This chapter analyses the opportunities and challenges for the development of regional value chains in East Africa (Comoros, Djibouti, Eritrea, Ethiopia, Kenya, Madagascar, Mauritius, Rwanda, Seychelles, Somalia, South Sudan, Sudan, Tanzania and Uganda). It first examines existing participation in global value chains. The chapter then analyses East Africa’s agri-food value chains and discusses their growth potential, opportunities and constraints. Finally, it addresses three policy domains for strengthening value chain integration in East Africa. The first domain concerns regional co-ordination, especially via the East African Community, to reduce barriers to intra-regional trade. The second policy domain regards how investment and cluster policies can help develop regional capacity in key value chains such as agri-food. The third domain identifies the public policies necessary to realise the regional Single Digital Market.

Africa's Development Dynamics 2022

Chapter 5. Integrating value chains in East Africa and the agri-food industry

Abstract

In Brief

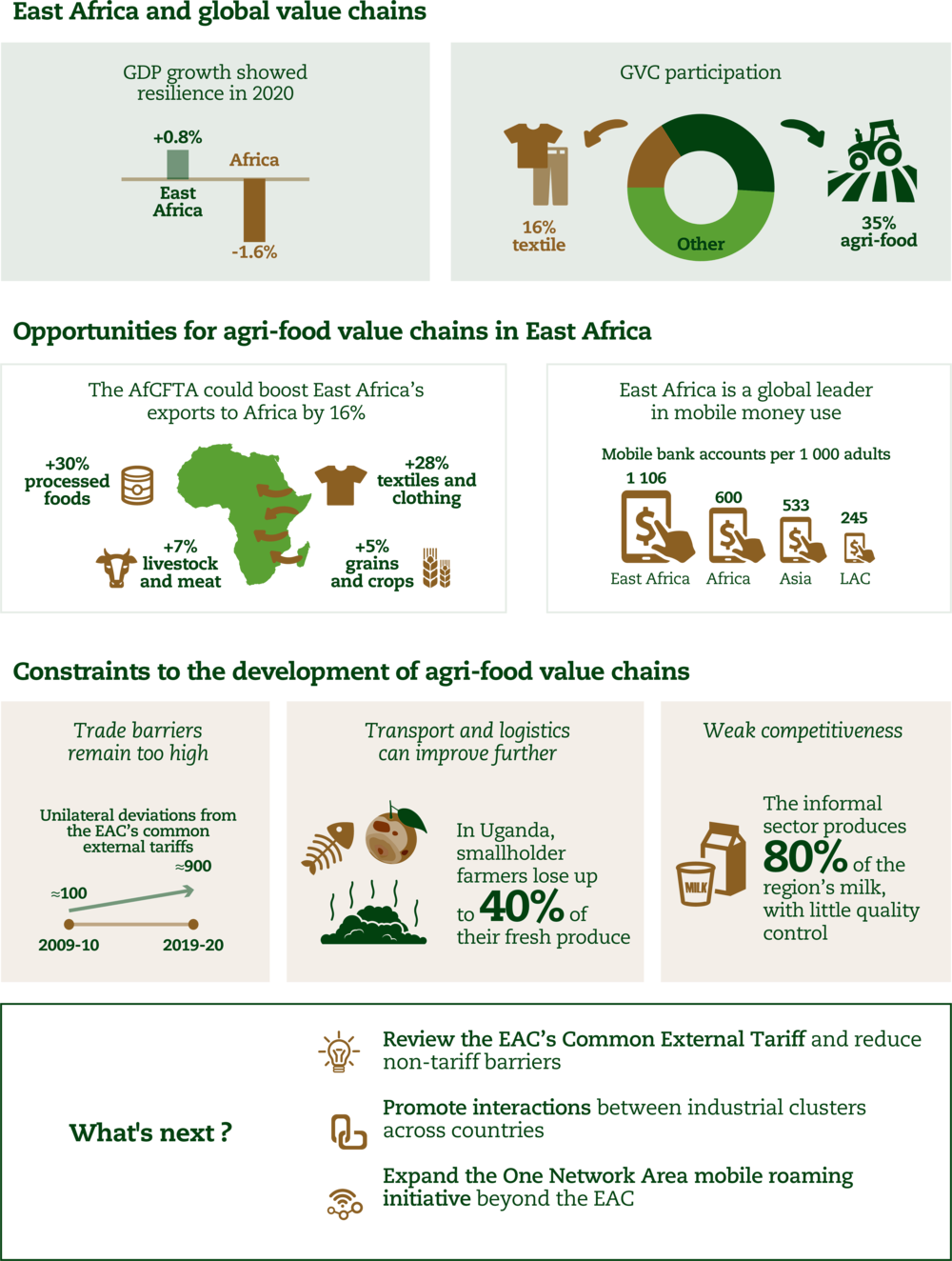

East Africa needs to enhance its participation in global value chains (GVCs). GVC participation in East Africa decreased from 3.8% of gross domestic product (GDP) in 2010 to 2.6% in 2015, a level below Africa’s average. Backward participation in global value chains plays a relatively more important role than elsewhere in Africa, but its share has been declining. COVID-19 has had a nuanced impact on the region. The collapse of global tourism has badly affected the most integrated countries in East Africa (Mauritius and Seychelles), while the larger and less integrated countries (such as Ethiopia and Tanzania) registered positive GDP growth in 2020.

Going forward, regional value chains such as agri-food can help accelerate industrialisation and create jobs. The African Continental Free Trade Area (AfCFTA), demographic growth, urbanisation and digital transformation create favourable conditions for the agri-food sector. However, policy interventions will be necessary to overcome persistent competitiveness issues and high intra-regional trade costs.

The region can address these challenges by focusing on three policy levers:

-

using the momentum from AfCFTA to reduce barriers to intra-regional trade, especially in reviewing the Common External Tariff and trade facilitations of the East African Community (EAC)

-

co-ordinating industrial strategies to strengthen regional competitiveness in key value chains such as agri-food, particularly with investment and cluster policies

-

co-operating in areas related to digital infrastructure, skills and regulatory harmonisation to realise the Single Digital Market.

East Africa (infographic)

East Africa regional profile

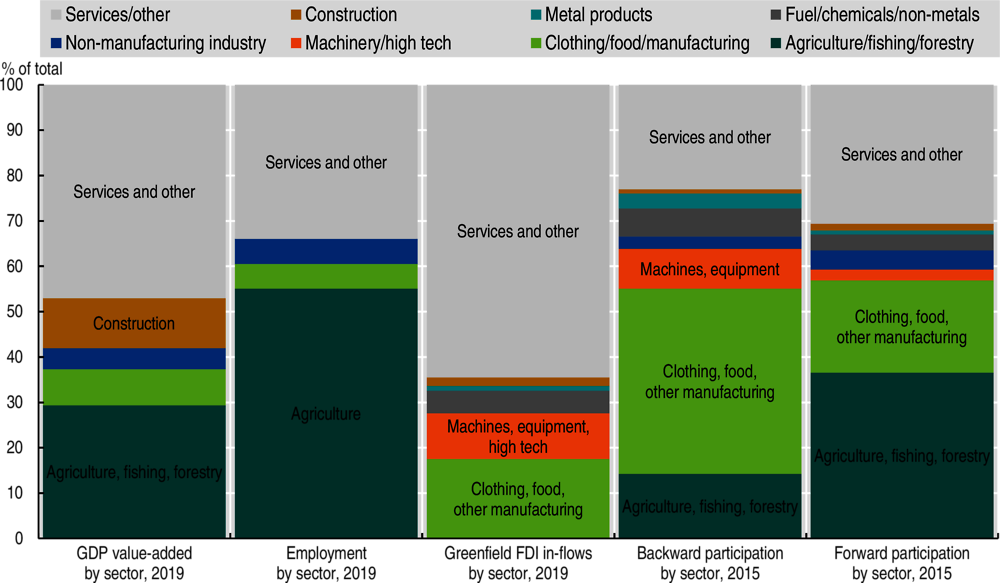

Figure 5.1. Economic and trade profiles of East Africa, expressed as % of total

Notes: GDP = gross domestic product; FDI = foreign direct investment. The different sources for the data do not share common definitions of economic sectors, commodities or activities. However, colouring is used in this figure in order to indicate shared themes across datasets.

Source: Authors’ calculations based on World Bank (2020), World Development Report 2020, GVC Database, www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data; fDi Markets (2021), fDi Markets (database), www.fdiintelligence.com/fdi-markets; and World Bank (2021), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

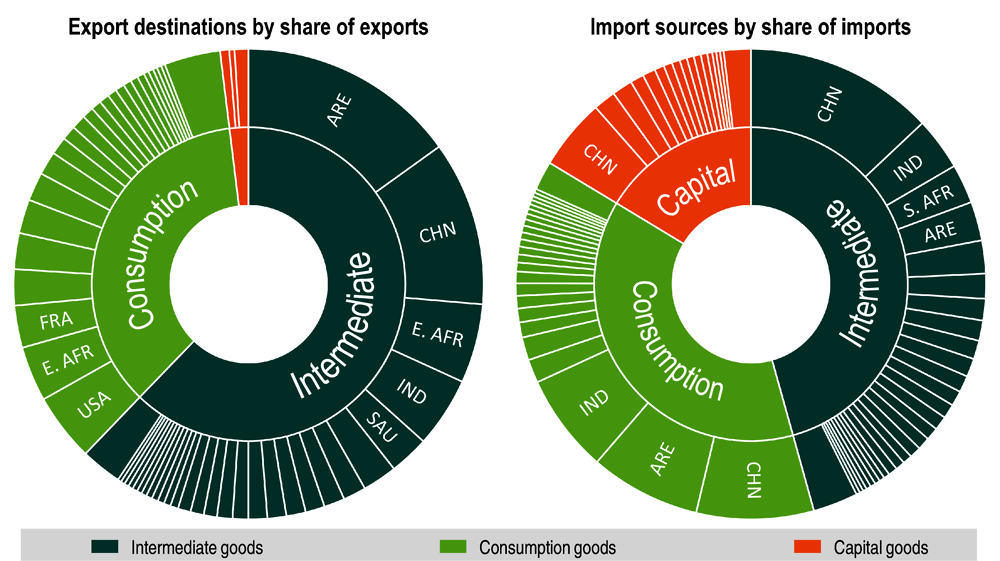

Figure 5.2. East Africa’s most important trade partners broken down by volume of trade in intermediate, consumption and capital goods

Notes: Countries are presented using their three-letter ISO codes. The African countries are aggregated into the five sub-regions defined by the African Union as follows: C. AFR = Central Africa, E. AFR = East Africa, N. AFR = North Africa, S. AFR = Southern Africa, W. AFR = West Africa. Interior trade within the Southern Africa Customs Union is excluded.

Source: Authors’ calculations based on data from CEPII (2021), BACI (database), www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37.

