This chapter discusses the extent to which Central Africa and its nine countries (Burundi, Cameroon, the Central African Republic, Chad, the Republic of the Congo (Congo), the Democratic Republic of the Congo (DRC), Equatorial Guinea, Gabon and São Tomé and Príncipe) are integrated into global value chains (GVCs). It provides an overview of the sub-region’s participation in GVCs, identifying strategic products and sectors. Focus then shifts to the wood value chain on account of its potential, its size and the restrictions imposed on it as a result of the COVID-19 pandemic. Finally, this chapter sets out proposals for public policies designed to drive the development of value chains in Central Africa, in particular the wood value chain, and discusses the need to improve the macroeconomic framework and the investment climate, address the lack of transport infrastructure and logistical infrastructure and develop professional skills in line with the needs of the market.

Africa's Development Dynamics 2022

Chapter 4. Integrating value chains in Central Africa and the wood industry

Abstract

In Brief

Central Africa’s participation in GVCs is still limited compared to Southern Africa and North Africa but greater than West Africa and East Africa. It is based mainly on forward linkage activities (trade and services) and only very slightly on backward linkage activities (research & development and design). Its integration into GVCs is driven by the primary sector, whereby exports of unprocessed raw materials (86.6% of total exports in Chad, 63.3% in Equatorial Guinea and 61.4% in the Republic of the Congo) do not contribute to the creation of added value or the redistribution of income.

Central African countries have a competitive advantage across a wide range of products, in particular ores and natural abrasives (hard rocks), cocoa, cotton and raw wood. Six of the sub-region’s nine countries are home to nearly 26% of the world’s remaining tropical rainforests, constituting the second largest area of its kind on the planet after the Amazon. The forestry sector, more precisely the wood industry, boasts opportunities for value chain integration. However, the countries need to implement strategies to scale down informal activities in favour of developing sustainable production chains as sources of growth and employment.

Despite the huge potential of the wood value chain, Central Africa’s share of the global market is still low: 6.28%, 9.70% and 5.38% of global production of tropical sawnwood, wood veneer and roundwood, respectively, in 2020. This weak position is only compounded by high transport costs, a lack of technical, commercial and marketing innovation, the pressure of competition from emerging economies and the issues associated with informality.

This chapter proposes three policies for consideration: i) improve the macroeconomic framework and the investment climate so that they are conducive to the development of the forestry sector; ii) address the lack of logistical infrastructure and transport infrastructure; and iii) develop professional skills that better meet the needs of the market.

Central Africa (infographic)

Central Africa regional profile

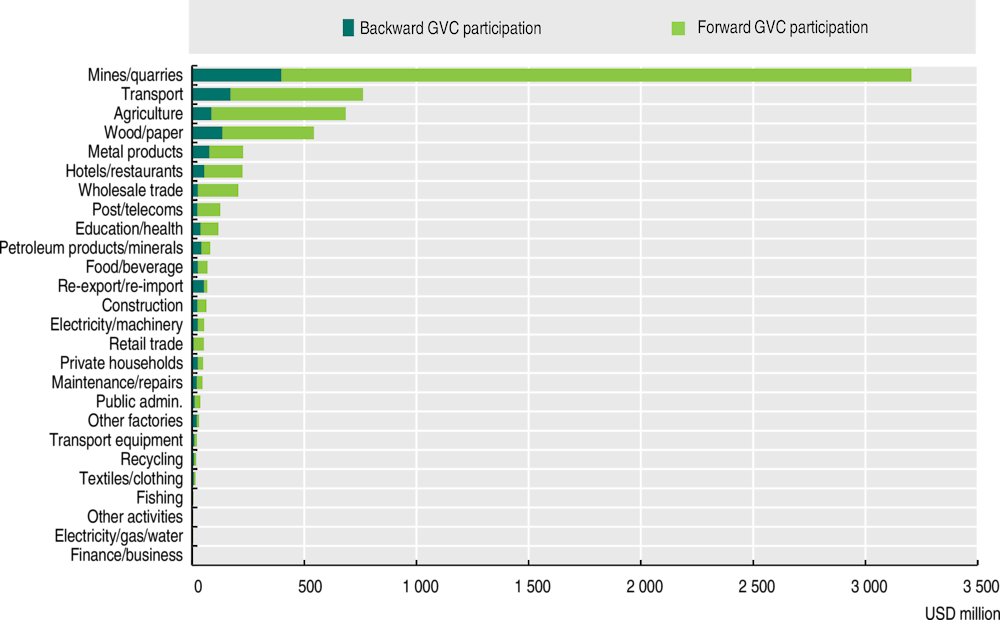

Figure 4.1. Economic and trade profiles of Central Africa, expressed as % of total

Notes: GDP = gross domestic product; FDI = foreign direct investment. The different sources for the data do not share common definitions of economic sectors, commodities or activities. However, colouring is used in this figure in order to indicate shared themes across datasets.

Source: Authors’ calculations based on World Bank (2020a), World Development Report 2020, GVC database, http://www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data; fDi Markets (2021), fDi Markets (database) www.fdiintelligence.com/fdi-markets; and World Bank (2021), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

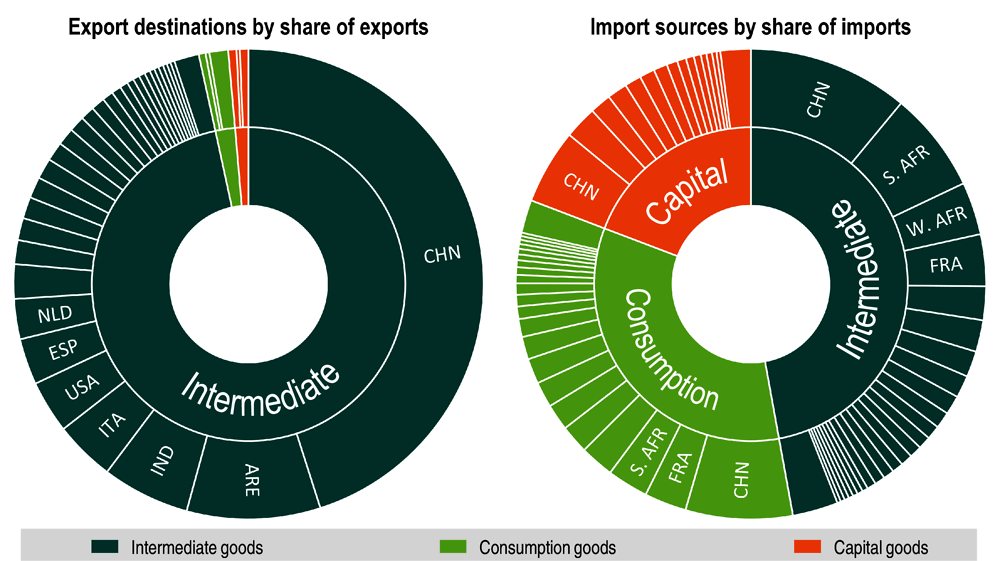

Figure 4.2. Central Africa’s most important trade partners broken down by volume of trade in intermediate, consumption, and capital goods

Notes: Countries are presented using their three-letter ISO codes. The African countries are aggregated into the five sub-regions defined by the African Union as follows: C. AFR = Central Africa, E. AFR = East Africa, N. AFR = North Africa, S. AFR = Southern Africa, W. AFR = West Africa. Interior trade within the Southern Africa Customs Union is excluded.

Source: Authors’ calculations based on data from CEPII (2021), BACI (database), www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37.

Central Africa is still poorly integrated into GVCs

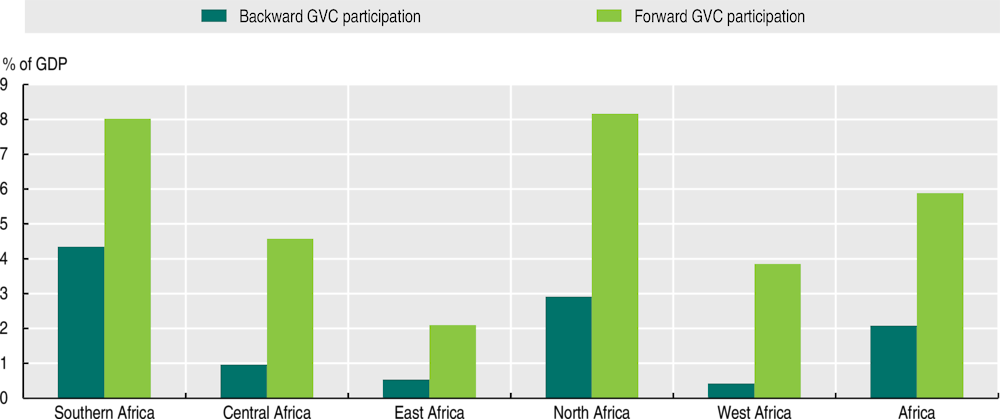

Central Africa is still one of the sub-regions least integrated into GVCs, while its participation is based mainly on forward linkage activities in value chains. Similarly, the foreign value-added content of exports (backward participation) is still relatively low compared to the domestic value-added content of exports (forward participation). Backward GVC participation accounted for just 1% of GDP in Central Africa in 2019 compared with 2.1% across Africa on average and 4.3% in Southern Africa (Figure 4.3).

This average figure conceals the fact that there are large disparities between the individual countries. The Republic of the Congo and Gabon are one step ahead, as their level of participation in GVCs is dominated by the forward linkages that they have been developing with the other countries (AUC/OECD, 2021a). In the Republic of the Congo, this is mainly due to the oil industry, which accounts for the lion’s share of exports, with local processing of the black gold. In addition to Congolaise de Raffinage (CORAF), which has been operational since 1982 and boasts capacity of close to 1 million tonnes a year, another refinery is currently under construction in Pointe-Noire which will have an estimated capacity of 2.5 million tonnes a year.

