Several regulations applicable to all tourism-related activities pose challenges to competition in Tunisia. This chapter will focus on horizontal legal provisions that cut across the various tourism activities analysed in the previous chapters. These norms are related to regulatory quality and enforcement, investment licensing procedures, and restrictions on foreign firms’ operations in the country. The chapter makes recommendations for reform.

OECD Competition Assessment Reviews: Tunisia 2023

9. Horizontal barriers and administrative burdens

Abstract

9.1. Regulatory quality

9.1.1. Description of the issues

The regulations reviewed in this assessment are dispersed across many different pieces of legislation. In order for businesses and consumers to gain a comprehensive understanding of the legislation applicable to a given economic activity, they must identify the relevant provisions in many separate texts and understand how these provisions interact with one another. For instance, as explained in Chapters 5 and 6, investments in sports and recreational activities such as dive centres, and in food and beverage service operations such as restaurants, is subject to various rules and regulations, some of which are implemented at the local level. In addition, subsequent modifications to core pieces of legislation have resulted in further fragmentation and, on many occasions, a lack of clear rules. Thalassotherapy centres are an illustration of this. Decree 2006‑3174 sets out a notification requirement for opening thalassotherapy centres, even though a 2011 modification of Law No. 1989‑120 made these centres subject to ex-ante authorisation without further details.

New legislation does not always explicitly repeal previous provisions. For example, the OECD identified a number of legal provisions that, although not explicitly abolished, have been implicitly repealed. According to authorities, in some cases, the implementing legislation for repealed legal texts remains in force.1 In other cases, however, the rule seems to be that the implementing legislation for repealed laws is considered repealed. Establishing with certainty whether a legal text remains in force or not is complex, time‑consuming, and requires repeated interaction with authorities.

In the course of this assessment, the OECD found conflicting provisions and legislation that is vague and inconsistently implemented. For instance, the renewal of marina concessions for successive periods of two years, according to Law No. 1995‑73, is inconsistent with Law No. 2009‑48, which stipulates that concessions can be extended for an additional period of up to 20 years.2 Customs rules regarding the immobilisation and release for free circulation of foreign-flagged boast and the use of yachts under the temporary import regime are a source of confusion, as detailed in Chapter 5.

The OECD also identified a number of activities for which implementing regulations are still missing, despite the legal texts having been enacted. This is the case with marinas and with tourist transport, as described in sections 5.2 and 8.1, respectively. A number of other activities lack adequate frameworks, such as short-term rental accommodation, street food and ride hailing.

Although this competition assessment focuses on barriers created by regulation rather than on how regulation is implemented in practice by the authorities, it is useful to highlight several issues involving the extent of enforcement in the country. Interviews with the representatives of the business community have confirmed that enforcement can be patchy. For instance, business associations have noted that travel agency regulation is not enforced. Category-B travel agencies frequently perform activities reserved for Category-A agencies, and service companies regulated by the Ministry of Industry and SMEs perform a significant number of the activities reserved for travel agencies. Similarly, stakeholders pointed out that most legislation applicable to alternative accommodation services is legally in force yet remains unenforced.

