This chapter identifies key challenges in transition finance, drawing on insights gathered through the OECD Industry Survey on Transition Finance, bilateral stakeholder consultations, and literature review. Scaling up financing for the transition across all sectors globally requires transition finance approaches to consider and respond to the current challenges and barriers that are encountered by market actors in this space. In this context, the challenges of corporates in emerging markets and developing economies (EMDEs) and micro, small and medium-sized enterprises (MSMEs) deserve special attention. The chapter concludes that credible corporate climate transition plans and increased transparency by corporates can address some key challenges, while others have additional, broader implications for policymakers and would require the use of complementary tools, including through the involvement of multilateral development banks (MDBs).

OECD Guidance on Transition Finance

3. Key challenges in transition finance

Abstract

3.1. Ensuring inclusiveness across sectors and geographies

Even though the costs of low-carbon technologies continue to decrease, the feasibility of implementing them is dependent on different factors, and notably on constraints arising from institutional, economic, socio-cultural, technological, ecological, and geophysical environments (IPCC, 2022[1]). These factors fundamentally affect the potential to implement different mitigation options, and this potential varies between sectors and regions of the world. Not all mitigation options may always be economically or institutionally feasible, especially in EMDEs, even though many are likely to be technologically feasible. In this context, the Intergovernmental Panel on Climate Change (IPCC) considers the main factor limiting their implementation to be institutional capacity and finds that feasibility challenges are highest in emerging economies, at least over the short- to medium-term (IPCC, 2022[2]).

Considering the immediate need to reverse national and global emission trajectories, available opportunities to sharply reduce emissions will be essential to exploit through transition finance, as a broader range of mitigation options gradually comes within striking range for many corporates and as governments continue to improve enabling conditions to remove existing barriers. To reduce feasibility challenges and risks, corporates can and should pursue a multi-technology approach to mitigation; the IPCC confirms that “pathways relying on a broad portfolio of mitigation strategies are more robust and resilient” (IPCC, 2022[2]). For example, the literature confirms that the net-zero transition of the industry sector will require a portfolio of solutions, ranging from energy efficiency improvements in production processes, shifting the power and heat supply from fossil fuels to renewables and renewables-based electrification, switching to low-carbon and renewable feed stocks, and deploying carbon capture use and storage, to increasing the reuse and recycling of materials (OECD, forthcoming[3]). At the same time, it will be essential to avoid investments in emission reduction opportunities that have the effect of locking in emissions. Such investments slow down the adoption of net-zero alternatives, and result in assets needing to be replaced before the end of their lifetime, when net-zero alternatives become commercially available. One example is unabated fossil fuel infrastructure, which, according to the IPCC, will with very high likelihood lock in emissions and slow down the implementation of net-zero alternatives by further compounding existing feasibility risks (IPCC, 2022[1]).

3.2. Key challenges

To provide guidance on credible corporate climate transition plans for global investors and financial institutions, this report considers existing common practices and recommendations from the range of initiatives relating to transition plans, as set out in Chapter 2 and Annexes A and B. This section outlines the most common challenges faced by financial market participants and corporates that are not fully addressed by existing transition finance approaches and where additional transparency is needed to ensure comparability and avoid greenwashing. It also highlights challenges that require further policy intervention by governments, regulators and MDBs. To help overcome these challenges, it provides suggestions to policymakers on how to fill current gaps arising from deficiencies in enabling environments. This discussion provides context for Chapter 4 and the elements of corporate climate transition plans that will ensure credibility – as these elements aim to mitigate some of the challenges laid out below.

3.2.1. Lack of granular and comparable corporate disclosure and forward-looking data on climate and climate transition planning

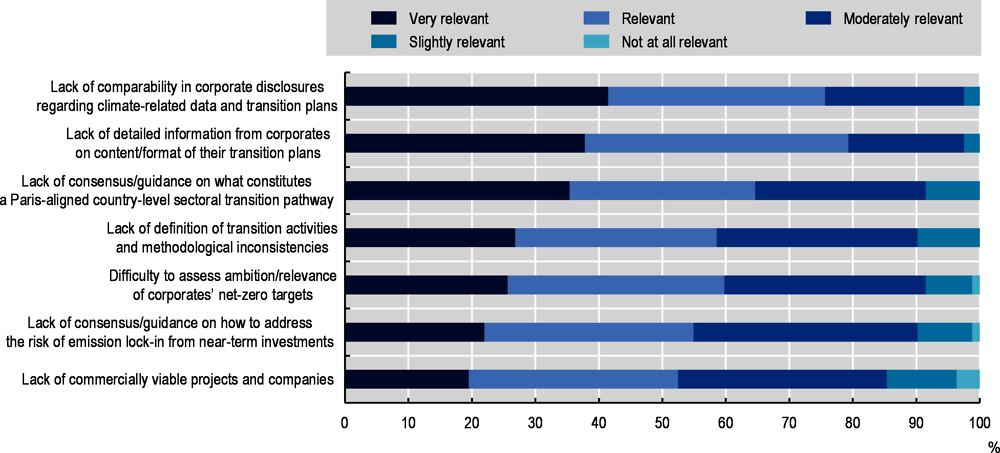

Responses by financial market participants to the OECD Industry Survey on Transition Finance indicate that a lack of detailed information from corporates on their climate transition planning is the main obstacle preventing them from identifying companies they could finance in line with their net-zero targets. As part of the survey, 79% of financial market participant respondents indicated that this lack of information was a relevant or very relevant obstacle. Similarly, 76% of respondents from financial markets found a lack of comparability in corporate disclosure of climate-related data and transition planning to be a relevant or very relevant obstacle. The lack of commercially viable projects or companies was cited by 52% of financial market respondents as relevant or very relevant, which was the lowest combined number among the different obstacles cited (see Figure 3.1).

