This chapter describes the economic and fiscal measures implemented by Belgium during the COVID-19 crisis, focusing on the main measures supporting businesses at the federal and federated levels. The chapter includes a set of recommendations aimed at helping Belgium strengthen the design and implementation of emergency economic and fiscal measures.

Evaluation of Belgium’s COVID-19 Responses

6. Economic and fiscal measures in Belgium

Abstract

Key findings

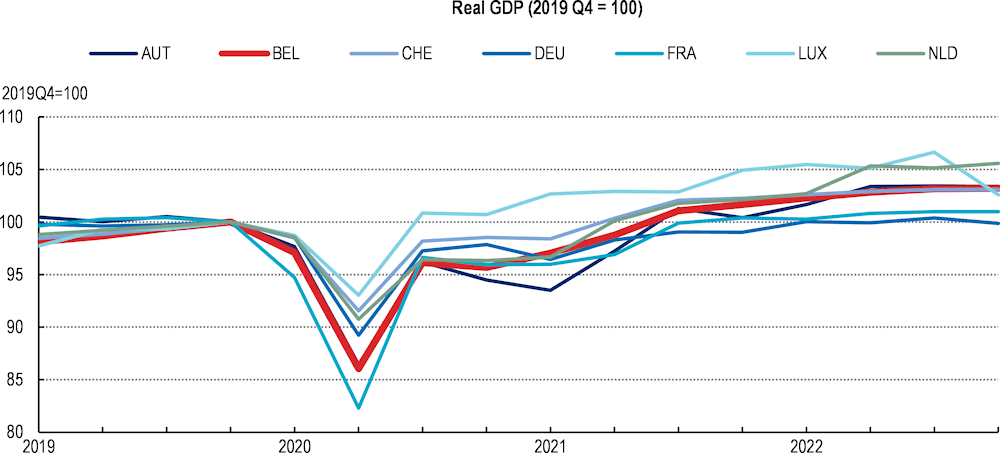

In line with other OECD countries, economic activity shrank considerably in Belgium as a result of the COVID-19 pandemic. Real GDP decreased by 14% between Q4 2019 and Q2 2020, which was primarily driven by a fall in consumption and investment. Contact-professions and service-oriented sectors were the most hardly hit by the decrease in activity, especially hotels, restaurants and cafés (HoReCa). An initial recovery in early summer 2020 was hindered by the second wave of the pandemic between autumn 2020 and beginning of 2021, but Belgium’s GDP recovered rapidly from Q3 2021 onwards.

Overall, the Belgian response to the economic crisis was similar to other OECD countries. Emergency support measures amounted to 4.9% of GDP. Belgium relied mostly on measures with a direct budgetary impact, amounting to 4% of GDP. The short-time work scheme (known in Belgium as chômage temporaire or temporary unemployment) accounted for more than half of spending and the rest went to grants and waivers on social security contribution and tax payments. The low take-up of liquidity measures (loans, guarantees and tax or contribution deferrals) limited their total cost to only 0.9% of GDP.

Support was delivered quickly at the federal level through the Federal Plans for Social and Economic Protection, which included the short-time work scheme, guaranteed loans and tax waivers or cancellations for self-employed workers and firms. These measures relied on existing schemes and institutions to reach beneficiaries, which allowed for a timely and efficient delivery.

In line with the division of responsibilities for economic policies, regional governments designed and implemented direct support (grants and subsidies) and guarantee schemes for SMEs. While this support was also delivered rapidly, differences in the timing, design and generosity of the measures existed across regions. Targeting measures to the hardest-hit firms also proved challenging as regional governments do not have access to a wealth of data collected by the federal government.

The Economic Response Monitoring Group (ERMG) set up at the beginning of the crisis to help co-ordinate the economic response facilitated inter-governmental dialogue but proved unsuited in designing and recommending measures. The monitoring of the crisis through firms’ surveys stands out within OECD countries, despite some limitations in the sampling and in setting up a consistent panel of firms. The early and continuous assessment of firms’ difficulties and needs proved useful to help policymakers adapt and develop the appropriate policy responses.

Overall, support helped preserve the economy from the shock induced by the pandemic. There was no wave of bankruptcies and job destructions. There are, however, disparities across sectors, with service-oriented industries recovering more slowly, and across workers, with individuals on temporary contracts more affected.

Most support went to businesses that were hit the hardest during the pandemic, in particular the HoReCa and cultural sector. However, support could have been made more targeted already in the early phases of the crises to those sectors suffering the greatest losses and viable firms facing hardship during the crisis. Data access and integration should be improved to effectively evaluate measures’ impact and design targeted measures.

6.1. Introduction

In March 2020, most OECD Member countries adopted sanitary restrictions to protect their populations from the COVID-19 pandemic. The pandemic together with the restrictions to mitigate it triggered a dramatic fall in economic activities starting in the second quarter of 2020, which governments tried to counteract with several economic and fiscal measures. Like other OECD Member countries, the economic and fiscal response to the crisis in Belgium included a variety of measures aimed at supporting businesses that were affected by the economic downturn. This chapter will first present the economic and fiscal consequences of the crisis and provide a comparative analysis of the size and type of measures put in place by Belgium. It will then analyse the co-ordination structure and delivery mechanism that guided the implementation of the measures. At the end, it will present an assessment of the impact of selected measures on firms’ activity during and after the crisis.

6.2. The economic consequences of the pandemic and the main features of the support measures in Belgium

This section provides a description of the economic shock induced by the pandemic on the Belgian economy, along with an aggregate overview of the government’s economic and fiscal support measures for businesses. The magnitude of the crisis and the Belgian policy response is further contextualised using a group of six neighbouring peer countries, which implemented similar policies to varying degrees, to highlight the challenges posed by the crisis and the policy tools used in response.

6.2.1. The fall in consumption triggered by the pandemic significantly reduced economic activity

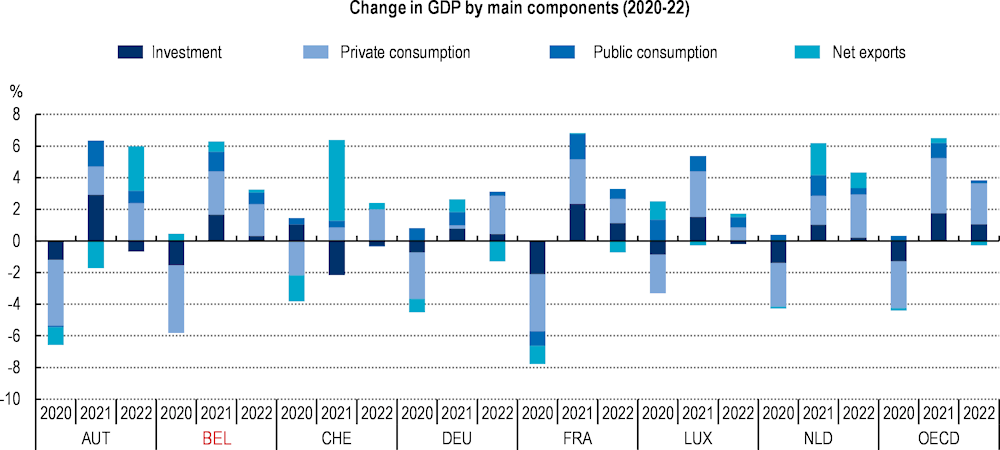

In the aftermath of the COVID-19 pandemic, the economic slowdown in Belgium was similar to other European Union (EU) and OECD Member countries (Figure 6.1). This economic shock was mostly driven by a fall in private consumption in the second quarter of 2020. The magnitude of the contraction in private consumption in 2020 in Belgium was greater than in the peer countries in the same period (Figure 6.2), while the rebound in 2021 and 2022 was slightly weaker. In 2020, public consumption remained stable and saw a modest increase in 2021 and 2022.

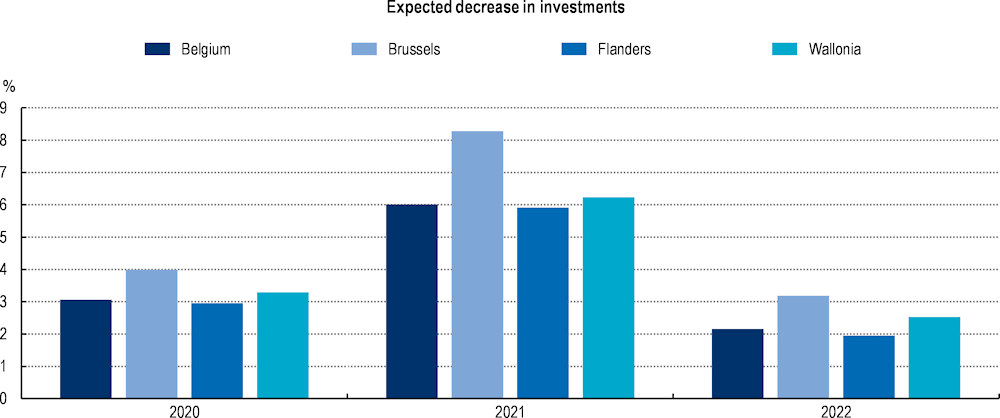

Total investment (gross fixed capital formation (GFCF)) also fell in 2020, although to a lesser degree than consumption (-1.5% of GDP compared to -4.3% of GDP for consumption in terms of contributions to GDP growth) and rebounded in 2021, when it contributed 1.7% of GDP growth. The decline in investment occurred in all sectors including corporate (accounting for around two thirds of GFCF in 2020), households and the general government. Despite the pandemic causing temporary disruptions, the resurgence of investments in 2021 indicates that many projects were postponed rather than cancelled. This was favoured by the federal tax deduction for investment and potentially also the stabilising effect of the short-time work scheme reducing labour costs and preventing disruptive layoff and recruiting cycles hindering the execution of investments (Haroutunian, Osterloh and Sławińska, 2021[1]). As part of the recovery, the proportion of public investment in total investment slightly increased between 2020 and 2021, compensating for the marginally slower recovery of corporate investment (OECD, 2023[2]).

Figure 6.1. Economic activity shrank considerably during the COVID-19 pandemic in Belgium

Figure 6.2. Private consumption and investment were responsible for the decline in economic activity

Source: OECD Economic Outlook 113 Database (June 2023) and National Accounts Database (June 2023).

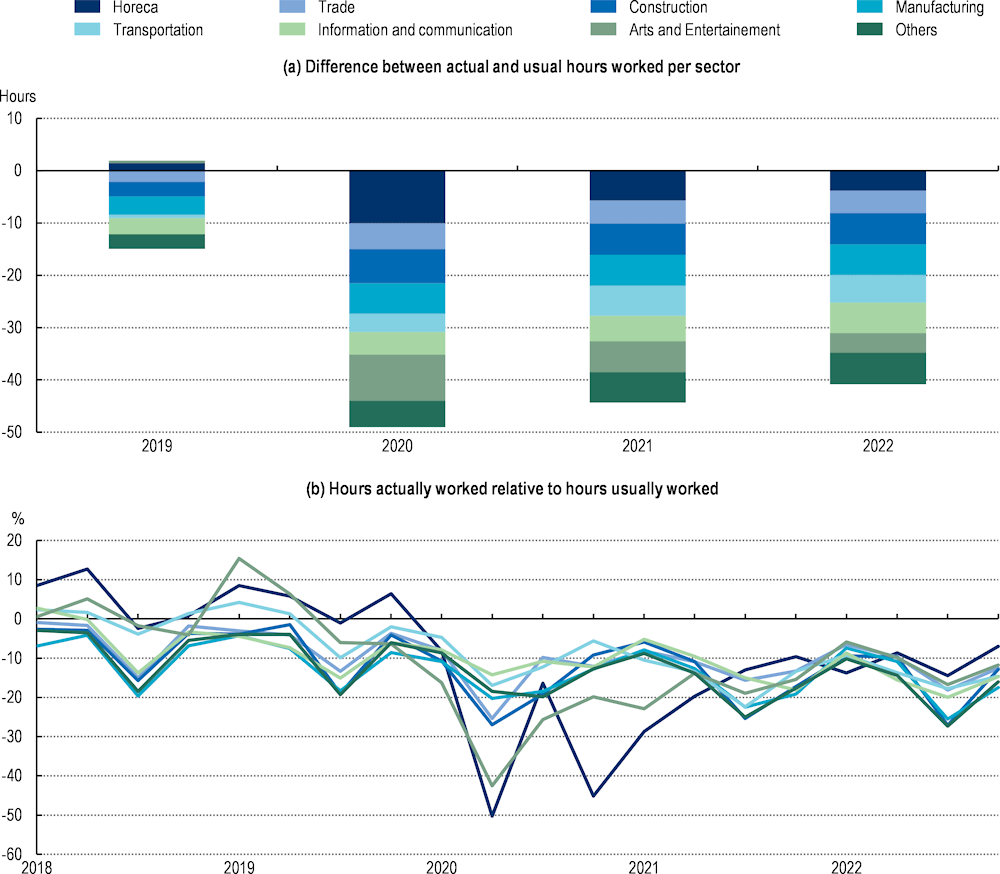

The pandemic also induced a significant reduction of actual working time in all sectors of the Belgian economy after Q2 2020 (Figure 6.3, panel A). Overall, 28.2% of workers reportedly worked less than usual in 2020, against 20.5% in 2019, which includes both people who kept their jobs but worked less and people who were laid off. Workers in HoReCa and in the arts and entertainment sectors reported the largest difference in working time (Figure 6.3, panel B). The recovery has been slow in all sectors and actual working hours remained well below their 2019 levels, even in 2022. Chapter 7 analyses in greater details the impact of the crisis on the labour market.

Figure 6.3. The pandemic had a lasting effect on working hours

Note: The actual hours worked correspond to the numbers of hours spent in work-related activities, while the usual hours are defined as the modal value of actual hours over a long reference period, excluding weeks of absence. The reduction in hours worked includes people who were laid off. The hours actually worked relative to the usual hours worked corresponds to the growth rate of actual hours worked, meaning the difference between actual and usual hours worked, divided by the usual hours worked (expressed in percent). A positive value in both panels corresponds to overtime.

Source: Statbel Labour Force Survey (LFS, survey waves 2018-2022).

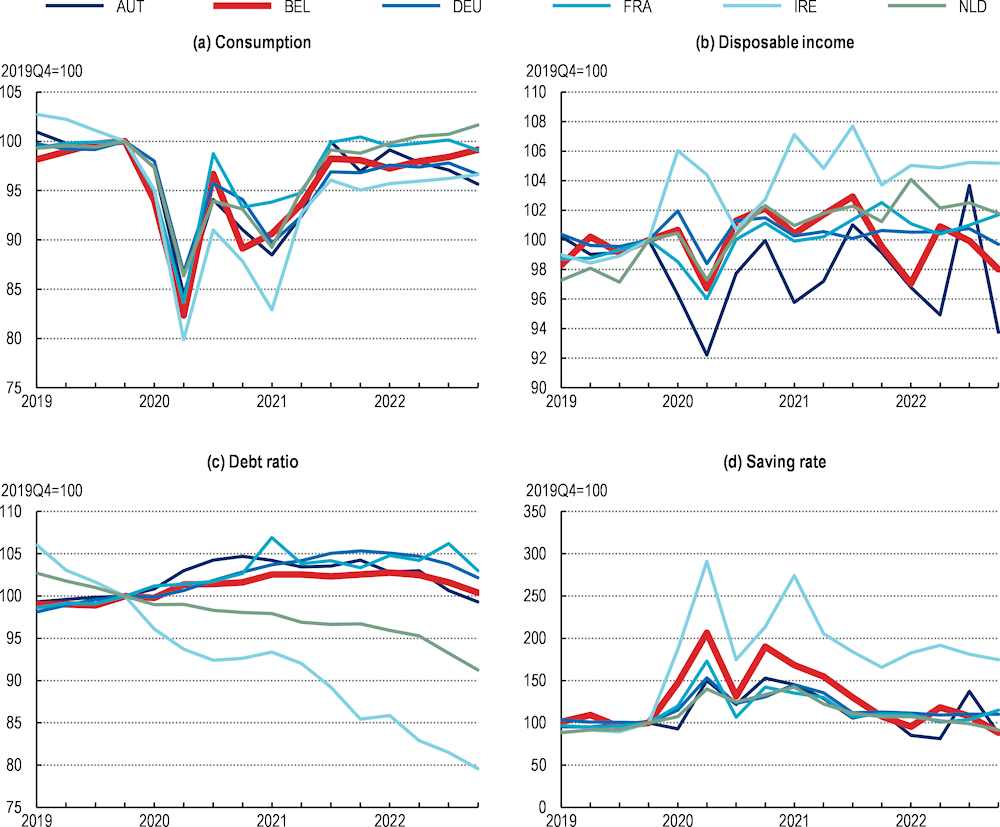

Figure 6.4. Household savings increased during the crisis

Note: Household debt includes all gross financial liabilities. The household saving rate is calculated as the ratio of net household savings (disposable income minus final consumption expenditure) divided by net household disposable income, plus the adjustment for the change in net household equity in pension funds.

