This chapter delves into the financing and investment required to develop India’s green hydrogen sector by 2030. It provides an overview of the current trends of the hydrogen market in India and summarises key announcements related to green hydrogen to date. It also highlights the barriers associated with green hydrogen development at various stages of the value chain and in order to scale up financing. This chapter then proposes seven recommendations on improving the enabling environment and financial support schemes to unlock required capital to meet 2030 targets.

Clean Energy Finance and Investment Roadmap of India

4. Green hydrogen

Abstract

Green hydrogen produced from clean energy sources like solar and wind power is an opportunity to reduce carbon emissions, contributing potentially to around 10% of global emissions reduction efforts needed by mid-century (IRENA, 2022[1]). It could substitute grey hydrogen, produced from fossil-fuels, for current applications mainly in refineries and fertiliser production plants, as well as replace coal and natural gas in various industries such as shipping and steelmaking.

India is fortunate to have high-quality, low-cost renewable energy resources that can produce green hydrogen. This can be used in different applications, either as direct use, for example in industry, or for eventual use and export of hydrogen carriers and products, such as green ammonia and fertilizers. These applications can also help to increase penetration of renewable energy in India’s energy system, improving the reliability of domestic energy networks (ESMAP, 2020[2]).

The complexity of the hydrogen value chain requires approaching development from a systems perspective to encompass barriers and opportunities across the future entire value chain, including identification of where green hydrogen can bring benefits, given national circumstances and priorities. India has a favourable background for the development of green hydrogen production and use, but the current ecosystem is still at an early stage and will require considerable efforts to unlock this potential through achievement of large-scale projects (FTI Consulting, 2020[3]).

Overview of India’s hydrogen market and trends to date

Several announcements in recent years have promised to deliver domestic electrolyser manufacturing capacity and green hydrogen production in India (Table 4.1). These announcements have been supported by initiatives looking to unlock the potential for green hydrogen production and use. For example, several global energy and industrial majors have announced strategies and investment initiative. Some of them came together to set up the India Hydrogen Alliance (IH2A) in March of 2021, focusing on measures to commercialise hydrogen technologies and systems in India and covering the entire value chain from production to transport and industrial use-cases (Box 4.1). In March of 2022, six companies from the renewable energy sector similarly created the Independent Green Hydrogen Association (IGHPA), which works as an advocacy group to provide inputs for the development of India’s green hydrogen and ammonia policy framework.

The Ministry of Power released the Green Hydrogen Policy in February of 20221. This policy addressed several salient risks and barriers to the development of green hydrogen and green ammonia with respect to the delivery of renewable power, including considerations for open access, banking and transmission costs. For example, the government will waive interstate transmission fees for 25 years for all projects commissioned before June 30, 2025. It also will allow 30 days of renewable energy banking for green hydrogen and green ammonia producers. These measures could decrease the transmission cost by a factor of four and reduce the cost of green hydrogen by as much as INR 60 (USD 0.8) per kg, or roughly a 20% decrease in expected green hydrogen production costs without this support (KPMG India, 2022[4]). The Green Hydrogen and Green Ammonia Policy also entails demand-side measures, such as qualifying the renewable energy purchased for green hydrogen and green ammonia production under RPOs. This measure has been confirmed in the Green Energy Open Access Rules notified by the Ministry of Power in July 2022 (PIB, 2022[5]). Additionally, MNRE will set up a single portal for all statutory clearances for the manufacturing, transport and storage of green hydrogen and green ammonia.

Table 4.1. Examples of announcements on the field of green hydrogen in India

|

Companies |

Date |

Type |

Description |

|---|---|---|---|

|

Reliance Industries Limited Stiesdal |

12 October 2021 |

Partnership |

Co-operation agreement on technology development and manufacturing of electrolysers in India, based on the HydroGen technology developed by Stiesdal. |

|

Ohmium |

24 November 2021 |

Electrolyser delivery |

The Indian subsidiary of Ohmium has shipped its first unit of electrolyser to the United States. It has been produced in its Bengaluru plant, which has a manufacturing capacity of 500 MW per annum. |

|

Larsen & Toubro HydrogenPro |

27 January 2022 |

Manufacturing capacity |

Memorandum of Understanding to set up a joint venture in India for Gigawatt-scale manufacturing of Alkaline Water Electrolysers based on HydrogenPro technology for the Indian market. |

|

Indian Oil Corporation |

22 February 2022 |

Electrolyser installation |

Plans to set up green hydrogen plants at its Mathura (40 MW electrolyser) and Panipat (15 MW electrolyser) refineries by 2024 to replace carbon-emitting units |

|

Greenko John Cockerill |

12 April 2022 |

Manufacturing capacity |

Partnership to develop a manufacturing capacity of 2 GW per annum and jointly develop large-scale green hydrogen projects |

|

Ayana Renewable Power Greenstat |

2 May 2022 |

Partnership |

Joint Development Agreement for development of green hydrogen projects powered by renewable energy The initial pilot project will be launched in Karnataka. |

|

Adani New Industries TotalEnergies |

14 June 2022 |

Acquisition |

TotalEnergies has acquired a 25% stake in Adani New Industries, planning to build capacity to produce a million tonnes of green H2 annually by 2030. Its first project will be a 2 GW electrolyser powered by 4 GW of wind and solar. |

|

Jindal Stainless (Hisar) Ltd Hygenco India |

10 August 2022 |

Partnership |

The companies have announced a partnership to install a Green Hydrogen Plant. that will enable to reduce the stainless steel company’s CO2 emissions by nearly 2 700 metric tonnes per annum. |

|

Ohmium |

8 September 2022 |

Electrolyser delivery |

Ohmium has signed an agreement to provide 343 megawatts of Proton Exchange Membrane (PEM) electrolysers to Tarafert, that is developing a large-scale urea fertilizer and green ammonia production facility in Mexico. The electrolyser will be manufactured in India, and the first 69 MW are to be delivered in 2025. |

Note: This table is a non-exhaustive list and just aims to highlight the momentum of announcements during the preparation of this Roadmap.

State governments are also taking action to bolster the policy environment set forth by the Ministry of Power. For example, the government of Tamil Nadu announced in April of 2022 the preparation of a Green Hydrogen Policy (The Indian Express, 2022[15]). The state of Kerala similarly aims to develop hydrogen-fuelled vehicles, focusing on heavy duty vehicles such as buses and trucks, and it announced a pilot project with ten buses supported by a viability gap funding of INR 10 million (USD 128 000) from the state’s government budget. Furthermore, Kerala is investigating industrial usages in refineries and is planning to develop hydrogen valleys inspired by international experience (Jyothilal, 2022[16]).

