A robust SME policy hinges upon a well-structured framework integrating policy, institutions, and regulations, supported by streamlined administrative procedures and effective insolvency systems. This chapter examines the responsiveness of EaP governments to SME requirements across three key dimensions. Firstly, it evaluates the state of the institutional and regulatory framework governing SME policies, encompassing progress in the institutional setting, legislative simplification and RIA, public-private consultations, and the regulatory framework for SME digitalisation. Subsequently, the chapter analyses SMEs’ operational environment, exploring aspects such as e-government services, business licensing, company registration, and tax compliance procedures for SMEs. Lastly, the chapter delves into bankruptcy and second chance provisions with a focus on preventive measures, survival and bankruptcy procedures, and second chance promotion. For each of the three dimensions, this chapter offers policy recommendations for the EaP region.

SME Policy Index: Eastern Partner Countries 2024

5. Pillar A – Responsive Government

Abstract

Introduction

Entrepreneurs in both developed and emerging economies must navigate a complex structure of government regulations, standards and procedures. However, while regulations governing business operations are essential, their implementation can sometimes be subject to difficult and costly mandatory requirements, thereby hindering entrepreneurship and discouraging entrepreneurial activity (OECD, 2020[1]). In addition, navigating the legal environment and complying with regulations can be cumbersome for SMEs, as the associated fixed costs disproportionally affect them as a result of limited operational capacity and other size-related constraints (OECD, 2022[2]; European Commission, 2008[3]). As a result, SMEs often perceive government authorities as a source of bureaucracy and complex, heavy-handed regulation.

Establishing clear and transparent institutional and regulatory settings is therefore critical to guide entrepreneurial activity and prevent lack of transparency, unpredictability of regulation, and corruption from undermining the business environment and creating obstacles to entrepreneurship. Therefore, an effective and efficient institutional and regulatory framework is an essential prerequisite for promoting entrepreneurial risk-taking, encouraging investment and innovation, reducing informality and corruption, and ensuring fair competition among businesses of all sizes (OECD, 2017[4]).

An effective and transparent regulatory environment is key to fostering entrepreneurship and supporting SME development at all stages of the business cycle, including entry, investment and expansion, transfer, and exit. Crafting an effective SME policy that comprehensively addresses these aspects is a complex task due to the highly diversified nature of the SME population and the intersection of SME policy with multiple domains of policy making. To navigate this complexity successfully, governments must establish a clear and strategic vision for SME policy, while building a broad consensus amongst all stakeholders, including the business community and SME associations, NGOs, experts, and relevant partner organisations.

The “Responsive Government” pillar investigates recent reforms across EaP countries through an assessment of three policy dimensions: 1) the institutional and regulatory framework for SME policy, 2) the operational environment for SMEs, and 3) bankruptcy and second chance. Table 5.1 presents the progress achieved by EaP countries in these areas since 2020.

Table 5.1. Pillar A: Country scores by dimension and sub-dimension (2024)

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

EaP average 2024 (CM) |

EaP average 2024 (CM) |

|

|---|---|---|---|---|---|---|---|---|

|

Institutional and regulatory framework for SME policy |

3.24 |

3.69 |

4.37 |

3.93 |

3.68 |

3.78 |

3.72 |

3.61 |

|

Institutional setting |

3.02 |

4.14 |

4.62 |

3.83 |

3.70 |

3.86 |

3.90 |

4.06 |

|

Legislative simplification and RIA |

3.03 |

2.90 |

3.50 |

3.35 |

3.27 |

3.21 |

3.16 |

3.13 |

|

Public-private consultations |

4.16 |

3.40 |

4.65 |

4.27 |

4.26 |

4.15 |

4.03 |

3.49 |

|

Institutional framework for SME digitalisation |

3.50 |

4.05 |

4.54 |

4.20 |

4.40 |

4.14 |

- |

- |

|

Outcome-oriented indicators |

3.00 |

4.00 |

5.00 |

5.00 |

3.00 |

4.00 |

- |

- |

|

Operational environment |

3.99 |

4.25 |

4.51 |

4.34 |

4.11 |

4.24 |

4.37 |

3.77 |

|

E-government services |

4.00 |

4.25 |

4.29 |

4.34 |

4.66 |

4.31 |

4.49 |

3.76 |

|

Business licenses |

3.66 |

3.96 |

5.00 |

4.69 |

4.40 |

4.34 |

4.33 |

3.99 |

|

Company registration |

4.88 |

4.52 |

5.00 |

4.74 |

4.52 |

4.73 |

4.80 |

3.94 |

|

Tax compliance procedures |

2.73 |

3.70 |

4.26 |

3.78 |

2.73 |

3.44 |

3.50 |

3.44 |

|

Outcome-oriented indicators |

4.56 |

5.00 |

4.11 |

4.11 |

3.67 |

4.29 |

- |

- |

|

Bankruptcy and second chance |

1.97 |

1.91 |

3.36 |

2.00 |

2.52 |

2.35 |

3.10 |

2.87 |

|

Preventive measures |

1.34 |

1.69 |

3.24 |

1.46 |

1.75 |

1.90 |

3.02 |

2.28 |

|

Survival and bankruptcy procedures |

2.74 |

2.15 |

4.13 |

2.72 |

3.39 |

3.03 |

4.04 |

3.74 |

|

Promoting second chance |

1.00 |

1.33 |

2.33 |

1.00 |

1.83 |

1.50 |

1.50 |

2.00 |

|

Outcome-oriented indicators |

2.71 |

2.71 |

2.71 |

2.71 |

2.71 |

2.71 |

- |

- |

Note: CM = comparable methodology; RIA = regulatory impact assessment. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Institutional and regulatory framework for SME policy

This dimension measures progress in establishing a well-functioning institutional and regulatory framework for SME policy making based on the “Think Small First”1 principle, the application of regulatory impact analysis (RIA) for business-related legislation, and the organisation of effective public-private consultations.

The application of the “Think Small First” principle, as presented in the EU Small Business Act, encourages policy makers to give due consideration to the impact that policy change will have on SMEs. To be able to take SME needs into consideration at an early stage of policy development, governments would benefit from devising comprehensive SME strategies, based on a clear and consistent SME definition and data collection goals, as well as by establishing a functional operational agency for policy implementation. Given the horizontal nature of SME policy, a related SME strategy would need to be co-ordinated on a regular basis amongst all line ministries, government agencies and other institutions tasked with SME policy making and implementation. Dedicated action plans are required to set clear targets, define measurable indicators, and allocate responsibilities and resources for policy delivery. All SME-related policies should be linked to broader socio-economic or development objectives and should reflect the main business constraints identified in a given country and local context.

Ex ante and ex post regulatory impact analysis (RIA) has great potential to ensure the promotion of better laws with less uncertainty. Evaluating the costs, benefits and social impact of regulation for SMEs (the so-called “SME test”2) enables policy makers to adapt regulations to smaller firms’ needs. In addition, implementing comprehensive public-private consultations while giving specific consideration to SME needs is a key requirement of the “Think Small First” principle.

Assessment framework

This dimension includes elements such as the definition of what an SME is; the institutions in charge of elaborating, implementing, monitoring and evaluating SME policy at the national level; and the mechanisms for policy dialogue and co-ordination.

Two important methodological changes have been introduced in this dimension since the previous SBA assessment: i) a new sub-dimension looks at the institutional framework for SME digitalisation, and ii) the analysis considers countries’ ability to regularly collect quantitative information to monitor the impact of policies on actual SME performance (“outcome-oriented indicators”).

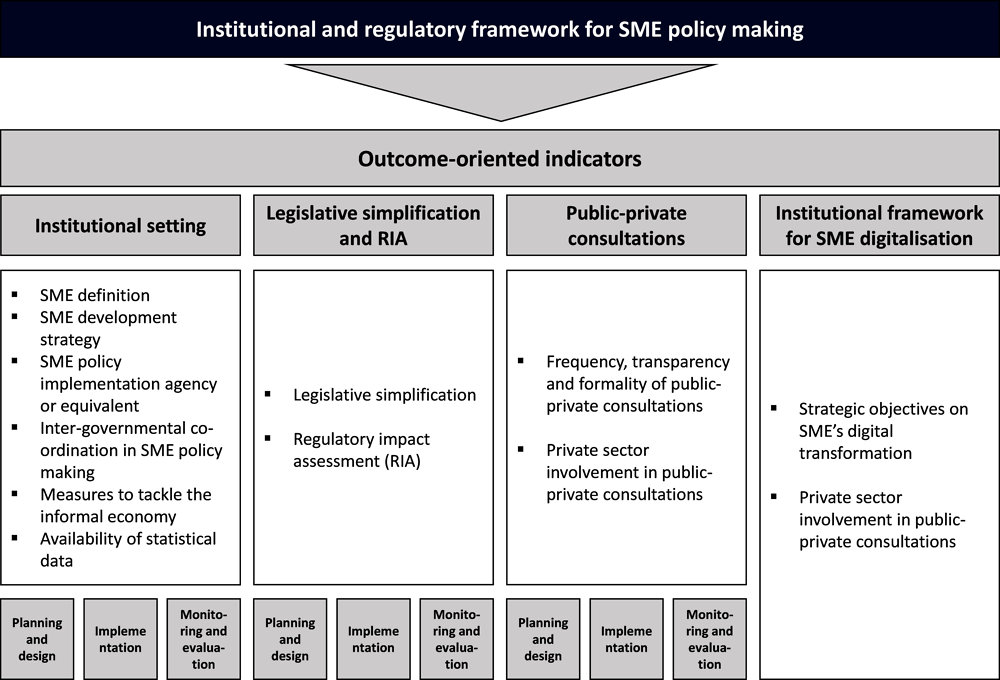

The updated assessment framework considers the following (see Figure 5.1):

Institutional setting: This sub-dimension examines the comprehensiveness and relevance of the framework for SME policy making, including the capacity of institutions in charge of designing and implementing interventions for the SME sector, and mechanisms for inter-institutional co-ordination.

