This chapter dives into the opportunities and challenges to financing energy efficiency in India with a focus on MSME sector and proposes a set of recommendations to scale it up. It provides an overview of past and existing policy initiatives aimed at awareness, training, and capacity building as well as providing financial support to energy efficiency projects. It also illustrates the various challenges across a project cycle and highlights future opportunities to address them. Building on this background, this chapter sets forth seven recommendations on improving the enabling environment and financial support schemes to step up finance and investments for energy efficiency, in the MSME sector and beyond.

Clean Energy Finance and Investment Roadmap of India

2. Energy efficiency upgradation, with a focus on MSMEs

Abstract

Industry is India’s largest energy consumer, accounting for more than half of final energy consumption in the country and nearly one-quarter of India’s total greenhouse gas (GHG) emissions (GoI, 2022[1]); (Gupta et al., 2019[2]). Industry energy intensity (energy consumption per unit of gross domestic product) could decline by nearly 50% over the next three decades, if energy efficiency measures are actively pursued (EIA, 2019[3]). Achieving these energy efficiency improvements would require more than INR 5-6 lakh crore (USD 62-73 billion) in total investments over 2017-2031, translating to annual investments of about 0.33-0.4 lakh crore (USD 4-5 billion) (BEE, 2019[4]).

Micro, small, and medium enterprises (MSMEs), which constitute more than 90% of all industrial units in India, play a critical role in industry energy consumption, even if their individual energy use is smaller than larger industries (GoI, 2022[1]). MSMEs are categorised on their annual investment and turnover amounts (Table 2.1), and altogether employ more than 111 million people. They also contribute to about 30% of India’s gross domestic product, including around 40% of India's exports in value added (MoMSME, 2020[5]); (BEE, 2022[6]).

Table 2.1. MSME classification by investment and annual turnover in India

|

Micro |

Small |

Medium |

|

|---|---|---|---|

|

Criteria for investment in plant, machinery and equipment |

Not more than INR 1 crore (USD 128 000) |

Between INR 1-10 crore (USD 128 000-1.3 million) |

Between INR 10-50 crore (USD 1.3 million-6.4 million) |

|

Criteria for annual turnover |

Not more than INR 5 crore (USD 640 000) |

Between INR 5-50 crore (USD 640 000-6.4 million) |

Between INR 50-250 crore (USD 6.4 million-32 million) |

Note: Classifications are for revised criteria applicable with effect from 1 July 2020. Currency conversions based on USD 1 = INR 79.9.

Source Retrieved from: (MoMSME, 2020[7])

MSMEs in India consume around 50 million tonnes of oil equivalent (Mtoe) in energy each year, or roughly the total final energy consumption of Argentina in 2020 (IEA, 2021[8]). This represents roughly 25% of all the energy consumed by the industrial sector. Energy-intensive operations in MSMEs, due to use of less efficient technologies, disproportionately impacts their profitability and overall competitiveness (Biswas, Sharma and Ganesan, 2018[9]). Without measures to address this energy intensity, overall MSME energy demand could increase by an annual growth rate of 6% over the coming decade (BEE, 2021[10]).

MSME units in India are typically characterised by geographical and industrial clusters representing various energy-intensive sectors like foundries, refractories, metallurgy, brass, brick, glass, ceramics, textiles, dyes, chemicals and processed foods. These clusters can depend on obsolete and energy-intensive technologies that result in high energy consumption. For instance, electric motors and motor-driven systems account for about 69% of the total industrial energy consumption in India. While all imported and domestically manufactured motors are required to conform to minimum IE21 class of efficiency since 2018, a minor share (~5%) of the current motor stock in India is IE3 level or better (U4E, 2020[11]). Energy audits conducted as part of a joint MSME project by The Energy and Resources Institute (TERI) and Shakti Sustainable Energy Foundation (SSEF) in the Ankleshwar chemical cluster in Gujarat found that energy savings of 5%-6% could easily be obtained by upgrading or replacing existing motors with IE3 motors. If integrated with systems like variable frequency drives and soft starters, savings could easily reach 10-15% in energy reductions (SSEF, 2017[12]). 20-30% reductions are feasible through adoption of other known energy efficiency measures.

Overview of MSME energy efficiency developments and trends to date

Investment in energy-efficient technologies will play a critical role in addressing high energy costs for MSMEs, which affect their economic competitiveness as well as their capacity to expand production and market activities. The Government of India highlighted energy efficiency as a key priority area under its 2008 National Action Plan on Climate Change (NAPCC). Energy efficiency was also enshrined in the National Mission for Enhanced Energy Efficiency (NMEEE) in 2011, which included four priority schemes to support energy efficiency uptake through market-based mechanisms (BEE, 2021[10]); (Natarajan et al., 2021[13]):

the Perform, Achieve, Trade (PAT) cap-and-trade scheme to reduce energy consumption in energy-intensive sectors;

the Market Transformation for Energy Efficiency (MTEE) bulk procurement programme for energy- efficient appliances;

the Energy Efficiency Financing Platform (EEFP) for raising awareness and building capacity of financial institutions, as well as to facilitate stakeholder interaction through a digital platform; and

the Framework for Energy Efficient Economic Development (FEEED) to develop fiscal instruments that leverage finance for energy efficiency projects.

The Bureau of Energy Efficiency (BEE) acts as the statutory body under the Ministry of Power (MoP) for directing energy conservation and energy efficiency efforts under the NMEEE. From 2011 to 2019, NMEEE delivered a 15% decline in India’s overall energy intensity (from 65.5 tonnes of oil equivalent per INR crore to 55.5 tonnes per crore), reducing carbon dioxide (CO2) emissions by an estimated 178 million tonnes annually (Natarajan et al., 2021[13]).

In 2019, following the success of NMEEE, BEE developed a new strategic plan called Unlocking National Energy Efficiency Potential (UNNATEE) for 2017-2031 that identified energy efficiency opportunities to fulfil India’s 2030 targets under its 2016 Nationally Determined Contributions (NDC) submission. UNNATEE set forth a framework for a revised and detailed action plan, called the Roadmap of Sustainable and Holistic Approach to National Energy Efficiency (ROSHANEE) to 2031, which outlines strategies to achieve India’s NDC and the opportunities identified within UNNATEE. Specifically, ROSHANEE identifies 12 focal areas, including industries and MSMEs, each linked to new and existing energy efficiency programmes, such as the PAT scheme and its proposed expansion to certain MSME segments (BEE, 2021[10]).

Other past and existing initiatives address energy efficiency at the national, sub-national or sectoral levels.

Awareness, training and capacity building schemes

A key challenge hindering energy efficiency uptake in MSMEs is lack of awareness and technical capacity. Several initiatives have worked to address awareness and to provide training and capacity building for implementing energy efficiency measures in MSMEs (Table 2.2). These initiatives build on the success of BEE’s National Programme on Energy Efficiency and Technology Upgradation of MSMEs (commonly referred to as the BEE SME Programme), launched in 2007, which focused on accelerating the adoption of energy-efficient technologies and practices in energy-intensive segments. The programme supported 100 technology demonstration projects in five sectors, including the preparation of cluster manuals, awareness raising, knowledge sharing and technical support (BEE, 2021[10]). Several other initiatives financed and supported by international funds, such as the Climate Investment Funds’ (CIF) Clean Technology Fund (CTF) and Global Environment Facility (GEF), also have awareness and capacity building components, in addition to financial support (see Table 2.3 below on such schemes).

