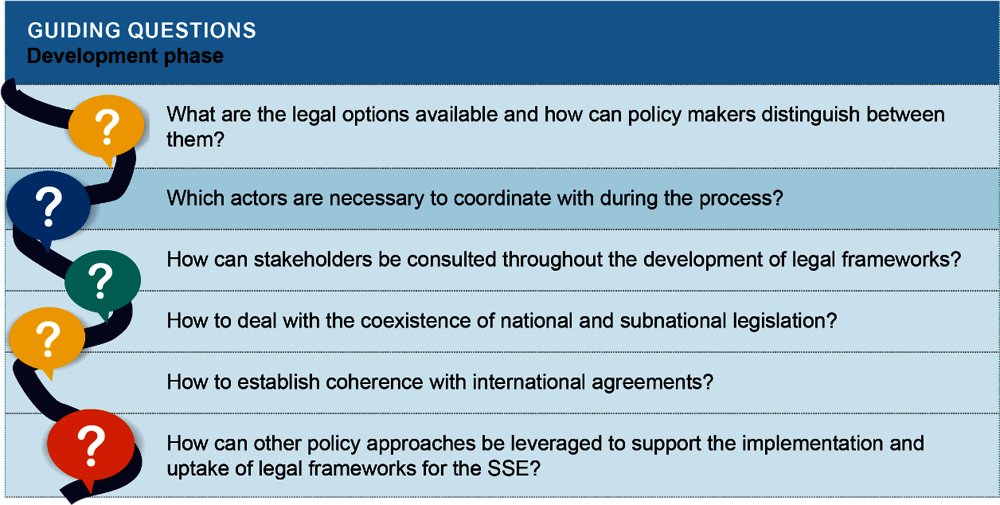

This chapter defines the steps needed to navigate through the development phase of legal frameworks for the SSE. It provides guidance on different approaches (statutory, substantial and hybrid) to use when designing framework laws as well as when to introduce or adjust legal frameworks, labels and statuses. Finally, the chapter highlights how best to engage relevant stakeholders to build consensus around a desired legal framework and to leverage complementary policy options in the development phase.

Policy Guide on Legal Frameworks for the Social and Solidarity Economy

2. Select legal options and involve stakeholders

Abstract

Why is this important?

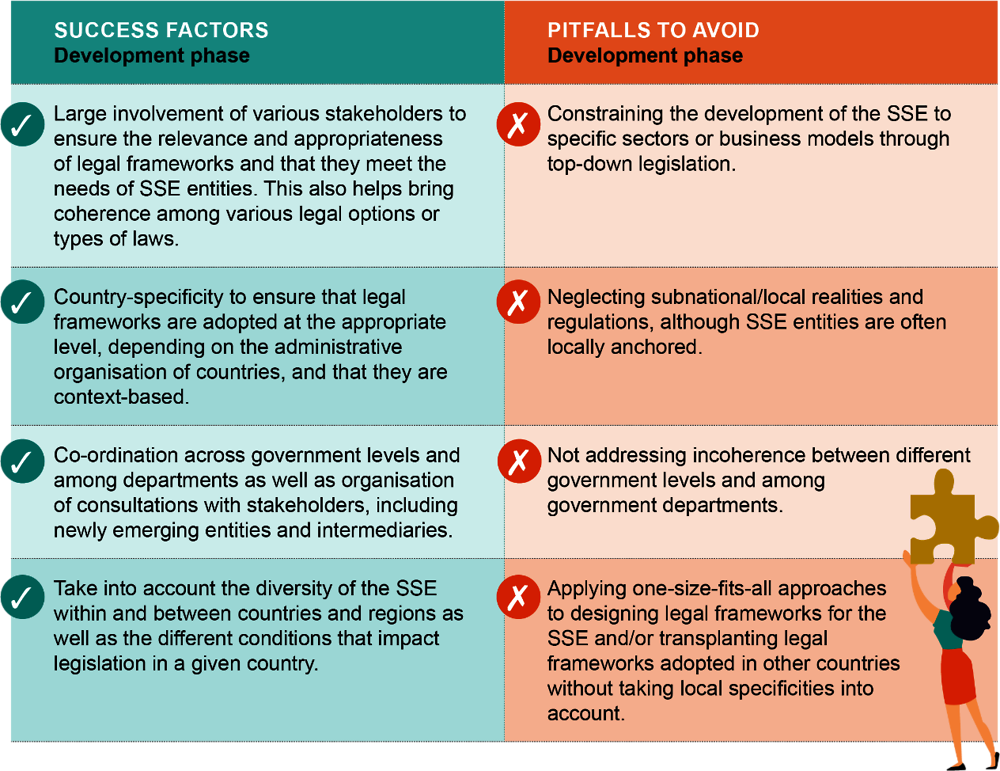

The process to develop legal frameworks can be challenging unless it benefits from comprehensive preparation and stakeholder involvement. Although there are no uniform trajectories to develop and implement social and solidarity economy (SSE) legislation (Jenkins, 2021[1]) there is a need for policy makers to develop a thorough understanding of some common elements needed for a successful law-making process, including political consensus, diverse and sustained stakeholder involvement, institutional commitment, co-ordination and appropriate timing. These considerations correspond to the development phase during which policy makers are presented with different options and approaches to SSE regulation and alternative policy measures that they can leverage to develop the SSE. Therefore, it is important to strike the right balance between tailoring legal frameworks to the diverse and often locally rooted SSE ecosystem on the one hand and avoiding fragmentation through “siloed” approaches to developing the SSE on the other hand.

This section will outline essential steps to navigate through the development phase. It will guide policy makers to select the appropriate legal approach for their country or region. It will provide guidance on determining the need for framework vs. specific laws, as well as the benefits of legal frameworks vs. other public policies. Additionally, it will discuss how to encourage stakeholder inclusion and how to achieve consensus among policy makers and the SSE field. It will also discuss opportunities to revise existing legislation and create coherence with existing legislation. Finally, it will explore alternative policy options that can be implemented without engaging in a complex and time-intensive legislative process.

How can policy makers help?

Infographic 2.1. Guiding questions: Development phase

Across countries the following success factors and pitfalls to avoid can help policy makers to achieve this objective.

Infographic 2.2. Success factors and pitfalls to avoid: Development phase

Determine the appropriate legal approach for the SSE

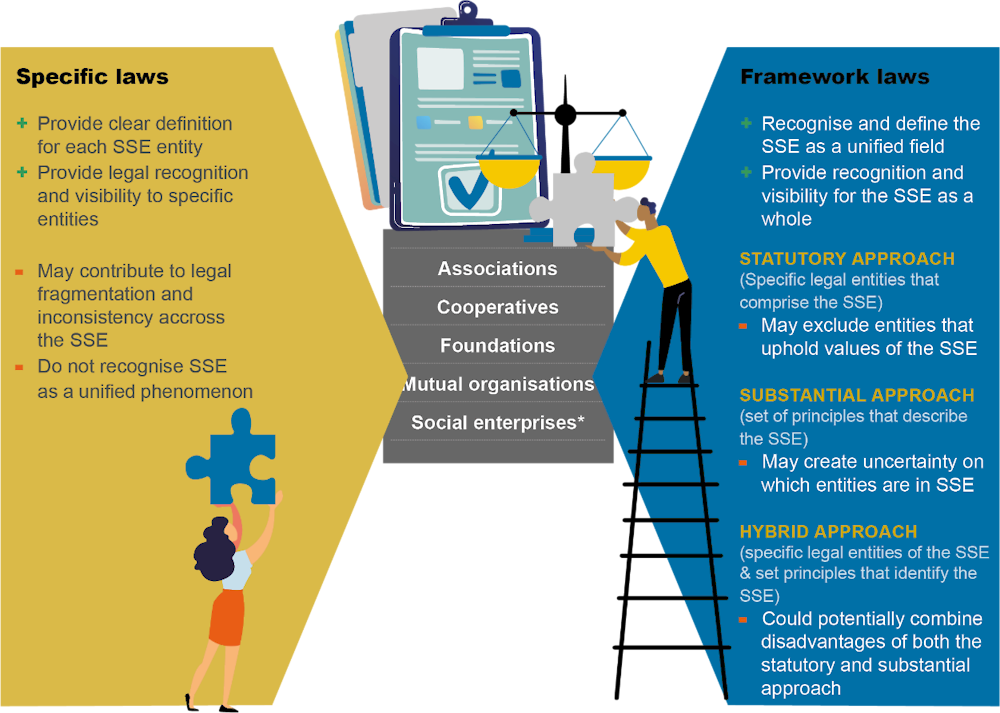

Identifying the available options for legal frameworks and gaining political support among elected officials and governments is a challenging but necessary step (see infographic 2.3). This often requires raising awareness about the specific social and economic benefits of the SSE as well as foster understanding of the specificities, benefits and needs of different SSE entities. With this, policy makers are better equipped to understand and chose among different options for legislation. Depending on the administrative organisation of a country, competences for the development of legal frameworks might be spread out or shared among national and subnational lawmakers.

