This chapter explores the financing and investment pathway to achieve India’s 2030 targets for offshore wind development. It summarises the key developments in the offshore wind sector to date, noting the results from several national and international initiatives. Furthermore, it highlights the barriers associated with offshore wind development at various stages of the project value chain as well as the policy opportunities to overcome them, acknowledging the expected impact of existing actions and strategies. It also provides an estimation of the investment needs for India’s offshore wind goals, identifying levers to lower project costs and assessing their potential impact. Finally, this chapter sets forth seven recommendations on improving the enabling environment and financial support schemes to help mobilise finance and investments for offshore wind in India.

Clean Energy Finance and Investment Roadmap of India

3. Offshore wind

Abstract

India’s ambitions to achieve 500 GW of non-fossil fuel electricity generation capacity by 2030 requires substantial expansion of current clean energy development, which has been propelled to date by solar and onshore wind additions.1 Unlocking the potential for new clean energy sources like offshore wind can help diversify India’s electricity mix, with benefits from use of various sources of renewable electricity and their different production patterns, thereby ensuring a more consistent (i.e. less variable) energy supply to meet India’s growing energy needs.

Offshore wind can also help to alleviate growing pressure from land competition for onshore wind developments. For example, changes in local land policies in the states of Gujarat and Tamil Nadu affected the cost and timelines for around 93% of onshore wind projects that were awarded through the central auctions in the two states (GWEC and MEC+, 2020[1]). Moreover, offshore wind typically has capacity utilisation factors of 40-45%, higher than onshore wind (30-35%) and solar power (20-25%), which can contribute to stabilising the power generation at state and country-level (Krishnan et al., 2022[2]).

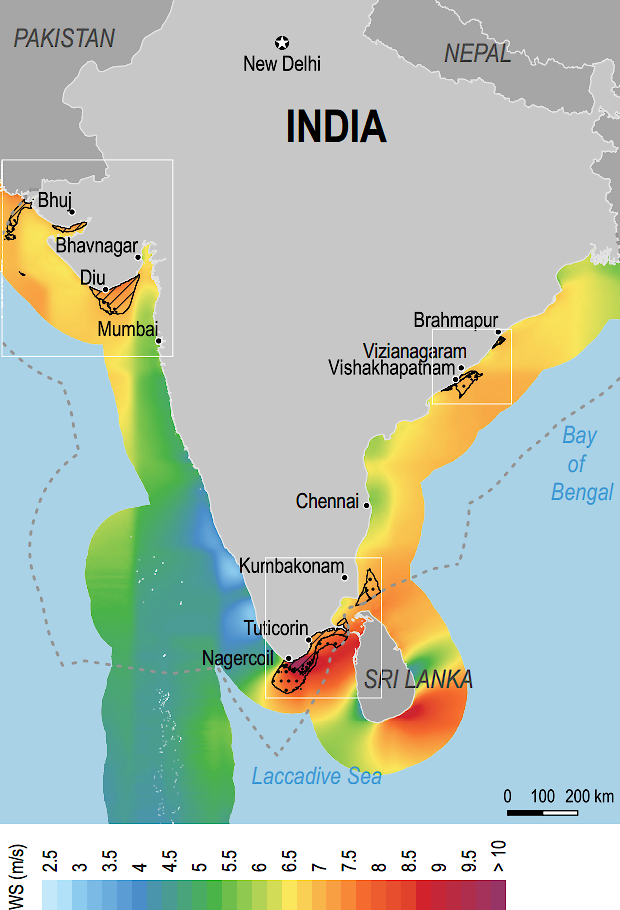

India fortunately has a considerable coastline, with about 7 600 kilometres of relatively shallow waters near to shore (within 12 nautical miles) and an exclusive economic zone of over 2.3 million square kilometres (Kumar Dash, 2019[3]). The overall technical potential for offshore wind within 200 kilometres of India’s coasts amounts to an estimated 174 GW2 of power (Gulia and Jain, 2019[4]) (Figure 3.1).

The government has already identified early destinations for project development off the coasts of Gujarat and Tamil Nadu, amongst other possible sites such as the state of Maharashtra. Estimates by the National Institute of Wind Energy (NIWE) and by partners under the Facilitating Offshore Wind Energy in India (FOWIND) suggest that Gujarat and Tamil Nadu alone have more than 65 GW of combined potential offshore wind power potential in feasible zones.3

Figure 3.1. India’s Offshore Wind Technical Potential

Note: The map displays the 100-meter height wind speed along the Indian coastline.

Source: (ESMAP, 2021[5])

Overview of offshore wind market developments and trends to date

The Ministry of New and Renewable Energy (MNRE) noted the important role that offshore wind will play in reaching India’s renewable energy targets in its 2015 National Offshore Wind Policy,4 which outlined several critical objectives to explore and promote offshore wind in India. It also identified NIWE as the nodal agency for development of offshore wind, including responsibilities to invite proposals for development of offshore projects, to co-ordinate resource assessments and to help developers to obtain approvals from various authorities, such as the Ministry of Environment, Forest and Climate Change (MoEFCC).

MNRE further clarified this policy framework through notices such as its 2018 Guidelines for Offshore Wind Power Assessment Studies and Surveys5 and its 2022 Strategy Paper for Establishment of Offshore Wind Energy Projects.6 NIWE also released a Wind Data Sharing Policy in 2019.7 In addition, several notable initiatives, such as the FOWIND project, supported preparation of offshore wind development in India, for instance through technical reports, mapping and feasibility studies (Table 3.1). The Indo-Danish Centre of Excellence for Offshore Wind (COE-OSW) also organised several workshops in recent years to support planning and permitting, financial framework and auction design, grid and offshore wind supply chain infrastructure, technical standards and rules for innovation.8

Building upon these initiatives, MNRE announced its offshore wind energy targets in 2022, with ambitions to achieve annual capacity additions of 4 GW for three years from financial year 2022-2023, followed by 5 GW yearly till 2030, to reach a cumulative auction capacity of 37 GW in 2030 (MNRE, 2022[6]). Eight preliminary zones were identified in Gujarat, with a further eight zones identified off the coast of Tamil Nadu. Five and seven zones each, respectively, are expected to be available for exploitation, and NIWE carried out multiple studies for the first planned area in a 370 square kilometre zone (Zone ‘B’ near the port of Pipavav) in Gujarat. This included a two-year wind resource assessment through light detection and ranging (LiDaR) measurements. NIWE also prepared oceanographic, geophysical and geotechnical investigations for the zone, as well as a rapid environmental impact assessment.

NIWE issued an Expression of Interest in April of 2018 for 1 GW of capacity additions off the coast of Gujarat. Interest from developers counted 35 firms,9 although projects did not proceed for a number of reasons, including high capital costs, infrastructure constraints and lack of a financial support scheme (GWEC, 2021[7]).

Further assessments, such as the project “Financial modelling of offshore wind farms in India” (FIMOI), as well as modelling and feasibility studies for Gujarat and Tamil Nadu, have since provided additional details on the expected levelised cost of energy (LCOE) for the first offshore wind projects and eventual support needed through the VGF (see Box 3.3). NIWE has conducted Geophysical and Geotechnical studies off Tamil Nadu coast, and NIWE is installing additional floating LiDaR to validate wind measurements. MNRE also noted that would invite developers to carry out detailed studies and surveys in other targeted zones, and that it was open to assessments for offshore wind project development within India’s exclusive economic zone.

Table 3.1. Key assessments in support of offshore wind development in India

|

Dates |

Actors |

Main Achievements |

Link |

|

|---|---|---|---|---|

|

Facilitating Offshore Wind Energy in India (FOWIND) |

2013-19 |

GWEC-led consortium (C-Step, DNV GL, WISE and the GPCL), supported by the European Union |

Identified 16 zones through offshore mapping and produced technical studies (e.g. on supply chain and port infrastructure) as well as pre-feasibility and feasibility reports for Gujarat and Tamil Nadu |

https://gwec.net/members-area-market-intelligence/fowind/ |

|

First Offshore Wind Power project in India (FOWPI) |

2016-19 |

COWI and WFMS, supported by the European Union |

Provided technical assistance and produced studies (including surveys, environmental scoping, cost-benefit analysis, and conceptual design, etc.) leading to the pre-financial investment decision (pre-FID) for zone off the coast of Gujarat |

https://www.cecp-eu.in/resource-center/post/fowpi-website/home |

|

Financial modelling of offshore wind farms in India (FIMOI) |

2019-22 |

COE-OSW, supported by the Government of Denmark |

Produced LCOE estimates for the first offshore wind farm in India (February 2021) and updated cost assessments (April 2022), as well as a Technology Catalogue (February 2022) and LCOE and VGF tool (April 2022) |

https://coe-osw.org/the-fimoi-report/ |

Notes: GWEC = Global Wind Energy Council; C-Step = Centre for Study of Science, Technology and Policy; WISE = World Institute of Sustainable Energy; GPCL = Gujarat Power Corporation Limited; WFMS = WinDForce Management Services Limited.