Table 2.2. Notable initiatives targeting awareness, training and capacity building of MSMEs

|

Name |

Agencies |

Timeframe |

Description |

|---|---|---|---|

|

National Programme on Energy Efficiency and Technology Upgradation of MSMEs (BEE SME Programme) |

BEE |

2007 (ongoing) |

Flagship programme covering awareness and capacity building, energy benchmarking, and technology demonstration projects in 35 MSME clusters |

|

Energy Conservation Guidelines for the MSME sector |

BEE |

2019 |

A document compiling best operating practices and equipment information for 25 energy intensive MSME sectors |

|

CII-Godrej GBC Resource Centre |

CII-Godrej GBC |

- |

A resource centre providing sector-specific analysis, technology compendiums, benchmarking manuals, and case study booklets |

|

Energy Saving Equipment List |

JICA |

2008 (ongoing) |

A list of energy-efficient technologies, technical specifications, and technology providers produced as part of the JICA-SIDBI MSME Energy Saving Project (Phase I) and regularly updated in subsequent phases |

|

Energy Efficient Technologies List for Financing |

BEE |

2022 |

A list of energy-efficient technologies and their technical specifications, average investment amounts, savings, and payback periods. |

|

Simplified Digital Hands-on Information on Energy Efficiency (SIDHIEE) |

BEE |

2019 |

A knowledge portal compiling resources like case studies, best operating practices, and details of latest energy efficient technologies |

|

Small and Medium Enterprises Energy Efficiency Knowledge Sharing (SAMEEKSHA) |

BEE, TERI |

2017 |

A platform for knowledge-sharing and supporting collaboration among industry, technology specialists, research institutions, government bodies, training institutes, funding agencies and academia |

|

SIDBI Knowledge Repository |

SIDBI |

- |

Digital portals providing MSMEs with simplified access to handholding support and expert mentors for financial and non-financial needs |

|

Multimedia tutorials |

BEE |

2007-2017 |

50 multimedia tutorials on energy efficient technologies developing for over 20 energy intensive SME sectors showcasing their benefits and operation |

|

TERI-SDC Scaling up Energy Efficiency in Small Enterprises |

TERI, SDC |

2014-17 |

Promoting the use of energy-efficient technologies in MSME sectors (foundry, aluminium, etc.) by sharing best practices and providing implementation support |

Note: This list in non-exhaustive. CII = Confederation of Indian Industry; GBC = Green Business Centre; JICA = Japanese International Cooperation Agency; SDC = Swiss Agency for Development and Cooperation; SIDBI = Small Industries Development Bank of India; SME = Small and medium enterprises.

Financial support schemes

Other initiatives have looked to address the financial barriers to energy efficiency in MSMEs. The Small Industries Development Bank of India (SIDBI) is the apex financial institution providing concessional financial products or risk mitigation instruments, including credit guarantees, microfinance, SME ratings, technology support, and use of fund-of-fund support for venture capital funds. SIDBI also plays a nodal role in financing and implementing programmes in partnership with international organisations and financial institutions such as World Bank, GEF and the United Nations Industrial Development Organisation (UNIDO) (Table 2.3).

In addition, international finance has been channelled through SIDBI’s bilateral credit lines with partners such as the German Kreditanstalt für Wiederaufbau (KfW), the French Development Agency (Agence Française de Développement, AfD) and the Japanese International Cooperation Agency (JICA). These credit lines have extended more than USD 1 billion (INR 7 800 crore) in financing for equipment, technologies and process improvements to about 6 000 MSMEs (Agrawal, 2016[17]).

Several initiatives have tried to address the high perceived default risk of financial institutions lending to MSMEs by providing a first loss facility. In 2012, BEE set up the Partial Risk Guarantee Fund for Energy Efficiency (PRGFEE), covering up to 50% of energy efficiency loans up to INR 10 crore (USD 130 000) per project (Natarajan et al., 2021[13]). However, the programme did not receive any applications from financial institutions during its seven years of operation and was eventually closed. Subsequently, the World Bank partnered with SIDBI to set up the Partial Risk Sharing Facility (PRSF), which provides up to 75% risk coverage on energy efficiency loans and had guaranteed over USD 18 million (INR 14 lakh crore) in energy efficiency projects by March 2020. The PRSF has also earmarked funding for technical assistance and capacity building initiatives (Reddy, 2020[18]).

Table 2.3. Notable initiatives providing financial support to MSMEs

|

Name |

Agencies |

Timeframe |

Funding |

Description |

|---|---|---|---|---|

|

Partial Risk Sharing Facility (PRSF) |

SIDBI, WB, GEF, CIF’s CTF, EESL |

2015 (ongoing) |

USD 43 million (INR 336 crore) |

Provides partial default risk coverage to 14 partner financial institutions on loans to energy efficiency projects implemented by 18 approved ESCOs via energy savings performance contracts; also provides technical assistance and capacity building to ESCOs |

|

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) |

MoMSME, SIDBI |

2000 (ongoing) |

INR 7500 crore (USD 960 million) |

Facilitates access to collateral-free credit for micro and small enterprises by providing credit guarantee cover of up to 85% on loans up to INR 200 lakh (USD 256 thousand) |

|

Promoting Energy Efficiency and Renewable Energy in Selected MSME Clusters in India |

GEF, UNIDO, BEE, MNRE, MoP, MoMSME |

2011-2019 |

USD 33 million (INR 258 crore) |

Supports market environment for energy-efficient technologies in energy-intensive applications, initially through pilot projects in 12 MSME clusters across 5 sectors |

|

Financing Energy Efficiency in MSME Programme (FEEMP) |

GEF, WB, SIDBI, BEE |

2010-2019 |

USD 16 million (INR 125 crore) |

Provides concessional financing through a revolving fund and support for awareness and capacity building, energy audits, and implementation of measures |

|

Promoting market transformation for energy efficiency in MSMEs |

GEF, EESL, UNIDO, BEE, MoMSME SIDBI |

2021 (ongoing) |

USD 31 million (INR 242 crore) |

Providing demonstrations of 35 energy-efficient technologies in 10 energy-intensive MSME clusters for possible demand aggregation through ESCO financing model; aims to set up a revolving fund mechanism to ensure replication |

|

SIDBI Venture Capital Limited (SVCL) |

SIDBI |

1999 (ongoing) |

An investment management company under SIDBI providing equity capital to start-ups and early-stage SMEs in manufacturing, agricultural and service sectors |

Note: This list is non-exhaustive. EESL = Energy Efficiency Services Limited; ESCO = Energy service companies; MoMSME = Ministry of MSMEs; MNRE = Ministry of New and Renewable Energy; WB = World Bank.