Infographic 2.3. Overview of impacts of framework and specific laws for the SSE

Note: social enterprises are not a specific legal form, but rather can take a diversity of legal forms (including, associations, cooperatives and foundations for example) and legal statuses.

Source: (OECD, 2022[2])

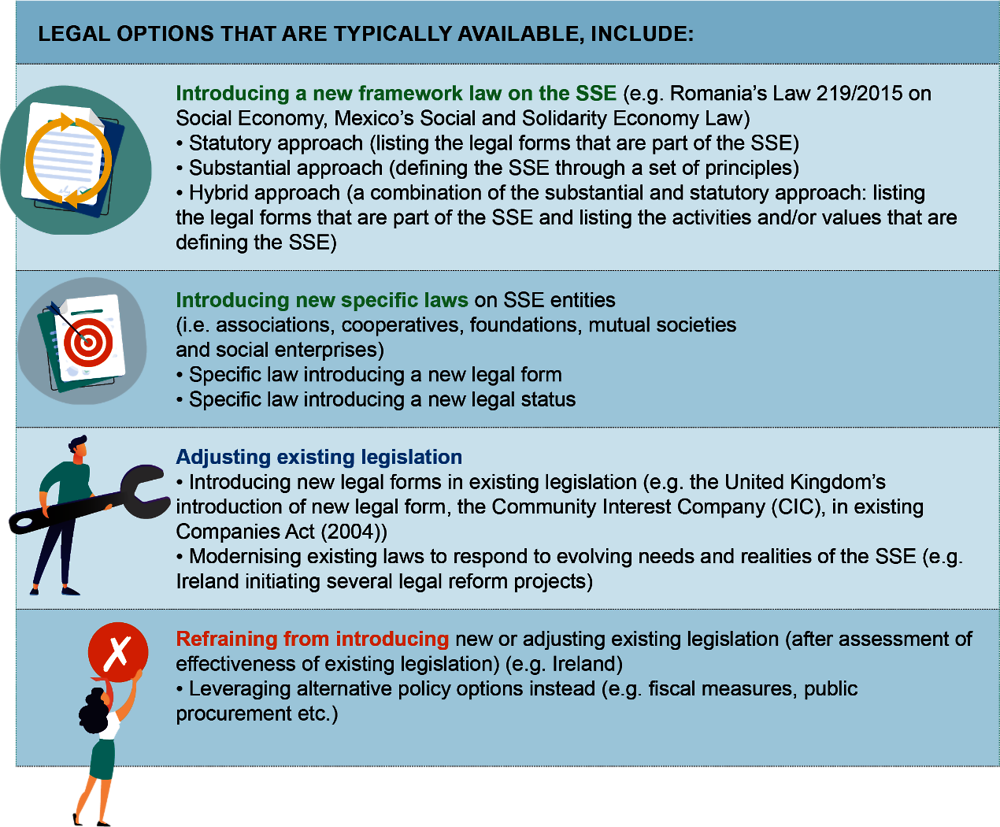

Grasp and distinguish the different legal options available

Countries where the distinct aspects of the SSE ecosystem are integrated (i.e. cooperatives, social enterprises, associations, mutual societies and foundations recognise themselves as part of the same phenomenon) tend to place emphasis on an overarching and substantial approach to legal frameworks. In these countries (e.g. Canada (Québec), France, Portugal and Spain), the SSE ecosystem tends to be well-developed and its components are supported by specific policies and strategies (fiscal measures, public procurements, etc.). In this context, specific laws that regulate certain SSE entities already exist before the notion of the SSE has emerged. This can be particularly observed with regards to more “traditional” SSE entities, such as associations, cooperatives and foundations, that are often regulated by long-established laws. With a subsequent adoption of framework laws countries seek to provide an official definition of the SSE and recognition to its specific governing rules and principles. Legal frameworks also help mainstream the various contributions of the SSE to other policies and strategic objectives.

Countries where the SSE ecosystem is developed but not integrated tend to privilege legislation on specific entities: in these countries, the SSE ecosystem is developed but not fully supported by tailored policies that could create a high level of integration between its different components (e.g. Brazil, India,). In this context, the approach to legal frameworks is more focused on defining entities and not on creating a general legal framework for the SSE.

Infographic 2.4. Options for legal frameworks on the SSE

Source: Authors’ elaboration

Introduce framework laws

Framework laws signal a clear intention of parliaments to frame a whole-of-government approach to develop and mainstream the SSE across sectors and policies (Hiez, 2021[3]). They can outline the principles and values of the SSE, define the SSE and its entities (e.g. Mexico) and support its development. Framework laws have been adopted in some countries at the national (e.g. France, Greece, Mexico, Romania, Spain, and Portugal) or subnational level (e.g. Province of Québec, Canada) (Poirier, 2016[4]). The approach used to clarify the SSE can also vary by country and even region (e.g. notions of the social economy, the solidarity economy or the third sector) (see also Annex D). Framework laws usually do not offer a comprehensive repository for all types of SSE entities. This is why they are most often preceded or complemented by specific laws (Hiez, 2021[5]). Framework laws are used to achieve a range of policy objectives and thus vary in form and function. Some define and raise the visibility of the social economy whereas others also assign specific responsibilities to government institutions to support the SSE or even regulate specific SSE entities.

There are three approaches to defining the SSE when designing framework laws, with each having advantages and disadvantages. Hence, policy makers need to assess which of these approaches best fits their context.

The statutory approach enlists the existing legal forms that are considered part of the SSE. According to the OECD, the following legal forms are part of the SSE: associations, foundations (including charities), cooperatives and mutual benefit organisations, as well as social enterprises, provided they are legally recognised through legal forms and/or statuses. Besides these forms, country-specific legal forms can be added as well (e.g. ejidos in Mexico1, misericórdias in Portugal2). The advantage of the statutory approach is that it provides legal certainty and clarity, as SSE entities are recognised based on their legal form. The advantage is apparent when governments want to harness SSE entities for certain policy objectives. The disadvantage is the formalistic character of this approach causes the recognition to be based on legal forms, regardless of the activities that are undertaken by the entities and the existence of their potential impact and benefit to society.3 Conversely, it is possible that certain entities are considered SSE entities without in reality creating a social impact.

The substantial approach defines the SSE through a set of principles (Hiez, 2021[3]). Regardless of their legal form, entities are qualified as part of the SSE based on the activities they undertake, their sector or their specific values etc. Some countries, such as Luxembourg have adopted a substantial approach and define the guiding principles and values of the SSE. The advantage of the substantial approach is its inclusive and wide approach, regardless of the legal form of the SSE entity (Hiez, 2021[3]).The disadvantage is the mere difficulty regarding the recognisability and enforceability. It requires more control to verify whether an entity is part of the SSE. Furthermore, the substantial approach does not provide clear criteria which makes it difficult for the general public to recognise SSE entities. Labels and statuses might provide a solution for this.

Often, countries decide to adopt a hybrid approach that combines the statutory and substantial approaches. This hybrid approach recognises SSE entities based on a list of legal forms that are considered to be SSE entities, regardless of the undertaken activities (“statutory approach”), and then a list of activities or values that are considered to be part of the SSE (“substantial approach”). The advantage of the hybrid approach is that it has the potential to combine the advantages of both the statutory and the substantial approach. On the flipside, this also means a risk of conflating the disadvantages of both approaches. Examples of the hybrid approach are the French Law on Social and Solidarity Economy, the Portuguese Social Economy Law (2013), the Bulgarian Law on Social and Solidarity Economy Enterprises (Box 2.1) and the Greek Social and Solidarity Law (2016) (Box 2.2) that all define the values of their respective SSE, while at the same time enlisting the different legal forms that are considered to be SSE entities.

Further examples include the 2011 Law on the Social Economy in Spain that defines the guiding principles of the social economy entities and lists the specific entities that are included in the social economy. Likewise, the law opens to “those entities that carry out economic and entrepreneurial activity, whose operating rules comply with the principles listed in the previous article” (article 5). Similarly, Mexico’s Social and Solidarity Economy Law (2012) defines the aims of the SSE as well as the principles and values of its entities while providing a list of the legal forms being part of the Social Sector of the Economy. This list also includes “all forms of social organisation for the production, distribution and consumption of socially necessary goods and services” (article 4), showing openness to other forms than the ones clearly identified.

