This chapter provides an assessment of the incentives to work in Lithuania. It begins with a discussion of optimal tax theory and an evaluation of the tax burden in Lithuania. Next, the chapter examines the current incentives to enter work followed by the incentives to progress in work.

OECD Tax Policy Reviews: Lithuania 2022

4. The incentives to work in Lithuania

Abstract

Introduction

Lithuania’s policy preference for redistribution may come at the cost of weaker work incentives among low earners. The optimal tax theory literature suggest a trade-off between strong targeted redistribution and weak work incentives where neither option is necessarily better but rather they provide possible options depending on a countries objectives. Striking the right balance between work incentives and redistribution depend on a society’s current distribution of income (relatively unequal in Lithuania), desire to redistribute (relatively strong in Lithuania) and the responsiveness of labour supply. Given Lithuania’s policy emphasis on redistribution, some modest to high PTRs and METRs are to be expected. High and positive effective tax rates at low-incomes are common among low-income workers in most countries and reflect not just low work incentives but also strong redistribution. High METRs are also caused by the phasing-out of targeted supports, which is sometimes the case in Lithuania. Indeed, the better the tax and benefit system targets low incomes, the higher the PTRs and METRs such that high effective tax rates can demonstrate effectively targeted redistribution policy.

Unemployment and social assistance benefits represent one form of redistribution that can lead to incentive traps. Research shows that tax and benefit policies are more effective at the extensive margin (i.e. encouraging the unemployed to enter work) than the intensive margin (encouraging those in work to work more) since the former low-income unemployed group tend to be more responsive to tax and benefit policies (i.e. they have a greater labour supply elasticity). On the extensive margin, Lithuania provides social supports to the unemployed and inactive persons, particularly single families with children. Such redistributive policies are equitable but they invariably produce incentive traps (see Box 4.2). Unemployment states can be short-term (individuals are entitled to unemployment benefit) and long-term (individuals are entitled to lower social assistance benefit) (Box 4.2),1 which in turn produce short and long-term PTRs. Short and long-term PTRs then measure work attractiveness during short and long-term unemployment spells respectively. As is the case in Lithuania and many OECD countries, UBs are gradually reduced in the short-term and then replaced in the long-term by lower social assistance benefits (see Table 6.1), which increases work attractiveness for longer unemployment spells thus potentially avoiding unemployment and/or inactivity traps.

Optimal income tax theory provides some general insights on the setting of taxes and benefits to balance efficiency and distributional objectives. There are a number of key insights from the literature for when marginal tax rates should be higher (Figure 6.2). First, when governments care about redistribution. Second, when few families and individuals are subject to the top marginal tax rate. Third, when a large numbers of families and individuals earn higher incomes. Fourth, when taxpayers are relatively less responsive to high tax rates. Low incomes in Lithuania may not provide a strong case for higher marginal effective tax rates, but wages have been rising rapidly in recent years. The responsiveness of low-income workers in Lithuania at the extensive margin is likely to be higher (as is the case in many countries) and relatively responsive groups should not face high tax rates. The substantial participation elasticities found for low-income workers imply that low-income workers should not face high effective tax burdens when moving into work, unless the preference for redistributing income to individuals out-of-work is extremely strong (Saez, 2002[1]). Instead, marginal tax rates should be higher further up the income distribution at points where taxpayers are less responsive but less prevalent.

Table 4.1. Lessons from optimal tax theory

|

Cases when METRs should be higher (according to optimal tax theory) |

Application to Lithuania |

|---|---|

|

The government cares more about redistribution. |

The XVII Government of Lithuania has placed a focus on redistribution, given its priority to reduce poverty, inequality and social exclusion. This may suggest that the government gives less weight to the loss in welfare of higher marginal tax rates. |

|

Few families are subject to the marginal rate. |

Lithuania’s low wage distribution implies few families are subject to the higher PIT rate and associated PIT METRs, so the cost in terms of labour supply would be lower than otherwise. |

|

A larger number of families earn higher incomes. |

Given the large share of low earners, it will be more challenging to raise marginal effective tax rates without negatively impacting labour supply. This case does not support higher METRs. |

|

Families are relatively less responsive to high tax rates (i.e. the cost in terms of reduced labour supply is lower). |

Low-income earners are typically more responsive to high effective tax rates. Taxpayers are typically more responsive at the extensive margin. Given the relatively high share of low-income and unemployed persons in Lithuania and evidence of a relatively high informal economy, this may support the case for lower METRs at lower incomes and higher METRs at higher incomes (where taxpayers may be relatively less responsive in terms of labour supply). More evidence is needed to evaluate the differential labour supply responses among low and high-income earners in Lithuania. |

Source: OECD analysis; (Brewer et al., 2006[2]).

The tax burden in Lithuania

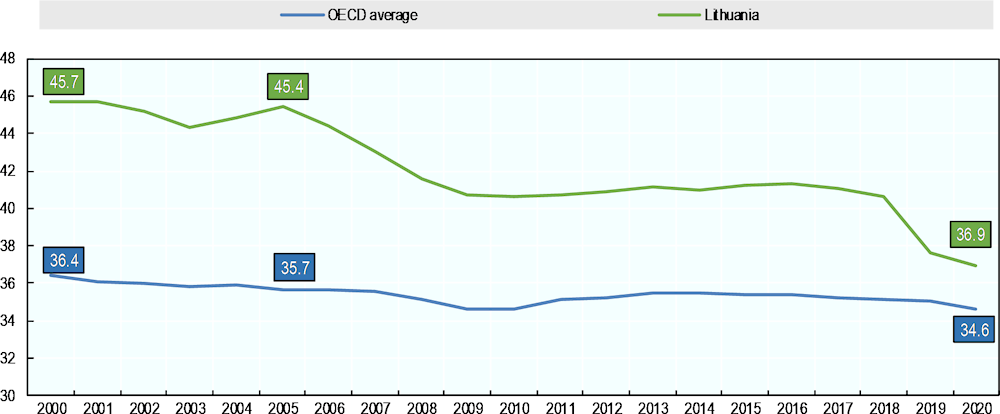

Lithuania has narrowed the tax wedge gap with the OECD average. Over the past two decades, the tax wedge in Lithuania has been declining notably before and during the Great Financial Crisis and more recently during its labour tax reform in 2019 and the subsequent COVID-19 pandemic that followed it (Figure 4.1).

Despite declines in 2019 and 2020, Lithuania’s labour tax burden remains above the OECD average. The average tax wedge in Lithuania for a single person at the average wage was 36.9% in 2020, above the OECD average of 34.6% (Figure 4.1). The tax wedge in Lithuania is driven mostly by employee SSCs and PIT, unlike the OECD average where the decomposition represents a more balanced split across employee SSC, employer SSCs and PIT. The average tax wedge in Lithuania fell in 2019 due partly to the cut in SSC rates and the accompanying introducing of the progressive PIT as part of the labour tax reform. It fell further in 2020 due to further reforms including COVID-19 tax and benefit provision responses (Figure 4.2). The tax wedge fell in 29 out of the 37 OECD countries in 2020, largely reflecting lower income taxes and linked to lower nominal AWs reflecting policy changes including tax and benefit measures introduced in response to the COVID-19 pandemic (OECD, 2021[3]).

Figure 4.1. Lithuania’s tax wedge has narrowed the gap with the OECD in recent decades

The average tax wedge in Lithuania and OECD, single person without children at the average wage, 2000 - 2020

Source: Taxing Wages 2021.

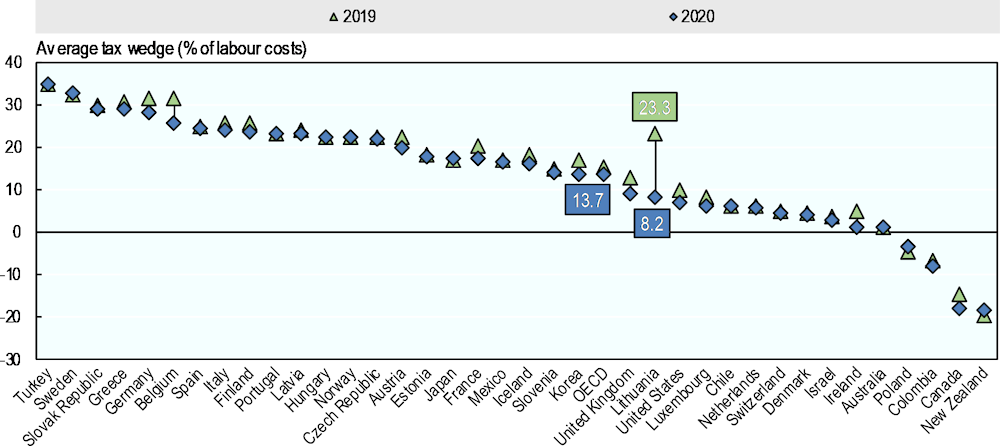

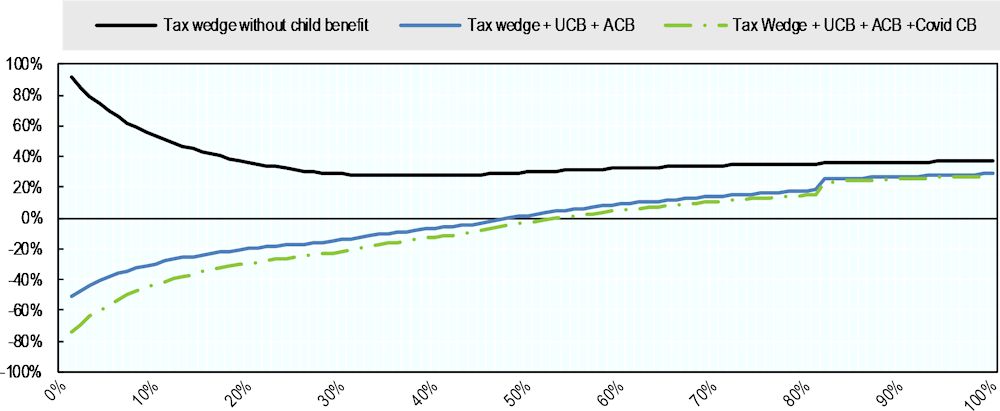

Lithuania cut the tax wedge in 2020 on low-income single parents by more than other OECD countries. The labour market in OECD countries in 2020 experienced a shock of a scale and spread not seen in recent memory (OECD, 2021[3]). Vulnerable groups, such as low-income workers, women and young people were disproportionately affected. Governments introduced measures to support employers and employees, such as job retention schemes, wage subsidies in addition to changes to labour taxes and cash benefits. Lithuania introduced a set of tax and benefit provisions including increasing the BA (see section 3.2) and the universal and additional child benefits (Figure 3.30). The average tax wedge in Lithuania declined between 2019 and 2020, modestly for an average wage earner but significantly for single and one-earner married couples with two children. Among low-income single parents with two children (at 67% of AW), the average tax wedge declined from 23% in 2019 to 8% in 2020 (Figure 4.2). The average tax wedge decline in the OECD was more modest, falling from 15% to 14%. Outside of these cases of low-income parent families, the average tax wedge in Lithuania for most other families is not that dissimilar to the OECD average.

Figure 4.2. The tax wedge for low-income single parents in Lithuania fell sharply in 2020

Average tax wedge for single parents with two children at 67% of the AW, Lithuania and OECD countries, 2019 and 2020

Source: Taxing Wages 2021.

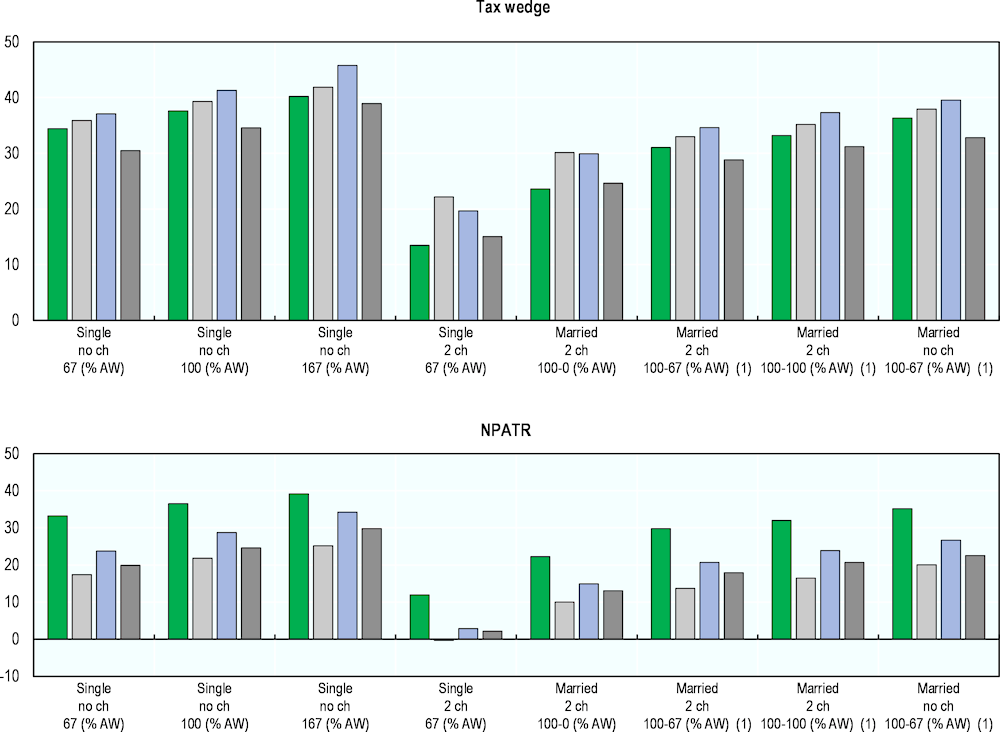

The tax wedge for all families in Lithuania lies below the average of the OECD-EU 22 and the Baltics. The tax wedge in Lithuania is below the average of the OECD-EU 22 and the Baltics for all family types but above many family types compared to the OECD average (Figure 4.3, Panel A). For low-income single parents (67% of AW) with two children, the tax wedge in Lithuania is markedly lower compared to all of the above average benchmarks. The NPATR in Lithuania is above the average of the OECD, the OECD-EU 22 and the Baltics in 2021 for all family categories, owing importantly to Lithuania’s high employee SSCs (Figure 4.3, Panel B).