Figure 3.1. Information gaps and a lack of comparability of relevant data are key obstacles to identifying companies that are committed to a credible net-zero transition

Note: Responses by financial market participants. The number of respondents for this survey question was 156.

Source: 2022 OECD Industry Survey on Transition Finance.

3.2.2. Variation in countries’ net-zero commitments and NDCs

The exact nature of the net-zero transition will be country-dependent, as it will be influenced by domestic socio-economic circumstances, geography, and capacity to leapfrog.1 This variability is reflected in the significant variation and diversity of existing net-zero targets along several key dimensions, such as their legal status, terminology, coverage, sectoral scope and timeframe (Jeudy-Hugo, Lo Re and Falduto, 2021[4]). The International Energy Agency (IEA) estimates that the pledges announced by parties to the Paris Agreement at the COP26 UN Climate Change Conference, together with the announcements made before then could be enough to hold the rise in global temperatures to 1.8°C by 2100 (IEA, 2021[5]). However, there continue to be significant divergences between NDCs and the available global pathways associated with meeting the temperature goal of the Paris Agreement (UNFCCC, 2021[6]).2

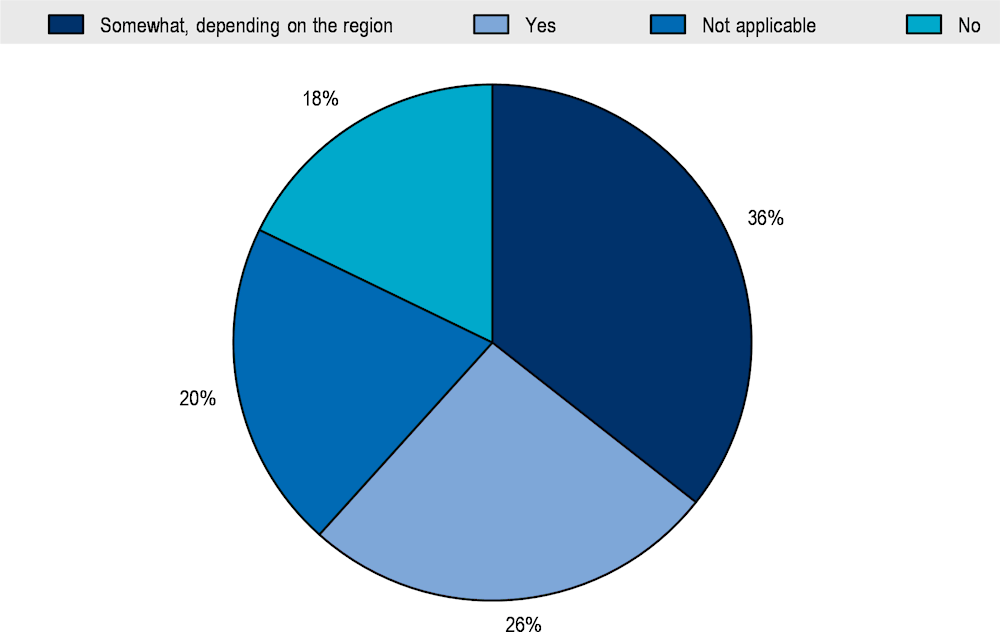

Some transition finance approaches, such as the one put forward by the TCFD, recommend that transition plans include a description of the temperature goal that was selected for alignment purposes, providing 1.5°C as one possible option (TCFD, 2021[7]). This allows for companies operating in jurisdictions with different regulatory mandates -- or varying sectoral decarbonisation strategies in place -- to raise finance, without having to adhere to a common temperature goal aligned with the Paris Agreement. While this approach is inclusive, it raises the question of whether a common benchmark is needed to ensure the alignment of transition plans with the temperature goal of the Paris Agreement. Without such a common point of reference, there is a risk of greenwashing (Shrimali, 2021[8]), which is an obstacle to growing this nascent market. This is confirmed by 62% of financial market respondents to the OECD Industry Survey on Transition Finance, who stated that they hesitated to provide transition financing generally, or for specific regions, because of insufficient clarity on how to assess credible corporate alignment with a pathway that is in line with the Paris Agreement’s temperature goal (see Figure 3.2 below). Moreover, flexibility with respect to targets makes it more challenging for international investors and financial institutions that operate across borders to compare plans across jurisdictions and come to a clear view on an entity’s environmental integrity. Conversely, having a common benchmark will reduce the variables international investors and financial institutions need to consider when assessing environmental integrity, while also increasing comparability across jurisdictions.

Figure 3.2. Financial market participants may hesitate to provide transition financing due to a lack of clarity on how to assess credible corporate alignment with a pathway that is in line with the Paris temperature goal

Note: Responses by financial market participants. The number of respondents for this survey question was 73.

Source: 2022 OECD Industry Survey on Transition Finance.

Information on the extent to which a corporate’s transition plan is aligned with net-zero commitments and related NDCs in the corporate’s jurisdictions of operation still can be useful to assess possible transition risks and opportunities linked to future changes in policy. However, disclosures on these elements do not provide a consistent benchmark for comparing climate ambition and environmental integrity across corporates and across jurisdictions. They are therefore complementary elements that can be useful for corporates and financial market participants but cannot substitute for a net-zero target and related transition planning in line with the temperature goal of the Paris Agreement.

3.2.3. Lack of national sectoral pathways

To date, only few countries have set sectoral emission limits or carbon budgets to meet their net-zero targets (Jeudy-Hugo, Lo Re and Falduto, 2021[4]). Similarly, even in jurisdictions where net-zero targets have been adopted, determination of a national emission budget and its disaggregation by sector and translation into sectoral plans and implementation roadmaps has in most cases not been definitively undertaken and widely recognised, and in many cases has not yet been attempted (see, for example, (Jeudy-Hugo, Lo Re and Falduto, 2021[4]), (WRI, 2019[9]), and (WRI, 2021[10])).