Source: OECD Economic Outlook 113 Database (June 2023) and National Accounts Database (June 2023).

The pandemic had a significant impact on the financial situation of Belgian households and their consumption patterns. As shown in Figure 6.4, consumption fell significantly but the fall in households’ income was less significant. As a result, at an aggregate level, households accumulated excess savings while their level of indebtedness experienced only a small change. Analysis conducted using the European Central Bank’s Consumer Expectation Survey, however, shows that this savings surplus was mostly generated by high-income households in Belgium, while low-income households were not able to increase their savings rate (Basselier and Minne, 2021[3]). The summer 2020 consumption rebound was quickly hindered by the second wave of the pandemic and the subsequent return of sanitary measures in Q4 of the same year.

Consumption then surged during the first half of 2021, which started to level off in the second half of the year before another setback in Q1 2022, following Russia’s unprovoked war of aggression against Ukraine. National consumption then remained below pre-pandemic levels throughout 2022. The recovery of consumption implied a swift reduction of household saving rate, which was back to pre-pandemic levels by the end of 2021.

6.2.2. The overall package of support measures was similar to those of other OECD countries

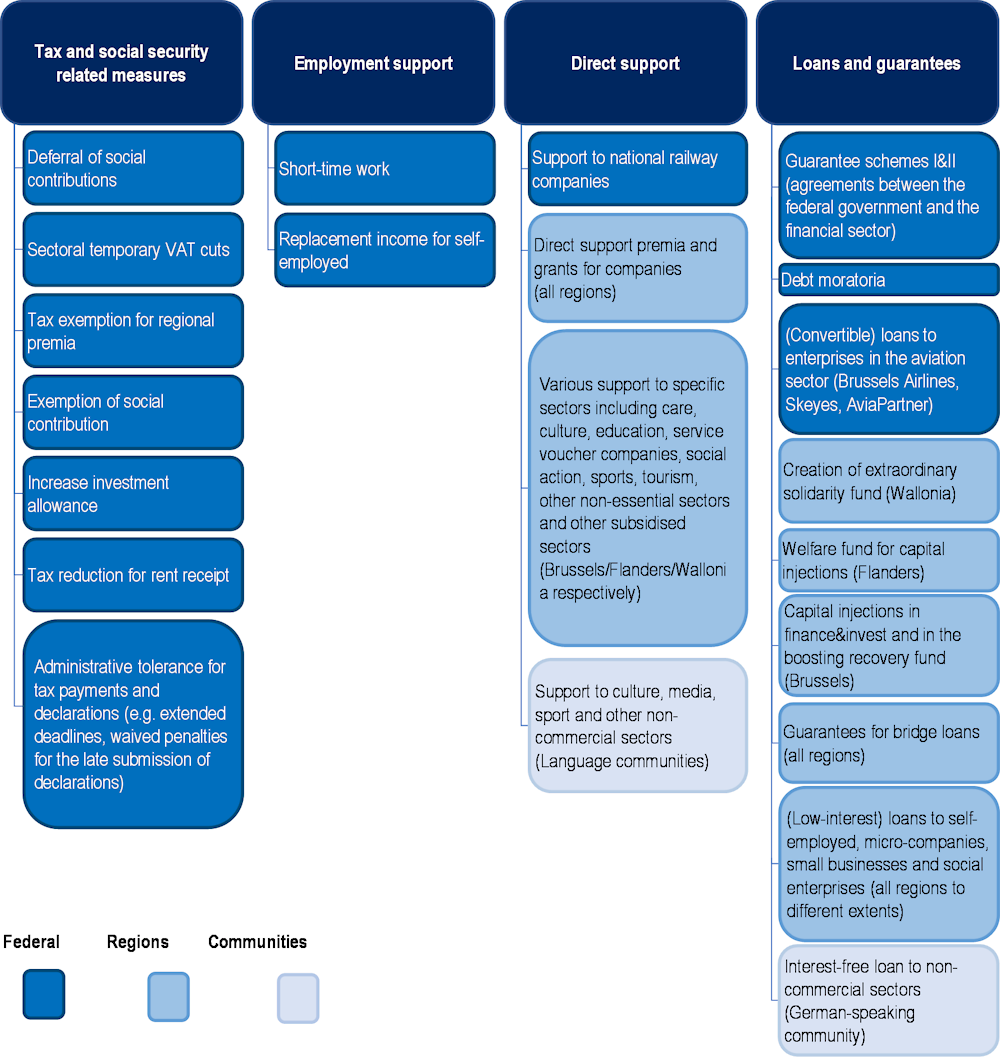

Similar to other OECD countries, the measures aimed at supporting the economy in Belgium can be grouped into four main categories: 1) tax and social security related measures (reductions, deferrals, waivers and adjustments to penalties and deadlines); 2) measures aimed at supporting employment; 3) direct support to business; 4) loans and guarantees. Tax and employment measures were the responsibility of the Federal government, while direct support was mostly provided by the regional and community governments. Some loans and guarantees were provided at all levels of government (Figure 6.5). Like other countries, Belgium tapered out programmes, maintaining support only to firms in sectors that were still directly affected, such as tourism or hospitality, through late-2021 and early-2022 as conditions normalised.

Figure 6.5. Support measures for businesses during the COVID-19 pandemic in Belgium

Source: Prepared by the authors.

The remaining part of this section will look at the overall package of measures implemented in Belgium and contrast it with other neighbouring and similar OECD countries (Austria, France, Germany, Ireland, Luxembourg, the Netherlands and Switzerland). Sections 3 and 4 of this chapter will examine the support measures provided by federal and federated entities and their impact in greater detail.

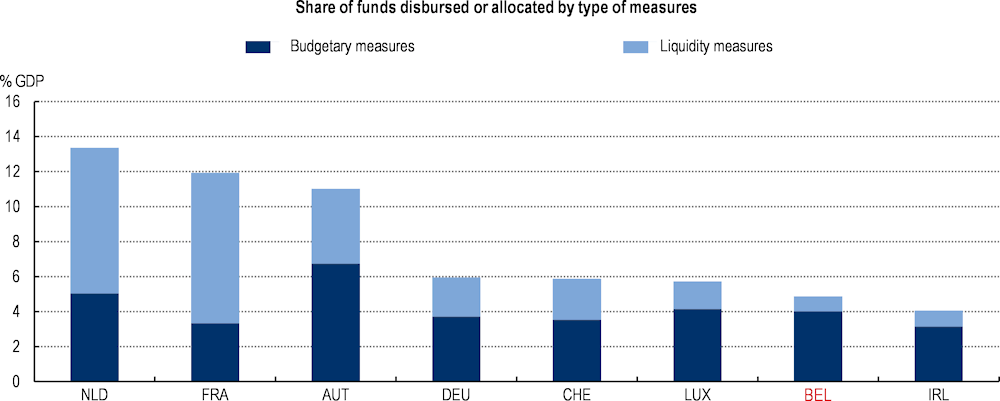

Belgium relied mostly on budgetary measures

Support measures can be further divided into two categories depending on their impact on the government’s fiscal balance: budgetary measures and liquidity measures. Budgetary measures directly impacted national fiscal balances when they were implemented. These measures include grants, short-time work schemes, and waivers on social security contributions or taxes. On the other hand, liquidity measures (loans, guarantees on private debt, and tax or contribution deferral) have no immediate impact on a country’s budget balance in the year when they are implemented, but imply contingent liabilities that could affect the fiscal position later, depending on the financial health of the beneficiary firms (Haroutunian, Osterloh and Sławińska, 2021[4]).

Countries’ aggregate budgetary measures varied only marginally, ranging from 3.1% of GDP in Ireland to 6.7% of GDP in Austria. Belgium was among the more generous, at 4% of GDP. Liquidity measures varied significantly across countries, with Belgium showing a much smaller take-up than in other countries, at 0.9% of GDP (Figure 6.6).

Figure 6.6. Belgian firms were granted more support through budgetary than liquidity measures

Note: The amounts are computed as the sum of the relevant support types from Q2 2020 to Q1 2022, divided by the mean annual GDP over the period. The indicated volumes are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from surveyed countries selected for this chapter. The amounts given for direct support and short-time work were disbursed. The amounts given for tax and social security contribution deferrals and State loans have been temporarily disbursed and the State guarantee measures have been allocated as guarantees.

Source: Government of the Grand Duchy of Luxembourg and OECD (2022[5]); State Accounts of the Swiss Confederation (Covid-19: Impact on federal finances); Ministry of Finance of the Netherlands (Corona Accounts); Federal Government of Germany (Überblickspapier Corona-Hilfen Rückblick) and OECD (2023[6]); Government of Ireland (Covid-19 Information Hub); Federal and Regional Governments of Belgium and Belgian Court of Audit (2021[7]); Government of France, French Court of Audit (2021[8]) and France Stratégie (2021[9]); Government of Austria (COVID-19 Finanzierungsagentur des Bundes GmbH) and OECD (n.d.[10]); EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

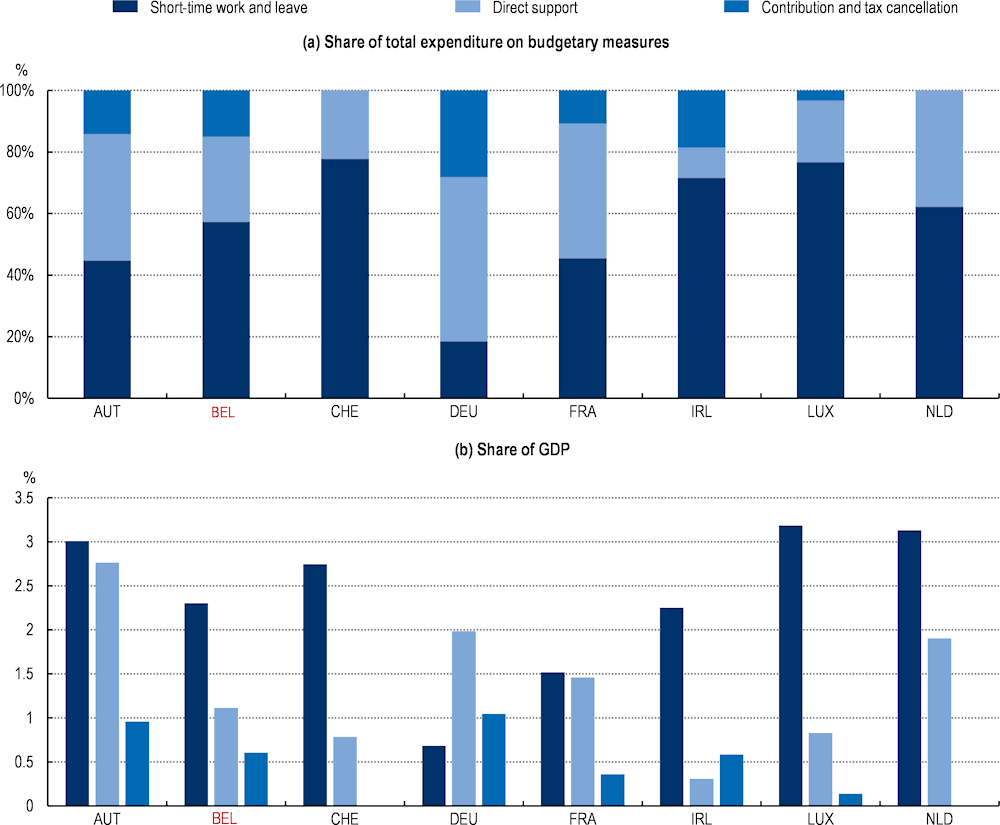

Employment support made up the largest share of budgetary measures

The public financing of short-time work (known in Belgium as chômage temporaire or temporary unemployment) was the main budgetary measure in Belgium and the peer countries. Public spending on the short-time work scheme reached 2.3% of GDP in Belgium, accounting for roughly 60% of all spending on budgetary measures between Q3 2020 and Q2 2022. Belgium’s spending on short-time work as a share of GDP was close to the median of the comparison group, in line with Ireland’s (2.3% of GDP per Figure 6.7).

Overall, countries with more generous income replacement schemes spent relatively less on their short-time work scheme. The Netherlands and Luxembourg, which spent 3.1% and 3.2% of GDP on their schemes, replaced up to 90 and 80% of workers’ incomes respectively. The generosity of Belgium’s scheme was increased around the average of the comparison group, covering 70% of lost wages (Table 6.1). Between November 2020 and March 2022, the short-time work scheme was made more generous, including adding an additional flat bonus of EUR 5.63. Access to the scheme was also made more accessible by establishing a simplified procedure and granting short-time work automatically to workers in firms that were forced to close because of sanitary restrictions and/or who were sick due to COVID-19. The cost of the scheme was borne by the government and workers through lower take-home pay (Thuy, Van Camp and Vandelannoote, 2020[11]). There was no employer co-payment, whereas on average across the OECD, firms covered 7% of the cost (OECD, 2021[12]). Chapter 7 discusses in greater details the short-time work scheme and its effects.

Figure 6.7. Belgium’s budgetary measures prioritised employment support

Note: The amounts are computed as the sum of the relevant support types from Q2 2020 to Q1 2022, divided by the mean annual GDP over the period. The indicated volumes are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from surveyed countries selected for this chapter. The amounts given for direct support, short-time work, and leave have been disbursed. The amounts given for tax and social security contribution deferrals and State loans have been temporarily disbursed and the State guarantee measures have been allocated as guarantees.

Source: Government of the Grand Duchy of Luxembourg and OECD (2022[5]); State Accounts of the Swiss Confederation (Covid-19: Impact on federal finances); Ministry of Finance of the Netherlands (Corona Accounts); Federal Government of Germany (Überblickspapier Corona-Hilfen Rückblick) and OECD (2023[6]); Government of Ireland (Covid-19 Information Hub); Federal and Regional Governments of Belgium and Belgian Court of Audit (2021[7]); Government of France, French Court of Audit (2021[8]) and France Stratégie (2021[9]); Government of Austria (COVID-19 Finanzierungsagentur des Bundes GmbH) and OECD (n.d.[10]); EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

Table 6.1. Temporary unemployment benefits per country

|

Country |

State contribution |

|---|---|

|

Austria |

Depending on previous income, 80 to 90% of normal gross monthly earnings. |

|

Belgium |

65% to 70% of the worker's mean revenue, with a EUR 5.63 bonus if the unemployment is due to force majeure or a EUR 2 bonus if it is due to economic difficulties. Social partners in some industries delivered additional bonuses, meaning total coverage varies across sectors. |

|

France |

Depending on the sector (protected, non-protected, not authorised to open), 60 to 70% of the usual net hourly wage for workers, falling to 36-70% for employers. |

|

Germany |

The pre-existing short-time work scheme was made more generous during the pandemic. Depending on the family status, 60 to 67% of the reference net wage, increasing to 70-77% on the fourth month if the decrease in working hours is above 50% (80-87% after the seventh month). |

|

Ireland |

20% of the normal daily unemployment benefit (fixed, between EUR 91.10 and EUR 203), additional bonuses for caregivers and people with children. |

|

Luxembourg |

80% of the reference gross hourly wage, 90% if the worker enrolled in a training programme when they were unemployed. |

|

Netherlands |

100% of all wages, degressive rates for employers depending on their revenue loss. |

|

Switzerland |

80% of the reference net wage, capped at EUR 11 530 per month. Social contributions were paid by the firm, but the employer's share on hours not worked was reimbursed through a subsidy. |

Note: Unemployment benefits are a competency of the federal government in Belgium.