Figure 4.3. The tax wedge in Lithuania is similar to Latvia and Estonia but sharply lower for low-income families with children

The tax wedge and the net personal average tax rate, by family type, 2021

Note: Baltics refers to an unweighted average of Latvia and Estonia.

Source: Taxing Wages 2022.

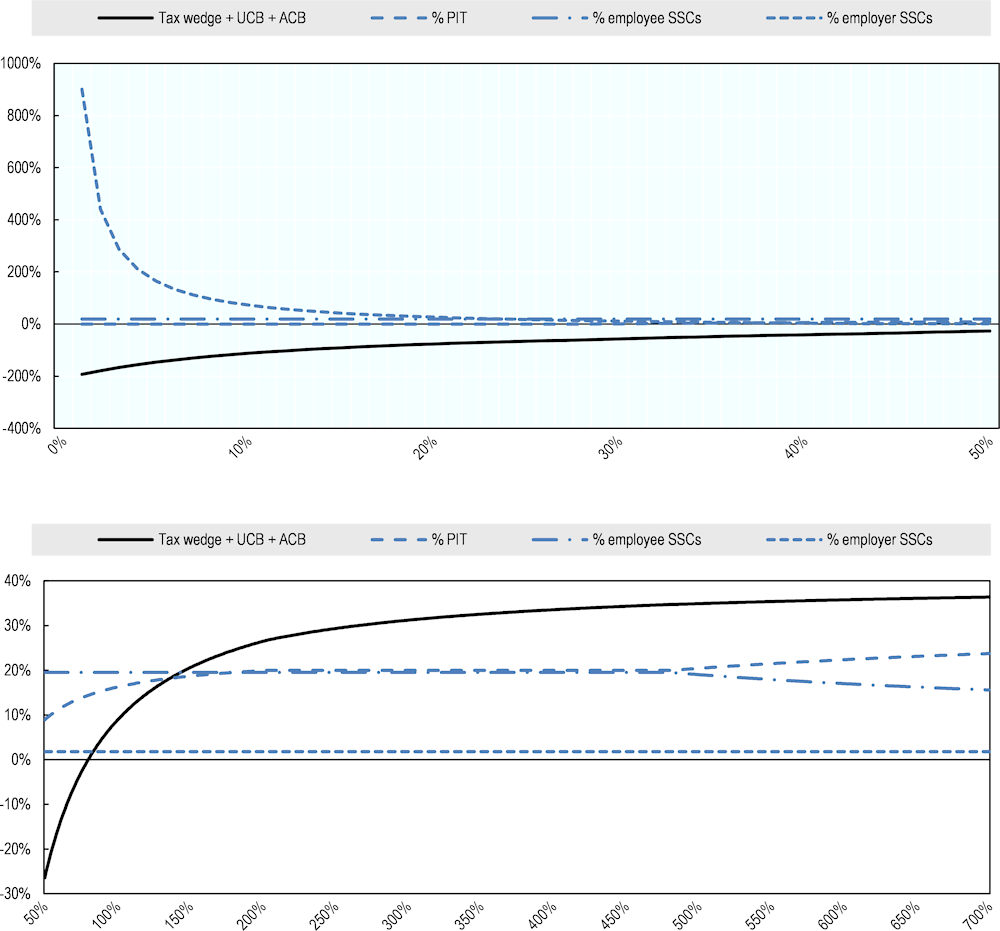

The tax wedge on very low incomes is very high due to the employer SSC floor. The employer SSC floor (aimed at widening social contribution coverage, see Figure 3.17) produces tax wedges that are high at low incomes but then decline sharply (Figure 4.4) (at gross incomes of 1%, 10%, 20% and 30% of the AW, the tax wedge is 92.1%, 54.0%, 37.0% and 28.6% respectively).

The tax wedge is progressive between half and twice the average wage, which is an income range comprising a large share of Lithuanian workers. The shape of the tax wedge is progressive between half and twice the AW, determined largely by the BA and to a lesser extent the progressive PIT rate schedule (as the higher PIT rate threshold does not kick-in until higher incomes and the employee SSC and the employer SSCs are flat) (Figure 4.4). Above twice the AW, the tax burden is relatively flat - between 200% and 600% of the AW, the tax wedge remains flat at 40.6%. Given the income distribution in Lithuania (Figure 2.9), the progressive tax wedge (Figure 4.4, Panel B) likely applies to many workers.

Figure 4.4. The tax wedge is progressive at low and middle incomes but flat at high incomes

Tax wedge, single individuals with no children, 0 – 700% AW

Note: To account for the skewed tax wedge distribution in the analysis, the income distribution is divided above and below 50% of the AW.

Source: Taxing Wages 2021.

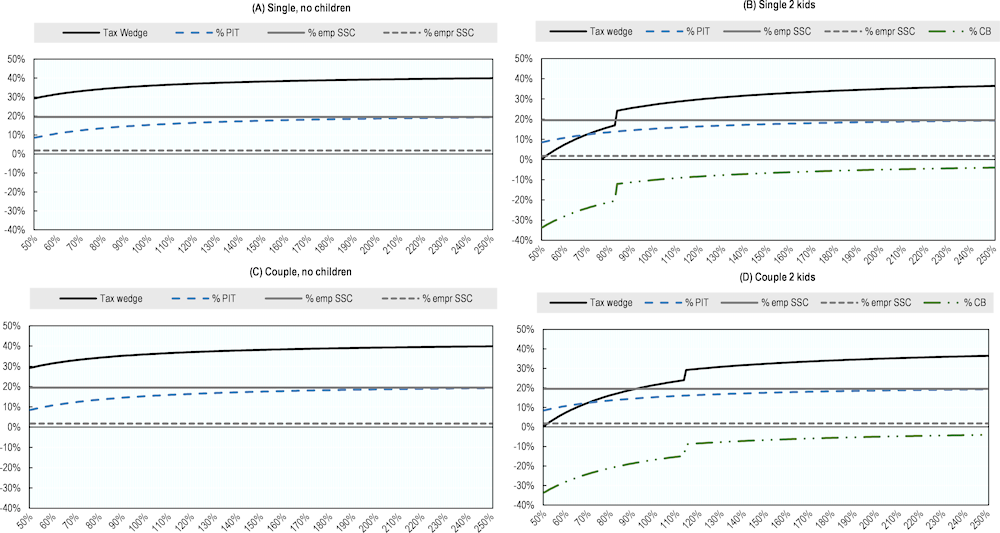

Single individuals face higher tax burden than single parents at all income levels, but especially at low incomes. For single parents with two children, child benefits produce a lower tax wedge at lower incomes and the tax wedge to be more progressive when compared to single individuals (Figure 4.5) (at 50%, 100% and 150% of the AW, the tax wedge is 0.5%, 27.3% and 32.4%). Childless singles and couples face similar tax wedges (Figure 4.5, Panel C).

Figure 4.5. Low-income single individuals face high relative tax burdens

Average tax wedge decomposition in Lithuania in 2020, gross incomes of 50% - 250%

Note: To examine the tax burden where most incomes are in Lithuania, incomes are considered between 50% and 250% of the AW (thus excluding an examination of very low and very high incomes as seen previously. Child benefits refer to universal child benefit and the additional child benefit (and not the COVID-19 supplemental child benefit and the maintenance child benefit). Child benefits are also shown as a share of labour costs (%CB). Note that the tax wedge includes child benefits but not other benefits.

Source: OECD analysis of Taxing Wages 2021.

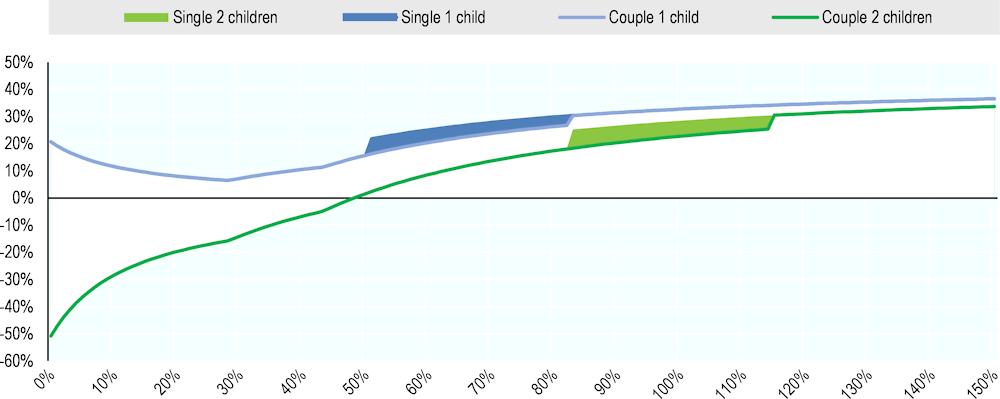

At middle-incomes, single parents face higher tax burdens than couple parents as the additional child benefit is withdrawn earlier. Middle-income couple parents with one child face lower tax burdens than middle-income single parents with one child (an additional 6% at 50% of the AW, which declines to 3% by 83% of AW) (Figure 4.6). Similarly, middle-income couple parents with two children face a lower tax burden than middle-income single parents with two children (an additional 7% at 83% of the AW, which declines to 5% by 114% of the AW) (Figure 4.6). At the AW for example, compared to a single family with two children, a couple with two children faces a lower tax wedge (19.1% vs 25.9%).

At low incomes, single individuals shoulder the bulk of the tax burden. The negative tax burdens faced by low-income single parents and the higher tax burdens faced by single individuals without children imply that single individuals shoulder the bulk of the tax burden at low income levels. Single parents with two children do not start to pay tax until about half the AW (gross incomes of 49% of the AW and when the covid child benefit is included at 54% of the AW). At 2/3 of AW, the tax wedge faced by single parents with two children is a third of single individuals (11% vs 33% respectively) (Figure 4.7).

Figure 4.6. At middle-incomes, single parents face higher tax burdens than couple parents

Tax wedge for single and couple parents with one and two children, incomes from – 0 150%, 2020

Note: Child benefits refer to both universal child benefit and additional child benefit.

Source: OECD analysis.

Figure 4.7. Low income single parents face negative tax burdens

Average tax wedge decomposition in Lithuania, childless single compared to single parent two children, gross incomes from 0% - 100%, 2020

Source: OECD analysis of Taxing Wages 2021.

