This chapter provides an assessment of the progress made by Armenia in implementing the Small Business Act (SBA) for Europe over the period 2020-23. It starts with an overview of Armenia’s economic context and dives further into the characteristics of the country’s SME sector. It then develops on the state of selected framework conditions for the digital transformation of SMEs. Finally, it analyses Armenia’s progress along twelve measurable dimensions grouped in five thematic pillars and sets out targeted policy recommendations.

SME Policy Index: Eastern Partner Countries 2024

10. Armenia: Small Business Act country profile

Abstract

Key findings

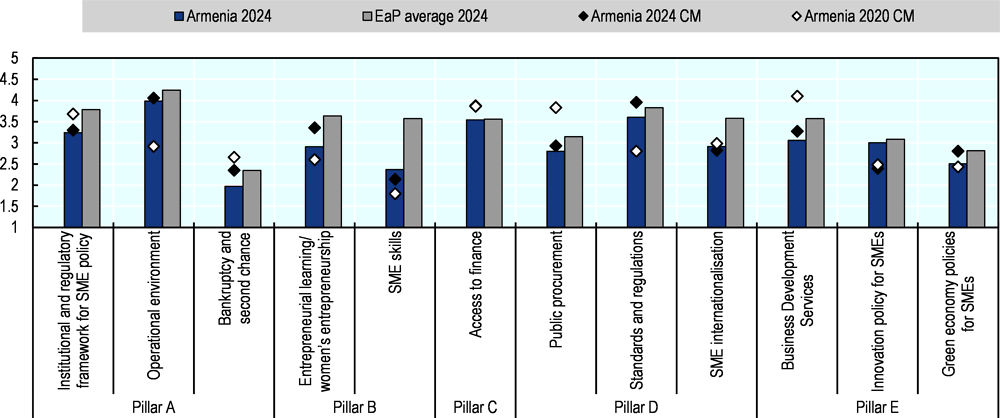

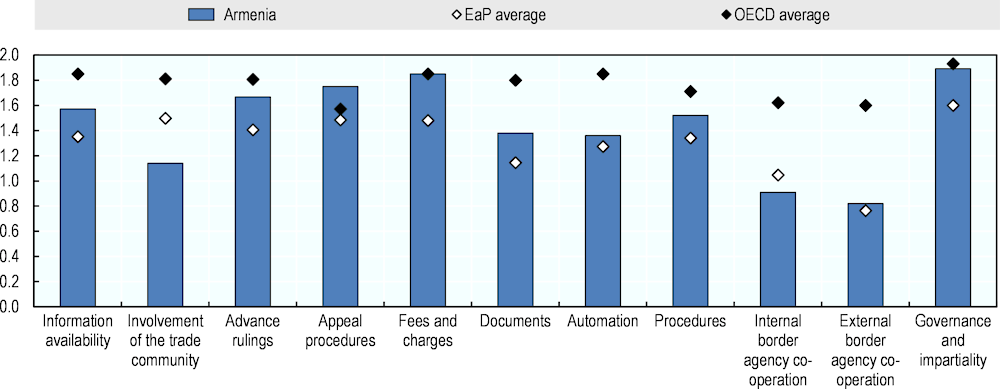

Figure 10.1. SME Policy Index scores for Armenia

Note: CM stands for comparable methodology. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Table 10.1. SME Policy Index scores for Armenia

Country scores by dimension, 2024 and 2020 vs 2024 CM

|

Pillar |

Dimension |

Armenia 2024 |

EaP average 2024 |

Armenia 2024 (CM) |

Armenia 2020 (CM) |

|---|---|---|---|---|---|

|

Pillar A |

Institutional and regulatory framework for SME policy |

3.24 |

3.78 |

3.29 |

3.68 |

|

Operational environment |

3.99 |

4.24 |

4.05 |

2.92 |

|

|

Bankruptcy and second chance |

1.97 |

2.35 |

2.35 |

2.66 |

|

|

Pillar B |

Entrepreneurial learning/ women’s entrepreneurship |

2.91 |

3.64 |

3.35 |

2.60 |

|

SME skills |

2.37 |

3.57 |

2.13 |

1.80 |

|

|

Pillar C |

Access to finance |

3.54 |

3.56 |

3.87 |

3.86 |

|

Pillar D |

Public procurement |

2.80 |

3.15 |

2.92 |

3.83 |

|

Standards and regulations |

3.60 |

3.83 |

3.96 |

2.80 |

|

|

SME internationalisation |

2.91 |

3.58 |

2.82 |

2.98 |

|

|

Pillar E |

Business Development Services |

3.06 |

3.57 |

3.27 |

4.10 |

|

Innovation policy for SMEs |

3.00 |

3.09 |

2.39 |

2.48 |

|

|

Green economy policies for SMEs |

2.51 |

2.81 |

2.80 |

2.43 |

Note: CM stands for comparable methodology. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Table 10.2. Implementation progress on SME Policy Index 2020 policy reforms – Armenia

|

Priority reforms outlined in the SME Policy Index 2020 |

Key reforms implemented to date |

|---|---|

|

Pillar A – Responsive Government |

|

|

Finalise and adopt a comprehensive, long-term SME strategy. Assess impact of the special tax regime for microenterprises and family businesses. Elaborate action plan for e-government strategy with open-data approach. Streamline insolvency legislation and introduce prevention measures. Implement a comprehensive and proactive second-chance strategy. |

Adoption of a national SME Development Strategy for 2020-2024. Expansion of range and accessibility of e-government services. Simplification of company registration procedures. Adoption of a National Digitalisation Strategy for 2021-2025. Amendment of the Law on Bankruptcy in 2020. |

|

Pillar B – Entrepreneurial Human Capital |

|

|

Integrate the entrepreneurship key competence into the curriculum and develop an entrepreneurial mindset. Introduce active teaching and learning methods as well as pre- and in-service training for teachers and school/university managers. Improve co-operation between education institutions and businesses through private sector involvement in skills intelligence collection and analysis and mandatory practical experience for all learners. Update the women’s entrepreneurship support strategy and set up a structured policy partnership. Establish a system for collecting and analysing SME skills intelligence. |

Integration of entrepreneurship into the curriculum and reflection of it in the learning outcomes of the state standards of general education. Training from 2021 to 2022 for all teachers in general education on technology and entrepreneurship for grades 2-7 and 10-11. Implementation by higher education institutions (HEIs) of entrepreneurial learning in different faculties. Development of a Platform for Women's Economic Empowerment targeting women's entrepreneurship and employment. Planning of women-specific initiatives, including the implementation of preferential interest rates, small grants, and women-only investment readiness programmes. Awareness-raising campaigns conducted. |

|

Pillar C – Access to Finance |

|

|

Complete reforms to insolvency / restructuring legal framework to strengthen creditor rights and promote corporate recovery. Establish an information platform with details about financial products relevant to business owners. |

Ongoing implementation of the new capital markets development strategy. Launch of an Economic Modernisation Program for interest rate subsidies on loans and leases to purchase modern (new) equipment. Adoption of a new regulation on investment-based crowdfunding. Adoption of the Financial Literacy Strategy for 2021-2025. |

|

Pillar D – Access to Markets |

|

|

Transfer institutional knowledge/capacity to Business Armenia’s successor. Enhance provision of export support and promotion services to SMEs. Expand conformity assessment services and ensure competition between domestic conformity assessment (CA) bodies. Work towards international recognition for national accreditation body. Increase use of e-procurement and promote the use of award criteria. Build contracting authorities’ capacity for wider competition / transparency. Analyse issues SMEs face in public procurement and address them with guidelines and training for contracting authorities and prospective tenderers. |

Modernisation of prior institute into National Body for Standards and Metrology (ARMSTANDARD). Development of annual state standardisation programmes for 2020-23. Improved services on standardisation, metrology, and conformity assessment. Preparation of the application for an EA Multilateral Agreement signature status for the international recognition of accreditation system. Mandatory use of e-procurement and possible use of e-auctions. Provision of trade insurance services by the Export Insurance Agency of Armenia (EIAA). |

|

Pillar E – Innovation and Business Support |

|

|

Broaden the palette of policy tools available to support innovative companies beyond the IT sector. Develop linkages between research institutions and the business sector. Develop an innovation strategy and action plans to increase co-ordination among different actors in the innovation ecosystem. Improve monitoring of current support programmes, measuring the impact of support programmes (particularly business development services, or BDS) on SME performance. Tasking an agency with outreach to SMEs to promote green practices. Implement a plan to support SME greening. |

Pilot project to collect data on SME adoption of digital technologies. Creation of a Ministry of High-Tech Industry (MoHTI) programme to help innovative start-ups and research teams to develop and commercialise their ideas. New set of indirect financial incentives to modernise the economy (Government Resolution 106-L, support for loan and leasing agreements to purchase new machinery and equipment). Inclusion of energy efficiency measures in the 2022-2030 Programme on Energy Saving and Renewable Energy. |

Context

Economic snapshot

Despite Russia’s war of aggression against Ukraine and Armenia’s exposure to the Russian economy, the country experienced unexpectedly strong GDP growth of 12.6% in 2022. This was driven largely by investment and strong domestic consumption, as well as a robust expansion of the tertiary sector, including tourism, financial services and real estate (EIU, 2023[1]). This sustained the economic rebound that followed the contraction (-7.2%) in 2020 due to the COVID-19 pandemic.