Other MSME support schemes

Other initiatives targeting MSMEs have played a complementary role in encouraging energy efficiency uptake (Table 2.4). For example, support schemes offered by the Ministry of Micro, Small and Medium Enterprises (MoMSME) do not explicitly target energy efficiency but can indirectly result in energy efficiency uptake. This is especially the case for erstwhile MoMSME schemes supporting technology upgradation, including the Credit Linked Capital Subsidy (CLCS) component of the Credit Linked Capital Subsidy and Technology Upgradation Scheme (CLCS-TUS) and Technology & Quality Upgradation Support for MSMEs (TEQUP). These schemes offered capital investment subsidies (up to 25% of project cost) for MSMEs to upgrade to improved (often energy-efficient) technologies. Though a large proportion of funds allocated to the TEQUP scheme was left unutilised, MoMSME disbursed around INR 5685 crore (USD 711 million) to almost 88 000 MSMEs through the CLCS component of the CLCS-TUS scheme over its lifetime (Biswas, Sharma and Ganesan, 2018[9]), (MoMSME, 2021[19]). Although both schemes have been discontinued, MoMSME is considering a new and revised capital subsidy scheme to support micro and small enterprises in the manufacturing and services industry to upgrade to domestically-produced technologies (MoMSME, 2021[19]).

Table 2.4. Other MSME support schemes relevant to energy efficiency

|

Name |

Agencies |

Timeframe |

Description |

|---|---|---|---|

|

Credit Linked Capital Subsidy (CLCS) component of the Credit Linked Capital Subsidy for Technology Upgradation Scheme (CLCS-TUS) |

MoMSME, SIDBI, 9 empanelled PSBs |

2000-2020 |

Provided capital investment subsidy (up to 15% of project amount) for MSME technology upgradation projects along with linked credit from nine empanelled financial institutions for the remaining project amount. |

|

Technology & Quality Upgradation Support for MSMEs (TEQUP) |

MoMSME |

2010-2017 |

Provided capital investment subsidy (up to 25% of project amount) to encourage MSMEs to adopt Energy Efficient Technologies (EETs) along with linked credit from empanelled financial institutions for the remaining project amount. |

|

Interest Subvention Scheme for Incremental Credit to MSMEs |

MoMSME |

2018-2021 |

Provided interest relief of 2% per annum on the incremental amount of working capital sanctioned or incremental term loan disbursed by eligible institutions to eligible MSMEs. Maximum financial assistance was capped at INR 100 lakh (USD 125 000) per MSME. |

|

Zero Effect-Zero Defect (ZED) |

MoMSME |

2016 (ongoing) |

Provides financial and technical assistance for MSMEs to achieve ZED certification, which certifies the quality and environmental friendliness of manufactured goods. |

Note: This list is non-exhaustive. PSB = Public Sector Banks.

Energy efficiency ambitions to 2030

In its latest NDC submission of August 2022, India has committed to 45% emissions intensity reduction of its GDP by 2030 compared to 2005 levels ( (PIB, 2022[20])). Given the sizeable and growing contribution of MSMEs in India’s industry energy consumption, promoting the uptake of energy-efficient technologies and process improvements for MSME units will play a central role in achieving India’s energy efficiency ambitions to 2030.

Barriers and challenges

While past schemes and policy programmes have led to considerable progress, several barriers continue to impede MSME energy efficiency adoption, including challenges financial institutions face in offering energy efficiency finance to MSMEs.

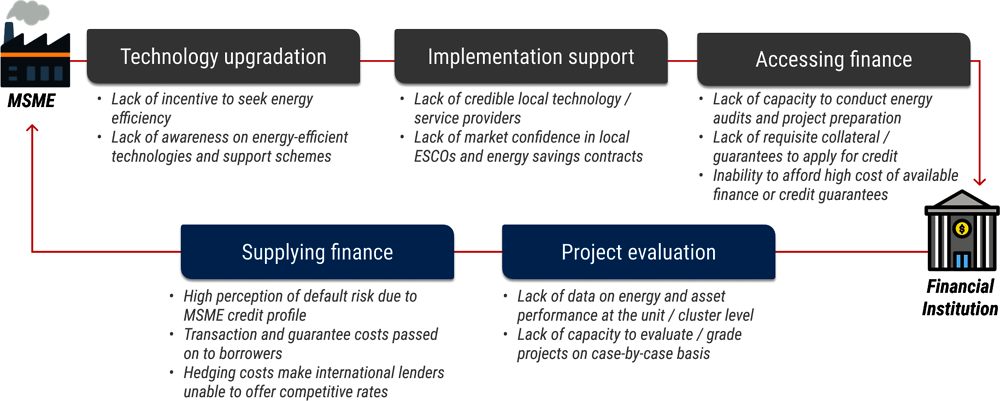

Broadly speaking, typical barriers can be categorised as challenges linked to awareness, capacity, and the costs of financing energy efficiency (Figure 2.1). For example, MSMEs often lack knowledge and awareness about energy-efficient technologies, good practices and the process to avail of financing, for instance through government schemes (ACMFN, 2019[21]). Part of this is also due to lack of incentive to voluntarily seek energy efficiency investments that are not directly linked to improvements in production capacity or export competitiveness, such as energy conservation measures (SSEF, 2017[22]). The result is a shortage of demand for energy efficiency measures by MSMEs.

Capacity to undertake the necessary steps to implement efficiency measures or to access financing is another challenge for MSMEs. One study on the factors influencing uptake of energy efficiency in MSMEs found that whilst 56% of surveyed enterprises monitored and recorded their energy use, only 35% had had conducted an investment-grade energy audit within the previous three years (Biswas, Sharma and Ganesan, 2018[9]). Many MSMEs also lack technical expertise or capacity to fulfil project preparation and documentation requirements for financing. Low availability of credible providers of energy-efficient technology and services (e.g. energy savings companies or ESCOs) at the local level, as well as the lack of confidence in energy service contracting, further impedes MSMEs capacity to implement efficiency measures.

Figure 2.1. Illustrative challenges in MSME energy efficiency finance along project cycle

Source: Authors

Absence of comprehensive data on energy consumed in the roughly six thousand MSME clusters in India also hampers efforts to improve energy efficiency uptake in MSMEs (Biswas, Sharma and Ganesan, 2018[9]). Efforts such as a 2012 benchmarking and data mapping of 36 MSME clusters across India helped to assess energy savings potential from specific energy-efficient technologies, but work is still needed to track MSME energy consumption to inform energy efficiency opportunities (TERI, 2012[23]). Available data and sharing of success stories also can be an issue to encourage replication of energy efficiency measures in other MSME units (SSEF, 2017[22]).

Access to affordable financing is another critical challenge for MSMEs, particularly given their smaller operations and smaller capital base (Natarajan et al., 2021[13]). In fact, self-financing was listed as the major source of financing for both capital and operational expenses for a majority of enterprises (Biswas, Sharma and Ganesan, 2018[9]). MSMEs looking for financing also often feel that their project loan proposals get rejected due to lack of requisite collateral or guarantees (SSEF, 2017[22]). While schemes like the CGTMSE enable access to collateral-free loans by providing a credit guarantee (up to 85% of project amount), the cost of availing such guarantees is often prohibitively high for MSMEs. Another challenge is the overall lack of suitable finance solutions, such as cash-flow based financing options, to support energy efficiency investments by MSMEs.