Box 2.1. Framework Law (Bulgaria)

Bulgaria adopted a framework law on the SSE in 2018. Broadly speaking, the Act on Enterprises of the Social and Solidarity Economy serves three purposes: defining the SSE, its principles and is components; empowering national and local authorities to promote the SSE; and establishing a register of social enterprises. The Act defines the SSE as “a form of entrepreneurship aimed at one or several social activities and/or social goals, including by the production of various goods or the provision of services in co-operation with state or local authorities, or independently”. It identifies five overarching principles of the SSE1 and classifies three types of entities as “subjects of the social and solidarity economy”, namely cooperatives, not-for-profit legal persons operating for public benefit and social enterprises.

The Act explicitly provides multiple levels of government with the ability to promote the SSE. At the national level, the Minister of Labour and Social Policy is responsible for promoting the SSE and social enterprises by assisting dialogue on the subject and promoting inclusion of stakeholders within SSE related initiatives. The Minister is tasked with helping them find specialised funding for their activities, organising training campaigns to develop their managerial capacity and maintaining a distinct certification brand for social enterprises as well as their goods and services. Additionally, the Act requires the Minister to co-ordinate with the National Statistical Institute to develop indicators for the SSE. Local governments are also encouraged to help SSE entities by supporting access to electronic platforms, developing support programmes at the municipal level, and cooperating with SSE entities. These measures may help to facilitate greater cross-government support for the SSE and equip policy makers at all levels of government to utilise a range of public resources to support SSE entities.

Entities of any legal form may apply to be listed on the register of social enterprises as established by the Act. Entities registered as social enterprises can qualify for incentives provided by public authorities such as a certification label on their products and greater support from local authorities, including access to finance and municipal property. While recent data on the number of social enterprises listed on the register remains unavailable, the European Commission estimates that over 3800 social enterprises were active in Bulgaria as of 2015. One notable feature of the register is the division of social enterprises into two categories: Class A or Class A+. Class A social enterprises meet four criteria: their activities generate social value as defined by the Minster; they are managed in a transparent manner with stakeholder participation throughout the decision-making process; at least 50% of after-tax profits are spent on social economy purposes; and, no less than 30% of employees are from a defined list of disadvantaged groups. Class A+ social enterprises meet all of these criteria but must also operate in areas with high unemployment, spend at least 50% (minimum BGN 75 000) of their post-tax profits on their social mission, and employ at least 30 persons from disadvantaged groups.

1. Priority of social over economic objectives; association for public and/or collective benefit; publicity and transparency; independence from state authorities; and participation of members, workers or employees in managerial decision-making.

Box 2.2. Framework Law (Greece)

In 2011, Greece approved the first law regarding social economy and social entrepreneurship (Law 4019/2011). The 2011 Law was replaced in 2016 by the framework law on Social and Solidarity Economy (Law 4430/2016) with the aim to clarify and simplify the Greek legal framework for the SSE, as well as to spread SSE practices in all potential fields of economic activity. Law 4430/2016 has introduced a series of new terms (e.g. social innovation, social benefit, collective benefit) to Greek legislation. Moreover, it attempts to unify the Greek SSE by recognising three different legal entities (Social Cooperative Enterprises (Koin.S.Ep), Social Cooperatives of Limited Responsibility and Employees’ Cooperatives (Koi.S.P.E)) as constituents of the Greek SSE sector by default. Additionally, the law broadens the SSE spectrum to include other legal forms provided they meet the given criteria (e.g. democratic decision-making, redistribution of profit).

In a similar vein, Law 4430/2016 expanded the registry of SSE entities to accept all legal forms that obtain the status of an SSE entity (previously the registry covered only for Koin.S.Ep and Koi.S.P.E). Run by the Ministry of Labour, Social Security and Social Solidarity (MoL), the registry is operated as an online database and consists of two subcategories: one registry in which the registration is mandatory for Social Cooperative Enterprises, Social Cooperatives of Limited Responsibility and Employees’ Cooperatives, while a second registry is open for all other legal forms that conform to the criteria set out in the 2016 Law. Thus, not all entities, which may be de facto social economy entities, are actually appearing in the registry. Nevertheless, the number of registrations has been gradually increasing since 2012, with a total number of 1,737registered SSE entities in May 2020.

Despite achieving notable breakthroughs, Law 4430/2016 has been criticised for creating legal ambiguity as well as conflicts with other laws, and for restrictive clauses, in particular the percentages on re-distribution of profit, reinvestment and employability, which are difficult to comply with for some entities, and even challenge the viability of their business model.

Introduce specific laws to define legal forms or legal statuses

Specific laws address SSE entities, namely associations, cooperatives, foundations, mutual societies and social enterprises. They impact the ability of SSE entities to engage in economic and social activities as they define their legal nature as well as governance structure and rules (Hiez, 2021[3]). Some specific laws provide a broad definition of the social economy (e.g. Luxembourg). Many countries developed specific laws which provide details about legal forms/statuses, governance rules of SSE entities, and in some cases tax benefits they are entitled to. Often specific law on SSE entities were created even before the notion of the SSE came into use. Thus, some countries have revised existing specific laws to ensure alignment with and/or implementation of the general principles set out in subsequent framework laws (e.g. France).

Specific laws introduce legal forms or legal statuses. A legal form is the legal structure adopted by an entity, such as an association, or cooperative or limited liability company (ESELA, 2015[11]). Legislation that defines legal forms for SSE entities establish specific purposes and set specific rules on the ownership, governance structure as well as distribution of profit, and governance control of organisations to distinguish them from other legal forms such as standard companies. A legal status, or qualification, can be adopted by a number of legal forms – for-profit and not-for-profit – based on the compliance with certain criteria such as asset lock, and stable and continuous production of goods and services (European Commission, 2020[7]). A legal status can have an impact on the treatment of those legal forms, for example, the fiscal treatment (ESELA, 2015[11]).

Based on the findings of the OECD scoping paper, policy makers should at least consider the implementation of specific statutory laws on associations and cooperatives, as these are the most used legal forms by the SSE in most countries (OECD, 2022[2]), (see Annex C for more details). The implementation of specific laws on foundations, mutual benefit societies and social enterprises can be useful for certain policy objectives but are subordinated to the need of specific statutory laws on associations and cooperatives.

Introduce laws to establish legal statuses

Framework laws or specific laws can introduce labels or statuses through which entities can be recognised as part of the SSE, regardless of their legal form. A legal status, or qualification, can be adopted by a number of legal forms – for-profit and not-for-profit – based on the compliance with certain criteria such as asset lock4, and stable and continuous production of goods and services (European Commission, 2020[7]) (Box 2.3). A legal status has an impact on the treatment of those legal forms, for example, the fiscal treatment (ESELA, 2015[11]). In countries that have adopted a substantial approach, a hybrid approach or countries without framework law, policy makers could consider the implementation of a status, label, or registration scheme for SSE entities. For example, in 2014, France adopted the Framework Law on the Social and Solidarity Economy which introduced the ESUS label (solidarity enterprise of social utility) enabling commercial companies to enter into the SSE ecosystem as long as they complied with the requirements of the law (OECD, 2022[2]).

The main advantage of a label or status is the recognisability for the general public and the legal certainty for SSE entities. The label or status makes it a widely recognised anchor point and facilitates the channelling of policy measures. Countries such as Italy, Germany and Hungary and the Netherlands award public benefit status to various types of SSE entities which enables them to qualify for specific tax exemptions and/or reductions depending on their type of operations (OECD, 2022[2]). The disadvantage of a label is its high cost. There must be some procedure in place to check whether an organisation fulfils the criteria to be granted the label. Furthermore, labels require a systematic follow-up system with renewal options after a certain period of time. As government agencies are often faced with a lack of resources, the undertaking of such checking procedures might be considered as an additional burden.

In federal states, there is an increased risk that labels and statuses are diffused across different levels, if both federal regional governments share legislative authority for them. The lack of alignment across levels of government may create conflicts of norms and uncertainty, thus undermining coherence and consistency of legal frameworks. Overlapping initiatives could be avoided by an integrated approach. But the coexistence does not necessarily bring confusion insofar as the area of application of each norm is clearly defined to avoid any contradictory provisions. In Belgium, the Brussels-Capital Region introduced in 2018 a specific “social enterprise” legal status available to all legal entities provided that they conform with a set of criteria; this regional legal status co-exists with the “social enterprise” legal status, only available for cooperatives, introduced at the federal level in 2019.