Box 4.1. India Hydrogen Alliance activities

Global energy and industrial majors have launched the IH2A in March of 2021 to support public policy and private sector actions in support of a domestic hydrogen supply chain in India.

A Steering Group comprised of Chart Industries, Reliance Industries Limited (RIL) and JSW Steel leads the coalition, supported by the work of six working groups covering the value chain, including:

Hydrogen production and electrolyser/fuel-cell manufacturing

Storage and transport

Hydrogen valleys

Steel and cement

Refineries and fertilisers

Heavy-duty vehicles

In March of 2022, IH2A proposed seven steps to commercialise green hydrogen in India, emphasising in particular the benefits to create a pipeline of green hydrogen hubs for GW-scale projects. This would be supported by public-private consortiums. The proposal highlighted opportunities to collaborate with multilateral development banks and government agencies to de-risk early market development. Capital-intensive funding required for large-scale projects could additionally rely on corporate and sovereign green bonds, global climate finance commitments, or a USD 1 billion (INR 0.75 lakh crore) Hydrogen Economy Development Fund, as proposed by IH2A in January of 2022.

In addition, IH2A proposed to lead a public-private H2Bharat Taskforce to identify and shortlist five GW-scale national green hydrogen hubs by mid-2023, bringing together all relevant stakeholders from the government, funding agencies and the industry.

Source: https://ih2a.com/.

Green hydrogen ambitions to 2030

India has taken initial steps to explore hydrogen as a source of energy. MNRE released a first roadmap for hydrogen fuel in 2006 (MNRE, 2006[17]), and hydrogen discussions resurfaced in recent years, for instance when Prime Minister Shri Narendra Modi announced plans for a National Hydrogen Energy Mission at the third Global Renewable Energy Investment Meeting and Expo in November of 2020.2 The Mission was then launched at India’s 75th Independence Day in August of 2021. The Ministry of New and Renewable Energy has accordingly prepared a draft Mission document. The draft Mission proposes a framework inter-alia for a phased implementation approach, demand creation, a basket of measures to support production and utilization of green hydrogen, support for indigenous manufacturing, Research & Development, pilot projects, enabling policies and regulations, and infrastructure development (PIB, 2022[18]). It includes plans to build upon expected growth in India’s hydrogen demand, for example in the fertilizer and refinery industries, which could increase from around 7 million tonnes in 2021 to nearly 12 million tonnes by 2030 (H2WorldNews, 2021[19]), and a target to produce 5 million tonnes of green hydrogen by 2030 (EQ International, 2022[20]). Analysis estimate that it would require a dedicated renewable generation capacity in a range from 25 to 100 GW by 2030, depending on the mix of renewable energy sources, which will influence the capacity factor of the electrolysers (IH2A, 2022[21]), (IHS Markit, 2022[22]); (EY and SED Fund, 2022[23]).

Policies providing a stable, long-term view and a uniform set of standards are key enablers to provide confidence for investors and industrial actors to invest in green hydrogen (ESMAP, 2020[2]). For instance, the lack of an agreed definition of green finance in India has been highlighted as a major barrier to attract investments (Prakash Jena and Purkayastha, 2020[24]). A green hydrogen definition within a taxonomy, national green finance framework or ESG criteria would strengthen the confidence of investors in green hydrogen projects, given increasing pressure to disclose the share of portfolios that meet such criteria. Engagement with international organisations to build consensus on the definition of green hydrogen, including building a sound certification and tracking of green hydrogen, will ensure that it leads to emissions reduction and best use of renewable energy sources, and will also help to remove barriers to global trade. This would help to mobilise needed finance, as green hydrogen technologies are capital-intensive.

Barriers and challenges

The cost of producing green hydrogen generally is higher than traditional hydrogen produced from steam methane reforming (SMR) or coal gasification. In 2020, costs of hydrogen from electrolysis were at around INR 400 (USD 5.1) per kg versus INR 140–180 (USD 1.8-2.3) per kg from SMR (Hall et al., 2020[25]).3

Producing green hydrogen at competitive costs is a major challenge, which depends on several key factors within the hydrogen value chain, including needs to reduce costs of electrolyser technologies and their manufacturing as well as the costs of renewable electricity inputs, and to increase the load factor of electrolysers (Hall et al., 2020[25]). Achieving a significant drop in the capital cost of electrolysers, for instance through technological learning and scale, alongside improvements in the efficiency of electrolysers and further reductions in the costs of renewable power, will influence long-term competitiveness of green hydrogen production as well as cost improvements for things like storage and transport of hydrogen (Hydrogen Council and McKinsey & Company, 2021[26]). At a global scale, the electrolyser costs could see a 40% cost reduction by 2030 and 80% by 2050 (IRENA, 2020[27]).

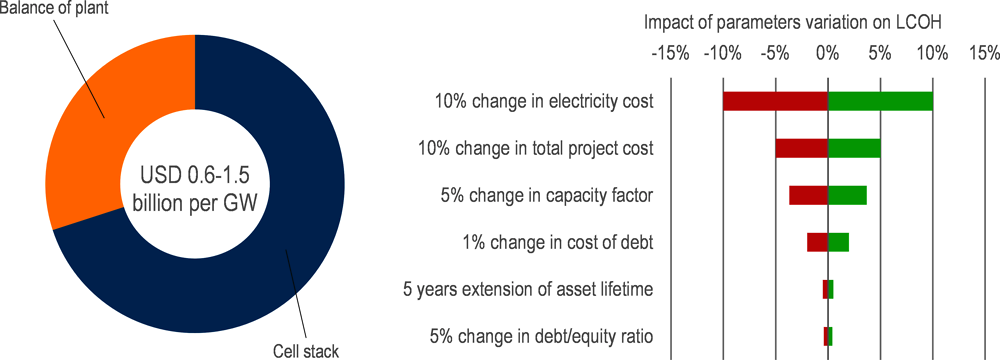

These parameters affect the overall levelised cost of hydrogen (LCOH) (Figure 4.1). For instance, a 10% change in the price of electricity can drastically impact the cost of hydrogen.4 Project costs, mainly driven by the CAPEX of electrolysers, and capacity factor equally influence the LCOH, as does the cost of finance, particularly give the overall levels of capital needed to implement hydrogen projects.

Figure 4.1. Illustrative cost breakdown and impact of influencing parameters on the cost of hydrogen

Notes: 1) The breakdown represents a ballpark figure for either alkaline or Proton Exchange Membrane (PEM) electrolysers. Illustrative sensitivity calculation based on 800 kUSD/MW, 60% capacity factor, 65/35 debt/equity ratio, 10% cost of debt, and debt tenure of 10 years. The percentage of variation of the main parameters are based on typical standard deviations across projects.

