This chapter presents key issues hampering social cohesion in the economies of the Western Balkans and puts forward policy recommendations to build more cohesive societies. Improved labour market outcomes and social protection are two complementary, mutually reinforcing ways of fostering social cohesion. Over the past decade, employment has grown in the region; however, unemployment and especially long-term unemployment remain high, and labour market participation is still low. Enhancing active labour market policies and supporting the integration of women and citizens from vulnerable groups are necessary steps to ensure all citizens can contribute to and benefit from social progress. While the Western Balkan economies have created social protection systems to provide necessary safety nets, a large share of citizens continue to face economic hardship and exclusion. More inclusive and fairer social protection systems and integrated social services, are needed to promote equal opportunities and fight exclusion and marginalisation.

Multi-dimensional Review of the Western Balkans

8. Fostering social cohesion in the Western Balkans

Abstract

A socially cohesive society is one that fosters the ability and willingness of its members to undertake collective action to improve societal well-being. To achieve a socially cohesive society, it is important to offer its members the opportunity to participate, to create a sense of belonging and promote trust among people, and to fight against exclusion and marginalisation (OECD, 2011[1]). Societies with low social cohesion suffer from disenfranchisement, making collective action more difficult. In turn, this limits the capacity of society to put in place means to share the benefits of progress. In good times, low social cohesion leads to increased inequality; in bad times, it can lead to violent manifestations of dissent. Actively fostering social cohesion can create a virtuous circle in which citizens feel they have opportunities to lead decent lives and to fulfil their personal objectives, and that they belong to a society that builds trust and improves the scope for collective action.

Investing in social cohesion is beneficial for citizens’ well-being and can support inclusive growth through multiple channels. Economies with more cohesive societies tend to have stronger institutions, which in turn support economic growth (Easterly, Ritzen and Woolcock, 2006[2]). The policies that support social cohesion, including social protection and labour policies, can kickstart a virtuous cycle by increasing citizen participation in society and the economy, fostering inclusive growth and opening fiscal and policy space for further improvements in inclusive institutions, in particular democratic governance institutions (Sommer, 2019[3]; OECD, 2011[1]). Available evidence supports key channels through which social protection policies in particular foster inclusive growth: social assistance contributes to increasing schooling among the poorest segments of the population, and social insurance reduces incentives for migration, especially among high-skilled workers (OECD, 2019[4]).

The Initial Assessment of this Multi-dimensional Review of the Western Balkans identified supporting social cohesion as a strategic priority for the region (OECD, 2021[5]). At present, several factors undermine such cohesion in the region. Underperforming labour markets leave many without attractive opportunities and strain the ability of citizens to be mutually supportive. Lack of participation in formal labour markets renders social protection systems, which are mostly contribution-based, unsustainable and under-dimensioned. Large inequalities between sub-regions and between ethnic groups add to the complexity. Local governments should be on the frontline in addressing these challenges, yet they often lack the capabilities in terms of organisation, incentives and funding.

Elements making up social cohesion feature high on the list of aspirations for the future in the region. The key elements include good governance, effective public services, rule of law and justice, decentralisation, quality health services, social protection and decent jobs. All ranked highly in four aspirational foresight workshops held in the region as part of the Initial Assessment of this review (OECD, 2021[5]). Having gathered a range of participants from various ministries and agencies, the private sector, academia and civil society, the workshops helped them to develop vision statements based on desired narratives of the lives of future citizens.

To provide suggestions for strengthening social cohesion in the Western Balkans, this report builds on an extensive peer-learning process with practitioners and expert assessment. Building on the Governmental Learning Spiral methodology (Blindenbacher and Nashat, 2010[6]), two peer-learning events brought together experts and practitioners from across the region and beyond to prioritise among challenges and solutions, develop ideas for action and learn from each other (Box 8.1).

Labour market policies and social protection constitute two complementary policy areas to foster social cohesion, as has become very clear during the COVID-19 pandemic. The complementarity stems from the ways in which the two policy areas interact and reinforce each other. Employment opportunities provide people income and prospects for personal development; in turn, it reduces financial pressures on the social protection system, making “room” to improve its quality. Social protection is vital in that it reduces poverty and inequalities, and serves as a safety net and support system. Co‑ordinated policy efforts that create adequate employment opportunities while also establishing an effective and fair social protection system may set the stage for a cohesive society: i.e. one that offers opportunities to participate, fosters a sense of belonging, promotes trust among people, and fights against exclusion and marginalisation.

Across three sections, this chapter investigates the state of affairs for key elements of social cohesion in the economies of the Western Balkans and explores policy recommendations to improve them. Section 8.1 provides overarching analysis of key development outcomes across the regional labour markets and social protection systems. Sections 8.2 and 8.3 analyse policy challenges, and provide suggestions that may apply to all regional economies, albeit to different degrees. To support learning from others, whenever possible, policy suggestions are complemented with country examples. The regional outcomes of the peer-learning workshops constitute the key analytical basis for the present report and guide the policy analysis and suggestions in Sections 8.2 and 8.3 (Box 8.1).

Box 8.1. Multi-dimensional Reviews of the Western Balkans: From Analysis to Action through peer-learning

Peer-learning, as implemented following the Governmental Learning Spiral methodology was a key process in the Multi-dimensional Review project. With three overarching aims – to identify central issues hampering social cohesion at the regional and economy levels; to suggest ideas for future policy actions at the economy-level; and to exchange policy experiences – the process brought together key stakeholders from the Western Balkans (Albania, Bosnia and Herzegovina, Kosovo, North Macedonia and Serbia). The peer-learning process on social cohesion comprised two rounds of workshops (Workshop One, 18-19 February 2021 and Workshop Two, 22 April 2021), each attended by 29 experts (about five per economy) representing various societal perspectives, including government, public employment agencies, civil society, academia and businesses.

Workshop One started with a regional plenary to select the most important and most urgent issues related to social cohesion in the region (Table 8.1). Of 15 issues raised, activation of long-term users of social benefits received the highest number of votes. This chapter and those following provide deeper analysis of the selected issues and policy suggestions clustered in two themes: supporting people to find opportunities in the labour market; and building effective, inclusive and financially sustainable social protection systems.

Following discussion at the regional level during the Workshop One, participants worked in economy-level groups to start developing ideas for action. These activities became the basis for the Workshop Two. During the two workshops, participants from each economy met to further specify actions, processes and requirements pertaining to their action plans.

In Workshop Two, participants from the five economies reconvened to present progress in developing action plans and to pose to other participants the most pressing questions in areas where they lack policy experience. Following the peer-learning exchange at the regional level, participants reassembled in their economy groups to suggest monitoring indicators relevant for their respective action plans.

Table 8.1. Results from voting on the most important and urgent issues

|

Issues |

Votes |

|

|---|---|---|

|

1 |

Activation of long-term users of social benefits |

****** |

|

2 |

Employment of women |

***** |

|

3 |

Gaps in design and coverage of active labour market policies |

**** |

|

4 |

High quality jobs |

*** |

|

5 |

In-work poverty |

*** |

|

6 |

Limited access to social insurance rights and benefits |

*** |

|

7 |

Access of marginalised groups to social services |

*** |

|

8 |

Employment programmes with focus on the most vulnerable |

*** |

|

9 |

Matching education and the labour market |

** |

|

10 |

Employment of people with disabilities |

** |

|

11 |

Community integrated social care services |

** |

|

12 |

Assessment of adequacy of social assistance benefits |

** |

|

13 |

Improving financing of local social protection services |

** |

|

14 |

Unbalanced regional development |

** |

|

15 |

Youth employment and education |

* |

Source: OECD peer-learning workshops.

Source: Blindenbacher and Rielaender (forthcoming[7]), How Learning in Politics Can Work; Blindenbacher and Nashat (2010[6]), The Black Box of Governmental Learning The Learning Spiral - A Concept to Organize Learning in Governments, World Bank Group, Washington, DC, https://doi.org/10.1596/978-0-8213-8453-4.

8.1. Social cohesion developments in the Western Balkans: Progress and challenges

8.1.1. Labour market outcomes have improved but employment opportunities remain inadequate for many

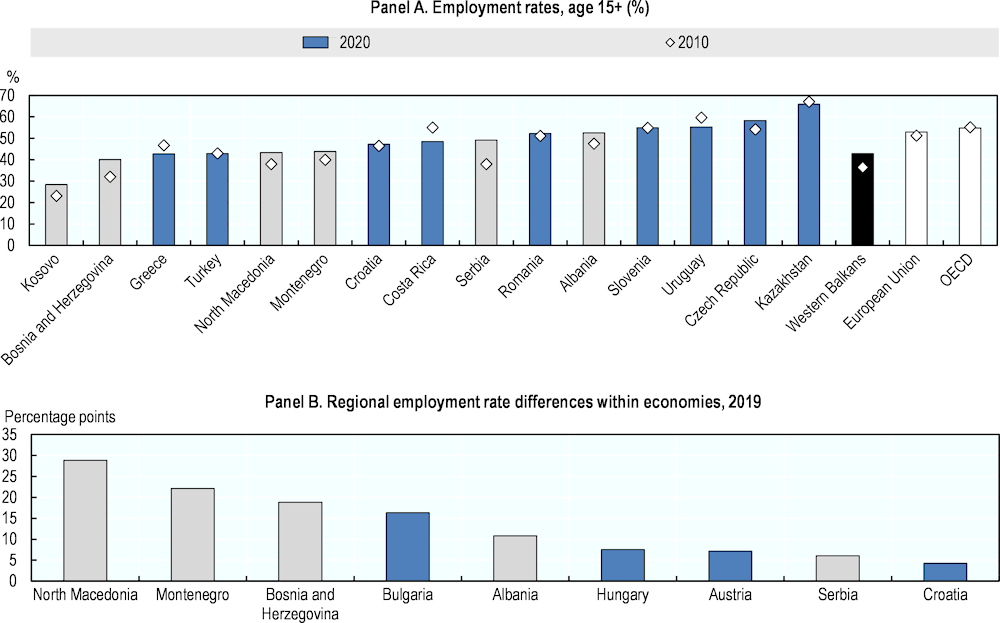

Job creation remains inadequate. Employment rates have increased over the past decades in most Western Balkan economies; however, they remain comparatively low (Figure 8.1 – Panel A). Some economies (Bosnia and Herzegovina, Montenegro, and North Macedonia) show significant differences in employment outcomes across territories, further hampering social cohesion (Figure 8.1 – Panel B). To date, a rather slow structural transformation and economic diversification has not led to job creation. Western Balkan economies struggle with skills gaps and mismatches as well as low productivity. In this context, wage increases in recent years have contributed to weakening labour cost-competitiveness, as they do not reflect growth in productivity (OECD, 2021[5]).

Figure 8.1. Employment performance has improved but employment differences within economies continue to hamper social cohesion

Notes: Panel B - Differences in employment rates are calculated as a difference between highest- and lowest-performing areas within each economy. Areas are based on NUTS2 classification. In Bosnia and Herzegovina, the areas reflect three entities: Republika Srpska (RS), Federation of Bosnia and Herzegovina (FBiH), and Brcko District.

Source: World Bank (2021[8]), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators; INSTAT (2021[9]), Statistical database (database), http://databaza.instat.gov.al/pxweb/en/DST/START__TP__LFS__LFSV/NewLFSY014/; Kosovo Agency of Statistics (2021[10]), ASK Data (database), https://ask.rks-gov.net/en/kosovo-agency-of-statistics; World Bank/WIIW (2021[11]), SEE Jobs Gateway (database), https://data.wiiw.ac.at/seejobsgateway-q.html.