The introduction of labels and statuses might not suffice as a stand-alone policy measure. Therefore, they should be complemented with additional policy measures. In 2014, Denmark adopted the Act on Registered Social Enterprises, which introduced amongst others the registration tool for social enterprises (Registreret Socialøkonomisk Virksomhed (RSV)). All legal forms with limited liability are eligible to be accredited by this voluntary legal status of social enterprise if they comply with a specific set of criteria. However, the uptake of this registration possibility was rather underwhelming at first, probably due to a lack of awareness of the register among eligible entities. The Committee on Social Economy, an informal working group with high-level stakeholders that emerged in an effort to sustain the policy initiatives already in place, recommended to provide guidance, fiscal and financial incentives, training opportunities and support for public procurement upon registration in order to strengthen the uptake of the legal status.

Box 2.3. Statuses and registration schemes for social enterprises

Some countries use certification and registration schemes to verify that social enterprises meet certain criteria. In 2014, Denmark introduced the Act on Registered Social Enterprises. Based on this act, social entrepreneurs were able to register themselves as social enterprises when they met five criteria: (i) the enterprise must have a social purpose which is “a primary purpose that is beneficial to society with a social, cultural, employment-related, health-related or environmental aim.”, (ii) significant commercial activity, (iii) independence of public authorities, (iv) inclusive and responsible governance, and (v) a social management of profit which means that the social enterprise must spend its profits on social objectives or reinvest them in the enterprise.

Another example is the Italian “Social Enterprise” label, eligible to every legal entity that meets certain criteria. This includes an entity (association, foundation, cooperative, company forms) that pursues activities of civil, solidarity and general utility purposes and that generates at least 70% of its revenues in one or more sectors specified in the Legislative Decree (health care, environmental protection, enhancement of cultural heritage, etc.). Alternatively, this label can also be obtained independently from the sector of activity by organisations that conduct entrepreneurial activity oriented to inclusion of disadvantaged or disabled workers/people in the labour market.

Some countries require a certification process for SSE entities. For example, Community Interest Companies in the United Kingdom have to pass the community-interest test executed by the Community Interest Regulator before they can incorporate as a Community Interest company. The test checks whether the purposes of the company “could be regarded by a reasonable person as being in the community or wider public interest.” Likewise, Korean SSE entities that want to obtain the “social enterprise” label under the Social Enterprise Promotion Act (2007) are required to go through a certification process of the Ministry of Employment and Labour.

Issuing a limited-duration recognition is another method to ensure the SSE-character of social enterprises. French entities that are recognised as ESUS (solidarity enterprise of social utility) are only certified as such for five-year periods. Similarly, the Association for Finnish Work issues three-year certifications for social enterprises. This approach is often used for specific accreditation schemes, such as the one recognising Work Integration Social Enterprises in a range of countries. This approach ensures that formally recognised SSE entities periodically undergo subsequent evaluations to verify that they still qualify.

Source: adapted from (OECD, 2022[2])

Adjust existing legislation or refrain from any legislative action

After careful assessment of the conditions and needs for legal frameworks, policy makers might choose to adjust existing legislation or refrain from any legislative action at all. Countries that already have an extensive body of law regulating different legal forms used by SSE entities (often this is a companies act or corporations act that pools different legal forms), might prefer to alter existing legal frameworks instead of introducing new legal framework. For example, the United Kingdom adjusted their existing Companies Act to introduce the Community Interest Company as a new legal form for social enterprises (Box 2.4). Adjusting existing legislation can also be used as to respond to the evolving needs and realities of the SSE ecosystem and to harmonise the legal landscape, by removing barriers or inconsistencies. For example, the Irish government has initiated several reform projects on laws applicable to SSE entities (Box 2.5).

Box 2.4. The United Kingdom’s introduction of the Community Interest Company (CIC)

Social enterprises in the United Kingdom can choose from a variety of legal forms, such as Community Benefit Society, Community Cooperative Society or Company Limited by Guarantee (CLG). However, the only legal form specifically designed to enable and regulate social enterprises is the Community Interest Company (CIC) that was introduced by the British government as part of the 2004 Companies Act, following a range of consultations between the British government and the social enterprise sector from 2002 to 2004. The CIC was established as a new type of limited company designed for social enterprises whose activities operate for the benefit of the community rather than for the benefit of the owners of the company. It is conceived as being flexible in terms of organisational structure (community co-operative, single member company) and governance arrangements (limited by guarantee, limited shares) while still providing limited liability.

The 2004 Companies Act also established the Office of the Regulator of CICs that is charged with deciding whether an organisation is eligible to become, or continue to be a CIC, as well as supporting the growth of CICs through “light touch regulation” and guidance on CIC matters. All CICs are required to deliver an annual report that is made available for the public. These reporting and disclosure requirements contribute to building legitimacy of the CIC among the general public and potential investors.

The CIC form has been central to the development of the social enterprise sector in the United Kingdom, with just over 200 CICs registered in the first year (2005-2006) and steadily growing to 18 904 CICs in 2019-2020. Moreover, the introduction of CICs offered an important precedent for other, subsequent developments of social enterprise organisational forms elsewhere. For example, the Canadian province of British Columbia introduced Community Contribution Companies (C3s) through an amendment of their Business Corporations Act in 2012. In June 2016, Nova Scotia (Canada) passed the Community Interest Companies Act allowing a business to be designated as a Community Interest Company.

Box 2.5. Modernising legal frameworks (Ireland)

Irish SSE entities adopt a variety of structures, from unincorporated ones (e.g. associations) to incorporated ones (e.g. Company Limited by Shares, Company Limited by Guarantee). Despite the introduction of amendments, many laws regulating such legal structures contained antiquated provisions and did not reflect the realities of the 21st century business and regulatory environment. Consequently, the Irish government initiated several legislation reform projects, namely the modernisation of the Companies Act as well as the currently ongoing project on Co-operative Societies legislation through which the co-operative model will receive specific legal recognition. There are no marks, labelling schemes or certification systems for SSE entities in Ireland but incorporated and unincorporated SSE entities can obtain a charitable status that allows for tax exemptions.

Until these changes, Irish cooperatives have primarily been operating under the Industrial and Provident Societies (IPS) Acts 1893-2021 that are considered no longer fit for purpose. Hence, the Department of Enterprise, Trade and Employment has completed a comprehensive review of the existing statutory code including consultations with stakeholders in 2009, 2016 and 2022. The responses received have informed the work on proposed legislation to repeal the IPS legislation and provide a modern legislative framework for Co-operative Societies as an attractive alternative to the company law model. The provisions will be similar in approach to the Companies Act 2014 but tailored to the distinctive characteristics of cooperatives and introduce modern corporate governance, accounting, compliance, and reporting requirements.

Despite not having a single overarching legal framework dedicated to the SSE specifically, Irish laws applicable to SSE entities have undergone or are currently undergoing modernisations. In exploring the design of new laws as well as in modernising existing laws, Ireland follows the recommended three-step approach of scoping, developing and evaluating legal frameworks.

Developing a conducive policy ecosystem can spur SSE development in the absence of legal frameworks. As adopting legal frameworks is often a complex and time-intensive process, it may sometimes be preferable to pursue other policy levers before proposing new legal frameworks. In some countries, SSE entities are not fully regulated. However, other targeted policies (e.g. national or subnational strategies, action plans etc.) put in place to support SSE development can lead to the development of a conducive ecosystem, even in the absence of comprehensive legislative measures (OECD, 2022[2]) For example, despite the lack of any national legal framework for the SSE, local governments in the Netherlands have successfully utilised public procurement and other strategies to support social enterprise development. As such, Amsterdam, Harlem, the Hague and Rotterdam support SSE entities, in particular social enterprises, with several programmes and action plans and by facilitating their access to resources through strategic collaborations (Platform31, 2020[23]). Even without any supportive national legislation or legal status, the number of social enterprises in the Netherlands is estimated to have nearly doubled between 2010 and 2016 (European Commission, 2020[7]). This outcome highlights how, under certain circumstances, policy ecosystems can stimulate the SSE development or the development of certain SSE entities despite the lack of specific legislation.

Strategies, action plans and other pubic polices can provide less complex and time-intensive ways to clarify core ideas of the SSE and coordinate government action. In contrast to legislation, public policies, however, lack standing and permanence, as changes in government can affect the attention and resources allocated to the SSE. In Denmark for example, the ecosystem for social enterprise has gone through a considerable degree of fluctuation in the decade between 2007 and 2018, as political decisions were “zig-zagging” in terms of legal and financial measures for social enterprises (Hulgård and Chodorkoff, 2019[24]; Andersen, 2021[25]).

Although legislative action is the most appropriate way to implement framework laws, there are examples of implementing a framework policy without legal intervention. In Bulgaria, the Council of Ministers adopted the National Social Economy Concept in 2014, thereby determining the objectives of the Bulgarian policy on social economy (European Economic and Social Committee, 2018[26]). Another example is Scotland (Box 2.6), where alternative policy options are used to shape the social enterprises space, instead of legislation for which competences are shared with the United Kingdom.