However, clear national sectoral targets and pathways, in line with the temperature goal of the Paris Agreement, are necessary to guide corporate transition planning and investor decision-making in a manner that accounts for the local context and conditions. This is confirmed by the OECD industry survey, where 69% of respondents stated that the lack of such pathways is a key obstacle to identifying companies committed to a Paris-aligned transition trajectory. Similarly, 17 out of 20 non-financial corporates that responded to this question view the lack of sectoral pathways and roadmaps as the main obstacle to developing a credible transition plan that is aligned with the Paris Agreement’s temperature goal.

To help fill this gap, there are several private sector initiatives that provide training and services to support companies in assessing their alignment with global emission pathways as well as setting relevant targets (see Box 3.1). However, these initiatives are mostly not tailored to specific country contexts and their policy environments, and are not always accessible to companies in EMDEs, especially not MSMEs. The development of robust targets and decarbonisation pathways for different sectors, and guidance on their translation into corporate-level pathways, will likely require effective coordination between governments, donors, and the private sector (OECD, forthcoming[11]), such as through relevant country platforms.

Box 3.1. From global- to corporate-level emission pathways

When setting emissions reduction targets, companies face the technical challenge of deriving corporate-level transition pathways from available scientific evidence on global GHG emissions pathways that align with the temperature goal of the Paris Agreement.

Several methods for deriving sector-specific decarbonisation pathways exist, with the most widely used ones being the sectoral decarbonisation approach (SDA) and the absolute contraction approach, developed by the partners of the Science Based Targets initiative (SBTi) (CDP, World Resources Institute, WWF and UN Global Compact) (SBTi, 2021[12]). Such methodologies allow to derive sector-level benchmarks, based on which performance of individual companies can be assessed and targets can be set. Many international initiatives are providing guidance, knowledge, training, and services to help companies set and/or assess their targets, decarbonisation strategies and transition plans. For example, SBTi helps companies set science-based decarbonisation targets; TPI, an asset-owner-led initiative, assesses corporates’ performance and preparedness for the transition to a low-carbon economy; and ACT, a French initiative, helps companies set and assess their strategies and plans to transition towards low-carbon pathways. SBTi, TPI and ACT mainly apply the SDA approach (ACT, 2021[13]; SBTi, 2015[14]; TPI, 2022[15]). It is worth noting that such approaches focus on global pathways and thus may not always sufficiently integrate region- or country-specific considerations, which is a key limitation (Noels and Jachnik, forthcoming[16]).

The SDA allocates the carbon budget to different sectors, to consider inherent differences among sectors, such as their mitigation potential, the concentration of emissions in the value chain, the sector’s expected growth, etc. The SDA mainly builds on IEA’s global sectoral scenarios, notably the Energy Technology Perspectives and more recent models in some cases. The current version of the SDA used in SBTi’s sector-specific guidance supports 1.5°C targets for power generation (and soon for other sectors as well), while the methods for other sectors rely on well-below 2°C pathways from the IEA. The SDA relies on the convergence principle, as it assumes that all companies in a sector will converge towards a common emission intensity in 2050. The SDA thus works well for homogenous sectors, such as power generation, iron and steel, aluminium, cement, pulp and paper, passenger and freight transport, and buildings. Within each sector, companies can derive their emission reduction targets based on their relative contribution to the total sector activity and their carbon intensity relative to the sector’s intensity in the base year. The ACA is a cross-sector method that applies a unique absolute emissions decrease rate to all sectors, in line with global decarbonisation pathways. It is mostly used to set targets by companies for those sectors where the SDA approach is not applicable, i.e., for heterogeneous sectors.

Note: There are currently different understandings and interpretation of what net-zero is with nuances in the terminology used by different actors (e.g., in terms of coverage of GHG emissions and other dimensions). (Jeudy-Hugo, Lo Re and Falduto, 2021[4]) provides detailed explanations of the differences in terminology around net-zero (see in particular Box 2.1).