Legislative simplification and RIA: The second sub-dimension looks at the actions taken by the government to reduce the administrative burden on SMEs, focusing on the process of legislative and regulatory simplification and the application of RIA, including the introduction of an SME test to evaluate the impact of new legislative and regulatory acts on small enterprises.

Public-private consultations: This involves assessing the frequency, transparency, inclusiveness and formal influence of public-private consultations with a view to ensuring meaningful representation and inclusion of small enterprises in the development of business-related legislation.

Institutional framework for SME digitalisation: This assesses whether and how support for SME digitalisation is embedded in the framework for SME policy making.

The section on outcome-oriented indicators for this dimension considers countries’ ability to regularly collect statistical information about the following indicators: i) the number of laws/regulations on which RIAs have been conducted, ii) the perception of regulatory quality, iii) the burden of government regulation, and iv) the share of actions/activities implemented as part of the annual SME action plan.

Figure 5.1. Assessment framework – Institutional and regulatory framework for SME policy msking

Analysis

Regional trend and comparison with 2020 assessment scores

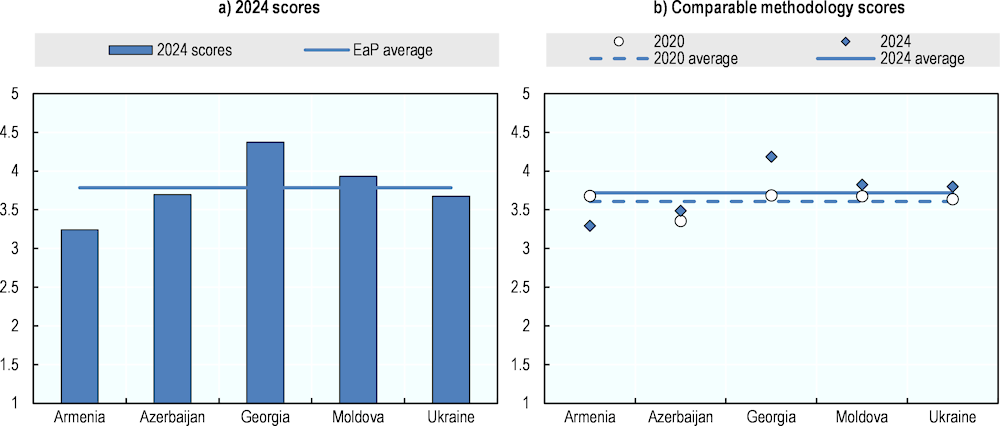

The EaP region has achieved incremental progress in the dimension covering the SME institutional and regulatory framework since the 2020 assessment. The regional average score for this dimension reached 3.78, reflecting a slight increase in the average country scores (calculated using a comparable methodology) compared to the SME Policy Index 2020. All EaP countries, except for Armenia and Ukraine, recorded incremental improvements in their performance across most of the sub-dimensions, with Georgia confirming its position as top performer.

The overall positive results demonstrate the region’s commitment to SME support and business environment reforms during a particularly challenging period. The four years between the end of 2019 and the end of June 2023, the data collection cut-off for the 2024 assessment, featured a series of negative events that have disrupted policy making since the second quarter of 2020. Those events included economic and social turmoil caused by the COVID-19 pandemic and the consequences of Russia’s invasion of Ukraine. Policy making returned to its regular course in the third quarter of 2022 across EaP countries, despite significant challenges. Ukraine, in particular, encountered remarkable difficulties due to the war, which to a certain extent impacted Moldova as well.

Figure 5.2. Institutional and regulatory framework, dimension scores

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Institutional setting

The 2020 SME Policy assessment noted that all EaP countries had established the main building blocks of SME policy, based on a clear SME definition, a clear mandate for SME Policy, an elaborated medium-term SME strategy, well-established policy co-ordination and monitoring mechanisms and an operational SME development agency (Table 5.2).

SME policy frameworks and strategies

The 2024 assessment confirms that all EaP countries have aligned their national SME definitions to that of the EU in terms of employment parameters. However, the definitions do not align with EU standards in terms of other parameters, i.e. turnover and company assets, as SMEs in EaP economies tend to exist on a smaller scale than in the EU.

Table 5.2. EaP and EU MSME definitions

|

Micro |

Small |

Medium |

Source |

|

|---|---|---|---|---|

|

EU |

< 10 employees ≤ EUR 2 million turnover ≤ EUR 2 million balance sheet total |

< 50 employees ≤ EUR 10 million turnover ≤ EUR 10 million balance sheet total |

< 250 employees ≤ EUR 50 million turnover ≤ EUR 43 million balance sheet total |

European Commission |

|

Armenia |

≤ 10 employees ≤ AMD 100 million turnover (~237 138 EUR) |

≤ 50 employees ≤ AMD 500 million turnover (~1 185 690 EUR) |

≤ 250 employees ≤ AMD 1500 million turnover (~3 557 070 EUR) ≤ AMD 1000 million balance sheet total (~2 371 380 EUR) |

Amendments to the Law on State Support of Small and Medium Entrepreneurship |

|

Azerbaijan |

≤ 10 employees ≤ AZN 200 000 turnover (~111 650 EUR) |

≤ 50 employees ≤ AZN 3 million turnover (~1 674 747 EUR) |

≤ 250 employees ≤ AZN 30 million turnover (~16 747 470 EUR) |

Decision of the Cabinet of Ministers of the Republic of Azerbaijan |

|

Georgia |

Not defined |

< 50 employees ≤ GEL 12 million turnover (~4 217 880 EUR) |

< 250 employees ≤ GEL 60 million turnover (~21 089 400 EUR) |

Geostat |

|

Moldova |

< 10 employees ≤ MDL 18 million turnover ≤ MDL 18 million balance sheet total (~929 185 EUR) |

< 50 employees ≤ MDL 50 million turnover ≤ MDL 50 million balance sheet total (~2 581 070 EUR) |

< 250 employees ≤ MDL 100 million turnover ≤ MDL 100 million balance sheet total (~5 162 140 EUR) |

Law No. 179 of 2016 |

|

Ukraine |

≤ 10 employees ≤ EUR 2 million turnover |

≤ 50 employees ≤ EUR 10 million turnover |

≤ 250 employees ≤ EUR 50 million turnover |

Commercial Code of Ukraine No. 436-IV The Commercial Code of U... | on January 16, 2003 № 436-IV (rada.gov.ua) |

Note: Exchange rates as of 28 September, 2023 (Oanda, n.d.[5])

All EaP countries completed the implementation of their respective SME strategies or equivalent strategic documents mentioned in the last SBA assessment, such as Azerbaijan’s strategic roadmap for the production of consumer goods at the level of small and medium entrepreneurship. As a positive element, all EaP countries adopted the good practice of conducting an evaluation or at least a review to monitor the progress of their strategy’s implementation and used the results to inform the design of a new strategy. In particular, Armenia, Georgia and Moldova conducted independent evaluations, while Ukraine conducted a comprehensive review of its strategy. In Azerbaijan the assessment of the roadmap was conducted by the Center for the Analysis of Economic Reforms and Communications (CAERC).

A new set of mid-term SME development strategies was under elaboration in early 2020 when the COVID-19 epidemic forced EaP countries to prioritise the design and quick implementation of economic emergency measures.

By the end of June 2023, only Georgia had put in place a dedicated medium-term SME Development Strategy for 2021-2025, supported by multi-year action plans. Moldova is completing the approval process for a new National Programme for Promoting Entrepreneurship and Increasing Competitiveness 2023-2026 (PACC 2023-2026) as its strategy elaboration process was delayed by the COVID-19 pandemic and the war in nearby Ukraine. Armenia had approved a new national SME Development Strategy for 2020-2024 in August 2020; while the strategy contains mid-term objectives, its focus was largely on measures designed to respond to the economic crisis generated by the pandemic, and the government is currently considering its review and update.

