This chapter examines the prospects and challenges to the development of regional value chains in Southern Africa (Angola, Botswana, Eswatini, Lesotho, Malawi, Mozambique, Namibia, South Africa, Zambia and Zimbabwe). It sketches the economic and trade background in the region by describing existing value chains and patterns of trade, growth and financial flows. It subsequently explores a case study of value chain development with respect to the automotive sector in Southern Africa: the current status and recent history of automotive value chain development as well as the major constraints to further development. The analysis draws out recommendations for deepening value chain industrialisation in the Southern African region and relates this to the AfCFTA as well as the consequences of the COVID-19 pandemic.

Africa's Development Dynamics 2022

Chapter 3. Integrating value chains in Southern Africa and the automotive industry

Abstract

In Brief

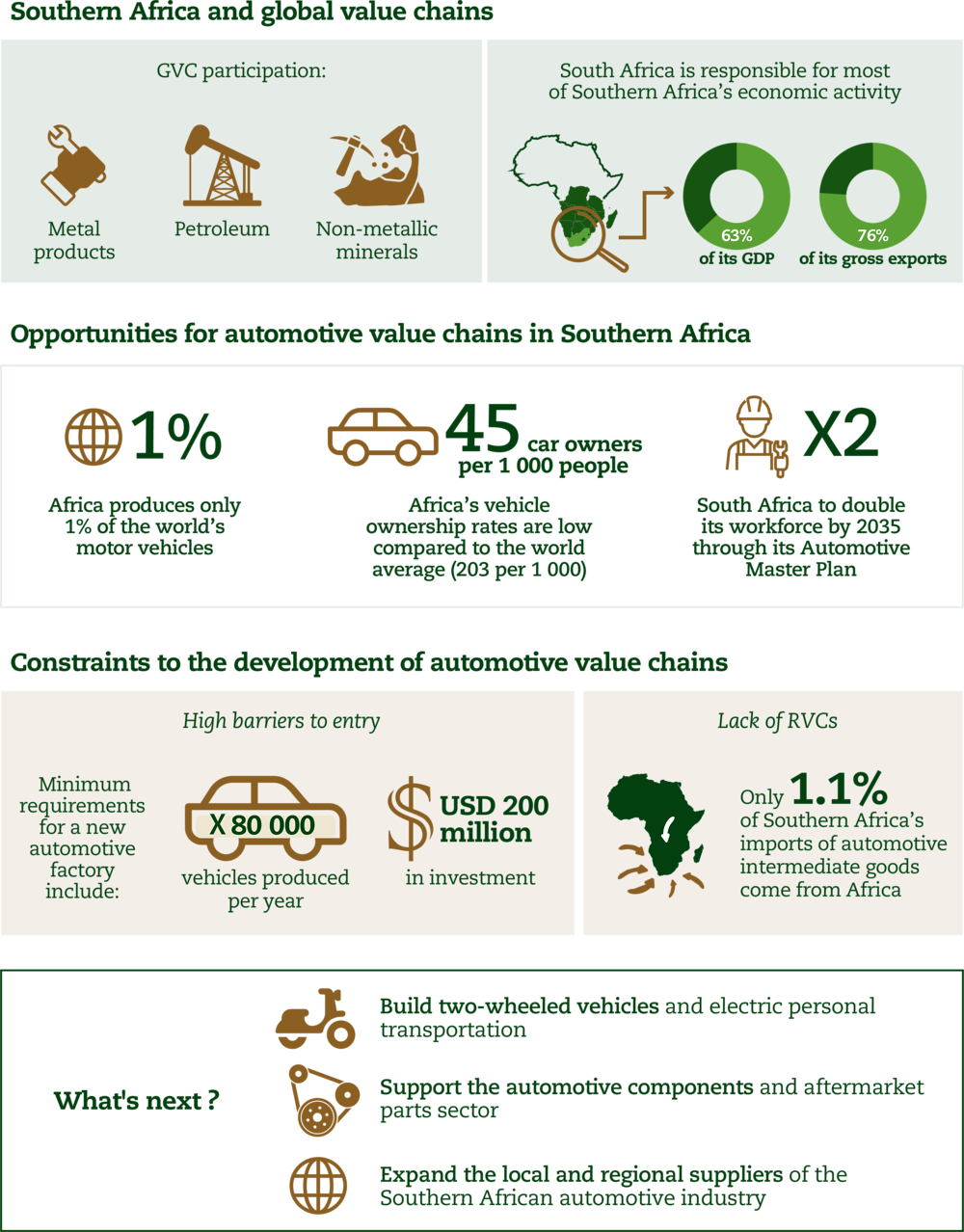

Southern Africa specialises in exporting primary products and is more integrated into value chains than any other African region. Southern Africa’s backward participation in global value chains is generally low for primary goods exporters but is higher than for the continent as a whole. The contribution of the automotive sector to value chains, which is the subject of this chapter because it has much potential to grow, is only a small proportion of total value chain participation (on average 4%) and of gross output (about 12%).

Since 2016, the region has faced economic challenges evidenced by low growth and investment. The COVID-19 pandemic has added to these headwinds in that it has had strong negative impacts on trade and will likely be felt in decreasing global value chain trade – and possible value chain “reshoring” as well. Nevertheless, the industry could drive recovery thanks to the resource endowment of the region, the growing domestic and export market, and progress in regional integration. Constraints on the development of Southern Africa’s automotive value chain include trade and regulatory policy as well as infrastructure and skills. There is considerable scope for the automotive sector to develop within the region and to contribute to greater intra-African trade and the formation of regional value chains.

For this to become a reality, policy makers need to pay attention to the following:

-

improving the business environment and creating sufficient “policy space” for trade policy and the development of manufacturing capabilities and skills across the region, drawing on South Africa’s experience in the automotive sector

-

investing in scaling up assembly plants in the region so that they can overcome competition from used vehicle imports that reduce demand for local production

-

prioritising economic recovery over the medium term while remaining vigilant towards ongoing developments in the COVID-19 pandemic, including new viral strains.

Southern Africa (infographic)

Southern Africa regional profile

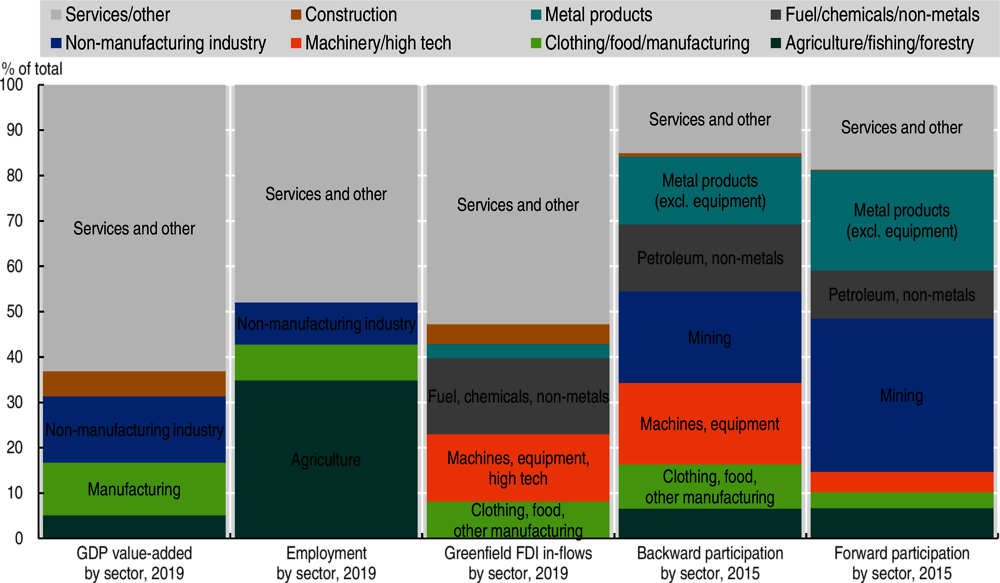

Figure 3.1. Economic and trade profiles of Southern Africa, expressed as % of total

Notes: GDP = gross domestic product; FDI = foreign direct investment. The different sources for the data do not share common definitions of economic sectors, commodities or activities. However, colouring is used in this figure in order to indicate shared themes across datasets.

Source: Authors’ calculations based on World Bank (2020), World Development Report 2020, GVC Database, www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data; fDi Markets (2021), fDi Markets (database), www.fdiintelligence.com/fdi-markets; and World Bank (2021), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators

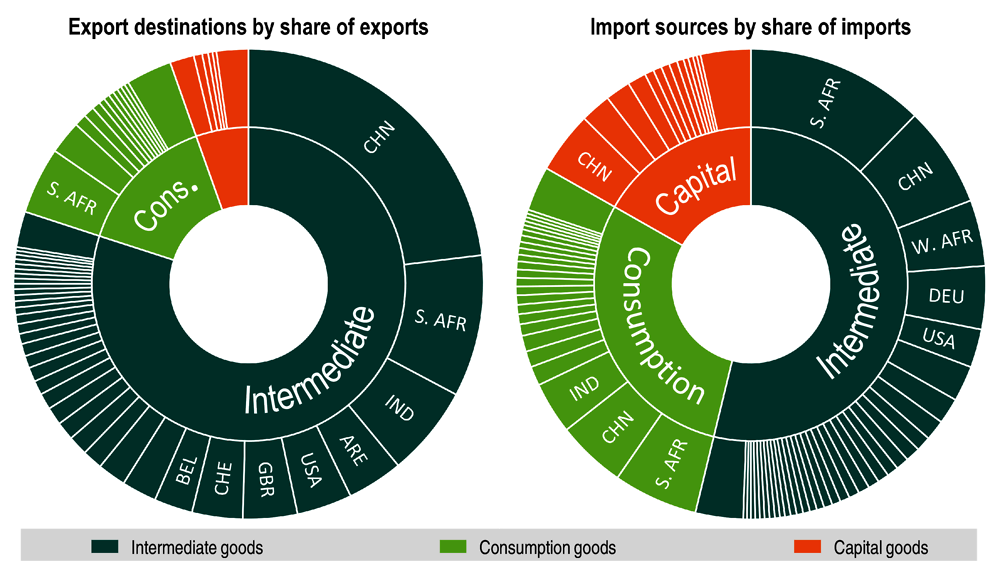

Figure 3.2. Southern Africa’s most important trade partners broken down by volume of trade in intermediate, consumption and capital goods

Notes: Countries are presented using their three-letter ISO codes. The African countries are aggregated into the five sub-regions defined by the African Union as follows: C. AFR = Central Africa, E. AFR = East Africa, N. AFR = North Africa, S. AFR = Southern Africa, W. AFR = West Africa. Interior trade within the Southern Africa Customs Union is excluded.