East Africa needs to enhance its participation in global value chains

East Africa’s participation in global value chains has been stagnating, largely due to subdued backward participation

East Africa ranked lowest in levels of GVC exports as a share of GDP in 2019, compared to other African regions. For countries in East Africa, GVC participation as a share of GDP was below the African average of 8% in 2019. Unlike in Africa’s two most integrated regions, North and Southern Africa, East Africa’s GVC participation as a share of GDP has not improved since 2000, according to our calculations based on data from the UNCTAD-Eora Global Value Chain Database (Casella et al., 2019). East Africa’s low level of GVC participation can be linked both to economic fundamentals such as landlockedness and small market size and to policy factors such as low levels of domestic productivity, the high cost of transportation and communication infrastructure and, for some countries, a relatively closed economy.

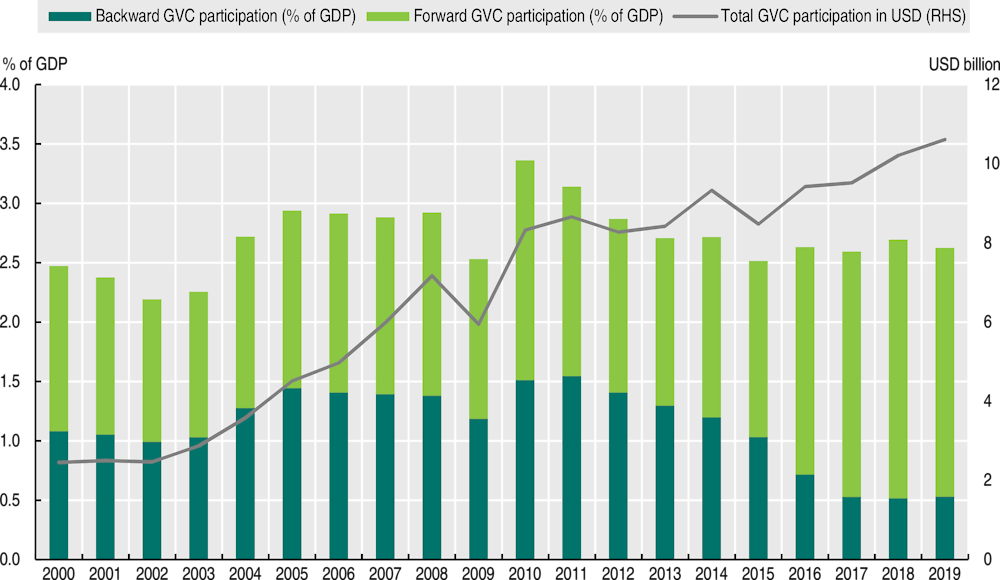

The region’s total GVC participation stagnated between 2010 and 2019 (Figure 5.3). Despite increasing slightly in nominal USD terms, as a share of total GDP, GVC participation declined from 3.4% in 2010 to 2.6% in 2019. This trend largely follows global trends in GVC participation, following the 2008 global financial crisis, uncertainties around trade agreements, trade conflicts between major trading partners and the emergence of labour-saving technologies which dampened incentives for the outsourcing of manufacturing (World Bank, 2020; UNCTAD, 2020).

Figure 5.3. East Africa’s participation in global value chains, 2000-19

Note: GVC = global value chain; RHS = right-hand side. The GVC participation for East Africa reported here is an average of national figures for GVC participation as a percentage of GDP weighted by national GDP expressed in PPP dollars.

Source: Authors’ calculations based on data from Casella et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc/.

The decrease in GVC participation was largely driven by the declining role of backward GVC participation. Backward participation refers to the share of a country’s imported inputs embedded in its exports. Between 2010 and 2019, backward participation decreased from 1.5% of GDP to 0.5% (Figure 5.3). This is a cause for concern, as global experience suggests that backward participation is more conducive to learning and upgrading among local producers (see Chapter 1).

In contrast, forward GVC participation increased over the period 2010-19, rising to 80% of East African GVC participation. Forward participation measures the share of a country’s exports that are used by an importing country for export production. Overall, forward participation as a share of GDP stood at 2.1% in East Africa in 2019, lower than Africa’s average (5.9%) due to the limited role of fuel and mining commodities in East Africa’s export basket (Figure 5.3). According to estimates based on country-by-country matrices of exported added value, between 2010 and 2019, forward GVC participation as a percentage of GDP increased by 0.24 percentage points, while backward participation decreased by 1 percentage point.

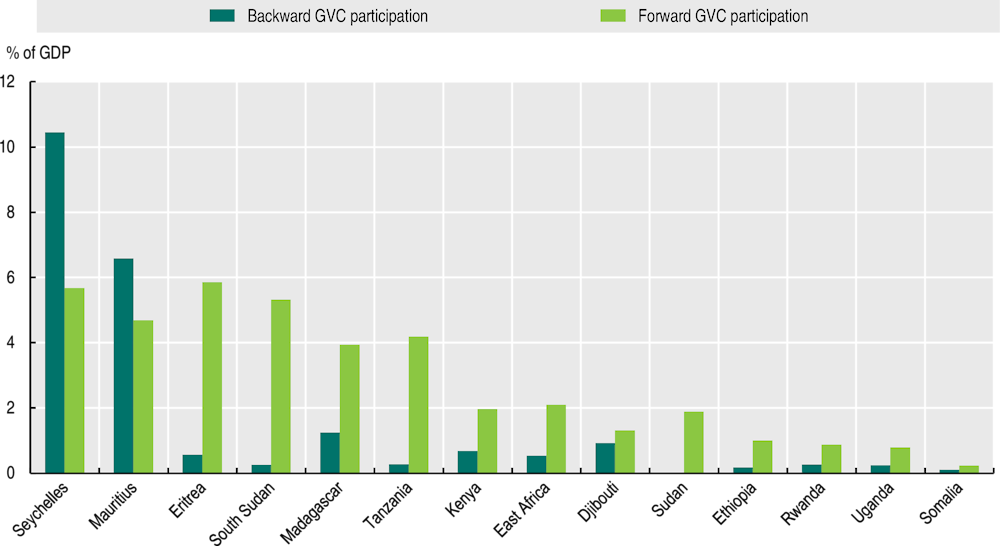

The composition of GVC participation varies considerably across countries. Mauritius and Seychelles have the strongest backward participation as a share of GDP (Figure 5.4), partly due to the importance of the large global-oriented luxury tourism sector that depends on foreign inputs and materials. Among members of the EAC, only Kenya (0.7%) outperforms the East African average of backward participation as a share of GDP (0.5%), whereas Mauritius (6.6%) and Seychelles (10.5%) both lead among non-EAC members, surpassing the African average of 2.1%.

Figure 5.4. Backward and forward participation in global value chains in selected East African countries, 2019

Note: The GVC participation for East Africa reported here is an average of national figures for GVC participation as a percentage of GDP weighted by national GDP expressed in PPP dollars.

Source: Authors’ calculations based on data from Casella et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc/.

East Africa’s participation in global value chains can bring new technology to the region and facilitate learning among local producers, which can help them internationalise their products, as shown in Kenya. For example, for the horticulture global value chain in Kenya, lead firms define how output is produced, processed and stored and indicate specific social and environmental conditions to follow. Furthermore, all of Kenya’s foreign-owned agricultural investors and about 80% of the country’s foreign-owned suppliers give some level of support to local companies. In fact, Kenyan farmers have started relying on rainwater harvesting techniques to adhere to environmental standards and using new seed varieties to make their produce more attractive to global consumers. Following the supermarket revolution in Kenya, local producers gained more independence from prior sales channels, which enabled them to forge more direct ties with global retailers. This allowed a new group of smaller local companies to enter the global value chain through sub-contracting arrangements (Qiang, Zhenwei and Steenbergen, 2021).

However, GVC firms are sometimes disconnected from the rest of the economy, thus limiting the potential for broad-based economic and social upgrading. This was shown by Newman et al. (2020) who compare linkages between multinational enterprises and domestic firms, predominantly located in special economic zones in Ethiopia, Ghana, Kenya, Mozambique and Uganda in Africa and Cambodia and Viet Nam in Asia. They found a lower incidence of long-standing supplier relationships between multinational enterprises and domestic firms in Africa than in Asia. They also noted that multinational enterprises in Africa are more likely to exclusively produce for the export market and to form backward and forward linkages with other multinational enterprises in the same country. Binding contracts are the most prevalent form of direct technology transfer to domestic firms in the African sample.

The impact of COVID-19 varies across countries and value chains in the region

Overall, East Africa’s GDP has shown resilience to the COVID-19 crisis. GDP growth has remained relatively resilient at 0.7%, compared to Africa’s GDP decline of -1.6% (IMF, 2021). Structural factors such as the low share of the population living in urban areas, the dominance of the rural economy (especially small-scale farming activities) and the youthful demographic structure have helped contain the spread of the pandemic. As net commodity importers, several economies in East Africa have also benefited from lower import bills for oil and food during the pandemic (Mold, 2020). Furthermore, this resilience reflects the relative isolation of some countries in the region from the global contraction. For example, two East African countries with relatively low levels of GVC participation as a share of GDP, Ethiopia and Tanzania, grew at the positive rates of 6.1% and 1% respectively in 2020 (Figure 5.5).

This macroeconomic resilience also reflects East African governments’ relative success in containing the COVID-19 health and economic shocks. East African countries adopted several strategies to mitigate supply- and demand-side shocks induced by the COVID-19 crisis. Light manufacturing continued operations thanks to workplace re-engineering and diversification into COVID-related essential goods; this was despite initial pandemic-related supply chain disruptions and light manufacturing not getting “essential sector” status. Most governments in the region encouraged business diversification and investment in personal protective equipment and essential goods.

Figure 5.5. Real gross domestic product growth in East African countries, 2020-22

Source: IMF (2021), Regional Economic Outlook: Sub-Saharan Africa, https://www.imf.org/en/Publications/REO/SSA/Issues/2021/10/21/regional-economic-outlook-for-sub-saharan-africa-october-2021.

The region has also accelerated its digital transformation during the COVID-19 crisis. The digital economy has thrived due to East African countries adopting more digital technology. The region has experienced a significant surge in the market valuation of technology-enabled health and education services, e-commerce and telecommunications (AUC/OECD, 2021; ITU, 2021). The business process outsourcing sector in some countries, such as Kenya, has remained resilient and gained the reputation of an adaptable business environment and strong destination for foreign direct investment (FDI) (Mitchell et al., 2021). A number of East African countries accelerated the use of mobile money payments to curb the impact of the COVID-19 crisis. For example, Kenya’s biggest telecommunications company, Safaricom, announced a fee waiver on East Africa’s key mobile-money product, M-PESA, to lower the physical exchange of currency. The company made all person-to-person transactions under 1 000 Kenyan shillings free for three months (Bright, 2020).

Nonetheless, several tourism-dependent countries in the region face considerable economic setbacks. In 2020, GDP contracted by 15% in Mauritius and 13% in Seychelles. Closed borders have caused an estimated 70% contraction of Mauritius’ tourism industry’s compared to pre-COVID levels (Qiang, Zhenwei and Steenbergen, 2021). The return to pre-COVID levels in tourism-related service sectors is predicted to be slow. Travel, tourism and transport services account for significant shares of annual gross export earnings of Djibouti (58%), Kenya (32%), Rwanda (35%), Mauritius (54%), Seychelles (41%), Tanzania (52%) and Uganda (37%), according to our calculations based on data from UN COMTRADE (UN, 2021). The slow recovery of global tourism will continue to affect the prospects of these countries.