Azerbaijan opted to include its strategic directions for SME policy within the framework of the new Socio-economic Development Strategy of the Republic of Azerbaijan (2022-2026), specifically under National Priority One: sustainable and growing competitive economy – promotion and sustainable and high economic growth.

In March 2021, Ukraine approved its National Economic Strategy 2030 (NES 2030), a framework document for economic policy, and began developing a new SME Development Strategy. However, after Russia’s invasion, the government stopped the strategy elaboration process and decided to focus on short-term action plans responding to the emergencies generated by the war, postponing the elaboration of a new strategy which should then be linked to the recovery and reconstruction plans.

All countries, except Azerbaijan, put effort into estimating the size of the informal economy. In addition, Georgia, Moldova, and Ukraine performed a background analysis on the characteristics of the informal sector. However, only Azerbaijan, Georgia, and Ukraine address the topic in their respective SME policy frameworks.

The new set of mid-term SME development strategies share with the previous strategies the primary objective of improving the operational environment for SMEs and pursuing regulatory reforms. Most of the strategies also include specific sections on supporting SME digital transformation, SMEs’ contribution to the green economy, and monitoring and evaluation (M&E).

The focus of all SME strategies in the EaP is on conducting horizontal measures, without selecting specific sectors of activity or segments of the enterprise population. While this approach is consistent with the need to further enhance market dynamics, it does not fully take into consideration new sectors and the emergence of new specializations across the region – for instance in the ICT, tourism, and agri-business sectors, which require the development of supportive ecosystems and call for an integration of different sets of policies, such as those for skills development, trade, infrastructure development and FDI attraction.

The new set of SME strategies should, therefore, explore how to generate synergies with sector/activity-oriented development plans and create opportunities for policy co-ordination with other sets of strategies and the broader national economic development plans.

SME development agencies

In order to respond to increased demand for SME support, particularly during the COVID-19 pandemic, most EaP countries made significant efforts to increase the operational capacity of their SME development agencies.

In particular, Azerbaijan expanded the network co-ordinated by KOBIA, its SME development agency. This network consists of SME Development Centres operating as both one-stop shops (providing services to entrepreneurs for all types of business activities, including business registration, taxes, licenses, permits and certificates) and 45 SME “friends” operating as KOBIA’s local representatives.

Georgia has significantly increased the financial resources allocated to Enterprise Georgia, from GEL 41 million (~EUR 14 million) in 2019 to GEL 291 million (~EUR 100 million)3, while Moldova in 2022 launched a reform and reorganisation of its SME development agency, now called the Organisation for the Development of Entrepreneurship (ODA), with the aim of improving its governance and simplifying access to SME support programmes.

In 2021, Ukraine transformed its Export Promotion Office into the Entrepreneurship and Export Promotion Office (EEPO) which is now effectively in charge of SME policy implementation as well as export promotion. This is a significant, positive and timely development, as Ukraine has been lacking an SME policy implementation agency that could act as a bridge between the central government and the SME population. EEPO is governed by a supervisory board which includes both the Ministry of Digital Transformation and the Ministry of Economy, and it is providing a valuable channel of communication and assistance with the enterprise sector. It also manages Diia.Business, the main business portal, which provides online training courses, consultations, and other business support services, in addition to conducting surveys of the enterprise operational conditions at a time of war (see Box 14.4. in the Ukraine country chapter).

The government of Armenia decided to merge the National Center for SME Development (SME DNC) with the Investment Support Center, while also transferring some of the competencies of the SME DNC to the National Center for Innovation and Entrepreneurship, as part of an effort to rationalise and reduce government agencies. The move has caused a temporary disruption in the implementation of SME support programmes, as it involved the closure of the regional network of DNC local offices (there were 10 offices in 2022). This has led to a concentration of the remaining SME development activities in the capital, as well as a reduction of the share of resources allocated to SME support versus investment attraction.

Over the last four years, the SME development agencies in the EaP countries have seen their missions evolve significantly. While they still play a crucial role in promoting entrepreneurship and entrepreneurial skills, they have expanded their activities linked to the provision of targeted business services supporting enterprise growth and digitalisation. In addition, the SME development agencies of Armenia, Georgia and Moldova play an important role as providers of credit guarantees to SMEs, a role that has relevant governance implications.

Table 5.3. Institutional setting, sub-dimension scores

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|

|---|---|---|---|---|---|---|

|

Sub-dimension score |

3.02 |

4.14 |

4.62 |

3.83 |

3.70 |

3.86 |

|

Planning & Design |

3.47 |

4.07 |

4.73 |

4.00 |

4.05 |

4.06 |

|

Implementation |

2.63 |

4.52 |

4.71 |

3.71 |

3.38 |

3.79 |

|

Monitoring & Evaluation |

3.13 |

3.40 |

4.20 |

3.80 |

3.80 |

3.67 |

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Legislative and regulatory simplification and RIA application to SME policy

Legislative and regulatory simplification remains a key priority for all EaP countries, as reflected by a regional average of 3.21. However, their performance in this sub-dimension has somewhat worsened in comparison to the 2020 assessment, except for Georgia.

Table 5.4. Legislative simplification and RIA, sub-dimension scores

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|

|---|---|---|---|---|---|---|

|

Sub-dimension score |

3.03 |

2.90 |

3.50 |

3.35 |

3.27 |

3.21 |

|

Planning & Design |

4.13 |

3.40 |

4.53 |

4.00 |

4.20 |

4.05 |

|

Implementation |

2.13 |

2.22 |

2.15 |

2.24 |

2.14 |

2.18 |

|

Monitoring & Evaluation |

3.13 |

3.53 |

4.73 |

4.73 |

4.20 |

4.07 |

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

All EaP countries performed strongly on planning and design. This is because all countries have some form of medium-term strategies and action plans for legislative simplification and, with regard to M&E, their monitoring mechanisms have not changed significantly over the last four years. However, their implementation performance has slipped, reflecting the fact that legislative and regulatory simplification has stalled in recent years. This is largely due to legislative delays stemming from emergencies related to the COVID-19 pandemic and the economic fallout from the war in Ukraine.

Progress in the application of RIA has been equally limited. Table 5.5 presents an overview of the application of RIA in the region.

Table 5.5. The application of Regulatory Impact Analysis in the EaP countries

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

|

|---|---|---|---|---|---|

|

Is there a legal obligation to conduct RIA on business- related legislation? |

For major legislative acts |

For all legislative acts |

For major legislative acts |

For all legislative acts |

|

|

Since when has RIA been formally requested? |

2020 |

2016 |

2020 |

2008 1 |

2003 2 |

|

Is the institution that proposes legislative acts obliged to conduct RIA? |

Yes, for all major legislative acts |

Yes, KOBIA and the Ministry of Economy for SME- and business-related legislation |

Yes, in case of amendments to existing legislative acts |

Yes, for all business-related legislation |

Yes |

|

Is there a body supervising the RIA applications? |

Yes, Department of Regulatory Impact, Prime Minister Office |

Yes, Law Service Division of the Presidential Administration |

Yes, the Administration of Government of Georgia 3 |

Yes, the State Chancellery |

Yes, the State Regulatory Service |

|

Is there a formal requirement to analyse the impact of new legislation on SMEs? |

No, and no formal SME test |

Yes, but no formal SME test |

Yes, SME test under preparation |

Yes, SME test under preparation |

Yes, SME test performed |

1 The methodology was updated in 2019 and is now aligned with EU standards. 2 The methodology was substantially reviewed and improved in 2015. 3 In the case of a legislative initiative by the Government of Georgia, RIA shall be performed by the Parliamentary Secretary of the Government of Georgia.

Source: SBA Assessment questionnaire 2024.

Moldova and Georgia have taken steps to apply RIA systematically to all new primary and secondary legislation and to align their RIA guidelines with international good practices. But while RIA application is well advanced in Moldova, it is not consistently applied in Georgia, partially due to skills gaps at the level of line ministries, lack of effective oversight and the existence of an RIA exemption list.

RIAs are also performed for major legislative acts in Armenia, which introduced new RIA standards in 2019, while in Azerbaijan, regulatory performance assessments using RIA elements are frequently carried out, in particular by the Ministry of Economy and the country’s SME Development Agency (KOBIA), for SME and business-related legislation.

In Ukraine, RIA applications are supervised by the State Regulatory Service of Ukraine (SRS), the central body that executes state regulatory policy, and they are systematically performed on major legislative acts. It is worth noting that despite the ongoing invasion, Ukraine has continued to implement its deregulation agenda, completing a relevant number of actions over the last two years. In addition, in January 2023, the government established an Inter-Agency Working Group on deregulation in order to improve deregulation policy co-ordination.

All EaP countries, with the exclusion of Armenia, are formally required to assess the impact of new legislative and regulatory acts on SMEs. To date, however, only Ukraine formally performs an RIA SME test, while Georgia and Moldova are planning to do it in the near future.