These barriers are compounded by similar challenges for financial institutions. For instance, commercial banks and non-banking financial companies (NBFCs) often lack sufficient awareness and capacity to apply energy efficiency financing concepts (e.g. technical risk factors in the appraisal process) (BEE, 2021[10]). Energy and asset performance data is also scarce, both at the unit or cluster level, contributing to an already high perception of risk by financial institutions. Lack of data and standardised documentation contributes to high transaction costs as well, for instance from due diligence to assess the expected return of measures on a case-by-case basis. This contributes to the high turnaround time for processing MSME loans and can further hamper financial institutions’ willingness to lend to MSME energy efficiency projects (RBI, 2019[24]). Other issues, like hedging costs faced by international lenders, can further increase the overall cost of financing.

There can be other issues that compound these barriers due to awareness, capacity and cost of finance. For example, a number of initiatives, such as the erstwhile CLCS-TUS and TEQUP, provided considerable financial support to MSME technology upgradation, including for energy-efficient technologies. Yet, these did not necessarily require energy efficiency measures to qualify under the schemes. Credit guarantee schemes like the CGTMSE and the PRSF likewise face challenges, such as delays in support payments, which may limit their use in practice. Programme costs (e.g. for processing and fees) also can add to cost of finance, discouraging use of these support mechanisms.

Opportunities and solutions

Several opportunities exist to enable MSME energy efficiency finance and investment, including measures that build upon current initiatives for awareness raising, training and capacity building. Others can address the overall cost of finance for MSME energy efficiency upgradation, whilst support for innovative solutions and new business models, for example through energy service contracting, can enable greater uptake of energy efficiency solutions by MSMEs (Table 2.4).

Many previous efforts have addressed lack of awareness and capacity through cluster-level knowledge dissemination and technology demonstration workshops, although the reach and replicability of such initiatives remains a challenge. Awareness programmes are often constrained by short funding timeframes, such that the project reporting phase begins before all programme targets are achieved. A survey of MSMEs that participated in energy efficiency workshops reported that only around 50% of participants were satisfied with the frequency, practical training, and case studies used in these workshops (Biswas, Sharma and Ganesan, 2018[9]). Further, such awareness programmes and workshops tend to be carried out in silos, despite the potential to achieve greater scale by pooling resources.

Table 2.4. Barriers to MSME energy efficiency financing addressed by past or existing measures

|

Actor |

Project cycle stage |

Barriers addressed |

Past / Existing measures |

|---|---|---|---|

|

MSME |

Technology upgradation |

Lack of incentive to seek energy efficiency |

|

|

Lack of awareness on energy efficient technologies and support schemes |

|

||

|

MSME |

Project implementation |

Lack of credible local technology / service provider |

|

|

Lack of market confidence in local ESCOs and performance-based contracting |

|

||

|

MSME |

Accessing finance |

Lack of capacity to conduct energy audit and project preparation |

|

|

Lack of requisite collateral / guarantees to apply for project finance |

|

||

|

Inability to afford high cost of available finance and / or credit guarantees |

|

||

|

Financial institution |

Project evaluation |

Lack of data on energy and asset performance at the unit / cluster level |

|

|

Lack of capacity to evaluate / grade projects on case-by-case basis |

|

||

|

Financial institution |

Supplying finance |

High perception of MSME default risk |

|

|

Due diligence costs passed on to borrowers as processing fees |

|

||

|

Hedging costs make international lenders’ rates uncompetitive |

BEE signed a Memorandum of Understanding with Office of Development Commissioner of the Ministry of MSMEs (DC-MSME) in 2019 for joint implementation of a programme for “Promoting Energy Security of the MSME sector” addressing awareness and technical capacity building. The programme, still awaiting implementation, will be a step in the direction of greater co-ordination across government authorities. It also is an opportunity to build upon the experience and lessons learned from BEE and DC-MSME initiatives, which can help to improve continuity and replicability of programme outcomes in the future.

Policy can also include financial or regulatory incentives and demand aggregation measures. Targets and policies, such as state-level energy efficiency obligations, green product standards for export, or higher minimum energy performance standards (MEPS) for widely used equipment (e.g. electric motors) can be effective in promoting MSME uptake of energy efficiency. Further, multilateral funding sources can be availed of to develop and deploy customised energy-efficient technology solutions for key MSME segments (see Annex B). BEE is likewise considering the expansion of the PAT scheme to certain MSME clusters, as originally proposed under ROSHANEE, to further incentivise energy efficiency investments. Revised versions of past MSME schemes providing credit subsidies for technology upgradation, like CLCS-TUS and TEQUP, likewise could explicitly include energy efficiency as a criterion for eligibility or preferential financing terms..

On the financial institution side of the equation, Roadmap stakeholders noted that modifying certain RBI regulations could potentially increase commercial lending to MSME energy efficiency. Examples include declaring energy efficiency as a requirement under priority sector lending (PSL) rule or making the 90-day default window flexible to accommodate MSME’s variable cash flows. Concessional financing terms to nodal financial institutions under upcoming technology upgradation schemes could similarly induce them to prioritise energy efficiency lending.

Several opportunities exist as well to improve the availability of MSME data and boost lender confidence in MSME energy efficiency projects. Initiatives have been undertaken by various ministries and independent agencies to collect data and develop knowledge products required by MSMEs and financial institutions to finance energy efficiency, but these remain widely dispersed and difficult to access. Consolidating this data and information would greatly improve transparency and serve as a foundation on which further data collection efforts can be based. Additional proposals from stakeholders include measures to appropriately classify existing data on lending to MSMEs for energy efficiency (e.g., by defining simplified criteria for tagging energy efficiency loans among technology upgradation loans) and to centralise and consolidate unit-level and cluster-level data (e.g., by incentivising MSMEs to file energy returns, digitising existing data from past projects and support schemes, improving digitalisation, and strengthening the monitoring, reporting & verification process on future support schemes).

BEE’s new digital platform under the EEFP has the potential to serve as a centralised data and information repository. This project aims to develop a digital matchmaking platform, where MSMEs can register interest or propose energy efficiency projects by providing basic details, which will then automatically be screened and passed on to BEE and empanelled financial institutions for further evaluation. Currently, only two financial institutions (YES Bank and the Indian Renewable Energy Development Agency) are empanelled with the EEFP, and there is a need to engage more local commercial banks and NBFCs with existing banking relationships with MSMEs to facilitate wider reach.

Further, there is scope for the platform to integrate additional features, such as an up-to-date dashboard of indicators on financing activities (e.g. projects financed and total investments made by enterprise type), a monitoring, reporting & verification functionality (e.g. project-level savings achieved, debt service obligations, cost of equity, etc.), as well as a resource centre providing technical and financial advisory services on energy efficiency projects. Although the platform does not specifically cater to MSMEs, it could serve as a medium to consolidate key informational tools, such as lists of energy-efficient technologies (such as BEE’s list released in September 2022), credible service providers and certified energy auditors, as well as simplified technical manuals (see Box 2.1 on an international example). These can help to address awareness gaps and ensure that matchmaking benefits are accessible to MSMEs.