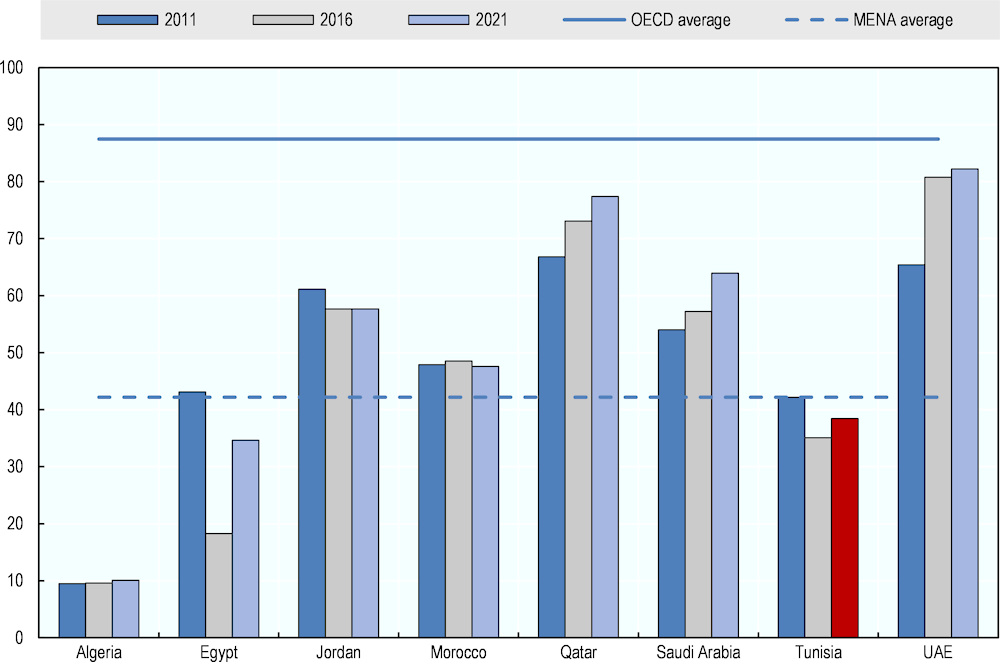

Shortcomings in regulatory quality are reflected in Tunisia’s score in the World Bank’s Worldwide Governance Indicators (see Figure 9.1). This estimate of regulatory quality captures the perception of a government’s ability to formulate and implement sound policies and regulations that permit and promote private sector development. Tunisia scores below both the OECD and the Middle East and North Africa averages.

Figure 9.1. World Bank Worldwide Governance Indicators: Regulatory quality percentile ranking

Note: The percentile rank ranges from 0 (lowest) to 100 (highest). The solid line is the average percentile rank of OECD countries (88) and the dashed line the average percentile rank of Middle East and North Africa region countries (42) in 2021.

Source: World Bank Worldwide Governance Indicators, http://info.worldbank.org/governance/wgi

9.1.2. Harm to competition

The difficulty of identifying applicable legislation in force, particularly due to obsolete or superseded provisions, can act as a regulatory barrier to entry. It creates legal uncertainty, and so potentially raises regulatory and legal compliance costs for market players.

The lack of clarity and predictability in the legal framework increases the complexity that companies and individuals face, negatively affects the business environment, and creates space for corruption and maladministration. The absence of application texts for enacted laws affects the legitimate expectations of new investors and increases the discretionary power of authorities.

The absence of adequate frameworks skews the playing field, fuels informality, and could have implications in terms of issues such as increased sanitary risks (in the case of street food, for example) and safety, security and data protection (in the case, for instance, of ride‑hailing and alternative accommodation services).

Outdated legislation can also act as a regulatory barrier by creating legal uncertainty, potentially raising compliance and legal costs for suppliers. Moreover, the proliferation of legislative texts, amid enforced general and sector laws, may result in considerable confusion and a lack of clarity for new investors, raising compliance costs and administrative burdens, especially for small enterprises.

By contrast, a clear and easily accessible regulatory framework is essential for new entrants that are not necessarily familiar with the national legal framework, and for small businesses, for which compliance costs and administrative burdens are relatively more important than for larger companies.

The transparent development and implementation of regulation is one of the key pillars of regulatory quality (see Box 9.1). Transparency and public accountability are among the requirements for sound governance by regulators (OECD, 2014[1]), as transparency enhances their accountability and confidence in them. In addition, clarity helps regulated firms understand regulators’ policies and expectations, and helps them to anticipate how these are monitored and enforced.

Box 9.1. Regulatory quality

Regulation is essential in many areas, but it can also be costly in both economic and social terms. Ensuring regulatory quality entails enhancing the performance, cost-effectiveness and legal quality of regulatory and administrative measures. The notion of regulatory quality includes:

Process: How regulations are developed and enforced, which should follow the key principles of consultation, transparency and accountability, and be evidence‑based.

Outcomes: Ensuring regulation is effective at achieving its objectives.

Efficiency: Quality regulation should not impose unnecessary costs.

Coherence: Regulation must not contradict the overall regulatory regime.

Simplicity: Regulations and their implementation rules must be clear and easy to understand.