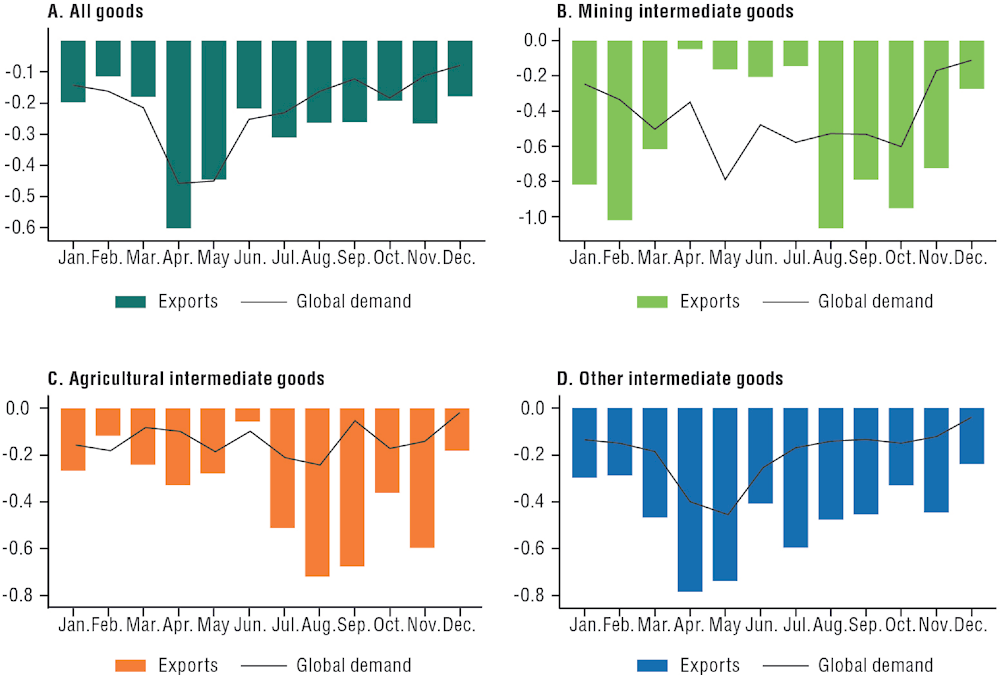

GVC exports from East Africa also faced sharp drops due to global supply chain disruptions. At the onset of the COVID-19 crisis in 2020, East Africa witnessed significant declines in trade flows, supply chain disruptions, border closures, increased surveillance and social distancing measures, delays in port handling, hikes in freight charges, and a general drop in port performance indices (Trademark East Africa, 2020). The restricted movement of goods and traders caused overall export values to high-income countries to drop by 39.9% and 24.4% between April and May 2020 (Figure 5.6).

Figure 5.6. Export growth versus global demand growth for East Africa, 2019-20

Note: The figure shows a comparison of each month’s exports in 2020 with the same month’s exports in 2019.

Source: Authors’ calculations based on monthly trade data from UN (2021), UN COMTRADE (database), https://comtrade.un.org/.

Overall, the impact of COVID-19 on value chains depended on whether the value chains were global or regional, whether production and distribution continued, and whether the specific sector was considered essential by consumers both domestically and globally. While the timing of collapse varied across product categories, sharp drops in international demand and the cancellation of orders adversely affected major agricultural exports (for example, coffee, tea, flowers and horticulture) and the region’s emerging light manufacturing sector (for example, the garment industries in Ethiopia and Mauritius) (EABC, 2021).

COVID-19 is changing the investment landscape, which will have important implications for medium-term GVC participation. Foreign direct investment, which typically follows GDP and trade recovery trends at a slower rate, fell by 16% in East Africa in 2020, as companies put mergers, acquisitions and greenfield investments on hold. In 2020, foreign direct investment slightly increased for Djibouti (8%), Somalia (4%) and Tanzania (2%), though most East African countries experienced a decline [e.g. Kenya (35%), Uganda (35%), Mauritius (48%) and Rwanda (62%)]. FDI inflows are likely to gain momentum by 2022 due to an expected rise in demand for commodities, new opportunities due to restructuring of global value chains and the finalisation of the AfCFTA investment protocol (UNCTAD, 2021a).

The COVID-19 crisis could create long-term opportunities for the continent, as multinationals may re-shore and near-shore their operations and diversify their supplier networks. The reconfiguration of global supply chains could lead to notable changes in certain sectors, such as fashion or electronic components. Promoting intra-regional investment could help to boost trade within the continent and reduce risks related to disruptions in international supply chains.

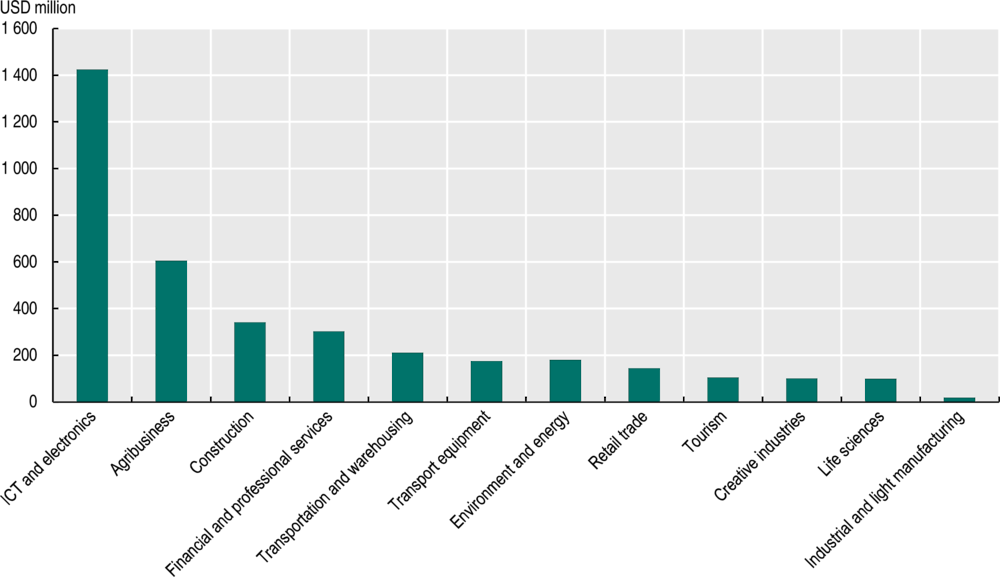

Since the COVID-19 crisis, East African countries have been breaking into new sectors while rebuilding existing ones. For example, the acceleration of the digital transformation has increased the attractiveness of information and communications technology (ICT) and agribusinesses in East Africa relative to other sectors (Figure 5.7). In fact, the economic recovery plans of the governments of Kenya (local value chains and component manufacturing), Mauritius (pharmaceutical and blue economy) and Rwanda (business process outsourcing) list strategic sectors to build relevant capability and competitiveness and to attract foreign direct investment. The rise of tech start-ups and regional platforms and the expansion of Africa-focused investments and acquisitions are expected to reshape the continents’ investment landscape.

Figure 5.7. Greenfield foreign direct investment to East Africa, by sector, March 2020-September 2021

The African Continental Free Trade Area provides new opportunities for developing regional value chains in East Africa

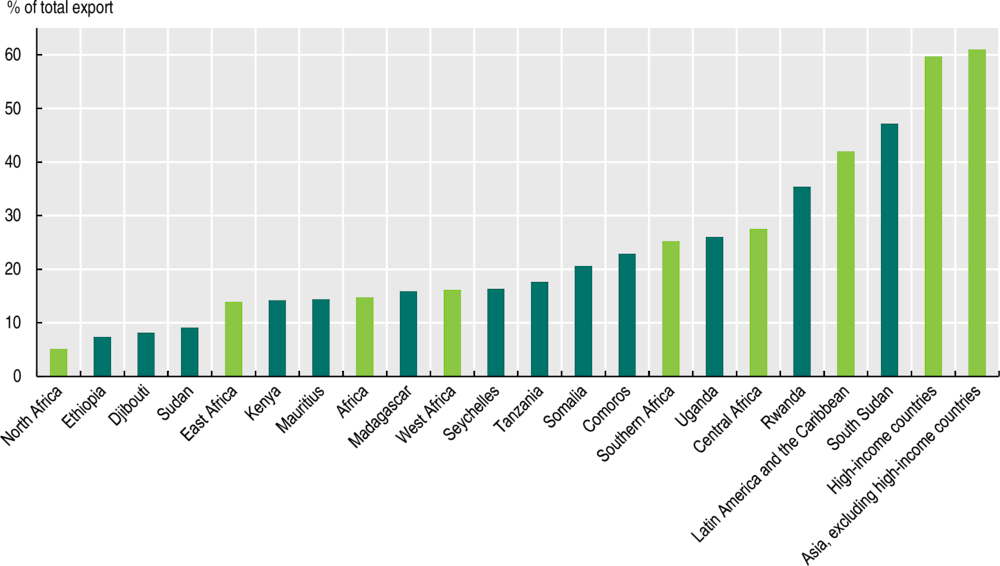

In trade in intermediate goods, East Africa lags behind Central and Southern Africa as well as Asia and Latin America and the Caribbean (Figure 5.8). The region’s performance in trade in intermediate goods (13.9%), while comparable with the African average (14.7%), is much lower than that of the continent’s two regions that trade the most [Central Africa (27.6%) and Southern Africa (25.2%)]. East Africa’s trade in intermediate goods is far behind that of Asia (61%) and Latin America and the Caribbean (42%). Djibouti, Ethiopia, Kenya, Mauritius and Sudan perform below the African average, while Madagascar and Uganda perform above it. Rwanda demonstrates a performance comparable to Latin America and the Caribbean, and South Sudan comparable to Asia.

Figure 5.8. Intra-continental trade in intermediate goods, 2000-19 average

Notes: Intermediate goods are the products classified by UN COMTRADE within the Broad Economic Categories 4, 21, 22, 31, 42, 53, 111, 121 and 322.

Source: The data presented in this figure are based on the international trade by commodity reported in the CEPII (2021), BACI (database), www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37.

High trade costs and weak competitiveness help explain East Africa’s lack of growth and upgrading in regional value chain participation. High tariffs on intermediate goods, restrictive rules of origin and insufficient services for connectivity are major impediments to the growth of RVC exports. For example, roaming costs in the EAC are notably higher than those for other regional economic communities; they are approximately double those in the Southern African Development Community (de Melo and Twum, 2020). The lack of competitiveness also prevents producers from breaking into the more complex manufacturing stages that have more demanding requirements. In East Africa, the agricultural investments are predominantly structured around the production of commodities such as sugar cane, raw milk and oil seeds. In the food sector, they are highly concentrated in beverages, tobacco, dairy and other processed food products.

Many East African countries have similar industrial capacities and compete in the same segments of global value chains, which limits their ability to find and exploit complementarities. Agriculture is among the top five sectors of GVC participation for nine East African countries. The textile and clothing sector is among the top five sectors for five of the region’s countries (Djibouti, Ethiopia, Madagascar, Mauritius and Tanzania), while the transport services sector is among the top five for ten countries. The similarity in relative comparative advantages or industrial policy sameness limits regional sourcing and production networks (Odijie, 2019).

