This chapter sets the scene for tax reform in Lithuania. The chapter reviews the economic, employment and inequality challenges facing the country. The chapter examines the wage income distribution and poverty risks with a focus on older workers. Finally, tax revenues and social spending are reviewed.

OECD Tax Policy Reviews: Lithuania 2022

2. Setting the scene for tax reform

Abstract

Lithuania’s economy and labour market are recovering

This section provides observations and general economic reform options based on this Tax Policy Review. For a review of Lithuania’s economy, see the OECD Economic Survey of Lithuania 2022 (OECD, 2022[1]).

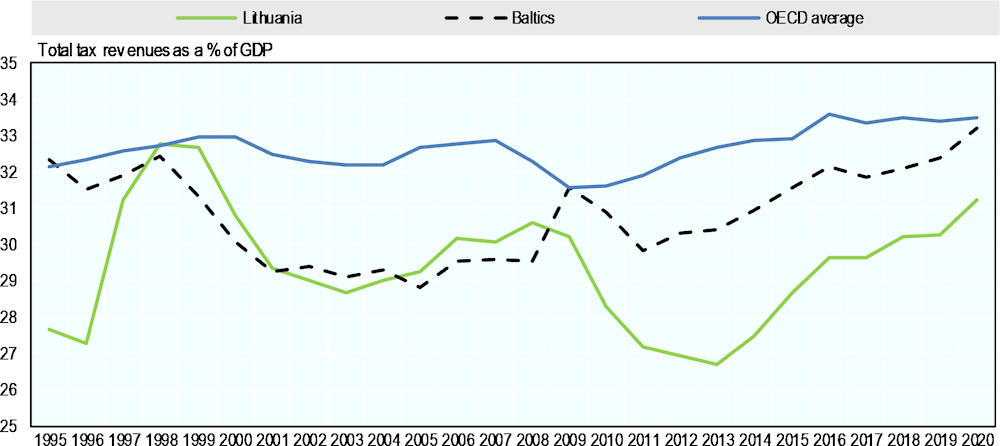

The Lithuanian economy has successfully emerged from the COVID-19 crisis. Since the mid-2000s, Lithuania’s per capita GDP growth has been above most OECD countries and other economies in the region (Figure 2.1). The COVID-19 pandemic hit a buoyant Lithuanian economy in 2020. Since then, GDP has rebounded rapidly and is projected to grow at 3.7% on average in 2022 and 2023 (OECD, 2021[2]). Productivity measured as GDP per person has accelerated in recent years, reaching an indexed score of 119 in Q4 2021 against a benchmark of 100 in 2015.1 However, labour productivity remains in the bottom third of OECD countries (Figure 2.1).

Figure 2.1. The economy has performed well but productivity remains low

Note: Labour productivity is measured in USD at current prices at current PPP per person employed. PPP measures the prices of the same basket of consumption goods in different countries.

Source: OECD compendium of productivity indicators.

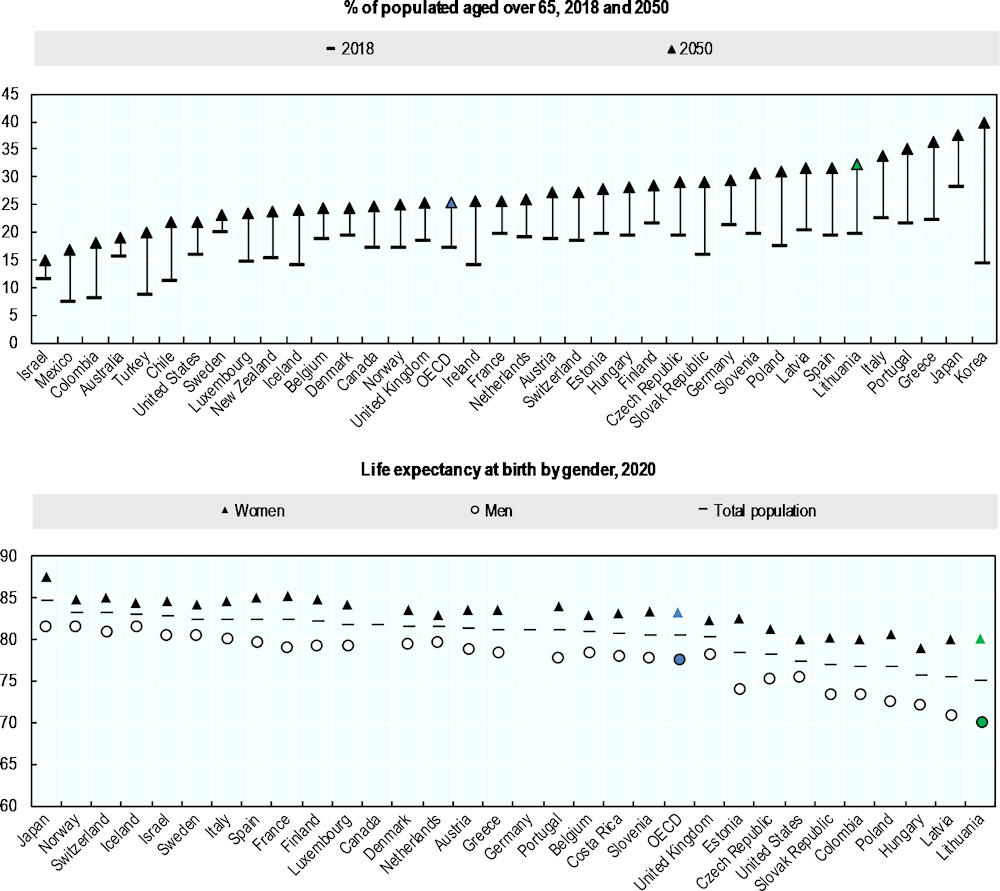

The labour market is recovering. The unemployment rate has recovered in Lithuania following the COVID-19 pandemic (Figure 2.3). It gradually declined from a peak of around 9% in mid-2020 to 7% in spring 2022. The unemployment rate currently remains modestly above the OECD average. Labour force participation rates are forecast to increase from 71.8% in 2020 to 72.9% by 2023 (Figure 2.3). High and rising labour force participation is driven by various factors including immigration of skilled workers, both foreign and returning Lithuanian, in addition to the rising retirement age, low pensions and social support (OECD, 2018[3]). The employment rate in Lithuania at 73.5% in Q4 2021 is relatively high, above the OECD average (68.7%) and between Latvia (70.2%) and Estonia (75.0%). Robust employment numbers are a contributory factor to wage growth in Lithuania (Figure 2.7).

Structural employment challenges remain

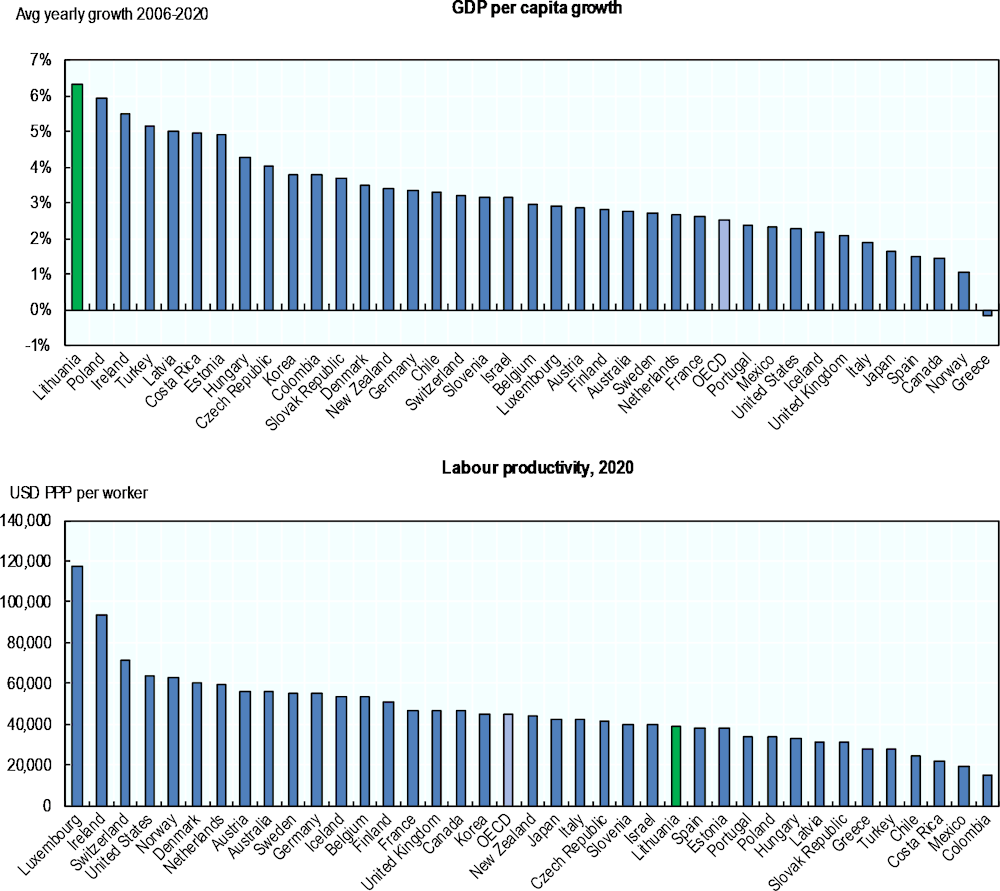

Lithuania’s demographic challenges will amplify employment and fiscal challenges. The working-age population in Lithuania is declining at about 1% per year on average (Figure 2.3). At the same time, Lithuania’s population is aging rapidly. Lithuania has a high 20% share of elderly persons (aged 65 and over) in 2018 against 17% in the OECD on average (Figure 2.2). The share of elderly persons is forecast to expand rapidly to 32% by 2050, which is among the fastest growth rates in the OECD (Figure 2.2). These structural developments imply that a growing retired population will be increasingly supported by a contracting working population. These trends will likely exacerbate labour shortages and the need for additional fiscal spending. In addition, labour tax revenues in Lithuania will be lower than otherwise as older workers have lower labour market participation rates than younger workers and because Lithuania does not levy PIT on pensions.

Poor health is a barrier to employment. Health limitations are among the most common obstacles to employment in Lithuania (Pacifico et al., 2018[4]). While life expectancy has improved in recent years reaching 75 years of age in Lithuania 2020, it remains among the lowest in the OECD (Figure 2.2). Low life expectancy in Lithuania reflects poor health outcomes in the country more generally. For example, 15% of the population self-reported as being in poor health compared to 15% in Latvia, 13% in Estonia and 9% in the OECD on average (OECD, 2021[5]). The life expectancy of Lithuanian women at 80 years of age is ten years above that of Lithuanian men, partly owing to better lifestyle choices among women (in a country where there are high proportions of daily smokers and high consumption of alcohol per capita).

Alcohol taxation has raised taxes and prevented avoidable illness. Alcohol consumption in Lithuania is among the highest in the OECD. Lithuania has increased excise taxes multiple times since 2009 and a further increase in 2017 when wine taxation doubled. Taxes on alcohol, wine and beer increased between 2009 and 2017. Some evidence exists that higher alcohol taxes led to a reduced disease burden and deaths (Rovira et al., 2021[6]). The fear that alcohol would be bought instead in neighbouring countries does not seem to have materialised, despite high populations at the border regions.

Skill mismatches and an educational divide contribute to unemployment challenges. Under-qualification and field-of-study mismatches among employees are more common in Lithuania than in many other OECD countries. In 2016, 14% of Lithuanian workers were underqualified for the requirements of their job and 21% where over-qualified, against 19% and 17% in the OECD respectively. Furthermore, 35% of workers had a field-of-study mismatch in Lithuania (i.e. they were employed in a job that did not match their skills), compared to 32% on average in the OECD. The educational divide in Lithuania’s labour market is large. The unemployment rate stood at 4% among highly educated 15 to 74 year-olds (with tertiary education) in 2021, whereas it was 9.3% among people with upper-secondary education and 16.6% among people with low (below upper-secondary) levels of education (according to data from Eurostat).

Figure 2.2. The population is aging rapidly and health outcomes are poor

Note: OECD is an unweighted average. Life expectancy at birth is the average number of years that a person can be expected to live, assuming that age-specific mortality levels remain constant. It is estimated by using the unweighted average of life expectancy of men and women. OECD average is an unweighted average of the countries shown.

Source: OECD population statistics database and OECD health status database, life expectancy.

