This chapter analyses public policies to revitalise the energy value chain and thus speed up post-COVID economic recovery in North Africa (Algeria, Egypt, Libya, Mauritania, Morocco and Tunisia). These countries face institutional, logistical, infrastructural and technical constraints that prevent them from taking full advantage of the energy value chain despite their immense natural endowments. The chapter opens with an overview of the macroeconomic context and how it relates to North African countries’ level of integration in value chains. The focus then shifts to the region’s energy potential and the importance of energy both to macroeconomic stability and to promoting employment. Finally, the chapter identifies the challenges and opportunities of the post-COVID environment before putting forward public policies to develop the energy value chain (EVC) in North Africa.

Africa's Development Dynamics 2022

Chapter 6. Integrating value chains in North Africa and the energy industry

Abstract

In Brief

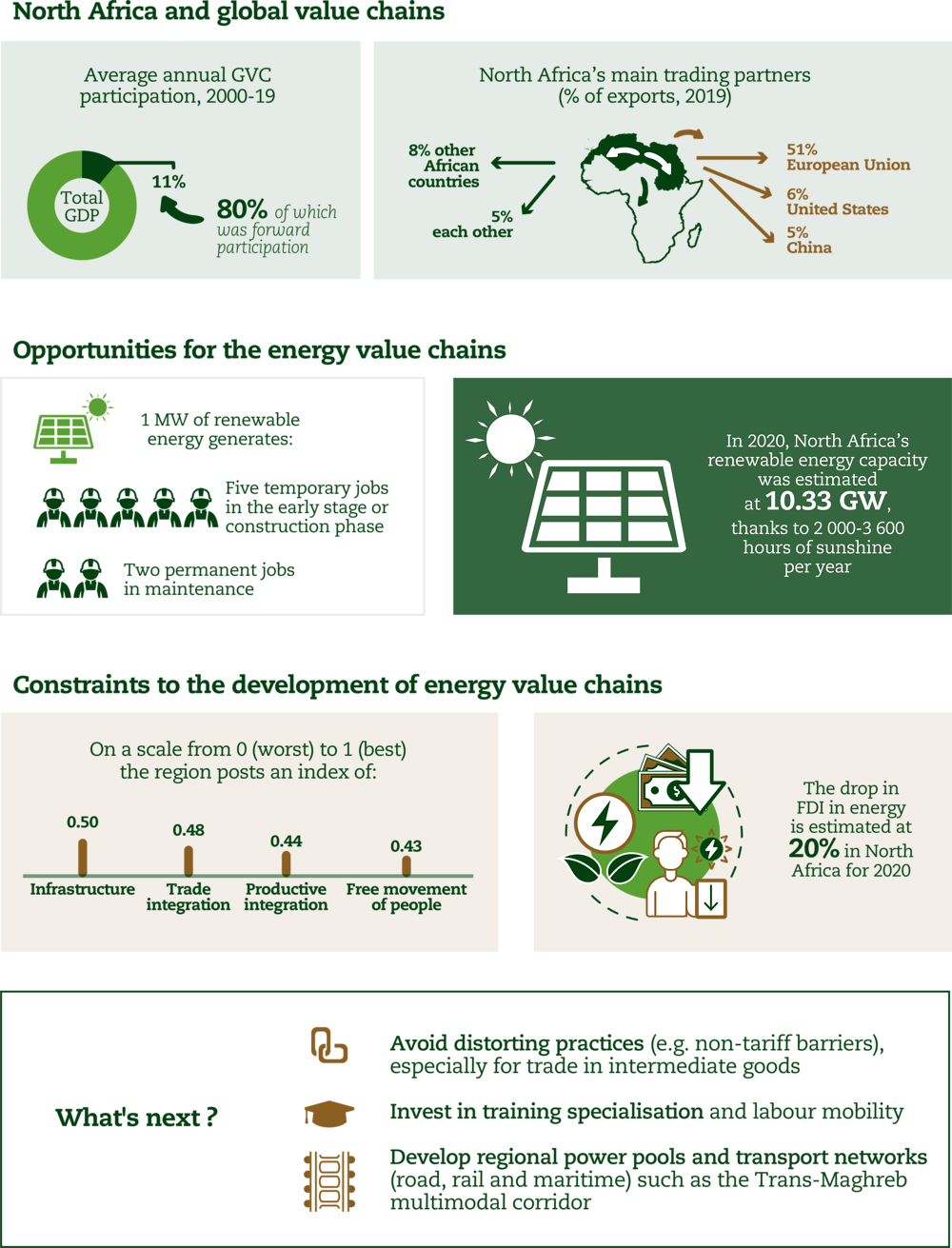

The instability of the macroeconomic environment, as exemplified by the 1.7% decrease in growth in 2020, makes it difficult for North African countries to integrate value chains, including energy value chains (EVCs). Nonetheless, as a result of the region’s non-renewable resource wealth (42.3% of its exports in 2018) and its significant potential for renewable energy (10.33 GW in 2020), energy remains a dominant factor in North Africa’s positioning in global value chains (GVCs). These endowments favoured the region’s GVC participation in 2000-19 along forward rather than backward activities (at 80% and 20% respectively), due to the limited sophistication and diversification of its fossil-fuel exports.

Although the renewable energy sector is a factor for macroeconomic stabilisation and leverages employment in the sub-region, institutional and technical constraints still weight on the EVC and hamper its development. However, the new possibilities and changes emerging from the COVID-19 pandemic are a source of opportunities. Those opportunities are enhanced by the ratification of the African Continental Free Trade Area (AfCFTA) by all North African countries. Specifically, policies to consolidate the EVC must build human capital, facilitate trade in energy through regional harmonisation of trade policies, develop transport and logistical infrastructures and improve the business climate.

North Africa (infographic)

North Africa regional profile

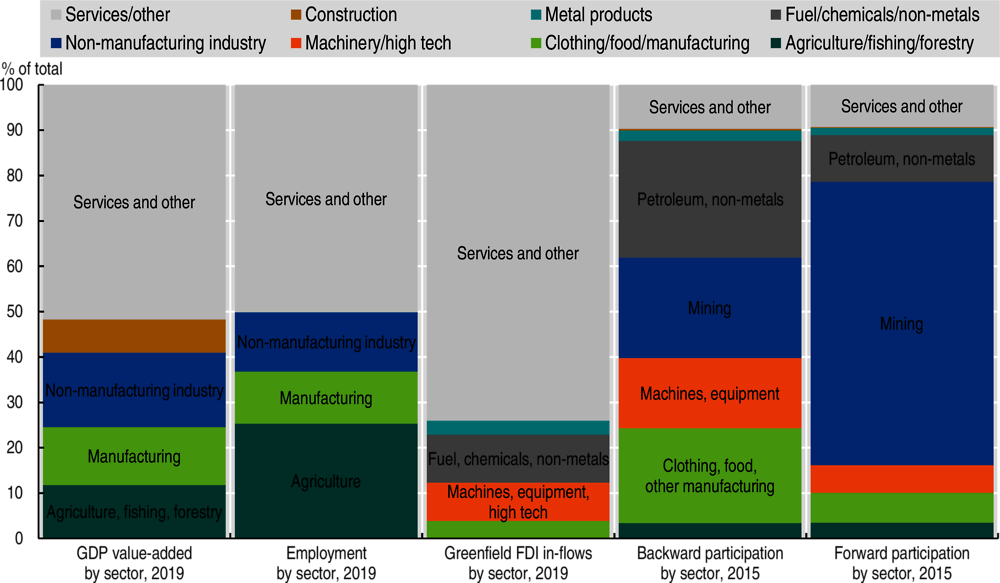

Figure 6.1. Economic and trade profiles of North Africa, expressed as % of total

Notes: GDP = gross domestic product; FDI = foreign direct investment. The different sources for the data do not share common definitions of economic sectors, commodities or activities. However, colouring is used in this figure in order to indicate shared themes across datasets.

Source: Authors’ calculations based on World Bank (2020a), World Development Report 2020, GVC database, www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data; fDi Markets (2021), fDi Markets (database); and World Bank (2021a), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

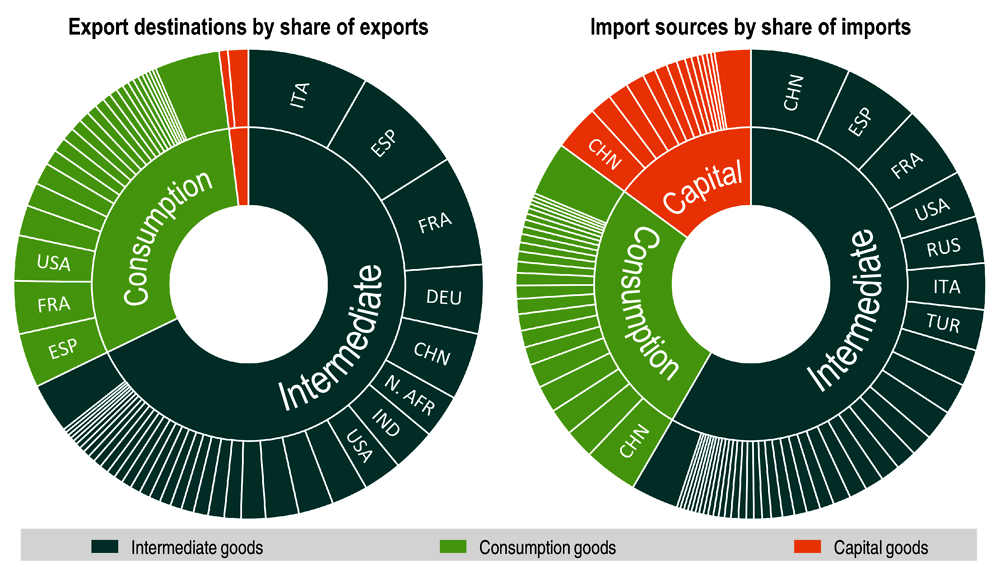

Figure 6.2. North Africa’s most important trade partners broken down by volume of trade in intermediate, consumption and capital goods

Notes: Countries are presented using their three-letter ISO codes. The African countries are aggregated into the five sub-regions defined by the African Union as follows: C. AFR = Central Africa, E. AFR = East Africa, N. AFR = North Africa, S. AFR = Southern Africa, W. AFR = West Africa. Interior trade within the Southern Africa Customs Union is excluded.

Source: Authors’ calculations based on data from CEPII (2021), BACI (database), www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37.

