This chapter provides an assessment of the progress made by Azerbaijan in implementing the Small Business Act (SBA) for Europe over the period 2020-23. It starts with an overview of Azerbaijan’s economic context and dives further into the characteristics of the country’s SME sector. It then develops on the state of selected framework conditions for the digital transformation of SMEs. Finally, it analyses Azerbaijan’s progress along twelve measurable dimensions grouped in five thematic pillars and sets out targeted policy recommendations.

SME Policy Index: Eastern Partner Countries 2024

11. Azerbaijan: Small Business Act country profile

Abstract

Key findings

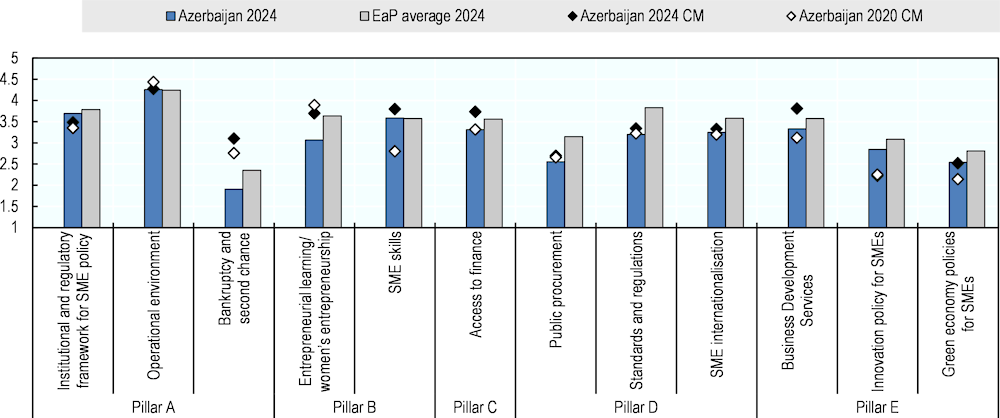

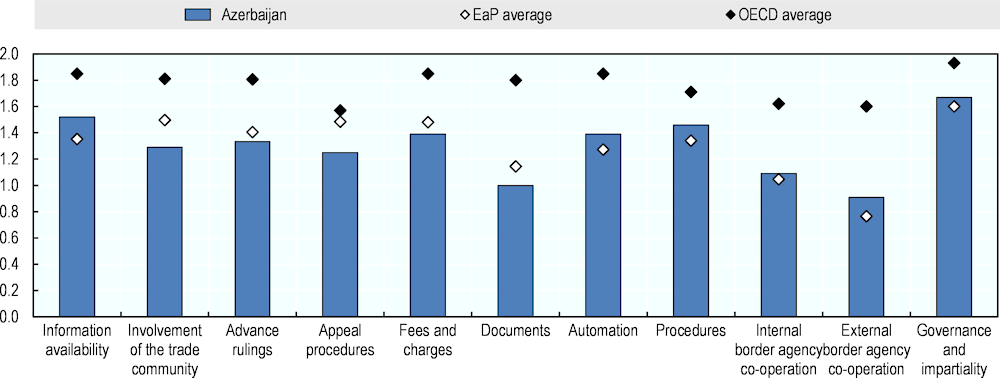

Figure 11.1. SME Policy Index scores for Azerbaijan

Note: CM stands for comparable methodology. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Table 11.1. SME Policy Index scores for Azerbaijan

Country scores by dimension, 2024 and 2020 vs 2024 CM

|

Pillar |

Dimension |

Azerbaijan 2024 |

EaP average 2024 |

Azerbaijan 2024 (CM) |

Azerbaijan 2020 (CM) |

|---|---|---|---|---|---|

|

Pillar A |

Institutional and regulatory framework for SME policy |

3.69 |

3.78 |

3.49 |

3.36 |

|

Operational environment |

4.25 |

4.24 |

4.28 |

4.44 |

|

|

Bankruptcy and second chance |

1.91 |

2.35 |

3.10 |

2.76 |

|

|

Pillar B |

Entrepreneurial learning/ women’s entrepreneurship |

3.07 |

3.64 |

3.70 |

3.89 |

|

SME skills |

3.59 |

3.57 |

3.80 |

2.80 |

|

|

Pillar C |

Access to finance |

3.31 |

3.56 |

3.74 |

3.32 |

|

Pillar D |

Public procurement |

2.55 |

3.15 |

2.70 |

2.66 |

|

Standards and regulations |

3.20 |

3.83 |

3.34 |

3.23 |

|

|

SME internationalisation |

3.25 |

3.58 |

3.33 |

3.20 |

|

|

Pillar E |

Business development services |

3.33 |

3.57 |

3.81 |

3.12 |

|

Innovation policy for SMEs |

2.85 |

3.09 |

2.22 |

2.25 |

|

|

Green economy policies for SMEs |

2.54 |

2.81 |

2.52 |

2.15 |

Note: CM stands for comparable methodology. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Table 11.2. Implementation progress on SME Policy Index 2020 policy reforms – Azerbaijan

|

Priority reforms outlined in the SME Policy Index 2020 |

Key reforms implemented to date |

|---|---|

|

Pillar A – Responsive Government |

|

|

Expand “Roadmap for the Promotion of the Production of Consumer Goods by SMEs in Azerbaijan” to include the services sector. Ensure that the SME Development Agency (KOBIA) responds to the needs of small businesses. Introduce measures to upgrade the IT skills of small entrepreneurs. Establish effective channels of consultation with organisations representing the entire SME sector. Define the regulatory impact assessment (RIA) guidelines and methodology and identify the leading body in charge of RIA applications. Promote alternative dispute resolution and simplified proceedings for SMEs. Adopt a proactive second-chance strategy for bankrupt entrepreneurs. |

Inclusion of SME policy measures in the Socio-Economic Development Strategy of the Republic of Azerbaijan 2022-2026. Establishment of the Public Council under KOBIA as the main channel of public-private consultations for SME policy. Systematic review of business legislation by the Commission for Business Environment and International Ranking. Establishment of an RIA division within the Ministry of Economy with reports made publicly available. Amendment of the Insolvency Law in December 2020 to clarify the grounds for debtor insolvency and creditors’ voting rights. |

|

Pillar B – Entrepreneurial Human Capital |

|

|

Introduce the entrepreneurship key competence at system level across all levels of education. Prioritise the independent evaluation of women's entrepreneurship support programmes and build-in engagement by non-government policy partners. Focus on the availability and quality of data for policy making and ensuring effective provision of SME training services for different target groups. |

Integration of an entrepreneurship module into the vocational education and training (VET) curricula; further development of infrastructure and career guidance services. Progress in non-formal learning and awareness-raising. Establishment of women’s resource centres in regions; increase public-private co-operation on women’s entrepreneurship. Development of a framework for the collection and analysis of data of SME skills used to inform policymaking. Development of a network of operators by KOBIA to improve training provisions. |

|

Pillar C – Access to Finance |

|

|

Enhance financial inclusion by supporting the development of non-bank financial services and deepening credit information. Adopt a new law on leasing. Improve the availability of statistical data on the financial sector to enable a more granular market assessment and develop products tailored to the needs of borrowers. |

Implementation of the Basel III principles. Adoption of an enhanced risk-based supervision and stress-testing model. Establishment of the first local venture fund “Caucasus Ventures”. Establishment of various portals and platforms to improve financial literacy. |

|

Pillar D – Access to Markets |

|

|

Ensure a co-ordinated approach and build KOBIA’s capacity to support SME internationalisation. Enhance SME access to trade financing and implement a support programme to create supply chain linkages between SMEs and large investors. Strengthen the national accreditation body and make it fit to enter into a bilateral agreement with EA. Implement targeted SME training and standardisation. Provide financial support for SMEs to implement technical standards. Ensure the use of e-procurement in a wider range of award procedures. Raise status, independence, capacity of central procurement institutions. |

National Plan for 2023-2025 on harmonisation of standardisation with international requirements and adoption of EU standards. Introduction of financial support for SMEs to acquire standards. Promotion of the use of e-commerce as an objective of the 2022-2026 Socio-Economic Development Strategy. Establishment of an online sales platform to support SMEs. |

|

Pillar E – Innovation and Business Support |

|

|

Organise innovation policies under a single national strategy. Establish co-ordination mechanisms among bodies providing business development services (BDS). Extend eligibility of grants for innovation beyond the IT sector. Build capacity of KOBIA and sub-structures’ staff to advise businesses. Outsource support services to private BDS providers and/or offer a co-financing mechanism to SMEs for first-time BDS use. Target green-economy policies towards the capacities and needs of SMEs. |

SME-related innovation policies included in the Socio-Economic Development Strategy 2022-2026. Outreach to SMEs ensured by KOBIA’s network of sub-structures (SME Houses, SME Development Centres and SME Friends). Introduction of a “startup certificate” for micro and small businesses for the sale of innovative products or services. Creation of KOBIA’s grant competitions for entrepreneurs. Regulatory and financial instruments to promote greening practices among SMEs, including via Entrepreneurship Development Fund. |

Context

Economic snapshot

As a major exporter of hydrocarbons, Azerbaijan benefitted from the sharp increase in oil and gas prices triggered by Russia’s full-scale invasion of Ukraine. GDP growth reached 4.7% in 2022, further sustaining the post-COVID-19 recovery following a decline of 4.3% in 2020 (Table 11.3). Nevertheless, as a negative consequence of the pandemic and the war, inflation rose to 6.7% in 2021 and further accelerated to almost 14% in 2022, driven by high global commodity and food prices (IMF, 2023[1]).

