This chapter introduces India’s ambitious clean energy transition goals as well as the levels of finance and investment needed to achieve them. It provides an overview of the clean energy finance and investment landscape in India, highlighting current sources of finance and the opportunities and limitations involved in scaling them up to required levels. This chapter also notes that the objective of the Clean Energy Finance and Investment Roadmap for India is to build consensus on a clear action plan to scale up finance and investment in three of India’s clean energy sectors, namely energy efficiency in MSMEs, offshore wind, and green hydrogen. Finally, it describes the consultative approach employed in the development of this Roadmap and details the steps and timeline followed during the stakeholder engagement process.

Clean Energy Finance and Investment Roadmap of India

1. Introduction

Abstract

India has achieved major advances in its energy sector over the last two decades, including increasing access to electricity for more than 700 million people since 20001 and achieving remarkable growth in clean energy technologies like solar power generation and energy-efficient appliances.

Energy policy reforms over the past decade have focused on creating enabling conditions to deliver on the government’s ambitions to achieve an affordable, secure and sustainable energy system. The result has been spectacular deployment of renewable energy capacity additions and energy efficiency measures, with equally remarkable drops in technology costs. For example, the Government of India launched the UJALA light-emitting diode (LED) scheme2 in 2015 to help households to save money on their electricity bills through efficient lighting. By January 2022, more than 365 million LED lights were distributed, saving an estimated 48 terawatt-hours (TWh) of electricity over seven years and bringing the retail price of bulbs down from INR 300-350 (USD 3.80-4.50) per unit to less than INR 80 (USD 1) per bulb (PTI, 2022[1]).

Progress on clean energy technology deployment in India continues, for instance with 1.5 gigawatts (GW) of renewable electricity capacity added in the first four months of 2022, bringing the cumulative installed renewable power total to more than 155 GW.3 Still, investment in renewable energy additions and in energy efficiency measures will need to scale up considerably if India is to meet the government’s ambitions to have 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources and reduce emissions intensity of its GDP by 45 per cent by 2030, compared to 2005 levels (Government of India, 2022[2]).

The COVID-19 pandemic and consequent recession in India also brought forward the critical need to align India’s clean energy ambitions with the country’s economic recovery plans, notably putting people back to work and ensuring a just energy transition, whilst enhancing India’s capacity to achieve its sustainable development goals. For example, more than 110 million people are employed by micro, small and medium enterprises (MSMEs) in India, whose energy expenses can be as much as 35-50% of total manufacturing costs (SIDBI and ISTSL, 2016[3]). High energy intensiveness, due in part to widespread use of less-efficient technologies, can make MSMEs vulnerable to fluctuations in energy prices and can impact their overall competitiveness (Biswas, Sharma and Ganesan, 2018[4]).

Aligning recovery efforts with the clean energy transition, for instance through targeted financial vehicles for MSME energy efficiency upgradation, is therefore an enormous opportunity to spur affordable, reliable and sustainable growth in India. Not only will this realise positive impacts on climate, but it also will enable economic multiplier effects, for instance through clean energy infrastructure development and in skilled labour creation to implement India’s clean energy transition.

To unlock these opportunities, targeted application of public funds, alongside international climate and development finance, can help to increase the overall flow of capital to renewable energy and energy efficiency development in India, for instance by addressing risks in financing projects. By targeting such barriers to finance and investment, these tailored interventions – ranging from training and capacity building to support for capital market tools such as green bond issuance – can “crowd in” investors and channel private capital at the required scales to meet India’s clean energy ambitions to 2030 and beyond.

Overview of clean energy finance and investment in India

India’s intended Nationally Determined Contribution (NDC) in 2016 estimated that the country required around USD 2.5 trillion (INR 163 lakh crores) between 2015 and 2030, or roughly USD 170 billion (INR 11 lakh crores) per year, for climate action (Acharya et al., 2020[5]). Subsequent estimates suggested that as much as USD 30-33 billion (around INR 2.1-2.4 lakh crores) per year in investment was needed to reach India’s renewable energy target of 450 GW installed capacity by 2030 (Dutt et al., 2019[6]); (Government of India, 2020[7]). The government also highlighted an investment potential of INR 8.4-12.6 (USD 120-175 billion), or roughly INR 1 lakh crore (USD 15 billion) per year on average, to achieve the country’s energy-intensity reduction targets of 33-35% by 2030 (Kumar et al., 2020[8]). Financing needs could increase to achieve the updated NDC submitted by the Government of India in August 2022.