Public-private consultations

Governments in EaP countries have a relatively well-established practice of conducting open and regular consultations with the private sector. The COVID-19 pandemic – and, in the case of Ukraine, the direct impact of the war – have pushed the governments to make further use of online platforms for public consultations. As a result, EaP countries perform remarkably well in this dimension, resulting in a regional average of 4.15.

Compared with the previous period, it is worth noting that SME representatives were consulted in all EaP countries during the elaboration of the new SME development strategies. It is now a regular practice to conduct public-private consultations prior to the approval of any legislative and regulatory act that has a major impact on SME operations.

The EaP countries have established different channels for consultations. Some focus specifically on SME policy issues, while others are open to the whole private sector. In Georgia, for instance, most SME policy issues are discussed at a session of the Private-Sector Development Advisory Council, while the Deep and Comprehensive Free Trade Agreement (DCFTA) consultative council deals with issues related to the implementation of the EU DCFTA, which has a major influence in guiding the government’s trade and regulatory policy. Similarly, Armenia has established an SME Development Council, which is managed by Investment Council (IC) Armenia through its role as Council secretariat. The Council meets on a quarterly basis and is typically chaired by the deputy prime minister (Box 5.1).

In Azerbaijan, the main consultation channel is the Public Council, which is coordinated by the SME development agency, KOBIA. The Ministry of Economy reportedly also conducts ad hoc meetings at sector level. In Moldova, public and private sector representatives meet weekly within the framework of a working group for the regulation of entrepreneurial activities, in addition to ad-hoc meetings held during the elaboration of legislative acts and policy documents.

In Ukraine, most consultations are conducted online through the Diia.Business platform.

All EaP countries require that public consultations are held through public electronic platforms before the approval of new laws during a pre-set time period. In certain cases, the requirement also applies to new regulations. While in some countries the platforms are managed centrally (see the e-draft.am platform in Armenia, the particip.gov.md platform in Moldova, and the ichange.gov.ge platform in Georgia), in Azerbaijan and Ukraine legislative acts are posted for consultation on the website of the responsible ministry. However, data on the usage of online consultation platforms and the responses by public institutions are limited and fragmented, so it is difficult to assess the use and effectiveness of online consultations.

Table 5.6. Public-private consultations, sub-dimension scores

|

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|---|---|---|---|---|---|---|

|

Sub-dimension score |

4.16 |

3.40 |

4.65 |

4.27 |

4.26 |

4.15 |

|

Frequency and transparency of PPCs |

4.33 |

3.11 |

4.67 |

4.50 |

4.42 |

4.20 |

|

Private sector involvement in PPCs |

4.07 |

3.40 |

4.96 |

3.67 |

4.73 |

4.16 |

|

Monitoring and evaluation |

4.00 |

4.00 |

4.00 |

5.00 |

3.00 |

4.00 |

Note: PCCs = public-private consultations. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Box 5.1. Armenia’s SME Development Council

In 2007, the European Bank for Reconstruction and Development (EBRD) initiated the establishment of Investment Councils (ICs) in its countries of operation to facilitate collaboration between governments and the private sector, with the aim of improving the investment climate. IC Armenia and its SME Development Council were created in 2012 through a joint initiative of the Government of Armenia and the EBRD. Initially supported by the EBRD, since 2020 it has been funded by the UK Government's Good Governance Fund (GGF).

The operations of the SME Development Council in Armenia encompass a public-private dialogue platform, connecting the Armenian government with SME associations to foster the development of business oriented legislative reforms. This includes two types of meetings:

Monthly sub-council meetings, led by the Minister of Economy, involving preliminary discussion of the identified issues and provision of proposals.

Quarterly council meetings, led by the deputy prime minister, and including the IC Armenia experts, to identify legislative bottlenecks hindering the smooth operation of SMEs in Armenia and to work closely with the respective ministries to develop reform packages targeted at bettering the business environment and investment climate in Armenia.

The Sub-Council consists of 11 members, including representatives from NGOs, business associations, and foundations as well as from the Ministry of Economy, State Revenue Committee, and Ministry of Finance. The Council includes additional members such as the head of the EBRD Resident Office in Armenia, the ambassador of the United Kingdom to Armenia, the deputy prime minister, and relevant state body ministers.

Over the past 10 years, the SME Development Council led by the IC Armenia team has achieved 25 large-scale legislative reforms, including preferential tax regimes for IT start-ups, the introduction of a sales tax, and leasing reforms. Since 2012, there have been 18 Council meetings, 5 of them chaired by Armenia’s Minister of Economy. The monthly Sub-Council meetings propose an average of 7-10 changes to SME-regulating legislation.

Institutional framework for SME digitalisation

This sub-dimension, included for the first time in the 2024 assessment, includes a number of indicators covering the use of electronic government platforms, the presence of strategic directions supporting the digital transformation of SMEs and their consistency with the overall SME development strategy, the role played by SME development and other public agencies in this domain as well as the monitoring of digital transformation initiatives.

The assessment results indicate that EaP countries perform well in this area, achieving an average score of 4.14.

All EaP countries have started taking SME digitalisation into consideration in their institutional and policy frameworks for SMEs. They are progressively integrating some related provisions in key policy documents (e.g., the National Digital Strategy in Armenia; existing or upcoming SME development strategies in Azerbaijan, Georgia, and Moldova). In terms of institutional settings, Georgia and Moldova have given a clear mandate and allocated resources to their SME development agencies to implement measures / programmes in the field. Azerbaijan is also investing significant resources and has established an Innovation and Digital Development Agency under the Ministry of Digital Development and Transport. As for Ukraine, the country has made digital transformation of the public administration, the productive sector, and the whole society a central objective and placed all actions under the co-ordination of a dedicated Ministry of Digital Transformation, while the Diia.Business platform has proved to be a very flexible and effective tool for communicating and providing services to the enterprise sector.

All EaP countries have shown a significant commitment to providing public support to accelerate the digital transformation; however, the measures implemented so far have been predominantly focused on fostering digital / IT start-ups, and have paid less attention to the digital transformation of entrepreneurs in non-IT sectors for instance. Moreover, the resources allocated to this objective in most EaP countries remain relatively limited.

Table 5.7. Institutional framework for SME digitalisation, sub-dimension scores

|

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|---|---|---|---|---|---|---|

|

Sub-dimension score |

3.50 |

4.05 |

4.54 |

4.20 |

4.40 |

4.14 |

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

The way forward

The new set of strategic documents on SME development should take into consideration the structural changes that occurred in the SME population due to the economic crisis generated by the COVID-19 pandemic. Revisions of the strategic documents should be conducted when necessary.

All EaP countries should take elaborate shorter-term action plans to secure the strategy implementation. Ukraine could consider elaborating its next SME Development Strategy once the situation in the country normalises, but it could already establish a task force to develop plans for supporting the enterprise sector, including SMEs, in the reconstruction phase. Meanwhile, Ukraine should continue with the implementation of short-term action plan to deal with the emergencies caused by the war.

All EaP countries should consider how to 1) generate synergies between their SME development strategies and sector/activity-oriented development plans and 2) develop more advanced instruments of policy co-ordination with other sets of strategies (local development, skill development and digitalisation) and the broader national economic development plans.

Much progress has been achieved over the last four years in improving the operational capability of the region’s SME development agencies. All EaP countries should follow the good practice of Moldova by upgrading the governance mechanisms of their SME agencies, and – particularly for those agencies that are also active in the provision of credit guarantees – increase their operational autonomy and set clear reporting lines to their respective supervising ministries.

RIA should be applied systematically to all new legislative and regulatory acts that are expected to have a significant impact on the business sector in all EaP countries, and the potential impact on small-scale enterprises should be evaluated through the RIA SME tests.

All EaP countries should ensure that public-private consultations (PPCs) are open to representatives of different classes and types of SMEs and that the voices of enterprises operating in new emerging sectors (e.g. ICT firms, agri-bio enterprises, small tourist operators and logistics firms) are heard and considered. Following the good practice introduced by Ukraine with the Diia.Business platforms, EaP countries should expand the use of electronic platforms to consult with the enterprise sector and conduct regular business surveys.

EaP countries should establish dedicated programmes designed to support the digital transformation of SMEs associated with sufficient human and financial resources, as well as measurable targets.

Operational environment for SMEs

Throughout their life cycles, businesses constantly need to interact with public institutions, physically or digitally, to carry out necessary procedures such as registering a company, obtaining a business licence, and filing and paying taxes.

Inadequate government services, lengthy and costly procedures, and onerous regulatory requirements can impose excessive burdens on businesses, potentially resulting in the loss of viable firms. SMEs are particularly affected, as they often operate on thin profit margins, so the resulting increased costs may force some to cease their operations (OECD, 2020[1]). By contrast, reducing the burdensome procedures for starting and managing businesses, as well as simplifying interactions with public authorities, enables SMEs to allocated limited resources to innovative activities or job creation (Parker and Kirkpatrick, 2012[7]), thereby leading to more-dynamic market entry and efficiency gains.