The macroeconomic environment makes it difficult for North African countries to further participate in value chains

The macroeconomic environment in North Africa remains unstable

The outlook for economic growth in North Africa continues to be relatively stable following the 1.7% drop recorded in 2020 as a result of the COVID-19 pandemic. Having risen steadily from 1.6% to 4.2% between 2014 and 2019, activity fell by 1.3% in 2020 (IMF, 2021). The drop was linked to the health crisis and sparked the worst depression for 20 years. The contraction caused by the collapse in oil prices was strongest in Libya (-59.7%), followed by Tunisia and Algeria, albeit to a lesser extent. The overall outlook, which assumes average growth of 5% over the next five years, can be improved if North Africa increases its participation in regional value chains (RVCs) and GVCs.

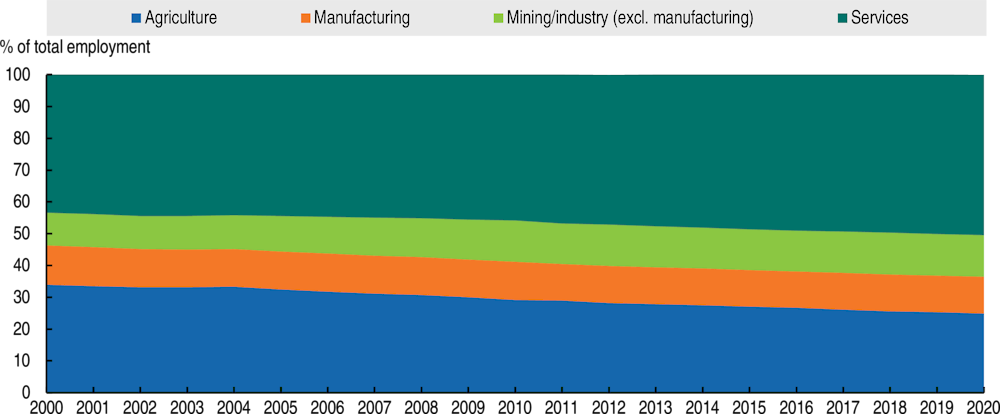

Despite the improved quality of the labour force, sectoral distribution of employment has not benefited industry and manufacturing. Over the 2000-20 period, the share of employment in services rose from 43% to 50%, and from 10% to 13% in mining and industry, whereas employment in manufacturing remained fairly steady (12%, Figure 6.3).

Figure 6.3. Sectoral distribution of employment in North Africa, 2000-20

Source: Authors’ compilation based on data from the ILO (2020), ILOSTAT (database), www.ilo.org/ilostat.

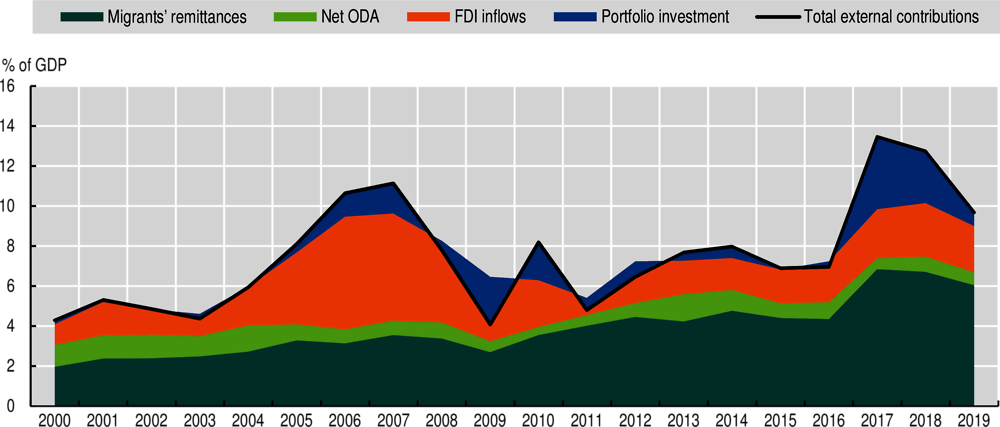

With the exception of migrants’ remittances, foreign financial flows to promote integration in value chains are not only weak but erratic. Upgrading domestic economies costs money. That money can come from the rest of the world if domestic savings are inadequate. The performance of foreign financial flows is erratic (Figure 6.4). Overall, the flows increased from 4.3% to 9.9% of GDP between 2000 and 2019, but were driven by migrants’ remittances (averaging 4% between 2000-19), which are intended for domestic consumption rather than productive investment. Foreign direct investment (FDI) and portfolio investments are crucial to GVC development. Certain countries such as Egypt, Morocco and Tunisia have provided for measures to improve the business climate so as to attract FDI. However, performance of FDI flows reflects general volatility. For instance, FDI inflows in North Africa represent 2.4% of GDP on average, compared to 2.9% in East Asia and the Pacific and 4.2% in Europe and Central Asia over the same period (World Bank, 2021a). Consequently, the under-development of industry in North Africa and the resulting low involvement of the region in GVCs can be explained by the weakness and instability of productive external financial flows. Harnessing FDI in industry remains a crucial step towards improving North African countries’ positioning in GVCs.

Figure 6.4. Financial inflows to North Africa as a percentage of GDP, 2000-19

Source: Author’s calculations based on OECD-DAC (2021), International Development Statistics (IDS) online databases, www.oecd.org/dac/stats/idsonline; UNCTADStat (2021), UNCTAD Statistics, http://unctadstat.unctad.org/wds/ReportFolders/reportFolders.aspx; World Bank (2021b), World Bank Migration and Remittances Data, www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data; IMF (2019), World Economic Outlook Database, October 2019 Edition, www.imf.org/en/Publications/WEO/weo-database/2019/October (portfolio flows and gross private savings are not included in more recent editions of this dataset).

North African countries continue to make slow progress in GVCs

Several factors have resulted in North Africa being better integrated in GVCs than any other African sub-region. Significant investment in infrastructure and manufacturing capacity has enabled flows of goods seamlessly to become part of GVCs in recent years. The region benefits from its proximity to the European Union (EU), and many of its countries have preferential access to the EU and US markets through association and free trade agreements (UNECA, 2016). Although North Africa has not taken full advantage of these strengths, it has been able to satisfactorily position itself in certain GVCs.

However, the fact that GVC participation is predominantly forward rather than backward reduces its GVC participation. While backward participation in value chains refers to the foreign value-added content of a country’s exports, forward participation refers to the local value added of third countries’ exports. For example, the degree of backward participation of a country that exports unprocessed raw materials is low because its exports contain no foreign added value. However, its forward participation will be higher because, once processed into finished products by third countries, the raw materials will contain a high level of value added by the country that imported the raw materials.

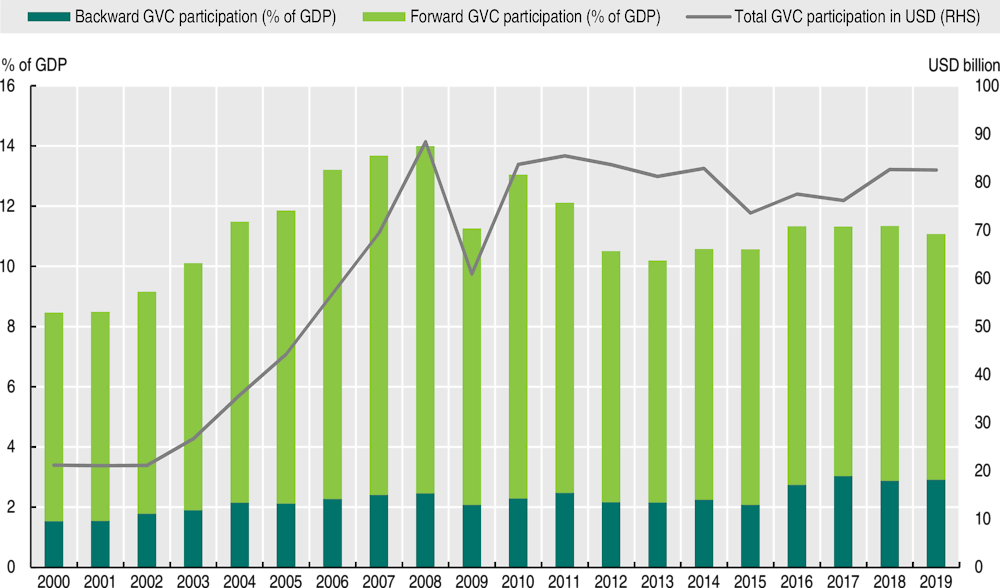

North Africa’s forward participation in GVCs increased more rapidly than backward participation in the period between 2000 and 2019. Overall, North Africa’s GVC participation was trending upwards (Figure 6.5) until the sharp fall caused by the international financial crisis of 2008. What is more, the countries of North Africa are integrated in the least profitable GVC segments. A high share of the value-added they generate is contained in third countries’ exports. Over the 2000-19 period, backward participation represented on average 20% of total GVC participation and forward participation represented 80%. The reason for this lies in the low level of sophistication and diversification of the region’s exports. Although it is crucial for North Africa to participate in GVCs, the priority must be to achieve better positioning through stronger backward participation. Developing chains for processing raw materials into finished or semi-finished products would make that objective achievable.

Figure 6.5. North Africa’s participation in global value chains

Note: GVC = global value chain; RHS = right-hand side. The GVC participation for North Africa reported here is an average of national figures for GVC participation as a percentage of GDP weighted by national GDP expressed in PPP dollars.

Source: Authors’ calculations based on data from Casella et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc/.

There are two models of GVC integration. The first is that of Algeria, Libya and Mauritania and involves strong forward participation. These countries’ leading exports are raw materials including gas for Algeria and Libya, and iron ores and fisheries products for Mauritania. Almost all manufactured and finished products are imported. In the second model, comprising Egypt, Morocco and Tunisia, exports have progressed from agricultural commodities to manufactured products. The private sector is comparatively developed and has better backward GVC participation. However, although the non-oil-producing countries have diversified, their participation in value chains is not better than that of the oil-exporting countries. During the 2000-19 period, the two countries with the highest average GVC participation were Libya (23%) and Algeria (21%), two oil-exporters. Tunisia and Morocco, on the other hand, which mostly export more complex products such as automobiles, wires and garments, had average GVC participations of 14% and 10%, respectively. Food products account for 49.3% of Egypt’s exports (AUC/OECD, 2019), but Egypt’s participation in GVCs was only 3% between 2000 and 2019.