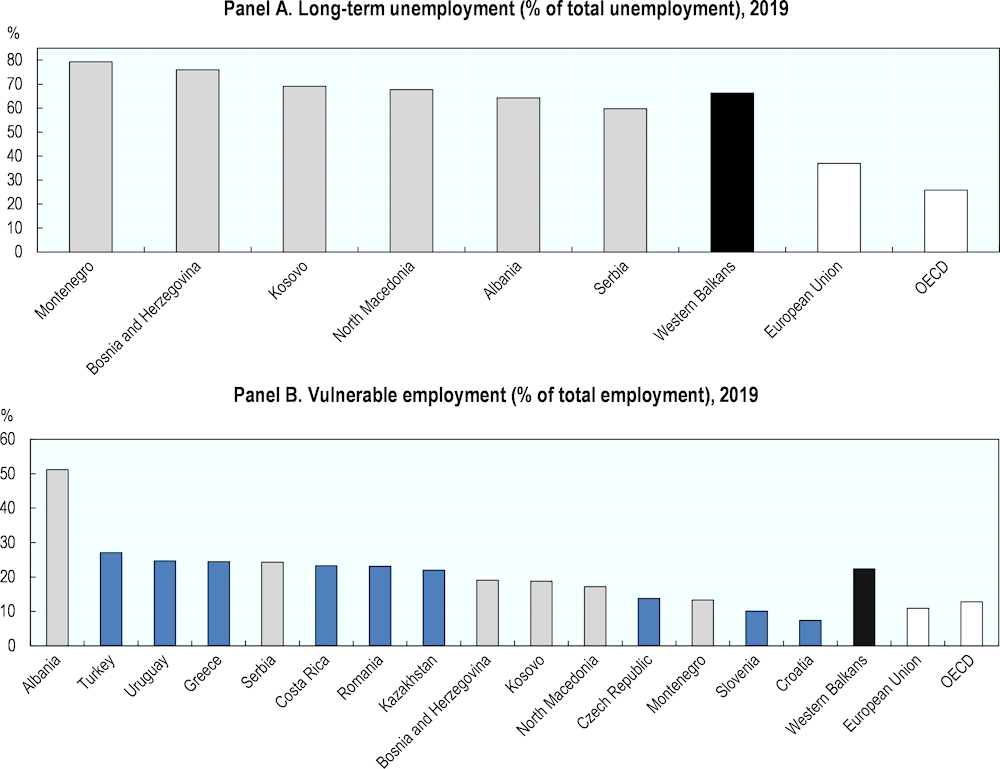

Long-term unemployment and vulnerable employment are of particular concern for social cohesion. Many Western Balkan citizens find themselves unemployed over long time periods, leading to a potential loss of productive human capital and disconnection from labour markets. In 2019, up to 66.3% of the unemployed had been so for more than one year (Figure 8.2 – Panel A). At 52.9%, the rate of long-term unemployment among the unemployed young (15-24 years) is almost as high, in sharp contrast to a share of 11.3% across the OECD (World Bank/WIIW, 2021[11]; OECD, 2021[12]). Vulnerable employment, defined as the share of contributing family workers and own-account workers in total employment, is also very high at 22.4% in 2019, with the highest rate being in Albania at 51.2% (Figure 8.2 – Panel B).

Figure 8.2. Many people are long-term unemployed or in vulnerable employment

Source: Eurostat (2021[13]), Data Explorer (database), https://ec.europa.eu/eurostat/data/database; OECD (2021[12]), OECD Statistics (database), https://stats.oecd.org/; World Bank/WIIW (2021[11]), SEE Jobs Gateway (database), https://data.wiiw.ac.at/seejobsgateway-q.html; World Bank (2021[8]), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

Long-term unemployment affects persons across society, with particularly high shares among older and low-skilled people. Long-term unemployment among those unemployed aged 55-64 years is striking – averaging 81.3% across the region (Table 8.2). The lack of employment opportunities at this age implies that unemployed persons are likely to exit the labour market and live on their savings or welfare support. Indeed, at 46.7% in 2019, employment rates for older adults are 21 percentage points lower than for prime-age adults (67.7%). This situation can create significant pressure on welfare systems and represents an important loss of human capital, especially given the accumulated skills of older persons. Before the COVID-19 pandemic, 648 000 workers – across all skill levels – were long-term unemployed in the region (World Bank/WIIW, 2021[11]), Rates are particularly high among the unemployed with low skills. In Bosnia and Herzegovina, as many as 88% of unemployed persons with low skills are in long-term unemployment. The high share of long-term unemployment among medium and high skill levels is also a concern, especially given the level of investment in education.

Table 8.2. Long-term unemployment affects many unemployed, across ages and skill levels

Long-term unemployment rate (% of unemployed)

|

Age |

Education |

|||||

|---|---|---|---|---|---|---|

|

15-24 |

25-54 |

55-64 |

Low (levels 0-2) |

Medium (levels 3-4) |

High (levels 5-8) |

|

|

Albania |

49.1 |

72.6 |

82.6 |

73.0 |

66.9 |

59.9 |

|

Bosnia and Herzegovina |

68.7 |

85.4 |

93.4 |

88.0 |

82.9 |

72.5 |

|

Kosovo |

44.7 |

62.9 |

82.3 |

76.8 |

53.2 |

54.4 |

|

Montenegro |

50.3 |

80.4 |

89.5 |

86.4 |

76.3 |

62.8 |

|

North Macedonia |

64.4 |

75.0 |

89.3 |

77.4 |

75.2 |

70.4 |

|

Serbia |

43.4 |

61.1 |

71.3 |

64.2 |

58.9 |

57.6 |

|

Western Balkans |

52.7 |

69.8 |

81.3 |

74.0 |

67.0 |

61.8 |

|

Austria |

13.9 |

30.1 |

51.2 |

32.9 |

28.3 |

24.1 |

|

Bulgaria |

46.5 |

58.5 |

64.9 |

N/A |

N/A |

N/A |

|

Croatia |

24.2 |

44.6 |

50.3 |

N/A |

N/A |

N/A |

|

Hungary |

25.3 |

40.5 |

50.0 |

38.9 |

40.2 |

29.0 |

Note: According to the International Standard Classification of Education, levels 0-2 correspond to early childhood, primary and lower-secondary education; levels 3-4 correspond to upper-secondary, post-secondary and short-cycle tertiary education; and levels 5-8 correspond to tertiary education and above.

Source: World Bank/WIIW (2021[11]), SEE Jobs Gateway (database), https://data.wiiw.ac.at/seejobsgateway-q.html.

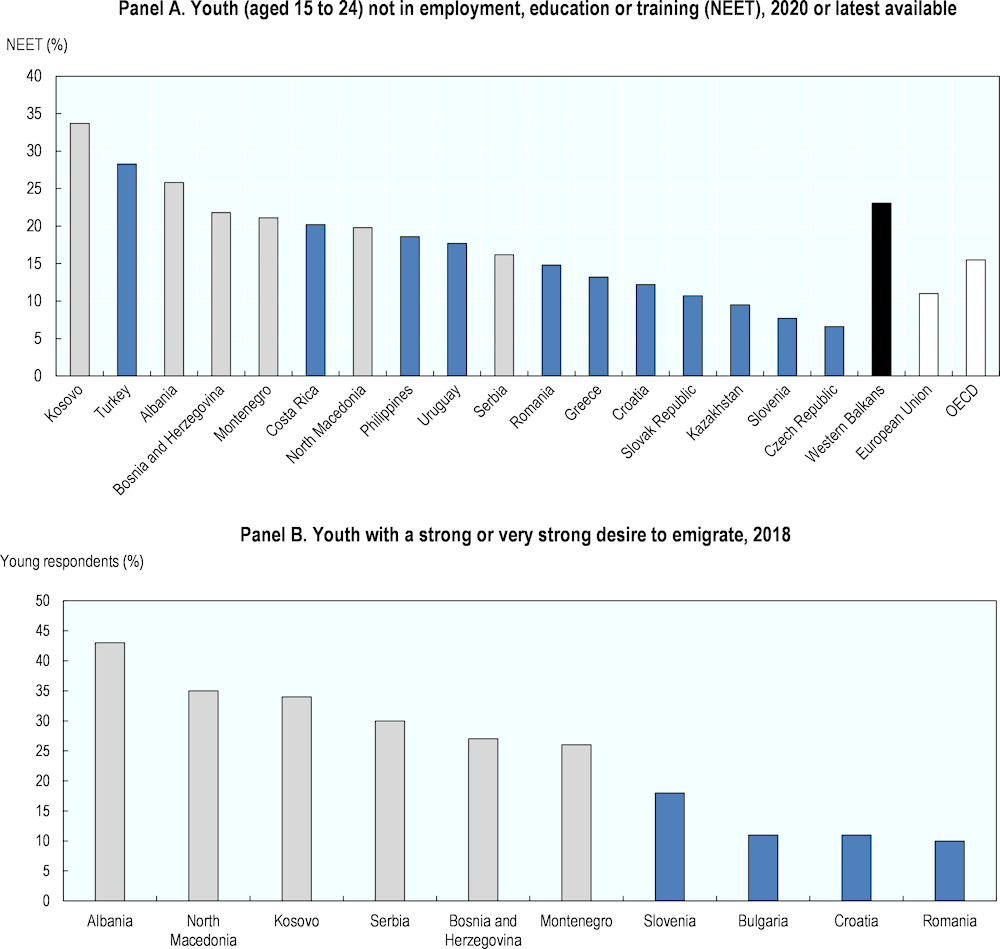

Youth in the region are not well integrated in education and labour markets, leading to brain drain. About one in four people aged 15 to 24 does not participate in education, training or employment in the Western Balkans (Figure 8.3 – Panel A). Higher standards of living, better employment opportunities and higher salaries abroad are prompting the youth to migrate (Lavrič, 2021[14]). Recent estimates (Figure 8.3 – Panel B) show about one-third (33%) of young people across the region expressing a strong or very strong desire to emigrate, ranging from 26% in Montenegro to 43% in Albania.

Looming demographic changes are expected to exacerbate human capital deficits. Low fertility and high emigration rates (World Bank, 2021[8]) are expected to intensify demographic pressures and weaken long-term growth prospects throughout the region. These factors will drive the old age dependency ratio (the share of population aged 65+ relative to population aged 20 to 64) from 26.8% in 2020 to 47.3% in 2050 (United Nations, 2020[15]).

Figure 8.3. High youth unemployment fuels desire to migrate

Source: Panel A - ILO (2021[16]), ILOStat (database), https://ilostat.ilo.org/data/; Panel B - Authors elaboration from Lavrič (2021[14]) based on Friedrich-Ebert-Stiftung (2021[17]) data.