Source: Authors’ calculations based on data from CEPII (2021), BACI (database), www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37.

Increasing Southern Africa’s participation in global value chains depends on improvements in trade, the economic context and financial flows

Primary industries have been mainly responsible for the region’s economic development

Commodity exports have been a major factor in Southern Africa’s economic evolution. The region’s mining sector represents 15% of gross domestic product (GDP), which is higher than for Africa as a whole (12%) and for other world regions (5-7%). Southern Africa includes several major mineral exporters, and its dominant economy, South Africa, is itself a major exporter of gold and platinum, along with motor vehicles.1 A drop in Southern Africa’s economic growth rate in the late 2010s coincided with a softening of commodity prices after 2012 when per capita GDP reached a peak.

Southern Africa’s economy would benefit from a shift in focus from exporting primary goods to participating in global manufacturing value chains. Global value chain (GVC) participation, or the amount of export value that is attributable to global value chains (see Box 3.1), can provide many benefits. In addition to boosting trade and growth, it can lead to industrial deepening, economic diversification, and technology and skills transfer. Southern Africa is already in a good position to shift to global manufacturing value chains, due to the well-developed motor vehicle industry in South Africa. This industry absorbs imported primary and intermediate goods and significantly drives exports of complex goods on the global market, creating a more diversified, sophisticated economy.

Box 3.1. Global value chain participation

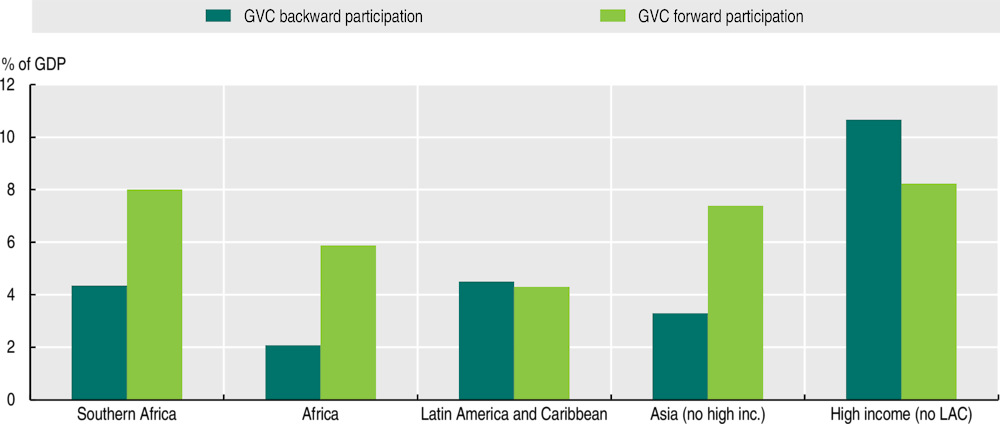

Global value chain participation or integration is a measure of the proportion of the total value of a country’s exports that is generated by global value chains. Total GVC participation includes backward participation and forward participation. Backward participation is the amount of a country’s export value that comes from imported intermediate products. Forward participation is the amount of a country’s export value that is added by national production and that is embedded in another country’s exports.

By construction, there is no overlap between a country’s backward participation and its forward participation. An example of backward participation is the importation by South Africa of leather vehicle seat covers from Lesotho, for further use in finished vehicle production. An example of forward participation is the export to China of commodities such as metals, which are further transformed into finished metal products such as transport equipment.

In general, the more a country’s production occupies the end of the production chains, the more it tends to have backward GVC participation, and the less it tends to have forward GVC participation (and there is no forward GVC participation if the production is of finished goods, by definition). Southern African countries, being overwhelmingly primary goods producers, would be expected to be far more integrated into forward participation than backward, as is confirmed in Figure 3.3.

Southern Africa has higher GVC participation thanks to forward participation in mining and to backward participation in manufacturing industries such as automobiles

In 2019, Southern African forward participation in global value chains was nearly twice as high as its backward participation ( Figure 3.3 ), but due to its manufacturing industries, backward participation was still higher than in other African regions. In 2015, three industries in Southern Africa had both the highest backward and the highest forward participation in global value chains. They were, in descending order: mining/quarrying, metal products and petrochemicals/minerals. All three of these industries had significantly higher forward than backward participation, but forward participation in mining was over two and a half times higher than backward participation (Figure 3.3).

Figure 3.3. Total backward and forward global value chain (GVC) participation, Africa and Southern Africa compared with other world regions, 2019 (as a percentage of gross domestic product)

Source: Authors’ calculations based on data from Casella et al. (2019), UNCTAD-Eora Global Value Chain Database, https://worldmrio.com/unctadgvc/.

On the other hand, in Southern Africa’s transport equipment sector, backward participation is more than four times greater than forward participation, which is contrary to the pattern observed for the economy as a whole (Figure 3.3). Table 3.1 provides some key indicators of GVC integration in the transport equipment sector in Southern Africa for the full period over which reliable sectoral data was available, 2000-15. Backward participation stands at 8.8% and forward at just 1.4%, reflecting a relatively small involvement in transport equipment value chains, especially those resulting in re-exports and further beneficiation down the chain. This implies that the region’s transport equipment sector is more mature (“upgraded”) as a manufacturing sector than the aggregate production in the region.

Table 3.1. Global value chain (GVC) participation with respect to the transport equipment sector in Southern Africa, 2000-15

|

Indicator |

USD million |

|---|---|

|

GVC backward participation – Total |

314 773 |

|

GVC backward participation – Transport equipment |

27 720 |

|

GVC backward participation – Transport equipment as a proportion of total |

8.8% |

|

GVC forward participation – Total |

472 618 |

|

GVC forward participation – Transport equipment |

6 708 |

|

GVC forward participation – transport equipment as a proportion of total |

1.4% |

Note: The values for backward and forward participation were calculated relative to the totals for GVC backward and forward participation, in order to scale the transport equipment sector’s GVC participation.

Source: Authors’ calculations based on World Bank (2020), World Development Report 2020, GVC Database, www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data.

Among the Southern African countries, GVC participation as a percentage of gross exports ranged from 31% to 55% in 2015 but tended to be higher in countries with larger manufacturing sectors ( Table 3.2 ). The lower percentages of gross exports corresponded to countries whose manufacturing sectors were smaller compared to their total outputs, such as Angola (6.0% of GDP) and Mozambique (9.3%). The countries on the upper end of the range had greater manufacturing outputs, such as Eswatini (33.2%) and Lesotho (16.9%).

Table 3.2. Comparisons of global value chain (GVC) trade with gross trade and manufacturing in Southern Africa (excluding Zimbabwe), 2015

|

|

GDP (USD million) |

Gross exports (USD million) |

GVC participation (USD million) |

GVC participation as % of exports |

GVC participation as % of GDP |

Manufacturing as % of GDP |

|---|---|---|---|---|---|---|

|

South Africa |

317 578 |

118 445 |

49 366 |

41.7% |

15.5% |

13.4% |

|

Angola |

116 194 |

26 108 |

8 029 |

30.8% |

6.9% |

6.0% |

|

Zambia |

21 245 |

4 273 |

1 459 |

34.1% |

6.9% |

7.9% |

|

Mozambique |

15 951 |

901 |

285 |

31.6% |

1.8% |

9.3% |

|

Botswana |

14 445 |

1 059 |

446 |

42.1% |

3.1% |

6.4% |

|

Namibia |

11 450 |

2 148 |

899 |

41.9% |

7.9% |

12.4% |

|

Malawi |

6 402 |

1 102 |

368 |

33.4% |

5.7% |

10.8% |

|

Eswatini |

4 061 |

1 129 |

561 |

49.7% |

13.8% |

33.2% |

|

Lesotho |

2 207 |

304 |

168 |

55.2% |

7.6% |

16.9% |

|

Southern Africa |

509 532 |

155 468 |

61 581 |

39.6% |

11.8% |

11.2% |

Source: Authors’ calculations based on World Bank (2020), World Development Report 2020, GVC Database, www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data.

South Africa dominates the region in terms of GVC participation in the transport equipment sector, and the bulk of this is backward participation. Table 3.3 presents 2015 data on GVC participation by country and specifically for the transport equipment sector; the first and fourth columns reveal that South Africa’s quantum in both categories dwarfs that of the other countries. The table shows that there is little meaningful GVC participation by any of the other countries in Southern Africa. Even South Africa’s forward transport equipment GVC participation is small at only 1.7% of all forward participation in global value chains.

Table 3.3. Indicators of global value chain (GVC) participation with respect to the transport equipment sector in Southern African countries (excluding Zimbabwe), 2015

|

|

GVC backward participation (USD million) |

GVC forward participation (USD million) |

||||

|---|---|---|---|---|---|---|

|

|

Transport equipment |

All products |

Transport equipment as % of total |

Transport equipment |

All products |

Transport equipment as % of total |

|

South Africa |

1 931 |

20 185 |

9.6 % |

507 |

29 181 |

1.7% |

|

Angola |

2 |

1 353 |

0.2 % |

4 |

6 676 |

0.1% |

|

Zambia |

6 |

545 |

1.1 % |

2 |

914 |

0.3% |

|

Mozambique |

2 |

78 |

2.7 % |

2 |

207 |

0.7% |

|

Botswana |

24 |

291 |

8.4 % |

1 |

155 |

0.7% |

|

Namibia |

49 |

600 |

8.2 % |

2 |

299 |

0.6% |

|

Malawi |

4 |

140 |

2.8% |

1 |

228 |

0.4% |

|

Eswatini |

5 |

422 |

1.2% |

1 |

139 |

0.4% |

|

Lesotho |

1 |

135 |

0.6% |

0 |

32 |

0.8% |

|

Southern Africa |

2 025 |

23 748 |

8.5% |

519 |

37 832 |

1.4% |

Source: Authors’ calculations based on World Bank (2020), World Development Report 2020, GVC Database, www.worldbank.org/en/publication/wdr2020/brief/world-development-report-2020-data.