Box 2.1. The Energy Efficient SME Platform for European Union countries

The Energy Efficient SME Platform (https://www.energyefficientsme.eu/) was developed with European Union Horizon 2020 funding on behalf of a consortium of knowledge institutes, non-profit organisations, and energy service suppliers from Austria, Germany, Italy, the Netherlands, Romania, and Sweden. The platform consolidates and publishes open-access information and resources to help SME clusters become more efficient and establish energy collectives with their local trusted partners.

Resources on this digital platform are organised into four key pillars:

Explore – provides a Handbook with detailed information on the energy collective approach.

Implement – provides practical guidelines, training materials and tools on a variety of topics, such as identifying relevant stakeholders, contracting energy service suppliers, identifying attractive energy efficiency technologies, self-evaluating energy consumption data and energy-related key performance indicators.

Get Inspired – provides examples and best practices from other successful energy collectives.

Interact – provides access to a community of energy collective developers to connect and exchange with

Source: www.energyefficientsme.eu/about/.

Previous initiatives by government agencies and international partners to create bankable and investor-ready projects have included capacity building elements for MSMEs (e.g., technical assistance for project preparation or financial support for investment-grade energy audits) as well as financial institutions (e.g., financial and technical support for energy efficiency project grading under BEE’s pilot Grading of Energy Efficiency programme). For instance, Further efforts are needed to build trust, for instance, by involving and building capacity of local actors (e.g., state designated authorities, MSME cluster associations, local financial institutions) dealing directly with MSMEs.

Capacity and confidence-building are also necessary to support the development of ESCO markets in India. ESCOs serve as intermediaries in the energy efficiency financing value chain, delivering projects that are financed through resulting energy cost savings (IEA, 2021[25]). With the ESCO model, MSMEs can avoid large upfront capital investments by entering into energy saving contracts with ESCOs and paying in instalments with savings on their monthly energy bills. At the same time, ESCOs can offer an aggregated pipeline of projects for financial institutions, thus making them less exposed to individual MSME risks.

Despite the success of bulk procurement programmes run by the super-ESCO Energy Efficiency Services Limited (EESL) for energy-efficient street lighting and super-efficient air conditioners, the ESCO market in India is still at a nascent stage. In particular, there is a shortage of local-level ESCOs with the capacity to service the MSME sector. For example, EESL runs the National Motor Replacement Programme (NMRP), through which it aims to sell 40 000 IE3 motors to industry clients, but more targeted and localised efforts are required to reach MSMEs and achieve full energy savings potential (U4E, 2020[26]). Further capacity building programmes should thus focus on training and incentivising to local ESCOs to provide the full range of services needed by MSMEs clusters, from developing or procuring custom technology solutions to installing, operating and maintaining them.

Market confidence in energy performance contracting and the ESCO model can be strengthened by developing energy savings insurance, an innovative financial product that covers projected paybacks from capital-intensive energy-efficient technology investments. With such an insurance product, ESCOs can back their contractual guarantees for the performance of their products and MSME clients can be assured of compensation in case projected energy savings are not realised. Several components need to be designed and strengthened simultaneously to establish an energy savings insurance (ESI) model in India, including standardised energy performance contracting, third-party technical validation procedures and an ESCO financing structure (CFL, 2015[27]). International partners have previously supported the successful implementation of ESI models in Colombia and Mexico, as well as numerous pilot projects in other Latin American countries, and interest to develop these elsewhere is expanding (Box 2.2).

Box 2.2. Energy Savings Insurance Program in Colombia

Project objective

The Energy Savings Insurance (ESI) pilot program in Colombia was launched in 2016 under the leadership of Bancóldex, the Colombian national development bank, with financial and technical support from the Inter-American Development Bank (IDB) and the Climate Investment Facility’s (CIF) Clean Technology Fund (CTF). The program offered a de-risking package consisting of both financial and non-financial elements designed to build investor confidence and drive investments in energy efficiency projects. The program was expected to support 104 firms to reduce about 13,977 tonnes of CO2 emissions annually through energy efficiency upgrades.

Barriers to investment

Energy-efficient technologies require higher upfront capital investments than conventional technologies, and returns are obtained over time in the form of energy savings and reduced energy bills. A key barrier to such investments is thus the lack of trust among investing firms that energy efficiency upgrades will deliver promised energy savings. Local financial institutions also lack the capacity to accurately evaluate creditworthiness of projects where eventual savings can be used to repay debt obligations, which further hinders firms’ access to long-term financing at competitive rates for such projects.

Financing strategy

The ESI model combines medium- and long-term credit lines with three risk mitigation instruments that support the identification and structuring of technically robust and bankable projects: a standard contract, technical validation, and the energy savings insurance.

The standard contract establishes the responsibilities of the supplier (supply and installation of equipment, guarantees, and expected energy savings) as well as the customer (timely payments, access to facilities, and adequate maintenance of the equipment).

The technical validation is carried out by an independent validator who evaluates and confirms the project’s technical potential to achieve the promised savings and verifies on site that the project has been built according to specifications. The validator also acts as an arbitrator in case of disagreements between customer and supplier in terms of actual savings generated by the project.

The energy savings insurance is activated upon technical validation of the project. It is a performance warranty provided by the supplier to the customer for the committed savings over the contract duration. If at any point in time, the project does not achieve the pledged savings, the insurance will financially compensate the client.

Insured projects are provided credit lines at special conditions, including preferential rates, grace periods and extended tenure. Additional incentives are also provided to investors and technology providers, including free technical validation, specialised technical support, access to capacity building services, expedited credit evaluation, and preparation and dissemination of success cases in events and electronic platforms.

Source: Inter-American Development Bank’s website

Targeted risk mitigation and payment security mechanisms are equally required to reduce the cost of financing and to unlock greater private capital for MSME energy efficiency. Particularly in the context of ESCO development, payment security mechanisms to financial institutions can help build confidence in the nascent ESCO market. Currently, payment security for MSME energy efficiency projects is available through existing government guarantees under the PRSF and CGTMSE schemes. International development finance institutions also offer risk mitigation products (e.g. the UNLOCK credit guarantee and ARIZ risk sharing mechanism by AFD, the Sustainable Renewables Risk Mitigation Initiative by the Energy Sector Management Assistance Programme, etc.) but their applicability to small-scale MSME energy efficiency projects remains challenging.

Roadmap stakeholders noted that design improvements are needed to make existing schemes like the PRSF and CGTMSE more flexible, more accessible and more effective. For instance, current procedures to avail of credit guarantees under these schemes involve extensive paperwork and significant delays in fund transfers in case of invocation, thus reducing the utility of the guarantee for lenders. Moreover, the cost of availing of these guarantees (with guarantee and service fees accounting for up to 2% of project costs) is often passed on to MSME borrowers, thus limiting the efficacy of such schemes. Proposed measures to reduce guarantee costs include risk adjustments (e.g. reducing the default risk coverage to reduce exposure or implementing a portfolio risk-adjusted guarantee fee structure for financial institutions) and concessional finance (e.g. charging a reduced uniform guarantee fee for lending to MSMEs or offsetting guarantee costs with government or international finance) (RBI, 2010[28]).

