This chapter focuses on the strategic importance of agri-food value chains in West Africa to a sustainable recovery and making the African Continental Free Trade Area (AfCFTA) operational. The first section gives an overview of regional integration into global value chains (GVCs). It shows how COVID-19 has impacted an economy that is not sufficiently embedded into upstream GVCs, although there are some stand-out industries, such as mining and quarries, and agri-food. The second section looks at the potential of agri-food value chains to capitalise on the region’s important agricultural resources and create quality jobs; and identifies constraints hindering their development. Finally, the third section sets out some strategic priorities for public policy to strengthen the region’s integration into agri-food value chains.

Africa's Development Dynamics 2022

Chapter 7. Integrating value chains in West Africa and the agri-food industry

Abstract

In Brief

The COVID-19 pandemic has taken a toll on the development of West African global value chains that were already struggling to cope with the structural problems faced by their economies. Production linkages between countries in the sub-region continue to be weak, but the linkages in the agri-food industries are no less strategically important to making the African Continental Free Trade Area (AfCFTA) operational. The region has natural strengths and an abundant supply of labour that could drive the development of agri-food value chains (AVCs) and make them a genuine vehicle for creating quality jobs. AVC development would also make it possible to create trading opportunities to meet the need for food security and encourage West African countries to participate in world trade.

However, there are a number of kinks in the various links in the AVC, including inefficient production caused by agricultural practices and environmental shocks, low rates of processing regionally, non-tariff barriers and unofficial fees. There is also an infrastructure deficit which makes it very difficult to seize new opportunities.

Two lines of action should be prioritised: i) the promotion of inclusive, sustainable AVCs that are vehicles for quality jobs; ii) enhanced regional and continental co-operation to improve the sector’s competitiveness and harvest the full benefits of the AfCFTA.

West Africa (infographic)

West Africa regional profile

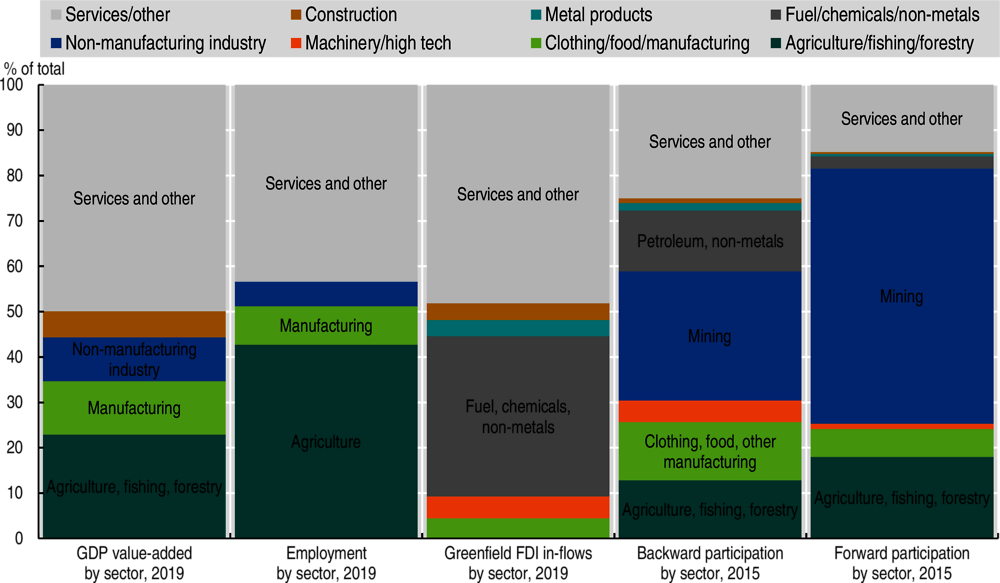

Figure 7.1. Economic and trade profiles of West Africa, expressed as % of total

Notes: GDP = gross domestic product; FDI = foreign direct investment. The different sources for the data do not share common definitions of economic sectors, commodities or activities. However, colouring is used in this figure in order to indicate shared themes across datasets.

Source: Authors’ calculations based on World Bank (2020a), World Development Report 2020, GVC Database, www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data; fDi Markets (2021), fDi Markets (database), www.fdiintelligence.com/fdi-markets; and World Bank (2021), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

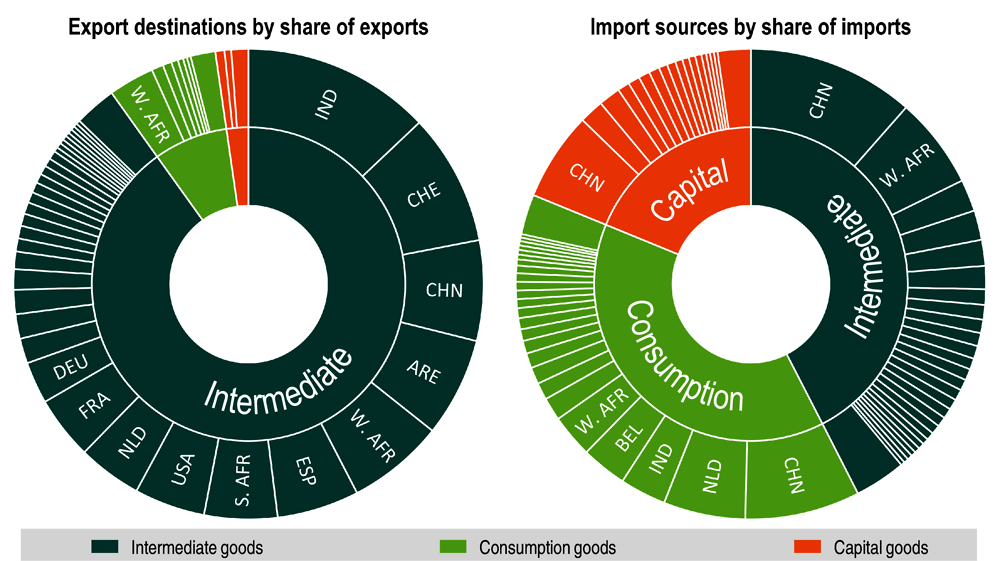

Figure 7.2. West Africa’s most important trade partners broken down by volume of trade in intermediate, consumption and capital goods

Notes: Countries are presented using their three-letter ISO codes. The African countries are aggregated into the five sub-regions defined by the African Union as follows: C. AFR = Central Africa, E. AFR = East Africa, N. AFR = North Africa, S. AFR = Southern Africa, W. AFR = West Africa. Interior trade within the Southern Africa Customs Union is excluded.

Source: Authors’ calculations based on data from CEPII (2021), BACI (database), www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37.

West Africa is contending with structural issues that have only been exacerbated by the COVID-19 pandemic

The COVID-19 pandemic has taken a heavy toll on the economies of the West African countries in various ways

In 2020, economic growth was affected in the 15 countries in the area, but to varying extents. The countries most exposed to external shocks were very seriously affected. In Cabo Verde, Guinea-Bissau, Sierra Leone and Nigeria, real GDP fell by between 14% (Cabo Verde) and 1.8% (Nigeria) (IMF, 2021). Growth also slowed, from 6.2% to 2.3% in Côte d’Ivoire between 2019 and 2020, and by 5.6 percentage points in Ghana. The cause: the various restrictions imposed locally and internationally, which disrupted supply chains and affected commodity prices.

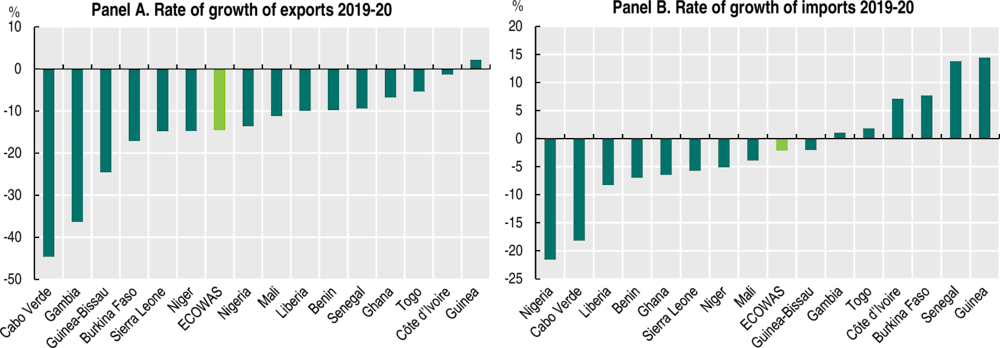

Flows of goods and services contracted sharply in most countries. Exports fell by an average 15% between 2019 and 2020 in the Economic Community of West African States (ECOWAS). Imports also contracted sharply in most of the countries, falling by between 25% for those most affected, such as Nigeria, and 2% for Guinea-Bissau (Figure 7.3). Nonetheless, six countries grew their imports of goods and services, bringing the average rate of change in ECOWAS to -2% (IMF, 2021).

Figure 7.3. Country focus: change in flows of goods and services 2019-20

Source: Authors’ calculations based on data from (IMF, 2021), World Economic Outlook (database), www.imf.org/en/Publications/WEO/weo-database/2021/April.

Financial inflows into the sub-region were also affected by the severity of the crisis. The ECOWAS diaspora’s remittances fell by around 20% over 2019-20 (World Bank, 2021). Remittances to Nigeria, which by itself accounted for 69% of inflows into West Africa in 2019, fell by 28% in 2020. The figure for Ghana, the second largest recipient of remittances in the sub-region with 11% of the total in 2019, fell by 12%. Additionally, there was an 18% drop in FDI over the same period (UNCTAD, 2021).

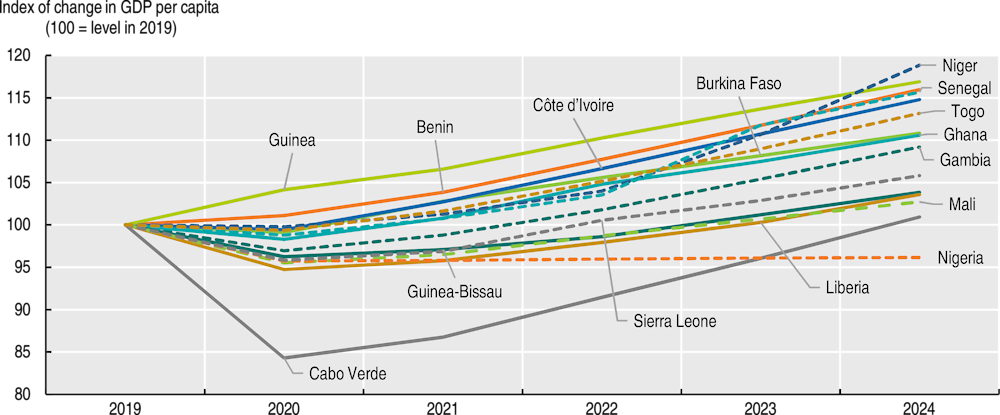

Support for production is a must for sustainable economic recovery post-COVID. Generally speaking, growth resumed in all countries but has not yet regained pre-pandemic levels, especially where per capita wealth creation is concerned. At current rates, an initial group of eight countries should be able to regain their pre-COVID-19 levels of GDP per capita by end 2021 (Figure 7.4). However, the other seven are unlikely to attain their 2019 per capita levels before end-2024, or even 2025. Budgetary room for manoeuvre is limited. The various emergency support measures for households and businesses introduced by governments in 2020 have already placed the public finances under stress in several countries. In Côte d’Ivoire, the debt-to-GDP ratio rose from 41.2% to 45.7% between 2019 and 2020, while in Ghana it rose from 64% to 78% between September 2019 and September 2020, and in Nigeria from 29.2% to 35% (IMF, 2021).