Against this backdrop, it is important that public administrations are responsive to SME needs, as prescribed by principle 4 of the Small Business Act (European Commission, 2008[3]). To this end, the provision of government services through digital platforms improves reach and efficiency and plays an important role in reducing corruption and informal economic activity, given the increased transparency, objectiveness and enforceability of decisions. The move to a one-stop, automated, web-enabled registry capable of delivering online products and services with authenticated users and documents represents global best practice. Further measures to promote business-friendly administrative procedures can include the application of the silence-is-consent principle as well as unification of identification numbers and enhanced data exchange across all government agencies. SMEs can also benefit from streamlined and tailored tax schemes because simplification provisions encourage business creation and reduce the burden of tax compliance, while also reducing tax collection costs.

Assessment framework

Two important methodological changes have been introduced in this dimension since the previous SBA assessment. First, all indicators from the World Bank’s Doing Business report – previously used to evaluate the effectiveness of company registration procedures and the ease of filing taxes – are no longer considered due to the discontinuation of the exercise. Second, the analysis now considers countries’ ability to regularly collect quantitative information to monitor the impact of policies on actual SME performance (“outcome-oriented indicators”).

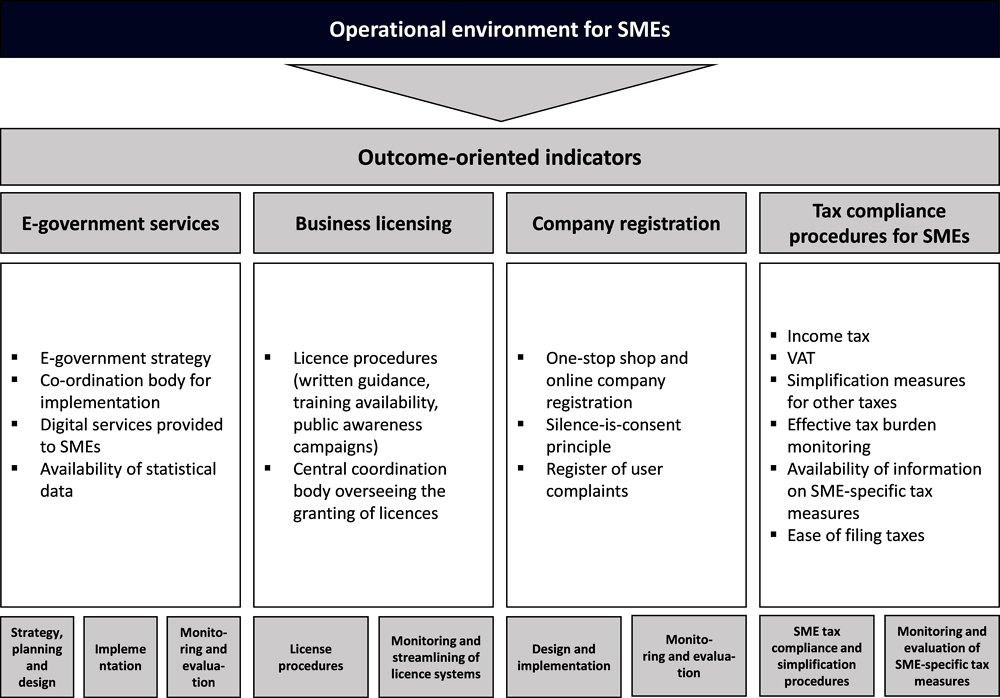

The updated assessment framework considers the following (see Figure 5.3):

E-government services: This sub-dimension assesses government’s strategies for providing e-services, the range of services provided, the level of inter-operability among the different data banks run by the public administration, and the actions taken to implement an open-data approach.

Company registration: The second sub-dimension, which focuses on the procedures necessary to register a company, includes indicators looking at the presence of one-stop shops and the introduction of single company identification numbers.

Business licencing: This subsection analyses the actions taken by governments to reduce the number of required business licenses and permits and to improve the business license allocation systems, through better co-ordination among the licensing institutions.

Tax compliance procedures for SMEs: The last sub-dimension assesses policies designed to simplify SMEs’ tax compliance, considering special tax regimes and incentives.

The new section on outcome-oriented indicators for this dimension considers countries’ ability to regularly collect statistical information for the following indicators: i) number of enterprises (by enterprise size class); ii) persons employed (by enterprise size class); iii) value added (by enterprise size class); iv) turnover (by enterprise size class); v) number or share of high-growth enterprises; vi) enterprise birth rate / business creation; vii) enterprise survival rate in first, second, third, fourth and fifth years of operation; viii) number of days required to obtain a company registration certificate; and ix) number of administrative steps required to obtain a company registration certificate.

Figure 5.3. Assessment framework – Operational environment for SMEs

Analysis

Regional trend and comparison with 2020 assessment scores

All EaP countries are deeply committed to cultivating a more favourable and supportive business environment for SMEs. This commitment has led to the recognition of enhancing the operational conditions for SMEs as a major policy priority.

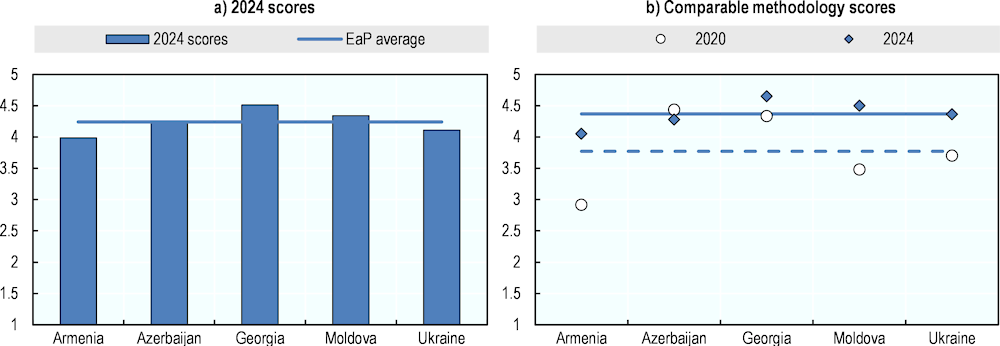

The 2024 assessment confirms the good results obtained in this dimension, with the average EaP score reaching 4.24. Comparison with 2020 results is difficult, as the indicators applied to the sub-dimensions dealing with company registration and tax compliance procedures have substantially changed. The overall picture confirms that Georgia has moved furthest towards international good practices concerning the SME operational environment. Armenia and Moldova have improved their performance; Azerbaijan’s score has remained substantially stable; and Ukraine, which was lagging behind in the 2020 EaP dimension average, has significantly improved its position.

Figure 5.4. Operational environment for SMEs, dimension scores

Note: CM = comparable methodology. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

E-government services

All EaP countries have made substantial progress in the sub-dimension related to the provision of e-government services, with the EaP average score reaching 4.31.

All countries have significantly increased the range of e-government services available through e-government platforms, simplified service accessibility and improved e-governance. The only area where progress has been relatively limited is M&E, as data on the use of e-government services by SMEs (especially data broken down by enterprise type and location) are relatively scarce. Better data availability could lead to more-targeted information campaigns and training for SMEs, further improving e-government utilisation rates.

All EaP countries currently have approved multi-year strategic documents guiding the expansion of e-government services. This may be a document dealing with public administration reform, as in case of the Public Service Development Strategy 2022-2025 adopted by Georgia in 2021, or a specific e-government strategy, as in the case of Armenia’s National Digitalisation Strategy and the Digital Azerbaijan project conducted by the E-Government Development Center.

The principle leading the transition towards e-government is “digital first and digital by default” – meaning that digital services cover, to the extent possible, the entire range of government services, while access to e-government services is made so easy that it becomes the preferred access route (although an alternative route is always available).

Each EaP country has also established, or is currently establishing, a single platform or access portal for e-government services. The Diia platform in Ukraine (see Box 14.4 in the Ukraine country chapter) is considered the most advanced tool in this regard, providing a wide range of e-services accessible throughout the country and to the Ukrainian diaspora abroad. E-government platforms are also operational in Armenia, Georgia and Moldova (which launch its MDelivery document delivery platform in 2022). Azerbaijan has developed a portal called the Azerbaijani Service and Assessment Network, or ASAN (asan.gov.az), which provides access to a wide range of services to the population, and is also working to bring all business services, which are currently accessible only through the websites of each administration, under a common platform.

Table 5.8. Map of the e-Government Service available in the EaP countries

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

|

|---|---|---|---|---|---|

|

Filing taxes and social contributions |

Fully digital |

Fully digital |

Fully digital |

Fully digital |

Fully digital |

|

Contributions to the pension funds |

Fully digital |

Fully digital |

Fully digital |

Fully digital |

Fully digital |

|

Services related to the cadastre |

Fully digital |

Partially digital |

Fully digital |

Fully digital |

Fully digital |

|

Issuing/obtaining business certificates, attestations, excerpts, and copies of acts |

Partially digital |

Fully digital |

Fully digital |

Fully digital |

Partially digital |

|

Applications to state support programs for SMEs |

Partially digital |

Partially digital |

Fully digital |

Partially digital |

Partially digital |

|

Reporting data to the statistical agency |

Fully digital |

Fully digital |

Fully digital |

Fully digital |

Fully digital |

Source: SBA Assessment questionnaire 2024.