Further measures to reduce the cost of finance include building upon existing initiatives, for example through cluster mapping and technology demonstrations, to reduce transaction costs and to ensure sufficient pipelines of energy efficiency data and demand. It is also important to ensure that general programme costs (i.e. administrative or “handholding” costs) of financial support schemes are not passed on to MSME borrowers and do not raise the eventual cost of finance.

Opportunities exist equally to address currency risks faced by international partners financing policy programmes targeting MSME energy efficiency or extending credit lines to MSME borrowers through local financial institutions. International lenders have more experience financing MSME energy efficiency projects and thus a lower risk perception, but currency hedging costs make their eventual costs of finance uncompetitive with local lenders. Such risks can be addressed by extracting lessons from foreign exchange hedging facilities, such as the Currency Exchange Fund (TCX) or MFX Currency Risk Solutions, which hedge impact investment projects through forward contracts and currency swaps. Tailoring such solutions, including addressing eventual regulatory barriers (e.g. limiting hedging by entities that do not hold the underlying asset) would help address costs.

Investment needs and financial support for energy efficiency

Estimated energy saving measures in the industry sector (including MSMEs and large industries) will require total investments of more than INR 5-6 lakh crore (USD 62-73 billion) to 2031 (BEE, 2019[4]). This represents roughly 45% of the total estimated potential investments of more than 10-13 lakh crore in energy savings measures in the overall economy across sectors to 2031. By comparison, over 1995-2018, only around USD 241 million (INR 1 900 crore) had been provided as financial support (including budgetary support, lines of credit, and grants) to roughly 8 000 MSMEs to implement energy efficiency measures (Biswas, Sharma and Ganesan, 2018[9]).

NRDC and the OECD assessed over 16 500 projects supported by the CLCSS and TEQUP schemes between 2016-21, where the estimated project capital expenditure (CAPEX) amount, based on the eligible amount of subsidy, typically fell between INR 0.2-0.6 crore (roughly USD 25-65 thousand). Additional data from MSME loan schemes offered by state banks and NBFCs showed that collateral requirements could often be in the range of 20-40%, suggesting that actual borrowed amounts (i.e. loans after the applied capital subsidy and collateral requirements) were in the typical range of INR 0.1-0.35 crore (roughly USD 13-45 thousand). Interest rates varied from as little as 6.75% to 27%, over tenures of 1.5 to 10 years (the average being around 5). Processing fees were as much as 1-3% (absolute) of those interest rates.

While these data are not necessarily a full picture of MSME financing, and while energy efficiency may not represent full project CAPEX, the spread gives a sense of magnitude and eventual implications for the cost of finance. For instance, reducing a five-year INR 0.2 crore loan by 1% or 2% (absolute) would reduce the overall borrowed cost to MSMEs by around INR 0.6-1.1 lakhs (around USD 800-1 500). Given current volumes under the CLCSS (around 8 500 projects are subsidised each year), a 1-2% interest rate reduction would thus represent as much as INR 350-800 crore (roughly USD 45-105 million) in eventual savings to borrowers. When considered within the context of scaling up MSME energy efficiency upgradation, for example if 2% of the roughly 10 million SMEs in India were to perform efficiency measures each year, savings from such improvements in the cost of financing could easily be in the INR 100-450 lakh crore (USD 1.5-6 billion) range over the next decade. Identifying and implementing measures to address the cost of finance, alongside other actions (e.g., training and capacity building to encourage energy efficiency adoption by MSMEs) will consequently play a critical role in unlocking those investment opportunities.

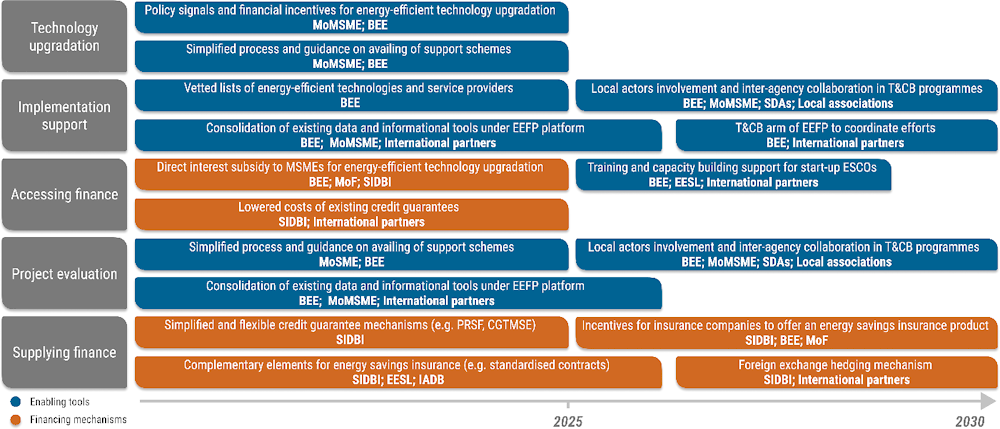

Roadmap to 2030

Meeting India’s NDC commitments and energy efficiency target by 2030 will require targeted action and tailored solutions through co-ordinated efforts across stakeholders, from energy efficiency stakeholders and MSME associations to state and central governments, financial players, local banks and NBFCs and international partners. Working together can bring forward solutions to address bottlenecks and enable the finance needed to unlock MSME energy efficiency potential.

Recommendations

The Roadmap proposes seven key recommendations to de-risk MSME energy efficiency investment and to enable the flow of finance to those projects. Proposed interventions are set forth across two key pillars: targeted enabling tools and specific financial support to address critical barriers in the MSME energy efficiency financing value chain. It should be noted that several of the following recommendations can be applied as well to promote energy efficiency across sectors beyond MSMEs.

Enabling tools

1. BEE and MoMSME should jointly strengthen incentives for MSMEs and financial institutions to seek energy efficiency measures through use of policy “carrots” and “sticks”.

Enabling the flow of capital to MSME energy efficiency projects requires an established and trusted pipeline of projects for banks and NBFCs to finance. MSMEs often lack the incentive to take up energy efficiency measures and technologies, as these tend to be capital-intensive investments with long payback periods and potentially uncertain returns. Creating and strengthening incentives, for example through policy and regulatory tools, can help to overcome shortage of demand.

Financial “carrots” can incentivise MSMEs to invest in energy efficiency, for example, by offering preferential financing terms for energy-efficient technology upgradation under schemes such as CLCSS or TEQUP. Similarly, financial institutions can be encouraged to lend to MSME energy efficiency projects, for instance, through government schemes offering concessional financing (e.g. via on-lending) to target energy efficiency loans.

Regulatory “sticks” can facilitate energy efficiency uptake whilst discouraging the use of inefficient technologies, for example, by setting stringent minimum energy performance standards (e.g., for electric motors) and by making inefficient technologies ineligible for technology upgradation subsidies. Obligations, for instance through state-level energy efficiency targets or by expanding the PAT scheme to medium enterprises or large SME clusters (appropriately targeted to avoid burdening struggling SME units) could also drive demand for energy efficiency.