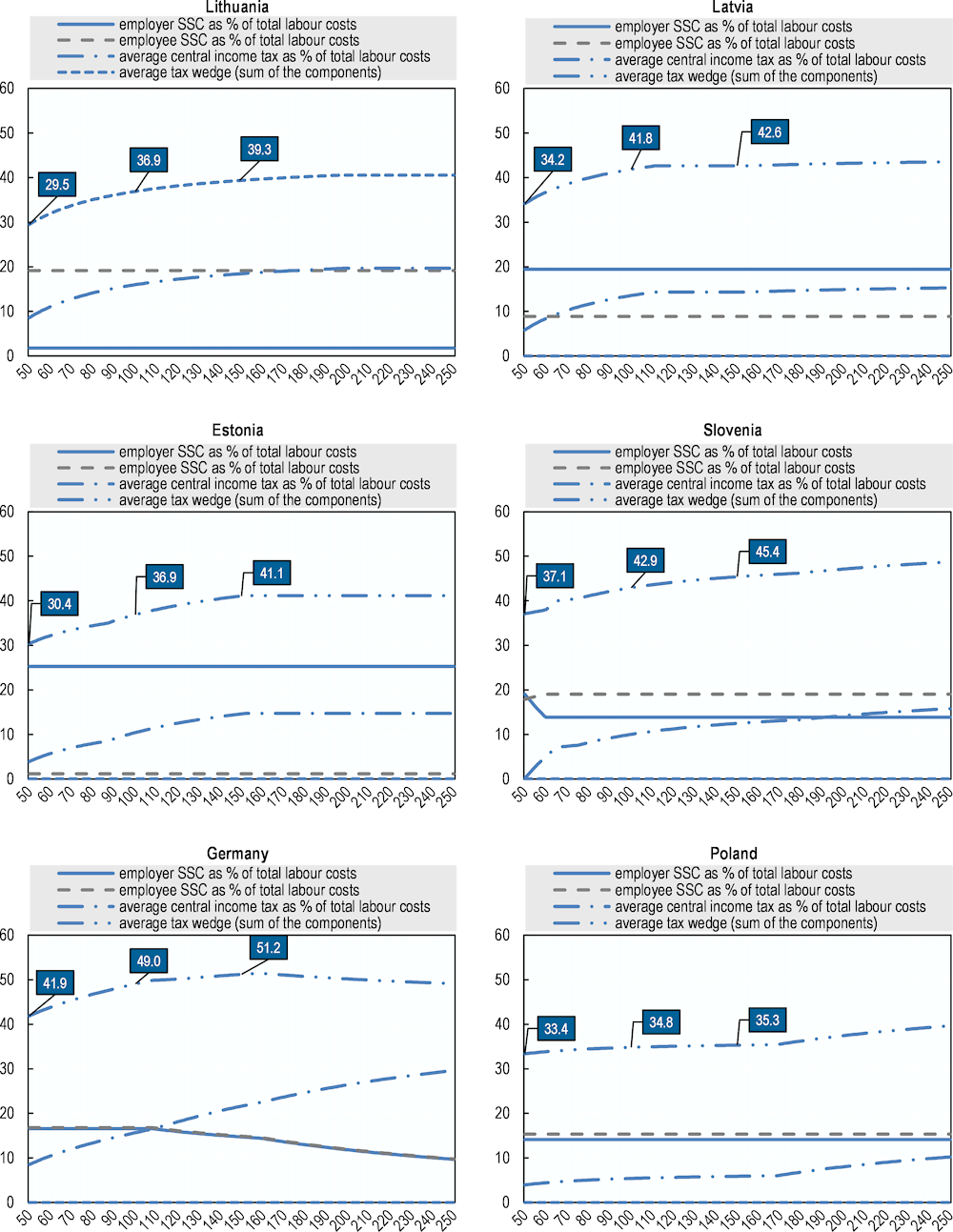

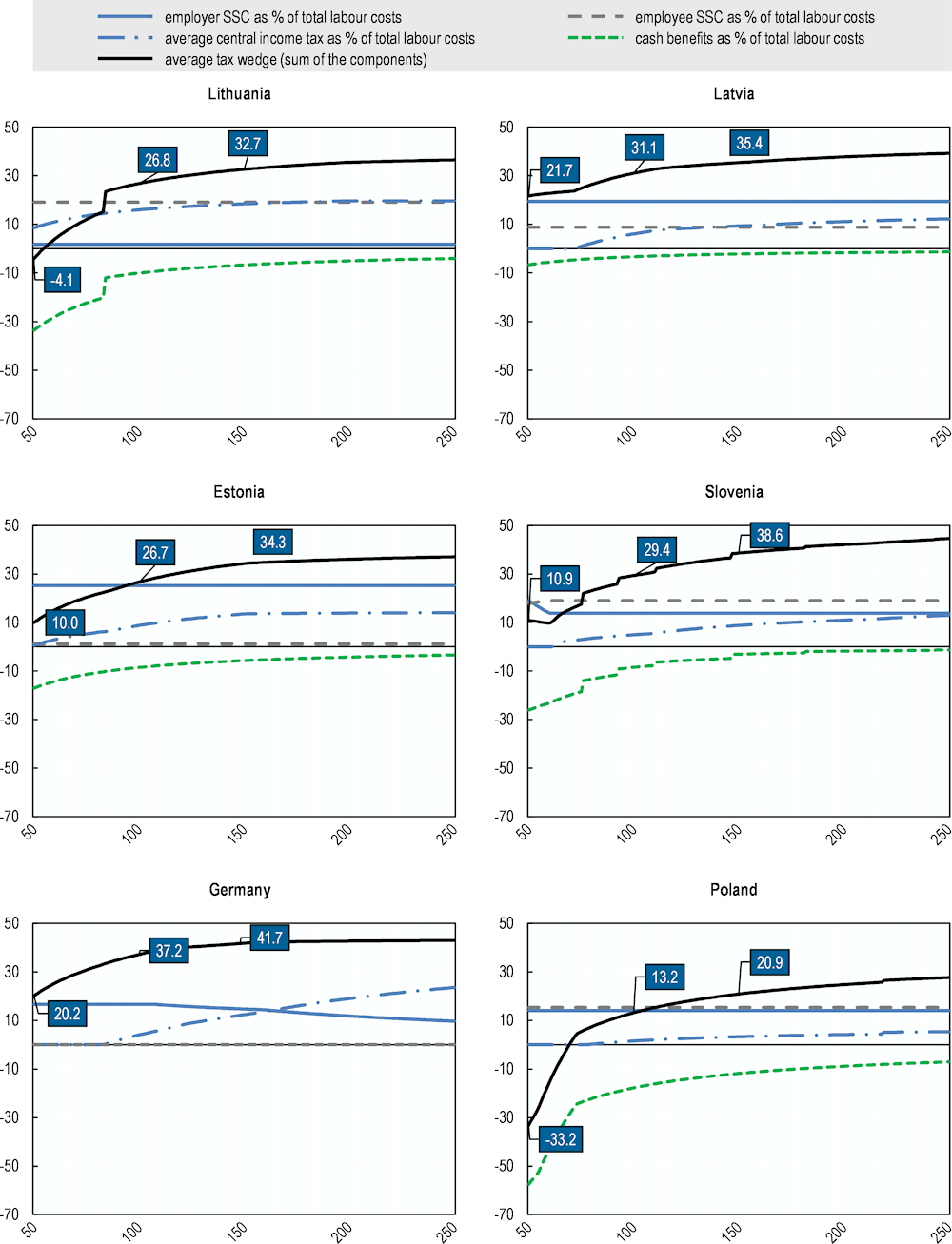

The tax wedge in Lithuania is somewhat low at both low and high incomes compared to selected peer countries. The tax wedge in Lithuania is low among low-income single individuals at half of the AW, where at 29.5% the tax wedge is the lowest among the selected OECD countries, similar to Estonia and only Poland has a lower tax wedge. At higher income levels of 150%, 200% and 250% of the AW, the tax wedge in Lithuania is also comparatively low at 39.3%, 40.6% and 40.6% respectively. These rates are below the average tax wedge of the other five comparison countries at these income levels (which are 43.1%, 43.8% and 43.6% respectively). Some countries have much higher tax wedges at 200% of the AW such as Germany (50.1%) and Slovenia (47.1%).

Figure 4.8. The tax wedge is not progressive at top incomes in international comparison

Average tax wedge decomposition in Lithuania and selected countries in 2020, single individuals with no children

Note: Average central income tax refers to the PIT. Since the gross income data to compare these countries are taken from OECD Taxing Wages 2021, which was produced earlier in 2021, the tax wedge results for Lithuania differ very slightly with the previous which are based on a more recently revised gross incomes for Lithuania. Unlike in the previous graph, this figure shows PIT, employee SSCs, employer SSCs and cash benefits as a share of labour costs.

Source: Taxing Wages 2021.

Tax wedge progressivity is low at higher income levels compared to selected peer countries. Lithuania’s tax wedge is progressive for low and middle incomes in international comparison but less so at higher incomes (Figure 4.8). Between 50% and 250% of the AW, Lithuania's tax wedge rises by 11.1 p.p. (from 29.5% to 40.6%), faster than Germany which rises by only 7.2 p.p. (from 41.9% to 49.1%). In addition, the tax wedge for low-income single individuals (67% of AW) as share of the tax wedge for high-income single individuals (at 167% of the AW) in Lithuania was the 10th highest in the OECD in 2021, indicating relatively low tax wedge progressivity.

Unlike many OECD countries, low-income single parents in Lithuania face negative tax wedges. For single parents with two children the tax wedge is somewhat low across the income distribution. Low income parents with two children (at 50% of AW) face not just a lower tax burden than selected OECD countries but a negative tax wedge of -4.1% (the selected OECD group average is 5.9%) (Figure 4.9). The negative tax burden for low-income parents in Lithuania arises because child benefits exceed PIT and SSCs in the tax wedge calculation.

High income single parents face somewhat low tax wedges in international comparison. At higher incomes, the tax wedge in Lithuania for parents with two children is low compared to the selected OECD countries.

The jump in the tax burden in Lithuania due to the withdrawal of the additional child benefit is modest but sharp in international comparison. The withdrawal of the ACB produces a fairly sharp increase in tax burden at 83% of the AW. While Slovenia, Latvia and Poland also show increased tax burdens between 70% and 90% of the AW, these are less sharp than in Lithuania.

Figure 4.9. The tax burden faced by single parents in Lithuania is low relative to peer countries

Average tax wedge decomposition in Lithuania and comparison countries in 2020, single parents with two children

Note: Child cash benefits include COVID-19 supplement benefits here as is standard in the OECD Taxing Wages model. Since the gross income data to compare these countries are taken from OECD Taxing Wages 2021, which was produced earlier in 2021, the tax wedge results for Lithuania differ very slightly with the previous which are based on a more recently revised gross incomes for Lithuania. Unlike in the previous graph, this figure shows PIT, employee SSCs, employer SSCs and cash benefits as a share of labour costs.

Source: OECD analysis of Taxing Wages 2021.

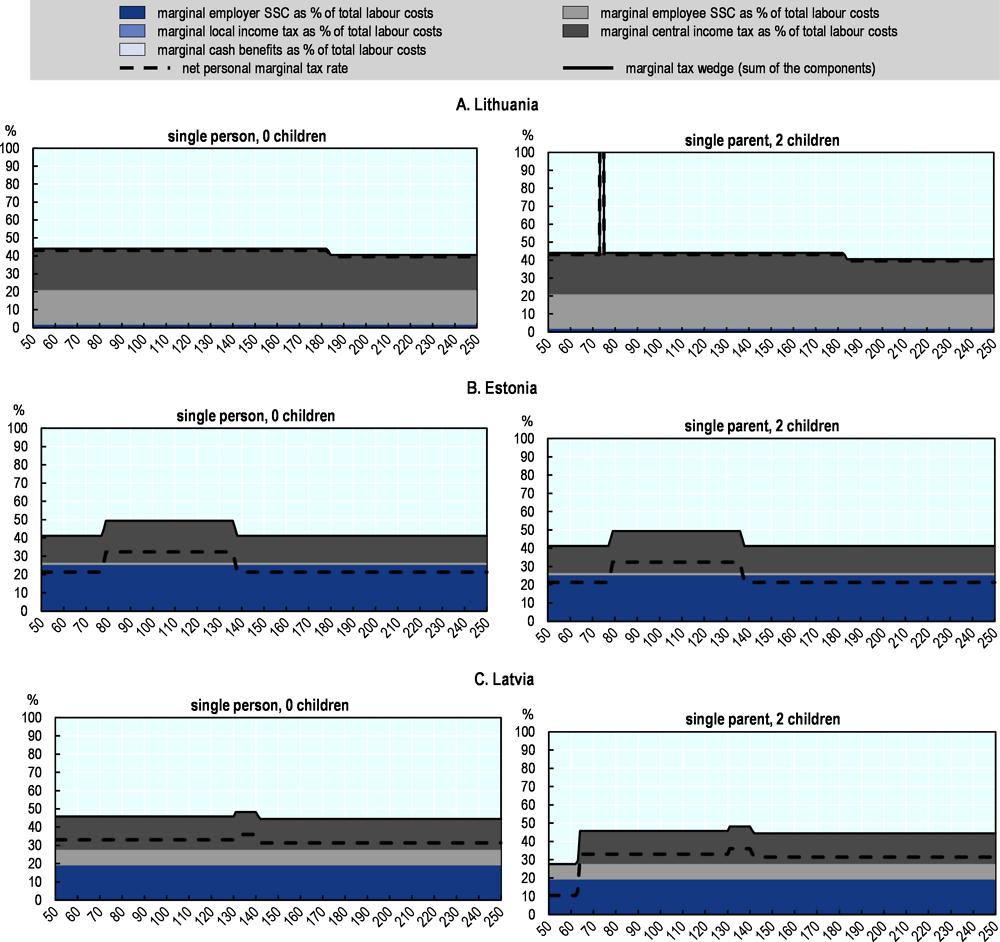

The marginal tax wedge for single individuals is quite flat. Compared to some OECD countries, the METR for singles remains flat at 43% for incomes up to about 180% of the AW before falling modestly to 40% as the BA is fully withdrawn (Figure 4.10A) (SSC ceilings do not take effect until higher income levels and so the marginal tax wedge is not impacted). Thus, the minimal variation in the METR points to limited behavioural distortions.

There is a sharp but brief spike in the marginal tax wedge below the AW as the additional child benefit is withdrawn. The METR for single parents jumps significantly at 74% of AW (Figure 4.10A) as the additional child benefit is withdrawn. Similarly sharp and brief increases in METRs are seen in Poland and Slovenia for parents with two children as benefits are withdrawn ( (OECD, 2021[3])).

Figure 4.10. There marginal tax wedge spikes for single parents as the additional child benefit is withdrawn

Marginal tax wedge decomposition in Lithuania and comparison countries, single persons with no children and single persons with two children, 2021

Source: Taxing Wages 2022.

The incentives to enter work

Standard PTR measures

A description of how the participation tax rate (PTR) is calculated and can be interpreted is provided in the appendix (see section 6) and in Box 4.1. A discussion of alternative PTR calculations is provided in Box 4.3. Work incentive traps are examined in Box 4.2.

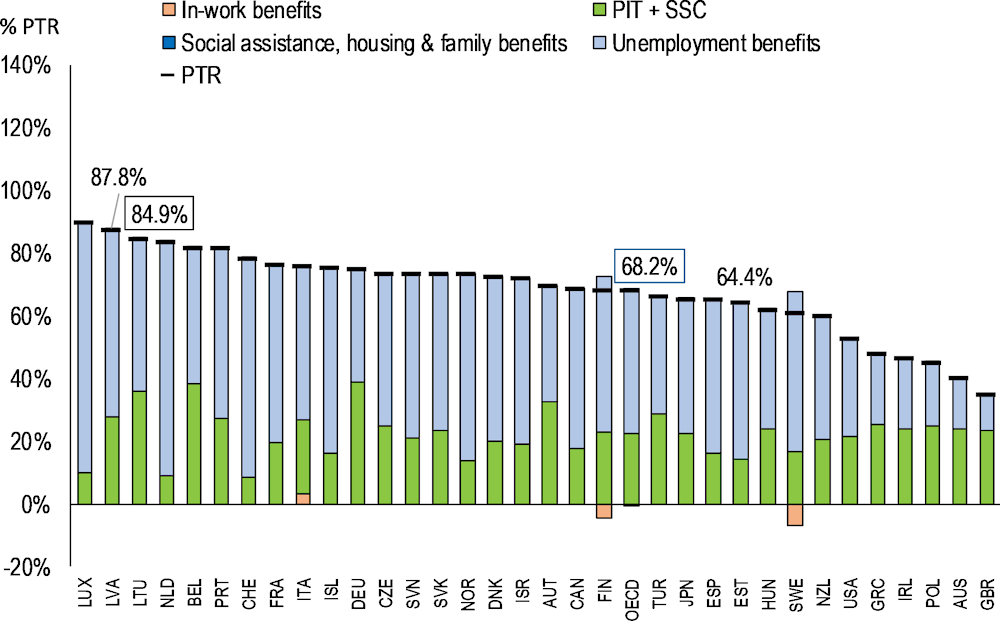

Measured using the standard PTR measure, the incentive to enter work for AW single individuals is among the lowest in the OECD, due mostly to the loss of unemployment benefits. Employing the standard PTR methodology (see Box 4.3), Lithuania has the third lowest work attractiveness for a single person at the AW in 2020 (a PTR of 84.9%), behind only Latvia and Luxembourg and above the OECD average (Figure 4.11). This reflects a lower incentive to work at short unemployment spells. The largest contributor to the work disincentive for single persons at the AW comes from benefits not taxes, specifically unemployment benefit (UBs), which represent half of the disincentive (49.1% as a share of gross income). This is not unusual in international comparison with most of the work disincentive for most OECD countries attributable to UB. Latvia, Estonia and the OECD average are in a similar range of UB as a share of gross income.

The contribution of PIT and SSCs to the work disincentives for single individuals is high. PIT and SSCs represent 36% of gross income, among the largest shares in the OECD. Lithuania’s PIT and SSCs are significantly larger than Latvia (27.8%), Estonia (14.4%) and the OECD average (22.4%).

Figure 4.11. Work attractiveness in Lithuania for average-income singles is relatively low

PTR decomposition (standard methodology) in Lithuania and OECD countries in 2020, single person at 100% of the average wage

Note: For details on the standard PTR methodology, see Box 4.3. Note: 33 OECD countries are examined. OECD refers to an unweighted average of the countries shown. The PTR is calculated based on the 2nd month of unemployment.