Economic growth has been supported by large capital inflows, owing to a substantial movement of businesses and people from Russia, around 39,000 of whom sought long-term residence (Sargsyan, 2022[2]). This inflow of people boosted the real estate sector, driving up rental prices and fuelling growth in the construction and services sectors. Armenian exports of goods grew 75% in 2022, as regional supply chains and trade flows found new configurations following the onset of the war (Central Bank of Armenia, 2023[3]). Although a sharp in food and energy prices accelerated pre-existing inflationary pressures, these eased in the second half of 2022, as monetary policy tightened and fiscal performance exceeded expectations (IMF, 2022[4]). Nonetheless, the economy remains highly dollarised, which continues to make the country vulnerable to external shocks resulting from currency fluctuations.

In 2022, industry and agriculture accounted for 18.5% and 10.4% of Armenia’s GDP, respectively, with the relative weight of the latter in the economy, steadily decreasing in the last decade. At the same time, the information and communications technology (ICT) sector has been rapidly expanding in recent years, compounded in 2022 by an influx of capital and skilled labour from Russia, particularly in the IT and digital services sectors. Only a month following the outbreak of the war in February 2022, 268 Russian citizens registered firms and 938 individuals obtained official status as entrepreneurs (OECD, 2023[5]). In 2022, the ICT sector grew by over 20% and generated 4.5% of Armenia’s GDP with the potential of growing further with the inflow of high-skilled specialists (Central Bank of Armenia, 2023[6]).

However, the sector is highly export-oriented and thus sensitive to fluctuations in the foreign currency market. For example, the appreciation of the Armenian dram in 2022 resulted in decreasing competitiveness for Armenian IT firms, which prompted the government to introduce a dedicated support package for affected companies (Ministry of High Tech Industry of the Republic of Armenia, 2022[7]). These policy efforts follow a period marked by a significant increase in the share of businesses that have started or increased online business activity – during COVID-19, this was the case for 48% of small businesses, 53% of medium-sized enterprises and 68% of large firms (World Bank, 2021[8]). Hence, Armenia’s steps to support its ICT sector, particularly IT firms, stem from the importance of accompanying the expansion of its digital business environment.

Despite the recent macroeconomic trends, to which the “one-off” positive shocks described above have significantly contributed, several socio-economic challenges persist, including high unemployment (13% in 2022) and poverty (26.5% in 2021), as well as low productivity growth (Armstat, 2023[9]). Exports are concentrated in terms of both products – mainly metals such as copper, gold, and iron, as well as tobacco and alcoholic beverages – and destinations, as nearly one-third of exports in 2021 went to Russia (Armstat, 2022[10]).

Table 10.3. Armenia: Main macroeconomic indicators, 2018-22

|

Indicator |

Unit of measurement |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|

|

GDP growth* |

Percent, year-on-year |

5.2 |

7.6 |

-7.2 |

5.7 |

12.6 |

|

Inflation* |

Annual percent increase, consumer prices |

2.5 |

1.4 |

1.2 |

7.2 |

8.7 |

|

Government balance1* |

Percentage of GDP |

-1.8 |

-1 |

-5.4 |

-4.6 |

-2.1 |

|

Current account balance** |

Percentage of GDP |

-7.2 |

-7.1 |

-4.0 |

-3.5 |

0.8 |

|

Exports of goods and services** |

Percentage of GDP |

39.4 |

41.4 |

29.8 |

35.3 |

47.7 |

|

Imports of goods and services** |

Percentage of GDP |

53.1 |

54.8 |

39.7 |

43.8 |

50.7 |

|

FDI net inflows** |

Percentage of GDP |

2.1 |

0.7 |

0.5 |

2.6 |

5.1 |

|

General government gross debt* |

Percentage of GDP |

51.2 |

50.1 |

63.5 |

60.2 |

49.3 |

|

Domestic credit to private sector** |

Percentage of GDP |

55.5 |

60.2 |

72.2 |

61.8 |

52.6 |

|

Unemployment2** |

Percentage of total active population |

13.2 |

12.2 |

12.2 |

12.7 |

12.6 |

|

Nominal GDP* |

USD billion |

12.5 |

13.6 |

12.6 |

13.9 |

19.5 |

1 General government net lending/borrowing.

2 Modelled ILO estimates.

Source: * (IMF, 2023[11]); ** (World Bank, 2023[12]); both accessed May 2023

Box 10.1. Armenia's policy support for SMEs during the COVID-19 pandemic

In response to COVID-19, Armenia adopted 25 anti-crisis measures to support households and businesses.

Financial support

Measures to support enterprises include:

Loans with preferential conditions to pay for salaries, equipment, food imports and raw materials, as well as breaks on taxes, duties and utilities.

Sector-specific programmes:

The tourism, agriculture, food, and manufacturing sectors could benefit from loans of AMD 2.5 to 50 million (EUR ~6 000 to 118 000) with a six-month grace period and no interest during the first two years, and a 12% rate applied in the third year. Other sector-specific measures include:

Interest rate subsidies and co-financing mechanisms for agricultural entities and co-operative farms.

Loans with full interest subsidies for grape suppliers and brandy and wine companies.

Covering 75% of the outstanding interest on loans for transport companies in tourism until March 2021.

One-time grants for entrepreneurs in the IT sector and interest-free loans for individuals starting a business.

Regulatory flexibility

In 2020, the government launched temporary depreciation acceleration and corporate income tax advance payments, with the former operating only for 2020. The corporate income tax was reduced from 20% to 18% and the flat personal income tax rate was set at 23% and then reduced to 20% in 2023.

Workforce support

Job retention was encouraged through wage subsidies:

One-time grants for businesses with 2-50 employees to cover the salary of every fifth employee.

For tourism-related enterprises that have maintained over 70% of their staff or 25% of payroll, wage subsidies covered the salaries of every third employee for a period of nine months.

Market support

To promote innovative business plans, the Ministry of Economy introduced support for competitive entrepreneurial ideas developed by beneficiaries seeking to start their business. In March 2022, businesses in Armenia were offered subsidies for loans to buy new equipment and machinery.

Measures to improve access to digital infrastructure

The Ministry of Economy conducted 55 training programmes targeted at SME skills development, including the development of online delivery tools and digital literacy training. Within the framework of Enterprise Europe Network, consultancy and information services were made available to SMEs.

The business environment has markedly improved, as the government has pushed through a number of reforms, including those designed to increase the ease of starting and doing business. However, businesses still face regulatory bottlenecks and general inefficiencies within the government bureaucracy (ITA, 2022[14]). In addition, Armenia’s relatively small market size and landlocked status tend to cap opportunities for economic growth. High transport costs and frequent delays at the Georgia-Russia crossing point, on which Armenia is highly dependent, constitute a choke point for Armenian trade. Since 2018, Armenia has taken steps to combat corruption, including establishing a new anti-corruption committee, strengthening the law on enforcement agencies, and creating a new anti-corruption court.

SME sector

The definition of micro, small and medium enterprise (MSME) in Armenia has not changed since 2011. In line with the EU definition, it is based on three criteria: employment, turnover and balance sheet (Table 10.4).

Table 10.4. Definition of micro, small and medium enterprises in Armenia

|

Micro |

Small |

Medium |

|

|---|---|---|---|

|

Employment |

< 10 employees |

< 50 employees |

< 250 employees |

|

Annual turnover |

≤ AMD 100 million (EUR ~237 138) |

≤ AMD 500 million (EUR ~1 185 690) |

≤ AMD 1 500 million (EUR ~3 557 070) |

|

Balance sheet |

≤ AMD 100 million (EUR ~237 138) |

≤ AMD 500 million (EUR ~1 185 690) |

≤ AMD 1 000 million (EUR ~2 371 380) |

Note: Exchange rate as of 28 September 2023 (OANDA, n.d.[15]).