Building and expanding on the OECD’s Recommendation of the Council on Improving the Quality of Government Regulation, it is possible to define regulatory quality as regulations that:

serve clearly identified policy goals and are effective in achieving those goals

are clear, simple and practical for users

have a sound legal and empirical basis

are consistent with other regulations and policies

produce benefits that justify costs, considering the distribution of effects across society and taking economic, environmental and social effects into account

are implemented in a fair, transparent and proportionate way

minimise costs and market distortions

promote innovation through market incentives and goal-based approaches

are compatible as far as possible with competition, trade and investment-facilitating principles at domestic and international levels.

Source: Adapted from Box 1.1, OECD (2015[2]), Recommendation of the Council on Public Procurement, https://www.oecd.org/gov/public-procurement/recommendation/.

To improve regulatory quality, the OECD recognises the need for governments to undertake comprehensive programmes that include systematically reviewing existing regulations to ensure their efficiency and effectiveness, and to lower regulatory costs for citizens and businesses (OECD, 2012[4]). Consequently, a clear and well-defined regulatory framework is crucial to facilitate new market entries and create a more favourable investment climate. As mentioned in the Recommendation of the OECD Council on Regulatory Policy and Governance:

“Effective regulatory governance maximises the influence of regulatory policy to deliver regulations which will have a positive impact on the economy and society and will meet underlying public policy objectives.”3

Discrepancies between legislation and its implementation matter because any policy or reform can have an impact only if it is implemented (O’Brien, 2013[3]). In a 2022 World Justice Project survey of regulatory enforcement, Tunisia ranked 64 among 140 countries.4 The survey took into account factors such as whether government regulations were effectively enforced and whether administrative proceedings were conducted without unreasonable delays.

When certain pieces of legislation are enforced and others are not, businesses and consumers may develop the impression that a framework is arbitrary. As result, current and potential market participants may hold back investment, to the detriment of the wider economy.

Controls and inspections by public authorities also play an important role in ensuring that legislation is implemented according to the original intentions of legislators. Rational actors, considering whether to engage in illegal conduct, will be discouraged by a higher probability of detection of such conduct and higher potential penalties (Becker, 1968[4]).5 Conversely, limited enforcement action by public authorities can have negative consequences for compliance by market players, and even for matters such as public health, if, for example, hygiene and health requirements are not met.

9.1.3. Policy recommendations

In light of these considerations, the OECD recommends that a comprehensive legislative review of regulation in Tunisia’s tourism industry is undertaken according to OECD best practice principles (OECD, 2020[5]) to ensure that: 1) superseded legislation is explicitly abolished; 2) all adopted legal texts, including circulars, are published, and when possible legally consolidated (for example, on the website of the Official Journal of the Republic of Tunisia); and 3) authorities’ websites provide updated lists of applicable legislation, when they do not do so already, to improve transparency and help new market entrants.

The OECD also recommends adopting a regulatory impact assessment (RIA) framework to inform policy makers’ decisions on the effectiveness and efficiency of this legislative review and of any forthcoming policies. The 2012 Recommendation of the OECD Council on Regulatory Policy and Governance provides principles for the integration of RIAs in the first stages of the public policy process for the elaboration of new regulatory proposals. This normative instrument is complemented by the OECD’s Regulatory Impact Assessment (OECD, 2020[6]), a practical guide for policy makers designing and implementing effective RIA systems (see Table 9.1).

Table 9.1. Key elements of the OECD’s best practice principles for regulatory impact assessments

|

|

|

|

|

|

|

|

|

|

|

|

Source: OECD (2020[6]), Regulatory Impact Assessment, https://doi.org/10.1787/7a9638cb-en; OECD (2012[7]), OECD Recommendation of the Council on Regulatory Policy and Governance, https://doi.org/10.1787/9789264209022-en.

9.2. Investment licensing

9.2.1. Description of the issues

The activities examined in this assessment are for the most part subject to complex, cumbersome licensing procedures. In the course of its assessment, the OECD identified 26 ex-ante authorisations, related mainly to accommodation, sports and recreational activities, restaurants, and passenger transport, imposing very detailed requirements and demanding that applicants provide a considerable number of documents, including feasibility studies and clearances from various government bodies. For instance, hotels and certain restaurants must go through a very detailed two‑step licensing process supervised by the Office National Du Tourisme Tunisien (ONTT), or Tunisian National Tourism Office, as described in Sections 3.2 and 4.2, respectively. If they intend to serve alcohol on their premises, hotels and restaurants must apply separately for an alcohol licence from the Ministry of Interior.

