This chapter provides an assessment of the progress made by Ukraine in implementing the Small Business Act (SBA) for Europe over the period 2020-23. It starts with an overview of Ukraine’s economic context and dives further into the characteristics of the country’s SME sector. It then develops on the state of selected framework conditions for the digital transformation of SMEs. Finally, it analyses Ukraine’s progress along twelve measurable dimensions grouped in five thematic pillars and sets out targeted policy recommendations.

SME Policy Index: Eastern Partner Countries 2024

14. Ukraine: Small Business Act country profile

Abstract

Key findings

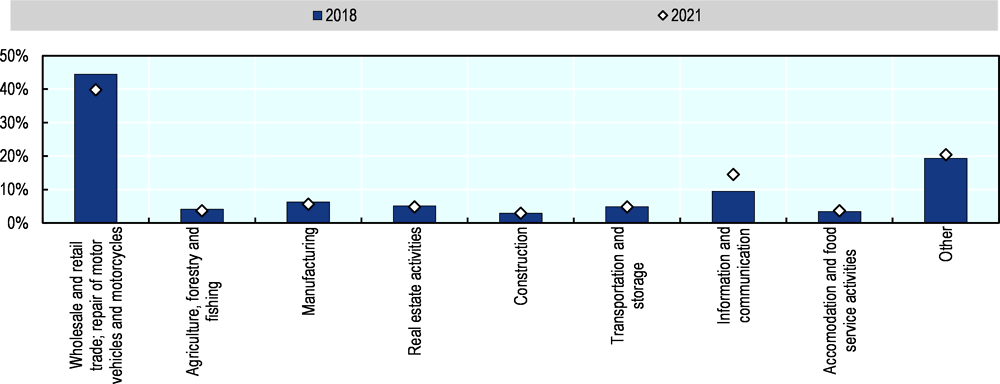

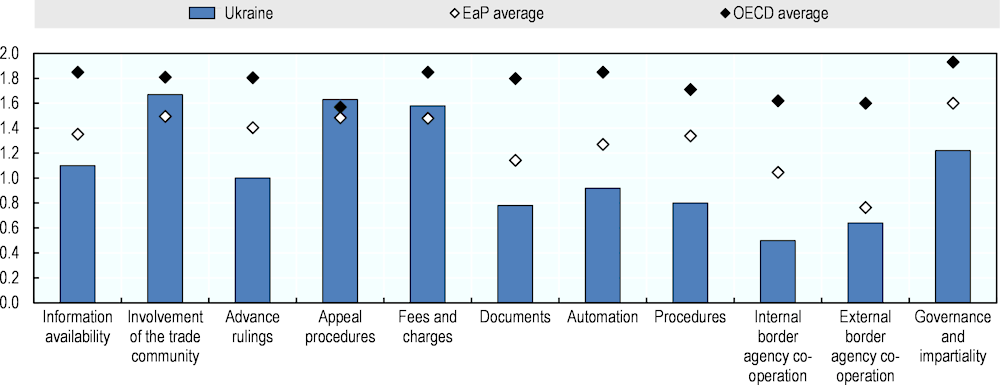

Figure 14.1. SME Policy Index scores for Ukraine

Note: CM stands for comparable methodology. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Table 14.1. SME Policy Index scores for Ukraine

Country scores by dimension, 2024 and 2020 vs 2024 CM

|

Pillar |

Dimension |

Ukraine 2024 |

EaP average 2024 |

Ukraine 2024 (CM) |

Ukraine 2020 (CM) |

|---|---|---|---|---|---|

|

Pillar A |

Institutional and regulatory framework for SME policy |

3.68 |

3.78 |

3.80 |

3.64 |

|

Operational environment |

4.11 |

4.24 |

4.36 |

3.70 |

|

|

Bankruptcy and second chance |

2.52 |

2.35 |

3.75 |

3.24 |

|

|

Pillar B |

Entrepreneurial learning/ women’s entrepreneurship |

3.95 |

3.64 |

4.56 |

3.83 |

|

SME skills |

3.91 |

3.57 |

4.12 |

2.97 |

|

|

Pillar C |

Access to finance |

3.40 |

3.56 |

3.63 |

3.54 |

|

Pillar D |

Public procurement |

3.61 |

3.15 |

3.25 |

3.22 |

|

Standards and regulations |

3.86 |

3.83 |

3.91 |

3.75 |

|

|

SME internationalisation |

3.77 |

3.58 |

3.60 |

2.75 |

|

|

Pillar E |

Business development services |

3.57 |

3.57 |

3.27 |

2.80 |

|

Innovation policy for SMEs |

3.03 |

3.09 |

2.42 |

2.01 |

|

|

Green economy policies for SMEs |

2.56 |

2.81 |

2.61 |

2.49 |

Note: CM stands for comparable methodology. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Table 14.2. Implementation progress on SME Policy Index 2020 policy reforms – Ukraine

|

Priority reforms outlined in the SME Policy Index 2020 |

Key reforms implemented to date |

|---|---|

|

Pillar A – Responsive Government |

|

|

Develop a new SME strategy and ensure there are sufficient resources to implement it. Evaluate the effectiveness of the SME Development Office (SMEDO) and its position in the institutional framework. Ensure that the new regulatory impact assessment (RIA) methodology is applied at all levels of government. Expand the regulatory reform process, focusing on areas of low performance. Implement an early warning system for detecting insolvency. Adopt a second chance strategy for bankrupt entrepreneurs. |

Transformation of the Export Promotion Office (EPO) into the Entrepreneurship and Export Promotion Office (EEPO) in 2021. Regular review by the State Regulatory Service of Ukraine of draft regulations and their RIAs. Launch of the Diia web portal, which offers e-services that simplify regulatory procedures for SMEs as well as information for entrepreneurs in financial distress. |

|

Pillar B – Entrepreneurial Human Capital |

|

|

Consolidate the current monitoring and evaluation (M&E) actions and create an M&E framework for key competence development. Develop a systematic approach to gathering SME skills intelligence data on a regular basis. Implement a policy framework for women’s entrepreneurship and develop a plan for activities in this sense. Ensure gender-sensitive data collection on business activities. |

Goals set in National Economic Strategy (NES) 2030 to develop entrepreneurial skills. Additional steps taken to foster assessment of learning outcomes. A wide range of training for women entrepreneurs, promoted on the Diia online one-stop shop. Regular surveys on barriers to women’s entrepreneurship. Enhanced public and private training opportunities for SMEs. The EEPO collects statistics and feedback on training. |

|

Pillar C – Access to Finance |

|

|

Complete reforms to strengthen the legal framework for non-bank financing instruments. Review SME financing support tools and ensure appropriate mechanisms are included to evaluate programmes. |

The National Bank of Ukraine (NBU) allowed banks to use cloud storage abroad. Support for SMEs through the government’s 5-7-9 programme. Update to the regulation on microfinance in 2021. Launch of Diia.Business, which offers a range of knowledge and training on financial literacy, accounting, etc. Adoption of a new Strategy for the Development of the Financial Sector of Ukraine in 2023, superseding the Fintech Development Strategy until 2025 approved in 2020. |

|

Pillar D – Access to Markets |

|

|

Ensure the funding and capacity of the EPO to expand its support services. Ensure the transparency and accountability of the trade financing programme provided through the Export Credit Agency (ECA). Introduce measures to support SMEs’ use of EU standards and conformity assessment services. Improve the effectiveness of market surveillance. Strengthen the review of public procurement activities, with a focus on the proper application of reasonable award and selection criteria. Conduct capacity-building activities to raise the knowledge and skills of contracting authorities. |

Development of a draft new Export Strategy, on the basis of information gathered through a business survey. 54 new EU-focussed technical regulations. Order No. 285 of Ukraine’s National Standardization Body “On the package adoption of the CEN-CENELEC European regulatory documents by Ukraine” to adopt 20 268 European CEN/CENELEC normative documents as national normative documents by 31 December, 2023. Support and training on standards and technical regulations for SMEs, with a focus on integration into the EU Digital Single Market. Development of a strategy for market surveillance. Advice and support received from EU for further developing public procurement; PPL successively amended; procedures simplified and competition enhanced; new medium-term development programme drafted. |

|

Pillar E – Innovation and Business Support |

|

|

Monitor the impact of innovation grants for SMEs and phase-in additional tools. Introduce incentives to commercialise publicly funded research. Establish a single information portal on starting/developing a business. Improve M&E of support programmes to measure the impact on SME performance and assess the effectiveness of support infrastructure. Provide information and direct support to SMEs on the benefits of the planned green public procurement policies. |

Establishment of the Ukrainian Startup Fund (USF) providing grants and support programmes to start-ups. Participation in Horizon Europe to fund research and innovation. Creation of Diia.Business portal, an online hub providing information and hosting trainings for Ukrainian entrepreneurs. The EEPO’s development of a network of Diia.Business Support Centres. Provision by private and state-owned banks of finance for green investments. |

Context

Economic snapshot

Ukraine’s economy is facing the toughest challenges of its recent history. COVID-19 caused a 3.8% decline in GDP in 2020 and, although the economy began to recover in 2021 (Box 14.1), Russia’s war of aggression against Ukraine in February 2022 inflicted severe damage, with civilian casualties in the tens of thousands, millions of people displaced within the country or abroad, significant infrastructure damage, trade disruptions and deep economic shocks (Box 14.2). As a result, real GDP shrank by 29.1% in 2022 (Table 14.3). Nevertheless, the economy showed considerable resilience: the full-year outcome was better than the 40-50% contraction projected at the start of the invasion and the economy largely stabilised after the first few months of the war. In mid-2023, real GDP growth estimates for the year stood in the 2-3% range (IMF, 2023[1]).