A high share of long-term unemployed are locked-out of the labour force

Unemployment is high among the elderly relative to the OECD average. Younger Lithuanians (aged 15 to 24 years of age), who often work in contact-intensive service sectors, were disproportionally affected by pandemic-induced unemployment, and even though the gap between youth and total unemployment has been declining, youth unemployment remains somewhat high (Figure 2.3). Younger Lithuania women have higher unemployment rates than Lithuanian men and higher unemployment rates than younger women in OECD countries on average. However, workers in Lithuania are transitioning more rapidly from old to new jobs than in most other OECD countries (Causa, Luu and Abendschein, 2021[7]). Labour market flexibility helps workers, particularly younger workers that are entering the labour market to find better job opportunities in an economy undergoing structural shifts following covid. Older Lithuanians (55 to 64 years of age) have an unemployment rate of 8.2% against the OECD average of 4.7%. The unemployment rate is especially high among older Lithuanian men at 8.7% relative to Lithuanian women and relative to older men in OECD countries on average.

Figure 2.3. Unemployment is high among some groups

Labour market indicators

Note: The labour force is comprised of employed and unemployed persons but not inactive persons. Labour force participation is calculated as the labour force divided by the working-age population between 15 and 74. Working age population is defined as the share of those aged 15 to 74. Younger, middle-aged and older workers refer to those aged 15 to 24, 25 to 54 and 55 to 64 respectively.

Source: OECD Economic Outlook No 110.

Despite strong economic growth, long-term unemployment remains stubbornly high. The share of long-term unemployment (i.e. those unemployed for more than a year) was 29% in Lithuania in 2020 against 18% in the OECD and it has declined only modestly in Lithuania from 30% in 2019 (Figure 2.3). Although the share of long-term unemployment was higher following covid, these data point to the existence of a pool of vulnerable people facing employment difficulties. Since the chances of finding high-quality jobs diminish as people stay out of employment for longer, reconnecting the long-term unemployed with jobs remains a major challenge. In addition, older individuals in Lithuania (aged 55 - 64) are also much more likely to be unemployed for 6 months or longer than for shorter periods (Figure 2.3).

Many long-term unemployed may be unable rather than unwilling to re-enter the labour market. Unemployment benefit duration in Lithuania of 9 months (see section 3.3) and a high share of Lithuanians unemployed for over a year implies that many long-term unemployed are unable to find work before unemployment benefits expire. This is despite the strong financial incentives to find a job, specifically the large cuts in benefits as unemployed people transition to lower social assistance benefits (policy options for supporting the long-term unemployed are discussed later in section 3.3). High long-term unemployment including among older individuals despite strong economic growth and the financial incentive to re-enter work suggest that there are additional challenges faced by the unemployed in re-entering the labour force. These challenges include the aforementioned skill and qualification mismatches but also low formal incomes and potentially relatively high informal incomes (see Figure 2.4).

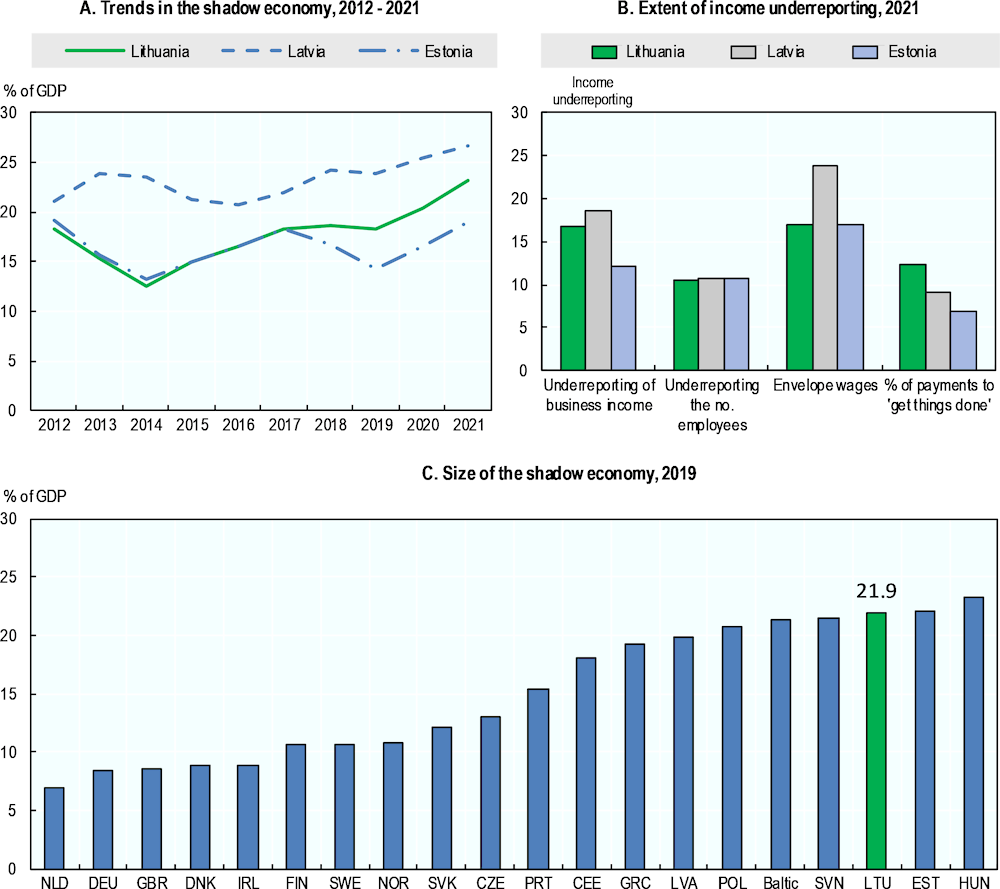

Despite a strong economy, informality is high

Informality is relatively high and has increased in recent years. Shadow economy generally refers to economic activity that should be reported to tax authorities but is not and therefore goes untaxed (OECD, 2017[8]).2 Measurement is notoriously challenging and estimates vary widely, ranging from 1 to 20% of GDP in OECD countries (OECD, 2017[8]). Shadow economy as a share of GDP in Lithuania has been estimated at 22% in 2019 (Figure 2.4). The SEE Riga Shadow Economy Index estimates shadow economy in Lithuania at 23% of GDP in 2021, below that found in Latvia (27%) but above Estonia (19%) (Putniņš and Sauka, 2021[9]) (Putniņš and Sauka, 2015[10]). Despite strong wage growth (Figure 2.7), shadow economy as a share of GDP increased by 3% in Lithuania in 2020. While trends in shadow economy as a share of GDP in Lithuania and Estonia had moved together between 2012 and 2017, the relationship has diverged since with shadow economy as a share of GDP moving higher in Lithuania.

Informality in Lithuania is driven by several factors including relatively high taxes. Companies operate in the shadow economy in Lithuania for many reasons including relatively high taxes and uncertainty about regulatory policies (Putniņš and Sauka, 2021[9]). Under-reporting of business income and so-called ‘envelope wages’ (i.e. a part of salary in the form of an undeclared cash payment) are of relatively greater concern in Lithuania compared to under-reporting of employees and payments to ‘get things done’ (Figure 2.4). Enhancements to tax enforcement and compliance by the tax administration must be part of the solution to addressing informality. Satisfaction with the performance of the tax administration in Lithuania has been improving (3.7 out of 5 in 2020 against 3.4 in 2019) and the perceptions of being caught for underreporting are high (44.3% believe there is a 76 – 100% chance of being caught for underreporting business profits) (Putniņš and Sauka, 2021[9]).

Informality may be higher in a low wage economy where taxes are less affordable. In economies with relatively lower take-home pay and higher informality like Lithuania (Figure 2.4), the financial incentives may be greater for households and businesses to purchase goods and services from the informal economy. Purchasing from the informal economy avoids paying labour taxes such as PIT and SSCs for employees and employers and indirect taxes such as VAT (which has a rate of 21%). In addition, in a relatively low wage economy (Figure 2.9), taxes may be less affordable which could encourage informal work. On the other hand, informality has increased in Lithuania over recent years during a period of rising wages and a growing economy more generally.

Figure 2.4. Informality appears to be high and rising

Source: Charts A and B are based on the SEE Riga Shadow Economy Index (Putniņš and Sauka, 2021[9]). The Index is based on an annual survey of company owners in Estonia, Latvia and Lithuania. The surveys are conducted between February and April each year and contain questions about shadow economy in the two previous years. In 2022, 501 owners were interviewed based on a random stratified sampling approach. Underreporting of business income refers to the average share of revenue in % that companies conceal from government. Underreporting of number of employees refers to the average share of employees in % working without a contract. Envelope wages refer to the average share of salaries in % which is paid by the employers, but concealed from the government. % of payments to ‘get things done’ refers to the average percentage of revenue paid as ‘bribes’. Chart C is based on Schneider, F. (September 2019), Latest developments of the shadow economy in the Baltic countries: What are the major causes and what could be done? University of Linz, Austria. In the analysis shown, shadow economy is defined as all legal production of goods and services that is deliberately concealed from public authorities.

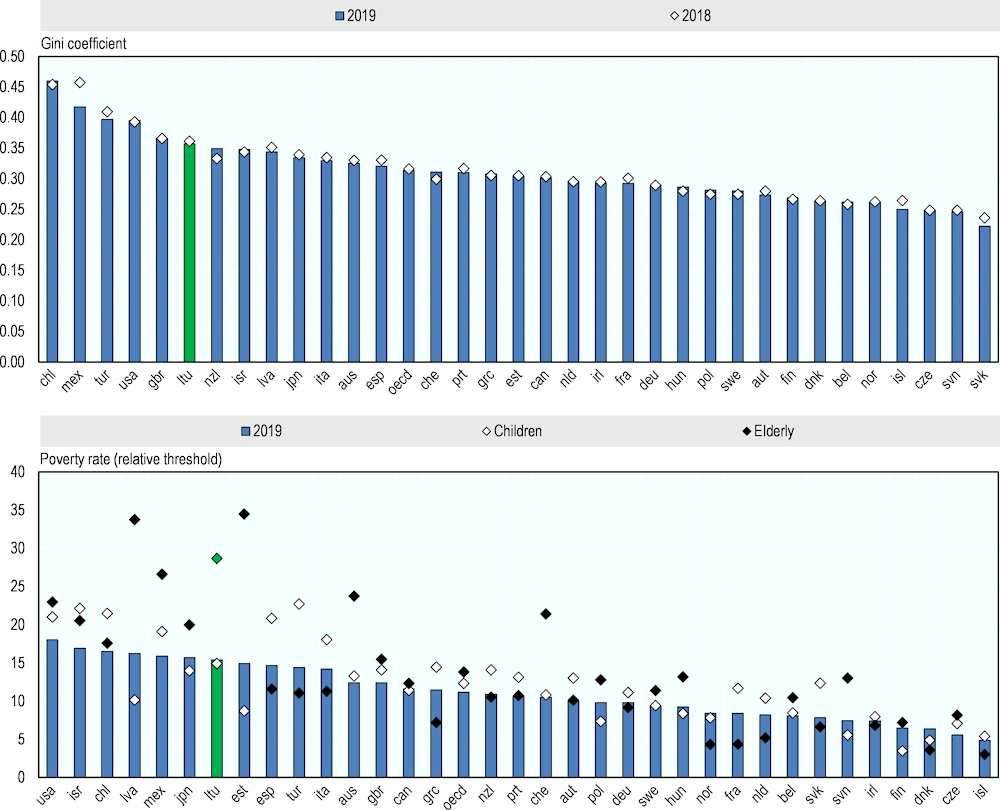

Income inequality remains high

Disposable income inequality in Lithuania places among the top 6 OECD countries. In most OECD countries, the gap between the rich and poor is at its highest in many decades. In 2019, the latest year for which data are available, the Gini coefficient of disposable income (i.e. after the impact of taxes and benefits) in Lithuania was 0.357, down modestly from 2018 (when it was 0.361) but above the OECD average (0.313) and ahead of Estonia (0.305) and Latvia (0.344) (Figure 2.5). Lithuania places among the top 6 OECD countries for income inequality in 2019. Rising income inequality is often a feature of rapidly growing economies such as Lithuania (Figure 2.1).