Source: Left chart is adapted from (Patonia and Poudineh, 2022[28]); for electrolysers in the range 10-100MW.

Lowering the costs of electricity inputs is a decisive factor to bring down costs of green hydrogen. Solar, wind and pumped hydro power purchase agreements at fixed prices below the average price of the green electricity day-ahead market can contribute to improving the electricity costs. Off-Grid solutions may also be encouraged after carrying out locational analysis of the power system, based on the size of the targeted green hydrogen output, as this would eliminate grid congestion and transmission issues. Reducing the cost of electrolyser technologies, for instance through development of local manufacturing capacities, can help to achieve cost-competitive LCOH in India, lowering prices to around INR 122-173 (USD 1.7-2.4) per kg of hydrogen in 2030 (NITI Aayog and RMI, 2022[29]). Yet, enabling some of these cost improvements will be challenging, at least in the short-term, as a domestic hydrogen value chain is established. For example, developers will likely need to import electrolysers for the first projects, given the time required to build large-scale manufacturing capabilities. This will influence technology costs, for instance due to foreign currency swaps and other potential factors such as import duties.

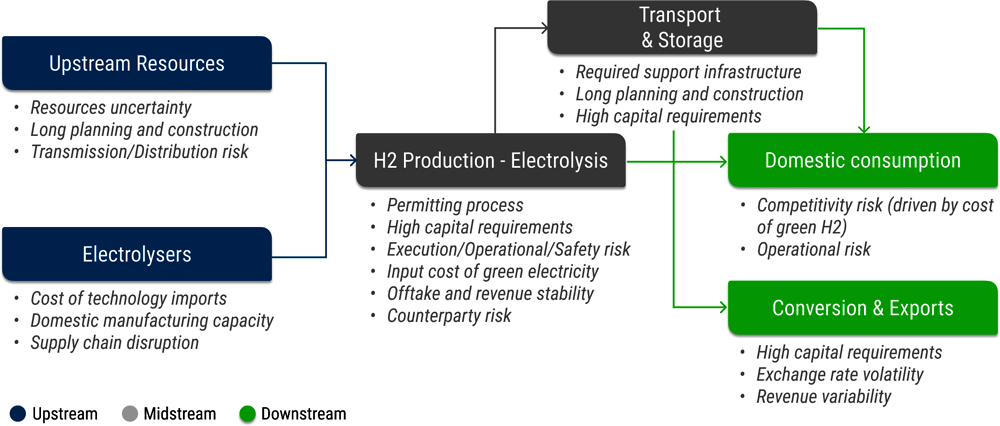

A robust value chain that lowers the cost of green hydrogen will be influenced by other elements within the hydrogen ecosystem, such as related infrastructure needs and supply chains for manufacturers. The challenge for green hydrogen projects is therefore to structure an acceptable risk profile for financing by allocating risks to those best able to take them, whether this be sponsors, insurers, financiers or ultimately in some cases, the government (Green Hydrogen Organisation, 2022[30]). Risks, for example from unclear policy and regulatory frameworks, and challenges in accessing finance will impact development of project pipelines (Figure 4.2). Many components, from manufacturing and supply of equipment to clear offtake for green hydrogen, will influence investment in projects, as well as the cost of finance for project development.

Roadmap stakeholders highlighted the so-called "chicken and egg" problem between supply and demand of hydrogen. Green hydrogen producers highlighted the need to incentivise demand creation to reduce the offtake risk, whilst potential consumers like the fertilizer industry underscored that increasing demand would rely on green hydrogen availability at scale and at a competitive price. Offtake risk is even more significant in the absence of guarantees, which increases risk of non-payment.

Stakeholders equally noted that uncertainties on electricity prices for green hydrogen production could weaken the competitiveness of industrial consumers. Industries with high exposure to the international market may have competitors that are not exposed to green hydrogen costs. Thus, the market price fluctuations of their products could move independently of green hydrogen production cost, which may lead to a volatility of the cost margins.

Figure 4.2. Common risks highlighted by stakeholders in the green hydrogen value chain

Note: These are illustrative examples of risks highlighted in stakeholder consultations and are not exhaustive.

Lack of infrastructure for green hydrogen transport and storage could also create vulnerabilities for future hydrogen projects. Several stakeholders noted that grey hydrogen today is produced and consumed at the same location, whereas achieving economies of scale for large green hydrogen projects (e.g. a GW scale) would require building shared infrastructures and grouping demand of end-consumers. As the transport of hydrogen over 5000 km in large-scale pipelines can remain below INR 80 (USD 1.0) per kg of hydrogen, building dedicated pipelines or repurposing part of the current natural gas network could provide benefits to connect areas where low-cost hydrogen can be produced to consumption centres (IRENA, 2022[31]). Long planning, development and construction phases for these support infrastructures may expose projects to delays.

Roadmap stakeholders emphasised that while many actors have identified green hydrogen as a strategic area of interest, the lack of a pipeline of projects with viable business cases is affecting the design of financing solutions. This makes it difficult to raise capital early in the project cycle. The absence of policy clarity to identify the priority sectors or hubs for green hydrogen would add an offtake uncertainty, on top of the technical risks on execution and operation. As green hydrogen projects are still perceived as high-risk investments, and in addition are typically large ticket sizes, solutions are needed to address risks and the impact these have on the cost of finance.

Other potential issues to finance can hamper investment flows. For instance, restricted access to finance for some developers may deter project developers and financial institutions to invest in green hydrogen projects. Long-term, low-cost debt is often not available and access to international private capital can help lowering the cost of finance.

Opportunities and solutions

Roadmap stakeholders stressed that green hydrogen is a “must-go” area to meet India’s clean energy ambitions, equally confirming their expectation that projects can become concrete over next 2-3 years with the right conditions. Achieving this enabling environment requires measures to address barriers and risks across the green hydrogen value chain, including several solutions already outlined in the Green Hydrogen Policy released in February of 2022 (Table 4.2). Covering partially or fully the hurdles through policies, de-risking instruments and financial support will help companies and financial institutions to accelerate investments in green hydrogen.