In 2022, exports of goods and services dropped by around 43%, while imports volume declined by 28%, owing to blocked transport routes (IMF, 2023[1]). The “Black Sea Grain Initiative” revitalised foreign trade by unblocking key seaports in the Black Sea, thereby improving access to international markets for Ukrainian agrifood companies, but Russia withdrew from the agreement in mid-2023. The transport issues represented a major challenge to Ukraine’s business sector, and in particular to SMEs, which have fewer resources and logistical opportunities. Since May 2022, the EU has mobilised EUR 1 billion for the “Solidarity Lanes” initiative to increase global food security and support for the Ukrainian economy (EU NeighboursEast, 2022[2]).

Over 40% of Ukraine’s SMEs had to stop or limit operations during the first weeks of the war (EBRD, 2023[3]). However, most Ukrainian SMEs adapted to the difficult situation, and only 6% of them had suspended operation by the end of the year (EBRD, 2023[3]). Their swift adaptation owed much to a successful transition of their business online and to a lowering of production capacities (EBRD, 2023[3]). Ukraine’s banking system has also demonstrated great resilience, supporting uninterrupted electronic payment operations. However, the enterprise sector continues to struggle, and in early 2023, the share of non-performing loans (NPLs) had grown by 8 percentage points on the previous year, to reach 38%, reversing the stable trend of gradual reduction observed since 2018 (National Bank of Ukraine, 2023[4]).

Ukraine’s international partners have provided military, humanitarian and direct financial aid to support the functioning of the government. Foreign budget support had reached USD 32.1 billion by the end of December 2022 and remains vital in 2023, as Ukraine’s budget deficit is expected to be more than USD 38 billion. The IMF and the Ukrainian authorities estimate financial assistance needs between USD 36 and USD 48 billion in 2023 to ensure macroeconomic stability, maintain key public services and restore critical infrastructure (European Commission, 2022[5]). The support package also envisages critical reforms in the areas of rule of law, good governance and anti-corruption (European Commission, 2022[5]).

The Ukrainian government has prioritised digitalisation through the creation of the Ministry of Digital Transformation in August 2019. In 2020 alone, the share of online retail trade had almost doubled, jumping from 1.2% to 2.1% of total retail turnover. The IT sector has held strong even during the war; in fact, in 2021-2022, information and communication economic activities generated 4.7% of Ukraine’s GDP, compared to around 3.8% in 2016. In 2021, export of IT services reached USD 7.1 billion, more than one-third of the total volume of exported services and one tenth of total exports, with 285 000 specialists employed in the sector. In 2022, the export of IT services increased by 5.8% year-on-year, reaching USD 7.5 billion. Electronic public services have also been developed, becoming widely accessible for all citizens and businesses. Digital government is one of the key recovery priorities.

Table 14.3. Ukraine: Main macroeconomic indicators (2018-2022)

|

Indicator |

Unit of measurement |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|

|

GDP growth* |

Percentage, year-on-year |

3.5 |

3.2 |

-3.8 |

3.4 |

-29.1 |

|

Inflation* |

Annual percentage increase, consumer prices |

10.9 |

7.9 |

2.7 |

9.4 |

20.2 |

|

Government balance1* |

Percentage of GDP |

-2.1 |

-2.1 |

-5.9 |

-3.6 |

-16.7 |

|

Current account balance** |

Percentage of GDP |

-4.9 |

-2.7 |

3.4 |

-1.9 |

4.9 |

|

Exports of goods and services** |

Percentage of GDP |

45.3 |

41.0 |

39.0 |

40.6 |

35.8 |

|

Imports of goods and services** |

Percentage of GDP |

54.0 |

49.1 |

40.5 |

42.0 |

52.0 |

|

FDI net inflows** |

Percentage of GDP |

3.7 |

3.3 |

0.0 |

3.7 |

0.2 |

|

General government gross debt*** |

Percentage of GDP |

60.4 |

50.5 |

60.5 |

48.8 |

81.7 |

|

Domestic credit to private sector*** |

Percentage of GDP |

34.5 |

30 |

28.2 |

23.6 |

23.5 |

|

Unemployment2*** |

Percent of total active population |

8.8 |

8.2 |

9.5 |

9.8 |

- |

|

Nominal GDP* |

USD billion |

130.9 |

153.9 |

156.6 |

199.8 |

160.5 |

1 General government net lending/borrowing. This balance considers grants received from IMF and other internal donors as part of revenues.

2 Modelled International Labour Organisation estimates.

Source *(IMF, 2023[1]); ** (National Bank of Ukraine, 2023[6]); *** (World Bank, 2023[7])

Box 14.1. Support for SMEs during the COVID-19 pandemic

In response to the COVID-19 pandemic, the Ukrainian government put in place various measures to help businesses stay afloat, such as loans, grants, subsidies and tax relief.

Financial support

In May 2020, the government revised the Economic Stimulation Programme to provide anti-crisis measures to facilitate access to finance for SMEs. Financial assistance has been provided via the Business Development Fund (BDF). Other initiatives included:

The “5-7-9” State Programme was extensively used to help SMEs and entrepreneurs. The main instruments were credit guarantees and partial compensation of interest on the loan. In 2020, the programme granted Ukrainian hryvnias (UAH) 16.5 billion in credit and loans to 6 957 SMEs.

To promote the vaccination campaign and support the most affected businesses, in December 2021 the Ukrainian government launched a special state support programme called eAid (ePidtrymka). Under this programme, individuals who completed the full vaccination cycle could open a virtual bank account through the Diia portal and receive 1 000 UAH (~25 EUR), which could be spent only to purchase selected goods and services (e.g. books, gyms, cinemas, concerts).

Regulatory flexibility

The government supported SMEs and women during the pandemic through:

Credit holidays: a special grace period for servicing loans during the quarantine for the population and businesses.

Tax reductions: businesses were exempted from paying certain taxes during the quarantine.

Workforce support

Partial unemployment assistance was provided for SME employers and employees of SMEs. Quarantine-related changes were introduced into the Labour Code to regulate the new reality of remote work, flexible schedules and salaries.

Market support and measures to improve access to digital infrastructure

The Diia.Business platform was introduced at the beginning of the pandemic to provide online services and training. The platform uses digital learning methods based on short videos and short learning modules. Diia.Business also prepared several publications on doing business during the pandemic (business cases, fundraising). Several online courses were developed in co-operation with international organisations and the private sector, including:

“Ten steps to start your own business”, as well as courses on starting a business in a few sectors, such as textiles, ceramics, food manufacturing and technology.

Grow up: Agro to support businesses in the agrarian sector.

Financial literacy courses, including subjects such as accounting, taxation, reporting systems, marketing and other skills.

An anti-corruption courses within the framework of the United Nations Global Compact in Ukraine’s Anti-Corruption Collective Action programme.

Source: (Diia, 2023[8]).

Box 14.2. Economic consequences of Russia’s full-scale invasion of Ukraine

Infrastructure

The direct damage on physical infrastructure in Ukraine was estimated at nearly USD 150 billion (EUR ~142 billion) by April 2023, which comprised damage inflicted upon:

the residential sector (USD 54.4 billion/EUR ~51.4 billion), with nearly 158 000 destroyed buildings

infrastructure (USD 36.2 billion/EUR ~34.2 billion)

enterprises’ assets (USD 11.4 billion/EUR ~10.8 billion)

the education sector, surpassing USD 9.1 billion (EUR ~8.6 billion), with the number of damaged or destroyed educational facilities at 3 200

energy infrastructure (USD 8.3 billion/EUR ~7.8 billion)

the healthcare sector (USD 2.7 billion/EUR ~2.6 billion), with 806 healthcare facilities damaged or destroyed, including 367 hospitals and 341 clinics.