The diversification strategy adopted by the Gabonese government has had a positive impact on the development of new sectors of activity, most notably in the agri-food and wood industries. The cultivation of oil palms, Para rubber trees and Indian rubber trees has been developed on an industrial scale thanks to the investment of the Singaporean Olam Group, which has accounted for more than 45% of total foreign direct investment (FDI) entering Gabon since 2010 (AfDB, 2020). Chad and Burundi’s weak participation in GVCs is due to the difficulties they have in processing their raw materials (AUC/OECD, 2018). Chad, where oil accounts for 75% of total exports, received approximately USD 1.38 billion in export revenue from unprocessed goods in 2018 compared with just USD 5 million from processed goods (Table 4.A1.1).

Figure 4.3. Total backward and forward GVC participation of the sub-regions of Africa in 2019 (as a percentage of GDP)

Note: GVC participation is measured based on the backward component, the forward component and the total rate of participation combining those two components.

Source: Authors’ calculations based on data from Casella et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc/

In Central Africa, the relatively high level of forward participation (more than 4% of GDP) at the expense of backward participation (1% of GDP) is due to the importance of trade in goods and services. According to the “smiling curve” principle, backward linkage activities such as research & development (R&D) create more added value than forward linkage activities such as marketing and distribution (Shih, 1996; Dedrick and Kraemer, 1998). In 2019, the sub-region ranked second in the continent in terms of intra-African trade in semi-finished goods, just behind Southern Africa (AUC/OECD, 2021a).

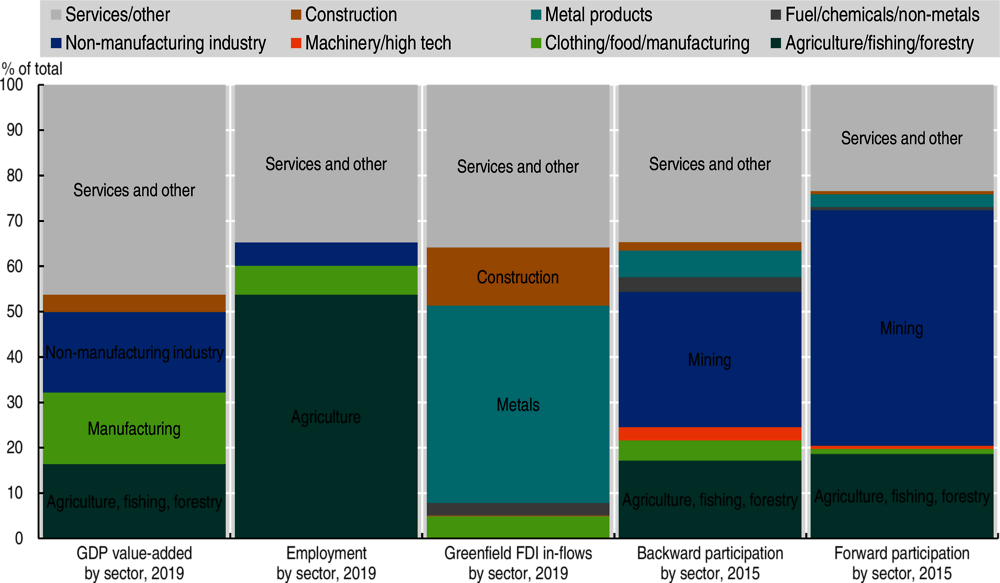

Central Africa’s integration into GVCs is still primarily driven by the primary sector and is dominated by exports of unprocessed raw materials on which the sub-region was, on average, 61% reliant in 2018 (AUC/OECD, 2021b). Mines and quarries, transport, agriculture and wood account for the largest proportion of its forward GVC participation (Figure 4.4). The domestic value-added content resulting from the exploitation of mining products and contained in the exports of the sub-region’s countries is estimated at over USD 3 billion, considerably higher than that of other sectors (AUC/OECD, 2021a). Furthermore, in Central Africa, exports of fully processed goods in 2018 totalled USD 191 million (Table 4.A1.1), far behind the continent’s other sub-regions (USD 23.7 billion in North Africa, USD 18.57 billion in Southern Africa, USD 6.13 billion in East Africa and USD 2.38 billion in West Africa).

Figure 4.4. Total value of export-related backward and forward GVC participation for Central Africa, in USD million, 2015

The sub-region’s countries that have registered an increase in exports also rely on raw materials and hydrocarbons, which is why they are vulnerable to external shocks. The countries are split into three clear groups based on the structure of their exports: countries which are dependent on oil (Cameroon, Chad, the Republic of the Congo, Equatorial Guinea and Gabon), countries which are dependent on non-renewable natural resources (more than 25% of exports in the Central African Republic and the Democratic Republic of the Congo), and countries which are not dependent on mineral resources (Burundi and São Tomé and Príncipe). For almost half of the countries, the exports-to-GDP ratio has increased, but only as a result of a rise in global demand and in domestic production of natural resources (whether oil or otherwise). This is the case for Chad, the Republic of the Congo, Gabon and the Democratic Republic of the Congo. Apart from Cameroon and Equatorial Guinea, the countries which have suffered a decline in exports in relation to GDP are Burundi and São Tomé and Príncipe, which are struggling to integrate into GVCs (Allard, Kriljenko and Chen, 2016).

Central Africa’s exports have increased over the past ten years thanks to discoveries of new oil fields and/or other non-renewable natural resources. Export volumes have developed in line with prices. By contrast, countries which have been unable to benefit from such resources or those whose governments have prevented proper exploitation of such resources have seen their export volumes decline. Overall, in almost all of the countries, raw materials are the driving force behind foreign trade.

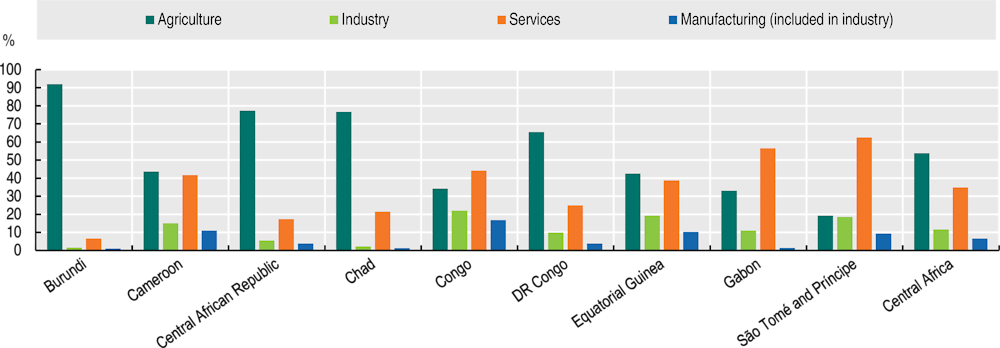

Primary sector industries, which are sources of GVC integration, create a lot of precarious employment with low added value. The primary sector, in particular agriculture, accounts for the lion’s share of employment in Central Africa (Figure 4.5). Although it varied heavily from country to country, agriculture was on average estimated to account for 52% of employment in 2019 and provided jobs to more than 75% of the working population in Burundi, the Central African Republic and Chad. Agricultural employment is still largely informal, and in 2018 informal employment accounted for 90% of total employment in Central Africa (ILO, 2020). The prevalence of informal employment makes it difficult for labour law to be properly enforced and restricts workers’ productivity in the face of strong competition in particular from countries in the Asia-Pacific region.1 In certain countries, such as São Tomé and Príncipe, Gabon and the Republic of the Congo, the wholesale and retail sector is still a rich source of employment accounting for more than 40% of all jobs.

Figure 4.5. Employment by sector in Central Africa in 2019 (percentage of total employment)

Source: Authors’ compilation based on data from the International Labour Organization (ILO), the United Nations Statistics Division, national accounts (analysis of main aggregates, dataset downloaded in July 2021) and the World Bank’s World Development Indicators (database and data issued by the central banks, national statistical institutes and the World Bank’s country offices).

The intercontinental market represents an opportunity to develop RVC trade but remains insignificant for Asian and European partners. Trade between Central African countries is valued at USD 300 million, i.e. 3% of exports (AUC/OECD, 2018), compared with more than USD 500 million with Southern Africa, Central Africa’s main trading partner in Africa (CEPII, BACI international trade database). These figures do not take into account the existence of a large volume of informal cross-border trade which accounts for close to 43% of the sub-region’s revenue (ILO, 2020). As such, although the statistics may not be fully accurate, they do show that this trade is comparable with that of regions such as the Caribbean and Latin America.

Box 4.1. Opportunities for processing mineral products in Central Africa

Copper, oil and bituminous minerals account for the lion’s share of the sub-region’s total exports – 86.6% in Chad, 61.4% in the Republic of the Congo and 63.3% in Equatorial Guinea (AUC/OECD, 2021a). These raw materials, exported to other regions of the world, improve these countries’ GVC participation, which is why policies designed to promote industrial hubs for processing them locally are so important.

The development of potash in the Republic of the Congo, for example, valued at USD 2 billion (UNECA, 2020), could result in a regional value chain (RVC), especially given that the sub-region continues to allocate vast resources to imports of food products: 38% of imports in Equatorial Guinea in 2017, 24% in Gabon, 21% in the Central African Republic, 18% in São Tomé and Príncipe, 17% in the Republic of the Congo and around 16% in Cameroon and the Democratic Republic of the Congo (AUC/OECD, 2019). Yet, the extraction and exportation of potash to Cameroon would, thanks to the existence of a large and qualified workforce, enable it to be processed into fertiliser, in turn enabling the sub-region’s demand for agricultural inputs to be met.