These investment needs are a substantial increase in comparison to current levels of spending on these sectors. In financial year 2019-2020, green finance flows in India amounted to USD 18 billion (INR 1.2 lakh crores) for energy efficiency and USD 22 billion (INR 1.5 lakh crores) for clean energy, driven by solar, onshore wind and hydro power (Khanna, Purkayastha and Jain, 2022[9]). India’s renewable energy sector reached USD 14.5 billion in investment in the 2021-22 financial year (Garg, 2022[10]). This was an increase of 125% over 2020-21 investments and a 72% increase over pre-COVID pandemic levels in 2019-20. Still, it is less than half the average yearly estimated investment needed to reach 2030 targets. When grid firming (e.g. batteries and demand response management) and transmission and distribution infrastructure to accommodate 450 GW are included, this annual spending would need to more than triple over the next decade (Buckley and Trivedi, 2021[11]).

Announcements made by the Honourable Prime Minister Shri Narendra Modi at the 26th Conference of the Parties (COP26) to the United Nations Framework Convention on Climate Change (UNFCCC) in November of 2021, including India’s goal to reach net-zero emissions by 2070,4 mean investment needs may be even greater. The International Energy Agency (IEA) estimates India could need as much as USD 160 billion (INR 12 lakh crores) in clean energy investment every year on average over the next decade to meet these new targets. That is more than a tripling of current estimated investment levels in clean energy development (Birol and Kant, 2022[12]). Yet, it also is an enormous opportunity to spur a major clean energy market in India.

Current sources and limitations for clean energy finance and investment

Scaling up the levels of investment needed to achieve India’s clean energy potential is feasible, but it will require new channels of financing beyond domestic financial institutions such as Larsen and Toubro, Yes Bank and Power Finance Corporation (PFC), which currently provide the bulk of clean energy finance, primarily through term loans (Esser, Gadre and Jaiswal, 2021[13]); (Vaze et al., 2019[14]). Given the quantum of financing required to 2030, these traditional lenders do not have the headroom to finance India’s 2030 targets by themselves (Garg and Sidhu, 2021[15]).

Investments in renewable energy and energy efficiency come mostly by domestic banks, such as the State Bank of India (SBI), and non-banking financial companies (NBFCs) (Dutt, Arboleya and Mahadevan, 2019[16]). There has been a sharply increasing interest from international banks to finance clean energy projects via the external commercial borrowing route set up by the Reserve Bank of India, in particular through green bonds and sustainable bonds (The Hindu Business Line, 2022[17]). As these financings are usually denominated in USD, the competitiveness and attractiveness of these instruments may be challenged by the recent spike in the global interest rates.

One important challenge for current debt market financing of clean energy projects in India is the capacity to scale up this lending. For instance, exposure limits and bank liability profiles can be an issue for increased financing of energy efficiency projects, particularly in extending additional credit to segments such as MSMEs, which already fall under priority sector lending rules. Power sector credit exposure ceilings and bank liability profiles also affect capacity to increase lending for renewable energy projects. In fact, aggregate power sector exposure (across all generation types, transmission and distribution) for Indian banks was around INR 6 lakh crores (roughly USD 77 billion) in March of 2020, or around ten times the annual lending to renewable energy projects. When including Rural Electrification Corporation Limited and Power Finance Corporation, the two predominant NBFCs that lend to power projects, this outstanding exposure was more than INR 13 lakh crores (USD 168 billion) (Garg and Sidhu, 2021[15]).

Changes in late 2020 by the Reserve Bank of India (RBI) doubled the loan limit for individual renewable energy projects as priority sector lending to INR 30 crores (about USD 4 million) (RBI, 2020[18]). Yet in practice, this regulatory change does not necessarily address limits in lending for large-scale projects, such as capital-intensive offshore wind installations (Jai, 2020[19]). The RBI guidelines also did not directly address an underlying issue facing domestic financial institutions in extending new credit to clean energy projects: notably that already stressed assets, including non-renewable power generation, are a challenge to increased lending for clean energy projects. This challenge was only exacerbated by the global health pandemic and subsequent economic recession (Kaur, 2019[20]); (Dutt, 2021[21]); (PTI, 2021[22]).

A secondary loan market could help to address some of these limitations in sector lending, as has been the case in countries with robust clean energy markets. Yet, such a secondary market was only recently established in 2021 under a new self-regulatory body set up by ten lenders, including the State Bank of India, as per recommendations by an RBI taskforce (ETBFSI, 2021[23]). A deeper and more liquid bond market in India would also help to recycle capital by offloading existing assets from banks and NBFCs to institutional and retail investors (Sandhu et al., 2018[24]). In fact, foreign bond markets have already been used by a number of Indian renewable energy developers to refinance debt at more attractive terms, mainly for projects that have reached operational phase and therefore bear limited or no construction risks. Yet, use of these secondary markets for capital recycling remains limited, in part due to concentration of India’s bond market in highly rated securities (i.e. AA and AAA ratings), which can be challenging for clean energy projects to achieve without an enhancement mechanism such as credit guarantee (Singh, Purkayastha and Shrimali, 2019[25]).

