainability-linked bonds)” (see the Glossary in Annex E for definitions). There have also been issuances explicitly labelled as “transition bonds” in the market. However, ICMA’s Handbook does not propose ‘transition’ as a separate market segment, but rather states that a ‘transition’ label applied to a debt instrument “should serve to communicate the implementation of an issuer’s corporate strategy to transform the business model in a way which effectively addresses climate-related risks and contributes to alignment with the goals of the Paris Agreement” (ICMA, 2020[6]). For this reason, ICMA considers that ‘transition bonds’ can be either green, sustainability bonds or sustainability-linked bonds issued by entities looking to align their financing strategy to their climate transition strategy and decarbonisation trajectory (ICMA, 2022[7]). Conversely, CBI proposes a ‘transition’ label and defines transition bonds as use-of-proceeds instruments used to finance activities or entities that are not low- or zero-emission (i.e., not green), but have a short- or long-term role to play in decarbonising an activity or supporting an issuer in its transition to Paris Agreement alignment (CBI, 2022[8]).

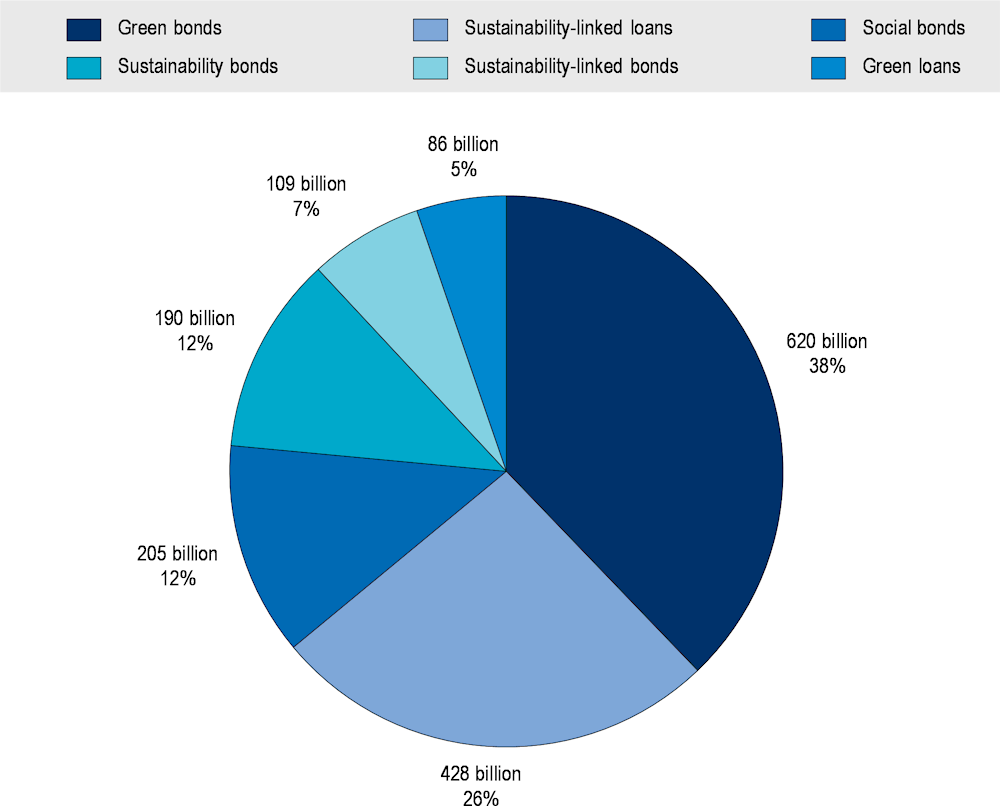

As Figure 2.4 below shows, the sustainable debt capital market (which amounted to USD 1.6 trillion in 2021, according to Bloomberg estimates) is dominated by green bonds (which represent 38% of 2021 issuances), sustainability-linked loans (SLLs) and bonds (SLBs) (which combined amounted to USD 537 billion in 2021 and accounted for 33% of the total), and, to a smaller extent, social and sustainability bonds.

Figure 2.4. Sustainable debt market by instrument (2021)

Since 2021, CBI also started to track bonds labelled as ‘transition’, while acknowledging the lack of agreed standards and definitions. According to CBI, the transition bond market is still relatively new but growing, with 13 bonds from ten issuers, amounting to USD 4.4 billion in 2021 (CBI, 2022[8]). CBI is currently developing sector-specific bonds and loans standards and criteria for several sectors, namely chemicals, cement, steel, hydrogen metal and mining, carbon capture and storage, and agriculture (CBI, forthcoming[10]).

2.2.1. The growth of sustainability-linked instruments

Sustainability-linked loans (SLLs) and bonds (SLBs) are relatively new and innovative performance-based financial instruments that allow companies to raise capital for general purposes.3 SLLs’ and SLBs’ financial and structural characteristics (such as the interest rate of a loan or coupon of a bond) vary depending on whether the borrower or issuer achieved sustainability performance targets (SPTs)4 for a predefined set of Key Performance Indicators (KPIs), which can cover a range of environmental and/or social targets.5 SLLs and SLBs represented respectively 26% (USD 428 billion) and 7% (USD 109 billion) of the total sustainable debt market in 2021 (see Figure 2.4 above) and represented the fastest growing segment.6 Most SLB issuances (88% of total issuance by volume) came from non-financial corporates (CBI, 2022[8]). SLBs include a penalty mechanism that is triggered in the event of non-compliance with pre-stipulated SPTs (trigger event). Penalty mechanisms can include coupon step-ups (most common), premium payments upon maturity set as fixed percentage (set in basis points) of redemption amount, or obligations to purchase offsets to meet the SPT calculated as a percentage (set in basis points) of the nominal amount. In case of SLLs, the interest rate on the loan increases if SPTs are missed.

As SLBs are accessible for issuers in any sector and geography, they are often described as a promising financial instrument for issuers in hard-to-abate manufacturing industry sectors such as iron, steel and petrochemicals production, who aim to raise financing for the entity’s decarbonisation. The sectoral breakdown of SLB issuances highlights the growing use of SLBs in industry subsectors. In 2021, the industry sector issued the second largest share of SLBs by volume (with the first being utilities) (CBI, 2022[8]). According to CBI, most sustainability-linked bonds (nearly 60% in Q1 2022, around USD 14 billion) target GHG or carbon emission reduction objectives. Of these targets, 77% were verified by the Science Based Targets initiative (SBTi) in Q1 2022, showing a steady increase from the previous year (CBI, 2022[11]).