Relative poverty rates place among the top 7 OECD countries. The relative poverty rate in Lithuania, defined as the share living on less than half the median disposable income, was 15% in 2019. This poverty rate is above the OECD average (of 11%) but similar to Latvia and Estonia. Old-age poverty in Lithuania is the third highest in the OECD in 2019, below only Latvia and Estonia (poverty is discussed in more detail later, see Figure 2.11).

Figure 2.5. Disposable income inequality and poverty rates are relatively high

Inequality and poverty in Lithuania and OECD countries, 2019

Note: Data refer to the total population and are based on equivalised household disposable income, i.e. income after taxes and transfers adjusted for household size. The Gini coefficient takes values between 0 (where every person has the same income), and 1 (where all income goes to one person). The poverty threshold is set at 50% of median disposable income in each country. 2019 refers to the 2019 income year as opposed to survey year. Children refers to those aged 18 and under. Elderly relates to those aged 65 and over.

Source: OECD income distribution database.

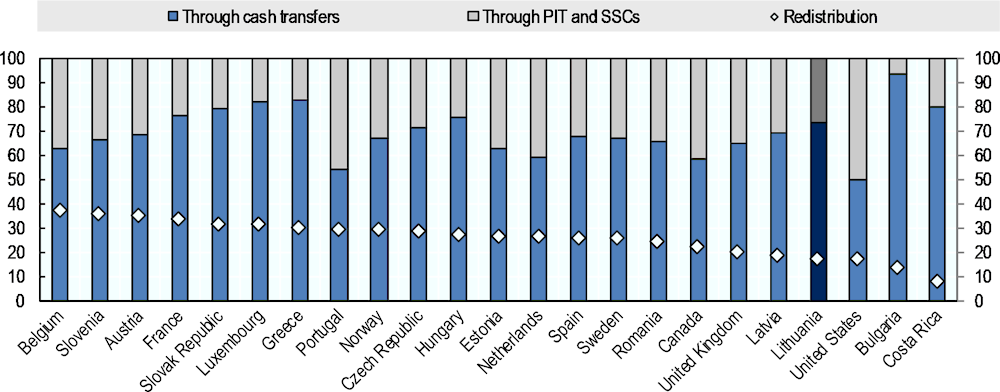

The redistributive role of taxes and transfers is limited. An initial assessment of income redistribution can be given by computing differences between the share of cash transfers received net of PIT and SSCs (paid by households) at different points on the income distribution (Causa and Hermansen, 2017[11]). In Lithuania, the market income Gini coefficient (inequality before taxes and transfers) is 42% in 2019 and the disposable income Gini coefficient (inequality after taxes and transfers) is 35%. Redistribution, defined as the difference between market and disposable income inequality as a share of market income inequality, is 17% in Lithuania 2019. The extent of redistribution in Lithuania is among the lowest in the OECD (Figure 2.6). This picture should be viewed with caution due to the absence of employer SSCs data and cross-country institutional differences in the design and funding of social security systems.

Taxes contribute less to reducing income inequality than transfers in Lithuania. 74% of the reduction in income inequality in Lithuania is due to transfers with the remaining 26% from taxes (PIT and SSCs). These shares are similar to the OECD average (Causa and Hermansen, 2017[11]). Indeed, a greater role of transfers in redistribution is in line with cross-country empirical studies in other countries (Immervoll et al., 2005[12]) (Joumard, Pisu and Bloch, 2012[13]) (Brys et al., 2016[14]).

Figure 2.6. The contribution of taxes and transfers to reducing inequality in Lithuania is low

The share of redistribution in Lithuania and OECD countries, 2019

Note: The redistribution figures shown are based on the working-age population from 18 to 65 because many pensioners will have no market income. Redistribution is defined as the difference between market income and disposable income inequality, expressed as a percentage of market income inequality. The new OECD income definition 2012 is used.

Source: OECD income distribution database.

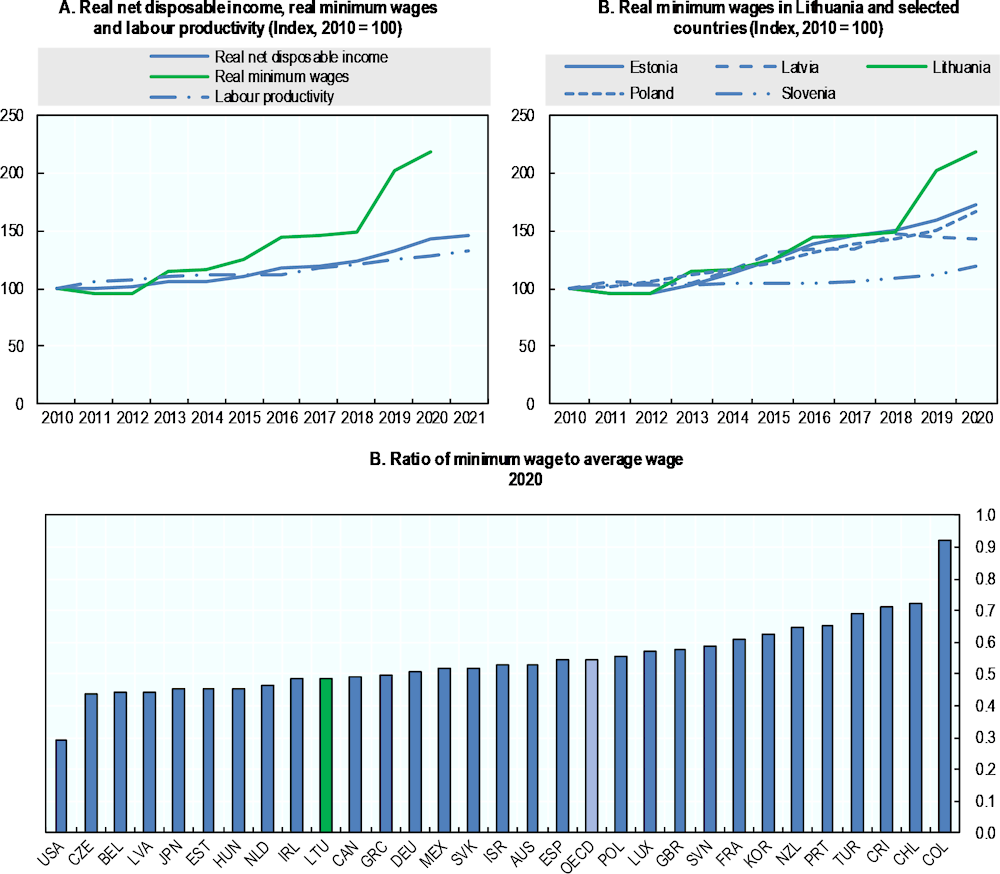

Wages are growing rapidly

Wages have risen rapidly outstripping labour productivity but remain below the OECD average. Real net disposable incomes in Lithuania were growing rapidly prior to the pandemic and have continued to rise since then, outpacing the growth in labour productivity (Figure 2.7, Panel A). Since 2010, average wages (in PPP) in Lithuania have increased by about 5% annually, reaching 65% of the OECD average in 2020. Average wages (in PPP) in Lithuania in 2020 were above Latvia, Estonia, Hungary and the Slovak Republic but below Poland and Slovenia.

The authorities have sharply raised minimum wages in recent years, but it remains low relative to average wages in international comparison. The minimum wage in Lithuania is set by the government taking into account several factors including current and previous wage levels in the economy and the needs of workers and their families.3 In recent years, the government have steadily raised the minimum wage to support low-income workers and reduce income inequality. The minimum monthly wage (MMW) in Lithuania increased from EUR 555 in 2019 to EUR 730 in 2022. Since 2017, the MMW has almost doubled. Since 2010, real minimum wage growth in Lithuania has outpaced both real net disposable income growth in the economy (Figure 2.7, Panel A) and real minimum wage growth in other countries (Figure 2.7, Panel B). Eurostat data confirm that statutory minimum wages were raised more quickly in Lithuania than in most EU countries since 2017. Despite minimum wage growth, the ratio of minimum to average wages in Lithuania remains below the OECD average in 2020 (Figure 2.7, Panel C). Data from Eurostat confirm that the minimum wage as a share of gross earnings in Lithuania is not particularly high at 46% in 2020 and the ratio has remained broadly stable since 2017.

Figure 2.7. Despite rapid growth, minimum to average wages remain low

Note: Real net disposable income of households and non-profit institutions serving households. Real minimum wages are in 2020 constant prices at 2020 USD PPPs. Labour productivity refers to the total economy.

Source: OECD Labour Force Statistics; OECD Economic Outlook No 110.

There may be scope to continue to raise the minimum wage but informality risks must be tackled simultaneously

The minimum wage is paid only for unskilled work (i.e. that does not require special skills or professional expertise). Skilled workers must be paid above the minimum wage. The minimum wage is indexed using the forecast average wage.

Setting higher minimum wages has the potential to increase the earnings of low-paid workers and support tax enforcement policy. National minimum wages are in operation in most EU Member States (21 out of 27) and aim to improve the income distribution by putting a floor on low wage earnings, thus making low-wage earners better-off and reducing the gap with high wage earners. However, minimum wages may come with efficiency loss if set at a level that reduces employers labour demand, especially in labour-intensive industries. In a review of the international evidence from the US, UK and other developed countries (Dube, 2019[15]) find overall muted effects of minimum wages on employment but significant increases in the earnings of low paid workers. (ILO, 2021[16]) find that improving the coverage, compliance and raising the level of the minimum wage up to two-thirds of the median have the potential to reduce income inequality. While minimum wage studies on Central Eastern and South Eastern European countries including Lithuania tend to find some disemployment effects, strong conclusions cannot be drawn ( (IMF, 2016[17])). (Hazans, 2007[18]) found that increases in the real minimum wages in Lithuania can have positive effects on labour force participation as it makes work pay. In a further paper on Lithuania, (Šuminas, 2015[19]) found no effect of minimum wage on employment rates over the 2003Q1-2014Q1 period. Using a large wage hike in Latvia between 2013 and 2015, (Gavoille and Zasova, 2021[20]) find that minimum wage hikes contributes to tax enforcement by pushing firms to covert part of the envelope to an official wage to stay under the radar of the authorities. Unreported wages then act as an employment buffer against minimum wage hikes in non-compliant firms. Unemployment can however fall in compliant firms employing minimum wage workers following a minimum wage hike.

However, setting higher minimum wages will not necessarily translate to better compensation for the low paid. First, even if compliance minimum wage regulation were perfect, the impact on take-home pay from a minimum wage hike will be somewhat blunted in Lithuania by relatively high SSCs at low incomes and the non-deductibility of SSCs from the PIT base. Second, compliance with minimum wages is unlikely to be perfect given informality (Figure 2.4). There is a body of empirical evidence for the ‘lighthouse effect’ whereby a statutory minimum wage acts as a signal to the informal sector so that wages in the informal economy increase following minimum wage hikes.4 The primary explanation for the effect is that minimum wages serve as a reference bargaining price for all workers in the economy (ILO, 2021[16]). As a result, minimum wage hikes such as those undertaken in Lithuania in recent years may risk indirectly raising informal wages and therefore the relative attractiveness of informal work compared to formal work. For example, some employers might opt to offset higher minimum wages by reducing hours or making ‘envelope payments’ (i.e. a part of salary in the form of an undeclared cash payment) (see Figure 2.4). In both scenarios, this represents an effective increase in informal wages (i.e. the same wage with less hours or additional ‘envelope wages’). In a study of several countries including Lithuania a negative correlation between the change in the minimum wage and changes in hours worked suggests that following minimum wage hikes, some employers pay the same but declare fewer hours ( (IMF, 2016[17]).