Source: OECD Tax and Benefit model TaxBen.

Box 4.1. Interpreting participation tax rates

Like METRs, PTR measurements are inversely related to work incentives because a high PTR indicates weak work incentives while a low PTR indicates strong work incentive. PTRs generally range between 0 (strong incentive to work) and 1 (weak incentive to work), with some rare exceptions. Although the analysis that follows will compare PTRs relative to other incomes, family types and countries, the table below gives an indication of how to interpret standalone PTRs in absolute sense. A PTR of 1 indicates no change in financial position from work (i.e. the additional gross earnings from entering work is exactly matched by taxes on gross income and the loss of benefits). A PTR of 0 indicates an individual keeps all earnings from working (i.e. pays no taxes and loses no benefits as they enter work). As a general rule of thumb, below a PTR of 0.5, work starts to pay. A PTR greater than 1 indicates a financial penalty to working while a PTR less than 1 indicates additional benefits gained from working.

Lower PTRs are associated with stronger financial incentives to work

|

PTR |

Financial incentive to work |

Description |

|---|---|---|

|

> 100% |

Penalty to work. |

Compared to being unemployed, working makes the taxpayer worse-off. Gross income earned from entering work is outweighed by taxes on gross income and the loss of benefits received. For example, when out-of-work income is greater than in-work income, the PTR > 1. |

|

100% |

No financial gain to work. |

Taxpayer is in the same financial position as if they were unemployed. The combination of tax and benefit withdrawal exactly subsumes all gross income from moving into work. For example, when net in-work income and net out-of-work income are equal, the PTR is equal to 1. |

|

50% |

Work starts to pay below this point. |

As general rule of thumb, work pays below this point relative to unemployed. At this point, the difference between net in-work income and net out-of-work income is half of gross income. |

|

0% |

All earnings kept by working. |

Compared to being unemployed, working taxpayer keeps all earnings and loses no benefits. For example, when the difference between net in-work income and out-of-work income is equal to gross income, the PTR is 0. |

|

< 0% |

Additional benefits to work. |

Compared to being unemployed, working provides additional benefits and less taxes. For example, when the difference between net in-work income and net out-of-work income is greater than gross income, the PTR is <1. |

Non-standard PTR measures

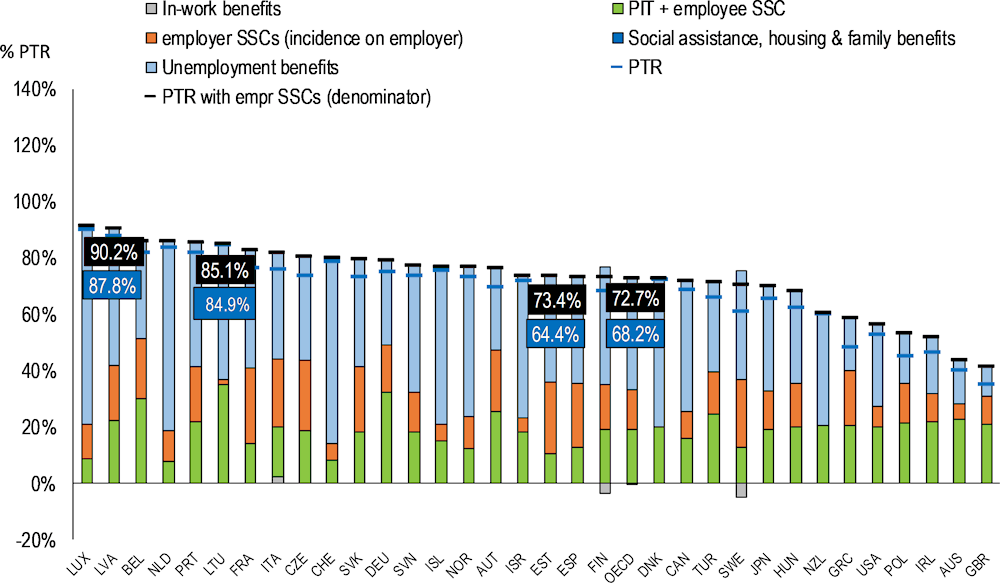

When employer SSCs are included in the PTR, the incentive to enter work for AW singles shifts from the 3rd to the 6th lowest in the OECD. The non-standard PTR will measure work as less attractive relative to the standard PTR in countries with smaller employer SSCs such as Lithuania (see Box 4.3). By including employer SSCs (that are relatively small in Lithuania vs most countries), PTRs increase by more in most other OECD countries than Lithuania, thus making work relatively more attractive in Lithuania (Figure 4.12). The non-standard PTR measure shows Lithuania has the 6th lowest work attractiveness in the OECD vs the 3rd lowest when the standard PTR was used.

Figure 4.12. Using a nonstandard PTR measure, the work disincentive in Lithuania remains in the top quintile among OECD countries

Standard PTR and non-standard PTR decomposition, single individual at 100% of the average wage in 2020

Note: OECD refers to an unweighted average of the countries shown.

Source: OECD Tax and Benefit model TaxBen.

Box 4.2. Work incentive traps

Redistributive tax and benefit policies can produce both short and long-term incentive ‘traps’

The unemployment trap. This trap occurs when benefits paid to the unemployed (and/or high tax rates imposed on low-income workers) narrow the gap between income received when in-work and out-of-work. This creates little incentive for an individual to move into work, thereby ‘trapping’ them in unemployment.

The inactivity trap. The inactivity trap is similar to the unemployment trap, except that it occurs where generous social assistance (and/or other benefits) are paid to an inactive individual (as opposed to an unemployment benefit, which an inactive person would be ineligible for), which produces little difference between in-work and out-of-work income thus ‘trapping’ them in inactivity. The inactivity trap can occur within families when an inactive partner would be taxed at relatively high levels due to their partner’s income.

The poverty trap. A third poverty trap can also occur as a result of targeted government support to the poor. While targeted government supports reduce fiscal costs relative to more expensive universal supports, they invariably require phasing-out. As they are phased-out, targeted supports reduce the multiple avenues of work incentive for those in employment including the incentive to increase earnings, the number of hours worked, the effort applied to work and investment in work-related training and skills. Consequently, a poverty trap encourages low-income workers to remain in poverty and dependent on benefits rather than to increase work and become income independent.

The first two traps of unemployment and inactivity correspond to short and long-term unemployment durations (where long-term is defined as greater than 9 months in Lithuania) which are in turn associated with short-term PTRs (where unemployment insurance benefit is received) and long-term PTRs respectively (where unemployment assistance benefit is received). Therefore, PTRs measure the extent to which those out-of-work are ‘trapped’ in either unemployment (usually higher PTRs, reflecting low work incentives) and inactivity (typically lower PTRs, reflecting higher work incentives). The poverty trap can instead be measured using METRs.

Table 4.2. Measuring unemployment traps using PTRs

|

Traps |

Unemployment state |

Duration in months (in Lithuania) |

Unemployment benefit |

Associated PTRs |

|---|---|---|---|---|

|

Unemployment trap |

Short-term |

<= 9 |

Unemployment benefit |

Short-term PTRs (typically higher) |

|

Inactivity trap |

Long-term |

> 9 |

Social assistance benefit |

Long-term PTRs (typically lower) |

Source: OECD analysis; (O’Donoghue et al., 2003[4]) (Immervoll, 2004[5])

Non-standard PTR measures by income, family type and unemployment spells

High SSCs are a contributor to the disincentive to enter work at low incomes, even at short employment spells. UBs are the largest contributor to the disincentive to enter work (Table 4.3). Reducing them further is challenging given poverty rates among the unemployed (Figure 2.1). Excluding UBs, the largest contributor to the work disincentive are employee SSCs followed by PIT. At incomes up to AW, the contribution of SSCs is larger than the contribution of PIT. At twice the AW, the contribution of SSCs and PIT are similar. Work incentives are relatively strong in Lithuania at higher incomes. At 200% of the AW, work incentives are in the middle of OECD countries and UBs as a share of gross income is similar to the OECD average. However, at low incomes near MMW, work incentives are particularly low (at a PTR of 100%, there is no financial gain to work and at a PTR of 50% work starts to pay). Differences in work disincentives between single persons and single parents are modest, largely because child benefits are provided to both those in and out of work.

Table 4.3. There is little financial gain to entering work at low incomes

Incentives to enter work by income and family type, single individuals and single parents with two children, non-standard PTR, 2-months unemployed, 2020

|

Non-standard PTR |

Contribution to Lithuania PTR |

||||||||

|---|---|---|---|---|---|---|---|---|---|

|

AW |

Family |

Lithuania rank |

Lithuania |

OECD |

UB |

Family & SA |

Employee SSCs |

Employer SSCs |

PIT |

|

40% |

Single |

7th |

89% |

78% |

63% |

0 |

19% |

2% |

6% |

|

Single 2k |

13th |

80% |

74% |

63% |

-10% |

19% |

2% |

6% |

|

|

50% |

Single |

6th |

88% |

74% |

58% |

0 |

19% |

2% |

9% |

|

Single 2k |

6th |

85% |

75% |

58% |

-3% |

19% |

2% |

9% |

|

|

100% |

Single |

6th |

85% |

73% |

48% |

0 |

19% |

2% |

16% |

|

Single 2k |

2nd |

91% |

75% |

48% |

6% |

19% |

2% |

16% |

|

|

200% |

Single |

15th |

67% |

65% |

27% |

0% |

19% |

2% |

20% |

|

Single 2k |

16th |

67% |

67% |

27% |

0% |

19% |

2% |

20% |

|

Note: 2k refers to 2 children. Assumes no housing benefit. 1st = highest PTR and work disincentive. Unemployment spell is assumed 2 months. Family benefits here includes social assistance and family benefits. At 40% of AW, family benefit incentive is 0% as benefits are same in and out of work. Negative social assistance due to in-work social assistance higher than out of work. Employer SSC rate is set at 1.8%.

Source: OECD Tax and Benefit model TaxBen.

Compared to the OECD average, Lithuania’s lower work incentives are driven by larger unemployment benefits, PIT and the absence of in-work benefits. When employee and employer SSCs are combined, the contribution of total SSCs to the work disincentive in Lithuania is similar to the OECD average at several income levels (Table 4.4). Compared to the OECD average, UBs and PIT in Lithuania make relatively larger contributions to the work disincentive (as measured by the non-standard PTR, see Table 4.4). This is particularly the case at lower incomes at and below the AW. In-work benefits increase work incentives in the OECD on average, especially at low incomes. Lithuania’s in-work social assistance (IWSA) performs a similar function at low incomes by increasing work incentives.

Table 4.4. Compared to the OECD average, Lithuania’s lower work incentives are driven by larger unemployment benefits and PIT and the absence of in-work benefits

Comparison of non-standard PTR contributions in Lithuania and the OECD, single parents with two children, 2-months unemployed, 2020

|

Contribution to PTR |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

AW |

Comparison |

PTR |

UB |

Family & SA |

Employee SSCs |

Employer SSCs |

Total SSCs |

PIT |

IW |

|

40% |

Lithuania |

80% |

63% |

-10% |

19% |

2% |

21% |

6% |

0% |

|

OECD |

74% |

54% |

3% |

6% |

14% |

21% |

0.3% |

-5% |

|

|

50% |

Lithuania |

85% |

58% |

-3% |

19% |

2% |

21% |

9% |

0% |

|

OECD |

75% |

50% |

5% |

7% |

14% |

21% |

3% |

-3% |

|

|

100% |

Lithuania |

91% |

48% |

6% |

19% |

2% |

21% |

16% |

0% |

|

OECD |

75% |

40% |

4% |

8% |

14% |

22% |

10% |

-0.7% |

|

|

200% |

Lithuania |

67% |

27% |

0% |

19% |

2% |

21% |

20% |

0% |

|

OECD |

67% |

25% |

3% |

8% |

14% |

22% |

18% |

-0.2% |

|

Note: 2k refers to 2 children. Assumes no housing benefit. 1st = highest PTR and work disincentive. Unemployment spell is assumed 2 months. Family benefits here includes social assistance and family benefits. IW refers to in-work benefits.

Source: OECD Tax and Benefit model TaxBen.

Cutting relatively high SSCs or PIT at low incomes would increase incentives to enter work for parents earning near the MMW (at both short and long-term unemployment spells). Short-term unemployed parents earning income near to the MMW have low work incentives driven by relatively high UBs (Table 4.5). Working does not make this group much better off than unemployment, reflected in the PTR of 80% (i.e. at a PTR of 100%, there is no financial gain to working). In-work social assistance plays a modest role in improving work incentives. Enhancing work incentives is challenging given that it is difficult to further reduce UBs with high and rising poverty risks among the unemployed. Long-term unemployed parents earning near the MMW have modest work incentives that are similar to the OECD average after a 10-month unemployment duration.

Table 4.5. Work incentives for parents earning near the minimum monthly wage are strongly determined by unemployment duration

Incentives to enter work, single parents with two children at 40% of AW, non-standard PTR, 2020

|

Non-standard PTR |

Contribution to PTR |

|||||||

|---|---|---|---|---|---|---|---|---|

|

Unemp spell |

Lithuania rank |

Lithuania |

OECD |

UB |

Family & SA |

Employee SSCs |

Employer SSCs |

PIT |

|

2 months |

13th |

80% |

74% |

63% |

-10% |

19% |

2% |

6% |

|

8 months |

16th |

77% |

69% |

48% |

3% |

19% |

2% |

6% |

|

10 months |

19th |

69% |

68% |

0% |

43% |

19% |

2% |

6% |

|

20 months |

14th |

69% |

64% |

0% |

43% |

19% |

2% |

6% |

Note: Assumes no housing benefit. 1st = highest PTR and work disincentive. Family benefits here includes social assistance and family benefits. Negative social assistance due to in-work social assistance higher than out of work. Employer SSC rate is set at 1.8%.

Source: OECD Tax and Benefit model TaxBen.

Compared to the OECD average, long-term lower income unemployed face low work incentives due to relatively high PIT and the absence of in-work benefits. Long-term unemployed parents earning near the MMW continue to have modestly lower work incentives than the OECD average due to mostly to a difference of higher relative PIT in Lithuania and the absence of in-work benefits (Table 4.6) (i.e. at 20 months of unemployment, unemployment benefits, family benefits and social assistance benefits combined are lower in Lithuania than in the OECD average).

