This chapter describes the market situation and highlights the medium-term projections for world fish markets for the period 2020-29. Price, production, consumption and trade developments for fish from catch and aquaculture are discussed. The chapter concludes with a discussion of important risks and uncertainties affecting world fish markets during the coming ten years.

OECD-FAO Agricultural Outlook 2020-2029

8. Fish

Abstract

8.1. Market situation

After strong growth in 2018, with overall production, trade and consumption reaching historic peaks, the global fisheries and aquaculture sector declined slightly in 2019.1 Aquaculture production continued to expand by over 2%, while capture fisheries declined by about 4% due to lower catches of certain species including cephalopods, cod and selected small pelagic species.

According to the FAO Fish Price Index,2 international fish prices were about 3% lower, on average, in 2019 compared to the previous year. This was primarily due to price declines for many important farmed species, including shrimp, salmon, pangasius and tilapia, but also for canned tuna as a consequence of supply outpacing demand. Economic contraction in some countries, along with trade tensions between some selected key producers and importers, contributed to a slight decline in global trade of fish and fish products of about 1% in 2019 compared to 2018 in both volume and value.

8.2. Projection highlights

Relative to the base period (2017-2019 average), nominal fish prices will increase at a rate between 1.5-2.1% p.a. over the next decade. In real terms, fish prices are projected to remain largely unchanged on average over the 2020-29 period – slightly negative for prices of fish oil, traded fish, capture fisheries and fishmeal; and slightly positive for aquaculture species. Despite differences in the magnitude, all prices are expected to follow similar trends, with small increases in the first half of the outlook period, followed by a decline in the second half. The factors contributing to that decline include faster growth in Chinese production and a reduced pressure on fish demand due to the recovery of the pork sector (as fish is one of the replacements for pork consumption) from the major outbreak of African swine fever (ASF). Due to the sustained demand for fishmeal and relatively stable supply, the price of fishmeal will continue to increase slightly relative to oilseed meals.

Global fish production is projected to reach 200 Mt by 2029, increasing by 25 Mt (or 14%) from the base period (average of 2017-19), though at slower pace (1.3% p.a.) than over the previous decade (2.3% p.a.). This slowdown of growth is driven by the combined effect of lower annual growth rates for both capture fisheries and aquaculture. One of the main factors behind these expected lower rates is the assumption that China’s fisheries and aquaculture policies for the next decade will align with its 13th Five-Year Plan (2016-20), which shifted priorities towards promoting sustainability and the modernisation of the sector with initial capacity reduction, to be followed by an expected faster growth, in particular of aquaculture production. This is particularly relevant as China is by far the world’s leading fisheries and aquaculture producer.

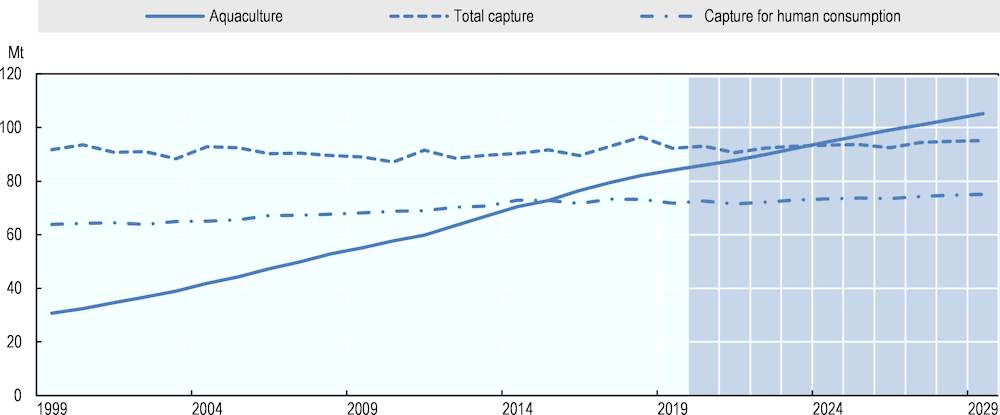

The contribution of aquaculture to global fish production should continue to grow (Figure 8.1) and surpass that of total capture fisheries (including the amount utilised for non-food uses) by 2024. By 2029, aquaculture production is projected to reach 105 Mt, 10 Mt more than the capture sector. Relatively low feed prices are also behind the future growth of aquaculture, and profitability in the sector is expected to remain high in the next decade, especially for species that require small amounts of fishmeal and fish oil. Capture fisheries are projected to see a moderate increase in production over the next decade (0.4% p.a.), notably due to expectations that improved management in several regions will continue to pay off including through a sustainable increased productivity of fish stocks. The share of capture fisheries production transformed into fishmeal and fish oil will remain stable at about 18%. However, total fishmeal and fish oil production are projected to increase by 10% and 17%, respectively, over the next decade, mainly reflecting a greater use of fish residues in their production. By 2029, the proportion of total fish oil obtained from fish waste is projected to grow from 41% to 45%, while for fishmeal this proportion will increase from 24% to 28%.