Table 4.2. Risks addressed in the Green Hydrogen and Green Ammonia Policy

|

Value Chain |

Barriers / risks addressed |

Description |

Measure |

|---|---|---|---|

|

Upstream Resources |

Long planning and construction phases |

|

|

|

Transmission/Distribution risk |

|

|

|

|

H2 production |

Permitting process |

|

|

|

Input cost of green electricity |

|

|

|

|

Offtake risk |

|

|

|

|

Transport and Storage |

Lack of infrastructures |

|

|

Notes: 1) The table identifies the risks that are addressed by the current Green Hydrogen and Green Ammonia Policy, based on a sub-selection of the risks identified in Figure 4.2. The policy includes additional measures, such as allowing companies to meet their RPOs via the purchase of green hydrogen. 2) Some risks are only partially covered by the measures in the table. For instance, other elements than power transmission lines will affect the long planning and construction phases of green hydrogen projects.

Future policies are expected to cover the entire value chain for hydrogen use, from demand creation through green hydrogen targets to supply support (e.g. with incentives for domestic equipment and green hydrogen production) and market enablers, such as infrastructure and supply chain developments. An integrated approach of the green hydrogen production increase with renewable electricity capacity development, water access policy and land use should also be considered. For instance, 115 GW of renewable power is needed to meet the 5 million production target of green hydrogen by 2030 (EY and SED Fund, 2022[23]). Aligning these volumes with the national renewable target of 450 GW by the same date must be considered, in particular to ensure that renewable capacity developed for green hydrogen does not hamper the development of direct electrification.

MNRE also indicated that it would provide support for research and development (R&D) for green hydrogen technologies. Encouraging deep research and creating suitable testing facilities will be key to bring down costs in the long run and to enhance the efficiency, safety and reliability of relevant systems and processes across the value chain. In addition, a working group has been set up to prepare a proposal for a framework of regulations and standards.

Stakeholders identified additional solutions for risks not covered yet by government policies and regulations. For instance, PLI schemes can be used to incentivise electrolyser manufacturers to establish capacity in India, which should lower equipment costs, particularly for scaling up development. The schemes could be time-bound and incentivise actors in the early phase of market development.

On the demand side, encouraging early market applications can help to boost demand with limited impact on final prices to consumers. Such applications will likely need complementary signals, such as the planned fertilizer and refinery industry obligations for green hydrogen use. Green hydrogen mandates for these sectors offers large opportunities to drive demand through domestic production, especially as ammonia and fertilisers are net imports in India today. Measures to develop demand from other hard-to-abate industries such as steel should be considered in by 2030, as their potential consumption could help accelerating the green hydrogen transition.

Stakeholders also underscored that a multi-year outlook of consolidated government tenders based on aggregated demand would facilitate green hydrogen market creation. This needs to be complemented with a set of instruments to lower risks for green hydrogen production. For example, a VGF mechanism could be applied for green electrolyser producers in early projects. A CfD model or double auction could similarly be applied for the first green hydrogen tender, allowing producers of green hydrogen to offer their lowest price against the highest bid price of industrial buyers. Auction winners would be producers with the lowest prices and buyers with the highest, and the difference between the two bids would be paid out by the government (or CfD facility) to winning bidders for the contract period.

International experience on the effectiveness of these schemes remains limited, as most countries are still in the definition phase of their support to large-scale hydrogen projects. For example, an assessment of support mechanisms to build a Low Carbon Hydrogen Business Model in the United Kingdom has been carried out via a public consultation led by the Department for Business, Energy & Industrial Strategy (Box 4.2) (BEIS, 2022[32]).

Related infrastructures could be supported by relevant funds, for instance under the National Infrastructure Pipeline. NIIF could likewise co-ordinate and channel investment in green hydrogen pipelines and storage facilities, as well as other related infrastructure like ports, which are crucial to develop green hydrogen hubs and/or exports.

Box 4.2. Consultation on Low Carbon Hydrogen Business Models in the United Kingdom

The United Kingdom’s Department for Business, Energy & Industrial Strategy has highlighted various options for the establishment of a viable green hydrogen business model using different support mechanisms, including:

Contractual payments to producers (e.g. CfDs), where producers receive a subsidy to cover the incremental cost of low-carbon hydrogen above the carbon-intensive alternative fuel.

Regulated returns, which allow hydrogen producers to earn a return on costs (e.g. using a Regulated Asset Base).

Obligations on suppliers, imposed on parties outside the hydrogen production sector (e.g. fuel suppliers or end users) to supply or consume a certain quantity of low-carbon hydrogen.

End user subsidies, applying a technology-neutral subsidy for carbon abatement.

A preference has been noted for contractual payments to producers and regulated returns, as these models transfer better the risk away from investors and reduce the risk of policy changes.

The consultation also has highlighted mechanisms to managing downside demand risk, through:

Backstop payments, where producers are paid regardless of demand levels, although this could lead to inefficient over-production and high per-unit support costs for taxpayers/consumers.

Split payments, in which separate support payments would be given to cover fixed and capital costs regardless of demand, but where variable costs are only covered when low-carbon hydrogen is being produced. The split payment approach has a key advantage as it avoids over-incentivisation for producers.

Additionally, revenue stabilisation is preferred, given its practicality and simplicity for deployment. The Department for Business, Energy & Industrial Strategy expresses a balanced view on the use of fixed support vs. indexed support (e.g. on natural gas or electricity). The latter may be particularly helpful if a revenue stabilisation approach is taken to avoid placing excessive input cost risk on investors.

Source: (BEIS, 2021[33])

Investment needs and financial support for green hydrogen

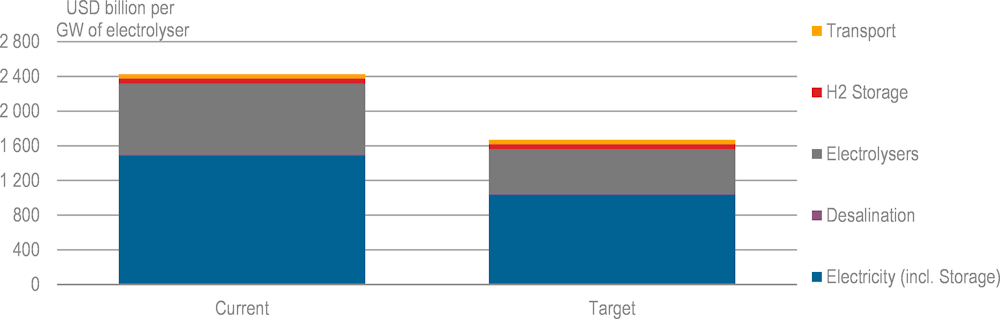

The investment need for green hydrogen projects will depend on project boundaries. An electrolysis project vertically integrated with dedicated renewables would require significant CAPEX, but the operating costs would be limited. It is worth noting that the cost for renewable electricity can be as low as INR 47 000 (USD 590) per kW for solar energy in India, whereas the global weighted average cost for offshore wind5 is close to INR 240 000 (USD 3000) per kW in 2021 (IRENA, 2022[34]). Conversely, an electrolysis project purchasing green electricity on the power exchange would require less upfront CAPEX (given the upstream accounting for the power generation CAPEX), but it would likely be exposed to higher levels and price fluctuations of its variable costs.