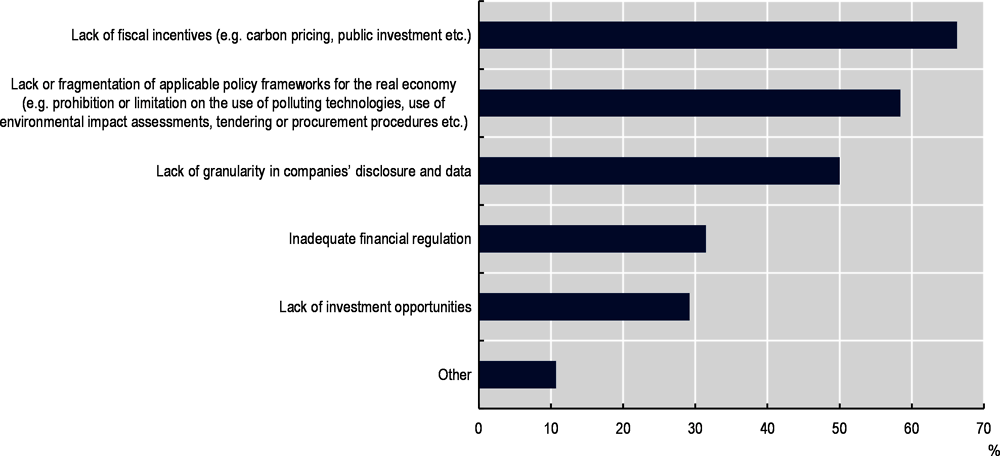

3.2.4. Enabling conditions

According to the IEA, energy investments will need to increase urgently in all EMDEs and especially in India, sub-Saharan Africa, and Southeast Asia. By 2030, energy investments in EMDEs should make up more than 40% of global energy investments to be in line with the IEA’s Net Zero by 2050 Scenario. This amounts to USD 1 trillion in annual spending on clean energy by 2030, compared to today’s investment volumes, which in 2020 amounted to USD 150 billion (IEA, 2021[17]). The reasons for this investment gap are manifold. For example, a survey among ASEAN Member’s confirms that they include funding hurdles, technology capacity gaps, technology availability, general lack of awareness as well as data gaps, preventing countries from transitioning their economies towards low-emission pathways (ASEAN, 2021[18]). Similarly, as shown in Figure 3.3, respondents to the OECD Industry Survey on Transition Finance consider that there are several gaps and drawbacks in the enabling environment, i.e., the policy, legal and institutional framework at country or regional level, which would need to be addressed to fully support a low-emission transition. In addition to a lack of granular disclosure and data by companies, respondents also cite a lack of fiscal incentives, such as inadequate carbon pricing or public investments, and a lack or fragmentation of the applicable policy frameworks for the real economy as major gaps. Applicable policy frameworks for the real economy may include the prohibition or limitation of the use of polluting technologies, relevant environmental impact assessments, as well as tendering and procurement procedures.

Affordability

Since the financing challenge will vary significantly by technology, sector and region, sources of finance will differ depending on project attributes and the technology development stage. New technologies in particular will require high upfront capital investment and might have new unmitigated risks and near-term competitive disadvantages. For example, using the full range of available technologies to decarbonise the chemical industry could cost as much as USD 500 per tonne of mitigated CO2 until 2050, which might be a deterrent for some companies in the sector (Saygin and Gielen, 2021[19]) In this context, certain low-carbon technologies may have a smaller impact in terms of emissions reductions but have faster returns on investment, while others may have a high estimated impact on emissions but do not have a business case under current conditions. Therefore, pilot projects and early development stages of breakthrough technologies (for example electric steam cracking), as well as technologies that are still at early stages of commercialisation, will often require public investment and technical support beyond private capital to increase technological readiness and support commercialisation (IEA, 2021[20]).

Figure 3.3. What are the main drawbacks and gaps in the enabling environment that should be addressed to fully support a low-emission transition?

Note: The number of respondents for this survey question was 169; multiple answers per respondent were possible.

Source: 2022 OECD Industry Survey on Transition Finance

Policy and institutional framework

As mentioned earlier in this chapter, institutional and economic feasibility can be seen as two of the key bottlenecks to rapidly putting in place necessary mitigation response options. This issue extends across sectors and is prevalent in energy (production and use), urban planning, buildings, and transport (IPCC, 2022[21]). This was confirmed by respondents of the OECD industry survey who cited a lack of fiscal incentives (including through appropriate carbon pricing) and a lack or fragmentation of applicable policy frameworks (including political acceptance, legal and administrative capacity and procedures) as the top two drawbacks in the enabling environment to be addressed to fully support the net-zero transition (see Figure 3.3). Combined, these two reasons are considered by respondents to be four times more important than a lack of investment opportunities. This points to the strong need to increase fiscal incentives, including through carbon pricing and tools like Carbon Contracts for Difference (see, for example, (Climate Friendly Materials Platform, 2020[22]), (ERCST, 2022[23])), and the need to reduce administrative and institutional bottlenecks, and streamline permitting granting procedures for low-carbon projects (OECD, 2018[24]).

The literature recognises that a lack of adequate carbon pricing and continued inefficient fossil fuel subsidies, especially in EMDEs, are key factors that reduce, for example, the competitiveness of clean energy (OECD, forthcoming[11]). This compounds existing affordability hurdles related to near-zero or net-zero technologies. Moreover, carbon border adjustment mechanisms will likely increase the cost of exports from countries that use emission-intensive energy sources and technologies, due to the carbon embedded in end products (OECD, forthcoming[3]). This would decrease the competitiveness of those goods and increase the need for domestic policy intervention to level the playing field between net-zero and emission-intensive technologies and sources of energy. Policy and institutional capacity will thus have a key role to play as an enabling factor for the scaling up of net-zero solutions (IPCC, 2022[2]). Like discussions around national net-zero targets and pathways, technical assistance, together with donor and investor coordination, such as through country platforms, can help increase this institutional capacity to transition. This type of support could be particularly impactful for MSMEs in the relevant jurisdictions.

3.2.5. Asset stranding and risk of carbon-intensive lock-in

Asset stranding and risk of lock-in are two sides of the same coin and are two of the main factors contributing to risks of greenwashing in transition finance. Asset stranding refers to the devaluation of assets, due to changes associated with the net-zero transition, before the end of their economic lifetime. It can encompass several different factors, including economic stranding, as a result of changing relative costs and prices, physical stranding, as a result of physical climate impacts such as floods and droughts, and regulatory stranding, as a result of changing policies (see, for example, (Carbon Tracker, 2017[25])). Carbon lock-in is the result of fossil fuel infrastructure or assets (existing or new) delaying or preventing the transition to near-zero or net-zero alternatives. This risk may be increased when private investors or financial institutions have a stake in those assets, as they will have an incentive in continuing the asset’s operation until the end of its useful life. There are several possible solutions to circumvent these problems and early retirement of high-emission assets and infrastructure is one of them (WRI, 2021[26]).

Navigating economic feasibility

Existing assets in EMDEs often do not employ best-available technologies (BATs), despite being relatively young (13 years on average in Asia, compared to a lifetime of up to 50 years, for example, for coal plants). While the concept of ‘Best-available technology’ or ‘Best-available technique’ (BAT) to prevent and control industrial emissions and pollution has different interpretations across the world, the EU definition is the most widely referenced one. According to that definition, BAT generally refers to techniques that can be implemented at scale, “under economically and technically viable conditions, taking into consideration the costs and advantages” (OECD, 2020[27]). BAT-associated environmental performance levels are based on “the range of emission levels obtained under normal operating conditions using a best available technique” and are fundamentally based on the performance of existing installations (OECD, 2020[27]).