There are other, additional challenges to current clean energy finance and investment in India. One is that domestic financiers typically do not provide fixed-price loans for long-term tenure (15-18 years) for clean energy projects (Sandhu et al., 2018[24]). This is a particular challenge for capital-intensive clean energy projects, such as large-scale wind farms, especially when projects have longer payback periods. Many “deep” energy efficiency measures that achieve substantial energy reductions (e.g., 30-50% or more) also often have longer returns on investment, and thus can require long-term financing.

These issues are compounded by the overall cost of debt in India, including high variable interest rates, especially for smaller-scale clean energy projects like distributed renewable energy generation and MSME energy efficiency upgrades. For example, the cost of finance accounts for 50-60% of renewable energy tariffs in India (Chawla, Aggarwal and Dutt, 2016[26]). High cost of finance equally affects private sector spending. For instance, Indian corporates looking to issue bonds for clean energy projects can pay high coupons, as rates of the government-issued bonds are equally high (Vaze et al., 2019[14]). Thus, concessional finance could alleviate real and perceived risks and play a catalytic role to attract private sector participation. MDBs have engaged to provide consistent financial flows to support country’s low-carbon pathways and have committed USD 66 billion in climate finance globally in 2020 (EBRD et al., 2021[27]). For instance, the Climate Investment Funds’ (CIF) Clean Technology Fund has track record of supporting technologies such as solar power in India, working with Multilateral Development Banks (MDBs) that implement CIF funding (Invest India, 2021[28]).

Addressing these limitations and enabling the scale of capital needed to achieve India’s clean energy targets to 2030 and beyond will thus require measures to address current risks and limitations in financing renewable energy and energy efficiency projects. This includes extracting lessons learned and good practices from global experiences in applying public funds to leverage private capital for clean energy projects (Box 1.1), especially as the Covid pandemic since 2020 and the global energy crisis since 2021 have shed light on the limited availability of public finance to achieve clean energy objectives. The overall scale of financing needed in India also requires use of instruments that can attract new investors and tap into capital markets, particularly as domestic banks and NBFCs realistically cannot double or triple their current levels of lending to projects.

Box 1.1. Global experiences in catalysing clean energy finance and investment

Lessons from global experiences in clean energy finance and investment show that targeted public interventions can support increased flows of capital to projects (Steffen, Egli and Schmidt, 2020[29]); (Wuester, Jungmin Lee and Lumijarvi, 2016[30]). For example, risk mitigation tools, such as the Partial Risk Sharing Facility (PRSF) for energy efficiency projects in India, have mobilised commercial capital for clean energy projects. Other transaction enablers, such as on-lending and co-lending structures, have helped financial institutions to gain confidence in lending to clean energy projects.

Common threads from experiences in applying and developing these financing vehicles highlight the importance of identifying the right instrument, where tailored solutions that address specific needs help to pave the way for private capital (OECD, 2021[31]). For instance, blended finance mechanisms have helped to de-risk investment in solar energy development and to leverage commercial finance for those projects. These solutions work best when interventions engage the right partners to ensure effective design and application. Lessons equally show that interventions are most effective when considering the eventual needs and risks of potential investors (OECD, 2022[32]).

The OECD Clean Energy Finance and Investment Mobilisation (CEFIM) programme works with governments, international partners and private sector actors to build evidence-based analysis on these tools and the market conditions that can improve finance and investment in clean energy development. A growing compendium of case studies and crosscutting analysis is available online and aims to provide a knowledge hub on experiences with solutions that can mobilise capital for clean energy projects.

Note: More information on the PRSF is available at www.sidbi.in/en/prsf-project. Further information on CEFIM programme analyses can be found at www.oecd.org/cefim/cross-cutting-analysis/.

Investor appetite and opportunities to channel capital for clean energy development

Clean energy projects in India already attract a wide variety of domestic and foreign investors, where India was ranked the most attractive emerging market for clean energy investment in Bloomberg New Energy Finance’s Climatescope in 2019 (BloombergNEF, 2020[33]). In recent years, large clean energy players such as ReNew Power, Adani Green Energy, Greenko, Hero Future Energies and Azure Power have looked to tap into this investor appetite, issuing green bonds in overseas markets with an average oversubscription of 370%. Strong market response equally helped developers to tighten bond pricing, with an average interest rate of 4.2% in 2021 (Garg and Sidhu, 2021[15]).