Furthermore, with 70% to 80% of the world’s columbite-tantalite (coltan) reserves (an ore used by the electronics and aviation industries, a substantial proportion of which comes from the Democratic Republic of the Congo), Central Africa could promote an integrated operations policy. According to official statistics from the Democratic Republic of the Congo, it exported 1 038.33 tonnes of coltan for a value in excess of USD 20 million in the first half of 2020 (Ministry of Mines of the Democratic Republic of the Congo, 2021). The construction of coltan processing plants pooling the production of the countries concerned would provide a thriving industry with numerous opportunities – instead of creating endless conflicts over the open-cast mines in eastern Congo.

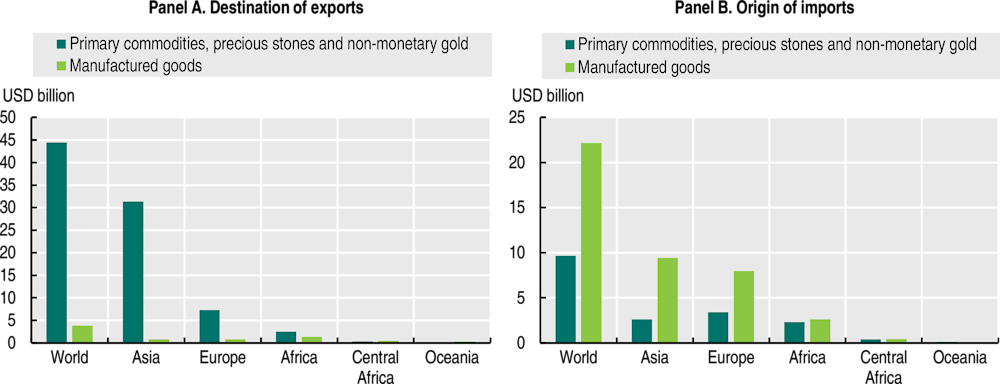

Outside of the continent, Asia and Europe are still Central Africa’s main trading partners. Although the main exports to Asia and Europe consisting of raw materials are valued at close to USD 31 billion and USD 7 billion respectively, imports are primarily of manufactured goods (Figure 4.6).

Figure 4.6. Main destinations/origins of primary commodities and manufactured goods exported from/imported to Central Africa, 2020 (in USD billion)

Box 4.2. Analysis of certain strategic value chains in Central Africa

Central Africa boasts revealed comparative advantages (RCAs) with regard to several products, including raw wood, cotton, ores and natural abrasives. In 2019, raw wood generated nearly USD 1.16 billion in export revenue in the Central African Republic, the Republic of the Congo, Equatorial Guinea and Gabon (Table 4.1), followed by cotton which generated USD 113.5 million in Chad. In the 2020-21 season, cotton production experienced growth and reached 125 000 tonnes (t) compared with 116 000 t in 2019-20 and 76 000 t in 2018-19 ( Financial Afrik, 2021). Ores and natural abrasives rank third among products with the greatest RCA, in particular in the Democratic Republic of the Congo on account of coltan. In São Tomé and Príncipe and Burundi, cocoa and tea provide the greatest RCA.

Table 4.1. Analysis of certain strategic value chains in Central Africa

|

Country |

Products with the greatest RCA |

Exports in 2019 (USD million) |

Opportunities |

Challenges to overcome |

|---|---|---|---|---|

|

Burundi |

Tea |

16.58 |

Second cash and export crop after coffee. 13% of the value of exports on average over the 2007-15 period (Ndimubandi and Schuster, 2018). |

Implementation of a regulatory body to limit economic constraints – limited investment, volatility of exorbitant production costs and prices ( Burundi Eco, 2021). |

|

Chad |

Cotton |

113.52 |

One of the mainstays of the economy. Sector benefiting from partnership with the European Union (EU, including France, Germany, Belgium, Portugal and Spain). |

Maintenance of rural tracks to facilitate the transportation of production from fields to ginning plants. |

|

DRC |

Natural abrasives, coltan |

107.12 |

The DRC was home to between 60% and 80% of the world’s known coltan reserves in 2020. |

Safety of producers, logistics and administrative issues relating to exportation and certification (Ecofin Agency, 2017). |

|

São Tomé and Príncipe |

Cocoa |

11.34 |

Primary source of revenue from exports: USD 9.5 million in sales in 2017, i.e approx. 93% of the country’s total exports and 2.4% of its GDP (IFAD, 2020). |

Training for farmers on how to process their crops and implement sustainable practices. |

|

Central African Republic Congo Equatorial Guinea Gabon |

Raw wood or squared timber |

51.47

249.06 3.64 860.57 |

World’s second largest area of tropical rainforests. The wood industry makes a significant contribution to GDP and to employment in the countries concerned (see below). |

High transport costs and poor state of commercial and logistical infrastructure. |

Source: Authors’ calculations and compilation based on the sources mentioned in the table above; data on RCAs and exports taken from the UNCTAD Merchandise Trade Matrix (UNCTADstat, https://unctadstat.unctad.org/EN/RcaRadar.html, consulted on 9 August 2021).

Case study: Promoting the wood RVC is essential

The forestry sector has been chosen on account of its huge potential

The forests of Central Africa constitute the world’s second largest area of tropical rainforests and are home to terrestrial ecosystems that are vital to the region’s development. They account for 26% of the planet’s remaining tropical rainforests, 10% of forest carbon emissions and 70% of Africa’s rainforest cover (FAO, 2020) and span across six countries: the Democratic Republic of the Congo, Gabon, the Republic of the Congo, Cameroon, the Central African Republic and Equatorial Guinea (Table 4.A1.3). Thanks to the immense quantity of carbon stored in their abundant vegetation, they act as a buffer mitigating global climate change and help to safeguard the food security of local populations. The sustainable management of these forests is essential for achieving several Sustainable Development Goals (SDGs), in particular those relating to responsible consumption and production, life on land and climate action. The forests of the Congo Basin carry out invaluable ecological services such as controlling floods and regulating the climate both in the local area and the wider region. Certain areas could be more sensitive to global changes than others (Réjou-Méchain et al., 2021).

The numerous plans to develop the forest value chain (FVC) have not resulted in the sustainable management of this key resource. The forests of Central Africa and their extremely rich biodiversity are brimming with the resources required for the Central African countries to participate in the global wood value chain. In 2003, the African Union (AU) defined the FVC as a future chain for Central Africa, since it boasts opportunities for developing low-carbon materials and could boost green building, drive growth and create jobs. The decision “taken by the countries to allocate production forests” could secure the forest cover and the economic activity generated could help to fight poverty, which is an indirect cause of deforestation.

The countries have struggled to enforce regulation of the exploitation of resources, threating Central Africa’s equatorial forests for many years on account of deforestation (Table 4.2). In 2020, no fewer than 600 000 hectares (ha) of primary forests were cut down in the Democratic Republic of the Congo, Cameroon, the Republic of the Congo, Gabon, Equatorial Guinea and the Central African Republic, constituting an increase of 9% compared to 2019. What is more, following deforestation, the forests that grow back are less dense. There are several possible causes of this deforestation phenomenon: shifting cultivation, the expansion of infrastructure, the harvesting of wood and conflicts in certain countries such as the Democratic Republic of the Congo, which hinder the monitoring of forest areas by public authorities. Furthermore, the COVID-19 pandemic is likely to increase deforestation due to reduced monitoring by public agencies.

Table 4.2. Rate of annual loss of forest cover in Central Africa

|

|

Forest area (1 000 ha) |

Rate of annual loss of forest cover (as a percentage) |

|

|---|---|---|---|

|

2010 |

2020 |

2010-20 |

|

|

Cameroon |

20 900 |

20 340 |

0.27% |

|

Congo |

22 075 |

21 946 |

0.06% |

|

Central African Republic |

22 603 |

22 303 |

0.13% |

|

DRC |

137 169 |

126 155 |

0.83% |

|

Gabon |

23 649 |

23 531 |

0.05% |

|

Equatorial Guinea |

2 532 |

2 448 |

0.34% |

|

Central Africa (average) |

|

|

0.28% |

Source: FAO (2020), https://www.fao.org/3/ca9825en/ca9825en.pdf.

Despite its modest contribution to GDP, the formal forestry sector remains a major source of employment in Central Africa (Table 4.3). Forestry activities make a limited contribution to GDP, between 2.67% and 5% in 2018 (ATIBT, 2020a), but account for 200 000 direct and indirect jobs (Table 4.3). In Gabon, the forestry sector represents the biggest source of employment after the State, providing 13 000 direct jobs, including 5 000 civil servant roles and 600 support officer positions in public forestry departments.

The forestry sector’s full contribution to economic growth is underestimated in official statistics due to the significance of the informal sector. Despite the difficulty involved in measuring the size of the informal wood market, informal production is estimated (in roundwood equivalent) to be 2.4 million m3 in Cameroon and 4 million m3 in the Democratic Republic of the Congo (ATIBT, 2020a). The informal sector is a source of employment, just like the formal sector, even if it involves unpaid subsistence activities related to the harvesting of wood, used as an energy source.

Table 4.3. The forestry sector’s contribution to GDP and direct and indirect employment in Central Africa

|

Country |

Contribution to GDP as a percentage, 2018 |

Jobs |

|

|---|---|---|---|

|

Direct jobs |

Indirect jobs |

||

|

Cameroon |

4.7% |

13 000 |

150 000 |

|

Gabon |

3.3% |

13 000 |

between 2 000 and 5 000 |

|

Central African Republic* |

5.0% |

4 000 |

6 000 |

|

DRC |

0.15% (2016) |

4 523 |

– |

|

Congo |

2.67% |

7 500 |

5 000 |

|

Equatorial Guinea |

– |

– |

– |

Sources: International Tropical Timber Technical Association (ATIBT, 2018 and 2020a), Activity Report, https://www.atibt.org/files/upload/Activity_report/ATIBT-ACTIVITY-REPORT-2020.pdf, and *AfDB (2018), https://www.afdb.org/sites/default/files/documents/publications/developpement_integre_et_durable_de_la_filiere_bois_dans_le_bassin_du_congo_-_regional_0.pdf.