Box 2.6. Alternative policy options for social enterprise development in Scotland

Social enterprise development in Scotland is impacted by the distribution of legislative competencies between the Scottish Parliament and United Kingdom Parliament. Scotland is part of the United Kingdom, but a process introduced in 1999, known as “devolution” allowed the Scottish Parliament to decide on certain matters without needing the approval from the United Kingdom Parliament. The Scotland Act 1998 established, under the topic of Industry and Trade, that “the creation, operation, regulation and dissolution of types of business association” is a matter of the United Kingdom Parliament, meaning that they are the law-making body for topics such as social enterprise legislation. The Scottish Government cannot legally define what a social enterprise is. Moreover, the diversity of entities that could potentially be labelled as social enterprise makes this task more difficult. Nevertheless, the Scottish Government describes them as “businesses with a social or environmental purpose, and whose profits are re-invested into fulfilling their mission. They empower communities, tackle social problems, and create jobs - particularly for people who are at a disadvantage in the standard jobs market” (Scottish Government, n.d.[27]).

Given the distribution of legislative competences, Scotland uses alternative policy options, rather than legislation, to foster social enterprise development. For example, in 2016 Scotland's Social Enterprise Strategy 2016-2026 was released setting out a comprehensive and long-term programme to develop the social enterprise sector. Furthermore, the Scottish Government supports the undertaking of a census on social enterprises every two years to understand their size and needs. So far, three Census Reports have been published showing an upward trend in most of the key indicators, such as number of entities, full-time employees and gross value added to the economy. The Scottish Government also directly funds initiatives such as the Just Enterprise programme (tailored business support to social enterprises), the Social Growth Fund (access to loans for social enterprises), and Firstport (Scotland’s agency for start-up social entrepreneurs). Lastly, the Scottish Government supports social enterprises through public procurement, as every public body is required by the Scottish Sustainable Procurement Action Plan to have at least one contract with Supported Businesses that are social enterprises where at least 30% of the workers are people with a disability or from disadvantaged groups.

Engage stakeholders and build consensus around a desired legal framework

Coordinate vertically and horizontally with government bodies

Policy makers aiming to develop legal frameworks should coordinate across different ministries/departments and levels of government. Considering the diversity and transversality of the SSE, various authorities might have competences on matters that are related to the SSE (e.g. labour, social affairs, corporations). The competent legislative body (national, regional, local) for developing legal frameworks on the SSE will be determined by the constitution of each country. In most countries, the national level will have the competence to implement a framework law, although this might differ in federal countries (e.g. Québec’s Social Economy Act).

Horizontal co-ordination: Policy makers should make sure that the most relevant government agencies and departments are involved in the legislative process, in order to streamline the different policies and avoid fragmentation and compartmentalisation of government support among various ministries and departments (OECD, 2014[31]; ILO, 2017[32]). If multiple government ministries and other institutions are responsible for implementing specific aspects of the legal framework, a lack of horizontal co-ordination could lead to inconsistent or even contradictory approaches. Designating a ministry or government institution to oversee SSE policy or establishing a formal mechanism to co-ordinate policy across multiple ministries can help to avoid such issues. In Luxembourg, the Law on Societal Impact Companies (2016) established strong horizontal co-ordination mechanisms that facilitated cross-ministry communication and collaboration. These proved important to harmonising policy implementation and, later, identifying and revising conflicting legal frameworks (OECD, 2022[33]).

Vertical co-ordination: In countries with national and subnational governments a clear dialogue among the different governmental levels is crucial, especially when both the federal and regional level have the competence to legislate. Different levels of government may adopt different approaches and even legal frameworks for the SSE. Subnational governments can introduce laws in federal and quasi-federal countries. They do so to organise the contribution of SSE entities for local or regional economic development (UNSRID, 2016[34]) and to reflect local realities. For example, Spanish regions have acquired competences in various social policy fields (education, (partial) health care, social care, labour market policies) (Moreno and Fisac-Garcia, 2017[35]). Moreover, in Spain 17 Autonomous Communities got legislative powers to regulate cooperatives in their territories. In Belgium, the federal state has authority to legislate organisational forms, while the competences for policy making in social policy fields is in most cases attributed to the regional levels. Besides, in some OECD countries, such as Canada, the federal system of government enabled provinces to establish their own legal forms for social enterprises such as Community Contribution Companies in British Columbia and Community Interest Companies in Nova Scotia.

These examples highlight the variety of ways in which local and regional governments can act autonomously to support the SSE. At the same time, such bottom-up approaches risk creating a jurisdictional patchwork of distinct operational environments within the same country that may enhance confusion and inhibit the development of the SSE as a whole at the national level. As such, it is important to engage with all levels of government to facilitate communication and minimise potential vertical co-ordination issues that may hinder the development of the SSE while still empowering subnational governments to help SSE entities meet their distinct needs. In some cases, legislation at the subnational level can support experimentation in specific areas before results may be generalised at the national level (Hiez, 2021[3]).

Regardless of the administrative organisation of a country (unitary, federal, quasi-federal) policy makers need to involve local governments (municipalities) in the drafting process of the legislation. It has been reported numerous times that SSE entities play an important role at a local level (OECD, 2022[36]). Therefore, the need for adequate legal forms is high at the local level, as this where the immediate impact of SSE entities is most visible. In turn, local governments can play a substantial role in the promotion of the SSE sector. For example, the implementation of the Social Economy Law in Spain through the Social Economy Strategy 2017-2020 was successful due to the intensive consultation of regional and local government levels in the legislative process. It worked because the strategy involved the competent bodies at the national levels, subnational levels, and representatives of entities of the sector, experts, and other relevant stakeholders (Konle-Seidl, 2022[37]). Main actors were the Spanish Social Economy Employers Confederation and the strong networks of cooperatives (Avila and Monzón, 2018[38])

Both horizontal and vertical co-ordination can be facilitated through the set-up of a “intergovernmental” advisory board or through special parliamentary commissions. Such an intergovernmental entity can be tasked with coordinating stakeholder consultations and the preparation of drafting documents, as well as organising consultations with other relevant non-governmental stakeholder (see further below). For example, the Framework Law on the Social Economy in Portugal was discussed in a specialised commission that consulted the main actors of the social economy, experts and labour unions (Ferreira and Almeida, 2021[39]). This consultation process started with the set-up of a governmental program for the development of the social economy (“PADES”) (Ferreira, 2015[40]). Part of this governmental programme was the empowerment of umbrella networks of SSE entities to have clear sight on the different needs of the organisations. In Poland, the preparation of the 2022 Act on the Social Economy began in 2016 as part of a broad dialogue, including partners from the social economy sector. The key forum for this dialogue was the National Committee for the Development of the Social Economy (NCESC), an auxiliary body of the Minister of Family and Social Policy, whose work involves representatives of the non-governmental sector, including representatives of the Council for Public Benefit Activity, local government administrations, the academia, the financial sector and social partners (Polish Ministry of Family and Social Policy, 2021[41]). In France, the Law on Social and Solidarity Economy of 2014 was strongly supported by the Interministerial Delegation of Social Economy in 1981, which later evolved into the State Secretariat for Solidarity Economy (Chabanet and Lemoine, 2021[42]).

Consult external stakeholders throughout the development of legal frameworks

Successful legal frameworks typically align with the vision of external stakeholders, government institutions and elected officials. Communicating with stakeholders from each of these groups helps to understand their respective positions and needs, and to ultimately generate consensus. While thorough and intensive consultations can be time-intensive, they can lead to more innovative, adapted and effective legislation in the long term. By involving a wide array of stakeholders, consultations can reduce information asymmetry, thereby reducing transaction costs when implementing or adjusting legal frameworks at a later stage. When adopting a top-down approach there is the risk of lacking input from the field and thus missing out on the SSE’s realities and needs (Alain and Mendell, 2013[43]). A broad consultation of stakeholders, through more or less institutionalised/formalised avenues, can reduce this risk. For example, Slovakia held a two-year long consultation process and collected input from academics, social entrepreneurs, (local) governments, etc. before adopting the Act on Social Economy and Social Enterprises in 2018 and defining the scope of SSE in the country.

The OECD 2012 Recommendation of the Council on Regulatory Policy and Governance and the 2014 Framework for Regulatory Policy Evaluation (OECD, 2014[44]; OECD, 2012[45]) offer guidance on how countries can best use consultation to ensure legal and regulatory processes are inclusive and open to interested groups and the public. A wide range of approaches could be used including informal consultation, circulation for comments, public hearings or creation of advisory bodies.