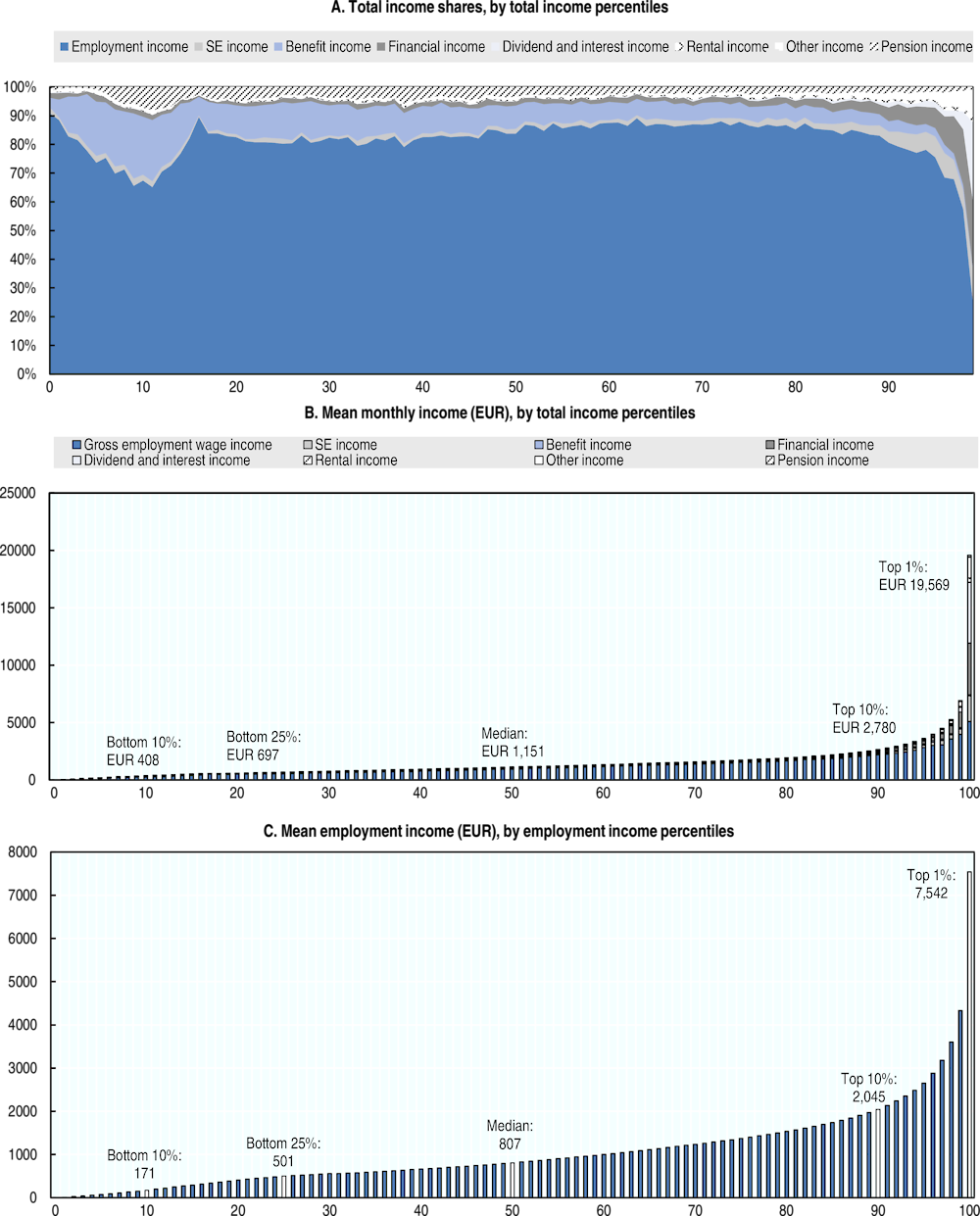

Wages represent the bulk of total incomes

Employment wage income represents the largest share of total income at all total income percentiles, except for the top 1%. The employment income share represents 81% of total income on average across all percentiles (Figure 2.8 Panel A). The employment income share is lower in the bottom decile, mostly due to a higher benefit income share but also self-employment income. The employment income share is also lower in the top decile, representing 74% of total income on average (excluding the top 1%) due to higher shares of financial income, self-employment income, benefit income and dividend, royalty and interest income. Among the top 1% of total income, the largest share of income is derived from dividend, royalty and interest income (27%) followed by employment income (26%), financial income (23.0%) and self-employment income (11.4%).5

Capital income is concentrated among the very highest-income employees. Dividend income, financial income from the sale of real estate and financial assets and rental income from immovable property are highly concentrated among the highest income individuals. The total income held by the top 20% is 10.1 times that of the total income held by the bottom 20% (i.e. the S80/S20 ratio). This compares to an S80/S20 ratio of 8.3 for employment income, 3.5 for pension income and 1.9 for benefit income.6 The S80/S20 ratio for total income exceeds employment income due to the very high concentration in the top decile of certain incomes including dividend, interest and royalty income (96% of this income category is in the top decile), financial income (81%), rental income (62%) and other income (76%). These income categories are often largely comprised of a few specific income sources (see note in Figure 2.8 for income source components). Dividend, interest and royalty income mostly relate to dividend income (87%). Rental income mostly relates to rental income from immovable property (75%). Financial income is comprised of income from the sale of real estate – the sale of a residence (36%), income from the sale of real estate that is not a residence (28%) - and income from the sale of financial assets (19%). A significant component of the other income category relates to gifts from close relatives (31%). Among the top 1% of total income, more than half of all income is comprised of capital income (from dividends, interest, royalty, financial income and rental income).

Middle-income employment incomes are supplemented by additional income sources including benefit, financial and rental income. Mean monthly total income (and employment income) at P10, P50, P90 and P99 is EUR 408 (EUR 171), EUR 1 515 (807), EUR 2 780 (2045) and EUR 19 569 (EUR 7 542) respectively (Figure 2.8 Panels B and C).7 This demonstrates that average total incomes exceed average employment incomes significantly at mid-to-high incomes (i.e. by approximately 40% at P25, P50 and P90) and average total incomes are more than double average employment incomes at very high and low incomes (i.e. P10 and P99).

Figure 2.8. Wages represent the bulk of income at almost all income levels

Total income shares and average total and employment incomes (EUR), by percentile, 2019

Notes on income definitions: Total income is defined as employment income, self-employment income, pension income, benefit income, financial income, dividends, royalties and interest income, rental income and other income. Pension income includes contributory old-age pension and total private pensions (including abroad pensions). Self-employment income is largely comprised of individual-activity income and business certificate income. Rental income is comprised of rental income from immovable property and rental income from other wealth. Financial income includes income from financial instruments, transfers of wealth and transfers of real estate. Financial income is largely comprised of income from the sale of a residence, income from the sale of real estate that is not a residence, income from the sale of movable asset and income from the sale of financial assets. Benefit income includes a wide range of selected benefits including unemployment benefit, child benefit, child birth-related benefits, health benefit, contributory maternity benefit, paternity benefit, social assistance benefit and contributory disability benefit. Other income includes a wide range of miscellaneous income sources.

Source: OECD analysis of microdata 2019.

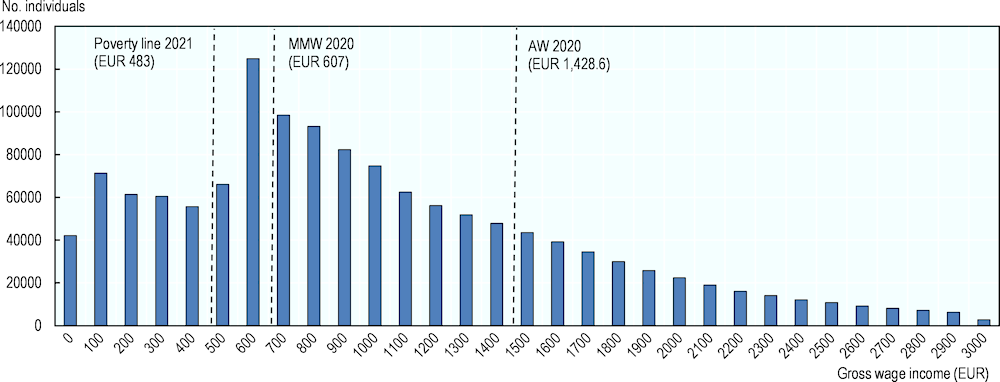

Wage income remains relatively low

Many employees earn low wages close to the minimum wage. 40% of individuals have monthly gross wage incomes of between EUR 500 and EUR 1,000 in 2020 (i.e. 35 – 70% of AW as calculated by Lithuania) (Figure 2.9). A high 9% report wages between EUR 600 and EUR 700 due to many workers earning the MMW. 29% have wages below the MMW. About 3 in 4 individuals earn wages below the AW, reflecting the positively skewed wage distribution and the wide gap between median and mean wages.

Figure 2.9. Many workers earn low wages

Monthly gross wage income distribution, 2020

Note: The official average wage (AW) shown is calculated by Lithuania. Based on 1.35 million individual wage earners. Based on this distribution, the implied monthly mean, median, bottom 10% and top 10% wage incomes are EUR 1,029, EUR 902, EUR 235 and EUR 1 973 respectively. The share of individuals with wage income below the poverty line and AW can be approximately estimated by using the nearest EUR 100 distribution bin.

Source: OECD analysis of Lithuanian Ministry of Finance data.

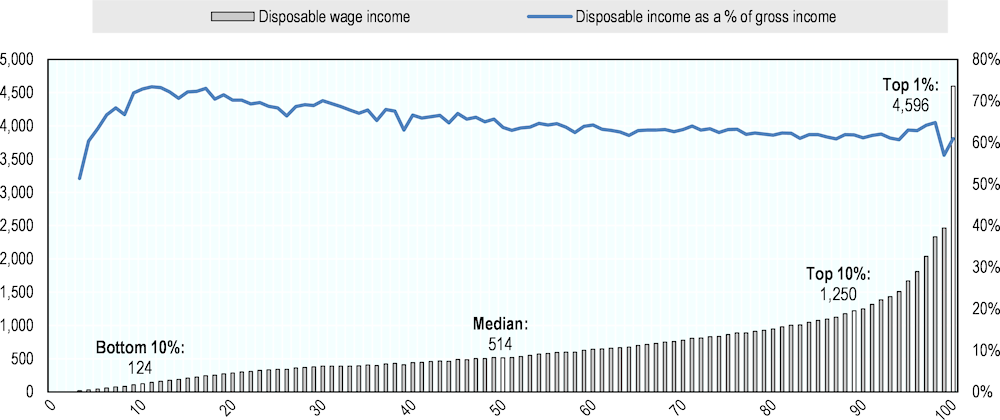

Low disposable incomes are linked to high poverty. Disposable incomes are low and unequal. The median, top 10% and top 1% gross (and disposable) incomes are EUR 807 (EUR 514), EUR 2 045 (EUR 1 250) and EUR 7 542 (EUR 4 596) respectively (Figure 2.10). Disposable incomes are linked to poverty (see next section). The data imply a monthly disposable income poverty line of EUR 308 (based on 60% of the disposable median), which implies that employees below the 22nd employment income percentile face poverty risk (Figure 2.10). This poverty risk estimate aligns with household survey-based equivalised estimates in Lithuania which show that 24% of the population have an income below 60% of the median disposable income (see Figure 2.11). The microdata analysis should be interpreted with caution as taxpayers may have other income sources and benefits not included (e.g. self-employment income) and the data do not take account of indirect taxes such as VAT and excise.

Figure 2.10. Disposable incomes are low

Mean monthly disposable incomes (EUR), by employment income percentile

Note: Figures reported in the graph relate to disposable monthly wage income (i.e. gross wage minus PIT and SSCs). Mean employment wage income is calculated by employment income percentile. The total number of taxpayers with positive employment income is 46 389 in the sample microdata (i.e. employees).

Source: OECD analysis of microdata 2019.