Sources: Unédic, VOX-EU / CEPR, prepared by the authors.

The short-time work scheme reduced the likelihood of layoffs of staff whose work was temporarily disrupted by the containment measures, but increased the likelihood of supporting jobs and businesses that were not economically viable, thus reducing the potential to reallocate resources towards more productive firms (Giupponi, Landais and Lapeyre, 2022[13]). Nonetheless, maintaining workers’ links with employment supported the country’s economic recovery by avoiding frictions associated with matching employees to vacancies in the aftermath of the crisis (OECD, n.d.[14]).

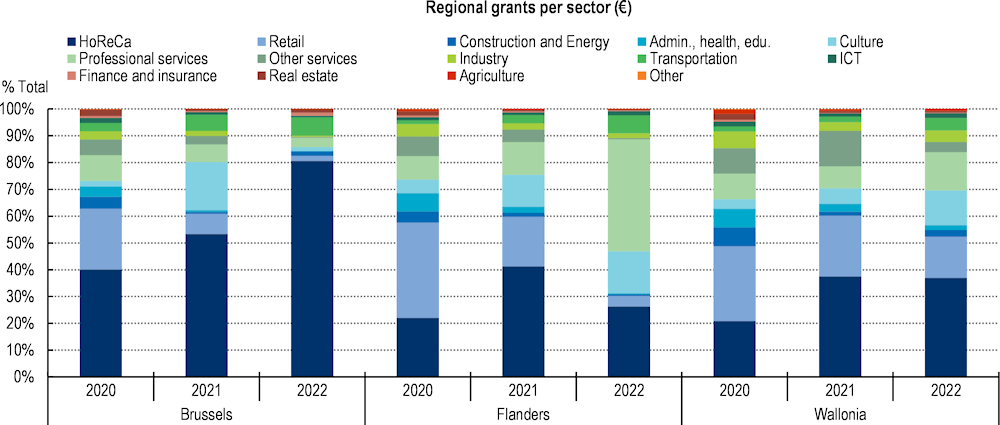

Direct support was significant, as were tax cancellations

Following the division of competencies between the federal and federated entities in Belgium, direct support could only be granted by regions and communities, which financed these measures. These support measures included subsidies, grants, and other premia for companies and self-employed workers. Direct support was meant to help firms cover fixed costs that were not addressed by other measures (e.g. short-term work, commercial rent loans) and was initially less targeted. On a national scale, Belgian firms received a significant volume of grants, accounting in total for 28% of support (1.1% GDP), comprising a diverse range of grants offered by the regions (discussed in more detail later in this chapter). This amount was in line with France and Luxembourg. By way of contrast, the Netherlands and Germany provided more grants, accounting for 38% of support in the Netherlands (1.9% GDP) and 53% in Germany (2.0% GDP).

Tax cancellation policies were the least commonly used budgetary measure in relative terms in Belgium and the other OECD countries (Figure 6.7). Belgium offered substantial tax and contribution relief, primarily in the form of VAT and social security contribution reductions, alongside tax exemptions for regional grants (known as premia) (0.6% GDP in total) and miscellaneous contribution exemptions, for instance on consumption cheques and overtime. This was in line with the level of cancellation of tax and contributions in Ireland (0.6% GDP), but nonetheless represented a more generous policy than in most other peer countries.

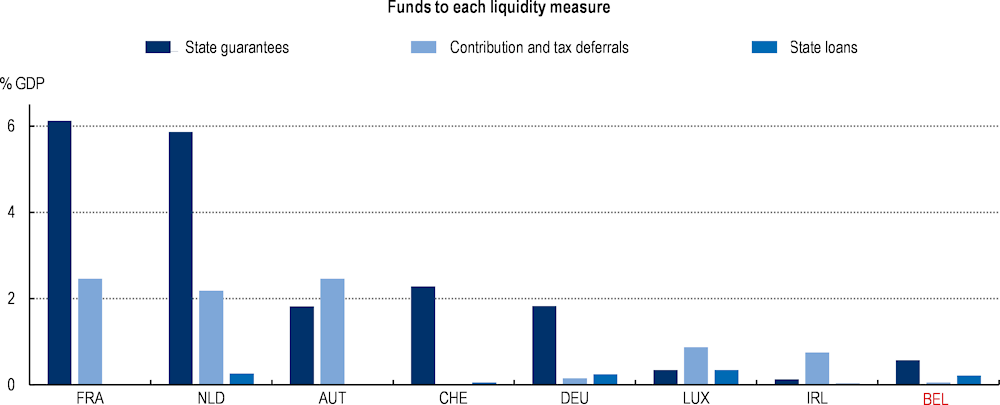

Liquidity measures accounted for a small share of Belgium’s support measures

State guarantees were the most widely used liquidity measure and were implemented in partnership with private banks. The uptake of the Belgian scheme was low relative to neighbouring countries (0.6% of GDP), which could be a consequence of its specific design: contrary to the other peer countries, the first federal scheme provided a guarantee over banks’ portfolios of loans to firms, rather than a share of each individual loan to firms (Table 6.2). The lending bank would fully bear the first 3% of losses, portfolio losses between 3 and 5% would be borne equally by the state and the bank, and 80% of losses above 5% would be borne by the state. This scheme was designed to split the risk between the federal state and the financial sector but may have deterred uptake from banks, and indirectly, from firms, which made limited use of the scheme (National Bank of Belgium, 2022[15]). The guarantee schemes in Belgium were implemented similarly to other federal countries, such as Germany and Switzerland: the federal government covered loans to large firms, while federated entities covered SMEs. Applications for guaranteed loans under the federal scheme were open until mid-2021 like in most peer countries, except France and Ireland where schemes ran until June 2022, and Switzerland where they stopped at the end of 2020. The liquidity of firms with outstanding debt was further supported by the corporate debt moratorium that was in place between April 2020 and June 2021. The moratorium allowed borrowers to agree a six-month deferral of principal repayment with their institutional lenders if they fulfilled a number of eligibility conditions, including not having been in arrears with outstanding debt and social security contributions prior to the crisis and facing a substantial pandemic-related turnover loss. The uptake of the moratorium reached around 8% of all bank-borrowing entities at the peak in September 2020 of which the majority were micro or small enterprises (Tielens and Piette, 2022[16]).

Most firms, especially those that did not belong to the most affected sectors, were in good financial health prior to the crisis, with moderate debt-to-asset ratios (Tielens and Piette, 2022[16]). Many firms could have likely weathered the crisis with low probability of default using guarantee and loan support - with a limited impact on the public budget.

Table 6.2. National guarantee schemes

|

Country |

Guarantee scheme |

Eligibility period |

Total spending |

Loss rate to date |

|---|---|---|---|---|

|

Austria |

3 national schemes (AWS, OeKB, OHT) depending on firms’ sector and size, covering 90% for loans larger than EUR 500 000 and 100% for loans under EUR 500 000. |

NA |

Disbursement of EUR 6.6 billion on liabilities and guarantees by 31 December 2020. |

NA |

|

Belgium |

2 federal schemes, the first one based on portfolio (first 3% of losses borne by the bank, the 3-5% after shared fifty-fifty between the bank and the state, and 80% of the losses above 5% covered by the state) and up to EUR 40 million. The second scheme covered up to 80% of losses. |

The first scheme was available from 1 April 2020 to 31 December 2020. The second scheme ran from 20 July 2020 to 1 July 2021. |

EUR 50 billion budget for the first scheme, EUR 10 billion passed on to the second scheme. |

Estimated 1% on 22 March 2020. |

|

France |

The Prêts Garantis par l'Etat (PGE) allowed loans up to 3 months of firms’ 2019 turnover, or 2 years of their total payroll. |

March 2020 to June 2022. |

EUR 145 billion, more than 700 thousand loans |

The estimated net loss rate was 3% in March 2022, with anticipated net losses at less than 1%. |

|

Germany |

Several KfW Corona-loan programmes at the federal level covering 80, 90 or 100% depending on firm size. Loan terms were under 60 months and firms paid a guarantee fee. Eligible firms for guaranteed bank loans had to meet 2 criteria out of the following 3: balance sheet exceeding EUR 43 million, sales revenues above EUR 50 million and/or a workforce larger than 249 employees on an annual average. Länder-level guarantees were also available for SMEs. |

Firms could take out loans with the federal guarantee until 30 April 2022 and state-level guarantees were available until 30 June 2021. |

NA |

NA |

|

Ireland |

The COVID-19 Credit Guarantee Scheme (CCGS) covered loans from EUR 10 000 to EUR 1 million with a 80% state guarantee, with terms up to 5.5 years. A range of loans were available, including term loans, working capital loans and overdrafts. It was available for SME and small Mid-Cap businesses established in Ireland and with a minimum loss of 15% in actual or projected turnover or profit due to COVID-19. Firms had to pay a small premium to the Department of Business from Q4 2020 to Q3 2022. |

September 2020 to June 2022. |

The expected budget was EUR 2 billion., and the total amount lent by November 2022 was EUR 708 million, with 9 857 loans. The state collected more than EUR 2 million through the firm-level fee. |

The total claim as of Q3 2022 was EUR 3.9 million, meaning 0.55% of the total EUR 705.2 million lent. |

|

Luxembourg |

The prêts COVID garantis par l'État were delivered by eight banks (BCEE, BIL, Banque de Luxembourg, Banque Raiffeisen, BGL BNP Paribas, ING, Bank of China et Banque BCP). Firms could borrow up to 25% of their turnover in 2019 to cover their immediate working capital investment needs with a 85% guarantee. |

18 April 2020 to 31 December 2021. |

194 million lent, meaning EUR 164.9 million guaranteed, with a total of 415 loans. There were over 500 additional non-guaranteed loans. |

By 22 January 2022, 4.58% default rate (19 loans), which amounts to EUR 13.815 million (7.12% of the total amount lent) |

|

Netherlands |

4 national schemes (GO-C, BL-C, BMKB-C, KKC) depending on firms’ sectors and size, covering 67.5 to 90% of loans, that range between EUR 50 000 and EUR 1.5 million. |

GO-C granted until 31 December 2020; BL-C and BMKB-C granted until 30 June 2020; KK-C granted until 1 July 2021. |

NA |

NA |

|

Switzerland |

Firms could take out COVID-19 bridging credits, with a 100% federal guarantee if the loans were under CHF 500 000, a 85% one for loans between CHF 500 000 and CHF 20 million (with an additional 15% guaranteed by the bank). Start ups could access a 65% federal guarantee cumulative with a 35% guarantee from their canton. |

26 March to 31 July 2020. |

CHF 16.9 billion lent (13.9 billion worth of loans below CHF 500 000 and 3 billion above) to 137 870 beneficiaries (136 737 below CHF 500 000 and 1 133 above). |

The total loss estimated on 5 July 2023 was CHF 64.5 million, out of CHF 16.9 billion granted (0.38%). |

Source: Government of the Grand Duchy of Luxembourg and OECD (2022[5]); State Accounts of the Swiss Confederation (Covid-19: Impact on federal finances); Ministry of Finance of the Netherlands (Corona Accounts); Federal Government of Germany (Überblickspapier Corona-Hilfen Rückblick) and OECD (2023[6]); Government of Ireland (Covid-19 Information Hub); Federal and Regional Governments of Belgium and Belgian Court of Audit (2021[7]); Government of France, French Court of Audit (2021[8]) and France Stratégie (2021[9]); Government of Austria (COVID-19 Finanzierungsagentur des Bundes GmbH) and OECD (n.d.[10]); EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

State loans were mostly granted to airlines and other travel-related firms which were especially impacted by the pandemic. The targeted nature of these loans resulted in them being the least-used measure (0.2% GDP per Figure 6.8).

Figure 6.8. Belgium provided less liquidity support than other countries

Note: The amounts are computed as the sum of the relevant support types from Q2 2020 to Q1 2022, divided by the mean annual GDP over the period. The indicated volumes are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from surveyed countries selected for this chapter. The amounts given for direct support, short-time work, and leave have been disbursed. The amounts given for tax and social security contribution deferrals and State loans have been temporarily disbursed and the State guarantee measures have been allocated as guarantees.

Source: Government of the Grand Duchy of Luxembourg and OECD (2022[5]); State Accounts of the Swiss Confederation (Covid-19: Impact on federal finances); Ministry of Finance of the Netherlands (Corona Accounts); Federal Government of Germany (Überblickspapier Corona-Hilfen Rückblick) and OECD (2023[6]); Government of Ireland (Covid-19 Information Hub); Federal and Regional Governments of Belgium and Belgian Court of Audit (2021[7]); Government of France, French Court of Audit (2021[8]) and France Stratégie (2021[9]); Government of Austria (COVID-19 Finanzierungsagentur des Bundes GmbH) and OECD (n.d.[10]); EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

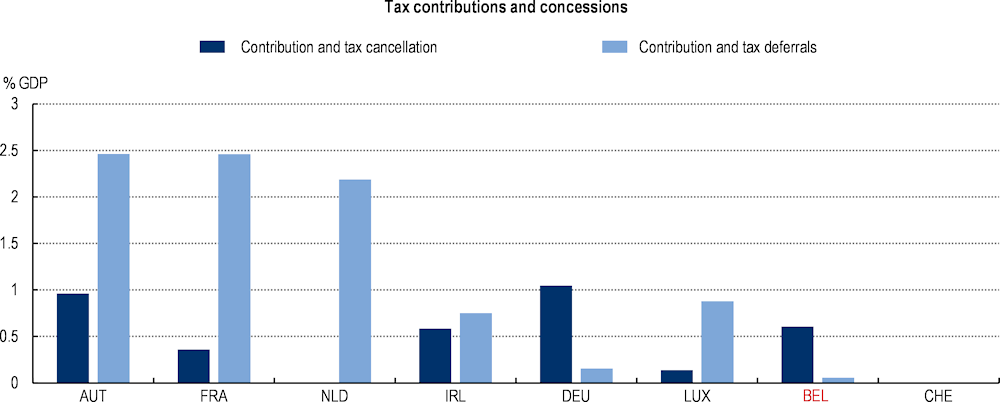

Belgium offered fewer tax deferrals than its peers, prioritising tax cancellations (0.6% GDP) over deferrals (0.1% GDP) (Figure 6.8). Nonetheless, Belgium’s total tax concessions were lower than most other countries (Figure 6.9).

Figure 6.9. Belgium offered fewer tax concessions but more cancellations than other countries

Note: The amounts are computed as the sum of the relevant support types from Q2 2020 to Q1 2022, divided by the mean annual GDP over the period. The indicated volumes are not exhaustive. They correspond to the main measures that the OECD has identified from public information and from surveyed countries selected for this chapter. The amounts given for direct support, short-time work, and leave have been disbursed. The amounts given for tax and social security contribution deferrals and State loans have been temporarily disbursed and the State guarantee measures have been allocated as guarantees.

Source: Government of the Grand Duchy of Luxembourg and OECD (2022[5]); State Accounts of the Swiss Confederation (Covid-19: Impact on federal finances); Ministry of Finance of the Netherlands (Corona Accounts); Federal Government of Germany (Überblickspapier Corona-Hilfen Rückblick) and OECD (2023[6]); Government of Ireland (Covid-19 Information Hub); Federal and Regional Governments of Belgium and Belgian Court of Audit (2021[7]); Government of France, French Court of Audit (2021[8]) and France Stratégie (2021[9]); Government of Austria (COVID-19 Finanzierungsagentur des Bundes GmbH) and OECD (n.d.[10]); EU PolicyWatch (Eurofound); Eurostat; prepared by the authors.