The sustainability-linked instruments market has experienced fast growth in the last couple of years, notably in Europe and North America, which dominate the issuance of SLBs and borrowing through SLLs (Environmental Finance, 2022[12]). Scaling up sustainability-linked financial instruments in EMDEs, whose capital markets are often underdeveloped and where Sustainable Development Goals (SDGs) investment needs are greatest, could allow issuers to tap into new sources of finance for their transition (OECD, 2021[13]) (see Box 2.1 below for further insights on the use of sustainability-linked instruments by corporates in hard-to-abate sectors in EMDEs).

However, the sustainability-linked debt market is still nascent, and it is likely too early to assess the credibility, integrity, and real ambition of KPI-linked instruments. Central banks and asset managers emphasised the need for greater transparency and consistency in the methodologies used in sustainability-linked instruments to provide comparable and credible forward-looking metrics (NGFS, 2022[14]). Moreover, concerns have been raised on the use of composite Environmental, Social and Governance (ESG) ratings as KPIs to link the financing with, as ESG scores are currently highly dependent on the assumptions used by ESG ratings and data providers (NGFS, 2022[14]). For instance, the European Central Bank (ECB) does not consider improvements in ESG ratings or scores as acceptable SPTs for the purposes of determining the eligibility of assets as collateral in its credit operations or for its asset purchase programmes (ECB, 2022[15]). In addition, further standardisation on the KPIs and SPTs used can allow for comparability and thus potentially scale up this market. For example, while most sustainability-linked instruments are tied to emission reduction-related KPIs, less than 20% of sustainability-linked bonds are linked to scope 3 emission reduction targets (S&P, 2022[16]).

Addressing global fragmentation of core ESG data and metrics, will be critical to address challenges that may undermine the effectiveness of sustainable finance approaches used in financial markets. In this respect, as called for by the OECD Policy Guidance on Market Practices to Finance a Climate Transition and Strengthen ESG Investing, relevant policymakers, financial authorities and central banks (where appropriate within domestic mandates) should strengthen the availability of reliable and quality ESG data and metrics in line with global baseline standards and financial authorities should use the tools available to them to support greater transparency of ESG ratings methodologies and oversight of ESG rating providers to ensure high quality and interpretability of methodologies and outputs (OECD, forthcoming[17]). Overall, further research, data and standards are needed to ensure that the sustainability-linked debt market can grow with integrity and credibility, for example on how to set credible yet ambitious targets, use sector-specific pathways and align incentives on the financial reward\penalty and on sustainability performance.

Box 2.1. The use of sustainability-linked instruments by companies in EMDEs: insights from case studies

To shed light on the potential and growth challenges of sustainability-linked financial instruments, this Guidance includes case studies on companies that raised sustainability-linked finance for their decarbonisation in hard-to-abate sectors, with examples from both emerging and developing economies (see Annex D for the rationale behind the selection of the case studies, further background and details). Insights gathered through the case studies included the following:

Sustainability-linked instruments are relatively cost-effective to put in place for companies that have already defined and committed to reaching sustainability targets and addressing environmental impacts. Based on views expressed in the case studies, the shift towards sustainability and the desire to tap into sustainable finance is often driven by a recognition that decarbonisation is necessary to remain competitive in the long-term, compounded by pressure from both investors and consumers towards low-carbon products, operations and value chains. A long track record of verified sustainability performance and data disclosure is a major facilitator to engage investors.

Issuance of sustainability-linked instruments contributes to mainstreaming sustainability objectives across all functions of a business and to creating synergies across teams within a company, including but not limited to operations, sustainability, corporate finance and purchasing departments. In some cases, fostering this whole-of-business approach requires changes in companies’ internal practices and processes. These instruments also allow investors to gain a better understanding of and familiarity with a corporate’s sustainability plan, decarbonisation strategy and how they plan to finance it.

Sustainability-linked instruments analysed in the case studies are often used for corporate financing needs. For instance, they can be used to refinance existing traditional loans, possibly extending their tenure as SLLs typically have 5-10-year maturities and linking them to company-wide sustainability KPIs. However, interviews highlighted that the industry decarbonisation will need to rely on the development and deployment of breakthrough technologies (e.g., clean hydrogen and carbon capture, utilisation and storage), which may require project-specific and longer-term financing. This could in some cases require a mix of public (where needed and additional, at concessional terms) and private financing, as some of these investments are capital-intensive and have long payback periods. During the interviews it emerged that an interesting model to boost the development of low-carbon technologies for industry could be one where companies play a transformational, ‘venture capitalist’ role, by collaborating with clean technology development companies and start-ups and eventually carrying out equity investments.

The issuance of sustainability-linked instruments is based on a corporate's sustainability financing framework reviewed by Second Party Opinion providers, which encompasses all the main KPIs and SPTs the company has set. Such frameworks usually follow ICMA’s Principles on Sustainability-linked Bonds and the Asian Pacific Loan Market Association’s (APLMA), Loan Market Association’s (LMA), and Loan Syndications and Tradition Association’s (LSTA) Sustainability-linked Loan Principles, under which the company reports on the performance achieved on those targets and KPIs, often through integrated and externally verified sustainability reporting.

While sustainability-linked financing frameworks are aligned with corporate sustainability/climate change strategies and policies (which typically include long-term targets and measures to achieve them), they are not necessarily linked with corporate transition plans and related capital expenditure (CapEx) and operational expenditure (OpEx) plans, mainly as sustainability-linked instruments are used for general purpose.

Companies are increasingly willing and eager to get their targets verified. All the companies interviewed have done so or are in the process of validating their targets by SBTi. However, SBTi's sector-specific target setting guidance for cement, chemicals, and steel (as well as other sectors) was developed using sectoral decarbonisation approaches in line with 2°C and well-below 2°C emission pathways. Sector guidance aligned with 1.5°C pathways is currently under development for the cement, steel, and chemicals sector (SBTi, 2022[18]). Moreover, several tools, methods and initiatives guiding the development or validation of emission reduction targets or pathways exist, often tailored towards different audiences and roles – they are listed in ICMA’s 2022 Climate Transition Finance Methodologies registry (ICMA, 2022[19]).

Sustainability-linked frameworks of companies in these sectors spell out specific decarbonisation targets, which differ across sectors. This enables investors and consumers to better understand the company’s decarbonisation pathways and to compare initiatives within the same subsector, although no or limited details are available at project level.