During a period of decreased overall trade, Southern Africa is increasing trade in intermediate goods within Africa

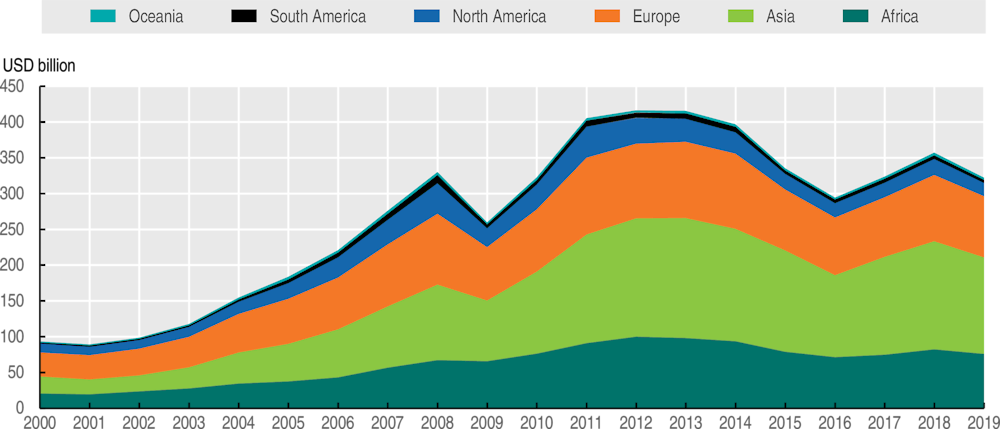

Southern African trade has declined, while shifting towards Asia and countries in other African regions. After reaching a peak in 2012, and especially since 2014, total Southern African trade has decreased (Figure 3.4), but the shares of trade with Asia and other African countries have increased. This greater Asian share of Southern African trade could pose a challenge to efforts to increase manufacturing intensity, because Asia’s manufacturing value added as a percentage of GDP is twice that of Africa and because Asia produces fewer primary goods.

On the other hand, the increased intra-African trade by Southern African countries could be a sign of a strengthening trading block. There is currently twice as much trade between Southern African countries as between Southern African countries and other countries in Africa, reflecting the high level of integration of the Southern African Customs Union (SACU) and to a lesser extent, the Southern African Development Community (SADC). Also, the advent of the African Continental Free Trade Area (AfCFTA) holds the promise of trade integration further afield than SADC, since market access to the rest of Africa and co-operation in areas such as investment and trade in services will improve.

Figure 3.4. Total trade for Southern Africa by world region, 2000-19

Source: CEPII (2021), BACI (database), www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37.

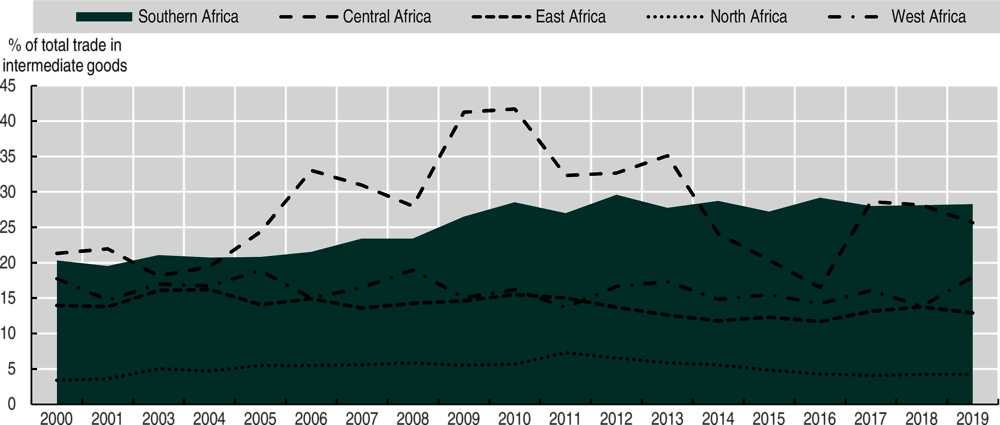

Southern African intra-continental trade in intermediate goods represents a higher percentage of total trade than that of any other African region and is nearly double Africa’s aggregate (Figure 3.5).2 The comparatively high degree of trade in intermediate goods in the Southern Africa region is being driven by the highly economically integrated countries of SACU plus Mozambique, Zambia and Zimbabwe. This group of Southern African countries participates in trade in intermediate goods to a greater extent than the other African regions, and Southern Africa’s intermediates trade is almost double that for the continent as a whole (CEPII, 2021).

Figure 3.5. Intra-continental trade in intermediate goods as a percentage of all trade in intermediate goods for Southern Africa and other African regions, 2000-19

Source: CEPII (2021), BACI (database), www.cepii.fr/cepii/en/bdd_modele/presentation.asp?id=37.

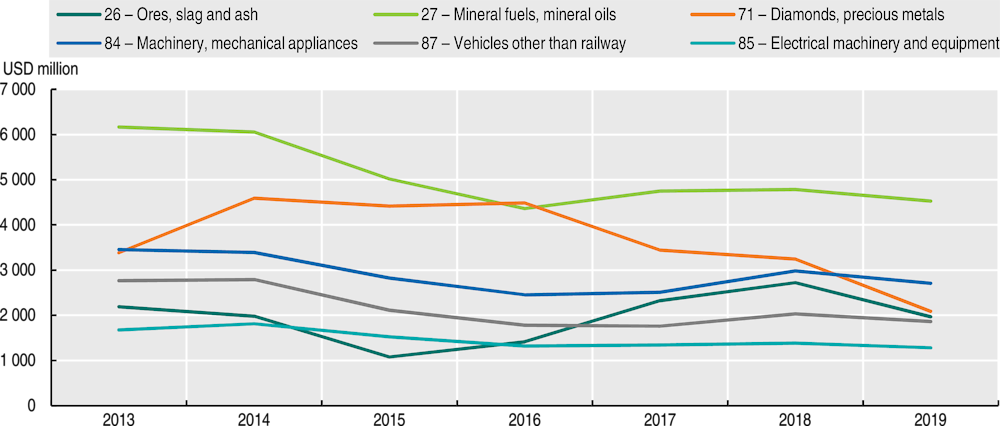

Vehicle products are the fifth most important traded product group within Southern Africa and one of three manufactured products groups in the top six. Fuels, mechanical machinery and diamonds top the list, but vehicle products are not far behind (Figure 3.6). Among motor vehicles, transport and passenger vehicles are the most traded product types but have been in decline recently while trade in vehicle parts, tractors and trailers has been more stable. Trade in transport vehicles (commercial vehicles) has increased with Japan and China, at the expense of Southern Africa. Trade in passenger vehicles, on the other hand, increased with India and the United Kingdom.

Figure 3.6. SADC’s top six intra-traded 2-digit product groups, 2013-19 (USD million)

Note: The broad 2-digit export product categories from UN Comtrade’s Harmonised System of 1996 are referenced here: 26 – “Ores, slag and ash”; 27 – “Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes”; 71 – “Natural, cultured pearls; precious, semi-precious stones; precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coin”; 84 – “Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof”; 85 – “Electrical machinery and equipment and parts thereof; sound recorders and reproducers; television image and sound recorders and reproducers, parts and accessories of such articles”; 87 – “Vehicles; other than railway or tramway rolling stock, and parts and accessories thereof”.

Source: ITC Trade Map (2021), Trade Map Data Portal, https://trademap.org.

COVID-19 has had a strong negative impact on trade volumes, and the automotive value chain is no exception

Global trade volumes plummeted as a result of the pandemic and its associated lockdowns, and Africa was more severely impacted than the global aggregate. The global economy was dealt a severe economic blow by the lockdowns, travel restrictions and business restrictions due to the pandemic. The worst effects on trade were felt during the second quarter of 2020, when global exports plunged 23% year on year (UN Comtrade, 2021) (see Table 3.4). For Africa and Southern Africa, the drop in that quarter was even greater, at 42% and 39%, respectively. After Q3, however, Southern Africa was less severely impacted. This appears to be the result of Southern Africa experiencing smaller negative impacts to its fuels and metals exports than the African aggregate, presumably due to better logistics mitigation in the presence of pandemic-driven slowdowns in transport facilities.

Table 3.4. Year-on-year change in total exports in the world, Africa and SADC region

|

|

2020-Q1 |

2020-Q2 |

2020-Q3 |

2020-Q4 |

|---|---|---|---|---|

|

World |

-9% |

-23% |

-25% |

-19% |

|

Africa |

-10% |

-42% |

-26% |

-17% |

|

SADC |

-8% |

-39% |

-14% |

-3% |

Source: Authors’ calculations based on ITC Trade Map (2021), Trade Map Data Portal, https://trademap.org data.

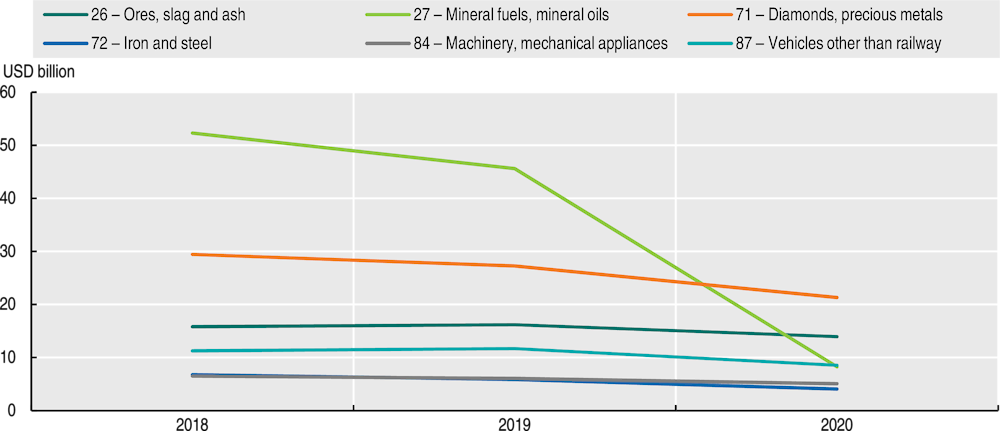

SADC exports declined in all six of its most important export product categories in 2020, which includes automotives (Figure 3.7). Fuel products dropped 84% between 2018 and 2020, while the other top five export categories saw two-year declines ranging from 12% to 40%. Although COVID-19 had an enormous negative impact on African trade for all of these product categories, trade was already in decline in 2019, before COVID-19 had spread.