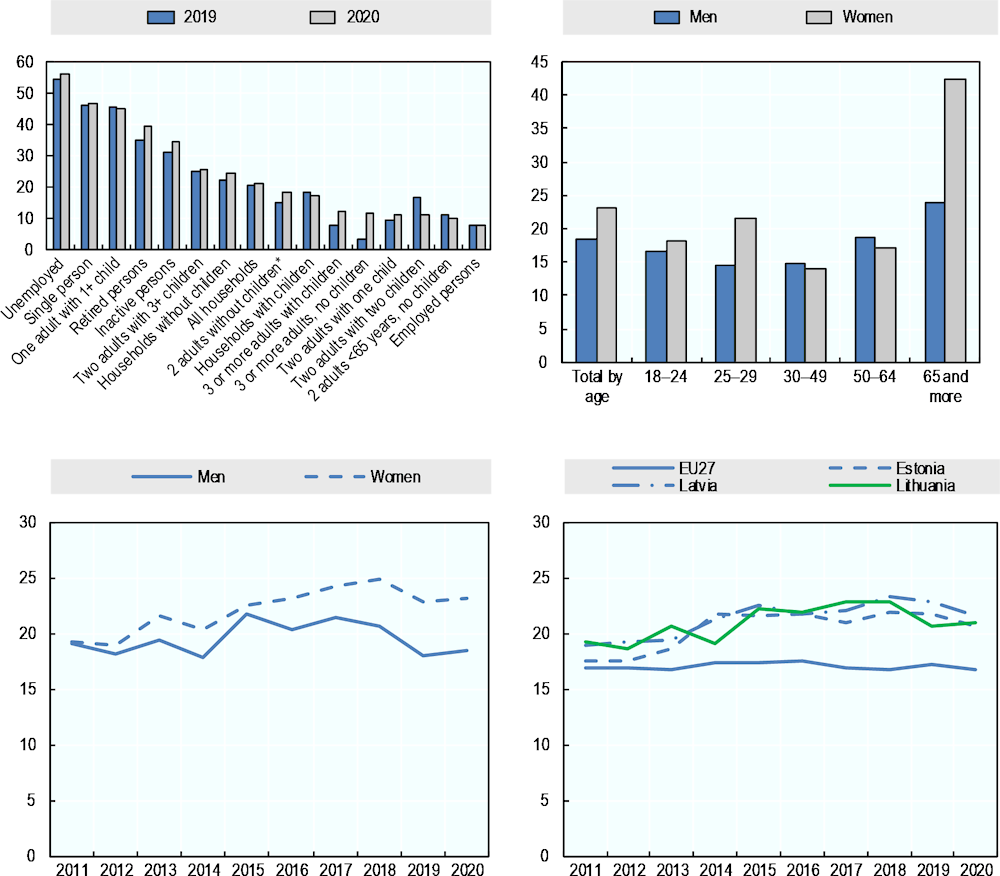

Poverty risks are high for some groups

There are several ways to measure poverty. Poverty measurement generally assumes a well-defined notion of living standards, namely a poverty line, which must be reached if a person is not to be deemed poor (Forster, 2013[21]). While there are several ways to measure poverty (such as absolute poverty and subjective poverty), relative poverty, which compares incomes relative to that of the population as a whole, can be usefully compared across countries (because they are independent of a specific country’s definition of needs) and tends to reflect how most people assess their own conditions by comparing with others (Boarini et al. 2006).

In Lithuania, 1 in 5 people face relative poverty risk, living on less than EUR 430 a month. 21% of all households in Lithuania live in relative poverty in 2020 (Figure 2.11), broadly unchanged since 2019. Relative poverty is above the EU-27 on average (17%) but broadly similar to Estonia (21%) and Latvia (22%). Work and employment opportunities are important factors in shaping the risk of poverty across countries. In countries such as Lithuania where the share of the working-age population is lower (and declining, see Figure 2.3), poverty rates tend to be higher.

The elderly face the highest risk of poverty across the age groups, particularly older women. Lithuania has one of the highest old-age poverty rates among the European OECD countries, although it ranks below Estonia and Latvia (Figure 2.5). Retired persons face high poverty risks of 40% in Lithuania in 2020, a marked increase from 35% in 2019 (Figure 2.11). In 2020, 36% of older persons (those aged 65 and over) were at risk of poverty with older women facing a higher poverty risk (42%) compared to men (24%) (Figure 2.11). Higher poverty rates among older women than older men is common in many countries and can partly be explained by the lower pension income received by women. The average pension for women in Lithuania is about 22% lower than that for men, according to official estimates, reflecting lower lifelong earnings and shorter contribution periods due to the earlier statutory retirement age and career breaks.

Longer life expectancy among Lithuanian women means that older single women may be vulnerable to poverty risks. Single households in Lithuania are often comprised of older women (poverty rates are high for both groups separately and there is overlap between them). This is partly due to the old-age gender gap in Lithuania whereby the life expectancy of Lithuanian women is ten years above that of Lithuanian men (Figure 2.2). As such, Lithuanian women are expected to have 22 years in retirement compared to just 16 years for men (in the OECD, the expected number of years in retirement is 20 and 24 for men and women respectively). Given that incomes continue to fall in older age (Figure 2.12), women with longer retirements may be more exposed to poverty risks.

The incomes of elderly families could be investigated longitudinally in the microdata following the death of a spouse given the old-age gender gap and income cliff. The large old-age gender gap and income cliff in Lithuania imply that elderly women spouses may be at further risk of poverty if overall family income falls as a result of the death of a partner. A widower’s pension of EUR 28.63 per month in 2021 is paid to the spouse of a deceased person with social insurance in Lithuania provided the deceased is of pension age.

Those hardest hit by poverty in Lithuania are the unemployed. More than half of the unemployed were at risk of poverty in 2020 (56%) (Figure 2.11). One contributing factor is limited unemployment benefit coverage, with only about one-third of the registered unemployed people receiving unemployment benefits, due to strict conditions (see section 3.3). Poverty rates among the unemployed increased by 2 percentage points between 2019 and 2020, which could partly be attributed to wages modestly outpacing unemployment benefits.8 Poverty risk for the unemployed is 7 times higher than for the employed in Lithuania. The difference is pronounced when comparing the unemployed groups with their peers in full-time and permanent jobs, supporting the view that good quality jobs is the best antidote to poverty (Causa and Hermansen, 2017[11]). While the overall in-work poverty rate does not stand out in international comparison, part-time and temporary workers face high poverty rates. Given high poverty rates among the unemployed, participation tax rates that measure incentives to enter work from unemployment represent particularly important indicators for Lithuania and perhaps even more so than indicators that measure incentives to progress in work (see section 4.3).

Single persons and single parents in Lithuania face high poverty risks. 47% of single adults in Lithuania are at risk of poverty in 2020, broadly unchanged since 2019. In single households there is no partner to cushion the impact of temporary income shocks (Eurostat, 2019[22]). Single-adult households can also be made up of jobless young people with low incomes (Koutsogeorgopoulou, 2020[23]). Child poverty is closely related to vulnerability of the household. The well-being of children is linked to the structure and employment status of the household (Thévenon et al., 2018[24]). Just under half of single parents with one child in Lithuania live below the poverty line (45% in 2020), which is also broadly unchanged since 2019. In addition, around a third of people with some or severe activity limitations live below the poverty threshold.

Figure 2.11. Poverty risks are high for the unemployed, single households and the elderly, particularly women

At-risk-of-poverty indicators in Lithuania and comparison countries, % of population

Note: At risk of poverty refers to 60% of median equivalised income after social transfers. *2 adults without children is abbreviated and refers to 2 adults, at least one 65+ years or over, without children. Employed persons, unemployed, retired persons and inactive persons refer to the at-risk-of-poverty-rate of persons aged 18 and older.

Source: Eurostat. Statistics Lithuania.

Two-adult families with three or more children face higher poverty rates than two-adult families with less than three children. Relative poverty also affects two adult households with one and two children (11.2% and 11.1% in 2020 respectively), but since 2019 the proportion at risk of poverty has increased for the former group (9.5% in 2019) but fallen significantly for the former (16.9% in 2019). Two adult families with three or more dependent children face a poverty rate that is 2.3 times greater than their counterparts with one dependent child.

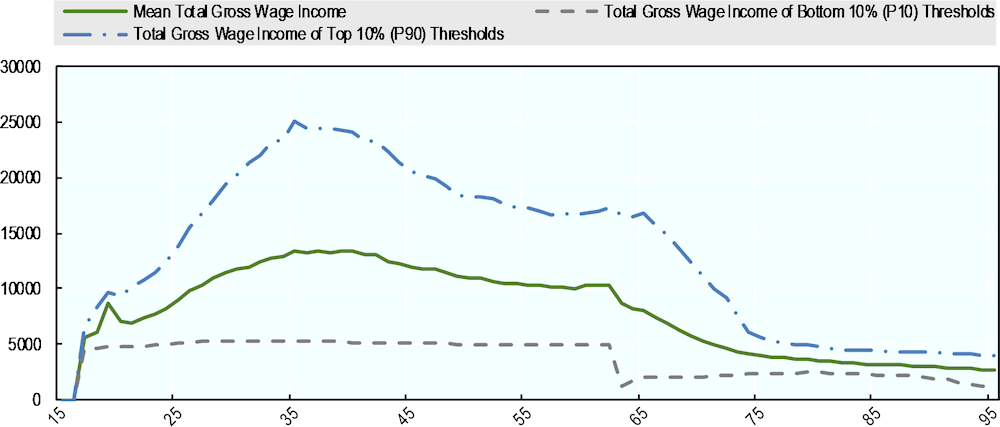

Poorer workers transitioning to retirement face a sharp income cliff and low pension replacement rates

A decade after retirement, incomes decline by about half from an already low level and the decline is greater for the lowest incomes than the highest incomes. There is a significant ‘income cliff’ as workers transition from work to retirement. Incomes drop by about half 10 years after the retirement age (Figure 2.12). The decline is greater for those in the bottom 10% than for those in the top 10% (between the ages of 62 and 72, incomes declined by 55%, 57% and 47% for low, middle and high incomes respectively). Among higher earners, the decline in incomes happens later in retirement due partly to different jobs across incomes including that higher earners in office jobs can work for longer than lower earners in physical jobs.

Figure 2.12. Gross wage incomes fall by about half in the decade after retirement

Gross wage income in Lithuania by age, 2017

Notes: The data are for taxpayers on low incomes (the bottom 10% or P10), middle incomes (the average mean wage) and higher incomes (the top 10% or P90). The data are for the year 2017 (the statutory retirement age in Lithuania in 2017 was 63.5 years for men and 62 years for women). Some part-time workers are included (but part-time workers with no pension income are excluded). Gross wage income = gross taxable employment income + non-taxable employment income (e.g. earned and taxed abroad therefore not taxable in LT due to treaties for the avoidance of double taxation) + old age pension income. The total taxpayers represented are 1 588 568.

Source: OECD data provided by Lithuania as part of Working Party 2 in 2019.

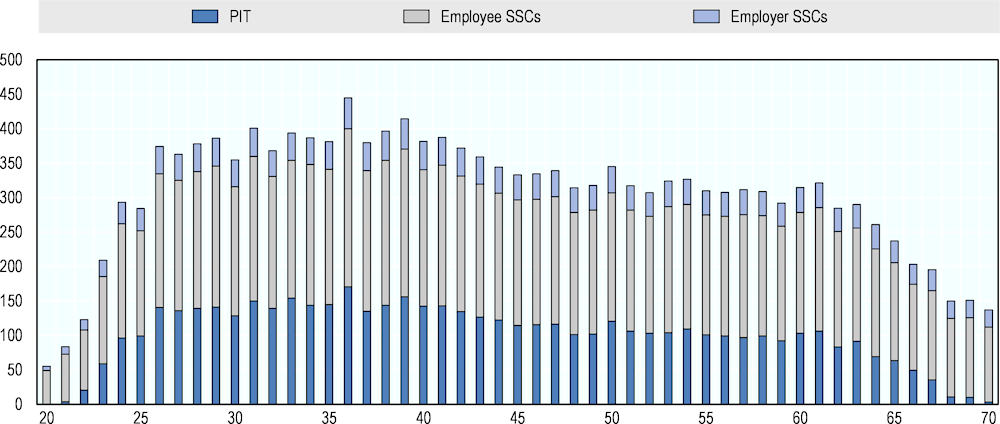

The reduced wages of older employees is reflected in lower SSCs and PIT paid. The average PIT and SSCs paid by an employee falls by 18% between 40 and 60 and by a further 56% between 60 and 70 (Figure 2.14).

Figure 2.13. Older employees pay less taxes on average

Mean PIT and SSCs paid (EUR), by age

Note: The total number of taxpayers with positive employment income is 46 389 in the sample microdata (i.e. employees).

Source: OECD analysis of microdata 2019.