Source: Case studies and interviews (see Annex D for further details)

While sustainability-linked issuances have been dominated by non-financial private corporates, these instruments are starting to also be considered by countries. Chile issued the world’s first-ever sovereign sustainability-linked bond in March 2022, a USD 2 billion issuance (S&P, 2022[20]), tied to two main sustainability-performance targets, which follows the country’s updated NDC: (i) achieving GHG emissions of 95 metric tons of carbon dioxide equivalent (MtCO2e) by 2030 and a maximum of 1,100 MtCO2e between 2020 and 2030 and (ii) achieving 50% of electric generation derived from Non-Conventional Renewable Energy (NCRE) sources by 2028 and 60% of electric generation derived from NCRE sources by 2032 (Ministry of Finance of Chile, 2022[21]). The World Bank recently published a framework for designing and assessing sovereign SLBs with payments linked to the performance of key climate and nature indicators. The framework outlines various options for setting and assessing the ambition and robustness of KPIs, while recognising that, due to data limitations and persistent implementation challenges, country pilots, consultations and capacity building are needed to further understand how KPIs for sovereign SLBs could be developed in practice (World Bank, 2021[22]).

2.3. Ensuring credibility and comparability

While the development of this market for transition-related financial instruments can be important, there are growing concerns, especially among financial market participants and civil society, regarding possible greenwashing by corporates issuing such instruments, as well as a lack of coordination and comparability across jurisdictions (see for example, (Shrimali, 2021[23]), (BNP Paribas, 2019[24]), (Nordea, 2021[25]), (CBI, 2021[26]), (Capitalmonitor, 2021[27])). Credible corporate transition plans, setting out the overall strategy of the corporate issuing such instruments, could help alleviate greenwashing concerns and reassure investors of the environmental integrity of the corporate issuing these instruments.

Moreover, in the context of global financial markets and multinational corporate operations and ownership structures, significant divergences in national and regional approaches can present a hindrance for the flow of investment and finance. Since such divergences can also lead to different levels of ambition in corporate and investment practices across jurisdictions, concerns around greenwashing are further compounded, leading to perceptions of increased reputational risk and inadequate stakeholder buy-in. To facilitate a smoother flow of global transition finance at the scale and pace required to achieve the temperature goal of the Paris Agreement, it is therefore crucial to bridge these cross-jurisdictional divergences and alleviate greenwashing concerns arising from existing approaches.

Efforts to bridge such differences face the need to balance the certainty and standardisation valued by financial markets with the varying capacities, domestic considerations, and priorities among countries and regions. The International Platform on Sustainable Finance’s (IPSF) Transition Finance Working Group and the G20 Sustainable Finance Working Group’s Framework for Transition Finance (developed for the Indonesian G20 Presidency in 2022) are examples of initiatives seeking to develop a common approach across jurisdictions.7 As transition finance is gaining momentum, including continued efforts to develop common approaches and increase coordination, there will likely be ongoing discussions among investors, governments and other stakeholders concerning the eligibility of specific investments in different country settings. This can be expected considering the continually evolving technological and definitional state of transition investments, as well as ongoing technical discussions on how to connect domestic sectoral corporate transition plans and pathways (where those have been developed) with global sectoral pathways. Credible sectoral pathways and detailed criteria have yet to be developed for many corporate actors across most jurisdictions, which is a key challenge to scaling up transition finance and is discussed in more detail in Chapter 3.

Since transition finance is directed at the systemic transformation of a corporate’s business model and operations towards low-emission pathways, providers of transition finance should be in a position to assess the economic and environmental integrity of the entire business strategy of a corporate trying to raise finance for that purpose. The most suitable instrument to convey this sort of information is a corporate climate transition plan, which sets out a company’s targets, commitments, and implementation actions. For this reason, investors increasingly expect companies to develop ambitious and robust transition plans (CA100+, 2022[28]). However, only a minority of companies are to date developing them; for example, only a third of companies that disclosed through CDP Worldwide in 2021 had climate transition plans in place (CDP, 2022[29]), with difference across and within sectors. Companies in the financial services, power and fossil fuels sectors showed the highest rates of climate transition plan disclosure (with 5% of all entities in each of these industries disclosing on CDP’s key transition plan indicators), whereas the transportation services and apparel industries had the lowest transition plan disclosure rates (with less than 0.3% of organizations disclosing) (CDP, 2022[29]).

For the few companies that are starting to develop standalone transition plans or incorporate relevant elements within their annual financial, climate or sustainability reporting, available disclosure is either inadequate or reveals plans that are not consistent with net-zero targets (IGCC, 2022[30]). For instance, results of the first assessment of CA100+ Net Zero Company Benchmark show that 60% of the assessed companies did not have strategies consistent with net zero, and merely 4% explicitly aligned their CapEx with their decarbonisation objectives (CA100+, 2022[28]). Similarly, analysis by the Transition Pathways Initiative (TPI) suggests that entities operating in transition-relevant industries are not aligned with the Paris Agreement temperature goal, with over a third significantly delaying action and not planning to align their pathways until after 2040 (Miller and Dikau, 2022[31]). According to the UK Transition Plan Taskforce (TPT), publicly disclosed transition plans vary in detail and quality, hindering assessments of their credibility (TPT, 2022[32]).

2.4. Credible corporate climate transition plans can enable the assessment of corporate climate strategies and goals

2.4.1. What is a transition plan?

In the absence of credible corporate transition plans, it is challenging for financial market participants to assess the extent to which a potential transition investment is legitimate from a financial, business, and environmental standpoint. To make this assessment, it is necessary to have a holistic overview of the corporate’s products and operations, and related decarbonisation trajectory across the entire entity. Various definitions of credible corporate transition plans exist, and no single definition has so far been recognised as an international standard.

However, a corporate transition plan is generally understood as a time-bound, crosscutting action plan that clearly sets out how a company intends to achieve its transition strategy (including targets, actions, progress and accountability mechanisms) and reach its goal to transform its business model, operations, assets and relationships towards low-emission, climate-resilient pathways that are aligned with the goals of the Paris Agreement (CBI, 2021[33]; CDP, 2021[34]; CPI, 2022[35]). As mentioned earlier in the text, this Guidance is focused on the decarbonisation aspect of the above definition, while recognising the importance of corporates understanding, assessing, and mitigating their exposure to climate-related risk, as well as ensuring climate resilience.