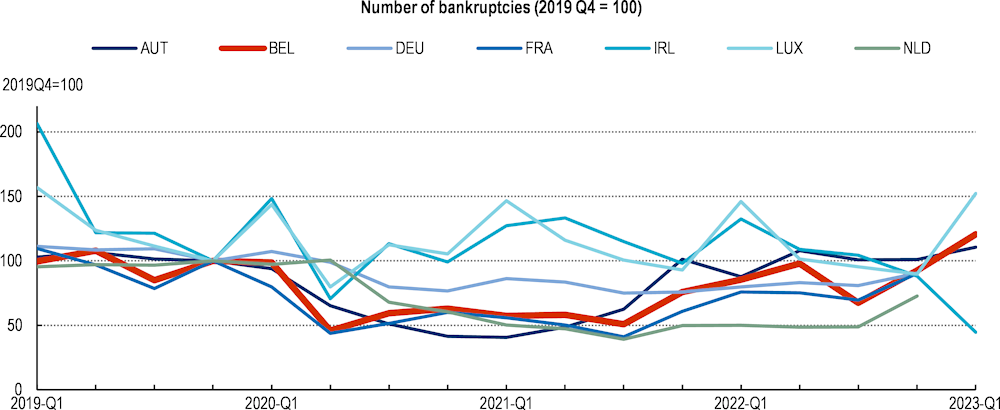

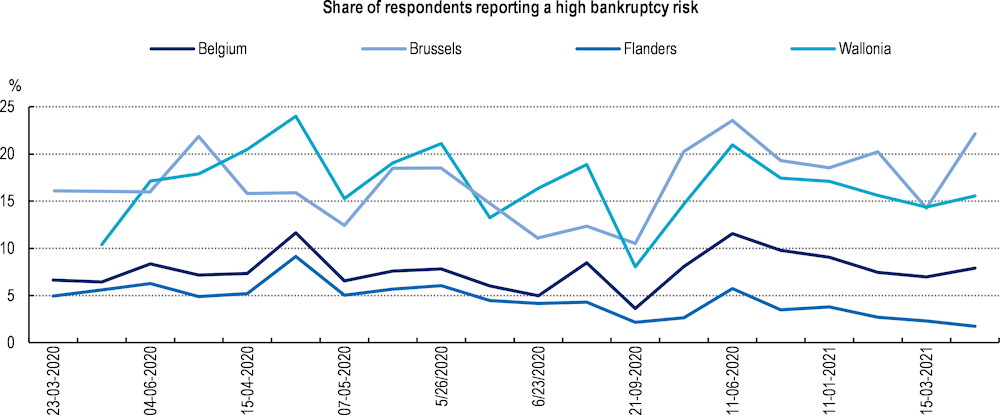

6.2.3. Unemployment and bankruptcies were not drastically affected by the crisis

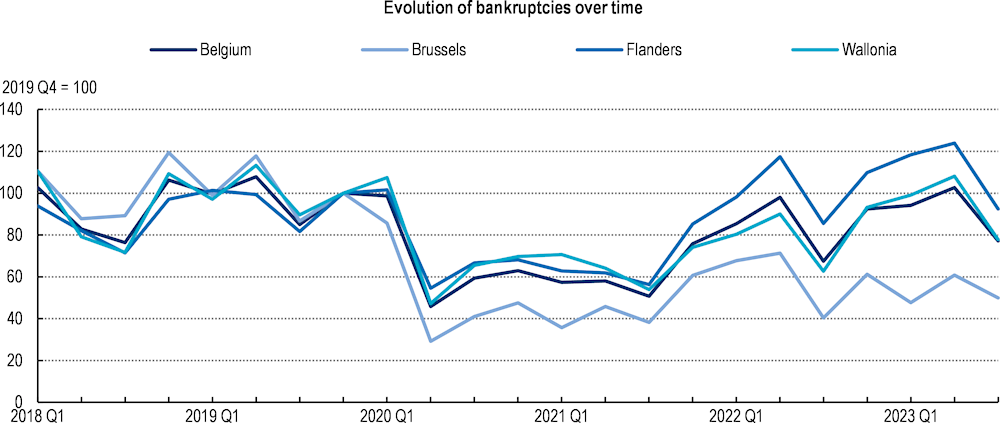

Overall, there were no widespread corporate bankruptcies and layoffs in the aftermath of the crisis. The number of bankruptcies fell significantly in the first quarter of 2020, remained low in 2020 and 2021 and returned to pre-crisis levels in 2022 as support measures were phased out (Figure 6.10). This trend was the result of a partial hibernation of the economy, consistent with what has been observed in other countries (see Eckert and Mikosh (2022[17]) on Switzerland for instance) and facilitated by the suspension of insolvency procedures. The first of such suspensions was effective between April 2020 and June 2020. The suspension was then reinstated in November 2020 until January 2021. The tax authority and the National Social Security Office subsequently suspended any insolvency procedures against firms failing to pay overdue taxes (until early 2022) and social security contributions (until autumn 2021) (Tielens and Piette, 2022[16]). Accordingly, the increase in bankruptcies in 2022 could also reflect delayed bankruptcies that would have occurred in 2020, as Epaulard, Martin and Cros (2021[18]) suggested in the French case.

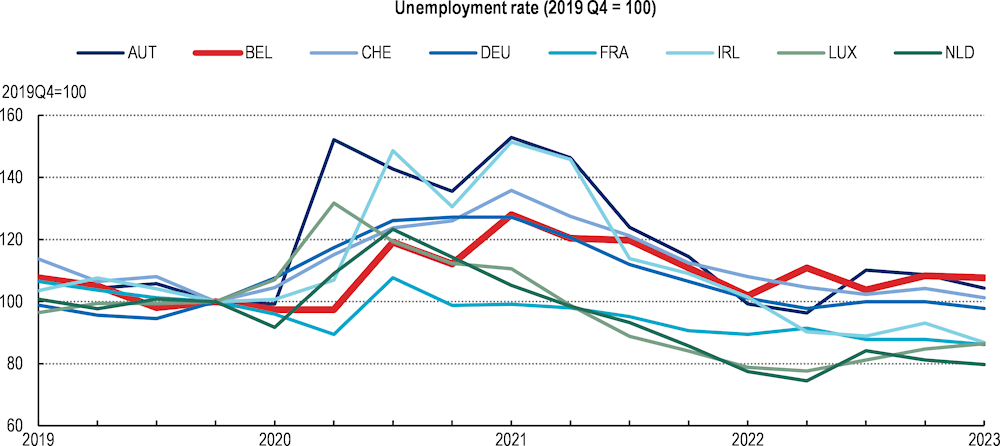

Additionally, the increase in the unemployment rate at the onset of the pandemic was lower than the average spike across the OECD (OECD, 2020[19]). Unemployment remained above its 2019Q4 level and above the OECD average by the end of 2022 in Belgium (Figure 6.11), although Belgium had experienced a significant fall in unemployment leading to record low rates before the crisis (OECD, 2020[20]). While the Belgian labour market is characterised by significant regional differences, the effects of the COVID-19 crisis were relatively similar across regions as highlighted in Chapter 7.

Figure 6.10. Bankruptcies dropped during the pandemic

Note: Data is not available for Switzerland; data on bankruptcies in Austria, Ireland and Luxembourg does not include NACE sectors A (agriculture, forestry and fishing), O (public administration and defence) and S94 (other service activities, activities of membership organisations).Source: OECD Timely Indicators of Entrepreneurship (June 2023), Statistics Austria, Eurostat Short-Term Business Statistics.

Figure 6.11. Belgium’s unemployment rate remained above pre-pandemic levels at the end of 2022

Unemployment remained high after the end of the crisis, which might suggest a restructuring of certain sectors, triggered for instance by the impact of teleworking on hotels, restaurants and cafés (HoReCa). But the stickiness of unemployment following the pandemic is also likely the result of structural factors: unemployment benefit replacement rates are high in Belgium, with long durations and low phase-out (OECD, 2022[21]) and the estimated probability of securing employment given an individual’s unemployed status is below 30%, the lowest value in the EU (Adalet McGowan et al., 2020[22]).

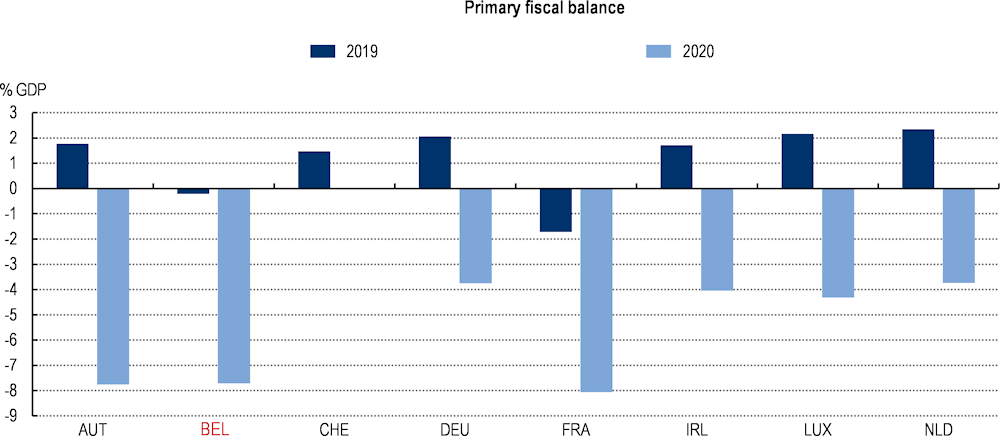

6.2.4. The support measures caused a significant increase in public spending

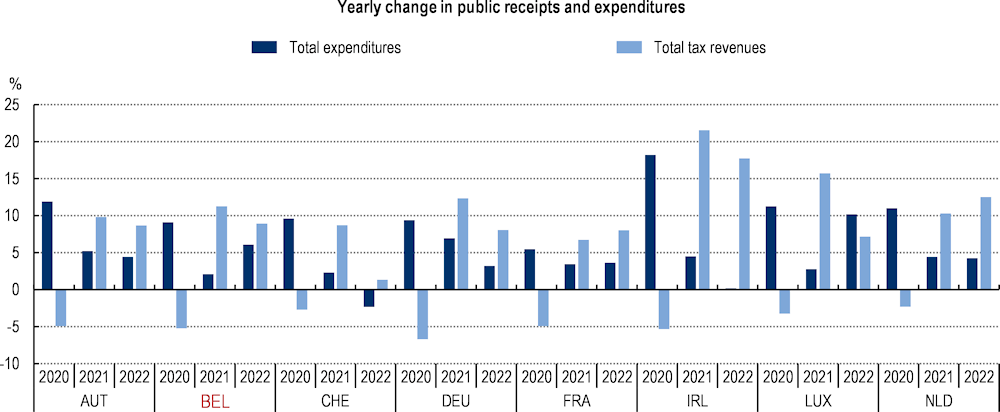

While the 2019 fiscal deficit in Belgium was comparable to the deficits of France and Austria its increase between 2019 and 2020 was much higher than the deficits recorded in the other peer countries (Figure 6.12).

Figure 6.12. Belgium’s fiscal deficit widened significantly in the first year of the pandemic

Note: The fiscal balance represents the net balance of revenues and expenditures of public administrations, including capital revenues and expenditures.

Source: OECD National Accounts (June 2023), authors' computations.

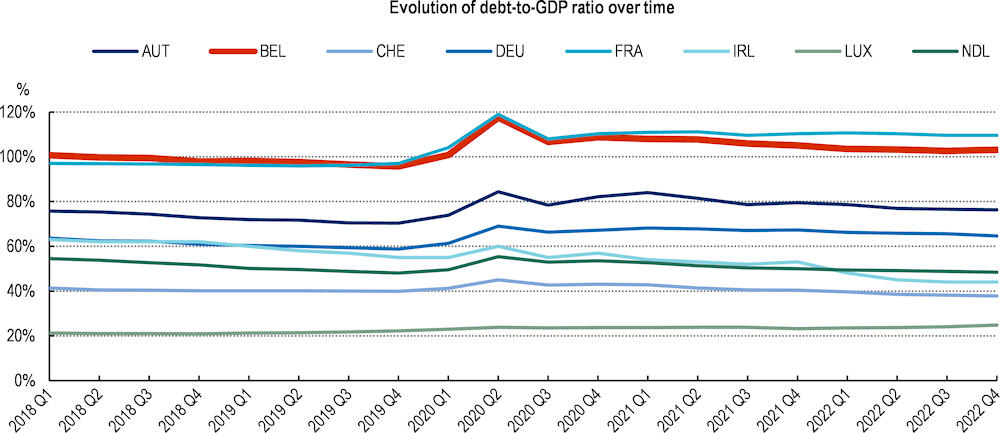

Belgium further saw its fiscal deficit widen to 8% of GDP in 2020 (from 1.7% in 2019), driven by both a sharp fall in revenues and a sizeable increase in expenditures (Figure 6.13). As a result, public debt increased to 109.2% of GDP by the end of 2021. A strong rebound in tax revenues in 2022 helped reducing public debt, to 102.6% of GDP at the end of 2022. However, Belgium’s debt-to-GDP ratio has been higher than in most of the peer countries (Figure 6.14).

Figure 6.13. Tax revenues recovered swiftly in 2022

Figure 6.14. The debt-to-GDP ratio in Belgium has been consistently higher than in most peer countries

Note: The debt-to-GDP ratio is computed following the Maastricht definition for EU countries and using the general government gross financial liabilities for Switzerland.

Source: OECD Economic Outlook 113 Database (June 2023).

6.2.5. Inflation has spiked since the COVID-19 crisis

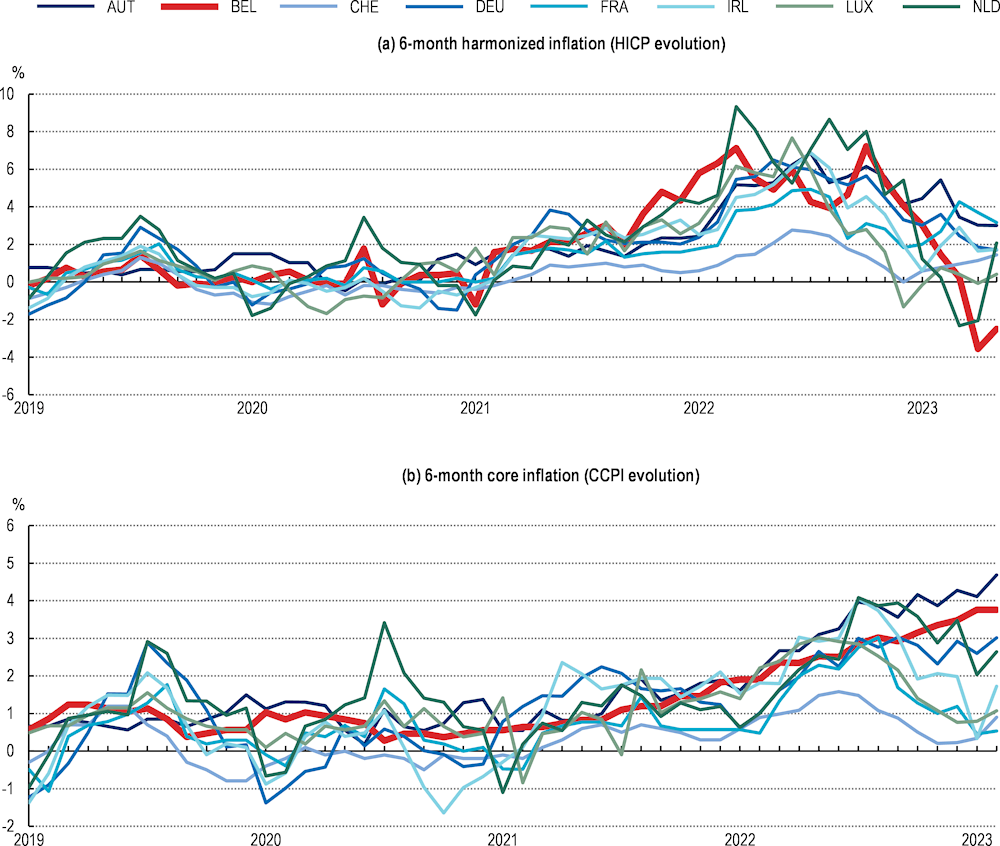

The actual 6-month-increase in the Harmonised Index of Consumer Prices (HICP) in Belgium was 3.7% in October 2021 and 7.1% six months later (Figure 6.15). Much smaller figures were observed for core inflation, with a 1.5% six-month increase in October 2021 and 2.4% increase six months later, which suggests that, while prices started increasing during the COVID-19 crisis, a large part of the rise in prices was due to energy and food, fuelled by Russia’s war of aggression against Ukraine and its impact on energy prices.