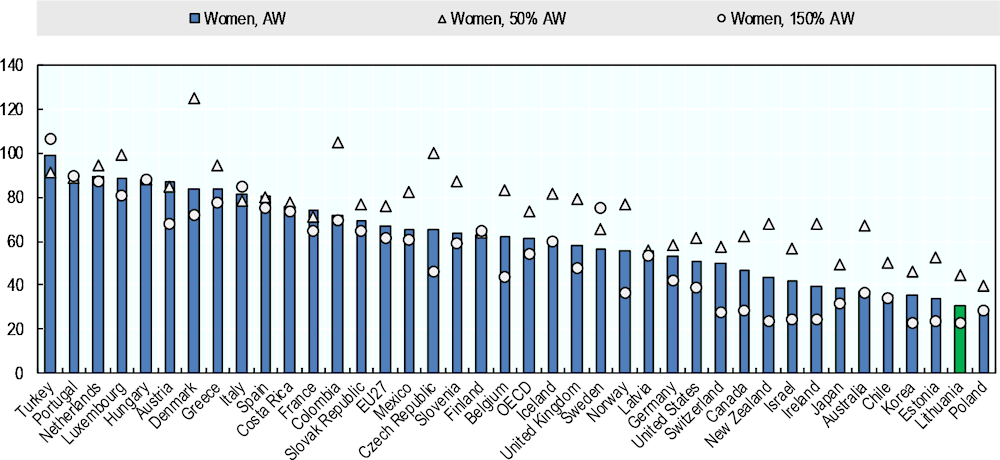

Net pension replacement rates in Lithuania are among the lowest in the OECD. Net pension replacement rates reflect the disposable income of individuals in retirement compared to when working. Net replacement rates in Lithuania at the AW are the second lowest in the OECD at 31% in 2020 (Figure 2.14) (net replacement rates in Lithuania are the same for men and women, see note). Net replacement rates in Lithuania are 11% higher than gross replacement rates due to the higher effective PIT and SSC rates on earnings than on pensions in retirement.

However, the pension system is redistributive. There is a wide difference between the replacement rates of high and low income earners. For those on lower incomes, replacement rates are higher (44%) than the average wage (31%) which are in turn higher than at higher incomes (23%). Despite a relatively redistributive pension system within Lithuania, net replacement rates for lower income individuals remain among the lowest in the OECD.

Figure 2.14. Net pension replacement rates are low

Net pension replacement rates at 50%, 100% and 150% of AW, OECD countries in 2020

Note: Replacement rates are shown for women since men and women have the same net pension replacement rates in Lithuania based on the OECD pension modelling. The net replacement rate is defined as the individual net pension entitlement divided by net pre-retirement earnings, taking into account personal income taxes and social security contributions paid by workers and pensioners. It measures how effectively a pension system provides a retirement income to replace earnings, the main source of income before retirement. This indicator is measured in percentage of pre-retirement earnings by gender.

Source: Pensions at a Glance 2021.

An increasing share of retired Lithuanian are working, in part to supplement low incomes. The employment rate among retired-age workers in Lithuania (aged 65 to 69) is 26% in 2020, up from 22% in 2018. It is above the OECD average in 2020 (23%) but below Estonia (34%) and Latvia (28%). Retired Lithuanians may have to work longer out of necessity rather than out of choice to supplement low retirement incomes and pensions (Figure 2.12 and Figure 2.14). Rising employment among the retired contributes to the high labour force participation rates in Lithuania (Figure 2.3).

Lithuania extended early retirement options in 2021 which may put pressure on the sustainability of the pension system. The extent of early retirement in Lithuania is reflected in the effective labour market exit age for men and women of 63.4 and 63.0 in 2020 respectively. The effective exit age for men and women are modestly below official retirement ages (64 and 63 in 2020), which is not uncommon in the OECD. However, Lithuania extended the options for early retirement in 2021. Retiring early in Lithuania remains possible up to five years before reaching the statutory retirement age and the associated penalty was reduced from 0.40% to 0.32% for each month of early claiming and made temporary for some workers (OECD, 2021[25]).9 This policy will increase the incentives to retire early and have a negative impact on pension finances.

Encouraging early retirement could contribute to reducing already low pension incomes. Early retirement will reduce pension incomes directly through the aforementioned early retirement penalty system. To add to this, low income workers who opt to retire before the official retirement age and do not yet receive their pension face a significant income decline in Lithuania (a drop of 76%) in the first year of retirement (at age 63, see Figure 2.12). While such a decline is not uncommon (for comparative examples in Slovenia and Ireland, see (OECD, 2018[26]) (OECD, 2019[27]), it is significant and the income recovery in subsequent years is very modest.

Rising life expectancy will outpace increases in the retirement age. In Lithuania, life expectancy is projected to increase for men and women from 71 and 81 years of age in 2019 to 74 and 83 by 2030 (European Commission, 2021[28]). The government plans to increase the retirement age for both genders to 65 by 2026. Consequently, the gap between life expectancy and retirement age will continue to widen in Lithuania despite increases in the retirement age. In this setting, even unadjusted pension benefits would imply greater redistribution of pension income to retirees at the expense of future generations who may ultimately have to pay the cost.

To support the sustainability and adequacy of the pension system, the government could consider establishing an automatic link between the retirement age and life expectancy when the pension age reaches 65. As life expectancy outpaces retirement age increases and the working-age population share declines (Figure 2.3), pension benefits will come under further pressure. Arguably the best way to at least maintain replacement rates while also improving the financial sustainability of the pension system without reducing pension adequacy is through an automatic adjustment mechanisms (AAM) that links the statutory retirement age to longevity trends (OECD, 2021[25]). Seven OECD countries link the statutory retirement age to life expectancy (Estonia, Denmark, Finland, Greece, Italy, Netherlands and Portugal). In Estonia, Denmark, Greece and Italy, there is a one-to-one link between statutory retirement and life expectancy (OECD, 2021[25]).

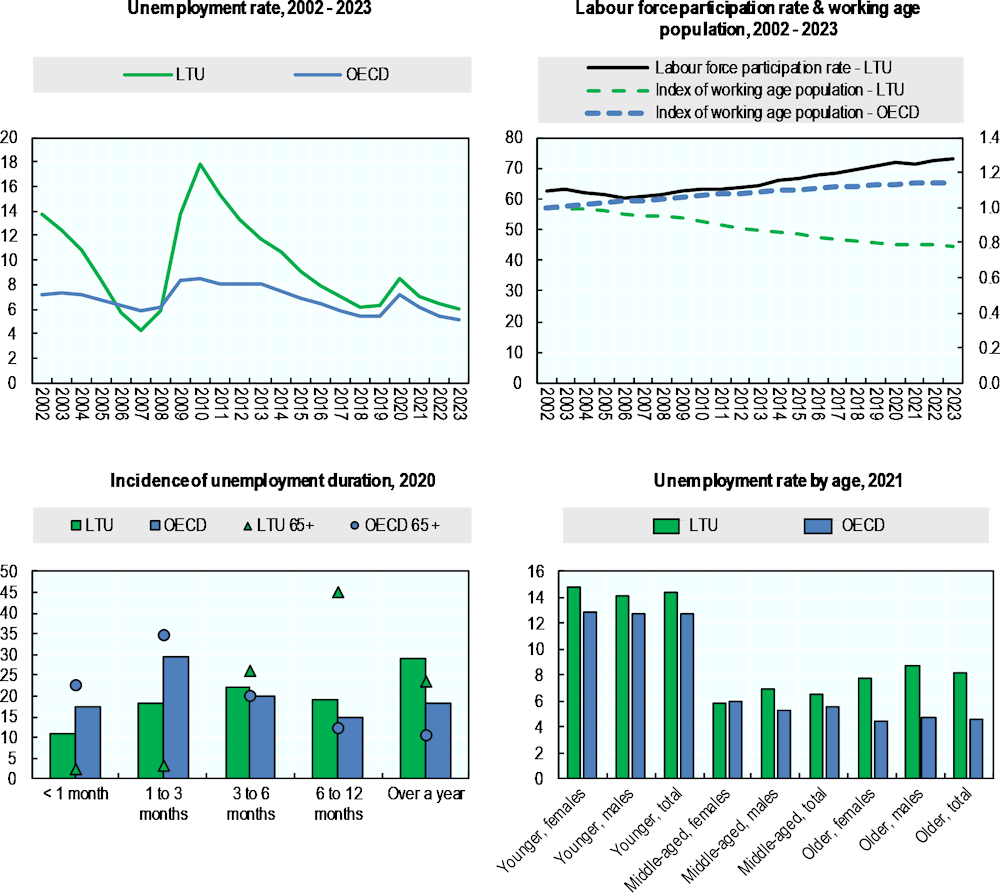

Despite a rising tax-to-GDP ratio, social spending remains low

Lithuania’s tax-to-GDP ratio has increased rapidly in recent years, although it remains below the OECD and Baltic average. Lithuania’s strong economic performance (Figure 2.1) has helped to bolster tax revenues. The tax-to-GDP ratio in Lithuania reached 31% in 2020 having risen rapidly in recent years from a low of 27% in 2013 (Figure 2.15). Much of the increase is attributable to rises in the PIT-to-GDP ratio (which rose from 3.6% in 2013 to 7.2% in 2019), which more than offset declines in the SSC-to-GDP ratio over the same period, and to a lesser extent increases in the VAT-to-GDP ratio (which rose from 10.7% to 11.6% between 2013 and 2019).10

Figure 2.15. Lithuania’s tax-to-GDP ratio remains below the OECD

Tax-to-GDP ratio in Lithuania, OECD and comparison countries, 1995 – 2020

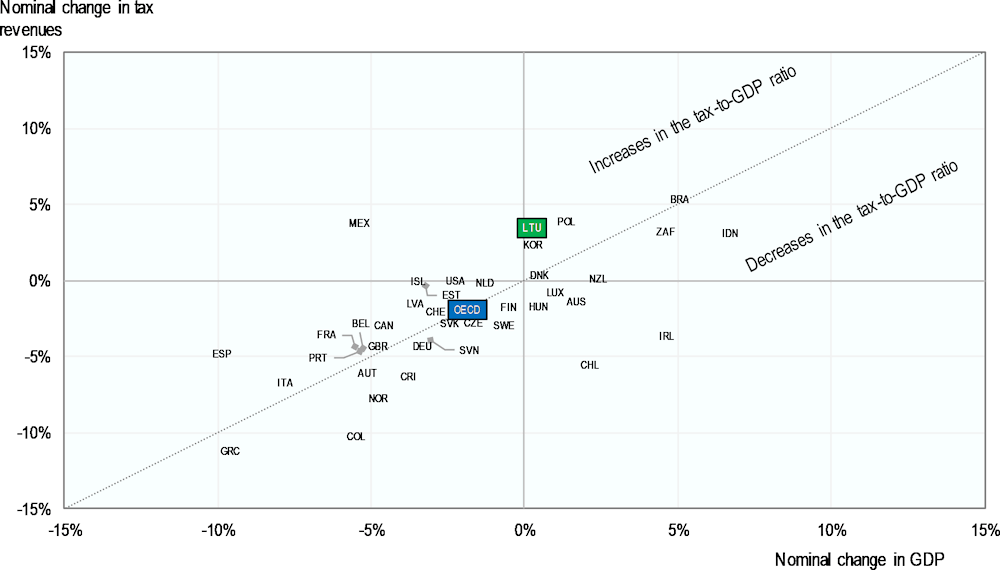

Lithuania is one of only a few countries to increase in tax revenues and GDP between 2019 and 2020. In OECD and partner countries, the higher share of taxes in total GDP in 2020 than in 2019 was generally the result of falls in GDP rather than tax revenues during the COVID-19 crisis. Lithuania is one of only five OECD countries that recorded an increase in both tax revenues and GDP along with Denmark, Korea, Poland and Turkey (Figure 2.16). In addition, Lithuania increased its tax-to-GDP ratio by almost 1 percentage point between in 2020, among the highest year-on-year changes in the OECD and most of the increase in Lithuania is attributable to an increase in the SSC-to-GDP ratio.

Figure 2.16. Lithuania increased both GDP and tax revenues during covid

Year-on-year change, percentage

The diagonal line across the graph represents the point at which the change in tax revenues and in GDP were of the same magnitude and therefore the point at which the tax-to-GDP ratio remained unchanged. Countries above the diagonal line had increases in their tax to GDP ratios; countries below it, had falls. Argentina and Turkey have not been included in this figure due to the distortive impact of high levels of inflation on nominal tax revenue and GDP data. Data for Australia, Brazil, Indonesia, New Zealand, and South Africa show the change between the fiscal years 2018 and 2019; data for Japan are not included as data on SSC revenues is not available.

Source: Revenue Statistics 2021 (2021[29]).