Clean energy development is also attracting growing investment in Indian companies. For example, a consortium of investors led by BlackRock and the United Arab Emirates sovereign wealth fund, Mubadala, announced in April of 2022 that it was buying a 10.5% stake in Tata Power Renewables for USD 525 million (around INR 4 thousand crore) (Proctor, 2022[34]). In 2021, Total France acquired a 20% stake in Adani Green Energy, including a 50% stake in 2.35 GW of operating solar assets, for a landmark USD 2.5 billion (INR 18 000 crore) (Jai, 2021[35]). Emerging clean energy segments, such as green hydrogen development, have likewise raised considerable interest with international players. This includes a number of announcements in 2021 and 2022 for direct investments, joint ventures and co-operative agreements, such as a memorandum of understanding signed in 2021 between Ayana Renewable Power and the Norwegian company, Greentat (REGlobal News, 2021[36]).

These positive developments highlight the opportunity to channel private capital to clean energy projects in India and to increase the overall flow of financing for India’s clean energy transition beyond traditional lending by domestic financial institutions. The growing use of capital market instruments like green bond issuances also illustrates the central role environmental, social and governance (ESG) funds can play in scaling up finance and investment in clean energy development. ESG loans and green bonds in India already represent more than USD 40 billion in cumulative debt issuances since 2010, where the energy sector has been the biggest recipient to date (Srivastava, 2022[37]). Substantial opportunity remains to tap into this growing market for India’s clean energy development ambitions, where nearly USD 650 billion poured into ESG-focused funds globally in 2021 (Kerber and Jessop, 2021[38]).

Objective of this Roadmap

Enabling the prospects for sustainable recovery and unlocking the necessary capital to achieve India’s clean energy ambitions requires a paradigm shift in current finance and investment. This includes channelling considerably greater levels of private capital to clean energy projects and attracting new investors such as ESG-focused funds.

Achieving this transformation will require a variety of measures that address risks and barriers for clean energy finance and investment through more targeted application of public finance, international climate and development funds, and other related support mechanisms. These can increase the pipeline of clean energy projects in India, redouble investor opportunities and crowd-in private sector finance.

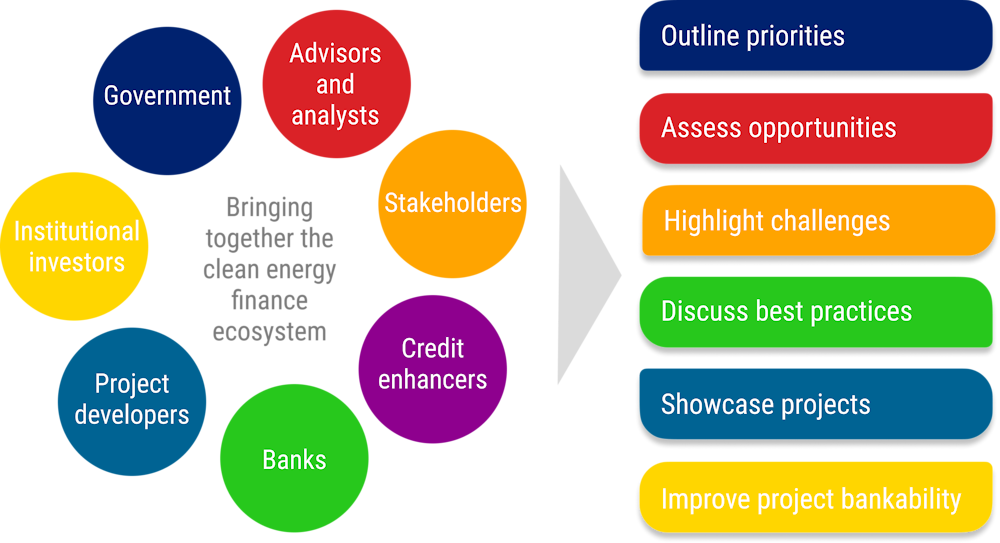

This Roadmap thus aims to bring government and private sector stakeholders together to agree upon a clear action plan that identifies and addresses bottlenecks complicating or constraining finance and investment in India’s clean energy sector (Figure 1.1). Specifically, the Roadmap seeks to identify solutions that can scale up finance and investment in offshore wind, green hydrogen and MSME energy efficiency upgradation.