Figure 8.1. World aquaculture and capture fisheries

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

By 2029, it is projected that 90% of the fish being produced will be utilised for human consumption, growing from 155 Mt in the base period to 180 Mt. However, mirroring changes in production, the rate of increase in fish available for human consumption is projected to slow from 2.5% p.a. in 2010-19 to 1.4% p.a. Growth in per capita apparent3 fish food consumption is also anticipated to slow, from 1.3% p.a. in 2010-19 to 0.5% p.a. over the projection period, reaching 21.4 kg by 2029. Nevertheless, per capita fish consumption is expected to continue to increase on all continents, except Africa, with the decline concentrated in Sub-Saharan Africa (-0.7% p.a. over the next decade), due to the population increasing more than supply. This raises potential nutritional concerns in the region, as fish represents an important source of animal proteins.4

About 36% of total fish production is projected to be exported in different product forms: fish for human consumption, fishmeal and fish oil (32% excluding intra-EU trade). After a slight decline in 2019, world trade of fish for human consumption is projected to increase once again, at a rate of 1.1% p.a. over the coming decade and by a total of 4 Mt (or 9%) by 2029. This rate of increase is lower than that observed in the past decade (1.4% p.a.), reflecting the slowdown in production growth. As well as retaining their position as major fish producers, Asian countries should remain the world’s main exporters of fish for human consumption, with their share in global exports increasing from 48% in 2017-19 to 50% in 2029. During the same period, OECD countries will remain the leading importers of fish for human consumption, although their share is expected to shrink from 53% to 50%.

Many factors can influence the evolution and dynamics of world fish production, consumption and markets and, as a consequence, a range of uncertainties exist when projecting into the future. These include external factors (climate, environmental conditions) and policy factors (fisheries management and governance, trade policies, and polices against illegal, unreported and unregulated fishing (IUU)). The implications of these uncertainties depend upon the extent to which they differ from the model’s assumptions, and the sector's capacity to adapt to them. Possible impacts of the COVID-19 outbreak on fish markets were not accounted for in the projections, but its potential consequences are discussed in the main issues and uncertainties section (in the web version of the fish chapter).

8.3. Prices

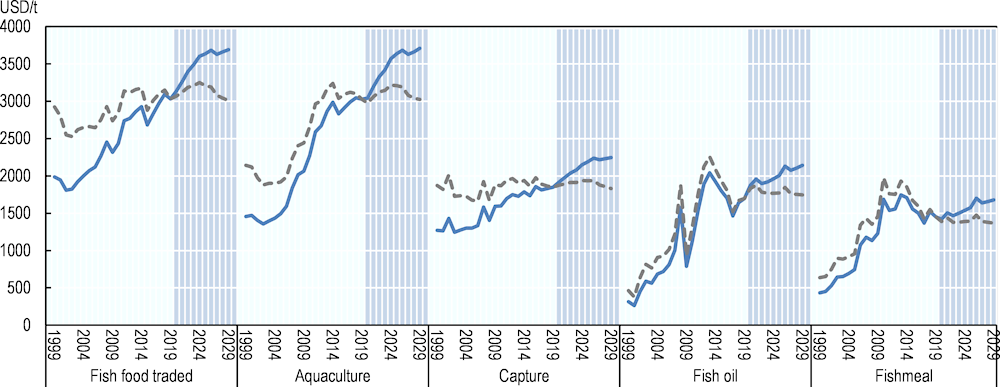

Fish prices will continue to be high in the next decade relative to historical levels. In nominal terms, they are anticipated to follow an increasing trend over the duration of the projection period. In real terms, fish prices are expected to rise until 2024 and to decrease during the 2024-2029 period (Figure 8.2), notably reflecting the expected impact of Chinese fisheries policies. These policies are projected to lead to limited fish production growth in the country at the beginning of the outlook period, while productivity gains are expected to result in faster production growth during the rest of the projection period. In addition, fish prices are expected to be also impacted by the price trends of potential meat substitutes, and by how long the price of pork will be inflated by the devastating ASF outbreak.