Sector/product-based analysis shows that the energy sector dominates North Africa’s GVC participation. Exports of minerals/oil represent 42.3% of the total figure, way ahead of services (16.7%) and agriculture (13.7%, Table 6.1). These statistics show that the EVC plays a key role in North Africa’s GVC participation. The bulk of oil-exporting countries have several refineries that increase their backward influence on the chain: there are 10 in Egypt, five in Algeria and five in Libya. These three countries are medium-sized players in the global market (ranking 26th, 16th and 10th respectively in terms of oil reserves). The other North African countries are net importers of oil and gas but have significant deposits of their own. In 2020, Libya’s proved oil reserves stood at 48.4 billion barrels (2.8% of world reserves), Algeria’s stood at 12.2 billion (0.7% of world reserves) and Egypt’s at 3.3 billion (0.2% of world reserves) (BP, 2021).

Table 6.1. Export shares by sector in North Africa (2018, as a percentage)

|

Sector |

Algeria |

Egypt |

Libya |

Morocco |

Mauritania |

Tunisia |

Annual average |

|---|---|---|---|---|---|---|---|

|

Agriculture |

0.8 |

10.2 |

0.2 |

13.6 |

48.0 |

9.6 |

13.7 |

|

Chemicals |

3.7 |

10.3 |

0.3 |

9.1 |

0.6 |

5.1 |

4.9 |

|

Electronics |

0.1 |

3.3 |

0.0 |

10.7 |

0.2 |

20.9 |

5.9 |

|

Machinery/equipment |

0.2 |

0.6 |

0.0 |

1.1 |

0.4 |

6.0 |

1.4 |

|

Metals |

0.2 |

4.6 |

1.1 |

1.4 |

0.8 |

2.9 |

1.8 |

|

Minerals/oil |

94.7 |

16.8 |

95.7 |

4.0 |

35.8 |

6.7 |

42.3 |

|

Others |

0.2 |

0.3 |

0.1 |

0.5 |

0.3 |

0.3 |

0.3 |

|

Services |

0.0 |

42.3 |

0.0 |

37.7 |

0.0 |

20.1 |

16.7 |

|

Stones |

0.1 |

4.9 |

2.6 |

0.6 |

13.6 |

0.5 |

3.7 |

|

Textiles |

0.0 |

6.5 |

0.0 |

12.5 |

0.1 |

23.6 |

7.1 |

|

Vehicles |

0.0 |

0.2 |

0.0 |

8.9 |

0.2 |

4.4 |

2.3 |

|

Overall total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

Source: Growth Lab (2021), Atlas of Economic Complexity, https://atlas.cid.harvard.edu.

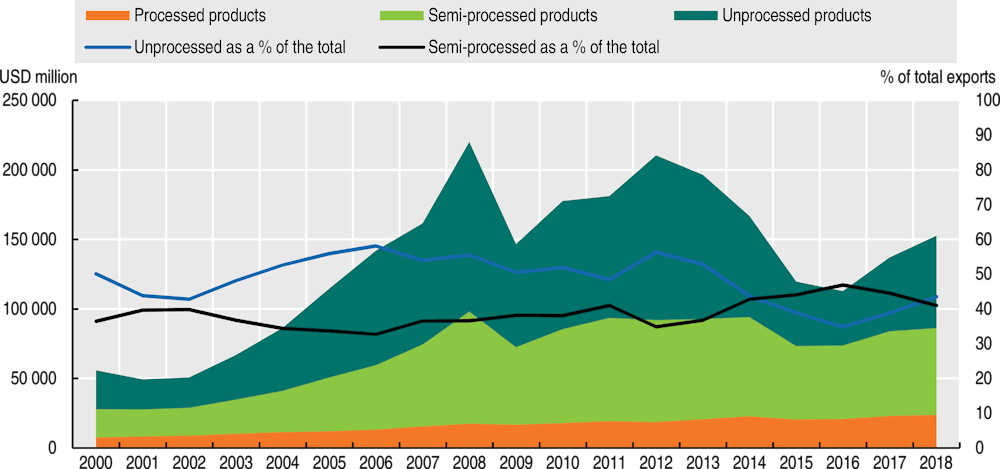

Over the 2000-18 period, exports of processed and unprocessed products grew overall, pointing to the region’s growing participation in international trade (Figure 6.6). Exports of unprocessed products, especially oil, fell sharply between 2013 and 2016 because of the supply glut triggered by the collapse in international prices. Between July 2014 and February 2016 the price of Brent crude oil fell by more than 65%, from USD 110 to USD 35 per barrel (INSEE, 2021). The slow-down in North African exports is linked to the economic downturn in China and the emerging countries, and to Iran’s return to the petroleum market following the Vienna Agreement signed on 14 July 2015.

Figure 6.6. Total exports by product manufacturing intensity

Source: Authors’ calculations based on modelling by Rieländer and Traoré (2015) and updated data from the International Trade Database at the Product-Level (BACI) developed by the Centre d’Études Prospectives et d’Informations Internationales (CEPII, 2020).

On average, oil is still the area’s primary product (40.3%), followed by manufactures (33%), food (13.1%), gold and metals (10.8%). Specifically, petroleum and its derivatives account for 97.7% of Libya’s exports and 95.9% of Algeria’s (AUC/OECD, 2019). This high dependence on black gold was reflected in a Herfindahl-Hirschmann Index (HHI), a measure of export concentration, of 0.76 for Libya and 0.32 for Algeria in 2018. By contrast, the export profile is more diversified in Egypt, Morocco (HHI of 0.04 in 2018) and Tunisia (HHI of 0.03 in 2018) – an asset for better integration in value chains.

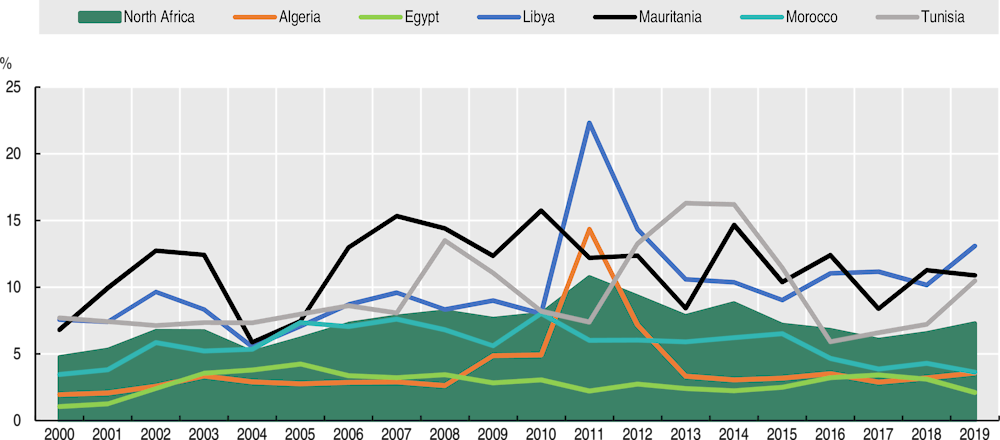

Additionally, the African continental market is an untapped opportunity to extend trade and develop RVCs. The North African countries do not trade much with each other (4.8% of exports in 2019) or with other African countries (8.2%). Their trade is mainly with Europe (50.9%) and, to a lesser extent, China (5.3%) and the United States (5.8%). Moreover, their integration is inadequate because of the low share of intracontinental trade in intermediate goods (average 7.2% between 2000-19, see Figure 6.A1.1 in the Annex), but also because of the similarity between their economies and the nature of the goods they export and import. Algeria and Morocco appear to have less involvement in intraregional trade in intermediate goods.

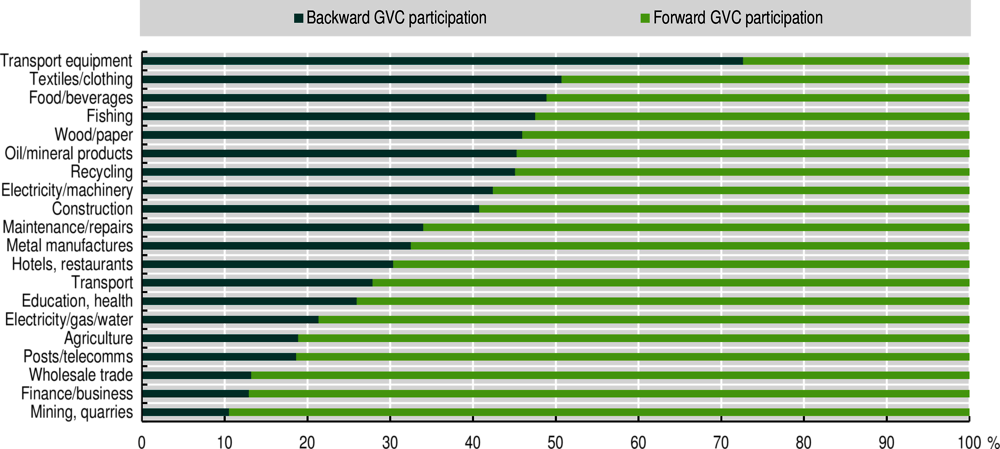

In order to boost the post-COVID recovery, North African countries should seek to increase their backward participation in other GVCs where they have a comparative advantage. To that end, they should continue to improve their positioning in those GVCs of greatest strategic importance in terms of employment and value creation. In Egypt, Morocco and Tunisia, services (finance/business, education/health, hotels/restaurants, etc.) dominate growth. Backward participation nears or exceeds 50% in transport equipment, textiles and clothing, and agri-food because of the progress in manufacturing (Figure 6.7). For these sectors, the control of the energy supply is still a major constraint that must be overcome in order to unleash growth and employment.

Figure 6.7. North Africa’s backward and forward sectoral participation in GVCs, 2015

Source: World Bank (2020a), World Development GVC Database, https://www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data.

Energy still dominates North Africa’s GVC positioning

The EVC is decisive for macroeconomic stability in North Africa

Control of the EVC is crucial to the macroeconomic stability of the oil-exporting countries of North Africa. Oil price volatility exposes them to external shocks. Since 2009, the price of a barrel of Brent crude increased steadily to settle above the USD 100 mark, between May 2011 and August 2014, before dipping to USD 30.7 in January 2016. Since then, the price of Brent crude has risen again and hovers around USD 60 (INSEE, 2021). Libya’s black gold revenues decreased from 62.4% of GDP in 2012 to 20.2% in 2016, before climbing again to 43.9% in 2019. The situation is similar in Algeria, where income from oil was 27.3%, 10% and 14.4% of GDP in 2011, 2016 and 2019 respectively (World Bank, 2021a).