While transition plans are often conceived as tools for companies to set out their actions to mitigate the impact of climate change and decarbonise, they can cover a much wider set of considerations (e.g., climate adaptation and resilience) related to a company’s transition to more sustainable pathways. For example, according to the European Financial Reporting Advisory Group (EFRAG), a transition plan is part of a corporate’s overall strategy for its transition towards a climate-neutral economy, while a climate change mitigation action plan is the part of a transition plan that is specific to GHG emission reductions (EFRAG, 2022[36]). A growing number of initiatives by industry, non-governmental organisations (NGOs) and think tanks provide principles, analysis, guidance, and frameworks on what constitutes a credible transition plan and necessary disclosure. Moreover, several initiatives exist that help companies set their transition targets or develop a transition plan. Similarly, some public authorities are beginning to codify standards related to transition plans into law or providing guidance to market actors on how to develop credible plans within their jurisdictions. Transnational initiatives are starting to develop more coordinated, high-level principles that can help guide the different national or regional initiatives. Within this overall universe, some approaches focus exclusively on transition plans of either financial institutions or non-financial corporates, while others refer to both. The remainder of this chapter provides an overview of ongoing initiatives related to frameworks on transition plans, their roles, and purposes. A detailed mapping on how existing initiatives address important elements of credible transition plans can be found in Table A B.1 in Annex B.

While existing frameworks on transition plans share several common elements, few initiatives, if any, cover the following aspects in depth:

The link between corporate transition plans and other sustainable finance and investment tools, such as taxonomies.

Mechanisms for the prevention of carbon-intensive lock-in.

The consideration of non-climate-related sustainability impacts in transition planning.

Proportionate treatment for MSMEs or companies operating in challenging policy environments, such as in EMDEs.

These important considerations and others are covered in greater detail in Chapter 4.

2.4.2. Non-governmental and industry-led initiatives on transition plans

Several frameworks, guidance and tools on climate transition plans exist, each with a specific focus, purpose, and target stakeholder (see Table 2.1 below). For instance, some provide disclosure frameworks and standards, others provide target-setting and sectoral pathways methodologies or data collection services, while others help assess, evaluate, and validate targets, plans and progress. Relevant examples of industry-led initiatives and frameworks on transition plans include those developed by the Task Force on Climate-related Financial Disclosures (TCFD) as well as the Glasgow Financial Alliance for Net Zero (GFANZ), amongst others.

TCFD’s Guidance on Metrics, Targets, and Transition Plans helps organisations to prepare disclosure of “decision-useful metrics, targets, and transition plan information” and how these link with related financial risks and impacts. The TCFD Guidance’s section on transition plans outlines key characteristics of effective transition plans and helps organisations to include aspects of their transition plans in their climate-related financial disclosures. TCFD identifies four main high-level elements on effective transition plans: (i) governance; (ii) strategy; (iii) risk management; and (iv) metrics and targets (TCFD, 2021[37]). Building on TCFD’s Guidance as well as other industry initiatives, GFANZ is currently developing work streams on both real economy transition plans as well as financial institutions’ transition plans, with a view to drive convergence on best practices and allow corporates to develop net-zero transition plans that meet the needs of financial actors (GFANZ, 2021[38]). GFANZ is a global coalition of leading financial institutions in the United Nations (UN)’s Race to Zero whose members are financial institutions representing around 40% of global private financial assets, committed to the goal of net zero by 2050. GFANZ’s Guidance on Financial Institution Net-zero Transition Plans offers recommendations geared towards operationalising members’ own net-zero commitments and focuses on four key approaches: (i) financing or enabling the development and scaling of climate solutions to replace high-emitting technologies or services; (ii) financing or enabling companies already aligned with a 1.5°C pathway; (iii) financing or enabling the transition of real economy firms, according to robust net-zero transition plans; and (iv) financing or enabling the accelerated managed phase-out of high-emitting assets (GFANZ, 2022[39]). In addition, while it does not explicitly focus on transition plans, the concept of climate transition financing in ICMA’s Climate Transition Finance Handbook focuses mainly on the credibility of an issuer’s climate-related transition strategy, commitments, and practices (ICMA, 2020[6]).

Several think tanks and NGOs have also put forward principles and guidance on transition plans. For example, CDP identifies six guiding principles and characteristics for climate transition plans (accountable, internally coherent, forward-looking, time-bound and quantitative, flexible and responsive, and complete) and eight main elements of credible transition plans, namely: (i) governance; (ii) scenario analysis; (iii) financial planning; (iv) value chain engagement and low carbon initiatives; (v) policy engagement; (vi) risks and opportunities; (vii) targets; and (viii) scope 1, 2 and 3 accounting with verification (CDP, 2021[34]).8 In a similar vein, CBI’s five hallmarks of credibly transitioning companies focus on the following elements: (i) Paris-aligned targets; (ii) robust plans; (iii) implementation action; (iv) internal monitoring; and (v) external reporting (CBI, 2021[26]).

Table 2.1. Existing initiatives and guidance on transition plans and strategies

|

Organisation |

Type of services provided |

Target stakeholder group(s) |

Transition plan-related report reviewed |

|---|---|---|---|

|

Validation/assessment and/or guidance/methodologies providers |

|||

|

Assessing low-Carbon Transition (ACT) initiative |

Services to support and assess corporate transition plans |

Governments, companies, and investors |

ACT Framework (ACT, 2019[40]) |

|

Climate Action 100+ (CA100+) |

Set of disclosure indicators designed for investors to assess the robustness of a company’s business plan and climate targets |

Investors |

Net-zero company benchmark (CA100+, 2021[41]) |

|

Climate Bonds Initiative (CBI) |

Bond standards and certification schemes, policy engagement and analysis |

Investors |

Transition finance for Transforming companies (CBI, 2021[33]) |

|

Climate Safe Lending Network (CSL) |

Multi-stakeholder forum to enable the banking sector to decarbonise |

Banks |

The Good Transition Plan (CSL, 2021[42]) |

|

Glasgow Financial Alliance for Net Zero (GFANZ) |

Forum for engagement of financial institutions to accelerate the transition to a net-zero global economy |

Financial institutions |

GFANZ – Our progress and plan towards a net-zero global economy (GFANZ, 2021[38]) |

|

International Capital Market Association (ICMA) |

Principles and recommendations for the development of international capital markets |

Financial institutions, investors, and corporates (issuers) |

Climate Transition Finance Handbook (ICMA, 2020[6]) |

|

Investor Group on Climate Change (IGCC) |

Investors alliance with a focus on climate change |

Investors and corporates |

Corporate Climate Transition Plans: A guide to investor expectations (IGCC, 2022[30]) |

|

Science Based Targets initiative (SBTi) |

Guidance for target-setting and target validation |

Corporates and financial institutions |

Science-based target setting manual (SBTi, 2020[43]) Corporate Net-Zero Standard (SBTi, 2021[44]) |

|

Transition Pathway Initiative (TPI) |

Assessment tool to rate corporations’ preparedness for a net-zero transition and benchmarks for corporate climate action |