The impact of the COVID-19 pandemic on the wood value chain in Central Africa has led to political responses

Like the rest of the world, Central Africa is gradually recovering from the worst economic recession recorded since the end of the 1980s. In addition to the health impact, COVID-19 has also taken its toll on business in the sub-region’s countries which had already been weakened by the recessionary effects of the fall in oil prices and security crises. During the first half of 2020, the respective governments implemented travel restriction, lockdown, social distancing and border closure measures in order to slow the spread of the pandemic. These measures led to a contraction of the sub-region’s real GDP growth of 5% in 2020, the worst performance in over two decades. Thanks to the partial lifting of the restrictions on account of a slowdown in the number of infections, there has been economic recovery in 2021 even though growth is expected to be zero according to forecasts (AUC/OECD, 2021a).

The measures designed to stop the spread of the pandemic have had a major impact on the forestry sector in general and the wood industry in particular. Border closures have hampered wood supply chains, which in turn has led to longer-term supply and demand issues. On the supply side, the cessation in some cases of the free movement of persons and goods has prevented businesses with links to the wood industry, from operating at full capacity leading to the postponement or cancellation of orders for wood and processed goods (Andrianarison and Nguem, 2020). Similarly, hold-ups along logistics chains have increased the risk of disruptions to supplies that are essential to production, thus impacting production capacity. All the sub-region’s countries have seen their export volumes decline (Table 4.4). In Cameroon, for example, exports of roundwood and furniture fell from USD 394 million and USD 805 000 respectively in 2018, to USD 131 million and USD 184 000 in the first half of 2020.

Exports have been affected by reduced demand from the sub-region’s main trading partners such as China and EU Member States, which have been heavily impacted by the pandemic. Central Africa’s wood-producing countries export the majority of their production to China, and most logs (roundwood) removed in Africa are marketed by Chinese companies. Statistics produced by Global Wood Markets Info (GWMI, 2021) show a decline in China’s imports of wood since the start of the pandemic. Instead of the forecast 17.5 million m³ of wood, China imported just 13.9 million m³ between January and May 2020, which is a reduction of 21% (Lubala and Mounzéo, 2020). In Cameroon and Gabon, forestry activity has decreased due to the decline in demand from China for the ovangkol and okoumé species (ITTO, 2021). In the Republic of the Congo, Congolaise Industrielle des Bois (CIB) and Interholco were the only companies that were operational during the first quarter of the lockdown (Ministry of Finance and the Budget of the Republic of the Congo, 2020). The sub-region’s economies have also been hit by a local demand shock in relation to the restrictive measures imposed by the governments but also the decline in household income.

Table 4.4. Exports of primary wood products and secondary processed wood products (wooden furniture) in Central Africa, 2018-20 (in USD thousand)

|

Country |

Roundwood |

Wooden furniture |

||||

|---|---|---|---|---|---|---|

|

2018 |

2019 |

2020 (first half) |

2018 |

2019 |

2020 (first half) |

|

|

Burundi |

0.09 |

– |

– |

99.69 |

138.63 |

10.05 |

|

Cameroon |

394 002.3 |

280 592.9 |

131 181.2 |

805.85 |

288.18 |

183.56 |

|

Central African Republic |

66 826.13 |

41 446.2 |

59 745.87 |

16.77 |

22.08 |

1.09 |

|

Chad |

– |

– |

– |

82.69 |

5.79 |

– |

|

Congo |

298 387.7 |

300 870.5 |

260 288 |

140.93 |

242.69 |

43.69 |

|

DRC |

40 995.88 |

34 914.59 |

62 322 |

67.07 |

20.54 |

1.54 |

|

Equatorial Guinea |

345 393.20 |

190 706 |

68 493 |

14.64 |

14.71 |

– |

|

Gabon |

19 797.05 |

16 856 |

993.55 |

222 |

283.86 |

133.27 |

|

São Tomé and Príncipe |

– |

– |

– |

6.38 |

36.46 |

36.46 |

Note: – = lack of information.

Source: Authors’ calculations based on ITTO data (2021), https://www.itto.int/biennal_review/?mode=searchdata.

Direct impacts in the wood industry have had knock-down effects on the sub-region’s workforce and companies. The industry is a major source of employment in Central Africa (Table 4.3). The strategic vision for the industry drawn up by the Central African Forests Commission (COMIFAC) sets out the creation of 60 000 jobs over the period from 2018 to 2030 (Forum Africain du Bois, 2018). However, high occupational safety and health risks, increased during the pandemic, added to the sanitary measures in place, make this vision unrealistic. These measures and other COVID-19-related travel restrictions, have led to important job losses in the forestry sector, where labour-intensive tasks are commonplace.

The pandemic has hampered efforts to promote sustainable forest management in Central Africa. Since those employed in the informal forestry sector are at high risk of losing their jobs, they may resort to undertaking illegal forestry activities such as producing charcoal and harvesting non-timber forest products (NTFPs) to meet medicinal, dietary and nutritional needs (UNDP, 2021). Furthermore, the pandemic is likely to lead to an increase in deforestation due to reduced monitoring by public forestry agencies (Box 4.3). The pandemic has resulted in an increase in illegal forestry activities in Central Africa due to shortcomings in the governance and funding of forestry agencies (Mbzibain et al., 2020).

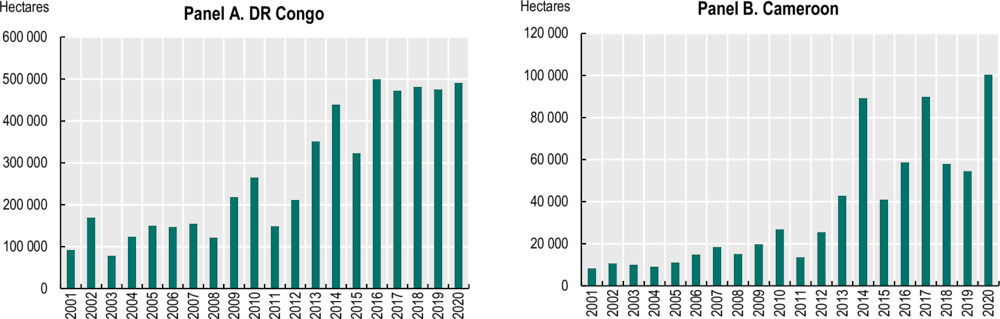

Box 4.3. Impact of COVID-19 in terms of loss of forest cover in the Democratic Republic of the Congo and Cameroon

Between 2001 and 2020, the total surface area covered by primary rainforests in the Democratic Republic of the Congo and Cameroon fell by 5.1% and 3.7% respectively, constituting a loss of nearly 5.32 million ha and 708 000 ha of primary rainforest. Deforestation accelerated in Cameroon in 2020. When the COVID-19 pandemic hit in 2020 causing travel restrictions and a global economic slowdown, Cameroon lost more than 100 000 ha of its primary forests in 2020, which is nearly double the surface area of primary forests destroyed in 2019 (Figure 4.7). According to data from GFW (2021a), most forest losses in Cameroon are attributable to agriculture. More than 60% of the losses were recorded in the central and eastern parts of the country, which are its main forest regions. In the Democratic Republic of the Congo, of the 1.21 million ha of forest cover lost in 2019, 494 000 ha were attributable to forestry and 203 000 ha to forest fires.

Figure 4.7. Loss of primary forest cover (in hectares) in the DR Congo and Cameroon, 2001-20

Note: The graphs represent the loss of humid primary forests, reaching 16% and 34% respectively of the total loss of forest cover in Cameroon and DR Congo between 2001 and 2020.

Source: GFW (2021a), https://gfw.global/3ekT11P.

The number of fire alerts in these countries has increased tenfold since the start of the pandemic. Taking only high-confidence alerts into account, some 10 034 Visible Infrared Imaging Radiometer Suite (VIIRS) alerts were recorded between 19 October 2020 and 17 May 2021 in Cameroon, which is high compared to previous years dating back to 2012 (GFW, 2021a). Over the same period, the number of high-confidence VIIRS alerts for the Democratic Republic of the Congo was estimated at 19 589.

A range of measures have been taken by the sub-region’s countries and numerous development partners in order to offset the impact of the pandemic on the wood industry. Governments, the private sector, civil society, the United Nations and the African Development Bank (AfDB) have joined forces to tackle the pandemic (Table 4.5).