Table 4.6. Compared to the OECD average, long-term lower income unemployed face low work incentives due to relatively high PIT and the absence of in-work benefits

Comparison of non-standard PTR contributions in Lithuania and the OECD, incentives to enter work, single parents with two children at 40% of AW, 2020

|

Unemp spell |

Comparison |

PTR |

UB |

Family & SA |

Employee SSCs |

Employer SSCs |

Total SSCs |

PIT |

IW |

|---|---|---|---|---|---|---|---|---|---|

|

2 months |

Lithuania |

80% |

63% |

-10% |

19% |

2% |

21% |

6% |

0% |

|

OECD |

74% |

54% |

3% |

6% |

14% |

21% |

0.7% |

-5% |

|

|

8 months |

Lithuania |

77% |

48% |

3% |

19% |

2% |

21% |

6% |

0% |

|

OECD |

69% |

44% |

9% |

7% |

14% |

21% |

0.4% |

-5% |

|

|

20 months |

Lithuania |

69% |

0% |

43% |

19% |

2% |

21% |

6% |

0% |

|

OECD |

64% |

26% |

20% |

7% |

14% |

22% |

1% |

-5% |

Note: Assumes no housing benefit. 1st = highest PTR and work disincentive. Family benefits here includes social assistance and family benefits. Negative social assistance due to in-work social assistance higher than out of work. IW refers to in-work benefits.

Source: OECD Tax and Benefit model TaxBen.

Low-income second-earners have weak incentives to enter work at short unemployment spells but quite strong incentives at long unemployment spells. Second-earners (often women) tend to be responsive to incentives in most countries. Second-earners in Lithuania have low work incentives at short unemployment spells, due mostly to high UBs but also high SSCs (Table 4.7). This incentive structure might encourage some low-income second earners to stay on unemployment up to the expiration of UBs at 9 months. However, work incentives are large at longer unemployment spells due to low social assistance benefits. At longer unemployment spells, work incentives are even larger when the second-earner has a higher income as the drop in social assistance benefits outweighs higher PIT rates. This incentive would encourage low-income second-earners to enter work if they had the opportunity, skills, training and health to do so. A significant pool of long-term and low-income unemployed second-earners might indicate an inability rather than an unwillingness to work.

Table 4.7. Long-term unemployed low-income second-earners have strong work incentives

Incentives to enter work, low-income second-earners by employment spell, non-standard PTRs, 2020

|

Non-standard PTR |

Contribution to PTR |

||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Unemp spell |

Family incomes |

Lithuania rank |

Lithuania |

OECD |

UB |

SA |

Employee SSCs |

Employer SSCs |

PIT |

|

2 months |

50% & 50% |

10th |

88% |

83% |

57% |

0% |

19% |

4% |

9% |

|

50% & 67% |

8th |

87% |

81% |

52% |

0% |

19% |

3% |

13% |

|

|

50% & 100% |

7th |

85% |

77% |

48% |

0% |

19% |

3% |

16% |

|

|

20 months |

50% & 50% |

10th |

58% |

64% |

0% |

27% |

19% |

4% |

9% |

|

50% & 67% |

25th |

54% |

62% |

0% |

20% |

19% |

3% |

13% |

|

|

50% & 100% |

22nd |

51% |

59% |

0% |

13% |

19% |

3% |

16% |

|

Note: Second-earner families compared against a baseline of 50% of AW first-earner and 0% of AW second-earner (i.e. unemployed). Assumes no housing benefit. 1st = highest PTR and work disincentive. Unemployment spell is assumed 2 months. Family benefits here includes social assistance and family benefits. Negative social assistance due to in-work social assistance higher than out of work. 0% family benefit disincentive as family benefits are same in and out of work. Employer SSC rate is set at 1.8%.

Source: OECD Tax and Benefit model TaxBen.

Box 4.3. Alternative PTR calculations using employer SSCs

Can employer SSCs be included in the calculation of participation tax rates?

Employer SSCs are not generally included in PTR and participation METR calculations because standard economic theory predicts that they are already reflected in equilibrium wages. Employer SSCs are not included in the OECD TaxBen or the EUROMOD current PTR and METR modelling. How might they affect comparability? First, they may confer a future benefit. However, the static modelling considers only current incomes. Second, to the extent that employer SSCs are tax incident on employees via wages in the long-term, employer SSCs are a tax on employees. If average wages are measured in an equilibrium state where these adjustments have taken place (i.e. the forward and backward shifting of employer contributions between employers and employees as translated through wages), then any difference in employer SSCs will already be reflected in the average wage. Under the assumption that such incidence shifting has taken already place, the standard calculation of PTR, does not include employer SSCs in its calculation.

While including employer SSCs is methodologically nonstandard for the calculation of PTRs, arguments exist for why they might be included in a country such as Lithuania. While including employer SSCs in the PTR represents a nonstandard approach, there are several rationale which provide a basis for considering its inclusion alongside the standard methodology in the case of Lithuania. First, there may be potential for upward bias in the PTR estimate in a country such as Lithuania given Lithuania’s large and atypical imbalance between employer and employee SSCs. Second, changes in employer SSCs may be incorporated in the behavioural decision making of employers and employees prior to the adjustment of wages to an equilibrium state as predicted by economic theory. Third, including employer SSCs in the PTR calculation provides equal weight to the role of employee and employer SSCs in their potential impact on work incentives (rather than only taking account of employee SSCs as in the standard methodology).

Applying the standard PTR methodology in Lithuania to examine trends in the incentive to enter work over time produces misleading conclusions. The standard methodology poses problems when comparing before and after Lithuania’s labour tax reform in 2019. For example, the standard PTR for a single individual at the average wage increased sharply from 65.1% in 2015 to 84.9% in 2020, due largely to employee SSCs representing a greater share of gross income (9.0% in 2015 and 19.5% in 2020). Such a shift appears to be striking as it was not seen in comparison countries such as Latvia, Estonia or the OECD average over the same period. However, drawing the conclusion that work attractiveness declined in Lithuania during this period would be misleading as the change reflects a policy shift to employer SSCs rather than a change in work incentives.

Several nonstandard PTRs can be calculated by including employer SSCs, which have the effect of increasing measured work incentives in countries. The table summarises the definition, rationale and equations related to a standard and a non-standard PTR measure. One way to calculate a nonstandard PTR that incorporates employer SSCs is to replace gross income in the standard PTR equation with total labour costs and assume the incidence of employer SSCs falls entirely on the employee. Conceptually, this nonstandard PTR measure would incorporate the notion that the employee considers their total remuneration to be total labour costs (instead of gross income), reflecting a dynamic setting where the employee takes account of the future entitlements associated with the employer SSC contribution (with the caveat that SSC contributions do not match perfectly with future SSC entitlements). At the same time, employer SSCs are deducted from in-work income to reflect the incidence of employer SSCs on the employee. Mathematically, as shown in table, the numerator remains the same (because total labour costs replace gross wages but simultaneously employer SSCs are deducted) and the denominator becomes total labour costs. The new denominator of labour costs comes with a new interpretation and has less of the same clear focus on current cash incomes. In addition, the decomposition of the nonstandard measure into tax and benefit components must each now be calculated as a share of labour costs, once again altering the decompositional interpretation. In terms of the measured impact on work incentives, the nonstandard measure is expected to be greater than the standard measure, reflecting lower work incentives1. With regard to interpretation, and contrary to standard economic theory, the nonstandard measure might be conceptualised as a pre-equilibrium work incentive measure before the full amount of incidence shifting has occurred between employees and employers. Note however that if standard economic theory is correct and the employer SSC is already reflected in reduced wages for the employee, the nonstandard measure would represent an excessively reduced work incentive measure.

Standard and nonstandard PTR measurements

|

PTR |

Description |

Rationale |

PTR in LTU 2020 |

PTR in OECD 2020 |

Equation |

|---|---|---|---|---|---|

|

Standard |

Employer SSCs not included |

Employer SSC impacts are already included in the wage |

84.9% |

67.9% |

(1) 1 – [Y_netIW - Y_netOW] / [ (Y_grossIW ] |

|

Nonstandard |

Employer SSCs included in denominator |

Additional incidence of employer SSC falls on employer |

85.1% |

72.7% |

(2) 1 – [Y_netIW - Y_netOW] / [ (Y_grossIW + SSC_er ] |

Note: PTRs relate to a single individual at 100% of the AW in 2020.

Source: OECD Tax and Benefit model TaxBen.

If employer SSCs were included in the PTR, countries would likely show reduced incentives to work but Lithuania less so due to its relatively smaller employee SSC. The non-standard PTR measure will generally measure work as less attractive in countries relative to the standard measure. The extent to which work is measured as less attractive will depend on the size of the employer SSC in the country. In OECD countries, employer SSCs differ significantly. In Lithuania, where employer SSCs are among the smallest in OECD countries, the measured reduction in the work incentive will therefore be relatively smaller compared to most other OECD countries. As a result, the nonstandard PTR will show Lithuania to have a relatively more attractive work incentive (since the measured work incentive would fall in all countries but fall by less in Lithuania). The table below shows, for a selection of comparison countries, that going from the standard to the non-standard PTR methodology changes the measured PTR by a modest 0.3% (from 84.9% to 85.1%) in Lithuania compared to a larger 4.4% (from 68.2% to 72.7%) in the OECD on average.

Standard and non-standard PTRs in Lithuania and comparison countries, single individual at 100% of the average wage in 2020

|

Standard PTR |

Non-standard PTR |

Difference |

Employer SSCs |

|

|---|---|---|---|---|

|

Lithuania |

84.9% |

85.1% |

+0.3% |

1.8% |

|

Estonia |

64.4% |

73.4% |

+9.0% |

25.3% |

|

Latvia |

87.8% |

90.2% |

+2.4% |

19.4% |

|

OECD* |

68.2% |

72.7% |

+4.4% |

Note: *OECD refers to an unweighted average of the OECD countries shown.

Source: OECD Tax and Benefit model TaxBen.

1. This is true when all variables in the equation are positive.

Standard PTR measure by income, family type and unemployment spells

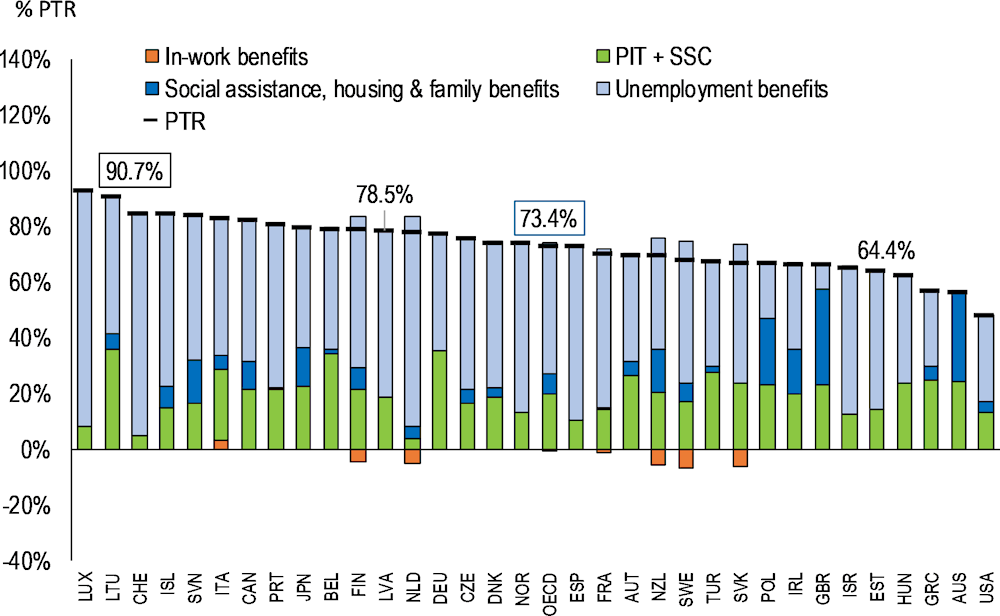

Average-income single parents in Lithuania have modestly lower work incentives than single individuals. This section returns to using the standard PTR measure. Compared to a single person earning the AW in Lithuania who have a PTR of 85%, single parents have modestly higher PTRs of 91%, reflecting lower work incentives driven by family benefits, namely the ACB that is withdrawn by the AW for single parents.2 The drivers of the work disincentive for single parents are not dissimilar to those for single individuals – they are largely attributable to UB and to a lesser extent SSCs and PIT but in addition the ACB (i.e. by moving from unemployment into employment at the AW, the child benefit is reduced due to the loss of the ACB) (see Figure 4.13). The incentive to enter work is the second lowest in the OECD, behind only Luxembourg. The PTR in Lithuania is higher than that of Latvia (78.5%) and Estonia (64.4%), where in both countries there is no loss of child benefit from moving to employment and there is only a universal child benefit in place (i.e. there is no additional child benefit). The PTR in Lithuania is also significantly above the OECD average (73%), reflecting relatively weak work attractiveness in international comparison for average-income single parents with two children.

Figure 4.13. Work attractiveness in Lithuania for average-income single parents is the second-lowest in the OECD

PTR decomposition (standard methodology) in Lithuania and OECD countries, single parent with two children at 100% of the average wage, 2020

Note: For details on the standard PTR methodology, see Box 4.3. Note: 33 OECD countries are examined. OECD refers to an unweighted average of the countries shown.

Source: OECD Tax and Benefit model TaxBen.