The COVID-19 pandemic has exacerbated macroeconomic imbalances in the oil-exporting countries. In Algeria, where the selling of hydrocarbons finances 60% of the state budget, revenues from exports fell by 40% between 2019 and 2020 because of the COVID-19 crisis (Ecofin Agency, 2021). In Libya, the double whammy of the oil embargo and the health crisis was a heavy blow to public finances. Oil rents fell from USD 22.4 billion to USD 1.7 billion between 2019 and 2020. The abyssal 92.2% drop resulted in a budget deficit (59.3% of GDP) and a current account deficit (52.6% of GDP) (Directorate General of the Treasury, 2021). Lowering export revenues increase the pressure on foreign exchange reserves and undermines the economic and monetary situation. Integration in GVCs for petroleum derivatives would allow diversification of revenue sources and reduce reliance on exports of crude oil.

There is scope for non-oil-producing countries in North Africa to develop value chains based on renewable energy (RE) so as to reduce the energy bills that worsen their trade deficits. The low refinery capacity of North Africa’s oil-producing countries affects the energy dependence of non-oil-producing countries such as Morocco and Tunisia. Between 2011 and 2014, Morocco imported on average, 90.6% of its energy consumption, compared to 28.6% by Tunisia (World Bank, 2021a). In 2015, Morocco’s energy imports accounted for 6.5% of GDP despite the drop in world prices (OECD, 2017). In 2019, Morocco imported the bulk of its butane gas consumption from the United States (44%) and Europe (40%), followed by Algeria (16%). Its petrol supplies come mainly from Europe – Spain, Italy, the Netherlands (87%) – and Russia (12%) (El Mouden and El Harrak, 2020). The region’s oil and gas needs are met by imports from Italy, Kuwait, Russia, Saudi Arabia, Spain and the United States (UNECA, 2018). Moreover, for non-oil-producing countries, imports of petroleum add to the trade deficit: Mauritania (-7.1% of GDP in 2019), Tunisia (-6.3% of GDP in 2019) and Morocco (-6.2% of GDP in 2019) (IMF, 2021).

For both models of GVC integration, greater deployment of RE would appear crucial to reduce structural dependence on world oil prices. Algeria, Egypt and Libya are among the 15 countries that have the largest bills for energy consumption subsidies, at USD 15.8 billion in Egypt in 2019, USD 13.1 billion in Algeria and USD 4.5 billion in Libya, amounting to 5.2%, 7.6% and 16.7% of their respective GDPs (IEA, 2019). In Morocco and Tunisia, the energy import bill weighs heavily on the external balance.

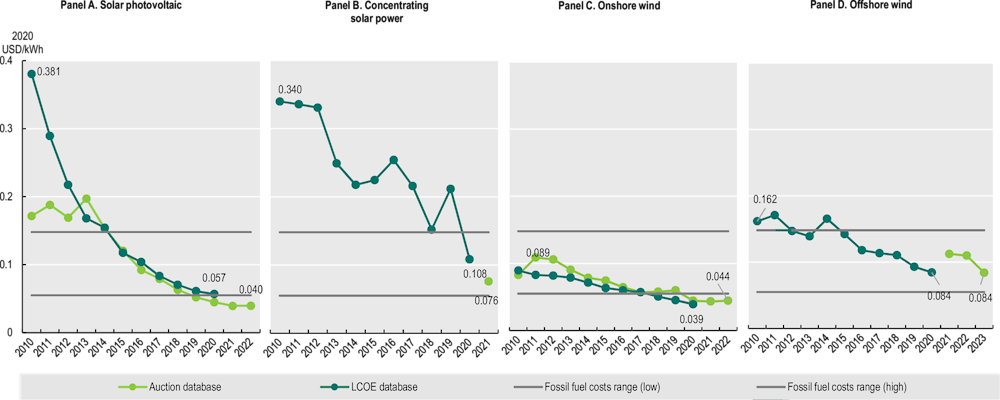

The objective of deploying RE could be achieved more easily because of the steadily falling costs of RE generation, which are close to those of fossil fuels. Wind and solar power cost between USD 0.07 and USD 0.18 per kWh, compared to USD 0.05 to USD 0.17 per kWh for fossil fuels (IRENA, 2021). The downward trend is also evident in other RE sources, as Figure 6.8 suggests. With this in mind, the Mediterranean Solar Plan (MSP) for North Africa forecasts cumulative capacity for export to Europe of 22 000 MW by 2030 (UNECA, 2018).

Figure 6.8. Trend in the global weighted-average LCOE and PPA/auction prices for solar PV, onshore wind, offshore wind and CSP, 2010-23

Source: IRENA (2021), Renewable Power Generation Costs in 2020, https://www.irena.org/publications/2021/Jun/Renewable-Power-Costs-in-2020.

The EVC, which is cross-cutting in nature, not only acts as an input in other value chains but also improves their productivity. North African countries are integrated in many GVCs: the most important of these are the textile, agri-food, automotive and aeronautics GVCs. Developing and controlling the supply of low-cost energy encourages production units that are more competitive and productive as well as being conducive to job creation. For example, petroleum derivatives (packaging) make it possible for the fuels/minerals value chain to supplement the agri-food value chain. Similarly, hydrocarbon derivatives (kerosene, gasoline, diesel) support the aeronautics and automotive value chains. Finally, control of the energy supply is a decisive criterion for foreign investors. The EVC is essential for GVC upgrading.

Renewable energies provide a significant platform where sustainable growth and job creation, both objectives for North Africa, can be accommodated

The renewable energy value chain (REVC) is of growing interest in view of environmental constraints. Renewable energies, especially solar energy, are the alternative to fossil fuels. North Africa is part of a world strategy to supply Europe with clean energy, and the projections are for clean energy to comprise at least 20% of the energy mix by 2030 (UNECA, 2012). The region has immense potential for solar thanks to its annual 2 000-3 600 hours of sunshine, compared to 1 500-2 000 hours in non-Mediterranean Western Europe, Canada and Russia. RE endowments have already enabled North Africa to make progress under well-constructed, precise national programmes for the next decade (Table 6.2). Between 2010-20, RE capacity rose by more than 40% to 10.3 GW in the sub-region (IEA, 2020).

Table 6.2. Renewable energy capacity in 2019 and objectives for 2030 in North African countries

|

|

Algeria |

Egypt |

Morocco |

Libya |

Tunisia |

|---|---|---|---|---|---|

|

Cumulative capacity |

0.7 GW |

5.5 GW |

3.7 GW |

0.01 GW |

0.4 GW |

|

Objective for 2030 |

22 GW |

54 GW |

10 GW |

4.6 GW |

2.8 GW |

Source: IEA (2020), Clean Energy Transitions in North Africa, https://www.iea.org/reports/clean-energy-transitions-in-north-africa.

North Africa already has an edge in RE development. In 2016, Morocco opened a large solar power station (580 MW) in Ouarzazate. The country’s hybrid thermal and solar power station in Aïn Beni Mathar has a capacity of 470 MW, of which 20 MW is solar. In 2018, Algeria had 24 photovoltaic power stations with a total capacity/power of 344 MW. Tunisia opened its first solar power station in 2019 in Tozeur with a capacity of 10 MW, and, in the same year, Egypt started operating the Benban solar farm, capacity 1 650 MW. In terms of wind energy, Morocco has 10 farms including Tarfaya power station (301 MW). Egypt has three wind farms (Hurghada, Zafarana and Gabal El-Zayt), whereas Tunisia has nine and plans to construct others such as Tbaga (Cap Bon), financed by the French Development Agency (AFD). Algeria launched its first wind farm (10 MW) in June 2014.

Additionally, national programmes set clear targets for the coming decade. According to Morocco’s National Electricity and Drinking Water Office (ONEE), in 2020 the country had an installed capacity of 10 557 MW, including 36.8% in RE, following the investment of MAD 3.5 billion (Moroccan dirhams) (USD 390 million) that same year. The aim is for 52% of installed power generation capacity to utilise renewable sources by 2030 and, by the same date, to reduce energy consumption by 15% compared to 2016 levels. Tunisia has signed several public-private partnership (PPP) contracts to boost the share of RE from 12% to 30% of power generation by 2030. Meanwhile, in 2014, Egypt launched a national strategy to diversify its energy mix that aims to raise its share of RE to 20%, then 42% of domestic production by 2022 and 2035, respectively.

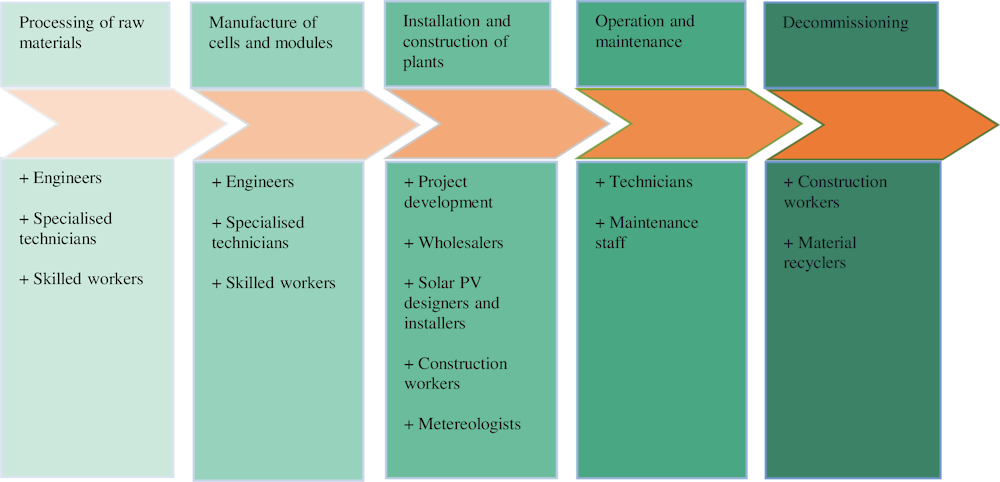

The REVC is a positive catalyst for skilled jobs and will help to improve young people’s employability. It contributes both directly and indirectly to job creation, a major challenge faced by the region. The establishment of solar and wind farms gives rise to new, often skilled jobs (Box 6.1). Studies suggest that RE creates close to three times as many jobs per investment unit as fossil fuels (IRENA, 2020). However, the greatest contribution to employment is likely to be indirect (Box 6.1), namely to skilled jobs, because the new production niches encouraged by RE involve innovative sectors and/or fairly complex goods. For instance, the solar energy value chain is fairly complex and requires expertise in advanced technologies, including the photovoltaic industry, the installation of photovoltaic panels, solar condensation and the transformation of solar energy into electricity (UNECA, 2018). In this light, North Africa’s participation in the REVC is along forward activities. For instance, domestic businesses import equipment either as complete units or as individual components for assembly into photovoltaic panels and installation.