Offshore wind ambitions to 2030

MNRE’s emerging policy framework and initiatives such as the FOWPI and FIMOI studies are helping to bring together the various pieces needed to enable development of the first offshore wind projects in India. Continued collaboration with international partners, such as the joint collaboration between NIWE and the United Kingdom’s Offshore Renewable Energy Catapult announced in May of 2022,10 equally illustrates that there is strong interest to develop India’s offshore wind market. This is reflected by similar announcements by developers and large industry players, like Tata Power and RWE Renewables, who signed a memorandum of understanding in February of 2022 to undertake technical and commercial assessments to facilitate offshore wind development (Frangoul, 2022[8]).

Nevertheless, unlocking the opportunity for offshore wind requires measures to build upon this momentum and address remaining gaps for finance and investment in project development. Targeted actions can deal with these barriers and ensure that the right policy clarity and market conditions are in place to make offshore wind projects in India an investable reality.

Barriers and challenges

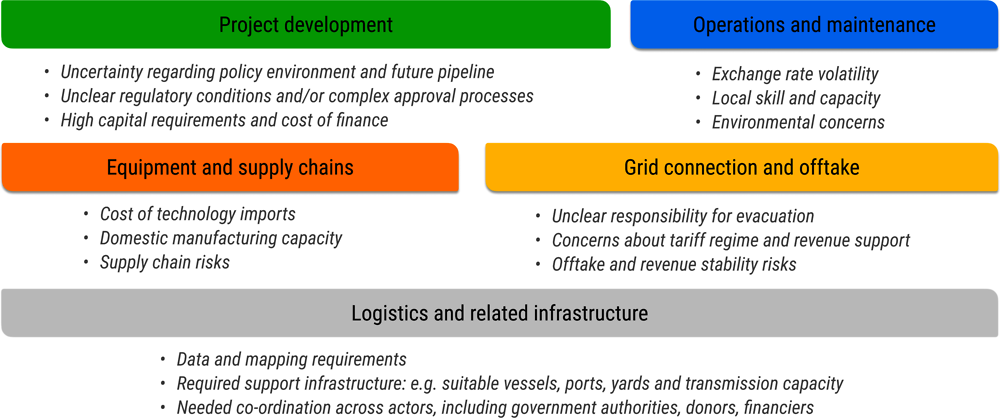

Several key themes emerged from stakeholder consultations by the OECD and NRDC and in the first Roadmap workshop in March of 2022. These themes touched upon a number of potential barriers and challenges along the value chain for offshore wind development, which consequently affect finance and investment in projects (Figure 3.2).

Figure 3.2. Common risks highlighted by stakeholders in the value chain for offshore wind projects

Note: These illustrative examples of risks highlighted in stakeholder consultations are not exhaustive.

Stakeholders emphasised that precision also was needed within the regulatory framework on aspects such as technical standards, local content requirements, taxation, and elements like seabed rights and lease awarding criteria. The regulatory environment can also facilitate approvals across the multiple authorities11 touching upon offshore wind development, where processes and timing for licensing and permit approvals under the 2018 Expression of Interest were an issue for some developers. Streamlining and centralising these approvals (e.g. through a “one-stop shop”) would improve this process and leave developer risks as much as possible to the boundaries of actual construction.12

In addition, stakeholders consistently noted that policy and regulatory conditions needed to address core project risks, such as revenue stability. Clarity on who will bear these risks, for instance through precisions on offtake agreements and the sanctity of power purchase agreements, is critical in getting financial institutions and investors to sign off on projects. Eventual guarantees (e.g. using a payment security mechanism) would also help to mitigate these risks, as would clarity on expected incentives and support. For future additions, it will be important to highlight these conditions and/or intended cost-reduction strategies if the planned VGF will be phased out after the first capacity additions.

Data and mapping were likewise noted as critical elements for assessing risks, where developers noted a preference to collect detailed information themselves once given exclusivity to study specific zones. Needs for further assessments were also highlighted, for instance to reflect trends in plant load factor over time, which is challenging with only one or two years of data. This information is not only useful for developers but can also validate need for support (e.g. the proposed VGF), for example if average wind speeds are in a decreasing trend. Stakeholders noted they were looking for further clarity on who will bear the responsibility for these detailed studies and surveys in the future, and equally whether this information will be made publicly available.

Infrastructure development (e.g. ports, yards and transmission capacity) was stressed as well, as was the development of domestic manufacturing capacity and clear supply chains. These will ensure a functional ecosystem for offshore wind development, including one that is capable of meeting India’s ambitious 2030 targets, and will play a key role in bringing down project costs. Importantly, stakeholders emphasised that logistics and value chain issues need to be treated in parallel to the first offshore wind projects, which realistically will rely on imported technology, in order to avoid major delays or hindered capacity additions. Ensuring sufficient market capacity (e.g. skilled labour) to deliver on 2030 ambitions likewise will help to lower offshore wind development costs.

Stakeholders indicated that there additionally may be potential environmental and/or social conflicts that require awareness raising and community outreach activities, where such issues have delayed or hindered projects in other countries (e.g. in fishing zones).

Lastly, stakeholders called attention to the high capital needs for offshore wind development and to the cost of finance as a critical factor in achieving offshore wind ambitions. Part of this cost of finance is due to project risks, which can be addressed through a clear policy environment and regulatory framework (e.g. through long-term power purchase agreements with off-takers with strong credit standing, or offtake guarantees to support weaker credits). Development costs can likewise be improved through support for a robust offshore wind ecosystem, for instance through support to enable domestic manufacturing capacity and supply chains. Yet even with these measures, stakeholders emphasised that meeting 2030 offshore wind ambitions will require solutions to raise sufficient scales of affordable capital (see section on investment needs below). Measures to encourage equity investors willing to bear early-market risks will help, but new sources of financing, including investment vehicles to pool different sources of finance, are needed to unlock a robust offshore wind market in India.

Opportunities and solutions

Targeted actions and tailored solutions can address these barriers and challenges to offshore wind development. This includes greater clarity on policy, which MNRE presented at the Roadmap workshops and in its updated strategy paper in July of 2022 (MNRE, 2022[6]) (Table 3.2).

The proposed VGF will apply to two tenders in 2023-24 and 2024-25, based on competitive bidding under a two-stage single bid process followed by a reverse auction,13 and SECI will guarantee the offtake for these additions. Grid connectivity will be carried out through Powergrid and the Central Transmission Utility (CTU), where offshore transmission and evacuation infrastructure from the developer substation (metering point) to the onshore meeting/interconnection point will be socialised. Fixed 30-year floor (seabed) lease agreements, currently under preparation, will be signed with successful bidders and MNRE or a designated agency for an annual fee of INR 1 lakh (USD 1 300) per square metre for allocated blocks. However, in case the survey is conducted by a developer for blocks or sub-blocks allocated with exclusivity rights for a fixed period, the quoted lease fee would be paid up to the commissioning of the offshore wind project or a defined fixed period, whichever earlier. Awarded capacity will equally have up to four years for project development from the date of signing the concessionaire agreement.14

Table 3.2. Indicative auction trajectory for offshore wind developments, 2022-30

|

Auction capacity under Model 1 |

Auction capacity under Model 2 |

Auction capacity under Model 3 |

Total auction trajectory (GW) |

Cumulated auctioned capacity (GW) |

|

|---|---|---|---|---|---|

|

2022-2023 |

4 |

4 |

4 |

||

|

2023-2024 |

1 |

3 |

4 |

8 |

|

|

2024-2025 |

2 |

2 |

4 |

12 |

|

|

2025-2026 |

4 |

1 |

5 |

17 |

|

|

2026-2027 |

4 |

1 |

5 |

22 |

|

|

2027-2028 |

4 |

1 |

5 |

27 |

|

|

2028-2029 |

5 |

5 |

32 |

||

|

2029-2030 |

5 |

5 |

37 |

||

|

Total |

1 |

24 |

12 |

37 |

37 |

Notes: Model 1 corresponds to specific zones where MNRE or NIWE has conducted studies, and is eligible for VGF; Model 2 encompasses Model 2(A), where developers will carry out studies themselves, and where the winning bidder will benefit from VGF, whilst under Model 2(B) developers will carry out studies and secure bilateral power purchase agreements or captive consumption, without benefitting from VGF; Model 3 will apply to zones not covered in Model 1 and Model 2, where developers can be allocated exclusive rights to carry out surveys, develop projects and secure bilateral power purchase agreements or captive consumption, without availing of VGF.