When existing assets are retrofitted or redesigned, there is a tendency to opt for BATs. However, these are often still emission-intensive solutions, as BATs are backward-looking, consider only existing installations, and focus on implementation at scale, thus leaving out necessary near-zero and net-zero solutions. Therefore, it is important that retrofitting of existing assets and infrastructures also enables them for the future use of near-zero or net-zero emission technologies, such as renewable and low-carbon fuels, which would not yet be reflected in BATs. This is necessary to avoid future asset stranding, even if technologies like renewable hydrogen are not fully commercially available for all project developers yet (OECD, forthcoming[3]). Considerations regarding economic feasibility can support the decision to plan for the use of transformative technologies, if costs projected over the lifetime of the asset take into account negative environmental externalities, the materialisation of future transition risk due to policy changes, and subsequent additional investment needs associated with a switch to a near-zero or net-zero alternative. These costs of re-investment can be avoided by strategically planning retrofitting and redesign in a manner that enables the future use of near-zero or net-zero technologies. However, especially in EMDEs, such an approach may also require the use of concessional finance (OECD, forthcoming[11]).

Preventing carbon-intensive lock-in

In April 2022, the IPCC clearly concluded that “the continued installation of unabated fossil fuel infrastructure will ‘lock-in’ GHG emissions”. Abatement in this context is defined as an intervention that can “substantially reduce the amount of GHG emitted throughout the life cycle; for example, capturing 90% or more from power plants, or 50-80% of fugitive methane emissions from energy supply” (IPCC, 2018[28]). Whether or not investments in fossil fuel infrastructure, including the deployment of emissions abatement technologies across existing infrastructure, should be part of transition finance approaches continues to be the subject of intense debate among policymakers, industry, and civil society. Therefore, considering the broad recognition that there is a need to prevent carbon-intensive lock-in (and subsequent asset stranding), existing approaches to transition finance have attempted to put in place broadly three types of safeguards to try to prevent carbon-intensive lock-in.

The first type of safeguard to prevent lock-in is to ‘future-proof’ emission-intensive assets. This approach requires ensuring that the newly built or retrofitted asset or infrastructure is enabled for the future use of near-zero and net-zero technologies. Such an approach was taken by the European Commission as part of the Recovery and Resilience Facility and the Commission proposal on a complementary delegated act under the EU Taxonomy (European Commission, 2021[29]; 2022[30]). In both cases, natural gas assets and infrastructures can be financed, if they comply with several conditions, including being enabled for the future use of renewable and low-carbon gases, as well as complying with a lifetime emission limit that would in theory ensure blending and switching to such gases during the lifetime of the gas plant. These conditions are useful in the case of long-term performance-based instruments, where the asset must comply with certain conditions and meet KPIs (such as a pre-defined level of blending with renewable or low-carbon fuels) at specific points in time but will be difficult to implement in the case of shorter investment cycles and without additional conditions and guarantees to ensure blending happens at the right moments. The result of insufficient abatement would likely be carbon-intensive lock-in, based on IPCC findings on new unabated fossil fuel infrastructure (IPCC, 2022[1]).

The second type of safeguard, aimed at ensuring that the switch of the emission-intensive asset or infrastructure to a near-zero or net-zero technology materialises, is for the asset or infrastructure owner to make additional commitments to invest into or allocate funds for research, development and innovation (R&D&I). For example, in the case of a Japanese company’s transition bond issuance, the company commits for the proceeds of the bond to be used for demonstration studies for ammonia and hydrogen co‑firing of thermal power plants, including the construction of a large-scale hydrogen supply chain, in order to support the future switch from coal (METI, 2022[31]). For fossil gas infrastructure, a comparable approach could be to invest into the production of renewable hydrogen or enter into contractual agreements with producers. This approach increases buy-in by the asset owner, can bring down technology costs if R&D&I efforts are effective, and can thus increase the likelihood for the switch to happen. It also supports the development and scaling up of new technologies. However, it does not guarantee that the new technology will ultimately be implemented, and therefore may not be sufficient to ensure implementation.

A third option is the introduction of sunset clauses and gradually more stringent criteria. This approach is incorporated in the European Commission’s proposed complementary delegated act and in ongoing work for the ASEAN Taxonomy. Under this approach, the activity is only counted as a transition activity until a specific date (e.g., 2030) and must comply with a new set of more stringent criteria thereafter. In isolation, this approach could also lead to lock-in, since infrastructure assets will be built before the sunset date and presumably will continue to operate, unless they are stranded. Moreover, calibrating the correct date for sunsetting is challenging, as it would need to be set in a manner that complies with the IPCC finding that global emission need to peak before 2025 (IPCC, 2022[1]). On the other hand, such an approach can provide an additional impetus to financial market participants and corporates for whom labelling an investment as ‘transition’ is important, to continue improving the performance of emission-intensive assets until such a point where they have near-zero or net-zero emissions. If criteria and sunset clauses are based on pathways in line with the Paris Agreement temperature goal, and enabling conditions are strengthened in parallel, then such an approach can provide visibility to financial market participants and corporates and allow them to gradually improve their performance. However, since this option fundamentally relies on investor and corporate appetite to, respectively, use and qualify under a ‘transition label’, it will likely be insufficient to encourage a whole-of-economy transition, unless combined with other methods. The ASEAN Taxonomy Board recognises this issue and is intending to use sunset clauses as part of a package of methods, which may include enhanced disclosure, to obtain better decarbonisation outcomes.