Table 4.5. Various political measures taken to offset the impact of the pandemic on Central Africa’s forestry sector

|

Country/countries |

Measure(s) |

|---|---|

|

Congo, DRC and Central African Republic |

April 2020: The Green Climate Fund Board approved 15 new projects totalling USD 1.2 billion in new climate funding designed to provide developing countries with firm support in order to enable them to ramp up their climate action in the face of COVID-19 (CBFP, 2021a). |

|

Congo |

April 2020: The Ministry of Finance and the Budget drew up and published customs, fiscal and financial measures designed to enable numerous tax and duty payments to be postponed and import and export taxes to be reduced in order to support forestry companies suffering a decline in activity (ATIBT/BVRio, 2020). |

|

Central Africa |

May 2020: The Wildlife Conservation Society put forward a package of strategic measures designed to reduce the risk of future epidemics of infectious diseases caused by bushmeat in Central Africa. The specific aims are to improve public health infrastructure, raise awareness so as to protect the health of indigenous peoples and local communities, stop supplies travelling from rural areas to urban areas, prevent the sale in towns and cities of mammalian species as bushmeat and develop early warning systems for emerging zoonotic diseases at the interface between humans, wildlife and forests (CBFP, 2021b). |

|

Central Africa |

May 2020: The International Tropical Timber Technical Association (ATIBT) adopted measures designed to maintain the activities of a responsible industry essential to the economic equilibrium of the sub-region’s countries. These measures concern five companies based in Cameroon, the Republic of the Congo and Gabon.1 Interholco (northern Congo), for example, which employs 1 000 people, implemented regional civic and educational programmes for employees and their families in collaboration with government bodies. Sanitary measures for staff and local residents were taken, including the acquisition of medical and hygienic equipment (ATIBT, 2020b). |

|

Chad |

June 2020: The AfDB awarded a grant of more than USD 20 million in order to finance the Support Project for G5 Sahel Member Countries to Combat the Coronavirus (COVID-19) Pandemic. The project’s objectives are to build case management capacity, ensure the availability of medical products for the prevention, control and treatment of symptoms and implement social protection measures in target communities including refugees and displaced persons, for example those from the Lake Chad area (G5 Sahel, 2021). |

|

Central Africa |

June 2020: The Food and Agriculture Organization of the United Nations (FAO) organised a forestry webinar on the topic “Building back better: COVID-19 pandemic recovery contributions from the forest sector". A joint survey was conducted by FAO’s Forestry Division and partners within and outside of FAO of between 200 and 400 participants a day, in particular representatives of countries, UN bodies, NGOs, international organisations, civil society and universities as well as individuals with an interest in the forestry sector. The findings indicated that the most relevant measures for mitigating the impacts of the pandemic were the adoption of digital technologies, resource efficiency and support designed to improve health facilities and healthcare in locations where main operations are carried out. For governments, the most relevant responses to the survey concerned support measures for accessing markets and stabilising supply and trade (legal, logistical and public procurement measures, etc.) and subsidised loans and/or tax exemptions for small and medium-sized forestry enterprises (Linhares-Juvenal, 2020). |

|

Central African Republic |

October 2020: Networks of civil society organisations such as the Global Greengrants Fund raised awareness of COVID-19 among local communities and indigenous peoples in the forest area in the south-west of the country. Communities benefited from awareness-raising initiatives and the distribution of hygiene kits (Wallot, 2021). |

|

Cameroon, Congo and Gabon |

December 2020: A platform was set up from 17 to 18 December for direct communication and co-operation among Chinese companies and ATIBT member companies working in Africa in order to promote the development of sustainable trade in hardwood (CBFP, 2021c). |

|

Cameroon |

December 2020: On 15 December, the Ministers for Forestry and Wildlife, Public Works and Public Contracts signed a joint order setting out provisions for the use of legally sourced wood in public procurement projects in Cameroon. This order forces operators involved in the construction of buildings and/or public procurement projects relating to wood products to provide proof that the wood being used was legally sourced. |

|

Cameroon |

January-February 2021: As part of the Regional COMIFAC Support Project, between January and February 2021 the German Corporation for International Cooperation (GIZ) conducted COVID-19 healthcare support missions in communities surrounding Lobéké National Park (22 to 30 January 2021) and Nki National Park (16 to 22 February 2021) located in the southeasternmost point of Cameroon. The aim of these missions was to distribute sanitary and medical equipment (CBFP, 2021d). |

|

Central African Republic and Congo |

June 2020: A module dedicated entirely to the risk analysis of wood and wood product supply chains was launched. “Ekwato" is a digital innovation designed to enable users to monitor and proactively analyse risk in relation to wood products. |

|

Gabon |

July 2021: On 2 July, a memorandum of understanding was signed between Gabon and Togo for a term of five years designed to facilitate the importation to Togo of Gabonese wood products that have undergone primary, secondary or tertiary processing. |

1. In addition to Interholco (northern Congo), this includes Rougier (Gabon, 1 100 employees), CIB-Olam (northern Congo, 1 800 employees), Pallisco-CIFM (Cameroon, 500 employees) and Precious Woods (Gabon).

Source: Authors’ compilation based on the sources mentioned in the table.

Strengths and weaknesses of the forestry sector

Despite huge potential to increase its integration into global wood value chains, Central Africa’s share in the global market is still weak. In 2020, the sub-region accounted for just 6.28%, 9.70% and 5.38% of global production of tropical sawnwood, wood veneer and roundwood, respectively (Table 4.A1.2). Between 2010 and 2020, roundwood production increased, but the sector is still dominated by Asia which is responsible for more than half of production across all of the industry’s segments. Gabon, which is the world’s fifth largest producer of wood veneer, is the only exception. It has its sights set on second place after Viet Nam, which primarily sources plantation wood (AfDB, 2018).

Table 4.6. SWOT (strengths, weaknesses, opportunities and threats) analysis of Central Africa’s wood industry

|

Strengths |

Weaknesses |

|---|---|

|

• The forests of the Congo Basin constitute the second largest rainforest area after the Amazon, accounting for:

• The forestry sector provides more than 200 000 direct and indirect formal jobs in Central Africa. • The multifunctionality of the forests is taken into account. • The forests of the Congo Basin accounted for more than 3% of the region’s GDP during the 2010s. • The forests are predominantly public: leverage for providing structure. • The Congo Basin is a carbon pool, storing it in the form of biomass. |

• Limited domestic processing of wood. • Transport costs which negatively affect price competitiveness. • Limited appeal of the industry’s professions and related training. • Lack of communication regarding wood, wood-related professions, products and companies. • Lack of respect for the law and lack of governance. • Production of sawnwood, roundwood, wood veneer and plywood is relatively low compared to Asian countries. • Issues relating to informal operations, in particular for productive activities with added value. |

|

Opportunities |

Threats |

|

• Contribution to climate action:

• Large workforce ready to be trained. Creation of additional jobs in Central Africa. • Transition of wood markets to more sophisticated products with greater added value. |

• Deforestation in Central Africa is steadily increasing (9% in 2020 according to Global Forest Watch). • Increasing development of firewood, requiring a structured approach in order to prevent disputes over usage. • High transport costs. • Lack of technical, commercial and marketing innovation. • Pressure of competition from emerging economies, in particular China. • Hazardous weather conditions. |

Sources: AfDB (2018), GFW (2021a) and Ecofin Agency (2021b).

The wood industry is at the heart of the development strategies adopted by the Central African countries in the 2010s. Gabon launched an ambitious plan in 2010 designed to catapult the country to the ranks of the emerging economies by 2025. Its entire industrialisation strategy hinges on the wood industry. Since 2010, Gabon has invested EUR 10 million, i.e. around XAF 6.5 billion (Central African CFA francs) within this framework (Le Nouveau Gabon, 2018). It is expected that 50 000 new jobs be added in by 2025 (Ecofin Agency, 2021b). Of the 400 known species of wood in Gabon, 60 are logged, the main one being okoumé (80% of wood exports in 2009).

There are strong signs of political will to industrialise the wood industry since the decision to ban logs (roundwood) exports was taken in 2010. This measure was designed to create new jobs and increase profits by exporting semi-finished products ready for consumption on the global market. For its part, in 2012, the Government of the Democratic Republic of the Congo set up an advisory committee to draw up the country’s new industrial policy. The wood industry was identified as a strategic challenge for insertion into GVCs. As such, integration via wood value chains can help modernise the private sector, create jobs and contribute to the green economy (DGF/DRC, 2018).

The Central African countries’ share of the tropical timber export market remains modest across all segments of the industry. In 2020, roundwood exports totalled 7% compared to 53.7% in the Asia-Pacific region (Table 4.7). However, the informal sector is prevalent, due to poor employment prospects in industry and agriculture. The volumes related to informal activities may significantly exceed those of industrial production (ATIBT, 2020a). A number of unresolved issues remain concerning the sustainable management of forest resources, the fight against corruption and the mobilisation of domestic resources by states. The latter remains limited with a tax-to-GDP ratio of 8.8% for 2018 (AUC/OECD, 2021a). Processed goods by SMEs are not oriented enough towards the continental and international markets. Companies involved in processing wood for domestic construction or the manufacturing of furniture do not manage to enter international markets and only achieve artisanal level production. Their access to credit could be improved, and tax barriers could be lifted to attract the necessary capital to increase productivity.

Table 4.7. Global exports of tropical roundwood and processed tropical timber products in 2020 (in thousands of m3)

|

|

Roundwood |

Sawnwood |

(Peeled or sliced) wood veneer |

Plywood |

|---|---|---|---|---|

|

Global tropical timber exports |

11 192.8 |

9 212.1 |

1 922.7 |

6 638.6 |

|

Africa |

3 044.7 |

2 204 |

405.5 |

119.5 |

|

Share of global tropical timber exports |

27.2% |

24% |

21.1% |

1.8% |

|

Central Africa |

784 |

222 |

9.42 |

0 |

|

Share of global tropical timber exports |

7% |

2.4% |

0.5% |

0% |

|

Asia-Pacific |

6 010.7 |

5 884.8 |

1 400.9 |

5 900.1 |

|

Share of global tropical timber exports |

53.7% |

63.9% |

72.9% |

88.9% |

|

South America |

2 059.1 |

725.5 |

77.3 |

271.9 |

|

Share of global tropical timber exports |

18.4% |

7.9% |

4% |

4.1% |

Source: Authors’ calculations based on data from the International Tropical Timber Organization (ITTO, 2020), https://www.itto.int/biennal_review/?mode=searchdata.