Migration

By May 2022, 8 million people had been internally displaced in Ukraine, another 8 million had been recorded across Europe, and more than 5 million Ukrainians had been registered for temporary protection or similar national schemes. By mid-2023, Ukraine’s military successes had allowed substantial return flows, but the UN agencies estimated that there were still 5.1 million internally displaced and 5.9 million refugees abroad as of July. This represents a huge challenge for local consumer demand and the labour market.

International trade

Ukraine’s traditional export and import routes (air, shipping and land-based) have been significantly disrupted since the invasion. Black Sea cargos previously constituted approximately 80% of total export volume and 50% of total imports volume (January 2022). Following the blockade of major seaports, Ukraine relied on small ports on the Danube River and on road and rail transport, but those rapidly became a bottleneck for large cargos, severely disrupting of the export of grain and other foodstuffs. Nevertheless, in 2022 Ukraine managed to increase its services exports, in particular in the field of telecommunications, computer and information services (40.5% of total services exports), transport (32.3%) and business services (11.2%).

Business sector

In December 2022, power cuts hit the largest energy-consuming industries, such as metalworking, the chemical industry and machine building. As a result, 89% of manufacturing enterprises had to suspend operations temporarily. Enterprises lost 23% of total working time. While industries that supply basic human needs (food and light sectors) have been resilient, microenterprises were hit hard, with a 31% loss of working time. Most companies installed backup power sources, but they are probably less available for micro and small enterprises (e.g. only 44% of microenterprises vs. 90% of large ones).

SME sector

Ukraine’s SME definition has not changed since 2012. The definition broadly aligns with EU criteria in terms of employment and turnover but does not include a balance sheet criterion (Table 14.4). The State Statistics Service of Ukraine (Urkstat) uses both the legal definition and a definition based on employment, to allow for comparability with EU countries.

Table 14.4. Ukraine’s definition of SMEs

|

Micro |

Small |

Medium |

Large |

|

|---|---|---|---|---|

|

Employment |

≤ 10 employees |

≤ 50 employees |

All enterprises that do not fall into the category of small or large enterprises |

≥ 250 employees |

|

Annual income |

≤ EUR 2 million |

≤ EUR 10 million |

≥ EUR 50 million |

Source: Commercial Code of Ukraine Art. 55, as of 22 March 2012.

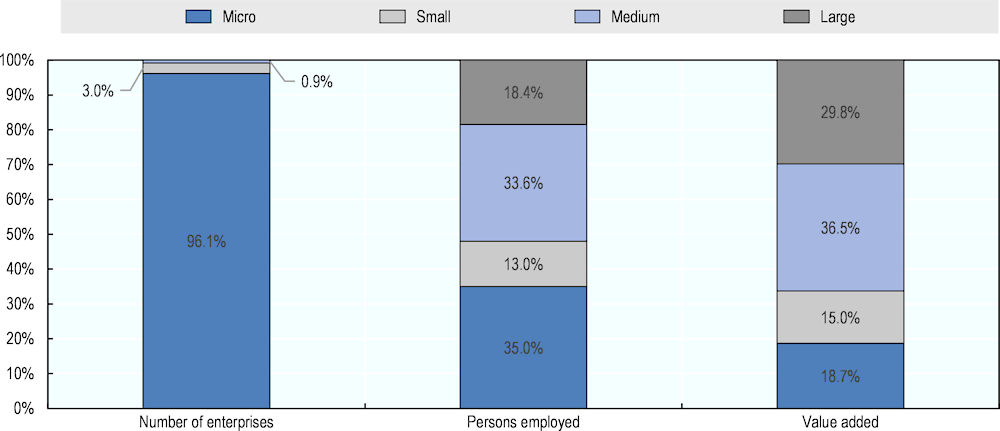

In 2021, SMEs made up 99.9% of all enterprises in the business sector; 96.1% of them were microenterprises. SMEs accounted for 81.6% of total business employment in Ukraine and generated 70.2% of value added at factor cost in the business sector (Figure 14.2).

Figure 14.2. Business demography indicators in Ukraine by company size (2021)

Note: The value-added at factor cost distribution was computed with 2020 data.

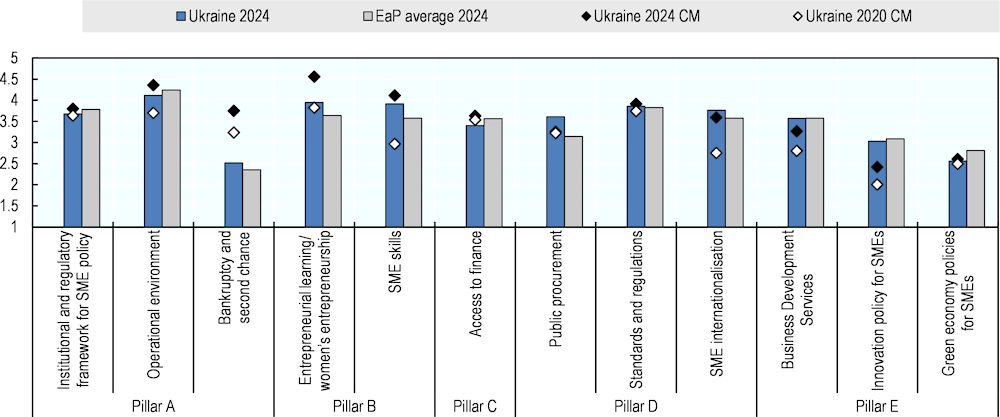

The majority of SMEs in Ukraine still operate in wholesale and retail trade (39.8%) and thus remain concentrated in low-value-added sectors. However, recent years have seen a growing number of SMEs in the ICT sector, at 14.5% in 2021 versus 9.5% in 2018 (Figure 14.3).

Figure 14.3. Sectoral distribution of SMEs in Ukraine (2021)

SBA assessment by pillar

SME digitalisation policies

Creating an environment conducive to the digital transformation of SMEs requires a comprehensive policy approach based on sound framework conditions for the digital economy as well as targeted support to help SMEs reap the benefits of digital solutions. Framework conditions refer to pre-requisites for the digital transformation, such as affordable access to high-speed broadband, a satisfactory level of digital literacy among citizens, and a well-coordinated and coherent policy approach and governance system for digital policies. In the context of SME development, those fundamentals need to be complemented with specific business support services, digital financial services for SMEs, and tailored support to engage in e-commerce to reach new markets.

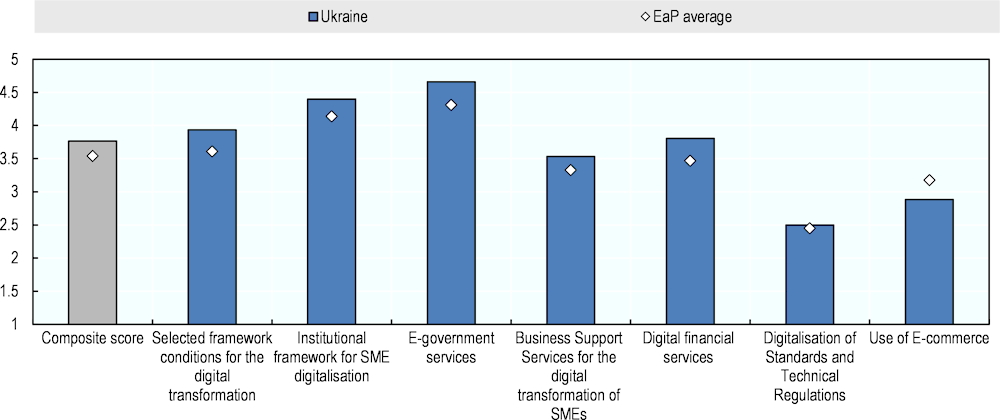

Reflecting the multi-faceted nature of the topic, this round of SBA assessment evaluates EaP countries’ policy approaches to SME digitalisation through i) a dedicated pillar on selected framework conditions for the digital transformation, as well as ii) six new sub-dimensions, incorporated in the pre-existing dimensions of the SBA assessment, to delve deeper into specific thematic policies to foster the digital transformation of SMEs. The weighted average of the scores for the new pillar and digitalisation-oriented sub-dimensions results in a composite score for SME digitalisation policies presented below (Figure 14.4).1

Ukraine performs slightly over the regional average, with a composite score of 3.77 for SME digitalisation policies. The assessment reveals strong achievements in building sound framework conditions for the digital transformation as well as institutional setting for SME digitalisation in particular. Ukraine also appears as regional top performer in terms of e-government services, thanks to the widely praised Diia initiative. More could be done to develop comprehensive support for the digital transformation of SMEs in non-IT sectors, and notably to help them reach new markets through e-commerce. Digitalisation of standards and technical regulations is addressed in an action plan, but implementation is still to follow.