Figure 7.4. Projected levels of per capita GDP in the 15 West African countries (base 100 = 2019)

Source: Authors’ calculations based on data from (IMF, 2021) World Economic Outlook (database), https://www.imf.org/en/Publications/WEO/weo-database/2021/October.

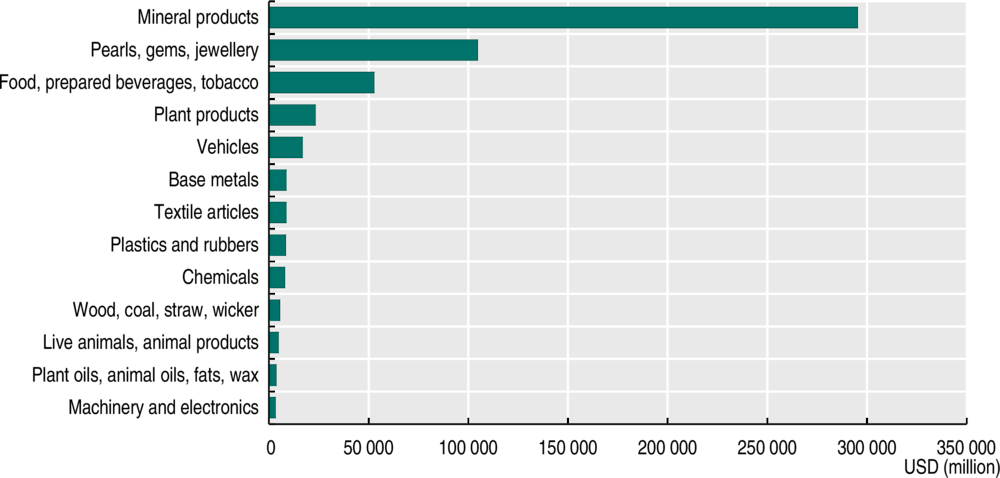

The weakness of the processing industry is still a major concern at sub-regional level. In West Africa, production and exports include primarily unprocessed agricultural and mining products whose prices depend on world prices. By way of illustration, the contribution of manufacturing to GDP in the sub-region is very low and has been on a downward trajectory for several years, falling from 16% in 2000 to 12% in 2019 (World Bank, 2021). At the same time, the goods exported from West Africa are chiefly primary commodities: minerals and food (Figure 7.5).

Figure 7.5. Cumulative exports by product category, West Africa, 2015-19 (USD million)

Source: Authors’ calculations based on the International Trade Database at the Product-Level (BACI) at the Centre d’Études Prospectives et d’Informations Internationales (CEPII, 2021), http://www.cepii.fr/cepii/en/bdd_modele/download.asp?id=37.

ECOWAS countries’ participation in global and regional value chains is still low

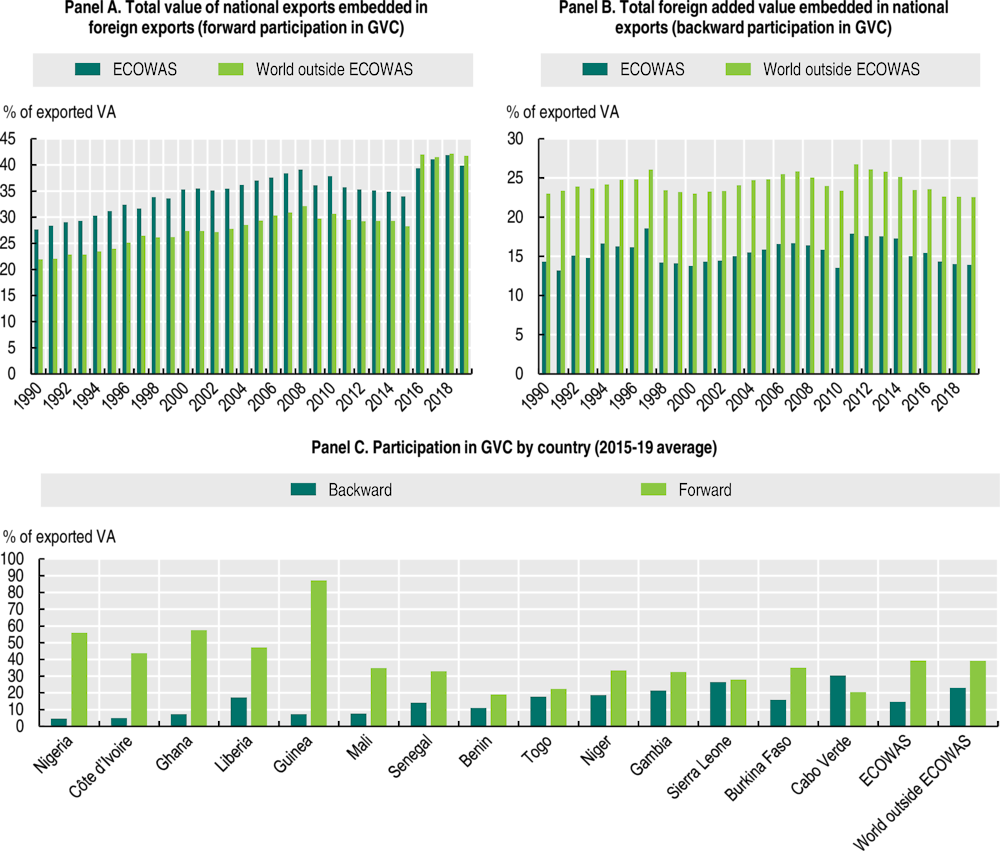

The bulk of the products exported are still at an early stage of processing and have little foreign value-added. Panel A of Figure 7.6 illustrates the low backward participation by ECOWAS countries in GVCs compared to the world average for the period 1990-2019. In other words, inputs from foreign countries represent a limited share of exports from the sub-region. Forward participation is much greater, even though it inherently involves much fewer benefits than strong backward participation. The bulk of goods exported are used as intermediate goods by the importing countries. Between 2015 and 2019, ECOWAS countries had, on average, an annual forward GVC participation amounting to 39.2% of exported value-added and an annual backward GVC participation amounting to 14.5% of exported value-added (Figure 7.6).

Figure 7.6. Overview of West African integration into global value chains (GVCs), 1990-2019

Note: Backward and forward GVC participation are expressed as a percentage of exported value added (“exported VA”). In this figure, GVC participation and exported value added for each year are calculated using a country-by-country matrix of value added contributed by each country to each other country’s exported added value. Backward GVC participation for a given country is the sum of all reported value added from foreign countries that is embedded in its exports. Forward GVC participation is the total domestically-originated value added embedded in foreign country exports. For a given country in a given year, exported value added refers to the total reported foreign and domestically-originated value added that is embedded in the country’s exports.

Source: Authors’ calculations based on data from Casella et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc/.

The ECOWAS countries are therefore upstream of the production process compared to the rest of the world. As such, the rewards associated with international trade are lower for them because they do not draw as much benefit as the rest of the world from strong backward participation, in particular with regard to quality improvements and reductions in the prices of final goods produced using better quality, imported inputs that cost less (Fally and Hillberry, 2018).

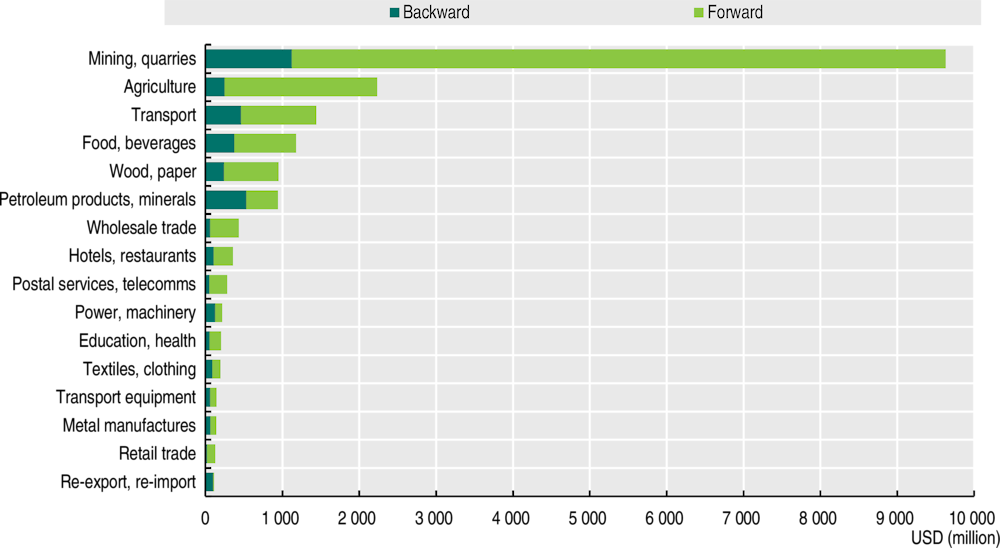

A number of key sectors are the chief contributors from ECOWAS countries to GVCs. They include mining and quarries, which generate the bulk of forward and backward participation (Figure 7.7). Agriculture and food also feature highly. This is reflected inter alia by the significance of foods and beverages in the region’s exports, which constitute on average 10% of total flows over the period 2015-19 according to data from the CEPII, compared to 5% for the African continent in its entirety, 7% for Latin America and the Caribbean, and 2% for low-income Asian countries. At the same time, 6% of West African imports were of foods and beverages, compared to 5% for the African continent in its entirety, and 3% for low-income Asian and Latin American countries.

Figure 7.7. Total value of backward and forward participation in GVCs by sector in West Africa (USD million), 2015

Source: Authors’ calculations based on Belotti, F., A. Borin and M. Mancini (2020), icio: Economic Analysis with Inter-Country Input-Output Tables in Stata, Policy Research Working Paper, No. 9156, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/33361.

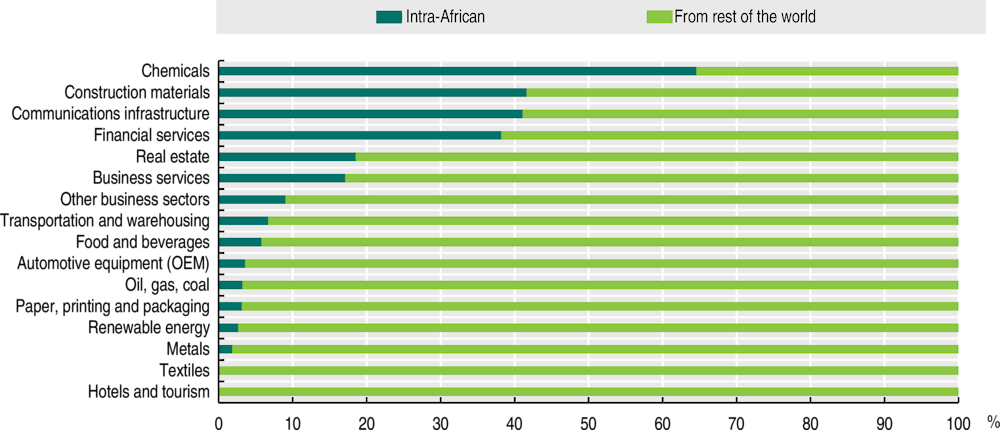

Additionally, new “greenfield” plans for investment by other African countries are greater in some sectors. Between 2016 and 2021, the communications infrastructure, chemicals, construction materials and financial services sectors attracted proportionately more investment, both actual and projected, from the rest of Africa than other sectors (Figure 7.8). Hence their importance for generating economic linkages between African countries and encouraging economic integration. However, such linkages account for only a small fraction of forward and backward participation in GVCs by the countries in the sub-region (Figure 7.7).