Figure 8.2. World fish prices

Note: Fish food traded: world unit value of trade (sum of exports and imports) of fish for human consumption. Aquaculture: FAO world unit value of aquaculture fisheries production (live weight basis). Capture: FAO estimated value of world ex-vessel value of capture fisheries production excluding for reduction. Fishmeal: 64-65% protein, Hamburg, Germany. Fish oil: N.W. Europe. Real price: US GDP deflator and base year = 2019.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The prices of wild caught fish are projected to fall 0.2% p.a. in real terms and result in a total decrease of 1.9% by 2029 compared to the base period. During the same period, aquaculture prices are projected to experience a very marginal increase in real terms in most years over the next decade, sustaining the profitability of aquaculture production in most years over the next decade. However, due to lower feed prices, which will shift supply upward, overall aquaculture prices are projected to decline by 2.0% in 2029 compared to the base period. In addition, the prices of traded fish products are projected to decrease by 2.8% in real terms over the outlook period, reaching a level lower than those observed in the 2010s but higher than in the 2000s.

The price of fishmeal will continue to increase slightly relative to oilseed meals. This results from fishmeal demand exceeding supply due to the expansion of aquaculture production and livestock breeding (mainly pigs and poultry). Fishmeal and fish oil represent a highly nutritious and digestible feed component and rich of Omega-3 fatty acids. Due to their relatively high price, they are increasingly used only for some species and at certain stages of animal rearing (for hatchery and finishing diets), which creates a premium for fishmeal over oilseed meals. For these reasons, the production of fishmeal and fish oil will remain profitable. Fishmeal prices will remain at high levels relative to substitute products despite a projected 7.4% decline in real terms over the outlook period due to a comparable decrease in oilseed meal prices. In El Niño years, which will negatively impact the catches of species such as Anchoveta which are mainly used for the production of fishmeal and fish oil, the difference in the price ratio to oilseed meals will be accentuated, as fishmeal supplies will be reduced.

The popularity of Omega-3 fatty acids in human diets and the growth in aquaculture production have contributed to an increase in the fish to vegetable oil price ratio. It is assumed this high ratio will be maintained over the outlook period and magnified in years when El Niño occurs. Fish oil prices in real terms experienced a significant rise from 2009 to 2013, followed by a decline up to 2017. However, prices remained higher than in 2009. Fish oil prices are projected to rise during the projection period; by 2029, they are projected to have increased by 7.1% in real terms compared to the base period, partly due to a 2.5% increase in the price of vegetable oil. However, due to the expected fluctuations over the next decade, fish oil prices are projected to decline slightly by 0.5% p.a. during the same period.

8.4. Production

Global fish production (from capture fisheries and aquaculture) is projected to increase from 176 Mt in the base period to 200 Mt by 2029. While this represents an additional 25 Mt of fish per year by 2029, both the rate of growth and the absolute increase in production continue to fall. In absolute terms, the increase in total fish production over the outlook period is projected to be 73% of that observed over the previous decade, when world fish production was 34 Mt higher by the final year. In addition, the rate of growth (14.0% over the outlook period) should be lower than the 23.8% achieved over the previous decade. This reflects lower growth rates in the aquaculture (2.3% p.a.) and capture fisheries production (0.4% p.a.) when compared to the previous decade (4.3% p.a. for aquaculture, 0.7% p.a. for capture). Despite this slower growth,5 aquaculture will remain the main driver of growth in fish production at the world level. Growing from a share of 47% of total fish production in the base year, aquaculture production is projected to overtake capture fisheries in 2024 and reach 52% by 2029.

Aquaculture production is projected to be 105 Mt by 2029, an increase of 28.4% relative to the base period, compared with 59.6% in the previous decade. This anticipated slowdown in aquaculture production growth will mainly be caused by lower productivity gains, more stringent environmental regulation and increasing scarcity of suitable locations due to competition from other land and water users. China, the world’s largest aquaculture producer, is expected to experience a substantial reduction in the growth rate of its farmed fish production. This results from the implementation of new policies favouring the sustainability and modernisation of the sector, which are projected to result in slower growth rates at the beginning of the outlook period, before picking up again towards the end of the outlook period. Overall, Chinese aquaculture production is projected to grow by 24.5% in the next decade, compared with 46.6% in the previous decade. By 2029, China is expected to account for 56% of global aquaculture production, compared with a share of 58% in the base period. At the world level, some of the reduced growth in Chinese production will be mitigated by greater increases in production elsewhere. Aquaculture production is expected to grow on all continents. The majority of world fish production will continue to originate from Asia, with a projected 89% of world aquaculture production by 2029.