In most cases logging is carried out under concessions, but European companies, which tend to demonstrate greater respect for certification, have been surpassed by Asian conglomerates. Forest certification, a sustainable forest management tool, constitutes an investment and encourages companies to self-regulate in order not to lose the label. As such, large European companies comply with legal standards requiring forest management plans, which have become obligatory. By contrast, Asian companies are often accused of conducting illegal activities.

With the help of foreign companies, countries have implemented international standards guaranteeing that wood is sourced from a sustainably managed environment. This move towards certification falls under the umbrella of sustainable forest management (Box 4.4). There are two types of certification in Central Africa: certificates concerning responsible forest management and those concerning the legal sourcing of wood (Table 4.8).

Box 4.4. The move towards certification

On the initiative of Global Forest Watch (GFW), a public-private partnership was set up in 1997 in order to create a source of verified information for the main forestry companies in Central Africa. Several large-scale producers have taken the necessary steps to obtain certification via recognised international forest certification systems. This voluntary move has gained traction as a result of the fact that the global wood market is becoming increasingly sensitive. In early 2004, the German company Congolaise Industrielle des Bois (CIB), announced its intention to strive to achieve the certification standards of the internationally recognised system of the Forest Stewardship Council (FSC) (COMIFAC, 2005).

The first FSC certificate was issued to CIB in 2005. As such, CIB was granted an initial concession covering 1.3 million ha, forming a buffer zone around the Nouabalé-Ndoki National Park in the north of the Republic of the Congo and ensured continuity with the Lake Télé Community Reserve in the south. In 2019, the total surface area of FSC-certified forests in the Republic of the Congo was approximately 2.5 million ha, attributed to the same companies (ATIBT, 2019). These companies all operate under forest concessions located in the northern part of the Republic of the Congo, which has the 12th largest surface area of FSC-certified forests in the world and the largest in Africa.

Since 2011, the international NGO Programme for the Endorsement of Forest Certification (PEFC International) deployed out an initiative designed to support the development of national standard systems in Central Africa, in particular in Gabon, Cameroon and the Republic of the Congo. Through the regional project entitled Pan-African Forest Certification – PAFC Congo Basin, ATIBT plans to expand the range of “third-party certification” services for sustainable forest management. It should be noted that this regional approach is a brand new, innovative step for PEFC. A webinar was organised on 1 February 2021, at the end of which the three countries, supported by Germany’s KfW Development Bank and ATIBT, expressed desire for this regional certification system to be implemented swiftly.

Weak governance of agroforestry production chains reduces the income of harvesters of agricultural resources (Ingram, 2017). Despite the adoption of standards in Cameroon, the Republic of the Congo and the Democratic Republic of the Congo, the main stakeholders in the value chains of non-timber forest products (honey, bush mangoes, cola and fuelwood, etc.), are vulnerable to price fluctuations of raw materials. Over recent years, the way that value chains are actually organised has diverged from the discourse of official authorities, donors and NGOs to become more dynamic and involve more stakeholders. Yet, informal management involving multiple stakeholders penalises the farmers, who are more vulnerable to corruption and at the mercy of unpredictable production costs. The most productive value chains are therefore those that are exclusive (i.e. that do not include stakeholders in the governance arrangements) because they are developed based on government arrangements with appropriate customary rules and restricted tenure and resource access (Ingram, 2017).

Table 4.8. The different certification systems in place in Central Africa

|

Certificates concerning responsible forest management |

|

|---|---|

|

FSC |

The Forest Stewardship Council (FSC), created in 1993 under the auspices of major international NGOs such as WWF, Greenpeace and the Rainforest Alliance, is considered to have the most demanding forest management certification system. This certification system is very active in Central Africa. |

|

PAFC |

The Pan-African Forest Certification (PAFC) system was set up in the mid-1990s and was designed to incorporate the values and socio-economic realities of forest management in Africa (Kouna Eloundou, Demaze and Djellouli, 2008). It has been operational in Gabon since 2004 and in Cameroon since 2007. There is also a PAFC organisation in the Republic of the Congo, and this association became a member of the PEFC Alliance in mid-2017 (ATIBT, 2018). The national members of Cameroon, the Republic of the Congo and Gabon have joined forces under the name PAFC Congo Bassin in order to develop a regional certification system. |

|

PEFC |

This programme, created in 1999, is based on the Rio Forest Principles. It involves a voluntary certification scheme designed to promote sustainable forest management which is certified by an independent third party (Kombila-Moulougui, 2019). |

|

ISO |

The system adopted by the International Organization for Standardization (ISO) provides a framework for the certification of environmental management systems. The ISO 9001 and ISO 14001 series cover more or less the same domains as forest management certification except that they do not set out any performance standards with regard to forest management and do not authorise the use of a label for products (Delvingt and Lescuyer, 2007). |

|

Certificates concerning the legal sourcing of wood |

|

|

OLB |

The system known as Origine et Légalité des Bois, which provides a certificate attesting to the wood’s origin and legality, was developed by Bureau Veritas. |

|

VLC |

Verification of Legal Compliance. |

Source: Authors’ compilation based on the sources mentioned in the table.

Many hurdles remain to strengthen participation in GVCs

Central Africa faces numerous challenges in promoting sustainable wood value chains, namely in relation to the lack of infrastructure, insufficient staff training, and forest governance.

The development of the value chains is reliant on higher-quality infrastructure and non-tariff cost control (Box 4.5). In Central Africa, high inland transport costs restrict the countries’ ability to diversify and participate in GVCs (Plane, 2021). The dense rainforests of the Congo Basin are located in remote areas. The forestry sector is therefore highly dependent on logistical infrastructure and the transport sector. While logistical corridors are multimodal (road, rail and waterway transport), road transport is more prevalent in Central Africa, which ranks amongst the least efficient in the world. Asphalted road networks total just 7 253 km and 1 630 km in Cameroon and Gabon compared with 14 700 km in Kenya and 44 215 km in Morocco (Ecofin Agency, 2020). Furthermore, it took 37 days to process a container in Central Africa compared with just over 14 days in North Africa, between 2010 and 2014 (Plane, 2019).

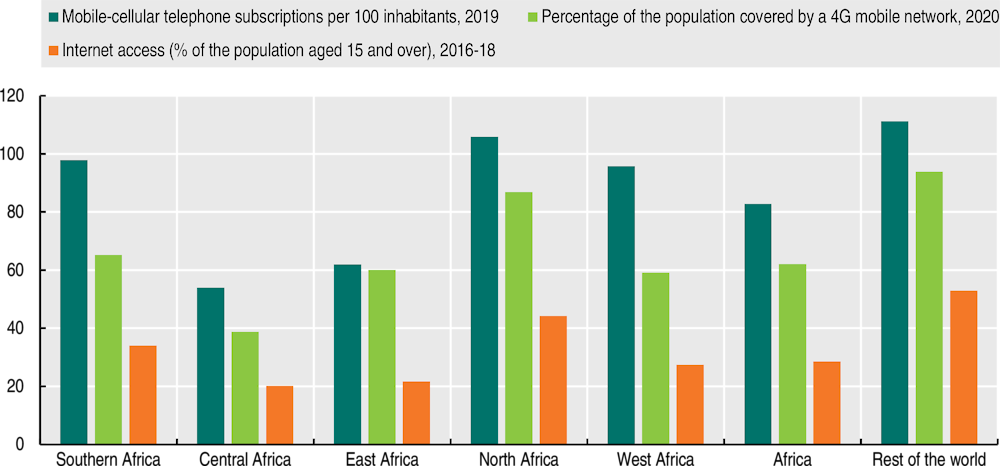

Integration into GVCs is heavily impeded in Central Africa by a severe lack of infrastructure with regard to services, in particular access to digital technology. Access to communication infrastructure in Central Africa is the poorest in the continent. According to the World Bank (2020b), the sub-region lags behind in terms of access to digital tools: in 2019, the mobile telephone subscription rate was 53.9%, and 20% of the population had Internet access compared to averages across the continent of 82.7% and 28.5% (Figure 4.8). Furthermore, the existence of numerous taxes on Internet services limits not only the expansion of such services but also, and most importantly, their integration into business activities (AUC/OECD, 2021b). ICT infrastructure enables companies involved in exports to access international markets swiftly, efficiently and cost-effectively. It increases the competitiveness of exports of manufactured goods and the ability of agricultural exporters to fulfil certain (sanitary and phytosanitary) requirements of international markets. ICT infrastructure also plays an essential role in increasing the productivity of the informal sector, as it enables informal companies to start using innovative technology and reduce transaction costs. However, it should be noted that the COVID-19 crisis has expedited the digitalisation process and the production transformation process of Africa in line with the African Union’s (AU) vision set out in Agenda 2063.

A lack of adequate skills hinders upgrading in the global wood value chain. Staff training courses offered at most training schools in Central Africa date back to before Independence, although they have evolved and must meet market requirements. These national schools of water resources and forestry are grouped together as part of the Réseau des Institutions de Formation Forestière et Environnementale en Afrique Centrale (Network of Forestry and Environmental Training Institutions in Central Africa – RIFFEAC). The National School of Water Resources and Forestry (ENEF) of Cap Estérias in Gabon, which has a regional focus, and the School of Water Resources and Forestry of Mbalmayo in Cameroon are two examples (Diansambu, 2020). ENEF-Gabon offers new training courses linked to the Bachelor’s-Master’s-Doctorate system, but only 27 students obtained a Master’s degree in wood science between 2013 and 2018 (Nkoumakali, 2020). This course will soon be enhanced by the introduction of training for engineers specialising in wood processing procedures. Such initiatives must be encouraged and supported.