The three focus areas have been selected in line with government priorities to unlock the potential for these segments within India’s economic recovery plans and its Aatma Nirabhar Bharat (Self-reliant India) ambitions. The energy efficiency focus is on MSMEs, specifically addressing the challenge to access finance for these actors, although some recommendations can be extended to all sectors and industries. For renewable energy, OECD and NRDC discussed multiple priority areas with stakeholders, at distributed and utility-scale renewable additions, including for emerging market opportunities. The choice of offshore wind and green hydrogen lies in the need to anticipate solutions to develop emerging sectors to overcome issues with early inertia and to bring down costs down, even as mature markets like solar and onshore wind continue to evolve.

Figure 1.1. Roadmap overview

Note: Unless otherwise noted, figures by the CEFIM programme.

In the following sections, this Roadmap outlines key challenges to scaling up capital for these three clean energy segments, as well as opportunities to tailor policy and market interventions to unlock private capital for these sectors whilst lowering the overall cost of finance for projects. Through stakeholder consultations and engagement across a number of fora, including the three workshops (described below), the Roadmap takes into account current market conditions, including as global economy recovers from the COVID-19 recession. It also considers investor expectations and emerging market trends in order to identify solutions that can scale up finance and investment in India’s clean energy projects, for instance as financial actors increasingly look for more climate and ESG-aligned investments.

Lastly, the Roadmap provides recommendations on actions that can be operationalised by the government with development partners, international donors and private sector stakeholders in order to unlock the capital needed to finance the clean energy transition in India. This includes suggestions on policy tools and potential investment vehicles that will help attract private capital at suitable scales.

Roadmap process and approach

The Roadmap is a strategic plan that describes the steps needed to unlock clean energy finance and investment for offshore wind, green hydrogen and MSME energy efficiency upgradation. This strategy was developed through a process that is as important as the plan itself, as the Roadmap aims to engage stakeholders in a common course of action that outlines priority areas and that assesses opportunities to address barriers to clean energy finance and investment through targeted actions. Through this process of engagement, the Roadmap aims to bring forward best practices and innovative solutions to improve the overall flows of capital to offshore wind, green hydrogen and MSME energy efficiency measures, both by improving the bankability of these projects and by attracting new investors to them.

The Roadmap process (Figure 1.2) was launched in June of 2021 with the formation of a government Steering Committee and Technical Working Groups (see below). Over the course of 2021-22, the core Roadmap team, led by the OECD and NRDC, engaged with stakeholders in a series of consultations and three workshops.

These dialogues and stakeholder consultations highlighted several policy and market issues that may be hindering the flow of finance for clean energy development, in addition to recommendations on potential ways to overcome these barriers. The Roadmap subsequently proposes actions to implement these solutions in the next three to five years and aims to build consensus across government and partners on steps to operationalise these measures and unlock India’s clean energy potential to 2030 and beyond.

Figure 1.2. Roadmap process through stakeholder engagement

Note: The colour coding suggests which actors can lead some key process steps, but several steps would involve several, if not all, listed stakeholder groups.

Roadmap Steering Committee & Technical Working Groups

The Roadmap was developed under the guidance of a Steering Committee comprised of representatives from diverse ministries across the government of India and chaired by the Ministry of New and Renewable Energy. Steering Committee members included:

Shri Dinesh Jagdale, Joint Secretary of the Ministry of New and Renewable Energy (MNRE)

Shri Aseem Kumar, Director (MNRE)

Shri Suman Chatterjee, Deputy Secretary of the Ministry of Power

Shri Abhay Bakre, Director General of the Bureau of Energy Efficiency (BEE)

Shri Ashok Kumar, Deputy Director General (BEE)

Md. Noor Rahman Sheikh, Joint Secretary of the Ministry of External Affairs

Shri Anand Kumar, Director, Ministry of Finance, Department of Economic Affairs

Smt. Kanchan Bhalla, Deputy General Manager, Indian Renewable Energy Development Agency

Shri Rajnath Ram, Advisor, Advisor, National Institution for Transforming India (NITI Aayog).

In addition, two Technical Working Groups were formed under the Steering Committee on renewable energy and energy efficiency (Table 1.1). These working groups deliberated key issues for clean energy projects and provided valuable feedback throughout the Roadmap process. They were comprised of representatives from government, industry, financial institutions and policy advisors.