Box 6.1. REVC’s job creation potential in North Africa

REVC activities and technology transfer can create direct jobs in five chain segments: manufacturing, construction, installation, operation and maintenance. Direct job profiles throughout the photovoltaic solar value chain are described in Figure 6.9. Indirect (sales, consulting, training) and induced jobs are also created, which are linked to the demand in industries that may be independent of RE. Ignoring for a moment the jobs created in related sectors, the African Development Bank (AfDB) estimates that 1 MW of renewable energy generates five temporary jobs in the starting or construction phase, and two sustainable jobs, mainly in maintenance (Table 6.3). Another promising field is the energy efficiency in the building sector, which creates even more jobs than the production or installation of solar boilers, the installation of photovoltaic systems, wind power or concentrating solar power stations (AfDB, 2016). However, jobs in the RE sector are vulnerable because of their reliance on public subsidies.

Table 6.3. Current and potential jobs in the RE sector

|

Technology |

Morocco |

Tunisia |

Algeria |

|---|---|---|---|

|

Current jobs in the RE field (all technologies) |

3 000 approx. |

3 350 (1 445 direct, 975 indirect, 930 in the energy efficiency sector) |

3 000 (direct and indirect) |

|

Solar-thermal energy/STE (projected jobs) |

- 920 permanent jobs by 2020, 1 600 by 2030 (PROMASOL Programme); - 5 000 (Blohmke et al., 2013) |

No information |

No information |

|

Photovoltaic – PV (projected/potential jobs) |

23 000 (Blohmke et al., 2013) |

4 000 (direct and indirect) |

No information |

|

Wind energy (projected/potential jobs) |

46 000 (Blohmke et al., 2013) |

No information |

No information |

|

Projected/potential jobs in RE (all technologies) |

35 120 by 2020 |

7 000-20 000 by 2030 |

137 000 (direct and indirect) by 2025; 252 000 by 2030 |

Source: AfDB (2016) and Blohmke et al. (2013).

Figure 6.9. Direct employment along the full photovoltaic solar value chain

Source: Compiled by the authors based on data from IRENA (2011) and GGGI (2020, Annex 6).

Ongoing constraints in developing the EVC in North Africa

Structural barriers hamper the development of the EVC

The institutional and legal framework, combined with governance issues, act as barriers to establishing energy-based RVCs in North Africa. Despite reforms to the institutional, legislative and regulatory frameworks in Morocco, Algeria and Tunisia, work remains to be done to strengthen the institutional frameworks in Egypt, Libya and Mauritania with a view to promoting RE and energy efficiency. Differences in the costs and complexities of RE technologies make it impossible to establish a feed-in tariff that ensures efficiency in domestic markets. Moreover, the absence of an intra-regional standard on harmonisation of feed-in tariffs makes the RE market uncompetitive and limits cross-border energy transfers. Governance and corruption, especially in the petroleum sector, are unfavourable to productive investment aimed at establishing RVCs. By way of illustration, the oil-exporting countries score comparatively poorly on business climate: the Doing Business index ranked Algeria and Libya 157th and 186th in 2020 respectively, compared to Morocco (53rd) and Tunisia (78th).

Interconnected production plants are required (backward and forward) in order to expand energy RVCs. Even though Tunisia and Morocco have relatively high trade integration indexes (0.78 and 0.55 respectively) because of their trading relationships with sub-Saharan Africa, North African regional integration is still too weak to enable full RVC development. The region has a trade integration index of 0.48 compared to a productive integration index of 0.44, and indexes of 0.50 and 0.43 for infrastructure and free movement of people, respectively (AU/AfDB/UNECA, 2019).

Although infrastructural development in North Africa is relatively high, the region is held back by the lack of EVC-specific infrastructure. Transport and distribution of fossil fuels are challenging because pipeline penetration is inadequate and storage capacity is limited. Theft, a common occurrence along the entire length of the pipelines, can interrupt and reduce supply flows. Often, pipelines cross dangerous areas where groups of insurgents may damage them or take control of the supply (Hafner, Tagliapietra and de Strasser, 2018).

Poor performance in logistics is a major constraint to the emergence of the EVC, which requires significant quantities of semi-finished products to be transported and stored. The connectivity of roads and ports in the region is inadequate, diminishing the likelihood of forming direct links between production sites in different countries, which is crucial to establishing RVCs. The average Logistics Performance Index in North Africa is 2.5, and customs clearance procedures are inefficient. Transhipment costs, difficulties encountered in transit and the absence of harmonised regulations also remain burdensome (AUC/OECD, 2019).

North Africa’s delayed adoption of new RE technologies and the size of fossil fuel subsidies are major constraints on the development of RE. Although the costs of RE have fallen in recent years, the industry is not yet commercially mature to enable economies of scale, except in the wind sector. The technology gap, combined with imports of RE components and under-developed innovative, preferential finance facilities, prevent North Africa from improving its positioning in REVCs.

The expansion of the energy RVC in North Africa suffers from poor progress in energy efficiency and the rise in emissions. Despite their efforts, countries have not yet managed to fully unlock the potential benefits of efficient energy use. Additionally, emissions from the hydrocarbons sector constrain their competitiveness. The average annual growth in CO2 emissions between 2009 and 2019 was 4.2%, 2.3% and 4.1% in Algeria, Egypt and Morocco, respectively (BP, 2021). Natural gas flaring, a frequent occurrence in Algeria and other countries, is a heavy producer of greenhouse gas emissions. Restricting flaring could provide opportunities for regional co-operation and encourage the emergence of a clean energy RVC.

COVID-19: A conjunctural constraint to revitalise the EVC

The COVID-19 pandemic disrupted EVCs in many ways. It affected supply and mobility operations through depletion of the materials, capital and inputs required for production and processing. The depletion is regarded as an additional shock to energy-based economies, as it restricted the resources needed to manage the health situation and undermined the opportunities for recovery and future growth.

FDI fell sharply during the health crisis because of social distancing measures and lack of investor confidence in regional economies. The latest forecasts show a drop of between 25% and 30% for Africa. The investments that are most affected are in energy and primary industries as a result of the fall in petroleum prices and the difficulties faced by airlines and tourism (UNCTAD, 2020). Foreign direct investment in energy is estimated to have fallen by 20% in 2020 as a whole in the region (IEA, 2020), slowing integration in energy GVCs.

The combination of demand and supply shocks from the COVID-19 pandemic has had repercussions on production and trade in oil-exporting countries. The dramatic fall in international prices, estimated at 70% between January and April 2020, led to one of the most serious shocks to the energy market. Net revenue in Algeria and Libya plummeted by 75-90%, severely straining these countries’ scope for countering the economic damage caused by the pandemic (IEA, 2020) and further undermining involvement in the EVC.

Decarbonisation is a significant challenge that will continue to disrupt energy demand worldwide. European giants that specialise in the automotive and aeronautic industries have established new manufacturing strategies that take the ecological challenges into account. Green energy will be an opportunity for several countries as part of the process of reshoring value chains, including in North Africa. This will boost the potential for certain niches in the mechanical and electronics industries that are already in place in oil-importing countries.

Demand for power has fluctuated widely, especially for industrial and commercial activities, owing to health restrictions. Disruption of the power market has had repercussions for production and trade in various industries, especially in countries that are net importers of petroleum. By contrast, in some of those countries, the fall in energy prices has led to a fall in the cost of power generation. In Tunisia, for example, the energy gap fell from USD 1.9 billion to USD 1.8 billion between 2019 and 2020 (INS, 2020).

Although less affected by the health crisis, the REVC has experienced some disruption. The depth of the crisis affected the production of components and the transportation of equipment rather than project management or maintenance. Containment measures and restrictions at borders led to the temporary closure of several factories manufacturing materials used to generate solar and wind power. Moreover, port closures and flight bans affected imports of batteries, solar panels, inverters and smart meters that are needed in the REVC.

Finally, the health crisis triggered a significant shock for SMEs in the solar energy sector. In particular, SMEs specialising in the photovoltaic industry experienced significant delays in delivery times. Residential solar panel installers faced ever-weakening demand because of the fall in purchasing power and consumer uncertainty. Maintenance activities were partially affected by restrictions on movement.

Nonetheless, there are opportunities for the integration of North Africa into energy value chains

Despite the threats, COVID-19 is an opportunity to develop EVCs

COVID-19 has encouraged reshoring and/or regionalisation of production activities, paving the way for North African countries to become better integrated in regional trade. The quest for greater resilience, reliability and autonomy in EVCs makes North Africa’s role inevitable. One of the key aspects of its involvement will be in the development of clean energy, an undertaking that is likely to have a ripple effect on the energy programmes of the countries in the region. The recovery plan for Europe announced by the EU illustrates this perfectly (Box 6.2).

Box 6.2. Recovery plan for Europe and EVCs for North Africa

The plan is the largest recovery package ever financed in Europe. A budget of EUR 2.018 trillion has been allocated to rebuilding a post-COVID-19 Europe, as a greener, more digital, more resilient Union. The package focuses particularly on fighting climate change, earmarking 30% of the EU funds to it – the highest share ever (e.g. up to EUR 30 billion for hydrogen).

The plan regards co-operation with neighbours on the southern shores of the Mediterranean as a key to success, a factor that could encourage the countries of North Africa to prioritise RE and hydrogen (Moreno-Dodson, 2020). Certain key factors could help these countries to promote the integration and development of EVCs, such as their strategic geographical location, rich resource endowments, a diversified mix of energy sources, and the necessary transmission infrastructure to get started.

Thus Europe’s search for strategic autonomy in energy, through the recovery plan, will increase North Africa’s attractiveness. This could take the form of agreements on production-sharing or trade facilitation, or investment in physical infrastructure and support the mobility of factors that are key to RVC development.

Source: EU (2021), The EU’s 2021-2027 long-term Budget & NextGenerationEU.