Figure 4.8. Current situation with regard to communication infrastructure in the sub-regions of Africa and the rest of the world

Sources: International Telecommunication Union (ITU) – online ICT Indicators Database (July 2020), GSMA Intelligence (updated in June 2020) and Gallup World Poll (consulted on 15 December 2019).

Box 4.5. The example of the Nkok special economic zone (SEZ) in Gabon

The Nkok SEZ, which was created in 2012, has become a model for the local wood processing industry and is attracting numerous investors. It is the largest furniture manufacturing hub in Central Africa. This model has inspired other countries in the Economic and Monetary Community of Central Africa (CEMAC), which decided during a teleconference held on 18 September 2020, to ban wood exports in the form of logs (roundwood) by all Central African countries as of 1 January 2022 (CBFP, 2020).

The Africa Finance Corporation (AFC) specialises in the financing of infrastructure in Africa, and has financed the creation of a furniture export industry in Gabon through the construction of two ports, creating some 6 000 jobs. When the two ports were sold on to international operators, AFC re-employed the capital, leveraging the organisational capacities it created to act as a fast-moving project development agency. The Gabon model is implemented in other West African countries (AFC, 2020). This financing and entrepreneurship example, led by African players and enabling linkages between foreign direct investment and local businesses, is key to realising the potential of African economic integration, especially in the context of the new African Continental Free Trade Area (AfCFTA) (OECD/ACET, 2020).

Any improvement in companies’ forest management is reliant on the application of various international standards adopted by the sub-region’s countries. Several forest management certification systems were in place in the 2000s (Table 4.8), but their implementation did not manage to prevent illegal logging. Stakeholders strove to improve forest governance in Central Africa in the 2010s through approaches designed to reassure importers and clients about the conditions under which the wood was produced, given the lack of management control system in place. However, some companies still struggle to meet forest management certification requirements.

The significance of the informal timber trade in Central Africa should encourage certification bodies to reach a compromise by striking a fair balance between environmental conservation and economic factors. Most Central African countries have demonstrated a keen interest in the Forest Law Enforcement, Governance and Trade (FLEGT) Action Plan by attending various meetings (Soh Fogno, 2018). Although this plan was adopted in 2003, it was not until 2010 that the first Voluntary Partnership Agreements (VPAs) were signed between certain wood-producing countries of Central Africa and the EU. As such, Cameroon (2010), the Republic of the Congo (2010), the Central African Republic (2012) and Gabon (2013) have signed VPAs negotiated as part of the FLEGT process (Soh Fogno, 2018; Kombila-Moulougui, 2019) banning illegal timber trade on the European market.

Sustainable and inclusive resource management is crucial for safeguarding the volume and quality of production from the forests of the Congo Basin. Ore mining and oil and gas production are expanding rapidly in Central Africa. These practices threaten biodiversity and sustainable logging, as they are uncontrolled. In fact, forest cover degradation impacts soil fertility, reduces rainfall and could endanger agricultural production and food security (Doumenge, Palla and Itsoua Madzous, 2021). Other threats come from forest degradation and fragmentation and all mining operations that encroach into the forests. Many biodiversity issues are caused by a lack of infrastructure and regulation concerning ore mining, the need for better governance, the displacement of population groups and conflicts – in particular in the east of the Democratic Republic of the Congo in the region that borders the Virunga National Park, where conflicts intensify during periods of scarce resources as different groups vie for the opportunity to operate the mines.

Several avenues need to be explored with regard to economic policy

CEMAC has developed a 2025 emergence plan designed to make member countries an area of shared prosperity. However, its implementation may be compromised by competing national projects on several fronts, such as the execution time frames and the similarity of economic programmes. Mindful of this situation, the CEMAC Heads of State have instructed the President of the CEMAC Commission to review this plan in order to place CEMAC at the heart of the sub-region’s development process. As a result, this institution should implement a strategy to pool all resources in order to identify any plans of community interest that are deemed to be sustainable only at national level. The development of regional value chains is part of the same aspiration. The following economic policy proposals are designed to reposition CEMAC as an institution for the promotion of sub-regional economic integration.

The macroeconomic framework should be improved in order to ensure a favourable investment climate for the development of value chains

Like all economic activity, participation in GVCs requires a stable macroeconomic framework. For Central African countries, this means, striking a balance between mitigating the impacts of the crisis and maintaining macrofinancial stability. In this respect, it is worth differentiating between the CEMAC countries which participate in monetary co-operation as part of the CFA Franc Zone and other countries of Central Africa. According to medium-term forecasts of the Bank of Central African States (BEAC), year-on-year inflation in CEMAC should stabilise around 2.3% by the end of 2021 and 2.7% by the end of 2022 and then return to 2.4% by the end of 2023. The debt ratio remains a community-wide concern at an average of 50%, although it is well below the limit of 70%. BEAC’s foreign exchange reserves should gradually increase in the medium term and reach 4.71 months of imports of goods and services by the end of the fourth quarter of 2022, compared with 3.73 months in 2021 (BEAC, 2021).

In addition, the sub-region’s enhanced value chain participation requires a reliable institutional environment that ensures a sustainable reform of the business climate. Improving the business climate would not only retain current investors but also attract new ones. Since 2015, the sub-region has been carrying out reforms such as those concerning the Uniform Acts of the Organization for the Harmonization of Business Law in Africa (OHADA) and those concerning national legislation, all of which has provided minority investors with new-found protection and made it easier to obtain loans (AUC/OECD, 2018).

Besides continued reforms, there is room for additional structural and institutional measures. Firstly, the liberalisation of imports could further attract investors and help develop the sector. In fact, offering other actors the opportunity to operate on the market is a way to stimulate competition and encourage local companies to improve their performance and increase their spending on research and development. Secondly, compliance with national rules and international certification standards must be enforced. In its plan to accelerate the forestry sector’s transformation, Gabon, for example, has set out reforms designed to ensure compliance with international certification standards, such as those concerning deforestation and carbon emissions, which have ushered in more foreign direct investment.

Investments need to be made once strategic sectors have been identified

In order to improve the level of value chain participation, it is important for each country to identify the strategic sectors and products for which it has a revealed comparative advantage. This is the case with tea in Burundi, cotton in Chad, coltan in the Democratic Republic of the Congo, cocoa in São Tomé and Príncipe and wood in the Central African Republic, the Republic of the Congo, Equatorial Guinea and Gabon (Table 4.1). The development of high-productivity sectors could also improve the participation of the sub-region’s countries in RVCs and GVCs. For Burundi and Chad, this would mean investing more in agriculture, which accounts for the lion’s share of the total value of GVC participation (AUC/OECD, 2021b). Similarly, diversification of agricultural produce, as recommended in Chad’s 2013 five-year plan (Ministry of Agriculture and Irrigation of Chad, 2013), could boost agricultural production whose levels are unable to meet national demand in many of these countries.

Lower transport costs in Central Africa can increase regional economic integration. Transregional corridors act as a catalyst for the transformation and regional integration of Africa. A prime example is the Congo–Central African Republic–Chad corridor. The roadworks designed to interconnect these three countries were planned to start in 2021 (Ecofin Agency, 2021a). They are expected to cost more than USD 1.7 billion and are part of the 11 major projects prioritised by the Economic Community of Central African States (ECCAS) to enhance sub-regional integration. Central African countries would benefit from rolling such initiatives out at the wider regional level. Waterway transportation is a low-cost and reliable option which is already heavily used by several operators.

The sustainable and inclusive management of strategic value chains needs to be strengthened

The objectives of the wood industry could be processed product-oriented rather than volume-oriented, following the example of Gabon. Of the 18 million hectares of forest in Gabon, 12 million are reserved for the production of wood. Exports of unprocessed logs (roundwood) have been banned since 2009. Total production fell from 3.4 million m3 in 2007 to 1.6 million m3 in 2017, while favouring an increase in the added value of the exported goods. Since 2016, the majority of exported wood has been processed, starting with sawnwood. Finally, all forest concessionaires must be registered with the FSC (IsDB, 2019).

Sustainable value chains can be developed as part of continued policies for reducing emissions from deforestation and forest degradation (REDD+). Central African countries have achieved the Aichi Biodiversity Target2 of ensuring that 17% of terrestrial areas in the forests of the Congo Basin are protected (Doumenge, Palla and Itsoua Madzous, 2021). Countries must use financial and administrative means to encourage informal industries to make the transition to formal industries in order to safeguard the sustainability of logging. In the short-term, they could adopt a two-pronged approach. First, small-scale logging must be gradually formalised as is the case with the PROFEAAC (promoting and formalising small-scale logging in Central Africa) project in the Yaoundé region. Second, the development of production chains around bioenergy, environmental services or carbon sequestration would provide operators involved in the informal sector with sustainable alternatives. In parallel, areas with the richest biodiversity should be protected from extractive industries, and environmental impact assessments should be required in the zones where such industries are authorised.

Authorities must adopt a collaborative, bottom-up approach with local communities and the private sector in order to better manage informal activities. Community forestry schemes were adopted at the national level by Cameroon and the Democratic Republic of the Congo in the 2000s. Despite ambitious management, in particular by listing the environmentally-friendly forestry activities, sustainable logging is being undermined by the mismatch between the financial needs of the local population and the actual managerial and financial implications. Communities offset the high cost related to land titles and operation licenses (USD 150 000 in the Democratic Republic of the Congo) by breaching the current conditions to ensure that their operations are financially viable (Lescuyer et al., 2012). Since 2020, in Cameroon, the Nachtigal Hydro Power Company has been committed to adopting environmental compensation measures for covering community forest areas with water for the construction of a hydraulic dam. The main measure concerns “payment for environmental services”. The most important of these measures, “payment for environmental services”, entails supporting populations for ceasing logging activities and carrying out conservation work on the remainder of the community forest areas.