Figure 3.7. Total exports from SADC countries for selected export categories, 2018-20 (USD billion)

Note: The broad 2-digit export product categories from UN Comtrade’s Harmonised System of 1996 are referenced here: 26 – “Ores, slag and ash”; 27 – “Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes”; 71 – “Natural, cultured pearls; precious, semi-precious stones; precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coin”; 72 – “Iron and steel”; 84 – “Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof”; 87 – “Vehicles; other than railway or tramway rolling stock, and parts and accessories thereof”.

Source: ITC Trade Map (2021), Trade Map Data Portal, https://trademap.org.

Among the measured economic impacts of the pandemic on Southern Africa include the following:

-

Economies such as Botswana and South Africa had GDP growth shocks reaching -10% (Green, 2021).

-

Greenfield foreign direct investment (FDI) projects across Southern Africa declined by 45% (Fennell, 2021).

-

83% of South African tourism businesses experienced at least 50% less revenue as a result of the pandemic (TBCSA, 2020). Other Southern African countries, for which tourism is also important, such as Botswana, Namibia and Zimbabwe, can be expected to be similarly impacted.

The impacts of the pandemic on global value chains will likely follow the impacts on trade, given that global value chains are the backward chains of value that generate the finished products that are demanded globally. In the context of these shocks to GDP growth and trade volumes, strong adverse effects on global value chains seem inevitable. Added to this must be the fact that the automotive value chain in Africa was already under pressure before the pandemic, with 66% of enterprises reporting a decline in earnings (Deloitte, 2020: 11).

The shocks to global value chains, which threaten production, employment, tax revenues and foreign exchange revenues, have prompted some transnational corporations to consider re-shoring production and “shortening” global value chains (Görg, 2021). Southern Africa is geographically removed from the main automotive industrial areas, i.e. the Far East and Europe, and this could negatively impact South Africa, still the most important African producer of automotive products. Policy responses to the pandemic and its fallout are addressed in the final section of this chapter.

Foreign direct and portfolio investments into Southern Africa are slowing, but greenfield investments into the automotive sector remain healthy

As with various indicators analysed hitherto, financial inflows to the Southern African region reflected the worsening economic climate, driven by the global trade war and its impact on the demand for commodities. Net FDI inflows dropped precipitously after 2015, both in levels and as a proportion of GDP (World Bank, 2021). The latter movement is somewhat surprising given that GDP growth itself slowed quite sharply over the same period. Analysis shows that portfolio investment net inflows were reversed even earlier, in 2009 (World Bank, 2021). These changes, given that they are pre-pandemic movements, do not bode well for the post-pandemic state of the region and underline the need for concerted effort to drive a sustained recovery.

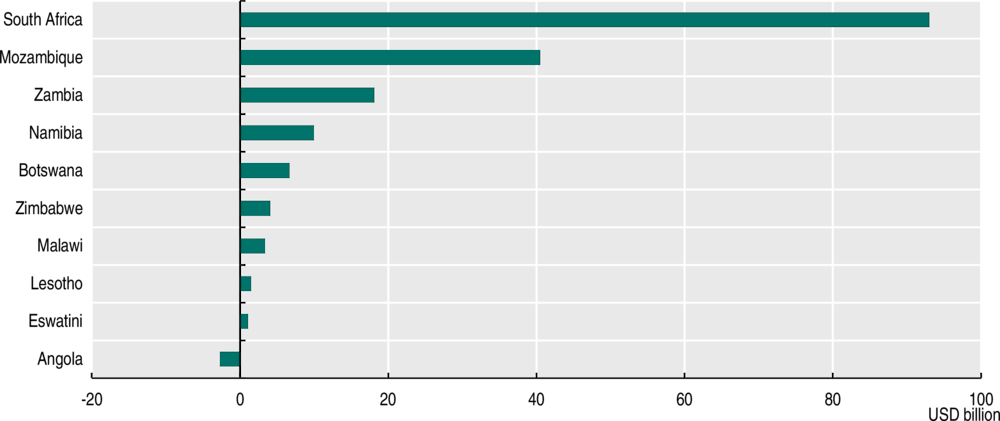

The performance of FDI flows per capita into the region has been mixed, not necessarily following a pattern of better performance for the larger economies. FDI flows per capita for South Africa outrank the region’s smaller countries, while Mozambique and to a lesser extent Zambia have had large relative FDI inflows given their economic size (Figure 3.8). The other countries appear to have benefited from FDI inflows in proportion to their economic size, with the exception of Angola which had net FDI outflows. Angola’s net FDI outflows reflected its disproportionately prominent oil sector that was hit with high price shocks during the pandemic. FDI into Angola should rebound along with the recovery in fuel prices.

Figure 3.8. Real foreign direct investment net inflows by Southern African country, 2000-19 (USD billion)

Source: Authors’ calculations based on World Bank (2021), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

Despite the negative movements in FDI, greenfield investment in South Africa’s automotive industry remained strong at the end of the last decade, with several large projects undertaken and initiated. According to TIPS (2020: 4-9), these included the following projects in 2019:

-

Bridgestone completed upgrades valued at ZAR 400 million at its Brits manufacturing plant.

-

Toyota completed a ZAR 454 million project to upgrade its light passenger vehicle plant in the Durban area. Part of this upgrade is the capacity to produce small truck kits for export and completion in Kenya. Toyota also announced a ZAR 2.43 billion investment to manufacture a new passenger vehicle, to begin in late 2021.

-

Isuzu announced investment in a ZAR 1.2 billion upgrade for its small truck production plant at Struandale.

-

KLT Automotive and Tubular announced a ZAR 525 million investment to expand a chassis manufacturing plant in Brits.

One of the largest recent investments is that announced by Ford in early 2021. It involves a USD 1 billion investment to expand production of the new Ranger model to 200 000 units per annum (Ford, 2021).

The automotive value chain can contribute to economic recovery in Southern Africa

The automotive industry has played a major role in the development of a number of countries and regions globally and has significant potential in Southern Africa and the rest of the continent. The sector has attracted considerable policy support due to its large size and the fact that it incorporates a wide range of manufacturing processes including metal working, plastics and electronics. It has also played a role in facilitating regional integration, for example in the North American Free Trade Agreement, the Association of Southeast Asian Nations (ASEAN) and the early stages of the formation of the European Union.

This case study examines the automotive industry in Southern Africa with a specific focus on regional value chains and the prospects for their further development. The automotive regional value chain is not yet well developed but is seen as having considerable potential (SADC, 2017) and is therefore key to future policy development. The case study emphasises Southern Africa but also briefly considers developments in the rest of the continent. This is important given the economies of scale necessary for developing regional production networks for the automotive industry.

The automotive industry is a sector with strong growth and job creation potential in Southern Africa and Africa more generally. With its sustained economic growth and rapidly expanding middle class, Africa represents one of the last major sources of growth for the global automotive sector. Vehicle ownership rates across the continent are low at 45 per 1 000 compared to a global rate of 203 per 1 000 (AIEC, 2021). The potential for expanded African production is also being boosted by rapid population growth and closer regional integration.

While the automotive sector is not very labour intensive, the multiplier effects are significant. In South Africa, which is far from realising its potential, 107 000 people were directly employed in vehicle assembly and component manufacture in 2020 (AIEC, 2021). The South African Automotive Masterplan targets the doubling of employment by 2035 through expanded vehicle production and increased localisation of parts.

Investing in the growth of motor vehicle manufacturing needs to be paired with a more sustainable transportation sector in Southern Africa. Developing competitive mass public transportation systems in Southern Africa will help create more sustainable cities and decrease air pollution, congestion, inefficient use of urban space and distortions of political priorities (Gössling, 2020). Reducing road deaths and injuries, already described as a “national emergency” in South Africa, is also important (Rondganger, 2021). Any investments in the automotive sector must therefore include plans to obtain or develop greener technologies and be reconciled with plans to develop sustainable quality infrastructure.

The Southern African automotive industry has considerable potential, with production dominated by South Africa

The Southern African automotive market has potential but, outside of South Africa, is dominated by used imports. South Africa accounted for 67% of SADC’s total automotive market in 2019. While the market grew rapidly in the previous period, slow growth especially in South Africa has led to stagnant market conditions over the last decade (Table 3.5). Apart from South Africa, the market is mainly being met by imports, especially of used cars.

Table 3.5. Motor vehicle sales, 2007-19 (units)

|

|

2007 |

2009 |

2011 |

2013 |

2015 |

2017 |

2019 |

|---|---|---|---|---|---|---|---|

|

South Africa – New vehicles |

676 108 |

395 222 |

572 241 |

650 745 |

617 749 |

555 716 |

536 611 |

|

Rest of SADC – New vehicles |

48 554 |

53 179 |

75 685 |

93 853 |

78 712 |

65 638 |

46 185 |

|

South Africa – Pre-owned imports |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Rest of SADC – Pre-owned imports |

225 394 |

190 323 |

241 959 |

314 548 |

217 584 |

178 812 |

222 208 |

|

Total SADC sales |

950 056 |

638 724 |

889 885 |

1 059 146 |

914 045 |

800 166 |

805 004 |

Source: Compiled from Barnes, Erwin and Ismail (2019), “Realising the potential of the Sub-Saharan African automotive market: The importance of establishing a sub-continental automotive pact” and the BMA database based on UN Comtrade (2021), UN Comtrade database, https://comtrade.un.org/data/.

Africa only accounts for less than 1% of global output, and South Africa dominates production. Africa produced only 720 000 vehicles in 2020, following a drastic decline in production mainly as a result of COVID-19. Relatively large-scale production takes place mainly in the south (South Africa) and in the north (Morocco and to a lesser extent Algeria and Egypt), but there is little vehicle production between them. Certain countries, such as Ethiopia, Ghana, Kenya and Nigeria, have some small-scale assembly, most of which takes place on a semi-knocked-down (SKD)3 basis with little domestic value added. South Africa dominates production on the continent and in Southern Africa, with an output of 447 218 vehicles in 2020 (AIEC, 2021). Growth over the past decade, even before COVID-19, was constrained by weak domestic economic conditions in South Africa.