Countries and regions have used a range of different types of stakeholder engagement to develop legal frameworks for the SSE. For example, countries such as Ireland used stakeholder surveys to determine whether it was beneficial to establish specific legal forms for certain SSE organisations (see Box 1.5). The Netherlands on the other hand developed a proposed legal form for SSE organisations before gathering formal public commentary and feedback that may be used to modify the legal form before it is adopted. Finally, the Brussels-Capital Region in Belgium opted to co-construct a legal framework for social enterprises with stakeholders during an intensive two-year process (Box 2.8).

Each stakeholder consultation approach entails its own pros and cons. The optimal choice for a given country or region will reflect the specific context and priorities. (Box 2.7) outlines common approaches for stakeholder engagement and provides insight into their respective benefits and downsides.

Box 2.7. Identifying and engaging stakeholders – A checklist for stakeholder inclusion

This box identifies the range of SSE entities that may exist in a given country to help policy makers engage with a diverse range of stakeholders when develop new legal frameworks for the SSE. Likewise, this box provides an overview of the various ways in which policy makers can engage with stakeholders during the development process.

Critical stakeholders

Social and solidarity economy entities

Associations

Cooperatives

Foundations

Mutual organisations

Social Enterprises

Networks, advocacy groups and intermediaries

Networks and advocacy groups may represent all of the SSE, but many represent specific types of entities. Bringing groups to the table that represent the full spectrum of the SSE is important.

National and subnational policy makers from relevant ministries and departments

Academia

Tools for Inclusion

Surveys disseminated among social enterprises and social enterprise associations: Surveys are a useful way to gather preliminary information on the needs and challenges faced by SSE entities. One advantage of surveys is that they can be quickly shared across SEE networks or targeted at specific types of SSE entities as needed.

Information gathering sessions with stakeholders: In person or virtual meetings present an effective way to engage in comprehensive discussions with stakeholders. Though more time intensive than surveys, information gathering sessions may lead to greater insight into the specific needs and challenges of stakeholders.

Public commentary on proposed legislation: Publishing proposed legislation to enable public feedback is an effective way to identify and address potential shortcomings before the legislation is formally adopted. One downside of this practice is that it may prevent stakeholders from participating in the development of the legal framework until a much later stage in the policy making process.

Co-construction of legal frameworks (Box 2.8) Enabling stakeholders to participate in each stage (from the diagnostic to design, implementation and evaluation) of the legal framework helps to ensure that the legal framework is aligned with their broad needs and realities. This inclusive approach helps to facilitate broader acceptance of the legal framework and avoids excluding or constraining specific types of social enterprises. While effective, this approach can be time and resources intensive.

Source: adapted from (OECD, 2022[33])

Policy makers need to carefully select external stakeholders, and strike balance between the more traditional stakeholders (labour unions, cooperatives etc.) and newer entities (e.g. social enterprises) as well as intermediary bodies. It has been observed that in some countries the legislative process experienced some obstacles and delay caused by traditional organisations (such as cooperatives and associations) (Gaiger, 2015[46]; Lévesque, 2013[47]). Social enterprises utilise a range of legal forms that include associations, cooperatives, charities, foundations, and mutual societies. These might also include conventional enterprises, such as limited liability companies, specific types of non-profit organisations and public benefit companies (e.g. the Czech Republic) (European Commission, 2020[7]). Countries that have limited their stakeholder consultations to well-established types of social enterprises such as WISEs while excluding emerging or less prevalent types of social enterprises, leading to developed legal frameworks that met the specific needs of a subset of social enterprises. This ultimately constrained the development of the overall social enterprise ecosystem by not encouraging the development of novel legal forms, business models and social objectives.

SSE networks, intermediaries and other representative bodies can help to identify relevant stakeholders and facilitate outreach. Intermediary bodies, comprising several actors from the SSE, can help policy makers navigate through the diversity of the SSE (Alain and Mendell, 2013[43]).Some of these intermediary bodies themselves are established as an instrument for legislative changes (e.g. the Chambres Régionales de l’Economie Social et Solidaire (CRESS) in France or the Confederacion Empresarial Espanola de la Economia Social (CEPES) in Spain). Equally important is the involvement of federations of certain sectors or sectoral networks (Alain and Mendell, 2013[43]). Federations of SSE entities such as Social Enterprise UK can help establish a common voice capable of advocating for the diverse needs of SSE entities. Employers’ federations have traditionally represented SSE-organisations (e.g. Unisoc) in Belgium and are involved, formally or informally, in the preparation of legislation. However, the lack of a common understanding of the SSE remains an obstacle to effective advocacy. The Netherlands has the common approach of organising a broad public consultation, which could be a potential remedy for the obstacle, while Slovakia has done a broad consultation round of diverse experts (European Commission, 2020[48]).

(Informal) networks play an important role as well. Through these networks, grassroots movements and other informal organisations can be detected more easily. In Québec (Canada), SSE entities are engaged in institutional innovation, driven by the Chantier de l’économie sociale, a network of networks, that is now a non-profit organisation representing all social economy actors. Its members include sectoral networks of collective enterprises, social movements, and local development intermediaries. (C.I.T.I.E.S., 2018[49]).The Chantier has significantly contributed to the co-construction of public policy on the SSE. (Alain and Mendell, 2013[43]) The increasing recognition of SSE in Québec in the past twenty years can be largely contributed to the adoption of framework law and the increased visibility (C.I.T.I.E.S., 2018[49]).

Box 2.8. The Brussels 2018 Ordinance on social enterprises (Belgium): an inclusive policy-making process to co-construct a legal framework for social enterprises

The Ordinance on the accreditation and support of social enterprises was adopted on 23 July 2018 in the Brussels-Capital Region in Belgium. The adoption of this Ordinance resulted from a two-year consultation process with various stakeholders, including the Economic and Social Council of the Brussels-Capital Region (CESRBC), the Brussels Employment Office Actiris, the Brussels Social Economy Consultation Platform extended to ConcertES and SAW-B. Additional stakeholders, such as academics, social enterprise federations and individual social enterprises, also participated in the consultation process.

Until 2018, social enterprises and other social economy entities active in the Brussels-Capital Region were largely associated with work integration. Hence, the objective of the policy-making process was twofold: (1) the revision of the 2004 and 2012 Ordinances on the social economy and the accreditation of work integration social enterprises; and (2) the recognition of social enterprises beyond work integration. Throughout all stages of the two-year long development of the ordinance, relevant stakeholders were involved through consultations, direct participation in expert discussions and surveys. As a result, the 2018 Ordinance establishes a set of criteria organised in three dimensions – social, economic and governance – and defines ‘social enterprise’ as private or public legal entities that implement an economic project, pursue a social purpose, and exercise democratic governance.

By starting the consultation process at an early stage of policy development, the Government of the Brussels-Capital Region was able to collect valuable information from a variety of stakeholders to better capture the situation experienced by work integration social enterprises but also to refine their understanding of the needs and realities of social enterprises working on issues beyond work integration. Such an inclusive process fostered dialogue between policy makers and main actors in the area and allowed to easily gather these main actors around a table when needed.

In short, the Brussels Ordinance on social enterprises and its policy-making process helped to both build common understanding of social enterprises and structure the overall space, which in turn fostered the development of social enterprises in the Brussels-Capital Region.

Establish legislative coherence across levels of government and existing legislation

Coherence of new legal frameworks for the SSE with existing legislation. Before introducing a new legal framework, be it on the national or subnational level, existing laws and regulations that apply to the SSE as a whole or specific SSE entities should be reviewed. This may include corporate laws, tax laws, and any specific laws that apply to the SSE. Building consensus among relevant parties and facilitating communication among them is a useful way to proactively identify potential legislative conflicts while the legal framework is under development. However, in many cases, legislative conflicts are not identified until after legal frameworks are adopted. One way to address potential legal conflicts is to identify them through dedicated studies and to engage with the relevant stakeholders to collect their perspectives on how they can be addressed.

Harmonise and synergise the coexistence of national and subnational legislation

Depending on countries, legal entities are regulated at the national and/or at the subnational level, which can lead to the coexistence of diverse norms for a given entity within a same country. This is linked to the administrative organisation and constitutional arrangements of countries. Stakeholder consultations revealed that multi-layered legislation may possibly bring legal confusion in certain cases. However, confusion could be prevented if the scope of application of each norm is clearly defined to avoid contradictory provisions. For example, in Canada, the Canadian Cooperatives Act regulates non-financial cooperatives that carry business in more than one jurisdiction and coexists with provincial and territorial cooperative legislation and regulations. India’s experience is similar with a diversity of state cooperative laws using different approaches to regulating cooperatives, while cooperatives present in more than one state become subject to the federal Multi-State Cooperative Societies Act of 2002 (see Box 1.4). In Spain, subnational governments can develop their own legal framework for cooperatives, based on the Social Initiative Cooperative adopted at the country level, which results in a diversity of types and classifications of cooperatives (including social initiative cooperative, social welfare cooperative, social integration cooperative and social cooperative (European Commission, 2016[56]).On the contrary, the United States has a strong tradition of adopting “Model Acts”, providing state legislators with a “basis” law, leaving the possibility of amending certain provisions or adding extra regulation.

