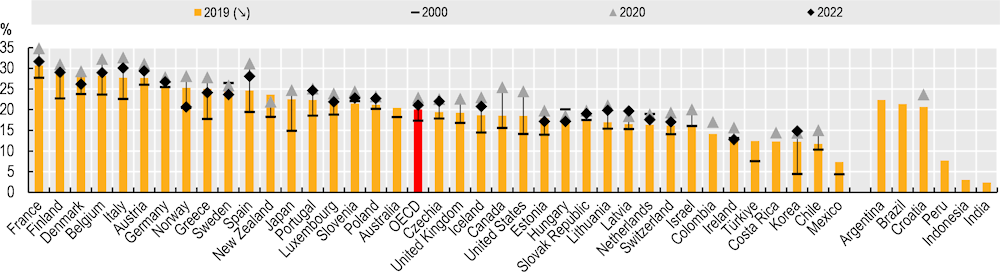

Public social expenditure‑to-GDP-ratios have changed rapidly in recent years. With the outbreak of the COVID‑19 pandemic, the public social expenditure‑to-GDP ratio increased by almost 3 percentage points from about 20% in 2019 to 23% in 2020 on average, across the OECD (Figure 6.10). About 2.5 percentage points of the 3 percentage point change was caused by an increase in public social spending, while 0.5 percentage points was related to a decrease in GDP. After the initial rise, spending-to-GDP ratios declined almost as rapidly as they increased: public social spending fell from 23% in 2020 to an estimate of 21% in 2022, on average across the OECD. This evolution contrasts starkly with the aftermath of the 2008/09 global financial crisis. Individual country experiences differ markedly. Canada, Spain and the United States recorded the highest increases in the public social spending-to-GDP ratio from 2019 to 2020 (more than 6 percentage points), while Denmark, Hungary and Sweden had the lowest increases (less than 1 percentage point).

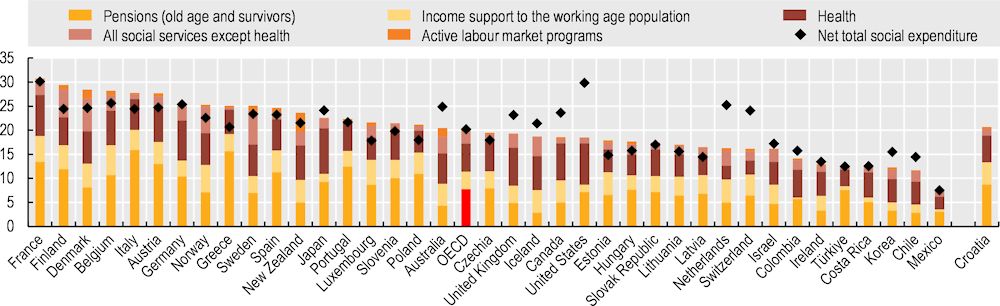

Across the OECD on average, old-age and survivor pension payments (7.7% of GDP) and health (5.8% of GDP) are the largest areas of public social spending (Figure 6.11). They both account for two‑thirds of total expenditure. At over 15% of GDP, public pension spending is highest in Greece and Italy and lowest in Chile, while Iceland, Korea and Mexico spend around 3% of GDP on pensions. In France, Germany, Japan and the United States public expenditure on health is over 8% of GDP, while it is less than 3% of GDP in Mexico, the Netherlands and Switzerland.

Accounting for the impact of taxation and private social benefits leads to some convergence of spending-to-GDP ratios across countries (Figure 6.11). Net total social spending is 20‑26% of GDP in about half of countries. It is even higher for the United States at almost 30% of GDP, where the amount of private social spending and tax breaks with a social purpose is much larger than in other countries. Both in terms of gross (before tax) and net total social expenditure, France is the biggest social spender in the OECD, at 30% of GDP.

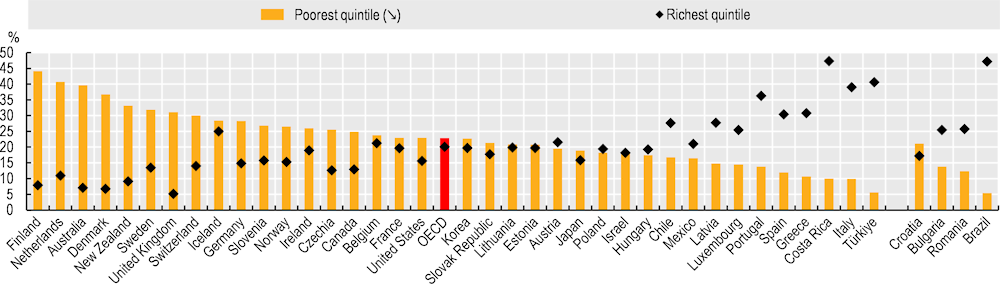

Cash benefits are not always tightly targeted to the poorest. In 2020, on average only 23% of public cash transfers received by working-age individuals went to households in the bottom 20% of the income distribution, while 20% went to households in the top 20% of the income distribution (Figure 6.12). These shares vary across countries. On the one hand, more than 40% of cash benefits go the poorest 20% in Australia, Finland and the Netherlands, countries with various income‑tested benefits. On the other hand, less than 15% of cash benefits go the poorest 20% in Greece, Italy, Luxembourg, Portugal, Spain and Türkiye, countries with a strong social insurance dimension where most benefits are related to past earnings.