Source: (MNRE, 2022[6])

Three potential models for capacity auctions

The “Model-1” approach may be extended to other zones where necessary studies and surveys have been carried out by NIWE. This model replicates the structure of comprehensive public-private partnerships, where the public sector bears risks that it is best placed to take on such as the transmission infrastructures, and the private sector is required to finance, build, and operate the generation units.

For other future tenders, MNRE indicated it would use a “Model-2” approach for other sites along India’s coastline. Under this approach, developers will be able to select offshore sites to carry out necessary surveys and studies, subject to approval by NIWE. Project development can then happen either through bidding under Model 2(A), with offtake through SECI or a state distribution company (DISCOM), or through sale of power under the open access regime under Model 2(B) (i.e., a bilateral agreement).

The bidding mechanism in Model 2(A) would follow the same procedure as Model-1, whilst in the case of open access sale of power, developers will submit detailed project reports within five years of the date of consent issued by NIWE and will not have access to VGF. This period may be extended up to a maximum of six years on a case-by-case basis, after which point all clearances shall be withdrawn and developers shall submit their study and survey data with NIWE.

A “Model-3” approach, under which private companies will obtain exclusive rights to develop blocks for captive electricity consumption and will not avail of VGF, could also be rolled out (PIB, 2022[9]). This model requires limited support and intervention from MNRE, and a tender under Model-3 could be launched within a year, upon the notifications of lease rules.

In all three models, grid connectivity for projects to 2030 will be covered by CTU. Lease agreements likewise will be treated with MNRE or a designated authority. NIWE will facilitate all the stage I and II clearances under a single window for no objection certificates (NoCs). MNRE additionally clarified that support for projects beyond the first two tenders would include fiscal incentives, such as the waiving of transmission charges. It also noted and that renewable energy certificate (REC) multipliers would be explored as a possible developer incentive. However, some stakeholders highlighted that each model could be further improved to provide confidence, for instance by extending volumes benefitting from seabed exclusivity rights, which would facilitate the progress of development and feasibility studies.

Box 3.1. Experience from the Dutch model to de-risk offshore wind projects

The development of offshore wind farms is one of the pillars of the Dutch climate policy, who has set a target of 11.5 GW of installed capacity by 2030. The Dutch Government aimed to reduce pre-bid investment risks, especially by establishing the Netherlands Enterprise Agency as a one-stop-shop for the project developers. The approach of the Dutch policy was developed within an initiative to reduce the cost of offshore wind power generation by 40%.

The model was founded on several key principles, starting with the pre-selection of sites and the preparation of environmental impact assessment and studies, and collection of data under the coordination of the Ministry of Economic Affairs and Climate Policy and the Ministry of Infrastructure and Environment. The realisation of the grid connection is ensured by TenneT, the transmission system operator. Once all these preparatory steps are finalised, and after a public consultation, a Wind Farm Site Decision is issued, which provide the main technical requirement from construction until decommissioning, and the Netherlands Enterprise Agency starts coordinating the auction process. The Government grants the necessary permit to the winning project developer as soon as the result of the tender is confirmed.

With this model, the Dutch government considered the price as the key criteria to select the winner, as other matters were equal for all developer, by design of the tendering process. In addition, a price cap was set from the first auction in 2015, and gradually decreased over the next auctions. In 2018, Vattenfall was awarded with Hollandse Kust Zuid offshore wind farm project in a subsidy-free tender under this model.

Several initiatives can replicate successful experiences of other renewable sources

In addition, MNRE noted that the drafting of contractual documents (e.g. implementation, concessionaire and connectivity agreements) is being prepared. There equally are several on-going studies under bilateral and multilateral co-operations to assess port and logistic infrastructure, grid and transmission capacity needs, supply chain updates and marine spatial planning.

MNRE also is setting up a test facility to replicate the successful experience of test centres in the United Kingdom. The Indian site, on Rameshwaram Island, will allow for testing of equipment, providing important data to inform how to optimise technology. It will equally act as a research facility and training centre.

These announcements respond to several core barriers highlighted for offshore wind development. They also noted that further measures can accelerate opportunities for offshore wind projects. For example, MNRE could work with the Ministry of Power and the Central and/or State Electricity Regulatory Commissions to extend separate renewable purchase obligations (RPOs) for offshore wind, similar to what is already done for hydropower. This would boost demand for offshore wind capacity (notably beyond the first 3 GW of early additions) via DISCOMS’ RPOs. Similarly, tenders could potentially bundle power, for instance to ensure round-the-clock power with offshore wind and other renewable energy sources. This approach worked well in the early days of solar in India, bundling it with cheaper thermal energy.

Replicating the solar approach to standardise contracting would likewise help to address project costs, as would eventual prequalification criteria for offshore wind projects. These can complement the single‑window for stage I and II clearances under NIWE and facilitate the overall speed of project development.

Opportunities to address risks specific to the offshore wind industry

Production-linked incentive (PLI) schemes such as those offered by IREDA15 can equally help to lower development costs, especially for scaling up capacity additions to 2030, by incentivising manufacturers to establish or expand production in India. Support by export credit agencies from other countries can similarly help to establish domestic supply chains for offshore wind development, as can other government-to-government or multilateral initiatives to address technology transfer, development and innovation.

Thorough risk studies can help to lower the cost of finance for projects, particularly as these provide additional comfort to investors, especially when paired with risk mitigation tools such as an offtake guarantee. Additional technical reports, such as on-going assessments looking at potential supply chain gaps and infrastructure needs will help developers and investors to assess expected project costs. Gains in project capital expenditure (CAPEX) will influence the overall need for financing, thereby addressing in part the cost of finance on offshore wind development.

Given the time between the beginning of project development and operations for offshore wind projects (typically between 5 and 7 years) and that the first offshore wind projects therefore will not be operational before subsequent auctions in the mid-2020s, stakeholders noted that the planned VGF may need to cover further rounds of project development (or by other support mechanisms). Using assessments like the FIMOI LCOE tool, MNRE could work with partners and international donors to close the eventual gap in expected VGF requirements beyond the first 3 GW. Lessons from the international experiences can also help identify suitable solutions for future capacity additions. For example, the contract for difference (CfD) model like that used in the United Kingdom could address risks for offshore wind projects beyond the planned VGF. Other market instruments (e.g. forwards, future, spreads and options) are also commonly used as hedging strategies against electricity price risks (Mbistrova and Nghiem, 2017[14]). Not only can these help to lower debt costs, but they can also help to increase debt capacity.

India can benefit from other international experiences in addressing offtake risk (both volume and price) and execution risks (e.g. operation and maintenance costs and resource uncertainty) (Krishnan et al., 2022[2]). For instance, global expertise in structuring PPAs to enable can help in financing of future offshore wind pipelines (Box 3.2). Similarly, lessons can be extracted from experiences in India with onshore solar and wind developments (e.g. the Madhya Pradesh solar park).

Lastly, greater co-ordination (not only government agencies but equally across developers, international partners and support such as development assistance) can help to avoid distortions in the market and ensure needs of the overall value chain for offshore wind (e.g. ports and transmission) are met. While bilateral initiatives can bring quick results, co-ordination across partners can deliver long-term benefits. For instance, a working group or country platform could help to co-ordinate public interventions, bilateral partnerships and international climate and/or development finance. Similar co-ordination already happens with industry and developers through initiatives such as the Indian chapter of the Global Wind Energy Council (GWEC).

Box 3.2. Denmark’s offshore wind tender model

Denmark is a worldwide leader in the development of offshore wind, with 2.3 GW total installed capacity in more than ten wind farms, among which the first large-scale projects commissioned in 2002-2003 (WindEurope, 2022[15]). In 2020, the Danish Energy Agency has released a model for tendering offshore wind farms, building upon the country’s experience in such projects. It highlights a range of risk mitigation measures implemented for upcoming tendering processes.