The reorganisation of GVCs is an opportunity for regional structural transformation and the development of EVCs. In their “Great Reset” agenda, Schwab and Malleret (2020) take the view that supply chains will be shorter, businesses will ensure they are no longer reliant on a single country or a single business in another country, and new opportunities will emerge that require significant investment in energy, a vital feature in many sectors and value chains (including pharmaceuticals, health materials and telecommunications). There is a genuine opportunity for North African countries to diversify, especially those that are most deeply rooted in globalisation and rely on GVCs to help them further industrialise; attract investment opportunities and gain market access; and benefit from technology acquisition and transfer (Egypt, Morocco and Tunisia in particular). For these countries, the development of specific REVCs will have the advantage of diversifying the risks and remedying the structural weaknesses of the region’s economies. The industries that could be involved in the REVCs include phosphates and their chemical by-products, agri-food, clothing, and oil and gas processing.

The pandemic has demonstrated the importance of digital technology in the management of GVCs, including EVCs. Digitalisation is increasingly shaping North African countries’ integration in GVCs. The COVID-19-induced expansion of digital technologies has led to improvements in supply chain management and monitoring, including over long distances. Therefore, the presence of start-ups specialising, for example, in the development of input delivery solutions and/or the provision of insurance and finance may bolster the North African countries’ integration in EVCs.

Digitalisation also offers an opportunity to develop REVCs. Poor regional integration in North Africa and the existing inadequate and unresponsive interconnections between the region’s economies have exacerbated the impact of the COVID-19 pandemic on supply chains. Clearly, greater digitalisation of procedures encourages interconnections. New electronic means of trading with neighbours and reduced commercial costs make digitalisation a vehicle for developing RVCs, including in energy.

The pandemic has also increased the need to speed up the energy transition so as to ensure a sustainable recovery and a more stable, more resilient economy in the future. The new environmental mechanisms introduced in the immediate aftermath of the crisis offer an opportunity to achieve economic transformation and technological innovation in North Africa. This would involve developing solar and wind energy technologies, for example by implementing plans for sea-water desalination plants powered by RE sources, while jump-starting ecological public transport systems.

The AfCFTA is good news for better integration in EVCs

The AfCFTA can help develop RVCs by removing barriers to trade, thus helping to support the industrial strategies of the region’s countries. The continental free trade agreement can encourage each country to evaluate their comparative advantages and bolster their industrial development. This would enable them to replicate successful business models and spread them across the region, thereby creating quality jobs in leading industries. Morocco has already managed to develop a quality fertiliser industry and has signed trade and investment agreements with sub-regional organisations in sub-Saharan Africa such as the Community of Sahel-Saharan States (CEN-SAD) and the West African Economic and Monetary Union (WAEMU). Under the AfCFTA, the Moroccan experience can be replicated, and energy-based processing industries in North Africa could be developed, thus improving the integration of the region’s countries in value chains.

The AfCFTA may also provide the impetus for the countries in the region to align their economic policies, encouraging the development of energy RVCs. The agreement could prove to be an opportunity to streamline and harmonise non-tariff barriers, including sanitary and phytosanitary rules and/or standards imposed on the oil and gas processing industries (chemicals and plastics industries, synthetic fibres and fabrics, etc.). It may also result in the removal of quantitative restrictions on imports of the components required for the photovoltaic industries (modules, panels, etc.). Finally, the agreement may encourage the regulatory harmonisation required for investment in solar energy (solar power stations for example). The ensuing convergence of economic policies would boost the development of RVCs in the oil and natural gas sector as well as in the RE sector.

Economic liberalisation within the framework of the AfCFTA may also result in efficient resource allocation, a move that would have favourable repercussions on the development of EVCs. Liberalisation should facilitate the flow of skills and technology transfer, encourage complementarity in infrastructure, reduce reliance on traditional markets (including the European market) and provide genuine opportunities for growth, especially for local businesses, which will be able to diversify and/or upgrade their products. If liberalisation occurs, it will allow oil and gas processing industries to develop in oil-exporting countries, and will provide a kick-start to industries associated with the assembly and installation of photovoltaic panels or the development of solar energy (production of silicon, wafers and photovoltaic cells) in petroleum-importing countries.

Finally, the AfCFTA may trigger the expansion of RVCs in North Africa by providing investment opportunities. Successful implementation of the AfCFTA would help to reduce production and processing costs, especially in energy-intensive manufacturing. Implementation of the agreement would have a favourable impact on, inter alia, trade and investment as a result of the relaxation of rules of origin, a re-consideration of export prohibitions, a review of investment and competition policies and more flexible property rules. Such trade and investment could promote the development of EVCs.

Appropriate public policies are a crucial stimulus to revitalise energy RVCs and GVC integration.

The countries of North Africa can count on solid PPP frameworks. Over 75% of installed renewable capacity in North Africa was deployed under policies that are attractive to private stakeholders (IEA, 2020). This includes competitive auctions between independent power producers (IPPs), feed-in tariffs and long-term corporate power purchase agreements.

Algeria has gradually established regulatory incentives for RE development, creating the Fonds national pour les ER, or National Fund for Renewable Energy (NFRE) in 2009, to which 1% of petroleum royalties has been allocated since 2011. The adoption of two Executive Decrees in 2017 (No. 17-98 and No. 17-204) requires that RE generation projects are distributed through calls for tenders and auctions.

Law 13-09 of 2010 introduced gradual liberalisation of the energy market in Morocco. The law authorises the production and export of electricity by any private producer provided it uses RE sources. The Moroccan Agency for Sustainable Energy (MASEN), established in 2012, is a “one-stop” government establishment that organises auctions, facilitates the land and infrastructure for the projects and issues the permits. In Morocco, competitive auctions among IPP for CSP have decreased bid prices by 25% from USD 190/MWh for Noor I Ouarzazate in 2012 down to USD 140/MWh for Noor II in 2015 (IEA, 2020). Between 2016 and 2019, competitive auctions drove down solar PV bids to USD 49/MWh for Morocco’s Noor PV I and to USD 24/MWh in Tunisia.

The development of regional integrated production networks is necessary in order to boost the advantages of EVCs

Joint public policies can be deployed to promote the region as a platform for power generation and export. The first step is for the regional integration agreements already established to become operational, namely the Greater Arab Free Trade Area (only Mauritania is not a member) and the Agadir Agreement signed in 2004 by Egypt, Jordan, Morocco and Tunisia. These agreements provide for a degree of equal treatment in terms of regulation of the region’s various trading partners. The ensuing removal of tariff and non-tariff barriers will encourage the establishment of oil and gas processing facilities in exporting countries and will facilitate the establishment of plants to manufacture the components to develop solar energy in the petroleum-importing countries.

These regional policies will encourage economic stakeholders to take advantage of the segmentation of production chains and meet specific needs of their economies. Under this framework, countries are called upon to develop clusters that encourage bridge-building between complementary production plants. Examples include areas where there are plastic-producing plants and composites alongside industries working in the automotive and aeronautics fields; or plants manufacturing synthetic fibres and fabrics alongside textile factories; or plants producing chemicals and fertilisers close to companies producing gas and phosphates. In Egypt, for example, industrial facilities in Ain-Sokhna are in close proximity to oil and gass processing plants (chemicals and pharmaceuticals, plastics, etc.).

The clustering of logistical platforms, support services, research centres and other relevant facilities would also enhance area-based approaches and stimulate positive, collaborative synergies. In this context, policies to attract global industrial partners can build energy-generating capacity in North Africa. This would involve, for example, attracting investors that specialise in oil refining or gas processing (notably in oil-exporting countries), together with multinationals specialising in the production of the wafers, photovoltaic cells and panels needed for solar energy (namely in countries that are net importers of oil). Similarly, the establishment of co-production platforms where foreign businesses are invited to set up production and processing subsidiaries in the region would be an interesting step towards establishing EVCs. Tanger-Med, for instance, is the ultimate industrial platform for domestic and international supply chains linked to the RE sector. Its strategic location close to the Strait of Gibraltar makes it an essential gateway to cross-border energy trade. Tanger-Med has positioned itself as an industrial ecosystem favourable to foreign investors by developing activities associated with RE (e.g. construction of wind turbine blades by Siemens).

Support to develop extractive industries and oil and gas processing can be provided by establishing special economic zones (SEZ). Such zones allow local businesses to take advantage of the expertise and know-how of multinationals, as well as more diversified structures of production and trade. More specifically, public policies that encourage more integration with leading firms could result in greater product complexity, potentially resulting in greater profits and stronger backward and forward integration. In May 2020, Egypt’s General Authority for Investment and Free Zones (GAFI) announced it had authorised licences for projects in the natural gas industry in accordance with free zone regulations, thus allowing the development of companies producing fertilisers and petrochemicals. Additionally, tax incentives by way of temporary reductions of certain types of investment, tax waivers, tax concessions and tax credits were awarded to Chinese investors established in the Suez SEZ. As a result, Egypt has been able to progress in the extraction value chain, after becoming a manufacturer of oil rigs and joints for drilling platforms, and is servicing groups operating on its territory.

The arrival of one or more multinational firms specialising in photovoltaics, followed by a rapprochement with local stakeholders, would likely help to develop this RVC. Encouraging manufacturers of photovoltaic panels to establish subsidiaries in at least one of the countries in the region would help them to break into the market. In Egypt, the use of tax and other incentives to attract recognised manufacturers of wafers, photovoltaic cells and panels made it possible to develop the industries required for the solar photovoltaic industry value chain, including steel, glass and pumps manufacturing.

Education and training reforms are vital to build production capacity and improve integration in the EVC

Higher-quality human capital, compliance with international standards and specialised skills are pre-requisites for GVC and RVC upgrading. To achieve this, investment in training will have to target technical and managerial skills as part of exchange programmes between energy multinationals and their local partners. Also, authorities must support research and development (R&D) because the ability to innovate is crucial in the extractive industries. Significant skill needs in RE remain. Applied research programmes for the energy sector and energy development need to be set up. In that respect, Tunisia’s technology clusters, which are regarded as training centres of excellence, are an experiment that should be widely rolled out across North Africa. The clusters provide platforms for innovation to assist businesses and enable them to benefit from technological progress.

The EVC requires the upskilling of the workforce, area in which North African countries still lag behind. For example, high skill levels are vital for the development of the REVC in the region. The need is particularly pressing for solar researchers, wind farm project managers and operators, geothermics technicians, energy modellers, and climate and thermal solar energy engineers (AfDB, 2016). Work has been done in North Africa in the past few years to establish R&D structures so as to develop research in RE, encourage energy efficiency and foster exchanges between businesses.

