This chapter is divided in two parts. In the first part, it assesses and provides reform options for the design of the tax system including the design of the personal income tax, the basic tax allowance and social security contributions. An assessment of the sustainability of the social security system is also included. In the second part, the chapter assesses and provides reform options for the design of the benefit system including unemployment benefit, housing benefit, social assistance benefit and child benefits.

OECD Tax Policy Reviews: Lithuania 2022

3. The design of the tax and benefit system in Lithuania

Abstract

Introduction

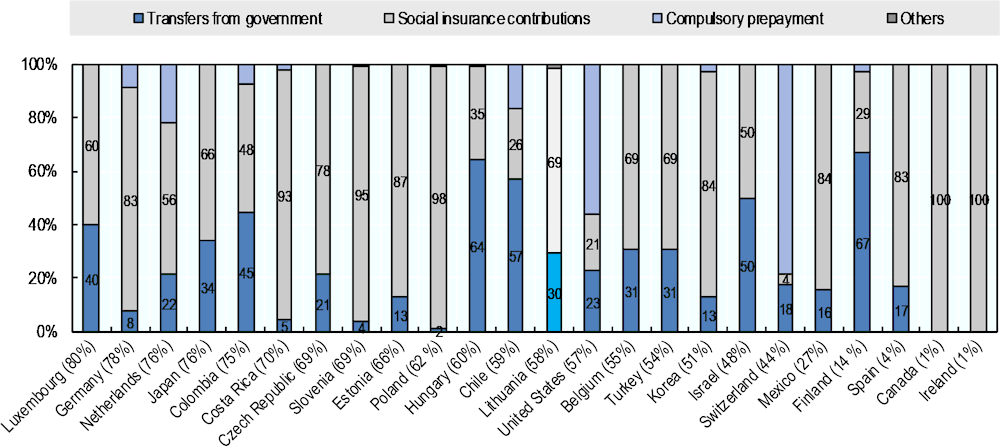

Lithuania has a range of interacting policy levers that influence the tax and benefit system. The purpose of the policy lever map is to provide an overview of the various policy levers that are available to Lithuania to make adjustments to the tax and benefit system (Figure 3.1). The map highlights interactions within the system, for example that social assistance benefit is means-tested according to net income which is in turn reduced by the PIT and SSC rates. Similarly, the number of persons in a family can determine both the amount of social assistance benefit and housing benefit. The structure of this chapter covers each tax and benefit policy lever in turn.

Figure 3.1. A tax and benefit policy lever map for Lithuania

Note: Some other targeted benefits such as pensions and sickness and disability benefit are not included. Housing benefit here is shown only for rent. Compensations for heating costs, drinking water costs and hot water costs are not included (Būsto šildymo, geriamojo ir karšto vandens išlaidų kompensacijos), which covers a larger share of households-house owners. This benefit is outside the scope of OECD TaxBen model as the model considers only households-renters. Average wage refers to OECD secretariat calculations for 2020 (see Taxing Wages 2021). Figures are for 2021 unless otherwise stated. BSB refers to basic social benefit. MMS refers to minimum monthly wage. AMCN refers to amount of minimum consumption needs. SSI refers to state supported income.

Source: OECD analysis adapted from OECD Tax-Benefit Model for Lithuania 2020 and 2021.

Lithuania introduced a wide-ranging labour tax reform in 2019. The stated rationale for the reform was to make social insurance clearer, more attractive, to reduce the tax burden on labour and to make labour taxation the most competitive in the Baltic States (Government of the Republic of Lithuania, 2018). The reform included a number of changes to taxes and benefits including the following:

The introduction of a progressive PIT-rate system (with two PIT rate brackets) from a flat PIT-rate system.

Shifting SSCs from employers to employees.

A mechanical upward compensation adjustment in gross wages.

The introduction of employee and employer SSC ceilings.

An increase in the basic allowance and adjustment to the basic allowance withdrawal rate.

Increases in universal child benefit and additional child benefit.

Since the reform, a range of further tax and benefit policy changes were made in 2020 and 2021 including:

Increases in the top-PIT rate.

Cuts in the top-PIT rate threshold.

Cuts in the employee SSC ceiling.

Cuts in the employer SSC ceiling followed by abolition.

Part of the SSCs previously used to cover social insurance pensions was shifted to general taxation.

Further increases in, and a redesign of, the basic allowance.

Box 3.1. Labour tax reforms in Romania and Latvia

I. Romania undertook a tax reform that shifted almost all employer SSCs to the employee

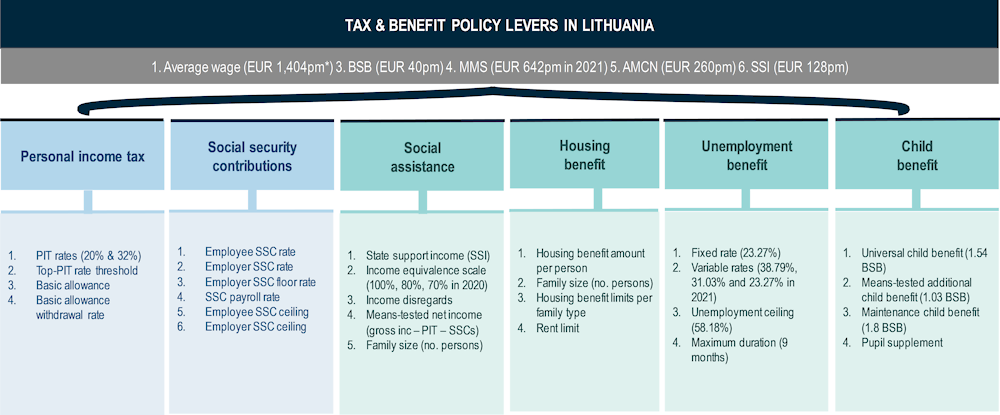

In 2018, one year before Lithuania’s labour tax reform, Romania undertook a labour tax reform that similarly shifted almost all employer SSCs to the employee. Unlike Lithuania which reduced total SSC rates to 20.97% in 2019 (by cutting employer SSC rates by more than it increased employee SSC rates), Romania kept total SSC rates about the same at 37.25% in 2018. Romania increased employee SSC rates by 19pp to 35% in 2018 (up from 16% in 2017) while employer SSC rates were cut by a similar 20.5pp to 2.25% (down from 22.75% in 2017). Lithuania increased employee SSCs by 10.5p.p. to 19.5% in 2019 (up from 9.0% in 2018) but cut employer SSCs by a significantly greater 29.03p.p. to 1.47% in 2019 (down from 30.5% in 2018).

Romania’s reform increased tax revenues, unlike Lithuania’s which was broadly neutral. Employee SSC revenues in Romania rose markedly from 3% to 9% of GDP in 2018. This was partly offset by declines in employer SSCs and PIT, which fell to 1% (from 5%) and 2% (from 4%) of GDP respectively. Total labour taxes increased by 1% reaching 13% of GDP following the reform. In Lithuania, increases in employee SSC revenues (from 4% to 9%) and PIT revenues (from 4% to 7%) were offset by reduced employer SSCs (from 9% to 1%).

Romania employed a different wage strategy to Lithuania, but gross wages still rose. Lithuania increased gross wages mechanically in January 2019 so that net disposable income for most workers remained unchanged. Statistics Lithuania data show that average monthly earnings by 30% in Q1 2019 compared to Q4 2018, suggesting that Lithuanian firms compensated workers with even higher gross wages than required by the mechanical adjustment. Average monthly earnings have continued to grow in Lithuania since then up to the latest data in 2022, albeit more slowly. In Romania, while no such mechanism was employed and instead wage bargaining occurred between employees and employers, gross wages increased steadily in the years after 2018 and up to 20221. Gross wages likely increased in Romania as the shift in SSCs from employer to employee allowed firms to increase gross wages without further increasing total compensation of employees and, at the same time, workers demanded higher gross wages to compensate for higher employee SSCs (European Commission, 2019[1]) (For a discussion of employer and employee SSC incidence see Box 3.2).

Figure 3.2. Taxes as a % of GDP in Romania and Lithuania, 2016 - 2019

Note: PIT refers to taxes on individual or household income including holding gains. Employee SSCs refer to compulsory social contributions by households. Employer SSCs refer to social contributions by employers. Employee SSCs in Romania are comprised of 25% general health SSC and 10% health SSC in 2018 (which were previously 10.5% and 5.5% respectively in 2017). An employee SSC for unemployment was also abolished in 2017.

Source: Data on Taxation, European Commission.

II. Latvia introduced a tax reform that included transitioning to a progressive PIT system

Latvia introduced a labour tax reform in 2018. The reform had several aims including strengthening tax wedge progressivity and reducing the tax burden on low-income earners with no dependents.

As part of the reform, Latvia transitioned to a progressive PIT rate system. A flat 23% rate was replaced with three PIT rate brackets of 20%, 23% and 31.4%. To support the financing of healthcare services, the SSC rate increased by 1 p.p. from 34.09% to 35.09%, shared equally between employers and employees (employer SSC rate increased 0.5 p.p. and employee SSC rate increased 0.5 p.p.).

Following the reform, tax revenues remained broadly similar and the impact on progressivity was limited. After the reform, SSCs-to-GDP increased from 8.4% to 9.2% while PIT-to-GDP fell from 6.6% to 6.0%. The decline in PIT-to-GDP was partly due to a relatively large proportion of taxpayers in the lower tax bracket that pay PIT at the lower rate. Overall, PIT and SSC revenues as a share of GDP remained broadly unchanged at 15.1% in 2018 (in 2019, PIT and SSCs both increased to 9.6% and 6.5% as a share of GDP respectively). The directionality of these PIT and SSCs changes had been anticipated by the authority’s pre-reform. Some evidence has pointed to a relatively limited impact on inequality following the reform as the progressive PIT schedule tended to benefit middle-income earners and was less well targeted at poorer households (Ivaškaitė-Tamošiūnė et al., 2018[2]).

1. According to data from Statistics Romania, monthly gross average earnings increased from 4143 Romanian leu in January 2018 to 6031 Romanian leu in January 2022.

The design of the tax system

Lithuania operates a worldwide personal income tax system. Lithuanian residents are taxed on their worldwide income while non-residents are taxed on the basis of the territoriality principle and, as such, are only taxed on income from Lithuanian sources. Worldwide taxation for personal income is more prevalent around the world than territorial taxation (Shum, Fay and Lui, 2017[3]).

A new rule in 2022 requires employers to pay all employment-related payments into employee bank accounts. Lithuania is a relatively high cash economy according to survey data from the European Central Bank. This policy brings Lithuania in line with many countries that have introduced stricter enforcement making it compulsory for employers to pay salaries through a bank account.

SSCs are not deductible from the PIT base, which is atypical among OECD countries. A common form of interaction between PIT and SSCs in OECD countries is the full or partial deductibility of SSC payments from the PIT base. For example, in Estonia, employee SSCs for unemployment insurance are deductible from PIT as a standard tax relief. In Poland, an allowance is provided for all social insurance contributions paid by the taxpayer and a tax credit is available for health insurance contributions. In Germany, SSCs are deductible up to specific ceilings. In Lithuania however, SSCs are not deductible from the PIT base.

Non-deductible SSCs imply lower disposable incomes. As SSCs are deductible from the PIT base in most OECD countries, SSC rate hikes narrow the PIT base and mechanically reduce effective PIT rates. As SSCs are not deductible in Lithuania, workers face relatively higher marginal and average PIT rates and have less disposable income relative to allowable SSC deductibility. The non-deductibility of SSCs in Lithuania support the case for not taxing future SSC pension benefits under the PIT as they have effectively already been taxed through higher PIT. Similarly, while shifting from employer to employee SSCs would mechanically reduce PIT revenues to some degree in most OECD countries due to lower taxable personal income (given constant total labour costs for the employer), it would not do so in Lithuania.

Lithuania transitioned to a progressive personal income tax system. Lithuania transitioned from its flat 15% PIT rate system to a progressive PIT rate system in 2019 with a lower 20% rate and an upper 27% rate. In 2020, the top-PIT rate was increased to 32% and the lower PIT rate remained the same (Table 3.1, Table 3.2).

Table 3.1. The PIT rate schedule

|

Monthly taxable income bracket (EUR) |

Marginal tax rate in 2020 |

|---|---|

|

Up to 8 690 |

20% |

|

Above 8 960 |

32% |

Note: In 2020, a 20% PIT rate applies to taxable income up to EUR 104 278 per year (EUR 8 698 per month) or 84 average wages (AW)and the PIT rate for the part exceeding this limit is 32%.

Source: OECD analysis.