The OECD has also identified eight operating requirements embedded in cahiers des charges, or sets of specifications, which are supposed to be ex-post regulatory alternatives. These include, for example, mandatory notification of every excursion by travel agencies (see Section 6.2), an obligation for private museums, galleries and art workshops to notify their programmes a year in advance (see Section 7.3), and one‑month advance notice and approval for marinas to organise leisure events and activities (see Section 8.3.

An online survey conducted among tourism professionals (see Annex A), revealed some anomalies in regulatory inspections and enforcement practices, especially relating to alternative accommodation. According to Decree‑Law No. 73‑4 on the control of the construction of tourism facilities,6 all tourist establishments are subject to inspection by Ministry of Tourism officials without notice at any time of the day or night. Article 16 of the law explains that owners, managers or others in charge of such establishments must facilitate these inspections by providing access and all required documents. Comments made by survey participants indicated a conflict of competence between the ministry’s inspectors and other authorities, such as police, and the lack of an adequate framework to challenge unfair or hostile inspections.

The complexity of the licensing environment in Tunisia is reflected by Decree No. 2018‑417.7 The decree, the longest in the country’s history, is emblematic of the current situation; annexes 1 and 3 of the decree detail, respectively, an exclusive list of 100 economic activities subject to licensing and 143 administrative authorisations or operational requirements relating to various activities and sectors. The decree also details timelines, procedures and conditions that applicants must fulfil in order to obtain authorisations.

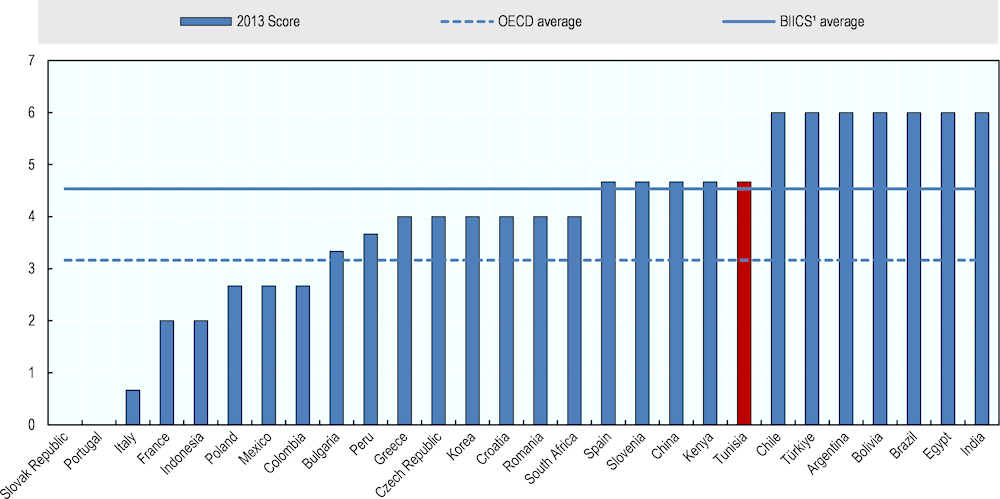

International benchmarking suggests that Tunisia has considerable room to promote entrepreneurship. The country’s performance, as measured by OECD product market regulation (PMR) indicators, reflects the above shortcomings. It shows that regulatory procedures for establishing businesses, and in particular authorisation systems, are cumbersome, and that the administrative burdens imposed on individual enterprises are particularly high, not only by OECD standards but also compared with a selection of emerging economies (see Figure 9.2).

Figure 9.2. PMRs: licences and permits

Notes: Country performance is ranked using a zero-to-six scale on which a lower value reflects a more competition-friendly regulatory stance. Data for Tunisia are for 2016. Data for other countries are for 2013.

1. Data represent simple averages for Brazil, India, Indonesia, China and South Africa.

Source: OECD-World Bank database on product market regulation.

In 2012, Tunisian authorities had already recognised the need to simplify regulations in order to promote economic activity. A “regulatory guillotine” announced in 2012 was supposed to produce an inventory of all administrative and regulatory procedures involved in conducting an economic activity, and to eliminate those that were obsolete or redundant. Some 500 procedures were deemed inappropriate in 2014. Unfortunately, the reform was never completed and these procedures are still in operation.