Azerbaijan imports about 30% of its wheat from Russia and is consequently making efforts to diversify its food supplies (OECD, 2023[2]). Additionally, due to its currency peg to the US dollar, imported inflation through increasing food prices was avoided (Central Bank of the Republic of Azerbaijan, 2023[3]).

Azerbaijan’s economy is dominated by mining and quarrying activities, mainly related to the extraction of crude petroleum and natural gas, accounting for 45% of GDP in 2022 (SSCRA, 2023[4]), while mineral fuels and oils account for the highest share of exported goods (88% in 2021) (SSCRA, 2023[5]). The country has the potential to cater to the EU’s efforts to reduce its energy dependence on Russia, especially after the completion of the Southern Gas Corridor. Thus, the dominance of the energy sector is unlikely to change in the near future. That said, although the sector generates high revenues, the sector provided jobs for less than 1% of the population in 2022. In contrast, the agricultural sector accounted for more than a third of employment in 2022, while generating only 4.8% of value added (SSCRA, 2023[6]).

However, Azerbaijan has adopted policies to diversify its economy, notably through its 12 Strategic Roadmaps for 2016-2020 and the Socio-Economic Development Strategy for 2022-2026. The latter reform plan introduces a private-sector-led growth model and seeks to enhance human capital, with a target of sustained 5% growth in non-energy sector during the 2022-2026 period (World Bank, 2023[7]). For 2022 alone, non-energy sector growth was recorded at 9.1% (year-on-year) and driven by services, including ICT (World Bank, 2023[7]). While the ICT sector is seen as instrumental and a potential driver of economic diversification in Azerbaijan, the share of the information and communication sector in the value-added generated in Azerbaijan reached its lowest point in 2022 with 1.4% – against annual results ranging from 1.6% to 2.1% between 2012 and 2021. In addition, the sector’s share in the average annual number of workers has stabilised at 1.9% or slightly below in recent decades (SSCRA, 2023[8]). Consequently, the share of the ICT sector in Azerbaijan’s GDP has decreased to 1.4% in 2022 against 1.8% in 2016 (SSCRA, 2022[9]).

Despite the ICT sector’s modest size, a significant share of Azerbaijani enterprises started or increased online business activity during COVID-19 – 60% of small enterprises, 71% of middle-sized firms, and 52% of large companies (World Bank, 2021[10]). Thus, SME growth has most to benefit from an expansion in the ICT sector. Nevertheless, SMEs are still lagging behind in adopting solutions, and the range of services offered for SMEs in non-ICT sectors to catch up remains limited (OECD, 2022[11]). Given the potential of the sector’s services to support all SMEs’ development and digitalisation, Azerbaijan has much to gain economically in boosting the productivity of its ICT sector.

Table 11.3. Azerbaijan main macroeconomic indicators 2018-2022

|

Indicator |

Unit of measurement |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|

|

GDP growth** |

Percentage, year-on-year |

1.5 |

2.5 |

-4.2 |

5.6 |

4.7 |

|

Inflation** |

Annual percent increase, consumer prices |

2.3 |

2.7 |

2.8 |

6.7 |

13.9 |

|

Government balance** |

Percentage of GDP |

5.4 |

8.9 |

-6.6 |

4.1 |

6.1 |

|

Current account balance** |

Percentage of GDP |

12.8 |

9.1 |

-0.5 |

15.2 |

30.5 |

|

Exports of goods and services* |

Percentage of GDP |

54.1 |

49.1 |

35.6 |

46.5 |

60.1 |

|

Imports of goods and services* |

Percentage of GDP |

37.6 |

36.8 |

36.4 |

29.8 |

27.0 |

|

FDI net inflows* |

Percentage of GDP |

3.0 |

3.1 |

1.2 |

-3.1 |

-5.7 |

|

General government gross debt** |

Percentage of GDP |

18.7 |

17.7 |

21.3 |

26.5 |

20.7 |

|

Domestic credit to private sector* |

Percentage of GDP |

20.8 |

23.0 |

26.0 |

22.9 |

18.3 |

|

Unemployment* |

Percentage of total active population |

4.9 |

4.9 |

7.2 |

5.9 |

5.5 |

|

Nominal GDP** |

USD billion |

47.1 |

48.2 |

42.7 |

54.6 |

69.9 |

Note: Government balance corresponds to General government net lending/borrowing; unemployment reflects modelled ILO estimates

Sources: * (World Bank, 2023[12]); ** (IMF, 2023[1]); both accessed May 2023, ***OECD Calculations based on (World Bank, 2023[12]) and (SSCRA, 2023[5])

Box 11.1. Azerbaijan’s support for SMEs during the COVID-19 pandemic

Financial support

During the COVID-19 pandemic, the Azerbaijani government offered support for businesses and individuals totalling 4.85% of the country’s GDP. This included additional funds for the Entrepreneurship Development Fund as well as AZN 80 million (EUR ~44.5 million) dedicated to microentrepreneurs.

In sectors negatively affected by the pandemic, businesses were offered the possibility to apply for state guarantees for 60% of the loan amount and a 50% interest rate subsidy on selected new loans, as well as an 10% interest rate subsidy on existing loans for a year. Unsecured microloans were distributed to the agricultural sector.

Regulatory flexibility

In 2020, deadlines for tax declarations and payment were extended. Azerbaijan amended its Tax Code and introduced temporary tax benefits and holidays to minimise negative effects on businesses. Measures included reductions in profit tax and social security contributions for businesses that were particularly impacted by the pandemic. Workforce support

The government provided AZN 215 million (EUR ~120 million) to partially cover the salaries of 300,000 employees. Unemployed and low-income citizens that lost earnings due to the pandemic also received a lump-sum payment of AZN 190 (EUR ~106). Taxpayers in sectors particularly affected by the pandemic were exempted from 75% of their income tax, from land and property tax for one year, and from rental tax for nine months.

The government also sought to provide assistance for individual entrepreneurs, as well as for business owners, to help pay wages through an online platform by transferring funds directly to their bank accounts. By the end of July 2020, almost 30,000 entrepreneurs had used it to pay salaries worth a total of almost AZN 98 million (EUR ~54.5 million).

Source: (IMF, 2021[13]), (OECD, 2020[14]).

SME sector

A new definition of SMEs was introduced in December 2018 with the objective of eliminating differences in the methodologies applied by the State Statistical Committee and the Ministry of Taxes. The new definition distinguishes between micro, small, medium-sizes, and large enterprises, and is aligned with the EU definition regarding the thresholds used for number of employees.

Table 11.4. Definitions of SMEs in Azerbaijan

|

Micro |

Small |

Medium |

|

|---|---|---|---|

|

Number of employees |

< 10 employees |

< 50 employees |

< 250 employees |

|

Turnover |

< AZN 200 000 (EUR ~111 650) |

< AZN 3 000 000 (EUR ~1 674 747) |

< AZN 30 000 000 (EUR ~16 747 470) |

Note: Exchange rates as of 28 September 2023 (OANDA, n.d.[15]).

Source: Resolution No. 556 of the Cabinet of Ministers of the Republic of Azerbaijan dated 21 December 2018.