The outcomes of the management of strategic value chains should be assessed and monitored in the long term whilst rolling out REDD+. Since 2011, the countries of the Congo Basin have been issuing guides to forest concessionaires to help them understand the policies. Another positive practice could consist of raising awareness about agroforestry systems and sustainable forestry among informal operators.

Skills should be developed and vocational training improved

The mismatch between market needs and training courses is a major obstacle hindering Central Africa’s insertion into GVCs. Ambitious reforms of the education system are required in order to close this gap. Local governments must prioritise the creation of specialised institutions geared towards sectors with high added-value potential. These specific skills would supplement basic education (OECD, 2017). Furthermore, governments need to promote R&D to seize the opportunities offered by GVCs and reap the greatest economic rewards.

The best approach in terms of vocational training would be to implement programmes designed to develop the skills required for those working in the wood industry to be able to carry out productive and environmentally-conscious operations. Central African countries could take inspiration, to a certain extent, from the model adopted in Germany where operators of chainsaws and other forestry equipment are required by law to complete a three-year course led by a forest supervisor. Furthermore, to become a supervisor, individuals must complete an additional higher training course lasting 800 hours (Ackerknecht, 2010).

Forestry training programmes must be continuously updated in order to meet the requirements of this fast-changing sector and ensure that Central African countries have the qualified human resources to achieve the goal of sustainable forestry. The countries of the Congo Basin face the major challenge of having to improve the quality of teaching and training in the forestry sector. Numerous initiatives have been put in place in order to meet this challenge. Between 2012 and 2019, RIFFEAC rolled out the intraregional human resource capacity-building project in the sub-region’s national forestry schools (Dieterle, 2020). Finally, investment in non-timber forestry industries (such as tourism) that are more environmentally-friendly and protect forests from deforestation is an issue that could be further explored.

Annex 4.A1. Additional tables

Table 4.A1.1. Trade by manufacturing intensity in Central Africa in 2018 (in USD million)

|

Country |

Total exports of unprocessed goods |

Total exports of semi- processed goods |

Total exports of fully processed goods |

Total exports of processed and unprocessed goods |

Total imports of unprocessed goods |

Total imports of semi- processed goods |

Total imports of fully processed goods |

Total imports of processed and unprocessed goods |

|---|---|---|---|---|---|---|---|---|

|

Burundi |

107 |

152 |

10 |

269 |

64 |

524 |

215 |

803 |

|

Cameroon |

2 621 |

1 581 |

33 |

4 236 |

387 |

3 210 |

1 917 |

5 514 |

|

Central African Republic |

79 |

17 |

3 |

99 |

14 |

121 |

78 |

213 |

|

Chad* |

1 386 |

141 |

5 |

1 532 |

65 |

396 |

277 |

737 |

|

Congo* |

7 304 |

2 673 |

53 |

10 030 |

172 |

1 385 |

832 |

2 389 |

|

DRC* |

3 040 |

7 658 |

22 |

10 720 |

302 |

4 230 |

2 436 |

6 968 |

|

Equatorial Guinea* |

4 006 |

1 718 |

11 |

5 735 |

22 |

559 |

261 |

842 |

|

Gabon* |

4 826 |

867 |

52 |

5 745 |

81 |

1 177 |

791 |

2 049 |

|

São Tomé and Príncipe |

13 |

8 |

2 |

23 |

7 |

111 |

43 |

160 |

|

Central Africa |

23 383 |

14 815 |

191 |

38 389 |

1 114 |

11 713 |

6 850 |

19 676 |

Note: *Resource-rich countries.

Source: FAO (2021), https://doi.org/10.4060/ca9825fr

Table 4.A1.2. Global production of tropical roundwood and processed tropical timber products in 2020 (in thousands of m3)

|

|

Roundwood |

Sawnwood |

(Peeled or sliced) wood veneer |

Plywood |

|---|---|---|---|---|

|

Global tropical timber production |

310 809 |

37 645 |

5 091 |

11 091 |

|

Africa |

55 160 |

7 578 |

1 090 |

633 |

|

Share of global tropical timber production |

17.75% |

20.13% |

21.42% |

5.71% |

|

Central Africa |

16 722 |

2 362 |

494 |

52 |

|

Share of global tropical timber production |

5.38% |

6.28% |

9.70% |

0.48% |

|

Asia-Pacific |

212 851 |

25 872 |

4 179 |

- |

|

Share of global tropical timber production |

68.48% |

63.9% |

82.10 |

- |

|

Latin America |

2 059.13 |

725.50 |

77.35 |

271.88 |

|

Share of global tropical timber production |

18.40% |

7.90% |

4.03% |

4.10% |

Source: Authors’ compilation based on data from the International Tropical Timber Organization (ITTO, 2020), https://www.itto.int/biennal_review/?mode=searchdata.

Table 4.A1.3. Forest area, land area and population density in Central Africa

|

Country |

Land area (1 000 ha) |

Population density, 2018 (people/km 2 ) |

Forest area (1 000 ha) |

|---|---|---|---|

|

Burundi |

2 568 |

435 |

280 |

|

Cameroon |

47 271 |

53 |

20 340 |

|

DRC |

226 705 |

37.08 |

126 155 |

|

Central African Republic |

62 298 |

7.49 |

22 303 |

|

Congo |

34 150 |

15.36 |

21 946 |

|

Gabon |

25 767 |

8.22 |

23 531 |

|

Equatorial Guinea |

2 805 |

46 |

2 448 |

|

São Tomé and Príncipe |

96 |

201 |

52 |

|

Chad |

125 920 |

12.29 |

4 313 |

Source: Authors’ compilation based on data from (FAO, 2020), https://fra-data.fao.org/

References

Ackerknecht, C. (2010), “Work in the forestry sector: some issues for a changing workforce”, Unasylva No. 234/235, Vol. 61, pp. 60-64, International Journal of Forestry and Forest Industries, Food and Agriculture Organization of the United Nations (FAO), Rome, https://www.fao.org/3/i1507e/i1507e12.pdf.

AFC (2020), Henri Konan Bedie Bridge – Côte d’Ivoire, Africa Finance Corporation, Lagos, https://www.africafc.org/what-we-do/our-projects/henri-konan-bedie-bridge-cote-divoire/.

AfDB (2020), African Economic Outlook 2020: Developing Africa’s Workforce for the Future, African Development Bank, Tunis, https://www.afdb.org/sites/default/files/documents/publications/afdb20-01_aeo_main_english_complete_0213.pdf.

AfDB (2018), “Développement intégré et durable de la filière bois en Afrique centrale: opportunités, défis et recommandations opérationnelles”, Regional Strategic Report, African Development Bank, Tunis, https://www.afdb.org/sites/default/files/documents/publications/developpement_integre_et_durable_de_la_filiere_bois_dans_le_bassin_du_congo_-_regional_0.pdf.

Allard, C. et al. (2016), “Trade Integration and Global Value Chains in Sub-Saharan Africa: In Pursuit of the Missing Link”, IMF Departmental Paper No. 16/05, International Monetary Fund (IMF), Washington DC, https://www.imf.org/external/pubs/ft/dp/2016/afr1602.pdf.

Andrianarison, F. and B.E. Nguem (2020), Effets socioéconomiques potentiels du Covid-19 au Cameroun – Une évaluation sommaire, 31 March, United Nations Development Programme (UNDP), Yaoundé, https://www.undp.org/content/dam/rba/docs/COVID-19-CO-Response/Socio-Economic-Impact-COVID-19-Cameroon-UNDP-Cameroon-March-2020.pdf.

ATIBT (2020a), “ATIBT summary table about the main data of the forest-wood sector in the Congo Basin”, Activity Report, International Tropical Timber Technical Association, Nogent-sur-Marne, https://www.atibt.org/files/upload/Activity_report/ATIBT-ACTIVITY-REPORT-2020.pdf.

ATIBT (2020b), “FAIR&PRECIOUS” forest managers commit to the fight against COVID-19 in Central Africa, International Tropical Timber Technical Association, Nogent-sur-Marne, 4 May, https://www.atibt.org/en/news/11112/fairandprecious-forest-managers-commit-to-the-fight-against-covid-19-in-central-africa.

ATIBT (2019), État des lieux des acteurs du secteur privé de la filière forêt-bois au Congo, International Tropical Timber Technical Association, Nogent-sur-Marne, https://www.atibt.org/wp-content/uploads/2020/02/RAPPORT-FINAL-Etat-des-lieux-acteurs-fili%C3%A8re-bois_AT_final.pdf.

ATIBT (2018), PAFC Congo Basin, International Tropical Timber Technical Association, Nogent-sur-Marne, https://www.atibt.org/fr/p/92/pafc-du-bassin-du-congo.

ATIBT/BVRio (2020), Covid-19: Analyse de l’impact social et économique sur le secteur forestier, République du Congo, International Tropical Timber Technical Association, Nogent-sur-Marne, Nogent-sur-Marne/BVRio, Rio de Janeiro, July, https://www.atibt.org/wp-content/uploads/2020/08/REPUBLIQUE-DU-CONGO-COVID-19-Analyse-de-limpact-social-et-%C3%A9conomique-sur-le-secteur-forestier-vFR-20200824.pdf.

AUC/OECD (2021a), Africa’s Development Dynamics 2021: Digital Transformation for Quality Jobs, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/0a5c9314-en.

AUC/OECD (2021b), “Statistical annex”, in Africa’s Development Dynamics 2021: Digital Transformation for Quality Jobs, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/9edaeb36-en.

AUC/OECD (2019), “Public policies for productive transformation in Central Africa”, in Africa’s Development Dynamics 2019: Achieving Productive Transformation, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/c1cd7de0-en.