Table 1.1. Technical Working Group Members

|

Renewable Energy |

Energy Efficiency |

|

Ministry of New and Renewable Energy (MNRE) |

Ministry of Power (MoP) |

|

National Institute of Wind Energy (NIWE) |

Bureau of Energy Efficiency (BEE) |

|

National Institute of Solar Energy (NISE) |

Small Industries Development Bank of India (SIDBI) |

|

National Institution of Bio-Energy (NIBE) |

Energy Efficiency Services Limited (EESL) |

|

Indian Renewable Energy Development Agency (IREDA) |

Power Finance Corporation (PFC) |

|

Solar Energy Corporation of India Limited (SECI) |

Confederation of Indian Industry (CII) |

|

Small & Medium Enterprises (SME) Chamber of India |

|

|

Ministry of Finance Department of Economic Affairs (DEA) |

|

|

Council on Energy, Environment and Water (CEEW) |

|

Stakeholder consultations

To prepare the Roadmap and gather stakeholder inputs, the OECD and NRDC held consultations with more than 115 people across 54 organisations leading to the Roadmap workshops (see below). These consultations helped to improve understanding of the critical needs and expectations (e.g. risk and return profiles) of key actors engaged in clean energy project development, finance and investment. Stakeholders consulted included a range of actors from project developers and energy firms, industry and industry associations to government officials, financial actors, international donors and multilateral institutions, think tanks and non-governmental associations. Inputs and information from these consultations helped to frame the three Roadmap workshops. Stakeholders also provided invaluable feedback on recommendations for actions that can be taken to improve finance flows and attract investors for clean energy development in India.

Workshops

The Roadmap process brought together stakeholders through a series of three workshops:

Workshop I (March 2022) to assess critical barriers and opportunities to prioritise action that improve clean energy finance and investment;

Workshop II (May 2022) to identify and assess innovative solutions and effective investment vehicles that can deepen capital markets and mobilise stakeholders and investors;

Workshop III (August 2022) to deep dive into two selected recommendations: an Energy Savings Insurance scheme for India (see Annex C) and blended finance facilities for Offshore Wind and Green Hydrogen (see Annex D).

In total, the three workshops brought together more than 200 participants from over 85 organisations representing government, civil society, industry, developers, financial institutions, international donors and multilateral development agencies. These workshops helped to bring forth a number of key opportunities and barriers that form the foundation of the Roadmap action plan, built on consensus from the workshop discussions. Summaries of the workshops are available at www.oecd.org/cefim/india/roadmap/.

References

[5] Acharya, M. et al. (2020), Landscape of Green Finance in India, Climate Policy Initiative (CPI), Delhi, https://www.climatepolicyinitiative.org/publication/landscape-of-green-finance/ (accessed on 27 May 2022).

[12] Birol, F. and A. Kant (2022), On track for 2070 net zero target: India’s clean energy transition is rapidly underway, benefiting the entire world, The Times of India, https://timesofindia.indiatimes.com/blogs/toi-edit-page/on-track-for-2070-net-zero-target-indias-clean-energy-transition-is-rapidly-underway-benefiting-the-entire-world/ (accessed on 27 May 2022).

[4] Biswas, T., S. Sharma and K. Ganesan (2018), Energy Efficiency Initiatives & Conservation Schemes by Indian MSMEs, Council on Energy, Environment and Water (CEEW), https://www.ceew.in/publications/factors-influencing-uptake-energy-efficiency-initiatives-indian-msmes (accessed on 27 May 2022).

[33] BloombergNEF (2020), Global investors’ appetite for Indian green firms rising, Bloomberg, https://www.bloomberg.com/professional/blog/global-investors-appetite-for-indian-green-firms-rising/ (accessed on 30 May 2022).

[11] Buckley, T. and S. Trivedi (2021), Capital Flows Underpinning India’s Energy Transformation Global Capital Is Primed and Ready, Institute for Energy Economics and Financial Analysis (IEEFA), https://ieefa.org/wp-content/uploads/2021/02/Capital-Flows-Underpinning-Indias-Energy-Transformation_February-2021.pdf (accessed on 12 June 2022).

[26] Chawla, K., M. Aggarwal and A. Dutt (2016), Analyzing the falling solar and wind tariffs: evidence from India, Asian Development Bank Institute, https://www.adb.org/publications/analyzing-falling-solar-wind-tariffs-evidence-india (accessed on 30 May 2022).

[21] Dutt, A. (2021), Funding India’s clean energy transition, The Hindu BusinessLine, https://www.thehindubusinessline.com/opinion/funding-indias-clean-energy-transition/article34085175.ece (accessed on 30 May 2022).

[16] Dutt, A., L. Arboleya and B. Mahadevan (2019), Clean Energy Investment Trends 2019: Evolving Risk Perceptions for Grid-Connected Renewable Power Projects in India, International Energy Agency (IEA) and the Council on Energy, Environment and Water (CEEW), https://www.ceew.in/publications/clean-energy-investment-trends-2019 (accessed on 27 May 2022).