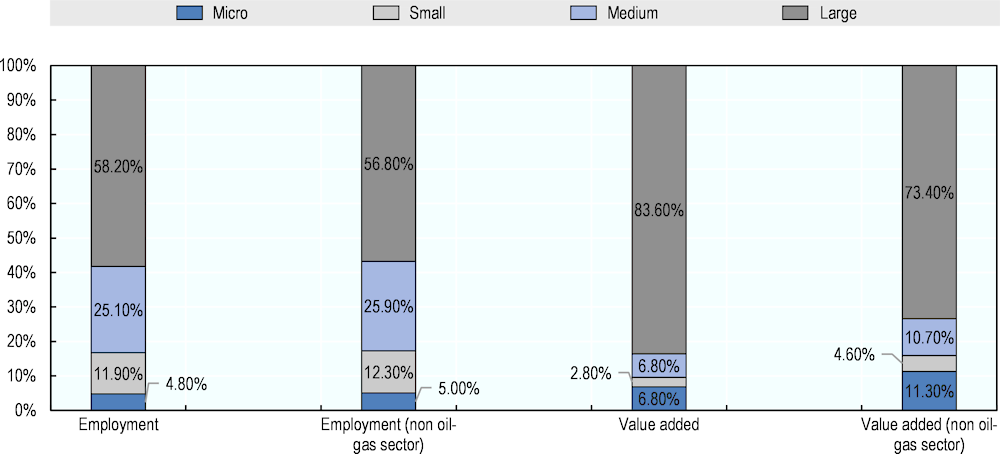

The economic potential of SMEs in Azerbaijan remains largely untapped. SMEs generated 16.4% of value added and accounted for 41.8% of total employment in 2021 (Figure 11.2). In the non-oil sector, SMEs generated 26.6% of value added and accounted for 43.2% of employment in 2021. While the value added of the non-oil sector has increased slowly but steadily in recent years (mostly driven by small enterprises), the share of employees in non-oil SMEs has shrunk by about 2 percentage points, to 43% in comparison to 45% in 2018 (SSCRA, 2022[16]; OECD et al., 2020[17]).

Figure 11.2. Business demography indicators in Azerbaijan, by company size (2021)

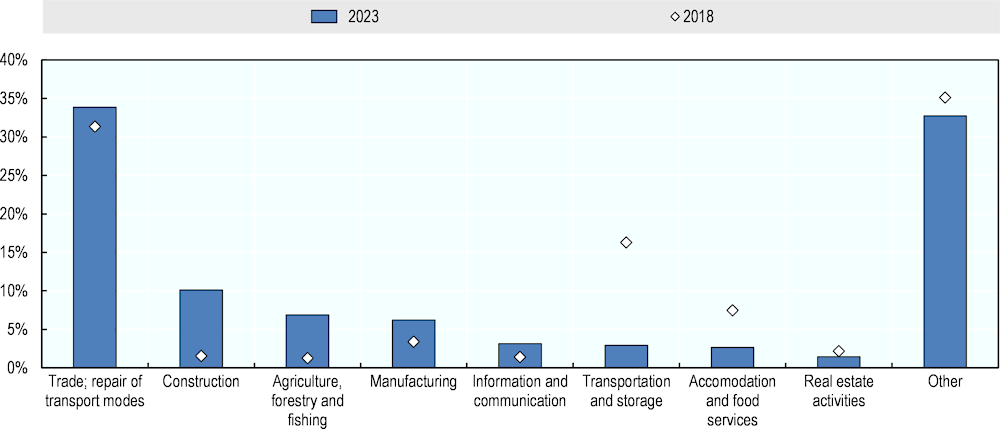

Most Azerbaijani SMEs are concentrated in relatively low value-added activities, such as trade and repair of vehicles, construction, and agriculture (Figure 11.3). The number of SMEs operating in these sectors changed substantially between 2018 and March 2023. The importance of the construction sector increased to a share of 10% of SME activity from 2% in 2018. Also, the agricultural sector has become more relevant for SMEs, with an increase to a share of 7% of SMEs. By contrast, the transport sector experienced a substantial decline of SMEs accounting for a share of only 3%.

Figure 11.3. Sectoral distribution of SMEs in Azerbaijan as of March 2023

Note: “Other” includes mining and quarrying, electricity, gas and steam production and supply, water supply, waste management, financial and insurance activities, professional, scientific, and technical activities, administrative and support service activities, education, human health and social work, arts/entertainment/recreation, and other service activities.

Source: OECD calculation based on data from Azerbaijan State Statistical Committee.

SBA assessment by pillar

SME digitalisation policies

Creating an environment conducive to the digital transformation of SMEs requires a comprehensive policy approach based on sound framework conditions for the digital economy as well as targeted support to help SMEs reap the benefits of digital solutions. Framework conditions refer to pre-requisites for the digital transformation, such as affordable access to high-speed broadband, a satisfactory level of digital literacy among citizens, and a well-co-ordinated and coherent policy approach and governance system for digital policies. In the context of SME development, those fundamentals need to be complemented with specific business support services, digital financial services for SMEs, and tailored support to engage in e-commerce to reach new markets.

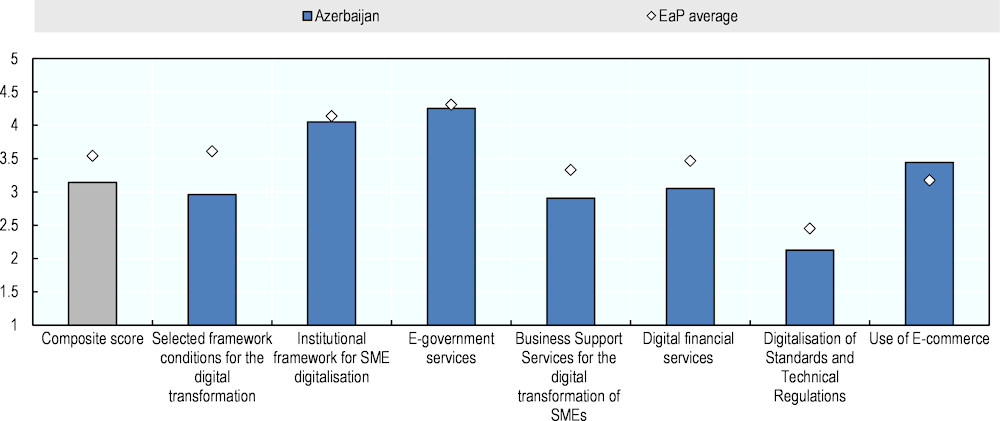

Reflecting the multi-faceted nature of the topic, this round of SBA assessment evaluates EaP countries’ policy approaches to SME digitalisation through i) a dedicated pillar on selected framework conditions for the digital transformation, as well as ii) six new sub-dimensions, incorporated in the pre-existing dimensions of the SBA assessment, to delve deeper into specific thematic policies to foster the digital transformation of SMEs. The weighted average of the scores for the new pillar and digitalisation-oriented sub-dimensions results in a composite score for SME digitalisation policies presented below (Figure 11.4).1

Azerbaijan’s composite score of 3.14 for SME digitalisation policies is driven by its institutional framework in that regard, with the Socio-Economic Development Strategy of the Republic of Azerbaijan 2022-2026 (SEDS) addressing the issue and the co-ordination efforts between stakeholders, as well as the sharp improvements in the provision of e-government services. The country also ranks among the top regional performers in terms of e-commerce, thanks to the measures planned in the SEDS, dedicated support for SMEs and the existence of a regulatory framework. On the other hand, Azerbaijan should pursue its efforts to create robust framework conditions (notably by adopting a national digital strategy (NDS), enhancing the collection of internationally comparable data and improving high-speed Internet accessibility), step up business support services for the digital transformation, and work on the digitalisation of standards and technical regulations.

Figure 11.4. Scores for SME digitalisation policies in Azerbaijan

Note: Further details on the assessment and calculation methodology can be found in the “Assessment framework” section in the “Digital Economy for SMEs” chapter, in the “Policy framework, structure of the report and assessment process” chapter and in Annex A. Additional information on institutional framework for SME digitalisation and e-government services can be found in Pillar A; on digital financial services in Pillar C; on use of e-commerce in Pillar D; and on business support services for the digital transformation of SMEs in Pillar E.

The following section details Azerbaijan’s performance in developing selected framework conditions for the digital transformation, while more information on digitalisation-oriented sub-dimensions can be found in the sections on the pillars they respectively belong to.

Selected framework conditions for the digital transformation

Individuals and firms, notably SMEs, cannot fully reap the benefits offered by the digital transformation without the existence of robust framework conditions, such as comprehensive digitalisation policies, access to high-speed Internet and well-rounded ICT skills among the population. Accessible, affordable and stable broadband connection is indeed the sine qua non to ensure widespread participation of citizens and businesses in the digital economy, and to stem the widening of the connectivity gaps between urban and rural territories, and between firms of different sizes. Furthermore, fostering digital skills development at all stages of life (through formal education and lifelong learning initiatives for adults) is essential to help the working-age population acquire the skills they need to embark on the digital transformation, produce tech-savvy consumers, and build a talent pool of IT specialists.