2. International partners should support the development of BEE’s new facilitation centre to enable a one-stop shop for energy efficiency data and resources.

Raising awareness among MSMEs and financial institutions to ensure adequate demand for energy efficiency projects requires a clear evidence base to increase confidence in those investments. This includes making sure sufficient data and informational tools are readily accessible to stakeholders. BEE’s new EEFP, with the right support from partners, can become a central hub for co-ordinating efforts to ensure future initiatives build upon previous successes and unlock opportunities for MSME energy efficiency financing.

The EEFP facilitation centre should work with domestic and international partners (e.g. MoMSME, TERI, JICA, etc.) to ensure the digital platform consolidates existing informational tools, such as sector-specific manuals on energy-efficient technologies, best operating practices, case studies and success stories, alongside information on available support schemes, lists of energy-efficient technologies and names of empanelled service providers.

The platform should consolidate existing project-level and cluster-level data on MSME energy performance (e.g., from past efforts by BEE, MoMSME and partners on energy mapping, energy auditing, detailed project preparation, standardised project documentation, and project evaluation and grading).

Building on SIDBI’s existing Knowledge Repository, EEFP could incorporate an interactive community feature, where MSMEs can access a network of practitioners and experts to share insights, experiences and best practices.

International partners specifically can provide financial and technical support to consolidate existing data and resources that can be built upon in the future (e.g., by tagging of energy efficiency loans sanctioned through the platform and by regular updates of performance data, support manuals and lists of credible local service providers).

3. International development partners with relevant Indian ministries should scale up, co-ordinate and pool training and capacity building efforts.

India’s rich experience in awareness raising, training and capacity building along the entire MSME financing value chain underscores that these efforts are critical to enabling energy efficiency finance and investments. Given the scope and scale of MSME activities in India, it is essential that these efforts continue and are both scalable and replicable, so that initiatives do not result in one-off exercises.

BEE should continue to collaborate with other agencies (e.g. under the recent MoU between BEE and DC-MSME) to explore opportunities to pool resources and increase capacity building activities, for instance under possible collaboration with SIDBI’s Knowledge Centre for MSMEs and in continued activities with internal partners.

Local actors, such as state designated authorities, MSME cluster associations and local financial institutions, should be involved to the greatest extent possible in these interventions in order to build trust and achieve maximum reach.

Special efforts should be made to target local ESCO capacity, as these actors have enormous, untapped potential to develop, procure, install, operate and maintain customised energy-efficient technologies that are needed by MSME industries and clusters.

International partners should support BEE’s facilitation centre to play a role in coordinating training and capacity building efforts, possibly through the creation of a revolving fund, particularly given the scale and scope of these activities and required resources to maintain them.

Financial support

4. BEE can target new interest subsidy support for MSME technology upgradation with the objective of lowering cost of finance for energy efficiency measures.

While past technology upgradation schemes like CLCS-TUS and TEQUP have offered credit subsidies to partner financial institutions, experience so far suggests that more effort is needed to translate these subsidies into lower borrowing costs for MSMEs and address high collateral requirements.

BEE should build on lessons and experiences from other programmes through interagency collaboration (e.g. with MoMSME on CLCS-TUS and TEQUP) in designing a new interest subsidy mechanism for energy-efficient technology upgradation in MSMEs.

This new interest subsidy mechanism should include a monitoring and verification component to track its impact on eventual interest rates offered to MSMEs by partner financial institutions.

5. SIDBI should work with BEE and international partners to improve the flexibility, pricing, and efficacy of existing credit guarantee schemes.

Credit guarantee schemes like PRSF and CGTMSE mitigate the high perception of default risk, but corresponding guarantee fees and service costs charged to participating financial institutions add to the final cost of finance for MSME borrowers (including ESCOs). Complicated paperwork to avail of guarantees is another current deterrent to financial institutions, and delays in reimbursements lead to an additional cost of provisioning in lenders’ books. Such issues need to be addressed to increase lender confidence in these mechanisms and increase their impact.

SIDBI can take advantage of improved data through BEE’s EEFP to target risks in its guarantee schemes, increase flexibility in the PRSF and CGTMSE mechanisms, and reduce the need for extensive paperwork. For instance, loan performance data can be used to assess the first signs of debt distress to redesign the schemes so guarantee payment is automatically triggered (e.g. within 30-45 days of default).

SIDBI should explore mechanisms to reduce the cost of availing guarantees for MSME clients, for example by reducing the default risk coverage ratio (e.g. from 75% to 50%) or by charging a concessional guarantee fee for lending to MSME energy efficiency loans. SIDBI can also work with international partners to apply blended finance to partially offset guarantee fees and service costs.

6. BEE and international partners should work together to pilot an energy savings insurance scheme (ESI) in India, while encouraging local ESCO market development in India (see Annex C).

ESCO market development in India remains a key, untapped opportunity to increase energy efficiency deployment through demand aggregation and project pipeline creation. A robust ESCO market can equally help to reduce transaction costs and improve MSME access to affordable finance. To unlock India’s ESCO market potential, financial instruments such as ESI are needed to address risks and improve confidence in the energy performance contracting model.

BEE should work with energy efficiency stakeholders, domestic and international financial actors (e.g. insurance companies), and regulatory agencies (e.g. the Insurance Regulatory and Development Authority or India) to pilot an ESI product, building upon experiences and lessons learned from international experience with such instruments.

Multilateral development banks and international donors can support the development of this ESI model, not only through direct financial support but also to support various elements of the insurance product (e.g. preparation of standardised documentation and technical validation methodologies).

The scope of the new UNIDO-EESL Promoting Market Transformation for Energy Efficiency can be expanded to increase participation of local ESCOs (potentially with training and capacity building services, for instance by EESL) and improve their capacity to implement performance-based contracting with an ESCO financing model.

7. SIDBI should work with MoF, MEA and international partners to establish a targeted foreign exchange hedging mechanism.

Currency hedging costs can limit international lender support for domestic policy programmes and credit lines to support MSME energy efficiency investment. Establishing a targeted foreign exchange hedging mechanism with a suitable financial intermediary can help reduce these costs and enable greater international support for MSME energy efficiency measures.

A foreign exchange hedging facility should be explored in earnest. A pilot programme, with support from international donors, can demonstrate the use of such a facility, ideally targeting financing for energy efficiency in the MSME sector. The said facility would be in-charge of channelling foreign currency loans, such that lending institutions are either able to avail of finance for further lending in INR or purchase currency swaps at a lower-than-market rate from the facility.

This hedging facility could be housed within and managed by a suitable financial intermediary such as SIDBI or a public sector bank with foreign exchange capabilities (e.g. SBI), engaged with relevant ministries such as MoF, RBI and MEA.

Blended concessional finance and grant support from international donors will be crucial to setting up the facility and make available low-cost currency swaps for early programme development.

Key actions and timeline

Figure 2.2. Overview of the main recommendations for Energy Efficiency of MSMEs until 2030

Note: T&CB: Training and Capacity Building; EE: Energy-efficient

Source: Authors

References

[21] ACMFN (2019), A Snapshot of the Indian Cleantech Financing Ecosystem, Asian Cleantech MSME Financing Network, https://www.energy.greenbusinesscentre.com/Publications/files/139acmfn.pdf (accessed on 16 June 2022).