If used in isolation, these methods have a lower likelihood of success in preventing carbon-intensive lock-in. But a combination of these approaches, together with the possible early retirement of high-emission assets (see Box 3.2), could help prevent carbon-intensive lock-in and as a result also minimise the risk of asset stranding.

Box 3.2. Financing mechanisms to accelerate the early retirement of coal assets in developing countries: emerging initiatives and models

Coal is the most emission-intensive fuel today, yet it is still significantly used in electricity generation. The IEA’s Net Zero Scenario envisages that no additional investments are made for new unabated coal plants, the least efficient coal plants are phased out by 2030, and the remaining coal plants still in use by 2040 are retrofitted to significantly reduce their emissions (IEA, 2021[32]). The IPCC projects that the global discounted value of unburned fossil fuels and stranded fossil fuel infrastructure will amount to USD 1-4 trillion from 2015 to 2050 on a trajectory that limits global warming to around 2°C, and it will be higher if global warming is limited to nearly 1.5°C (IPCC, 2022[1]). Phasing out coal in the power sector requires halting the construction of new plants combined with managing the decline in emissions from existing plants (e.g., through retrofitting with CCUS or co-firing with low-emission fuels such as biomass or ammonia) or retiring them entirely (IEA, 2021[32]). The challenge of managing early coal retirement is particularly complex in EMDEs, especially in India, People’s Republic of China (China) and some Southeast Asian countries, where coal is the cornerstone of the electricity supply and coal-fired power plants are relatively young (in Asia, on average 13 years) (IEA, 2021[33]).

A key challenge to speed up early retirement is that 93% of coal plants globally are insulated from competition from renewables by long-term contracts and non-competitive tariffs (Bodnar et al., 2020[34]), which risk locking in highly polluting energy supplies. Early retirement requires a range of financial mechanisms that are tailored to plants of different types and ages, as well as to the varied market structures within which they operate (IEA, 2021[32]). At present, public entities such as governments and MDBs are the main drivers of initiatives to finance early coal retirement (Christoph, Mengdi and Ulrich, 2022[35]). For example, the Energy Transition Mechanism is an initiative led by the Asian Development Bank (ADB) to accelerate the transition from legacy coal to clean energy, by creating two complementary multi-million-dollar funds financed by governments, MDBs, private investors, philanthropies, and long-term investors. One of the two funds will be used to buy legacy coal power plants and retire or repurpose them within 15 years, which is earlier than if they remained with their current owners. The other fund will use proceeds from the asset’s sale and other sources to invest in renewable energy plants and enabling infrastructure such as grids and storage. ADB recently completed a pre-feasibility study that included financial and technical analysis in three pilot countries (Indonesia, the Philippines, and Viet Nam). A full feasibility study is underway to determine the financial structure of the ETM, identify coal plants for inclusion in the pilots, and design just transition activities (ADB, 2021[36]). Such mechanisms would be designed for specific countries to be effective and based on a country’s energy needs and nationally determined contributions (Kanak, 2021[37]). Similarly, the Climate Investment Funds (CIF) launched the nearly USD 2.5 billion Accelerating Coal Transition investment program, an initiative to advance a just transition from coal power to clean energy in emerging economies, starting with South Africa, India, Indonesia, and the Philippines. This program will combine concessional financing with technical assistance to de-risk and pilot investments to support the coal transition, including by providing capacity, repurposing or decommissioning coal assets, and creating social protection programs for coal-dependent communities (CIF, 2021[38]).

Country platforms are also emerging as a potentially important model to unlock finance to support EMDEs’ transitions to low-carbon and resilient development paths. In 2020, the G20 endorsed the ‘G20 Reference Framework for effective Country Platforms’, recognising the importance of continuing to implement existing country platforms and encouraging the development of new ones (G20, 2020[39]). The country platform model could address some of the issues of the current international climate finance landscape (ODI, 2022[40]). Moreover, current initiatives for a just transition away from coal are still new and small-scale and remain incomplete (Muller and Robins, 2021[41]). Initiatives covering some key elements of country platforms already exist, and others are being developed. An example is the Just Energy Transition Partnership (JETP) in South Africa, which committed to decarbonise its coal-dependent electricity sector. To support South Africa’s efforts in early retirement of coal plants, building cleaner energy sources and supporting coal-dependent regions, in 2021 the United States, Germany, France, the United Kingdom and the EU pledged to mobilise USD 8.5 billion over the next three to five years (UK COP26, 2021[42]). In 2022, G7 Leaders recognised and supported partnerships such as JETPs and affirmed their intent to move forward in negotiations on JETPs with Indonesia, India, Senegal, and Viet Nam (G7, 2022[43]).

As initiatives to finance early retirement accelerate, increasing attention is devoted to the role of DFIs and MDBs in supporting this transition, overseeing the process and mobilising financing from private investors through blended finance (Kanak, 2020[44]). This raises the need to ensure additionality and impact of concessional financing provided (OECD, 2018[45]), as any use of public funds to compensate owners and secure early retirements on climate grounds needs to be carefully assessed to ensure that funding is focused on assets that are unlikely to be retired on their own (IEA, 2021[32]). While both concessional and non-concessional development finance can be part of blended finance structures, the use of concessional resources requires particular care, given its scarcity, and its allocation should be based on transparent and competitive processes (OECD, 2018[45]; Bodnar et al., 2020[34]). Governments’, development finance institutions’ and MDBs’ resources could usefully focus on addressing the severe economic and social consequences of the early retirement of high-emitting assets for all the actors in the supply chain, namely workers, communities, utility companies and other local businesses, and governments, to name a few.