National digital strategy

Azerbaijan has been making policy efforts to accelerate the digital transformation of its economy and society. The Strategic Roadmap for Development of Telecommunications and Information Technologies (ICT Roadmap) and the Strategic Roadmap for the Production of Consumer Goods at the Level of Small and Medium Enterprises in the Republic of Azerbaijan (SME Roadmap), adopted in 2015, fostered the implementation of several measures for digitalisation between 2016 and 2020, such as the development of the digitalisation of public services and financial tools to help SMEs acquire digital technologies. More recently, in January 2023, Azerbaijan adopted a so-called “ICT package” notably entailing legislative changes to further encourage the growth of the IT sector. Regarding the digital transformation of the economy at large, measures are currently foreseen in the Socio-Economic Development Strategy of the Republic of Azerbaijan 2022-26 (SEDS), which foresees, in its Action Plan approved in July 2022, the creation of a standalone National Digital Strategy, the Digital Economy Strategy. The latter should be finalised by the end of 2023.

For the preparation of this upcoming document, Azerbaijan has worked towards co-ordinating efforts across stakeholders. The design of the new strategy was assigned to the Ministry of Economy and, within the Ministry, the Centre for Coordination and Analysis of the Fourth Industrial Revolution (Box 11.2). A dedicated Working Group on the Preparation of the Digital Economy Strategy was established by Order of the Minister of Economy of the Republic of Azerbaijan dated 12 December 2022, aiming at ensuring internal co-ordination and co-operation with international donors and consulting organisations. The institutions involved include the Central Bank, the Ministry of Digital Development and Transport, the Ministry of Science and Education, the Ministry of Finance, the State Service for Special Communication and Information Security, the State Agency for Public Service and Social Innovations under the President of the Republic of Azerbaijan, relevant structures of the Ministry of Economy, and external consultants.

While the SEDS sets targets to assess the implementation of the planned measures, Azerbaijan collects only a limited number of indicators related to the digital transformation of SMEs specifically – which might hinder impact evaluation.

Moving forward, Azerbaijan should ensure the adoption of a comprehensive policy approach in its upcoming National Digital Strategy. It should also include provisions for the digital transformation of non-IT sectors, notably SMEs – as this aspect would benefit from additional efforts. To ensure concrete impact, the strategy will need to set clear objectives, associated with sufficient budget/resources and targets, and process- and result-oriented key performance indicators to allow for the monitoring and evaluation of each policy action. Since limited co-ordination during the implementation of previous policy documents has been lowering the impact of policy initiatives (OECD, 2022[11]), Azerbaijan should pursue a multi-stakeholder approach, building on the newly established working group, and also involve private sector representatives to ensure all views are taken into account. Finally, Azerbaijan could consider collecting additional data, in line with EU and OECD methodologies, to enable better assessment of policy measures and international comparisons.

Broadband connectivity

Azerbaijan has made significant policy efforts to develop broadband connectivity in recent years. Several policy documents have been adopted and implemented, such as the Telecom Road Map 2017-2020 and the Regional Development Plans for 2009-13, 2014-18, and 2019-23. The above-mentioned ICT Roadmap also sets targets towards improving access to broadband across the Azerbaijani territory. A strategy and action plan on broadband for 2021-24 have reportedly been adopted, although the documents are not available online.

In terms of recent achievements, Azerbaijan has made considerable improvements in fixed broadband speed in recent years, notably fostered by government investment in infrastructure, but uptake levels remain below those of its EaP and OECD peers. The government has planned further measures to improve the situation, including the development of a new regional fibre-optic network, the Trans-Eurasian Information Superhighway, and the broadband strategy reportedly aims at having 100% of households covered and a minimum download speed of 25 Mbps by 2025. Despite being below EaP averages for fixed and mobile broadband uptake, Azerbaijan has made progress in reducing digital divides between urban and rural areas, with the current gap appearing quite low according to International Telecommunication Union (ITU) data (see Figure 4.4. in the “Digital Economy for SMEs” chapter). Azerbaijan also has one of the highest shares of individuals using Internet across the EaP region.

However, broadband subscriptions are still below OECD and EU levels, and Internet affordability has slightly decreased in recent years. Azerbaijan collects a range of data on digital divides, which offer up-to-date insights on broadband uptake by different target groups. This notably reveals persisting challenges in terms of businesses’ Internet access, with barely half of Azerbaijani firms having an Internet connection.

Moving forward, Azerbaijan should pursue its efforts to foster access to high-speed Internet across its territory. To this end, it could consider i) lowering barriers to broadband access through regulation and policies designed to enable investment, while safeguarding competition and investment incentives; ii) implementing measures to strengthen the resilience of communication networks, such as network diversity and redundancy, to reduce connection disruptions; iii) increasing digital literacy, as the lack thereof remains a challenge to broadband uptake in rural areas; and iv) conducting regular multi-stakeholder meetings, including with network providers, consumers and local authorities.

Digital skills

Digital skills policies are included in the SEDS 2022-26. The latter foresees the implementation of digital literacy at all education levels, the creation of educational resources, and lifelong learning initiatives. The topic was previously mentioned in the ICT Roadmap and also embedded in national legislation – such as the national qualifications framework (NQF) approved by the Cabinet of Ministers in 2018 (outlining digital skills at all levels of education) and the general education legislation that includes digital competence as a key competence for vocational education and training (VET) and lifelong learning.

With regard to education systems, the SEDS foresees the introduction of awareness-raising campaigns and the development of an “ICT-based infrastructure” in education facilities, as well as training for teachers and managers and the improvement of ICT materials, notably computers. It also provides for the creation of educational resources for educators, students, and parents, and an increase of graduates in tech fields. As for lifelong learning opportunities, Azerbaijan seeks to improve the quality and accessibility of digital skills training. To this end, a “digital academy” will be created, providing training and re-training for management professionals, starting with civil servants.

In addition to these policy plans, several initiatives have already successfully been implemented – such as courses in science, technology, engineering, and mathematics (STEM) offered to children and students by the Innovation and Digital Development Agency (IDDA); the Digital Skills project of the Ministry of Education; and additional courses provided to individuals and businesses by the Information-Communication Technologies Application and Training Centre under the Ministry of Digital Development and Transport. One of the latest milestones in the country lies in the development of the IT Hubs project, implemented jointly by the C4IR, EBRD and StrategEast company. It will offer 11 months of training in such areas as computer science, programming and business analysis to people between the ages of 19 and 30 in different regions and cities of Azerbaijan, with the aim of increasing their employability. Further training opportunities are being developed by the C4IR, as mentioned in Box 11.2.

Box 11.2. Azerbaijan’s Centre for Analysis and Coordination of the Fourth Industrial Revolution (C4IR)

Established in 2021 by and within the Ministry of Economy of the Republic of Azerbaijan, the Centre for Analysis and Coordination of the Fourth Industrial Revolution (C4IR) focuses primarily on analysing and co-ordinating challenges, initiatives, strategies and projects related to the digital economy.

Working in collaboration with public- and private-sector partners, as well as academia, the Centre aims to develop and test policies and regulatory frameworks designed to harness the potential of key emerging technologies with the goal of positioning the country as a leader in the field.

The “Fourth Industrial Revolution” (4IR) – characterised by the convergence of digital, biological and physical technologies – is profoundly transforming economies, industries and societies. C4IR endeavours to capitalise on these changes to drive opportunities and benefits for Azerbaijan's development in the digital era.

The Centre’s activities include:

Policy analysis: The Centre conducts analyses of emerging technologies' impact on various sectors, identifying potential policy implications. It offers research-based recommendations to policy makers, fostering an enabling environment that promotes innovation while safeguarding privacy, security and ethics.

Collaboration and co-ordination: Serving as a platform for collaboration, C4IR facilitates partnerships among diverse stakeholders, including government agencies, private sector companies, academic institutions and civil society organisations. The goal is to encourage innovation and shared approaches to 4IR related issues.

Pilot projects and prototyping: The Centre often undertakes pilot projects and prototyping initiatives to demonstrate the practical applications of emerging technologies. These projects showcase how new technologies can be integrated into industries and society, leading to positive outcomes.