The “only once” principle, which implies that a user’s data are automatically exchanged among public institutions and are not requested each time a user makes an enquiry, is only partially applied across the region due to issues related to the inter-operability of public sector data banks. Only in Georgia does this principle appear to be consistently applied.

Also, the practice of collecting data on the use of e-government services by SMEs and conducting enquires about the satisfaction of e-government service users is not systematically applied.

Table 5.9. E-government services, sub-dimension scores

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|

|---|---|---|---|---|---|---|

|

Sub-dimension score |

4.00 |

4.25 |

4.29 |

4.34 |

4.66 |

4.31 |

|

Strategy, planning & design |

3.93 |

4.30 |

4.92 |

4.82 |

4.56 |

4.51 |

|

Implementation |

4.21 |

4.33 |

4.36 |

4.42 |

4.88 |

4.44 |

|

Monitoring & Evaluation |

3.67 |

4.00 |

3.00 |

3.33 |

4.33 |

3.67 |

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Company registration

Company registration procedures are relatively simple, fast and inexpensive in all EaP countries. The 2020 assessment already had recognised substantial progress made by the EaP countries in this sub-dimension. Over the last four years, while no major changes have been recorded, online registration capacity has been further expanded and company registration fees have been reduced in some countries. The 2024 EaP average is 4.73, and all EaP countries have recorded scores for this sub-dimension above 4.00. While the 2024 assessment indicates that there has been incremental progress in this area, a direct comparison with the 2020 scores is not possible since the 2020 scores were based largely on data from the World Bank’s Doing Business report, now discontinued.

Georgia and Armenia have confirmed their position as leaders in this area. Company registration in these two countries can be performed entirely online (through a single act) and released in a few minutes, and new enterprises are given a single registration number valid for interactions with all public administration bodies.

Ukraine and Azerbaijan have also simplified company registration procedures. In Azerbaijan, this is part of the government’s efforts to improve the country’s position on rankings made by international organisations and research institutes. Company registration can be conducted online and in Ukraine the entire procedure can be completed in about in three days. Azerbaijan, Moldova and Ukraine have abolished public fees for company registrations.

Table 5.10. Company registration, sub-dimension scores

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|

|---|---|---|---|---|---|---|

|

Sub-dimension score |

4.88 |

4.52 |

5.00 |

4.74 |

4.52 |

4.73 |

|

Design & implementation |

4.80 |

4.20 |

5.00 |

4.90 |

4.20 |

4.62 |

|

Monitoring & evaluation |

5.00 |

5.00 |

5.00 |

4.50 |

5.00 |

4.90 |

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Business licencing

The reduction in the number of compulsory business licenses and the simplification of business license application procedures have been long-term objectives of regulatory reform in all EaP countries. The EaP countries have continued to improve in this regard, achieving a regional average score of 4.34. Notably, all countries recorded significant progress, particularly in the reduction of license requirements and the simplification and transparency of license-granting procedures.

All EaP countries have established an online portal for handling most license applications. In Moldova, the online platform covers 86% of all license applications and operates as a one-stop shop. Similarly, in Georgia most license applications can be made online and the “silence is consent” principle is applied. Ukraine approved a new Law on Licenses in 2019 and has put a legal limit to the value of license fees. Azerbaijan has reviewed the number of compulsory licenses and reduced the licenses fees by 50%, with a further 50% reduction for applicants located in less developed areas. Armenia is also operating a central online platform for license applications, but it has slightly increased the number of compulsory licenses to cover activities that present public safety risks.

Table 5.11. Business licencing, sub-dimension scores

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|

|---|---|---|---|---|---|---|

|

Sub-dimension score |

3.66 |

3.96 |

5.00 |

4.69 |

4.40 |

4.34 |

|

Licence procedures |

4.14 |

4.43 |

5.00 |

4.43 |

4.83 |

4.57 |

|

Monitoring & streamlining of licence systems |

3.33 |

3.64 |

5.00 |

4.87 |

4.11 |

4.19 |

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Tax compliance procedures for SMEs

For this 2024 assessment, the structure of this sub-dimension has been radically changed from that adopted for the 2020 assessment. While the previous structure focused mainly on tax compliance procedures and the administrative tax burden on SMEs, using data from the now-discontinued World Bank Doing Business report, the new structure analyses the main characteristics of each country’s tax regime for enterprises and individual entrepreneurs, as well as the actions taken by the national tax administration to monitor the tax burden on SMEs and individual entrepreneurs and evaluate the effective tax rates imposed on those groups of tax payers. Therefore, the 2020 scores and the 2024 scores for this sub-dimension should be compared with caution.

Starting in the second quarter of 2020, to counteract the negative impact of the COVID-19 epidemic on enterprise business activity and stimulate economic recovery, all the EaP countries introduced a number of temporary tax measures – a mix of tax exemptions, tax payment delays and accelerated depreciation rates – aimed at easing the tax burden on the enterprise sector, targeting in particular the sub-sectors most affected by the pandemic. Most those emergency measures have now been phased out, starting from the end of 2022.

The overall results of the 2024 assessment show that all EaP countries have established a relatively light and well-balanced tax regime for SMEs, although gaps are recorded in the area of the systematic monitoring of the tax burden and the calculation of the effective tax rates on SMEs, as well as the administration of VAT refunds in a number of EaP countries. The 2024 EaP average is 3.44, with Georgia being the only country to record an average sub-dimension score higher than 4.00.

All EaP countries have introduced simplified tax regimes for individual entrepreneurs and small-scale enterprises. In all EaP countries – with the exception of Azerbaijan, where the special regime applies only to individual entrepreneurs – these two categories of economic entities can opt for a non-VAT taxpayer regime and are subject to an average turnover tax varying from 1% in Georgia to 5% in Armenia. The standard corporate income tax rate is set at 20% in Armenia, Azerbaijan and Georgia; at 18% in Ukraine; and at 12% in Moldova. In Ukraine a temporary surcharge of 2% was introduced in 2022 to finance the cost of the war.

Some EaP countries have introduced tax incentives for specific enterprise types. This is the case in Azerbaijan, which covers the enterprises qualified as “start-ups” by KOBIA as well as “cluster enterprises” and in Moldova, which applies a highly reduced tax regime to enterprises located in ICT parks.

All EaP countries have also introduced measures to reduce the administrative burden associated with tax declarations and tax payments. All countries have established online tax and VAT declaration systems, but only Georgia and Moldova have introduced automatic VAT refund systems for all enterprise categories. The tax administration system in Ukraine is still relatively complex, in terms of the number of tax regimes and the number of taxes applied to enterprises and individual entrepreneurs.

All EaP countries are making efforts to improve the monitoring of tax regimes and the evaluation of effective tax rates. For instance, Azerbaijan and Moldova have started to evaluate the effective tax burden on SMEs, while Georgia and Moldova undertake regular evaluations of measures aimed at easing tax compliance for SMEs.

Table 5.12. Tax compliance procedures for SMEs, sub-dimension scores

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|

|---|---|---|---|---|---|---|

|

Sub-dimension score |

2.73 |

3.70 |

4.26 |

3.78 |

2.73 |

3.44 |

|

Tax compliance & simplification procedures |

3.12 |

3.59 |

4.53 |

3.35 |

3.12 |

3.54 |

|

M&E of SME-specific tax measures |

2.14 |

3.86 |

3.86 |

4.43 |

2.14 |

3.29 |

Note: M&E = monitoring and evaluation. See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

The way forward

The EaP countries should systematically collect data on the use of e-government services by different categories of SME (by size, type of ownership and location) to i) identify the type of enterprises that encounter more difficulties in accessing and using e-government services and ii) map the use of e-government service by SMEs. This would allow public agencies to improve the design of e-government services and to conduct promotional campaigns and training sessions targeting SMEs with lower e-government service utilisation rates.

Company registration procedures in EaP countries are among the most advanced. However, all EaP countries should continue to monitor their performance in this area, for instance by measuring time, costs and administrative steps required and monitoring the performance of their registration agencies.

All EaP countries should calculate the effective tax rate applied to different categories of SMEs and evaluate the impact of special tax regimes and incentives targeting individual entrepreneurs and small enterprises in order to avoid potential distorting effects and disincentives to enterprise growth.

Automatic VAT-refund systems should be put in place in all the EaP countries (currently only Georgia and Moldova have developed such a system). All countries should act to minimise the potential for fraud and misuse by applying risk-assessment techniques.