In the United States, the regulation of corporations is historically a matter of state rather than national law. Thus, corporations primarily are regulated by the states where they are incorporated. Substantive regulation of how corporations are structured or managed is mostly a matter of state law and that state law is most often that of Delaware. Today the state of Delaware is home to most large corporations incorporated in the United States and Delaware’s judicial system, namely the Delaware Court of Chancery, strongly impacts the evolution of corporate law (Thomas, Thompson and Wells, 2022[57]). At the same time, federal law has also helped to recognise and promote certain SSE entities. For example, the Cooperative Marketing Act of 1926 authorises the Department of Agriculture to assist cooperatives (USDA, 2017[58]) while the 2018 Main Street Employee Ownership Act includes provisions that facilitate access to funding for workers cooperatives (Lechleitner, 2018[59]).

In India’s federal system, cooperatives are subject to different laws depending on the region. Cooperatives operating only in one state are subject to the relevant laws of that state (e.g., the Maharashtra Co-operative Societies Act of 1960, the Co-operative Societies Act of 1972 of the Union Territory of Delhi). The diversity of state cooperative laws resulted in different approaches to regulating cooperatives, ranging from territories that granted greater autonomy to cooperatives in business activities and management, to others that intervened more in their operations and staff decisions. In contrast, cooperatives present in more than one state become subject to the 1984 Multi-State Cooperative Societies Act, which was amended in 2002. Between 1986 and 2022, 1 367 multi-state cooperative societies were registered with federal authorities in India (Ministry of Cooperation, 2022[60]).

Likewise, legal frameworks for the SSE as a whole can be adopted at the national or at the subnational level. A national law can help encourage coherence among various legal frameworks adopted at subnational levels, while subnational legal frameworks can be seen as an opportunity to experiment local policy frameworks before deploying them to the whole country (Hiez, 2021[3]). In Spain for example, the social economy development in some Autonomous Communities, such as Balearic Islands, Galicia, Murcia and Navarre, among other regions, is strongly connected with some crucial developments at the national level to achieve a comprehensive legal ecosystem. The OECD mapping and consultation meetings also highlighted that subnational legal frameworks can support better alignment with local realities and needs. In Canada for instance, the province of Québec adopted the Social Economy Act in 2013 while this notion is not recognised at the national level or in other provinces and territories.

Legal frameworks can be developed at different speeds at national and subnational levels. In federally organised countries, subnational governments might regulate the SSE to the extent of their legislative competences possible, whereas at the federal level the development of legal frameworks might be politically challenging and slow to advance. For example, in Brazil a national solidarity economy law has been discussed since 2012, but not adopted until now (Box 2.9). In the meantime, the vast majority of Brazilian states have developed a law that aims to promote and develop the solidarity economy (see Annex F). In the absence of a national SSE law, the federal system has allowed the adoption of many state-level laws to promote the SSE.

Box 2.9. State of SSE legislation in Brazil

A national solidarity economy law has been proposed in Brazil since 2012, but this initiative has not yet been successful. The bill (4685/2012) passed through several filters, such as the approval of the Economic Development, Industry, Commerce and Services (CDEIC) and Finance and Taxation (CFT) committees but was archived in 2015 due to the end of the legislative period. The bill was de-archived the same year with the start of the new legislature, approved by the Chamber of Deputies in 2017 and delivered to the Senate. In 2019, the bill was approved with amendments by the Senate and sent back to the Chamber of Deputies for their approval and publication. The amendments modified parts of the original text, and the bill is now being processed under the number 6606/2019 which “Provides for solidarity economy enterprises, the National Solidarity Economy Policy and the National System of Solidarity Economy”. Since then, the new bill (6606/2019) is going through the different committees of the Chamber of Deputies to approve the text amended by the Senate. Immediate next steps include receiving the approval of the Finance and Taxation (CFT) and Constitution and Justice and Citizenship (CCJC) committees.

The lack of this law has a direct impact on the development of the SSE in the country, but other national laws also help to promote it. The lack of a national solidarity economy law impedes public policy from helping to address the challenges faced by economic solidarity enterprises in the country, such as limited financing, lack of legitimacy, informality, and difficulties in production and trade. However, other national laws and decrees in the past have contributed to the promotion of the SSE in the country. Examples include Decree No. 5.063 of 2004, which determined the functions of the National Secretariat of Solidarity Economy, and Law 10.933/2004, which encourages cooperativism, associativism, and the development of new forms of solidarity economy in the Multiannual Plan of the Federal Government for the period 2004-2007. Additionally, Decree No. 8163 of 2013 on the National Programme of Support for Associativism and Social Cooperativism, targeting the coordination and execution of actions that are aimed at the development of social cooperatives and solidarity-based economic enterprises.

In the absence of a national SSE law, the federal system has allowed the adoption of many state-level laws to promote the SSE. The vast majority of Brazilian states have a law that aims to promote and develop the solidarity economy. Many of these laws have very similar objectives and are written in much a similar way. Other states such as Amazonas or Paraiba do not have such laws, but they have passed legislation that supports SSE entities. For example, the state of Amazonas passed Law 5.474/2021 which provides guidelines for economic and financial assistance for the recovery of cooperatives and solidarity economic enterprises, while the state of Paraiba adopted Law 11.869/2021 which provides guidelines for the establishment of a state policy for investments and social impact enterprises.

Foster coherence with international agreements

International fora increasingly pick up the SSE as a topic on their agendas. While there are no legal frameworks on the SSE at the global level, and notably within the United Nations system, there are a number of texts negotiated inter-governmentally that refer to various elements of the SSE at large or to specific SSE entities in particular (Jenkins, 2021[1]). These include amongst others the tripartite ILO Recommendation No. 193 (2002) on the Promotion of Cooperatives (ILO, 2002[63]), the ILO Recommendation No. 204 (2015) on Transition from the Informal to the Formal Economy (ILO, 2015[64]), as well as the ILO conclusions on decent work and the SSE from the International Labor Conference 2022 (ILO, 2022[65]). Similarly, the 2022 OECD Recommendation on Social and Solidarity Economy and Social Innovation is the first internationally agreed standard for guiding countries in defining policies and frameworks for developing their social economy (OECD, 2022[36]). Each text agreed at the international level can provide “guidance” to member states, but they are not tools for enforcement from the top down.

EU-level regulatory actions to promote greater sustainability also affects the operating conditions of the SSE in EU countries. In particular, new regulations promoting environmental, social and governance (ESG) approaches for businesses will likely influence SSE entities operating in Europe. First, the draft Directive on Corporate Sustainability Reporting and Corporate Due Diligence and Accountability (European Parliament, 2021[66]) stipulates that all companies ranging from SMEs to large firms will be obligated to comply with European ESG norms. Similarly, a draft Directive on Sustainable Corporate Governance is designed to enable companies to focus on longer-term socially and environmentally sustainable value creation rather than short-term benefits. Finally, the Taxonomy Regulation 2020/854 establishes important technical criteria to measure ESG performance. Though these developments are not directly related to the SSE, they reflect a potentially growing trend of using additional international legal approaches and standards to further the objectives of SSE entities even as SSE-specific legislation is adopted at national and subnational level (OECD, 2022[2]).

Leverage complementary policy options

Legal frameworks for the SSE can enhance the efficacy of other policy instruments. By providing the SSE with legal recognition, legal frameworks can facilitate its inclusion in other initiatives. While legal frameworks help complement and complete SSE ecosystems, they cannot catalyse its development alone. This section will explore how other policy instruments can complement and interact with legal frameworks to support the SSE ecosystems.

Facilitate access to funding and finance

Governments may choose to allocate funding and develop financial instruments to help SSE entities access adequate and sustained sources of finance. SSE entities finance their activities through a range of resources, such as revenues from sales, public subsidies, private investments, donations or volunteering. They often struggle to access finance for a number of reasons, including their prioritisation of social impact over profit objectives, limited business competencies and strict legal rules for financing institutions, which make them appear to be high-risk and low reward investments (ILO, 2017[32]). Research suggests that SSE entities have inadequate access to capital and finance due to various reasons (C.I.T.I.E.S., 2018[49]; Chambre française de l’ESS, 2017[67]; Salvatori and Bodini, Forthcoming 2023[68]). Most financial instruments are designed towards for-profit corporations, having the remuneration of investors as their main goal. Consequently, common financial instruments are not readily applicable to SSE entities (Salvatori and Bodini, Forthcoming 2023[68]). Public actors can play a role in providing tailored financial support to SSE entities but also in developing instruments to help leverage and guarantee private resources for the SSE. For example, in Bulgaria, the first step towards supporting SSE entities occurred when the Social Assistance Agency opened a procedure for the direct provision of grants, with the main objective of developing social entrepreneurship (Ilcheva, 2021[69]).