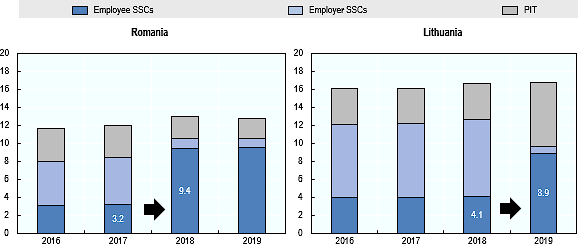

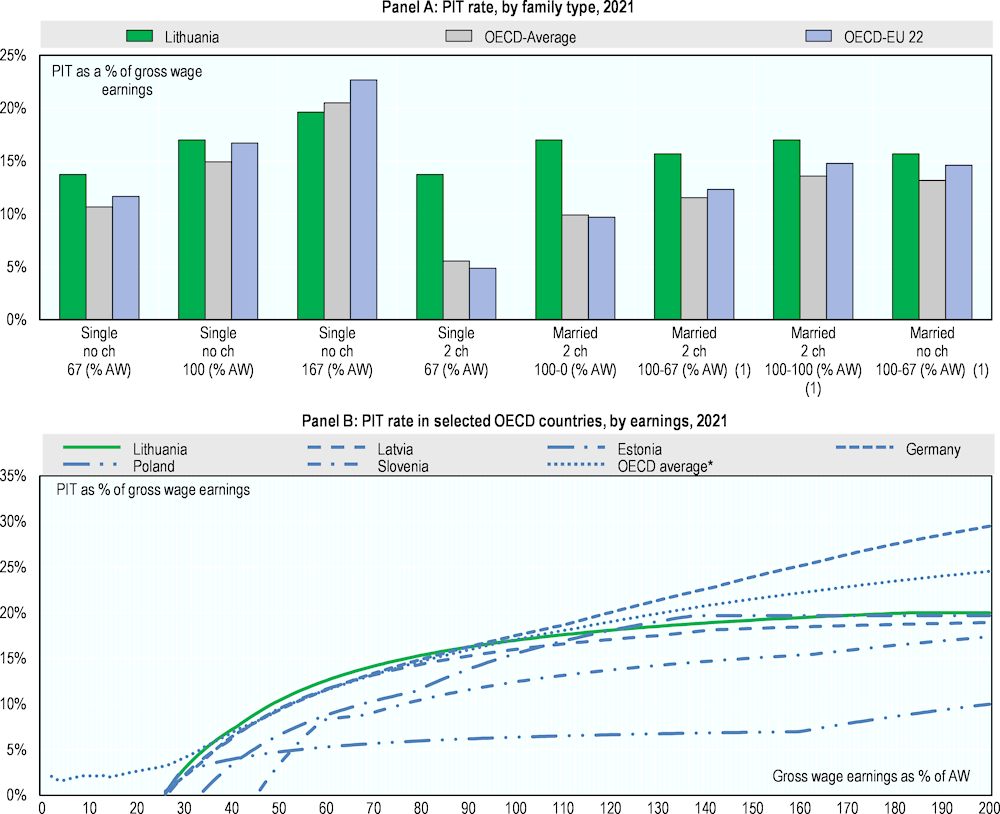

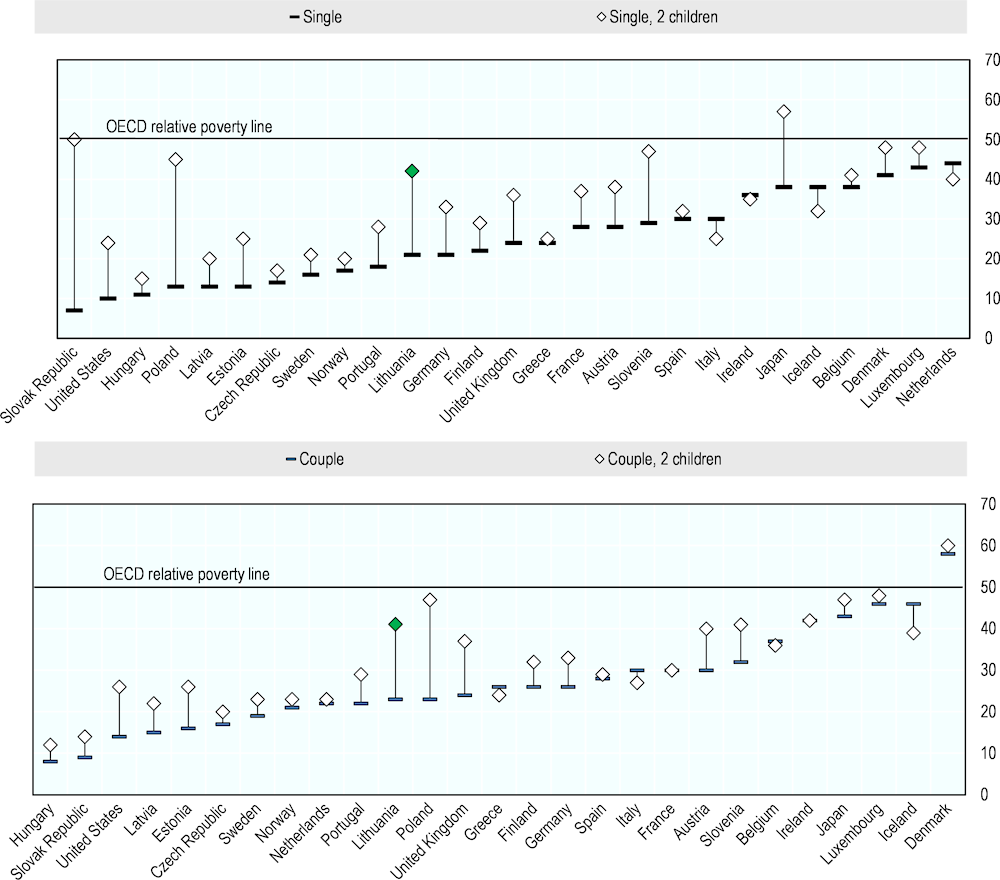

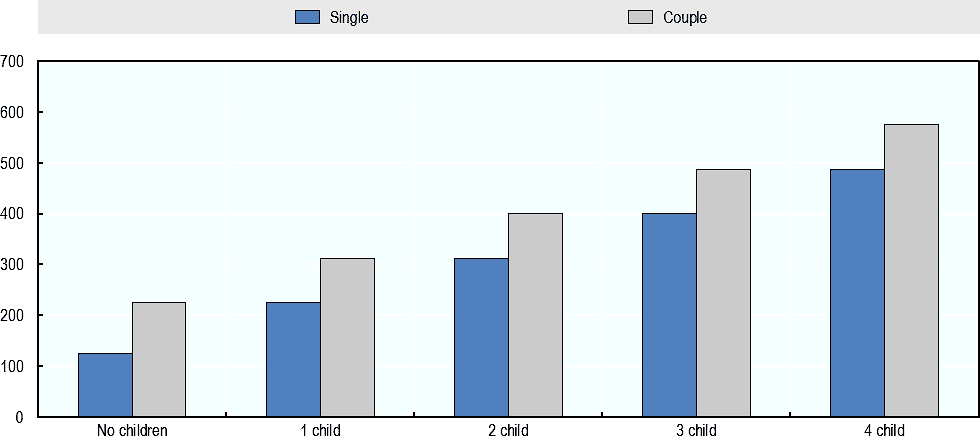

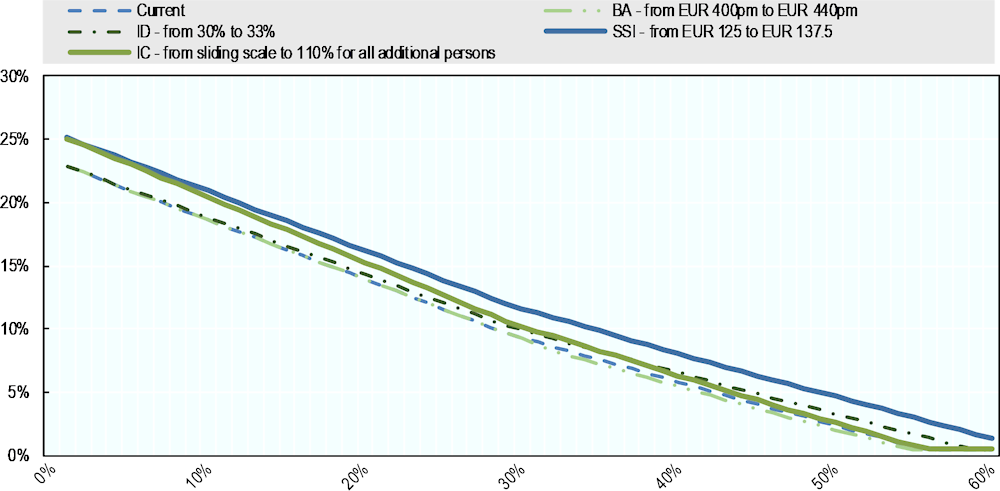

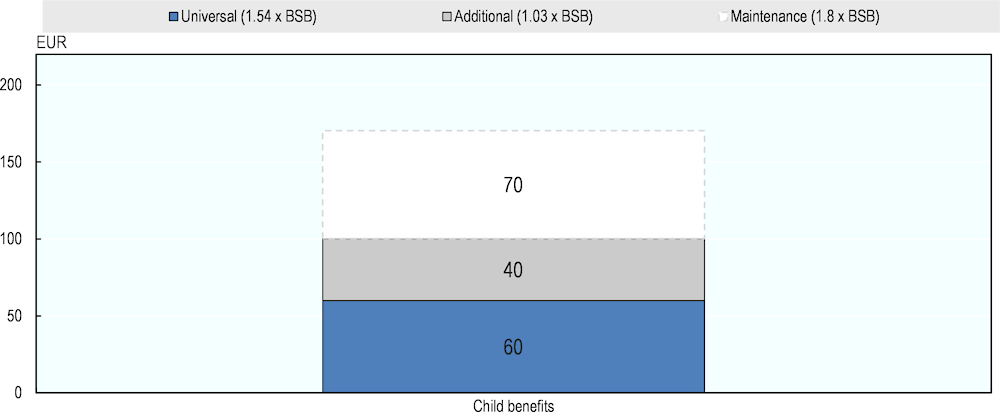

Average and marginal PIT rates are relatively compressed. At lower incomes (67% of AW), average PIT rates in Lithuania rank among the top 10 OECD countries (Figure 3.3). Relatively high PIT rates at low incomes contribute to the work disincentive in Lithuania (see chapter 4). At higher incomes (AW and 133% of AW), average PIT rates are in the middle of OECD countries. Average PIT rates are relatively compressed ranging from 14% to 20%, indicating relatively little PIT progressivity. Marginal PIT rates in Lithuania are in the middle of OECD countries. Marginal PIT rates are the same for the income levels shown, again reflecting not much progressivity.

Figure 3.3. PIT rates are relatively compressed

Marginal and average PIT rates in OECD countries, 2021

Note: Analysis relates to an average single individual without children. The marginal rates are expressed as a percentage of gross wage earnings.

Source: OECD tax database.

Average PIT rates are quite high at incomes below the average wage. Average PIT rates for single individuals in Lithuania are above the OECD average at lower incomes (below the AW) but below the OECD average at higher incomes (167% of AW) (Figure 3.4 Panel A). Single and couple Lithuanian parents with two children have markedly higher average PIT rates than the OECD average. The average PIT rate in Lithuania is above the OECD average and several peer countries between about 1/3 of the AW and the AW (Figure 3.4 Panel B). Above the AW, the average PIT rate in Lithuania remains flat while the OECD average PIT rate rises.

Figure 3.4. Average PIT rates are quite high at low incomes

Average PIT rates, 2021

Note: In panel A, ch = children. 1 = two-earner couple. In panel B, data refers to a single individual with no children. In panel B, OECD average refers to an unweighted average of the average PIT rate by percentile in 29 OECD countries for which data are available.

Source: OECD tax-benefit model. Model version 2.4.0. Taxing Wages 2022.

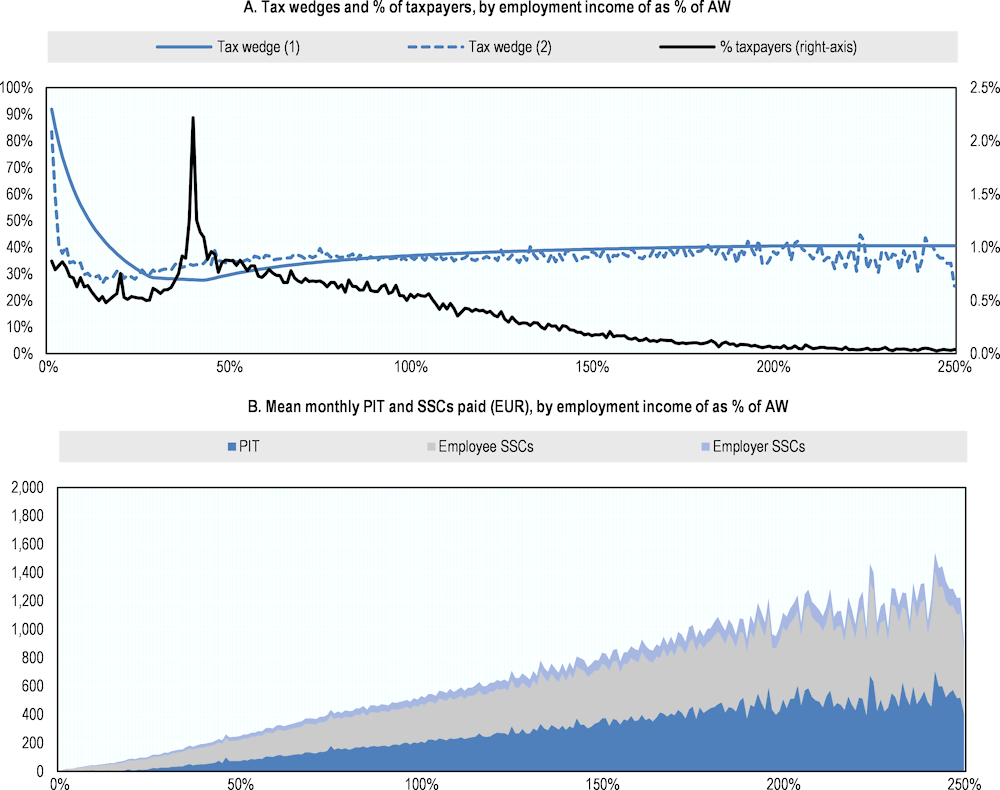

Microdata analysis confirm that many lower income employees face relatively high tax burdens. Over 1/3 of employees earn below half the AW (Figure 3.5, Panel A). The average backward-looking tax wedge by percentile calculated using the microdata (i.e. tax wedge 2 in Figure 3.5, Panel A) and the hypothetical tax wedge (i.e. tax wedge 1 in Figure 3.5, Panel A) highlight a relatively flat tax burden across the employment income distribution and high tax burdens at low incomes (due to the employer SSC floor) (Figure 3.5, Panel A). In addition, mean PIT and SSCs paid by employment income in the microdata are consistent with the tax rules (Figure 3.5, Panel B) - the PIT share rises over time because the PIT rate rises steadily as the BA is tapered and the SSC shares are flat due to the flat employee and employer SSC rates.1

Figure 3.5. Many lower income employees face high tax burdens

Tax wedges, share of taxpayers and taxes paid, by total income as % of AW

Note: Tax wedge (1) is based on the OECD Taxing Wages model in 2021 for a single employee using the same AW. Tax wedge (2) is the mean backward-looking tax wedge by percentile calculated using the microdata in 2019. The total number of taxpayers with positive employment income is 46 389 in the sample microdata (i.e. employees). The microdata is for the year 2019. Some key tax rules have changed since 2019. In 2019, the BA was EUR 3 600 for annual incomes up to 12 MMS (EUR 6 660). The lower PIT rate was 20% (up to 120 AW i.e. EUR 136 334) and the upper PIT rate was 27%. In 2021, the BA had increased to EUR 4 800 up to 12 MMS (i.e. EUR 7 704). The lower PIT rate is 20% (but up to 60 AW i.e. EUR 81 162) and the upper PIT rate increased to 32%. The employee and employer SSC rates of 19.5% and 1.47% remained the same. In 2021, the employee SSC ceiling was cut to 60 AW and the employer SSC ceiling was abolished.

Source: OECD analysis of microdata 2019.

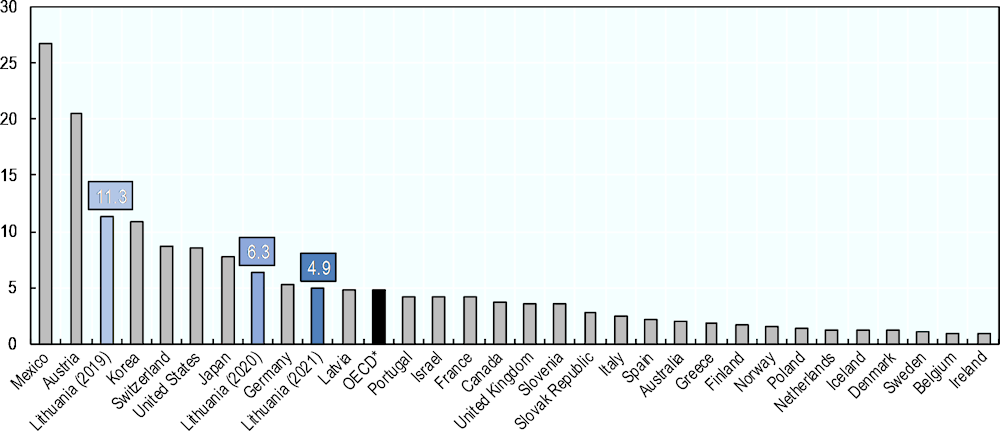

Lithuania has halved the top-PIT rate threshold in recent years but it remains high. Lithuania has cut the top-PIT rate threshold (i.e. the income level at which the top-PIT rate starts to apply) from about 10 to 5 annual AWs between 2019 and 2021 (Table 3.2).2 The top-PIT rate threshold as a share of the gross wage in Lithuania has gone from being one of the highest among OECD countries to converging towards the average in OECD countries (Figure 3.6). However, the top-PIT rate threshold remains high at EUR 8 698 in 2020 relative to the monthly average wage of EUR 1 400 (OECD estimate3) and the monthly minimum wage (MMW) of EUR 1 400. The cuts to the top-PIT rate threshold between 2019 and 2021 (which increase the tax burden on higher earners) should be considered in the context of employee and employer SSC ceilings, which were jointly reduced to the same AW multiples during that period (which reduce the SSC burden on higher earners, see Table 3.8 in the SSC section).

Table 3.2. Lithuania has cut top-PIT rate thresholds and increased top PIT rates

PIT rates and higher PIT-rate thresholds in Lithuania, 2018 - 2021

|

2018 |

2019 |

2020 |

2021 |

|

|---|---|---|---|---|

|

PIT rates |

15% |

20% and 27% |

20% and 32% |

20% and 32% |

|

Top-PIT rate threshold (as a multiple of annual AW) |

none |

10 |

7 |

5 |

Notes: Monthly AW are converted to annual AW by dividing by 12. In 2021, 60 * EUR 1 352.70 = EUR 81,162 per year. In 2020, 84 * EUR 1241.4 = EUR 104 277.60 per year. In 2019, 120 * EUR 1,136.2 = EUR 136,344.

Source: OECD analysis.

Figure 3.6. The top-PIT rate threshold has converged towards the OECD average

Top PIT thresholds as a share of gross wages in Lithuania and selected OECD countries, 2020

Note: Gross wages incomes are based on OECD secretariat calculations from Taxing Wages 2021 publication. In Lithuania, the average wage is EUR 12 095 in 2019 and EUR 16 426 in 2020. Average wage in Lithuania in 2021 is assumed to be the same as 2020. *OECD refers to an weighted mean average for the selected countries shown.

Source: OECD tax database; Taxing Wages 2021.