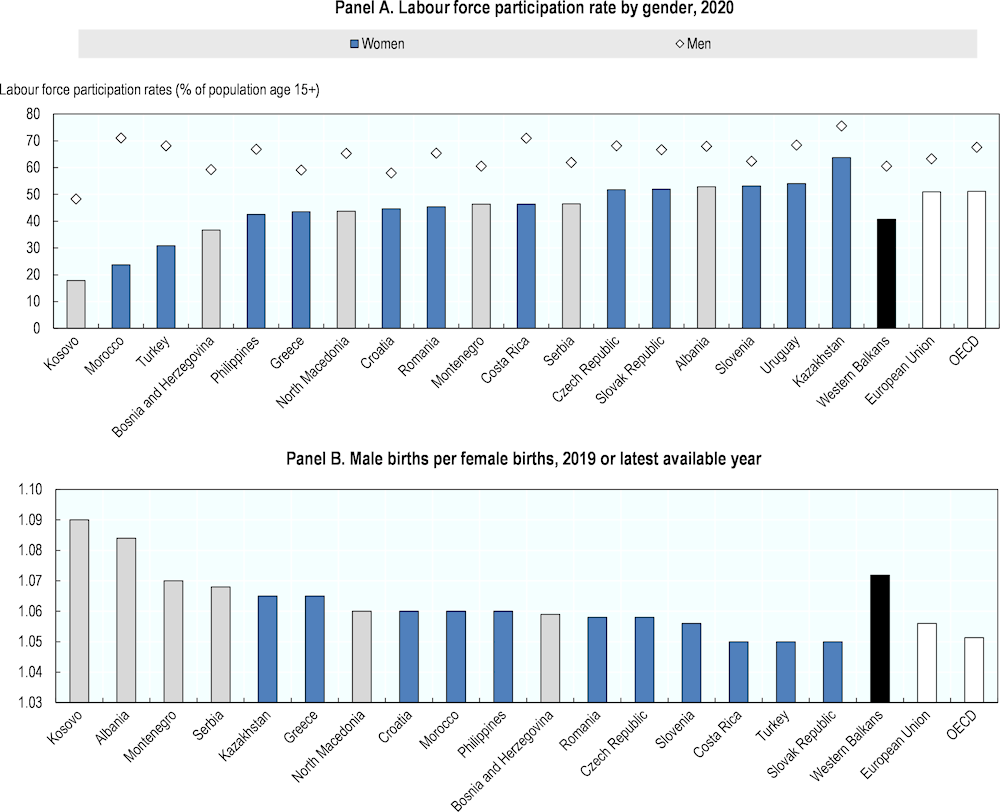

Women often lack equal opportunities to participate in paid work due to traditional norms, lack of care services and other barriers. While variations exist across Western Balkan economies, the regional gender gap in labour force participation (19.9 percentage points) is significantly higher than averages in the OECD (16.5) and the European Union (12.4) (Figure 8.4). There was a drop in labour force participation in 2020 in comparison to 2018 for both men and women, driven by the COVID-19 pandemic.

Figure 8.4. Selected indicators underscore that Western Balkan economies have not yet achieved gender equality

Note: Panel B. Data for Kosovo refer to 2014.

Source: UNFPA/World Vision (2012[18]), Sex Imbalances at Birth in Albania, www.unfpa.org/sites/default/files/resource-pdf/UNFPA_report_Albania2012.pdf; World Bank (2021[8]), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators.

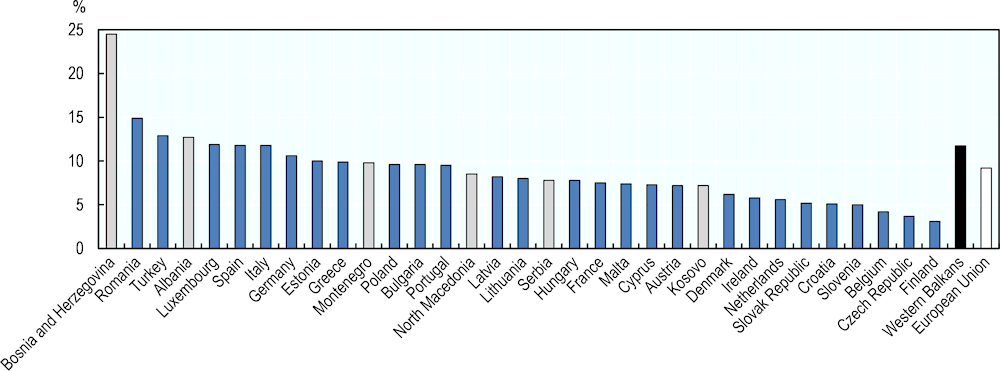

Employment does not guarantee well-being throughout the region. In-work poverty, the share of persons who declared to be at work (employed or self-employed) and who are at risk of poverty, is particularly high among workers in Bosnia and Herzegovina and Albania (Figure 8.5), suggesting that many people work but are unable to secure sufficient work or earn an adequate hourly rate. High in-work poverty rates affect self-employed and part-time workers in particular, which suggests that a low level of working time is a significant contributor to in-work poverty (Jorgoni, 2019[19]; Obradović, Jusić and Oruč, 2019[20]; Gerovska Mitev, 2019[21]; Haxhikadrija, Mustafa and Loxha, 2019[22]). Supporting the working poor may improve the number of quality jobs and reduce incentives for informal activities.

Figure 8.5. In-work poverty is relatively high in some economies

Notes: Share of people who are employed but have an equivalised disposable income below the at-risk-of-poverty threshold, which is set at 60% of the national median equivalised disposable income (after social transfers). Data for Bosnia and Herzegovina are for 2015; data for Kosovo are for 2018.

Source: Eurostat (2021[13]), Data Explorer (database), https://ec.europa.eu/eurostat/data/database; Obradović, Jusić and Oruč (2019[20]).

8.1.2. Social protection systems in the Western Balkans could further reduce poverty, tackle inequalities and address discrimination

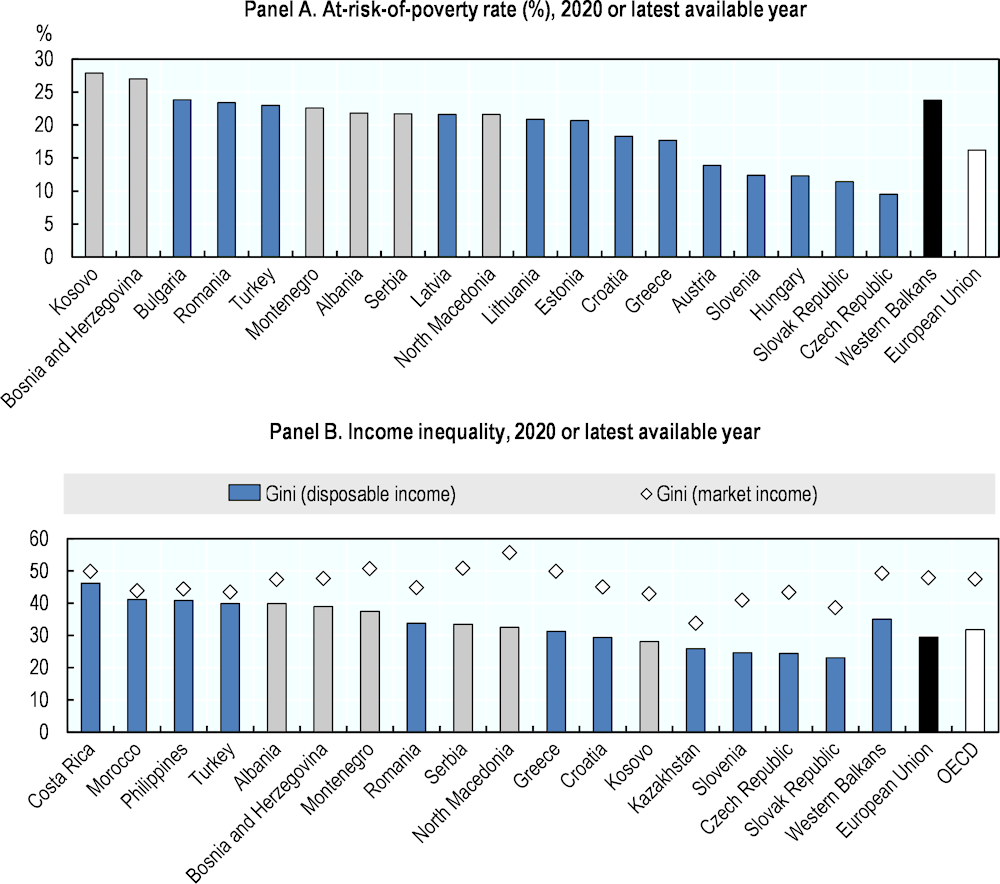

Despite positive economic performance in recent decades, many people in the Western Balkans still face a high risk of poverty. The share of people living at risk of poverty – defined as having an equivalised1 income below 60% of the national median income after social transfers – was 23.8% in 2020 (Figure 8.6 – Panel A). Relative income poverty, measured as at risk of poverty, particularly affects people living in rural areas, those with only primary education and the unemployed (Eurostat, 2021[13]).

Income inequality varies significantly across the region, depending on the effectiveness of social policies. Differences in market and income inequality (based on disposable income) reveal variations in both the effectiveness of tax-and-transfer systems in buffering inequalities and the underlying economic structures that constitute higher levels of inequality in some countries than in others. Overall post-redistribution income inequality (inequality based on disposable income) stands at 35.1 (as measured by the Gini index) in the region, compared with 29.5 in the European Union and 31.8 in the OECD (Figure 8.6 – Panel B).

Figure 8.6. Many people continue to live in poverty and relatively high inequalities persist

Note: The at-risk-of-poverty rate is the share of persons with an equalised income below 60% of the national median income after social transfers. Panel A - The latest available year is 2015 for Bosnia and Herzegovina, and 2018 for Kosovo. Panel B - The latest available year is 2014 for Bosnia and Herzegovina, Montenegro and Morocco, 2015 for the Philippines, 2016 for North Macedonia and Slovak Republic, 2017 for Croatia, Czech Republic, Greece, Kosovo, Romania, Serbia and Slovenia, and 2018 for Albania, Costa Rica, Kazakhstan and Turkey.

Source: Eurostat (2021[13]), Data Explorer (database), https://ec.europa.eu/eurostat/data/database; ESPN (2019[20]), In-work poverty in Bosnia and Herzegovina, https://ec.europa.eu/social/BlobServlet?docId=21121&langId=en; Solt (2019[23]), The Standardized World Income Inequality Database, Versions 8-9 (dataset), https://doi.org/10.7910/DVN/LM4OWF.

Territorial inequalities in economic development and well-being exist in all economies in the region. One example of this is in Albania, where job opportunities are concentrated in Tirana, accounting for about 52% of all jobs. Social services, which are the responsibility of the local government (as in most regional economies), are either underdeveloped or missing in many parts of Albania, due to poor capacities and local authorities’ lack of experience. In Serbia, poverty rates in the Southern and Eastern Serbia (Region Južne i Istočne Srbije) are three times higher than in the Belgrade Region (Beogradski Region). Access to infrastructure, such as public water supply, remains an issue in rural areas in most economies.

Many minority groups, such as Roma and lesbian, gay, bisexual, transgender and intersex (LGBTI) people, face adverse well-being outcomes, also due to discrimination. Negative stereotypes, violence or denial of access to public services and jobs leave these groups largely marginalised. In all economies, Roma have very low health coverage, lower employment rates and poor access to education, public services and infrastructure (e.g. piped water and electricity), particularly in rural areas. Across economies, up to half the population believes homosexuality is a sickness and LGBTI communities often report personal experiences of harassment. Key institutional building blocks, such as empowered equity bodies can help efforts to address discrimination. However, when it comes to specific policies, the evidence suggests that closely targeting policies to the specific barriers faced by women and minorities is important for their success (OECD, 2020[24]).

Rapid population ageing will be a major challenge for achieving further increases in living standards and ensuring the financial sustainability of public social expenditure. Across the region, population ageing is already putting considerable pressure on the financial sustainability of social security systems, especially on pension expenditures and medical expenses, which tend to rise steeply at older ages. This is coupled with the rising challenge of providing quality of life and care for the growing elderly population.

