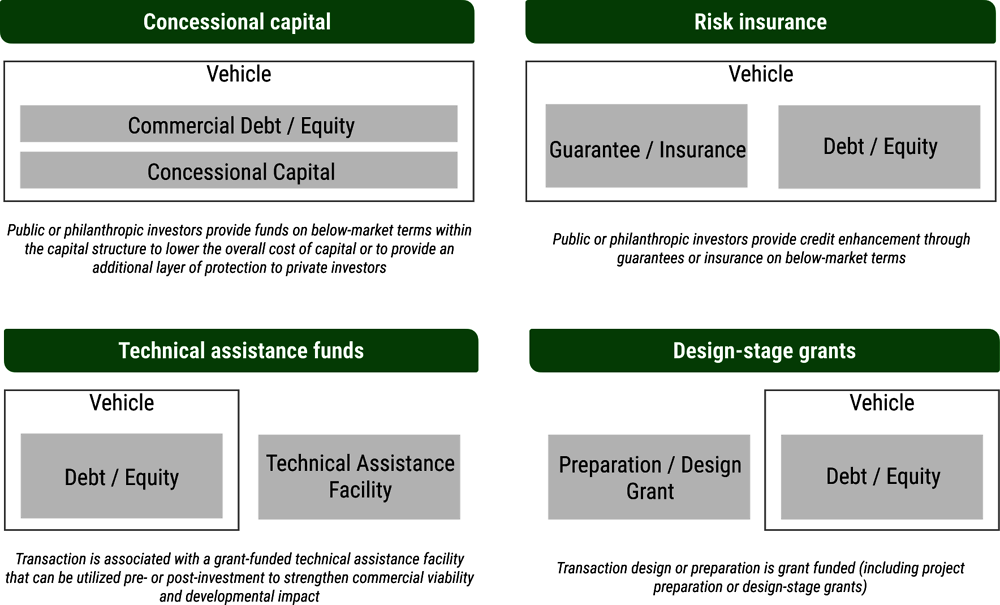

Blended finance has mobilized approximately $171 billion in capital towards sustainable development in developing countries to-date (Convergence, 2021[1]). In accordance with OECD definitions,1 blended finance structures can involve concessional funding from public or philanthropic sources mobilising private capital for projects that cannot raise commercial finance on their own,2 primarily because perceived and real risk are too high for private investors. Governments (including development co-operation agencies) represent close to 69% of the total capital in blended finance funds and facilities, and MDBs are the second largest source of capital (Dembele et al., 2022[2]).

Establishing sectoral blended finance facilities for (a) offshore wind and (b) green hydrogen in India could allow various organisations to invest alongside each other while achieving their own objectives. In particular, these facilities could be integrated in development strategies and sector investment plans of the Government of India, with the ultimate goal to lower the levelized cost of clean energy and develop self-sustaining private investment market.

The blended finance facilities should provide a limited window of concessionality to serve the first few gigawatts until a target cost of energy is achieved, with the objective of lowering risks and the cost of capital to build self-sustaining private investment markets. To this end, the facilities would channel funds from domestic and international donors and financial institutions. Blended Finance facilities can be supported by broader activities, such as the identification of projects (e.g. through the National Infrastructure Pipeline), or the development of knowledge and training resources for offshore wind and green hydrogen.

While detailed needs assessment must be undertaken, this concept note outlines the key elements to address in the process of designing and setting up such facilities.3