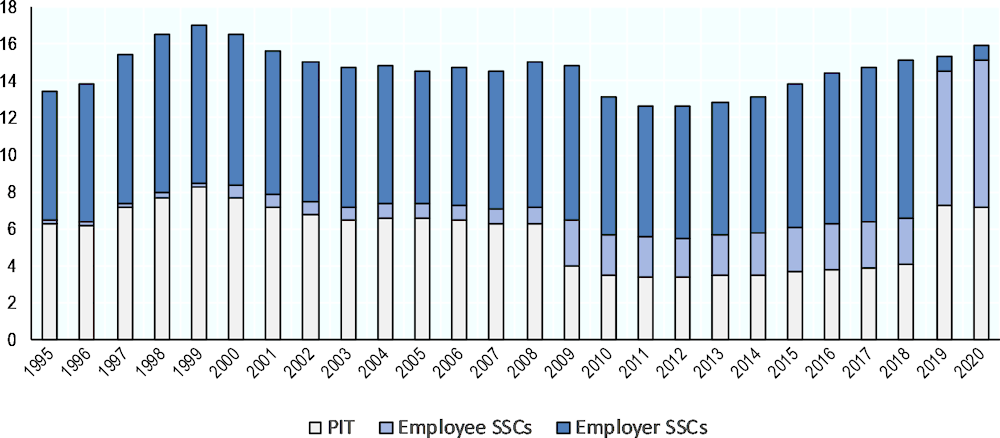

Developments in labour tax revenues

In 2019, the year of the labour tax reform, labour tax revenues remain broadly unchanged. PIT and total SSC revenues as a share of GDP increased only modestly in 2019 (Figure 3.7). This occurred because the PIT-to-GDP ratio and the employee-SSCs-to-GDP ratio rose from 4.1% to 7.2% and 2.5% to 7.3% respectively, but they were mostly offset by the employer-SSCs-to-GDP ratio decline from 8.5% to 0.7%. After that in 2020, employee-SSCs-to-GDP increased while employer-SSCs-to-GDP and PIT-to-GDP remaining broadly unchanged.

The reform involved the most significant reshuffling of the labour tax mix in decades. Employee SSC revenues as a share of GDP have gone from playing a minor role in 1995 to a major role in 2020 and vice versa for employer SSC revenues (Figure 3.7). To explore the consequences of this SSC reshuffling, Box 3.2 considers the role of the tax incidence concept for employee and employer SSCs. Box 3.1 examines the case study of Romania in 2018 which also shifted most of its SSCs from the employer to the employee.

Figure 3.7. Labour taxes were broadly unchanged in 2019

Labour tax revenues as % of GDP, 1995 - 2020

Note: PIT relates to incomes and profits of individuals (code 1110). Employee and employer SSCs relate to OECD revenue statistics codes 2100 and 2200 respectively.

Source: Revenue Statistics 2021 (2021[4]).

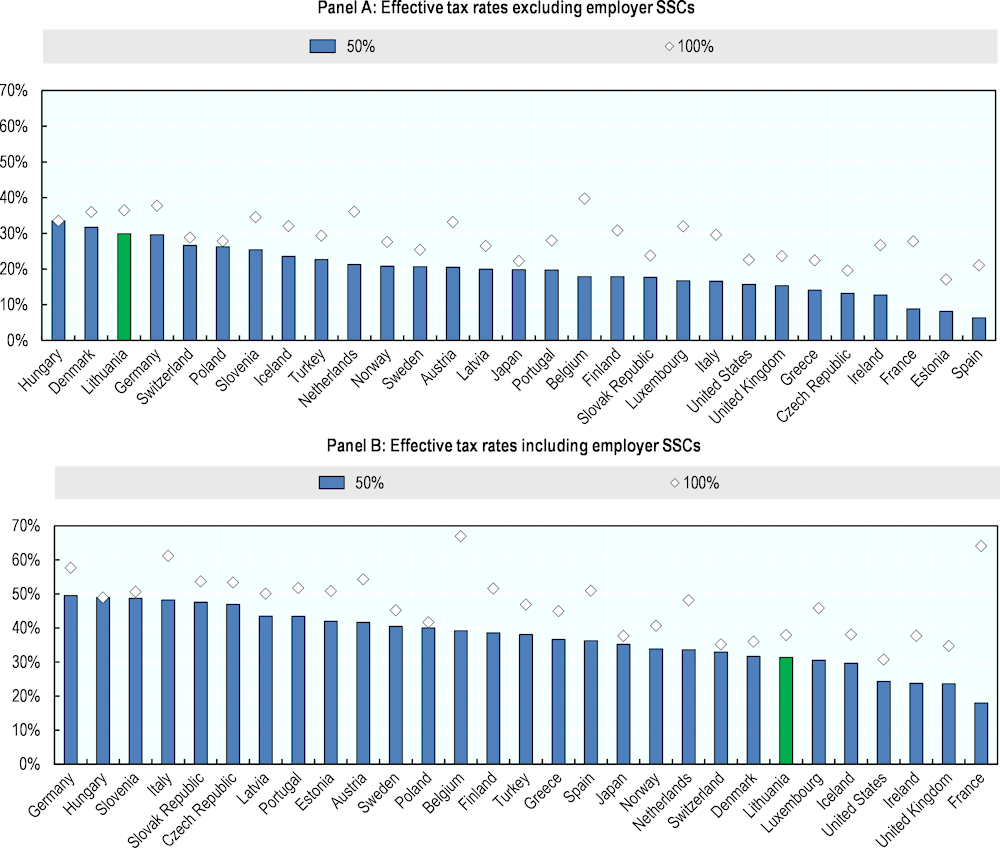

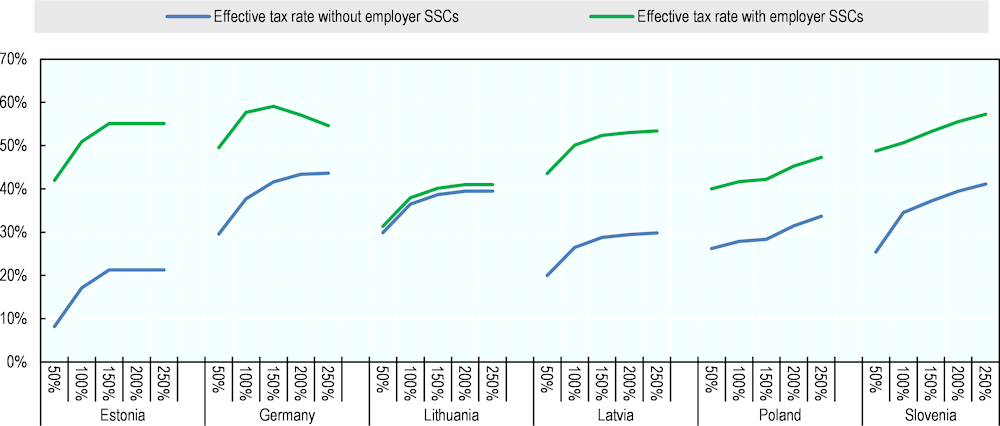

The personal income tax system could be more progressive at the top

The effective tax rate is high in international comparison but low when employer SSCs are included. Average effective tax rates (AETRs) for a single individual with no children in Lithuania in 2021 are the third highest in the OECD at low and middle incomes (50% and 100% of the AW respectively) (Figure 3.8 Panel A). AETRs at low incomes are driven mostly by employee SSCs (see section 3.2). When employer SSCs are included in the ETRs (which is not a typical measure used in OECD Taxing Wages that brings the calculation closer to a tax wedge type measure), Lithuania’s AETRs do not change by much (Figure 3.8 Panel B). Lithuania’s AETRs are now lower when compared to other OECD countries because the AETRs of other countries have increased by more (due to Lithuania’s relatively lower employer SSCs). A similar trend occurs at high incomes. At 200% of AW, measured without employer SSCs, AETRs in Lithuania are the 8th highest in the OECD countries shown in 2021. A single individual with no children at 200% of the AW in Lithuania faces a lower AETR than in Germany but higher than in Estonia, Latvia and Poland (Figure 3.9). However, when employer SSCs are included, a single individual earning 200% of the AW in Lithuania is then ranked the 4th lowest among the OECD countries shown in 2021.

Figure 3.8. Effective tax rates in international comparison

Effective tax rates including and excluding employer SSCs, single individual with no children earning 50% and 100% of the AW, 2021

Source: Taxing Wages 2022 tax decomposition data. OECD tax benefit model 2021.

AETRs in Lithuania are relatively flat at higher incomes. AETRs in Lithuania are compressed, ranging from 30% at low incomes (50% of the AW) to 40% at high incomes (250% of the AW) (Figure 3.9). AETRs at high incomes (above the AW) are also quite flat. In these two respects, Lithuania’s ETR structure is not dissimilar to Germany. In addition, the PIT rate on low-incomes (67% of AW) as a share of the PIT rate on high-incomes (167% of AW) is the fifth-highest in the OECD at 70% in 2021, indicating relatively little PIT progressivity. Including employer SSCs in AETRs makes Lithuania’s ETRs comparatively lower but the ETR structure remains quite compressed and flat.

Figure 3.9. Effective tax rates are not very progressive at the top

Effective tax rates, single individual with no children, gross income as % of AW, 2021

Note: The effective tax rate is the share of gross income that is due to the government as income tax and employee social-security contributions, minus social benefits received. The effective tax rate including employer SSCs is calculated by adding employer SSCs as a share of gross wage earnings to the effective tax rate.

Source: Taxing Wages 2022 tax decomposition data. OECD tax benefit model 2021.

Rapidly rising wages may induce bracket creep. Rapidly rising inflation and nominal wage growth in Lithuania (Figure 2.7) means that taxpayers will reach the higher marginal tax rate more quickly than previously (i.e. bracket creep). Consequently, the non-indexation of PIT brackets (i.e. PIT brackets are not systemically increased to account for wage growth or inflation) effectively increases the tax burden.

The introduction of a middle PIT rate bracket could be considered

Few employees face the top PIT rate due to the high top PIT rate threshold. Despite the top PIT rate threshold being cut from 10 to 5 annual AW between 2019 and 2021 (i.e. to EUR 81 162),4 it remains high in the context of the employment income distribution. To be liable for the top PIT rate, employees would need to earn in the top 1% of employment income as measured by employment income percentiles (i.e. the average employment income in the top 1% is EUR 7 542 per month or EUR 90 501 per year) (Figure 2.7, Panel C). The top PIT rate threshold is also high in a total income distribution context as it is similar to the mean total income of the top 2% of employees as measured by total income percentiles (i.e. EUR 83 122, see (Figure 2.8, Panel B).

A new middle PIT rate bracket could be considered. The introduction of a third middle PIT bracket could be considered which would effectively act as a de facto top PIT bracket if the current top PIT rate bracket were retained (given that so few employees face the current top PIT rate). Some combination of a reduced top PIT rate threshold and the introduction of a third middle PIT bracket could also be envisaged. A PIT rate threshold targeted at the top 10% and 5% of employees (rather than the current top PIT rate which targets only the top 1%) would correspond to a top PIT rate threshold of about 1.5 and 2.0 times the annual AW (instead of the current 5 times the AW) (Figure 2.8, Panel C).

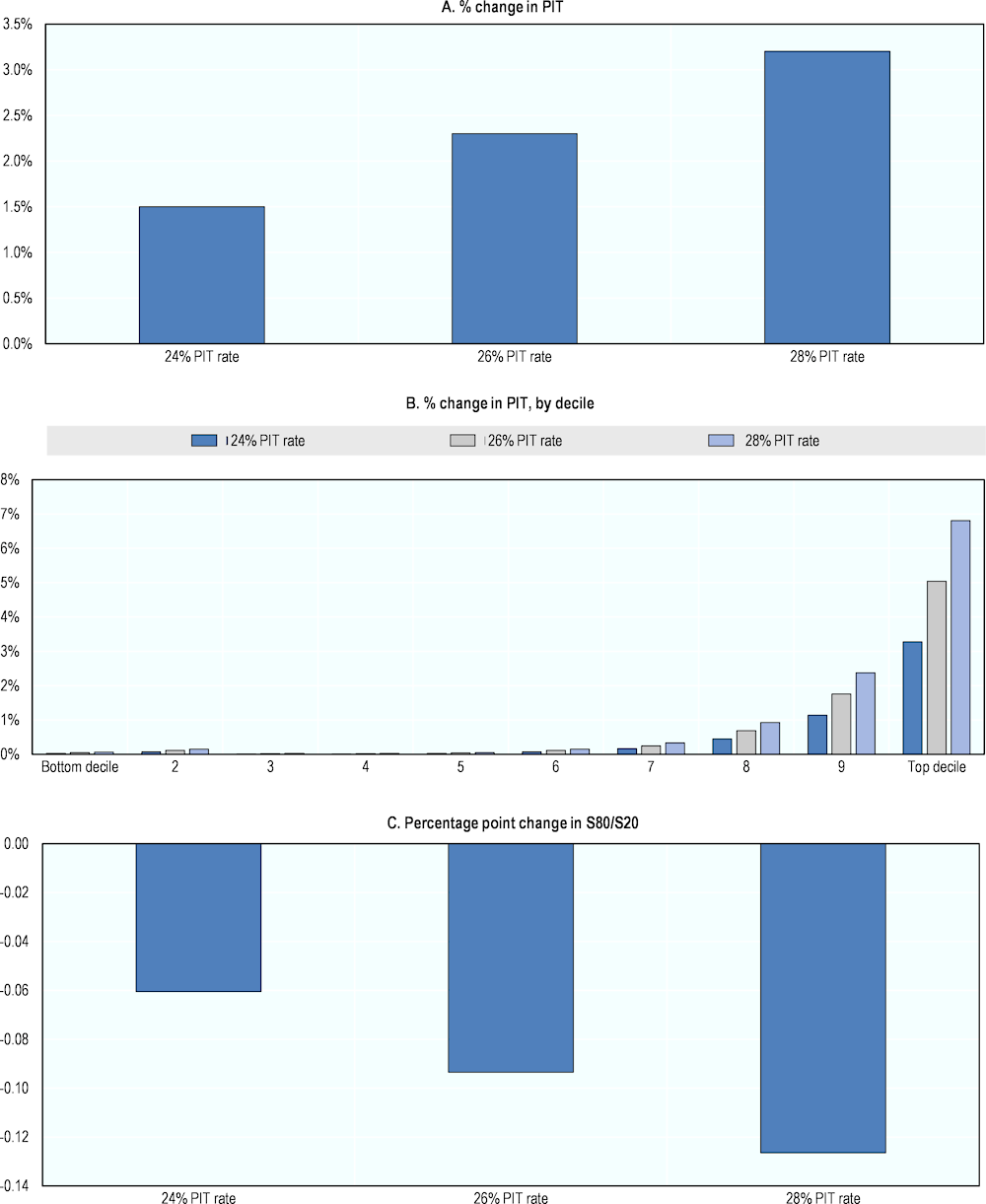

Introducing a middle PIT rate bracket would raise PIT revenues. The introduction of a middle PIT bracket at 2 annual AW at PIT rates of 24%, 26% and 28% would raise PIT revenues by 1.5%, 2.3% and 3.2% respectively (Figure 3.10, Panel A). Almost all of the additional PIT would be raised from employees in the top income quintile and particularly in the top decile (Figure 2.8, Panel B). The introduction of a middle PIT bracket would lead to a modest reduction in income inequality as measured by the S80/S20 ratio (Figure 3.10, Panel C). Setting the middle PIT rate threshold at 1.5 annual AW could also be considered. The simulations in Figure 3.10 are based on EUROMOD, which is a tax-benefit microsimulation model for the European Union that is maintained, developed and managed by the Joint Research Centre (JRC) of the European Commission (see the note in Figure 3.10 for details).

Cutting the top PIT rate and simultaneously aligning the SSC ceiling with the top PIT rate threshold would reduce overall PIT and SSC revenues. Cutting the top PIT rate threshold from 5 to 4 annual AW and simultaneously aligning the SSC ceiling with the PIT rate threshold would raise PIT revenues but reduce SSC revenues. Overall PIT and SSC revenues would decrease modestly and income inequality would increase modestly (the S80/S20 ratio would increase by 0.0023 percentage points from 10.7604 to 10.7627).

Figure 3.10. The introduction of a new middle PIT rate bracket would raise PIT revenues and reduce inequality

Simulating the introduction of a middle PIT bracket, 2 annual average wages

Note: EUROMOD is a tax-benefit microsimulation model for the European Union that is maintained, developed and managed by the Joint Research Centre (JRC) of the European Commission, in collaboration with Eurostat and national teams from the EU countries. This report makes use the beta-version of the model for Lithuania, based on version I3.0+, adapted to run on the input data derived from national administrative registers. This version is not available to the public. The tax-benefit system simulated in the baseline scenario refers to the one in force in 2022. The underline input data come from national administrative registers for year 2019. Uprating factors are used to bring the income values from the income reference period to the policy year, in this case from 2019 to 2022. Simulations provide static results, as no labour supply or general equilibrium effects are estimated in EUROMOD.

Source: Simulations performed by the EUROMOD team of the European Commission’s Joint Research Centre (JRC).