Government authorities can establish training centres specialising in energy. The regional centres, which would produce a pool of skilled workers that the region’s private-sector employers could tap into, could bolster integration in regional and global energy value chains. They would enable countries to achieve economies of scale, specialise, and develop comparative advantages in energy. Engineering and project management should be the focus for extractive economies seeking greater integration in the oil and gas value chains. Economies that want to improve their positioning in REVCs need to build capacity through centres for technology, engineering and innovation. For example, Morocco has established institutes for RE training and energy efficiency (IFMEREEs) that operate according to a management model commissioned by the State from professionals in the sector. Such innovative approach gives businesses a key role in vocational training based on skill acquisition and work-study programmes involving hands-on experience and classroom learning.

The countries in the region can also bolster their education and training partnerships, especially those related to green energy and the environment. Collaborations of this kind make it possible to expand technical and professional training networks with partners (especially in Europe) and to reduce the costs of investment and training in the specialist area of RVCs. The Western Mediterranean Forum for Education, Research and Innovation (part of the “5+5 Dialogue”), which brings together education ministers, proposes specific programmes in line with prevailing priorities in scientific research, innovation and higher education (Moreno-Dodson, 2020). Another example is the Regional Center for Renewable Energy and Energy Efficiency (RCREEE) that proposes capacity-building programmes at the request of countries in the Middle East and North Africa region (MENA) that are seeking to build and strengthen their skills, qualifications and expertise in RE and energy efficiency.

The education and training systems in North Africa must evolve so as to ensure better control of EVC integration. There should be a shift towards mixed systems that combine general and vocational education. In the same vein, vocational training in energy and study programmes with private-sector involvement need to be developed, together with expanded use of apprenticeship models that give young people an opportunity to learn while working (World Bank, 2020b). Excellence pathways should also be encouraged to include work-study programmes. The existence of domestic R&D structures is apt to facilitate entry into EVCs, for example the Renewable Energy Development Center (CDER) in Algeria, the Center for Energy Research and Technology (CRTEn) in Tunisia and the Institut de Recherche en Énergie Solaire et en Énergies Nouvelles, or Solar and New Energy Research Institute (IRESEN) in Morocco. These structures are part of national strategies, while global technological, economic and social progress requires a regional response. The financial and human resources needed can be met only as part of a regional R&D strategy, in partnership with similar structures in the North (UNECA, 2012).

A more flexible, more mobile workforce can build human capital and thus help to develop the REVCs. Mobility provides easy access to specialised labour, a factor that encourages efficient use of available human resources and has a positive impact on sectoral investment (David and Marouani, 2017). It also drives demand by increasing inflows of human capital (Plaza and Ratha, 2011). Public policies that encourage mobility are therefore required in North Africa, especially harmonisation of education, social protection and employment policy in the region. Despite divergent policies in the region, some initiatives are in place in the form of membership of international technical bodies, such as the World Association of Public Employment Services (WAPES) whose aim is to bolster co-operation, knowledge exchange between countries. Its members include Tunisia, Algeria, Mauritania and Morocco.

Trade facilitation and harmonisation of trade policies are crucial to EVC development

A trade policy where the rules of the game are clearly set out can stimulate intraregional trade, and thus encourage the establishment of RVCs. To this end, additional measures are vital: countries need to remove barriers to the free movement of goods and services in the region, simplify customs and border control procedures, and sign bilateral agreements on the mutual recognition of conformity assessment for high added-value products (AUC/OECD, 2019). Mutual recognition of conformity assessments allows for the removal of technical barriers in the EVC, including environmental, security and health standards. Article 6.2 of the Free Trade Agreement between Morocco and the United States could be replicated: it provides that goods should be cleared by customs, to the extent possible, within 48 hours of arrival. It requires goods to be released at the point of arrival, without interim transfer to warehouses or other locations.

North African countries should prevent unfair competition, especially in respect of trade in intermediate goods. They are urged to get rid of non-tariff barriers, which are often used for non-economic purposes (boosting profit, supporting cartels, etc.), and to introduce a mutual recognition system for technical, sanitary and phytosanitary standards. This encourages trade in intermediate goods utilised in the oil and gas processing industries, and trade in the materials required to manufacture, assemble and install the equipment needed to generate RE. Countries are also called on to harmonise their tax systems or at least enter into co-operation agreements for subsidy/compensation schemes. The reform of the hydrocarbons compensation system in Egypt and the introduction of the mechanism for the automatic adjustment of fuel prices in Tunisia could be a good starting point for the region as a whole.

The standardisation of trade facilitation measures is required to defragment the production process in North Africa. This would entail the development of trade corridors, the introduction of common border posts, co-ordination of trade documents and the establishment of common agreements on regional transit. Harmonisation of customs regulations could enhance the trade potential of the entire region. The general roll-out of the UNI-PASS in Algeria is relevant here. The system originated in South Korea and helps to reduce customs clearance times, limit fraud, enable the establishment of a one-stop shop for the exchange of electronic data between foreign trade operators, and digitalise customs procedures.

Digitalisation can facilitate trade and value chain development in North Africa. It favours intra-sectoral integration, decarbonisation of value chains and the development of intra-regional trade. In such an environment, it is important to establish a one-stop shop to found businesses, speed up import and export procedures for the goods required in EVCs and launch online platforms to certify imported goods. Online issuance of licences restricts direct contact with the authorities and reduces corruption. PortNet, in Morocco, is a one-stop shop for external trade procedures. It is a national platform that integrates the information systems for the entities involved, improves supply chain efficiency and accelerates the movement of goods through automation of procedures while reducing the costs and delays of logistical operations (UNECA, 2020).

The development of transport infrastructure, logistics and networks is a driver for regional integration and EVC consolidation

Improving road transport capacity must continue to be a priority in North Africa for the EVCs. Accordingly, public policies should resolve issues of inefficiency and lack of capacity that are often reflected in hesitancy among businesses operating in the energy sector. In particular, this involves setting up regional and national programmes covering projects for transport infrastructure and logistics. Major trans-African road projects are under way, including the Central Section of the Trans-Maghreb Motorway Axis, which stretches from Agadir in Morocco to Ras Ajdir on the border between Tunisia and Libya, the Cairo-Dakar or the Algiers-Lagos highways. These will improve transport of intermediate goods and the components required by EVCs in North Africa while reducing journey times and transit costs.

Creating inexpensive, rapid transport corridors between various centres in the region is vital, as shown by Central Asia’s experience (Box 6.3). They will be linked to each other across the entire chain so as to facilitate the movement of goods in the region. To that effect the logistics infrastructure between the various specific points must be modernised. This will encourage rapid, low-cost transportation of the components required to operate EVCs, thus facilitating the system of shared production all along the chain.

Box 6.3. Transport corridors: Central Asia’s experience

The new transport corridors have changed the industrial landscape of Central Asia by modifying trade and production models, giving rise to significant socio-economic and geopolitical powers and logistical changes.

Several transport-corridor projects aim to boost regional development and integration by providing high levels of transport connectivity and integrating different modes of transport.

The largest initiative, announced in 2013 by Chinese President Xi Jinping during his visit to Kazakhstan as part of the new “Silk Road”, aims to revitalise trade across Asia, Europe and Africa. After initially focusing on energy and infrastructure, the project later expanded to trade, manufacturing, the Internet and tourism.

The initiative has two main segments: the Economic Road Belt, which includes land corridors connecting China with different parts of Asia, the Middle East and Europe, and the Maritime Belt linking Asia, Africa and Europe (ITF, 2019). Linking production networks reduces delivery times for certain types of consumer goods and high value-added equipment, including in the energy sector. Central Asia will benefit from transhipment, maintenance and refuelling activities. It will have better market access for its natural resources and agricultural products, and this will help it to develop RVCs and position itself effectively in GVCs.

The development of maritime and railway lines is crucial for trade flows and reducing costs – two important pre-requisites for developing energy RVCs in North Africa. New shipping lines that could boost trade in hydrocarbons are planned, like that of Wazzan II in Morocco, which links the ports of Tangiers, Casablanca, Monrovia, Abidjan, Tema, Takoradi and Cotonou. Another shipping line will link the cities of Gabès and Sfax to Dakar, Abidjan and Tema (AUC-OECD, 2019). Additionally, development of the rail network would speed up trade in mining products and boost RVCs. The aim of Morocco’s 2040 Rail Strategy is to develop the national network and contribute to regional development. The scheduled re-opening of the line between Tunis and Annaba in Algeria should accelerate regional connectivity.

Countries in the region should also consider joining existing major energy projects and favour intra-regional undertakings. The EuroAfrica Interconnector project includes the development of a 2 000 MW electricity network between Egypt, Cyprus and Greece. Similarly, the Elmed project concerns the development of a new, underwater, 600 MW high-voltage direct current link between Tunisia and Sicily. It is also possible to link power stations (Tobruk in Libya and Saloum in Egypt, Tataouine in Tunisia and Al-Rowis in Libya, Jendouba in Tunisia and El-Hadjar in Algeria) and to strengthen their power generation capacity. The aim is to increase RE exports to Europe and within the sub-region.

The shortfalls in infrastructural management and finance must be resolved if the process of developing value chains in North Africa is to succeed. To that end, devolving the management of ports and airports to efficient state-owned entities would reduce waiting times and improve consignment monitoring. In Morocco, for example, the Moroccan Agency for Logistics Development (AMDL) was set up as part of the Strategy to improve National Competitiveness in Logistics for 2010-15: private funds were harnessed and logistics platforms were developed within industrial zones. The strategy has been updated and has become the National Integrated Strategy to Develop Competitiveness in Logistics by 2030. Its primary objectives are to reduce logistics costs, speed up GDP growth and contribute to the sustainable development of Morocco.

Similarly, further efforts are needed in order to create a reliable environment for public-private partnerships (PPPs). To that effect, updated laws and the creation of bodies or units specifically dedicated to PPPs within existing institutions could lead to more efficient investment in infrastructure, bring in new technologies and skills and reduce the funding burden. In Egypt, for example, the revised law on PPPs streamlined contracts of this kind, particularly by reducing the publishing time for call for tenders and by introducing new mechanisms for private-sector sub-contracting (OECD, 2021). The new law made possible several infrastructural projects of interest to the energy sector, including the development of the Safaga Industrial Port.

The establishment of dedicated regional energy networks could increase trade in North Africa and encourage the development of EVCs. Some of these countries can leverage their geographical location and energy resources to develop hydroelectric power and develop future trade in electricity throughout the region. Projects along the Nile in Egypt or in Manantali in Mauritania could boost the energy market in North Africa. Agreements on shared production can strengthen the production of hydrogen, a chemical element that could become a new driver for energy market integration in North Africa, and between the sub-region and Europe, thus facilitating trade in electricity throughout the region.

