This Tunisia competition assessment project began in June 2021 and was carried out in five phases, as agreed between Tunisian authorities, the EU and the OECD. This annex describes the methodology followed in each of the project stages.

OECD Competition Assessment Reviews: Tunisia 2023

Annex A. Methodology

Stage 1: Mapping the sector and its regulation

The objective of Stage 1 of the project was to identify and collect sector-relevant laws and regulations. The main tools used to identify the applicable legislation were online databases, the websites of relevant authorities and sector-specific reports by private and government bodies. In addition, in order to ensure that all the important pieces of legislation were covered by the study, the team consulted with industry participants and all competent public bodies involved in the sector, and with members of the High-Level Advisory Group (HLAG), composed of senior government officials.

Over the course of the project, lists of legislation were refined as additional pieces of legislation and regulation were discovered by the team or issued by the authorities, while other instruments initially identified were found not to be relevant to the sector or no longer in force. In total, approximately 163 instruments were selected for analysis, including laws, decrees, ordinances, regulations, public notices and concession contracts.

Another important objective of the first stage (which extended for the duration of the project) was the establishment of contact with the market through the main authorities, industry associations and private stakeholders active in the sector. The OECD team conducted fact-finding missions and met with government and private stakeholders. Interviews with market participants contributed to a better understanding of how the sub-sectors under investigation actually work in practice and helped with discussions of potential barriers deriving from legislation. In total, more than 36 public and private stakeholders contributed to the report.

The team also launched an online survey to better understand the issues in each sub-sector from the perspective of private stakeholders. The survey’s main goal was to verify whether private stakeholders considered that their sub-sectors faced regulatory barriers. The team held more than 27 meetings with associations and companies operating in all sub-sectors to present the online survey and to explain the concept of regulatory barriers as per the OECD Competition Assessment Toolkit. The team received 96 responses to the survey, and its results were very useful.

Based on the outcomes of the survey, meetings and discussions of the practical problems stakeholders face, and backed up by further research, the OECD team identified legislation to be prioritised for areas in which prima facie barriers to competition existed and impacts on competition could therefore be expected.

Stage 2: Screening the legislation and selecting provisions for further analysis

In the second stage of the project, the main task was screening the legislation to identify potentially restrictive provisions and providing an economic overview of the relevant sub-sectors.

The legislation collected in Stage 1 was analysed using the framework provided by the OECD Competition Assessment Toolkit. This toolkit provides a general methodology for identifying unnecessary obstacles in laws and regulations and for developing alternative, less restrictive policies that still achieve government objectives. One of the main components of the toolkit is a competition assessment checklist that asks a series of simple questions to screen laws and regulations with the potential unnecessarily to restrain competition (see Box A A.1).

Based on the toolkit methodology, the OECD compiled a list of all the provisions that were affirmative in respect of any of the attributes in the checklist. The government experts and members of the HLAG received draft lists and were given an opportunity to comment. The final list consisted of almost 447 provisions with the potential to restrict competition in Tunisia’s tourism sector.

The OECD also prepared an extensive economic overview of the relevant sub-sectors (and refined it during later stages), covering industry trends and key indicators such as revenues, employment and prices. The analysis conducted during this stage aimed to gather background information to better understand the mechanisms of the sub-sectors, provide an overall assessment of competition, and examine the most important players and authorities.

Box A A.1. OECD competition assessment checklist

Further competition assessment should be conducted if a piece of legislation is affirmative on any of the following counts:

A) Limits the number or range of suppliers

This is likely to be the case if the legislation:

1. grants a supplier exclusive rights to provide goods or services

2. establishes a licence, permit or authorisation process as a requirement of operation

3. limits the ability of some types of suppliers to provide a good or service

4. significantly raises the cost of entry or exit by a supplier

5. creates a geographical barrier to the ability of companies to supply goods, services or labour, or invest capital.