In 2016, Tunisia’s government took some steps to improve the regulatory environment, such as adopting a “silence is consent” rule, which was embedded in Law No. 2016‑71 on investment.8 This rule applies to licences and other authorisation procedures with a statutory response period of 60 days, after which, if no official response to an authorisation request has been given, the request is deemed to be approved. The government also adopted a “once only” principle as part of an omnibus law approved in 2019 to improve the business climate, stipulating that authorities should not require from investors any documents already in their possession or provided by other public bodies.9

The adoption of Decree No. 2018‑417 is an important milestone in this reform effort. Annex 2 of the decree includes a list of 27 economic activities to be regulated through ex-post controls on compliance instead of ex-ante authorisations. More recently, Presidential Decree No. 2022‑317, which amended Decree No. 2018‑417, removed the ex-ante licensing requirements for another 15 activities, including guest houses, as well as ten administrative authorisations.

Nevertheless, the OECD was informed that many of the ex-ante authorisations that were supposed to be removed following the adoption of Decree No. 2018‑417 are still in place since related ex-post regulation and cahiers des charges are still pending.

9.2.2. Harm to competition

Although licensing and permitting can be useful, even indispensable, regulatory tools to manage risks among certain types of establishments and risks related to certain activities, they must be used in a discerning manner. Indeed, like all ex-ante barriers, licensing and permitting can cause serious economic harm, severely curtailing competition, imposing substantial administrative and financial burdens on regulated entities, raising actual and perceived barriers to new market entry, and hindering innovation and investment.

To the best of the OECD’s knowledge, none of the licences or operational requirements reviewed in the course of this assessment can be requested or submitted online. Applications must be submitted in person and should include all related forms and documents, mostly on paper.

Consultations with stakeholders, including through the online survey, revealed that the “silence is consent” rule has not been effectively implemented and that public bodies do not respect it, continuing to request additional documents to extend authorisation deadlines further. The “once only” principle has been similarly stalled, which authorities attribute to technical difficulties hindering interconnectivity and reciprocal access to government databases.

The OECD’s analysis has shown that many of the licences examined in this assessment suffer from a lack of transparency in terms of process and their associated evaluation criteria, and sometimes have uncertain outcomes, conferring considerable discretionary power on authorities, especially at the local level. Stakeholders informed the OECD that the timelines for some licences, such as those for individual taxis or for selling alcohol, can be measured in years.

Licensing and permitting may support anti-competitive behaviour and reflect regulatory capture, as incumbent firms have strong incentives to lobby regulators to use these arrangements to protect them from competition. The use of licensing and permitting should be confined to cases in which achieving regulatory goals (such as environmental protection and safety) or managing access to scarce resources can effectively be done only ex-ante, or where ex-ante barriers will be economically far more efficient than trying to remediate potential harm ex-post.

In addition, application and review procedures, alongside substantive and documentary requirements, should be simplified and streamlined as much as possible by using digitalisation, reducing duplication, ensuring transparency, and shortening deadlines. Licensing and permitting can thus move from constituting a major entry barrier to serving as a useful regulatory instrument.

Regulatory inspections and enforcement make up the ex-post part of official control of regulatory compliance, often linked to verifying that applicable permits and licenses have been obtained, and that operators remain in compliance with their requirements.

Although inspections and enforcement are indispensable instruments to ensure the effective application of regulations, frequent problems include overlaps and conflicts of competences between different government authorities and agencies, inadequate targeting, and a lack of proportionality. These result in inspection practices that can simultaneously be ineffective at achieving regulatory objectives (such as safe food, a protected environment and health), costly in terms of scarce public administration resources, and extremely burdensome for businesses.

The threat of unfair or excessively aggressive inspections can also act as a major deterrent to investment, business creation and growth, even when start-up procedures are simplified, leading reform efforts to disappoint in terms of their impact.

9.2.3. Policy recommendations

The OECD recommends that Tunisian authorities consider streamlining licensing procedures according to international best practices. Among the key requirements of best practices is that regulatory systems and instruments must be risk-based, risk-proportional and risk-focused. For permitting and licensing, this implies that they must be used only when absolutely necessary to protect key elements of public welfare, such as in cases where the level of risk and risk drivers mandate them and no other way exists to achieve these goals effectively, or if doing so only ex-post would entail much diminished effectiveness and/or far higher costs.