Preliminary studies co-ordinated by the power grid Transmission System Operator (TSO) will provide critical data on site resources, soil conditions, environmental impact on fauna and flora, as well as on traditional uses of the ocean, such as fisheries. This will provide crucial information for project developers, and the winning bidder will have to carry out additional studies in order to obtain permits and license to operate. In order to bring clarity on the licensing process, the tender material includes drafts prepared by the Danish Energy Agency.

The Danish Energy Agency initiated a negotiated procedure with prior call for competition, enabling the tenderers to discuss the conditions of the tender, and to propose modifications eventually leading to more competitive prices.

Given that the project lifetime will influence the return on investment, and therefore the bid price, the license duration has been extended to 30 years to correspond to the technical lifetime of the turbines, with an option to benefit from a further 5-year extension.

In parallel of the state tenders, Denmark has implemented an “open door” process, allowing project developers to apply to establish an offshore wind farm at the location of their choice. Subsequently, the Danish Energy Agency studies their proposal and grant the project developer the permission to undertake preliminary studies. This process can enable to speed up the deployment of renewable energy capacity.

Source: (Danish Energy Agency, 2020[16])

Investment needs and financial support for offshore wind

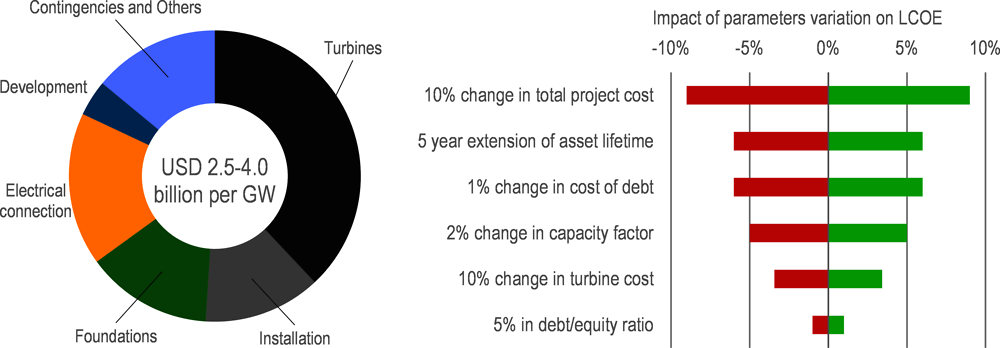

Exact costs for offshore wind project development depend on a multitude of factors, from location and technology choice (e.g. bottom-fixed or floating turbines) to import costs and relevant taxes. Operational conditions (e.g. plant load factor) and maintenance costs in turn influence developer expectations on LCOE, as do considerations for project risks such as payment delays or failures.

Globally, offshore wind costs continue to decline, from an average LCOE of around USD 0.162 (INR 7.41) per kilowatt-hour (kWh) in 2010 to USD 0.084 (INR 6.22) per kWh in 2020 (IRENA, 2021[17]). In terms of total installed costs, this represented a global average of around USD 3.2 billion (INR 0.24 lakh crore) per GW in 2020, although the range in CAPEX across projects varied considerably and reached more than USD 5.5 billion (INR 0.4 lakh crore) per GW.

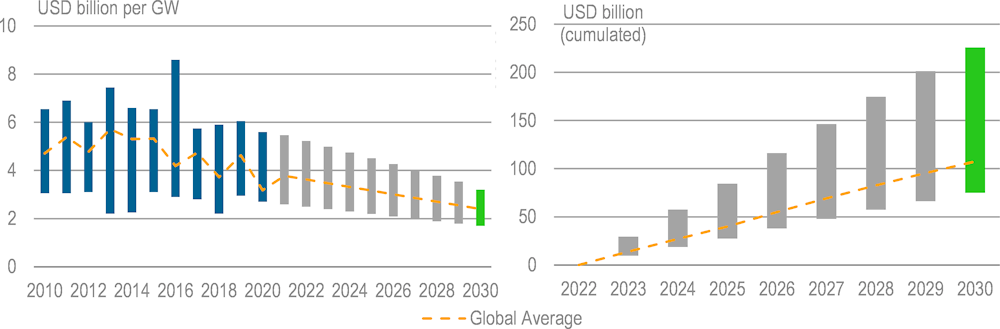

Presuming India would benefit from international experiences and continued technology learning curves, CAPEX needs for 37 GW of offshore wind capacity over the next decade may be in the order of USD 75-150 billion (INR 5.7-11.5 lakh crores) (Figure 3.3). This follows a global average installed cost declining from around USD 3.7 billion (INR 0.28 lakh crore) per GW in 2021 to around USD 2.4 billion (INR 0.18 lakh crore) per GW in 2030, where this range is in line with suggested potential costs of USD 2-4 billion per GW as indicated by stakeholders during the Roadmap process.

Figure 3.3. Illustrative trajectory of installed costs and investment needs for offshore wind in India

Note: Given the performance achieved by India in other clean energy sectors, with total installed costs lower than the global average for solar and wind power (IRENA, 2022[18]), the likely target for India would be between the lower bound of the bars and the dotted line highlighting the global average.

Source: Adapted from (IRENA, 2021[17]) and using 2030 cost estimates from (IRENA, 2019[19]).

On a per unit basis, stakeholder estimates suggested that LCOEs for offshore wind projects in Tamil Nadu and Gujarat could be in the range of INR 7 to 9 (roughly USD 0.10-0.12) per kWh, potentially reaching INR 11 or 12 (USD 0.15-0.16) or higher per kWh for the first projects. A 2022 FIMOI study on cost estimates for the first offshore wind farms in India estimated that LCOEs for Tamil Nadu with Final Investment Decision (FID) in 2025 would be INR 7.4 (USD 0,09) per kWh and Gujarat would be INR 12.2 (USD 0.15) per kWh (COE-OSW, 2022[20]). Import duties, particularly for the first projects, and local content requirements would further increase these development costs.

Identifying levers to lower project costs will have substantial influence on the competitiveness of offshore wind solutions, where, for example, onshore wind tariffs in 2020 were around INR 2.8-2.9 per kWh (Bhatti, 2021[21]). Roadmap stakeholders highlighted that comparison to onshore wind and solar prices does not reflect the system benefits brought by offshore wind development in India and that it would make more sense to compare offshore wind to thermal power installations using natural gas, whose LCOE ranges from around INR 3.7 to 6.7 (USD 0.05-0.09)16 per kWh (IEA, 2021[22]). Overall, there was strong agreement that offshore wind prices can come down substantially through a combination of measures that address project risks, alongside tools that address technology costs and the overall cost of finance.

The OECD and NRDC assessed the potential impact of various measures to address the cost of offshore wind development using the FIMOI LCOE tool developed by COE-OSW.17 Technology costs, such as lower turbine costs, can substantially influence offshore wind LCOE (Figure 3.4). It is perhaps early to assess future operational opportunities, but extended asset lifetimes would also help to improve LCOE.

The cost of finance, with a typical lending interest rate of 9.5% in 2019 (Esser, Gadre and Jaiswal, 2021[23]), will equally play a critical role in achieving deployment targets to 2030 at more competitive LCOE. For example, lowering the cost of debt by 1% (over a base of 10%) for offshore wind projects could lower LCOE by as much as 5%. This represents a return of roughly USD 100 million for each GW installed, presuming a reference CAPEX of around USD 3 billion per GW.

Figure 3.4. Illustrative impact from the variation of parameters on offshore wind LCOE

Note: Illustrative sensitivity calculation based on USD 3 billion per GW at 45% capacity factor, 65/35 debt/equity ratio, 10% cost of debt and debt tenure of 10 years. Variation of the main parameters are based on typical standard deviations across projects.

Sources: Values and breakdown on the left chart based on (IRENA, 2021[24]), (IRENA, 2022[18]), (Lazard, 2021[25]). OECD analysis using COE-OSW FIMOI LCOE tool (COE-OSW, 2022[20]).

Stakeholders noted that these solutions to lower development costs will require combinations of public and private capital, including possible blended finance from international donors, to address project risks and to support market development (e.g. to ensure training and capacity of local market actors). For instance, offtake guarantees and VGF will help to lower the cost of finance by directly addressing revenue stability and security, which are critical concerns for lenders and investors (Box 3.3). Stakeholders highlighted that these types of risk mitigation tools are more likely to affect the cost of finance relative to other options. For example, expanding Priority Sector Lending (PSL) rules to target offshore wind may help to increase overall lending to projects, and achieving lower rates for PSL loans compared with regular loans would reduce the cost of finance.18

Public financial institutions and international partners (e.g. export credit agencies) can also help to address the underlying cost of finance, for instance by providing combinations of equity and long-tenure loans (i.e. 15-20 years). Multilateral agencies and development finance institutions can likewise contribute by extending credit lines, by proposing partial credit guarantees or first-loss provisions, or by offering credit wrapping. They can also finance projects as co-participants or through other forms of blended finance to help close the viability gap of early projects to reduce the risks for private capital.