Source: Amendments to the Law on State Support of Small and Medium Entrepreneurship (Legal Information System of Armenia, 2011[16]).

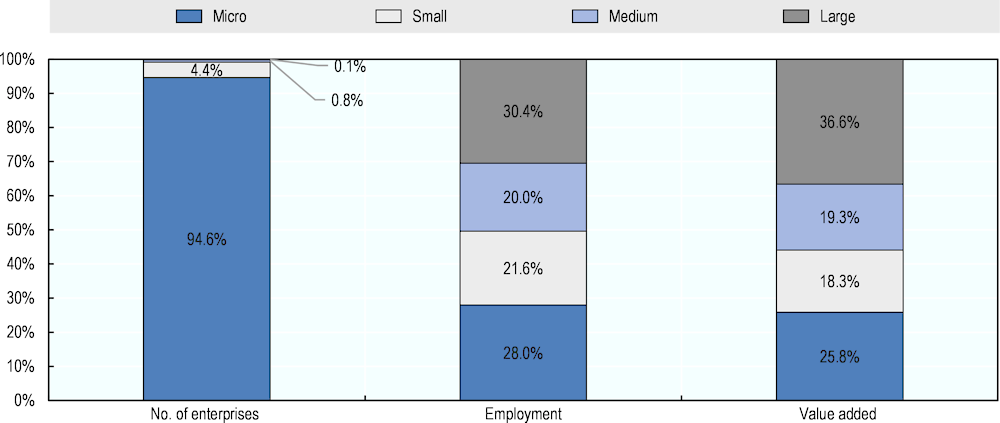

According to 2021 data, SMEs comprise almost 99.9% of all enterprises in the business sector, with micro-enterprises constituting 94.7%. SMEs account for 69.6% of total persons employed and generate up to 63% of value added (Figure 10.2).

Figure 10.2. Business demography indicators in Armenia, by company size (2021)

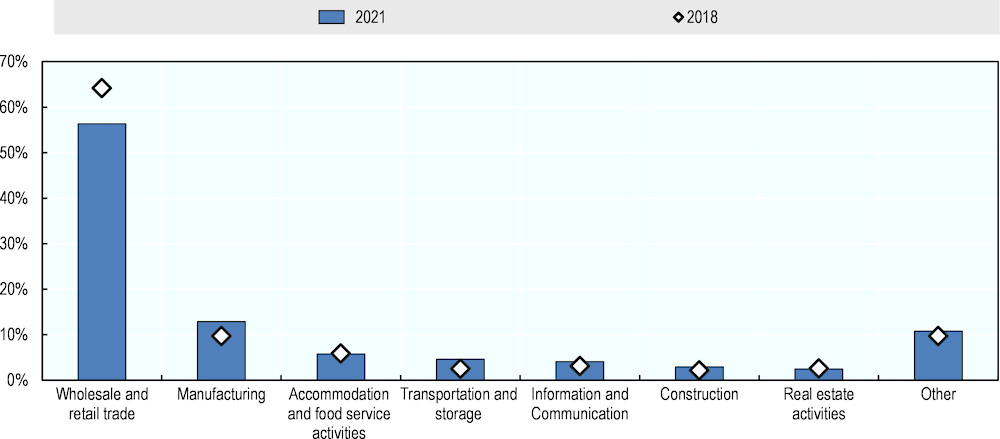

Most SMEs are concentrated in low-value-added activities, with 56% operating in wholesale and retail trade (Figure 10.3). While the shares of SMEs in most economic sectors experienced minimal changes between 2018 and 2021, the share in the wholesale and retail sector notably decreased (by 7.8 percentage points), while the share in manufacturing increased (by 3.1 percentage points).

Figure 10.3. Sectoral distribution of SMEs in Armenia (2021)

Note: “Other” includes the following sectors: administrative and support service activities, real estate activities, construction, repair of computers, mining, energy and water supply.

Source: (Armstat, 2022[17]).

SBA assessment by pillar

SME digitalisation policies

Creating an environment conducive to the digital transformation of SMEs requires a comprehensive policy approach based on sound framework conditions for the digital economy as well as targeted support to help SMEs reap the benefits of digital solutions. Framework conditions refer to pre-requisites for the digital transformation, such as affordable access to high-speed broadband, a satisfactory level of digital literacy among citizens, and a well-co-ordinated and coherent policy approach and governance system for digital policies. In the context of SME development, those fundamentals need to be complemented with specific business support services, digital financial services for SMEs, and tailored support to engage in e-commerce to reach new markets.

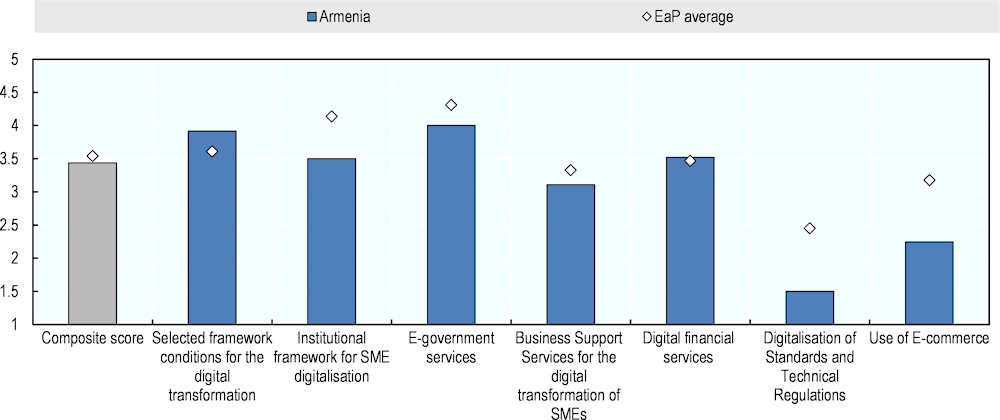

Reflecting the multi-faceted nature of the topic, this round of SBA assessment evaluates EaP countries’ policy approaches to SME digitalisation through i) a dedicated pillar on selected framework conditions for the digital transformation, as well as ii) six new sub-dimensions, incorporated in the pre-existing dimensions of the SBA assessment, to delve deeper into specific thematic policies to foster the digital transformation of SMEs. The weighted average of the scores for the new pillar and digitalisation-oriented sub-dimensions results in a composite score for SME digitalisation policies presented below (Figure 10.4)1.

Overall, Armenia reaches a composite score of 3.44, close to the regional average. The country’s performance is driven by a strong policy framework for digitalisation, i.e. the ongoing national digital strategy and related provisions planned to support SMEs – although the institutional settings for SME digitalisation remain less developed than in EaP neighbours so far. Armenia has also made further progress in increasing the provision of e-government services and digital financial services are being introduced, constituting a pillar of the Central Bank’s general development strategy. E-commerce and digitalisation of standards and technical regulations appear as the weakest areas: although they are both embedded in the national digital strategy, full implementation of concrete measures has yet to materialise.

Figure 10.4. Scores for SME digitalisation policies in Armenia

Note: Further details on the assessment and calculation methodology can be found in the “Assessment framework” section in the Digital Economy for SMEs chapter, in the “Policy framework, structure of the report and assessment process” chapter and in Annex A. Additional information on institutional framework for SME digitalisation and e-government services can be found in Pillar A; on digital financial services in Pillar C; on use of e-commerce in Pillar D; and on Business support services for the digital transformation of SMEs in Pillar E.

The following section details Armenia’s performance in developing selected framework conditions for the digital transformation, while more information on digitalisation-oriented sub-dimensions can be found in the sections on the pillars they respectively belong to.

Selected framework conditions for the digital transformation

Individuals and firms, notably SMEs, cannot fully reap the benefits offered by the digital transformation without the existence of robust framework conditions, such as comprehensive digitalisation policies, access to high-speed Internet and well-rounded ICT skills among the population. Accessible, affordable and stable broadband connection is indeed the sine qua non to ensure widespread participation of citizens and businesses in the digital economy, and to stem the widening of the connectivity gaps between urban and rural territories and between firms of different sizes. Furthermore, fostering digital skills development at all stages of life (through formal education and lifelong learning initiatives for adults) is essential to help the working-age population acquire the skills they need to embark on the digital transformation, produce tech-savvy consumers and build a talent pool of IT specialists.