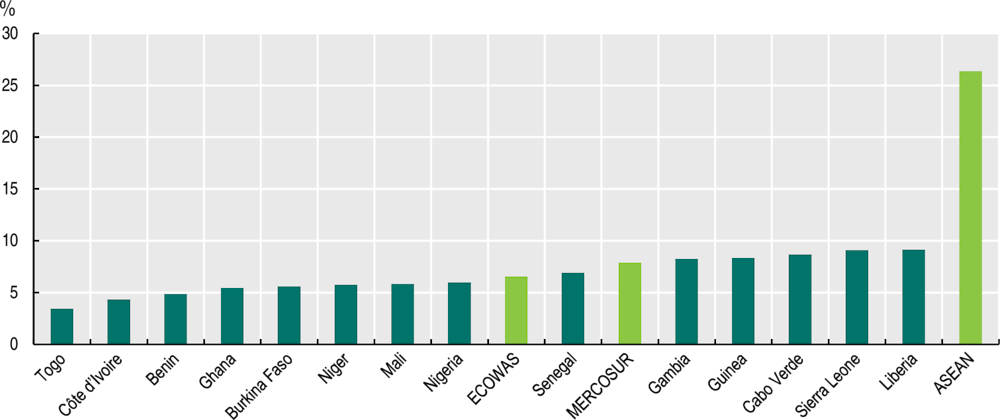

It is clear that West African countries’ participation in RVCs is fairly limited. Very few inputs used in production processes come from other countries in the region. On average, 6.5% of added value exported by ECOWAS member countries to their sub regional partners was re-exported to third countries (outside the sub-region) in 2015 (Figure 7.9). By way of illustration, the figure was 26% for members of the Association of Southeast Asian Nations (ASEAN), suggesting also that the level of regional economic integration is well below its potential.

Figure 7.8. New investment projects by sector of activity in West Africa: Intra-African share of the 2016-20 total (%)

Source: Authors’ calculations based on the fDiMarkets database (2021), Financial Times, https://www.fdimarkets.com.

Figure 7.9. Proportion of intra-regional exports re-exported to third countries, 2015

Source: Authors’ calculations based on Belotti, F., A. Borin and M. Mancini (2020), icio: Economic Analysis with Inter-Country Input-Output Tables in Stata, Policy Research Working Paper, No. 9156, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/33361.

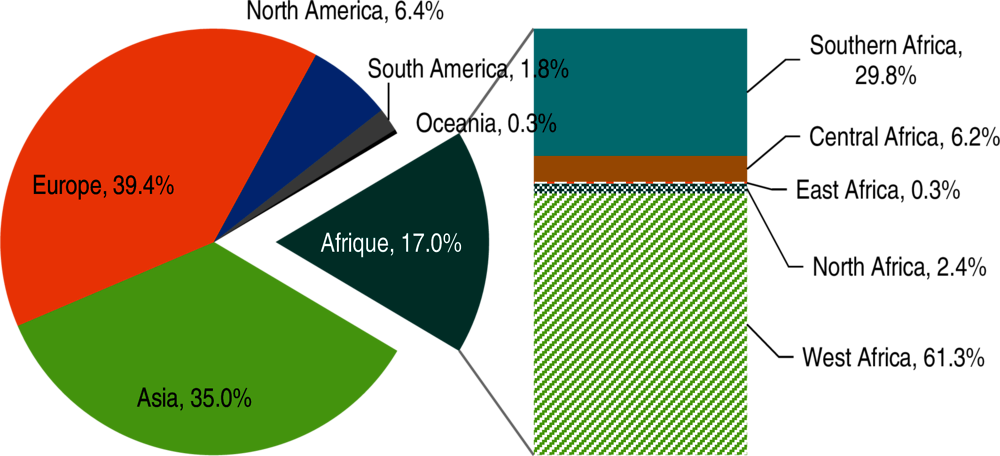

In 2019, only 17% of exports from ECOWAS countries went to African countries, compared to 39% to Europe and 35% to Asia (Figure 7.10). Having said that, 61% of exports to Africa from ECOWAS countries went to countries in the sub-region, implying that the production linkages between West African countries are greater than with the rest of the continent.

Figure 7.10. Destinations of exports from West African countries, 2019

Source: Authors’ calculations based on the International Trade Database at the Product-Level (BACI) at the Centre d’Études Prospectives et d’Informations Internationales (CEPII, 2021), http://www.cepii.fr/cepii/en/bdd_modele/download.asp?id=37.

A sustainable economic recovery in Africa post-COVID requires a workable response to the issue of food security

Supply chains have proved to be particularly fragile. The restrictions adopted regionally and internationally – land border closures and travel restrictions – seriously disrupted the food supply in West Africa. The movement of transhumant herds was severely affected in Benin and some areas of Niger. Basic food prices were higher than the average for the five previous years (CILSS, 2020). The incomes of itinerant salespeople and restaurateurs fell. No fewer than 44% of households working in the informal sector said when questioned that the crisis was linked to a sharp drop in their income (Koffi et al., 2020). Very quickly, in fact during a video conference on 30 March 2020, it became apparent that the ministers for food and agriculture were concerned about the consequences of prolonged disruption to regional supply channels. As a result, several restrictions were eased or lifted in May 2020.

Several government measures were deployed to keep the agri-food sector afloat, especially in Burkina Faso, Côte d’Ivoire and Ghana. In Burkina Faso, CFAF (XOF) 30 billion was earmarked for the procurement of agricultural inputs and cattlefeed. In Côte d’Ivoire, around XOF 250 billion in financial support was set aside for producers of the chief export products (among them cocoa and cashew nuts), and to support the production of food crops (Government of Côte d’Ivoire, 2020). In Ghana, the number of people receiving fertilisers and seeds rose from 1.2 to 1.5 million (MoFEP, 2020). Additionally, support for businesses in the informal sector was established in several countries: XOF 5 billion for Burkinabe vendors of fruits and vegetables, and XOF 100 billion to support all informal sector stakeholders in Burkina Faso (Government of Burkina Faso, 2020).

Direct financial support and food distribution were also provided to the most vulnerable people. For example, Côte d’Ivoire earmarked XOF 170 billion to support the most disadvantaged households (Government of Côte d’Ivoire, 2020), and XOF 69 billion in Senegal (OECD/SWAC, 2020b). In April 2020, the Government of Togo launched the “Novissi” initiative to provide monthly support to the poorest people throughout the state of emergency. Three weeks later, the programme had 1.3 million people on its register and had already made first payments of between XOF 10 500 and XOF 12 500 (around USD 20) to 500 000 people’s personal electronic wallets to meet basic needs (food, water, electricity, communication). In an article published in May 2020, two Nobel Prize winners in Economics, Esther Duflo and Abhijit Banerjee, welcomed this initiative (Duflo and Banerjee, 2020).

Despite these significant efforts, food security is still an issue in the region. Pre-COVID projections were that 11.4 million people were likely to experience acute food insecurity between March and May 2020, rising to 17 million between June and August – the lean season between two harvests when food stores are at their lowest (OECD/SWAC, 2020a). The COVID-19 pandemic exacerbated the situation. In 2020, crop production rose by 5.1% compared to 2019, and by 14.8% compared to the average for the five previous years within the West African Economic and Monetary Union – WAEMU (BCEAO, 2021). However, West Africa is the region of the world where under-nutrition has grown the most, from 12.9% to 18.7% between 2019 and 2020, affecting 75.2 million people in 2020 compared to 50.6 million in 2019 (FAO et al., 2021).

West Africa’s strong agricultural potential can help to encourage a sustainable and inclusive economic recovery

Demographic and urban dynamics are conducive to the development of regional agri-food value chains

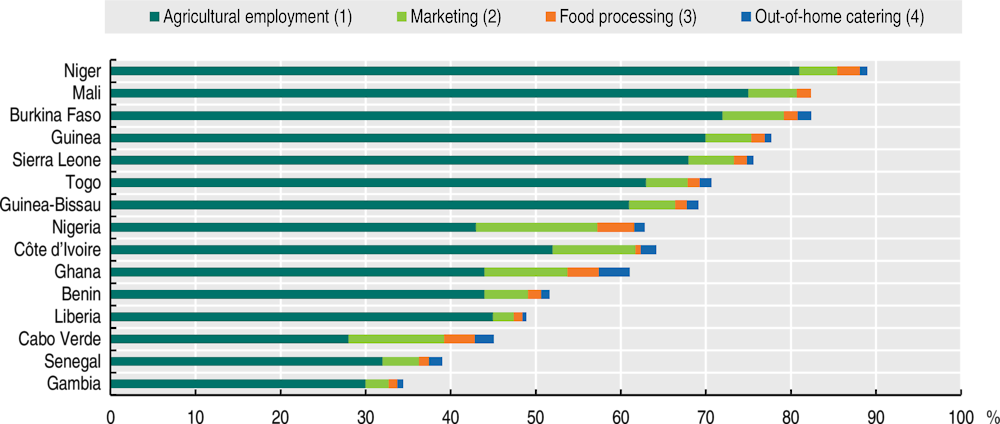

The agri-food economy is a key vehicle for job creation. The agricultural sector is the main job-provider in the region: over 50% of people live in rural areas, and 65% of the active labour force works in the agricultural sector. Women account for 80% of employment in the processing of agricultural production, 70% in marketing and close to 90% in sales of ready-to-eat products consumed in the street (Allen, Heinrigs and Heo, 2018; OECD/SWAC, 2019). In total, the food economy in West Africa employs 82 million people, and accounts for 66% of all employment in the region (Allen, Heinrigs and Heo, 2018; OECD/SWAC, 2021).

Figure 7.11. Contribution of the food economy in West Africa to total employment, 2018

Note: (2+3+4) = Non-agricultural employment; (1+2+3+4) = Employment in the food economy.

Source: Authors’ illustration, based on data modelled by Allen, Heinrigs and Heo (2018), https://doi.org/10.1787/dc152bc0-en.

The dynamics of regional demand provide trading opportunities to farmers and to agri-food business and industries. In 2018, the value of regional agricultural production was USD 84 billion (FAOSTAT, 2020), with greater downstream opportunities. The total contribution of the food economy, from agricultural production to catering services, via marketing and processing, is USD 260 billion in West Africa, or 35% of GDP (Allen, Heinrigs and Heo, 2018). In West African households, food accounts for 50% of total spending, on average. In Nigeria, for example, growth in the chicken sector is assessed to be 20% per year for the period 2010-20 (Adeyeye, 2017). Several local companies service the growing demand from towns in the south west using maize producer networks in the centre and north of the country for poultry-feed (Ghins and Zougbédé, 2019).