Capacity building: C4IR plays a crucial role in enhancing digital skills and capabilities among individuals and organisations to adapt to the demands of the 4IR. This includes offering training programmes, workshops and awareness campaigns designed to empower stakeholders to harness the potential of new technologies effectively.

For example, the Centre collaborates with the US company Coursera and both parties signed an agreement to provide a wide range of courses covering programming, artificial intelligence, big data, machine learning, blockchain and cloud technologies. The project will also provide access to courses on leadership, communication and English language skills. Offered in collaboration with relevant government agencies, these courses will contribute to advancing digital literacy and skills development in Azerbaijan.

Source: (World Economic Forum, 2023[18]).

Nevertheless, digital skills levels in Azerbaijan remain below those of the country’s EaP, EU and OECD peers, with almost half of the population having only basic digital skills. No dedicated educational framework yet exists for fostering digital skills from initial schooling onwards, and data reveal considerable urban-rural gaps in schools across the country, e.g. in terms of pupils using the Internet. While Azerbaijan has some data on levels of basic and standard digital skills, insights remain scarce, with a lack of information on, for example, the levels of advanced digital skills in the population and of digital literacy among firms’ managers and employees. Azerbaijan also does not yet have digital skills anticipation tools in place – these are only conducted on an ad hoc basis, by international donors. The country is, however, implementing a pilot project jointly led by the Statistical Office, the Ministry of Digital Development and Transport and ITU this year, to assess digital skills among households, university students, and public and private sector employees, but results are not yet available.

Moving forward, Azerbaijan should i) strengthen skills assessment and anticipation tools, and notably adopt a digital competence framework to provide a benchmark against which to measure skills levels among individuals and businesses (in line with the EU’s Digital Competence Framework, or DigComp) to ensure international comparability and recognition; ii) ensure digital skills training opportunities across the country, to bridge current divides; and iii) foster the development of a multi-stakeholder approach on digital skills policies, ensuring the involvement and co-ordination of all relevant actors, including education providers, local authorities and firms.

Pillar A: Responsive Government

Institutional and regulatory framework

Since 2020, Azerbaijan has consolidated the achievements made on the institutional and regulatory framework for SME policy under the 2016-2020 SME Road Map, expanded the SME support network, and made further progress in upgrading the legislative framework concerning SMEs.

The government’s main policy priority remains the improvement of the operational environment for SMEs and the diversification of the country’s economic structure. Therefore, SME policy is seen as an integral component of the country’s socio-economic strategy.

Institutional setting

The SME policy mandate in Azerbaijan is placed under the Ministry of Economy and specifically under the Department for Entrepreneurship Development. SME policy is conducted and implemented by the Small and Medium Business Development Agency (KOBIA) operating under the Ministry of Economy. Other agencies and public bodies relevant for SME policy are the Commission for Business Environment and International Ranking under the Presidential Administration, which is in charge of promoting and co-ordinating regulatory reforms; the Centre for the Analysis of Economic Reforms and Communications (CAERC), which handles reform planning and monitors the implementation of the reform plans; and the Innovation and Digital Development Agency, placed under the Ministry of Digital Development and Transport, whose mandate involves promoting the development of an ecosystem supporting innovation, the development of e-government services, and enterprise digital transformation.

The implementation of the SME Road Map was completed in 2020 and it has reached most of its objectives, particularly with regard to the establishment of KOBIA and the network of SME support bodies. CAERC has monitored the Road Map implementation and conducted a review of SME Road Map achievements.

At present Azerbaijan does not have a specific multi-year SME strategy. Its main SME policy directions and measures are presented in the SEDS 2022-26 under National Priority One: sustainable and growing competitive economy – promotion and sustainable and high economic growth. The government opted to include SME policy objectives in the broader national development strategy in order to ensure cohesion and co-ordination of SME policy measures with the country’s broader economic development and productive diversification strategy. Activities related to SMEs are distributed among different thematic chapters of the Socio-Economic Development Strategy. The implementation of the Socio-Economic Development Strategy is conducted by CAERC, which regularly reports to the Presidential Administration and the Council of Ministers.

As planned in the Strategy, the government has recently approved three legislative acts concerning SMEs. The first act facilitates the distribution of SME products by large commercial companies, while the second act promotes cluster development (see below). Finally, the Law "On the Development of Micro, Small and Medium Enterprises", adopted at the end of 2022, defines the forms and methods for providing state support to micro, small and medium enterprises (MSMEs). The law covers various issues, including the goals, principles, and main directions of state policy for the development of MSMEs; conditions for providing support to entrepreneurial subjects; forms of support; procedures for monitoring and evaluation; and other areas including state financial support, advice and information support, and product production. In addition, the law provides for the establishment of a permanent group to co-ordinate activities in the field of development of MSMEs. Finally, the law foresees the creation of a single register of MSMEs.

As mentioned earlier, the main SME policy implementation body is KOBIA. The agency, established in 2017, has a total staff of 240 people and is at the centre of a network providing orientation and assistance to individual entrepreneurs, start-ups and small enterprises. The network consists of i) SME Development Centers, operating as structural divisions of KOBIA where professional trainers-experts provide business-oriented training, advice and support for business plan development and other services; and ii) SME Houses located in Baku, Khachmaz, and Yevlakh that operate as one-stop shops and provide services to entrepreneurs for all type of business activities, including business registration, tax issues, licenses, permits and certificates. The network also includes 45 SME Friends operating as KOBIA’s local representatives. KOBIA conducts policy actions on the basis of a five-year action plan, complemented by six-month plans monitored by CAERC.

Legislative simplification and RIA

The systematic review of business legislation, co-ordinated by the Commission for Business Environment and International Ranking under the Presidential Administration, has substantially contributed to an overall improvement of the business environment. According to the Ministry of Economy, over 50% of business-related legislation had been reviewed by the end of 2022. However, where new legislative acts and regulations are concerned, the adoption of regulatory impact assessment (RIA) is still at an initial phase and its application is relatively limited. The Law "On Licenses and Permits" dated March 15, 2016, mentioned RIA as one of the tools available for the evaluation of the impact of new state regulation in the field of licenses and permits. Elements of RIA are applied during the elaboration of new legislative acts and regulations resulting from the work conducted by the different committees operating under the Commission for Business Environment and International Ranking. An RIA division has been established within the Ministry of Economy, while the application of RIA methodology is supervised by the Legal Division of the Presidential Administration. All RIA reports are publicly available, and examples of RIA exist in other normative legal acts of the Republic of Azerbaijan. A recent example concerned the Law "On Environmental Protection” and specifically on legal and economic regulation related to environmental protection. However, RIA is currently applied to less than 25% of new law laws and regulations.

Azerbaijan has not formally applied an SME test to RIAs. However, according to Article 9.5 of Presidential Decree No. 148 dated June 26, 2018, all central and local executive authorities and municipal bodies, public legal entities created on behalf of the state, and legal entities whose shares are controlled by the state should make an assessment of how new legislative and normative acts affect the activity of MSMEs and should consult with KOBIA as part of the legislative and normative process.

The "Impact Assessment" section of the "Global Indicators of Regulatory Governance" (GIRG) Project implemented by the Global Indicators Group of the World Bank also reviewed and audited RIA applications in Azerbaijan and noted the absence of a single specialised state body for developing RIA’s guidelines and conducting RIA.

Public-private consultations

Since 2020 Azerbaijan has made progress in promoting public-private dialogue. The Public Council operating under KOBIA functions as the main channel of public-private consultations in the SME policy area. In 2022, seven public discussions were organised under the umbrella of the Public Council. These events covered the topics of construction business, business opportunities in the creative industry, mediating disputes related to entrepreneurial activity, digital entrepreneurship, the role of private business in education, medical business, and agribusiness. More than 550 entrepreneurs participated in public discussions. KOBIA also manages the official website of the Public-Private Partnership (PPP) Development Centre (www.pppdc.gov.az), whose purpose is to inform interested parties within the framework of partnership relations between the public and private sectors, and to stimulate the implementation of PPP projects. Finally, it is important to mention the private sector participation in the committees operating under the Commission for Business Environment and International Ranking, which include representatives of state entities as well as private sector associations and other stakeholders.

Institutional framework for SME digitalisation

Promoting SME digitalisation is one of the objectives of the SEDS 2022-26. The topic of SME digitalisation is not covered by a specific section of the Strategy; instead, it is dealt with in the sections dedicated to the development of the digital economy, promoting digital skills and an innovation society. The Ministry of Economy and the SME Development Agency (KOBIA) are also members of the working group in charge of formulating the country’s digital economy strategy and the implementation action plans, securing the co-ordination between the SME digitalisation objectives contained in the Socio-Economic Development Strategy and the country’s strategy on the development of digital economy.