Table 3.6. Vehicle production by major African producers, 2016-20 (units)

|

|

2016 |

2018 |

2020 |

|---|---|---|---|

|

South Africa |

599 004 |

610 854 |

447 218 |

|

Morocco |

345 106 |

402 081 |

248 430 |

|

Egypt |

36 230 |

18 500 |

23 754 |

|

Algeria |

42 008 |

70 797 |

7541 |

|

Total |

1 022 348 |

1 102 232 |

720 156 |

1. Small-scale SKD type operations are not included here. Algeria’s output virtually came to a halt in 2020 as a result of the closure of a number of plants following a corruption controversy and changed regulations (Arab Weekly, 2021).

Source: Authors’ calculations based on OICA (2020), www.oica.net/, and AIEC (2021), South African Automotive Export Manual 2021, https://aiec.co.za/downloads/AutomotiveExportManual2021.pdf

South Africa is a major exporter of automotive products, but further integration is necessary for regional value chains to develop

South Africa is a large automotive exporter to global markets. In 2020, the country’s automotive exports amounted to USD 10.7 billion, down from USD 14 billion the previous year. The exports included 271 288 vehicles valued at USD 7.4 billion, and components were valued at USD 3.3 billion (AIEC, 2021). Vehicle exports accounted for 61% of output, with the main market being Europe.

Intra-continental automotive trade consists mainly of exports from South Africa, and regional value chains are weakly developed. South Africa’s exports to the region principally include vehicles, aftermarket parts and, increasingly, SKD kits. Morocco exports mainly to the European Union. With the automotive industry on the continent concentrated in just a few countries, the outcome is unbalanced trade.

South Africa’s automotive exports to the rest of Africa, while significant, have not grown very rapidly over the last decade. Exports to the rest of the continent represented 17% of South Africa’s total automotive exports in 2020, but they have declined since 2010. Africa’s share of South Africa’s component exports is more significant. These accounted for 30% of total component exports in 2020 and amounted to USD 761 million but have also been declining. These automotive exports mainly go to other SACU and SADC countries (Table 3.7). Total automotive exports to SADC (including SACU) amounted to USD 1.46 billion in 2020, 81% of South Africa’s total automotive exports to Africa. The bulk of component exports to SADC are for the aftermarket comprising products such as tyres (USD 65.3 million), engine parts (USD 41.8 million), transmission shafts (USD 37.8 million), engines (USD 26.1 million) and gauges/instruments/parts (USD 23.1 million) (AIEC, 2021). The concentration of exports within SADC and especially SACU illustrates the impact of closer integration.

Table 3.7. South African automotive exports to the world and Africa, 2010-20 (USD million)

|

|

2010 |

2012 |

2014 |

2016 |

2018 |

2020 |

|---|---|---|---|---|---|---|

|

World |

9 478 |

10 571 |

10 653 |

11 629 |

13 497 |

10 671 |

|

Africa |

2 418 |

3 155 |

2 912 |

2 128 |

2 393 |

1 797 |

|

Africa, percentage of total |

26% |

30% |

27% |

18% |

18% |

17% |

|

BELN |

1 229 |

987 |

1 388 |

1 134 |

1 049 |

741 |

|

SADC (excluding BELN) |

669 |

1 157 |

995 |

721 |

998 |

719 |

|

BELN, percentage |

51% |

31% |

48% |

53% |

44% |

41% |

|

SADC (excluding BELN), percentage |

28% |

37% |

34% |

34% |

42% |

40% |

|

The rest of Africa (excluding BELN and SADC), percentage |

21% |

32% |

18% |

13% |

14% |

`19% |

|

Passenger and light vehicles |

628 |

1 328 |

1 391 |

993 |

1085 |

797 |

|

Medium and heavy vehicles |

105 |

146 |

341 |

272 |

320 |

239 |

|

Components |

1 684 |

1 681 |

1 179 |

863 |

988 |

761 |

Note: BELN = Botswana, Eswatini, Lesotho and Namibia.

Source: AIEC (2012, 2015, 2018, 2021), Automotive Export Manual, https://aiec.co.za/

While South Africa is a major exporter to the rest of Africa, it imports little from the continent. The biggest suppliers to South Africa from the rest of Africa are Botswana, Morocco, Lesotho, Tunisia, Eswatini and Egypt, but the amounts are small, amounting in 2020 to less than USD 100 million (Table 3.8). This represents just 1.1% of South Africa’s imports of original equipment and aftermarket parts.

A few labour-intensive suppliers have left South Africa to take advantage of lower labour costs. An example is the relocation of Pasdec, a wiring harness manufacturer, which shifted production to Botswana in 2015 (Barnes et al., 2021). Another example is a leather seat manufacturer which relocated to Lesotho, where wages are much lower. Labour unions in South Africa strongly opposed this move. Leather seating is a very labour-intensive operation and used to be one of South Africa’s major component exports, with seat kits being flown into Europe. But most export production has moved to Central Europe to be closer to major assembly plants, and the industry has declined in both South Africa and Lesotho.4 While these examples signify the development of regional value chains, they are quite limited in scale and constitute a key policy challenge (Markowitz and Black, 2019).

Table 3.8. South Africa’s automotive exports and imports in Africa, 2020 (USD million)

|

Exports to the rest of Africa |

Imports from the rest of Africa |

||

|---|---|---|---|

|

Namibia |

320.3 |

Botswana |

79.1 |

|

Botswana |

288.7 |

Morocco |

6.5 |

|

Zimbabwe |

213.2 |

Lesotho |

2.6 |

|

Zambia |

162.5 |

Tunisia |

1.6 |

|

Mozambique |

146.8 |

Eswatini |

1.6 |

|

Eswatini |

78.6 |

Egypt |

1.3 |

|

Kenya |

70.0 |

|

|

|

Democratic Republic of the Congo |

67.3 |

|

|

|

Ghana |

63.2 |

|

|

|

Lesotho |

54.5 |

|

|

Source: AIEC (2021), Automotive Export Manual 2021, https://aiec.co.za/downloads/AutomotiveExportManual2021.pdf

Regional integration and regional value chains are of critical importance in developing the automotive sector, and prospects are improving. The small size of most national markets in Africa makes regional integration essential to expand effective market size. The level of development of regional value chains in the automotive industry in Africa and in Southern Africa is limited, but the prospects in the medium term are good. This is due to three factors: growing continental demand for vehicles, closer economic integration and the fact that a number of African governments have set clear objectives for developing the industry. But given the scale of the industry and its tendency to cluster in a few locations, not every country can participate meaningfully. This means that a broader process of developing regional value chains that incorporates all sectors will be critical to spread the gains of regional integration and industrialisation.

The automotive industry is scale intensive especially in relation to the small size of the market in Africa. Estimates vary, but production of around 80 000 units per annum is normally needed to justify investment in a new assembly plant, and this may require investment of USD 200 million or more (Barnes et al., 2021). The world-scale Renault plant in Morocco, which is the largest assembly plant on the continent, required an investment of USD 1 billion. Small SKD operations require minimal investment but add negligible value. Low-volume complete-knocked-down (CKD) operations can be developed with relatively low investment costs, but production costs will be high, and the operations lack the scale to attract component investments. It is clear, therefore, that for significant investments to be made in the industry, market access to regional and/or international markets is required.

National automotive industries are unevenly developed in Southern Africa and across the continent

South Africa and Morocco dominate production on the continent, but a number of other African countries have embarked on programmes to develop the sector. In Southern Africa, Angola and Namibia are working to boost the automotive sector with sector-specific programmes. In other regional groupings, Ethiopia, Ghana, Kenya and Nigeria are actively promoting the industry. But in nearly all the smaller producer countries, programmes generally allow for minor SKD-type assembly. This section outlines the main developments in these national industries and the policies that are being applied. The emphasis is on Southern Africa, although the industries in other regions also receive mention.

South Africa is home to seven light vehicle producers as well as several assemblers of medium and heavy vehicles. The seven are Toyota, Nissan, Ford, Isuzu, BMW, Volkswagen and Mercedes Benz. Much of the assembly of medium and heavy commercial vehicles takes place on an SKD basis.

Box 3.2. South Africa’s automotive policy and industry development

The development of the South African automotive industry has been largely driven by specific policy programmes that have made it a globalised and export-oriented industry. Historically, the sector was protected by high tariffs and local content requirements until 1989 when the first steps were taken to liberalise it.

A major change took place in 1995 soon after the first democratic elections, with the introduction of the Motor Industry Development Programme (MIDP). Since that point, the industry has increasingly become internationally integrated. One of the key objectives of the MIDP was to encourage a rationalised industry structure. This meant increasing the scale of production per model, as this was the only way component production could become competitive (Black, 2009). Tariffs were gradually lowered from high levels, and the introduction of import-export complementation arrangements allowed local vehicle assemblers to rebate import duties by exporting. They could, for instance, specialise in producing one model for the domestic and export market and import other models.

In 2013, the MIDP was replaced by the Automotive Production and Development Programme (APDP). There have been no further tariff reductions below the 25% level. The APDP provided production rather than direct export incentives. While rapid export growth was achieved, the level of localisation of parts manufacture remains low, with local content levels of around 40%.

The recently developed South African Automotive Masterplan (SAAM) has ambitious objectives in terms of raising output and local content. But with the setback of Covid-19 and low growth in South Africa, these objectives may be difficult to achieve. A key objective of the SAAM is to expand vehicle and component production for the regional market.

In Southern Africa, outside of South Africa, automotive development is limited. Zimbabwe has the most experience with automotive production, with companies such as Willowvale Mazda Motor Industries. This company produced up to 9 000 vehicles per annum in the 1990s and counted 2 000 employees in 1997. But Zimbabwe’s economic difficulties since 2000 led to Willowvale Mazda Motor Industries closing down although some aftermarket parts production has remained. Small-scale assembly has restarted on an SKD basis in collaboration with the Chinese firm Beijing Automotive Group Co., Ltd. (Barnes et al., 2021). A country with a potentially large vehicle market is Angola. It has indicated a desire to establish the industry as part of its diversification efforts and some small-scale SKD assembly is underway.

Small-scale automotive development is taking place within SACU, some of which is integrated into the South African industry. An SKD plant in Botswana was established under licence from Hyundai in the 1990s, mainly supplying the South African market. To meet South African regulations, it was required to invest in CKD assembly. However, the plant shut down in 2000 due to financial difficulties (Zizhou, 2009). Botswana has nonetheless become a large supplier of wiring harnesses to the South African automotive industry with two companies in operation: Pasdec and Kromberg & Schubert. Lesotho had two large leather seat operations supplying export markets via South African assemblers, but this industry has suffered a major decline.