Figure 6.15. Inflation started to rise in Belgium and peer countries during the COVID-19 crisis

Note: The Y-axes on the left graphs report the six-month evolutions of the Harmonised Index of Consumer Prices (HICP) and of the Core Consumer Price Index (CCPI) respectively. The Y-axes on the right graphs report the Trailing Twelve Month (TTT) evolutions of the Harmonised Index of Consumer Prices (HICP) and of the Core Consumer Price Index (CCPI) respectively.

Source: Eurostat, World Bank.

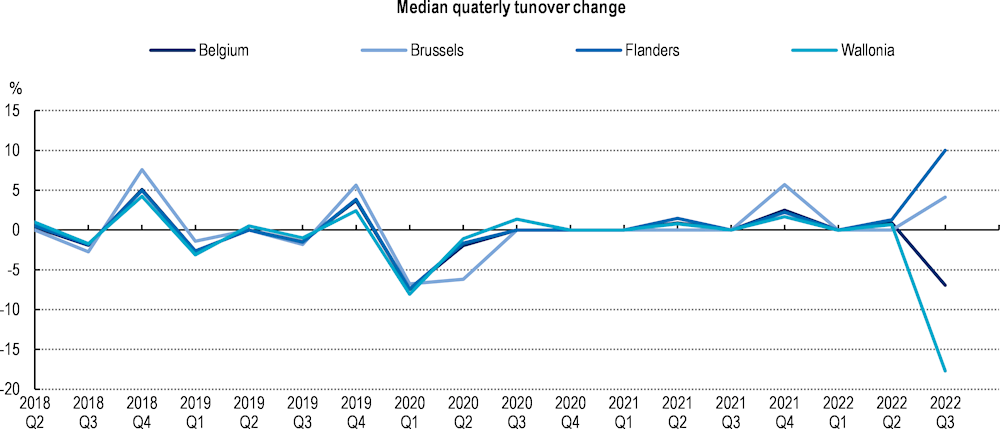

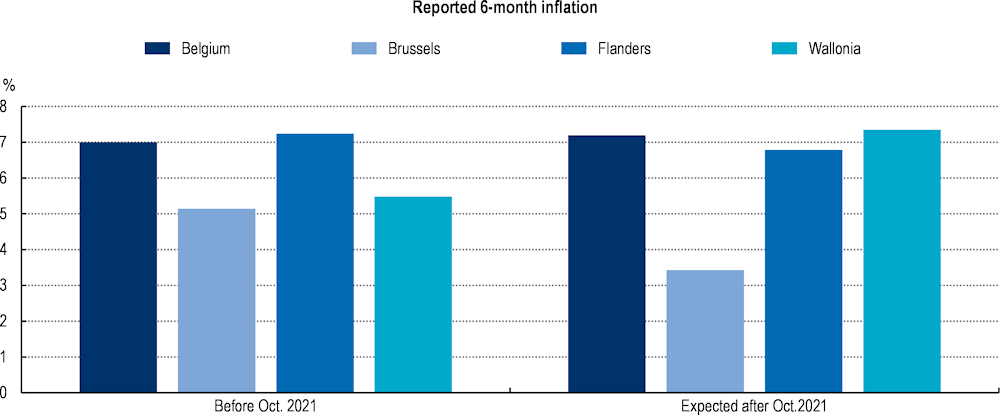

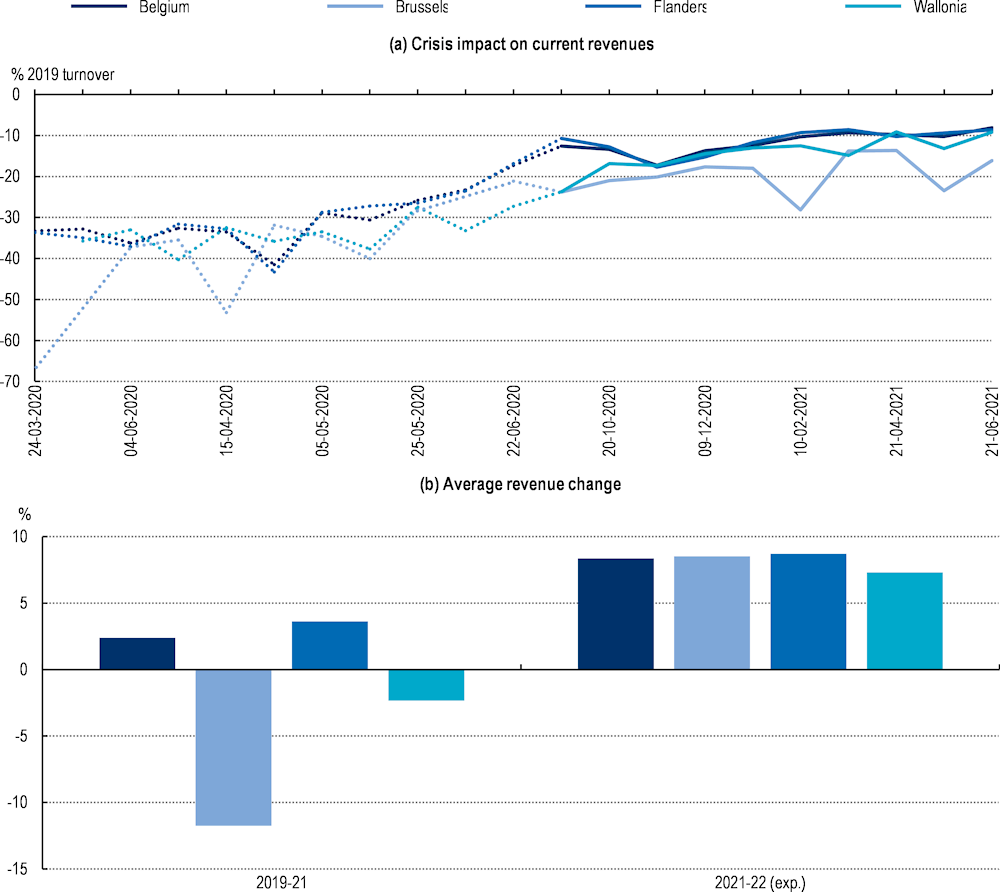

Indeed, according to the surveys conducted by the Economic Risk Management Group (ERMG) set up by Belgium at the onset of the crisis, some inflation expectations were building up during the COVID-19 crisis. Belgian business owners already reported a 7% increase in their resale prices on average in October 2021, compared to the six previous months (Figure 6.16). Although these figures reflect business owners’ perception of prices during and after the crisis and not measured or projected inflation, it is interesting to note that businesses themselves perceived an impact of the pandemic on their resale prices. They also expected high inflation rates for the following 6 months, except in Brussels-Capital where firms reported a 3% increase.

Figure 6.16. Firm’s self-reported and expected inflation rates were lower in Brussels-Capital

Note: In October 2021, respondents were asked to report how their prices had evolved for the past six months, and how they expected them to evolve over the upcoming 6 months (in Flemish and in French). They could choose between “no impact, “an increase” and several options presented as a percentage decrease (e.g. “0%-5% decrease”). The Y-axis reports the average using the midpoint of the reported interval.

Source: ERMG surveys (wave 23).

6.2.6. A key insight is that emergency economic and financial support to firms mitigated the shock but greater emphasis could have been put on liquidity measures

Belgium reacted quickly to the crisis and put in place a package of measures that was broadly in line with other OECD countries. It favoured budgetary measures over liquidity measures, with a heavier weight on direct support and tax and social security cancellations (rather than deferrals). To even more effectively counter similar shocks in the future, Belgium could consider:

Shifting the focus from budgetary to liquidity measures such as state guarantees to lower the fiscal burden while still effectively preserving viable firms: The low default rates even in countries with relatively limited use of budgetary measures, suggest that liquidity measures can be effective in avoiding bankruptcies and protecting jobs. In Belgium, liquidity measures, in particular state guarantees, were little used by firms, in part due the availability of generous direct support. A less generous or more targeted package of grants and tax cancellations could serve as an incentive to use liquidity measures as the first line of protection given the relatively good financial health and moderate indebtedness of firms in most economic sectors prior to the crisis. Grants could rather serve as a second line of protection for financially viable firms in more severe hardship during the crisis. With a high public debt, resorting to liquidity measures would also help limit the impact on already strained public finances.

Providing easier access for businesses to loans and guarantees: The low take-up of state-guaranteed loans provided by the federal government was also partly due to a complex system that relied on guaranteeing banks’ loan portfolios. A more effective alternative could be to guarantee each individual loan to a firm to make the access to the loan more evident for business.

Better targeting the fiscal stimulus: The risk of fuelling inflationary pressures with excessively generous and untargeted support packages should be carefully considered. Households, especially those with higher incomes, generated substantial excess savings during the two lockdowns. With the disruption of supply chains generated by the global pandemic, the surge in demand put upward pressures on prices (di Giovanni et al., 2023[23]).

6.3. Implementation of economic and fiscal measures

This section provides an overview of the co-ordination mechanisms, design and timing of the economic and fiscal measures put in place to counteract the COVID-19 pandemic. The effectiveness of the measures in preserving firms’ liquidity and employment was highly dependent on timely implementation and targeting. Although the COVID-19 pandemic affected similar firms similarly across the country, the separation of competencies across federal and federated entities implied differentiated access to support depending on the region and/or language community where firms were located. The lack of an established mechanism to co-ordinate economic support across levels of governments emerged as a key challenge in designing and implementing support measures. Co-ordination between federal and federated entities was limited and mostly based on informal exchanges between the different administrations.

6.3.1. The different levels of government were autonomously responsible for the support measures, creating some differences across regions

The Belgian federal government and federated entities designed and implemented economic and fiscal measures independently from one another, following their respective constitutional competencies. The federal government is primarily responsible for tax policies and the regional governments of Flanders, Wallonia, and Brussels-Capital are responsible for economic support. The language communities, in co-ordination with municipalities, are responsible for supporting cultural initiatives, education and other subsidised local sectors (e.g. tourism). Accordingly, they granted support to business and organisations in the cultural sector, along with tax-free premiums to tourism enterprises.

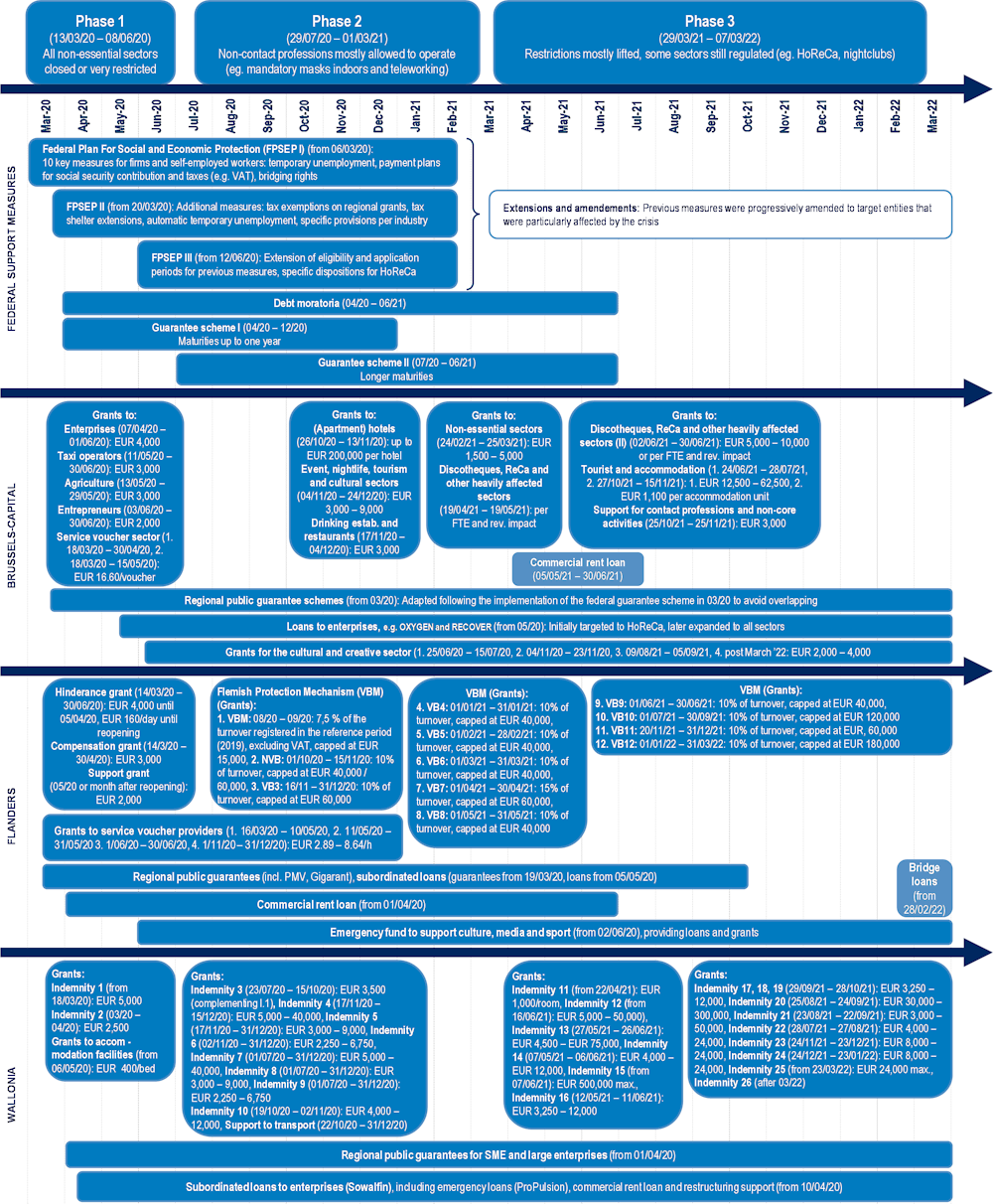

During the COVID-19 pandemic, this distribution of responsibilities meant that the provision of direct and loan support to business varied in terms of coverage and generosity, design, and implementation. Implementation of the main support measures adopted by the federal and federated entities evolved along three main phases, following the evolution of the pandemic and the strictness of sanitary measures imposed on businesses and households (Figure 6.17).

Figure 6.17. Key-economic and fiscal measures followed the sanitary restrictions

Note: The timeline provides an overview of the most significant support measures that fall under the categories defined in Figure 6.5 and were implemented before 31 March 2022.

Source: Prepared by the authors.