National digital strategy

Digitalisation is a policy priority for the government. In 2021, the Digitalisation Strategy of Armenia for 2021-2025 (DSA) was adopted, aiming at ensuring i) efficient, transparent and data-driven public administration; ii) economic modernisation and increased competitiveness through digital platforms and smart solutions; and iii) development of digital skills and widespread use of digital solutions in society. The strategy aims to digitally transform government, business and society and covers cybersecurity, data policies, broadband connectivity, digital skills and legislation. It also entails provisions designed to accelerate SME digitalisation. In particular, the document aims at raising awareness of digital technologies across the private sector; fostering SMEs’ uptake and use of digital solutions by various means (including events, legislative incentives and consulting programmes); and providing automated software-as-a-service (SaaS)-type solutions (accounting, personnel management, warehouse management, etc.) on a public cloud platform (free or on preferential terms). Additional measures are planned to develop e-commerce and innovative solutions.

The DSA’s Action Plan is accompanied by a dedicated budget. During 2021-25, it is planned to allocate at least AMD 20 billion (EUR ~47 mln) for the implementation of the DSA. Moreover, Armenia has worked to build a multi-stakeholder approach to digitalisation policies: in 2019 the government established a “Digitalisation Council” that brings together the deputy prime minister; the head of the Prime Minister's Office; the Ministers of Economy and High-Tech Industry; the deputy ministers of the Ministry of High-Tech Industry (MoHTI); the Minister of Education, Science, Culture and Sports; the First Deputy of the State Revenue Committee; and the CEO of Ekeng CJSC and the head of the SDG Innovation Lab in Armenia. The draft strategy also benefitted from public feedback through the e-draft.am platform2 and from reviews by World Bank experts. With regard to implementation, the MoHTI is tasked with a co-ordination role, and the strategy foresees the establishment of working groups of working groups (made up of representatives from the IT sector) to conduct consultations around general strategic and individual digitisation projects. The Central Bank is also closely involved in the implementation process. Finally, the Information Systems Agency of Armenia (ISAA) was established in 2022 to ensure an overarching vision for Armenia’s digitalisation. The agency is responsible for the development of technological foundations and digital society in the country, providing technical resources, organisational capabilities, a legal/regulatory framework, and a platform for collaboration by relevant public stakeholders, as well as the private sector, to effectively foster digitalisation.

Monitoring and evaluation of the Strategy will be performed annually by the Audit Chamber.

The DSA foresees establishing key performance indicators (with associated targets) to facilitate this. However, while some of these indicators will allow for the assessment of progress in some areas, such as e-government and broadband connectivity (see below), they do not capture in areas like SME digitalisation or digital skills. Moreover, some of the selected indicators could be improved. For example, the Action Plan sets the improvement of Armenia’s ranking in the UN E-Government Development Index as a target, but such change in ranking is contingent on other countries’ performance; taking into account the score instead of the ranking would allow for a more accurate depiction.

Moving forward, Armenia will need to closely monitor the implementation of its DSA, ensuring that roles are clearly defined, and that funding is predictable and secure. Indeed, the implementation report published in March 2023 revealed that targets have been only partly met. Continued co-ordination with all relevant stakeholders should be enhanced – encompassing the Ministry of Labour, local authorities, and non-governmental stakeholders such as businesses, the civil society and trade unions. The latter are indeed crucial to shaping digitalisation policies and supporting their implementation (Gierten and Lesher, 2022[18]). Finally, Armenia should consider collecting additional data on the digital transformation to help monitoring policy impact – the OECD Going Digital Framework and its indicators can serve as a useful example.

Broadband connectivity

The DSA provides for the development of broadband connectivity and digital services and aims to expand access in remote regions. As a follow-up to this document, a dedicated National Strategy for Broadband Connectivity is currently being developed. Indeed, the COVID-19 pandemic and resulting increase in demand for Internet services and telecommunication prompted the government to update its agenda for broadband connectivity. The MoHTI mapped existing and operating optical-cable transmission networks in the public and private sectors, identifying their capacities and corresponding network topologies; it also assessed demand in the different regions of Armenia. The conclusions fed into a draft strategy titled “Ensuring access to broadband Internet connectivity in the territory of the RA 2022-24”, which was then revised by a dedicated working group established in 2022. The draft was published on the e-draft platform in April 2022 and is yet to be approved.

There have been some considerable improvements in broadband uptake and quality in Armenia in recent years. In 2021, Armenia had a fixed broadband penetration rate of 16.7% (with a 60% increase between 2016 and 2021, i.e. the largest increase in EaP countries), and a mobile broadband penetration rate of 90.6% (+61% over the same period). Meanwhile, close to 79% of Armenians use the Internet, +22% since 2016. Armenia also saw the development of high-speed networks, with fourth-generation-plus (4G+) technology for mobile networks currently covering 100% of settlements. In 91% of the settlements, the 4G+ coverage of at least two operators' mutually penetrable mobile communication technology is available. Further efforts are planned, with the DSA providing for the construction and improvement of a fibre optic network. In December 2022, the median speed of a fixed broadband download was 40.1 megabits per second (Mbps) (Armenia ranking 99), while the median speed of a mobile Internet download was 24.7 Mbps (Armenia ranking 82) (Ookla, 2023[19]). Overall, data reveal noteworthy progress in bridging the digital gap between urban and rural areas in Armenia in recent years. The DSA further aims at providing 80% of households in both rural and urban areas with access to high-speed Internet and e-government services by 2025. Additional measures are foreseen in the draft broadband strategy to increase access to digital services for several target groups, such as individuals with disabilities.

However, despite the recent increases, uptake in broadband subscriptions remains limited, especially for fixed broadband, which is lower than EaP, EU and OECD peers (21% for EaP countries on average, and about 35% for OECD and EU median values). This difference can be partly explained by persisting Internet affordability issues: while prices for mobile broadband have dropped to 1% of gross national income (GNI) per capita in 2021, prices for fixed broadband in Armenia are still above the International Transport Union’s (ITU) 2% target, reaching 3.5% GNI per capita in 2021 – the highest value in the EaP region. Moreover, assessment and monitoring of digital divides are impeded by the lack of disaggregated data on subscriptions, coverage and quality of service. Data on firms’ broadband uptake and speed, for instance, are not available.

Moving forward, Armenia could further encourage broadband uptake by improving Internet affordability, especially for fixed broadband, and improving data collection to allow for accurate and regular assessments of remaining digital divides, notably on businesses’ access to high-speed Internet. Providing access to open and reliable data on subscriptions, coverage and quality would also enhance consumer choice by helping them making informed decisions, while incentivising providers to improve network quality. Finally, Armenia should consider conducting multi-stakeholder consultations throughout the development and implementation of its upcoming broadband strategy; currently, such consultations (which involve non-governmental representatives) are usually held only on an ad hoc basis. Some national telecom operators (MTS Armenia, Ucom, Telecom Armenia) participated in stakeholder consultations organised during the development of the broadband strategy, but such exchanges should continue moving forward – and should also involve consumers, regulatory authorities, and all levels of government.

Digital skills

The DSA acknowledges that there is a shortage of professionals with digital skills in the private and public sectors, primarily due to a mismatch between education and the labour market. In 2020, only one-sixth of the population used e-government tools, mostly for information purposes, and only 5% of the population used Internet banking – a share significantly lower than in the EU and Georgia, for instance (World Bank, 2020[20]). According to the UN E-Government Survey 2022, Armenia ranks 64th out of 193 countries, slightly behind Georgia but ahead of Moldova.

Well aware of this pressing issue, Armenia has included digital skills as one of the priorities of the DSA. The latter outlines a plan to introduce in-depth courses in schools as an essential step for the development of digital literacy. Moreover, Armenia has planned various measures and educational programmes for different age and social groups – such as people with special needs (as an important means of social and professional integration), women and girls, and residents of communities and remote villages – for whom courses will be organised, along with awareness-raising activities on e-government services. The DSA foresees, for instance, the creation of e-service centres across the country and online courses for seniors and those without advanced technological skills, while civil servants will benefit from training in digital security issues. In terms of recent achievements, Armenia has included digital competence as a key competence in the national education curricula at all education levels.

Armenia’s approach to digital skills benefits from the active involvement of non-governmental stakeholders. While digital skills policies are implemented by the MoHTI, the Ministry of Education, Science, Culture and Sports, the Ministry of Economy, the Central Bank, and the ISAA, representatives from the private sector have launched several successful initiatives to develop digital talents. In particular, there are a number of cases of co-operation between higher education institutions and businesses on these topics. The TUMO Labs education programme, for instance, connects tech companies with universities, offering students opportunities to acquire skills in science, technology, engineering, and mathematics (STEM) through guided self- and project-based learning. The centre has experienced significant success, with approximately 95% of participants finding high-paying jobs in the field upon graduating from the TUMO-led 42 Yerevan initiative (42 Yerevan, 2023[21]) (see Box 4.2 in the “Digital Economy for SMEs” chapter).