In addition to risk mitigation tools, public financial institutions such as IREDA can help to provide finance at more attractive rates. In fact, a parliamentary committee on energy recommended in early 2022 that IREDA should be given a special window for borrowing at repo rate (raised to 4.9% in June of 202219) to ensure availability of low-cost funding for renewable energy projects, in line with the government’s 500 GW target (FE Bureau, 2022[26]). The panel also recommended that MNRE should explore the possibility of exempting state-run lenders like IREDA, PFC and REC Limited from payment of guarantee fees (up to 1.2% per annum) for raising funds from multilateral agencies.

Box 3.3. Estimating the cost of VGF to unlock investment in offshore wind in India

The Indian Ministry of New and Renewable Energy (MNRE), the National Institute of Wind Energy (NIWE) and the Danish Energy Agency (DEA) have created a knowledge hub called the Centre of Excellence for Offshore Wind and Renewable Energy (CoE) in 2021. The CoE has launched the FIMOI tool in 2022, proposing a detailed economic assessment of the LCOE and dimensioning of a VGF to achieve a target price for offshore wind.

FIMOI estimates a rapid decrease of the LCOE between 2020 and 2030 in Tamil Nadu and Gujarat, respectively from INR 10.3 to 5.2 (USD 0.26 to 0.07) per kWh, and from INR 14.4 to 7.8 (USD 0.181 to 0.10) per kWh. Considering a target price of INR 3.5/kWh, which could enable offshore wind to be competitive on the Indian power market, an investment subsidy under the VGF scheme could amount to INR 0.5-0.6 lakh crores (USD 6.6-7.3 billion) for the initial eligible capacity of 3 GW.

The FIMOI analysis considers a full scope, although MNRE has informed that the transmission of power from the offshore substation to onshore transmission will be provided free of cost until 2030. By excluding this item, the dimensioning of the VGF could be reduced by close to one third for the first 12 GW. This would enable to reach a potential leveraging factor slightly above 1 to 1.

The FIMOI report highlights that the tool could be further developed and improved in the future by incorporating additional elements, for instance on taxes, other economic incentives beyond VGF, or the financing structure of the projects.

Stakeholders insisted that these types of support instruments, while taking different forms, should seek to address specific barriers to offshore wind development, notably taking on risks that are hindering private capital or that add to the cost of capital for projects. Additionally, stakeholders noted that the scale and complexity of offshore wind projects, including financing needed across the entire offshore wind value chain, means that support likely needs be multifaceted, potentially requiring multiple financial solutions and risk mitigation tools from a range of partners to enable an effective and robust ecosystem.

Moreover, there will remain substantial investment needs for offshore wind development to 2030 and beyond, even with early market support to address risks and achieve cost improvements. Stakeholders noted that no single bank or investor will be able to meet such intensive capital requirements. For example, domestic lenders, who play a key role in financing onshore wind and solar, already face power sector lending limits, and the overall magnitude of funds required for offshore wind (e.g. USD 2-5 billion per GW) will require them to tap into other financial pools, such as secondary markets. Private players, including big industry, will also need to guarantee a certain return on capital employed as overall investment levels increase, meaning they will require financial leverage.

Experience with offshore wind development in other countries illustrates that raising these scales of capital is possible through multiple sources of finance, such as a consortium of investors, like those used for offshore wind projects in the North Sea (Box 3.4). This pool of investors helps to address individual risks and could be supported through existing platforms in India, such as the National Infrastructure Investment Fund (NIIF), possibly with support from multilateral agencies that have experience with syndication and related guarantees. Infrastructure Investment Trusts (InvITs) can likewise provide a platform for investors to access renewable energy projects (Srivastava, 2021[28]). For example, Virescent Renewable Energy Trust (VRET), one of India’s first “pure-play” renewable energy InvITs, raised INR 460 crores (USD 62 million) in September of 2021 with both foreign and domestic investors (Tisheva, 2021[29]). These types of structures can also be used as a tool to recycle capital by selling shares in operating units and use the proceeds to develop new renewable energy projects.

Box 3.4. Trends and lessons from financing offshore wind development in Europe

Europe invested EUR 16.6 billion (INR 1.4 lakh crore) in offshore wind projects in 2021, with an average CAPEX of EUR 3.5 million (INR 29 crores) per installed MW. The projects that have reached final investment decision are located in the United Kingdom, Germany, France and Denmark. Around two-thirds of the overall investment in offshore wind projects have been financed via project finance, for an amount of EUR 11.9 billion (INR 2.0 lakh crores), and one-third via corporate finance. The average debt-equity ratio of offshore wind projects using project finance has reached 78:22, with a total of 96 active lenders in 2021, including commercial banks, multilateral development banks and development finance institutions.

Thanks to a better understanding of the risks of offshore wind and the growing experience of the wind energy financing ecosystem in Europe, project finance has become the preferred structure for new projects. The percentage of debt financing has increased by around fifteen points over the past decade, and the spread between interest rates for offshore wind projects and the basis rate have decreased. Therefore, the cost of finance has decreased, and in turn the cost of production of electricity from offshore wind farms became more competitive.

Several initiatives are ongoing to better integrate offshore wind in larger energy ecosystems and to diversify the sources of finance to further mitigate the risks associated with capital-intensive projects, and eventually develop projects without relying on government funding. For instance, the pension funds Pension Danmark and PFA Pension partnered with the energy company SEAS-NVE to develop up to 10 GW offshore wind, electricity storage and power-to-X projects. Energinet, Gasunie and TenneT, three power Transmission System Operators (TSOs) in Northern Europe, have founded the North Sea Wind Power Hub (NSWPH) in 2017. The NSWPH promotes a “Hub-and-Spoke concept” to integrate offshore wind capacity with several national power grids and with future green hydrogen pipelines.

As the deployment of offshore wind capacities will require a significant investment, recycling capital can be critical to develop new projects. The construction of a wind farm typically lasts three to four years, and the debt providers take into account execution risks, such as the risk to delay the project, which drives up the interest rates. Once the wind farm is operational and generates revenues, the risks are lower, thus there is an opportunity to refinance the project at better interest rates. Project developers can also decide to sell shares of commissioned projects and use the proceeds to develop new projects.

Sources: (PwC, 2020[10]), (offshoreWind.biz, 2020[30]), (North Sea Wind Power Hub, 2021[31]), (WindEurope, 2022[32])

Capital-market solutions, such as green bonds and sustainability-linked bonds, can equally raise money for offshore wind projects. More than USD 10 billion in green bonds for clean energy projects were issued in India between 2016 and 2021 (Srivastava, 2022[33]), and sustainability-linked instruments and Masala bonds, such as those issued by PFC and IREDA,20 are likewise helping to mobilise capital. While there is considerable appetite for Indian issuances for renewable energy projects in the international capital markets, the domestic market has seen limited issuances. Indian institutional investors prefer investing in AA and above rated securities and few utility-scale renewable energy projects have met this rating threshold (Singh, Dutt and Sidhu, 2020[34]). Support of first issuances for offshore wind in India, for example through the government’s plans to issue green, could raise awareness for these projects and provide improved insight (e.g. on asset performance) to investors. This could equally be done through collaboration across multiple actors to support issuance at high credit ratings, as was previously done for infrastructure projects in India. For example, the Asian Development Bank (ADB) supported a first-of-a-kind facility with the India Infrastructure Finance Company Limited (IIFCL) and domestic financial institutions in 2012 to provide partial guarantees on INR-denominated bonds issued by Indian companies for infrastructure projects. ADB took on part of the guarantee risk, helping projects to achieve A or AA credit ratings (Aravamuthan, Ruete and Dominguez, 2015[35]).

Other forms of support may be required to unlock finance and investment at suitable scales via global capital markets. For instance, accessing large capital volumes through international markets may require hedging to treat foreign exchange (Fx) and other offshore wind investment risks. This could be to support early market technology imports (e.g. via export credit agencies) as well as to facilitate investment by international firms in establishing or expanding manufacturing capacity in India. Such examples also exist via tools through private banks. For example, Siemens Gamesa Renewable Energy arranged EUR 174 million in Fx hedging contracts for sustainable transactions in a deal arranged by BNP Paribas in 2019. This helped the group to mitigate Fx exposure for selling offshore wind turbines in Chinese Taipei (Menendez, 2019[36]).