Countries in the region, especially in the EAC, have co-operated to address issues with notable successes. The efforts include operationalising the EAC Common Market, which has facilitated the free movement of goods, labour, services and capital. Individual successes include i) harmonising regional standards for several agricultural and food products, for example dairy and maize; ii) setting up the EAC Customs Union and building the capacity of the related trade institutions; iii) establishing a Common External Tariff in the region; and iv) instituting a single tourist visa that allows visitors to travel freely between Kenya, Rwanda and Uganda.

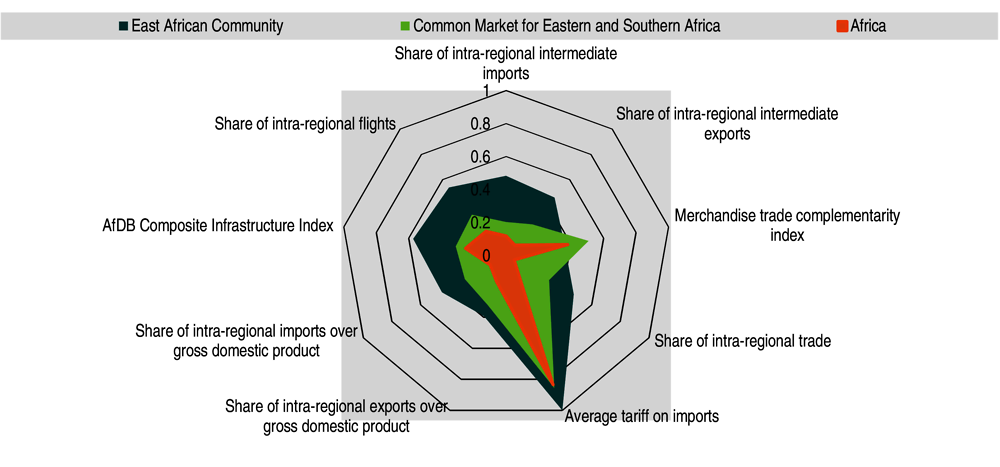

Productive and infrastructure integration,1 the main building blocks of regional sourcing and production networks, remain the weakest links in regional integration for East Africa’s Regional Economic Communities. 2 Among Africa’s Regional Economic Communities (RECs), the EAC has the highest share of intra-REC trade in intermediate goods and the lowest average tariff on intra-regional imports, while COMESA scores the highest in merchandise trade complementarity (Figure 5.9). Total intra-REC trade in the EAC, while the second highest among African Regional Economic Communities, is lower both in levels and in growth than intra-REC trade in Asia and Latin America and the Caribbean [the Association of Southeast Asian Nations and the Mercado Común del Sur (MERCOSUR), respectively] (de Melo and Twum, 2021).

Figure 5.9. Trade and infrastructure integration: Intra-regional performance scores

Source: AUC/AfDB/UNECA (2019), Africa Regional Integration Index Report 2019, www.integrate-africa.org/fileadmin/uploads/afdb/Documents/ARII-Report2019-FIN-R40-11jun20.pdf.

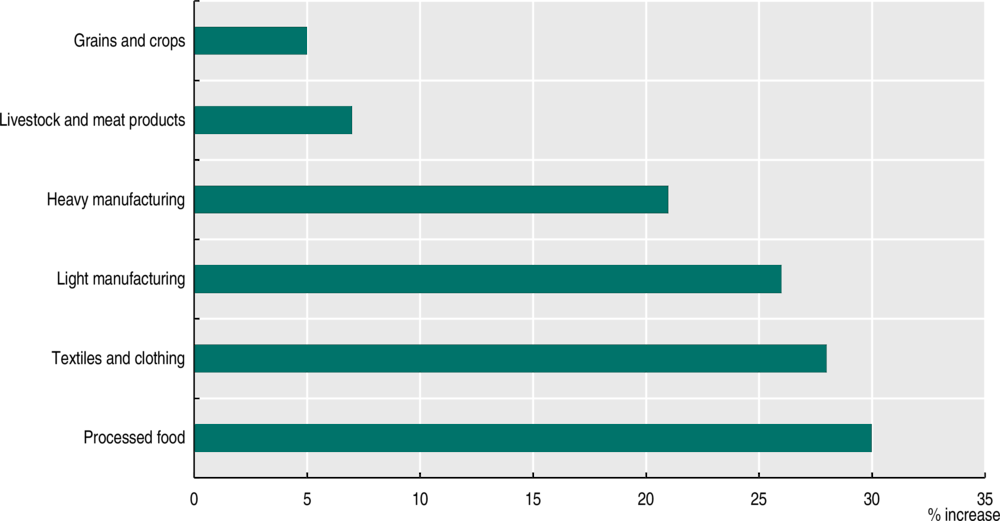

The AfCFTA offers renewed opportunities for East African producers to tap regional and continental markets, especially in the agri-food value chains. A computable general equilibrium model based on data from the Global Trade Analysis Project suggests that completely removing existing tariffs on all intra-African trade could increase East Africa’s exports to the rest of the continent by 16% (UNECA/TradeMark, 2020). Benefits would be particularly pronounced for sectors like processed food, textiles and clothing, and light manufacturing (Figure 5.10). Producers would have access to the whole East African market, with a GDP of USD 880 billion. Furthermore, the AfCFTA opens up the possibility of trading with the rest of the continent under a single set of rules and of progressively eliminating tariffs and non-tariff barriers to trade.

Figure 5.10. Modelled increase in East African exports to Africa thanks to the African Continental Free Trade Area, by sector

Source: UNECA/TradeMark East Africa (2020), Creating a Unified Regional Market: Towards the Implementation of the African Continental Free Trade Area in East Africa, https://archive.uneca.org/sites/default/files/PublicationFiles/tmea_afcfta_report_5_june_2020.pdf.

Regional agri-food value chains offer great potential for industrialisation and job creation but require supportive policies

Developing agri-food value chains is critical to tackling long-term challenges in East Africa

The development of agri-food value chains is imperative to resolve the challenge of food security in the region, fueled by demographic growth. The rising population and growing food demand are elevating the risks of food insecurity. East Africa’s population growth rate of 2.9% per year is increasing pressure on agriculture, food and nutrition. As the region is not self-sufficient in most of these basic food commodities, its dependence on imports is set to increase. Between 1998 and 2018, food imports rose by over 1 000% in Ethiopia, 300% in Kenya and 122% in Tanzania (Mitchell et al., 2021).

Strengthening agriprocessing can help diversify rural markets both directly and indirectly. Agriprocessing is a subset of the manufacturing sector that processes raw materials and intermediate goods from the agricultural sector. By adding value to small and medium-sized farms’ agricultural produce, agriprocessing can increase revenues from farming production, accelerate farming productivity and drive employment growth. Higher farm revenues, in turn, tend to generate greater rural demand for non-farm products, opening up business opportunities for the rural population and stimulating broader rural development.

Downstream segments of agri-food value chains (such as food processing, packaging, transport and retail) offer opportunities for creating non-farm jobs to absorb agricultural labour and accelerate structural transformation in the region. Agriculture remains the largest employer in East Africa, accounting for 55% of total employment in 2020 – the highest share in Africa. A large majority of workers in this sector are women, youth and informal workers. Employment in manufacturing, on the other hand, has been declining; it dropped from 8% of total employment in 2000 to 5% in 2020. Analysis based on data from Ethiopia, Malawi, Mozambique, Tanzania, Uganda and Zambia suggests that labour productivity (measured as GDP per hour worked) in food manufacturing is about eight times higher than in farming (Tschirley, 2015).

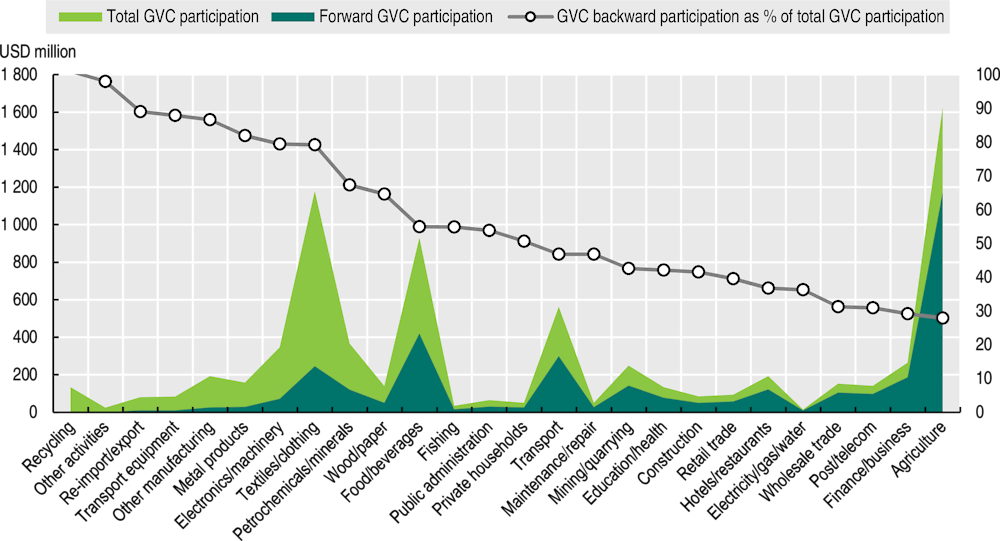

In particular, the food processing segment of the agri-food chain appears most promising for increasing backward participation in global value chains. Food processing includes activities in which raw agricultural products undergo chemical, mechanical or physical transformation to become new products for human consumption. For example, milk can be processed into high-value concentrated dairy products with long shelf lives. While agriculture accounts for 22% of the region’s GVC participation, it is the least performing in backward participation (28%). In contrast, the food and beverage activity accounts for 14% of East Africa’s GVC participation, with backward participation making up 55% of that (Figure 5.11).

Figure 5.11. East Africa’s participation in global value chains, by sector, 2015

Source: Authors’ calculations based on data from World Bank (2020), World Development Report 2020, GVC Database, www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data.

Box 5.1 presents the example of dairy value chains, which have demonstrated significant potential in the region. Currently, a large portion of domestic food processing consists of simple transformations, such as grinding maize, rather than creations of marketable processed products. For example, in Uganda, where food processing accounts for 40% of the country’s manufacturing output, half of this amount is attributed to sugar, coffee and tea processing (Fowler and Rauschendorfer, 2019).

Looking further forward, rapid urbanisation and the rising middle class create new opportunities for upgrading in these value chains through increased demand for higher-value and more processed foods. According to the United Nations estimates, 29% of East Africa’s population currently lives in urban areas, and the number is expected to rise to 41% by 2050. This urbanisation is being accompanied by a transition in dietary patterns that favours foods with better quality and higher protein content (FAO, 2017). Tschirley et al. (2015) projected that the post-farm segment of the agri-food system in East and Southern Africa would rise from 8% in 2014 to 10-12% by 2025 and 11-14% by 2040. In contrast to rural populations, most urban dwellers do not produce food but resort to local markets. Urban demand is now over 50% of all food demand, and a 2-5% rise in per capita incomes further increases urban demand through markets (Tschirley et al., 2015).