The government is supporting this impetus through such initiatives as the recently launched Private Sector Cooperation of the Higher Education Institution for the Training of Specialists, as part of its efforts to develop a talent pool of IT specialists in the country. The programme foresees conducting a training-needs analysis of IT specialists, developing appropriate training courses, further promoting HEI-private sector co-operation, establishing new technological centres/laboratories in and outside Yerevan, and training 1000 specialists in engineering, cyber security, IT and blockchain through intensive 3-6 month courses.

However, Armenia’s achievements in digital skills assessment and anticipation remain relatively scarce. Data on digital skills levels (across individuals of different target groups and businesses) are not regularly collected and analysed. The EU4Digital benchmark of digital skills indicators available, published in 2020, revealed that Armenia lags behind its EaP peers in this regard (EU4Digital, 2020[22]). This significantly impedes policy monitoring and evaluation: despite its provisions for digital skills development, the DSA does not set specific targets to monitor progress in this regard, only foreseeing an increase to at least 60% of people 16-65 years old using electronic tools. Digital skills anticipation exercises are also at a nascent stage, although Armenia benefits from some promising donor-funded ad hoc initiatives – such as the Edu2work platform, which provides fresh insights on skills demand and informs policymaking, notably for labour market policies. There is, nonetheless, no systemic country approach for now.

Moving forward, Armenia could i) ensure the involvement of all relevant stakeholders and co-ordination between the different public and private initiatives, raise awareness of the support available and monitor and evaluate impact; ii) improve digital skills assessment and anticipation tools – notably by collecting data and adopting a digital competence framework on the basis of which the skills acquired could be benchmarked and certified (in line with the EU’s Digital Competence Framework, or DigComp); and iii) further promote digital skills development among businesses, especially small ones, as few provisions have been planned and implemented in that direction so far – even though the lack of digital literacy is evidently a major obstacle to SME digitalisation.

Pillar A: Responsive Government

Institutional and regulatory framework

Armenia has been conducting a proactive SME policy since the early 2000s. However, despite significant progress between 2016 and 2019, further efforts to improve the institutional framework for SME policy, including regulatory reform, were put on hold in 2020, mainly due to the impact of the COVID-19 pandemic and increased political instability. Although the reform process resumed in 2022, it has produced mixed results.

Institutional setting

The mandate to design and co-ordinate SME policy is assigned to the Ministry of Economy. Until recently, the National Center for SME Development (SME DNC), established in 2002, was in charge of implementation, offering a wide range of support programmes through its headquarters in Yerevan and a network of 10 regional offices. In 2016, the Armenian government launched its first SME Development Strategy, covering 2016-18. Upon conclusion of the strategy, the Ministry of Economy commissioned an independent evaluation. In August 2020, a new national SME Development Strategy was approved for 2020-24, largely based on the recommendations emerging from the previous strategy’s evaluation.

The new strategy has three key objectives: i) achieving a productivity growth averaging 3% per year during 2021-23 and 7.5% in 2024, ii) increasing employment in the SME sector by an average of 2.5% per year and iii) raising Armenia's score in the Global Entrepreneurship Index from 22.8 in 2020 to 40 in 2024, as a measure of improvements in entrepreneurial activity and business environment (GEDI, 2019[23]). The strategy also identified a set of measures designed to improve the competitiveness of the SME sector by developing the capacity and entrepreneurial culture of SMEs, facilitating SME access to markets, and providing a favourable institutional and legal environment for SMEs. An action plan for 2020-22 was also approved. However, the implementation of the strategy faced a very difficult start and was carried out only partially. During 2020-22, the plan was to spend AMD 8.8 billion (EUR ~21 mln) on the implementation of SME support activities, of which AMD 5.1 billion (EUR ~12 mln) was to be allocated from the state budget, with the remaining gap expected to be filled by donors. Overall, the current strategy remains largely unimplemented.

An additional disruptive element in the strategy implementation was the government’s decision in 2022 to dismantle the SME DNC and transfer its mandate to mandate to two government bodies: the Department of Entrepreneurship (within the Ministry of Economy) and a different government agency, the Investment Support Center. The latter agency, now re-branded as Enterprise Armenia, is therefore in charge of SME policy and investment promotion, although the allocation of resources between the two tasks is not clear. The restructuring also led to the closure of the network of SME DNC local offices and the concentration of all SME development activities in the capital, while the government ponders various options for supporting local development. Nevertheless, as of May 2023, the government plans to establish a new entity to support SME development, although details on its mandate, the resources, and timeline for its establishment are yet to be defined.

Given the changes in the regional geo-political context, the emergence of a new ICT sector, the re-orientation of trade flows and the establishment of Enterprise Armenia, the Ministry of Economy is currently working on a review of the SME Development Strategy and its extension to 2026. As the strategy and action plan for implementation are under review, planned monitoring and evaluation functions are also under consideration.

The informal sector has a relevant presence in Armenia, but the current SME Development Strategy presents no specific actions to limit its size. Informality is mainly seen as a tax compliance issue.

Legislative simplification and RIA

No significant changes have occurred with regards to the implementation of regulatory reforms and the application of regulatory impact assessment (RIA) since the previous SBA assessment. Nevertheless, reform of the regulatory framework remains a long-term priority for the government. Over the past decade, the number of redundant regulations governing entrepreneurial activity has decreased significantly. However, the process of regulatory reform is far from complete, as less than 25% of all primary and secondary legislation having an impact on business activities is estimated to have been reviewed so far. Since 2019, Armenia has also taken steps to regularly implement RIA as part of its legislative and regulatory processes. According to the current legislation, an RIA of a draft law or a draft government decision must be conducted if it can have a significant impact on the business environment. The RIA should cover the following aspects: i) economic, including business environment and competition; ii) public finance; iii) social; iv) health; and v) environmental. In practice, RIAs are routinely conducted as part of the regulatory reform process, but no SME test has been applied so far.

Public-private consultations

The Armenian government has a long-standing practice of frequent public-private consultations. The Investment Council of Armenia (ICA), in particular through the SME Development Council, serves as a broad platform for public-private dialogue (PPD) on business-oriented legislative reforms between the government and SME associations. Membership in the SME Development Council is open to all relevant associations and non-governmental organisations (NGOs). However, the final list of members is approved by the prime minister. Regular meetings of the SME Development Council, chaired by the Minister of Economy, and of the Investment Council, chaired by the deputy prime minister, are conducted every two months, to guarantee a regular involvement of the Ministry of Economy.

All draft laws and draft decisions of the government are subject to public consultations, which are conducted through a single website: www.e-draft.am.

Public-private dialogue has been further enhanced with the launch, in December 2022, of a new initiative supported by USAID, aiming at improving PPD practices in relation to the approval of several legislative changes – for instance, the amendments to the Civil Code, the Tax Code and the Banking and Finance Laws.

Institutional framework for SME digitalisation

The SME Development Strategy (2020-2024) calls for an acceleration of SME digitalisation and indicates that the government is committed to supporting SMEs' digital presence on commercial platforms. Actions related to those objectives were included in the Action Plan related to the strategy implementation, and in 2021 AMD 50 million (EUR ~118 000) was allocated for technical support to the digital transformation of export-oriented SMEs, with most of the funding provided by donors.

In addition, the Digitalisation Strategy of Armenia for 2021-25 outlines a programme to promote the use of digital solutions among SMEs. In particular, applications such as the SaaS-type automated solutions (accounting, human resource management, warehouse management, etc.) will be provided on a public cloud platform for free or on preferential terms. However, an operational agency supporting SME digital transformation has not yet been identified.

The way forward

To continue improving its institutional and regulatory framework for SMEs, Armenia should complete the revision and update of the current SME Development Strategy. Its objectives should be consistent with the recovery from the crisis related to the COVID-19 pandemic and with the structural changes occurring in the country’s economy, i.e. the growth of the ICT sector. The government should identify an agency with a clearly defined mandate to support SME development, and ensure that adequate human and financial resources are allocated in line with the revised objective of the SME Development Strategy. In addition, Armenia should ensure that SMEs located outside the capital continue to have access to business support and training services and conduct those activities in the framework of a revised local development strategy. To conclude, Armenia should extend the application of RIA to all relevant primary and secondary legislative acts and introduce an SME test.