In both cases, the project would include CAPEX for electrolysers, which typically ranges from INR 27 000 (USD 350) per kW to INR 125 000 (USD 1 600) per kW for alkaline electrolysers (IRENA, 2022[35]). Due to the potential various configurations, a case-by-case analysis is required to assess investment needs at the project level, in particular if electricity and hydrogen infrastructures required for transport and storage are included (Figure 4.3). Should projects not be co-located with renewable energy, or if demand centres are not near the hydrogen production, the cost of hydrogen storage and transportation would increase greatly.

Figure 4.3. Illustrative CAPEX for a 1 GW electrolyser project with co-located renewable energy

Notes: Assumptions based on 50% onshore wind and solar power, with respective target price of USD 800 (INR 64 000) per kW and USD 400 (INR 32 000) per kW, and a target electrolyser price of USD 550 (INR 44 000) per kW. The final system cost to develop 25 GW electrolyser may vary greatly depending on (i) the type of renewable electricity sources; (ii) the connection to projects to the grid or the development of off-grid projects; (iii) the availability of existing natural gas pipelines for retrofitting or the installation of new pipelines; (iv) the possibility to store hydrogen in geological formation or the need to use line pack storage or steel tanks.

IH2A estimates that as much as USD 25 billion (INR 2 lakh crores) in public and private funding is needed to set up 25 GW of electrolyser capacity by 2030 and produce 5 million tonnes of green hydrogen (IH2A, 2022[21]). Another analysis considers that 1 million tonnes of green hydrogen corresponds to around 11-13 GW of electrolyser capacity, which would result in 55-65 GW of electrolysers to achieve this 2030 green hydrogen production target (NITI Aayog and RMI, 2022[29]). Other studies estimates that achieving this production would require at least 40 GW of electrolysers and 100 GW in renewable generation capacity by 2030, and slightly more than USD 100 billion (INR 8 lakh crores) of investment (IHS Markit, 2022[22]); (EY and SED Fund, 2022[23]).

Multiple sources of finance will be needed to achieve these levels of green hydrogen production, especially given the ticket size for large-scale projects, which is likely a major barrier for a single actor to bear, particularly given associated risks. Solutions to lower the development costs for green hydrogen and achieve required investment levels will thus require public funding, notably to reduce the risks of first-of-a-kind projects in India and specifically to leverage private investments in early market development. Multilateral Development Banks (MDBs) and Development Finance Institutions (DFIs) can also support development, for example through blended finance solutions addressing early project risks to support both the market creation and the market growth phases.

In addition, further development of capital markets for clean energy projects in India will be required to enable project developers to tap into different financial instruments and capital sources. This can be supported by development of a national green or sustainable finance taxonomy (possibly based on existing ones, such as those in Europe and Singapore) to provide a clear set of rules. Company disclosure requirements can likewise help investors to monitor the quality of portfolios, particular as the pool of investors seeking ESG performance continues to grow in India and globally. These actions can be a first step before evaluating the possibility to extend Priority Sector Lending (PSL) to the green hydrogen value chain.

Roadmap stakeholders highlighted that a typical financing structure of 20-30% equity and 70-80% debt should be targeted for green hydrogen projects by the end of the decade. Considering current (and targeted) costs of electrolysers with ambitions for 25-40 GW capacity by 2030, as much as INR 0.8 lakhs crore (USD 9.5 billion) in equity and INR 1.8 lakhs crore (USD 22.0 billion) in debt would need to be raised over the next decade (for electrolysers only).6 To help achieve these ratios and leverage the overall capital needed, early green hydrogen projects will thus likely require grants or subsidies to address risks, attract investors and lower the overall upfront equity required.

International support (e.g. via export credits and development finance) can also build upon on-going technical co-operation, joint ventures and technology collaborations to facilitate market development. On the financing side, donor co-ordination can avoid duplicating efforts, as donors can have different requirements, eligibility criteria and due diligence procedures.

As the market develops and matures, the overall magnitude of public contributions and blended finance should naturally decline, helping to achieve commercial sustainability (OECD, 2018[36]). Indicators to support decisions on exiting blended finance interventions should be defined, for example after reaching scale (in GW of electrolysers), cost (in INR/kW for electrolysers, in INR/kWh for electricity), penetration rate (in % of green hydrogen in total hydrogen consumption), revenue (in INR/kg of hydrogen), and/or by observed project replication without support (e.g., when actors no longer use auctions to agree on a price).

These types of pre-set indicators can also help to evolve the level of public and donor support as the market developers. For instance, progress in market development, based on indicators such as those noted above, could trigger the switch from VGF or a CfD approach to a credit enhancement mechanism, such as a first loss facility. This could help to limit the cost of public contribution whilst maintaining a certain support to de-risk continued project development. Evolution of support, with emphasis on risk mitigation, would likely ensure lower cost of finance for project developers.

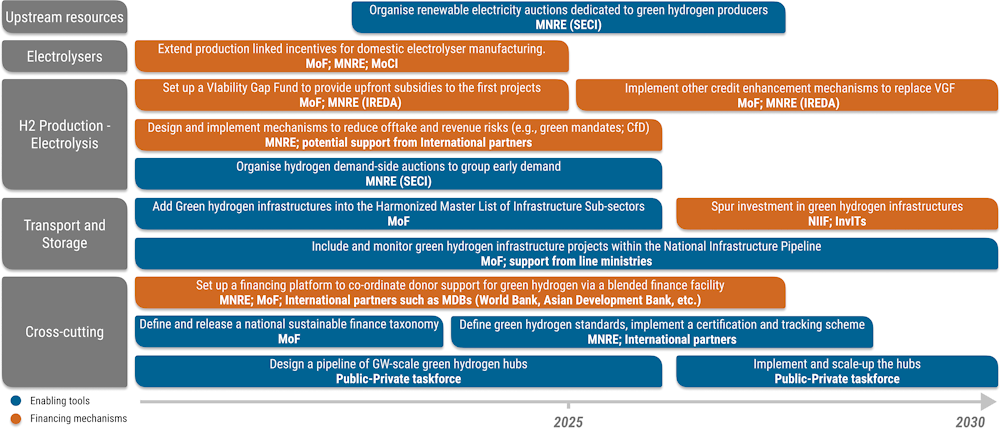

Roadmap to 2030

Meeting India’s green hydrogen ambitions to 2030 and beyond will require a number of targeted actions and tailored solutions through co-ordinated efforts across stakeholders, from developers and investors to state and central governments and international partners. Working together can bring forward solutions to address bottlenecks to project development and enable the finance needed to unlock a robust green hydrogen market.