3.3. Way forward: A whole-of-economy approach, in line with the Paris Agreement

Since the transformation of the global economy to meet the temperature goal of the Paris Agreement requires deep emission cuts across multiple sectors, and the avoidance of greenwashing to provide confidence to investors, credible corporate climate transition plans will be key. A credible plan will be centred on the entity’s projected emissions performance, pathway and target, the proposed steps to be taken to achieve this, including an analysis and justification of alignment with the temperature goal of the Paris Agreement. Such a plan will be integrated into the company’s overall strategy to increase climate-related opportunities, balance costs, mitigate risks of carbon-intensive lock-in and prevent asset stranding. Chapter 4 describes in more detail the elements of credible corporate climate transition plans.

At the same time, some challenges, notably related to the enabling environment, require additional intervention at the level of policy, regulation, technical assistance, and capacity-building. Capacity-building at the level of firms, local administrations, and government, as well as policy changes to improve the enabling conditions for mitigation options is necessary to increase the economic and institutional feasibility of those options, especially in EMDEs. This can be done, for example, by supporting the development of national strategies and sectoral pathways and targets that are in line with the temperature goal of the Paris Agreement. Conversely, investments and policies that decrease feasibility, such as inefficient fossil fuel subsidies and investments into new or existing unabated fossil fuel assets and infrastructure, require definitive reorientation. Country platforms are one important approach that can help to coordinate government strategies, donors, MDBs, and private investors, as well as manage the provision of technical assistance and capacity-building, in order to put in place the necessary changes in the policy and institutional environment to spur investments in existing low-carbon and innovative transformational technologies.

References

[13] ACT (2021), From global carbon budget to company pathways, https://actinitiative.org/wp-content/uploads/pdf/act-position-from-global-carbon-budget-to-company-level-climate-targets.pdf.

[36] ADB (2021), Energy Transition Mechanism Explainer: How ETM Will Support Climate Action in Southeast Asia, https://www.adb.org/news/features/energy-transition-mechanism-explainer-support-climate-action-southeast-asia (accessed on 15 June 2022).

[18] ASEAN (2021), ASEAN Taxonomy for Sustainable Finance.

[34] Bodnar, P. et al. (2020), How to retire early: Making accelerated coal phaseout feasible and just, Rocky Mountain Institute.

[25] Carbon Tracker (2017), Stranded Assets, https://carbontracker.org/terms/stranded-assets/ (accessed on 17 June 2022).

[35] Christoph, N., Y. Mengdi and V. Ulrich (2022), Global Practices for Financing of Early Coal Retirement for Accelerated Green Energy Transition, Green Finance & Development Center FISF Fudan University and Centre for Sustainable Finance, SOAS University of London, https://greenfdc.org/wp-content/uploads/2022/03/D3_Early_Coal_Retirement_Best_Practices.pdf.

[38] CIF (2021), CIF Begins Historic $2.5B Coal Transition Pilot in Four Developing Countries, https://www.climateinvestmentfunds.org/news/cif-begins-historic-25b-coal-transition-pilot-four-developing-countries (accessed on 15 June 2022).

[22] Climate Friendly Materials Platform (2020), Carbon Contracts for Differences: their role in European industrial decarbonization, https://climatestrategies.org/wp-content/uploads/2021/03/Carbon-Contracts_CFMP-Policy-Brief-2020.pdf.

[23] ERCST (2022), Reflection not on Carbon Contracts for Difference (CCfDs), https://ercst.org/wp-content/uploads/2022/01/20220104-CCfD-reflection_note_final.pdf.

[30] European Commission (2022), Taxonomy Regulation Complementary Delegated Act, https://ec.europa.eu/finance/docs/level-2-measures/taxonomy-regulation-delegated-act-2022-631_en.pdf.

[29] European Commission (2021), “Commission Notice: Technical guidance on the application of ’do no significant harm’ under the Recovery and Resilience Facility Regulation 2021/C 58/01”, Official Journal of the European Union, Vol. OJ C 58, pp. 1-30, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021XC0218%2801%29.

[39] G20 (2020), G20 Reference Framework for Effective Country Platforms, http://www.mof.gov.cn/en/Cooperation/mulid/202011/P020201104581749367491.pdf.

[43] G7 (2022), G7 Chair’s Summary: Joining Forces to Accelerate Clean and Just Transition towards Climate Neutrality, https://www.g7germany.de/resource/blob/974430/2057418/9a1d62b3c5710b4c1989f95b38dc172c/2022-06-27-chairs-summary-climate-neutrality-data.pdf?download=1.

[33] IEA (2021), Coal 2021 Analysis and forecast to 2024, https://iea.blob.core.windows.net/assets/f1d724d4-a753-4336-9f6e-64679fa23bbf/Coal2021.pdf.

[5] IEA (2021), COP26 climate pledges could help limit global warmimg to 1.8C, but implementing them will be the key, https://www.iea.org/commentaries/cop26-climate-pledges-could-help-limit-global-warming-to-1-8-c-but-implementing-them-will-be-the-key (accessed on 21 April 2022).

[17] IEA (2021), Financing Clean Energy Transitions in Emerging and Developing Economies, https://www.iea.org/reports/financing-clean-energy-transitions-in-emerging-and-developing-economies.

[20] IEA (2021), Net-Zero by 2050: A Global Roadmap for the Energy Sector, https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector_CORR.pdf.

[32] IEA (2021), World Energy Outlook 2021, IEA, https://www.iea.org/reports/world-energy-outlook-2021.

[2] IPCC (2022), AR6 WGIII Draft Technical Summary, https://report.ipcc.ch/ar6wg3/pdf/IPCC_AR6_WGIII_FinalDraft_TechnicalSummary.pdf.

[21] IPCC (2022), AR6 WGIII Full Report, https://report.ipcc.ch/ar6wg3/pdf/IPCC_AR6_WGIII_FinalDraft_FullReport.pdf.

[1] IPCC (2022), Sixth Assessment Report - Mitigation of Climate Change: Summary for Policymakers, https://www.ipcc.ch/report/sixth-assessment-report-working-group-3/.