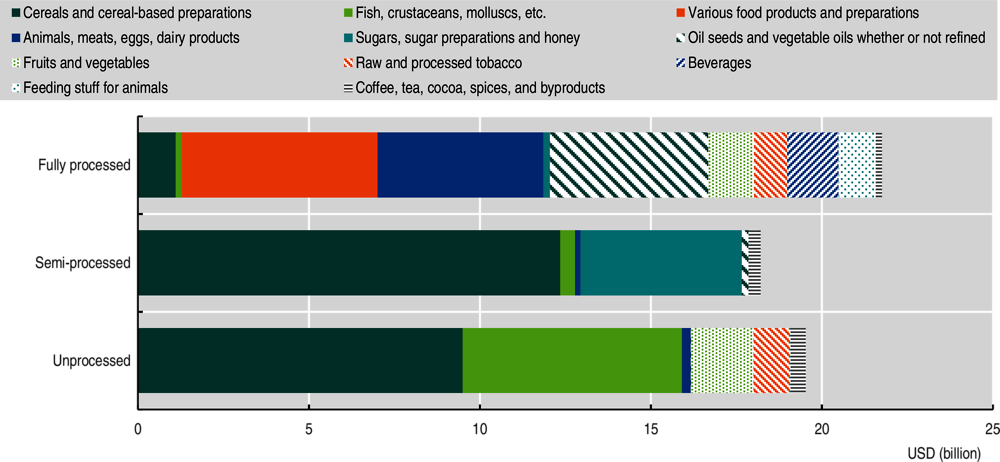

Food demand is focused more on processed products. Demographic growth and rapid urbanisation are sustaining this demand. The total population, estimated at 400 million people in 2020, is set to reach 540 million in 2030 (OECD/SWAC, 2020a). Urban transition changes food habits, particularly with the emergence of a significant African middle class which covers incomes of between USD 2-USD 20 per day inclusive per person in purchasing power parity (PPP). Towns account for over 67% of food demand, while urbanisation is producing changes in methods of consumption. Although food accounts for 55% of income, households prefer processed products (fruit juices, pastas, canned goods) which offer a better fit logistically and in terms of preparation (Allen and Heinrigs, 2016). Local processing is no longer sufficient to meet demand. Between 2016 and 2020, the ECOWAS countries imported close to USD 60 billion-worth of food products, two thirds of which (67.2%) were semi-processed or processed (Figure 7.12).

Figure 7.12. Details of food products imported by ECOWAS by level of processing, cumulative total for the period 2016-20 (USD billion)

Source: Authors’ calculations based on modelling by Rieländer and Traoré (2015) and updated data from COMTRADE, 2021 (accessed via https://wits.worldbank.org in October 2021).

In terms of volumes of production, the region is in a dominant position globally for several agricultural and food products (Table 7.1). Between five and nine West African countries regularly rank among the world’s top 20 producers of 10 or so agricultural products (AUC/OECD, 2019). In 2018, the region alone contributed more than 33.9% of Africa’s agri-food production, or USD 81.4 billion (FAOSTAT, 2020).

In terms of exports, agri-foods account for the highest proportion of the contents of a basket containing the top 20 products. Among the top 20 exports between 2016 and 2019, 15 were agri-food products and accounted for 33% of the basket’s value (Table 7.2). Thus the agri-food sector provides the region with good prospects for specialisation. Local stakeholders have a solid base in the processing of several products such as vegetable oil, cassava by-products (Box 7.1), sugar-cane and tropical fruits. Côte d’Ivoire and Ghana are ploughing increasing investment into local cocoa processing. In Nigeria, industrial processing of wheat and powdered milk is developing using imported inputs (Hollinger and Staatz, 2015).

Table 7.1. Examples of high-potential agricultural products in West Africa

|

Agricultural products |

Total production, 2019 (thousands of tonnes) |

West Africa’s share in world production volumes 2019 (%) |

West Africa’s share in African production volumes 2019 (%) |

|---|---|---|---|

|

Fonio |

700.5 |

100 |

100 |

|

Karite nuts (sheanuts) |

759.8 |

100 |

100 |

|

Yams |

69 892.2 |

94 |

96.5 |

|

Cocoa, beans |

3 395.8 |

60.7 |

90.5 |

|

Ginger |

715.6 |

17.5 |

88.2 |

|

Fruits, citrus, nes |

4 558.5 |

31.4 |

85.9 |

|

Okra |

2 775.6 |

27.9 |

84.4 |

|

Kola nuts |

255.9 |

83.5 |

83.5 |

|

Oil, palm fruit |

17 168.9 |

4.2 |

78.5 |

|

Maize, green |

1 300.9 |

15.7 |

73.8 |

|

Cashew nuts, with shell |

1 696.4 |

42.8 |

72.7 |

|

Millet |

9 552.4 |

33.7 |

69.7 |

|

Cashewapple |

167.6 |

12.7 |

68.3 |

|

Papaya |

951 |

6.9 |

64.2 |

|

Onions and shallots, green |

797.3 |

17.7 |

63.3 |

|

Taro (cocoyam) |

4 619.5 |

43.8 |

60.6 |

|

Groundnuts, with shell |

9 350.7 |

19.2 |

56.2 |

|

Cassava |

100 877.6 |

33.2 |

52.5 |

|

Pineapple |

2 962.3 |

10.5 |

51.3 |

|

Sorghum |

13 344.7 |

23.1 |

46.6 |

|

Chillies and peppers |

452.3 |

10.6 |

43.2 |

|

Plantains and others |

10 530.4 |

25.3 |

39.4 |

Source: Authors’ calculations based on FAOSTAT data, FAOSTAT, http://www.fao.org/faostat/en.

Table 7.2. Rankings of agri-food products among the top 20 export products by country in West Africa (2016-19)

|

|

Number of agri-food products in the top 20 exported products (2016-19) |

Shares of agri-food products in the total value of the top 20 basket (%), 2019 |

Number of those exported agri-food products with an RCA greater than 10 |

|---|---|---|---|

|

Benin |

11 |

17.5 |

3 |

|

Burkina Faso |

11 |

5.5 |

5 |

|

Cabo Verde |

9 |

85.1 |

2 |

|

Côte d’Ivoire |

14 |

57.7 |

8 |

|

Gambia |

4 |

91.7 |

10 |

|

Ghana |

15 |

17.4 |

4 |

|

Guinea |

9 |

2.2 |

2 |

|

Guinea-Bissau |

5 |

95.4 |

1 |

|

Liberia |

11 |

1.4 |

3 |

|

Mali |

7 |

2.8 |

2 |

|

Niger |

6 |

37.7 |

1 |

|

Nigeria |

13 |

2.4 |

11 |

|

Senegal |

15 |

29.2 |

2 |

|

Sierra Leone |

10 |

10.3 |

8 |

|

Togo |

15 |

11.8 |

6 |

|

West Africa |

15 |

5.7 |

– |

Note: The basket of goods comprises all goods for export that have shown a revealed comparative advantage (RCA) following the approach set out by Balassa (1965) for at least four consecutive years (2016-19). Two baskets have been identified: the first is the basket of the top 20 exports and includes all products for export. The second basket includes agri-food products only.

Source: Authors’ calculations based on the International Trade Database at the Product-Level (BACI) at the Centre d’Études Prospectives et d’Informations Internationales (CEPII, 2021), http://www.cepii.fr/cepii/en/bdd_modele/download.asp?id=37.

Box 7.1. Cassava, a value chain with great potential

Cassava is one of the most important tropical root crops in West Africa: more than 100 million tonnes are produced every year, equivalent to 52.5% and 33.2% of African and global production respectively. It provides many derived food products (leaves, semolina, gari, flour, cake, etc.). The cassava crop is profitable, resistant to climate change and low maintenance. Its cultivation is still very much a family affair, as reflected in the groups of small-holders, and covers small areas of up to two hectares in communal fields. Women are most prevalent in the value chain, accounting for up to 80% of the workforce in terms of production, 100% of workers in processing and 90% in marketing. Nigeria produces 57 million tonnes annually of tuberous roots of manioc, making it the world’s leading producer (FAOSTAT, 2020).

Processing is still done on a small scale using small industrial units, whereas sales take place through informal channels (restaurateurs, private operators exporting all over Africa and Europe). By-products such as gari from Nigeria and attiéké (semolina of cassava) produced in Côte d’Ivoire are exported to other countries including Guinea, where there is a supermarket called “Maison de l’Attiéké” (Attiéké House). New initiatives are emerging, especially in Nigeria where innovative technology is processing fresh peels into pulp for animal feed, and generating biogas for use as an alternative energy source, thus reducing fossil fuel emissions.

Source: Authors’ compilation.

Nonetheless, all three links are hampered by barriers that slow the development of agri-food value chains

The three main links in the agricultural value chain – agricultural production, product processing and trade – are still subject to external and internal shocks that constrain the sector’s development. They include inefficient production caused by farming practices and environmental shocks; low processing rates as a result of poor development of human capital, the financial system and socio-economic infrastructures; and non-tariff barriers and unofficial fees (Table 7.3).

Table 7.3. Constraints on the development of agri-food value chains in West Africa

|

Constraints related to agricultural production |

|

|---|---|

|

Low productivity, competitiveness and value added through all farming systems and value chains |

• Climate variability and change • Soil degradation and depletion • Dominance of rainfed agriculture • Considerable biophysical constraints as a result of parasites, disease and weeds • Issues regarding tenure of land • Poor access to input markets and market production • Low capacity to adapt to and adopt technological innovation |

|

Constraints related to processing |

|

|

Poor development of human capital, the financial system and socio-economic infrastructures |

• Low level of technical and professional skills (engineering for the agri-food sector) • Poor integration of women in the formal workforce • Poor support for local SMEs in the agri-food sector • Low use of technology |

|

Constraints related to trade |

|

|

Non-tariff barriers and other unofficial parallel fees |

• Large number of checkpoints • Poor logistical capacity • Dysfunctional customs transit procedures • Primacy of national interests to the detriment of measures adopted at regional level • Poor quality of the business environment • Poor marking of food products • Quantitative restrictions (import quotas) • Poor certification of food products • Undeveloped market information systems • Large number of currencies |

Source: Authors’ compilation.

The region’s infrastructure deficit increases trade costs and makes it difficult to seize new opportunities

The energy supply is still insufficient and too unreliable to support the processing of some agricultural products. Electricity access and the reliability of the grid scored 51.5 and 40.5 respectively in 2019 on a scale of 0 to 100 (WEF, 2019). This implies that there are additional costs in preserving perishable foods and also has adverse effects on market prices. Initiatives are springing up to develop the renewable energies sector, but the rate of investment is still low. In Senegal, the national strategy to diversify energy sources has increased total power generation by 22% through connection to the grid of 168 MW of photovoltaic solar power, 51 MW of wind energy and 75 MW of hydroelectricity. Côte d’Ivoire is also awaiting construction of Africa’s first floating solar power station, which was announced in 2018.