Bankruptcy and second chance

Business failure, as much as business creation, is part of a dynamic, healthy market. Well-designed insolvency and restructuring procedures ensure that viable firms are restructured, while unviable firms are liquidated, so as to ensure that productive assets remain in use and scarce resources are allocated efficiently (IMF, 1999[8]). On the other hand, inefficient, lengthy and burdensome proceedings represent additional costs for both creditors and debtors (OECD et al., 2020[9]). In this context, efficient and predictable insolvency regimes can improve the allocation of capital and labour in the economy, thereby increasing productivity and output (Diez et al., 2021[10]). In addition, as efficient insolvency laws are one of the key criteria investors use to decide whether to invest across borders, increasing confidence in cross-border financing can boost capital markets (European Commission, 2020[11]).

Timely identification and resolution of financial difficulties are also pivotal elements of a comprehensive framework as they can prevent bankruptcy altogether, thus effectively lowering the rate of bankruptcy and optimising the value of assets that creditors can recover (Garrido, 2012[12]; European Commission, 2011[13]). Relevant measures include early-warning mechanisms to facilitate early detection of financial distress (e.g. alert mechanisms triggered by non-payment of taxes or social security contributions) (European Parliament, 2019[14]), as well as advisory services (such as debt counselling) and information tools (such as self-test websites) provided to businesses fearing failure. When designed and implemented properly, similar measures can help SMEs identify and overcome financial challenges, maintain continuity, and continue contributing to the economy. Furthermore, in accordance with Principle 2 of the Small Business Act, it is important to “ensure that honest entrepreneurs who have faced bankruptcy quickly get a second chance” (European Commission, 2008[3]) by implementing initiatives to reduce the cultural stigma surrounding entrepreneurs’ failure, and by providing failed entrepreneurs with the tools necessary to re-enter the market.

Assessment framework

This dimension assesses the extent to which EaP countries are facilitating market exit and re-entry for businesses by adopting effective and efficient frameworks to prevent and face insolvency, as well as to re-start businesses after bankruptcy.

Three important methodological changes have been introduced in this dimension since the previous SBA assessment: i) a new thematic block has been introduced to investigate performance, monitoring, and evaluation of policies to prevent insolvency; ii) all indicators from the World Bank’s Doing Business report previously examined to assess performance, monitoring and evaluation of insolvency frameworks are no longer considered due to the discontinuation of the exercise; and finally, iii) the analysis now considers countries’ ability regularly to collect quantitative information to monitor the impact of policies on actual SME performance (“outcome-oriented indicators”).

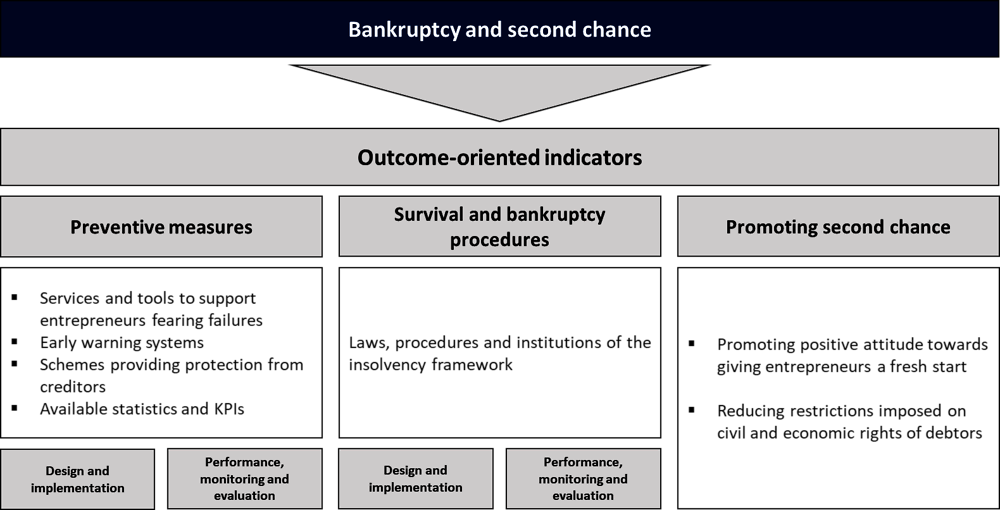

The assessment framework considers the following (see Figure 5.5):

Preventive measures: This sub-dimension looks at the design, implementation and monitoring of measures designed to prevent insolvency, including early-warning mechanisms to facilitate early detection of financial distress. It also examines the advisory services and information tools (such as debt counselling and self-test websites) provided to businesses fearing failure.

Survival and bankruptcy procedures: Here, the design, implementation and monitoring of insolvency regimes in EaP countries is assessed, looking at how relevant laws and procedures align with international best practice.

Promoting second chance: This sub-dimension examines the extent to which EaP countries facilitate re-entry in the market of failed but honest entrepreneurs seeking a fresh start.

The section on outcome-oriented indicators for this dimension considers countries’ ability to regularly collect statistical information about the following indicators: i) number of bankruptcies (by enterprise size class), ii) share of insolvency procedures that result in rehabilitation rather than liquidation of the enterprise, iii) average time required by insolvency proceedings, iv) average cost of insolvency proceedings (as a percentage of the estate), v) recovery rate (in cents on the dollar), vi) average time required to obtain full discharge from bankruptcy, and vii) the share of second-chance entrepreneurs among all active entrepreneurs.

Figure 5.5. Assessment framework – Bankruptcy and second chance

Analysis

Regional trend and comparison with 2020 assessment scores

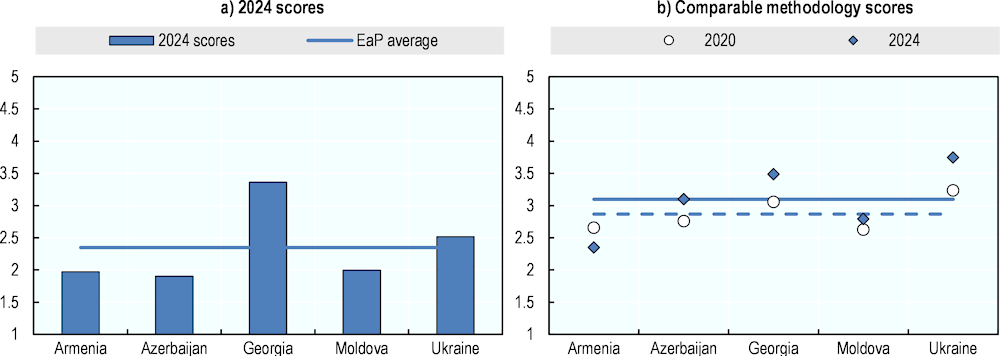

Uneven progress has been achieved in the field of Bankruptcy and second chance with respect to the previous SBA assessment, with EaP countries proceeding at different paces across the different sub-dimensions. Overall, all countries improved their performance with respect to the 2020 assessment, except for Armenia. However, this dimension remains one of the weakest performance areas across the EaP region, with an average score of 2.35 (see Figure 5.6), which indicates substantial scope for improvement. This outcome can largely be attributed to EaP countries’ weak frameworks for preventing bankruptcy and their limited efforts to promote second chance for failed but honest entrepreneurs.

Figure 5.6. Bankruptcy and second chance, dimension scores

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Preventive measures

This sub-dimension looks at measures in place to prevent insolvency. Timely identification and resolution of financial difficulties can effectively lower the rate of bankruptcy and optimise the value of assets that creditors can recover (Garrido, 2012[12]; European Commission, 2011[13]). Relevant measures include early warning mechanisms to facilitate early detection of financial distress (e.g. alert mechanisms triggered by non-payment of taxes or social security contributions) (European Parliament, 2019[14]), as well as advisory services (such as debt counselling) and information tools (such as self-test websites) provided to businesses fearing failure. When designed and implemented properly, similar measures can help SMEs identify and overcome financial challenges, maintain continuity, and continue contributing to the economy.

All EaP countries show significant room for improvement in their measures to identify financial distress and prevent insolvency. This clearly emerges from the sub-dimension scores (Table 5.13), which average 1.90. It is important to mention that the scores are also negatively affected by the introduction of a new thematic block that assesses efforts to monitor and evaluate existing measures to prevent insolvency - an area in which all countries, except Georgia, underperform.

In all EaP countries, except Armenia, businesses in financial distress can access information on available government support, as well as training courses for entrepreneurs fearing failure; and in Azerbaijan, Georgia and Ukraine they can seek advice via dedicated websites or call centres. Georgian SMEs experiencing financial difficulties can access advisory services and generic guidance through the web guide businessguide.ebrd.ge, developed by the EBRD in partnership with Enterprise Georgia and the Rural Development Agency. Additionally, in Moldova, ODA’s staff has been trained on the topic of early-warning systems, and such mechanisms have been applied to some companies on a trial basis. In 2021, through the implementation of the DanubeChance2.0 project, ODA carried out several activities related to the elaboration of a national early warning mechanism. However, the project has expired and, although there is a proposal for a new Second Chance Programme for SMEs, it has not yet been approved.