The way forward

Moving forward, Azerbaijan should ensure that all SME-related measures listed in the Socio-Economic Development Strategy are implemented in a timely fashion, that SME policies are backed by short-term action plans, and that the implementation of those actions is regularly monitored. For this purpose, the Ministry of Economy in association with KOBIA should publish a yearly report on SME development and economic structure diversification. Azerbaijan should also conduct regular public-private consultations (i.e. every three to six months) involving the Ministry of Economy, KOBIA, and representatives of the SME community (entrepreneurs, experts, local administration and NGOs) to review the implementation of SME objectives set in the Socio-Economic Development Strategy and to discuss measures related the country’s contingent economic conditions. Finally, the country should upgrade the RIA methodology and bring it in line with international best practices and extend RIA to all new relevant primary and secondary legislative acts.

Operational environment for SMEs

In the previous assessment, Azerbaijan scored above the EaP average in most of the sub-dimensions related to the SME operational environment, with the exception of business licenses. The improvement of the operational environment is one of the two main pillars of the country’s SME policy, together with productive transformation. Since 2020, Azerbaijan has made incremental progress in improving the operational environment for SMEs, specifically in relation to the provision of e-services, driven by the COVID-19 pandemic.

Azerbaijan has taken a unique approach in the area of operational environment reform, bringing it under the supervision of the highest authority in the country. The Commission for Business Environment and International Ranking, operating within the Presidential Administration, acts as the main co-ordination body for regulatory reforms in this area. The Commission, chaired by the First Deputy Prime Minister, co-ordinates the work of a number of committees, composed by government entities and representatives of private sectors and other stakeholders, covering several topics. Each committee targets a specific indicator related to the operational environment used by international institutions and aims at improving the country’s performance and international ranking. Six of those committees are chaired by the Ministry of Economy, which is also a member of all other committees. The committees’ work is monitored by CAERC, which ensures that their work is in line with the objectives set in the country’s Socio-Economic Development Strategy.

E-government services

Over the last few years, Azerbaijan has made significant progress in the provision of the e-government services, in terms of both range and accessibility. The Azerbaijani Service and Assessment Network (ASAN) system, created in 2012 by the State Agency for Public Service and Social Innovations under the President of the Republic of Azerbaijan, provides access to a range of e-government services and is widely used by the population as well as by the business community, with terminals located in public spaces and in the ASAN service centres. The development of e-government is part of the Digital Azerbaijan project conducted by the E-Government Development Centre, a public entity operating under the State Agency for Public Services and Social Innovations. The objective of the project is to bring all e-government services under a single centrally managed portal. The IDDA is in charge of providing technical expertise to the various public administrations to lead to the establishment of the single portal for e-government services. It is also responsible for ensuring secure inter-operability across different public sector data banks and organising training courses in digital skills open to all categories of workers, in addition to promoting cyber security through a dedicated Cyber-security Centre.

Company registration

There have been no major changes in the company registration process since the last assessment. As before, the process is free of charge and can be conducted online through a dedicated website.

Business licensing

In the past, obtaining business licenses in Azerbaijan was a relatively complex process. However, since 2015 the government has acted to reduce the number of the licenses required. According to current legislation, the Ministry of Economy is in charge of issuing licenses for 23 types of entrepreneurial activity (excluding licenses issued by other authorities covering financial sector activities or activities concerning state security). Since 2020, the government has also reduced the average amount of the license fees by 50% and a further 50% discount is applied if the enterprise requires an additional license to operate in a province different from that of its headquarters.

In addition, license applications can now be made online through a “Licenses and Permits” portal (lisenziya.gov.az) managed by the Ministry of Economy. Launched in 2018, the portal was created to allow for the electronic issuance of licenses and permits and for the further improvement of the provided services, including the receipt of opinions from eight relevant institutions as part of the application process.

Tax compliance procedures for SMEs

Since 2019, the Tax Administration has introduced a number of measures to lower the tax burden on small enterprises and simplify tax administration procedures. Incomes of individuals who carry out entrepreneurial activities without creating a legal entity are subject to income tax at a rate of 20%, taking into account the expenses deducted from the income as determined by the Tax Code. A further simplified income tax regime is in place for individual entrepreneurs who have no employees. Income from dividends from entrepreneurial activities are exempted from taxes for shareholders/owners of enterprises not subject to VAT and a 75% tax reduction is in place for individual entrepreneurs.

The corporate income tax is set at 20%. However, enterprises that have obtained the “start-up” status from KOBIA benefit from a total corporate income tax exemption for a period of three years. In addition, the new Law on Clusters Development foresees income tax exemption for enterprises classified as member of clusters for a seven-year period, pending detailed regulations from the Ministry of Economy and the Tax Administration.

The evaluation of the efficiency of tax and customs incentives in effect or proposed in Azerbaijan is governed by the "Rules for the evaluation of the efficiency of tax and customs incentives" adopted by the Cabinet of Ministers of the Republic of Azerbaijan (Decision No. 436, dated 3 November 2020). The Ministry of Finance is the institution responsible for the Centralised Electronic Registry System of tax and customs incentives and exemptions.

The way forward

To continue improving the operational environment for SMEs, Azerbaijan should complete the elaboration of the country’s Digital Economic Strategy, making sure that it covers also the provision of e-government services and it is consistent with the Digital Azerbaijan Project.2 The level of co-ordination among different institutions should be improved in order to develop a unique platform for accessing e-government services. Inter-operability among public sector data bases should also be improved. In addition, Azerbaijan should systematically monitor the usage of e-government services by different types of SMEs and promote digital skills among those enterprises that do not make use of those services. Finally, the country should develop effective monitoring mechanisms to assess whether the new tax incentives introduced with the legislative acts on start-ups and cluster enterprises have produced the expected results.

Bankruptcy and second chance

Azerbaijan has taken some steps to improve its bankruptcy framework since the last SBA assessment. The Law No. 326-IQ “On Insolvency and Bankruptcy” (the Insolvency Law), adopted in June 1997 and last amended on in December 2020, remains the main legislative document regulating insolvency and bankruptcy procedures. The recent amendments clarify the grounds for insolvency of debtors willing to begin bankruptcy proceedings, regulate court hearings,3 and clarify which creditors have a voting right on the recovery. Moreover, the Commission on Business Environment and International Ratings of the Republic of Azerbaijan has taken steps to further strengthen the current legislative framework by establishing a dedicated working group.

Although there are no particular incentives for extrajudicial voluntary agreements, the Insolvency Law allows the debtor to initiate insolvency proceedings with minimum involvement of the court. In this case, a creditors’ meeting is convened, and an insolvency practitioner is appointed by the court. However, this out-of-court procedure is led mainly by the creditors and the court is still involved in any approval of a reorganisation agreement concluded out of court. In addition, the insolvency framework does not foresee abbreviated or simplified procedures for small cases or SMEs. Statistics on insolvency proceedings are very limited and bankruptcy cases remain rare (in 2019 there were 18 bankruptcy cases before the administrative-economic courts, 16 of which were in Baku) (EBRD, 2021[19]). There is no monitoring mechanism in place to regularly assess the insolvency framework.

Measures to prevent insolvency remain insufficient. Although training in financial management is available to all businesses through KOBIA’s website, it is not specifically targeted at entrepreneurs in financial distress or fearing failure. Also, no early warning systems exist to help businesses identify potentially threatening financial conditions. Finally, although there are no restrictions imposed during the period of bankruptcy that might prevent entrepreneurs from a fresh start, there is no established and structured policy framework to promote second chance for honest entrepreneurs that go bankrupt.

Pillar B: Entrepreneurial human capital

Entrepreneurial Learning

Since the last SBA assessment, Azerbaijan has taken additional measures to promote entrepreneurial learning across education levels and the national population at large. Most progress has been achieved with regard to vocational education, with the entrepreneurship module being integrated into the VET curricula, in line with the State Standards of Vocational education adopted in March 2019. This allows students to acquire knowledge and skills in the field of entrepreneurial activity, organisation and planning of activities, such as business plan development. Azerbaijan has continued to develop VET infrastructure, such as the Sumgayit Vocational Education Centre inaugurated in 2020. Students also benefit from career guidance services through nine career services in these VET centres that include awareness-raising about entrepreneurial opportunities. Student competition are being implemented to encourage learners to engage in a practical entrepreneurial experience, such as the Youth Business Workshop in VET that started in 2021. Azerbaijan is also working towards fostering non-formal learning, with the adoption in 2020 of a rule to support recognition of skills acquired in non-formal ways.