Figure 14.4. Scores for SME digitalisation policies in Ukraine

Note: Further details on the assessment and calculation methodology can be found in the “Assessment framework” section in the Digital Economy for SMEs chapter, in the “Policy framework, structure of the report and assessment process” chapter and in Annex A. Additional information on institutional framework for SME digitalisation and e-government services can be found in Pillar A; on digital financial services in Pillar C; on use of e-commerce in Pillar D; and on Business support services for the digital transformation of SMEs in Pillar E.

The following section details Ukraine’s performance in developing selected framework conditions for the digital transformation, while more information on digitalisation-oriented sub-dimensions can be found in the sections on the pillars they respectively belong to.

Selected framework conditions for the digital transformation

Individuals and firms, notably SMEs, cannot fully reap the benefits offered by the digital transformation without the existence of robust framework conditions, such as comprehensive digitalisation policies, access to high-speed Internet and well-rounded ICT skills among the population. Accessible, affordable and stable broadband connection is indeed the sine qua non to ensure widespread participation of citizens and businesses in the digital economy, and to stem the widening of the connectivity gaps between urban and rural territories, and between firms of different sizes. Furthermore, fostering digital skills development at all stages of life through formal education and lifelong learning initiatives for adults is essential to help the working-age population acquire the skills they need to embark on the digital transformation, produce tech-savvy consumers, and build a talent pool of IT specialists.

National digital strategy

Ukraine does not have a single document as a National Digital Strategy. It has, however, been working on developing a strategic vision for its digital transformation: a Digital Agenda for Ukraine 2020 was developed to align Ukraine’s digitalisation with EU standards. It was followed by the adoption of a Concept for Development of the Digital Economy and Society 2018–2020. Digitalisation currently features prominently in different key policy documents (Table 14.5): the National Economic Strategy 2030 (NES 2030), for instance, defines digital economy as a key priority for Ukraine’s economic policy (Direction 18. Digital economy). Additional aspects of the digital transformation are mentioned in the Strategy for Implementation of Digital Development, Digital Transformations and Digitalisation of the State Finance Management System for the period until 2025 (Strategic Goals 1-32). Provisions concerning digitalisation are mentioned in the Strategy for Digital Transformation of the Social Sphere and in State Regional Development Strategy for 2021-2027. This document focuses on infrastructure development and digital transformation of the regions. There is also a Strategy on the Integration of Ukraine into the European Union Digital Single Market (the “Roadmap”). Notwithstanding Russia’s ongoing war, Ukraine is pursuing and stepping up its digitalisation efforts, and developing plans for post-war recovery, with digital transformation constituting a thematic pillar of the draft Recovery Plan (National Council for the Recovery of Ukraine, 2022[15]). Ukraine’s current approach also emphasises artificial intelligence (AI), with substantial efforts to align with the EU AI Act and to develop an adequate regulatory framework to this end.

Table 14.5. Policy framework for the digital transformation in Ukraine

|

Policy document and timeframe |

Status |

Main objectives |

Selected measures |

|---|---|---|---|

|

Concept for Development of the Digital Economy and Society 2018-2020 |

Different action plans approved |

Endorse priority areas, initiatives and digitalisation projects developed under the Europe 2020 Strategy. |

Adoption of the Action Plan for the Implementation of eServices Development Concept for the years 2019-2020. Adoption of the Action Plan on the Implementation of the International Open Data Charter Principle. Approval of the Action Plan on the Implementation of a Cybersecurity Strategy in Ukraine in 2018. |

|

Strategy on Integration of Ukraine into the European Union Digital Single Market (“Roadmap”) 2018-2023 |

Ongoing |

Break down barriers and create new uniform rule on online services freeware distribution, most notably in digital marketing, e-commerce and telecommunications, and to strengthen the cybersecurity of networks and information systems. |

December 2020: The Law on Electronic Communications which implements the EU Electronic Communications Code synchronously with the EU member states. December 2021: Law on NCEK (National Telecom Regulator). September 2022: The Law on Official Statistics. December 2022: The Law on Amendments to Certain Legislative Acts of Ukraine on Ensuring the Conclusion of an Agreement between Ukraine and the European Union on Mutual Recognition of Qualified Electronic Trust Services and Implementation of European Union Legislation in the field of electronic identification. June 2023: The Law on Protection of Consumer Rights. |

|

Strategy for Digital Transformation of the Social Sphere Since 2020 |

Ongoing |

Ensure European standards for the functioning of social protection institutions, the provision of social services, the financial stability of the social sphere, increasing its transparency and optimising its administrative expenditures. Create a unified information environment of the social sphere. Help the government contribute to social cohesion through the use of digital technologies. |

Creation of a unified information base of the social sphere. Unified register of providers and recipients of social services and benefits, as well as the introduction of a system verifying them. “eBaby” (implemented 2020-22) to simplify the procedure for receiving services related to childbirth. Web portal of electronic services of the Pension Fund of Ukraine providing remote services through the personal accounts of citizens and employers. |

|

Strategy for Implementation of Digital Development, Digital Transformations and Digitalisation of the State Finance Management System 2021-2025 |

Ongoing |

Solve the problem of the lack of integration between the information from the online public financial management system, the lack of a single data warehouse with up-to-date information available to all public authorities, the obsolescence of individual platforms and the lack of automated information exchange with many other government agencies |

Centralising the IT resources and IT functions of the Ministry of Finance and central executive bodies; priority is given to the centralisation of cloud technologies, the creation of a single data warehouse and the gradual transition to a new level of service-oriented systems by ensuring the availability of public services online. Creating a Committee of Information Technology Management in the Public Finance Management System. Developing co-ordination and co-operation processes with the Treasury, the State Tax Service, the State Custom Service, the State Audit Service, and the State Financial Monitoring Service. Regulating the functioning of the Unified Information and Telecommunications System of the public financial management system. |

|

State Regional Development Strategy for 2021-2027 |

Ongoing |

Ensure economic growth, facilitating regional development, and preventing corruption. Enhance unity and foster a decent life for citizens in a united, decentralised, competitive and democratic Ukraine. |

Providing financial assistance to underdeveloped regions through financial support. Directing subsidies and state aid mainly for creating of capital construction objects (state investment exclusively in state or communal property). Strengthening the integrating role of agglomerations and large cities and thereby creating a legislative framework for the functioning and development of agglomerations, ensuring a balanced development of the territories that are part of them. |

|

National Economic Strategy 2030 |

Ongoing |

Offer a coherent vision regarding the strategic course of Ukraine’s economic policy by defining the long-term economic vision. Develop Ukraine’s digital economy as a main driver of economic growth. |

Increasing IT education in public educational institutions. Raising the overall digital skills levels of citizens through private and communal initiatives regarding digital skills and non-formal education. Improving telecommunication infrastructure through targeted support to commercially disadvantaged regions and efforts to bridge the digital gap between urban and rural areas. Harmonising digital legislation by developing a draft law to make the necessary changes to the Law of Ukraine “About electronic commerce”, ensuring the implementation of the Strategy of Integration to the European Digital Market of the EU, and supporting the development of local crowdfunding and the principle of “peer-to-peer” within the framework of the EU4Digital Programme. |

|

Draft Recovery Plan |

Under preparation |

Overcome crises, including those caused by Russia’s full-scale invasion. Reconstruction and further development of the country. The key development goals are to accelerate the economic growth of regions and territorial communities based on the effective use of domestic potential, job creation, improved employment and the accessibility of public services. |

Developing public e-services. Institutional development of digitalisation, e.g. through strategic planning for the development of the digital sphere of Ukraine until 2025. Developing the Diia Centres network, e.g. by updating and filling the Diia Centres platform and improving monitoring and evaluation of the quality of administrative services. Developing public electronic registers, optimising them and centralising support; introducing electronic interaction. Improving the government regulation of the use of electronic trust services, creating favourable conditions for the provision and receipt of electronic identification services. |

Ukraine has worked towards a multi-stakeholder approach for the design and implementation of digitalisation policies. It created a Ministry of Digital Transformation in 2019, responsible for digitalisation policies, and the minister was granted the status of vice prime minister in 2022. Further co-ordination efforts were provided through the development of special digitalisation units in most government bodies, with the establishment of a new position of chief digital transformation officer and deputy minister in each ministry. The aim was to ensure co-operation across ministries at national and regional levels.