Asset owners |

TPI state of transition 2021 (TPI, 2021[45]) |

|

Disclosure frameworks |

|||

|

International Sustainability Standards Board (ISSB) |

Sustainability-related disclosure standards |

Investors and corporates |

Draft Climate-related Disclosures (IFRS, 2022[46]) |

|

Task Force on Climate-Related Financial Disclosures (TCFD) |

Disclosure Framework on climate risks and opportunities |

Financial institutions |

Guidance on climate related metrics, targets, and transition plans (TCFD, 2021[37]) |

|

Transition Plan Taskforce (TPT) |

Development of a gold standard for transition plans |

Companies |

A Sector-Neutral Framework for private sector transition plans (TPT, 2022[32]) |

|

Data collection and analysis |

|||

|

CDP |

Collection of self-reported environmental data; scoring; analysis |

Investors, companies, cities, states, and regions |

Climate Transition Plan – Discussion Paper (CDP, 2021[34]) |

|

Climate Policy Initiative (CPI) |

Analysis and advisory services |

Governments, businesses and financial institutions |

What Makes a Transition Plan Credible? Considerations for financial institutions (CPI, 2022[35]) |

|

Net Zero Tracker |

Data collection and analysis on net-zero targets |

Governments, sub-national entities, businesses and financial institutions |

Net Zero Tracker data (Net Zero Tracker, 2022[47]) |

Note: This list is non-exhaustive overview. A more detailed mapping of how these initiatives address key elements of transition plans can be found in Table A B.1 in Annex B.

2.4.3. Transition plans as part of public initiatives

Several public, often government-led, proposals and regulatory initiatives are emerging at national and regional level, setting out expectations on the need for companies to develop and publish climate transition plans.

European Union (EU)

In its sustainable finance strategy, the European Commission acknowledges the need for financial institutions to improve their disclosures of sustainability targets and transition planning (European Commission, 2021[48]). As part of the 2021 Sustainable Finance package, the European Commission published a legislative proposal for a Corporate Sustainability Reporting Directive (CSRD), which will amend the existing Non-Financial Reporting Directive (NFRD). In June 2022, the European Parliament and Council reached a provisional political agreement on the CSRD (Council of the EU, 2022[49]). The CSRD would mandate companies in scope to report in compliance with European Sustainability Reporting Standards (ESRS), which are being developed by the European Financial Reporting Advisory Group (EFRAG) and would be adopted by the European Commission as delegated acts. The proposed CSRD introduces a requirement for companies to provide information about any sustainability targets set and the progress made towards achieving them, as well as the plans of the company to ensure that its business model and strategy are compatible with the transition to a sustainable economy and with the limiting of global warming to 1.5°C, in line with the Paris Agreement. EFRAG’s ESRS E1 on Climate Change sets out proposed standards for disclosure requirements on transition plans in line with the Paris Agreement. These requirements call for explanations of (among others): (i) the alignment of targets with limiting global warming to 1.5°C; (ii) the decarbonisation levers identified and key actions planned, including the adoption of new technologies; (iii) the financial resources supporting the implementation of the transition plan; (iv) the locked-in GHG emissions from key assets and products and the plan to manage them; (v) the future alignment of economic activities to the Taxonomy; (vi) how the transition plan is embedded in and aligned with the overall business strategy; (vii) the progress made in implementing the plan (EFRAG, 2022[36]).

Moreover, recently there have been relevant EU-level developments on the monetary policy and banking supervision front. As part of the European Central Bank (ECB)’s overall climate strategy for banks, the ECB has recently stressed the need for banks to have Paris Agreement-compatible transition plans with concrete intermediate milestones and associated KPIs, as part of a bank’s strategy-setting and business plan. The ECB also highlighted the need for transparency and appropriate disclosure of banks’ transition plans (ECB, 2021[50]).

Japan

Japan’s 2021 Basic Guidelines on Climate Transition Finance put forward a set of (not legally-binding) considerations on key elements transition finance issuers should disclose about their strategies, actions, and plans, in line with ICMA’s Climate Transition Finance Handbook. According to the Guidelines, issuers are expected to disclose their transition strategies and plans and to execute them as part of the company’s integrated reporting, sustainability reporting and statutory documents. Issuers should specify how climate change is an environmentally material part of their business activities. They should also disclose their short-, mid- and long-term targets, including the base years. There are further elements that are “optimally recommended” for issuers to have or disclose as per the Guidelines (covered in more detail in Annex A) (FSA, METI and Ministry of Environment, Japan, 2021[51]).

Switzerland

Switzerland’s plan to mandate TCFD climate-related financial disclosures for larger companies across all sectors of the economy includes publishing transition plans. The plan advises firms to rely to the extent possible on the TCFD’s October 2021 Guidance on Metrics, Targets, and Transition Plans. A public consultation on the TCFD ordinance is currently underway until the summer of 2022, with the aim for it to enter into force on 1 January 2023 (Swiss State Secretariat for International Finance, 2022[52]). Listed firms with more than 500 employees, balance sheet exceeding CHF 20 million and revenues exceeding CHF 40 million in the preceding years will be expected to implement the legislation starting in 2024 for FY 2023. The legislation will not only cover the climate-related risks faced by these companies, but will also ask the firms to disclose the climate impact of their activities, as embodied in the concept of double materiality. The requirements will focus on meaningful, comparable, and, where possible, forward-looking and scenario-based disclosures.

In addition, Switzerland introduced voluntary guidelines (so called “Swiss Climate Scores”) that reflect what it considers best practice transparency on the Paris Agreement-alignment of investment products (Swiss State Secretariat for International Finance, 2022[53]). The Scores include indicators of the current state (e.g., portfolio emissions and exposures to fossil fuels), as well as forward-looking indicators, including based on portfolio alignment metrics. The indicators will provide investors with decision-useful information on climate aspects to help them choose financial products that best fit their preferences. At the entity level, Switzerland is regularly assessing the climate-alignment of its financial market based on the Paris Agreement Capital Transition Assessment (PACTA)9 methodology.