Moreover, different tools have been developed for entrepreneurial learning, such as a new textbook on entrepreneurship, and the launch of the free online portal tehsilim.edu.az offering different courses on entrepreneurial education and innovation. Entrepreneurship is also promoted among the general population, for instance through annual events (e.g. Youth Entrepreneurs Forums), communication campaigns in various media, and showcasing of good practices: KOBIA recently implemented a programme with GIZ to upgrade business and management skills, which included a study tour in different cities and the involvement of successful entrepreneurs who shared their stories.

Finally, there are several examples of co-operation between higher education institutions and businesses, although limited to Baku. KOBIA has signed memoranda of understanding (MoUs) on co-operation with different universities, such as the Azerbaijan University of Economy, Baku State University, and Azerbaijan Diplomatic Academy (among others). These include non-business faculties, which is a notable progress since 2020. This falls within the SEDS 2022-26 objective to implement professional entrepreneurial learning programmes in co-operation with public, private, and academic sectors.

However, Azerbaijan does not currently have an action plan to support entrepreneurial learning. In that regard, there is no formal national policy partnership clearly defining roles of the different stakeholders involved in entrepreneurial learning policies, resulting in co-ordination challenges. The country’s overall progress on entrepreneurial learning has been rather limited since 2020. Entrepreneurial learning remains circumscribed to vocational education, and higher education in some instances – but not beyond economics, management, and education specialities. As a result, not all Azeri students engage in at least one practical entrepreneurial experience. Entrepreneurship is not promoted as a career option in general secondary schools nor non-business faculties.

Moving forward, Azerbaijan should include entrepreneurship key competence in all education levels, implementing relevant support in that regard – developing materials, providing pre- and in-service teacher training on the topic, and including entrepreneurship in career guidance in general education. Entrepreneurship could also be further promoted in non-business academic curricula. Azerbaijan could complement its efforts by fostering the development of an entrepreneurial spirit and mindset among students, beyond the hard skills taught (e.g. business plans). Finally, monitoring and evaluation practices could be improved by enhancing the quality and range of indicators collected.

Women's Entrepreneurship

Women’s entrepreneurship is mentioned in the SEDS 2022-26 and in the recently adopted law On the development of micro, small and medium enterprises, which is more focused on entrepreneurship, with a direction on support provision for women-led businesses. However, these documents do not outline concrete measures to support female entrepreneurs since the end of the SME Roadmap in 2020. In terms of institutional framework, while Azerbaijan does not currently have a formal national policy partnership on women’s entrepreneurship, KOBIA actively co-operates with the private sector, notably with Azerbaijan women’s entrepreneurship development association (Azərbaycanda Qadın Sahibkarlığının İnkişafı Assosiasiyası, or AQSiA).

Some initiatives have been implemented to support women entrepreneurs in the country and help them unleash their potential. Women-specific programmes have been launched by both public and private actors, sometimes in co-operation: the Scale up Accelerator Program, for instance, is an initiative of AQSiA jointly implemented with KOBIA, the Ministry of Economy, the State Committee on Family, Women and Children Affairs, the US Embassy in Azerbaijan, PASHA Bank and PwC Azerbaijan. The eight-week programme notably aims at equipping women with knowledge and skills in digital transformation, communications, investment rules, and self-development. Information on government support programmes available for women entrepreneurs is available on KOBIA and AQSiA’s websites.

Particular progress has been made with regard to support for women entrepreneurs in regions: 17 Women’s Resource Centres, created by the State Committee on Issues of Family, Women and Children of the Republic of Azerbaijan, are operating in different cities of the country, providing training and consultancy services to help women start their own business. The Centre in Ganja, for instance, implemented the Women’s Leadership Summer School, during which women can learn about the government’s support measures available for them and extensive information on how to establish and develop a business.

Moreover, Azerbaijan has initiated some actions to encourage women and girls to go into STEM, fields in which they remain largely under-represented. Support measures include awareness-raising and networking activities, e.g. the Women in STEM festival, where female students can find out more about employment opportunities in large companies and hear speeches and masterclasses from experts; and targeted support, although these remain donor-led (e.g. the UNDP Women and Girls in STEM Mentorship programme).

Despite these various and welcome policy developments, Azerbaijan does not have a comprehensive policy approach to women’s entrepreneurship. Provisions in existing policy documents are rather limited and the scatteredness of policy initiatives convolute coordination across stakeholders, as well as monitoring and evaluation of women’s entrepreneurship policies in general. Furthermore, while women-only programmes are being developed, women’s participation in KOBIA’s SME training remains rather low, with only 30% of participants to training being women in 2021. Overall, data on female entrepreneurs appears limited, with no studies on barriers to women’s entrepreneurship being regularly conducted.

Moving forward, Azerbaijan should adopt a comprehensive policy approach to women’s entrepreneurship, with clearly defined measures, targets, timeframe, task allocation across stakeholders, and monitoring and evaluation. This would help streamline and co-ordinate efforts and assess the concrete impact of the different support measures and programmes. Moreover, Azerbaijan could complement existing efforts by fostering women’s participation in KOBIA programmes, tackling persisting gender stereotypes, and developing measures to tackle women’s involvement in the informal economy. Finally, improved data collection and the conduction of regular assessments/studies on female entrepreneurs in the country would further allow to identify persisting challenges and developing relevant solutions.

SME Skills

Azerbaijan has achieved considerable progress in the area of SME skills since the last SBA assessment. The SME agency, KOBIA, has developed a network of operators – SME Development Centres, SME Houses, SME Friends – across the Azeri territory, which has led to strong improvements in training provision. The SME Development Centers have been providing courses on a wide range of topics (1600 in 2021), from business law to project management, leadership, and export promotion legislation. Moreover, the establishment of an online video training platform has considerably enhanced outreach (notably to outlying regions), and helped SMEs weather the COVID-19 crisis by granting them access to 180 online training courses – including in digital skills and the green economy.

In an effort to tailor training content to SME needs, KOBIA now uses systematic surveys to collect feedback from participants on the training received. This has been reportedly used to improve courses, and the Agency reports plans to develop additional content based on the remaining identified needs.

As recommended in SMEPI 2020, which highlighted the weak SME skills intelligence available in the country, Azerbaijan has worked to develop a framework for collection and analysis of data on SME skills of both managers and employees. The indicators currently available include insights in such areas as in-house training provided by small firms, and surveys are now conducted to assess the training needs of entrepreneurs (KOBIA, 2022[20]). The latter have been used to inform policy making at the national level.

Building on these recent efforts, monitoring practices and data quality could be further improved. KOBIA currently considers the number of participants and their level of satisfaction when adjusting its training programmes (by e.g. changing trainers/experts, revising materials, or developing new in-demand topics). This approach could be refined by capturing the actual impact of training on skills development and SME performance. Also, the Labour Market Observatory, established in 2019, has begun performing labour market analyses, but skills anticipation exercises remain at a very nascent stage.

Moving forward, Azerbaijan could raise awareness of training available among SMEs and the general population, helping them navigate between the different possibilities. Monitoring and evaluation could be improved by evaluating the skills acquired and the impact of training on SME performance and by improving the quality of data collected and published. Finally, Azerbaijan should consider enhancing skills assessment and anticipation tools, building on the new Labour Market Observatory.

Pillar C: Access to finance

Legal and regulatory framework

The previous SBA assessment noted significant progress in strengthening the legal framework for secured transactions. Since then, there have been no notable reforms in this area, and an assessment of commercial banks on the question of how well the framework for secured transactions works suggests there is room for improvement, especially when it comes to enforcement. For instance, according to a recent survey of 19 commercial banks in the country, banks are relatively satisfied with the scope and creation of securities (more so for immovable than movable assets), but all banks view the enforceability of security rights as not efficient. (EBRD, 2022[21]) Improving enforcement should therefore become a priority, as the system for secured transactions could be compromised if it does not play its critical role as the last step of the chain.

The Central Bank of Azerbaijan has managed to improve its regulatory and supervisory framework following major turmoil in the sector in 2015-16, and continuity of policies assisting the emerging credit growth will be important in order to cement an environment for healthy financial development. Basel III principles are being introduced and implemented and the Central Bank has moved toward an enhanced risk-based supervision and stress-testing model. Currently, however, non-financial disclosure requirements for banks relate only to corporate governance standards and do not take into account environmental or social aspects. There is also no climate-related stress testing or green taxonomy. These are areas of increasing importance that should be incorporated into a forward-looking supervisory approach. The Central Bank has worked with IFIs and experts on developing its first Sustainable Finance Roadmap, which is an important step in this direction.