The NES 2030 was developed with the involvement of experts, scientists, officials and people’s deputies through the establishment of a dedicated working group headed by the prime minister. More than 500 participants from the public and private sectors contributed to its creation: representatives of more than 20 analytical centres, more than 30 business associations, 40 bodies of executive power, expert circles and civil society, and people’s deputies. The Secretariat of the Cabinet of Ministers leads the design, implementation, monitoring and evaluation of the strategy. It ensures co-ordination among state institutions responsible for provisions on digitalisation, i.e. the Ministry of Economy, the Ministry of Digital Transformation, the Ministry of Development of Communities and Territories, and the Ministry of Social Policy (mainly within the Strategy for Digital Transformation of the Social Sphere).

The NES 2030 provides for monitoring the implementation of the strategy, according to the set targets. Initial plans foresaw the monitoring to be carried out on a single e-governance web portal, which would summarise information on the implementation progress and analyse the degree to which specific target indicators had been achieved in the reporting period. The Strategy for Digital Transformation of the Social Sphere also has target indicators for the implementation of the strategy. However, despite these provisions, Russia’s war against Ukraine, the occupation of part of the territory and the need to restore the infrastructure in the de-occupied territories, are posing considerable challenges to monitoring and evaluating the results of the strategies.

Current strategies give limited consideration for the digitalisation of businesses. The NES 2030 mentions the need to develop digital skills among businesses and a shared technology centre to foster access to digital tools but it does not provide for a comprehensive approach for support to SMEs’ digitalisation. Moreover, policy documents do not have any targets to evaluate progress on SMEs’ digitalisation. The previous SME Strategy did not address this issue either.

Moreover, the implementation has been challenged by Russia’s war: beyond the challenges encountered in monitoring and evaluation, the lack of and/or reallocation of funding and resources to implement the strategy might hinder its execution. For example, the budget allocated to the Ministry of Digital Transformation was lowered from UAH 1 351 million (EUR ~35 million) in 2022 to UAH 616 million (EUR ~16 million) in 2023; most of the funds were awarded to e-governance, but there has not been any funding for “priority digital projects”. However, the Ministry of Digital Transformation works in close co-operation with international partners such as the United States Agency for International Development (USAID), the Swiss Agency for Development and Cooperation (SDC), the United Nations Development Programme (UNDP), and various companies (e.g. Google, VISA, Microsoft), which provide financial resources for a considerable number of activities and initiatives.

Moving forward, Ukraine could build on its impressive progress to date by developing a comprehensive approach to SME digitalisation and including relevant provisions in policy documents, associated with measurable targets and funds – e.g. on support programmes tailored for businesses, e-commerce and digital security. Regarding policy implementation, the authorities could create co-ordination mechanisms that involve non-governmental stakeholders, who play a major role in shaping and supporting the implementation of digitalisation policies. This could take the form of a public-private working group meeting, for instance, as a follow-up to the one formed for the development of the NES. Additional co-ordination tools would also further lower the risk of overlap and duplication between the different policy documents covering digitalisation issues.

Broadband connectivity

The government fully acknowledges the importance of broadband connectivity for the country’s development. This is reflected in the NES, which includes targets to increase mobile and fixed Internet coverage and seeks to stimulate the deployment of 5G networks in large cities. It is also reflected in the State Regional Development Strategy for 2021-2027, which aims to have all Ukrainian schools connected to the Internet by 2027 (up from the 2019 baseline of 37%). Ukraine does not have a national broadband plan: the Concept of Digital Economy and Society Development in Ukraine 2018-2020 envisioned the development of a dedicated National Strategy for the Development of Broadband Internet Access. The Ministry of Digital Transformation held public discussions in 2020 on a draft, but it was never officially adopted. However, in 2021, the Ministry of Digital Transformation approved the Plan of Measures for the Development of Broadband Access to the Internet for 2021-2022, which paid considerable attention to improve the legal regulation of access to broadband Internet providers, access to energy and transport infrastructure, the connection of social infrastructure institutions to fixed broadband Internet access, and the creation of a state platform that shows the state of development of Internet access in different regions of Ukraine (Cabinet of Ministers of Ukraine, 2021[22]). The results of the implementation are not publicly available, and a follow-up document has not yet been approved. However, the National Council for Recovery of Ukraine has included provisions for fostering access to high-speed Internet in the Draft Ukraine Recovery Plan, emphasising the topic’s importance for the country’s post-war recovery (National Council for the Recovery of Ukraine, 2022[15]). Moreover, multi-stakeholder meetings are planned to discuss improvements in access to broadband (Ministry of Digital transformation of Ukraine, 2021[23]).

The publicly available indicators on subscriptions, coverage and quality of service reveal that Ukraine has already achieved considerable improvements in broadband connectivity over recent years. It appears to be the EaP country with the sharpest increase in uptake, especially for mobile broadband subscriptions (+969% in 2015-20 vs. 81% on average across the region), and for fixed broadband (up 60% vs. 38% for the regional average).

Moreover, the authorities have worked in recent years to tackle digital divides between urban and rural areas – e.g. in the Strategy of Regional Development and the Plan for 2021-2022. The government notably provided subventions to local budgets for the implementation of measures to increase the availability of broadband Internet access in rural areas. Despite these efforts and sizeable progress, digital gaps persist across regions and firms – an urban/rural gap of 14.6 percentage points in 2021, somewhat above the EaP average and OECD/EU values. Ukraine also lags OECD and EU levels in terms of businesses connectivity, the size of the gap being negatively correlated with the size of the company.

Policy implementation has, of course, been hampered by the war; many of the initiatives of the government and the Ministry of Digital Transformation in the field of broadband connectivity have had to be postponed. Moreover, access to the Internet and the quality of data transmission have decreased due to Russian and Belarusian cyber and physical attacks. More than 4 000 base stations and 1.7 million fixed Internet lines were fully damaged or destroyed, which represents about a quarter of all Internet networks in Ukraine and created significant losses for over 700 telecom companies. Since the fall of 2022, Ukraine has been experiencing planned and emergency power outages, which also hinders the stable provision of Internet access. However, Ukrainian providers have begun to modernise and switch to the use of fibre-optic cable. This technology allows access to the Internet even in the absence of electricity in the network if the provider uses generators at key nodes and subscribers connect the router to an uninterrupted power source (power bank or battery). The war has shown the resilience of Ukrainian Internet service providers, their flexibility and willingness to adapt to the war to provide Internet access in very difficult conditions. Satellites such as SpaceX’s Starlink have also become part of the critical infrastructure, enabling quick restoration of communication in de-occupied territories and hospitals, schools, energy and social sectors. Progress was also made in terms of national and international roaming.

Moving forward, Ukraine should pursue its applaudable efforts in ensuring broadband connectivity for citizens and firms across the Ukrainian territory. The upcoming policy documents and measures should address the remaining digital divide in rural areas, and foster access to high-speed Internet in Ukrainian firms, especially small ones, as a very first step of their digitalisation journey. There will also be a need to restore Internet supply infrastructure in territories liberated from Russian occupation. When rebuilding (i.e. roads and other infrastructure), Ukraine should consider laying fibre at the same time.

Digital skills

Despite the absence of a dedicated National Digital Strategy in Ukraine, digital skills development is addressed in several policy documents, framing Ukraine’s efforts in that regard. The Concept of Development of Digital Competences (hereafter “the Concept”), adopted in 2021, sets overall guidelines for policy makers to develop the Ukrainian population’s digital skills, defining key principles, approaches and objectives and suggesting actions (Cabinet of Ministers of Ukraine, 2021[24]). The NES 2030 also addresses this issue, with a strategic goal of increasing the level of digital skills of citizens within the Direction on Digital Economy, indicating that citizens' underdeveloped digital skills are holding back a full-fledged transition to the digital economy (Cabinet of Ministers of Ukraine, 2021[25]). The document envisages the implementation of online and offline digital education courses, support for private initiatives regarding digital skills in non-formal education, and the introduction of digital consultants who would raise citizens’ knowledge on how to use fully digitalised services. In terms of the institutional framework, there are efforts at co-ordination on digital skills policies: for example, consultations were held with representatives of education institutions and the National Academy of Sciences of Ukraine to prepare the Concept. A National Skills and Jobs Coalition was reportedly created, as well as an Inter-Industry Council on Digital Development, Digital Transformations and Digitalisation.