Recommendations

The Roadmap proposes seven key recommendations to de-risk investment in green hydrogen development and to enable the flow of finance to those projects. Proposed interventions are set forth across two key pillars, notably targeted enabling tools and specific financial support to address critical barriers across the green hydrogen value chain, bridge the current economic gap and create an enabling environment for investment.

Enabling tools

1. MNRE should design for demand-side or double auction process for hydrogen to achieve faster economies of scale.

It is likely that the first applications of green hydrogen in India will be in natural gas network, fertilisers and ammonia, where green hydrogen can replace a small share of other fuels. While individual users may have limited green hydrogen needs, aggregating demand-side volume can help reach a critical mass.

MNRE could make use of auctions, for instance through SECI, to aggregate volumes for green hydrogen supply and demand. Organising hydrogen auctions to aggregate demand will enable to warrant investment for centralised production and justify building common user infrastructure. This model can help to increase scale and intensify competition, thus improving the LCOH.

The design of auctions can be tailored to allow the first large scale users, such as hard-to-abate industries, to pay a price enabling them to remain competitive in their subsector. This would provide better clarity for the government to couple the auction process with other support mechanism such as Contract for Difference (CfD) and ensure an efficient allocation of public money.

For this purpose, MNRE could set up sectoral tables where (a) Offtakers from the same sector can come together, aggregate their demand and learn from each other; (b) Suppliers can gather to network and find an offtaker. This model could be implemented by replicating the approach of the European Clean Hydrogen Alliance (European Commission, 2022[37]).

The demand-side hydrogen auctions could be complemented by renewable energy auctions dedicated to Green Hydrogen and Green Ammonia producers. Organising such auctions through SECI could enable to monitor the evolution of the winning bids, thus helping to ensure the competitiveness of green hydrogen production, and possibly help to better estimate the potential needs for other support instruments such as CfD.

Such auctions would help in the mid-term to combine solar, onshore wind, offshore wind and pumped hydro capacity for hybrid auctions earmarked for green hydrogen production, in order to support all these sectors simultaneously, ensure additionality, and optimise the power supply portfolio and costs of green hydrogen producers. Given the risk of limited land and water access, such scheme could explore the benefits of producing green hydrogen from offshore wind plants and floating marine solar plants.

Moreover, refineries, ammonia producers and other bulk users have indicated interest in setting up their own Green Hydrogen production facilities. The government may consider organising renewable energy auctions to supply the quantum and profile of renewable energy for such process. Such auctions would also ensure additionality, and possibly support a faster deployment of renewable electricity capacity.

2. A Public-Private Taskforce should provide a framework to build a pipeline of GW-scale green hydrogen hubs.

The concept of hydrogen valleys or hydrogen hubs has emerged to overcome the limitations of individual projects by covering multiple steps of the hydrogen value chain and more than one end-use sector in large-scale projects in a given geographical area. Combining various uses within the same area (e.g., an industrial cluster, a port or a city) can create synergies and help achieve economies of scale, optimise costs and reduce variation of demand. Given the GW-scale target, the hubs would need to be matched with large supply projects. MNRE may issue a consultation framework to identify and support potential hubs.

For this pipeline of projects, a broader range of aspects need to be looked at (e.g. other decarbonisation strategies like direct electrification) to deploy hydrogen when it is the solution that makes most sense.

The way it is phrased, it seems to be demand, which will not happen without GW-scale supply.

IH2A is promoting the approach to develop “Bharat Hubs” for green hydrogen, and has proposed on 30 June, 2022 to develop twenty-five green hydrogen projects and five national hydrogen hubs by 2025 through public-private partnerships (pv India, 2022[38]).

3. MNRE should engage in the international dialogue to converge on a common definition of green hydrogen and implement certification and safety standards.

India can exploit its low-cost renewable electricity sources to decarbonise its economy, and to become a global exporter of green hydrogen and its derivatives. Engagement with international organisations to build international consensus on the definition of green hydrogen and building a sound certification and tracking scheme for green hydrogen will help guaranteeing that the production and use of green hydrogen leads to CO2 emissions reduction. In the future, this could help to remove barriers to international trade.

Although the industry has consumed hydrogen for decades as a feedstock, the production and consumption are mainly occurring on-site, in a strictly controlled environment. Scaling up the production leads to building huge storage facilities and infrastructure, and the increasing role of transportation and distribution will expose more users. Building a safety culture through global collaboration and implementation of global safety standards and best practices will be very important, as an accident can undermine the green hydrogen momentum. Existing initiatives, such as the Center of Excellence in Hydrogen, can be used as platforms to facilitate capacity building, training and R&D development in this area (CoE-H, 2022[39]).

MoF could build on a national sustainable finance taxonomy in order to bring confidence to domestic and international finance institutions. A growing number of countries have released green or sustainable finance taxonomies. They are becoming increasingly recognised, with companies set to begin reporting based on these standards, and investors targeting to increase the share of their portfolio that is aligned with the taxonomies. India can build on international experiences of existing taxonomies and make the eligibility criteria compatible with its net-zero and intermediate targets. It would help align the domestic and international financial flows with the country’s objectives, and could as well avoid duplication of efforts, as several organisations are following internal mechanisms to classify their projects as green or sustainable.

Financial support

4. IREDA should take the lead to co-ordinate donor support for green hydrogen production via a financing platform and the creation of a blended finance facility for green hydrogen (see Annex D)

The platform could be designed with a partner MDB to bring together investors and donors (both domestically and internationally), under the guidance of MoF and MNRE.

The platform could coordinate interventions by donors and develop a blended finance facility, to de-risk and mobilise capital and that could be managed by an agency such as IREDA.

The high-ticket size for green hydrogen project, the high risk associated with early markets, and the lack of maturity of the finance community in that subsector can deter investors from green hydrogen projects. The platform could bring together project developers and public and private finance institutions to identify the most suitable sources of financing for green hydrogen projects.

The platform could be structured to cover several areas of the value chain, or projects of hydrogen valleys. The scope definition could notably be carved out with MDBs, which can provide a wide array of blended finance instruments to support the entire value chain, from renewable electricity to ports infrastructures: donor coordination could enable to target their intervention where they will have the highest impact. It should also be the preferred platform to propose project development assistance, with a focus on developing blended finance solutions.