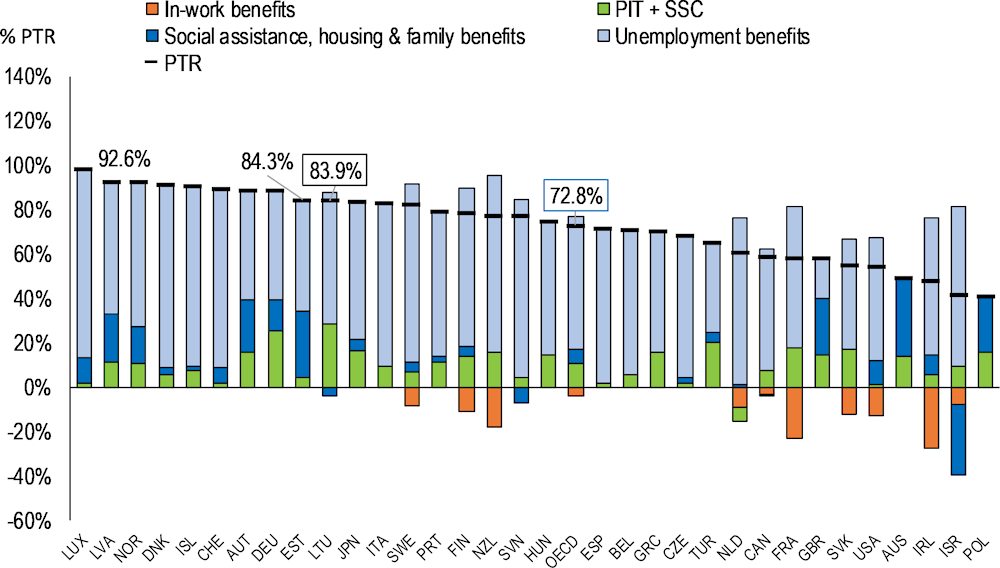

Measured using the standard PTR (without including employer SSCs), the share of work disincentive from PIT and SSCs for low income single parents is the highest in the OECD. Figure 4.14 shows the PTRs for low-income single parents (50% of AW) with two children in Lithuania and OECD countries in 2020. Lithuania’s PTR (of 84%) is above the OECD (73%) but below Latvia (93%) and Estonia (84%). The primary work disincentive for low-income single parents with two children in most OECD countries is the UB, which represents 60% of gross income in the OECD on average. Lithuania has a similar UB share (at 59% of gross income) to the OECD but its PTR remains higher due to a larger PIT (8.7% vs 2.5%) and particularly SSC (19.5% vs 8.0%) shares of gross income. Indeed, single parents with two children in Lithuania have the highest share of PIT and SSCs in the OECD (one non-OECD country which has an even higher share of PIT and SSCs than Lithuania is Romania, due to its high 35% SSCs as a share of gross income (see Box 3.1 for a discussion of Romania’s tax reform that shifted most SSCs to the employee). In many OECD countries including Estonia and Latvia there is a considerable work disincentive associated with social assistance, housing and family benefits but there is no such work disincentive in Lithuania. In this case for a low-income single parent with two children, this largely occurs in Estonia and Latvia due to the full loss of housing benefits which are not lost in Lithuania (in Estonia, there is also a smaller loss from social assistance) at low income levels. In all three countries, for this family type, there is no work disincentive from child benefits as they are afforded equally to families both in-work and out-of-work at low incomes.

Figure 4.14. For low-income single parents in Lithuania, the share of work disincentive driven by taxes is the highest in the OECD

PTR decomposition (standard methodology), single parent with two children at 50% of the average wage, 2020

Note: OECD refers to an unweighted average of the countries shown.

Source: OECD Tax and Benefit model TaxBen.

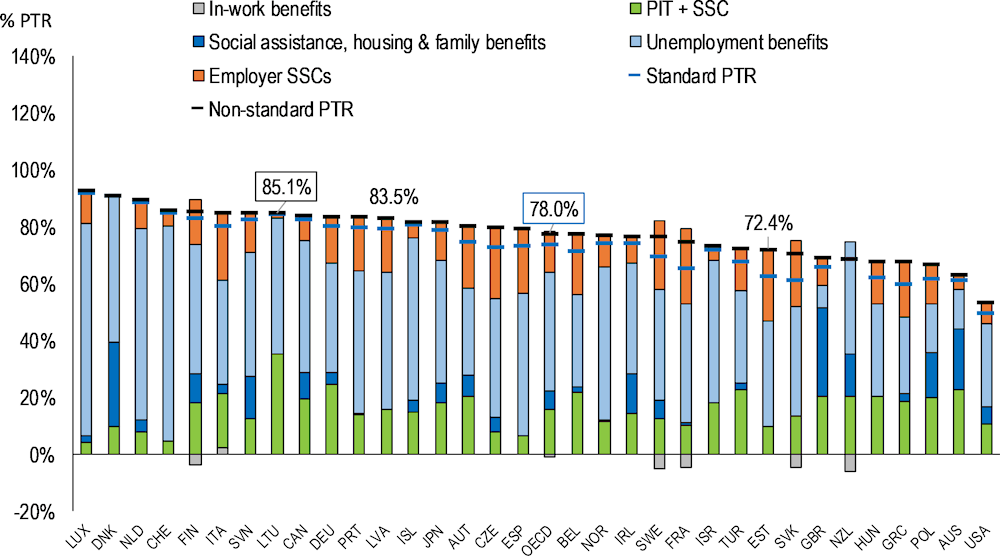

Under both standard and non-standard PTR measures, the incentive to enter work for average-income couples in Lithuania is similar to that of single individuals. Compared to childless singles at the AW in Lithuania, couples with children have similar work incentives, as measured by both standard PTRs (84.8% vs 84.9%) and non-standard PTRs (85.1% vs 85.1%). Under the non-standard PTR measure, measured work attractiveness rises in Lithuania as expected in international comparison – Lithuania’s changes from having the 5th highest work disincentives in the OECD to the 8th highest work disincentives (Figure 4.15). Under either measure, work incentives in Lithuania for average-income two parent families are relatively low. As was the case for single individuals, the contribution of PIT and SSCs to the work disincentive in Lithuania is among the highest in the OECD.

Figure 4.15. For average-income two parent families, the share of work disincentive associated with PIT and SSCs in Lithuania is the highest in the OECD

PTR decomposition (non-standard methodology), couple at 100% of the average wage with two children in 2020

Note: OECD refers to an unweighted average of the countries shown.

Source: OECD Tax and Benefit model TaxBen.

Based on the standard PTR measure, the incentives to enter work within Lithuania among groups at high poverty risk

Work incentives improve as incomes rise

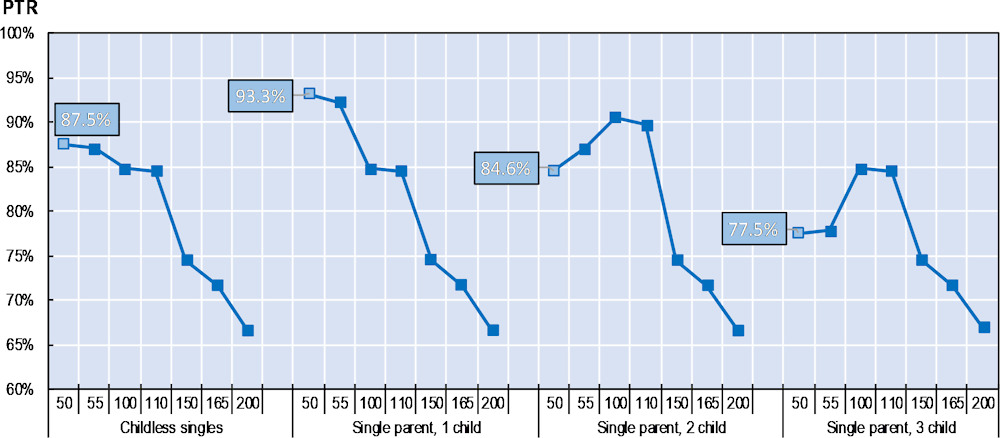

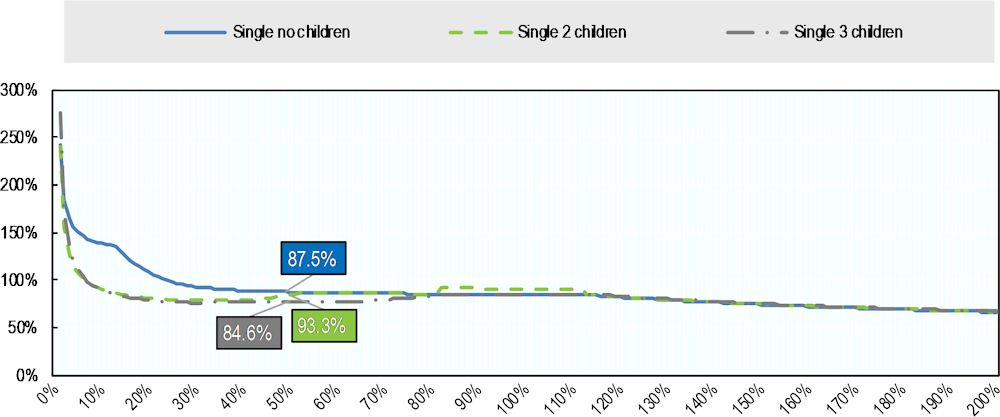

The attractiveness of entering work in Lithuania for single families with and without children starts low at low income levels and rises with income, particularly for incomes above the AW as most benefits are withdrawn. This section uses the standard PTR measure for comparing work incentives within Lithuania. The non-standard PTR measure may have more value when comparing work incentives across countries. The incentive to enter work from unemployment rises at higher income levels across all family types (evidenced by a declining PTR), albeit at varying degrees (Figure 4.16). For childless singles, the incentive to enter work from unemployment is lowest at lower incomes (50% of the AW), rises gradually to middle-incomes (100% of the AW) and then rises more rapidly at higher incomes (150% of the AW). In all family types, work incentives increase sharply between 100% and 150% of the AW as the UB cap is reached3. Having a job at higher incomes is more attractive than at low incomes because the loss of UBs is relatively less and outweighs higher taxes as a share of gross income. For high income earners (+150% AW), work incentives are identical across family types. Raising the tax burden through a higher PIT on high earners may impact high-income families in an equal way regardless of family structure.

Single parents with one child face high unemployment trap risks

For low-income single parents with one child, unemployment traps are quite high. For low-income single parents with one child, the incentive to enter work is particularly unattractive relative to the same family on higher earnings (Figure 4.16). For single parents with one child, the incentives to enter work rise with income. The incentives to work are particularly low at lower incomes (50% of the AW) because of the loss of the means-tested additional child benefit. The incentives to work for low-income parents with one child (PTR is 93.3%) are lower than for singles (PTR is 87.5%) so the risk of an unemployment trap is higher for low income single parents with one child.

Among larger families, work is least attractive for middle-earners. For larger families with two and three children, work incentives are smaller at middle-incomes (100% of AW) than lower incomes due the ACB. The reverse is true for single parents with one child single individuals. For instance, single parents with two children at 50% and 100% of AW, PTRs are 84.6% and 90.5% (i.e. the work incentive has decreased) whereas for single parents with one child at 50% and 100% of AW, PTRs are 93.3% and 84.8% (the work incentive has increased). Therefore, compared to parents with one child, parents with two children likely face modestly higher poverty trap risk as they transition from low to middle incomes in that they may be discouraged from increasing their earnings (the poverty trap is however better investigated using METRs).

As low-income single parents grow family size from one to three children, unemployment trap risks fall and work incentives improve helped by in-work social assistance and the additional child benefit. Figure 4.16 also examines the financial incentives for a single individual to have a child and for small families to have additional children. Although child benefits are larger for larger families, they do not create a disincentive to enter work because they are available equally to both families in-work and out of work. For low-income single parents with one, two and three children, the PTRs are 93.3%, 84.6% and 77.5% respectively, reflecting greater work incentives for families with more children. For single parents with one child, lower work incentives arise from the loss of the additional child benefit while for single parents with two and three children, lower work incentives are driven by higher losses in in-work social assistance. Overall, among low-income families, unemployment trap risks are higher for smaller families.

Middle-income single parents with two children have modestly weaker incentives to return to work compared to those with one child. One atypical albeit modest incentive produced by the benefit system design is that middle-income parents with one child that have a second child face weaker work incentives. For single parents with one child, work is most unattractive at lower incomes (at 50% and 55% of AW) whereas for single parents with two children work is most unattractive at middle-incomes (at 100% and 110% of AW). This occurs because the means-tested additional child benefit is withdrawn for those in-work (making work less attractive relative to unemployment) and it is withdrawn at a lower net income level for single parents with one child than for single parents with two children. Therefore, the tapering of the additional child benefit at different incomes reduces work incentives at low incomes for the former and middle-incomes for the latter (in-work social assistance also plays a minor role for parents with two children).

Figure 4.16. Low work incentives in Lithuania tend to rise with higher incomes and family sizes

Short-term PTRs, single families with and without children at selected incomes, 2020

Note: PTRs for childless singles and single parents at selected income levels (50%, 55%, 100%, 110%, 150%, 165% and 200% of AW. The PTRs are shown within a high range on the vertical axis (from 60% to 95%) and should be interpreted accordingly. Unemployment benefit is assumed to be in months 1 – 3.

Source: OECD Tax and Benefit model TaxBen.

Very low earners are worse-off from working

Very low-income single individuals are worse-off from working. At very low incomes (10% to 50% of the AW) entering work from unemployment is very unattractive, especially for single individuals (Figure 4.17). Given that IWSA produces a PTR of just below 100% (i.e. where there is no incentive to work), very low-income childless singles (below 25% of the AW) are penalised by working as the decision to work makes them worse-off financially (reflected by PTRs above 100%). Low work incentive for poorer families partly reflect effective redistribution policies in Lithuania, including in this case relatively high UB during initial unemployment spells (Figure 3.21).

Figure 4.17. Very low-income childless singles are made worse-off by entering work

PTR decomposition (standard methodology), single individual and single parent with two children at 100% of the average wage, 2020

Source: OECD Tax and Benefit model TaxBen.

Single-earner couples earning below the average wage have weak work incentives

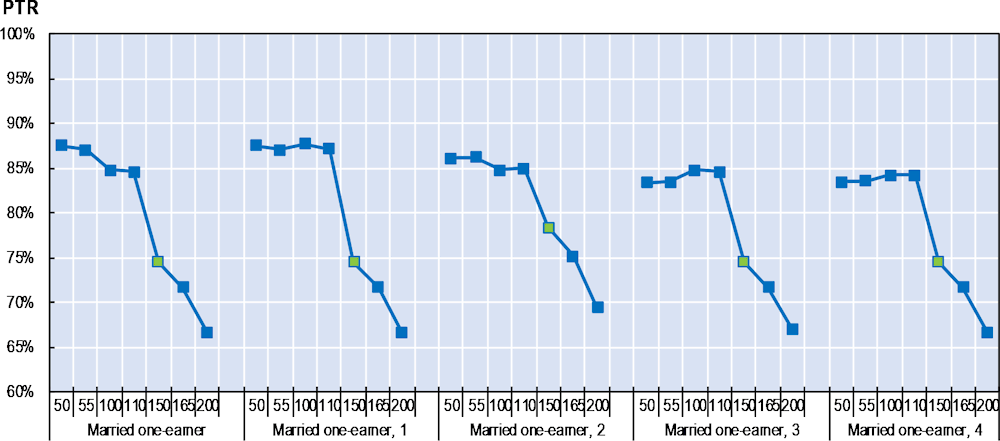

For one-earner couples, the incentives to enter work from unemployment for low to middle-income are relatively weak. The incentive for low to middle-income couples to enter work is relatively weak regardless of family size (Figure 4.18) since UBs are relatively high for short spells of unemployment (2 months of unemployment in this case, although the second adult not claiming UB in this modelling scenario). At higher incomes (at and above 150% of the AW), work disincentives improve but remain quite high.