As of March 2023, deposit dollarisation remained high at 46%, which may constrain the sector’s ability to extend local currency loans in the longer term. Nevertheless, foreign currency lending has declined, with only 10% of new loans and around 20% of banks’ loan portfolios denominated in foreign currency. Regulatory provisions that encourage local currency lending, such as higher capital requirements and risk weights for foreign currency loans and mandatory disclosure of the risks of FX borrowing, have supported this trend.

The banking sector is quite concentrated, with the assets of the top four banks representing around 68% of total banking assets as of June 2023. This share has increased since the last assessment in 2019. Greater support to smaller banks with a more pronounced SME focus and strategies, including FDI, would be helpful in fostering competition which in turn could encourage greater supply of finance to SMEs.

The Baku Stock Exchange has a premium and a standard segment with a total of 24 stocks and 254 bonds issued. Issuances, especially in the premium segment, are dominated by state-owned entities, whereas in the standard segment, a majority of issuers of both stocks and bonds are financial institutions with only a limited number of corporates present.

Sources of external finance for SMEs (bank financing, non-banking financing, and venture capital)

Following a slow recovery from the 2015-16 crisis, Azerbaijan went through a double shock from reduced demand for oil coupled with a decline in economic activity due to measures against the COVID pandemic in 2020. In this environment, new lending was largely suspended in the country and the sector embarked on a major loan restructuring, reaching around 12% of the sector’s gross loan portfolio. In addition, the licenses of four banks with long-standing solvency issues were withdrawn in 2020, largely completing a major sector clean-up since 2015-16. The government stepped in with a significant support package for real sector borrowers and the Central Bank introduced several regulatory changes to ease pressure on banks on a temporary basis (now fully phased out).

After a low in December 2020, lending recovered with positive credit growth year-on-year. Since the last assessment, the share of SME loans in total loans has steadily increased, from around 42% in 2019 to 51% in the first half of 2022. Around 12-14% of SME lending has been publicly supported (Central Bank of the Republic of Azerbaijan, 2022[22]). This means that access to finance has eased overall, which is also reflected in results from an enterprise survey conducted in 2019 where 26% of SMEs identified access to finance as an obstacle to doing business, compared with 34% in 2014 and 50% in 2009. For those businesses needing a loan but not able to access one, the main reasons were high interest rates and collateral requirements (EBRD, 2020[23]).

Support programmes were expanded during the pandemic and are mainly provided through the Entrepreneurship Development Fund, which issues guarantees and subsidised loans. In 2022, 2 726 soft loans were disbursed through the Fund, the vast majority of which went to SMEs (see Box 11.1). Although there is an annual audit report on the Fund’s activities, there does not seem to be a separate, formal impact evaluation mechanism and no channel through which private banks can provide feedback. Applications are open to businesses in the non-oil sector and certain investments are identified as a priority, such as projects related to, for example, innovation, digitalisation, greening and tourism.

When it comes to non-bank financing, SMEs can access microfinance, leasing and factoring opportunities, but these sources remain underdeveloped. A clear picture is difficult to establish in the absence of reliable data, however. A new Strategy for Financial Inclusion is currently being drafted which should provide a more supportive legal framework for microfinance by allowing MFIs to provide auxiliary services and by expanding payment options for micro loans. Leasing and factoring are available through some banks, but leasing activities are not regulated, and uncertainty in the legal framework around the definition of different types of factoring hinders the wider development of this instrument. Work on a draft law on leasing is currently being carried out, and a review of factoring legislation (with a view to enabling supply-chain finance and easing the use of movable assets as collateral) is underway. These efforts will be crucial to bring both sectors onto a more promising footing and provide SMEs with much-needed alternatives to bank financing.

Due to a missing legislative framework, venture capital remains nascent and until recently there was not much investment activity. However, in November 2023 the first local venture fund, “Caucasus Ventures”,was established with paid-in capital by the Innovation and Digital Development Agency, PASHA Holding, and local entrepreneurs, amounting to AZN 11.3 million (EUR ~6.3 mln). The plan is to invest these funds in around 50 projects in Azerbaijan and the wider region over the coming five years. So far, three investments have been made, and it is too early to tell whether this fund could act as a catalyst for the sector. For earlier-stage investments, grants and accelerator support from the Innovation Agency are available, but information about support opportunities is not easy to access, and funding beyond the very initial stages is difficult to get. No business angel network exists, either, which means that start-up funding, in particular from private investors, is very scarce.

Financial literacy

The Central Bank conducts annual financial literacy surveys to gauge the level of financial literacy in the population. This is an important foundation for formulating policy responses to improve financial literacy. Following on the previous Financial Literacy Strategy in 2016, Central Bank is currently preparing a new strategy with the aim of adoption it by end 2023. In recent years, a number of resources have been made available to enhance the understanding of the population, including entrepreneurs specifically. A general financial literacy portal (bizimpullar.az) provides access to news and basic information around finance and monetary policy. In 2022, the portal was accessed by 30,957 visitors. It is complemented by a training platform (edu.e-cbar.az) offering online courses on more in-depth topics such as capital markets, how insurance works, digital financial literacy, etc. In addition, an information platform (infobank.az) provides information around different types of financial instruments that people can access and attracted 14,007 visitors in 2022. These resources cater to both the general population as well as entrepreneurs. Monitoring of usage is useful to gauge whether the offer corresponds to what people need or expect, but the Central Bank should consider more rigorous evaluations of its programmes and how they translate into better financial literacy among the population in order to establish a clear link between the policy efforts made and the outcomes measured in its annual surveys.

Digital financial services

In 2023, the Central Bank prepared a Digital Payments Strategy which covers aspects of digital financial service regulation. It is centred around 5 pillars: (i) improvement in legislation to support digital payment provision, (ii) expansion of coverage, (iii) development of risk-based regulation, (iv) increase in financial inclusion, and (v) improvement in financial literacy. All of these aspects can also support the development of digital financial services more generally. The development of digital payments and their outreach is also supported by the International Finance Corporation (IFC) in co-operation with Swiss and German donors. (IFC, 2021[24])

Several stakeholders are involved in discussions around digital financial services, such as the Central Bank as well as the Azerbaijan Banking Association. There seems to be no multi-disciplinary task force that brings together representatives from different branches of government and the private sector to discuss and decide on regulatory approaches to digital financial services. Having such an institution in place is particularly important in the context of digital financial services given that they span across spheres of activity that require solutions from different disciplines.

Provisions on data protection and rules around data sharing are in place. However, outsourcing provisions are not yet fully regulated, meaning there is currently no requirement for or limit on, for instance, banks outsourcing even core services. The application of a wider toolbox (e.g. . suptech4 application, regulatory sandbox, central bank digital currency) by the Central Bank is still at a nascent stage, but some preparatory work is underway.

The way forward

Moving forward, Azerbaijan should improve the legal framework for secured transactions by facilitating the use of movable assets as collateral and strengthening the system for enforcement. This would require a wider review of legislation as well as enforcement mechanisms, both in and out of court. A lengthy and difficult enforcement process makes banks more reluctant to lend to SMEs at reasonable rates, and heavy reliance on immovable assets reduces funding opportunities for asset-light businesses, many of which tend to be SMEs.

In addition, the country should deepen financial inclusion by supporting the development of non-bank financing options. The adoption of the new financial inclusion strategy as well as the new law on leasing would be an important step in this direction. These instruments need to become viable financing options for SMEs in order to give entrepreneurs the ability to choose the t instruments best suited to their individual needs and situations. The available information platforms are already a good tool for raising awareness, but now policy attention should focus on making these options usable.

The scope and depth of statistics on access to finance for SMEs should be further improved, especially with regard to non-bank funding sources, where no statistics are currently publicly available. These statistics will allow important for the government to (a) formulate effective and targeted policy responses and (b) monitor whether policy changes have an impact on financial outcomes. Making the statistics public, meanwhile, would mean they can also become an important information source for financial service providers working to develop new product offerings that are tailored to the needs of SMEs in the country.

Across the board, policies should focus on bringing in private funding and investment instead of using public sources. For example, while the newly established venture fund has the potential to improve the financing environment for start-ups, more policies are required that leverage private money and create an environment in which private investors are able to operate in the country.

Pillar D: Access to markets

Public procurement

Since the latest assessment, some successive adjustments of details in the legal framework as well as enhancements to the e-procurement system have been made, while principles and practices have seen little change.