United Kingdom

The United Kingdom is also moving towards making publication of transition plans mandatory. Initially, this will require asset managers, regulated asset owners and listed companies to publish transition plans that consider the government’s net-zero commitment, as per TCFD-aligned disclosure requirements, on a comply-or-explain basis. The United Kingdom government has set up a high-level Transition Plan Taskforce (TPT), with a two-year mandate, bringing together industry, academia, NGOs and regulators to develop a ‘gold standard’ for transition plans and associated metrics, coordinating with international efforts under the Glasgow Financial Alliance for Net Zero (GFANZ) and other global bodies. At the time of drafting, the TPT was consulting on the definition of a transition plan. The UK Government's working definition of a transition plan is that it “sets out how an organization will adapt as the world transitions towards a low-carbon economy” (UK Government, 2021[54]). According to the TPT, a transition plan of listed companies and financial institutions should include: (i) high-level targets the organisation is using to mitigate climate risk, including greenhouse gas reduction targets (e.g. a net-zero commitment); (ii) interim milestones; and (iii) actionable steps the organisation plans to take to achieve its targets (TPT, 2022[55]). The TPT will develop a Sector-Neutral Framework, Sectoral Templates, and accompanying Guidance for Preparers and Users of Transition Plans (TPT, 2022[32]).

United States

In March 2022, the United States’ Securities and Exchange Commission (SEC) proposed a rule (currently published for consultation) change to standardise registrant companies’10 climate-related disclosure, in order to provide investors with consistent, comparable, and decision-useful information for making their investment decisions. In addition to disclosure about climate-related risks, their material impact and risk management processes, the SEC proposes disclosure on climate-related targets or goals and transition plans for issuers that have adopted such targets or plans (SEC, 2022[56]). According to the SEC, a transition plan to mitigate or adapt to climate-related risks may be an important element of a corporate’s climate-related risk management strategy, especially if it operates in a jurisdiction that has made commitments under the Paris Agreement to reduce its GHG emissions. Under the SEC’s proposed rule, companies that have adopted transition plans would be required to discuss how they plan to mitigate or adapt to identified physical and transition risks and may also discuss how they plan to achieve climate-related opportunities. The proposal also requires updating disclosure related to transition plans each fiscal year by describing the actions taken during the year to achieve the plan’s targets.

2.4.4. Transnational initiatives related to transition finance and transition plans

G20 Sustainable Finance Working Group (SFWG)

Under the Indonesian G20 Presidency, the G20 Sustainable Finance Working Group (SFWG) is developing a high-level transition finance framework and is pursuing work to strengthen the credibility of financial institution commitments (G20, 2022[57]). The framework for transition finance will relate to five main elements: (i) identification of transitional activities and relevant investments; (ii) reporting of information on transition activities; (iii) developing transition finance instruments; (iv) policy incentives; and (v) measuring and mitigating negative social and economic impacts.

International Platform on Sustainable Finance (IPSF)

The IPSF is a multilateral forum that aims at deepening international cooperation and coordination on relevant initiatives to scale up sustainable finance, notably in the areas of taxonomy, disclosures, and standards and labels. In 2022, the IPSF established a working group on transition finance, which is conducting analysis on how existing sustainable finance alignment approaches (such as taxonomies, labels and portfolio alignment metrics, as well as corporate strategy and disclosure) already take into account transition considerations. Following this analysis, the IPSF is developing Transition Finance Principles at activity-, entity-, and portfolio-level for jurisdictions that are considering including or strengthening transition finance considerations within their sustainable finance frameworks. The principles are split between “principles for robust transition targets” and “principles for demonstrating the ability to deliver”. The former covers climate temperature goals, the setting of credible targets, inclusiveness, and compatibility with social goals. The latter looks at the information that is needed to ensure credibility, internal governance, external engagement, reporting, and performance (IPSF, forthcoming[58]).

International Sustainability Standards Board (ISSB)

In 2021 the IFRS Foundation Trustees announced the creation of a new standard-setting board, the International Sustainability Standards Board (ISSB), to deliver a comprehensive global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information about companies’ sustainability-related risks and opportunities. In March 2022, the ISSB published draft proposals on general sustainability-related disclosure requirements and climate-related disclosure requirements (IFRS, 2022[59]). As part of the latter, the ISSB proposes a range of disclosures about entities’ transition plans, including information on how it is responding to significant climate-related risks and opportunities, information regarding climate-related targets of transition plans, as well as quantitative and qualitative information about the progress of such plans (IFRS, 2022[46]).

References

[61] 2DII (2018), PACTA / Climate Scenario Analysis Program, https://2degrees-investing.org/resource/pacta/.

[40] ACT (2019), ACT Framework, https://actinitiative.org/wp-content/uploads/pdf/act-framework-eng-2019-04-09.pdf.

[9] Bloomberg (2022), ESG by the Numbers: Sustainable Investing Set Records in 2021, https://www.bloomberg.com/news/articles/2022-02-03/esg-by-the-numbers-sustainable-investing-set-records-in-2021 (accessed on 15 March 2022).

[24] BNP Paribas (2019), Transition bonds - New funding for a greener world, https://cib.bnpparibas/app/uploads/sites/2/2021/03/markets-360-brief-on-transition-bonds.pdf.

[28] CA100+ (2022), 2021 Year in Review - A Progress Update, https://www.climateaction100.org/wp-content/uploads/2022/03/Climate-Action-100-2021-Progress-Update-Final.pdf.

[41] CA100+ (2021), Net Zero Company Benchmark, https://www.climateaction100.org/net-zero-company-benchmark/ (accessed on 29 April 2022).

[27] Capitalmonitor (2021), Why transition bonds have failed to make their mark, https://capitalmonitor.ai/sector/energy-and-utilities/why-transition-bonds-have-failed-to-make-their-mark-so-far/ (accessed on 28 April 2022).

[11] CBI (2022), Sustainable Debt Market Summary Q1 2022, https://www.climatebonds.net/files/reports/cbi_susdebtsum_q12022_01e.pdf.

[8] CBI (2022), Sustainable Debt, Global State of the Market 2021, https://www.climatebonds.net/files/reports/cbi_global_sotm_2021_02f.pdf.

[33] CBI (2021), Transition finance for transforming companies, https://www.climatebonds.net/files/files/Transition%20Finance/Transition%20Finance%20for%20Transforming%20Companies%20ENG%20-%2010%20Sept%202021%20.pdf.

[26] CBI (2021), Transition finance for transforming companies: Avoiding greenwashing when financing company decarbonisation, https://www.climatebonds.net/files/files/Transition%20Finance/Transition%20Finance%20for%20Transforming%20Companies%20ENG%20-%2010%20Sept%202021%20.pdf.