5. MNRE should define and confirm financial support to reduce perceived risks for first-of-a-kind capital investments

In the short-term, confirm the modalities of the VGF proposed for an initial capacity of 3 GW. For vertically integrated renewables and electrolysers projects, as CAPEX and fixed costs constitute the majority of costs, this would probably help unlocking private capital. In the mid-term, clarifying how the eligibility rules to VGF will be re-evaluated beyond the first 3 GW would provide additional certainty to project developers to engage on site surveys.

The amount allocated to the VGF could be affected by the implementation of other instruments and parameters influencing the market competitiveness of green hydrogen, such as:

The mechanism to reduce and stabilise RE price for Green Hydrogen production.

The gap between the achieved green hydrogen price and grey hydrogen price to enable price stability for consumers.

The revenue guarantee mechanism.

In the mid-term, other credit enhancement mechanisms should be explored in order to increase the efficiency of the public finance. Indeed, while it is expected that the scale-up of the green hydrogen market will bring down the CAPEX costs, the cost of finance or offtake risks may linger on. In that case, providing partial credit guarantees or establishing a first-loss provision fund could improve the creditworthiness of investments while achieving a better financial leverage than a VGF.

6. MNRE should design a mechanism to reduce offtake and revenue risks for first-of-a-kind green hydrogen producers

International partners, such the UK, the European Union or Japan, could share their experience or provide assistance to set up such a scheme.

On demand side, green hydrogen demand mandates for existing consumers (fertilisers’ producers and refineries) or early market applications (e.g., blending with natural gas) could help build up sufficient volumes to enable large scale electrolysis projects. Sustainable public procurement could also support the green hydrogen demand, for instance by committing to emission thresholds for steel used in public infrastructures, which would encourage steelmakers to switch their process.

On pricing side, auctions and revenue guarantee may provide an additional risk mitigation:

Grouping demand would help to mitigate offtake risk and to optimise use / mutualise costs to build infrastructures for the first projects, especially valid if it applies to an identified hub/cluster. It could also help benefit from scale effect.

If the price of electricity remains too high, providing support to green hydrogen producers with a CfD indexed on electricity price would substantially reduce risks. This needs to be considered in parallel with the VGF to ensure that there is no double-subsidization of projects.

A compensation of price difference between suppliers and customers in a double auction process could as well promote a ramp-up of hydrogen demand at large scale (H2Global, 2022[40]).

7. MNRE should reinforce incentives to develop a domestic manufacturing capacity for electrolysers.

Initial projects are likely to involve substantial import of components. As several partnerships have been announced between Indian and foreign companies, export credit agencies could play a central role both in equity and debt financing.

Extending the production-linked incentives scheme or equivalent financial support for domestic manufacturing of electrolysers would help attract large investments from the private sector for the local manufacturing activities serving the green hydrogen value chain consistent with the “Make in India” strategy.

MNRE could pursue a first analysis on the ability of Indian manufacturing ecosystems to select the most critical components of electrolysers that could be produced domestically.

Key actions and timeline

Figure 4.4. Overview of the main recommendations for Green Hydrogen until 2030

Source: Authors

References

[32] BEIS (2022), Hydrogen Business Model and Net Zero Hydrogen Fund: Electrolytic Allocation Round 2022, https://www.gov.uk/government/publications/hydrogen-business-model-and-net-zero-hydrogen-fund-electrolytic-allocation-round-2022 (accessed on 13 September 2022).

[33] BEIS (2021), Low Carbon Hydrogen Business Model: consultation on a business model for low carbon hydrogen.

[41] BloombergNEF (2022), Financing India’s 2030 Renewables Ambition.

[39] CoE-H (2022), Center of Excellence Hydrogen – Green Hydrogen in India, https://coe-h.com/ (accessed on 9 September 2022).

[20] EQ International (2022), India plans to produce 5 million tonnes of green hydrogen by 2030, https://www.eqmagpro.com/india-plans-to-produce-5-million-tonnes-of-green-hydrogen-by-2030/ (accessed on 10 September 2022).

[2] ESMAP (2020), Green Hydrogen in Developing Countries, World Bank, http://www.worldbank.org (accessed on 1 June 2022).

[37] European Commission (2022), Roundtables of the European Clean Hydrogen Alliance, https://single-market-economy.ec.europa.eu/industry/strategy/industrial-alliances/european-clean-hydrogen-alliance/roundtables-european-clean-hydrogen-alliance_en (accessed on 13 September 2022).

[23] EY and SED Fund (2022), Accelerating Green Hydrogen Economy.

[3] FTI Consulting (2020), India’s Energy Transition Towards A Green Hydrogen Economy.

[30] Green Hydrogen Organisation (2022), Green hydrogen contracting – financing of green hydrogen projects, https://www.energy.gov/eere/fuelcells/hydrogen-storage-challenges (accessed on 1 June 2022).

[40] H2Global (2022), The H2Global Mechanism, https://www.h2-global.de/project/h2g-mechanism (accessed on 13 September 2022).

[9] H2WorldNews (2022), India - New policy to cut Hydrogen cost by 40-50 pc, https://h2worldnews.com/india-new-policy-to-cut-hydrogen-cost-by-40-50-pc/ (accessed on 1 June 2022).

[19] H2WorldNews (2021), India - Modi announces National Hydrogen Mission, https://h2worldnews.com/independence-day-pm-modi-announces-national-hydrogen-mission/ (accessed on 1 June 2022).

[25] Hall, W. et al. (2020), The Potential Role of Hydrogen in India: A pathway for scaling-up low carbon hydrogen across the economy, The Energy and Resources Institute (TERI).

[26] Hydrogen Council and McKinsey & Company (2021), “Hydrogen Insights: A perspective on hydrogen investment, market development and cost competitiveness”, http://www.hydrogencouncil.com. (accessed on 12 April 2022).

[21] IH2A (2022), Media Release: IH2A seeks Union Budget support for India’s hydrogen economy - IH2A, https://ih2a.com/announcements/media-release-union-budget-support-for-indias-hydrogen-economy/ (accessed on 10 June 2022).

[22] IHS Markit (2022), India takes initials steps towards hydrogen economy by cutting production costs, https://cleanenergynews.ihsmarkit.com/research-analysis/india-takes-initials-steps-towards-hydrogen-economy-by-cutting.html (accessed on 20 June 2022).

[1] IRENA (2022), Geopolitics of the Energy Transformation: The Hydrogen Factor, https://www.irena.org/publications/2022/Jan/Geopolitics-of-the-Energy-Transformation-Hydrogen (accessed on 24 March 2022).