Box 3.2. Employer and employee SSC incidence

The theoretical literature argues that formal tax incidence (who legally is obliged to pay tax) is irrelevant for effective tax incidence (who eventually bears the burden of the tax), at least in the long run. This line of argument suggests that the same given increase in employee SSCs or employee SSCs is immaterial of who the tax burden falls on. The effective tax incidence (i.e. who eventually pays the tax or is ‘out-of-pocket’, irrespective of who has paid the cash) of an SSC increase is ultimately borne by the employee, typically through the mechanism of reduced wages, and this occurs regardless of whether the tax is paid by employers (through an employer SSC increase) or employees (through an employee SSC increase). In standard economic theory, this occurs because employees are more inelastic than employers to SSC changes. In this context, inelasticity means that workers have few good alternatives to work because they have to ‘pay the bills’ somehow and are unlikely to have sufficient capital to live off that exclusively. By contrast, employers have more good substitutes – they can swap labour for capital or relocate to where labour is cheaper. For example, in a meta-analysis, Melguizo and Gonzalez-Paramo (2013) find that two-thirds of the incidence of labor taxes generally fall on employees, albeit there is a very wide range of estimates.

The empirical literature finds that, in general, SSC cuts lead to higher employee wages but also that the tax incidence may vary across different settings (e.g. short run versus longer run, SSC rate increases versus decreases, changes in employee versus employer SSCs, etc.). While relatively few studies directly examine the incidence of employer and employee SSCs, some of the more recent and empirically rigorous studies indicate that there is relatively limited shifting of SSCs to employees in the form of changed wages. A number of studies use macroeconomic evidence based on cross-country regressions (such as (Arpaia and Carone, 2004[5]) find evidence that the incidence differs in the short-term (perhaps reflecting short-term stickiness of nominal wages). There are also a number of quasi-experimental studies. (Gruber, 1995[6]) finds evidence that a decrease in pension SSCs in Chile led to an equivalent increase in wages that is consistent with the full incidence of SSCs on employees. (Anderson and Meyer, 1997[7])find that companies with larger employer SSC reductions increase employee earnings roughly one-for-one (and employment is unaffected). They interpret this as evidence that the incidence of employer SSC is largely or fully on workers. There finding may also, at least in part, be explained by behaviour shifts (i.e. employees working harder due to a SSC cut, which induces employers to increase salaries). For example, using three large increases in SSCs in France between 1976 and 2010, (Bozio, Breda and Grenet, 2017[8])find very limited shifting of SSCs to employees in the form of lower wages. They interpret this as wage stickiness prevents employer SSCs from being shifted to employees in the short-term. (Adam, Phillips and Roantree, 2019[9])find that statutory incidence matters for the short-term economic effects of SSCs in the UK. They interpret their findings as evidence that employees change their hours in response to SSCs, but that in the short to medium term at least, the formal incidence of SSCs can matter for their behavioural impacts and economic incidence. (Bozio, Breda and Grenet, 2019[10])find that the tax incidence falls on employers for reforms that have no tax-benefit linkage whereas the incidence of SSCs falls on employees in reforms with strong tax-benefit linkages. A tax-benefit linkage distinguishes SSCs from other labour income tax. If workers incorporate in their labour supply decisions not only net wages but also expected benefits, behavioural responses may be reduced (because workers have even less incentive to shift to alternatives). In that case, SSCs with strong tax-benefit linkages are expected to be fully shifted to workers.

The design of the basic allowance

Lithuania increased the basic allowance in recent years. A personal basic allowance (BA) (i.e. a tax-exempt amount) is applied to employment income in Lithuania to calculate taxable income. The BA was EUR 350 per month in January 2020, the max BA was available up to EUR 607 per month and a tapering equation was applied thereafter (Table 3.3). In response to the COVID-19 pandemic, the BA was increased to EUR 400 in July 2020 and the withdrawal rate was modestly increased. This change was applicable for the whole of 2020. In 2021, the BA threshold was increased to EUR 642 and the withdrawal rate was modestly decreased. In 2022, the BA was increased to EUR 460 and the number of ‘break points’ was increased from one to two. Between 2019 and 2020, the rate of increase in the BA in Lithuania of 13% was higher than the rate of increase in some other OECD countries (including Canada +5.0%, Germany +3.6% and United Kingdom +0.6%).

The basic allowance as a share of the average wage is not dissimilar to that found in some other OECD countries. The maximum BA increased in Lithuania represented 27% of the AW in 2022. In Slovenia, Latvia, the Slovak Republic and Estonia, the BA represented 17%, 28%, 33% and 36% of the AW respectively in 2020.

Table 3.3. Lithuania has increased the basic allowance in recent years

|

2020 |

2021 |

2022 |

|

|---|---|---|---|

|

Max BA (per year / per month) |

400 |

400 |

460 |

|

Max BA income threshold(s) (EUR): |

607 |

642 |

730 & 1 678 |

|

BA formula(s) above threshold: |

400 – 0.19*(inc – 607) |

400 – 0.18*(inc – 642) |

Between MMW – 1 678: 460 – 0.26*(inc – 730) Above 1 678: 400 - 0.18*(inc – 642) |

|

Max BA as a % of AW |

29% |

26% |

27% |

Notes: 2020 refers to the basic allowance introduced in July 2002. ‘inc’ refers to individual gross income. If the BA as calculated by the formula is negative, it is assumed equal to zero. In 2022, there are two thresholds with two different associated BA formulas. AW for 2020 Jan, 2020 July, 2021 and 2022 are based Statistics Lithuania average gross monthly earnings for 2020Q1, 2020Q2, 2021Q1 and 2021Q4 2021KQ (latest available data), which are EUR 1 381, EUR 1 398.5, EUR 1 517.4 and EUR 1 679.3 respectively. MMW refers to minimum monthly wage.

Source: OECD analysis.

Lithuania operates a basic tax allowance withdrawal system, which is common in OECD countries. The withdrawal rate determines both the rate at which the BA is decreased for higher incomes above the maximum BA threshold and the income level at which the BA is no longer received at all. As incomes start to increase above the BA threshold, the amount withdrawn increases. Withdrawal-type systems are operated in different forms in several OECD countries including Slovenia, the Slovak Republic and Latvia.

The BA withdrawal rate can be used to increase the progressivity in the middle part of the income distribution. Since the withdrawal rate starts at the max BA threshold and ends when the BA is fully withdrawn, the withdrawal rate targets tax burden adjustments in the low to middle part of the income distribution. A withdrawal rate of zero implies no withdrawal and the BA becomes a flat amount that all taxpayers benefit from irrespective of their income. A withdrawal rate close to one implies a rapid rate of BA reduction so that effectively only low incomes can benefit from it. The increase in the withdrawal rate from 17% in 2020 to 26% in 2022 contributed to increased PIT progressivity.

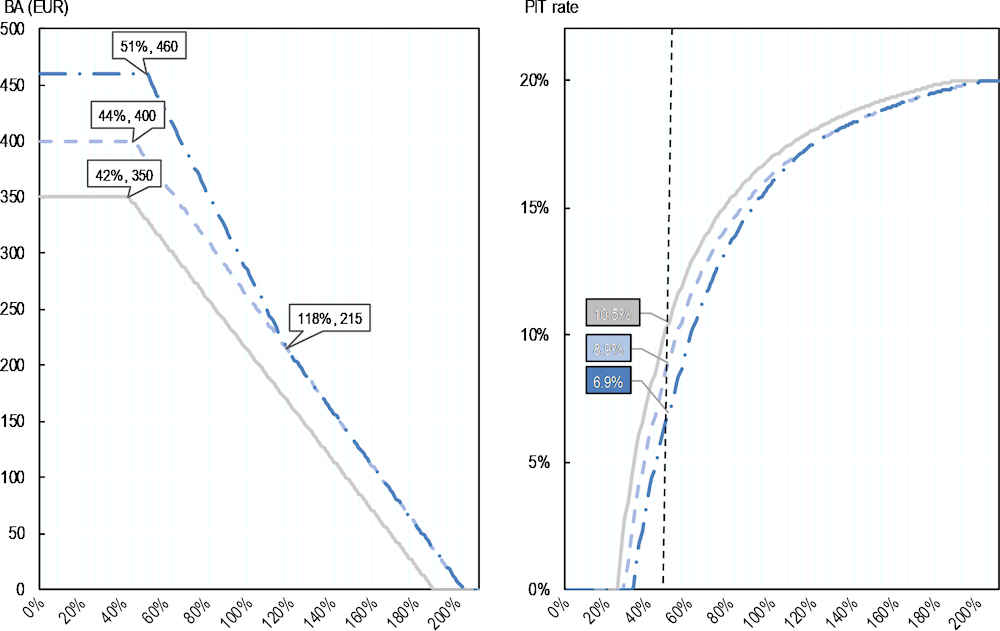

The 2022 basic allowance redesign introduces more progressivity in to the tax system through both a higher basic allowance and a faster tapering rate as incomes rise. The BA 2022 reduces the PIT burden at low incomes and supports progressivity, reflected in the downward shifted PIT curve (Figure 3.11). An employee at 50% of the AW has seen their PIT fall from 11% to 9% to 7% in 2020, 2021 and 2022 respectively (Figure 3.11). Compared to the 2021 BA design, the 2022 BA design has a first ‘break point’ with a steeper slope and a second ‘break point’ that matches the 2021 BA design at higher incomes. The first ‘break point’ tapers more quickly than the 2021 taper rate as incomes are increased beyond the BA max threshold. The second ‘break point’ occurs at 118% of the AW and slows the rate of the BA taper to match that of the 2021 design.

Limitations of the basic allowance

The basic allowance is somewhat untargeted. While the BA is and has been an overall effective way to produce PIT progressivity in Lithuania, it is somewhat untargeted. Compared to the 2020 BA, the 2022 BA is withdrawn at a higher income, which may benefit some higher earners. As a result of the BA increase between 2020 and 2022, a high earner (150% of the AW) saw a modest average PIT rate cut from 19.1% to 18.7%. The BA is fully withdrawn at 189% of the AW in 2020 and at 203% of the AW in 2021 and 2022, after which point the average PIT rate converges to the 20% marginal PIT rate (and at higher incomes to the 32% PIT rate).

Most of the basic allowance benefit went to workers earning between the minimum and average wage. The large share of Lithuanian workers with wages between the MMW and the AW (Figure 2.9) led to this cohort receiving the largest share of the BA benefit. 57% of the BA in 2020 went to individuals earning between the MMW and the AW despite that the cohort represented only 44% of individuals. 29% went to those below the MMW (Figure 2.9). Therefore, the structure of the wage distribution contributed to most of the BA benefit going to middle rather than lower wage earners.

Figure 3.11. The 2022 basic allowance has a higher amount and a faster tapering rate

The amount of the basic allowance (EUR) and the percentage PIT rate in Lithuania, 2020 – 2022

Note: A caveat to the analysis show is that the BA is examined in each year in nominal terms using the average wage in 2020 (on the x-axis) but the real BA value is declining given inflation and rising wages in Lithuania

Source: OECD analysis.

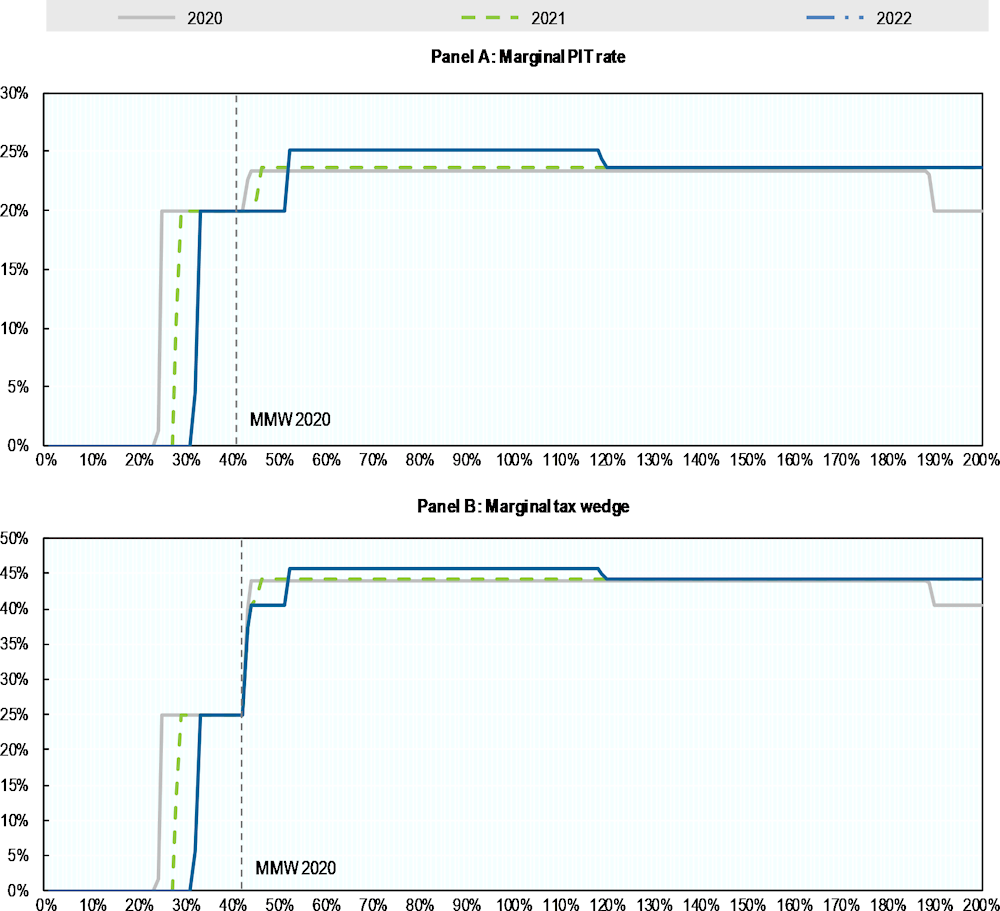

The basic allowance design in 2020 and 2021 produce some marginal PIT rate spikes at low incomes close to the minimum monthly wage. The marginal PIT rate patterns in 2020 and 2021 are broadly similar (Figure 3.12, Panel A). The first spike in the marginal PIT rate occurs as employees first start to pay PIT (at 31% of the AW in 2021, slightly above the level of 2020 due the greater BA). The second spike occurs as the max BA starts to be tapered out (at about the MMW in 2020). The marginal tax wedge is higher than the marginal PIT rate but follows a similar pattern (Figure 3.12, Panel B).

The 2022 basic allowance design produces even higher marginal PIT rates spikes than in previous years. For the 2022 BA design, the first spike in the marginal PIT rate is the same magnitude as in 2020 and 2021 but it occurs at a higher income due to the higher BA amount. The second spike occurs after the max BA threshold and is larger in magnitude than in previous years due to the more rapid BA tapering.

The basic allowance design may produce modest poverty traps but for many workers. For both the marginal PIT rate and the marginal tax wedge between 2020 and 2022, spikes in the marginal tax rates occur at about 1/3 and 1/2 of the AW. A large share of Lithuanian employees earn wages at these incomes. These spikes could reduce the incentives for low-income employees to earn more income, to work more hours or to work harder beyond these thresholds (to avoid additional tax burdens). Modestly high marginal tax rates could also make working extra hours in the informal economy more attractive, which is not low or decreasing in Lithuania (Figure 2.4). The extent to which employees ‘bunch’ below these marginal tax rates should be examined further in the tax record data.

Figure 3.12. The basic allowance produces marginal tax rate spikes at low income levels

Marginal PIT rate and marginal tax wedge, based on basic allowance in 2020, 2021 and 2022

Note: The basic allowance amounts in EUR are set at 350, 400 and 460. The basic allowance thresholds in EUR are set at 607, 642 and 730 (and 1,678). The AW is set at the 2020 level of EUR 16,844 as calculated by the OECD secretariat and the MMW in 2020 is 607.

Source: OECD modelling.