Best international practice shows that in order to ensure that risks created by businesses during their operations are effectively managed and regulatory compliance is maximised, reform should cover not only ex-ante and start-up phases, but also the improvement of ex-post regulatory inspections and enforcement (OECD, 2014[8]). A risk-targeted, risk-proportional approach is again the approach that will ensure authorities’ efforts target businesses and activities presenting the highest combined level of likelihood and potential magnitude of harm. Such an approach also achieves results while limiting costs and optimising resource efficiency for both the private and the public sector. It makes growth and development far easier for businesses and provides a much more conducive environment for investment.

The OECD Regulatory Enforcement and Inspections Toolkit (OECD, 2018[9]) provides a useful basis for authorities to undertake detailed assessments of their inspections and enforcement frameworks. The toolkit was developed to serve as a simple means of assessing the level of development of inspection and enforcement systems in any given jurisdiction, institution or structure, and to identify strengths and weaknesses, as well as areas for improvement (see Box 9.2).

Box 9.2. The OECD Regulatory Enforcement and Inspections Toolkit

The OECD Regulatory Enforcement and Inspections Toolkit is based on the 2014 OECD best practice principles for regulatory enforcement and inspections (OECD, 2014[8]). The document presents a checklist of 12 criteria divided into sub-criteria to make them easier to use. The criteria are:

1. evidence‑based enforcement

2. selectivity

3. risk focus and proportionality

4. responsive regulation

5. long-term vision

6. co‑ordination and consolidation

7. transparent governance

8. information integration

9. clear and fair process

10. compliance promotion

11. professionalism

12. reality check.

Source: OECD (2018[9]), OECD Regulatory Enforcement and Inspections Toolkit, https://doi.org/10.1787/9789264303959-en.

9.3. Restrictions on foreign investment

9.3.1. Description of the issues

The participation of foreign companies in several activities related to Tunisia’s tourism sector is subject to restrictions and screening procedures. For instance, legislation provides that foreign travel agencies may operate in Tunisia only in accordance with international conventions or subject to reciprocity. Discussions with authorities revealed that foreign travel agencies cannot directly operate in Tunisia. They may operate only indirectly through partnerships with Tunisian travel agencies.

Some accommodation services, mainly gîtes rural, or rural lodges, are partly affected by restrictions imposed on non-nationals when it comes to owning agricultural land, stipulated in Law No. 2016‑71 on investment. Restrictions apply also to the recruitment of foreign managers.10 Some sports and leisure activities are affected by similar restrictions. For instance, the operation of water sports centres is reserved for Tunisian nationals (see Section 8.6), and paid maritime passenger transport is subject to a screening procedure for foreigners (see Section 8.4). Most passenger land transport services, such as taxis and other non-regular public road transport, are strictly reserved for Tunisian nationals (see Section 5.4). Foreign investment in vehicle hire services is subject to a screening procedure if it exceeds 50% of total capital (see Section 5.3).