Operational environment for SMEs

The improvement of the operational environment has been a main priority for the government since the early 2000s. While noticeable progress has been achieved in several areas, Armenia’s scores in all sub-dimensions related to the improvement of the operational environment for SMEs presented in the 2020 EaP SME Policy Index have been below the EaP average, apart from the dimension related to company registration.

Since 2020, Armenia has made significant efforts to expand the range and the accessibility of e-government services. It has also continued to make incremental progress over the other sub-dimensions by further simplifying company registration procedures and by introducing a new simplified tax regime for micro-entrepreneurs.

E-government services

In 2021, the government adopted the Digitalisation Strategy of Armenia through 2025, placed under the supervision of the Ministry of High-Tech Industry (see above), that established ambitious goals for promoting e-government services. Targets were set for promoting the use of digital solutions, encouraging e-commerce, and enhancing the digital transformation at enterprise level. At the same time, following Russia’s war of aggression in Ukraine, the country has received a significant inflow of IT experts from Russia which has contributed to the expansion of the ICT sector and increased the country’s technical capacity to implement ICT solutions. The government is offering an increasingly wide range of e-government services – including online filing of tax returns and social security contributions, e-licensing, e-cadastre, e-procurement, e-payments services, and e-registration of companies. All e-services can be accessed from a central bilingual portal at e-gov.am. In addition to online services, in 2020 the first unified office for public services was launched in Yerevan, providing a wide range of services to citizens and enterprises.

Company registration

In recent years, Armenia has introduced some of the world’s most efficient, transparent, and low-cost company registration procedures. Company registration continues to be a highly simplified and efficient process. All procedures can be conducted either online or through a physical "one-stop shop" system. As a result of the registration, the applicant receives a state registration number, a taxpayer identification number, and an account number along with a personal payment card for social payments.

All forms required for completing the registration process, including the standard articles of incorporation, are produced automatically during the registration process. In February 2021 amendments to the Law on State Registration of Legal Entities were approved, further simplifying the online registration process, abolishing the online registration fee, and introducing a deadline for registration completion by public entities.

Business licensing

A comprehensive set of information on all licenses, including license applications, is available through the centralized e-licenses portal3, which serves as a single-entry point for requesting licenses and permits. Over the previous four years, the number of licensed activities has expanded slightly due to public safety concerns. For example, the production and maintenance of medical equipment, all types of pre-school services, and some transport services are now subject to licenses.

Tax compliance procedures for SMEs

Tax administration is relatively simple, and tax returns can be filed online. In 2020, a new tax regime for micro-entrepreneurs came into force. Under this preferential tax system, taxpayers are exempt from all basic taxes and can hire an unlimited number of employees. Legal entities, individual entrepreneurs, and individuals can all operate under this tax system if their annual turnover does not exceed AMD 24 million (EUR ~57 000). Furthermore, at the beginning of 2020, the corporate income tax rate was reduced from 20 to 18%, and the flat personal income tax rate was set at 23%. A further reduction to 20% was applied at the beginning of 2023. A turnover tax has been introduced to replace value-added tax (VAT) and (or) corporate income tax for SMEs. To qualify for the turnover tax regimes, enterprises must have an annual turnover not exceeding AMD 115 million (EUR ~270 000). The turnover tax rate varies from 1.5% to 25% depending on the type of activity but is generally 5%. While the new tax regimes for micro-entrepreneurs and SMEs have reduced the tax burden and simplified tax compliance procedures, at the same time they may have also introduced incentives to hide part of the enterprise turnover in order to qualify for the new regimes, thereby increasing the size of the informal economy.

The way forward

To further improve the operational environment for SMEs, Armenia should i) conduct a review of the range of available e-government services and fill gaps related to the provision of good-quality services to SMEs; ii) improve co-ordination among public entities for the provision of e-government services, especially in areas where it appears to be weaker, i.e. business licenses and tax compliance; iii) systematically collect data on the use of e-government services by SMEs and take actions to increase their usage by improving SME digital skills and conducting promotional campaigns; and iv) calculate the effective tax rates imposed on different types of SMEs and make sure that tax incentives do not generate distortions and promote turnover and income under-declaration.

Bankruptcy and second chance

Bankruptcy proceedings for legal and natural persons are governed by the Law on Bankruptcy adopted on 25 December 2006 and subsequently amended. The law formally provides for restructuring procedures, protection of creditors’ rights, and discharge procedures, and it applies to private businesses as well as state-owned enterprises (SOEs). Bankrupt entrepreneurs can obtain a formal court decision declaring them non-fraudulent and thus excusable. The last amendment to the law in April 2020 introduced significant changes, such as the improvement of the regulatory system for insolvency practitioners with the creation of self-regulatory associations of practitioners under the control of the Ministry of Justice (MoJ), and the introduction of the electronic exchange of documents between the specialised insolvency courts, state and local authorities, and insolvency practitioners (EBRD, 2021[24]).

However, the legislation could be further improved to reach international standards (EBRD, 2021[25]). In particular, bankruptcy procedures and the operation of insolvency courts could be streamlined by introducing out-of-court debt restructuring procedures as a less costly alternative to formal bankruptcy proceedings.

Moreover, Armenia has not substantially advanced since 2020 as regards the implementation of preventive measures to assist entrepreneurs in financial distress. The government could consider introducing pre-insolvency tools – such as public awareness campaigns highlighting available support, publicly sponsored advisory services, and early-warning systems – to support entrepreneurs in the early stages of financial difficulties. Additionally, Armenia could consider implementing a dedicated policy strategy or information campaign to promote “second chance” for bankrupt entrepreneurs seeking a fresh start. To this end, the government should also remove existing barriers for failed entrepreneurs to re-enter the market (e.g. the restriction imposed by the Armenian Tax Code, according to which an entity that declares bankruptcy is prevented from working under the preferential tax regime for five years). To conclude, activities to monitor and evaluate both bankruptcy-prevention measures and survival-and-bankruptcy procedures remain limited, and the government could consider developing monitoring and evaluation practices to increase the efficiency and effectiveness of its bankruptcy and prevention policy.

Pillar B: Entrepreneurial human capital

Entrepreneurial Learning

Entrepreneurial learning is part of several national official documents, including the SME Development Strategy 2020-2024 and the Gender Policy Implementation Strategy. According to the action plan of the SME Strategy, Armenia planned to spend AMD 136 million (EUR ~320 000) on activities aimed at improving the entrepreneurial skills of entrepreneurs and employees of SMEs. As recommended in the SME Policy Index 2020, the new SME strategy broadened Armenia’s approach to entrepreneurial learning by emphasising the need to promote the development of an entrepreneurial mindset (leadership, responsibility, proactivity, willingness to take risks) and related skills, such as teamwork and project management.

Currently, entrepreneurship is integrated into the subject "Technology" in grades 2-7, and as a dedicated topic in grades 10-11 and in all vocational education and training (VET) specialties. Accordingly, entrepreneurship as a key competence is reflected in the learning outcomes of the state standards of general education and all specialties of vocational education. Armenia has made further progress in teacher training since the last SBA assessment: the Ministry of Education, Science, Culture, and Sports collaborates with the NGO Junior Achievements of Armenia to promote entrepreneurship education in public schools, including training teachers and developing teaching materials. In 2021-22, all teachers in general education were trained in Technology and Entrepreneurship (for grades 2-7 and 10-11, respectively). Additional efforts are being provided in that direction with the support of GIZ.

With regard to higher education institutions (HEIs), several Armenian HEIs are now implementing entrepreneurial learning in non-business faculties and non-technological faculties, with donor support. For example, the State Academy of Fine Arts of Armenia implemented a Creative Entrepreneurship training programme in 2019, with the sponsorship of the British Council. The latter has also funded six “Creative Spark” partnerships in seven Armenian universities. Furthermore, some HEIs, such as the American University of Armenia, have been co-operating with businesses to promote entrepreneurial learning, although these cases remain limited to business faculties.

However, Armenia shows overall mixed progress since 2020. There is still no formal national policy partnership in place, and not all learners engage in at least one practical entrepreneurial experience. There have not been significant improvements in the ways entrepreneurial learning is promoted among the population, nor in career guidance. More emphasis could be put on non-formal learning. Despite a few ad hoc examples, education−business co-operation remains scarce – there is no systemic co-operation between SMEs and secondary schools (either in general education or in VET), and the topic remains unaddressed in policy documents so far. Finally, the assessment reveals a lack of monitoring and evaluation: recommendations from the monitoring and evaluation of lifelong entrepreneurial learning activities are not integrated into further improvement of national policies, and students are not tracked after graduation.