Improving the business climate can speed the establishment of energy value chains

Improvements to the business climate continue to be necessary in order to develop EVCs in North Africa. Red tape, the time that formalities take, and corruption in the energy sector can be off-putting to multinationals and entrepreneurs. Inflexible regulations prevent them from taking full advantage of the opportunities that value chains offer. Consequently, governance must improve – a process that requires enhanced procurement procedures, evaluation and selection, and greater transparency. Accordingly, a relaxation of the regulations around production, transportation and processing activities could be a good starting point: it would open these activities up to competition and improve efficiency. For example, in 2019, Algeria began the process of approving a new law on hydrocarbons that aims to provide fiscal and contractual incentives for early investments. In Morocco, improvements to the regulatory framework boosted the presence of the private sector in RE: Law 16-08 authorised the cement industry to develop wind-power projects both for their own use and to sell surplus production to the ONEE.

Establishing independent regulatory agencies may attract greater investment in power generation, transformation and distribution networks. The fact that there are separate regulators that act in an objective and transparent manner can help to boost confidence in the region and encourage the development of energy RVCs. The presence of regulatory authorities that operate under government line ministries (as is the case in all North African countries) must not deter investors from entering the market. For instance, Morocco was one of the first countries in the region to strengthen conditions conducive to investment in renewable electricity generation. In particular, it was able to develop and standardise regulatory concessions while reducing both the time and the procedural complexity of obtaining an authorisation.

The support of dedicated investment promotion agencies can speed up North African countries’ integration in energy value chains. Such agencies play a significant role in attracting investment in those sectors regarded as priority areas, including energy (refining, fuel processing plant, factories manufacturing components required to produce solar energy, etc.). The Tunisia Investment Authority (TIA) and the country’s Foreign Investment Promotion Agency (FIPA), Egypt’s GAFI, Morocco’s Agence Marocaine de Développement des Investissements et des Exportations (Moroccan Investment and Export Promotion Agency, AMDIE) and Algeria’s Agence Nationale de Développement de l’Investissement (National Investment Promotion Agency, ANDI) are key in this respect. Policies to support the financial and human resources that these agencies need in order to operate are therefore vital.

If businesses operating in value chains are to become more competitive, input costs must fall – especially in respect of transport – and access to a wide range of services must improve. Gradual liberalisation of trade in services is vital in North Africa to make FDI more attractive and improve technology upgrades (Karam and Zaki, 2020). Financial intermediation and business services is the segment where most RVCs in energy emerge and develop (Tsakas and Moukaddem, 2019). This presupposes the widespread presence of financial institutions offering a variety of tools such as Islamic finance, microfinance, participatory finance or Green Funds (Hausser, Tsakas and Moukaddem, 2019). Telecommunications and digital technology are also essential for co-ordinating and interconnecting complex, geographically dispersed production chains. The development of digital platforms for factory automation or redesigning cloud-based energy platforms can encourage the emergence of an ecosystem of private providers that support value-chain development (AUC/OECD, 2021).

Strengthening bilateral and multilateral partnership programmes in North Africa will increase national stakeholders’ capacities to support RVC development. Such programmes take the form of loans, equity injections, guarantees or technical support. They also complement the authorities’ efforts to support the private sector in various industries, including energy. The Tunisian-German energy partnership established in 2012, and managed by the German Corporation for International Cooperation (GIZ), is a good example of technical co-operation to promote energy transition. It is structured around thematic working groups in which government representatives from both countries participate.

Finally, the countries of North Africa must develop and co-ordinate SME-oriented policies focused on tackling the informal sector and improving competitiveness. This means facilitating access to credit by reducing guarantee requirements, providing public guarantees to profitable SMEs and developing microcredit. Streamlining taxes and charges can also support anti-corruption efforts in the energy sector. For instance, the project “Strengthening Business Integrity in Morocco” could be replicated by other countries in the region. The project is a partnership between the government, private sector and civil society representatives with the purpose of supporting anti-corruption work and promoting business integrity in three strategic sectors, including energy.

Annex 6.A1. Trade in intermediate goods for North Africa

Figure 6.A1.1. Intracontinental trade in intermediate goods as a percentage of all trade in goods for North Africa, 2000-19

Source: Authors’ calculations based on data from the International Trade Database at the Product-Level (BACI) developed by the Centre d’Études Prospectives et d’Informations Internationales (CEPII, 2020).

References

AU/AfDB/UNECA (2019), Africa Regional Integration Index, Report 2019, African Union, Addis Ababa/African Development Bank, Tunis/United Nations Economic Commission for Africa, Addis Ababa, https://www.integrate-africa.org/fileadmin/uploads/afdb/Documents/ARII-Report2019-FIN-R40-11jun20.pdf.

AUC/OECD (2021), Africa’s Development Dynamics 2021: Digital Transformation for Quality Jobs, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/0a5c9314-en.

AUC/OECD (2019), Africa’s Development Dynamics 2019: Achieving Productive Transformation, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/c1cd7de0-en.

AfDB (2016), The Renewable Energy Sector and Youth Employment in Algeria, Libya, Morocco and Tunisia, African Development Bank, Abidjan, Côte d’Ivoire, https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/The_Renewable_Energy_Sector_and_Youth_Employment_in_Algeria__Libya__Morocco_and_Tunisia.pdf.

Blohmke, J. et al. (2013), The Economic Impacts of Desert Power: Socio-economic aspects of an EUMENA renewable energy transition, Dii GmbH, Munich, June, https://dii-desertenergy.org/wp-content/uploads/2016/12/2013-07-30_Dii_EIDP_EN_Digital.pdf.

BP (2021), BP Statistical Review of World Energy, British Petroleum Company, London, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2021-full-report.pdf.

Casella, B. et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc (accessed on 1 June 2021).

CEPII (2021), International Trade Database at the Product-Level, Centre d’Études Prospectives et d’Informations Internationales, http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=37 (accessed on 1 June 2021).

CEPII (2020), BACI International Trade Database at the Product-Level, Centre d’Études Prospectives et d’Informations Internationales, Prime Minister/France Stratégie, Paris.

David, A. and M. A. Marouani (2017), “Migration Patterns and Labor Market Outcomes in Tunisia”, Working Paper, No. 1166, Economic Research Forum, Giza, https://erf.org.eg/app/uploads/2017/12/1166.pdf.

Directorate General of the Treasury (2021), Libye: situation économique et financière, Ministry of the Economy, Finance and the Recovery, Paris, https://www.tresor.economie.gouv.fr/PagesInternationales/Pages/3a565bec-efdf-4533-a19f-776f470ff9f7/files/b2df6a0b-22cf-428a-bb12-9abdebf5fcdc.

Ecofin Agency (2021), “En 2020, les recettes d’exportations de pétrole et de gaz de l’Algérie ont chuté de 39%”, Ecofin Agency, Mediamania, Geneva, https://www.agenceecofin.com/trade/0507-89799-en-2020-les-recettes-d-exportations-de-petrole-et-de-gaz-de-l-algerie-ont-chute-de-39.

El Mouden, W. and Y. El Harrak (2020), “Pétrole et gaz au Maroc: approvisionnement, stockage… Rabbah dévoile les chiffres clés du secteur”, Le 360, Casablanca, 2 June, https://fr.le360.ma/economie/petrole-et-gaz-au-maroc-approvisionnement-stockage-rabbah-devoile-les-chiffres-cles-du-secteur-216452.

EU (2021), The EU’s 2021-2027 Long-Term Budget and NextGenerationEU, Directorate-General for Budget, European Commission, Brussels, 29 April, https://op.europa.eu/en/publication-detail/-/publication/d3e77637-a963-11eb-9585-01aa75ed71a1/language-en.

fDi Markets (2021), fDi Markets Database, https://www.fdiintelligence.com/fdi-markets (accessed on 1 June 2021).

GGGI (2020), “Employment assessment of renewable energy: Power sector pathways compatible with NDCs and national energy plans”, Global Green Growth Institute (GGGI), Seoul, Korea, https://gggi.org/site/assets/uploads/2020/06/Employment-Assessment-of-Renewable-Energy_Web_final.pdf.

Growth Lab (2021), The Atlas of Economic Complexity, Center for International Development, Harvard University, Cambridge, MA, https://atlas.cid.harvard.edu.

Hafner, M., S. Tagliapietra and L. de Strasser (2018), Energy in Africa: Challenges and Opportunities, SpringerBriefs in Energy book series, Berlin, https://link.springer.com/book/10.1007/978-3-319-92219-5.

Hausser, T., C. Tsakas and K. Moukaddem (2019), “Developing Social Entrepreneurship and Social Innovation in the Mediterranean and Middle East”, Med Brief, No. 23, Forum Euro-Méditerranéen des Instituts de Science Économique (FEMISE), Marseilles, 23 September, https://www.femise.org/wp-content/uploads/2019/09/MEDBRIEF-23-final-1.pdf.

IEA (2020), Clean Energy Transitions in North Africa, International Energy Agency, Paris, October, https://iea.blob.core.windows.net/assets/b9c395df-97f1-4982-8839-79f0fdc8c1c3/Clean_Energy_Transitions_in_North_Africa.pdf.

IEA (2019), Energy Policies beyond IEA Countries: Morocco, International Energy Agency, Paris, https://webstore.iea.org/energy-policies-beyond-iea-countries-morocco-2019.

IMF (2021), World Economic Outlook Database, October 2021 Edition, International Monetary Fund, www.imf.org/en/Publications/WEO/weo-database/2021/October.

IMF (2019), World Economic Outlook Database, October 2019 Edition, International Monetary Fund, https://www.imf.org/en/Publications/WEO/weo-database/2019/October.

INS (2020), “Commerce extérieur aux prix courants”, Note Mensuelle, National Institute of Statistics, Tunis, December, http://www.ins.tn/sites/default/files/publication/pdf/Comext-12mois2020.pdf.

INSEE (2021), International prices of imported raw materials – Brent crude oil (London) – Prices in euros per barrel, National Institute of Statistics and Economic Studies, Paris, https://www.insee.fr/en/statistiques/3532438?sommaire=3530679.

IRENA (2021), Renewable Power Generation Costs in 2020, International Renewable Energy Agency, Abu Dhabi, https://www.irena.org/publications/2021/Jun/Renewable-Power-Costs-in-2020.

IRENA (2020), Renewable Power Generation Costs in 2019, International Renewable Energy Agency, Abu Dhabi, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Jun/IRENA_Power_Generation_Costs_2019.pdf.