Some 53% of the Ukrainian population was assessed as having digital skills that were below basic in 2019. Since then, considerable progress has been made in Ukraine in implementing a number of initiatives to foster digital skills development at all stages of life. With regards to the education system, digital competence is included as a key competence in the Basic component of preschool education and in state standards of both primary and secondary education. COVID-19 and the war in Ukraine have been forcing teachers and students to use online learning to ensure the safety of learning and access to education for people who were forced to evacuate and are unable to attend classes at school or university. Courses have been developed to improve teachers’ digital skills. Moreover, several universities co-operate with IT firms, e.g. organising joint training event, seminars, and master classes.

A wide range of tools have been put in place to accelerate digital skills development among the population, in line with EU practices – making Ukraine the EaP leader in the field. Citizens can assess their level of digital skills with the online self-assessment tool Digigram, which has been developed for different target groups and already benefitted almost 700 000 users over the past two years (incl. over 200 000 teachers). The government of Ukraine used DigComp 2.1: The Digital Competence Framework for Citizens to create the Digital Competence Framework for Citizens of Ukraine, as foreseen in the Concept (which also included the development of methodological recommendations for the application of this Framework). DigComp derivatives are also being developed for different target groups, such as educators and civil servants. Based on the Digital Competence Framework, the Ministry of Digital Transformation has launched a national online platform for the development of digital literacy, Diia.Digital Education, where Ukrainians can take free digital literacy courses and test their knowledge. The courses are designed in the form of an educational series, where the topics of the courses are explained in short videos. Attendees can pass a test at the end and get their skills certified. Training is informal and corresponds to the concept of lifelong learning.

The regular collection of granular data enables monitoring, an element also emphasised in the Concept. Ukraine is one of the most advanced EaP countries in terms of digital skills assessment practices, as underlined in the EU4Digital comparative survey (EU4Digital, 2020[26]). The Ministry of Digital Transformation conducts nationwide surveys to monitor the dynamics of the population’s level of digital skills. Such data have been collected twice so far (in 2019 and 2021), and show improvements: according to the survey, the share of Internet users increased from 88% to 92%, while the number of Ukrainians whose digital skills are below the basic level decreased from 53% in 2019 to 47.8% in 2021. The survey also illustrated the significant impact of COVID-19 on the use of Internet services: 52% of respondents indicated that they tried digital tools for the first time during the pandemic (online shopping, paying utility bills online, etc.). Overall, the significant improvements in Ukraine's digitalisation path have been reflected in international rankings such as the Network Readiness Index 2022, where Ukraine leads its income group – with strong performance on digital literacy.

However, more remains to be done, as Ukrainians’ digital skills remain below OECD/EU levels. Building on the inclusion of digital competence in national curricula, students’ progress in acquiring the different skills should be systematically assessed to ensure quality of education. Like EU practices, digital competence frameworks will also need to be regularly updated based on scientific research and stakeholder feedback to ensure their continued relevance, taking into account rapidly changing skills needs. Moreover, more could be done to promote digital skills among entrepreneurs and employees in non-IT sectors. Ukraine should finalise its Digigram version for entrepreneurs as well as the specific digital competence framework and ensure recognition of acquired competences to foster the employability of beneficiaries. The country could also develop reskilling and upskilling opportunities to tackle the remaining skills mismatches and help citizens meet labour market demand. Indeed, despite the booming IT sector, the lack of digital skills is still a major obstacle to SME digitalisation, as most companies cite the lack of experienced employees and expertise as a barrier to their digital transformation (35% and 31% of survey respondents, respectively) (German Economic Team, 2021[27]). Finally, additional data could be collected on the digital skills of SME managers and employees, and skills anticipation tools could be further developed: there are no regular digital skills forecasting exercises, and skills anticipation remains overall limited to some labour market forecasts, whose results are not publicly available.

Pillar A: Responsive Government

Institutional and regulatory framework

Ukraine has made progress in strengthening the institutional framework for SME policy since the last SBA assessment; however, this positive momentum has been disrupted by Russia's invasion of Ukraine. The government has reacted to the emergency by focusing on assistance to enterprises operating in strategic sectors and increasing the functions of the dedicated platform Diia.Business, which serves as a communication channel between the government and businesses and as a provider of essential administrative services to SMEs. Over the medium term, EU candidate status entails an agenda for institutional and regulatory reforms and an incentive to adopt good practices, while providing the basis for an enlarged programme of EU financial and technical assistance.

Institutional setting

The implementation of Ukraine’s first SME Development Strategy (2018-2020) has come to an end but no new strategy has been introduced. As a result, the country lacks policy documents that comprehensively cover SME-related issues. A new SME strategy should be adopted at the end of the war, in line with the priorities of the reconstruction plans and the EU accession roadmap and after assessing the extent of the damage to the country’s productive capacity.

As for the actions taken before the war, it is important to note that in March 2021, Ukraine approved the NES (see above), which contains Direction 17 on entrepreneurship (Development of entrepreneurship). The strategy sets five strategic goals for entrepreneurship development: 1) ensuring an effective state policy on the development of entrepreneurship; 2) stimulating the development of an entrepreneurial culture and competences; 3) establishing conditions to increase the level of access to finance; 4) creating conditions for increasing enterprises’ access to markets; and 5) stimulating innovations development. The NES also identifies a number of priority sectors such as ICT, agriculture and food production, hospitality and creative industries, all characterised by a high SME presence.

Although the NES does not have an action plan with time-bound targets or allocated funding, it envisages “target indicators 2030” for each direction. Most of the target indicators for entrepreneurship are declarative. Specific targets related to Direction 17 on entrepreneurship include improving Ukraine’s ranking in the Global Competitiveness Index (from 73rd to 40th place) and the Global Innovation Index (from 45th place to 30th), financial and economic literacy training for 10 million citizens, and the growth of venture funding for Ukrainian start-ups (from USD 510 million to USD 5 billion). Nevertheless, there are no specific interim targets that correspond to specific actions.

The Ministry of Economy remains the central body in charge of developing and implementing SME policy, including SME support programmes and infrastructure, entrepreneurship promotion, and other SME-related issues. As digital transformation became a key national priority, the government established the Ministry of Digital Transformation in 2019.

The government also reorganised the state bodies that implement SME support policy. In autumn 2018, the Ministry of Economy established the SME Development Office (SMEDO), a donor-funded advisory body employing external private consultants. In addition, in the same year, within the framework of a donor-funded project, the government established the Export Promotion Office (EPO), a state institution to support Ukrainian exporters. In 2021, the agency was transformed into the Entrepreneurship and Export Promotion Office (EEPO), which de facto is now in charge of SME policy implementation as well as export promotion. The EEPO is accountable before the supervisory board, which includes both the Ministry of Digital Transformation and the Ministry of Economy. The agency, together with the Ministry of Digital Transformation, implements the national project for the development of entrepreneurship and export Diia.Business. The EEPO is in charge of the Diia.Business portal, which provides online trainings, consultations and other business support services (see below). Diia.Business has established a network of Diia.Business Support Centres where entrepreneurs can receive offline consultations.

The EEPO is fully operational and well-staffed. According to the Law on the State Budget, it receives funding as an export promotion institution. The 2023 state budget provides UAH 36.8 million (EUR ~1 million) for EEPO’s activities. At the same time, its activities remain heavily dependent on international aid. In 2021, the institution received EUR 754 000 from donors, complemented by UAH 14.5 million (EUR ~475 000) from the 2021 state budget.

Despite the obstacles created by the war, EEPO has reached a high level of functionality and the Diia.Business platform is seen as an innovative instrument. In 2023, EEPO, together with the partners of the Consortium of the European Network of Enterprises in Ukraine, won the UkraineReady4EU Project in the European grant competition Business Bridge and attracted vouchers in the amount of EUR 3.75 million for 1 500 Ukrainian enterprises affected by the full-scale war.

In addition to supporting Ukrainian enterprises operating in the domestic market, EEPO focuses on the promotion of the export of goods, works and services of Ukrainian manufacturers, playing the role of a Trade Promotion Office (see below).