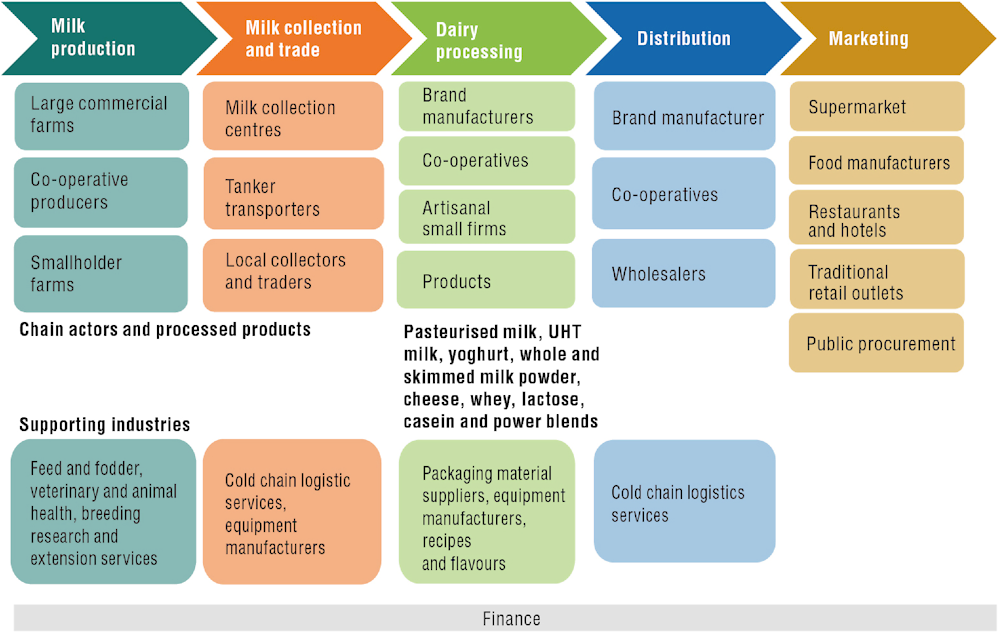

Box 5.1. East Africa’s dairy value chains

The dairy industry is one of the fastest-growing agricultural subsectors in East Africa. It has generated significant economic returns, employment opportunities, food security and rural development. East Africa has a relatively large consumption of milk and dairy products compared to other African regions (Bingi and Tondel, 2015). The emergence of the middle class in most East African cities and urban areas has fuelled high demand for dairy products, which has accelerated the subsector’s growth. As a result, the dairy industry has become an attractive destination for investors and has generated important returns, including through the transfer of technology.

Producers have taken advantage of the EAC’s institutional trade arrangements to develop regional dairy value chains. The Single Customs Territory, the 60% Common External Tariff on dairy products originating outside the region and the harmonisation of regional standards for dairy products have helped facilitate intra-regional trade. Between 2002-05 and 2010-13, the volume of average annual intra-regional trade in dairy products in East Africa increased 11 times from 1 530 tons to 18 449 tons. In the EAC, Uganda has become the first exporter of dairy products, exporting to both the regional and overseas markets. Rwanda exports small quantities of dairy products to Burundi, the Democratic Republic of the Congo (DRC), and South Sudan (Bingi and Tondel, 2015).

Upgrading remains a challenge for producers in the dairy value chain. More than 80% of the milk produced in East Africa (up to 98% in Ethiopia and 95% in Tanzania) is still generated by the informal sector, thus eluding quality control measures and limiting the scope for value chain investment and structuring. Only in a few countries, including Kenya and Uganda, are the dairy value chains more advanced, with a large number of stakeholders, milk processing plants and distributors. Yet, they face both difficulties in obtaining stable and quality sources of milk and in reaching consumers.

Increased investment and policy interventions can accelerate upgrading within the dairy value chains. Greater and more targeted investment can help reduce capacity gaps in areas such as innovation and product development, distribution and marketing to enhance dairy supply chains in the EAC. EAC countries can also enhance their negotiation position when engaging with large global firms by acting as a regional block. In the milk collection segment of the industry, better training and licensing of milk collectors can improve milk collectors’ adherence to quality standards. Furthermore, better co-ordination between public and private stakeholders and international development agencies is imperative for implementing harmonised regional standards or better aligning investment flows in the EAC. For example, the Rwanda National Dairy Platform helped create a joint long-term plan for market upgrading which can be a vehicle for better-structured policy actions and co-ordination of private investment.

Figure 5.12. Dairy regional and global value chain

Source: Adapted from Abdulsamad and Gereffi (2017), Dairy value chains in East Africa, www.theigc.org/wp-content/uploads/2017/03/Dairy-chain-brief.pdf.

The COVID-19 crisis highlights weaknesses in productive capacity and intra-regional trade of agri-food products

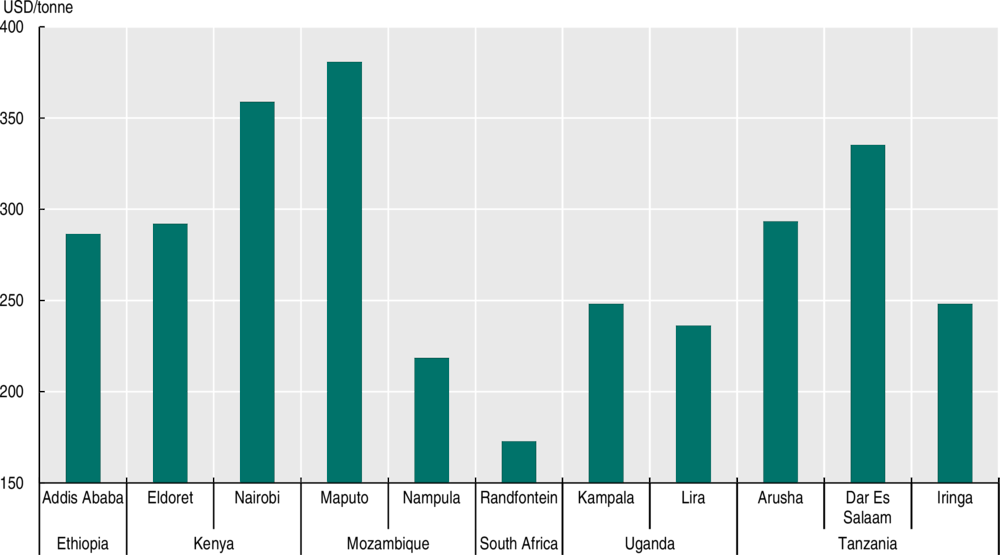

The high costs of regional trade contribute to the fragmentation of East Africa’s agriprocessing value chain. The variation in maize prices across different East African cities (Figure 5.13) demonstrates the lack of market integration in the region due to both tariff and non-tariff barriers (Oiro, Owino and Mendez-Parra, 2017; OECD/FAO, 2020). These include non-tariff barriers to trade, in particular high transportation costs, inefficiencies at border posts, sanitary and phytosanitary regulations, and discretionary exports controls, among others.

Developing the transport and logistics service sector can reduce high trade costs. In Uganda, small-holder farmers lose up to 40% of their fresh produce because of a lack of reliable cold storage systems. Inefficient logistics raises the costs of trading and reduces the potential for trade. Small and medium-sized enterprises typically face twice the logistics costs of large firms because of their lower economies of scale. Better storage management for food produce can increase the efficiency of the food supply chain, reduce food waste and open up new opportunities for landlocked and remote areas.

Figure 5.13. Price spreads for maize across East Africa

Note: This figure is based on the wholesale prices collected by the FAO GIEWS FPMA tool for 2018.

Source: OECD/FAO (2020), Agricultural Outlook 2020-2029, https://doi.org/10.1787/888934141798.

Weak production capacities and low-quality inputs prevent upgrading in these chains. Local producers often lack adequate capacities to upgrade and meet higher standards, and the economies in which they are embedded provide limited opportunities for scale production. For example, maize farmers in Rwanda and Uganda are in want of appropriate warehouse and storage capacities, quality inputs (seeds and fertiliser), liquidity, and clear market information (notably on standards). In Uganda, the informal market is the source of 85-90% of all seeds used by farmers, where improved varieties constitute only 5-15% of seeds and public enforcement of quality standards is difficult (Daly et al., 2017).

Local production capacities need to be enhanced to address increasing food dependency. As the region is not self-sufficient in most basic food commodities, its dependence on imports is set to increase. Joint region- and continent-wide measures to increase domestic production are necessary to prevent shortages, including attracting investments, both domestic and foreign, in food and agri-food subsectors.

The COVID-19 crisis has had immediate consequences on regional production. East Africa’s food processing industry has suffered labour shortages and delays in the supply of agricultural inputs. In Kenya, for example, food processors face labour shortages as well as reduced imports of agricultural inputs for processing, owing to significant delays in cross-border trade. At the same time, trade interruptions and mitigation measures have disrupted local agri-food value chains in the short to medium term by creating bottlenecks in transport, logistics, processing and sales in urban and peri-urban areas. Vulnerable people who must commute daily to provide services and labour to cities are also affected, as lockdowns restricting such commutes often signify a total loss of income for casual labour, small food outlet vendors, minibus drivers and others reliant on daily wages.

The pandemic may also have strong knock-on effects on farmers and aggravate the food crisis. Although rural areas may have been less affected by the pandemic in the beginning, the disruptions in local value chains have created an additional shock to smallholder farmers. In the medium term, smallholders are likely to face rising levels of poverty, food insecurity and malnutrition, as food becomes less accessible and as staple food prices climb. In Ethiopia, Kenya, Tanzania and Uganda, the impact of COVID-19 on food security has been exacerbated by a second outbreak of desert locusts in April 2020, causing significant damage to crops and pastures. Lower farming income together with a reduction in remittances may reduce the ability for farmers to access inputs. This heightens the risk of producing crops and livestock below capacity and worsens a food crisis previously triggered by droughts and economic mismanagement.

The COVID-19 crisis has further limited the movement of agricultural goods and remittances, which could discourage future investment in regional agri-food value chains. Most countries in East Africa have restricted movement across borders, limiting the informal cross-border trade of basic food staples such as cereals and remittances. In fact, there have been significant delays of border crossings for cargo trucks between Kenya and Uganda and between Kenya and Tanzania, which have had ripple effects on agri-food value chains downstream. Furthermore, governments in the region responded to previous food shortages by introducing export bans of agri-food products, which reduced the incentives for firms in East Africa to source their critical inputs from other countries in the region (Brenton and Hoffmann, 2016).

The digital transformation can facilitate agri-food value chains with the help of accommodative public policies

Both East African governments and start-ups have used new digital business models and innovations to make the agri-food value chains more efficient. East Africa is a global leader in mobile money use. The region counts 1 106 registered mobile money accounts for every 1 000 adults, compared to 600 for all of Africa, 533 for Asia and 245 for Latin America and the Caribbean. The rapid development of mobile money has lifted about 2% of Kenyan households (about 194 000) out of extreme poverty and has helped 185 000 women to transition from subsistence farming into business or sales occupations (Suri and Jack, 2016). The Kenyan business Twiga Foods established a new partnership with the e-commerce platform Jumia to distribute fruits and vegetables directly to customers’ homes. Twiga Foods has over 100 000 customers in Kenya that rely on its services and distributes more than 600 tons of products to 10 000 retailers daily (Kene-Okafor, 2021).