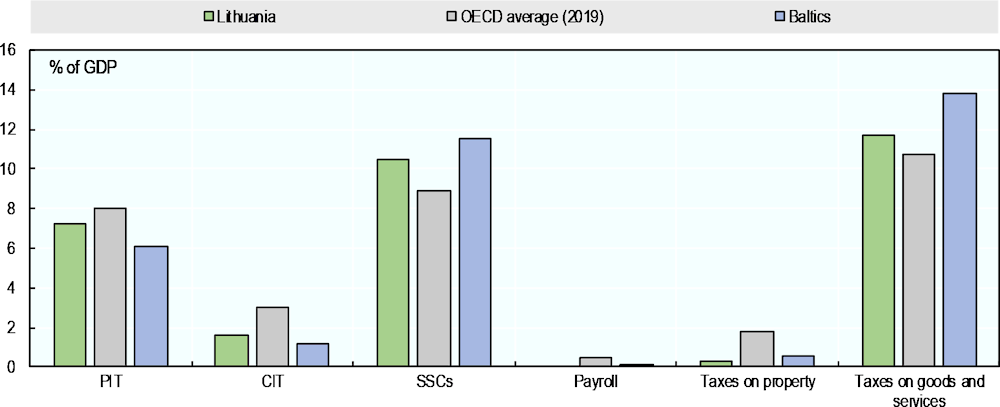

Lithuania’s tax structure is relatively concentrated in taxes on goods and service and labour taxes. Lithuania’s tax mix is concentrated in indirect taxes and labour taxes (Figure 2.17). Compared to the OECD average, Lithuania’s tax mix is tilted towards goods and services (11.7% vs 10.8%) and SSCs (10.4% vs 8.9%) and to a lesser extent towards PIT (7.2% vs 8.0%) and CIT (1.6% vs 3.0%). Total labour taxes in 2020 as a share of GDP are broadly similar in Lithuania, the Baltics and the OECD average (17.6%, 17.6% and 17.4% respectively)11.

Figure 2.17. Lithuania’s tax mix is concentrated in taxes on goods and services and SSCs

Taxes as % GDP, 2020

Notes: OECD average data is for 2019. Baltics refer to the average of Estonia and Latvia. PIT refers to taxes on individuals (OECD code 1100). CIT refers to taxes on corporate (1200). SSCs refers to total social security contributions (2000). Taxes on property and taxes on goods and services refer to codes 4000 and 5000 respectively.

Source: OECD Revenue Statistics 2021 (2021[29]).

Lithuania’s tax mix could be more conducive to economic growth. Taxes can be grouped based on their potentially distortive effects on growth (OECD, 2010[30]). Less distortive taxes include consumption taxes (which are high in Lithuania), recurrent taxes on immovable property and inheritance taxes (which are low), while CIT, PIT and SSCs tend to be more harmful for economic growth. In Lithuania, the sum of the distortive taxes accounts for 62% of total tax revenues in 202012. This is high relative to the sum of the same set of distortive taxes in Estonia (60%) and Latvia (53%).

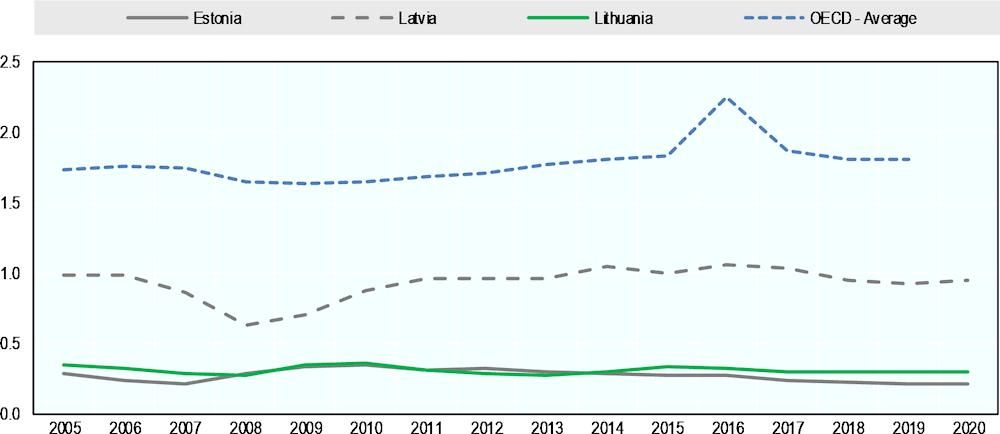

Property taxes are among the least harmful taxes for growth, but they play a minor role in Lithuania. In OECD countries, empirical analysis concluded that recurrent taxes on immovable property, in particular when owned by households, were the least damaging tax for long-run economic growth, compared to consumption taxes, personal income taxes and corporate income taxes (Johansson et al., 2008[25]). Recurrent taxes on immovable property can be efficient because the tax base is immobile (which limits the behavioural response to the tax) and visible (which makes it harder to evade). Designed correctly, recurrent taxes on immovable property can enhance fairness by for example exempting a certain amount of residential property wealth from tax. In Lithuania, property tax revenues are low representing 0.3% of GDP in 2020 against 0.2% in Estonia, 0.9% in Latvia and 1.8% in the OECD on average in 2019 (Figure 2.18). Revenues from taxes on property have also remained broadly stable in recent decades.

Figure 2.18. Tax revenues from property are low

Revenues from taxes on property as % of GDP, 2005 - 2020

Note: Property taxes code 4000 in OECD revenue statistics.

Source: Revenue Statistics 2021 (2021[29]).

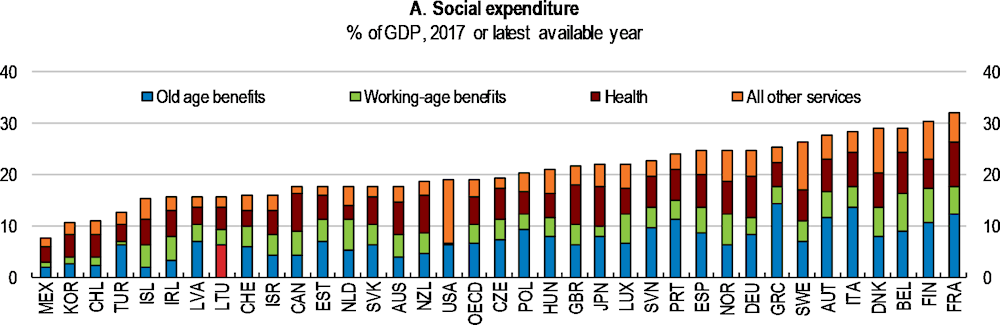

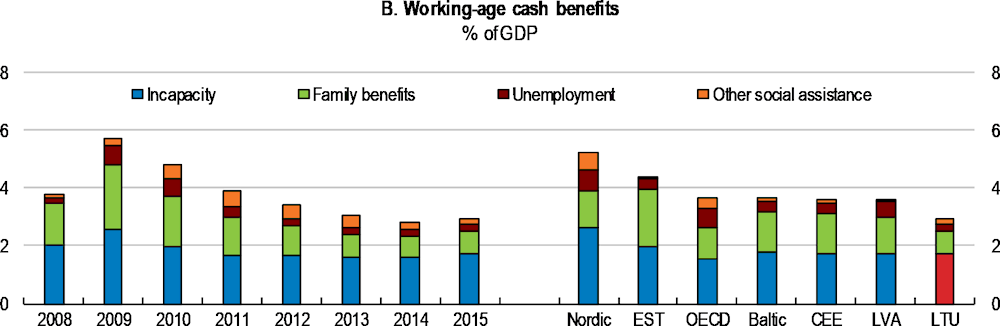

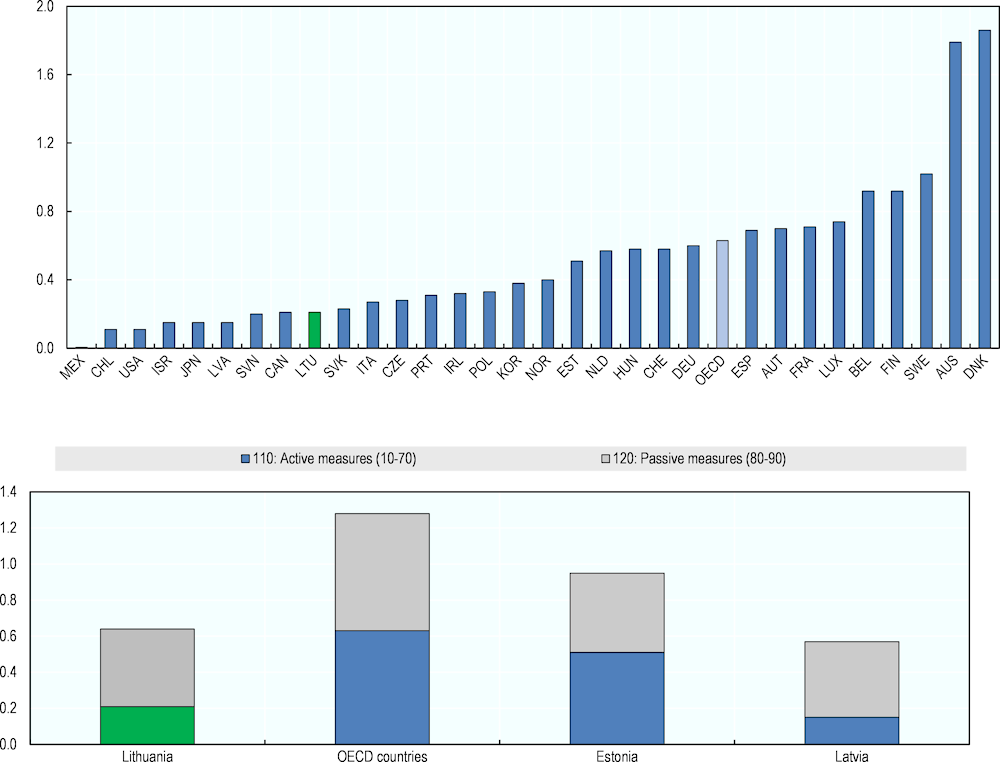

Despite rising tax revenues, social spending is low in international comparison, although it has increased in recent years. Social expenditure as a share of GDP in Lithuania is 16.7% in 2019, above Latvia (16.4%) but below Estonia (17.7%) and the OECD average (20.0%). A decomposition of social expenditure in 2017, which does not take account of the generosity of benefit increases in recent years, shows that the level of spending in health may be low in the context of the ongoing challenges (Figure 2.2) and the level of working-age benefits are low relative to the need to support inclusivity given rising wages for some. In addition, social spending as a share of GDP in Lithuania on old-age benefits, active labour market programmes and unemployment were 6.1%, 0.3% and 0.2% in 2017, all of which were below the OECD average.

Developing and upgrade low skills. Lithuania’s spending on education is modest in international comparison both in terms of per student spending and as measured in terms of GDP (OECD, 2021[31]). The OECD skills strategy (2021) made a number of recommendations to enhance skills in Lithuania. These included increasing labour market relevance of tertiary education given ICT shortages, making vocational and higher education skills more responsive to labour market needs and strengthening foundational skills (literacy, numeracy and problem solving) and education and training among older adults (OECD, 2021[31]).

Figure 2.19. Social spending is low

Social expenditure and working-age cash benefits in Lithuania and selected OECD countries, 2017

Note: Panel A: Working-age benefits includes spending on unemployment, family benefits, incapacity, and other social assistance. Panel B: Only cash benefits are included (i.e. excludes in-kind benefits). Average groups are as follows: OECD-EU: EU countries who are OECD members; EU27: European Union members; Baltic: Estonia, Latvia, and Lithuania; Nordic: Denmark, Finland, Iceland, Norway, and Sweden; CEE (Central European Economies): Czech Republic, Hungary, Poland, Slovak Republic, and Slovenia. International comparison data refer to 2017 or the latest available year. Data for LTU and OECD average are for 2015.

Source: OECD social expenditure database (OECD, 2020[32]).

Active labour market spending is low. Lithuania’s active labour market programme (ALMP) spending as a share of GDP is among the lowest in the OECD in 2019. This is partly due to relatively low active labour market spending on employment incentives and training. Passive labour market measures are mostly comprised of out-of-work income maintenance and support. According to recent OECD research on training and unemployment subsidies for the unemployment (OECD, 2022[33]), Lithuania needs to make further efforts to make ALMPs more effective, more available, and to target them more to people who need them the most. The findings included increasing spending on ALMPs, with an emphasis on programmes that support upskilling and reskilling and promote employment in the primary labour market. The OECD research also recommends expanding upskilling and reskilling opportunities, particularly for people who need them the most and for whom the social returns in terms of achieving a more inclusive labour market may be greatest, notably older jobseekers aged 50 and above, low-skilled persons and long-term unemployed.

Figure 2.20. Active labour market policies could be strengthened

Active labour market policy spending, % of GDP, 2019

Notes: 10: PES and administration. 20: Training. 40: Employment incentives. 50: Sheltered and supported employment and rehabilitation. 60: Direct job creation. 70: Start-up incentives.