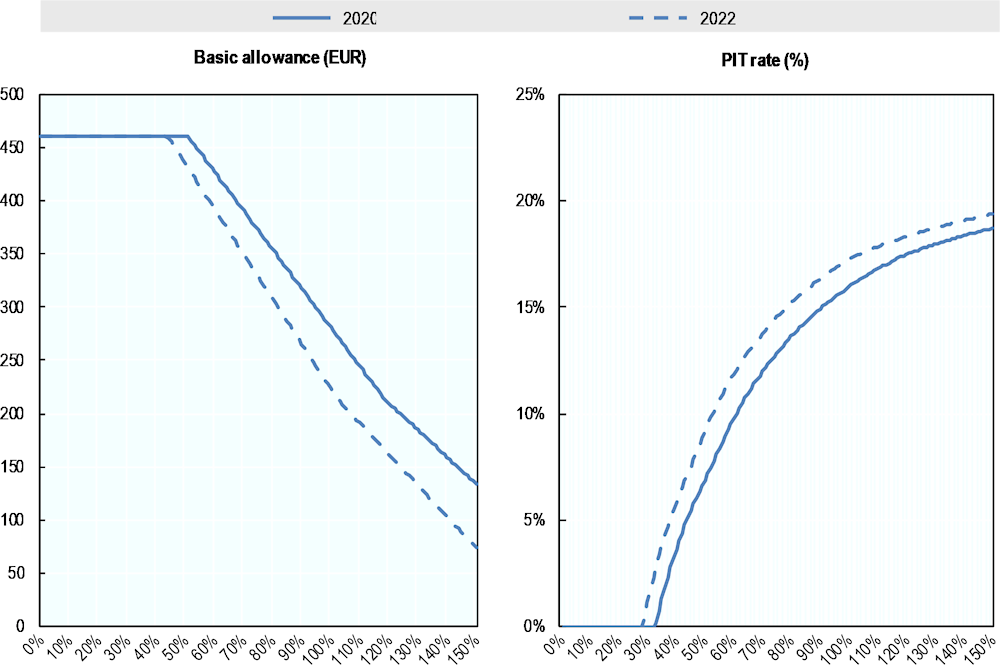

Rising wages reduce the value of the basic allowance. Rising wages driven by inflation undermine the value of the BA. As wages rise, the max BA threshold is reached at a lower income of 44% of AW instead of 51%, implying higher effective PIT burdens on employees (Figure 3.13). Similarly at 50% and 100% of the AW, higher wages imply higher PIT rates of 9% vs 7% and 17% vs 16% respectively.

The basic allowance should be inflation-linked. The BA is not formally indexed to inflation. It is however set annually by the government informed by the increase in the MMW (the MMW is in turn set by the government, unions and employers indexed based on the MMW as a share of the forecast AW). Indexing the BA to inflation is relatively common internationally. A rationale for a BA generally is to help cover job-related expenses. Since job-related expenses rise with inflation, it follows that the BA should also be inflation-linked. Inflation in Lithuania was reported as among the highest in the OECD. The CPI reached 19% in May 2022. Linking the BA to inflation in Lithuania would maintain its value in real terms including for low-income workers.

Whether the basic allowance should be linked to wage growth is a policy choice, but it could come with PIT revenue risks. Linking the BA to a measure that might outgrow inflation, such as the MMW or the AW, is a policy choice. The purpose of a BA and a progressive PIT system is partly that a growing economy with rising wages will translate to higher PIT revenues. However, by linking the BA to increases in wages instead of inflation, a relatively larger share of workers could be exempt from paying any PIT when wages outpace inflation. It may be preferable from both a compliance and PIT revenue perspective that low-income workers pay a small PIT amount rather than none at all.

Figure 3.13. Rising wages reduce the relative value of the basic allowance and increases average effective PIT rates

The basic allowance and the average PIT rate, based on a simulated AW in 2020 and 2022

Note: 2020 average wage is based on the OECD secretariat calculations. This is increased by 9.9% in 2021 and a further 5.3% in 2022 based on Statistics Lithuania average wage increases in 2021. Note that in 2022 wages increased even more quickly.

Source: OECD analysis.

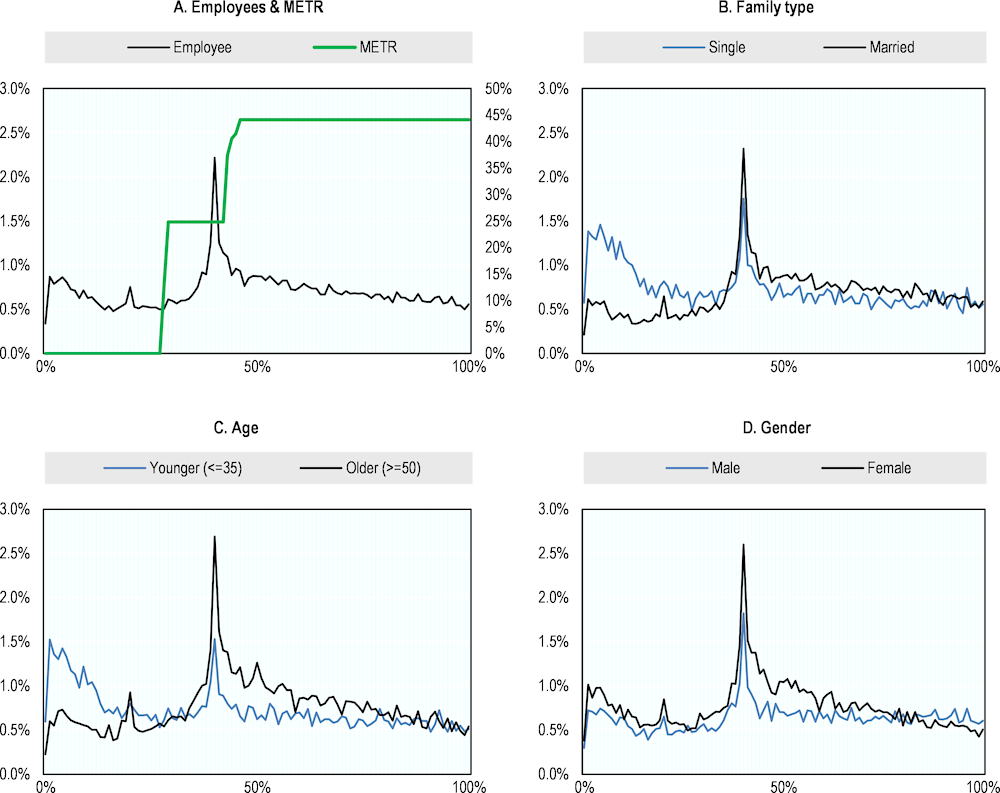

The design of the basic allowance may be contributing to income bunching

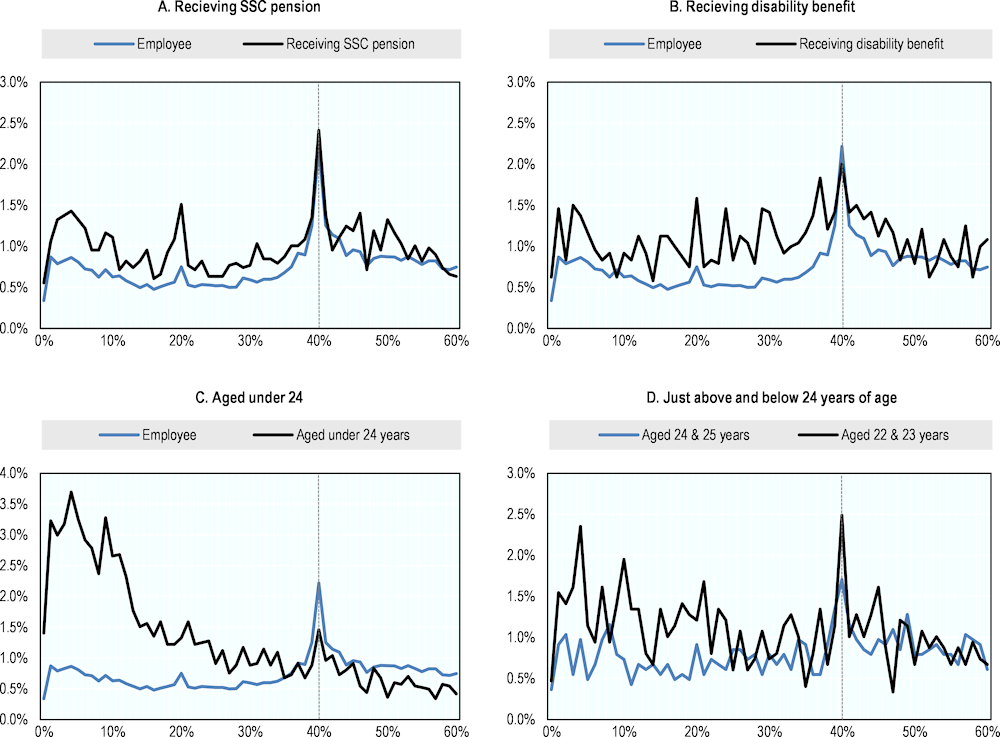

There is evidence of employee income bunching at the minimum monthly wage, particularly among older, married and female employees. The MMW is the most commonly reported employment wage income among employees (i.e. EUR 555 in 2019). 4.7% of employees report an income between 39% and 41% of AW (Figure 3.14, Panel A). Income bunching is higher for different employee types. In the aforementioned 39% to 41% of AW income range, income bunching is higher for married couples vs single individuals (5.0% vs 3.8%), for older employees aged over 50 vs employees aged under 35 (5.7% vs 3.5%) and for female vs male employees (5.6% vs 3.8%) (Figure 3.14, Panels B, C and D). Income bunching is particularly high for employees that are aged above 50, married and full-time employees (6.4%). Single and younger workers under the age of 35 are more likely to report income at very lower incomes between 0 – 5 of the AW ((Figure 3.14, Panels B and C).

Income bunching at the minimum wage coincides with a jump in the METR due to the loss of the maximum basic allowance as incomes rise. While much of the income bunching is likely due to the MMW itself, the sharp distributional spike in the share of employees reporting an income at the MMW occurs just before a spike in the METR, which is partly driven by the tapering of the max BA.5 Therefore, employees may be responding to this jump in the METR by reporting incomes below it at the MMW (i.e. ‘income bunching’) partly to benefit from the max BA and so as not to lose the BA at higher incomes. If this were the case, the greater degree of income bunching among older employees, married couples and women could suggest that these groups are particularly responsive to increased METRs.

Figure 3.14. There is evidence of employee income bunching at the minimum monthly wage

Bunching of employees at the MMW, % of employees, by employment income as % of AW

Note: Analysis based on 43,389 individual taxpayers with positive employment income. Of these, 55% are married and 29% are single. 33% are younger (i.e. 35 years of age or younger) and 34% are older (i.e. 50 years or older). 50% are female and 50% are male.

Source: OECD analysis of microdata 2019.

Medium-term PIT reform options

The introduction of an in-work benefit could be investigated further as part of future work

An in-work benefit could be envisaged. In-work benefits are welfare schemes designed to provide income supplement to needy families or individuals on the condition that they work (OECD, 2005[11]). In-work benefits (IWB) typically involve tax reductions or cash transfers that are conditional on labour market participation. The value IWBs, such as an earned income tax credit (EITC), commonly depend on the recipient’s earned income. The value of the credit increases gradually with income (phase-in) until it reaches a maximum credit amount (plateau). Beyond a certain earned income threshold (the phase-out threshold), the value of the credit is gradually reduced to zero. IWBs are typically means-tested and may be targeted at specific groups. When designed correctly, the IWBs have the potential to alleviate in-work poverty and increase work incentives and labour market participation for lower income workers (OECD, 2011[12]). Table 3.4 outlines selected advantages and limitations of introducing an IWB in Lithuania.

In-work benefits tend to help the unemployed find jobs and the unemployed face high poverty rates. High and rising poverty rates among the unemployed (Figure 2.11) suggest that disincentives to enter work or inability to work may be a more pressing policy concern for Lithuania than disincentives to progress in work. Most evidence suggests that IWB have positive employment effects when moving from unemployment to work (Chetty, Friedman and Saez, 2013[13]) (Blundell and Shephard, 2012[14]). This occurs because the substitution effect (workers can gain more per hour worked with an IWB) tends to outweigh the income effect (workers reduce hours as IWB raise disposable income). With regard to progressing in work, the evidence is more mixed and the effects tend to be smaller (OECD, 2011[12]). However, this may be less of a concern in Lithuania given high employment and participation rates and relatively lower poverty among the employed (Figure 2.3).

An in-work benefit could compensate for relatively high PIT and SSCs faced by low income workers. A refundable in-work benefit that reduces with income could support formal work incentives among low-income workers by compensating for modestly high average effective PIT rates and high and less progressive employee SSCs. The phase-in region of an EITC in-work benefit typically incentivises labor supply increases at the intensive margin (i.e. longer hours) as the tax credit amount increases with gross earnings.

The merits of an in-work benefit programme are stronger in individual-based tax systems such as in Lithuania. In an individual-based tax system such as in Lithuania, IWB work incentives are stronger relative to IWB in a household-based tax system (which depends on household size and is mean-tested) as it may reduce incentives for the second earner to enter work (Bargain and Orsini, 2004[15]).

In-work benefits are typically costly. Spending on the EITC programmes in the United States and the United Kingdom ranges from 0.4 to 0.5% of GDP (OECD, 2020[16]). However, these costs are at least partly outweighed by lower welfare payments since some jobseekers find a job as a result of the IWB. This in turn helps to broaden in the tax base. EITCs can be financed with PIT revenues rather than SSC revenues so that there is no loss to SSC funds.

A challenge for designing an EITC in Lithuania is that it could add to an already complex tax and benefit system. The complex structure of the EITC and its interaction with the rest of the tax and benefit system make its impact on labour supply dependent on its design and on household characteristics, such as marital status and number of children (Liebman, 1998[17]); (Eissa and Williamson Hoynes, 2004[18]). Estonia introduced a non-payable tax credit for low-income earners in 2016 and abolished it a year later in 2017, reflecting the challenges of adding additional complexity to the tax system. An EITC would increase marginal tax rates, which are already high for low income workers over the income range where the BA is tapered out.

Table 3.4. Selected advantages and limitations of in-work benefits

|

Advantages |

Limitations |

|---|---|

|

- IWBs have positive employment effects at the extensive margin and the unemployed in Lithuania face high poverty rates. - IWBs could help to compensate for relatively high PIT and SSCs faced by low income workers. - Work incentives are stronger in an individual-based tax system such as in Lithuania. - Supports redistributes to lower-income households and reduces poverty if labour supply is increased and workers are sufficiently responsive at the extensive margin. - May support women through its interaction with the gender income gap and due to a high share of single women households facing poverty at low incomes. - Encourages second earners to enter work that have low work incentives in Lithuania at short unemployment durations. - Encourages single parents to enter work, especially when economy is strong, as is currently the case in Lithuania. - Complementary to Lithuania’s active labour market programmes that promotes jobs and enhances skills. |

- IWBs are relatively costly. - Adds to Lithuania’s already complex tax and benefit system. - May interact with other out-of-work benefits such as social assistance and unemployment benefits. - Mixed evidence of positive labour market effects at the intensive margin (i.e. number of hours worked). - Mixed evidence of poverty reduction, which depends on the IWB design. - May reduce work incentives to work longer hours or work more for those already in work. - Employers may cut wages in response to the IWB. - Are relatively ineffective in weak labour markets. |

Source: OECD analysis. (Saez, 2002[19]) (OECD, 2005[11]) (Vandelannoote and Verbist, 2020[20]).