[6] Dutt, A. et al. (2019), Financing India’s Energy Transition A Guide on Green Bonds for Renewable Energy and Electric Transport, Council on Energy, Environment and Water (CEEW), https://www.ceew.in/sites/default/files/ceew-study-on-greenbonds-for-renewable-energy-and-electric-transport-india-17Jun19.pdf (accessed on 30 May 2022).

[27] EBRD et al. (2021), 2020 Joint Report on Multilateral Development Banks’ climate finance.

[13] Esser, S., R. Gadre and S. Jaiswal (2021), 2030 India Roadmap Multiplying the Transition: Market-based solutions for catalyzing clean energy investment in emerging economies, BloombergNEF and Climate Investment Funds (CIF), https://www.climateinvestmentfunds.org/sites/cif_enc/files/knowledge-documents/bnef-cif_fi_project_2030_roadmap_slide_deck_india.pdf (accessed on 11 June 2022).

[23] ETBFSI (2021), Secondary loan market association: Secondary loan market may help banks exit stressed loans, The Economic Times Banking, Financial Services and Insurance (ETFSI) News, https://bfsi.economictimes.indiatimes.com/news/banking/secondary-loan-market-may-help-banks-exit-stressed-loans/85425946 (accessed on 30 May 2022).

[15] Garg, S. and G. Sidhu (2021), Thriving domestic green bonds market key to India’s energy transition, The Financial Express, https://www.financialexpress.com/opinion/thriving-domestic-green-bonds-market-key-to-indias-energy-transition/2339722/ (accessed on 30 May 2022).

[10] Garg, V. (2022), Renewable Energy Investment Surges in India, Institute for Energy Economics and Financial Analysis (IEEFA), https://ieefa.org/resources/renewable-energy-investment-surges-india (accessed on 10 June 2022).

[2] Government of India (2022), India’s Updated First Nationally Determined Contribution Under Paris Agreement (2021-2030).

[7] Government of India (2020), Economic Survey, Ministry of Finance, Delhi, https://www.indiabudget.gov.in/budget2020-21/economicsurvey/ (accessed on 27 May 2022).

[28] Invest India (2021), Climate Investment Funds’ Action Plan in India, https://www.investindia.gov.in/team-india-blogs/climate-investment-funds-action-plan-india (accessed on 10 September 2022).

[35] Jai, S. (2021), TOTAL France to acquire 20% stake in Adani Green Energy for $2.5 bn, Business Standard News, https://www.business-standard.com/article/companies/total-france-to-acquire-20-stake-in-adani-green-energy-for-2-5-bn-121011800425_1.html (accessed on 12 June 2022).

[19] Jai, S. (2020), Doubling priority lending for renewables to help only small installations, The Business Standard, https://www.business-standard.com/article/economy-policy/doubling-priority-lending-for-renewables-to-help-only-small-installations-120090600370_1.html (accessed on 27 May 2022).

[20] Kaur, A. (2019), “NBFCs faced severe liquidity crunch after mutual funds stopped refinancing loans: Economic Survey”, The Economic Times, https://economictimes.indiatimes.com/mf/mf-news/nbfcs-faced-severe-liquidity-crunch-as-mutual-funds-stopped-refinancing-loans-economic-survey/articleshow/70069512.cms?from=md (accessed on 30 May 2022).

[38] Kerber, R. and S. Jessop (2021), Analysis: How 2021 became the year of ESG investing, Reuters, https://www.reuters.com/markets/us/how-2021-became-year-esg-investing-2021-12-23/ (accessed on 6 June 2022).

[9] Khanna, N., D. Purkayastha and S. Jain (2022), Landscape of Green Finance in India, Climate Policy Initiative.

[8] Kumar, A. et al. (2020), Unlocking National Energy Efficiency Potential (UNNATEE): Strategy Plan Towards Developing an Energy Efficient Nation (2017-2031), PricewaterhouseCoopers Pvt. Ltd, https://beeindia.gov.in/latest-news/unlocking-national-energy-efficiency-plan-unnatee-report.

[32] OECD (2022), “OECD blended finance guidance for clean energy”, OECD Environment Policy Papers, No. 31, OECD Publishing, Paris, https://doi.org/10.1787/596e2436-en.

[31] OECD (2021), Global experience in catalysing renewable energy finance and investment, Organisation for Economic Co-operation and Development (OECD), https://www.oecd.org/cefim/india/global-study/ (accessed on 1 October 2021).

[34] Proctor, D. (2022), BlackRock-led Group Invests $525M Toward India Renewable Energy, Power, https://www.powermag.com/blackrock-led-group-invests-525m-toward-india-renewable-energy/ (accessed on 30 May 2022).