Lessons could be extracted from these experiences for the Indian market, as well as from other international experiences in hedging risks. For instance, use of sophisticated and competitive hedging is common in the United Kingdom to address risks for offshore wind projects. This broadened participation beyond commercial banks (e.g. to investment banks) and has driven down hedging prices, including for cross-currency swaps (Lancaster, 2019[37]).

Roadmap stakeholders also noted that one way to help direct finance to clean energy development, including through capital markets, is through a sustainable finance framework. Development of a national green taxonomy in India, possibly based on existing ones, such as those in Europe and Singapore, would provide a clear set of rules and mitigate perceived risk of ‘green washing’. Investor and company disclosure requirements would likewise help drive investment in clean energy projects like offshore wind, particularly as the pool of investors seeking ESG performance continues to grow in India and globally.

Roadmap to 2030

Meeting India’s offshore wind ambitions to 2030 and beyond will require a number of targeted actions and tailored solutions through co-ordinated efforts across stakeholders, from developers and investors to state and central governments and international partners. Working together can bring forward solutions to address bottlenecks to project development and enable the finance needed to unlock a robust offshore wind market.

Recommendations

The Roadmap proposes seven key recommendations to de-risk offshore wind investment and to enable the flow of finance to those projects. Proposed interventions are set forth across two key pillars, notably targeted enabling tools and specific financial support to address critical barriers across the offshore wind value chain, bridge the current economic gap and create an enabling environment for investment.

Enabling tools

1. MNRE should provide improved clarity on the policy framework and regulatory conditions for projects to 2030, complementing the 2022 Strategy Paper for Establishment of Offshore Wind Energy Projects.

Well-established offshore wind markets require clear policies with long-term targets and transparent regulatory conditions, which facilitate investment decisions, especially as these projects are capital intensive. Recent announcements (e.g. on auction schedules, offtake, evacuation infrastructure and seabed leasing) are important steps forward, but ensuring these details are spelled out clearly within policy and regulations will help developers and investors to assess opportunities and risks.

A policy update should clarify the volumes that will fall under Model 2(A) to thus be eligible for VGF and other revenue support beyond 2024, and it should clarify other developer obligations (e.g. local content requirements) and incentives (e.g. import duty reductions or tax benefits).

In preparation of the first offshore wind auctions in 2022-24, the update can also specify expected (or else potential) future market demand mechanisms, for example using bundled/hybrid auctions, RPOs and weighted RECs; which will help to establish bilateral contracts and address offtake risk (with lesser risk for SECI). Given that anticipated offshore wind tariffs are unlikely to be competitive with onshore wind, solar and conventional energy, RPOs would be an important policy tool to create demand certainty for investors.

The updated framework can serve as a template for Tamil Nadu, Gujarat and other states to update their own offshore wind policies and regulations, which will help to ensure consistency in the overall operational environment for developers.

Ideally, all these policy and regulatory elements will be included and where possible streamlined under the proposed single-window by NIWE, ensuring a “one-stop shop” for offshore wind projects.

2. The Ministry of Commerce and Industry (MoCI), supported by MNRE, should begin work with industry to jump start domestic offshore wind supply chains and manufacturing capacity as soon as possible, especially to ensure these are in place in time for capacity additions beyond the first projects.

In addition to a clear policy and regulatory environment, achieving 2030 deployment targets will require an efficient administrative process to deliver 37 GW of capacity additions in a relatively short window of time, whilst equally enabling opportunities to lower technology and project development costs.

Support can include a PLI scheme and expanded PSL, as has been done for the solar industry. Caution is recommended in applying any local content requirements, specifically for components not currently produced in India, as the offshore wind market develops in the coming years. Strict requirements risk increasing development costs and project lead times, where more gradual application of local content requirements (e.g. as done in the United Kingdom and Denmark) has supported development of robust offshore wind industries and lower projects costs.

International partners can support market development via technology transfer support for joint ventures and co-operative activities (e.g. under industry agreements), as well as through support for training and capacity building, for instance for skilled labour creation in the domestic manufacturing industry.

3. MNRE and the relevant authorities (e.g. Powergrid, CTU and state transmission authorities, and the port authorities in Tamil Nadu and Gujarat) should plan and co-ordinate necessary infrastructure development in support of offshore wind capacity additions.

To avoid unwanted delays or additional expenses in future offshore wind additions, relevant infrastructure like ports, yards and transmission capacity needs to be developed in time to accommodate offshore wind capacity additions to 2030 and beyond.

For initial offshore wind projects up to 2030, the dedicated evacuation infrastructure will be provided by CTU.

The needs for other potential infrastructural developments, such as roads and bridges to accommodate transport of larger blades, must be assessed. Planning and co-ordination can likewise look to cluster supply and manufacturing capacities, for instance close to ports.

Assessments and plans can also look at the development of green energy corridors, with eventual infrastructure developments such as transmission, distribution, conversion and storage capacities to use offshore wind to produce green hydrogen for use in local industries.

Financial support

4. MNRE should work with partners to co-ordinate finance and investment moving forward, for instance through a financing platform that brings together donors, investors and other relevant development players for the development of a blended finance facility for offshore wind (see Annex D).

The complexity of establishing a vibrant offshore wind market, including related infrastructure development, manufacturing and supply chain investments, means that stakeholder co-ordination and co-operation will play a key role in ensuring timely, sufficient and affordable finance and investment for the entire offshore wind value chain.

This type of co-ordination has worked well to identify critical challenges and key opportunities to enable offshore wind development, for example through industry initiatives like the India chapter of the Global Wind Energy Council (GWEC). A similar platform for financial actors, development assistance and climate finance can help to ensure relevant support and suitable financing vehicles are in place to deliver on offshore wind ambitions.

The platform, hosted and managed by a specially designed unit in an existing agency like IREDA, would help to ensure specific risks and challenges are addressed, whilst avoiding duplication of efforts and ensuring the overall value chain of needs to unlock the potential for offshore wind is sufficiently supported. It can equally facilitate investor dialogues.

The platform could coordinate interventions by donors to support project de-risking that can be delivered via a blended finance facility, to which donors can contribute capital, and that could be managed by an agency such as IREDA. The facility would be intended to mobilise private capital through de-risking, focussing on one single and well-defined area.

The blended finance facility for offshore wind could include a number of different mechanisms. For example, multilateral development banks could serve as co-investors or provide sub-ordinated debt and equity to help unlock commercial capital. They can equally help through more traditional concessional finance, for example providing suitable loan tenures for offshore wind (e.g. above 15 years after commissioning date).

5. MNRE should assess suitable financial instruments, including potential sources of funding for such mechanisms, to provide needed risk assurance for offshore wind project development in the coming years. These tools can also help to lower the cost of finance for project development and possibly be integrated in the blended finance facility.

Expected costs for early offshore wind projects, in addition to development risks for the first capacity additions, means support like the proposed VGF is needed to address higher LCOE and offtake risks. Continued support equally may be necessary beyond the first planned capacity additions and as the market develops, given the scope and scale of achieving 37 GW of capacity additions by 2030.

This includes work with relevant Indian counterparts like Ministry of Finance, development partners and multilateral agencies to raise sufficient funds for VGF to cover early capacity additions.

International partners can support MNRE in assessing and developing other financial instruments such as CfD auctions and hedging instruments that offer safeguards to developers against volatile prices. This could be through a consortium of development and climate finance, working with Indian institutions like IREDA.

MNRE and IREDA, working with relevant authorities like SECI, should assess solutions to address payment risks via financial instruments like payment security or credit enhancement mechanisms. While RPOs and weighted RECs will help to address offtake risks, risk of late payments or non-payments by DISCOMs may still be a major concern for developers and can be mitigated by such mechanisms, which could equally be supported by development and/or climate finance.

6. In addition to pursuing financial incentives such as PLI for manufacturing, MNRE should work with domestic and international partners to channel finance and investment for the offshore wind ecosystem, including relevant financial support mechanisms to unlock private capital for these developments.

Unlocking finance and investment in offshore wind development will require additional financial support for development of domestic supply chains and manufacturing capacity as well as infrastructural needs. This could be integrated in the blended finance facility if these parts of the value chain are selected with international partners as a focus area.

SIDBI, IREDA and other relevant financial institutions can provide required capital and relevant risk mitigation for domestic manufacturing capacity and supply chain development, for instance using targeted financial instruments like low-interest loans (or subsidised interest rates, for instance with partner banks and NFBCs), guarantees and grants (where applicable).