For one-earner couples, the additional social assistance benefit available to larger families is likely too modest to meaningfully improve weak work incentives. Work is made modestly more attractive for low-income larger families with two or more children because of additional in-work social assistance benefit (which is greater for families with more children). However, the in-work social assistance benefit is more than offset by the work disincentives of lost benefits and higher taxes from working so that overall the additional in-work social benefit is unlikely to meaningfully enhance the already weak work incentives.

Figure 4.18. Unemployment traps are relatively high for low to middle-income one-earner couples

Short-term PTRs for one-earner couples with and without children (one adult transitioning to work from unemployment where unemployment period is 2 months) in Lithuania in 2020

Note: In the OECD TaxBen Model, the ‘first adult’ is transitioned from unemployment to work and claiming unemployment. The ‘first adult’ is assumed to have been unemployed for two months. The ‘second adult’ is unemployed and not claiming unemployment (in both cases, the same % of AW is used).

Source: OECD Tax and Benefit model TaxBen.

Second-earners face high unemployment trap risks

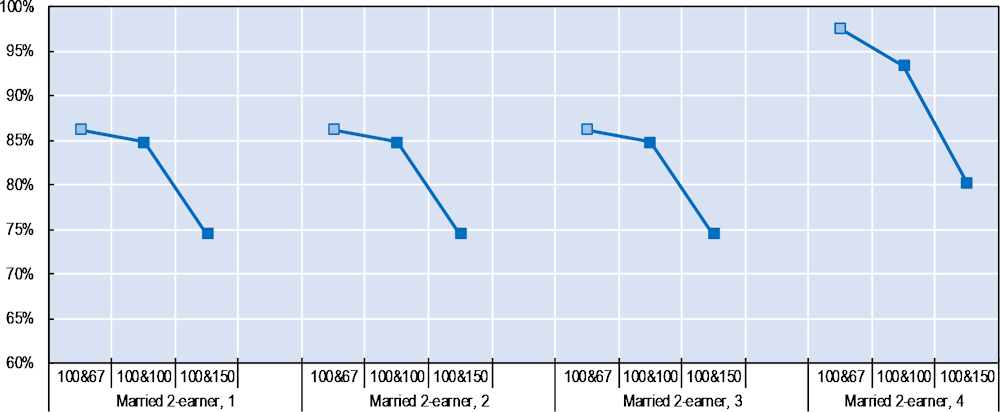

Second-earners, who are more likely to be women, tend to face lower work incentives and have higher responsiveness to work incentives than primary-earners. Second-earners have historically been, and still tend to be on average more likely to be women. The work incentives faced by second-earners are often lower than primary earners and the average tax wedges for second earners are often higher than for single individuals, which is reflected in lower participation rates. Second-earners tend to have a greater than average relative responsiveness to work incentives than other groups in most countries. Furthermore, non-tax measures such as childcare subsidies can also play a major role in the decision of second earner to enter work. Other measures such as flexible working and limited parental leave are also likely to encourage work. Given that many social transfers, including unemployment benefit, social assistance and housing support in Lithuania are targeted at low-income households, especially those with children, potential second earners in low-income households are most likely to face weak financial incentives to work.

Lithuania’s individual-based taxation could minimise reduced work incentives relative to family-based taxation. Lithuania operates an individual-based taxation system, as is increasingly the case in OECD countries (as opposed to family-based taxation). Lithuania does not have tax allowances or tax credits which often have family-based components. Lithuania does not face the higher work disincentives for second-earners that come with family-based taxation due to second-earners being immediately taxed at a higher marginal tax rate than individuals (i.e. the primary earner in a family-based taxation setting has already effectively used up the lower tax brackets and allowances leaving the second-earner to face higher marginal and average tax rates). Even where there is no family based taxation, many countries have benefits withdrawn on the basis of family income. Indeed, this is the case in Lithuania where social assistance benefit and other means-teste benefits are based on net family income. Therefore, by increasing their earnings second-earners in Lithuania risk reducing benefits producing a disincentive to enter work.

The incentives to enter work for low and middle-income second-earners in Lithuania are weak, particularly for those from larger families. Figure 4.19 shows the incentive for a second-earner in a married couple to enter work at different income levels (67%, 100% and 150% of the AW). The baseline case is that only one adult is earning an income of 100% of the AW and the second adult is claiming UB (assumed to be unemployed for a period of two months and their previous income is the same as the comparison in-work income). According to the analysis, second-earners with one, two and three children face the same equally low work incentives. Low-income second-earners have lower work incentives too. Low-income second-earners (at 67% of the AW) have a PTR of 86.1% compared to high-income second-earners (at 150% of the AW) who have a PTR of 74.5%. For second-earners in large families (with four children), work incentives for low-earners and middle-earners (at 67% and 100% of the AW) are even lower at 97.5% and 93.5% respectively, driven by reduced child benefits while in-work compared to unemployment.

Figure 4.19. Work incentives for low and middle-income second-earners are weak

METRs – Second earner income (at 67%, 100% and 150% of AW) versus one earner couple (at 100% of AW and unemployed adult claiming unemployment benefit) in Lithuania in 2020

Note: Two-earner couple earn 100% and 67%, 100% and 100% and 100% and 150% of the AW respectively. For one-earner couples, the ‘second adult’ earns 100% of the AW and the ‘first adult’ is assumed to be unemployed for a period of two months and receives unemployment benefit based on an assumed previous income which is the same as their in-work comparison level of income. Note that in the OECD TaxBen Model, the ‘first adult’ is transitioned from 67%, 100% and 150% of the AW the ‘second adult’ earnings is held the same at 100% of the AW.

Source: OECD Tax and Benefit model TaxBen.

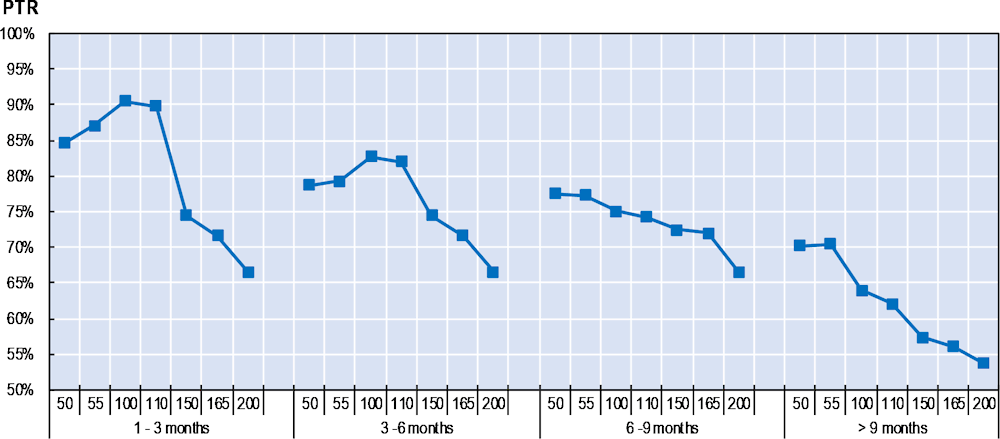

At longer unemployment spells, work incentives rise as unemployment benefits are cut

For parents in the first 6 months of unemployment in Lithuania, the largest contributor to work disincentives are unemployment benefits but this switches to taxes thereafter. UBs as a share of gross income fall at longer unemployment spells. For a single parent with two children at the AW after 2, 4, 7 and 10 months out-of-work, the share of the work disincentive (as measured by the PTR) associated with UBs is 49%, 41%, 33% and 22% (in social assistance) respectively (Figure 4.20). For the same family type in each of these unemployment states, the share of the work disincentive associated with PIT and SSCs remains constant at 17% and 20% respectively (so the total tax-related disincentive is 36%).

As parents remain out-of-work for longer spells, work incentives become increasingly strong due to progressively large relative declines in unemployment benefits. For single parents with two children at the AW, UB amounts decline from EUR 8,229 annually (at 2 months) by 16% to EUR 6,922 (at 4 months) by 19% to EUR 5,615 (at 7 months) and finally transition to social assistance benefit by declining 32% to EUR 3,828 (at 10 months). The fall in UB is caused by the decline of the variable UB rate in each subsequent quarter. The increasingly rapid drops in out-of-work UB provide an increasingly strong financial incentive to enter the workforce sooner rather than later after becoming unemployed.

The unemployment benefit cap increases work incentives for individuals with higher earning potential by making unemployment less attractive (particularly short-term). UBs (fixed and variable) are capped (at EUR 760.01 in Q1 2020 or 58.18% of the AW as calculated by Statistics Lithuania) regardless of unemployment duration. Consequently, the greater UBs available at shorter unemployment spells will be capped at lower (previously insured) incomes compared to longer employment spells. For a single parent with two children, the maximum UB is reached with a (previously insured4) income of just 114% of the AW after 2 months compared to 143% and 190% after 4 and 7 months respectively. Compared to having no cap, capping UBs reduces the benefit to (previously insured) high-earners – who are likely to have the potential to earn more - particularly for shorter unemployment spells, which in turn increases work incentives for high-earners. Given the UB cap’s role as redistributive mechanism in the design of the unemployment in Lithuania, and it’s potential to increase work incentives for higher-earners, a modest reduction in the cap could be considered.

Figure 4.20. The incentive to enter work falls with unemployment duration as unemployment benefits are progressively withdrawn

Short and long-term PTRs for different periods of unemployment, single parents with two children, Lithuania in 2020

Note: PTRs are for single parents with two children for longer unemployment spells corresponding to short-term PTRs (when families receive unemployment benefits at 2, 4 and 7 months respectively) and long-term PTRs (when families receive social assistance at 10 months). Analysis considers a single parent with two children in Lithuania and compares the in-work state with a range of out-of-work states.

Source: OECD Tax and Benefit model TaxBen.

As low-income parents transition to longer unemployment spells, work incentives continue to remain quite low

As parent’s transition from nine to ten months out-of-work, and unemployment benefits are replaced by lower social assistance benefit, work attractiveness rises sharply at high incomes but only modestly at low incomes. Since UBs at nine months are higher for higher income levels and unemployed social assistance is flat across incomes (for a given family type), moving from nine to ten months out-of-work implies that UBs will decline as a share of higher incomes. Consequently, work attractiveness rises significantly with higher incomes. At low (50% of AW), mid (100% of AW) and high incomes (150% of AW), PTRs fall from 77.5% to 70.3%, 75.0% to 63.9% and 66.6% and 53.7%. However, for low-income parents, work incentives still remain quite low even at longer unemployment durations.

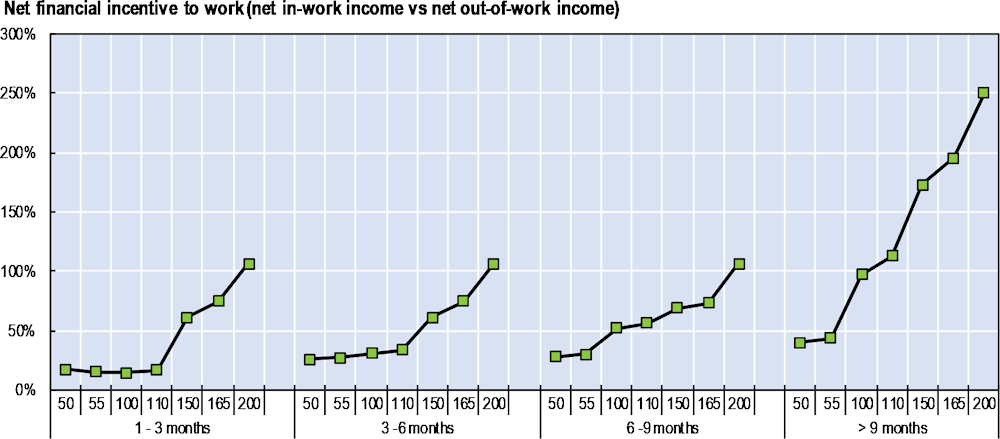

While the PTR measures the incentives produced by the tax and benefit system, more direct financial incentive measures could shed light on individuals incentives. While PTRs capture the incentives produced by the tax and benefit system as a share of gross incomes, it is not necessarily the case that they adequately capture the incentives that individuals respond to when considering entering work. A more direct measure of the financial incentive to work for individual decision-making (as opposed to assessing the role of the tax and benefit system) might be captured by the percentage increase in additional net earnings that an individual can gain from working instead of remaining unemployed. Unlike the PTR, this measure does not include gross income. Using this financial measure, Figure 4.21 shows that for a parent that is out-of-work for one quarter, entering work at 50%, 100%, 150% and 200% of the AW would increase net income by 17.4%, 14.9%, 61.0% and 106.6% respectively. Put differently, a high-income parent earning twice the AW, who is currently unemployed but who has the skills and opportunity to enter the labour market is in a position to more than double their net take-home income. While the probability may be low that a long-term unemployed parent have the skills and opportunities to find employment at the high earnings multiples suggested by this measure, the analysis highlights the importance of developing those skills and producing those opportunities. Despite this seemingly attractive incentive to more than double net income, the PTR associated with this same example is somewhat high at 66.6%. Similarly, in the case of a high-income individual earning twice the average wage on long-term unemployment (> 9 months), entering work would increase incomes by more than 250% but the associated PTR is 53.7%. These examples highlight the broader point that the PTR measures the work incentives produced by the tax and benefit system as a share of gross income, which can be different than more direct measures of the additional net income an individual can earn by working compared to unemployment. Consequently, it is useful to consider both measures in assessing the role of incentives on individual responses.

Figure 4.21. A more direct measure of financial incentive indicates a strong incentive to work for high-earners, if the right skills and opportunities were in place

The financial incentive to work*, single parents with two children, Lithuania in 2020

Note: *The financial incentive is defined as the percentage by which net income is larger in-work than out-of-work.

Source: OECD Tax and Benefit model TaxBen.