Timing and implementation of federal support

Federal support measures were implemented quickly through the Federal Plan for Social and Economic Protection (FPSEP), which included ten schemes for self-employed workers and firms. The main measures taken were temporary unemployment, VAT cuts and deferrals, the implementation of a debt moratorium and the establishment of a guarantee on bank loans. The FPSEP was first revised a month after its introduction, to make support more accessible: temporary unemployment due to force majeure became automatic and further tax exemptions were established. The federal plan was revised a second time at the end of the first phase of the crisis, to extend the debt moratorium and the guarantee scheme. These measures were then adjusted until the end of the crisis whenever necessary to meet firms’ needs following the evolution of sanitary restrictions.

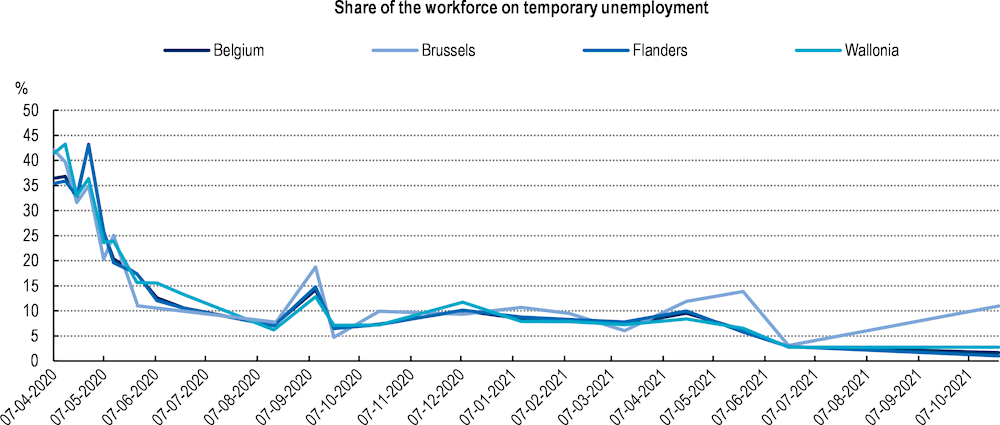

The use of temporary unemployment was rather homogeneous across regions (Figure 6.18). The share of firms’ workforce in temporary unemployment tended to decrease over time, with a spike during phase 2 consistent with the beginning of the second lockdown (Q4 2020) as shown in the surveys conducted by the Economic Risk Management Group (ERMG) during the crisis (Box 6.3).

Figure 6.18. The use of temporary unemployment was evenly distributed across regions

Note: Respondents were asked to self-report the proportion of their workforce that was currently in temporary unemployment. The continuous shares correspond to the midpoint value within each bracket.

Source: ERMG surveys (waves 2-23).

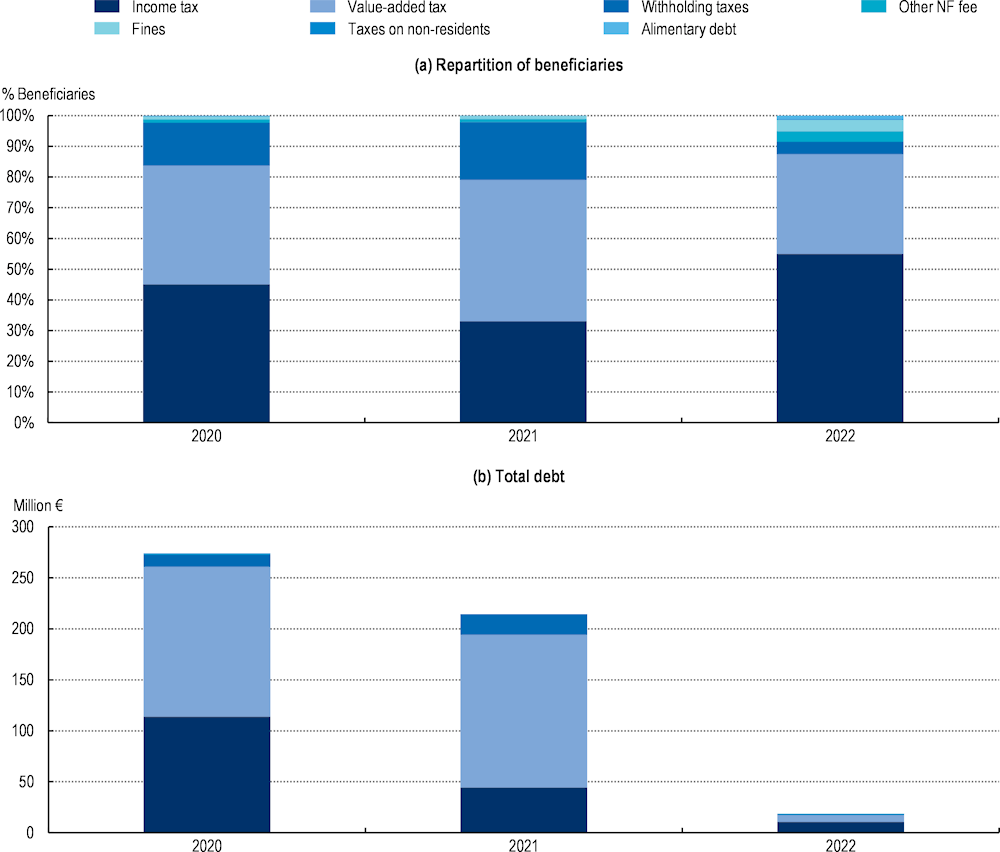

Regarding tax deferrals specifically, 99% of applications were approved in 2020, and 90% in 2021. The number of applications dropped from more than 11 000 in 2021 to approximately 3 000 in 2022, which is consistent with the phasing out of the crisis, and the approval process became stricter – only 53% of applicants obtained deferred payment plans in 2022.

More than 80% of approved applications in 2021 were linked to income and value-added taxes, and withholding taxes accounted for almost all other applications (Figure 6.19, panel A). Applications became more diverse in 2022, with a larger share of firms applying for payment plans related to fines, taxes on non-residents, alimentary debts, and other non-financial fees, but these did not account for a large share of the total debt subjected to tax payment deferrals (Figure 6.19, panel B). Applications dropped substantially in 2022 in terms of total debt under a deferred payment plan, which accounted for a mere 6.7% of the total amount of deferred taxes in 2020.

Figure 6.19. Most payment deferral applications were linked to income and value-added taxes

Note: The data is aggregated by year of application and only accepted applications are included. "Fines" refer to administrative or penal fines; income and withholding taxes comprise taxes on companies, moral persons and natural persons.

Source: Federal Public Service Finance; authors' computations.

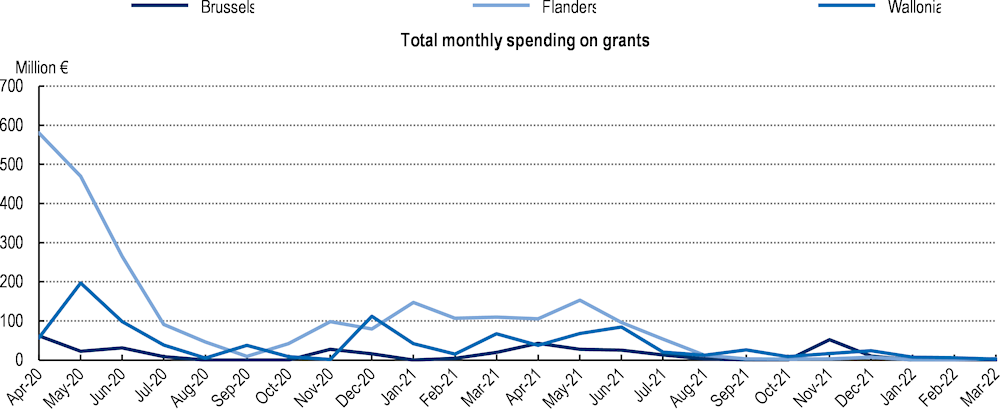

Timing and implementation of regional support

Regional measures consisted in direct support, meaning grants and subsidies to firms in distress, guarantee schemes and emergency loans. For the provision of loans and the implementation of the regional guarantee schemes, all regions relied on pre-existing private or semi-public investment funds operating in the respective regions. In terms of total volumes of support, regional loans and guarantees played a less important role compared to direct support, even though there were regional differences in the importance of the amounts committed to guaranteed loans (Belgian Court of Audit, 2021[7]). Most schemes remained available until early 2022 and were phased out thereafter.

All three regions established simple lump-sum grants with varying amounts at the onset of the crisis aiming to provide support quickly and with minimal administrative burdens for beneficiary firms. In Flanders, these lump-sums were replaced by a more complex mechanism after August 2020 with eligibility and grant size depending on turnover in a reference period (turnover loss compared to the reference period). Wallonia and Brussels maintained the lump sum structure of direct support but further differentiated the amount per grant starting in Fall 2020, for instance by making it dependent on the number of employees of the beneficiary firm. For some, but not all, of the subsequently issued instruments, eligibility was made dependent on a minimum loss of turnover compared to a reference period. As the crisis evolved, all three regions strengthened the targeting of grants to sectors that were most affected by sanitary restrictions.

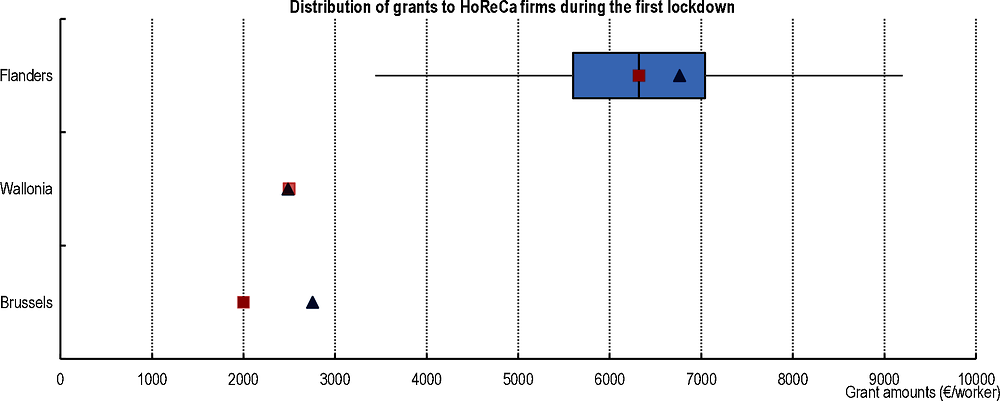

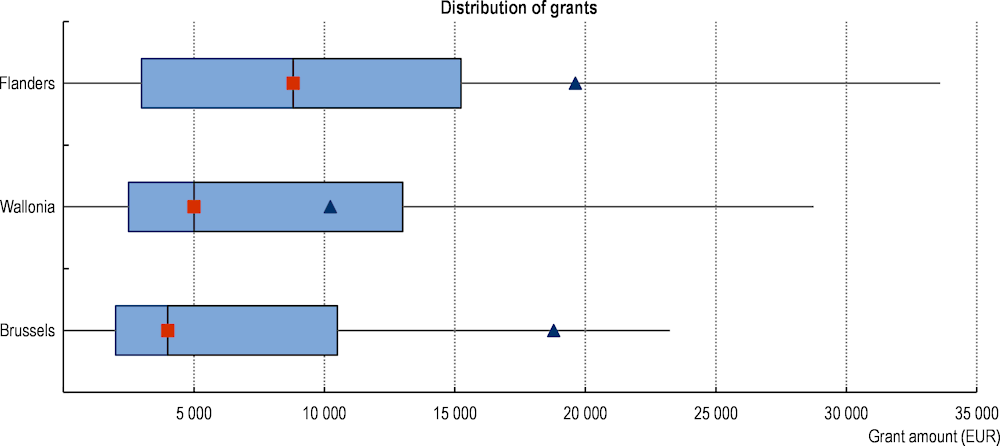

The level of generosity of direct support during the first lockdown, the period with the strongest contraction of economic activity and the highest concentration of support payments, varied across regions (Table 6.3). A HoReCa company that was closed for the full length of the first lockdown was entitled to direct support of EUR 4 000 (through the “Prime COVID-19”) in Brussels-Capital and EUR 5 000 in Wallonia (only the Indemnité 1 is taken into account as Indemnité 2 was directed to different firms and could not be cumulated).). In Flanders, the combination of a grant of EUR 4 000 for the period between 14 March and 5 April 2020 (“Corona hinderpremie”) and another daily rate of EUR 160 for 64 days until the end of the lockdown (“Hinder dagpremie”) could drive the direct support for such a firm up to EUR 14 000. Consequently, firms received different amounts of support per worker (Figure 6.20). After the first lockdown, the described measures were replaced or topped up with new grants, rebalancing some of the initial differences. In Wallonia for instance, almost two-thirds of total grant volumes were distributed after August 2020.

Table 6.3. Firms received more or less generous support depending on the region where they were located

Main direct support measures during the first lockdown (13 March - 8 June 2020)

|

Target group |

Brussels-Capital |

Flanders |

Wallonia |

|---|---|---|---|

|

Firms forced to close |

Fixed premium for enterprises for firms forced to fully close / cease activity: EUR 4 000 Lump sum compensation premium for entrepreneurs and micro enterprises forced to close from 3 June 2020: EUR 2 000 |

Corona nuisance premium and additional closure premium for firms forced to fully close: EUR 4 000 (14 March 2020 to 5 April 2020), thereafter daily premium of EUR 160 / mandatory day of closure |

Compensation to enterprises No. 1 for firms forced to fully close or active in a strongly affected sector: EUR 5 000 |

|

Firms with revenue impact/disrupted operations |

Grants to firms in specific sectors (e.g. agriculture, service voucher companies) varying between EUR 3 000 and 4 000 |

Corona compensation premium for firms with at least 60% turnover loss: EUR 3 000 or EUR 1 500 for self-employed |

Compensation to enterprises No. 2 for firms or self-employed that applied for full bridging rights before 5 May 2020: EUR 2 500 |

Note: Only the most significant measures are shown in terms of economic and sectoral coverage

Source: Belgian Court of Audit, Interactive COVID-19 inventory (2021[24]), Information gathered by the authors through a questionnaire sent to Belgian authorities and semi-structured interviews conducted with Belgian authorities in June 2023.

Figure 6.20. Direct support received by HoReCa firms during the first lockdown was not homogenous across regions

Note: The boxplots display the highest and lowest values within Q3+1.5(Q3-Q1) and Q1-1.5(Q3-Q1) respectively, the interquartile range Q3-Q1 (blue box), the median (red squares) and the mean (triangles); outliers are not displayed. Firms' sector of activity was defined at the local unit level. Only applications submitted before the end of the first period (2 June 2020) were considered, meaning applications to the Indemnité 1 in Wallonia, the Prime COVID-19 in Brussels-Capital and the Hinderpremie inclusief dagpremie and/or Compensatiepremie in Flanders. Grant amounts were aggregated per beneficiary if they received more than one. The number of employees in each firm is assumed to be the midpoint of their size class (e.g. a firm is assumed to have 7 employees if its employment class is “5 to 9 workers”).

Sources: Service Public Régional de Bruxelles (SPRB), Agentschap Innoveren & Ondernemen (VLAIO), Service Publique de Wallonie Economie, Emploi, Recherche (SPW EER) ; authors' computations.

Table 6.4 below compares the design of direct support and co-operation mechanisms between different levels of government in Belgium and in three other European OECD countries with federal structures: Austria, Germany and Switzerland. Belgium differs from these three countries in that the design, generosity level and implementation (i.e. the processing of grant applications and decisions on accruing amounts) of direct support measures were all decided at the regional level. By way of contrast, in Germany and Switzerland, the design and generosity were agreed at the federal level, whereas in Austria all three (design, generosity and implementation) were a federal responsibility.

Further, given the lack of a financial equalisation mechanism across federated entities in Belgium, federated entities did not have the same financial capacity to provide support, which could have impacted the schemes’ generosity. In the three federal countries considered, potential cross-regional discrepancies were addressed with either a full (Austria and Germany) or partial (Switzerland) coverage of the costs of direct support by the federal government, ensuring parity of support to similar firms located in different regions.