Growth rates will vary across species, resulting in a change of the composition of aquaculture production by 2029. The share of dominant farmed species, such as carps and molluscs, is projected to decline to 56% by 2029, down from a peak of 77% in the mid-1990s. The share of shrimps and prawns and that of tilapia and catfish (including pangas) will increase over the outlook period.

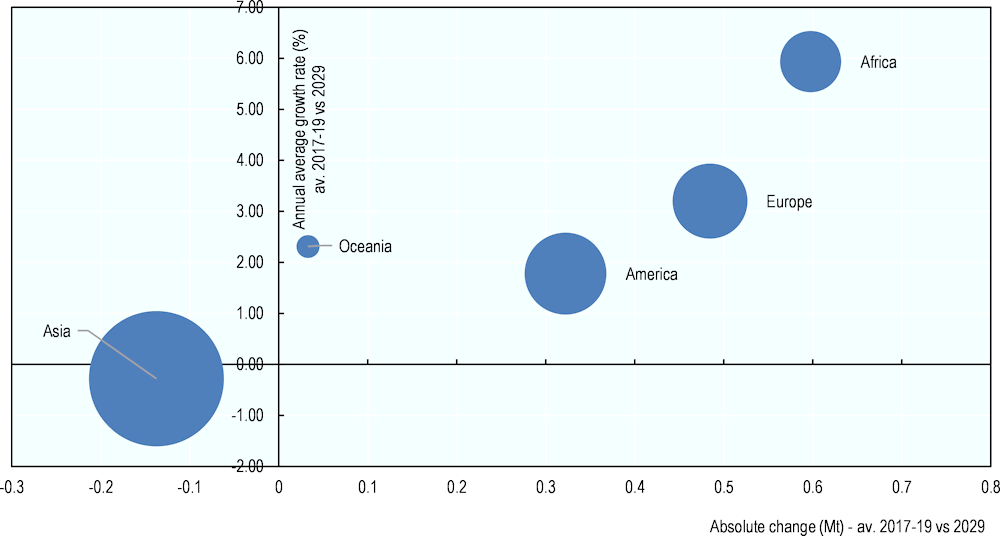

Capture fisheries production is projected to increase slightly over the next decade (0.4% p.a.). By 2029, capture fisheries production is projected to reach 95 Mt, up 1.3 Mt compared with the base period. This upward trend is due to expectations of improved catches in some fishing areas stimulated by the relatively high fish prices or where stocks of certain species are recovering, also associated with better management which can increase the productivity of fish stocks and thus capture possibilities, as well as from reduced on-board waste and discards. The highest growth rate and largest increase in volume terms in capture fisheries production is expected in Africa, while Asia is the only continent projected to experience a decline, mainly linked to the expected reduced capture fisheries production of China (-10% by 2029 compared to the base period) (Figure 8.3). On a country basis, the largest increases in capture fisheries are projected in the Russian Federation (+0.6 Mt), the Philippines (+0.3 Mt), and Indonesia (+0.3 Mt). In the years of the El Niño6 phenomenon, capture fishery production in South America will decline, resulting in world capture production falling approximately 2% during these periods. The share of capture fisheries production destined for direct human consumption is projected to increase from 77% in 2017-2019 to 79%, or 2.3 Mt, by 2029. Most of the remaining 20 Mt is expected to be reduced to fishmeal and fish oil.

Figure 8.3. Growth in world capture fisheries production by continent

Note: The size of the bubble represents the average capture production (Mt) in 2017-2019.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