The incentives to progress in work

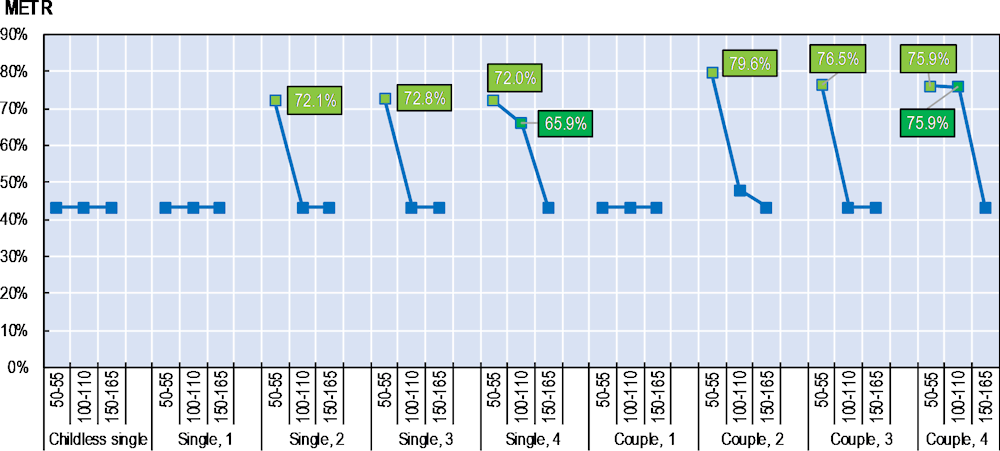

Larger low and middle-income single and couple families face high poverty trap risks

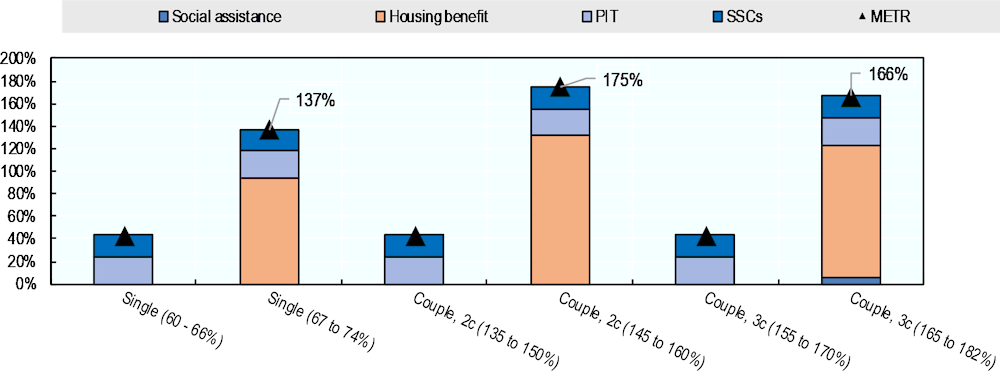

Poverty traps in Lithuania may exist among low-income families with two or more children and also among middle-income families with four children. The financial incentive to increase gross earnings by 10% among lower earners (from 50% to 55% of the AW) with larger families (with two or more children) is relatively low (as reflected in high METRs ranging from 70% to 80%) (Figure 4.22). The incentive to increase gross earnings by 10% is also low among middle-income families with four children. For all other family types and incomes shown, METRs are considerably lower (ranging from 40% to 50%). Drivers of the work disincentive include PIT and SSCs but also the withdrawal of social assistance benefit. Social assistance benefit protects low-income families but also produces work disincentives, which underscores the importance of reconciling redistribution and equity with efficiency (Table 4.1). This highlights the potentially important role of active labour market policies including linking benefits to participation in training programmes to prevent skill loss (Figure 2.20).

Figure 4.22. Poverty traps may exist among larger low-income families and large middle-income families

METRs associated with increasing income by 10% in Lithuania, various income levels and family types in 2020

Note: The calculation of the METRs is the same as the calculation of the PTR across two discrete income levels (i.e. where the out-of-work net income in this case is a lower income level) and the METRs take account of the taxation of additional in-work income plus the withdrawal of income-tested benefits. METRs for single individuals with no children, single parents with children and one-earner couples with children in Lithuania in 2020 for a 10% increase in gross incomes at 50%, 100% and 150% of the AW. Couples refers to one-earner couples and the non-earning adult is assumed not to be claiming unemployment. Housing benefits not included.

Source: OECD Tax and Benefit model TaxBen.

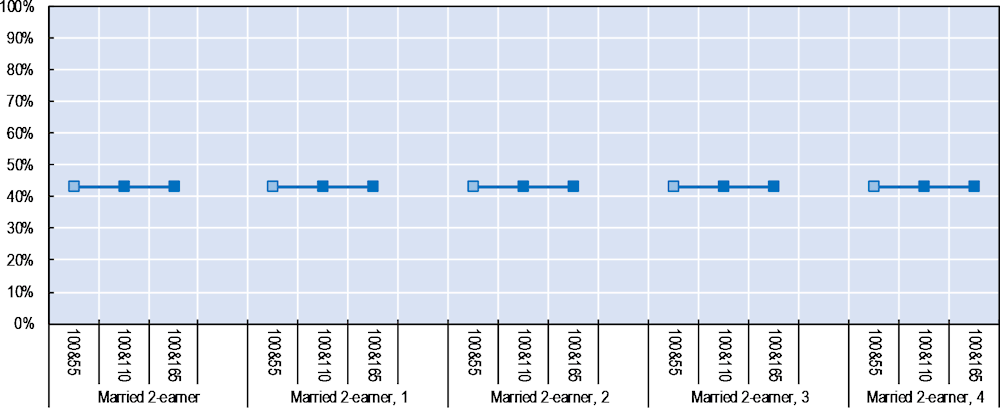

Second-earners are unlikely to face significant poverty traps

Once in employment, second-earners in a family have relatively high incentives to earn more partly because benefits are not withdrawn. Despite weak incentives to enter work for second-earners (Figure 4.19), the incentives to progress once in work are relatively high (METR is 43.3%) as there are no benefit withdrawals (Figure 4.23). Work incentives for second-earners are the same regardless of family size and income (for the low, middle and high income points shown). The constant METRs at higher incomes reflect a lack of labour tax progressivity in Lithuania at higher incomes (Figure 4.23).

Figure 4.23. Poverty traps for second-earners are low, regardless of family size and income

METRs associated with a 10% increase in second-earner income (at 50% to 55%, 100% to 110% and 150% to 165% of AW) in Lithuania in 2020

Note: Work incentives for second-earners to progress once in work by examining the METRs associated with a 10% increase in the earnings of second-earners. In the OECD TaxBen Model, the ‘first adult’ is transitioned from 50% to 55%, 100% to 110% and 150% to 165% of the AW and the ‘second adult’ earnings is held the same at 100% of the AW.

Source: OECD Tax and Benefit model TaxBen.

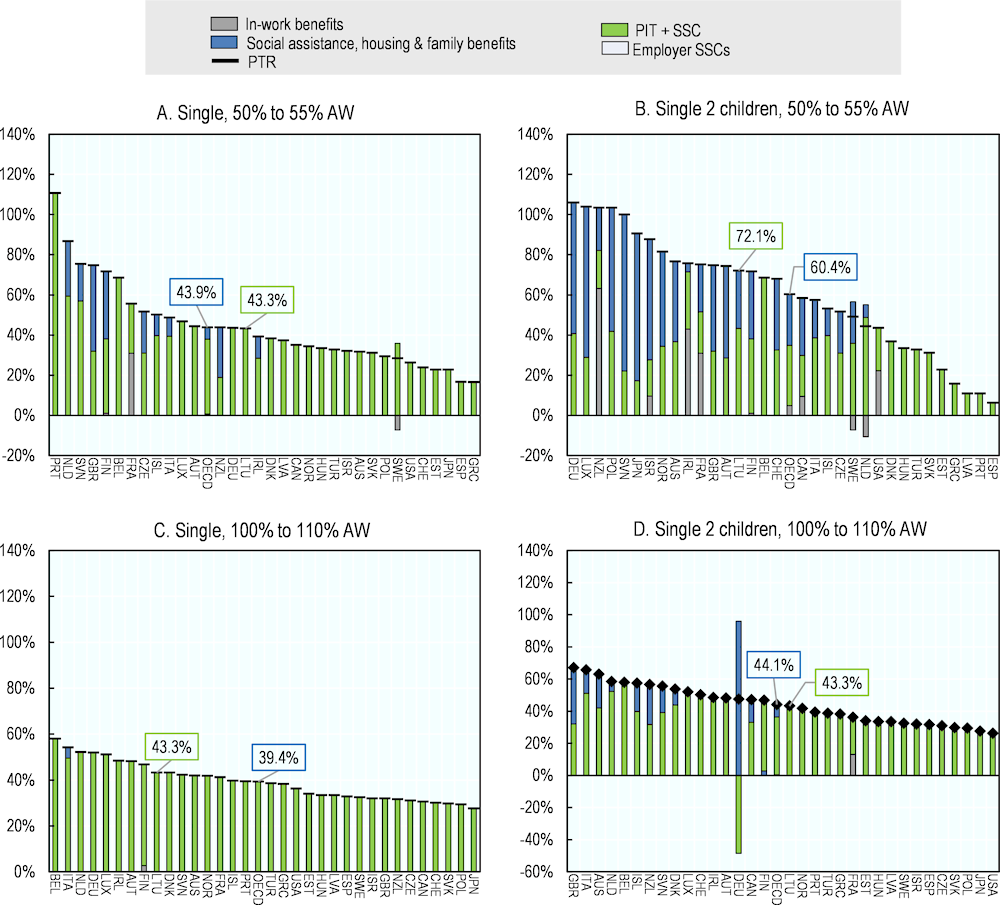

Middle-income large families are at risk of poverty traps in international comparison

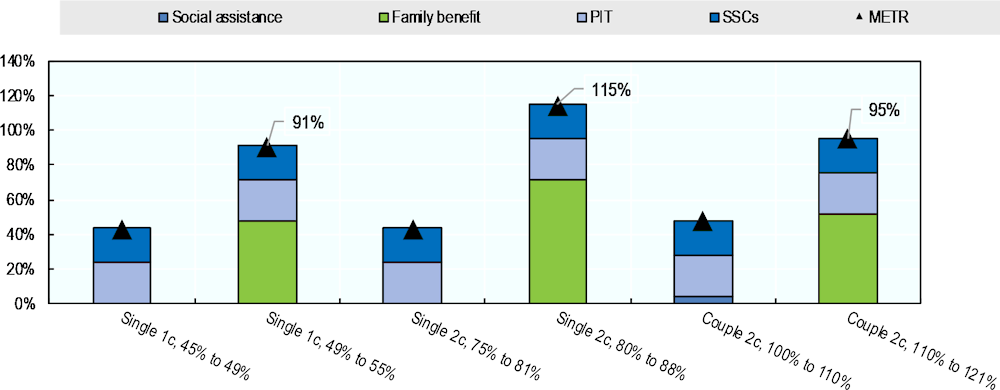

Low-income single families with two children may face some poverty traps. For low-income singles, the disincentive to increase earnings by 10% is similar to the OECD average (Figure 4.24, Panel A). The work disincentive is mostly driven by the additional PIT and SSCs that would be paid upon earning more. For low-income single parents with two children, the disincentive to work more is significantly higher than for singles without children and higher than the OECD average due higher taxes and the loss in social assistance benefit (Figure 4.24, Panel B).

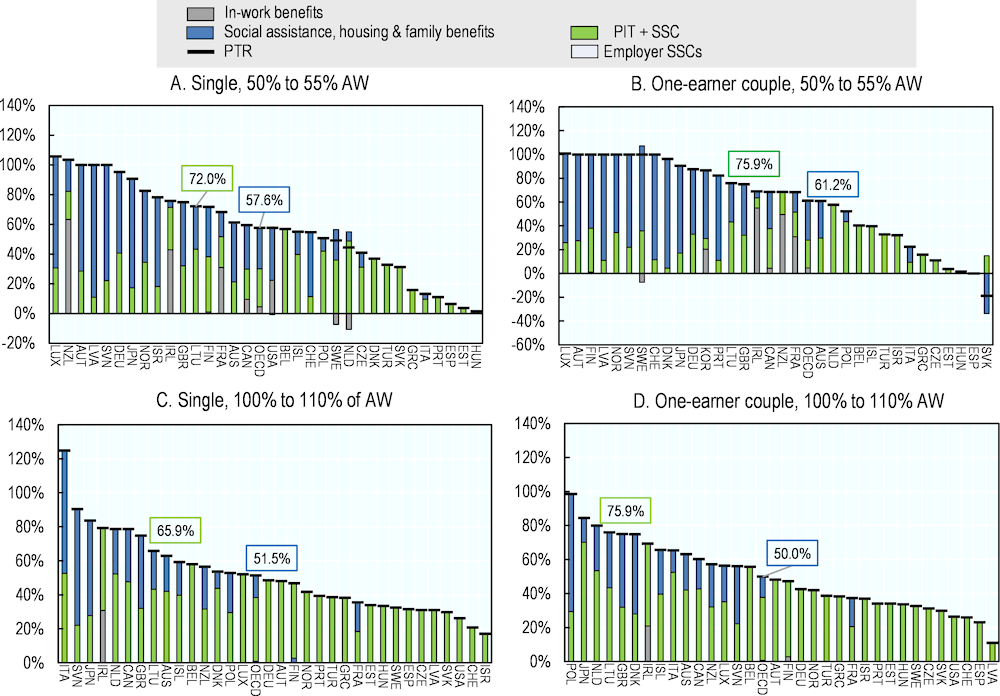

Large low and middle-income families in Lithuania have relatively lower incentives to progress in work by international comparison, producing potential poverty traps. For low-income large single families (with four children) the METR is high at 72.0%, driven by PIT and SSCs (43.3%) and the loss of social assistance (28.7%) vs the OECD average METR of 57.6% (Figure 4.25, Panel A). Similar results compared to the OECD are obtained for one-earner couple families (Figure 4.25). For middle-income large families, the disincentives to progress in work are similarly high and above the OECD average, driven mostly by taxes. For middle-income one-earner couples with four children, the disincentive to progress in work is higher due to a relatively larger loss in in-work social assistance benefit (since social assistance in Lithuania is increased per each additional person in the family including adults).

Figure 4.24. Low-income single families with children face high poverty traps in international comparison