Moving forward, Armenia should adopt a formal policy partnership on entrepreneurial learning and further foster non-formal learning. Building on existing efforts, teacher training could be strengthened by i) having pre-service teacher training institutions implement entrepreneurship key competence as a compulsory topic; ii) providing in-service teacher training covering entrepreneurship in VET institutions; and iii) providing training on the topic for school and university managers. Moreover, the successful cases of co-operation between HEIs and businesses could serve as an example to foster co-operation between general secondary schools and SMEs, to further promote entrepreneurial learning at all education levels. Finally, monitoring and evaluation could be improved, notably by tracking graduates.

Women's Entrepreneurship

According to the Global Entrepreneurship Monitor’s (GEM) 2020 report on Armenia, the share of women involved in entrepreneurship, despite being lower than that of men, is increasing (Global Entrepreneurship Monitor, 2020[26]). The report reveals that the motivation of men and women differs significantly, as more women start a business "to make a difference in the world," while men are rather motivated by "[creating] a large fortune or income" and "[continuing] the family tradition”. However, both women and men creating a business are mostly subsistence entrepreneurs, choosing this path because job opportunities are scarce (Ameria CJSC, 2020[27]). An IFC study conducted in 2020 found that women-owned businesses tend to be younger and smaller. While both male and female entrepreneurs typically receive support from family members in their entrepreneurial endeavours, the pressures associated with running a household and caring for children remain major challenges for women entrepreneurs (IFC, 2021[28]).

Since 2020, Armenia has taken several measures to foster women’s entrepreneurship. This topic is addressed in several policy documents, including both the SME Strategy and the Gender Policy Implementation Strategy for 2019-2023 and their related action plans. Armenia is now working on developing a “Platform for Women's Economic Empowerment” training project targeting women’s entrepreneurship and employment, with co-financing from the Ministry of Labour and Social Affairs, the Ministry of Economy and UNDP. The project seeks to empower at least 50 aspiring and 50 current women entrepreneurs, as well as 250 women with low economic capacity. As of December 2022, 209 aspiring and 54 current women entrepreneurs were participating in the training, according to the Ministry of Economy.

Additional women-specific initiatives have been planned, with various focuses – such as preferential interest rates foreseen in the SME strategy, small grants implemented by the SME Cooperation Association and UNDP in 2021 to encourage women’s entrepreneurship in regions, and the Enterprise Incubator Foundation (EIF)’s women-only investment readiness programme. Moreover, some awareness-raising campaigns have been conducted, e.g. in conjunction with International Mathematics Day 2022 and the UNDP-led series of Accelerator #5 programmes,4 which aim to inspire girls and women to engage in STEM fields.

Nevertheless, women’s entrepreneurship policies would benefit from better co-ordination across public and private stakeholders. Current policy documents contain neither measures for strengthening the capacity of non-government organisations and networks active in the field, nor co-ordination measures between the different relevant ministries. Moreover, more could be done to raise awareness of the support available, e.g. by publishing information about government support for women entrepreneurs on a dedicated website. Finally, monitoring and evaluation remains limited: support policies and programmes are not monitored and evaluated, and there are no regular surveys being conducted on barriers to women’s entrepreneurship.

Moving forward, Armenia could i) strengthen co-ordination across public and private stakeholders engaged in women’s entrepreneurship policies, to foster a common assessment of women entrepreneurs’ remaining needs, optimise efforts and ensure proper monitoring and evaluation of the initiatives’ impact; ii) complement its support by addressing persisting yet overlooked issues, such as informality; and iii) improve monitoring and evaluation, e.g. by conducting regular surveys on barriers to women’s entrepreneurship (building on the good GEM Monitor example). Beyond measures addressing women’s entrepreneurship, Armenia could implement additional measures to foster gender equality, including a gender sensitivity check of existing and proposed policies affecting women entrepreneurs.

SME Skills

Facilitating the development of current and future SME skills, together with allocating financial support for SME training programmes, is essential to tap into Armenia’s entrepreneurial potential.

The SME State Support Annual Program, previously managed by the SME DNC, offered support in areas such as youth and women's entrepreneurship and internationalisation. However, following the restructuring of the SME DNC, responsibility for these initiatives has been re-distributed among separate organisations. The department of Entrepreneurship of the Ministry of Economy is now responsible for the provision of general information and training services for SMEs, while Enterprise Armenia is in charge of managing support in the framework of the Enterprise Europe Network. Within the framework of Action 9, over 2020-22 the Ministry of the Economy organised 55 skill-development training courses in which 601 SMEs participated.

Most of the SME/start-up skills development programmes, however, are delivered by NGOs, largely as a component of donor-funded projects. As a leading contributor to national skills intelligence, the Enterprise Incubator Foundation carries out a range of activities, such as digital and entrepreneurial training for SMEs, in schools, and for lifelong learning of adults. Overall, a wide range of accelerators and incubators have been developed to implement training and mentorship programmes. These include the IRIS Business Accelerator, the SAP Start-up Factory, the BANA Business Incubator, the Armenia Startup Academy, and the ImpactAim accelerators.

Similarly, in an apparent step forward since the last SBA assessment, some ad hoc training-needs analyses and skills-anticipation exercises have been conducted by international organisations and private consulting firms, supported by donors.

However, Armenia still lacks a national framework for the collection and analysis of data on SME skills. Despite some statistics being collected on SME participation in state-supported training, data on SME skills and needs is very scarce, and no analysis of SME skills data has been undertaken since the last assessment. No skills assessment and anticipation tools have been implemented yet. The scattered training and mentoring initiatives, implemented by various stakeholders, make it difficult to establish an overview of beneficiaries, and increase the risk of overlapping services. SMEs can also struggle to navigate between the training offers, to understand the differences and to select the most appropriate one(s) – indeed, there is no one-stop shop / web-based platform to help them identify training programmes. Some areas remain uncovered, such as greening – the Climate Change Tech Accelerator, which used to cover this area, was not re-conducted after 2020. Moreover, despite the COVID-19 pandemic, there has been very little progress in the development of online training (as recommended in 2020), and there is no example of digital learning methods being used. Finally, monitoring and evaluation of support programmes are still at a nascent stage, with no impact evaluation being conducted.

Moving forward, Armenia could increase co-ordination among business support service providers and donors to avoid overlaps and maximise impact. Enhancing collaboration between business associations already involved on the topic (such as the Chamber of Commerce and Industry) and other stakeholders (such as Business Armenia) would also help co-ordinate efforts and gather first-hand private sector views on persisting needs. In the medium/long term, the country should consider reducing its reliance on NGOs’ provision of upskilling and reskilling initiatives for SMEs to ensure support does not remain limited to basic training but offers opportunities for entrepreneurs at all stages of business development. Furthermore, raising awareness of the different training opportunities available would considerably help SMEs navigate between the different offers – e.g. through a single online portal. Publishing all available SME training events on an integrated website would enhance access to knowledge. In parallel, Armenia should develop a national framework to allow for systemic collection and analysis of data on SME skills, and use the insights gathered to develop new training programmes and inform policymaking. Finally, monitoring and evaluation practices could be improved by ensuring the assessment of the concrete impact of each of the training initiatives. Establishing an impact monitoring framework for SME training would ensure the high quality and efficiency of implemented capacity-building services, while the good training practices identified could then feed into new programmes.

Pillar C: Access to finance

Legal and regulatory framework

Armenia has a reasonably well-developed legal framework for bank lending. A functioning cadastre and register for movable assets are in place and according to a recent bank survey conducted by the EBRD, around half of Armenian banks think that the framework works well – although enforcement needs to be strengthened, with a quarter of banks thinking enforcement of security rights over immovable assets is too cumbersome, and 46% of banks thinking the same when it comes to movable assets (EBRD, 2021[29]). Consequently, banks tend to not rely on movable assets for their credit decisions toward SME customers. Credit information is collected from banks, non-financial institutions and utilities, allowing a wider range of the population to build up a credit history.

The Central Bank of Armenia has strengthened its supervisory toolkit by further aligning its regulatory framework with the Basel III principles and improving its risk-based supervision framework that was first adopted in 2017 (IMF, 2022[4]). Past measures to encourage local currency lending seem to have taken hold, as dollarization in the country has reduced: around 40% of corporate lending by banks and credit organisations was in local currency in June 2023 compared to 22.7% in June 2019, at the time of the last SBA assessment. At the moment, ESG reporting is not yet required, meaning that banks have no non-financial disclosure requirements; consequently, no green taxonomy is in place yet, although one is under development.