Legislative simplification and RIA

The government is proceeding with the implementation of the deregulation reform that began with donors’ support in 2015. In 2019, it approved a new deregulation plan, the “Plan of measures to deregulate economic activity and improve the business climate, an action plan to improve the conditions for doing business in Ukraine”, that was set to expire at the end of 2022. In January 2023, the government extended the implementation time frame. The reform is ongoing, but the most important changes were introduced before the previous assessment (e.g. the last amendments to the RIA guidance introduced in 2016). The government also included deregulation in the NES 2030 under Direction 3 (Regulatory environment). However, the “target indicators 2030” only envisage an improvement in Ukraine’s positions in international rankings. The deregulation plan targets both primary and subordinate legislation on regulatory requirements in different sectors. The ministries of Economy, Infrastructure, Regional Development, and Ecology and Natural Resources oversee the highest number of deregulation actions. According to the State Regulatory Service of Ukraine, 57 actions had been completed as of 21 January 2022 (e.g. the Ministry of Economy completed 19 out of the 32 planned actions).

In January 2023, the government established the Interagency Working Group on Issues of Accelerated Review of Instruments of State Regulation of Economic Activity. At that time, there were more than 1 000 regulatory instruments in place (including 528 permits, 224 licenses and 157 approvals). The first meeting of the working group recommended abolishing 47% of licenses and permits. Other licenses and permits must be mainly digitalised or amended. At the second meeting, in February 2023, the working group recommended abolishing or amending 90% of regulations managed by the Ministry of Environmental Protection and Natural Resources and government bodies under it. Such rapid decisions demonstrate that the government plans to foster deregulation efforts.

The State Regulatory Service of Ukraine (SRS) is the central body that executes state regulatory policy. According to the law, the SRS regularly reviews draft regulations and their RIAs. For example, in 2021, it reviewed 4 101 draft legal acts: 603 laws and regulations developed by central executive bodies, 64 draft regulatory acts developed by local executive bodies and 3 434 draft regulatory acts developed by local self-government authorities. In 2022, it reviewed 962 draft legal acts: 453 laws and regulations developed by central executive bodies, 24 draft regulatory acts developed by local executive bodies, and 485 draft regulatory acts developed by local self-government authorities. The RIA guidelines include the obligation to conduct RIA SME tests.

In 2020, the government officially launched the Diia portal, whichoffers multiple e-services that simplify regulatory procedures for SMEs. This is the most important change since the previous assessment. Entrepreneurs can start a business online (both legal persons and individual entrepreneurs), pay taxes, obtain permits and benefit from many other online services that reduce regulatory burdens. The government widely promotes the use of the portal and today Diia is one of the most widely used applications in Ukraine. At the same time, the government and local authorities support an extensive network of regional one-stop shops known as Centres of Administrative Services. According to the Diia portal, there are approximately 3 800 Centres and remote workplaces. Information on their location, contacts and infrastructures can be found on the Diia.Business portal.

Public-private consultations

The Law on Basic Principles of the State Regulatory Policy in the Economic Activities Sphere mandates public-private consultations for the development of business-related draft regulations. The legislation does not limit forms of consultations but sets strict requirements about the time frame (a minimum of one month and a maximum of three months from the date of publication). Formal and informal meetings between public institutions and the private sector are frequently held on an ad hoc basis, and the Ukrainian Business Council has played an active role in the elaboration of the NES. Nevertheless, there are no aggregated data on all public-private consultations in Ukraine, although government bodies and local authorities report on such consultations.

Institutional framework for SME digitalisation

At the moment Ukraine has not elaborated a strategic document on SME digitalisation. Promoting SME digitalisation is one of the objectives listed the National Economic Strategy 2030, under the broad objective of developing digital skills in the business sector. Strategic directions related to SME digitalisation include: 1) the implementation of eight roadmaps for digital transformation of key industries, including agriculture, machine building, tourism, light industry, food and processing, energy, mining, and defense; 2) the creation of new opportunities for the realisation of human capital, development of innovative, creative and digital industries and businesses; and 3) actions to make the development of creative, innovative and digital industries a main state policy priority.

Competence over SME digitalisation comes under the Ministry for Digital Transformation, operating in co-ordination with the Ministry of Economy, while EEPO is in charge of implementing SME digital transformation programmes. However, no funds have been allocated to those programmes given the current budget limitations.

The war has produced an acceleration of the digitalisation of the society and the use of e-government digital platforms (Diia, Diia.Business and Vzaemo.Diia), forcing SMEs to adopt digital tools. EEPO is supporting the digital transformation by proving online courses to SMEs. The Ministry of Digital Transformation of Ukraine is also working on promoting the application of AI technologies among businesses and in establishing AI governance rules, aligning them with those of the EU.

The way forward

Moving forward, the government should continue to elaborate short-term action plans for SME support to respond to the emergencies generated by the Russian invasion. At the same time, it should consider establishing a working group including SME representatives, local community representatives, and experts to elaborate a plan for the post-conflict recovery and reconstruction, looking at the role that SMEs could play in this phase, setting the basis for the elaboration of the country’s post-conflict SME development strategy. To further strengthen the institutional and regulatory framework for SMEs, the government should continue to implement its deregulation plan under the National Economic Strategy 2030, focusing on the actions that could speed-up the reconstruction phase and the re-development of industrial sites damaged during the conflict.

Operational environment for SMEs

Between 2020 and 2022, Ukraine made incremental progress on implementing the Economic Deregulation Strategy and the Public Administration Reform Strategy, with 94 actions completed so far. The most significant progress achieved is represented by the online provision of a wide range of administrative services to SMEs, in line with the country’s digital strategy.

E-government services

Ukraine has actively promoted the development of a digital government in recent years. The main document in this field is the Concept of E-governance Development in Ukraine, approved on 20 September 2017. In addition, as mentioned above, the NES 2030 also defines the “digital economy” as a key priority and includes relevant elements pertaining to government digitalisation. The Ministry of Digital Transformation is responsible for the development and implementation of e-governance policy.

In 2020, the government introduced the Diia.Business platform as a subproject of the Diia e-services ecosystem. The Diia.Business portal offers numerous resources to raise awareness among entrepreneurs on the available e-services. The portal provides information to SMEs on the availability of digital government services and instructions for using them. Ukraine continues to expand the list of services available online for SMEs. Some noteworthy ones include filing taxes or social security returns, pensions, the cadastre, reporting enterprise statistics, and the unified state register of court decisions.

The government also promotes the use of other digital platforms developed in the framework of the Diia project. In 2021, the government introduced the Vzaemo.Diia sub-project, designed to become an e-democracy instrument. The website included services such as e-consultations, e-surveys, e-petitions, and other e-democracy instruments. At the same time, the Ministry of Digital Transformation is transforming the mobile app Diia into a state "super app”, constantly expanding its range services, including participation in polls and the possibility of executing tax payments.

It should be noted that local communities have already also used other digital platforms for public-private consultations, including E-Dem. The platform was developed within the framework of the E-Governance for Accountability and Participation (EGAP) programme, implemented by the East Europe Foundation in co-operation the Ministry of Digital Transformation and funded by Switzerland.

The “Resolution of the Cabinet of Ministers of Ukraine Approving the Regulations on Data Sets to be Published in the Form of Open Data”, introduced in 2015, contains a formal requirement whereby government data should be “open by default”. These requirements, however, have been suspended during the martial law.

Overall, Ukraine has made significant progress in the development of e-government. According to the United Nations E-Government Development Index, in 2020 Ukraine ranked 69th among 193 countries with a score of 0.7 points (United Nation, 2022[28]). In 2022, it had moved up to the 46th position with a score of 0.8 points. Despite all the challenges associated with the war, the Ministry of Digital Transformation of Ukraine continues to actively develop the open data sphere in Ukraine. According to the results of the Open Data Maturity 2022 EU report, Ukraine ranks second in Europe in terms of open data maturity (Carsaniga et al., 2022[29]).

Company registration

Ukraine has made remarkable progress in simplifying and speeding up the company registration process. In 2016, according to the ABCA survey, the average registration time was 11 days. In 2021, business registration took on average 6.3 days (based on the Municipal Competitiveness Index, prepared by the Institute for Economic Research and Policy Consulting and USAID Competitive Economy programme). Nevertheless, the duration of the procedures depending on the size of the city, ranging from 3.6 days in Rivne to 14.4 days in Dnipro. Since 2023, enterprises have been able to register online through the Diia digital platform. The automatic registration consists of two steps: application submission and registration. The approximate time needed to complete the procedure is 11 minutes and it is free of charge. Online registration is available across the entire territory for natural persons (unincorporated enterprises), and since October 2020 for the registration of a limited liability company based on a model charter can be conducted through the Diia portal. Since 2021, all applications in electronic form for the registration of individual entrepreneurs are accepted through the Diia portal and only require a single step. As a further step towards the simplification of company registration procedures, since April 2021, the State Registrar is no longer required to check the documents attached to the online application to confirm the registration prior to the registration in the state register. Those functions are now performed automatically.