[17] Agrawal, P. (2016), Energy Efficiency Financing in MSMEs, Small Industries Development Bank of India, http://pace-d.com/wp-content/uploads/2016/08/2-SIDBI-Initiatives-for-EE-Project-Financing.pdf (accessed on 17 June 2022).

[16] BEE (2022), BEE’s List of Energy Efficient Technologies for Financing, https://beeindia.gov.in/sites/default/files/BEE%27s%20List%20of%20Energy%20Efficient%20Technologies%20for%20Financing%283%29.pdf (accessed on 30 September 2022).

[6] BEE (2022), SME | Bureau of Energy Efficiency, https://beeindia.gov.in/content/sme (accessed on 16 June 2022).

[10] BEE (2021), ROSHANEE: Roadmap of Sustainable and Holistic Approach to National Energy Efficiency, Bureau of Energy Efficiency, Ministry of Power, Government of India, https://beeindia.gov.in/sites/default/files/ROSHANEE%20DOCUMENT.pdf (accessed on 16 June 2022).

[15] BEE (2020), Annual Report 2019-20, Bureau of Energy Efficiency, Ministry of Power, Government of India, https://beeindia.gov.in/sites/default/files/Bee%20%28Annual%20Report%20-%20Artwork_0.pdf (accessed on 17 June 2022).

[4] BEE (2019), Unlocking National Energy Efficiency Potential (UNNATEE): Strategy Plan Towards Developing an Energy Efficient Nation (2017-2031, Ministry of Power, Government of India, https://beeindia.gov.in/sites/default/files/UNNATEE_0.pdf (accessed on 16 June 2022).

[9] Biswas, T., S. Sharma and K. Ganesan (2018), Factors Influencing the Uptake of Energy Efficiency Initiatives by Indian MSMEs, Council on Energy, Environment, and Water, https://www.ceew.in/publications/factors-influencing-uptake-energy-efficiency-initiatives-indian-msmes (accessed on 16 June 2022).

[27] CFL (2015), Energy Savings Insurance, https://www.climatefinancelab.org/wp-content/uploads/2015/04/ESI_handout.pdf (accessed on 17 June 2022).

[3] EIA (2019), Alternative industrial sector outcomes in India: India’s energy use could be much higher, EIA International Energy Outlook 2019, https://www.eia.gov/outlooks/ieo/section_issue_aiso.php (accessed on 16 June 2022).

[1] GoI (2022), Energy Statistics India 2022, National Statistical Office, Ministry of Statistics and Programme Implementation, https://www.mospi.gov.in/documents/213904/1606151/Energy%20Statistics%20India%2020221644825594802.pdf/aed59aac-4d5a-995b-1232-bb68397cd873 (accessed on 16 June 2022).

[2] Gupta, V. et al. (2019), Greenhouse Gases Emissions of India (subnational estimates): Manufacturing Sector (2005-2015 series), http://www.ghgplatform-india.org/industry-sector (accessed on 16 June 2022).

[25] IEA (2021), Evolving Energy Service Companies in China, International Energy Agency, https://www.iea.org/reports/evolving-energy-service-companies-in-china (accessed on 16 June 2022).

[8] IEA (2021), World Energy Balances, International Energy Agency, https://www.iea.org/reports/world-energy-balances-overview (accessed on 16 June 2022).

[14] Mishima, M. (2018), FY2016 Ex-Post Evaluation of Japanese ODA Loan Project “Micro, Small and Medium Enterprises Energy Saving Project (Phase 2)”, OPMAC Corporation, https://www2.jica.go.jp/en/evaluation/pdf/2016_ID-P218_4_f.pdf (accessed on 17 June 2022).

[19] MoMSME (2021), No.1(12)/CLCSS/Misc./2019-20/641-670, http://www.dcmsme.gov.in.

[5] MoMSME (2020), Annual Report 2020-21, Government of India, https://msme.gov.in/sites/default/files/MSME-ANNUAL-REPORT-ENGLISH%202020-21.pdf (accessed on 16 June 2022).

[7] MoMSME (2020), What’s MSME | Ministry of Micro, Small & Medium Enterprises, https://msme.gov.in/know-about-msme (accessed on 16 June 2022).

[13] Natarajan, B. et al. (2021), India’s Energy Efficiency Landscape: A Compilation of Policies, Priorities and Potential, Alliance for an Energy Efficient Economy, New Delhi, https://aeee.in/wp-content/uploads/2021/05/India%27s-Energy-Efficiency-Landscape-Report.pdf (accessed on 16 June 2022).

[20] PIB (2022), Cabinet approves India’s Updated Nationally Determined Contribution to be communicated to the United Nations Framework Convention on Climate Change, https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1847812 (accessed on 9 September 2022).

[24] RBI (2019), Report of the Expert Committee on Micro, Small and Medium Enterprises.

[28] RBI (2010), Report of the Working Group to Review the Credit Guarantee Scheme of the Credit Guarantee Fund Trust for Micro and Small Enterprises, Reserve Bank of India, https://www.rbi.org.in/scripts/PublicationReportDetails.aspx?UrlPage=&ID=585#ISS (accessed on 23 June 2022).

[18] Reddy, P. (2020), Initiatives by SIDBI on Energy Efficiency, Small Industries Development Bank of India, http://sameeeksha.org/pdf/presentation/SIDBI_EE-initiatives.pdf (accessed on 17 June 2022).

[22] SSEF (2017), An Energy Efficiency Strategy for Small and Medium Enterprises (SMEs) - Vision 2025, Shakti Sustainable Energy Foundation, https://shaktifoundation.in/report/energy-efficiency-strategy-small-medium-enterprises-smes-vision-2025/ (accessed on 16 June 2022).

[12] SSEF (2017), Pilot - An ESCO-based Financial Model in the Ankleshwar Chemical Cluster in Gujarat - Shakti Sustainable Energy Foundation, The Energy and Resource Institute, https://shaktifoundation.in/report/pilot-esco-based-financial-model-ankleshwar-chemical-cluster-gujarat/ (accessed on 16 June 2022).

[23] TERI (2012), Benchmarking and mapping Indian MSMEs energy consumption, The Energy and Resources Institute, http://sameeeksha.org/brouchres/AFD_Brochure.pdf (accessed on 16 June 2022).

[11] U4E (2020), “National motor replacement programme - India Case Study”, https://united4efficiency.org/resources/national-motor-replacement-programme-india-case-study/ (accessed on 9 September 2022).

[26] U4E (2020), National Motor Replacement Programme India Case Study - United for Efficiency, United National Environment Programme, https://united4efficiency.org/resources/national-motor-replacement-programme-india-case-study/ (accessed on 22 June 2022).

Note

← 1. IE, or International Efficiency, is an international standard defined by IEC 60034-30-1, which stipulates the energy efficiency of low-voltage alternating current motors. There are four IE classes: IE1 represents standard efficiency; IE2 represents high efficiency, IE3 represents premium efficiency, and IE4 represents super-premium efficiency.