Applying digital applications has enhanced the functioning of trade-related services. Automated customs procedures and electronic certificates of origin can accelerate the movement of goods across borders and improve tracking along supply chains. The new Kenya-based start-up Solar Freeze provides mobile solar-powered cold rooms to small-scale farmers to store their temperature-sensitive produce. It works with 3 000 small-scale farmers and has helped to increase agricultural yields by more than 150% since 2016 (Kibiti and Strubenhoff, 2019).

Digital solutions can help tackle longstanding challenges in agricultural production. Digital solutions have increased agricultural output and farmers income and developed more effective management of food security and agricultural transformation. Tumaini, an app used in Uganda, relies on artificial intelligence to determine product diseases from photographs taken by farmers (McKinsey, 2021). Advances in technology are also making it possible to comprehensively secure land rights in participatory and cost-effective ways that were unimaginable even a decade ago. For example, in 2018, the Rwanda Land Management and Use Authority, the Rwandan Information Society Authority and the United States Medici Land Governance established a blockchain-driven electronic process for land registration, which enables faster and more transparent data sharing to accelerate land transfers.

Digital solutions require supportive policy interventions. Barriers such as access to digital infrastructure, skills and financing prevent the widespread adoption of digital technologies. In many cases, digital solutions require complementary regulations and physical investments. For example, Kenya’s Land Registration Act 2012 gave the Registrar of Lands the mandate to develop an electronic registry of land. However, the automation programme has stalled due to various challenges including damaged or missing land records and poor ownership. Social institutions remain essential for providing locally legitimate processes to adjudicate on disputed claims (e.g. clarifying rights and agreeing on boundaries prior to a formal register entry).

Regional co-ordination is key to strengthening East Africa’s agri-food value chains

Policy makers in East Africa need to maintain the momentum in reducing barriers to intra-regional trade

Policy makers and the private sector have expressed strong interest in greater economic integration of the EAC. Contrary to other regional integration blocks in Africa, countries in EAC have signed, ratified and implemented most protocols into a treaty. These include the EAC Customs Union in 2005, the EAC Common Market in 2010 and the EAC Single Customs Territory in 2014. All of these have helped reduce tariffs but have also resulted in a rise in non-tariff barriers largely related to sanitary and phytosanitary standards, vehicle axle load and weight limits, insurance requirements, trade administration costs, suspended taxes and rules of origin, among others.

For the EAC, a comprehensive review of the Common External Tariff (CET) is imperative to maintain the stability and protect the integrity of the CET. The rising use of exclusions and duty remissions and revisions destabilises the CET and provides room for protectionism and unhealthy competition (Rauschendorfer and Twum, 2020). Governments can protect the integrity of the CET from entrenched interests by adopting simplified tariff bands and product classifications, strengthening regional competition authorities, and leveraging private sector champions and representation. In reviewing the CET, countries should aim towards limiting duty remissions and revisions to strictly essential interventions and introducing the progressive liberalisation of protected industries. Renegotiating the exclusion list can allow each member state to specialise in a particular segment to serve the regional market. In contrast, completely abandoning the exclusion list would be politically difficult, as the list permits small countries to develop and protect livelihoods.

Countries need to continue investing in the automation of trade and customs procedures such as electronic certificates of origin (e-CoO). A recent assessment of progress of e-CoO indicates that implementation has been slow both in COMESA and SADC, with only Mauritius having completely developed its facility (Mafurutu, 2020). The use of e-CoO in conjunction with the adoption of simple and easy rules of origin under the AfCFTA is of paramount importance to commercial exporters.

East Africa introduced trade facilitation measures in response to the COVID-19 crisis. The EAC issued a common region-wide strategy for recovery from the crisis. The strategy comprises a harmonised system for certifying and sharing test results, the adoption of an EAC digital surveillance and tracking system for drivers, the support of agricultural value chains and the establishment of special-purpose financing schemes for small and medium-sized enterprises. Other initiatives include the Regional Electronic Cargo Tracking System (RECTS), created by Uganda in 2013 and since adopted by Kenya and Rwanda, which helps monitor and track cargo operations and increases the interoperability of transport monitoring systems in East Africa. In addition, the Transport Corridor Trip Monitoring System to be piloted along the Zambia-DRC border is aimed at building a regulatory framework that ensures cross-border transport and transit monitoring to reduce COVID-19 transmission. This system will be integrated with the RECTS.

Reducing barriers to service trade can also help strengthen East Africa’s potential as a hub for service sectors such as ICT, travel and transport. Kenya, Madagascar, Mauritius and Rwanda have developed key capabilities to compete in the global value chains of ICT-enabled services, but there are ongoing challenges in breaking into the global value chains of business process outsourcing (Mann and Graham, 2016). For the service sectors, investment protocols and trade and investment facilitation are intricately linked with market liberalisation issues, with a commercial presence abroad being the most prevailing mode of delivery for trade in services. Yet, negotiations on trade in services are the most contentious, and the outcomes are often the most difficult to implement.

Regional co-ordination of national industrial strategies can help strengthen regional competitiveness

Regional co-operation needs to strike a balance between protecting domestic interests and promoting regional capabilities in strategic industries. The current global context reflects rising levels of economic protectionism and a retreat from market liberalisation and integration. Many governments have protected strategic sectors, including their state-owned enterprises (SOEs) and healthcare-related sectors (e.g. with export bans). In East Africa, especially within the EAC, countries have identified opportunities for regional industrial competitiveness and co-ordination in key sectors such as agri-food and textile. It also launched a Cotton, Textiles and Apparel Strategy in 2019, which aims at an integrated and globally competitive textiles and apparel industry (see Annex 5.A1).

Global lead firms can strengthen key segments of value chains. Global lead firms can help stimulate upstream industries in domestic economies, boost productivity through the transfer of technology and skills, and improve access to credit and markets for local producers. In agri-food value chains, foreign investments in infrastructure and the introduction of modern production practices can yield substantial benefits to small-scale farmers and local communities (UNCTAD, 2015). Value chains driven by market-seeking foreign direct investment need a well-crafted investment protocol governing such investment and the facilitation of capital mobility. Globally competitive, low-cost labour-intensive value chains require a different approach (especially greater sourcing flexibility) than skill- and capital-intensive manufacturing value chains.

Cluster policies can facilitate linkages if successfully designed and funded

Cluster policies can help create useful linkages between global lead firms and the local producers. Due to the low level of competitiveness by most East African producers, proactive policy support is necessary to promote local sourcing and the participation of domestic firms. One such form of support is cluster policies. They help concentrate public investment, capacity and co-ordination, and the close proximity inherent in clusters is conducive to knowledge transfer and innovation from lead firms. The scale, density and economic interactions that industrial clusters provide help facilitate connections between lead firms and local industrial networks through forward and backward linkages, between firms and workers (through labour pools and specialised skills) and between firms and consumers (through better access to market).

The success of clusters depends on policy design and many other criteria. Notably, local sourcing and participation of domestic firms are contingent on the policy designs of clusters such as special economic zones (including zone eligibility criteria, investor incentives, foreign ownership requirements and local market supply restrictions), the density and capability of supplier base, and sectoral specialisations of zones (Farole, 2011). Such place-based industrial policies command technical expertise, bureaucratic competence and the continuous upgrading of capabilities. Countries compete for foreign direct investment with a well-defined proposition based on cluster dynamism, comparative advantage and well-crafted incentive package. Therefore, more needs to be done to strengthen supplier development programmes and to build institutional capabilities to effectively implement cluster policies.

East African countries need to increase their efforts in retaining foreign direct investment as part of their COVID-19 response. Countries in the region have already implemented a range of FDI-retention policies. Ethiopia, for example, created a USD 6.5 million fund for wage subsidies to businesses in industrial parks (Table 5.1). Global experience suggests that keeping an arm-length relationship between the cluster management board and the lead firms is critical to facilitating joint problem-solving while avoiding policy capture.

Table 5.1. Cluster policy instruments to retain foreign direct investment and promote exports in response to COVID-19 in East Africa

|

Programme approach |

Example |

|---|---|

|

Transportation and export advantages |

East Africa: Free railway transport of manufacturing goods between Djibouti and Ethiopia, discounted logistics prices for exporters, and the lifting of the minimum price set by the National Bank of Ethiopia (NBE) for horticulture exports |

|

Wage subsidies/Job protection |

Ethiopia: A USD 6.5 million fund for wage subsidies and incentives to reward businesses in industrial parks that are able to adapt to COVID-19 |

|

New industrial parks |

Ethiopia: New garment industrial park in Hawassa by China’s Sinoma International Engineering Co. |

|

Liberalisation of foreign direct investment |

Ethiopia: Opening up all industries to foreign direct investment of at least USD 200 000 for a single project and allowing foreign direct investment in certain transport services |

|

New investment incentives |

Rwanda: Revised investment incentive scheme and investment code to reduce operational costs |

|

Fast-track development of industrial parks |

Uganda: Fiscal support including accelerated development of industrial parks, support of import substitution and export promotion through funding to Uganda’s Development Bank |

Source: Authors’ compilation.

In East Africa’s agri-food value chains, public investments and regional co-ordination can help increase the competitiveness of domestic producers. Public investments in agricultural research and development and extension services can help to boost productivity, as can programmes to promote farmers’ access to inputs (seeds, fertilisers, machinery) and to financing. Regional co-ordination can also address persistent challenges such as transboundary crop and livestock diseases, limited national research and breeding capacities, knowledge sharing, and the establishment of databases and of early warning and forecasting systems. To this end, the EAC has been actively pursuing a regional approach to enhancing food supply chains that includes policy harmonisation to enable the free flow of food staples from surplus areas to deficit areas, driven primarily by price incentives and market forces.

Cross-border special economic zones can promote interactions between industrial clusters across countries. Ethiopia and Kenya agreed to establish a free trade zone and develop infrastructure along the Moyle border region to create a commonly administered economic hub. This follows previous experience in West Africa (cross-border economic zone encompassing Burkina Faso, Côte d’Ivoire and Mali) and in Southern Africa (Musina/Makhado Special Economic Zone in South Africa). The Tatu City Special Economic Zone in Nairobi attracted USD 70 million from Cold Solutions to construct the largest cold storage warehouses in East Africa.

These cross-border special economic zones (SEZs) require strong institutional capacities. Cross-border SEZs involve deep policy integration and require political support from all governments involved and co-ordination at both state and local levels is crucial. Although cross-border industrial development is challenging, more countries are trying to align their SEZ strategies within regional efforts (UNCTAD, 2021b; World Bank, 2021). For example, ministers of industry from the 21 COMESA member states have approved the implementation strategy of the regional local content policy framework and the management of SEZs and industrial parks. The strategy aims to facilitate regional peer learning, to profile select SEZs as centres of excellence and to strengthen regional cross-border SEZs. Adherence to such frameworks can help guide member states when implementing SEZ strategies and industrial parks at the national level.