[31] IRENA (2022), Global hydrogen trade to meet the 1.5°C climate goal: Part II – Technology review of hydrogen carriers, http://www.irena.org/publications.

[34] IRENA (2022), Renewable Power Generation Costs in 2021, http://www.irena.org.

[35] IRENA (2022), Renewable Technology Innovation Indicators: Mapping progress in costs, patents and standards, http://www.irena.org/publications (accessed on 10 June 2022).

[27] IRENA (2020), Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5°C Climate Goal, http://www.irena.org/publications (accessed on 20 June 2022).

[13] JSHL (2022), Press Release: Jindal Stainless to become India’s first stainless steel company to install a Green Hydrogen Plant, http://www.facebook.com/JindalStainlessOfficial.

[16] Jyothilal, K. (2022), Kerala is planning hydrogen valleys in select cities, https://renewablewatch.in/2022/04/21/views-of-k-r-jyothilal/ (accessed on 9 June 2022).

[4] KPMG India (2022), India’s green hydrogen ambition: Setting the wheels in motion, https://assets.kpmg/content/dam/kpmg/in/pdf/2022/03/Indias-green-hydrogen-ambition.pdf (accessed on 30 May 2022).

[8] Larsen & Toubro (2022), L&T signs MoU with HydrogenPro for manufacturing Hydrogen Electrolysers in India, https://www.larsentoubro.com/pressreleases/2022/2022-01-27-lt-signs-mou-with-hydrogenpro-for-manufacturing-hydrogen-electrolysers-in-india/ (accessed on 20 June 2022).

[17] MNRE (2006), National Hydrogen Energy Road Map, http://164.100.94.214/sites/default/files/uploads/abridged-nherm.pdf (accessed on 1 June 2022).

[29] NITI Aayog and RMI (2022), Harnessing Green Hydrogen - Opportunities for deep decarbonisation in India, http://www.rmi.org (accessed on 5 July 2022).

[36] OECD (2018), Blended Finance Principles for Unlocking Commercial Finance for the Sustainable Development Goals.

[14] Ohmium (2022), Ohmium Signs Agreement with Tarafert to Provide 343 MW of Green Hydrogen for Ammonia, https://www.ohmium.com/news/ohmium-signs-agreement-with-tarafert-to-provide-343-mw-of-green-hydrogen-for-ammonia (accessed on 13 September 2022).

[28] Patonia, A. and R. Poudineh (2022), Cost-competitive green hydrogen: how to lower the cost of electrolysers?, Oxford Institute for Energy Studies, https://www.oxfordenergy.org/wpcms/wp-content/uploads/2022/01/Cost-competitive-green-hydrogen-how-to-lower-the-cost-of-electrolysers-EL47.pdf (accessed on 20 June 2022).

[5] PIB (2022), Ministry of Power notifies ’Green Energy Open Access’ Rules to accelerate ambitious renewable energy programmes, https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1842737 (accessed on 11 September 2022).

[18] PIB (2022), “National Hydrogen Mission”, https://idsa.in/issuebrief/india-national-hydrogenet (accessed on 1 June 2022).

[24] Prakash Jena, L. and D. Purkayastha (2020), Accelerating Green Finance in India: Definitions and Beyond, Climate Policy Initiative, http://www.climatepolicyinitiative.org (accessed on 1 June 2022).

[38] pv India (2022), IH2A chalks out roadmap to accelerate hydrogen commercialization in India, https://www.pv-magazine-india.com/2022/07/04/ih2a-chalks-out-roadmap-to-accelerate-hydrogen-commercialization-in-india/ (accessed on 4 July 2022).

[10] pv magazine India (2022), Greenko partners Belgium’s John Cockerill to build India’s largest hydrogen electrolyser factory, https://www.pv-magazine-india.com/2022/04/12/greenko-partners-belgiums-john-cockerill-to-build-indias-largest-hydrogen-electrolyser-plant/ (accessed on 30 May 2022).

[12] Recharge (2022), ’World’s largest green hydrogen ecosystem’: Tycoon Adani and oil giant TotalEnergies link for $50bn India spree, https://www.rechargenews.com/energy-transition/worlds-largest-green-hydrogen-ecosystem-tycoon-adani-and-oil-giant-totalenergies-link-for-50bn-india-spree/2-1-1237555 (accessed on 20 June 2022).

[7] SolarQuarter (2021), Ohmium Ships its First “Made in India” Hydrogen Electrolyzer Unit to the United States, https://solarquarter.com/2021/11/24/ohmium-ships-its-first-made-in-india-hydrogen-electrolyzer-unit-to-the-united-states/ (accessed on 1 June 2022).

[6] Stiesdal and Reliance (2021), Media Release: Reliance New Energy Solar Limited (RNESL) and Denmark’s Stiesdal A/S sign a cooperation agreement to collaborate on technology development and manufacturing of HydroGen Electrolyzers in India.

[11] The Economic Times (2022), Ayana Renewable Power partners with Greenstat Hydrogen India to develop green hydrogen projects, https://economictimes.indiatimes.com/industry/renewables/ayana-renewable-power-partners-with-greenstat-hydrogen-india-to-develop-green-hydrogen-projects/articleshow/91263333.cms?from=mdr (accessed on 1 June 2022).

[15] The Indian Express (2022), Tamil Nadu to come up with Green Hydrogen policy, https://indianexpress.com/article/cities/chennai/tamil-nadu-to-come-up-with-green-hydrogen-policy-study-scope-for-hi-speed-train-network-7877743/ (accessed on 1 June 2022).

Notes

← 1. The measures announced in the policy are matched with the risks identified during the Roadmap in Table 4.2.

← 2. Information on the 3rd Global RE-INVEST Renewable Energy Investors Meet & Expo, organised by MNRE from 26 – 28 November 2020 on a Virtual Platform, can be found on: https://re-invest.in/.

← 3. While natural gas prices have seen significant increase in the context of the global energy crisis that started in 2021, closing the gap between costs of hydrogen from electrolysis and from SMR, this could be short-lived, whereas investments are usually made on the basis of long-term price levels.

← 4. In the case of green hydrogen, the electrolyser would likely rely on new capacity of renewable electricity generation. When considering the comprehensive project scope, the investment in renewable energy assets can represent the largest part of the total investment (Figure 4.3).

← 5. India has no offshore wind capacity by the end of 2021.

← 6. This would correspond to around 10% of the required funding to meet India’s wind and solar 2030 capacity targets (BloombergNEF, 2022[41])