Source: OECD labour market statistics database.

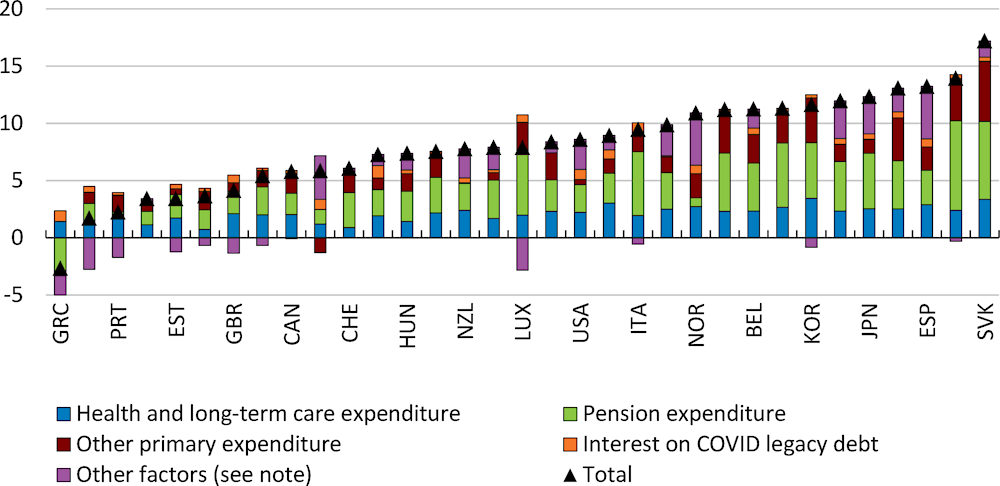

Long-run fiscal sustainability in Lithuania is favourable due to a relatively strong fiscal position, low spending and high employment. Much research has demonstrated that fiscal sustainability is a concept fraught with uncertainties (Blanchard, Leandro and Zettelmeyer, 2021[34]). To quantify long-run fiscal sustainability, OECD research uses an indicator of long-run fiscal pressure that is premised on the idea that governments would seek to stabilise public debt ratios at projected 2022 levels by adjusting structural primary revenue from 2023 onward (Guillemette and Turner, 2021[35]). This approach shows that the potential future fiscal pressure to keep the public debt ratio at current levels in Lithuania is relatively low. Lithuania would need to increase the structural primary revenue by 2 percentage points of GDP between 2021 and 2060 compared to 8 percentage points for the median country (Figure 2.21). There are at least three reasons for this. First, the structural fiscal position in Lithuania is better to begin with (i.e. just before Covid) so there is less need for adjustments, reflected in the negative ‘other factors’ category. Second, initial spending is lower in Lithuania than in other countries so even proportionate increases translate to smaller increases as a percentage of GDP. The projection does not however account for countries expanding coverage and generosity of spending over time. Third, employment rates are high and rising in Lithuania which projected in the future imply higher revenue and reduced spending all else equal.

Figure 2.21. The potential future fiscal pressure to keep the public debt ratio at current levels in Lithuania is relatively low

Change in fiscal pressure between 2021 and 2060, % pts of potential GDP

Note: The chart shows how the ratio of structural primary revenue to GDP must evolve between 2021 and 2060 to keep the gross debt-to-GDP ratio stable near its current value over the projection period (which also implies a stable net debt-to-GDP ratio given the assumption that government financial assets remain stable as a share of GDP). Expenditure on temporary support programmes related to the COVID-19 pandemic is assumed to taper off quickly. The necessary change in structural primary revenue is decomposed into specific spending categories. The component ‘Interest on COVID legacy debt” approximates the permanent increase in interest payments due to the COVID-related increase in public debt between 2019 and 2022. The component ‘Other factors’ captures anything that affects debt dynamics other than the explicit expenditure components (it mostly reflects the correction of any disequilibrium between the initial structural primary balance and the one that would stabilise the debt ratio).

Source: (Guillemette and Turner, 2021[35]).

References

[34] Blanchard, O., A. Leandro and J. Zettelmeyer (2021), “Redesigning EU fiscal rules: from rules to standards”, Economic Policy, Vol. 36/106, pp. 195-236, https://doi.org/10.1093/EPOLIC/EIAB003.

[14] Brys, B. et al. (2016), “Tax Design for Inclusive Economic Growth”, OECD Taxation Working Papers, No. 26, OECD Publishing, Paris, https://doi.org/10.1787/5jlv74ggk0g7-en.

[11] Causa, O. and M. Hermansen (2017), “Income redistribution through taxes and transfers across OECD countries”, OECD Economics Department Working Papers, No. 1453, OECD Publishing, Paris, https://doi.org/10.1787/bc7569c6-en.

[7] Causa, O., N. Luu and M. Abendschein (2021), “Labour market transitions across OECD countries: Stylised facts”, OECD Economics Department Working Papers, No. 1692, OECD Publishing, Paris, https://doi.org/10.1787/62c85872-en.

[15] Dube, A. (2019), “Impacts of minimum wages: review of the international evidence”.

[28] European Commission (2021), “The 2021 Ageing Report. Economic and Budgetary Projections for the EU Member States (2019-2070)”, https://doi.org/10.2765/84455.

[22] Eurostat (2019), Europe 2020 indicators - poverty and social exclusion - Statistics Explained, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Archive:Europe_2020_indicators_-_poverty_and_social_exclusion&oldid=394836 (accessed on 25 April 2022).

[21] Forster, M. (2013), “The OECD approach to measure and monitor income poverty across countries”.

[20] Gavoille, N. and A. Zasova (2021), “What we pay in the shadow: Labor tax evasion, minimum wage hike and employment 1 Introduction”.

[35] Guillemette, Y. and D. Turner (2021), “The long game: Fiscal outlooks to 2060 underline need for structural reform”, OECD Economic Policy Papers, No. 29, OECD Publishing, Paris, https://doi.org/10.1787/a112307e-en.

[18] Hazans, M. (2007), “Looking for the workforce: The elderly, discouraged workers, minorities, and students in the Baltic labour markets”, Empirica, Vol. 34/4, pp. 319-349, https://doi.org/10.1007/S10663-006-9029-5.

[16] ILO (2021), Global wage report, https://www.ilo.org/wcmsp5/groups/public/@dgreports/@dcomm/@publ/documents/publication/wcms_762534.pdf (accessed on 25 April 2022).

[17] IMF (2016), “Central, Eastern, and Southeastern Europe: How to Get Back on the Fast Track; Regional Economic Issues; May 2016”.

[12] Immervoll, H. et al. (2005), “Household Incomes and Redistribution in the European Union: Quantifying the Equalising Properties of Taxes and Benefits”, SSRN Electronic Journal, https://doi.org/10.2139/SSRN.842044.

[13] Joumard, I., M. Pisu and D. Bloch (2012), “Tackling income inequality: The role of taxes and transfers”, OECD Journal: Economic Studies, https://doi.org/10.1787/eco_studies-2012-5k95xd6l65lt.

[23] Koutsogeorgopoulou, V. (2020), “Reducing poverty and social disparities in Lithuania”, OECD Economics Department Working Papers, No. 1649, OECD Publishing, Paris, https://doi.org/10.1787/b631de7d-en.

[33] OECD (2022), Connecting People with Jobs, OECD Publishing, Paris, https://doi.org/10.1787/26164140.

[1] OECD (2022), OECD Economic Surveys: Lithuania 2022, OECD Publishing, Paris, https://doi.org/10.1787/0829329f-en.

[5] OECD (2021), Health at a Glance 2021: OECD Indicators, OECD Publishing, Paris, https://doi.org/10.1787/ae3016b9-en.

[2] OECD (2021), Lithuania Economic Snapshot - OECD, https://www.oecd.org/economy/lithuania-economic-snapshot/ (accessed on 20 April 2022).

[31] OECD (2021), OECD Skills Strategy Lithuania: Assessment and Recommendations, OECD Skills Studies, OECD Publishing, Paris, https://doi.org/10.1787/14deb088-en.

[25] OECD (2021), Pensions at a Glance 2021: OECD and G20 Indicators, OECD Publishing, Paris, https://doi.org/10.1787/ca401ebd-en.

[29] OECD (2021), Revenue Statistics 2021: The Initial Impact of COVID-19 on OECD Tax Revenues, OECD Publishing, Paris, https://doi.org/10.1787/6e87f932-en.

[32] OECD (2020), OECD Economic Surveys: Lithuania 2020, OECD Publishing, Paris, https://doi.org/10.1787/62663b1d-en.

[27] OECD (2019), Yours inclusively? Income mobility in Ireland, 10 years of tax record microdata, https://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=ECO/WKP(2019)48&docLanguage=En (accessed on 25 April 2022).

[3] OECD (2018), OECD Economic Surveys: Lithuania 2018, OECD Publishing, Paris, https://doi.org/10.1787/eco_surveys-ltu-2018-en.

[26] OECD (2018), Reshaping the Personal Income Tax in Slovenia, OECD, https://www.oecd.org/tax/tax-policy/reshaping-the-personal-income-tax-in-Slovenia.pdf.

[8] OECD (2017), Shining light on the shadow economy, https://www.oecd.org/tax/crime/shining-light-on-the-shadow-economy-opportunities-and-threats.pdf (accessed on 14 April 2022).

[30] OECD (2010), Tax Policy Reform and Economic Growth, OECD Tax Policy Studies, No. 20, OECD Publishing, Paris, https://doi.org/10.1787/9789264091085-en.

[4] Pacifico, D. et al. (2018), “Faces of Joblessness in Lithuania: A People-centred perspective on employment barriers and policies”, OECD Social, Employment and Migration Working Papers, No. 205, OECD Publishing, Paris, https://doi.org/10.1787/3657b81e-en.

[9] Putniņš, T. and A. Sauka (2021), “Measuring the shadow economy using company managers”, Journal of Comparative Economics, Vol. 43/2, pp. 471-490, https://doi.org/10.1016/J.JCE.2014.04.001.

[10] Putniņš, T. and A. Sauka (2015), “Measuring the shadow economy using company managers”, Journal of Comparative Economics, Vol. 43/2, pp. 471-490, https://doi.org/10.1016/J.JCE.2014.04.001.

[6] Rovira, P. et al. (2021), “Alcohol taxation, alcohol consumption and cancers in Lithuania: A case study:”, https://doi.org/10.1177/14550725211021318, Vol. 39/1, pp. 25-37, https://doi.org/10.1177/14550725211021318.

[19] Šuminas, M. (2015), “Effects of Minimum Wage Increases on Employment in Lithuania”, Ekonomika, Vol. 94/2, pp. 96-112, https://doi.org/10.15388/Ekon.2015.2.8235.

[24] Thévenon, O. et al. (2018), “Child poverty in the OECD: Trends, determinants and policies to tackle it”, OECD Social, Employment and Migration Working Papers, No. 218, OECD Publishing, Paris, https://doi.org/10.1787/c69de229-en.

Notes

← 1. Seasonally adjusted. Based on OECD productivity database, productivity and unit labour costs.

← 2. A proposed OECD definition is as follows: Economic activities, whether legal or illegal, which are required by law to be fully reported to the tax administration but which are not reported and which therefore go untaxed unlike activities which are so reported.

← 3. The government sets the minimum wage based on the recommendation of the Tripartite Council of the Republic Lithuania.

← 4. Much of the evidence for the ‘lighthouse effect’ comes from countries with high levels of informality, particularly countries in Latin America.

← 5. Self-employment income is largely comprised of individual-activity income (75%) followed by business certificate income (24%).

← 6. Pension income mostly relates to the contributory old-age pension income (96%).

← 7. Note that total income percentiles are used for total income and employment income percentiles are used for employment income.

← 8. Gross average wages grew 9.4% between Q1 2020 and Q1 2019 compared to unemployment benefits which grew 9.2% between January 2021 and January 2020.

← 9. Note that reductions are not applied for workers with long social insurance insurance records of 40+ years and receiving early retirement pensions for less than 3 years.

← 10. The ratio of SSCs-to-GDP declined from 10.8% to 9.6% between 2013 and 2019.

← 11. Total labour taxes refers to PIT, SSCs and payroll taxes combined.

← 12. PIT, CIT and SSCs represent 23.0%, 5.1% and 33.4% of total tax revenues respectively.