East African countries should co-operate to achieve the regional Single Digital Market

East Africa has a promising digital economy. For example, Kenya is among the three big e-commerce players in Africa, and Rwanda aspires to be a digital hub for business process outsourcing and knowledge process outsourcing, having just become the African e-commerce hub headquarters of the AfCFTA (Tralac, 2020; Banga, 2020). Kenya and Rwanda are pioneers of digital economy blueprints and digital financial inclusion, as well as cyber security.

The Single Digital Market for East Africa can help consolidate the region’s emerging digital economy and, like the Digital Economy Accelerator for Development (DEA4D) project, contribute to countries’ individual digital development. The Single Digital Market can facilitate regional connectivity, build data and online markets, and support ongoing regional integration initiatives (AUC/OECD, 2021). It aims simultaneously to harmonise the regional digital economy and to improve and develop national digital infrastructure. The Single Digital Market is currently in the initiation stage, following the development of a roadmap report, which defined its vision and strategic actions for implementation. Kenya, Rwanda and Uganda are also pursuing national digital development under the DEA4D project which addresses country-specific constraints identified through digital economy diagnostics. For example, it helped formulate Kenya’s Digital Economy Blueprint (Nyakanini et al., 2020).

Promoting universal coverage of the One Network Area (ONA) and investment co-operation in digital infrastructure is imperative to further reduce communication costs and achieve affordable access to digital infrastructure, notably for landlocked countries. ONA is an initiative to lower cross-border roaming charges, initially in Kenya, Rwanda and Uganda. In 2020, Tanzania joined the network, ahead of the EAC deadline. Tanzania currently provides telecommunications services to seven countries in the region and aspires to be a telecommunications hub of East and Central Africa. Also in 2020, Rwanda and Tanzania initiated talks to expand the partnership to the telecommunications sector. Burundi is the only East African country that has yet to join the network (Anami, 2021).

Harmonising regulations on digital trade, consolidating and ensuring the interoperability of digital platforms and payment systems, and promoting mutual regulatory co-operation are imperative. For example, under the Smart Africa Alliance, national governments, development partners and members of the private sector co-operate to advance smart procurement of digital infrastructure. The initiative aims to harmonise digital development through benchmarking country progress against the digital economy blueprint and to pilot selected initiatives in member states, with an emphasis on harmonisation.

Attracting investment in regional digital infrastructure and strengthening digital economy enablers are crucial to promoting regional value chains in the digital economy. Challenges in digital development include disparate and non-existent digital strategies, platform interoperability, and under-developed digital economy enablers such as skills (see Box 5.2). The e-commerce protocol in the AfCFTA could address issues of facilitation, market access and co-ordination with regional organisations working to meet the infrastructural challenges (through initiatives such as the Africa e-commerce platform and Afreximbank’s Pan African Payment System) (Tralac, 2020; ITU, 2021).

Box 5.2. Developing skills for the digital era in East Africa

Strong public-private partnerships can help overcome East Africa’s shortage of digital skills and eliminate gender disparities in those skills. By investing in sound partnerships between governments, industries, and technical and vocational education and training institutions, countries can increase educational opportunities. For example, the public-private partnerships of Enabel and MTN established digital services (including computers, servers and Internet connections) for innovation hubs in nine vocational training institutions. They provided youth with the opportunity to use the educational resources for skills development. In Rwanda, to address gender disparities in digital skills, WeCode offers ICT training to working-age Rwandan women irrespective of whether they have a prior ICT degree.

Countries can pool resources in developing regional centres for skills development. For example, the African Leadership University (ALU), with campuses in Mauritius and Rwanda, equips students with key skills that young entrepreneurs will need in the future and builds strong linkages between potential employers through work placements. The ALU will be expanded to 25 campuses across the continent to train 3 million young leaders over the coming 50 years. Another example is the Master’s programme African Masters of Machine Intelligence in Rwanda, which is supported by Google and Facebook. The programme, at the African Institute for Mathematical Sciences, trains African researchers and engineers to use artificial intelligence in a variety of sectors. Students from the institute have a completion rate of 91%, with all students accepting jobs within the continent.

Promoting intra-regional skills mobility to alleviate skills shortages and foster further integration. Skills mobility is an important determinant of backward and forward participation in global manufacturing value chains for African countries (Yameogo and Jammeh, 2019). Mutual recognition agreements implemented in the Regional Economic Communities lay the groundwork for professional licensing standardisation to support the AfCFTA’s implementation. For instance, the Common Market Protocol of the EAC recognises academic and professional labour qualifications, which facilitates sector-specific mutual recognition agreements in accounting, architecture, engineering and veterinary practices.

Annex 5.A1. Textile and clothing global value chains in East Africa

The textile and clothing sector is a critical source of employment in East Africa. The sector is composed of a majority of micro, small and medium-sized enterprises, generating large-scale employment – both for skilled and unskilled workers – especially for youth and women. In Ethiopia, the textile and clothing sector creates more than 80 000 jobs, and almost 80% of the workers employed in its apparel and garment segment are women. Furthermore, the apparel and garment segment has been growing in Kenya, Madagascar, Mauritius, Rwanda, Tanzania and Uganda (see Table 5.A1.1).

Table 5.A1.1. Performance of the textile and clothing sector in East Africa, 2016

|

Country |

Number of major factories |

dominant products |

Apparel, in USD million, (%) and as a % of GDP |

Direct employment |

Exports, in USD million |

Imports, in USD million |

|---|---|---|---|---|---|---|

|

Kenya |

22 |

Apparel, second-hand clothing |

374 (91%) 0.5% |

40 000 |

412 |

1 871 |

|

Uganda |

3 |

Cotton fiber, apparel, home textiles, second-hand clothing |

Not available |

5 000 |

22 |

108 |

|

Tanzania |

17 |

Cotton fiber, apparel, home textiles, second-hand clothing |

47.6 (40%) 0.1% |

20 000 |

236 |

977 |

|

Ethiopia |

70 |

Apparel, home textiles, cotton yarn |

81.4 (76%) 0.15% |

80 000 |

107 |

773 |

|

Madagascar |

70 |

Apparel, fabric |

625 (94%) 6.4% |

100 000 |

662 |

573 |

|

Mauritius |

100 |

Apparel, fabric, cotton yarn |

702 (89%) 6.4% |

45 000 |

785 |

354 |

Source: Authors’ compilation based on UN (2021), UN COMTRADE (database), https://comtrade.un.org/, and a review of empirical literature.

Most countries in the region have substantial untapped resources for growing cotton and developing a vibrant export-oriented textile and clothing sector. For example, Kenya has an estimated 385 000 hectares of land suitable for cotton production. However, only a fraction of that land is under cotton cultivation. The annual production of cotton lint in Kenya is approximately 7 000 tons versus a potential production of 200 000 tons of lint (ITC, 2020). The country has a vibrant textile and clothing sector with 22 major factories employing about 40 000 employees. In 2016, Kenya’s apparel exports to the rest of the world were valued at USD 374 million (USAID, 2018). Furthermore, between 2013 and 2018, Ethiopia’s textile and apparel industry has grown by 51%.

East Africa’s textile and clothing value chain has integrated into global production networks, with limited regional linkages. For textile and footwear production, for example, the region’s import of intermediate goods more than doubled in ten years, from USD 911 million in 2009 to USD 2 089 million in 2019, while the share of regional sourcing dropped from 4.5% to 2.6% over the same period.

The global textile and clothing value chain is expected to continue to provide jobs. Large-scale automation in the textile and clothing sector is unlikely to occur in the near future, especially in labour-intensive segments such as sewing. Recent estimates suggest that in the next 15 to 20 years, manual labour in the sector will remain economically more attractive than automation (Tilman et al., 2020). Rising wages in China could push 81 million low-cost industrial jobs, including those in the textile and clothing sector, to other countries, such as those in East Africa.

Increasing competitiveness is critical to reducing the region’s dependence on preferential access to global markets for attracting investments. In terms of labour productivity, Ethiopia is the only country in the region that can compete with other global production hubs, such as Bangladesh and Viet Nam. While producers in the many East African countries benefit from duty-free market access to the European Union (under the Economic Partnership Agreement and Everything But Arms initiative) and to the United States (under the African Growth and Opportunity Act), they need to increase their competitiveness to sustainably take advantage of such opportunities. In the past, the loss of preferential market access has led to a complete burst of the domestic industry in Madagascar and Mauritius (Fernandes et al., 2019). At home, local producers also face difficulty in competing with imported second-hand clothing.

A lack of skilled technicians and specialists limits productivity gains and value addition in the textile and clothing value chain. A shortage of skills can lower gains from capital investment because often companies do not have adequately skilled staff to operate new equipment. For example, in Ethiopia, the weak linkage between universities and technical and vocational educational training institutions, insufficient standardised certifications of training, and the absence of in-company training courses are bottlenecks to skills upgrading. Furthermore, as Ethiopia’s textile and clothing sector is relatively young, many managers lack sector-specific knowledge and locally owned companies find it more difficult to access foreign expertise than do foreign-owned companies (ITC, 2015).

Disregarding environmental and social standards can have negative spillover effects and render producers ineligible to supply to socially concerned buyers. For example, in Ethiopia, factory workers often exceed the maximum amount of allowed working hours and are exposed to technologically outdated and environmentally damaging machinery. In fact, few Ethiopian factories have certifications from the European Union’s Business Social Compliance Initiative or the United States Worldwide Responsible Accredited Production, which could help increase demand for products. In addition, the Ethiopian textile and clothing sector constitutes a major part of the manufacturing sector and hence defines the country’s environmental and social conduct for other manufacturing production chains (ITC, 2015).

References

Absulsamad, A. and G. Gereffi (2017), “Dairy value chains in East Africa”, Policy Brief, International Growth Centre, www.theigc.org/wp-content/uploads/2017/03/Dairy-chain-brief.pdf.

Anami, L. (2021), “Tanzania joins One Network Area for lower cross-border call tariffs”, The East African, www.theeastafrican.co.ke/tea/business/tanzania-joins-one-network-area-3412976, (accessed 1 November 2021).

AUC/OECD (2021), Africa’s Development Dynamics 2021: Digital Transformation for Quality Jobs, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/0a5c9314-en.

AUC/AfDB/UNCECA (2019), African Regional Integration Index 2019, African Union Comission, African Development Bank and United Nations Conference for Economic Comission for Africa, www.integrate-africa.org/fileadmin/uploads/afdb/Documents/ARII2019_technical_report_EN.pdf.

Banga, K. (2020), “Can the digital economy help mitigate the economic losses from COVID-19 in Kenya?”, Supporting Economic Transformation, 20 April 2020, Overseas Development Institute, https://set.odi.org/wp-content/uploads/2020/04/Can-the-digital-economy-help-mitigate-the-economic-losses-from-COVID-19-in-Kenya.pdf.

Bingi, S. and F. Tondel (2015), “Recent development in the dairy sector in Eastern Africa: Towards a regional policy framework for value chain development”, European Centre for Development, https://ecdpm.org/wp-content/uploads/BN-on-dairy-sector-in-EA_final1.pdf.

Brenton, P. and B. Hoffman (2016), Political Economy of Regional Integration in Sub-Saharan Africa, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/24767.

Bright, J. (2020), “Africa turns to mobile payments as a tool to curb COVID-19”, 25 March 2020, Techcrunch, https://techcrunch.com/2020/03/25/african-turns-to-mobile-payments-as-a-tool-to-curb-covid-19/ (accessed 9 November 2021).