Poorly developed logistics and transport infrastructures reduce opportunities for integration and adversely affect trade costs. The majority of rural areas of production are still cut off as a result of a dearth of information or inadequate transport infrastructure. The transport infrastructure deficit (roads, railways, railway network services), coupled with inadequate public service infrastructures and some specific services (marketplaces, warehouses, logistics services and communications networks, etc.) affect the efficiency of the food systems (OECD/SWAC, 2021). While 12 out of 15 countries (the exceptions being Mali, Burkina Faso and Niger) have relatively extensive coastlines, the average liner shipping connectivity score was 13.6, and efficiency of seaport services was 40.8 on a scale of 0 to 100 (WEF, 2019). The region has only two railways linking landlocked countries, namely the Transrail (Dakar-Bamako) and Sitarail (Abidjan-Ouagadougou) corridors. Moreover, the lack of co-ordination in transit management, together with operational inefficiency, makes it difficult to optimise costs and the time taken to transport goods (WCO, 2014). There are several other emerging constraints linked to infrastructure quality, the high number of unchecked parallel corridors and the payment of illegal fees on the roads (Teravaninthorn and Raballand, 2009).

Box 7.2. Pineapple, a high-growth product facing constraints

Between 1995 and 2016, world production of pineapples rose from 12 to 25.5 million tonnes, 3 million of which are from Africa. In 2016, Nigeria’s output of 900 000 tonnes made the country the continent’s top producer and the world’s eighth-largest. Benin’s annual output of 400 000 tonnes makes pineapple the country’s third-largest subsector, accounting for 4.3% of agricultural GDP and 1.2% of total GDP (Kpenavoun Chogou, Gandonou and Fiogbe, 2017). Benin exported 2 949 tonnes to the European Union (EU), and Côte d’Ivoire and Ghana exported 21 604 t and 13 517 t to the same destination respectively.

The subsector acted as a springboard to self-employment and gave rise to micro, small and medium-sized production, processing and export enterprises. However, according to Iwuchukwu, Nwobodo and Udoye (2017), the chief constraints on pineapple production were infrastructure-related, mainly the lack of road access where West Africa has an estimated shortfall of USD 100 billion per year, and the lack of technical knowledge on the use of improved technology. Benin’s produce was rejected in Europe in 2016-17 because of excess ethephon, a pesticide that accelerates pineapple production and accentuates the yellow colouring agent in the fruit. Benin had to suspend exports of pineapples coloured using the agent because ethephon residue in the fruits was higher than the levels permitted in the EU.

Some leading enterprises are putting initiatives in place to promote the quality of their products. One example is Blue Skies in Ghana and Benin.

-

Blue Skies, a specialist in processing the region’s fresh fruit and vegetables, introduces producers to agronomists who support them by providing free training and technical support. The producers also benefit from interest-free financial support and a certification process for the products they grow.

-

The relationship between the management team and the local authorities is part of a public-private partnership (PPP) with clear mutual commitments. This approach helps to generate social and economic development in the producer country. Blue Skies has positioned itself as a template for sustainable AVC development and a success in making a functional move upmarket. It extended its activities in Benin in 2020.

Source: Authors’ compilation drawing on L’Économiste (2019); AfDB/OECD/UNDP (2014); Blue Skies (2020); https://www.youtube.com/watch?v=GlYFcMF2YFQ.

Table 7.4. Selected technological components of economic competitiveness in West Africa, 2019

|

Country |

Infrastructures |

ICT adoption |

Business-to-Consumer (B2C) index |

Intellectual property protection |

Innovation capability |

Skills of workforce |

|---|---|---|---|---|---|---|

|

Benin |

40.2 |

23.4 |

21 |

50.6 |

28.4 |

50.6 |

|

Burkina Faso |

34.8 |

26.8 |

19 |

45.9 |

24.8 |

40.5 |

|

Cabo Verde |

53.7 |

44.7 |

- |

47.9 |

24.8 |

48.5 |

|

Côte d’Ivoire |

47.9 |

41.3 |

31 |

51.1 |

30.7 |

51.3 |

|

Gambia |

47.4 |

31.4 |

- |

49.1 |

30.5 |

54.1 |

|

Ghana |

46.6 |

49.1 |

43 |

62 |

32.9 |

54.6 |

|

Guinea |

41.7 |

28.7 |

14 |

40.6 |

34.9 |

54 |

|

Mali |

43.9 |

27.9 |

22 |

32 |

29 |

45.7 |

|

Nigeria |

39.7 |

33.4 |

53 |

33.3 |

32.2 |

38.8 |

|

Senegal |

51.3 |

35.8 |

43 |

56.6 |

31.9 |

54.6 |

|

West Africa |

44.7 |

34.3 |

- |

46.9 |

30 |

49.3 |

Source: Authors’ calculations based on the World Economic Forum Report Database (WEF, 2019) and UNCTAD (2020), UNCTADStat.

Public policies to strengthen the agri-food value chain in West Africa

The control of agri-food value chains has occupied a central place in policy agendas in West Africa since the world food crisis in 2008. The ECOWAS Regional Agricultural Policy (ECOWAP) is part of “a modern and sustainable agriculture, based on the effectiveness and efficiency of family farms and the promotion of agricultural enterprises through private-sector involvement. While being productive and competitive in the intra-Community market and international markets, it must ensure food security and provide a decent income to its working population” (ECOWAS, 2017). In order to realise this potential, however, better tools are required, especially support for small local stakeholders and region-wide structuring of value chains. This section will focus on five strategic lines of action that can play a role in achieving those objectives.

The participation of small, local producers and suppliers in high value-added activities can be promoted through better access to innovative services

Overall, AVCs have essentially grown up around the informal sector. In 2019, traditional agriculture still employed 42.19% of people in work. On average, 76.5% of West African workers are in vulnerable employment; the situation in Cabo Verde is somewhat better, at 35.2%. Around 69.9% of young people over 15 years of age working in the sector do so independently, 17.7% provide support to families, and barely 18.5% are in salaried employment (ILO, 2020).

In the short term, national and regional policies can harness digital resources to improve integration of informal sector stakeholders into value chains. Start-ups specialising in agritech and innovative services are mushrooming in West Africa. The region hosts Africa’s first unicorn (Jumia in Nigeria) as well as other dynamic start-ups in logistics (AgroCent; Kobo360) and e-commerce (Konga, Carmudi Janngo and Jovago), and especially the brightest rising stars in real-time mobile digital transactions (Interswitch, OPay, Flutterwave, etc.). Other promising innovations for agricultural development include shared-economy models, blockchain and digital tools for land rights (AUC/OECD, 2021).

Governments can work with tech companies to spread the best farming practices. Improving agricultural extension services and connecting the rural-urban supply chains can generate big wins in fighting pockets of poverty and informality in rural areas.

-

For example, since 2011, the multi-country programme myAgro has been working with more than 89 000 smallholders in Mali, Senegal and Tanzania in order to increase market access. It began by using mobile solutions as alternatives to credit and rapidly developed to provide full support at all levels, from delivery of high-quality inputs to training. This translates in figures to a rise of USD 178 in each farmer’s annual income and a 78% increase in production (Rieckmann, 2020).

-

Since 2012, in partnership with Cellulant Ltd, the Government of Nigeria has used e-wallet solutions on mobile phones to manage the distribution of seed and fertiliser in remote areas, thereby reducing inefficiencies (AUC/OECD, 2021). Similar models are in place in Burkina Faso, Côte d’Ivoire, Liberia and Senegal (Goyal, 2014).

-

Additionally, a good number of large agro-industry businesses are working to establish services to help with traceability (Box 7.3). Mobile solutions of this kind enable leading stakeholders to interact with small local producers, resulting in larger transaction values and volumes (GSMA, 2016).

In addition, the cost of accessing services should continue to be reduced and the regulatory framework for e-commerce strengthened. The average cost of Internet services is four times higher than in other developing countries, while communications infrastructures are not fully utilised. In 2019, the Business to Consumer (B2C) index, which reflects capacity to engage in e-commerce, was only 26.2 in West Africa, and ranged from 5.4 (Niger) to 53.2 (Nigeria), giving an average value for Africa of 33.6 (UNCTAD, 2020). In March 2020, Ghana became the first African country to launch a universal QR code enabling all Ghanaians to make instant merchant payments from their mobile money wallets, bank accounts or international cards (GSMA, 2021).

Box 7.3. Last mile digitalisation of the agri-food value chain is under way

Very few smallholders manage to accumulate savings or access formal agricultural credit, insurance and saving products. In order to mitigate existing shortfalls and promote reliable supply chains, mobile service operators and certain agri-food multinationals are increasingly investing in digital innovations for farmers.

In August 2014, Ivorian microfinance institution Advans partnered with a number of cocoa co-operatives and MTN Côte d’Ivoire to offer farmers in 40 co-operatives a branchless Advans savings account accessible via a mobile money account. In 2017, the initiative had reached 100 co-operatives (13 500 farmers, 6 000 of whom continue to be active). In May 2015, the Ivorian bank Société Ivoirienne de Banque (SIB) partnered with Orange Côte d’Ivoire to digitalise 1 000 cocoa growers’ bi-annual premium payments for certified sustainable cocoa.

In 2016, Swiss business Barry Callebaut introduced a geo-traceability application, Katchilè, enabling cocoa beans to be tracked from 65 000 farmers in Côte d’Ivoire. The app has also been launched in Ghana and Indonesia. In 2017, the US multinational Cargill launched an electronic payment initiative for 30 000 Ghanaian farmers through a partnership with mobile payment systems (E-Zwich, provided by the Bank of Ghana, MTN Mobile Money and Tigo Mobile Money). Additionally, the Singaporean business Olam has established Ofis, a rural information system, in 21 countries. Ofis allows farmer groups and co-operatives to manage their traceability operations, and integrates digital payments functionality. In Côte d’Ivoire, Ofis is used in cocoa, coffee, rubber and cashew nut value chains.

Source: Authors, based on GSMA (2017).

Access to finance and support for co-operatives should be increased

The low levels of SME finance are a barrier to local processing. Between 2003-15, only Burkina Faso, Mali and Niger allocated more than 10% of the national budget to agriculture and sustainable development for at least five years (ECOWAS, 2017). Over the same period, the allocation made by West Africa as a whole amounted to 5% of the public purse. One of the resolutions in the Malabo Declaration of the African Union (AU) in 2014 was to reaffirm the member countries’ commitment to allocate at least 10% of public expenditure to agriculture. However, few of the countries in the region have succeeded in doing so regularly, despite the commitments they entered into.

Finance also involves harnessing private resources for agri-food. Although harnessing public resources is still paramount, the debate on finance should be widened so that all economic stakeholders in the sector have access to the financial services appropriate to their investment needs. Domestic credit to the private sector amounted to only 24% of GDP in 2019. The average score for financing of SMEs is 39.9, and venture capital availability is low (Table 7.5). The average score in the region for venture capital availability is only 26.1 out of 100, whereas the share of insurance premium volume in GDP is less than 1%. Poor development of local insurance markets has enormous effects on farmers when incidents occur.

Table 7.5. Skills, financial system and technological capability in West Africa

|

Country |

Domestic credit to the private sector, % GDP, 2019 |

Insurance premiums, % GDP, 2014-16 |

Financing of SMEs, score 2018-19 |

Venture capital availability, score 2018-19 |

|---|---|---|---|---|

|

Benin |

23.3 |

0.7 |

39.5 |

19.2 |

|

Burkina Faso |

30 |

0.7 |

29.6 |

12.1 |

|

Cabo Verde |

61.8 |

1.2 |

43 |

33.1 |

|

Côte d’Ivoire |

24.6 |

1.2 |

24.4 |

16.6 |

|

Gambia |

5.7 |

- |

42.3 |

33.1 |

|

Ghana |

15 |

1.1 |

46.1 |

30.6 |

|

Guinea |

10.3 |

- |

61.9 |

43.5 |

|

Mali |

26.2 |

0.6 |

38.9 |

28.1 |

|

Nigeria |

14.7 |

0.3 |

30.2 |

16.9 |

|

Senegal |

28.2 |

1.2 |

43.3 |

27.4 |

|

West Africa |

24 |

0.9 |

39.9 |

26.1 |

Source: Authors’ calculations based on the World Economic Forum Report Database (WEF, 2019).