Namibia has ambitions in the automotive industry and is actively trying to promote investment. The country’s Pilot Investment Promotion Strategy for the automotive sector mentions attracting investment in automotive testing, metal components, wiring systems and the assembly of commercial vehicles (Industriall, 2020). A small SKD operation, Peugeot-Opel Assembly Namibia, a joint venture between PSA and the Namibia Development Corporation, has been established. It undertakes SKD assembly of Peugeot and Opel vehicles in a small facility in Walvis Bay (Industriall, 2020). But because this is an SKD plant, it cannot export to South Africa, as this contravenes SACU rules, which require full-scale assembly.5 This has led to threats by PSA to close the facility. Also in Namibia, the firm Windhoeker Maschinenfabrik undertakes assembly of light armoured vehicles for the defence and security industries.

Vehicle production in the rest of Africa takes place mainly in Morocco. Morocco is the second-largest producer on the continent and has attracted investment from Renault, PSA as well as major first-tier suppliers (Stuart, forthcoming). The country is closely integrated into the European Union and mainly exports to the European market. Egypt has a long history of automotive production but has never attained sufficient scale to enable competitive production and significant exports.

In East and West Africa, a number of countries are planning to develop their small-scale automotive industries, and opportunities are improving. Ethiopia, Ghana, Kenya and Nigeria have developed automotive policies6 and have attracted investment, including by multinational firms. But these are small-scale assembly operations that mainly take place on an SKD basis (Markowitz and Black, 2019; Ugwueze, Ezeibe and Onuoha, 2020). The problem with small-scale SKD production is that it creates minimal potential for developing value chains that incorporate manufacturing original equipment components. There is also small-scale motorcycle assembly as well as a small component industry that mainly produces for the aftermarket (Black, 2017).

Key constraints on the development of Southern Africa’s automotive value chain include trade and regulatory policy as well as infrastructure and skills

Southern Africa (and Africa as a whole) comprises a large number of mainly small economies. Even South Africa, with a new vehicle market in excess of 500 000 units per annum (pre-COVID), lacks the market size to constitute an independent market in the automotive sector. The term “automotive space” was used by Sturgeon and Florida (1999) to denote the market size required for the development of the industry. This could constitute a very large market, such as China or India, or a large adjoining market, as is the case for Morocco in relation to the European Union. An alternative type of “automotive space” is a regional trade agreement such as the Southern Common Market (MERCOSUR) or ASEAN which effectively enlarges a number of smaller markets. The AfCFTA with its combined market of USD 3.4 trillion and population of 1.38 billion certainly makes this possible, but there are a number of stumbling blocks.

Imported used vehicles provide a cheap source of transport but militate against regional assembly. Used cars and commercial vehicles account for the bulk of vehicle imports into most countries in Southern Africa although they are barred in South Africa. Within SADC, apart from South Africa, imported pre-owned vehicles represented an estimated 73% of the market in 2019 (see Table 3.5). In these countries, used vehicles are imported at low cost from advanced countries and domestic assembly cannot compete. The ban on used car imports in South Africa is a longstanding regulation and is quite effectively implemented, although small numbers of used vehicles, ostensibly headed for neighbouring markets, find their way into the South African market. Countries that are unlikely to attract new vehicle assembly would be reluctant to give up the right to import used cars. The issue of used cars provides a good example of the contending regional interests which create obstacles to regional integration and industrialisation raised by Byiers et al. (2018).

The automotive industry can help fast track regional integration but can also lead to protectionist pressures. Multinational firms can pressure governments to increase market access and improve cross-border infrastructure (Lung and van Tulder, 2004). But efforts by large numbers of countries to develop their own industries could frustrate regional integration. As we have seen, a number of countries have established small-scale SKD operations for the domestic market. These add little value or employment and do not serve as a basis for industrial development. While countries may intend to transition to CKD production, this seldom happens as firms baulk at the large investment required. The proliferation of these small national industries has also led to countries installing tariffs to protect their infant firms from competition from neighbours.

South Africa’s automotive policy regime creates a number of complications for further regional integration. Some SADC member states are concerned that if they loosen tariffs and establish a regional tariff scheme, South Africa, with APDP support, will outcompete their prospective industries. Within SACU, countries must comply with the APDP which offers significant support, but the smaller member states (Botswana, Eswatini, Lesotho and Namibia) have limited capacity to conform to the highly complex regulations (Barnes et al., 2021). To qualify for a Production Rebate Credit Certificate for exporting, they need a level of domestic value addition which may be difficult to attain (Markowitz, 2016). There are, therefore, a number of complications in promoting free trade even within SACU and more generally within SADC (Barnes et al., 2021).

Logistics and delivery reliability is also of key importance. This is a major reason why component firms cluster close to major assembly plants. For regional value chains to develop, easy cross-border transport is necessary. This in turn requires both high-quality cross-border infrastructure as well as efficient and low-cost border transit formalities (Stuart and MacLeod, forthcoming). Apart from these, transport links, power and other infrastructure issues need to be addressed.

The automotive industry has extremely high technical and quality standards which require a skilled workforce and advanced manufacturing capabilities. Developing the supply chain demands a skilled workforce and also more enhanced manufacturing capabilities among potential second- and third-tier firms. The African Union Development Agency’s Skills Initiative for Africa seeks to promote innovative skills development throughout the continent in conjunction with the private sector. It operates a Finance Facility and Technical Component. The South African-based industry could also play a role in transferring skills and industrial capabilities to the region, which would be another benefit of closer integration and an unfolding regional automotive production network (Barnes et al., 2021). Policy pressure to expand the supplier industry could lead multinational assemblers and first-tier suppliers to build capabilities among second- and third-tier suppliers.

Expanding vehicle assembly and the production of original equipment components, motorcycles and aftermarket parts can boost regional value chains

The development of regional value chains in the automotive sector requires much greater production in a number of countries in Southern Africa. Significant opportunities exist in assembly and original equipment components. Motorcycle production has potential as an entry point to vehicle production and possibly also to electric vehicles. Likewise, producing aftermarket parts can contribute to strengthening the automotive value chain.

There are opportunities for expanding vehicle assembly and deepening the supply chain in South Africa and the broader region. In Southern Africa, vehicle assembly is likely to continue to be based primarily in South Africa. The South African Automotive Masterplan, which comes into effect in 2021, aims to increase the level of local content in domestically assembled light vehicles from 40% to 60% by 2035. Even if local content reaches only 50%, this would have a significant impact in terms of creating new opportunities for suppliers from the region. For the purposes of the Masterplan, local content is currently defined as production within SACU.

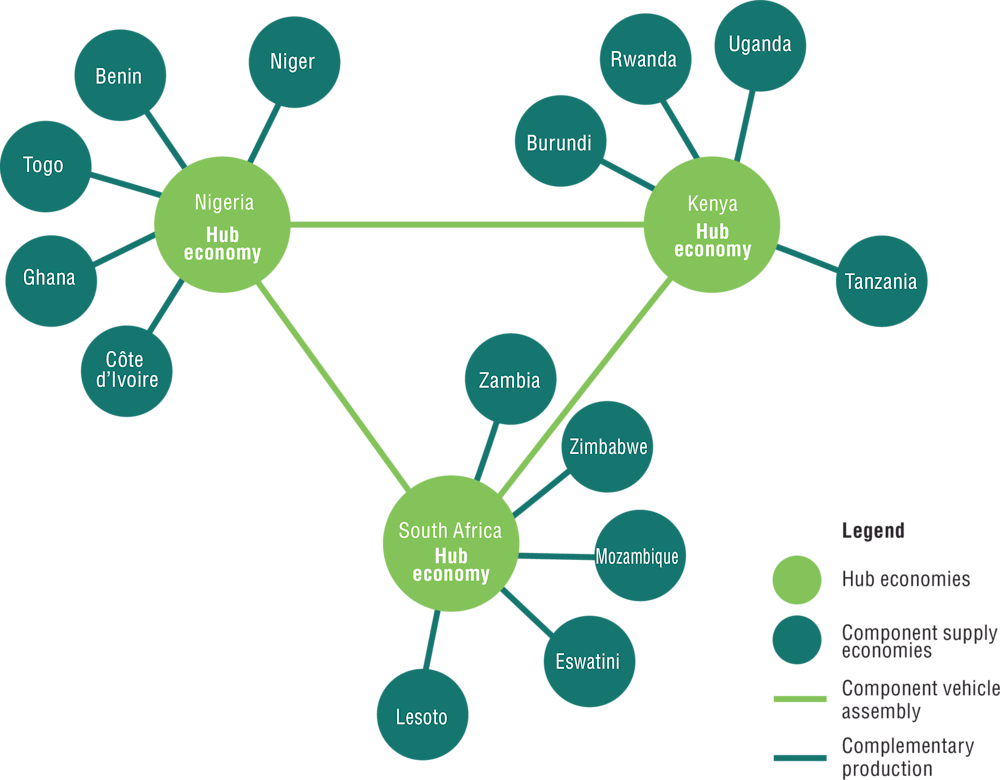

Establishing a supplier base in countries in Southern Africa is a clear opportunity but will be difficult to realise. Established in 2015 to push for integration, the African Association of Automotive Manufacturers (AAAM)7 is actively promoting a Pan African Auto Pact. The proposal is for a hub-and-spoke model (Figure 3.9) in which assembly takes place in various regional centres which are then supplied with parts from adjoining countries (Barnes, Erwin and Ismail, 2019). In Southern Africa, this would comprise South Africa forming the assembly “hub” with other countries in the region providing components. This is certainly a possibility in the medium to longer term, but the potential for all countries to be involved is limited. The automotive industry tends to cluster in a few locations, and assemblers prefer to have local parts makers in close proximity. Poor logistics and border hold-ups are anathema to modern, large-scale production. Even Lesotho, which is well located in relation to major South African production centres in Gauteng, Durban and the Eastern Cape and is part of a customs union with South Africa, has found it difficult to attract new automotive component investment (Black, 2017).

Figure 3.9. Hub-and-spoke model for developing an automotive pact in sub-Saharan Africa

Source: Barnes, Erwin and Ismail (2019), “Realising the potential of the Sub-Saharan African automotive market: The importance of establishing a sub-continental automotive pact”.