Casella, B. et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc/ (accessed 1 October 2021).

CEPII (2021), BACI (database), Centre d’Etudes Prospectives et d’Informations Internationales, www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37 (accessed 1 October 2021).

Daly, J. et al. (2017), “Maize value chains in East Africa”, International Growth Centre, https://www.thegic.org/wp-content/uploads/2017/05/Daly-et-al-2017-Maize-paper-1.pdf.

De Melo, J. and A. Twum (2021), “Prospects and Challenges for Supply Chain Trade under the Africa Continental Free Trade Area”, Journal of African Trade, 25 January 2021, https://doi.org/10.2991/jat.k.210105.001.

De Melo, J. and A. Twum (2020), “Supply chain trade in East Africa: Prospects and challenges”, FERDI Working Paper P263, https://ferdi.fr/en/publications/supply-chain-trade-in-east-africa-prospects-and-challenges.

EABC (2021), “Impact of COVID-19 on light manufacturing (production/processing, distribution and export) in the East African Community (EAC)”, East African Business Council, https://eabc-online.com/download/impact-of-covid-19-on-light-manufacturing-production-processing-distribution-and-export-in-the-east-african-community-eac/.

Farole, T. (2011), Special Economic Zones in Africa: Comparing Performance and Learning from Global Experience, World Bank, Washington, DC https://documents1.worldbank.org/curated/en/996871468008466349/pdf/600590PUB0ID181onomic09780821386385.pdf.

FAO (2017), The State of Food and Agriculture: Leveraging Food Systems for Inclusive Rural Transformation, United Nations Food and Agriculture Organisation, Rome, www.fao.org/3/I7658EN/i7658en.pdf.

Fernandes A. M. et al. (2019), “Are trade preferences a panacea? The export impact of the African Growth and Opportunity Act”, Policy Research Working Paper No. 8753, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/31316.

fDi Markets (2021), fDi Markets (database), www.fdimarkets.com (accessed 1 October 2021).

Fowler, M. and J. Rauschendorfer (2019), “Agro-industrialisation in Uganda: Current status, future prospects and possible solutions to pressing challenges”, Working Paper, International Growth Centre, www.theigc.org/wp-content/uploads/2019/11/Fowler-and-Rauschendorfer-2019-Working-paper-v2.pdf.

IMF (2021), Regional Economic Outlook: Sub-Saharan Africa, International Monetary Fund, Washington, DC, www.imf.org/en/Publications/REO/SSA/Issues/2021/10/21/regional-economic-outlook-for-sub-saharan-africa-october-2021.

ITC (2020), Kenya: Cotton, Textile and Apparel Sector Investment Profile, International Trade Centre, https://www.intracen.org/uploadedFiles/intracenorg/Content/Redesign/Projects/PIGA/Kenya_CTA_booklet_20200513_web.pdf.

ITC (2015), Ethiopia: Textile and Clothing Value Chain Roadmap 2016-2020, International Trade Centre, Geneva, https://www.intracen.org/uploadedFiles/intracenorg/Content/Redesign/Projects/SITA/Ethiopia%20TC%20VCR%205-2_web.pdf.

ITU (2021), Digital Trends in Africa 2021: Information and Communication Technology Trends and Developments in the Africa Region, 2017-2020, International Telecommunications Union, www.itu.int/pub/D-IND-DIG_TRENDS_AFR.01-2021/fr.

Kene-Okafor, T. (2021), “Kenya’s Twiga raises $50M to scale food solutions across Africa”, 1 November 2021, Techcrunch, https://techcrunch.com/2021/11/01/kenyas-twiga-raises-50m-to-scale-affordable-food-solutions-across-africa/ (accessed on 6 November 2021).

Kibiti, B. and H. Strubenhoff (2019), “How off-grid cold storage systems can help famers reduce post-harvest losses”, Brookings, www.brookings.edu/blog/future-development/2019/10/16/how-off-grid-cold-storage-systems-can-help-farmers-reduce-post-harvest-losses/ (accessed 1 November 2021).

Leyaro, V. (2021), “Trade effects of East African Customs Union in Tanzania: Application of a structural gravity model”, WIDER Working Paper 2021/55, https://www.wider.unu.edu/publication/trade-effects-east-africa-customs-union-tanzania.

Mafurutu, R. (2020), “Use of Electronic Certificates of Origin now and beyond Covid-19 in intra-African trade”, www.tralac.org/blog/article/14710-use-of-electronic-certificates-of-origin-now-and-beyond-covid-19-in-intra-african-trade.html.

Mann, L. and M. Graham (2016), “The domestic turn: Business process outsourcing and the growing automation of Kenyan organisations”, The Journal of Development Studies, Vol. 52/4, pp. 530-548, https://doi.org/10.1080/00220388.2015.1126251.

McKinsey (2021), “How digital tools can help transform African agri-food systems”, McKinsey, www.mckinsey.com/industries/agriculture/our-insights/how-digital-tools-can-help-transform-african-agri-food-systems.

Mitchell, C. et al. (2021), “Transforming Africa’s food systems from the demand side”, Boston Consulting Group, www.bcg.com/publications/2021/transforming-africa-food-systems-from-demand-side.

Mold, A. (2020), “Risk and resilience: How East Africa could bounce back from the COVID-19 Pandemic”, OECD Development Matters blog, https://oecd-development-matters.org/2020/06/02/risk-and-resilience-how-east-africa-could-bounce-back-from-the-covid-19-pandemic/.

Newman, C. et al. (2020), “Linked-in by FDI: The role of firm-level relationships for knowledge transfers in Africa and Asia”, The Journal of Development Studies, Vol. 53/3, pp. 451-468, https://doi.org/10.1080/00220388.2019.1585813.

Nyakanini G. et al. (2020), Unlocking the Digital Economy in Africa: Benchmarking the Digital Transformation Journey, Digital Impact Alliance, https://digitalimpactalliance.org/research/unlocking-the-digital-economy-in-africa-benchmarking-the-digital-transformation-journey/.

Odijie, M. E. (2019), “The need for industrial policy coordination in the African Continental Free Trade Area”, African Affairs, Vol. 118/470, pp. 182-193, https://doi.org/10.1093/afraf/ady054.

OECD/FAO (2020), OECD-FAO Agricultural Outlook 2020-2029, Organisation for Economic Development and Cooperation/Food and Agriculture Organisation of the United Nations, www.fao.org/3/ca8861en/CA8861EN.pdf.

Oiro, R., B. Owino and M. Mendez-Parra (2017), “Non-tariff barriers and complaints in the East African Community’s reporting process”, Working Paper, Overseas Development Institute, https://cdn.odi.org/media/documents/11409.pdf.

Qiang, C. Z., L. Zhenwei and V. Steenbergen (2021), An Investment Perspective on Global Value Chains, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/35526.

Rauschendorfer, J. and A. Twum (2020), “Unmaking of a customs union: Regional (dis)integration in the East African Community”, Working Paper F-20020-UGA-1, International Growth Centre, www.theigc.org/wp-content/uploads/2021/01/Rauschendorfer-and-Twum-2020-Working-paper.pdf.

Suri T. and W. Jack (2016), “The long-run poverty and gender impacts of mobile money”, SCIENCE, Vol. 354/6317, pp. 1288-1292, https://www.science.org/doi/10.1126/science.aah5309.

Tilman, A. et al. (2020), “Exporting out of China or out of Africa? Automation versus relocation in the global clothing industry”, Working Paper, Deutsches Institut für Entwicklungspolitik, https://www.die-gdi.de/discussion-paper/article/exporting-out-of-china-or-out-of-africa-automation-versus-relocation-in-the-global-clothing-industry/.

Trademark East Africa (2020), “Regional traders seek answers on cross-border cargo delays”, Trademark East Africa, https://www.trademarkea.com/news/regional-traders-seek-answers-on-cross-border-cargo-delays/.

Tralac (2020), “An agenda for the AfCFTA Protocol on e-Commerce”, 25 June 2020, Tralac Blog, https://www.tralac.org/blog/article/14692-an-agenda-for-the-afcfta-protocol-on-e-commerce.html.

Tschirley, D. et al. (2015), “Africa’s unfolding diet transformation: Implications for agrifood system employment”, Journal of Agribusiness in Developing and Emerging Economies, Vol. 5/2, pp. 102-136, https://doi.org/10.1108/JADEE-01-2015-0003.

UN (2021), “Monthly trade data” in UN Comtrade (database), United Nations, New York, https://comtrade.un.org/ (accessed 1 October 2021).

UNCTAD (2021a), World Investment Report 2021: Investing in Sustainable Recovery, United Nations Conference on Trade and Development, https://www.un-ilibrary.org/content/books/9789210054638.

UNCTAD (2021b), Handbook on Special Economic Zones in Africa: Towards Economic Diversification across the Continent, United Nations Conference on Trade and Development, https://unctad.org/system/files/official-document/diaeia2021d3_en.pdf.

UNCTAD (2020), World Investment Report 2020: International Production Beyond the Pandemic, United Nations Conference on Trade and Development, https://unctad.org/fr/node/27504.

UNCTAD (2015), Commodities and Development Report 2015: Smallholder Farmers and Sustainable Commodity Development, United Nations Conference on Trade and Development, https://unctad.org/system/files/official-document/suc2014d5_en.pdf.

UNECA/TradeMark East Africa (2020), Creating a Unified Regional Market: Towards the Implementation of the African Continental Free Trade Area in East Africa, United Nations Economic Commission for Africa, Addis Ababa, https://hdl.handle.net/10855/43754.

USAID (2018), USAID East Africa Trade and Investment Hub: Overview of the Cotton, Textile and Apparel Sectors in East Africa Region (Kenya, Uganda, Tanzania, Ethiopia, Madagascar and Mauritius) and Benchmarking with Sri Lanka and Bangladesh, https://agoa.info/images/documents/15582/hubmappingofeacandbenchmarkingwithsrilankaandbangladesh.pdf.

World Bank (2021), World Development Indicators (database), World Bank, Washington, DC, https://databank.worldbank.org/source/world-development-indicators (accessed 1 October 2021).

World Bank (2020), World Development Report 2020: Trading for Development in the Age of Global Value chains, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/32437.

Yameogo, N. D. and K. Jammeh (2019), “Determinants of participation in manufacturing GVCs in Africa: The role of skills, human capital endowment and migration”, Policy Research Working Paper No. WPS 8938, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/32058.

Notes

← 1. The Productive Integration Index captures the extent to which countries regionally source intermediate goods and complement each other with their merchandise exports, whereas the Infrastructural Integration Index proxies for cross-border road connectivity, cross-border electrical infrastructure, the cost of mobile roaming. The latter is a composite index of nine measures of the state of electricity, transport, information and communication technologies, and water and sanitation in an area. It serves in place of comprehensive, reliable data on regional infrastructure (AUC/AfDB/UNECA, 2019).

← 2. “This implies that production is not geographically dispersed within the continent and countries are not reaping the benefits of variations in comparative advantage across countries. This may largely be due to poor or inexistent logistics that are necessary for regional supply to be operational.” (AUC/AfDB/UNECA, 2019)