Table 5.13. Preventive measures, sub-dimension scores

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|

|---|---|---|---|---|---|---|

|

Sub-dimension score |

1.34 |

1.69 |

3.24 |

1.46 |

1.75 |

1.90 |

|

Design & implementation |

1.86 |

2.71 |

3.60 |

2.14 |

2.89 |

2.64 |

|

Performance, monitoring & evaluation |

1.00 |

1.00 |

3.00 |

1.00 |

1.00 |

1.40 |

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Unfortunately, despite the above-mentioned initiatives, information on tools and support available to SMEs often lacks visibility and accessibility. Even though both public and private institutions offer services to SMEs in financial distress, they often fail to advertise them effectively. Moreover, well-developed and comprehensive early-warning systems that can detect circumstances that could potentially lead to insolvency4 are not yet in place in any of the countries. Box 5.2 (below) discusses the evolution of early warning systems in Europe, and Box 5.3 (at the end of the chapter) presents an example of an early warning tool. Finally, most of the EaP countries have yet to develop systems to monitor existing measures for preventing insolvency. The only exception is Georgia, where the insolvency reform, including initiatives to prevent bankruptcy, has been monitored and evaluated under the project ReforMeter, a reform-tracking tool supported by the USAID Economic Governance Program and implemented by the ISET Policy Institute.5

Box 5.2. Early-warning systems in European Commission Directive 2019/1023

European Directive on restructuring and insolvency

The adoption of Directive 2019/1023 on restructuring and insolvency signifies a pivotal achievement in the development of European insolvency law and was the culmination of complex negotiations. Before this, in 2014 the European Commission issued Recommendation 2014/135/EU, which discussed substantive insolvency matters, such as the need to ensure a second chance for honest entrepreneurs and establish restructuring procedures outside the scope of formal insolvency proceedings. The final text of the Directive was adopted in 2019 and set minimum standards in various areas related to restructuring and insolvency.

Design of early-warning systems

Early-warning systems are one of the main building blocks of Directive 2019/1023. They can act as a self-assessment tool entrepreneurs can use to assess their economic situation and financial performance, and are particularly useful for SMEs, which usually lack in-house analytics. Such systems can be implemented in numerous ways and have varying degrees of sophistication. A simple tool could be represented by a software application on a public website where entrepreneurs can input relevant data and obtain a preliminary diagnostic. More advanced early-warning systems can go beyond mere self-assessment and detection and trigger an intervention mechanism, e.g. by automatically involving an auditor when a concrete financial risk is identified.

Two additional elements are key to design an effective early warning system:

Identification of well-defined indicators. These indicators should serve as triggers, signalling potential economic issues within the enterprise. For instance, they could include a combination of financial ratios that assess factors such as liquidity, profitability, efficiency and viability, as well as leverage, among others.*

Integration with insolvency and debt restructuring mechanisms. The early warning system should be connected to insolvency and debt restructuring processes. This connection can take various forms, from sending alert messages to entrepreneurs in financial distress to mandating insolvency or preventive restructuring proceedings if corrective actions are not taken promptly. It is essential to ensure that this integration always respects the confidentiality of sensitive financial information, which is vital to prevent entrepreneurs from being disincentivized to use the early warning systems.

* These ratios are respectively working capital / total assets, retained earnings / total assets, earnings before interest and taxes / total assets, and debt/earnings ratio.

Source: (Garrido et al., 2021[15])

Survival and bankruptcy procedures

This sub-dimension assesses the design, implementation and monitoring of insolvency regimes in EaP countries, looking at how relevant laws and procedures align with international good practice. Analysed aspects include the existence of laws or other procedures on distressed companies, receivership and bankruptcy, the provision of out-of-court restructuring as a less-costly alternative to formal bankruptcy proceedings, and the existence of simplified reorganisation procedures for smaller firms. In addition, this sub-dimension assesses the scope and structure of the monitoring and evaluation system.

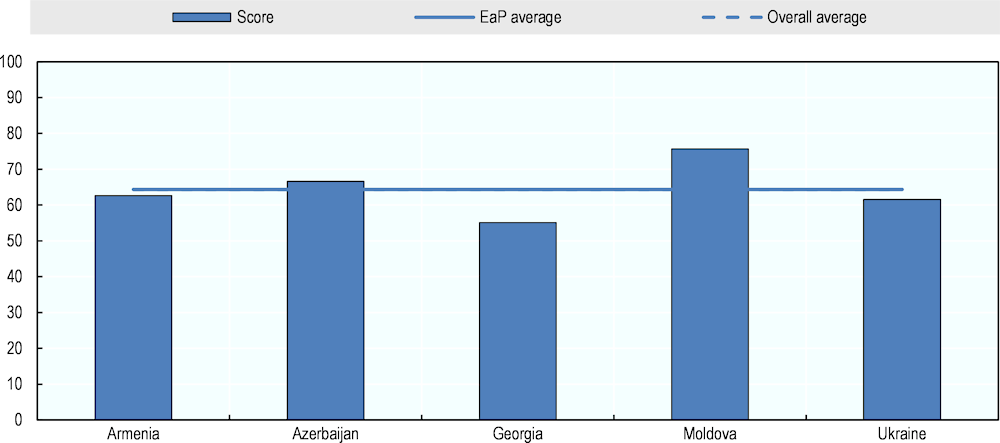

EaP countries have fairly well-designed bankruptcy frameworks, achieving an average score of 3.03, (Table 5.14). The scores in this sub-dimension, however, are negatively affected by changes to the assessment methodology.

Somewhat positive results also emerge from the EBRD Business Reorganisation Assessment (EBRD, 2021[16]), which monitored insolvency policies and practices during the COVID-19 crisis. The assessment, conducted through a questionnaire, was carried out to provide the EBRD, its economies of operations and investors with an up-to-date overview of business reorganisation tools and to propose areas where further development of national legislation is needed. According to the results of this study, EaP countries perform, on average, at the same level as other assessed countries (Figure 5.7), with a particularly solid performance in the area of “General Approach to Corporate Reorganisation”6. It is important to note, however, that this assessment does not take into account reforms implemented after the cut-off date (7 November 2020), and that the results for Georgia are based on previous legislation that was in force in 2020.

Figure 5.7. EBRD Business Reorganisation Assessment (2020)

Note: The scale goes from 0 to 100, where 100 represents best performance. The assessment considers insolvency frameworks only as they were at the cut-off date of 7 November 2020. In particular, results for Georgia are based on the previous legislation in force in 2020.

Source: OECD calculations based on EBRD (2021[16]), Business Reorganisation Assessment.

Since 2020, all countries, except Ukraine, have amended their legislative frameworks for bankruptcy, resulting in important improvements. In Armenia, the amendments led to the establishment of a self-regulatory association of practitioners and to the introduction of the electronic exchange of documents between all parties involved in a proceeding. In Azerbaijan, issues regarding the grounds for insolvency and the voting rights of the creditors on the recovery plan were clarified, and regulations on court hearings were introduced. In Moldova, significant improvements were made with the introduction of a simplified bankruptcy procedure and the establishment of an electronic registry for insolvency cases. Finally, in Georgia, the adoption of a new law significantly transformed and improved the insolvency regime, shifting the focus from liquidation to rehabilitation.

Since the last assessment, Georgia and Moldova have introduced out-of-court settlements, which are now available in all EaP countries, except in Armenia. The availability of such simplified procedures and the existence of specialised commercial or insolvency courts in all countries (with the exception of Moldova), have improved the efficiency and speed of insolvency regimes. On the other hand, although insolvency registers are available in all countries except Azerbaijan, aggregated data on insolvency cases is not available. Finally, abbreviated or simplified procedures for small cases or SMEs are available only in Georgia and Moldova.

Table 5.14. Survival and bankruptcy procedures, sub-dimension scores

|

Armenia |

Azerbaijan |

Georgia |

Moldova |

Ukraine |

EaP average |

|

|---|---|---|---|---|---|---|

|

Sub-dimension score |

2.74 |

2.15 |

4.13 |

2.72 |

3.39 |

3.03 |

|

Design & implementation |

3.35 |

3.88 |

4.33 |

3.80 |

3.96 |

3.87 |

|

Performance, monitoring & evaluation |

2.33 |

1.00 |

4.00 |

2.00 |

3.00 |

2.47 |

Note: See the “Policy framework, structure of the report and assessment process” chapter and Annex A for information on the assessment methodology.

Despite these positive elements, substantial room for improvement remains. In particular, Armenia, Azerbaijan and Ukraine should consider the introduction of simplified or pre-packaged proceedings specifically targeting small cases and/or SMEs.7 These mechanisms should provide for shorter timelines and fewer formal requirements, allowing for time- and cost-efficient reorganisation of SME debtors. Moreover, all EaP countries should direct more effort into monitoring and evaluating insolvency procedures, developing comprehensive mechanisms to increase the efficiency and effectiveness of bankruptcy frameworks. Finally, countries should collect and make available more comprehensive and systematic data on insolvency and efficiency of procedures.

Promoting second chance