Encouraging access to finance for entrepreneurs and SMEs in the agricultural sector is still a sine qua non for strengthening value chains during their development. The system to harness private finance could be more effective.

-

The bank loan guarantees provided by international bodies such as the French Development Agency (AFD) or the African Guarantee and Economic Co-operation Fund (FAGACE) to encourage access to local credit have a role to play. However, the bulk of guarantees awarded involve wide-ranging projects and should be better targeted to include small producers and local entrepreneurs. Co-operation with microcredit establishments that normally target these groups should therefore be stepped up.

-

Moreover, the widespread use of stock guarantees could also alleviate credit constraints. As noted by Brulé-Françoise et al. (2016), for example, storage and warehousing capacities, as well as infrastructures for compliance with standards, are among the elements still lacking in the sub-region.

Supporting producer co-operatives and organisations is vital because they play a key role in the development of value chains. Co-operatives open the way to technical and financial assistance, investment in adequate infrastructure (refrigerated storage in warehouses, machinery, etc.). They increase farmers’ bargaining power in purchases and sales and help to spread good agronomic practices. In addition, co-operatives facilitate the development of innovative activities such as certification and processing. For example:

-

In Mali, a group of farmers took the initiative to organise themselves into a co-operative named Yeleton. They then obtained finance from the banks and support from the Government to obtain a tractor to cultivate their communal and individual farms (Diama, 2020).

-

In Niger, the Made Bane Farmers’ Union of Falwell experienced a significant increase in production of quality seeds, and created inputs shops and grain banks. The members of the Union have received training on improved varieties suited to local conditions and were subsequently accredited as Certified Seed Producers, enabling them now to supply other unions (Diama, 2020).

-

In Togo, as part of the West Africa Agricultural Productivity Program (WAAPP), the provision of parboiling equipment to groups such as the Femmes Vaillantes co-operative in Anié has enabled them to triple their productivity (World Bank, 2020b).

Follow-up actions aimed at agri-food businesses can be effective in building local processing capabilities. Improving the skills of AVC stakeholders is vital. In addition to the efforts required to improve the general level of formal education, follow-up centres offering training in agri-food business skills could be of huge benefit to the region. A large share of young people in employment are already out of the education system. One third of 15-29-year-olds, a significant proportion of the population, have no education (UNESCO, 2020).

The centres could provide short, practical training to the out-of-school population who are unemployed, to encourage them to go into agriculture or the processing of agricultural products. In Mali, the Baguinéda Centre de Formation en Entrepreneuriat Agricole (CFEAB) provides people in this category with short, 10-day training courses. The trainers go to the students in a dedicated mobile vehicle, teaching them how to manufacture various products such as hibiscus syrup (bissap) and zaban, tamarind syrup or mango jam (Le Cam, 2019). Since 2010, the centre has trained more than 2 000 out-of-school young people who now have a professional training certificate and a job in the AVC. In 2017, Senegal opened its first French-language agricultural university in West Africa (Université du Sine Saloum el Hâdj Ibrahima Niass), which aims to focus on local features to make agriculture a driver of growth. A number of co-operatives have been producing juices and jams for several decades, but there has been no proper structure in the sector for them to become canned, vacuum-packaged flagship exports. This is one statistic that could change as a result of the integrated agropolises that are under construction, which will incorporate centres for training young people in agri-business trades (Box 7.4).

Box 7.4. Integrated agropolises and community agricultural estates in Senegal

Senegal has decided to build several agri-food processing clusters (or integrated agropolises). The project is the flagship of the Emerging Senegal Plan (PSE), and is based on a policy of enhancing private investment initiatives (farmers, SMEs) in order to stimulate balanced, sustainable, inclusive development across the country. The objective is to increase the industrial sector’s contribution from 12% to 25% of GDP between 2014-35 by developing agricultural basins with strong market potential.

The first such project began in 2020 in the south (Kolda, Sédhiou and Ziguinchor) and will be brought into service in 2022. The project should generate 49 500 jobs, 14 500 of which will be direct and 35 000 indirect, and will impact close to 65 000 households, or approximately 365 000 people, 60% of whom are young, and 50% of them women. Two other agropolises are planned for the centre (Diourbel, Fatick, Kaffrine and Kaolack) and north of the country (Louga, Matam and Saint-Louis) by 2024. The construction of the basins should encourage development and increases in the production of non-timber forest products (baobab, honey, grains and wild fruits, oils and resins, brewing, etc.), and improvements in the quality of natural resources management (smart agricultural practice, climate change adaptation, biogas energy generation and restoration of forest plant cover).

Additionally, a community agricultural estate (DAC) covering 5 000 hectares was opened July 2021. Named Keur Momar Sarr and located in Louga, the DAC is one of the first four sites in operation of the 11 that are planned in the pilot phase. It has an irrigation system, an area for packaging and packing agricultural products, cold rooms to store fruits and vegetables, and a farm specifically for training young people in the production and processing of agricultural products.

Source: Authors’ compilation.

Finally, it is important to facilitate women’s access to land tenure, in view of the significant contribution they make to agricultural output. Rates of discrimination against women in ten countries in the region are high or very high (Benin, Burkina Faso, Côte d’Ivoire, Gambia, Ghana, Guinea-Bissau, Niger, Nigeria, Sierra Leone and Togo). In Burkina Faso, Cabo Verde, Côte d’Ivoire, Gambia, Guinea, Mali and Senegal, women represent 43% of the agricultural workforce on average, but only 8% of land owners (OECD, 2018). These gender disparities stem primarily from the predominance of discriminatory customary laws and poorly enforced legislative frameworks governing land and property. For example, Benin’s Rural Land Code (2007) grants equality in land ownership rights, but customary law stipulates that only men can inherit land.

The response to environmental pressures must include the adoption of modern production methods to encourage the production of sustainable products

West Africa is still one of the richest regions in terms of agricultural resources, but it must respond rapidly to environmental pressures. According to FAOSTAT (2020), it covers a total land area of 511.54 million hectares criss-crossed by major rivers, and 47.6% of the land is agricultural. In some countries, including Côte d’Ivoire, Gambia, Ghana, Nigeria, Sierra Leone and Togo, over 50% of the land is arable. However, only 42.4% of the potential was exploited in 2018. Moreover, more than 1 million hectares of land in Mali, Liberia, Nigeria and Ghana are covered by inland waters that are necessary for irrigation. The region also benefits from maritime coasts with a wealth of fisheries resources that also provide opportunities for local fish processing.

Agricultural and grazing systems remain very extensive and exert pressure on the region’s ecosystems and available forestry resources. Between 1975 and 2013, forest cover shrank by 37% to only 16.6%, compared to the African average of 21.4%. Additionally, around 90% of pastureland and 80% of cultivation areas in the West African Sahel are significantly affected by soil degradation, including erosion (FAO, 2015).

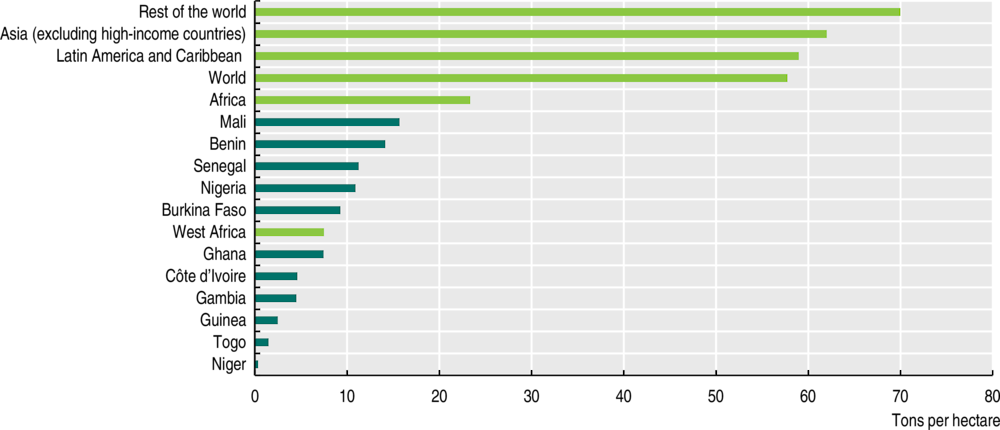

Attenuating the effect of climate variability on farms’ productivity will therefore involve adequate application of fertilisers and the use of improved seeds. In 2018, for example, the amount of nutrient nitrogen by area of cultivated land in West Africa was only 7.5 t/ha compared to an average of 70 t/ha in the rest of the world (Figure 7.13). In Ghana, the low demand for fertilisers is the result of modest yield response (Kolavalli, 2019). Higher returns depend on complementary actions such as the use of improved seeds and better agronomic practices. The development of the different varieties of New Rice for Africa (NERICA) by the West Africa Rice Development Association (WARDA) illustrates this and has contributed to raising the yield obtained by farmers in some countries in the region (Dibba et al., 2012; Diagne, Midingoyi and Kinkingninhoun-Medagbe, 2013). This is also the case for the development and distribution of improved cocoa seeds by the National Agricultural Research Centre (Centre National de Recherche Agronomique, CNRA) in Côte d’Ivoire, which doubled yields (CCC, 2014) while helping to combat viruses that infect cocoa plantations (Box 7.5).

Figure 7.13. Agricultural use of nutrient nitrogen by area of cultivated land (t/ha), 2018

Source: Authors’ calculations based on FAOSTAT data (2020), online database, http://www.fao.org/faostat/en.

Additional irrigation is also crucial. In 2017, only 10% of irrigable land was actually irrigated (FAO, 2020), the same as in 2007 (9%). Higginbottom et al. (2021) attribute this situation to the fact that projects are sometimes too ambitious and prioritise low-value crops, reducing the projects’ economic viability. Nonetheless, there are some exceptions such as the Kpong Irrigation Scheme (KIS) in Ghana, which enables local rice producers to achieve yields comparable to irrigated rice yield in Asian countries (Takeshima et al., 2013). However, the KIS project’s success has not been replicated elsewhere in Ghana, despite fairly similar conditions.

Box 7.5. The cocoa sector and the challenge of climate adaptation

Cocoa is the world’s third-largest food market, accounting for around USD 10 billion of trade annually. West Africa is the world’s leading producer, accounting for 60.7% of world production of cocoa beans and 90.5% of African production in 2019 (FAOSTAT, 2020). The leading producers are Côte d’Ivoire, Ghana and Togo, with more than 50% of world supply. As a mainstay of the Ivorian economy, the sector contributes between 15% and 20% to GDP formation, employs close to 600 000 growers and provides a living for around 6 million people, according to the Coffee and Cocoa Board (Conseil du Café-Cocoa, CCC).