The in-work social assistance could be eased and the duration of assistance could be extended to improve work incentives

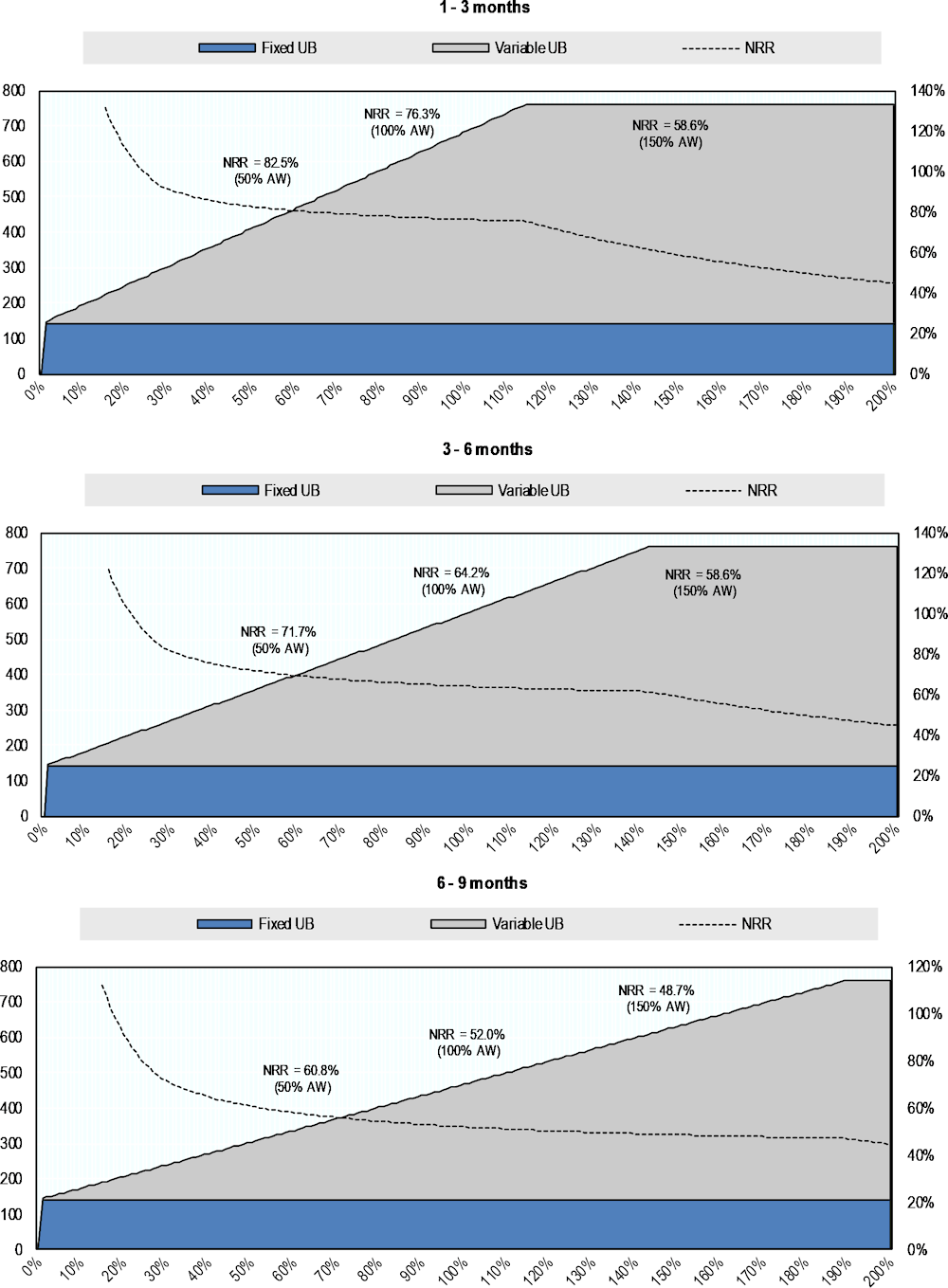

Lithuania operates in-work social assistance for individuals starting new jobs, but its current scope is limited. In-work social assistance (IWSA) is provided to out-of-work individuals that move into employment. The scope of IWSA is by definition narrower than in-work benefit, which is usually available to a broader group of low-income workers (only about 2 000 individuals currently receive IWSA). To be eligible for IWSA, taxpayers must meet several eligibility criteria including the following. First, recipients must be receiving SA benefits (i.e. qualify for the income means-test and other SA eligibility conditions for at least one month). Second, once in work, recipients must earn income of at least the MMW or the minimum hourly pay (thus part-time workers are included provided they earn at least the minimum hourly pay). IWSA is based on a person’s income before they enter work. It is not means-tested against current income. Third, recipients must be registered with the employment service for at least 6 months. The former two criteria are likely to significantly limit eligibility while the latter registration with the employment service is unlikely to disqualify many taxpayers (since it is a standard mandatory requirement for receiving SA by working-age adults).

In-work social assistance was reformed in 2020. To encourage social benefit recipients to enter the labour market, eligibility for IWSA was simplified in June 2020 by removing the condition on the upper wage limit, which was of approximately the AW. The amount of IWSA was doubled and the amount was set to decline with duration. For 1 to 3 months, the amount of IWSA is set at 100% of previous SA (paid during the last 6 months prior to employment). For 4 to 6 months and 7 to 12 months, the IWSA falls to 80% and 50% of the previous SA respectively. After 12 months, IWSA is no longer available.

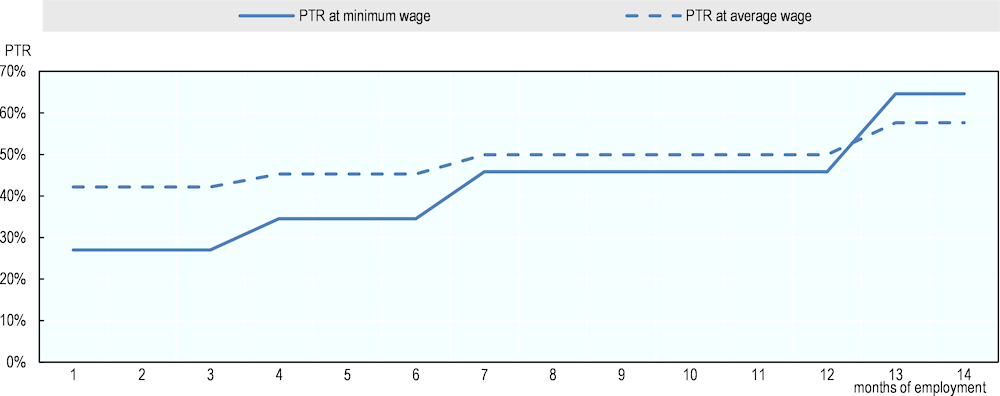

The amount of IWSA depends on employment duration but not on current income. The reform in 2020 implies that the effect of IWSA on work incentives is the strongest at the beginning of employment spell. The PTR of entering work at the minimum wage is 27% with full IWSA (i.e. at one month of employment) and increases to 65% after 12 months of employment when the IWSA expires (Figure 3.15). Similarly, the PTR of entering work at the AW is 42% with full IWSA and 58% after IWSA expires (Figure 3.15). Since the IWSA upon entering work equals the previous SA out-of-work, initial IWSA removes all disincentives to work associated with the loss of means-tested SA. Work disincentives in the first 3 months of employment are produced only by SSCs and PIT.

Figure 3.15. In-work social assistance falls with longer employment duration

PTR for a single parent with two children starting work at the minimum and average wage, 2021

Source: OECD Tax and Benefit model TaxBen (version 2.4.1).

Redesigning the in-work social assistance with in-work benefit characteristics could improve work incentives but it would not be without challenges. Unlike an in-work benefit (IWB), the IWSA reduces with duration rather than with income (i.e. it is not means-tested with income), it has strict eligibility criteria and it is time-limited (Table 3.5). Some of the IWSA criteria could be redesigned to be more similar to an IWB to increase the incentives to work while also retaining its current SA function. However, such a redesign would not be without challenges. Setting the amount and taper rate of an IWB is perhaps the most challenging but important aspect of its design. Setting the amount depends on several factors including the difference between out-of-work income and in-work work income, the level of income support relative to the MMW, the cost of the programme (and how it could be funded) and the numbers of workers earning income at the income levels where the benefit is tapered. Additionally, sufficient time would need to be provided to induce wage progression given that most studies show wage progression at 3–4% per year (OECD, 2005[11]).

In-work social assistance could be increased beyond the level of social assistance similar to Slovenia to increase work incentives but this would come with several drawbacks. Several OECD countries have adopted social assistance-related measures that support incentives to enter work (Table 3.6). Slovenia’s Financial Social Assistance implies that those who work more hours have higher SA relative to those who work fewer hours (Table 3.6). This means a person entering work becomes eligible for higher SA, which is then tested against their current income. However, such a design has drawbacks as, apart from being relatively costly, it increases income at particular hour thresholds and may prevent work progression beyond these thresholds. A wider set of policies that increase work incentives for new employees in selected OECD countries is shown in Table 3.6.

In-work social assistance eligibility criteria could be eased and the duration of assistance could be extended to improve work incentives. Given the challenges of redesigning the IWSA so that it tapers with income like an IWB, a relatively more straightforward redesign option that has the potential to improve incentives to work include adjusting the eligibility criteria and time duration. IWSA could be broadened by reducing the requirement time to register with the employment services from 6 months to e.g. 3 months. The IWSA could be extended by increasing the current retention of 100% of the IWSA for 3 months for a longer duration such as 6 months.

Table 3.5. Comparing Lithuania’s in-work social assistance with an in-work benefit

|

Policy |

Characteristics |

|---|---|

|

Lithuania’s in-work social assistance programme |

- Main purpose is social assistance / poverty alleviation and providing stronger work incentives for those on social assistance - Conditional on labour market participation (i.e. starting a new job) - Reduces with time but not dependent on current earnings - Strict eligibility criteria & limited reach - Conditional on already receiving social assistance - Time-limited (i.e. can only be received for 12 months) - Means-tested on income before moving into work - Somewhat limited targeting at specific groups (e.g. greater assistance for larger families) |

|

In-work benefit programmes |

- Dual purpose of labour market participation and in-work poverty alleviation - Conditional on labour market participation - Increases as incomes rise (phase-in) up to a maximum (plateau) before declining gradually to zero (phase-out) - Often widely available to low-income workers - Sometimes time-limited - Means-tested (depends on earned income) - Often targeted at specific groups (e.g. older workers with low skills, individuals with poor health and single mothers) |

Source: OECD analysis.

Table 3.6. Various policies that increase work incentive for new employees in selected OECD countries

|

Country |

Social assistance-related measures |

Tax design rules |

|---|---|---|

|

Slovenia |

Financial social assistance |

-The first adult or single person who is working between 60 and 128 hours per month receives 126% of the basic minimum income (BMI). -The first adult or single person who is working more than 128 hours per month receives 151% of the basic minimum income (BMI). |

|

Croatia |

SSCs |

- Employers do not have to pay health insurance contributions for a period of 5 years if taxpayers are younger than 30 years, if a job contract was closed for a continuous period and for the first time with that person. |

|

Poland |

PIT |

-The government introduced ‘PIT Zero’ for young adults under 26 years. It provides a full exemption of income tax for wages coming from either standard employment or non-standard employment, unless gross earnings exceeds a threshold. |

|

Poland |

Activation allowance |

-If an unemployed person finds a job before exhausting the unemployment benefit, the unemployed can receive an activation allowance. This is a standalone benefit, whose eligibility depends on previous entitlement to the unemployment benefit. -In 2022, Poland expanded PIT zero to a broader set of employees including Polish citizens returning from abroad to work in Poland, families with 4+ children and working seniors over the age of 60 (women) and men (65). |

|

Slovakia |

Activation allowance |

-Monthly allowance for household members that have earned income of at least the minimum monthly wage. |

|

Austria |

In-work benefit |

-The amount of the benefit is individually calculated by raising the unemployment benefit or unemployment assistance by 45%, 55% or 60% depending on the working hours. -The maximum duration of the benefit receipt is one year. |

Source: OECD TaxBen country reports available at http://oe.cd/TaxBEN.

The design of social security contributions

Most employer SSCs were shifted to the employee. With regard to SSC rates in 2019, employer SSC rates were cut (from 30.5% to 1.47%) and employee SSC rates were increased (from 9.0% to 19.5%) (Table 3.7). Consequently, total SSC rates (employer and employee) were cut by almost half in 2019. Between 2019 and 2021, SSC rates remain unchanged.

To compensate employees for higher employee SSCs, gross wages were adjusted upwards. The authorities increased gross wages mechanically by 28.9% in January 2019 in an attempt to keep the disposable incomes of employees unchanged. In 2018, the employer SSC rate was 30.5%, of which 28.9% was shifted to employees in 2019. The breakdown of the 28.9% included pension insurance of 22.3%, health insurance of 3%, and sickness insurance of 1.4% and maternity insurance of 2.2%.

Table 3.7. SSC rates in Lithuania, 2018 - 2021

|

2018 |

2019 |

2020 |

2021 |

|

|---|---|---|---|---|

|

Employee SSC rates |

9.0% |

19.5% |

19.5% |

19.5% |

|

Employer SSC rates |

30.5% |

1.47% |

1.47% |

1.47% |

|

Total SSC rates |

39.50% |

20.97% |

20.97% |

20.97% |

Note: Employer SSC rates are comprised of 1.31% unemployment social insurance and 0.16% accidents at work and occupational diseases social insurance. Note that this is a general rate - In practice four categories of rates of insurance contributions for accidents at work and occupational diseases are applied, depending on company’s risk profile. Note that employer SSC ceiling has been abolished in 2021.

Source: OECD analysis.

Employer SSCs in Lithuania are comprised of three components.

First, the employer SSC rate in Lithuania of 1.47% in 2020 is comprised of:

1.31% for unemployment insurance, and

0.16% for insurance from accidents and work and occupational diseases.

Second, the employer payroll SSC rate of 0.32% in Lithuania is comprised of:

0.16% of gross wage for the Guarantee fund, and

0.16% of the gross wage for the Long-term employment benefit fund (to pay severance pay for the damage caused by occupational accidents or diseases).

Finally, an employer floor or minimum amount was introduced in 2018.

Lithuania does not levy SSCs on pensions, similar to about half of all OECD countries. PIT and SSCs play an important role in old-age income support. 21 out of 38 OECD countries levy SSCs on pensions (OECD, 2021[21]). Among OECD countries that levy SSCs on retirees, the SSC rate is always lower for retirees than for workers. In most OECD countries, pensions are not typically subject to pension SSCs or unemployment SSCs but they are sometimes subject to health SSCs (OECD, 2021[21]), which older individuals disproportionately use and benefit from.

The cuts to employer SSC rate and total SSC rates may have induced employers to raise employee wages to offset the decline in disposable incomes. Following the shifting of SSCs from employers to employees, employees are prima facie worse-off and employers better-off. The incidence of the change in the SSC mix generally falls on the employee (for a discussion of SSC incidence see Box 3.2) because there are few good alternatives to work for most people. Given that the evidence in the research literature for differential labour supply effects in employee and employer SSCs is scarce and weak (Box 3.2), it may be reasonable to assume that the labour supply effect of increases in employee SSC and employer SSCs are similar. Under this assumption, the labour supply effects of employee and employer SSCs can be usefully considered together (i.e. total SSCs). In Lithuania, total SSCs as a share of gross income have declined in Lithuania in recent years (Figure 3.16). Economic theory predicts that in the long-term (when the effective tax incidence becomes predominant) the incidence will largely fall on the employee through higher wages than would be the case otherwise. This occurs partly because employers must increase wages to offset the decline in disposable incomes for employees. The studies of (Gruber, 1995[6]) and (Anderson and Meyer, 1997[7]) show that employer SSC rate cut can lead to one-for-one increases in employee wages, which suggests that employer SSC incidence falls fully or mostly on workers. Average gross monthly earnings increased by 30% in Lithuania in Q1 2019 compared to the previous quarter, indicating that companies compensated workers with even higher wages than the 28.9% required by the upward mechanical adjustment. A similar wage increase in Romania following its shifting of SSCs from the employer to the employee (see Box 3.1).