[10] CBI (forthcoming), Climate Bonds Standard and Certification Scheme, https://www.climatebonds.net/standard/available-soon.

[29] CDP (2022), Are companies being transparent in their transition?, https://cdn.cdp.net/cdp-production/cms/reports/documents/000/006/127/original/2021_Climate_transition_plan_disclosure_FINAL.pdf?1647432846.

[34] CDP (2021), Climate Transition Plan: Discussion Paper, https://cdn.cdp.net/cdp-production/cms/guidance_docs/pdfs/000/002/840/original/Climate-Transition-Plans.pdf?1636038499.

[49] Council of the EU (2022), New rules on corporate sustainability reporting: provisional political agreement between the Council and the European Parliament, https://www.consilium.europa.eu/en/press/press-releases/2022/06/21/new-rules-on-sustainability-disclosure-provisional-agreement-between-council-and-european-parliament/.

[35] CPI (2022), What Makes a Transition Plan Credible? Considerations for financial institutions, https://www.climatepolicyinitiative.org/wp-content/uploads/2022/03/Credible-Transition-Plans.pdf.

[42] CSL (2021), “The Good Transition Plan - Climate Action Strategy Development Guidance for Banks & Lending Institutions: COP26-version”, https://static1.squarespace.com/static/5e0a586857ea746075c561a3/t/61fa7a928bf1444954619fa5/1643805346245/CSLN+Good+Transition+Report+01.22.pdf.

[15] ECB (2022), FAQ on sustainability-linked bonds, https://www.ecb.europa.eu/paym/coll/standards/marketable/html/ecb.slb-qa.en.html.

[50] ECB (2021), Overcoming the tragedy of the horizon: requiring banks to translate 2050 targets into milestones, https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp211020~03fba70983.en.html (accessed on 29 April 2022).

[60] ECB (2020), ECB to accept sustainability-linked bonds as collateral, https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200922~482e4a5a90.en.html (accessed on 15 March 2022).

[36] EFRAG (2022), Exposure Draft ESRS E1 Climate Change, https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%2FSiteAssets%2FED_ESRS_E1.pdf.

[2] EIB (2021), Common Principles for Climate Mitigation Finance Tracking, https://www.eib.org/attachments/documents/mdb_idfc_mitigation_common_principles_en.pdf.

[12] Environmental Finance (2022), Sustainability-linked bonds and loans – Key Performance Indicators (KPIs), https://www.environmental-finance.com/assets/files/research/sustainability-linked-bonds-and-loans-kpis.pdf.

[48] European Commission (2021), Strategy for financing the transition to a sustainable economy, https://ec.europa.eu/info/publications/210706-sustainable-finance-strategy_en (accessed on 2 May 2022).

[51] FSA, METI and Ministry of Environment, Japan (2021), Basic Guidelines on Climate Transition Finance, https://www.meti.go.jp/press/2021/05/20210507001/20210507001-3.pdf.

[57] G20 (2022), The 2nd Meeting of the Sustainable Finance Working Group (SFWG) – G20 Presidency of Indonesia, https://g20.org/the-2nd-meeting-of-the-sustainable-finance-working-group-sfwg/.

[39] GFANZ (2022), Financial Institution Net-zero Transition Plans, https://assets.bbhub.io/company/sites/63/2022/06/GFANZ_Recommendations-and-Guidance-on-Net-zero-Transition-Plans-for-the-Financial-Sector_June2022.pdf.

[38] GFANZ (2021), GFANZ Progress Report, https://assets.bbhub.io/company/sites/63/2021/11/GFANZ-Progress-Report.pdf.

[7] ICMA (2022), Guidance Handbook, https://www.icmagroup.org/assets/GreenSocialSustainabilityDb/The-GBP-Guidance-Handbook-January-2022.pdf.

[19] ICMA (2022), The Principles announce key publications and resources in support of market transparency and development, https://www.icmagroup.org/News/news-in-brief/the-principles-announce-key-publications-and-resources-in-support-of-market-transparency-and-development/.

[6] ICMA (2020), Climate Transition Finance Handbook: Guidance for Issuers, https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Climate-Transition-Finance-Handbook-December-2020-091220.pdf.

[46] IFRS (2022), Draft IFRS S2 Climate-related Disclosures, https://www.ifrs.org/content/dam/ifrs/project/climate-related-disclosures/issb-exposure-draft-2022-2-climate-related-disclosures.pdf.

[59] IFRS (2022), ISSB delivers proposals that create comprehensive global baseline of sustainability disclosures, https://www.ifrs.org/news-and-events/news/2022/03/issb-delivers-proposals-that-create-comprehensive-global-baseline-of-sustainability-disclosures/ (accessed on 2 May 2022).

[30] IGCC (2022), Corporate Climate Transition Plans: A guide to investor expectations, https://igcc.org.au/wp-content/uploads/2022/03/IGCC-corporate-transition-plan-investor-expectations.pdf.

[58] IPSF (forthcoming), IPSF Transition Finance Working Group.

[3] METI (2020), Concept Paper on Climate Transition Finance Principles Study Group on Environmental Innovation Finance in Japan, Ministry of Economy, Trade and Industry, Japan, https://www.meti.go.jp/press/2019/03/20200331002/20200331002-2.pdf.

[31] Miller, H. and S. Dikau (2022), Preventing a ’climate minsky moment’: environmental financial risks and prudential exposure limits: Exploring the case study of the Bank of England’s prudential regime.

[21] Ministry of Finance of Chile (2022), , https://www.hacienda.cl/areas-de-trabajo/finanzas-internacionales/oficina-de-la-deuda-publica/bonos-esg/bonos-slb/chile-s-slb-framework#:~:text=More%20specifically%2C%20Chile%20has%20included,of%20no%20more%20than%201%2C100.

[47] Net Zero Tracker (2022), Net Zero Tracker, https://zerotracker.net/analysis.

[14] NGFS (2022), Enhancing market transparency in green and transition finance, https://www.ngfs.net/sites/default/files/medias/documents/enhancing_market_transparency_in_green_and_transition_finance.pdf.

[25] Nordea (2021), Transition Finance: Funding the shift to a green economy, https://www.nordea.com/en/news/transition-finance-funding-the-shift-to-a-green-economy.

[5] OECD (2021), OECD Roundtable on Transition Finance - Summary Record, https://www.oecd.org/cgfi/OECD-roundtable-on-high-level-principles-for-transition-finance-summary.pdf.