Motorcycle production is a value chain with potential because it offers an easier entry point into automotive production and numerous other advantages. A number of African countries have high motorcycle densities, including Angola, Mozambique, and parts of East and West Africa. They mostly import their motorcycles, but there is some domestic assembly. Motorcycle technology is simpler, and given the large size of the market in many African countries, it is easier to attain economies of scale. Smaller two-wheeled vehicles are also better adapted to the development of sustainable cities. It is important to note that motorcycle production played a key part in the development of the industry in parts of Asia, including India, Thailand and Viet Nam.

An interesting possibility is the prospect for electric two-wheelers, to develop a more sustainable vehicle fleet. These vehicles already dominate the Chinese two-wheeler market and are growing rapidly in other parts of Asia, again including India, Thailand and Viet Nam (Black et al., 2019). Apart from the fact that electric two-wheelers are becoming competitively priced relative to conventional motorcycles, they are being actively promoted in Asia as a means of reducing urban air pollution. Ambient particulate matter pollution is a rapidly growing problem in Africa (OECD, 2021a). In Southern Africa, the worst affected counties (according to the measure of premature deaths per million population) are Mauritius, South Africa and Botswana, in that order (OECD, 2021a). In Asia, electric two-wheelers are also seen as a means to develop electric technology which looks set to dominate vehicle transport within the next two decades. In addition, fuel-importing countries consider them as a way of reducing the import burden. Rwanda is actively promoting electric mobility, and three companies – Ampersand, Safi and Rwanda Electric Mobility – are reportedly undertaking or planning small-scale assembly of electric two-wheelers (Industriall, 2020).

The production of aftermarket parts offers an opportunity for industrialisation and for the development of regional value chains. Under difficult circumstances, such production clusters have developed in many parts of Africa such as Nnewi, Nigeria (Abiola, 2008) and Suame, Ghana (Adeya, 2008). With growing numbers of cars (including older cars) on the roads, the aftermarket potential is significant. While aftermarket parts are not inputs into other production processes, they do require numerous inputs and sub-components, which could be supplied from the region. They could also provide the basis for producing original equipment components as assembly develops in countries outside of South Africa. Equally, the development of an original equipment component industry would facilitate aftermarket production.

Public policies can strengthen the automotive value chain in Southern Africa

With progress being made towards regional integration, most notably with the establishment of the AfCFTA, important continent-wide initiatives are underway. In its September 2021 Declaration, the African Union’s Specialized Technical Committee of the Ministers of Trade, Industry and Minerals called on the African Union Commission, Afreximbank, the African Development Bank, the United Nations Economic Commission for Africa, the United Nations Industrial Development Organization and AAAM to accelerate the creation of a continental automotive development strategy. The basic requirements are, firstly, a viable “automotive space” of sufficient size to attract large-scale investment. Secondly, the market requires a modest level of protection and policy support. In this context, protection refers to the regional entity as a whole while allowing for free internal trade. South Africa has the only established automotive manufacturing industry in the region, and a higher level of protection and support would be necessary for smaller countries and nascent industries. The third requirement is to continually upgrade infrastructure and industry capabilities. The COVID-19 pandemic aside, prospects are now much better. This is because the market has growth potential and a number of countries are developing policies to promote the industry.

Regional integration and an appropriate trade policy are crucial for a successful automotive industry

Only a large integrated market can begin to offer the scale required for major investment. This requires the continued removal of tariffs and other barriers within the continent as well as easier cross-border access. In this regard, SADC is the obvious regional economic community (REC) for integrating the automotive industry and facilitating cross-border value chain trade. Besides being a free trade area, SADC has adopted the SADC Industrialisation Strategy and Roadmap, which calls for decisive action by members to promote regional industrialisation, investment and trade. In addition, to enable a successful regional automotive industry, countries in Southern Africa should play a role in the value chains commensurate with their comparative and competitive advantages in the supply of components to the hub countries assembling the vehicles.

A modest level of protection (tariff and non-tariff barriers) on imports from outside the continent is necessary to develop the automotive industry and regional value chains in Southern Africa. There is tension between policy approaches that seek to protect and localise the industry and those that allow it to be exposed to competition. The South African automotive industry was established behind trade barriers and with wide-ranging policy support, including subsidies. Similar protection measures, including local content requirements,8 were used to establish automotive industries in many other emerging market countries (Lee and Mao, 2020). Yet trade barriers also work to counteract the development of regional value chains in that they restrict the through-flow of imports and also, therefore, exports (containing imported inputs) (OECD, 2013). In addition, experience in Asia shows that longer-term success in automotive value chains is not achieved just through protection but also through exposure to competition (Lee and Mao, 2020).

Multilateralism is important for establishing regional value chains – it means that regional industrial prerogatives are addressed by negotiation between participants. The AfCFTA and, more directly, SADC will be key in policy development for a Southern African regional value chain in the automotive sector for several reasons:

-

Trade barriers with third parties, that pertain to the automotive regional value chain, can be made consistent across member states.

-

Investment agreements can be negotiated at the REC level with third parties and designed to be equitable across member states.

-

Exports can be boosted through plurilateral trade agreements such as the European Union economic partnership agreements (EPAs) and the African Growth and Opportunity Act. An EPA between the European Union and the members of SADC (currently excluding Angola) provisionally entered into force in October 2016.

-

The smaller countries in SADC can integrate their trade and investment by leveraging REC policies on free trade and the promotion of regional investment (OECD, 2013, 2016). Within SACU, Botswana and Lesotho have been able to do this to a degree.

The business environment and incentives are vital for attracting investment

The general business environment is key to appeal to investors – trade, industrial and regional policies will fail if the business environment is not conducive to investment. This is an area where Southern Africa lags behind. An improved business environment requires the following:9

-

Upgraded power, water, bulk services, ports, air, road and rail infrastructure. Even South Africa, with its relatively advanced infrastructure, suffers from severe power constraints, and high port and rail costs pose a major challenge. With its far-flung supply chain, demanding quality standards and just-in-time production, the automotive industry is particularly demanding in terms of transport infrastructure. This also poses challenges for the development of regional value chains.

-

Stronger institutions including property rights, commercial contracts, policy and regulatory certainty as well as personal and business safety and security. Any deterioration in the strength of institutions, policy effectiveness or regulatory quality will compromise regional industrialisation strategies.

-

More developed backward-linked services sectors, such as transport, financial, distribution, communications and business services. In addition, with the rising technological content of motor vehicles and components, the technology services sector must be capable as well. At present, Cape Town is the best-known technology hub in Southern Africa and could serve as a model and a means for technology development elsewhere in the region (Stuart, 2019). The important ingredients for success in developing technology services are to promote education, support technology entrepreneurship and provide incentives for innovation.

-

A competitive steel industry. An aspect of the business environment for the automotive sector is the backward-linked steel industry, which needs to be able to supply steel inputs competitively. South African automotive industry representatives cite this as a problem which has resulted in the high proportion of imported steel products used in the industry (OECD, 2016).

Box 3.3. Regional trade and industrial policies need to consider the specific issues in the automotive sector

Efficient production requires large-scale assembly plants which are necessary to attract investment in the component sector. The proliferation of small-scale SKD-type operations is the outcome of inappropriate policy (such as exceptionally high rates of effective protection for minor final assembly) and should be discouraged. Such operations provide negligible value addition or possibilities for the domestic supply of components. In addition, firms that use SKD assembly may seek to thwart policy measures designed to attract larger-scale investments. Policies need to promote specialisation and large-scale production in order to support local and regional suppliers. Thus not all countries should try to enter the industry, especially the vehicle assembly sector. Regional integration requires regional specialisation, which would be better for all stakeholders. Other industrial sectors may offer greater prospects in line with comparative advantage.

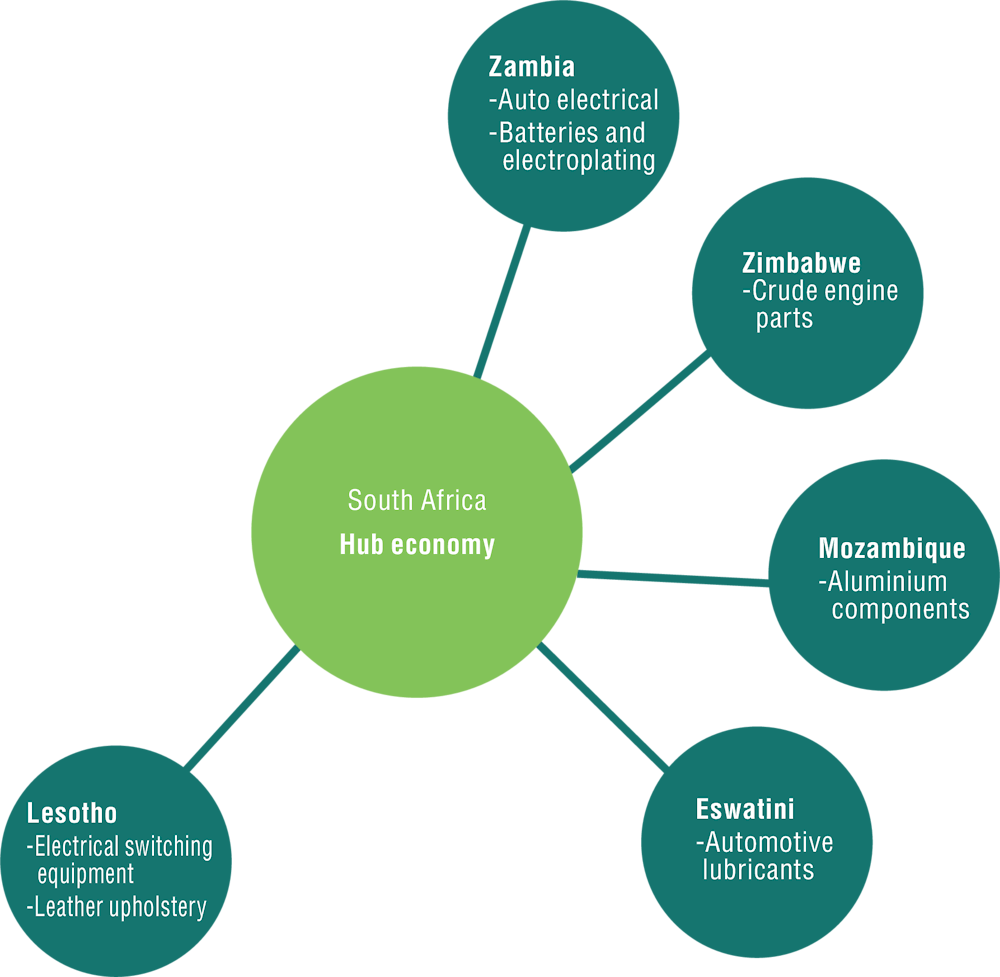

One possible method for identifying the distribution of value chain participation among countries is revealed comparative advantage (RCA) analysis, where a country’s existing export successes inform its potential role in value chains. Venter (2019) and Stuart (2020) refer to RCA analysis to suggest, for example, that Zambia’s copper industry could position itself for value chain participation in auto-electrical components production. Other examples from Stuart (2020) are Lesotho specialising in electrical switching components, Mozambique specialising in the production of aluminium components such as cylinder heads and Zimbabwe specialising in aspects of basic engine construction.1 This potential configuration is visualised in Figure 3.10.