Table 6.4. Responsibilities for direct support in selected OECD countries with federal structure

|

Variables |

Belgium |

Austria |

Germany |

Switzerland |

|---|---|---|---|---|

|

Direct support measures in place |

Non-repayable grants: lockdown closure compensation, loss of turnover compensation, compensation for severely affected sectors |

Non-repayable grants: fixed cost allowances, lockdown turnover compensation, loss compensation, default bonus |

Non-repayable grants: small businesses / affected sectors, fixed cost allowances, hardship assistance |

Non-repayable hardship ordinance in form of grants |

|

Responsibilities of the federal level |

None |

Design, Generosity, Implementation, Financing |

Design, Generosity, Financing |

Design,Generosity, Financing (partially), Ex post verification of implementation with risk-oriented random inspections |

|

Responsibilities of the regional level |

Design, Generosity, Implementation, Financing |

None |

Implementation |

Implementation, Financing (partially) |

|

Comments |

Heterogenous generosity and design across region |

Implementation through a federal ad hoc entity, the COVID-19 Finanzierungs-agentur des Bundes GmbH (COFAG) |

Grant applications treated by authorities or agencies at the regional level (Bundesland). |

Financing shared between levels of government, with the federal government taking the majority share. Applications for grands were treated by authorities or agencies at the regional level (Cantons). |

Source: Belgium: Court of Audit, Interactive COVID-19 inventory (2021[24]), Austria: COVID-19 Finanzierungsagentur des Bundes GmbH (COFAG) (2023[25]), Germany: German Federal Ministry of Finance (2023[26]), Switzerland: Swiss Confederation (2023[27]).

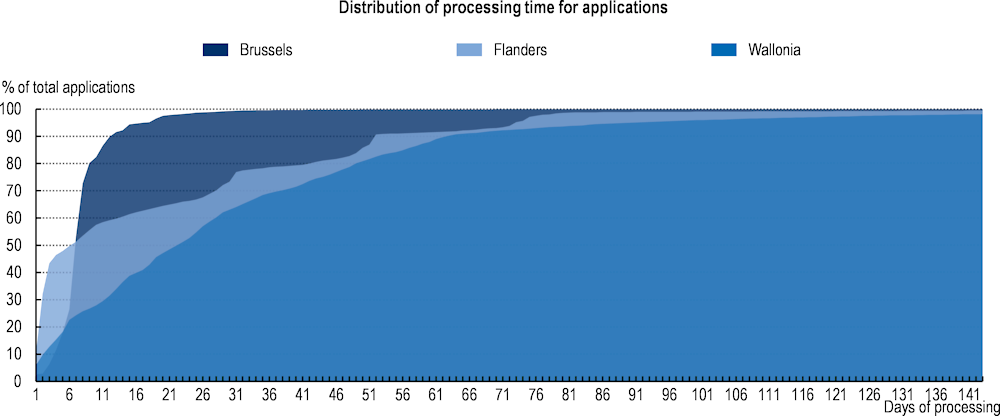

Differences in design and implementation mechanisms could have also impacted processing and response time. Overall, processing time was relatively short: 57% of applications for direct support were processed in less than 12 days – against 50% in Luxembourg, for which data are available (OECD, 2022[5]). There were, however, differences across regions, as the median waiting time was 6 days in Brussels-Capital and Flanders but reached 22 days in Wallonia (Figure 6.21). These differences can also reflect different levels of complexity of the different applications received by the regional administrations. Further, as regions were fast to deliver support at the onset of the crisis and did not systematically have access to the relevant data to be able to check eligibility conditions, ex post verifications have led to the regularisation and reimbursement of some of the support received by firms that unjustly received it.

Figure 6.21. Processing time of direct support applications varied across regions

Note: Only applications submitted before Q1 2022 were considered, delays longer than 143 days were omitted for visualisation purposes.

Sources: Service Public Régional de Bruxelles (SPRB), Agentschap Innoveren & Ondernemen (VLAIO), Service Publique de Wallonie Economie, Emploi, Recherche (SPW EER) ; authors' computations.

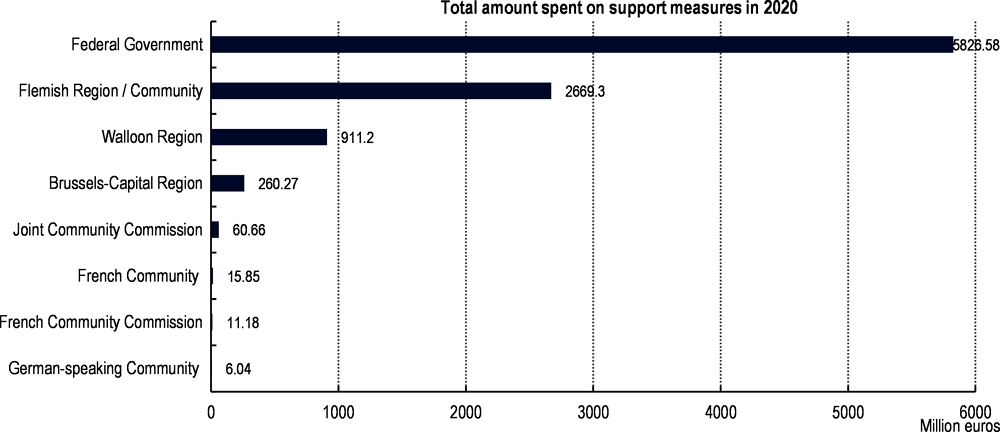

Implementation of targeted support by language communities

In Belgium, the three language communities (Flemish, French and German) are responsible for cultural matters, education and the use of languages. As such, they provided support to the care and education sectors, and to other subsidised sectors under their responsibility such as sports, tourism, culture, and entertainment, whereas the support for businesses was primarily provided by the federal and regional entities. The support granted by communities was designed in line with their competencies and taking other government levels into account, and eligibility typically required a significant revenue loss together with not being eligible or not benefiting from support from the federal or regional governments. Consequently, the total spending of the French and German-speaking communities was less significant than the amounts rolled out by the federal government or the regions as shown for 2020 in Figure 6.22.

Figure 6.22. The federal government and the regions were the main provider of support to businesses

Note: Only government support measures (Federal Government, Regions, Communities and Community Commissions) that were targeting business and taken between March and December 2020, including their extensions in 2021, are considered in the chart.

Source: Interactive COVID-19 Inventory (Belgian Court of Audit, 2021[24]).

Given the very targeted nature of the support implemented by the communities, the remainder of this section detailing implementation and co-ordination mechanisms will focus on the federal and regional levels. They were the main provider of support to Belgian businesses, which makes it all the more important to understand the challenges they faced to deliver efficient policies in a timely manner.

6.3.2. Co-ordination was limited across levels of government and mostly relied on the Economic Risk Management Group

Under normal circumstances, formal co-ordination between federal, regional and community governments on financial and economic issues takes place cross-governmentally through the Concertation Committee, a body established to resolve conflicts regarding the division of competences between the different public entities of Belgium’s federal state, where federal and federated authorities are given an equal voice at the decision-making table. Interministerial conferences play an important role on thematic issues, such as Finance and Budget as well as Economy, SMEs, Self-Employed Workers and Energy (see Chapters 1 and 3 in this report for a complete overview). Yet, during the pandemic, these co-ordination bodies reportedly did not handle the alignment and co-ordination of economic and fiscal support measures to businesses across different governments, and institutions mostly worked independently (Table 6.5).

Table 6.5. Overview of the institutions responsible for main support measures to firms

|

Government level |

Federal |

Brussels Capital |

Flanders |

Wallonia |

|||||

|---|---|---|---|---|---|---|---|---|---|

|

Institution |

FPS Finance |

National Bank of Belgium (NBB) |

National Employment Office and National Institute for the Social Security of the Self-employed |

Brussels Economy and Employment |

Finance&-invest.Brussels |

Flanders Innovation & Entrepreneurship (VLAIO) |

Participatie-maatschappij Vlaanderen (PMV) |

Service public de Wallonie (SPW) |

Wallonie Entre-prendre (formerly three seperate entities) |

|

Mandate during the crisis |

Responsible institution for all corporate tax related support measures. |

Responsible for co-chairing the ERMG, in particular for monitoring the economy (via the ERMG surveys) and for keeping the central inventory of COVID-19 measures |

The National Employment Office was responsible for the implementation of the employment support measures directed to enterprises and the National Institute for the Social Security of the Self-employed for self-employed workers |

Implementing agency for most direct support measures in Brussels-Capital. Contact point for business with questions regarding the pandemic and support measures |

Supporting various actors affected by the COVID-19 pandemic by offering targeted credit instruments |

Implementing agency for most direct support measures in Flanders. Contact point for business with questions regarding the pandemic and support measures |

Ensuring liquidity of (small) enterprises during the crisis through loan provision |

Implementing institution for most direct support measures in Wallonia. Contact point for business with questions regarding the pandemic and support measures. |

Ensuring liquidity of (small) enterprises during the crisis through loan provision |

|

Measures under responsibility |

Sectoral temporary VAT cuts and deferrals Tax exemption for regional grants Increase investment allowance Tax reduction for rent receipt Administrative tolerance for tax payments and declarations |

Not directly responsible for implementing support measures. |

Temporary unemployment Replacement income for self-employed (bridging rights) |

Lump-sum grants to affected enterprise and self-employed Grants to affected enterprise and self-employed, relative to turnover loss Grants targeted to specific sectors (e.g. agriculture, culture, events) |

Low-interest loans to various sectors, self-employed, SME and social enterprises Loans to the cultural and events sectors and guarantee fund for the events sector Participation in boosting.brussels |

Lump-sum grants to affected enterprises and self-employed Grants to affected enterprise and self-employed, relative to turnover loss |

Bridge loans Loans for paying commercial rent Loans to culture, media and sport |

Lump-sum grants to affected enterprises and self-employed Grants to affected enterprise and self-employed, relative to turnover loss |

Emergency loans / capital injection |

|

Operational implementation (agency level) |

Partly automatic (VAT), upon request, or indicated in the tax declaration |

N/A |

Provision upon declaration by the firm / self-employed |

Application via a dedicated online portal |

Online application similar to a regular credit application procedure |

Application via a dedicated online portal |

Online application similar to a regular credit application procedure |

Application via an online portal that was further developed during the crisis |

Online application similar to a regular credit application procedure |

Source: Belgian Court of Audit, Interactive COVID-19 inventory (2021[24]), Court of Audit assessment reports (2021[7]), Information gathered by the authors through a questionnaires sent to Belgian authorities and semi-structured interviews conducted with Belgian authorities in June 2023.

Rather, on 19 March 2020, the federal government created the Economic Risk Management Group (ERMG) to co-ordinate the economic response to the crisis and monitor its impact on economic activities (Box 6.1). Initially, the ERMG was tasked with developing and recommending measures to the federal government. However, it quickly became evident that the ERMG was not suited to carry out this task due to the broad set of actors involved. Consequently, the mandate of the ERMG focused on three core tasks: monitoring the economic effects of the crisis through a series of surveys conducted across the business community (as well as households), ensuring business continuity, and facilitating co-ordination between the government and private actors.

Box 6.1. The Economic Risk Management Group (ERMG)

The ERMG brought together representatives of the different levels of government, the National Bank of Belgium (NBB), the Federal Planning Bureau, employer representatives, social partners and academia. It was co-chaired by Pierre Wunsch, the Governor of the NBB, and Piet Vanthemsche, a former senior civil servant and President of the Boerenbond, a professional association of Flemish farmers. The ERMG facilitated the management and co-ordination of the economic crisis in three areas:

Ensuring the continuity of business and infrastructure: As part of the ERMG’s efforts to ensure the continuity of business and infrastructure during the crisis, the Business Continuity Planning Task Force (BCPT) was dedicated to preventing critical enterprises in Belgium's economic production process from being disrupted by the imposed sanitary measures. The BCPT co-developed a comprehensive guide to assist companies in safely resuming or continuing their business activities, facilitated a transversal audit of the Business Continuity of the Belgian food chain and provided crucial support to the exit strategy, working alongside the Group of Exit Strategy Experts (GEES).

Monitoring the impact of the COVID-19 pandemic on businesses, sectors, and financial markets: The economic monitoring unit monitored the state of the Belgian Economy in short intervals using an unprecedented tool: the ERMG surveys. The surveys were implemented, compiled, and published by the NBB after being distributed to businesses by various employer associations represented in the ERMG. The insights of the surveys could be used in “real time” to inform economic policy action such as support to business (the results of the ERMG surveys are discussed in more detail in section 6.3.4).

Collecting data and information of the economic measures: In the absence of a formal co-ordination mechanism for the implementation of the economic measures, the NBB assumed a crucial role by collecting and compiling information on the support measures implemented, creating a comprehensive inventory of COVID-19 support measures of different institutions and estimates of their budgetary impact.

The ERMG held regular meetings until July 2020, after which its main missions ended, including the Business Continuity Planning Task Force. Nonetheless, the NBB and the business representatives within the ERMG continued to monitor the economic impact of the crisis, using the ERMG surveys. The NBB also continuously updated the COVID-19 measure inventory. The Court of Audit subsequently built on this inventory to develop an interactive inventory of support measures.

Source: Website of the National Bank of Belgium: About the ERMG https://www.nbb.be/en/about-ermg (2020[28]), Belgian Court of Audit report “Support measures for businesses and individuals in the context of the COVID-19 crisis - Support measures by the federal government” (in Dutch and French): https://www.ccrek.be/FR/Publications/Fiche.html?id=5080944b-5101-4895-8b6a-3a73985a6f27 (2021[7]).

The creation of a body like the ERMG was unique among OECD countries with federal government structures. Despite the limits highlighted above, the collaboration between the National Bank of Belgium and business associations within the ERMG provided a unique opportunity to monitor the Belgium economy almost in real time via the ERMG surveys. This experience proved valuable also in the energy crisis, following Russia’s war of aggression against Ukraine, when the surveys were resumed.

6.3.3. Data exchanges across the administration were limited

The ERMG surveys served as an important tool in helping the different administrations to adjust the measures, building on the perceptions of beneficiaries. However, the surveys could not substitute for the use of administrative data in designing, monitoring and evaluating support measures. Indeed, there were limited exchanges between the regional agencies that were responsible for implementing some of the support measures and the federal institutions that collect data on firms’ balance sheets and tax payments. Some exchanges occurred at an informal level and some protocols to facilitate these exchanges were initiated, but by and large, data on firm performance that could have helped target some of the economic measures were not used during the COVID-19 pandemic. Belgium is no exception here as data exchanges on the implementation of the COVID-19 support measures were limited also among federal countries in the peer group. Some countries like France were able to use data for monitoring and evaluating the support measures during the crisis. This approach appears to be helpful in establishing protocols for exchanging and linking data across administrations (Box 6.2).

Box 6.2. Data collection and evaluation of the impact of emergency economic and fiscal measures in France

The Cœuré Commission was established within France Stratégie, an analytical body affiliated with the Prime Minister’s Office, in the early phases of the crisis to evaluate the impact of the economic measures implemented during the COVID-19 pandemic. The Commission built a consolidated database, including data on the measures received by beneficiary firms (short-time work scheme, grants, public loans) and data on beneficiary firms’ performance (turnover, debt and solvency). The database informed an evaluation presented to the government in July 2021 that served as a basis to design the subsequent recovery package, as the analysis highlighted which sectors suffered the most from the crisis and were slower to recover, and which firms were the most impacted overall based on their size, activity and age (France Stratégie, 2021[9]).

While France has a long-standing data sharing policy, the pandemic acted as an accelerator to establish formal mechanisms between administrations. For instance, the ex post audit of the temporary unemployment framework was used to formalise exchanges between the Directorate General of Public Finances (DGFiP), the Directorate General for Employment Professional Training (DGEFP) and the Labour Ministry (Cours des Comptes, 2023[29]). In future crisis, these channels could be used to more efficiently direct support to sound and stable firms.