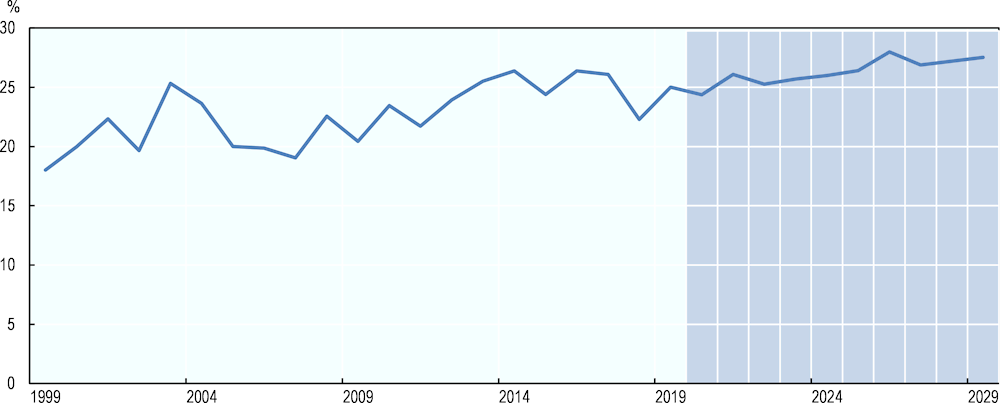

The production of fishmeal and fish oil is projected to grow by 10.2% and 17.2% respectively by 2029, compared to the base period, reaching 5.9 Mt and 1.4 Mt in product weight. They can be obtained either from whole fish or from fish residue, a by-product of processing. Despite the decline in the proportion of world capture fisheries production reduced to fishmeal and fish oil, the production of fishmeal and fish oil (in product weight) produced from whole fish is projected to increase in 2029 by 5.6% and 9.2%, respectively, compared to the base period. The drivers for such increase include the rather high price of fishmeal and fish oil, together with the anticipated higher capture fisheries production. A growing share of fishmeal and fish oil will be obtained from fish residue. In 2029, the amount of fishmeal obtained from fish waste is projected to account for 28% of total fishmeal production, up from 24% in the base period (Figure 8.4). For fish oil, the share is projected to reach 45% of total production by 2029, compared with 41% in the base period.

Figure 8.4. Share of total fishmeal production produced from fish residue

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

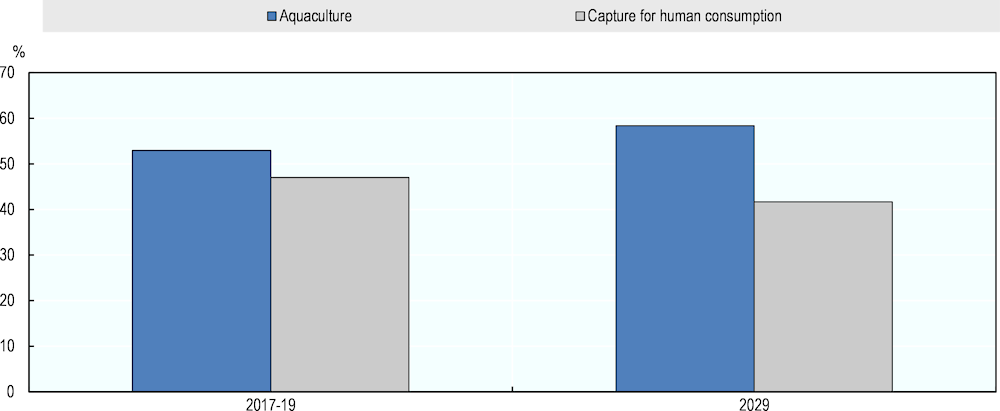

8.5. Consumption

By 2029, it is projected that 90% of fish production will be consumed as food. At the global level, fish for human consumption is projected to increase by 16.3%, or an additional 25 Mt, to reach 180 Mt by 2029. The amount of fish for human consumption will expand on all continents; however, the magnitude of the rise will vary from one continent to another, reflecting different fish consumption baseline levels and population growth rates. In terms of total fish food supply, the highest growth rate is projected in Africa (+25.4%) and the lowest in Europe (+5.8%), where consumption levels per capita reach high levels and are near saturation. With +17.3%, Asia does not have the highest growth but being by far the largest fish consumer, the continent will account for 75% of the additional amount of fish consumed by 2029. China on its own will account for 40% of that additional volume. Such growth will be enabled by rising incomes, a growing urban population and more diversity in the types of fish and product forms offered to Chinese consumers through domestic production and imports. The share of fish originating from aquaculture in total food fish consumption will continue to increase year after year. By 2029, 58% of the fish available for human consumption is projected to originate from aquaculture, up from 53% in 2017-19 (Figure 8.5).