Figure 3.10. Potential hub-and-spoke model for developing an automotive pact in Southern Africa

Source: Authors’ elaboration.

Approximately 80% of the value of a car lies in the components, which therefore comprise the bulk of industrialisation opportunities for the development of regional value chains. Policies should take account of this from the outset and aim at developing an assembly industry with a significant proportion of parts produced domestically or in the region. Currently, even in the South African industry, local content levels of approximately 40% (using an expanded definition)2 are quite low. Supplier development policies are key.

The widespread importation of used vehicles poses a major challenge to industry development, and well-designed policy could gradually phase down these imports. Except for South Africa, the bulk of vehicles entering Southern African markets are used vehicle imports, mainly from Japan. A wide range of measures apply, ranging from no restrictions (Lesotho, Madagascar, Malawi and Zambia) to various incremental taxes based on vehicle age and emission standards (UNEP, 2017). An initial step would be to move towards greater harmonisation of the policies regarding used car imports applicable in the region. It is unlikely that the current pattern – substantial importation by some countries and zero or little by others – could be changed overnight. However, harmonisation would have to become an aspect of any regional value chain industrialisation strategy. This harmonisation would need to consider the potential for domestic industrialisation opportunities as well as the benefits to consumers of low-cost used car imports. There are also trade-offs between the environmental benefits of used car sales in terms of increasing the vehicular lifespans, contrasted with the harms of using older, more polluting vehicles.

Policy should take account of today’s global transition to electric vehicles and sustainable transportation. Africa does not face the problem of large-scale sunk investment in internal combustion engine technology and can leapfrog to the new technologies. South Africa may be compelled to make this leap as Europe rapidly transitions to electric technology, following a roadmap to ban petrol and diesel vehicles in the European Union by 2035. In addition, many cities around the world are also seeing enormous economic benefits from developing more walkable urban designs. Low motor vehicle ownership could create more openings for sustainable transportation, such as light rail. At the end of 2019, Alstom Ubunye inaugurated a rail factory in South Africa3 which contributes to the manufacturing of X-Trapolis Mega electric trains and is seen as crucial to the development of the entire African rail market.

1. Niche automotive component specialisation by Southern African countries that already exists would be Lesotho’s production of leather automotive seats and Botswana’s production of electrical wiring harnesses.

2. Local content is defined here as wholesale value less all imported content and therefore includes the assembly process.

3. See Zasiadko (2019).

Investment incentives can play a role in attracting the FDI necessary to build participation in automotive value chains. Many countries, such as the Czech Republic, Mexico and Turkey, have used incentives to attract FDI to their automotive sectors (OECD, 2016). Incentives have included tax breaks, training allowances, low-cost land and direct investment subsidies. In most emerging market producer countries, the assembly sector is foreign-owned or operates under foreign technology licences. However, a large-scale assembly sector creates opportunities for supplier development including of domestically owned firms.

Manufacturing capabilities and skills need developing

Manufacturing capabilities and skills need strengthening across the region. While South Africa has a long history of large-scale automotive production, it faces a shortage of skills. Neither the technical and vocational education and training colleges nor the Sector Education and Training Authority system is regarded as delivering what is required. One result is the scarcity and high cost of technicians, artisans and managers in the automotive sector.

There are, however, a number of interesting public-private collaborations involving foreign and domestic firms, industry organisations, and local or national governments. Below are examples from South Africa; neighbouring countries could draw on this experience perhaps with the support of agencies such as Skills Initiative for Africa:

-

The Durban Auto Cluster, which runs programmes on best practices.

-

The Automotive Industry Development Centre (AIDC), an initiative of the Gauteng provincial government. The AIDC is engaged in supplier development that includes a range of training activities (lean manufacturing, quality management, clean production, maintenance), and runs incubation centres for small firms located close to assembly plants in Gauteng province.

-

The Mercedes-Benz Learning Academy in East London is a public-private initiative equipped with world-class technologies for training artisans in the fields of robotics, plant automation and metal joining technologies. It provides shop floor, apprenticeship and advanced skills training in the automotive and other industries.

-

The Automotive Supply Chain Competitiveness Initiative (ASCCI) is a national collaborative project which seeks to promote localisation of suppliers (Black, Barnes and Monaco, 2019).

COVID-specific responses have attempted to address the large shocks to the economy

The policy responses to COVID-19 by Southern African governments have been mixed but reflect a typical response to a severe economic shock. How countries continue to react to the impacts of the pandemic will be critical for the automotive industry and will have repercussions on it for decades to come. In some ways, the situation of the automotive value chain in Africa currently mirrors that of the global and especially the United States automotive industry following the 2008 financial crisis – the last major global recession. At that time, United States policy makers implemented a range of measures, for example direct financial assistance as well as indirect measures such as taking over liabilities; purchase subsidies paid to consumers; and quasi-nationalisation of the industry, though only temporarily until the industry recovered (Van Biesebroeck and Sturgeon, 2010: 217-218).

African governments have lesser ability to provide direct financial support but can take other useful measures proven by policy responses to COVID-19. Liquidity easing, tax credits, and other incentives and waivers are possible in that they involve revenue forgone rather than revenue paid out. The bulk of COVID-19 measures by Southern Africa comprise the following:

-

Monetary measures to promote liquidity. Angola, Eswatini, South Africa and Zambia all dropped their central bank lending rates to historically low levels.

-

Financial support to industry either through direct means such as wage subsidies or indirect means such as tax relief measures. Angola introduced two subsidy plans, one aimed at micro, small and medium-sized enterprises (MSMEs) and another at larger enterprises. Botswana provided a relief package including loan guarantees to MSME firms. Malawi implemented two tax relief measures and one subsidy measure aimed at all enterprises and specifically at MSMEs in certain sectors. The South African Department of Labour implemented a subsidy for workers below a certain wage threshold.

-

Support to vulnerable sectors of society via grants and other forms of aid. Botswana implemented a relief package, part of which included wage subsidies and income grants. Mauritius provided wage subsidies to workers and direct financial assistance to the self-employed. South Africa momentarily raised existing social grants and extended a temporary grant.

COVID-19-specific policy measures are probably too limited to prevent damage to the automotive value chain. COVID-19 policies pursued in Southern Africa as an initial response to the pandemic fallout are unlikely to prevent negative impacts on the automotive value chain. This is because these measures are by implication limited in scope, focusing only on emergency and temporary relief. In some cases, support measures were exhausted before the end of 2020 – such as South Africa’s Unemployment Insurance Fund relief. The lowering of interest rates to historical levels and the extension of loan guarantees in many Southern African countries are policy measures aimed at providing temporary relief to industries facing sharp reductions in demand, but in themselves they cannot solve the fundamental problem, which are negative impacts on global demand.

Nevertheless, at the time of writing, the impacts of the COVID-19 pandemic are abating, with a resurgence in the demand for commodities and with Africa’s most important trade partner, China, recovering well economically. In the first quarter of 2021, global commodities demand began to recover, led by a rise in the crude oil price. This reflects renewed confidence that a recovery is in sight. Demand for commodities is higher than for finished goods, however, and going forward the automotive industry faces not just this challenge but also the more general one of moving from internal combustion engine power to electric. Recovery is possible, but it will require building back not just to consolidate existing markets but also to address the requirements of greener transport technologies in future.

While the process of recovery is underway, there is a real danger of the “shortening” of value chains and the re-shoring of production. Rather than go this path, the countries of Southern Africa should use the opportunity to rebuild better trade and production relationships and creatively extend them to meet the considerable potential of the region.

References

Abiola, B. (2008), “The Nnewi automotive components cluster in Nigeria”, in D. Zheng (ed.), Knowledge, Technology and Cluster-based Growth in Africa, World Bank, Washington, DC.

Adeya, C. (2008), “The Suame manufacturing cluster in Ghana”, in D. Zheng (ed.), Knowledge, Technology and Cluster-based Growth in Africa, World Bank, Washington, DC.

AIEC (2021), Automotive Export Manual 2021, Automotive Industry Export Council, Pretoria, https://naacam.org.za/wp-content/uploads/2021/04/AutomotiveExportManual2021.pdf.

AIEC (2018), Automotive Export Manual 2018, Automotive Industry Export Council, Pretoria, www.abrbuzz.co.za/publications/press-and-customers/naamsa/AutomotiveExportManual2018.pdf.

AIEC (2015), Automotive Export Manual 2015, Automotive Industry Export Council, Pretoria, https://naacam.org.za/wp-content/uploads/pdf/automotiveexportmanual20154.pdf.

AIEC (2012), Automotive Export Manual 2012, Automotive Industry Export Council, Pretoria.

Arab Weekly (2021), Algeria finds no way out car manufacturing fiasco, https://thearabweekly.com/algeria-finds-no-way-out-car-manufacturing-fiasco.

Barnes, J., A. Black, C. Markowitz and L. Monaco (2021), “Regional integration, regional value chains and the automotive industry in Sub-Saharan Africa”, Development Southern Africa, Vol. 38/1, www.tandfonline.com/doi/full/10.1080/0376835X.2021.1900788.

Barnes, J., A. Erwin and F. Ismail (2019), “Realising the potential of the sub-Saharan African automotive market: The importance of establishing a sub-continental automotive pact”, A Report for Trade & Industrial Policy Strategies (TIPS) and the African Association of Automotive Manufacturers (AAAM).

Black, A. (2017), Diversifying Lesotho’s Manufacturing Economy: Automotive Components Mini-Study, unpublished report for the Government of Lesotho.