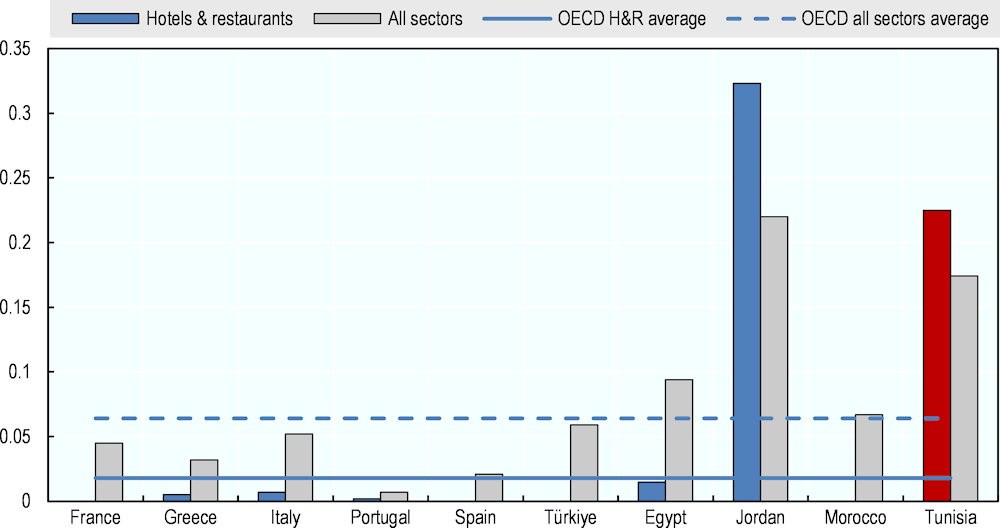

Tunisia’s score on the OECD’s Foreign Direct Investment Regulatory Restrictiveness Index11 reflects the effect of these measures (Kalinova, Palerm and Thomsen, 2010[10]). The index measures four types of statutory restrictions on foreign direct investment: 1) foreign equity restrictions; 2) screening and prior-approval requirements; 3) rules for key personnel; and 4) other restrictions on the operation of foreign enterprises. Tunisia scores above the OECD average and that of most nearby countries in the hotels and restaurants sector (see Figure 9.3).

Figure 9.3. FDI restrictiveness in hotels and restaurants, 2020

Notes: Index scale 0 to 1, with 1 being the most restrictive. The horizontal lines correspond to the average of all OECD countries for hotels and restaurants (0.018) and all sectors (0.06).

Source: OECD FDI restrictiveness index database, https://stats.oecd.org/Index.aspx?datasetcode=FDIINDEX#

9.3.2. Harm to competition

The restrictions on foreign individuals and businesses engaging in tourism activities in Tunisia constitute an exception to the National Treatment Instrument under the OECD Declaration on International Investment and Multinational Enterprises, to which Tunisia acceded in May 2012 (see Box 9.3).

Box 9.3. The OECD Declaration on International Investment and Multinational Enterprises

In May 2012, Tunisia became the 44th country to sign up to the OECD Declaration on International Investment and Multinational Enterprises. The declaration, adopted in 1976, is a policy commitment by governments to:

provide an open and transparent environment for international investment

encourage the positive contribution that multinational enterprises can make to economic and social progress.

The declaration includes four instruments, each underpinned by a decision of the OECD Council on follow-up procedures:

The National Treatment Instrument commits adherent countries to accord foreign-controlled enterprises operating in their territories treatment no less favourable than that accorded to domestic enterprises in similar situations.

The Guidelines for Multinational Enterprises are recommendations on responsible business conduct that firms observe on a voluntary basis. Observance of the guidelines is supported by a unique implementation mechanism: adherent governments, through their networks of “national contact points”, are responsible for promoting the guidelines and helping to resolve issues that arise under the specific instances procedures.

The Instrument on Conflicting Requirements calls on adherent countries to avoid or minimise conflicting requirements imposed on multinational enterprises by governments of different countries.

The Instrument on International Investment Incentives and Disincentives encourages adherent countries to make such measures as transparent as possible so that their scale and purpose can be easily determined, and it institutes a consultation and review procedure to make co‑operation among adherent countries more effective.

Source: Adapted from OECD (2012[11]), OECD Investment Policy Reviews: Tunisia, https://doi.org/10.1787/9789264179172-en.

The principle of national treatment means foreign businesses operating within a country’s territory should be treated no less favourably than domestic enterprises. As an adherent country, Tunisia is committed to honouring the obligations under this instrument, including the notification of exceptions to the national treatment regime. The principle of national treatment is set out in Tunisia’s investment law (Article 7, Law No. 2016‑71). Nevertheless, the abovementioned provisions remain in force. The OECD’s FDI Regulatory Restrictiveness Index, which reflects notified exceptions to the national treatment regime, demonstrates the restrictive nature of Tunisia’s services sector.

The restrictions directly limit the number of suppliers and potential investors. They may affect prices and quality, as competition with foreign firms may render both local and foreign firms more efficient.

More generally, the implications of services restrictions typically go beyond sector borders, limiting potential economy-wide productivity gains. Barriers to FDI in these activities remain more stringent than observed elsewhere. Apart from a few economies in Asia, these activities have been largely, if not fully, liberalised worldwide.

9.3.3. Policy recommendations

The OECD recommends that the Tunisian authorities consider lifting or reducing the nationality requirement and the associated restrictions imposed on foreign investors in the tourism industry, in line with the update to Law No. 2016‑71, which establishes the principle of freedom of investment and the participation of non-Tunisian nationals in Tunisian companies, and with the National Treatment Instrument of the OECD’s Declaration on International Investment and Multinational Enterprises.