8.2. Suggestions for helping people find opportunities in the labour market in the Western Balkans

Creating employment opportunities is essential for fostering social cohesion in the Western Balkans. This section analyses key regional labour market issues put forward by the peer-learning participants as well as policy suggestions based on international practice. The peer-learning participants selected low labour market integration of long-term unemployed and social welfare beneficiaries as a key issue in the region, noting that it leads to loss of skills and motivation for people while also representing a large burden on social protection systems. Lack of equal conditions for women, Roma and people with disabilities to participate in employment was identified as another major issue that hampers social cohesion and further reduces human capital, with potential negative impacts on growth. Sections 8.2.1 - 8.2.3 shed more light on these issues and suggest options for going forward.

8.2.1. Making active labour market policies effective

Active labour market policies (ALMPs) play an important role in connecting people with jobs and making them job-ready2. The main goal of ALMPs is to increase employment opportunities for job seekers and to improve matching between jobs (vacancies) and workers (i.e. the unemployed) (European Commission, 2017[25]). To be successful, ALMPs need to give people motivation and incentives to seek employment while also increasing their employability, including by adapting their skills to current and future demand. In parallel, ALMPs should seek to expand employment opportunities. Various interventions can be included in ALMPs (European Commission, 2018[26]), which are broadly split into two categories: labour market services (Category 1) and labour market measures (Categories 2-7).3 Labour market services cover all services and activities of the public employment service (PES), together with any other publicly funded services for job seekers. Labour market measures cover interventions that aim to provide the unemployed or people at risk of unemployment with new skills or work experience in order to improve their employability, subsidise employers to create new jobs and/or take on unemployed people or provide placement in public jobs, and interventions supporting self-employment.

Unemployment benefits are an important complement to ALMPs but their development is uneven across the region. Unemployment benefits act as automatic stabiliser at the aggregate level by supporting job seekers in maintaining their living standards during unemployment and in seeking better job matches. To ensure complementarity, both unemployment benefits and ALMPs need to be well designed, for example by including job-seeking obligations and links to ALMP participation (OECD, 2018[27]). In Albania and Montenegro, unemployment benefits are very low, set at less than half the minimum wage. In Serbia and North Macedonia, benefits are set at 50% of previous average wages, which is in line with several OECD countries. In most economies in the region, benefits are available for 12 months; in Serbia and in Bosnia and Herzegovina (Federation of Bosnia and Herzegovina), eligibility can extend to 24 months. In general, throughout the region, unemployment beneficiaries have a mutual obligation to look for jobs and/or to participate in trainings. In reality, very often monitoring remains limited (OECD, 2021[28]) and in some economies such obligations are likely ineffective given the low levels of unemployment benefits.

The nature of labour market challenges varies among different groups of people and calls for two strategic approaches to effectively implement ALMPs:

First, ensure effective early interventions and make the most of existing job opportunities for people who have recently entered unemployment, aiming to re-integrate them into labour market. Rapid labour market re-integration of persons that have recently lost employment ensures that people continue earning income and applying their skills. Rapid re-integration can also reduce financial pressures on social protection systems and lower the risk that people become long-term unemployed.

Second, activate the long-term unemployed and people who have never been in employment (including young and vulnerable people) through intensified individualised support and an integrated implementation approach, involving collaboration with various stakeholders. Activating the long-term unemployed can reduce the need for welfare support and avoid further deterioration of valuable skills. Young persons and vulnerable groups, including Roma, often have not had an opportunity to participate in employment. These groups represent a particular challenge for ALMPs either due to their lack of work experience or low skill levels. Low integration of young and vulnerable groups is a missed opportunity that can hamper growth and social cohesion.

Although Western Balkan economies have various ALMPs in place, overall participation is low. The share of job seekers participating in ALMP measures (Categories 2-7) ranges from 5.3% of registered unemployed in Serbia (in 2018) to 9.3% in Kosovo (in 2016) (Table 8.3). Substantially higher shares are recorded (2016) in Croatia (22.1%), Slovak Republic (26.8%) and Hungary (71.4%) (European Commission, 2021[29]). With the exception of Bosnia and Herzegovina, most ALMP interventions across the region were focused on training. Sheltered jobs and supported return to work are the main form of ALMP in Bosnia and Herzegovina, and remain also quite sizeable in Serbia. Across the region, the share of youth participating in ALMPs is higher than that of adults (Table 8.3).

Table 8.3. ALMPs coverage of measures and participation vary between economies

Share of participation in different ALMPs measures (Categories 2-7 of ALMPs) per number of unemployed registered with employment services in 2018 (or latest available)

|

Albania |

Bosnia and Herzegovina |

Kosovo |

North Macedonia |

Serbia |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Total |

Youth |

Total |

Youth |

Total |

Youth |

Total |

Youth |

Total |

Youth |

||

|

Registered job seekers |

64 781 |

11 960 |

435 266 |

56 681 |

101 773 |

32 987 |

94 721 |

20 151 |

552 513 |

54 226 |

|

|

ALMP participants (% of registered unemployed) |

7.4 |

30.9 |

7.6 |

13.5 |

8.5 |

22.9 |

8.1 |

11.6 |

5.3 |

9.7 |

|

|

ALMP participants by category (% of all ALMP participants) |

|||||||||||

|

2 |

Training |

.. |

.. |

5.6 |

.. |

84.4 |

.. |

37.4 |

46.5 |

36.7 |

60.8 |

|

3/4 |

Employment incentives |

.. |

.. |

NA |

.. |

5.5 |

.. |

27.8 |

34.8 |

0.7 |

0.2 |

|

5 |

Sheltered and supported employment and rehabilitation |

.. |

.. |

90.4 |

.. |

.. |

2.8 |

0.9 |

33.4 |

20.0 |

|

|

6 |

Direct job creation |

.. |

.. |

.. |

9.5 |

.. |

15.6 |

6.8 |

13.9 |

13.2 |

|

|

7 |

Start-up incentives |

.. |

.. |

3.9 |

.. |

0.6 |

.. |

16.4 |

10.9 |

15.3 |

5.6 |

Note: Data on ALMPs participation by measure are from 2018, total registered unemployed are from 2018, and youth registered unemployed are from 2019. Numbers for Kosovo are from 2016. .. : Not Available.

Source: CPESSEC (2019[30]), Statistical Bulletin No. 9, https://www.docdroid.net/qvBC3jr/statisticki-bilten-br-9-cpessec-finalno-converted-pdf; RCC (2021[31]) Study on Youth Employment in the Western Balkans, https://www.rcc.int/download/docs/Study-on-Youth-Employment-in-the%20Western-Balkans-08072021.pdf/7464a4c82ee558440dfbea2e23028483.pdf Jahja Lubishtani (2018[32]), The Effectiveness of Active Labour Market Policies in Reducing Unemployment in Transition Economies, https://core.ac.uk/download/pdf/226765796.pdf; Government of Albania (2020[33]), Employment, Training, and Equal Opportunities, https://rm.coe.int/rap-cha-alb-11-2020/16809cd971.

Unemployment registration with PES varies considerably across the region depending on their capacity and the requirements of social assistance programmes. In Bosnia and Herzegovina and Serbia, registered unemployment is significantly larger than unemployment as measured by the labour force survey (by 57% and 25% respectively). By comparison, registered unemployment is 37% of survey-measured unemployment in Albania, 70% in Kosovo and 47% in North Macedonia. Registration with the PES is tied to a range of social benefits in Serbia and in the Federation of Bosnia and Herzegovina,4 including basic health insurance coverage. This generates high incentives to register as unemployed, including for workers in the informal economy and those who are not actively looking for work (ILO/Council of Europe, 2007[34]; ETF, 2006[35]). By providing incentives for workers to register, such regulatory provisions increase the reach of the PES; however, they also stretch the ability of agencies to perform a control function and can overload placement officers with potential cases.

Low staffing levels in regional PES and high administrative workloads are key factors that limit the effectiveness of ALMPs and hamper connecting people with jobs. In 2016, the number of job seekers per PES counsellor ranged from 329 in Albania to 969 in Republika Srpska in Bosnia and Herzegovina (Table 8.4). Such a burden hinders the effectiveness of personalised counselling and job placement services (OECD, 2021[28]). In addition, PES counsellors in the region have to administer a large volume of requests for unemployment benefits. In Serbia and in Bosnia and Herzegovina, for example, unemployed persons need to register at PES in order to receive unemployment benefits, including health insurance; in Albania, social assistance beneficiaries need to register to obtain means-tested benefits. As this administrative burden falls on PES offices, counsellors are unable to effectively implement ALMPs and connect people with jobs. Even though more jobs were available per unemployed person, estimates from 2016 show large gaps in effectiveness to connect people with jobs among PES local offices within each of the regional economies. The highest effectiveness gap (i.e. lowest performance) is found in Montenegro. Serbia showed the lowest effectiveness gap. Simulations show that boosting the effectiveness of the worst-performing PES offices could improve job placement rates (Table 8.5).

Table 8.4. Public employment service counsellors attend to a high number of job seekers

Caseloads (number of job seekers) of public employment service (PES) staff in Western Balkans and benchmark economies in 2016

|

Albania |

Bosnia and Herzegovina |

Kosovo |

North Macedonia |

Serbia |

Croatia |

Slovenia |

||

|---|---|---|---|---|---|---|---|---|

|

FBiH |

RS |

|||||||

|

Caseload |

329 |

619 |

969 |

769 |

463 |

436 |

169 |

137 |

Note: Caseloads calculated by dividing total staff by total job seekers. Data on Kosovo from 2019.

Source: World Bank (2018[36]), Functional Reviews of the Public Employment Services in the Western Balkans, https://openknowledge.worldbank.org/bitstream/handle/10986/35656/Functional-Reviews-of-the-Public-Employment-Services-in-the-Western-Balkans-Overview.pdf; European Commission (2016[37]), Assessment Report on PES Capacity, https://ec.europa.eu/social/BlobServlet?docId=16967&langId=en; OECD (2021[28]), Competitiveness in South East Europe 2021, https://doi.org/10.1787/dcbc2ea9-en.

Table 8.5. Reducing differences in effectiveness between local PES offices could improve job placements across economies

Estimated effectiveness gap, and potential placement gains if gap is closed for 2016

|

Albania |

Bosnia and Herzegovina |

North Macedonia |

Montenegro |

Serbia |

||

|---|---|---|---|---|---|---|

|

FBiH |

RS |

|||||

|

Formal jobs in area per unemployed |

10.5 |

1.2 |

1.8 |

.. |

3.6 |

2.7 |

|

Within-economy average effectiveness (average of branch effectiveness relative to “best practice” office) |

41% |

67% |

.. |

54% |

25% |

78% |

|

Job placement gains if respective effectiveness gap is closed |

120% |

25% |

.. |

73% |

300% |

20% |

Note: The definition of “best practice” is economy-specific; as such, the different PES cannot be ranked against each other. The effectiveness gap is estimated by the World Bank by identifying the most efficient PES office and benchmarking it with other inefficient offices using a similar mix of inputs (resources used by offices such as number of staff and expenditure) and outcomes (number of registered unemployed transitioning into formal jobs). Additional multivariate analysis includes control variables such as socio-economic conditions and local labour demand, with the result that poorer local labour demand (e.g. in Albania and Serbia) is linked to lower office effectiveness. Kosovo was not part of the study. .. : Not available.

Source: World Bank (2018[36]), Functional Reviews of the Public Employment Services in the Western Balkans, https://openknowledge.worldbank.org/bitstream/handle/10986/35656/Functional-Reviews-of-the-Public-Employment-Services-in-the-Western-Balkans-Overview.pdf.

Policy options for reducing unemployment durations and long-term welfare dependency through ALMPs

Ensuring rapid labour market re-integration of those who have recently lost their jobs will require increased capacities of public employment agencies, closer collaboration with employers to leverage existing jobs and better integration of technological solutions.