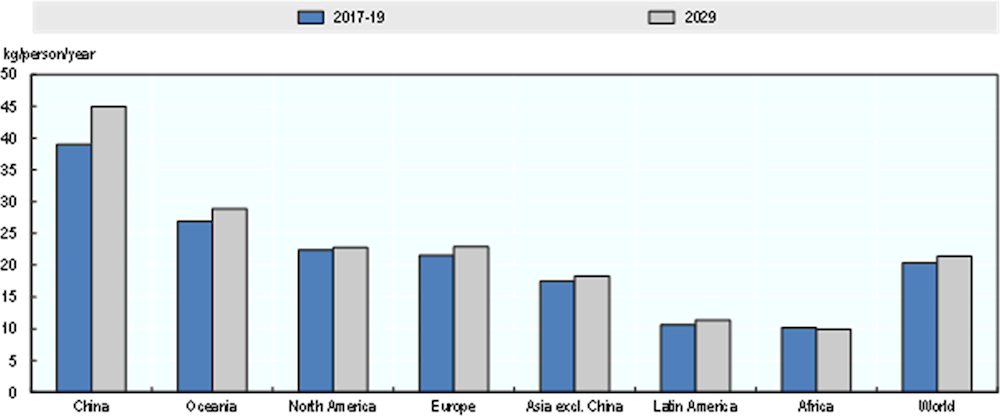

On a per capita basis, apparent fish consumption is projected to be 21.4 kg in live weight equivalent (LWE) by 2029, up by 4.7% from 20.4 kg in 2017-2019 (Figure 8.6). This represents a lower increase than in previous decades. Overall, per capita apparent fish food consumption is projected to increase by 0.5% p.a. during the outlook period, compared to 1.3% p.a. over the previous decade. However, this trend will differ across and within countries in terms of quantity and product forms. This diversity arises from geographic, economic and cultural factors. Fish consumption per capita is projected to rise on all continents, except Africa. This is explained by the fact that growth in aquaculture and capture fisheries production, as well of imports of fish and fish products will not increase sufficiently rapidly to compensate the strong growth in population. In Africa, fish consumption per capita is projected to decrease to 9.9 kg LWE by 2029, down from a peak of 10.6 kg in 2014 and 10.2 kg in the base period. The decline will be even more significant in Sub-Saharan Africa. This situation is of particular concern because the region has the highest prevalence of undernourishment in the world and because fish is an important source of proteins and micronutrients in many African diets. Fish contributes on average to 23% of total animal protein intake in Sub-Saharan Africa, compared with 17% at the world level.

Figure 8.5. Share of aquaculture and capture in total fish available for human consumption, 2017-19 vs 2029

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 8.6. Per capita fish consumption – 2017-19 vs 2029

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Among the 20 Mt of fish going to non-food uses, it is projected that the majority (83%) will be consumed as fishmeal and fish oil. The rest will serve other non-food uses such as ornamental fish, culturing, fingerlings and fry, bait, pharmaceutical inputs, or as direct feed for farming. Due to their high prices and major innovation efforts, fishmeal and fish oil will continue to be used in more limited amounts in aquaculture feeds and to be more frequently used as strategic ingredients to enhance growth at specific stages of fish production. By 2029, it is projected that 83% of fishmeal and 66% of fish oil will be consumed as aquaculture feeds. China will continue to be the main consumer of fishmeal, with a projected share of 35% of the total by 2029. The European Union will remain the largest consumer of fish oil, accounting for 16% of total fish oil consumption, with about a quarter used as aquaculture feeds and three-quarters as other uses, including direct human consumption.

