The Energy Savings Insurance (ESI) model was first developed by the Inter-American Development Bank (IDB) in 2014, with the support of Basel Agency for Sustainable Energy (BASE), to drive investments in energy efficiency projects. It has since been implemented in eight Latin American countries targeting small and medium enterprises (SMEs) among several sectors, notably healthcare, tourism, hospitality, and agriculture.

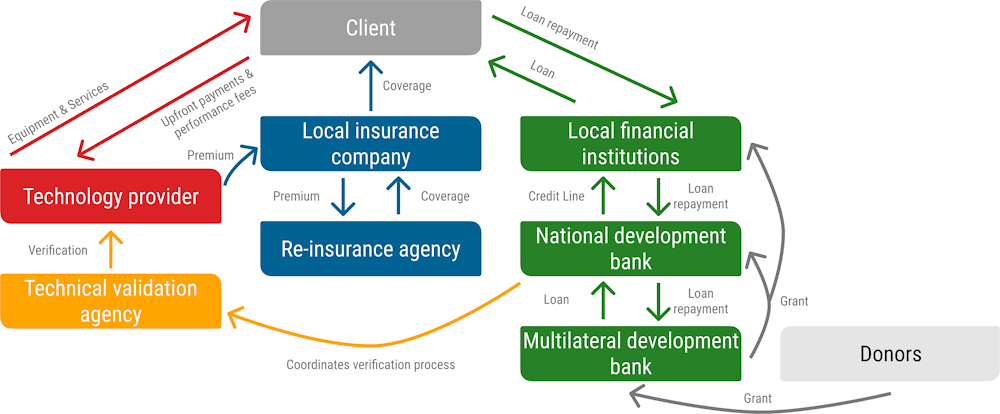

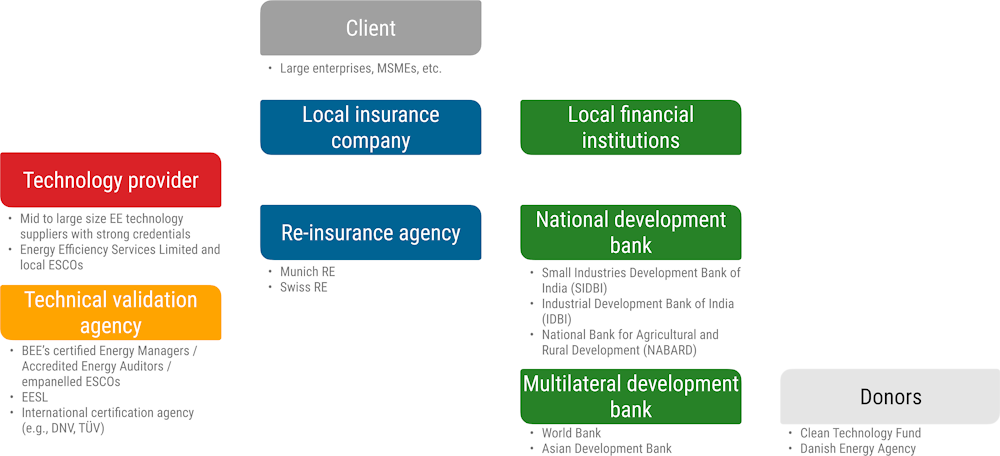

The ESI model is a de-risking package consisting of both financial and non-financial elements designed to build investor confidence in energy efficiency projects. It has four building blocks that support the identification and structuring of technically robust and bankable projects: standard contract, technical validation, energy savings insurance, and concessional financing.

The standard contract establishes the responsibilities of the supplier in terms of supply and installation of equipment, corresponding guarantees, and the promised energy savings relative to a benchmark (established by the supplier using standardised methodologies). It also commits the customer to timely payments, access to facilities, and adequate maintenance of the equipment.

The technical validation is carried out by an independent agency who evaluates and confirms the project’s technical potential to achieve the promised savings and verifies on site that the project has been built according to specifications approved in the initial evaluation. This actor also determines which party is entitled to compensation in case of disagreements on the achieved performance and actual savings generated by the project. The validator's roles are defined in the standard contract and its decisions are binding for both parties.

The energy savings insurance is a performance warranty provided by the supplier to the customer for the committed savings in a period of time previously agreed between the two parties. If at any point in time, the project does not achieve the pledged savings, the insurance agency will financially compensate the client. The energy savings insurance is activated upon technical validation of the project, and is further backed by a reinsurance agency.

Insured projects are financed with concessional credit lines usually set up by donor agencies and multilateral development banks. Lenders provide preferential terms under these credit lines, including preferential interest rates, grace periods and extended tenures.