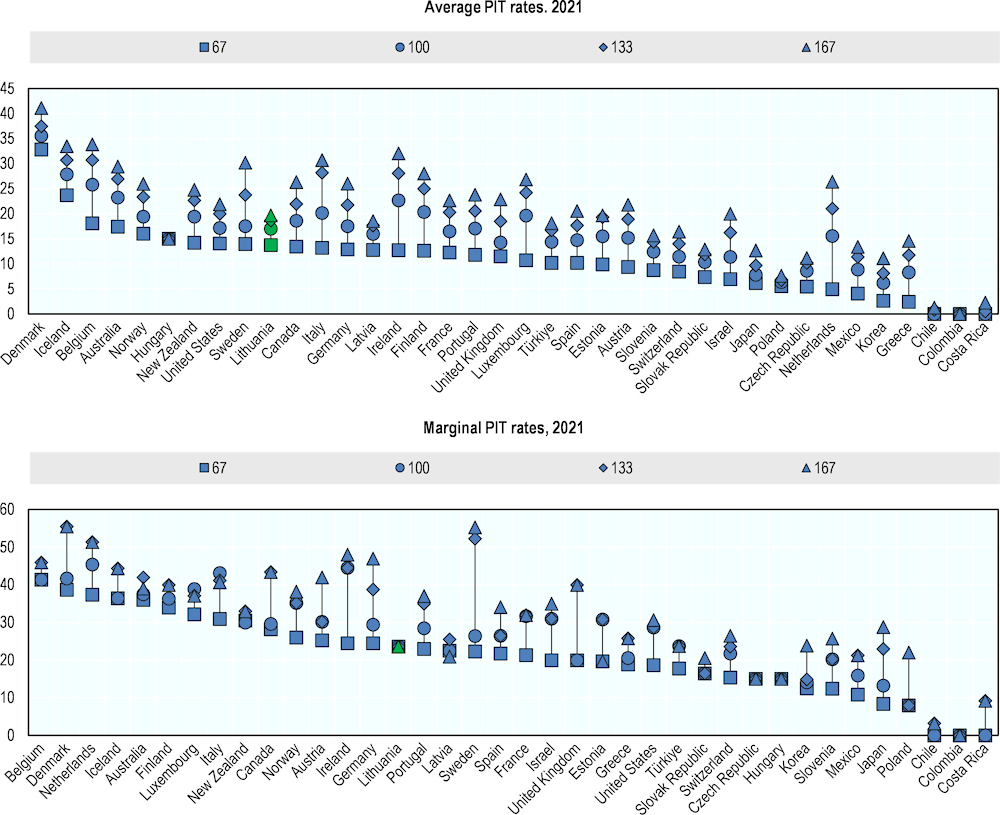

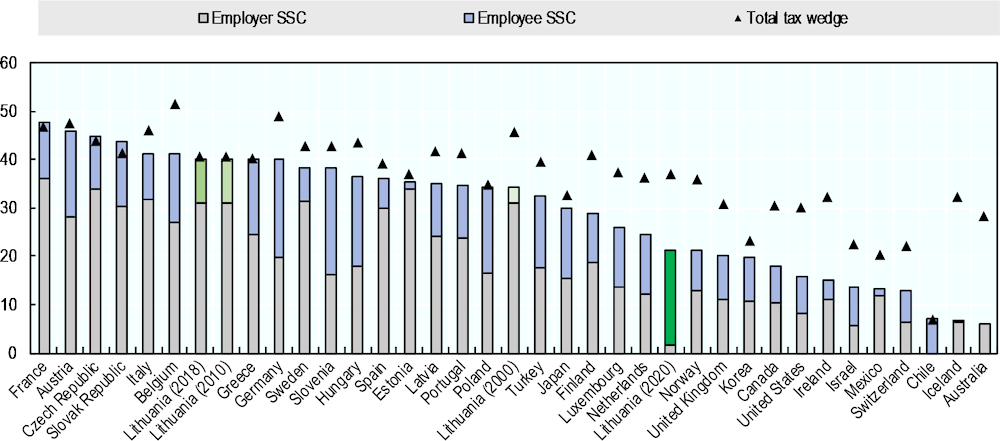

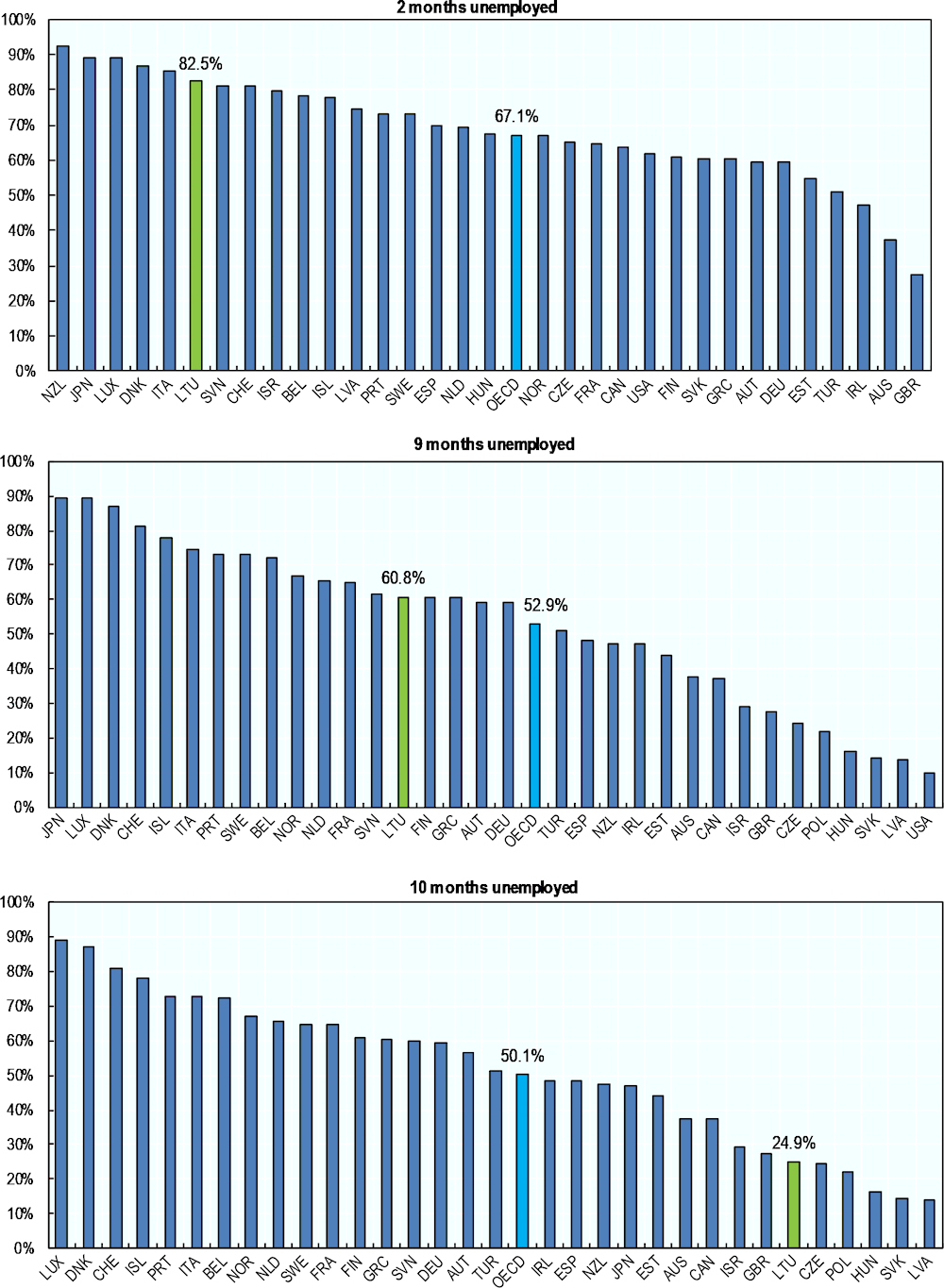

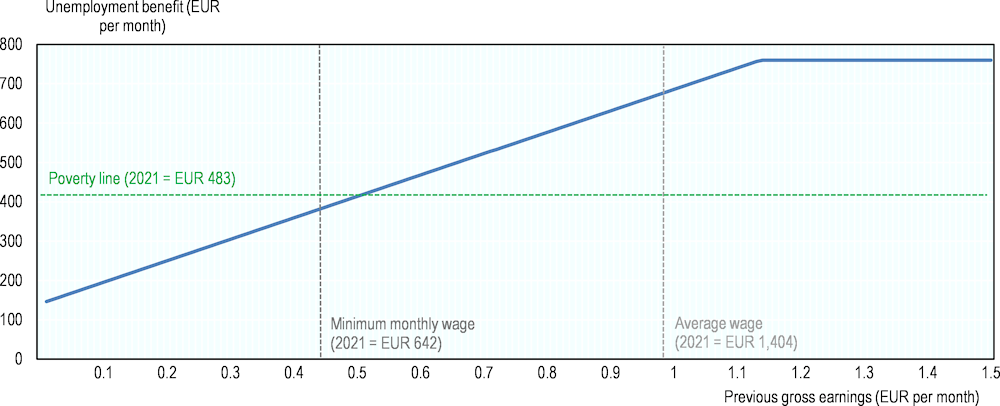

SSC rates and revenues

Total SSC rates are somewhat low in international comparison but employee SSCs are among the highest in the OECD. Lithuania’s employee SSC rate of 19.5% is the third highest in the OECD, behind only Slovenia and Germany. The ratio of employee-to-employer SSCs in Lithuania is by far the highest in the OECD (Figure 3.16). Total SSC rates in 2020 are historically low in Lithuania. They are lower in 2020 than in any year going back to 2000. In addition, total SSC rates are lower than in Latvia and Estonia, where the total SSC rate is about 35% in both countries in 2020.

The shifting of virtually all employer SSCs to the employee in 2019 represented a significant departure from the SSC rate mix over the past two decades (Figure 3.16). As discussed previously in the PIT section (Figure 3.7), this shift was reflected in reduced SSC revenues (i.e. employee SSCs increased but were outweighed by employer SSC declines) and broadly revenue-neutral labour taxes (due to a compensating increase in PIT revenues). In 2020 however, while PIT revenues remain stable, total SSC revenues increased sharply to 8.7% of GDP from 8.1% in 2019. This increase moved Lithuania’s total SSC revenues from being below the OECD average to above it (total SSCs as a share of GDP are 8.4% in the OECD in 2019).

Figure 3.16. Total SSC rates are somewhat low in international comparison

Total SSC rates and tax wedge as a share of the average wage in 2020

Note: Analysis is for an individual at 100% of the AW.

Source: OECD tax database.

SSC ceilings

Since their introduction in 2019, SSC ceilings have been steadily cut. SSC ceilings were simultaneously introduced for employees and employers (excluding health insurance contributions) for incomes above 10 annual AW in 2019. The rationale for the SSC ceilings was partly to compensate for the higher PIT burden associated with the introduction of the progressive PIT rate system (discussed previously, see Table 3.2). In 2020, the employee and employer SSC ceilings (excluding insurance contributions) were reduced to 7 annual AW. In 2021, the ceiling for employee SSCs was further reduced to 5 annual AW and the employer SSC was abolished. From 2021, the employee SSC ceiling only applies to employees overall employment income (combined from all employers, as opposed to each employer individually as was previously the case).

Table 3.8. SSC ceilings have been steadily cut

SSC ceilings and top-PIT rate threshold, in annual AW, 2019 - 2021

|

Employee SSC ceiling |

Employer SSC ceiling |

|

|---|---|---|

|

2019 |

10 |

10 |

|

2020 |

7 |

7 |

|

2021 |

5 |

Abolished |

Note: An SSC ceiling is the income level above which additional income is not subject to SSCs. Monthly AW are converted to annual AW by dividing by 12.

Source: OECD analysis.

SSC ceilings remain high in international comparison. The employee SSC ceiling of 5 times the annual AW in 2021 is high in international comparison. In OECD countries, the ceiling usually applies to wage levels higher than 1.67 of the AW (OECD, 2021[22]). Lithuania’s high employee SSC ceiling imply that high earners make a financial contribution to the funding of the social security system.

SSC ceiling cuts in recent years reduced the SSC burden on higher earners. The introduction of the SSC ceilings in 2019 reduced the SSC burden on high earners. Subsequent cuts to the SSC ceiling in 2020 and 2021 further reduced the SSC burden for higher earners. The abolition of the employer SSC ceiling in 2021 increased the SSC burden on higher income employers, albeit the increased SSC burden is small owing to the low employer SSC rate. The top-PIT rate threshold was also reduced jointly with the employee SSC ceiling between 2019 and 2021 (Table 3.8) and will have increased the PIT burden on middle and higher earners. The threshold values for both the PIT and SSCs is dependent on the size of the AW set by law each year which is in turn set based on actual wages in the economy.

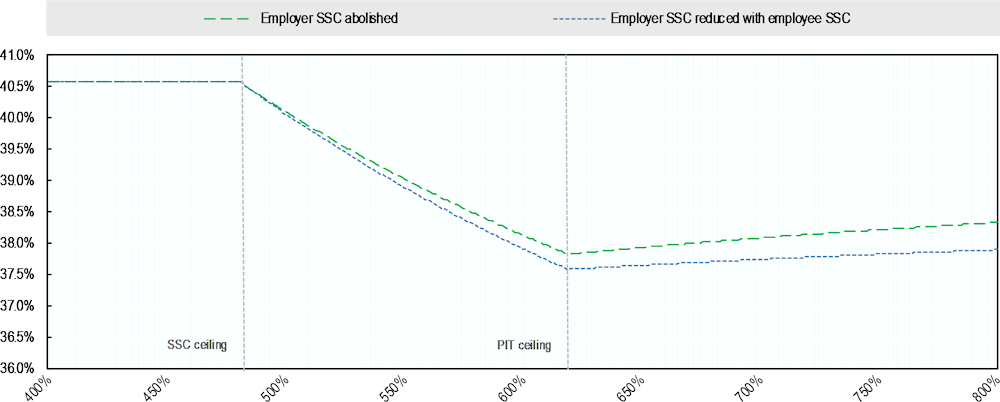

The abolition of the employer SSC ceiling in 2021 increased the tax wedge on higher earners, but only modestly. The tax burden on high earners has increased with the abolition of the employer SSC ceiling in 2021 compared to when the ceiling was in place. However, the impact of abolishing the employer SSC ceiling on the tax wedge is limited by the low employer SSC rate and it only starts to take effect at high income levels (Figure 3.17).

Figure 3.17. The abolition of the employer SSC ceiling will modestly raise taxes on high earners

Tax wedge in Lithuania with and without the employer SSC ceiling, 50% - 800% of AW

Note: Compares employer SSC ceiling reduction to the same level as that of the employee SSC ceiling in 2021 (i.e. EUR 6 674 or 60 AW) with the abolition of the employer SSC in 2021. Given that the ceiling is adjusted annually to take account of wage changes, gross wage labour income is estimated by the OECD secretariat of EUR 16 426 in 2020 is used in the analysis (Taxing Wages 2021). A 2021 gross wage labour income could be estimated by increasing the figure by 9.9% (based on Statistics Lithuania wage growth) but this has little impact on the results. Source: OECD analysis; Taxing Wages 2021; Statistics Lithuania.

The merits of raising the employee SSC ceiling depends on several factors including the extent of SSC revenues that could be raised, arbitrage opportunities and equity considerations. For schemes such as health insurance, which are relevant given aging and relatively poor health outcomes in Lithuania (Figure 2.2), contribution ceilings imply that high-income earners do not participate with their full earnings in the redistributive scheme, which may not conform to the principle that people should contribute according to their financial capacity to do so. If Lithuania wished to generate additional resources to finance the social security system, particularly in healthcare where the benefit entitlements are mostly independent of the level of contributions paid, it could consider reinstating higher employee SSC contribution ceilings. The additional resources could help to reduce SSC contribution rates. The capacity for Lithuania to support income inequality by raising the employee SSC ceiling depends on several factors, some of which may need further empirical examination. The potential SSC revenue that could be raised by increasing the employee SSC ceiling will be limited by a relatively small number of high incomes (so revenue costing is needed). From an efficiency perspective, high-income earners could respond by leaving the country and working abroad. There may also be arbitrage opportunities for employees to switch to more lightly taxed income sources. From an equity perspective, raising the employee SSC ceiling weakens the link between SSC contributions paid and SSC benefits received. Raising the employee SSC ceiling may arguably be unequitable given that some higher earners will pay SSC contributions on a greater share of their income but receive no correspondingly higher pension SSC entitlement as a result.

Table 3.9. SSC and top-PIT rate threshold policy options

|

Policy |

Policy objective |

Impact on tax burden & tax revenues |

Selected risks |

|---|---|---|---|

|

Cut employee SSC ceiling (undertaken in 2020 & 2021) |

- Offset higher PIT burden associated with progressive PIT system - Reduce high SSC ceilings |

Reduce SSC burden on higher incomes & reduce associated SSC revenues |

- May increase income equality - Reduces SSC revenues |

|

Cut top-PIT rate threshold (undertaken in 2020 & 2021) |

- Raise PIT revenues - Reduce income inequality |

Increase PIT burden on higher incomes & raise associated PIT revenues |

- PIT revenue raised may be small given small number of high incomes - Risk employees may switch to more lightly taxed income sources - Risk employees leave the country to work abroad |

|

Increase employee SSC ceiling (not undertaken) |

- Raise SSC revenues - Reduce income inequality |

Increase SSC burden on higher incomes & raise associated SSC revenues |

- SSC revenue raised may be small given small number of high incomes - Weakens link between capped SSC benefits & capped contributions |

Source: OECD analysis.

High SSCs discourage work and encourage informality

High employee SSCs may reduce labour supply while low employer SSCs may increase labour demand. High employee SSCs may reduce labour supply and work incentives, particularly for individuals with weaker attachments to the labour market such as those on low incomes, older workers and second earners. High employee SSCs lower disposable income among low earners, potentially reducing work incentives. On the other hand, low employer SSCs may help to keep labour costs down for the employer and increase labour demand and to minimise distortions in firms and sectors where skills and labour productivity are low.

High SSCs could risk making informal employment relatively more attractive. In practice, employers are often in a position to transfer most of the SSC burden back to workers. Exceptions to this are when workers have strong bargaining power (which might be lower in an economy like Lithuania where there are large skill mismatches and relatively fewer high-skill workers in demand), when many workers are paid around the minimum wage (which cannot legally be reduced further), when workers value social protection (which may increase given visibility of employee SSCs) and when unemployment replacement rates are generous (not particularly generous in Lithuania). On this basis, employers may be able to transfer the SSC burden to Lithuania workers, albeit this is limited due to low employer SSCs.