References

[4] Becker, G. (1968), “Crime and Punishment: An Economic Approach”, Journal of Political Economy,, Vol. Vol. 76/2, pp. 169-217, https://doi.org/10.1086/259394.

[10] Kalinova, B., A. Palerm and S. Thomsen (2010), OECD’s FDI Restrictiveness Index: 2010 Update, OECD, https://doi.org/10.1787/18151957.

[3] O’Brien, P. (2013), Policy Implementation in Italy: Legislation, Public Administration and the Rule of Law, OECD Publishing, https://doi.org/10.1787/5k44sssdmgzs-en.

[6] OECD (2020), Regulatory Impact Assessment, OECD Best Practice Principles for Regulatory Policy, OECD Publishing, Paris, https://doi.org/10.1787/7a9638cb-en.

[5] OECD (2020), Reviewing the Stock of Regulation, OECD Best Practice Principles for Regulatory Policy, OECD Publishing, https://doi.org/10.1787/1a8f33bc-en.

[9] OECD (2018), OECD Regulatory Enforcement and Inspections Toolkit, OECD Publishing, Paris, https://doi.org/10.1787/9789264303959-en.

[2] OECD (2015), Recommendation of the Council on Public Procurement, https://www.oecd.org/gov/public-procurement/recommendation/.

[1] OECD (2014), Factsheet on how competition policy affects macro-economic outcomes, http://www.oecd.org/daf/competition/factsheet-macroeconomics-competition.htm.

[8] OECD (2014), Regulatory Enforcement and Inspections,. OECD Best Practice Principles for Regulatory Policy, OECD Publishing, Paris, https://doi.org/10.1787/9789264208117-en.

[11] OECD (2012), OECD Investment Policy Reviews: Tunisia, OECD Publishing, Paris, https://doi.org/10.1787/9789264179172-en.

[7] OECD (2012), OECD Recommendation of the Council on Regulatory Policy and Governance, OECD Publishing, Paris, https://doi.org/10.1787/9789264209022-en.

Notes

← 1. For instance, this is the case for many implementing texts of Law 1990‑21, which was repealed by Law No. 2016‑71, and for the 1991 Competition Act, no longer in force and replaced by the 2015 Competition Act.

← 2. See Article 26 of Law No. 95‑73, related to maritime public areas, and Article 25 of Law No. 2009‑48, promulgating the Maritime Ports Code.

← 3. The 2012 OECD recommendation on regulatory policy and governance.

← 4. See: https://worldjusticeproject.org/rule-of-law-index/global/2022/Tunisia/Regulatory%20Enforcement/

← 5. The choice of whether or not to engage in illegal behaviour depends on the comparison between the expected benefits of such behaviour and the expected cost of being caught. The latter depends on the probability of detection and the cost of being detected, such as the size of any financial penalty.

← 6. Amended by Law No. 2006‑33 on the simplification of procedures in the field of administrative authorisations relating to the tourist sector.

← 7. Decree No. 2018‑417, relating to the publication of the exclusive list of economic activities subject to authorisation and the list of administrative authorisations for carrying out projects, related provisions and their simplification.

← 8. Article 4 of Law No. 2016‑71 and Article 6 of Decree No. 2018‑417.

← 9. Article 2 of Law No.2019‑47. This law modified 24 laws relating to investment through the simplification procedures for establishing and financing companies.

← 10. When a company structure is required or chosen by a tourist establishment, Article 6 of Law No. 2016‑71 provides that companies may recruit managers of any nationality up to a limit of 30% of the total number of executives until the end of the third year from the date of the company’s legal constitution or the date of its effective commencement of activity. This rate must be reduced to 10% from the fourth year from the said date.

← 11. The OECD FDI Regulatory Restrictiveness Index gauges the restrictiveness of a country’s FDI rules. It covers only statutory measures discriminating against foreign investors (such as foreign equity limits, screening and approval procedures, restrictions on key foreign personnel, and other operational measures). Other important aspects of an investment climate (such as the implementation of regulations and state monopolies, preferential treatment for export-oriented investors and special economic zone arrangements, among others) are not considered. Please refer to (Kalinova, Palerm and Thomsen, 2010[10]) for further information on the methodology.