Business licensing

Business licensing is regulated by the 2015 Law on Licensing Economic Activities with Amendments. Information on licenses and permits’ requirements is available on the Single Public Portal of Administrative Services as well as on the Diia portal, while a single interactive portal is under development. License applications can be completed online. According to Part 1 of Article 14 of the Law on Licensing, when a licensing fee is not established by law, it should amount to one living wage.

Tax compliance procedures for SMEs

SMEs view tax administration procedures as a burden on their activity. According to a survey conducted by the German Economic Team, in 2020, businesses spent on average 327.5 hours to submit and pay for the three main types of taxes (income tax, value added tax and employment tax, including contributions to social insurance). However, Ukraine has adopted a simplified tax system for SMEs since 1998 and efforts are under way to reduce the tax administrative burden. The current tax regime identifies four groups of taxpayers: 1) individual entrepreneurs whose annual income does not exceed UAH 1.1 million (EUR ~29 000) and who do not have employees; 2) individual entrepreneurs whose annual income does not exceed UAH 5.6 million (EUR ~145 000) and who employ less than 10 persons; 3) individual entrepreneurs or legal persons whose annual income does not exceed UAH 7.8 million (EUR ~203 000); and 4) individual entrepreneurs (farms) and legal persons whose agricultural production does not exceed 75% of total production. According to the simplified taxation system, each of the four groups is subject to a specific tax regime. Entrepreneurs falling under Group 1 pay a single tax up to 10% of the subsistence minimum. Those in Group 2 pay a single tax up to 20% of the minimum wage. Entrepreneurs and enterprises that are part of Group 3 are subject to a single tax set at 3% of total revenues for VAT payers and at 5% for VAT non-payers. Those under Group 4 pay a single tax calculated based on the type of agricultural land exploited.

The simplified tax system also envisages simplified accounting and filing rules. Tax declarations and tax payments can be filed and paid online. In 2022, the government introduced a number of changes regarding the single tax to support Ukrainian businesses of all sizes during the war. Almost all businesses (with a turnover less than UAH 10 billion or EUR ~260 million) became eligible to choose 2% single tax payments. Nevertheless, the government plans to abolish this instrument in 2023.

An enterprise must pay VAT when its sales amount to more than UAH 1 million (EUR ~26 000). The base VAT rate is 20%. According to a study conducted by the European Business Association, enterprises encounter problems with receiving VAT refunds, as 95% of the refund declarations are subject to checks.

The way forward

To further improve the operational environment for SMEs, Ukraine should 1) continue to implement the reform of company registration procedures, further reducing the time required to complete it and extending the application of the new procedures across the whole country; 2) calculate the effective tax rate applied to different types of individual entrepreneurs and SMEs, in order to identify potential distorting effects on enterprise growth of different tax regimes and incentives; and 3) introduce an automatic VAT refund system for all enterprises that present a low-risk profile for tax evasion.

Bankruptcy and second chance

Insolvency proceedings in Ukraine are governed by the Code of Ukraine on Bankruptcy Proceedings effective since October 2019. While the new code introduced important elements (personal bankruptcy for individuals, more transparent sales procedures through e-platforms, etc.) enhancing its compliance with international standards (OECD et al., 2020[30]), it has also been the object of criticism. For instance, Engels, Biryukov and Chumak (2020[31]), in their EU-funded study, argue that Chapter VIII on foreign bankruptcy proceedings is not in line the EU acquis. Moreover, contrary to the old law, the new code does not envisage provisions on out-of-court agreements, which are instead regulated by the Commercial and Procedural Code (Chapter V). Although many law firms have conducted different assessments of the insolvency framework (e.g. ENGARDE (2021[32]) and the EU-funded report by Engels, Biryukov and Chumak (2020[31])), no official review has been carried out recently.

Since the entry into force of the new Code, a significant number of events and campaigns directed to entrepreneurs fearing failure have been taking place. In 2020-21, the Ukrainian Bar Association, within the framework of the USAID “Financial Sector Transformation Project” and with the participation of the Ministry of Justice, implemented the project "Providing Advice on Restoring the Solvency of Individuals". The project entailed an extensive communication campaign involving leading Ukrainian media, as well as direct counselling (USAID, 2021[33]). In addition, several institutions, such as the Ukrainian Bar Association and the National Association of Insolvency Administrators, held annual forums to discuss issues related to bankruptcy.

Entrepreneurs seeking a fresh start can find useful information on the Diia.Business portal, including a checklist on how to restart a business (Diia.Business, 2023[34]). While these resources are mostly targeted to businesses that interrupted their activities as a consequence of the war, they also provide useful information for all entrepreneurs seeking a second chance. The Diia.Business portal also offers valuable resources for entrepreneurs to strengthen their entrepreneurship skills, including the ability to understand their needs and problems and identify and tackle financial distress. Relevant initiatives in this context are represented by the online course “10 steps to launch your own business” (Diia.Business, 2023[35]) which covers lessons on financial matters, and a web page presenting “the path of an entrepreneur” (Diia.Business, 2023[36]). In addition, it is important to mention that the government is currently working on a draft law to implement EU Directive 2019/1023 into Ukrainian regulation. This directive establishes minimum rules for EU Member States' preventive restructuring frameworks, with the aim of removing barriers to the effective preventive restructuring of viable debtors facing financial difficulties across the EU.2

However, there are no structured early warning systems in place and existing measures to prevent insolvencies are not being monitored and evaluated. Moving forward, Ukraine should consider further expanding activities to promote the rehabilitation of honest entrepreneurs, reduce the cultural stigma surrounding business failure, and develop measures to prevent insolvency.

Pillar B: Entrepreneurial Human Capital

Entrepreneurial learning

Ukraine has been making continuous policy efforts to promote entrepreneurial learning. The topic is addressed in the NES 2030 and in the Strategy of Development of High Education in Ukraine for 2022-2032, which includes entrepreneurial skills in higher education as one of its strategic goals.

Over recent years, Ukraine has successfully implemented a number of initiatives to foster the development of an entrepreneurial spirit and competences among citizens. The reform of the education system in 2016 and the approval of the Concept of State Policy “New Ukrainian School” by the Cabinet of Ministers marked a milestone. It notably embedded EntreComp and resulted in entrepreneurship being included as a key competence in the national education curricula at all levels of education – as highlighted in the 2020 SME Policy Index. The related Action Plan, approved in 2017 and running until 2029, defines targets for the development of entrepreneurial learning and paved the way for further progress. Additional documents have been adopted since the last assessment to foster the assessment of learning outcomes. For secondary schools, for instance, the State Standard of Basic Secondary Education, adopted in 2020, mentions entrepreneurship and financial literacy as a key competence that students should have acquired upon completion of the educational level. A Youth Entrepreneurial Competence Framework was also developed to help assess entrepreneurial competence. Moreover, Ukrainian schools continue to apply innovative teaching and learning methods. For example, the project “Social school entrepreneurship”, implemented by Future Development Agency in Vinnytsia region since 2021, combines learning methods such as active learning and flipped classroom and is organised for lower secondary and upper secondary school students. In addition, the pandemic fostered the development of new online tools to enable distance learning. For example, in 2020 the All-Ukrainian Online School was created for students in grades 5-11 as a platform for distance and hybrid learning as well as a source of support for teachers, with video lessons, tests, and materials for independent work in 18 main subjects.

In higher education, entrepreneurial learning is further supported through several cases of co-operation between higher education institutions (HEIs) and businesses. Some companies organise courses for students and/or invite them to participate in business forums; for example, Deloitte provides special courses for students “Business through the eyes of the owner: From start-up to IPO”. In addition, ten universities benefit from a network of business incubators called “YEP”, a Ukrainian-Estonian entrepreneurship programme to develop start-ups among students. Diia.Business also launched the Diia.Business Centre for Youth Entrepreneurship Development on the basis of Taras Shevchenko National University of Kyiv to help students start their own business, notably through workshops, master classes, business conferences and educational events. However, these examples remain ad hoc – such events do not take place in all universities, and, while Ukraine has an increasing number of examples of co-operation between SMEs and general secondary schools, these practices are not yet widespread. Ukraine also supports lifelong learning and promotes entrepreneurship beyond education. A wide range of measures are being implemented to this end, by both public and private stakeholders.