Limitations on data availability impacted not only the design of the measures but also the evaluation of their impact. The Court of Audit did assess the implementation of COVID-19 support measures, but focused on their co-ordination and implementation, based on a qualitative analysis, as a quantitative evaluation of their impact could not be conducted.

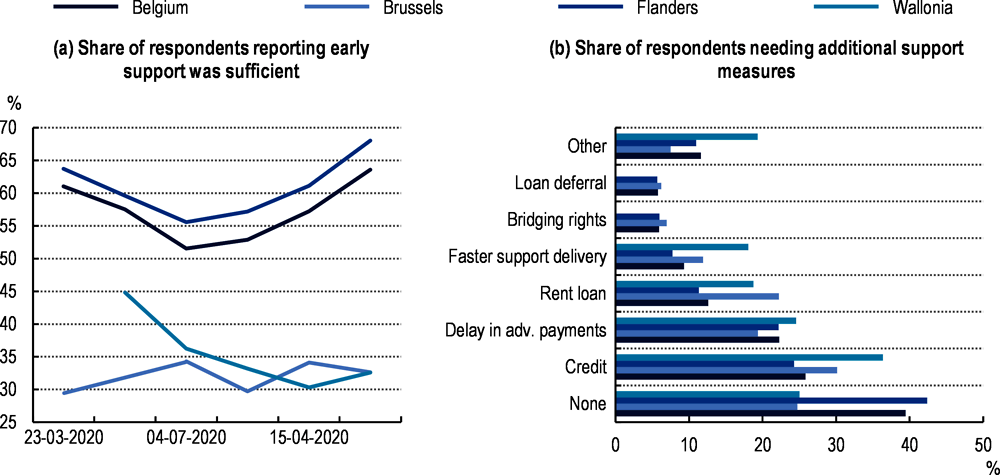

6.3.4. The perceived effectiveness of the measures varied across regions

The ERMG surveys conducted during the COVID-19 pandemic (Box 6.3) point to differences in the perceived usefulness and impact of the support measures provided across the regions, which in turn can be linked to different design features adopted by the federated entities (Figure 6.23). Firms located in Flanders appeared overall more satisfied with the support measures available, which is consistent with Flemish grants having been more generous and more quickly adjusted to firms’ needs.

Box 6.3. ERMG survey data

In the framework of the ERMG, the NBB designed a survey to monitor firms’ situation during the crisis, administered weekly during the first phase of the crisis and then more sporadically in close co-operation with the key Belgian federations for companies and the self-employed (BECI, Boerenbond, NSZ/SNI,UNIZO, UCM, UWE, VBO and VOKA). Business owners and CEOs were asked questions with respect to their revenues, the impact of the crisis on their investment and employment plans, and their perception of support measures (Reusens, 2023[30]; Minne and Reusens, 2020[31]).

Unless otherwise specified, the average metrics reported in the graphs included in this section of the chapter were computed using sector-level weights: each sector was assigned a percent weight reflecting their contribution to the overall Belgian economy in 2019. These weights did not account for differences in regional distributions and therefore any comparison across regions is made with particular care and indicating a trend rather than a representative estimation. Regional averages were not computed whenever there were no respondents for a sector with a weight larger than 1% (wave 1 for Wallonia, waves 2 and 10 for Brussels-Capital).

Table 6.6 presents an overview of the variables and the corresponding survey waves. Flemish firms are slightly over-represented among respondents with respect to their weight in the Belgian economy, and firms located in Brussels-Capital tend to be under-represented.

Table 6.6. Descriptive statistics from the ERMG surveys

|

Survey question |

Mean |

Min. |

Max. |

Std. dev. |

Obs. Brussels |

Obs. Flanders |

Obs. Wallonia |

Survey waves |

|

|---|---|---|---|---|---|---|---|---|---|

|

Concern about the impact of the current situation |

7 |

1 |

10 |

3 |

4 547 |

55 405 |

16 243 |

2-23 |

|

|

Impact of crisis on this week's revenue |

-19 |

-100 |

88 |

51 |

5 036 |

56 638 |

19 724 |

1-22 |

|

|

Impact of crisis on last week's revenue |

-20 |

-100 |

88 |

52 |

606 |

11 098 |

1261 |

7-11 |

|

|

Change in workforce size during 2020 |

-5 |

-100 |

5 |

16 |

875 |

7 750 |

3 501 |

14-18 |

|

|

Expected change in workforce size during 2021 |

-3 |

-100 |

5 |

15 |

1 356 |

12 007 |

5 266 |

14-18 |

|

|

Impact of crisis on 2020 investments |

-21 |

-100 |

5 |

33 |

1 082 |

9 393 |

4 689 |

13-16 |

|

|

Impact of crisis on 2021 investments |

-19 |

-100 |

5 |

32 |

2 325 |

18 753 |

9 566 |

13-21 |

|

|

Impact of crisis on 2022 investments |

-12 |

-100 |

5 |

27 |

1 241 |

8 375 |

4 730 |

17-21 |

|

|

Change in revenue compared to Oct. 2019 |

1 |

-100 |

100 |

31 |

64 |

1 373 |

233 |

23 |

|

|

Expected change in revenue by Oct. 2022 |

8 |

-100 |

100 |

21 |

65 |

1 367 |

229 |

23 |

|

|

Price variation compared to 6 months ago |

7 |

-40 |

100 |

13 |

81 |

1 277 |

472 |

23 |

|

|

Expected price variation in 6 months |

7 |

-40 |

100 |

11 |

86 |

1 214 |

487 |

23 |

|

|

Share of workforce currently in temporary unemployment |

22 |

0 |

100 |

36 |

2 598 |

32 310 |

9 881 |

2-23 |

|

|

Use of additional funding |

Categorial variables |

219 |

2 619 |

367 |

17 |

||||

|

Evaluation of bankruptcy risk |

4 335 |

52 922 |

15 198 |

1-20 |

|||||

|

Issues with the commercial rent payments |

274 |

1 709 |

791 |

18 |

|||||

|

Expected survival (months) |

1 746 |

32 704 |

4 363 |

1-11 |

|||||

|

Reasons for economic issues |

4 252 |

44 765 |

17 658 |

1-6, 12-22 |

|||||

|

Reasons for liquidity issues |

4 368 |

54 703 |

15 088 |

13- 23 |

|||||

|

Issues obtaining a loan |

280 |

1 754 |

840 |

18 |

|||||

|

Support measures that should be implemented |

1 016 |

17 796 |

2 839 |

1-5 |

|||||

|

Is the support received sufficient |

1 192 |

20 999 |

3 302 |

1-6 |

|||||

|

Type of support used |

953 |

17 484 |

2 432 |

1-5 |

|||||

Note: All reported statistics are unweighted and computed over the entire period.

Source: ERMG surveys.

Figure 6.23. Firms’ satisfaction improved over time as support measures were adjusted

Note: Results are derived from answers to the questions “In your opinion, are the current support measures sufficient?” and “In addition to existing measures (such as temporary unemployment or tax deferral), what measures do you need to maintain your liquidity position?”. Respondents were only able to select “Bridging loans” and “loan payment deferrals” during the first wave – hence not observed for Wallonia. Respondents were able to select several answers, hence the shares do not sum to 100%.

Source: ERMG surveys (waves 1-6 (a) and 1-5 (b)).

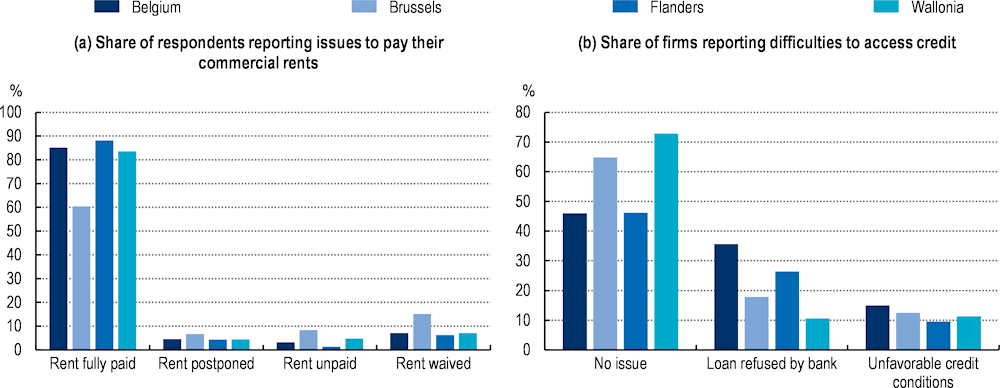

At a more granular level, there were also differences across regions in terms of reported issues in paying commercial rents and accessing loans (Figure 6.24). Firms’ access to credit was reportedly easier in Flanders, as more than 70% of Flemish firms did not report any issue to obtain a loan, against only 45% of firms located in Wallonia or Brussels-Capital.

Figure 6.24. Firms in Flanders had less difficulty to pay their commercial rents and access loans

Note: Respondents were asked to report their difficulties to pay their commercial rents and to obtain loans (in Flemish or French). Four choices were available regarding their rent: fully paid, agreement with the landlord to postponed, unpaid without the landlord’s consent and waived by the landlord. Difficulties to access loans could be due to the bank refusing the application or the borrower refusing the bank’s offer.

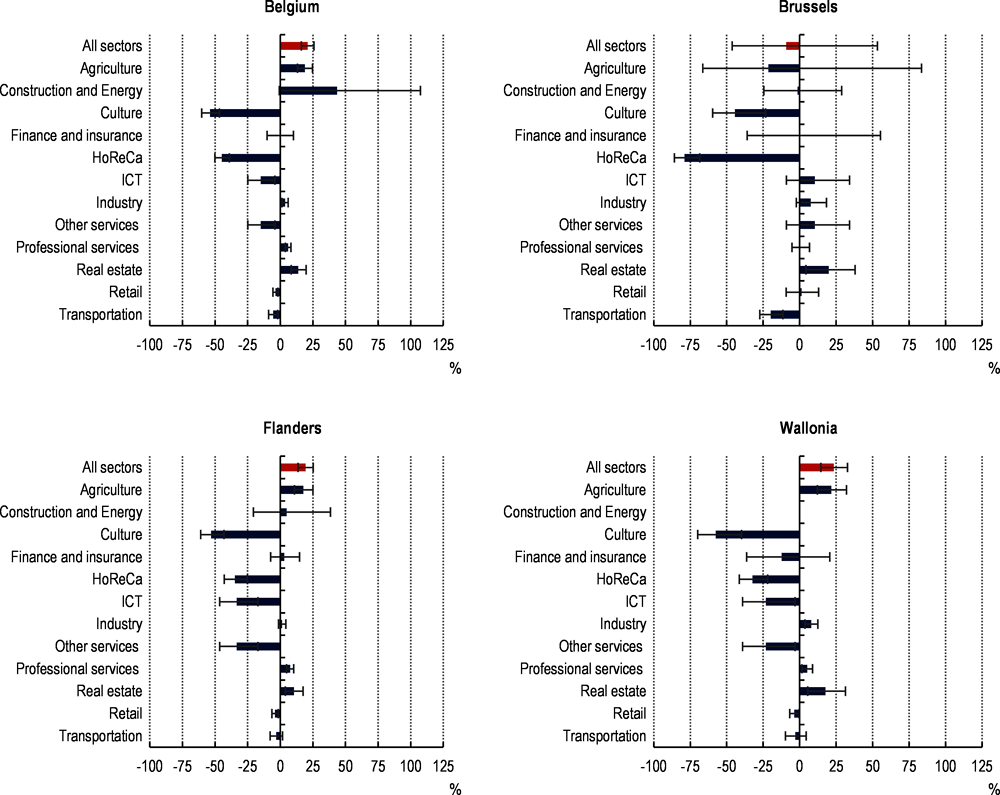

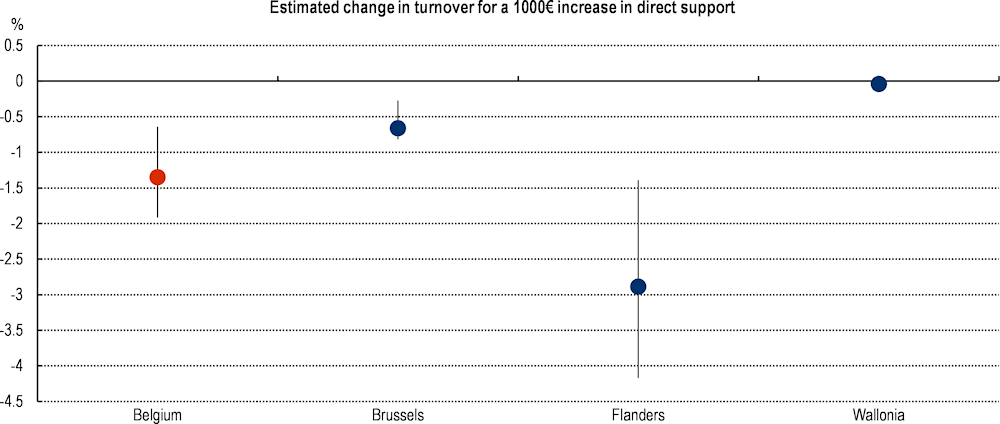

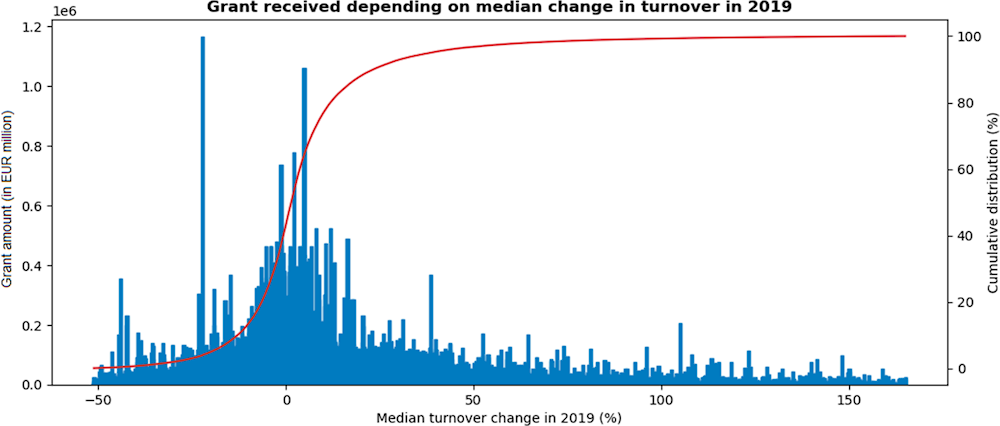

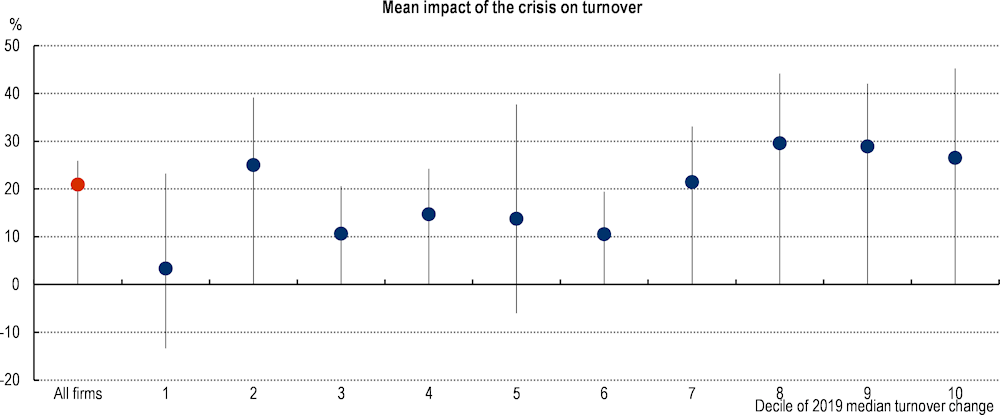

Source: ERMG surveys (wave 18).