8.6. Trade

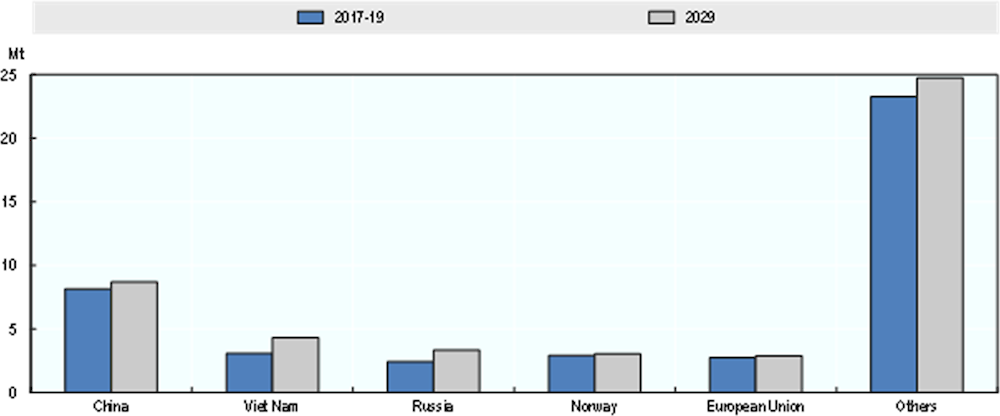

After contracting in 2019, global trade in fish and fish products is expected to expand over the coming decade, though at a slower pace compared to the previous decade. High demand, increasing fish production, improved logistics, and globalisation of food systems should further expand international fish trade. However, the slower growth of fish production will constrain the expansion of trade. By 2029, it is projected that about 36% of production will be traded (32% if excluding intra-EU trade). World exports of fish for human consumption are projected to reach 47 Mt LWE by 2029, an additional 4 Mt LWE in absolute terms when compared with the base period. This represents a rise of 9.4% in the next decade, more than halving the 23.0% increase in the previous decade.

The bulk of the growth in fish exports for human consumption is projected to originate from Asian countries, which will account for about 67% of the additional exports by 2029 (Figure 8.7). Asian countries, being the main producers, are expected to remain the major exporters. Their share in world exports for human consumption is projected to increase from 48% to 50% as a result of further expansion of their aquaculture production. China will remain the largest exporter of fish for human consumption. However, its share in global exports of fish for human consumption is projected to decline to 18% by 2029, compared with 19% in the base period. This reflects slower production growth in China, more fish being produced for domestic consumption, and strong growth in production and exports among large exporting countries, such as Viet Nam and the Russian Federation. These two countries are projected to see their exports grow by 36% and 34%, respectively, over the outlook period. Such growth will increase their share of global fish exports for human consumption to 9% and 7% respectively by 2029. The Russian Federation is expected to overtake Norway as the third largest exporter of fish for human consumption, in volume terms, by 2025. The factors contributing to this rise in Russian exports are the combined increase of fish production and imports of fish and fish products (+13% and +51%, respectively, in 2029 compared to the base period) and the Russian Federation’s declining population.

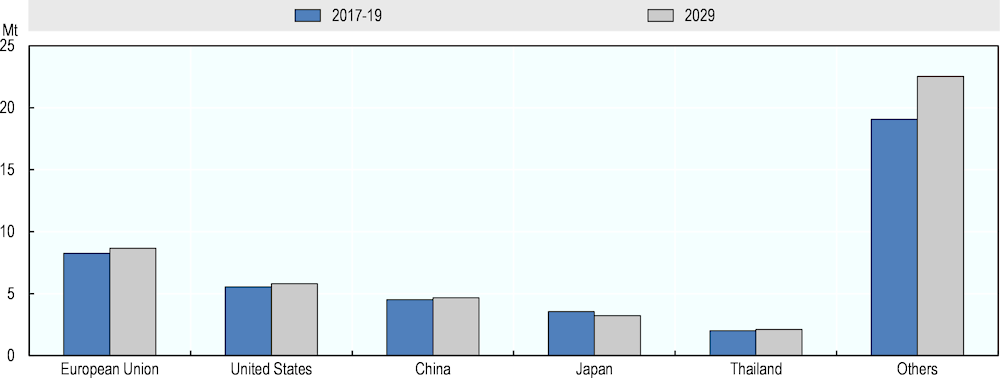

339. The European Union, the United States, China, and Japan will continue to be the leading importers of fish for human consumption; they are projected to account for 19%, 12%, 10% and 7% of global imports respectively by 2029 (Figure 8.8). Imports by the European Union, the United States and China are projected to increase over the next decade (+4.9%, +3.9% and +5.6% respectively), but at a slower pace than in the previous decade. In Japan, the decline in imports is projected to accelerate (-9.2%), as younger generations favour meat over fish and the decline in population accelerates. In the United States and the European Union, imports are expected to grow at a slower pace as consumption levels of animal products are near saturation. In China, imports are projected to decline at 0.4% p.a. in the next decade compared with a growth of 4.3% p.a. in the previous one. This dramatic slowdown also reflects the implementation of Chinese policies, which point to an increase in the production of farmed fish destined for domestic consumption, which previously had to be imported. It is also linked to more moderate population and income growth compared with the previous decade. Among the leading importers, the Russian Federation is one of the few countries where growth in imports should be stronger in the next decade compared with the past ten years (+51% compared to –42%). Russian imports were particularly low between 2014 and 2019 as a result of economic sanctions related to the conflict in Ukraine and during the next decade a change of trading routes and partners is expected. Rising imports are also projected for Africa (+39%). With stronger projected growth in imports than in production, Africa is expected to become increasingly dependent on fish food imports. The share of imports in its fish food supply is projected to reach 40% by 2029, compared with 36% in the base period.