[13] OECD (2021), Scaling up Green, Social, Sustainability and Sustainability-linked Bond Issuances in Developing Countries, https://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=DCD(2021)20&docLanguage=En.

[17] OECD (forthcoming), Policy Guidance on Market Practices to Finance and Strengthen ESG Investing: Input to the G20 Sustainable Finance Working Group.

[4] Platform on Sustainable Finance (2021), Transition finance report - March 2021, https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/210319-eu-platform-transition-finance-report_en.pdf.

[16] S&P (2022), Global sustainable bond issuance to surpass 1.5 trillion USD in 2022, https://www.spglobal.com/ratings/en/research/articles/220207-global-sustainable-bond-issuance-to-surpass-1-5-trillion-in-2022-12262243.

[20] S&P (2022), World’s 1st sovereign sustainability linked bond issued by Chile, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/world-s-1st-sovereign-sustainability-linked-bond-issued-by-chile-69226229.

[18] SBTi (2022), Sector Guidance, https://sciencebasedtargets.org/sectors.

[44] SBTi (2021), SBTi Corporate Net-Zero Standard, https://sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf.

[43] SBTi (2020), Science-Based Target Setting Manual, https://sciencebasedtargets.org/resources/legacy/2017/04/SBTi-manual.pdf.

[56] SEC (2022), The Enhancement and Standardization of Climate-Related Disclosures for Investors, https://www.sec.gov/rules/proposed/2022/33-11042.pdf.

[23] Shrimali, G. (2021), Transition Bond Frameworks: Goals, Issues, and Guiding Principles, https://energy.stanford.edu/sites/g/files/sbiybj9971/f/transition_bond_frameworks-_goals_issues_and_guiding_principles_0.pdf.

[52] Swiss State Secretariat for International Finance (2022), Federal Council initiates consultation on ordinance on climate reporting by large companies, https://www.admin.ch/gov/en/start/documentation/media-releases.msg-id-87790.html.

[53] Swiss State Secretariat for International Finance (2022), Federal Council launches Swiss Climate Scores for climate transparency in financial investments, https://www.admin.ch/gov/en/start/documentation/media-releases/media-releases-federal-council.msg-id-89524.html#:~:text=The%20Swiss%20Climate%20Scores%20contain,net%20zero%20target%20by%202050).

[1] Tandon, A. (2021), “Transition finance: Investigating the state of play: A stocktake of emerging approaches and financial instruments”, OECD Environment Working Papers, No. 179, OECD Publishing, Paris, https://doi.org/10.1787/68becf35-en.

[37] TCFD (2021), Task Force on Climate-Related Financial Disclosures - Guidance on Metrics, Targets, and Transition Plans, https://assets.bbhub.io/company/sites/60/2021/07/2021-Metrics_Targets_Guidance-1.pdf.

[45] TPI (2021), TPI State of Transition Report 2021, https://www.transitionpathwayinitiative.org/publications/82.pdf?type=Publication (accessed on 1 May 2022).

[32] TPT (2022), A Sector-Neutral Framework for private sector transition plans - Call for Evidence, Transition Plan Taskforce (TPT), https://transitiontaskforce.net/wp-content/uploads/2022/05/TPT_Call_for_Evidence.pdf.

[55] TPT (2022), TRANSITION PLAN TASKFORCE Terms of reference, https://transitiontaskforce.net/wp-content/uploads/2022/04/TransitionPlanTaskforce-TofR-3.pdf.

[54] UK Government (2021), Fact Sheet: Net Zero-aligned Financial Centre, https://www.gov.uk/government/publications/fact-sheet-net-zero-aligned-financial-centre/fact-sheet-net-zero-aligned-financial-centre.

[62] UN DESA and IPSF (2021), “Improving compatibility of approaches to identify, verify and align investments to sustainability goals”, https://g20sfwg.org/wp-content/uploads/2021/09/G20-SFWG-DESA-and-IPSF-input-paper.pdf.

[22] World Bank (2021), Striking the Right Note: Key Performance Indicators for Sovereign Sustainability-Linked Bonds, https://documents1.worldbank.org/curated/en/935681641463424672/pdf/Striking-the-Right-Note-Key-Performance-Indicators-for-Sovereign-Sustainability-Linked-Bonds.pdf.

Notes

← 1. The exact activities covered vary across approaches and can range from energy-intensive manufacturing activities, such as steel, iron, aluminium, and cement, to hard-to-abate transport such as aviation, to investments in fossil-based energy production.

← 2. Interpretations of the concept and implications of economic viability vary across approaches, with different views on the relative importance of economic competitiveness, compared to technological viability. For example, the approach set out by the Climate Bonds Initiative clearly states that technological viability is more important than economic competitiveness (Tandon, 2021[1]). This is further discussed in Chapter 3.

← 3. It is worth noting that analyses comparing market volumes of SLB debt with other thematic debt should be conducted only for illustrative purposes, since SLBs are used for general financing purposes whereas funds raised by green, social and sustainability bonds are earmarked for specific uses (CBI, 2022[8]).

← 4. Key Performance Indicators (KPIs) are quantifiable metrics used to measure the performance of selected indicators. KPIs have corresponding Sustainability Performance Targets (SPTs). SPTs are targets under which issuers commit to making measurable improvements in key performance indicators over a predefined timeline. SPTs should be ambitious, material and where possible benchmarked and consistent with an issuer’s overall sustainability/ESG strategy.

← 5. In June 2022, ICMA published a registry of approximately 300 illustrative key performance indicators (KPIs) for Sustainability-Linked Bonds, classified by sector, split into core and secondary indicators, with references to global benchmarks for the KPI definition and targets calibration (ICMA, 2022[19]).

← 6. The issuance of SLBs has become more attractive since the European Central Bank decided in 2020 to accept them as eligible collateral for Eurosystem credit operations and also for outright purchases for monetary policy purposes, provided they comply with all other eligibility criteria (ECB, 2020[60]).

← 7. Other examples include but are not limited to the PRI/World Bank Implementation Guide for Sustainable Investment Policy and Regulation Tools – Taxonomies of Sustainable Economic Activities, and IPSF/UNDESA 2021 input to G20 SFWG (UN DESA and IPSF, 2021[62]).

← 8. CDP’s annual collection of corporate environmental data includes most of these elements.

← 9. PACTA is a methodology and tool which measures financial portfolios' alignment with various climate scenarios consistent with the Paris Agreement (2DII, 2018[61]).

← 10. Registrant companies are those that register a class of securities with the Securities and Exchange Commission (SEC).