Capital markets are regulated under the Law on Securities Market, the Law on Investment Funds and a number of other relevant regulations. In 2020, a new capital markets development strategy was approved and is currently under implementation. The Armenia Securities Exchange is the local stock market which is regulated by the Central Bank of Armenia. Key activities are listing and trading of stocks and bonds, with 28 active issuers and close to 100 traded bonds, as of September 2023. This means that the market is relatively small, and listings consist primarily of banks and a number of local corporates. Equally, 82% of corporate bonds issued are by local banks. The exchange therefore does not seem to constitute a realistic funding option for medium-sized or smaller companies. However, the Ministry of Economy submitted a proposal to support bond issuers with transaction costs and the acquisition of a rating from a rating agency, which was approved in June 2023. These measures could help encourage more issuances.

Sources of external finance for SMEs (bank financing, non-banking financing, and venture capital)

Credit to corporates and SMEs in absolute terms has remained relatively stable since December 2019, and while GDP in current prices dipped in 2020 due to the pandemic, it has grown since then (IMF, 2021[30]). This suggests a gap between the financial sector and the real economy. It would be important to bridge this gap in order to turn the financial sector into a pillar that supports economic growth going forward. Indeed, improving access to finance is one of four pillars of the country’s SME Development Strategy 2020-2024 which aims to facilitate SME growth and productivity and is also reflected in the Government of Armenia’s 5-year programme 2021-26. Activities to date have focused on improving access to finance for start-ups and growth companies, non-bank financing mechanisms such as leasing and crowdfunding, and the development of capital markets.

When it comes to SMEs’ perception of their ability to access financing, Armenia has one of the highest shares of firms thinking that access to finance is a major or very severe obstacle to doing business. According to a recent enterprise survey, around 35% of SMEs indicate a lack of external funding sources to be a major issue (the only country in the region with a higher share, 46%, is Ukraine). Around 32% of SMEs who are credit constrained (i.e. they need a loan but cannot access one) report that they did not take out a loan because of unfavourable interest rates, suggesting that there is a clear issue of affordability (EBRD, 2021[31]).

The recent re-organisation of the institutional structure through which SME support is provided means that Enterprise Armenia is likely to take on most of the responsibilities that resided with the SME DNC before (others now sit with the Ministry of Economy directly). The restructuring has also triggered a more in-depth review of existing funding programmes, including the credit guarantee scheme (supported by the EU and World Bank). During the COVID pandemic, the credit guarantee scheme was propped up to provide guarantees of around AMD 1 billion (EUR ~2.36 mln), a significant increase compared to previous levels. The scheme currently has little private sector involvement and is entirely reliant on government funding – two aspects that should be reviewed as part of its general overhaul. In addition, while regular monitoring of results by the Ministry of Economy is carried out, no evaluations or impact assessments seem to be carried out. This is a major shortcoming as such more in-depth assessments are crucial to assess the workings of the programme and its impact on financial inclusion. The same applies to other access to finance support programmes, including the interest rate subsidy provided by the Economic Modernisation Program. Results from such evaluations should also be shared with various stakeholders (including private banks and business associations) in order to create the opportunity for a feedback loop around programme design. This is extremely important in order to determine whether programmes are effective in reaching their policy goals.

The Ministry of Economy has also launched an Economic Modernisation Program which provides interest rate subsidies on loans and leases for the purchase of modern (new) equipment and machinery. The total budget of the programme for 2023 is AMD 8.2 billion (EUR ~19.4 mln). The subsidy rate ranges between 6% and 10%, depending on the instrument and currency (leasing instruments and local currency funding attracts a higher interest rate subsidy) (Ministry of Economy of Armenia, n.d.[32]). The programme has certain caps in place, for instance, on duration and amount of the subsidy, but it does not limit repeated use, which could constrain its potential to reach new beneficiaries. Including both loans and leasing products in the programme is a good way to encourage leasing activities rather than solely focusing on bank credit. Financial support is also available through several programmes managed by the German-Armenian Fund (GAF). Some programmes funded by international financial institutions (IFIs) are also managed through the GAF, targeting female-owned or managed enterprises as well as firms active in agriculture and tourism.

Access to non-bank financing has improved since the last assessment when it comes to leasing and venture capital (VC). However, microfinance volumes have steadily dropped by 30% since 2019 (Central Bank of Armenia, n.d.[33]). Microfinance is mainly provided through credit organisations that are regulated by the Central Bank of Armenia. They are not allowed to raise deposits, somewhat limiting their role within the financial system. The legal framework for leasing and factoring is based on the Civil Code, which stipulates that these services can only be provided by a bank or licensed entity. While factoring volumes have been stable since the last assessment, leasing transactions have seen a more than five-fold increase between 2019 and 2022. The uptake of leasing as a financing instrument is further supported by the Economic Modernization Program discussed above. A similar approach to support factoring is under discussion.

Private equity could be further developed, but given the size of the market, there are a reasonable number of equity and VC funds active in the country. One example is the EU-Armenia SME Fund managed by Amber Capital, which aims to support SMEs with growth potential. It is supported by a range of IFIs and private and institutional investors, including the EU and EBRD, as well as the Armenian government (via the Armenian National Interests Fund). More generally, Armenia’s government has made efforts to develop the VC sector and tap into the Armenian diaspora for investments. In 2013, Armenia’s first venture fund, Granatus Ventures, was launched with government participation to invest in start-ups in the tech sector. Since then, the fund’s portfolio has grown substantially, and a number of successful exits have been completed. In 2019, a second fund, Granatus Tech4SDG, was launched with support by UNDP to invest in tech start-ups with a strong potential for ESG impact. There are also a number of private VCs operating in the country, many of which focus on earlier stages of development. To build on positive past experience, a proposal for a fund of funds supported by the government is currently under consideration. Business angels can connect and exchange through the Business Angel Network of Armenia (BANA), which brings together local investors as well as Armenians living abroad. Finally, the Central Bank adopted new regulation on investment-based crowdfunding in February 2022 to facilitate the offering of crowdfunding platforms in the country.5

Financial literacy

The latest Financial Capability Survey was conducted in 2019. The results suggest that fewer than half of Armenians have an adequate understanding of financial concepts. In response, the National Financial Literacy Strategy for 2021-2025 focuses on improving personal and household level financial literacy in the population. To help raise financial awareness, the Central Bank of Armenia has launched two online platforms. One of them is abcfinance.com which explains financial concepts, provides guidance on how to go about making certain financial decisions (e.g., how to plan for retirement, manage debt, types of payments etc.), and provides practical tools, for example, on budgeting. It also contains educational material aimed at younger people as well as teachers. The second platform, fininfo.am, provides information about financial instruments and allows potential borrowers to compare products. These are all important steps and tools to improve the understanding of financial concepts among the population. Both the strategy and platform primarily target the general population, however, and only offer limited resources targeted at small business owners.

Digital financial services

No formal strategy for digital financial services has been developed, but it is a pillar in the Central Bank’s general development strategy. The leading authority dealing with issues in this field is the Central Bank of Armenia whose Financial Stability and Regulation Directorate deals with policy and regulatory approaches to digital financial service provision. The regulatory framework surrounding digital finance is still under a relatively early stage of development. Data protection is currently covered by general regulation but plans exist to regulate the use and protection of data in the context of digital finance specifically, and to move toward an open finance framework in which data sharing obligations and their modalities will be defined. More sophisticated regulatory tools such as supervisory technology (“suptech”), regulatory sandboxes, and a Central Bank digital currency are not in place yet, but are under development.

The way forward

Access to credit for SMEs could be strengthened by improving the legal framework for secured transactions. When it comes to taking security, the use of movable assets as collateral should be made easier. Banks clearly do not see this as a viable option. Following an analysis to determine why this might be the case, necessary steps should be taken to remedy this issue. Furthermore, enforcement processes will need to be streamlined and made more efficient to encourage bank lending to SMEs. Even if the definition and registration of collateral worked well, the lack of an efficient enforcement mechanism will be a major drag on bank lending as commercial banks need to spend significant resources to protect themselves in the case of borrower defaults.

Introducing ESG reporting requirements would improve the overall regulatory framework by allowing the monitoring of a wider range of parameters that are increasing in importance. In this context, it is important to set out clear standards for reporting so that banks are able to follow straightforward rules when it comes to the analysis of their portfolios. In this context, finalising the development of a green taxonomy will be crucial to move forward on this front.