Demand for cocoa, as approximated by crushed volume, is primarily from Europe and the United States, which import 75% and 50% respectively of their stocks of beans from West Africa before they are processed and most of the value-added is derived. An industrial complex is under construction in Côte d’Ivoire to increase local processing capacity from 500 000 to 1 million tonnes (AFP, 2020).

Despite rising volumes in the past few decades, agricultural productivity remains low in order to maintain comparative advantage on the world stage. One of the major constraints on the sector relates to ageing plantations and the renewal of cocoa trees. Over 20 years, the productivity of the Ivorian orchard has stagnated at around 450-550 kg/ha. Plant diseases such as swollen shoot and brown rot that flourish in tropical countries cause 30% of the annual harvest to be lost.

The lack of training, extensive farming practices and under-use of appropriate phytosanitary products hamper yields, degrade soil quality and exert pressure on the forest-tree orchard. Between 1960 and 2019, the forested area of Côte d’Ivoire declined from 12 to 3 million hectares. Close to 80% of cocoa producers live on less than USD 3 per day.

The difficulties that growers have in gaining access to finance restrict the opportunities for developing plantations and the procurement of modern agricultural products and equipment. Moreover, tax rates amount to up to 22% of the cost-insurance-freight (CIF) value of exports, one of the highest in the world. This results in tax rates of around 40% on growers’ turnover, and over 50% on their profits.

A number of initiatives are under way to improve the cocoa value chain by embedding the standards laid down by the cocoa industry under the label “sustainable cocoa” in order to provide consumers with good quality products in a sustainable fashion. The Ivorian Government and the EU – the leading buyer of Ivorian cocoa, accounting for 67% of the volume of cocoa exported – held a high-level meeting on 22 January 2021 in the aim of setting up an inclusive framework for dialogue with a view, first, to establishing a co-operative working relationship and pooling knowledge and experience and, second, to establishing a framework for co-ordination that can be used to help build sustainable cocoa cultivation.

Source: Authors’ compilation, CCC.

Non-tariff barriers hamper the development of value chains at regional level

Launched in January 2021, the African Continental Free Trade Area (AfCFTA) provides a framework conducive to facilitating trade and accelerating the development of regional AVCs. The AfCFTA aims to establish a single continental market of more than 1.3 billion people by 2027. Effective liberalisation of intra-regional trade, combined with investment in trade infrastructure, would connect landlocked markets to coastal countries: this is the basis of food demand dynamics. Measures that are absolutely crucial to accelerate the AfCFTA’s entry into operation must therefore be taken in order to provide solutions to the many structural issues facing the countries in question.

To that end, there should be greater, stricter compliance with the agreements signed between states on transit facilitation. The ongoing presence of formal and informal tariff and non-tariff barriers to internal trade deters economic agents from winning regional markets. In November 2017, eight ECOWAS countries still required country-of-origin certificates for food shipments, even though they were abolished in 2003 (Mercier, 2018). This policy is a genuine barrier to trade because certificates of origin give rise to a cost that is borne by traders, and the process for obtaining them is lengthy and cumbersome (UNCTAD, 2018). These costly barriers adversely affect the competitiveness of local stakeholders on regional markets.

Enhancing the competitiveness of products also involves efforts to co-ordinate regulatory frameworks governing sanitary and phytosanitary rules and standards (SPS). The AU’s SPS policy framework and Annex 7 to the text of the AfCFTA Agreement focus on the need to harmonise SPS standards at continental level. This would make it possible to organise flows of agri-foods and to limit undue restraints on trade. For example, Cadot and Gourdon (2014) estimate that SPS measures increased food prices in sub-Saharan Africa by 13%. In West Africa, work to improve matters is under way, including the adoption in 2002 of the West African Quality Programme (WAQP) adopted by WAEMU that was extended to all ECOWAS countries in 2007. The WAQP, a regional regulatory framework for SPS measures, was intended to apply within ECOWAS. However, at the time of writing, there are still financial, technical and human resources constraints on the implementation, oversight and enforcement of the measures adopted.

Initiatives for cross-border co-operation around export sectors could improve product competitiveness and attract investment

Countries should continue to focus on harmonising the regulatory and legal framework for attracting investment. In this regard, countries see considerable merit in going beyond isolated national frameworks. Improvement in the business environment throughout the region is vital in order to attract major investment. Governance and institutional factors associated with the performance of the regulatory and fiscal framework should, inter alia, ensure protection for property rights, attract investors and limit the effects of corruption. In 2020, the region scored 51.8 points for ease of doing business compared to the world score of 63 points and a score of 78.4 for the OECD. Togo was the highest-placed West African country, ranking 97th in the world (out of 189 countries) and ninth in Africa. Only Togo and Nigeria (131st) were among the 10 economies that implemented the most reforms (World Bank, 2020c).

Governments can also work together to rebalance the power relationship in the governance of the value chains for the region’s primary export crops. By working together, states increase their room for manoeuvre in negotiations with international purchasers. This has, for example, happened in the cocoa value chain between Côte d’Ivoire and Ghana, which control 60% of the global market and now set price floors below which cocoa will not be sold; this takes the form of a decent income differential, set at USD 400 per tonne for the 2020/21 season (CCC, 2020). Other forms of co-operation such as the introduction of quality marks or rules governing shared corporate responsibilities are also possible.

The introduction of cross-border special economic zones (SEZ) could stimulate regional complementarities. The aim of the tax incentives and greater availability of infrastructures that SEZ offer to businesses is to create hubs for employment and competitiveness within countries. The fact that they are cross-border in nature inherently promotes the development of complete value chains. It enables businesses to capitalise on regional complementarities, hence the cross-border Sikasso/Korhogo/Bobo-Dioulasso (SKBO) SEZ between Mali, Burkina Faso and Côte d’Ivoire. Established in 2018, it aims to exploit cross-border agricultural and mining potential and create jobs. There is likely to be merit in scaling up initiatives of this kind throughout the sub-region. Cross-border SEZs can play a significant role in attracting FDI because of the business facilities they provide. They could thus contribute to technical knowledge transfer, upgrading productive capacities, and therefore the opportunity to integrate product-processing activities that add value.

References

Adeyeye, A. (2017), Business and Investment Opportunities in the Agribusiness Industry of Nigeria, NTU-SBF Centre for African Studies, Nanyang Technological University, Singapore, 31 August, https://www.ntu.edu.sg/docs/librariesprovider100/abi/2017_aug_business-and-investment-opportunities-in-nigeria-agribusinesscd0cbe2b74494ff7a0ceed00cd823e64.pdf?sfvrsn=5445f1b8_2.

AfDB/OECD/UNDP (2014), African Economic Outlook 2014: Global Value Chains and Africa’s Industrialisation, African Development Bank, Tunis/OECD Publishing, Paris, https://doi.org/10.1787/aeo-2014-en.

AFP (2020), “La Côte d’Ivoire lance la construction de deux nouvelles usines de transformation du cocoa”, Agence France Presse in Le Monde, Paris, 23 September, https://www.lemonde.fr/afrique/article/2020/09/23/la-cote-d-ivoire-lance-la-construction-de-deux-nouvelles-usines-de-transformation-du-cacao_6053261_3212.html.

Allen, T. and P. Heinrigs (2016), “Emerging Opportunities in the West African Food Economy”, West African Papers, No. 1, OECD Publishing, Paris, https://doi.org/10.1787/5jlvfj4968jb-en.

Allen, T., P. Heinrigs and I. Heo (2018), “Agriculture, Food and Jobs in West Africa”, West African Papers, No. 14, OECD Publishing, Paris, https://doi.org/10.1787/dc152bc0-en.

AUC/OECD (2021), Africa’s Development Dynamics 2021: Digital Transformation for Quality Jobs, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/0a5c9314-en.

AUC/OECD (2019), Africa’s Development Dynamics 2019: Achieving Productive Transformation, African Union Commission, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/c1cd7de0-en.

Balassa, B. (1965), “Trade Liberalisation and ‘Revealed’ Comparative Advantage”, The Manchester School, Vol. 33, Issue 2, pp. 99-123, https://doi.org/10.1111/j.1467-9957.1965.tb00050.x.

BCEAO (2021), BCEAO Annual Report 2020, Central Bank of West African States, Dakar, https://www.bceao.int/sites/default/files/2021-11/BCEAO_ANNUAL_REPORT_2020.pdf.

Belotti, F., A. Borin and M. Mancini (2020), “icio: Economic Analysis with Inter-Country Input-Output Tables in Stata”, Policy Research Working Paper, No. 9156, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/33361.

Blue Skies (2020), Blue Skies launches new state-of-the-art facility in Benin, Blue Skies, Cotonou, 26 February, https://www.blueskies.com/blue-skies-launches-new-state-of-the-art-facility-in-benin (accessed on 15 June 2021).

Brulé-Françoise, A. et al. (2016), “Le crédit à l’agriculture, un outil-clé du développement agricole”, Techniques Financières et Développement, Vol. 124, No. 3-4, pp. 35-52, Épargne Sans Frontière, Paris, https://doi.org/10.3917/tfd.124.0035.

Cadot, O. and J. Gourdon (2014), “Assessing the Price-Raising Effect of Non-Tariff Measures in Africa”, Journal of African Economies, Vol. 23, Issue 4, pp. 425-463, Centre for the Study of African Economies (CSAE), University of Oxford, Oxford, https://doi.org/10.1093/jae/eju007.

Casella, B. et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc/ (accessed 1 June 2021).

CCC (2020), Projet national de lutte contre le swollen shoot, Coffee and Cocoa Board, Ministry of Agriculture, Republic of Côte d’Ivoire, Abidjan, http://www.conseilcafecacao.ci/index.php?option=com_content&view=article&id=123&Itemid=202.

CCC (2014), Programme Quantité-Qualité-Croissance “2QC” 2014-2023, Coffee and Cocoa Board, Ministry of Agriculture, Republic of Côte d’Ivoire, Abidjan, March, http://www.conseilcafecacao.ci/docs/PROGRAMME_2QC_2014-2023.pdf.

CEPII (2021), BACI International Trade Database at the Product-Level, Centre d’Études Prospectives et d’Informations Internationales, Prime Minister/France Stratégie, Paris, www.cepii.fr/cepii/en/bdd_modele/download.asp?id=37 (accessed on 18 August 2021).

CILSS (2020), “Impact of the COVID-19 pandemic on food and nutrition security in the Sahel and West Africa”, Watch-keeping Newsletter, No. 5, August 2020, Permanent Interstate Committee for Drought Control in the Sahel, Ouagadougou, http://www.cilss.int/wp-content/uploads/12/Watch-Newsletter-Covid-19-FNI-N5.pdf.

Diagne, A., S.-K.G. Midingoyi and F.M. Kinkingninhoun-Medagbe (2013), “Impact of NERICA Adoption on Rice Yield: Evidence from West Africa”, in Otsuka, K. and D. Larson (eds.), An African Green Revolution, Springer, Dordrecht, https://doi.org/10.1007/978-94-007-5760-8_7.

Diama, A. (2020), Farmer cooperatives across West and Central Africa help expand access to improved seeds, boosting yields, International Crops Research Institute for the Semi-Arid Tropics (ICRISAT), West and Central Africa, Bamako, www.icrisat.org/farmer-cooperatives-across-west-and-central-africa-help-expand-access-to-improved-seeds-boosting-yields.