Strengthening the capacities of PES to ensure a personalised and adapted approach to individual needs. Reducing the burden of PES counsellors is vital to provide better and more personalised services to job seekers. This could be achieved by reducing counsellors’ administrative tasks and/or by increasing the number of counsellors. To improve the quality of placement services, an experiment in Germany saw 14 local public employment offices hire additional caseworkers to lower the staff/client ratios to an average of 1:70 (from the usual 1:80 to 1:250). Evaluations showed that, with lower caseloads, PES offices could intensify counselling, monitoring and sanction efforts while also boosting contacts with local firms, resulting in shorter benefit durations for the unemployed. The costs of hiring additional caseworkers were offset by decreased unemployment benefit expenditures within a period of about ten months (OECD, 2016[38]). An option to increase resources with relative ease is to contract out employment services, for example for specific groups (disabled persons, long-term unemployed) through outcome based contracts. Some of the advantages of such an approach include increased flexibility to scale resources up or down with unemployment registrations, more efficient service provision, and more tailored services and choice for job seekers (Langenbucher and Vodopivec, 2022[39]).

Leverage existing jobs by increasing collaboration between employers and PES. Providing quality services to the private sector may improve the reputation of the PES as a reliable service provider for employers and increase the availability of vacancies advertised at the PES. Having dedicated “employer relationship” staff could be considered as a means to manage intake and registration of vacancies, inform employers about available ALMPs, provide targeted support for SMEs that lack human resource departments and carry out other activities. PES in the United Kingdom has put in place a Small Business Recruitment Service to serve the needs of companies with fewer than 50 employees. The service includes a specialist employer helpline, advice on the local labour market, additional support for advertising vacancies (e.g. wording and design), and post-recruitment support (OECD, 2015[40]). To further incentivise employers to publish vacancies at PES and to better link job seekers with employers, PESs could integrate job placements with job-related skills trainings to meet the labour demand of firms. South Africa offers a valuable example in which intermediary youth accelerator organisations work with the PES to provide demand-driven trainings that align with skills needed for specific jobs (Romero and Kuddo, 2019[41]).

Technology can cost-effectively boost the reach and accessibility of services by PES, with self-service options potentially reducing the need for personal encounters. Technology can facilitate the work of PES in several ways. The administrative burden of PES staff, for example, can be decreased by transferring the application for unemployment benefits to an online platform. Several OECD countries have implemented this option with varying degrees of take-up – from 1-2% of claimants in Spain to 88% in the United Kingdom (OECD, 2015[40]). Online training modules can be offered, as is done in Belgium (OECD, 2015[40]). Offering online encounters between employers and job seekers (replacing physical encounters in local PES offices) can also be effective, as shown by a programme offered by the PES in Sweden that replicates the concept of ”speed-dating” (OECD, 2015[40]).

Profiling tools help increase the efficiency of PES services by targeting resources to those most in need and offering job seekers services and support adapted to their profile. Statistical profiling can help increase the efficiency of PES service provision in the economies in the region given very high PES caseloads and the need to improve targeting. Statistical profiling includes the application of tools which assess the job-finding prospects of job seekers and help to deliver employment services more efficiently. Statistical profiling has several advantages: it delivers services more efficiently by placing clients in different groups depending on their needs, it assesses the prospects of job seekers to find work, it can help to improve the cost-efficiency of PES, and is an input into targeting and tailoring to job seekers’ needs, complementing or supporting the assessment carried out by case workers. The use of statistical profiling has become widespread across OECD countries (Box 8.2). To ensure a positive impact, it is important to overcome key potential limitations of statistical profiling, including data lags, a lack of accuracy, and a lack of transparency. Likewise, involving all stakeholders, especially case workers, in the implementation of any type of profiling early on is crucial (Desiere, Langenbucher and Struyven, 2019[42]).

Provide adequate opportunities to job seekers to take up trainings to reskill or upskill in line with the labour market needs. Skills are a key determinant of worker productivity and labour market outcomes. Workers with higher proficiency are more likely to be employed and command higher wages (OECD, 2018[27]). Evidence shows that training programmes that develop technical skills and competences generally improve the probability of finding employment. To be most effective, skills development programmes need to focus on skills demanded by the labour market and complement the formal education system (Sida, 2021[43]).

Activating long-term unemployed and vulnerable groups will require increased individualised attention, establishing incentives for PES staff to increase their focus on these groups, potentially introducing programmes that are different in nature and approach, and setting up an integrated targeting approach involving collaboration with various stakeholders.

Individualised support should be strengthened and promoted in the regional economies. PES can establish specialised units or case managers for specific groups (e.g. long-term unemployed young people, people with disabilities, Roma and other ethnic minorities) or rely on external provision when expert knowledge is required to deal with specific labour market integration issues. In Europe, employment services such as Arbetsformedlingen in Sweden or the VDAB in Flanders, Belgium, have diversified their services after the first offer of support. As such, they have tasked their staff with specific parts of counselling, while automating first level support to reduce the weight of basic and repetitive questions on initial job seeker contacts. For example, VDAB has so called job mediators who are specialised in relevant sectors in Flanders, such as construction, retail and ICT (Finn and Peromingo, 2019[44]). Reducing the burden on PES counsellors (see above) may also create space for more individualised support.

Establish incentives for PES to ensure adequate effort is directed toward better labour market integration of long-term unemployed and people lacking relevant job experience. Evidence has shown that attitudes of PES counsellors towards job seekers matter in terms of quality and effectiveness of the services provided (OECD, 2021[45]). The success rate of PES counsellors in matching hard-to-employ job seekers with jobs may also be increased by providing salary additions as a function of the staff member’s effectiveness.

Introduce special measures targeted at overcoming group-specific obstacles to employment. Due to their lack of work experience and relevant education, young people are one of the groups that face high barriers for entering employment. Youth Guarantee Schemes aim to improve the prospects of the young who register as unemployed by providing them with the right to a job offer, an opportunity to carry on with education or inclusion in an active employment measure. Activating this vulnerable group by offering pathways can help mitigate the risk of long-term unemployment and its deleterious effects on youth. North Macedonia launched such a scheme, the Youth Guarantee, in 2018. In its first year, 5 266 young people participated (2 694 of whom were women). Just under half (2 209 or 42%) successfully completed the scheme with 1 972 finding jobs (925 women) within four months. Over the next two years, participants quadrupled: by 2020, the scheme had 25 502 registered (12 863 women) with 7 684 finding employment within four months (ETF, 2021[46]). In the case of Roma, a population group facing more limited access to services and economic opportunities, technology can facilitate registration and follow-up with the PES. Contacting the PES via mobile phones, instead of in-person meetings or via e-mail, can increase the reach of the PES and boost placement chances of unemployed Roma. A similar approach has been used in South Africa, with trained youth accelerators reaching young job seekers who often live in informal settlements via phone calls. The accelerators carry out psychometric and qualitative assessments to profile the young beyond their often limited formal education qualifications (OECD, 2021[47]).

An integrated approach to activating long-term unemployed and vulnerable groups requires increased co-operation with other institutions such as non-governmental organisations (NGOs), social care services, educational institutions, local communities and other stakeholders that operate locally. The PES in Bulgaria has established a good practice in which youth mediators, Roma mediators and PES case managers work in the field to identify unemployed and provide help for their job-seeking activities, such as editing résumés, preparing job applications, and mediating between them and employers (Robayo-Abril and Millan, 2019[48]).

Entrepreneurship development programmes should be implemented alongside other ALMPs, especially in economies with high levels of self-employment and informal employment. Employment services that focus on matching job seekers to vacancies may not address the needs of self-employed workers and subsistence entrepreneurs, including small-scale agricultural workers in the informal economy (Sida, 2021[43]). Conversely, entrepreneurship promotion programmes can have very positive outcomes on employment and earnings in low and middle-income economies (Kluve et al., 2017[49]). Such programmes are most effective if they combine interventions that address the multiple obstacles to entrepreneurship, in particular they often combine capital injections with business or technical training.

Box 8.2. Statistical profiling in public employment services: The case of a new profiling tool in Austria

Profiling tools assess the prospects of job seekers to find work, and support the allocation of workers in different groups according to their needs. Profiling tools are used across OECD countries to determine the timing and intensity of support for job seekers in accordance to their likelihood of finding a job. As they support targeting and tailoring services to needs, they help improve the cost-efficiency of public employment services.

In November 2018, the Austrian PES introduced its first statistical profiling model (AMAS). The model uses data from administrative sources to predict the probability of moving into employment. Based on evaluations, the model achieves a very high level of accuracy (between 80% and 85%) using existing administrative data sources only.

The profiling model consists of two functions which assess clients’ likelihood of reintegration into the labour market in the short term and long term. The short-term function assesses the probability of moving into unsubsidised employment for at least three months in the first seven months after the start of unemployment. The long-term function estimates the probability of moving into unsubsidised employment for at least six months over 24 months. Based on the assessment, clients are then assigned to three different client groups: high, medium and low chance of labour market reintegration. Profiling is typically used to focus on job seekers most at-risk of long-term unemployment, but Austria has recently shifted to provide support earlier to clients in the medium-risk group as this group may benefit more from ALMPs.

The model makes use of socio-economic variables (gender, age, nationality), information on job readiness (education, health limitations, care responsibilities), and opportunities (regional labour market situation). A clear strength is the use of all available labour market history information for each job seeker, including detailed information on prior work experience (type and intensity), frequency and duration of unemployment, and participation in active labour market programmes. The full labour market history is available for about two thirds of all new clients. The history is typically incomplete for youth, individuals with longer periods outside the labour market and migrants. Regional labour market data is captured through segmenting regional PES offices into five clusters, based on supply and demand for labour in each region.

Source: Desiere, Langenbucher, and Struyven (2019[42]), Statistical profiling in public employment services: An international comparison, https://dx.doi.org/10.1787/b5e5f16e-en.

8.2.2. Create equal opportunities for vulnerable groups to participate in the labour market

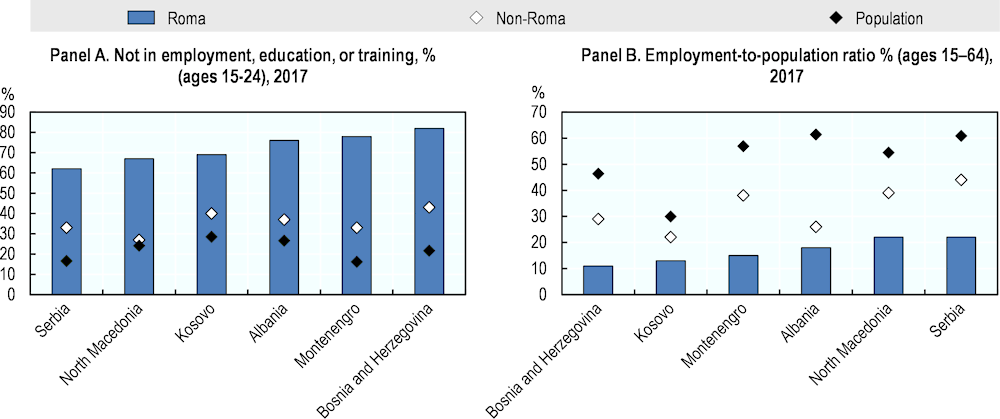

The Roma constitute about 5% of the regional population and face particularly challenging labour market situations. Throughout the region, minorities – especially Roma – and people with disabilities face poor conditions to enter employment. Although accurate figures are scarce, estimates show as many as 1 027 500 Roma across the region, constituting 5.3% of total population, ranging from 1.7% in Bosnia and Herzegovina to 9.6% in North Macedonia (European Commission, 2014[50]). Labour market outcomes of Roma are significantly worse than those of other population groups (Figure 8.7). Roma have lower educational attainment and face various barriers to access on-the-job training and vocational skills. In addition, Roma generally have less access to networks and information about vacancies, placing them in a disadvantaged position when searching for jobs (Robayo-Abril and Millan, 2019[48]). This opens the scope for active labour market programmes designed to train them in occupations in which they are traditionally underrepresented to benefit from wage differentials between sectors.