The diversity of possible financial instruments reflects the diversity of the SSE. Just as SSE entities vary in terms of size, legal form and areas of activities etc., so is the variety of instruments conceivable to support their development, including loans, investment capital, guarantees or bonds. Legal frameworks can support access to finance by providing SSE entities with legal recognition, which is often necessary for them to access many types of funding. Stakeholder consultations confirmed that one benefit of creating a specific legal form for social enterprises in Slovakia was enabling their access to European Social Funds (OECD, 2022[2]). Another example is Canada that has created a Social Finance Fund in 2018 which is designed in such way that it can support SSE entities regardless of their activities (Sousa, 2021[70]). This is an advantage as most grants, subsidies or other finance initiatives are focused on a specific policy objective (e.g. housing, reducing poverty, employment of individuals who have difficulties entering the market). The Government committed to making up to CAD 755 million available over the next 10 years to “charitable, non-profit and social purpose organisations” to better enable them to participate in the social finance market (ILO, 2021[71]). In India, the Government and the Reserve Bank provide micro-loans (microfinance) to achieve financial inclusion and livelihood promotion. They play an important role in the emergence of SSE entities in the country (Morais, Dash and Bacic, 2016[72]).

Specific finance instruments customised to the needs and specificities of particular SSE entities are needed. Fintech products hold potential for improving access to finance for the SSE, for instance by creating platforms that allow social entrepreneurs to tap into large numbers of small investors or lenders (i.e. crowdsourcing) (OECD/European Commission, 2022[73]; Bruton et al., 2015[74]). More traditional instruments, such as funds, can also be customised to specific SSE entities. An interesting initiative, for example, are the Italian solidarity funds (Fondi Mutualistici). These funds were introduced by Law 59/1992 with the objective to empower and consolidate the existing cooperative sector in opposition to the on-going wave of privatisation (Bernardi et al., 2022[75]). These funds’ mission is to support starting and existing cooperatives and to promote the cooperative system in general (through loans or equity) (Bernardi et al., 2022[75]) The main income of these solidarity funds comes from member cooperatives and consortia, that are required to transfer 3% of their annual profits to the funds (Article 11, § 4 of the Law of 59/1992). Every cooperative needs to adhere to a cooperative association (with allocated solidarity fund) or transfer the amount to the government.

The success of SSE entities depends on their access to finance at every stage of their development (Hiez, 2021[3]). Especially at an early stage, many SSE entities have difficulties finding finance (Jenkins, 2021[1]), which could be alleviated through mechanisms that provide seed money. Seed capital can be provided by private financing institutions while being guaranteed by government up to a certain percentage. These guarantees might convince private financers to invest in the start-ups. Alternatively, governments can provide seed capital themselves through subsidies or grants. However, these mechanisms should be limited to a certain time period to avoid dependency on government resources in the long run. In 2007, Québec launched the Fiducie du Chantier de l’économie sociale (Chantier Social Economy Trust), which acts as an intermediary between the financial market and SSE entities (Salvatori and Bodini, Forthcoming 2023[68]) and offers a range of financial products to support SSE entities at each stage of their development. The Trust was created with contributions from the federal government and other solidarity finance actors (including a fund created by trade unions). The federal contribution in particular, was a success factor, as it allowed the Chantier to offer first-loss protection to other investors (C.I.T.I.E.S., 2018[49]; Salvatori and Bodini, Forthcoming 2023[68]). Since 2007, it has invested CAD 49 million in 192 projects and has created 3 183 jobs (C.I.T.I.E.S., 2018[49]).

Financial innovations and existing financial instruments need to adapt to the changing realities of the marketplace and the SSE. For example, in the United States, charitable giving in 2021 increased in nearly every sector, with gifts aimed at public-society benefit growing by 23.5%. Therefore, new financial instruments for charitable giving are being engineered and promoted by asset managers. Moreover, existing mechanisms such as Donor Advised Funds (DAFs) are growing. Corporate giving also is growing in the United States, increasing by 23.8% in 2021 from 2020 (NPTrust, n.d.[76]). This too has led to increased scrutiny with some research highlighting correlations between corporate giving and regulatory advocacy by charitable recipients on behalf of those corporate interests.

Lastly, facilitating financial literacy can help SSE entities find new avenues to finance. Legally recognising individual SSE entities can help them qualify to participate in business support programmes such as business development, skills and training. Policy makers can boost financial literacy training and education for social entrepreneurs which will allow them to make better financial decisions, thereby increasing their chances of short-term and long-term success (OECD/European Commission, 2022[73]).A successful initiative is the creation of CAP Finance in Québec, which is a network for “socially responsible finance” (C.I.T.I.E.S., 2018[49]). CAP Finance provides an institutional space for financial actors in order to exchange information on social finance and facilitate the “social learning” aspects of all partners regarding social finance instruments.

Avoid barriers from tax and competition law

Countries use a range of tax incentives and fiscal policies to encourage the development of the SSE and incentivise socially beneficial activity in specific sectors and target groups. Leveraging tax laws and fiscal policies to support the SSE and incentivise socially beneficial behaviours is a way for governments to achieve positive social outcomes with minimal public expenditure while also creating incentives to preserve the social mission of SSE entities. Legal frameworks for the SSE can enable authorities to use certification and registration systems to ensure that tax exemptions and fiscal benefits are directed at entities with firm commitments to achieving social objectives. In Estonia, only non-profit associations and foundations that have been approved by the Tax and Customs Board are eligible for income tax reductions.

Tax exemptions for SSE entities enable them to direct their funds towards social objectives and create important incentives to operate as an SSE entity. The majority of countries provide some form of income tax exemption to associations and foundations, particularly those that do not engage in commercial activities. In some countries, income tax exemptions restrict certain commercial activities of the eligible non-profit entities, mainly to maintain a level playing field among corporations that operate the same activities (e.g. the economic activities of eligible non-profits will be strictly limited to necessary activities to pursue its social mission (Denmark, Luxembourg) or completely restricted (Croatia). Social Initiative Cooperatives in Spain, with a recognised non-profit mission, are taxed on up to 10% of their revenues. Likewise, certain countries such as Belgium and France do not tax income for SSE entities that utilise profit locks. Tax benefits outside the scope of corporate income taxes (Value Added Tax (VAT)) can be considered as well. For example, the Slovakian Act 112/2018 on Social Economy and Social Enterprises includes the possibility of reducing the VAT rate to 10% for goods and services that are provided by registered social enterprises that use 100% of their profit for their primary social objectives (European Commission, 2020[48]).

Tax reimbursements and similar measures can be used to encourage individuals and businesses to donate to or invest in SSE entities. Donors are often able to claim tax reimbursements on donations to specific SSE entities (e.g. Canada, Belgium, Germany India, Luxembourg, the Netherlands and the United States) and in some cases can automatically choose to direct a certain percentage of their annual tax contributions to an organisation of their choice. These policies enable individuals to donate to SSE entities of their choice, thus facilitating access to funding for the SSE. Some countries incentivise investment in SSE entities by providing specific tax advantages or deductions to the investors. For example, investors in France, Italy and the United Kingdom who invest in social enterprises are eligible for tax deductions, while cooperatives benefit from specific tax in most countries. Another creative approach relates to “win-win loans” for individuals lending money to SSE entities (e.g. Belgium) which exempts interest rates paid by SSE entities from income tax. In the United Kingdom, the Social Investment Tax Relief programme helps to support charities and includes specific conditions on which companies can benefit from the programmes. Criteria include being registered as a charity, community interest company, community benefit society or an accredited social impact contractor employing fewer than 250 people and having less than GBP 15 million in assets.

Sector or activity-specific tax benefits enable countries to incentivise specific activities or sectors rather than specific types of entities. For example, businesses in Finland and Hungary that operate in sectors such as healthcare, sports, social services, education, vocational training and similar activities are exempt from VAT. Belgium provides social security tax breaks for entities operating in the healthcare and social services sectors. This approach enables governments to provide targeted support that reflects their policy priorities. In addition, subnational governments (provinces, regions, municipalities) can award specific tax breaks as well to these entities. For example, the Korean Social Enterprise Promotion Act (2007) explicitly grants local authorities the competence to grant tax breaks to recognised enterprises.