B) Limits the ability of suppliers to compete

This is likely to be the case if the legislation:

1. limits sellers’ ability to set the prices of goods or services

2. limits the freedom of suppliers to advertise or market their goods or services

3. sets standards for product quality that provide an advantage to some suppliers over others or that are above the level that certain well-informed customers would choose

4. significantly raises the costs of production for some suppliers relative to others, especially by treating incumbents differently from new entrants.

C) Reduces the incentive of suppliers to compete

This may be the case if the legislation:

1. creates a self-regulatory or co-regulatory regime

2. requires or encourages information on supplier outputs, prices, sales or costs to be published

3. exempts the activity of a particular industry or group of suppliers from the operation of general competition law.

D) Limits the choices and information available to customers

This may be the case if the legislation:

1. limits the ability of consumers to decide from whom they purchase

2. reduces the mobility of customers between suppliers of goods or services by increasing the explicit or implicit costs of changing suppliers

3. fundamentally changes the information required by buyers to make purchasing decisions effectively.

Stage 3: In-depth assessment of harm to competition

The provisions carried forward to Stage 3 were investigated in order to assess whether they could result in harm to competition. In parallel, the team researched the policy objectives of the selected provisions so as to better understand the regulation. The objectives of policy makers were identified in readings of the legislation, when applicable through discussions with relevant public authorities, and/or through academic literature.

The in-depth analysis of harm to competition was carried out qualitatively and involved a variety of tools, including economic analysis and research on regulations applied in other jurisdictions. All provisions were analysed, relying on guidance provided by the OECD’s Competition Assessment Toolkit. Exchanges with government experts and market participants complemented the analysis by providing crucial information on lawmakers’ objectives, real-world implementation processes, and the effects of the provisions.

Stages 4 and 5: Formulation of recommendations and final report

Building on the results of Stage 3, the OECD team developed recommendations for those provisions that were found to restrict competition. It formulated alternative policy proposals that are less restrictive for suppliers but which still aim to fulfil policy makers’ initial objectives. For this process, the team relied on international experience whenever available.

In addition, the benefits of removing barriers to competition were analysed qualitatively and, whenever feasible and meaningful, quantitatively. In these cases, the expected impact of lifting a regulatory restriction relied on the standard methodology of measuring the effect of policy changes on consumer surplus. This is explained in Box A A.2.