Dibba, L. et al. (2012), “The impact of NERICA adoption on productivity and poverty of the small-scale rice farmers in the Gambia”, Food Security, Vol. 4, No. 2, pp. 253-265, Springer, Dordrecht, https://doi.org/10.1007/s12571-012-0180-5.

Duflo, E. and A. Banerjee (2020), “Coronavirus is a crisis for the developing world, but here’s why it needn’t be a catastrophe”, The Guardian, London, 6 May, https://www.theguardian.com/commentisfree/2020/may/06/vulnerable-countries-poverty-deadly-coronavirus-crisis.

L’Économiste (2019), “Production d’ananas: L’Afrique reste derrière mais l’avenir est prometteur”, L’Économiste, Cotonou, 17 July, https://leconomistebenin.com/2019/07/17/production-dananaslafrique-reste-derriere-mais-lavenir-est-prometteur.

ECOWAS (2017), 2025 Strategic Policy Framework: Summary, ECOWAS Department of Agriculture, Environment and Water Resources, Abuja, http://araa.org/sites/default/files/media/ECOWAP%202025%20Strategic%20Policy%20Framework%20ENG.pdf.

Fally, T. and R. Hillberry (2018), “A Coasian Model of International Production Chains”, Journal of International Economics, Vol. 114, pp. 299-315, Elsevier, Amsterdam, https://doi.org/10.1016/j.jinteco.2018.07.001.

FAO (2020), AQUASTAT database, Food and Agriculture Organization of the United Nations, Rome, http://www.fao.org/aquastat/statistics/query/index.html?lang=en.

FAO (2015), Status of the World’s Soil Resources (SWSR), Food and Agriculture Organization of the United Nations, Rome, http://www.fao.org/documents/card/fr/c/c6814873-efc3-41db-b7d3-2081a10ede50.

FAO et al. (2021), The State of Food Security and Nutrition in the World 2021: Transforming food systems for food security, improved nutrition and affordable healthy diets for all, Food and Agriculture Organization of the United Nations, Rome, in partnership with the International Fund for Agricultural Development (IFAD), the United Nations Children’s Fund (UNICEF), the World Food Programme (WFP) and the World Health Organization (WHO), https://doi.org/10.4060/cb4474en.

FAOSTAT (2020), Food and agriculture data, Food and Agriculture Organization of the United Nations, Rome, https://www.fao.org/faostat/en.

FAOSTAT (2019), Countries by commodity, Food and Agriculture Organization of the United Nations, Rome, https://www.fao.org/faostat/en/#rankings/countries_by_commodity.

fDi Markets (2021), fDi Markets Database: the in-depth crossborder investment monitor from the Financial Times, London, https://www.fdimarkets.com (accessed in October 2021).

FEM (2019), The Global Competitiveness Report, World Economic Forum, Geneva, https://fr.weforum.org/reports/global-competitiveness-report-2019.

Ghins, L. and K. Zougbédé (2019), “The food economy can create more jobs for West African youth”, OECD Development Matters (blog), Organisation for Economic Co-operation and Development (OECD)/Sahel and West Africa Club (SWAC), Paris, 23 August, https://oecd-development-matters.org/2019/08/23/the-food-economy-can-create-more-jobs-for-west-african-youth.

Government of Burkina Faso (2020), Message à la Nation de Son Excellence Monsieur Roch Marc Christian Kaboré, Président du Faso, Président du Conseil des Ministres sur la Pandémie du COVID-19, 2 April, https://www.presidencedufaso.bf/message-a-la-nation-de-son-excellence-monsieur-roch-marc-christian-kabore-president-du-faso-president-du-conseil-des-ministres-sur-la-pandemie-du-COVID-19.

Government of Côte d’Ivoire (2020), Pandémie du Coronavirus: présentation du plan de soutien économique, social et humanitaire, Abidjan, March 2020, https://www.gouv.ci/doc/1585943114Pandemie-du-coronavirus-COVID-19-Presentation-du-plan-de-soutien-economique-social-et-humanitaire.pdf.

Goyal, A. (2014), “Expanding Africa’s Digital Frontier: Farmers Show The Way”, World Bank Blogs, World Bank, Washington, DC, https://blogs.worldbank.org/africacan/expanding-africa-s-digital-frontier-farmers-show-way.

GSMA (2021), State of the Industry Report on Mobile Money 2021, GSM Association, London, https://www.gsma.com/sotir.

GSMA (2017), Opportunities in agricultural value chain digitisation: Learnings from Côte d’Ivoire, GSM Association/UK Aid, Department for International Development (DFID), London, October, https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2018/01/Opportunities-in-agricultural-value-chain-digitisation-Learnings-from-Côte-d’Ivoire.pdf.

GSMA (2016), Market size and opportunity in digitising payments in agricultural value chains, GSM Association Intelligence, London, November, https://data.gsmaintelligence.com/api-web/v2/research-file-download?id=18809386&file=market-size-and-opportunity-in-digitising-payments-in-agricultural-value-chains-1482140000731.pdf.

Higginbottom, T.P. et al. (2021), “Performance of large-scale irrigation projects in sub-Saharan Africa”, Nature Sustainability, Vol. 4, No. 6, pp. 501-508, Nature Portfolio, Springer, Amsterdam/Macmillan, London, https://doi.org/10.1038/s41893-020-00670-7.

Hollinger, F. and J.M. Staatz (2015), Agricultural Growth in West Africa: Market and Policy Drivers, Food and Agriculture Organization of the United Nations (FAO), Rome, https://www.fao.org/publications/card/en/c/866496a3-f459-4fee-8c13-cd66897c97cf.

ILO (2020), Labour force characteristics, International Labour Organization statistics (ILOStat), Geneva, in Statistical Annex to Africa’s Development Dynamics 2021, African Union Commission (AUC), Addis Ababa, and OECD Publishing, Paris, https://raw.githubusercontent.com/AfDDAnnex/AfDDDDAf2021/main/AfDD_2021_Annex_Table_Tab09.xlsx.

IMF (2021), World Economic Outlook Database, International Monetary Fund, Washington, DC, https://www.imf.org/en/Publications/WEO/weo-database/2021/October (accessed on 18 November 2021).

Iwuchukwu, J.C., C.E. Nwobodo and C. E. Udoye (2017), “Problems and Prospects of Pineapple Production in Enugu State, Nigeria”, Journal of Agricultural Extension, Vol. 21, No. 1, February, http://dx.doi.org/10.4314/jae.v21i1.14.

Koffi, S. et al. (2020), COVID-19 Pandemic: Impact of Restriction Measures in West Africa, Economic Community of West African States (ECOWAS) Commission, the World Food Programme (WFP), United Nations Economic Commission for Africa (UNECA) and the Regional Centre of Excellence against Hunger and Malnutrition (CERFAM), https://www.researchgate.net/profile/Babau-Sogue/publication/349111526_Covid-19_Pandemic_Impact_of_restriction_measures_In_West_Africa_Acknowledgement/links/602135f1a6fdcc37a80ee231/Covid-19-Pandemic-Impact-of-restriction-measures-In-West-Africa-Acknowledgement.pdf.

Kolavalli, S. (2019), “Developing Agricultural Value Chains”, in Ghana’s Economic and Agricultural Transformation: Past Performance and Future Prospects, Diao, X. et al. (eds.), Chapter 8, pp. 210-240, International Food Policy Research Institute (IFPRI), New York, and Oxford University Press, Oxford, https://doi.org/10.2499/9780198845348_08.

Kpenavoun Chogou, S., E. Gandonou and N. Fiogbe (2017), “Mesure de l’efficacité technique des petits producteurs d’ananas au Bénin”, Cahiers Agricultures, Vol. 26, No. 2, EDP Sciences, Les Ulis, March, http://dx.doi.org/10.1051/cagri/2017008.

Le Cam, M. (2019), “Au Mali, des formations pour montrer aux jeunes qu’ils peuvent réussir dans l’agriculture”, Le Monde, Paris, 27 November, www.lemonde.fr/afrique/article/2019/11/27/au-mali-des-formations-pour-montrer-aux-jeunes-qu-ils-peuvent-reussir-dans-l-agriculture_6020764_3212.html.

Mercier, S. (2018), “The Cost of Transporting Cereals in West Africa”, IFPRI Discussion Paper, No. 1759, International Food Policy Research Institute (IFPRI), Washington, DC, http://ebrary.ifpri.org/cdm/ref/collection/p15738coll2/id/132820.

MoFEP (2020), Ghana COVID-19 Alleviation and Revitalization of Enterprises Support, Ghana Ministry of Finance and Economic Planning (MoFEP), Accra, https://www.mofep.gov.gh/sites/default/files/news/care-program.pdf.

OECD (2018), “Gender Inequality in West African Social Institutions”, West African Papers, No. 13, OECD Publishing, Paris, https://doi.org/10.1787/fe5ea0ca-en.

OECD/SWAC (2021), “Food System Transformations in the Sahel and West Africa: Implications for People and Policies”, Maps & Facts, No. 4, Sahel and West Africa Club/OECD Publishing, Paris, April, https://www.oecd.org/swac/maps/Food-systems-Sahel-West-Africa-2021_EN.pdf.

OECD/SWAC (2020a), “Food and Nutrition Crisis 2020: Analyses & Responses”, Maps & Facts, No. 3, Sahel and West Africa Club/OECD Publishing, Paris, November, https://www.oecd.org/swac/maps/Food-nutrition-crisis-2020-Sahel-West-Africa_EN.pdf.

OECD/SWAC (2020b), “History, politics, environment and urban forms in Africa”, in Africa’s Urbanisation Dynamics 2020: Africapolis, Mapping a New Urban Geography, Sahel and West Africa Club/OECD Publishing, Paris, https://doi.org/10.1787/b6bccb81-en.

OECD/SWAC (2019), “Women and Trade Networks in West Africa”, West African Studies, Sahel and West Africa Club, OECD Publishing, Paris, 4 April, https://doi.org/10.1787/7d67b61d-en.

Rieckmann, K. (2020), Moving smallholder farmers out of poverty at myAgro, myAgro, 29 June, https://www.youtube.com/watch?v=EvgAX6uocd8.

Rieländer, J. and B. Traoré (2015), “Explaining Diversification in Exports Across Higher Manufacturing Content: What is the Role of Commodities?”, OECD Development Centre Working Papers, No. 327, OECD Publishing, Paris, 1 September, https://doi.org/10.1787/5jrs8sq91p9x-en.

Takeshima, H. et al. (2013), “Dynamics of Transformation Insights from an Exploratory Review of Rice Farming in the Kpong Irrigation Project”, IFPRI Discussion Paper, No. 01272, International Food Policy Research Institute (IFPRI), Washington, DC, June, http://ebrary.ifpri.org/utils/getfile/collection/p15738coll2/id/127744/filename/127955.pdf.

Teravaninthorn, S. and G. Raballand (2009), Transport Prices and Costs in Africa: A Review of the Main International Corridors, Directions in Development: Infrastructure, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/6610.

UNCTAD (2021), World Investment Report 2021: Investing in Sustainable Recovery, United Nations Conference on Trade and Development, United Nations Publications, New York, https://unctad.org/system/files/official-document/wir2021_en.pdf.

UNCTAD (2020), UNCTADStat (World Statistical Database), United Nations Conference on Trade and Development, Geneva, https://unctadstat.unctad.org/wds/ReportFolders/reportFolders.aspx.