International partners, such as export credit agencies, can support development of supply chains and manufacturing capacities through financial instruments such as concessional loans, loan guarantees, current swaps or hedging products, and even first-loss equity. Technical Assistance Programmes may also be conducted by multilateral agencies to reduce the developmental risk.

The National Infrastructure Pipeline (NIP) and NIIF can channel investment in large infrastructure additions such as ports and transmission lines. Development finance and multilateral funds can support this through injection of capital, including credit enhancement and risk mitigation support, such as first-loss guarantees, to address risks.

The Government of India can also use sovereign green bonds, or serve as a co-investor for such instruments, to support large infrastructure additions. Support could equally include waiver of guarantee fees or credit enhancement for issuance by other entities, such as public investment funds.

7. Domestic partners such as IREDA, the Ministry of Finance and RBI should support MNRE to assess opportunities, challenges and limitations in use of financial instruments to access capital markets in India and internationally.

Achieving offshore wind ambitions to 2030 and beyond will require capital market instruments to unlock the quantum of finance and investment needed to meet these targets. Access to capital markets can help to address limitations in lending for domestic banks and NBFCs, particularly given the scale of capital required for 37 GW of capacity additions. Capital market instruments equally can help to lower the cost of finance, as has been illustrated in bond issuances for renewable energy projects in recent years.

Efforts include assessing the impact of related costs, such as government guarantees, as well as the role of other support mechanisms (e.g. credit enhancement or first-loss provisions) that can enable debt capital market solutions like green bonds for offshore wind projects at affordable costs.

Measures can include support for development of refinancing vehicles, such as asset-backed securities, to recycle existing capital for new projects. Specifically, use of such vehicles for existing onshore solar and wind debt can attract institutional investors, such as insurance and pension funds, who have shown a preference for operating assets.21 Given the complexity in preparing these deals, specialised bodies such as InvITs or an Alternative Investment Fund (AIF) could be used (at least in the near term) to address structural concerns and deploy investment strategies on behalf of investors. This could be prepared by IREDA with help of international partners.

MNRE and IREDA, alongside other relevant energy authorities, should work closely with the Ministry of Finance as it prepares a sustainable finance framework for India, to ensure that renewable energy is clearly reflected in rules and definitions (e.g. under a sustainable finance taxonomy). This will help to direct financial flows to offshore wind and other clean energy projects, whilst mitigating perceived risk of ‘green washing’ for investors.

Key actions and timeline

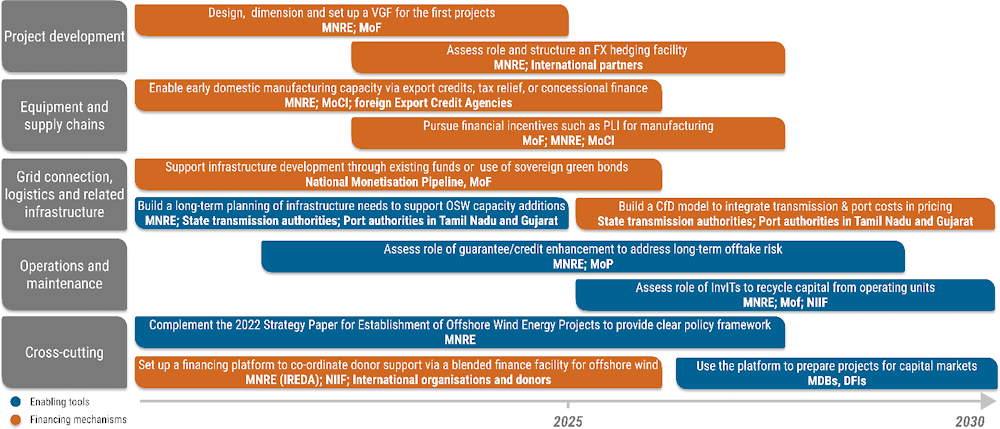

Figure 3.5. Overview of the main recommendations for Offshore Wind until 2030

Source: Authors

References

[35] Aravamuthan, M., M. Ruete and C. Dominguez (2015), Credit Enhancement for Green Projects: Promoting credit-enhanced financing from multilateral development banks for green infrastructure financing, International Institute for Sustainable Development (IISD), https://www.iisd.org/system/files/publications/credit-enhancement-green-projects.pdf (accessed on 11 June 2022).

[12] BASF (2022), Vattenfall and BASF participate in offshore wind farm tender Hollandse Kust West, https://www.basf.com/global/en/media/news-releases/2022/04/p-22-209.html (accessed on 9 September 2022).

[21] Bhatti, J. (2021), India’s offshore wind energy: A roadmap for getting started, Down to Earth, https://www.downtoearth.org.in/blog/energy/india-s-offshore-wind-energy-a-roadmap-for-getting-started-78010 (accessed on 10 June 2022).

[27] Centre of Excellence for Offshore Wind and Renewable Energy (2022), The FIMOI Report, https://coe-osw.org/the-fimoi-report/ (accessed on 4 July 2022).

[20] COE-OSW (2022), The FIMOI Report, Centre of Excellent for Offshore Wind and Renewable Energy (COE-OSW), https://coe-osw.org/the-fimoi-report/ (accessed on 10 June 2022).

[16] Danish Energy Agency (2020), “The Danish Offshore Wind Tender Model”.

[5] ESMAP (2021), Offshore Wind Technical Potential, https://esmap.org/esmap_offshorewind_techpotential_analysis_maps (accessed on 3 July 2022).

[23] Esser, S., R. Gadre and S. Jaiswal (2021), 2030 India Roadmap Multiplying the Transition: Market-based solutions for catalyzing clean energy investment in emerging economies, BloombergNEF and Climate Investment Funds (CIF), https://www.climateinvestmentfunds.org/sites/cif_enc/files/knowledge-documents/bnef-cif_fi_project_2030_roadmap_slide_deck_india.pdf (accessed on 11 June 2022).

[13] EURACTIV (2018), Dutch offshore wind farms first in world to go subsidy-free, https://www.euractiv.com/section/energy/news/dutch-offshore-wind-farms-first-in-world-to-go-subsidy-free/ (accessed on 9 September 2022).

[26] FE Bureau (2022), Panel for special lending window for IREDA, Financial Express (FE), https://www.financialexpress.com/economy/panel-for-special-lending-window-for-ireda/2426250/ (accessed on 11 June 2022).

[8] Frangoul, A. (2022), RWE, Tata Power to scope offshore wind projects in India, CNBC Sustainable Energy, https://www.cnbc.com/2022/02/21/rwe-tata-power-to-scope-offshore-wind-projects-in-india.html (accessed on 11 June 2022).

[4] Gulia, J. and S. Jain (2019), Offshore Wind Energy in India: a territory ready to be explored, JMK Research & Analytics, https://jmkresearch.com/wp-content/uploads/2019/10/Offshore-Wind-Energy-in-India_JMK-Research.pdf (accessed on 3 June 2022).

[7] GWEC (2021), An Ocean of Potential: Recommendations for Offshore Wind Development in India, Global Wind Energy Council (GWEC) India, https://gwec.net/wp-content/uploads/2021/04/April-2021-India-Offshore-Wind-Statement-2.pdf (accessed on 3 June 2022).

[1] GWEC and MEC+ (2020), India Wind Outlook Towards 2022: Looking beyond headwinds, Global Wind Energy Council (GWEC) and MEC Intelligence, http://www.gwec.net (accessed on 3 June 2022).

[22] IEA (2021), India Energy Outlook 2021 World Energy Outlook Special Report, International Energy Agency (IEA), Paris, https://www.iea.org/reports/india-energy-outlook-2021 (accessed on 10 June 2022).

[18] IRENA (2022), Renewable Technology Innovation Indicators: Mapping progress in costs, patents and standards, http://www.irena.org/publications (accessed on 10 June 2022).

[17] IRENA (2021), Renewable Power Generation Costs in 2020, International Renewable Energy Agency (IRENA), Abu Dhabi, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Jun/IRENA_Power_Generation_Costs_2020.pdf (accessed on 10 June 2022).

[24] IRENA (2021), Renewable Power Generation Costs in 2020, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Jun/IRENA_Power_Generation_Costs_2020.pdf (accessed on 20 June 2022).

[38] IRENA (2020), Renewable energy finance: Institutional capital, http:///publications/2020/Jan/RE-finance-Institutional-capital (accessed on 11 September 2022).