[1] PTI (2022), “Govt distributes 36.78 cr LEDs under UJALA scheme”, The Economic Times of India, https://economictimes.indiatimes.com/industry/energy/power/govt-distributes-36-78-cr-leds-under-ujala-scheme/articleshow/88710534.cms?from=mdr (accessed on 27 May 2022).

[22] PTI (2021), NBFCs’ stressed assets may touch Rs 1.5-1.8 lakh crore by March-end: Report, The Economic Times, https://economictimes.indiatimes.com/industry/banking/finance/nbfcs-stressed-assets-may-touch-rs-1-5-1-8-lakh-crore-by-march-end-report/articleshow/80995431.cms (accessed on 30 May 2022).

[18] RBI (2020), RBI Releases Revised Priority Sector Lending Guidelines, Reserve Bank of India - Press Release 2020-2021/284, https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=50310 (accessed on 31 May 2022).

[36] REGlobal News (2021), Ayana Renewable Power, Greenstat Hydrogen India sign a MoU for hydrogen technology development, https://reglobal.co/ayana-renewable-power-greenstat-hydrogen-india-sign-a-mou-for-hydrogen-technology-development/ (accessed on 30 May 2022).

[24] Sandhu, P. et al. (2018), Clean Energy for All: Framework for Catalytic Finance for Underserved Clean Energy Markets in India, Natural Resources Defense Council (NRDC) and the Center on Energy, Environment and Water (CEEW), https://www.nrdc.org/sites/default/files/catalytic-finance-underserved-clean-energy-markets-india-report-201810.pdf (accessed on 30 May 2022).

[3] SIDBI and ISTSL (2016), Unlocking the Energy Efficiency Potential in MSMEs through 4E (End to End Energy Efficiency) Programme.

[25] Singh, D., D. Purkayastha and G. Shrimali (2019), From Banks to Capital Markets: Alternative Investment Funds as a Potential Pathway for Refinancing Clean Energy Debt in India, Climate Policy Initiative (CPI), http://climatepolicyinitiative.org/wp-content/uploads/2019/07/Alternative-Investment-Funds-as-a-Potential-Pathway-for-Refinancing-Clean-Energy-Debt-in-India.pdf (accessed on 30 May 2022).

[37] Srivastava, S. (2022), IEEFA India: The rise of ESG investing and sustainability reporting | IEEFA, Institute for Energy Economics and Financial Analysis (IEEFA), https://ieefa.org/articles/ieefa-india-rise-esg-investing-and-sustainability-reporting (accessed on 6 June 2022).

[29] Steffen, B., F. Egli and T. Schmidt (2020), “The Role of Public Banks in Catalyzing Private Renewable Energy Finance”, Renewable Energy Finance, pp. 197-215, https://doi.org/10.1142/9781786348609_0009.

[17] The Hindu Business Line (2022), Economic Survey for 2021-22: Liberalised ECB norms enabled renewable energy companies to tap overseas funding, https://www.thehindubusinessline.com/news/economic-survey-liberalised-ecb-norms-enabled-renewable-energy-companies-to-tap-overseas-funding/article64959811.ece (accessed on 10 September 2022).

[14] Vaze, P. et al. (2019), Securitisation as an enabler of green asset finance in India, Climate Bonds Initiative, London, https://www.climatebonds.net/files/reports/securitisation-as-an-enabler-of-green-asset-finance-in-india-report-15052020.pdf (accessed on 27 May 2022).

[30] Wuester, H., J. Jungmin Lee and A. Lumijarvi (2016), Unlocking Renewable Energy Investment: The role of risk mitigation and structured finance, International Renewable Energy Agency (IRENA), Abu Dhabi, https://www.irena.org/publications/2016/Jun/Unlocking-Renewable-Energy-Investment-The-role-of-risk-mitigation-and-structured-finance (accessed on 6 June 2022).

Notes

← 1. For more information on energy access improvements, see: https://www.iea.org/topics/energy-access.

← 2. For more information on the UJALA LED scheme, visit: http://ujala.gov.in/.

← 3. Installed renewable electricity capacity includes large hydropower. For more information on renewable energy additions and total installed power generation capacity, see: https://mnre.gov.in/the-ministry/physical-progress and https://powermin.gov.in/en/content/power-sector-glance-all-india.

← 4. See Prime Minister Shri Narendra Modi’s remarks at COP26: www.mea.gov.in/Speeches-Statements.htm?dtl/34466/National+Statement+by+Prime+Minister+Shri+Narendra+Modi+at+COP26+Summit+in+Glasgow.