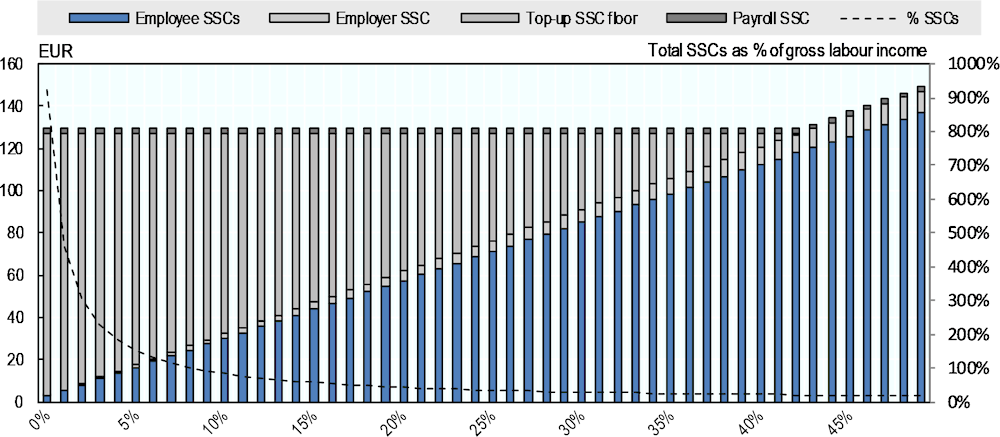

The employer SSC floor ensures low-income workers receive a minimum SSC benefit contributions but it could risk disincentivising employers from hiring

The employer SSC floor was introduced in Lithuania in 2018. The employer SSC floor (or minimum amount), which was introduced in 2018, ensures that a minimum SSC contribution is paid on behalf of employees. For low-income employees with a monthly wage below the MMS (43% of AW in 2020), employers must calculate and pay employer and employee SSCs (at a total rate of 20.97%) on the MMS base for employees from an income base of at least the MMS. As such, employers pay employer and employee SSCs on behalf of employees based on the difference between the calculated wage and the MMS. The SSC floor does not apply to all workers and some are excluded including pensioners, disabled persons, young workers, workers receiving maternity, and paternity or child care benefits.

The employer SSC floor ensures that low-income workers make a minimum SSC contribution and indirectly ensures that they benefit from a minimum social benefit. At low income levels, SSCs would be low if it were not for the employer SSC floor due to relatively low employee SSCs, employer SSC and payroll rates (Figure 3.18). The employer SSC acts as a top-up by ensuring a minimum SSC contribution for low-income workers. The employer SSC floor also has the potential advantage of encourage employers to engage in the formal economy by helping to reduce the under-reporting of hours worked.

However, the employer SSC floor produces high tax wedges at very low incomes which could disincentivise employers from hiring low-income workers. At low-income levels (up to 21% of the AW in 2020), the employer SSC floor contribution is the largest contributor to total SSC contributions (at 10%, 15% and 20% of the AW, the SSC floor represents 72.6%, 64.3 and 52.9% of total SSCs) (Figure 3.18). As such, the employer SSC floor drives high SSCs and tax wedges as a share of gross incomes (at 10%, 15% and 20% of the AW, the employer SSC floor contributions represents 69.7%, 39.5% and 24.4% of gross incomes). This produces a perverse effect because the tax system makes it relatively more expensive for employers to hire low-income than high-income workers because the employer SSC is higher as a share of gross income at low incomes than at high incomes. If employers are responsive to the employer SSC component of labour cost at low incomes, this could reduce hiring at low incomes. At 44% of the AW, the employer SSC is floor phased-out and the effective employer SSC remains constant thereafter. Beyond 44% of the AW, total SSCs (employee and employer SSCs) continue to rise in nominal terms (because incomes are rising) but total SSCs as a share of gross incomes remains flat at 21.3% (19.5% + 1.47% employer SSCs + 0.3% payroll SSCs).

Figure 3.18. The employer SSC floor ensures that low income workers make a minimum SSC contribution

Decomposition of SSCs in Lithuania in 2020, 0 – 50% of the AW

Source: OECD analysis.

Whether the gap between the SSC floor and actual SSCs paid by vulnerable groups could be financed through general taxation depends on the extent to which the minimum wage is appropriately set and enforced. To encourage their employment, some vulnerable groups are exempt from the SSC floor (for example, parents that are receiving child-care benefits up until the child is 2 years of age, people with disabilities, those aged up to 24 years of age and the self-employed). The exemptions could contribute to these vulnerable groups receiving low social benefits (for example, illness benefits). Funding the gap between the SSC floor and actual SSCs paid up to the MMW for these groups through the state budget could help to support these groups. However, it could also encourage employers to try to pay full-time workers below the MMW if the MMW is set theoretically above worker productivity levels and MMW enforcement is relatively weak (i.e. if employers can pay workers below the MMW in the informal economy with limited risks of detection).

Employers appear to reduce hiring in response to the SSC floor

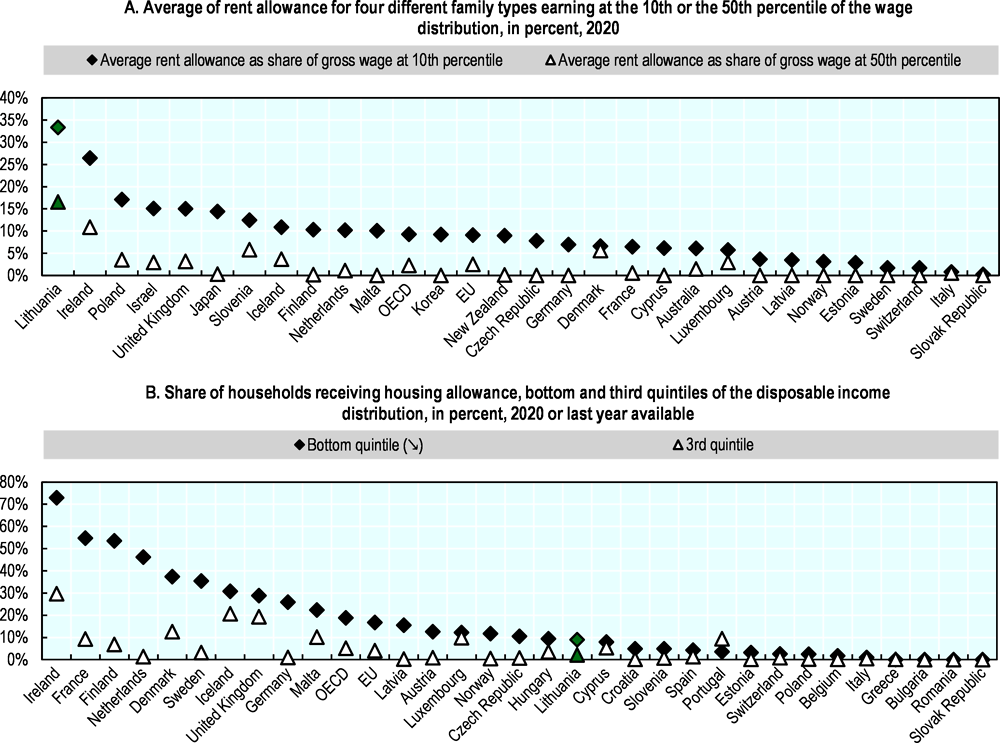

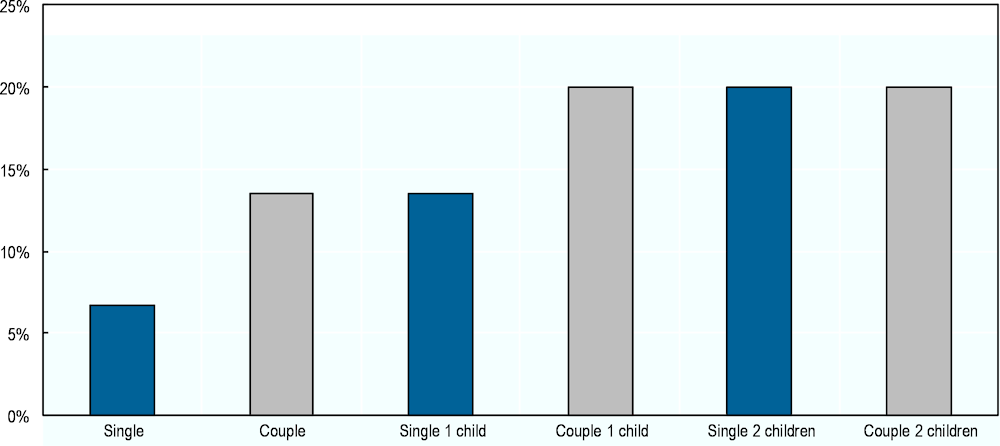

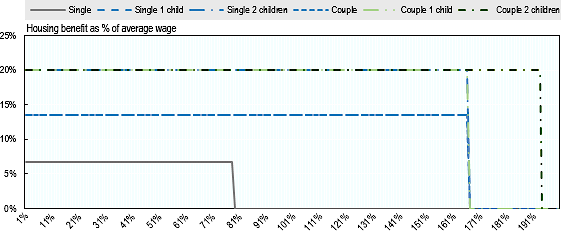

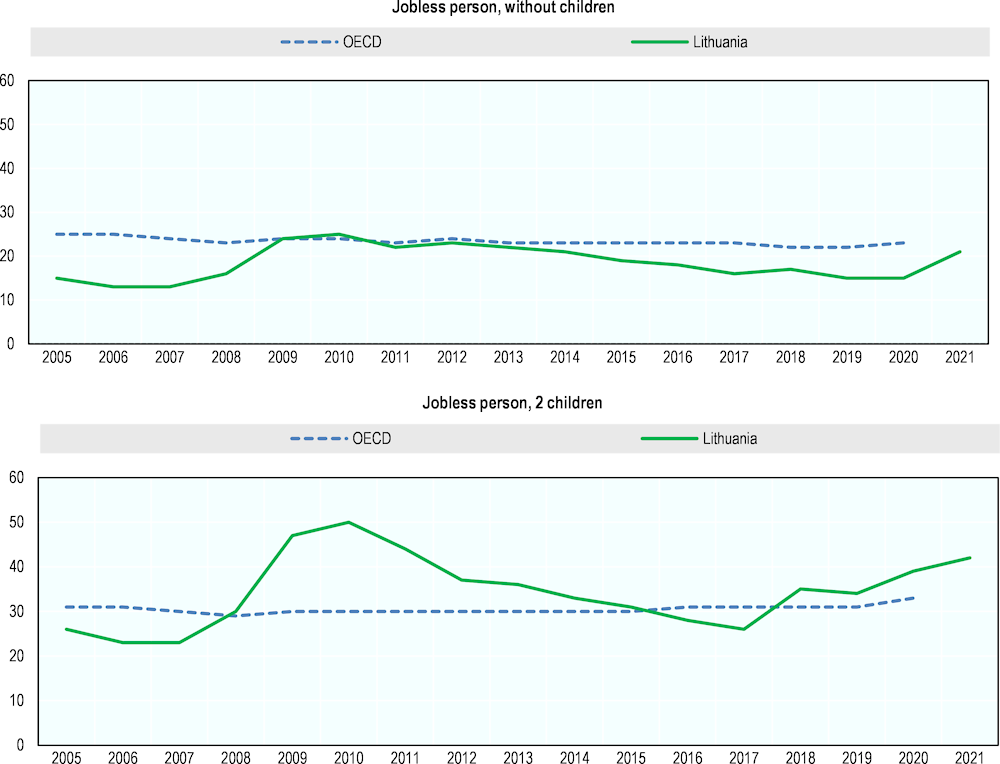

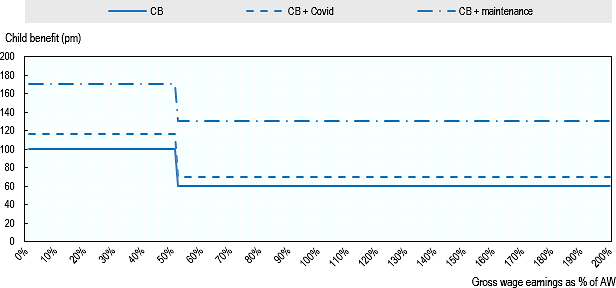

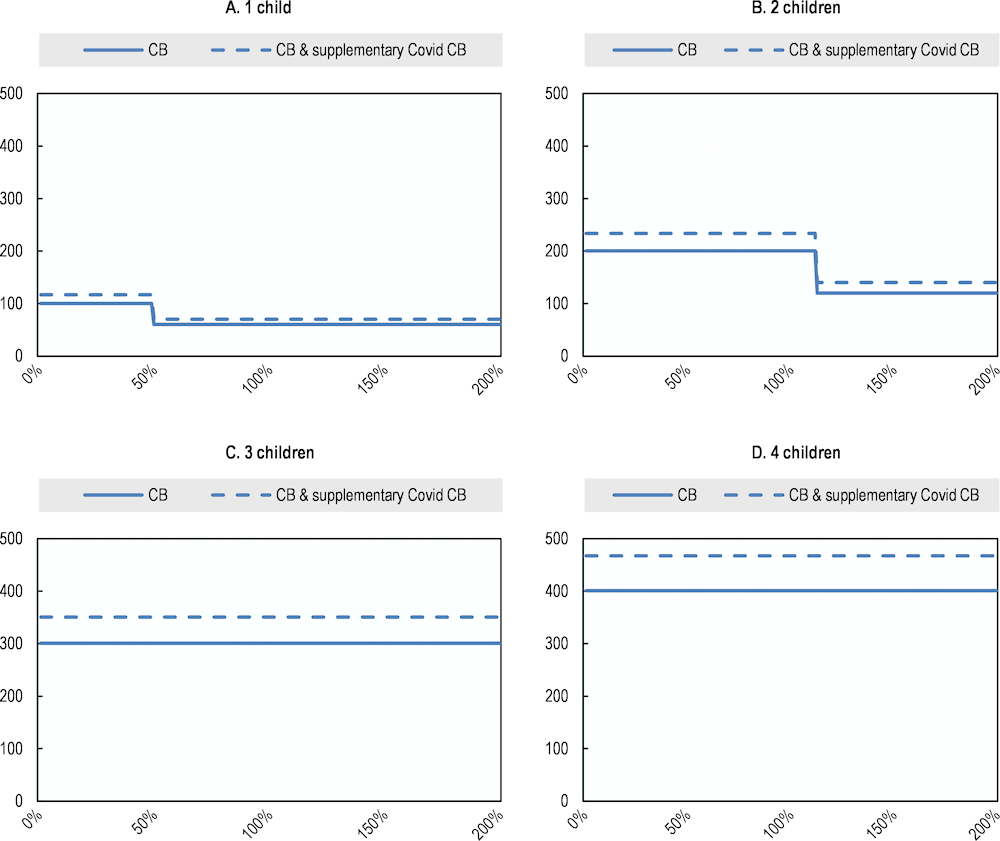

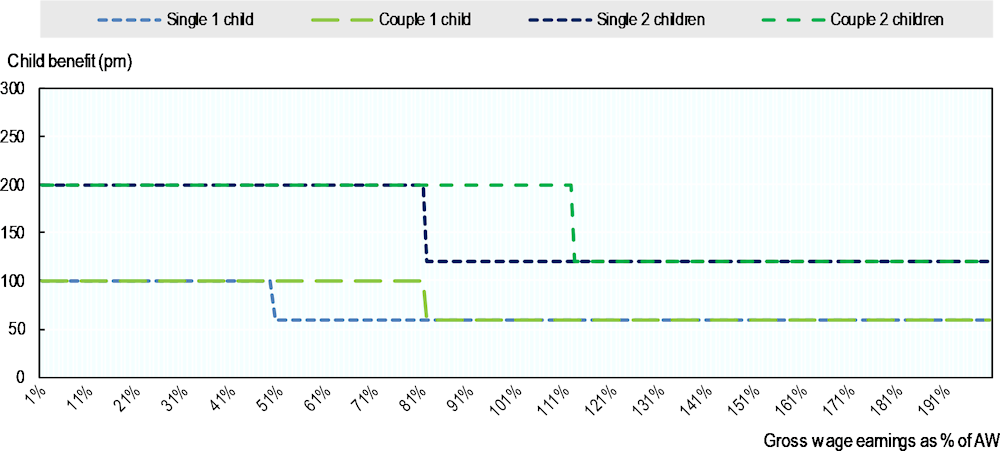

A simplistic comparison shows that there are fewer employees when the SSC floor applies compared to when it is not. Due to the employer SSC floor, employers pay employer and employee SSCs on an SSC base of the MMW for employees earning income below the MMW. The employer SSC floor produces a higher tax wedge than would otherwise be the case (in the absence of the SSC floor), which could disincentive employers from hiring low-income workers. However, do employers reduce hiring where the SSC floor is effective? Leaving aside the large share of employees earning the MMW, a simple comparison on either side of the MMW shows there are fewer employees for a given income range below the MMW than above it. 5.6% and 5.4% of employees earn between 10% and 20% and between 20% and 30% of the AW but a notably higher 8.0% and 7.2% earn between 50% and 60% and 60% and 70% (Figure 3.19, Panel A). This trend is consistent with reduced hiring below the SSC floor (although it does not demonstrate reduced hiring).