People with disabilities also face barriers to employment, starting at early levels of education; they are also subject to many stereotypes and other forms of marginalisation. Some efforts are being made in the region to integrate people with disabilities into employment. Albania, for example, has made important progress by adopting two relevant laws: the law “On Promotion of Employment” (15/2019) defines a quota on employing people with disabilities (i.e. 4% of all employees); and the reforms to the law “On Protection from Discrimination” (124/2020) reinforces protection against discrimination. Despite these efforts, further progress is required to create employment opportunities for disabled persons who are able and willing to work and thus reduce pressures on social protection expenditures (OECD, 2021[28]).

Figure 8.7. Roma have worse labour market outcomes than neighbouring non-Roma and the general population

Note: Data source is the UNDP-World Bank-EC Regional Roma Survey (RRS) data from 2017, which includes Roma who live in Roma clusters (areas in which the concentration of Roma ranges between 10% and 40%) and non-Roma living in close proximity of the sampled Roma (within 300 meters). Sample sizes for RRS were 750 Roma and 250 non-Roma households (Robayo-Abril and Millan, 2019[48]).

Data for general population for NEET is for 2018, for employment-to-population for 2019.

Source: Robayo-Abril and Millan (2019[48]), Breaking the Cycle of Roma Exclusion in the Western Balkans, https://documents1.worldbank.org/curated/en/642861552321695392/pdf/Breaking-the-Cycle-of-Roma-Exclusion-in-the-Western-Balkans.pdf; World Bank/WIIW (2021[11]), SEE Jobs Gateway (database), https://data.wiiw.ac.at/seejobsgateway-q.html.

Policy options for integrating vulnerable groups into the labour market

Connecting people with disabilities and minority groups (such as Roma) with jobs requires policy actions targeted at their individual obstacles to enter employment, including overcoming discrimination, development of social enterprises, and other policies.

Take steps to reduce stereotypes in education and the workplace. The regional economies could conduct awareness-raising activities in the education sector and for the broader public, showcasing potential impacts of better integration of people with diverse backgrounds and abilities in terms of both increased social cohesion and impact on growth. Public institutions should serve as role models for inclusive workplaces while also encouraging private sector employers to work with disadvantaged groups.

Foster development of social enterprises (SE) as a stepping stone for integrating vulnerable groups into the labour market. SEs exist across the Western Balkans and often constitute an integral part of their development strategies, although many are still at an early stage of development and face several barriers for operations (Andjelic and Petricevic, 2020[51]). Low access to funds, which SEs need to grow and develop, is one main obstacle of particular importance considering that SEs focus primarily on social impact and operate with low profitability, given that they work with people with disabilities and other vulnerable groups with low skills and limited work experience. Currently, funding in the region comes mainly from grants and start-up investments (Andjelic and Petricevic, 2020[51]). To overcome the issue of low funding, SEs in Ireland can access loans through the provider Clann Credo, which shares 50% of loan default loss with the Social Finance Foundation. Adapted training is needed for social entrepreneurs in areas such as business development. Additionally, policies targeted at raising awareness among the general public could showcase the importance of SEs and their full potential, which in turn can increase their profitability. Likewise, the public sector could increase demand for SEs’ products by prioritising them in public procurement clauses. Co-ordination with an array of stakeholders for formulating such clauses has proven successful in the case of Barcelona City (OECD/European Union, 2017[52]). Finally, it would also be important to ensure that activities of social enterprises are oriented and adapted towards skills that vulnerable groups have and are in close geographical proximity to these groups.

Offer incentives for employers and ALMPs to increase chances for labour market participation of vulnerable groups. Various policy options – such as employment quotas, wage subsidies and services for employers – can increase incentives for recruitment of vulnerable groups. ALMPs tailored to the specific needs of vulnerable job seekers are also important. To integrate young people with mental disabilities into the labour market, the Dutch PES has been subcontracting specialised services, delivered by NGOs. Such services offer vocational training and the ability to obtain job experience (Scharle and Csillag, 2016[53]). Based on evaluation, about one in three participants achieved labour market integration in the period 2005‑10. Complementary to such programmes, it would be important to improve rehabilitation, regulation on the level and conditions of disability benefits, and make changes in public education with an aim to improve access and quality.

8.2.3. Strengthen women’s role in society by supporting their integration into the labour market

Although there are variations across the Western Balkan economies, the low participation of women in paid work in the Western Balkans is striking. Studies show that the lack of women’s participation in the labour market has been hindering economic growth in the region (Suta, 2021[54]). Despite variations between the economies and recent progress, the regional gender gap in labour force participation of 19.9 percentage points (in 2020) is significantly higher than the OECD average of 16.5 in 2020 (Figure 8.4).

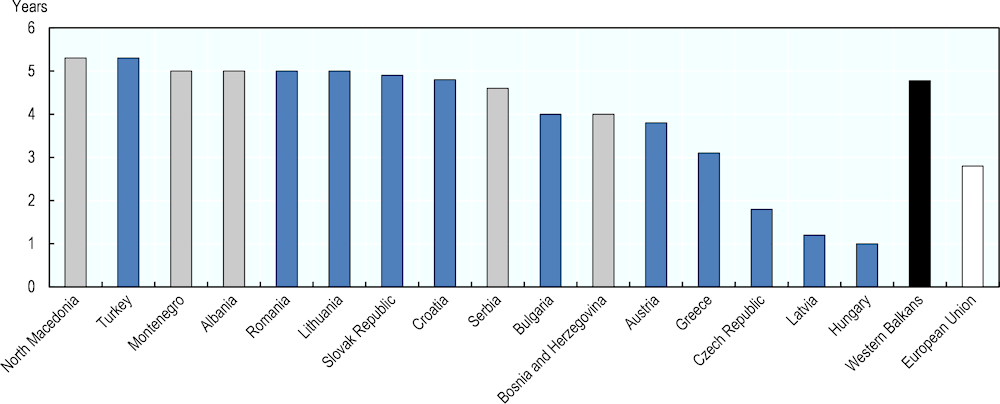

Women across the region face several barriers to entering formal employment, including lack of available childcare, institutional barriers and social norms. Women workers with children have to find ways to reconcile work and family life. In all Western Balkan economies, a comparatively long childcare gap, defined as the period in which families with children are unable to benefit from either childcare leave or a guaranteed place for their child in early childhood education and care (ECEC) until compulsory primary education, impedes access to work outside the home for several years (Figure 8.8). Enrolment in ECEC remains low in the region, especially in Bosnia and Herzegovina and North Macedonia (Table 8.6). Demand for ECEC exceeds available places in most regional economies (European Commission, 2019[55]).

Figure 8.8. Large childcare gaps exist across the Western Balkans

Note: The childcare gap is defined as “the difference between the maximum length of adequately compensated post-natal childcare leave and the earliest start of a universal place guarantee in ECEC (legal entitlement or compulsory ECEC). When there is no guaranteed place in ECEC, the gap is calculated until the start of compulsory primary education” (European Commission, 2019[55]).

Source: European Commission (2019[55]), Key Data on Early Childhood Education and Care in Europe, https://eacea.ec.europa.eu/national-policies/eurydice/content/key-data-early-childhood-education-and-care-europe-%E2%80%93-2019-edition_en.

Lack of flexible work arrangements also affect women’s participation in the labour market. Part-time work can be a way to combine family duties and employment and could potentially increase female labour market participation. In the Western Balkans, the share of women working part time ranges from 4.3% of total employment in Kosovo to 22.4% in Albania. By comparison, the share of women working part time in the OECD is 25.1% (World Bank/WIIW, 2020[56]). Economies that have relatively high mandatory minimum social security contributions, such as Albania, Bosnia and Herzegovina, North Macedonia and Serbia (Table 8.6), may be discouraging low-paid, part-time employment.

Social norms, such as gender stereotypes and patriarchal culture, continue to prescribe the unpaid caretaker role to women. Women bear the brunt of unpaid care work in the household (a main self-reported reason for labour market inactivity). Albanian women spend over six times more time on unpaid household chores than men, compared to around two times more in comparable regional economies (such as Serbia) and in the OECD (OECD, 2019[57]). Among those in the labour force, engagement as unpaid family workers is high among females in the region, ranging from 29.4% of female employment in Albania to 3.5% in Montenegro, compared with 1.4% in the European Union (Table 8.6).

Table 8.6. Female labour market participation in the Western Balkans and factors affecting women’s participation

2020 or latest available year

|

Albania |

Bosnia and Herzegovina |

Kosovo |

Montenegro |

North Macedonia |

Serbia |

EU-27 |

OECD |

||

|---|---|---|---|---|---|---|---|---|---|

|

Labour market outcomes |

Labour force participation women (%) |

52.9* |

36.7 |

17.8 |

46.4 |

43.7 |

46.5 |

50.9 |

51.1 |

|

Gender gap labour force participation (percentage points) |

15.1* |

22.5 |

30.4 |

14.2 |

21.6 |

15.4 |

12.4 |

16.5 |

|

|

Childcare |

Childcare gap (years) |

5 years** |

4 years** |

.. |

5 years** |

5.3 years** |

4.6 years** |

2.8 years ** |

.. |

|

Enrolment in ECEC (0-2 years) (%) |

.. |

11.2 |

4.9** |

40.9 |

18.2** |

42.2 |

33.9* |

36.1* |

|

|

Enrolment in ECEC (3-5 years) (%) |

75.1 |

27.3 |

13.9** |

78.1 |

41.8** |

65.3 |

99.9 |

81.7 |

|

|

Institutional factors |

Part-time work women (%) |

22.4* |

10.3* |

4.3* |

4.7* |

5.3* |

13* |

24 |

25.1 |

|

Minimum required social security contributions base |

Minimum wage (EUR 243) |

Minimum wage (EUR 266 in RS, EUR 208 in FBIH) |

No minimum threshold for SSCs |

No minimum threshold for SSCs |

50% of average wage (EUR 303) |

35% of average wage (EUR 223.3) |

.. |

.. |

|

|

Total social security contributions (% of gross wages) |

21.6* |

41.5% (FBiH) 33% (RS)* |

10.0* |

34.3* |

27* |

36.5* |

34.0 |

26.1 |

|

|

Social norms and gender stereotypes |

Female-to-male ratio of time devoted to unpaid care work (%) |

7.2*** |

.. |

.. |

.. |

3.2*** |

2.5*** |

2.1*** |

2.4*** |

|

Contributing female family workers (% of female employment) |

29.4** |

5.6** |

4.9* |

3.5** |

8.3** |

7.7** |

1.4** |

2.0** |

Note: *2019, **2018, *** 2014. ..: Not available.

Labour market activity for age group 15+years (World Bank, 2021[8]).

Data on Kosovo’s ECEC enrolment not available on WDI like for other countries, but for 0-4 years instead of 0-2 years (ESPN, 2019[58]), and for 3-5 years (World Bank, 2021[8]).