[19] IRENA (2019), Future of Wind: Deployment, investment, technology, grid integration and socio-economic aspects, International Renewable Energy Agency, Abu Dhabi, https://www.irena.org/-/media/files/irena/agency/publication/2019/oct/irena_future_of_wind_2019.pdf (accessed on 12 June 2022).

[2] Krishnan, D. et al. (2022), Winds of Change: Learnings for the Indian Offshore Wind Energy Sector, World Resources Institute, New Delhi, India, https://files.wri.org/d8/s3fs-public/2022-06/winds-of-change-wri-india.pdf?VersionId=.Al3io30STI3Lio4ni2WYqT5jCVRT.QS (accessed on 4 July 2022).

[3] Kumar Dash, P. (2019), Offshore Wind Energy in India, Akshay Urjay, https://www.researchgate.net/publication/333717700_Offshore_Wind_Energy_in_India (accessed on 3 June 2022).

[37] Lancaster, R. (2019), Renewables hedging evolves swiftly as banks crowd in, Global Capital, https://www.globalcapital.com/article/28mu1gy2kbsmo8qw9v7cw/sri/renewables-hedging-evolves-swiftly-as-banks-crowd-in (accessed on 12 June 2022).

[25] Lazard (2021), Lazard’s Levelized Cost of Energy Analysis - Version 15.0.

[14] Mbistrova, A. and A. Nghiem (2017), The value of hedging: new approaches to managing wind energy resource risk, Wind Europe, https://windeurope.org/wp-content/uploads/files/about-wind/reports/WindEurope-SwissRe-the-value-of-hedging.pdf (accessed on 11 June 2022).

[36] Menendez, M. (2019), Siemens Gamesa pioneers the green foreign exchange hedging market, Siemens Gamesa Renewable Energy (SGRE), https://www.siemensgamesa.com/newsroom/2019/10/191030-siemens-gamesa-green-fx-with-bnp (accessed on 12 June 2022).

[6] MNRE (2022), Strategy Paper for Establishment of Offshore Wind Energy Projects.

[11] Netherlands Enterprise Agency (2022), Dutch Offshore Wind Guide: Your guide to Dutch offshore wind policy, technologies and innovations.

[31] North Sea Wind Power Hub (2021), Towards the first hub-and-spoke project, https://northseawindpowerhub.eu/knowledge/towards-the-first-hub-and-spoke-project (accessed on 4 July 2022).

[30] offshoreWind.biz (2020), Danish Consortium Raring to Bankroll North Sea Energy Island, https://www.offshorewind.biz/2020/06/24/danish-consortium-raring-to-bankroll-north-sea-energy-island/ (accessed on 4 July 2022).

[9] PIB (2022), Offshore Wind Energy in India, https://pib.gov.in/PressReleseDetailm.aspx?PRID=1832708 (accessed on 1 July 2022).

[10] PwC (2020), Financing offshore wind: A study commissioned by Invest-NL, http://www.pwc.nl.

[34] Singh, V., A. Dutt and G. Sidhu (2020), RE-Financing India’s Energy Transition Limited Period Subsidised Credit Enhancement for Domestic RE Bond Issuances Centre for Energy Finance.

[33] Srivastava, S. (2022), IEEFA India: The rise of ESG investing and sustainability reporting | IEEFA, Institute for Energy Economics and Financial Analysis (IEEFA), https://ieefa.org/articles/ieefa-india-rise-esg-investing-and-sustainability-reporting (accessed on 6 June 2022).

[28] Srivastava, S. (2021), IEEFA India: Infrastructure investment trusts unlock value in renewable energy assets, Institute for Energy Economics and Financial Analysis, https://ieefa.org/articles/ieefa-india-infrastructure-investment-trusts-unlock-value-renewable-energy-assets (accessed on 11 June 2022).

[29] Tisheva, P. (2021), India’s first renewables InvIT raises USD 62m led by AIMCo, Renewables Now, https://renewablesnow.com/news/indias-first-renewables-invit-raises-usd-62m-led-by-aimco-755806/ (accessed on 11 June 2022).

[32] WindEurope (2022), Financing and investment trends 2021, https://windeurope.org/intelligence-platform/product/financing-and-investment-trends-2021/ (accessed on 4 July 2022).

[15] WindEurope (2022), Wind energy in Europe: 2021 Statistics and the outlook for 2022-2026, https://windeurope.org/intelligence-platform/product/wind-energy-in-europe-2021-statistics-and-the-outlook-for-2022-2026/#downloads (accessed on 3 July 2022).

Notes

← 1. Physical progress on installed renewable energy capacity, as of end-April 2022, consisted of 40.5 GW of onshore wind power, 55.3 GW of solar power, 10.2 GW of biomass co-generation, 4.6 GW of small hydro power and around 0.5 GW of waste to power and energy sources. Large hydro capacity accounted for another 46.7 GW. For more information on renewable energy additions and total installed power generation capacity, visit: https://mnre.gov.in/the-ministry/physical-progress and https://powermin.gov.in/en/content/power-sector-glance-all-india.

← 2. For more information on technical offshore wind potential estimates by the World Bank Energy Sector Management Assistance Program (ESMAP), visit: https://esmap.org/esmap_offshorewind_techpotential_analysis_maps.

← 3. Information on the Facilitating Offshore Wind in India (FOWIND) studies are available on the MNRE offshore wind portal: https://mnre.gov.in/wind/offshore-wind/.

← 4. For more information on the 2015 National Offshore Wind Energy Policy, see: https://mnre.gov.in/img/documents/uploads/3debfe9158b643d8a3e06a7a007f2ef9.pdf.

← 5. For further information on the 2018 Guidelines for Offshore Wind Power Assessment Studies and Surveys, see: https://mnre.gov.in/img/documents/uploads/a341c6e68bce413392b0383f18a647ef.pdf.

← 6. For further information on the 2022 Strategy Paper for Establishment of Offshore Wind Energy Projects, see: https://mnre.gov.in/img/documents/uploads/file_f-1657882722533.pdf

← 7. For more information on the NIWE Wind Data Sharing Policy, see: https://mnre.gov.in/img/documents/uploads/345c9baad1734e92816214239107292d.pdf.

← 8. For more information on COE-OSW events and analysis, visit: https://coe-osw.org/.

← 9. The list of participants under the 2018 Expression of Interest includes: www.eqmagpro.com/wp-content/uploads/2018/06/EOI_Participants_list.pdf.

← 10. For more information, see: https://ore.catapult.org.uk/press-releases/ore-catapult-and-niwe-announce-uk-india-offshore-wind-collaboration/.

← 11. See Annex A of the 2015 National Offshore Wind Energy Policy: https://mnre.gov.in/img/documents/uploads/dd5f781d18d34b9ca796f5364f7325bb.pdf.

← 12. The 2022 Strategy Paper for Establishment of Offshore Wind Energy Projects states that NIWE will facilitate as single window for clearances.

← 13. A reverse auction is a type of auction in which potential sellers bid for the prices at which they are willing to sell their goods and services to one buyer. Sellers then place bids for the amount they are willing to be paid for the good or service, and at the end of the auction the seller with the lowest amount wins.

← 14. For further information as presented by MNRE at the Roadmap workshops, visit: www.oecd.org/cefim/india/roadmap/.

← 15. For more information on IREDA’s PLI schemes, see: https://www.ireda.in/pli-scheme-documents.

← 16. LCOE is for combined-cycle gas turbine (CCGT) power generation.

← 17. For more information on the FIMOI LCOE tool, see: https://coe-osw.org/fimoi-lcoe-and-vgf-tool/.

← 18. Capital subsidy schemes in India, for instance for MSME technology upgradation, have not explicitly addressed the cost of capital for borrowers. For more information, see Chapter 2 on MSME energy efficiency finance and investment.

← 19. For more information, see: www.business-standard.com/article/finance/rbi-raises-repo-rate-by-50-bps-to-tame-prices-pegs-fy23-gdp-growth-at-7-2-122060900047_1.html#:~:text=The%20six%2Dmember%20Monetary%20Policy,to%20expectations%20of%20further%20monetary.

← 20. For more information, see: www.climatebonds.net/2017/09/ireda-usd300m-green-masala-bond-launch-lse-climate-bonds-certified; https://economictimes.indiatimes.com/markets/bonds/how-pfc-get-record-5-demand-against-1-bn-offshore-bond-sale/articleshow/69746264.cms.

← 21. Between 2009 and 2019, over 75% of renewable energy deals involving institutional investors were in operating assets (IRENA, 2020[38]).