[28] IPCC (2018), Summary for Policymakers — Global Warming of 1.5 ºC, https://www.ipcc.ch/sr15/chapter/spm/ (accessed on 1 May 2022).

[4] Jeudy-Hugo, S., L. Lo Re and C. Falduto (2021), Understanding countries’ net-zero emissions targets, OECD Publishing.

[37] Kanak, D. (2021), How to accelerate the energy transition in developing economies, https://www.weforum.org/agenda/2021/01/how-to-accelerate-the-energy-transition-in-developing-economies/.

[44] Kanak, D. (2020), How to replace coal with renewables in developing countries, World Economic Forum, https://www.weforum.org/agenda/2020/05/how-to-replace-coal-and-accelerate-the-energy-transition-in-developing-countries/ (accessed on 15 June 2022).

[31] METI (2022), Transition Finance - case Study 8: JERA Co., Inc., https://www.meti.go.jp/policy/energy_environment/global_warming/transition/transition_finance_case_study_jera_eng.pdf.

[41] Muller, S. and N. Robins (2021), Financing the just transition beyond coal, https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2021/10/Financing-the-just-transition-beyond-coal.pdf.

[16] Noels, J. and R. Jachnik (forthcoming), Assessing the climate consistency of finance: taking stock of methodologies and their links to climate policy objectives (forthcoming), OECD Environment Working Papers, http://www.oecd.org/environment/workingpapers.htm.

[40] ODI (2022), “Country platforms” for bold climate action?, https://odi.org/en/insights/country-platforms-for-bold-climate-action/.

[27] OECD (2020), Best Available Techniques (BAT) for Preventing and Controlling Industrial Pollution, Activity 4: Guidance Document on Determining BAT, BAT-Associated Environmental Performance Levels and BAT-Based Permit Conditions, https://www.oecd.org/chemicalsafety/risk-management/guidance-document-on-determining-best-available-techniques.pdf.

[24] OECD (2018), Developing Robust Project Pipelines for Low-Carbon Infrastructure, OECD Publishing, https://doi.org/10.1787/9789264307827-en.

[45] OECD (2018), OECD DAC Blended Finance Principles, https://www.oecd.org/dac/financing-sustainable-development/development-finance-topics/OECD-Blended-Finance-Principles.pdf.

[11] OECD (forthcoming), Blended Finance Guidance for Clean Energy.

[3] OECD (forthcoming), Framework for Industry’s net-zero Transition: Developing financing solutions to accelerate industry’s net-zero transition in emerging and developing economies.

[19] Saygin, D. and D. Gielen (2021), “Zero-Emission Pathway for the Global Chemical and Petrochemical Sector”, Energies, Vol. 14/13, p. 3772, https://doi.org/10.3390/EN14133772.

[12] SBTi (2021), Understand the Methods for Science-based Climate Action, https://sciencebasedtargets.org/news/understand-science-based-targets-methods-climate-action#:~:text=The%20Absolute%20Contraction%20Approach%20(ACA,setting%20science-based%20targets%20choose (accessed on 30 April 2022).

[14] SBTi (2015), Quick Guide to the Sectoral Decarbonisation Approach, https://sciencebasedtargets.org/resources/legacy/2015/05/A-Quick-Guide-to-the-Sectoral-Decarbonization-Approach.pdf.

[8] Shrimali, G. (2021), Transition Bond Frameworks: Goals, Issues, and Guiding Principles, https://energy.stanford.edu/sites/g/files/sbiybj9971/f/transition_bond_frameworks-_goals_issues_and_guiding_principles_0.pdf.

[7] TCFD (2021), Task Force on Climate-Related Financial Disclosures - Guidance on Metrics, Targets, and Transition Plans, https://assets.bbhub.io/company/sites/60/2021/07/2021-Metrics_Targets_Guidance-1.pdf.

[15] TPI (2022), TPI Sectoral Decarbonisation Pathways, https://www.transitionpathwayinitiative.org/publications/100.pdf?type=Publication (accessed on 30 April 2022).

[42] UK COP26 (2021), Political Declaration on the Just Energy Transition in South Africa, https://ukcop26.org/political-declaration-on-the-just-energy-transition-in-south-africa/ (accessed on 15 June 2022).

[6] UNFCCC (2021), Nationally determined contributions under the Paris Agreement: Revised synthesis report by the secretariat, https://unfccc.int/sites/default/files/resource/cma2021_08r01_E.pdf.

[10] WRI (2021), 10 Big Findings From the First Batch of Long-Term Strategies, https://www.wri.org/insights/findings-long-term-strategies-first-batch#:~:text=All%20countries%20were%20expected%20to,strategy%20to%20the%20United%20Nations. (accessed on 14 April 2022).

[26] WRI (2021), What is Carbon Lock-in and How Can We Avoid It?, https://www.wri.org/insights/carbon-lock-in-definition#:~:text=Carbon%20lock%2Din%20occurs%20when,can%20seriously%20imperil%20climate%20action. (accessed on 17 June 2022).

[9] WRI (2019), Which Countries Have Long-term Strategies to Reduce Emissions?, https://www.wri.org/insights/which-countries-have-long-term-strategies-reduce-emissions (accessed on 14 April 2022).

Notes

← 1. The concept of leapfrogging in the context of sustainable development refers to accelerated development that is notably marked by the skipping of less efficient and polluting technologies, through the faster adoption of more advanced ones. The adoption of solar energy technologies instead of creating fossil fuel infrastructure is one such example, which aims to avoid replicating the environmentally harmful development trajectories that were followed by advanced economies.

← 2. It is important to note that NDCs analysed as part of the latest UNFCCC synthesis report do not consider announcements made at COP26, since only NDCs submitted by 12 October 2021 were included in that report.