Source: World Bank/WIIW (2021[11]), SEE Jobs Gateway (database), https://data.wiiw.ac.at/seejobsgateway-q.html; OECD (2021[12]), OECD statistics (database), https://stats.oecd.org/; Eurostat (2021[13]), Eurostat (database), https://ec.europa.eu/eurostat/data/database; European Commission (2019[55]), Key Data on Early Childhood Education and Care in Europe, https://eacea.ec.europa.eu/national-policies/eurydice/content/key-data-early-childhood-education-and-care-europe-%E2%80%93-2019-edition_en; UNESCO Institute for Statistics (UIS) (2021[59]), Education Sustainable Development Goals (database), http://data.uis.unesco.org/; World Bank/WIIW (2020[56]), Western Balkans Labor Market Trends 2020, https://wiiw.ac.at/western-balkans-labor-market-trends-2020-dlp-5300.pdf; World Bank/WIIW (2019[60]), Western Balkans Labor Market Trends 2019, https://documents1.worldbank.org/curated/en/351461552915471917/pdf/135370-Western-Balkans-Labor-Market-Trends-2019.pdf; World Bank (2021[8]), World Development Indicators (database), https://databank.worldbank.org/source/world-development-indicators; World Bank (2021[61]), OECD (2014[62]), Gender, Institutions and Development (database), https://stats.oecd.org/Index.aspx?DataSetCode=GIDDB2019; Friedrich-Ebert-Stiftung (2020[63]) Country profile - Bosnia and Herzegovina, https://library.fes.de/pdf-files/bueros/sarajevo/17436.pdf; Kosovo Agency of Statistics (2020[64]), Labour Force Survey 2019, https://ask.rks-gov.net/media/5412/labour-force-survey-2019.pdf.

Policy options for creating equal opportunities for women to participate in the labour market

Ensuring equal opportunities for women requires a multi-faceted approach, such as providing adequate and affordable childcare, addressing institutional barriers, and combatting negative stereotypes.

Improve access to childcare to facilitate labour market integration. Addressing limited access to childcare was a key issue put forward by peer-learning participants, especially in Bosnia and Herzegovina. Evidence shows that supplying low cost child care leads to increased employment and increased earnings for mothers (Sida, 2021[43]). Governments in the region should consider increasing supply and affordability of places in ECEC or investing in suitable alternatives, especially for children under the age of three. Several options exist to address the lack of childcare facilities, including increasing public investments for new facilities in areas where they are lacking, giving priority to low-income families in existing public facilities, and building a case for private sector investment in the childcare market. To increase access to funds, local government should also be better equipped to mobilise resources, including accessing EU grants that provide funding for childcare.

Provide appropriate frameworks for part-time work and improve flexible working arrangements. To do so, it would be important to first establish legislation to support the principle of equality between part-time and equivalent full-time workers to eliminate discrimination in hourly wages and conditions of work. In addition, it would also be important to review the structure of tax and benefit systems to avoid disincentives linked to minimum social security contributions and the loss of social benefits at low levels of labour income. Complementarily, introduction of flexible working arrangements can facilitate the return of women to work after maternity leave, including options for shared parental leave.

Address the root causes of low female labour market participation embedded in social norms. Appropriate normative and institutional frameworks are needed to promote, monitor and enforce equality and non-discrimination based on gender. The economies in the region have legislation mandating equal pay for work of equal value, but gender equality legislation and protection against gender violence and gender-based discrimination still has room for progress (OECD, 2019[57]). The approval in 2021 of the Law on Gender Equality in Serbia is a welcome development, as are discussions towards the approval of a Gender Equality Law in North Macedonia. Addressing gender gaps in wages, hours worked, occupations held and sectors of employment also requires specific action. Encouraging fathers to take parental leave can lead them be more involved in care duties, with lasting effects on their involvement in children’s growth and positive effects on children’s wellbeing. Father-specific parental leave quotas are used in a number of OECD countries (Iceland, Sweden) to that effect (OECD, 2016[65]).

Reduce stereotypes about women in education and in the workplace. The regional economies could conduct awareness-raising activities on gender equality in the education sector and for the broader public, showcasing the relevance of increased women’s participation in terms of both increased social cohesion and impact on growth. This can further empower women and encourage them to take part in professions traditionally done by men. Public institutions should serve as role models for higher inclusion of women.

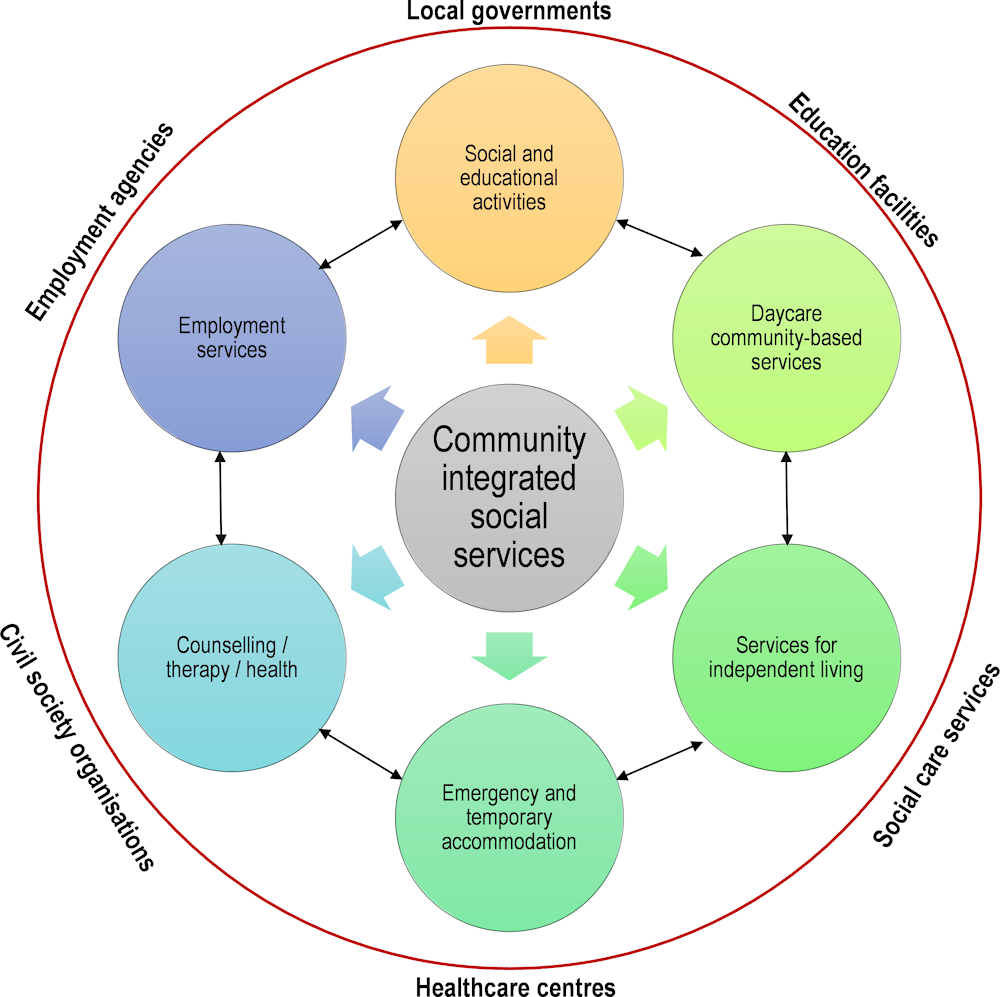

8.3. Suggestions for building effective, inclusive and financially sustainable social protection in the Western Balkans

Social protection is key for inclusive development and for building socially cohesive societies. This section analyses key regional issues affecting social protection as put forward by the peer-learning participants as well as policy suggestions based on international practice. At present, various labour market challenges undermine the effectiveness of social security systems to provide safety nets to people. In turn, these challenges are jeopardising the financial sustainability of such systems. Additionally, social assistance systems are often poorly targeted and inadequate, and do not sufficiently integrate beneficiaries into labour markets, thereby further increasing their dependency on welfare. Finally, local governments, which have a lead role in creating integrated social service delivery systems, often have very limited capacity and funding to fulfil their role. Sections 8.3.1 - 8.3.3 shed more light on these issues and suggest options for going forward.

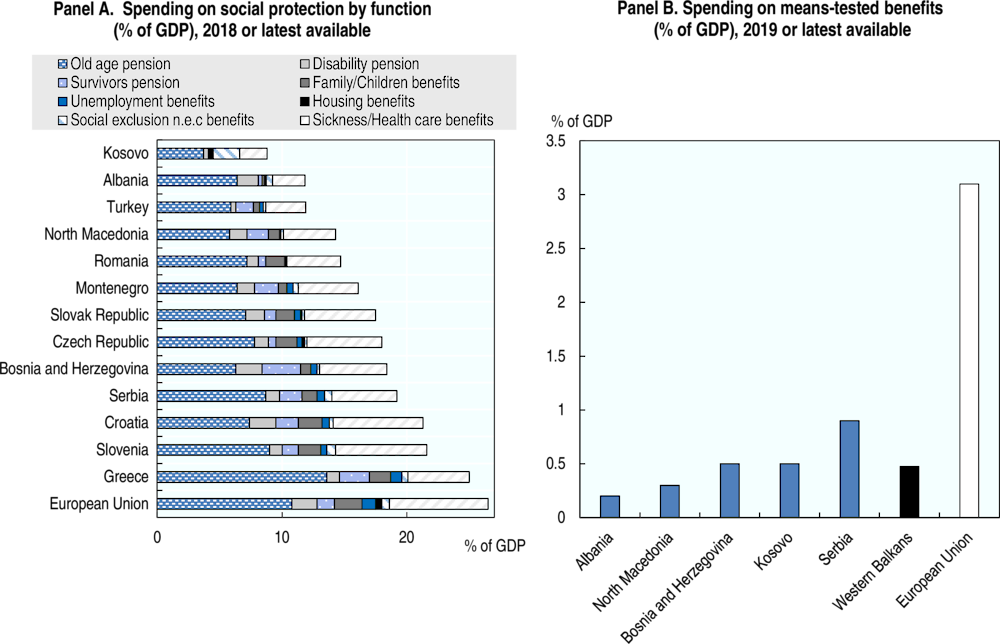

Social protection systems in the region often do not provide adequate income security to those most in need. Most social protection systems in the Western Balkans combine contribution-based social security benefits with tax-financed social assistance and services. Public spending on social protection expenditure as a share of gross domestic product (GDP) (including healthcare) is 16% in the Western Balkans, ranging from 8.8% in Kosovo to 19% in Serbia; in comparison, the EU average is 26.5%5 (Figure 8.9 – Panel A). Most of the public social expenditure in the region is directed toward pensions. A high share of workers in the informal sector do not have access to benefits from the contribution-based system. Spending on means-tested benefits makes up only a very small share of overall social protection spending and – due to low benefit levels and, in some cases, poor targeting – does not sufficiently contribute to poverty alleviation (Figure 8.9 – Panel B). Meanwhile, some status groups (such as veterans and their families) receive more generous benefits in the form of pensions and social assistance benefits, regardless of their needs and labour market participation.

Figure 8.9. The bulk of social protection spending flows to pensions, while social assistance for the most vulnerable is underdeveloped

Note: n.e.c. = not elsewhere classified. In Panel A, the latest available year for Albania is 2017.