Box A A.2. Measuring changes in consumer surplus

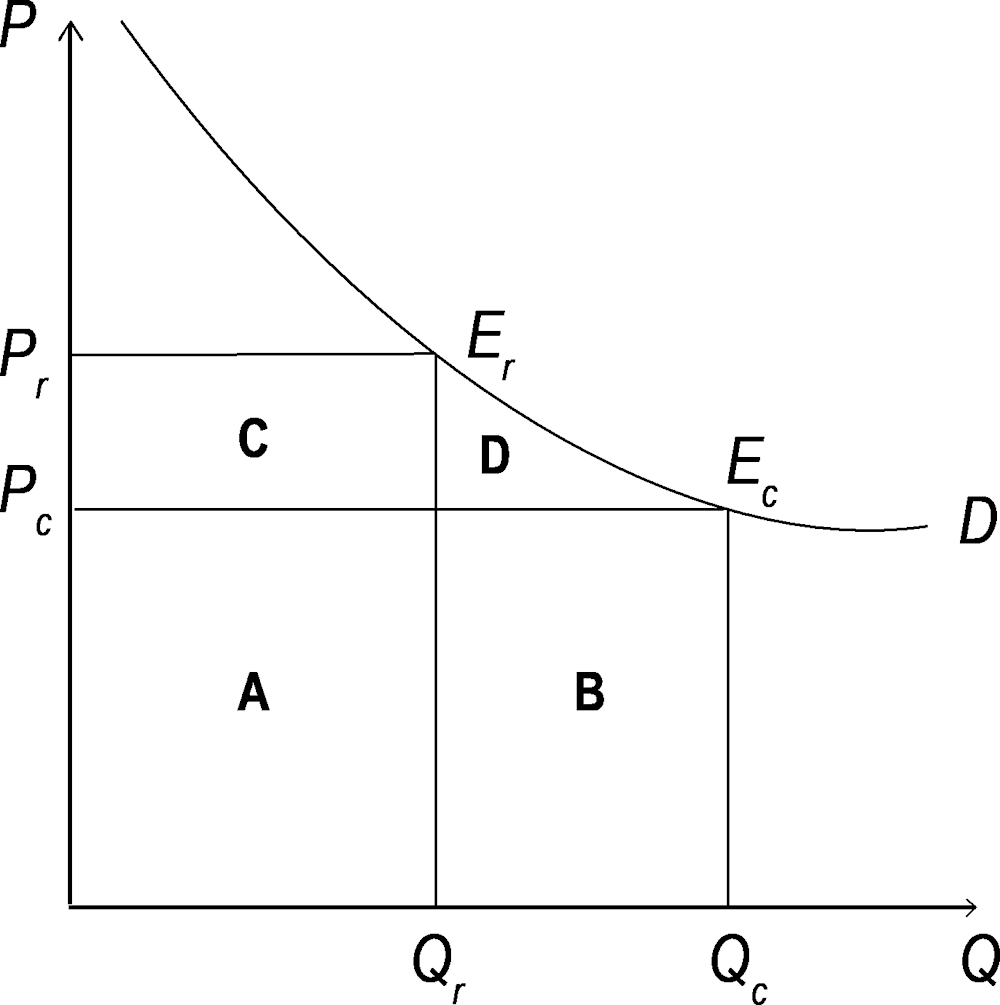

The effects of changing regulations can often be examined as movements from one point on the demand curve to another. For many regulations that have the effect of limiting supply or raising prices, an estimate of consumer benefit or harm from the change from one equilibrium to another can be calculated. Graphically, the change is illustrated for a constant elasticity demand curve: E_r shows the equilibrium with the restrictive regulation; E_c shows the equilibrium point with the competitive regulation. The competitive equilibrium is different from the restrictive regulation equilibrium in two important ways: lower price and higher quantity. These properties are a well-known result of many models of competition.

Figure A A.1. Changes in consumer surplus

The marginal cost curve is assumed to be flat at .

Under the assumption of constant elasticity of demand, the equation for consumer benefit is:

Where price changes are expected, a basic formula for such a standard measure of consumer benefit from eliminating the restriction is:

Where : standard measure of consumer benefit; : percentage change in price related to restriction; : sector revenue; and : demand elasticity. When elasticity is not known, a relatively standard assumption is that This value corresponds to more elastic demand than in a monopoly market, but also far from perfectly elastic as in a competitive market. Under this assumption, the expression above simplifies as:

According to this diagram, sales value can either increase or decrease, depending on the price elasticity of demand. By moving to the competitive equilibrium,, rents (the area “”) are eliminated as the price goes down from to . The increase in consumer surplus (), is explained by the areas “” and “”. When the equilibrium is shifted to , activity in volume terms increases from to . At the same time, total revenue will also include the area “”. Therefore, total revenue is explained by the areas “””” at the equilibrium , and the areas “””” at the equilibrium . If the absolute value of the price elasticity of demand is lower than 1, then the area “” is larger than the area “”, in which case sales value decreases. Conversely, if the price elasticity of demand is higher than 1, the area “” is larger than the area “”, in which case sales value increases.

Source: OECD (2019), Competition Assessment Toolkit: Volume 3. Operational Manual, http://www.oecd.org/competition/toolkit.

Draft recommendations were presented to the HLAG. Following consultation with the relevant public stakeholders, the recommendations were finalised and this final report was produced. In total, 354 recommendations were submitted to the Tunisian Government.