Source: Eurostat (2021[13]), Database, https://ec.europa.eu/eurostat/data/database; Mustafa and Haxhikadrija (2019[66]), Financing social protection – Kosovo, https://ec.europa.eu/social/BlobServlet?docId=21854&langId=en; Ymeri (2019[67]), Thematic Report on Financing social protection: Albania, https://ec.europa.eu/social/main.jsp?catId=1135&intPageId=3589; ILO (2021[68]), Review of social protection system in Albania; http://www.ilo.org/budapest/what-we-do/publications/WCMS_798635/lang--en/index.htm; European Commission (2021[69]), Economic Reform Programme of Albania (2021-2023) - Commission Assessment, https://data.consilium.europa.eu/doc/document/ST-8097-2021-INIT/en/pdf.

8.3.1. Creating a more inclusive and fair social security system in the Western Balkans

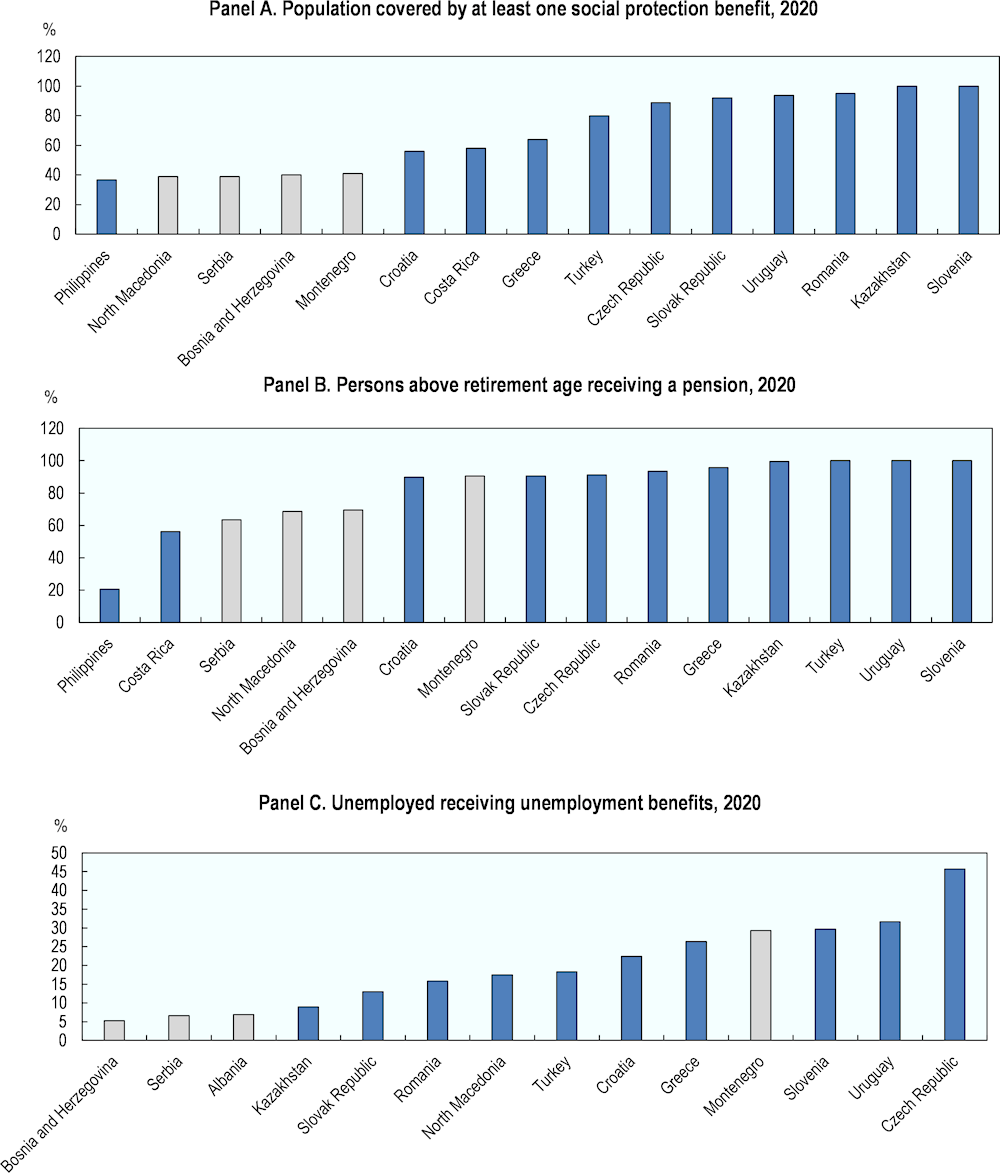

Current social security schemes do not provide a wide safety net for many people in the region. Across four Western Balkans economies for which data are available, only about 40% of the population is covered by at least one social protection benefit, leaving many without adequate protection (Figure 8.10 – Panel A). Except in Montenegro, the share of persons above retirement age who receive a pension ranges from 63.5% in Serbia to 69.5% in Bosnia and Herzegovina, indicating that about one-third of the elderly do not have income security in their old age (Figure 8.10 – Panel B).6 Regarding the unemployed more broadly, only about 6% receive unemployment benefits in Albania, Bosnia and Herzegovina, and Serbia, which is below other benchmark economies. This likely reflects that many long-term unemployed have exhausted their benefits, informality and limited opportunities for some, especially the young, to contribute to the social security system before becoming unemployed (Figure 8.10 – Panel B).

The structure of labour markets in the region is part of the challenge. Due to the lack of adequate and stable employment opportunities, many people, especially the young, do not contribute to unemployment insurance long enough to qualify for unemployment benefits. Additionally, many long-term unemployed have exceeded the duration of their unemployment benefit entitlements. This comes with an accompanying risk of exiting the labour market altogether, making future work less likely, which disenfranchises people. Finally, many people work informally and are very likely not contributing to the social security system; as such, they have no access to unemployment benefit entitlements and pension security.

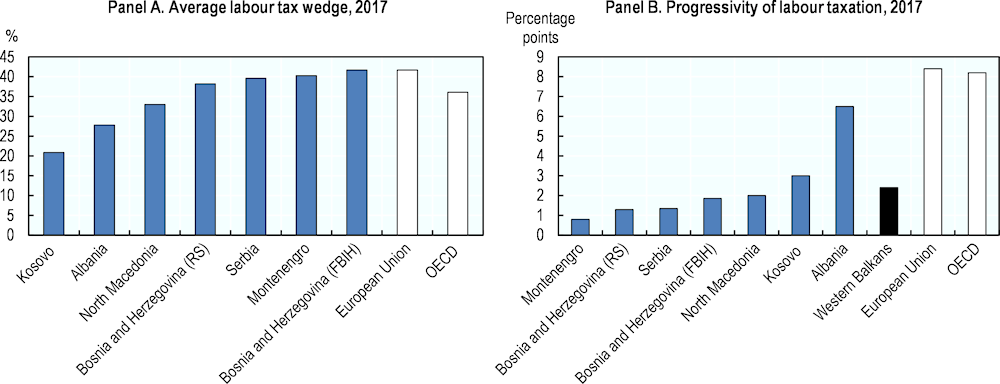

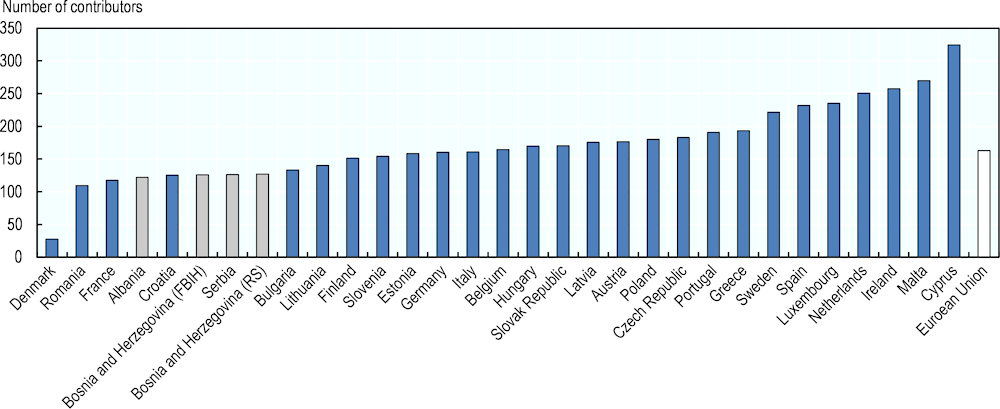

High social security contributions in the Western Balkans, combined with lower and relatively flat personal income tax schedules, create a relatively high and regressive labour taxation, affecting especially low-wage earners. The overall level of labour taxes, measured as a tax wedge for a single worker at 100% of the average wage,7 is relatively high in three of the six Western Balkan economies (Serbia, Montenegro, and Bosnia and Herzegovina) – and also to some degree in North Macedonia (Figure 8.11 – Panel A). High tax wedges tend to discourage employers from formalising employment relationships with workers. The structure of labour taxes (the relative shares of personal income tax and social security contributions in total labour taxes) is tilted heavily toward contributions in almost all economies of the region. Furthermore, the progressivity of personal income tax8 is non-existent or very modest in all economies except Albania (Figure 8.11 – Panel B).9 The low degree of progressivity within the chosen range of the wage distribution, coupled with relatively high minimum social security contributions, means that low-earning workers in these economies face a higher relative tax wedge than those earning the average wage. This reduces the take-home pay of low-wage earners and those working shorter hours, often incentivising them to work informally or exit the labour market altogether (World Bank/WIIW, 2019[60]).

Figure 8.10. Scope exists to increase the coverage of social protection schemes in the Western Balkans

Note : In Panel A, the proportion covered by at least one social protection benefit is a ratio of the population receiving cash benefits under at least one of the contingencies/social protection functions (contributory or non-contributory benefit) or actively contributing to at least one social security scheme to the total population.

Source: ILO (2021[16]), ILOSTAT, https://ilostat.ilo.org/data.

Figure 8.11. High labour market taxation often renders social security ineffective

Note: Panel A displays the statutory tax burden on a representative worker earning the average wage. The European Union average displayed in this figure includes 22 members and the United Kingdom (previous member): Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, Slovak Republic, Slovenia, Spain and Sweden. In Panel B, progressivity of labour taxation is calculated as the percentage point increase of the tax wedge between workers earning 67% of the average wage and workers earning 167% of the average wage.

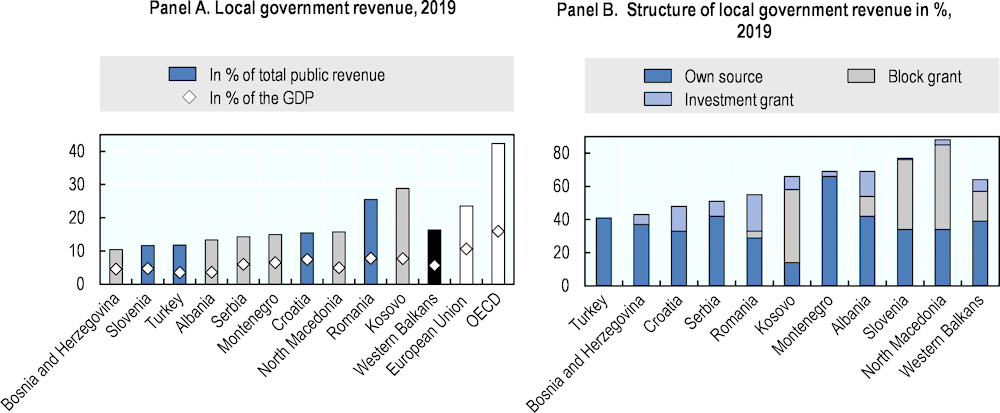

Source: World Bank/WIIW (2019[60]), Western Balkans Labor Market Trends 2019, https://documents1.worldbank.org/curated/en/351461552915471917/pdf/135370-Western-Balkans-Labor-Market-Trends-2019.pdf.