Figure 8.7. Exports of fish for human consumption by major exporters in 2017-19 and 2029

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 8.8. Imports of fish for human consumption by major importers in 2017-19 and 2029

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Exports of fishmeal are projected to increase during the next decade, growing 8.4% to reach 3.4 Mt (product weight) by 2029. Peru will remain the leading exporter of fishmeal, but its share in total exports is projected to decline from 34% to 31% over the outlook period. China will remain the largest importer, projected to account for 44% of total fishmeal imports by 2029. Globally, since aquaculture production is growing faster than fishmeal production, a greater amount of oilseed meals is used in aquaculture feed rations. This amount is projected to increase by almost 35% in 2029 compared to the base period. Fish oil exports are projected to increase by 19% over the next decade, mirroring the production trend. The European Union and Norway will be the main importers of fish oil in 2029, accounting each for nearly 25% of global fish oil imports. Fish oil is mainly used in the salmon industry and as food supplements.

8.7. Main issues and uncertainties

The projections in this Outlook assume stable macro-economic and climate conditions over the projection period, and make specific assumptions with respect to the impact of Chinese policies on fish production. A shock to any of these variables, as well as other unexpected shocks, could result in different outcomes. This section discusses some specific uncertainties that may arise over the projection period.

Trade policies are a major factor affecting trade dynamics and routes in fish markets. As a result, the implementation of new trade agreements over the outlook period could alter fish trade considerably. Multilateral trade agreements are proving difficult to ratify, but bilateral trade agreements may be more likely to occur over the projection period. Unexpected trade policy decisions could also affect the accuracy of the projections. For example, the trade dispute between China and the United States which has seen both countries impose tariffs on one another's fish and fish products has led to a drop in the volumes traded between the two countries, but also to increased export competition on other markets such the European Union. The Russian Federation ban on imports of food from the United States, Australia, Norway, Canada, and the European Union imposed in response to Western economic sanctions has also resulted in a large decline in fish imports and higher consumer prices.

Domestic fisheries policies also influence fish production trends. With China being the main capture fisheries and aquaculture producer and fish exporter, this is notably the case of China’s current Five-Year Plan, which focuses on sustainability and modernisation of the sector. However, uncertainties remain regarding the exact effects of such policies on production and trade volumes and a slower or faster production growth than anticipated could have significant consequences on global production, trade and consumption volumes of fish and fish products.

More generally, government support policies through direct subsidies, tax exemptions or the financing of services to the fisheries sector also tend to encourage production. Changes to support policy patterns in the future, which could for example result from an agreement at the World Trade Organisation on the elimination of subsidies that encourage unsustainable fishing, could thus affect the reliability of projections.

The projections indicate that future growth in fish production will come primarily from aquaculture. Intensification, expansion into new spaces, and innovative technologies for land-based and offshore farms are expected to be the main drivers of growth. However, many factors have the potential to limit this growth such as, land and water reduced availability, disease outbreaks, feed, seed supply and genetic resources. Other means of production, such as land-based (e.g. recirculating aquaculture systems – RAS) aquaculture systems, have the potential to deliver a new supply source, if well managed. Limiting factors are likely to vary across regions. In developing countries, for example, the lack of an environmental policy might represent a higher threat than in developed countries.

Demand trends could also affect the projections. Changing consumer preferences, such as the rise in vegetarian or vegan lifestyles, are difficult to assess. Depending on the share of population adopting them, fish markets could be impacted either positively or negatively. Sustainability considerations will continue to influence the future demand of fish. One consequence of these trends is an increased requirement for transparency and traceability along the supply chain. Demand for fish also depends on trends observed in the animal protein sector. For example, the current ASF situation in China's pork production is leading to increased fish consumption.

The COVID-19 pandemic is having significant impacts on the global economy, including on the fisheries and aquaculture sector. The magnitude and duration of the current outbreak remain uncertain, but all steps from harvest to processing to trade to final consumption are likely to be impacted. In the short term, production, processing and distribution of fish could be affected by labour shortages, new regulations aimed at containing the pandemic, and blockages to transportation routes, as well as by a contraction of demand. Small-scale fishers and fish farmers, who represent a large share of those employed in the sector, are likely to be heavily impacted if they cannot sell their products or buy the required inputs. A global contraction of trade is also expected, which potentially has significant implications for the fisheries and aquaculture sector, as fish is a highly traded commodity. A more general loss of income-earning opportunities in the economy as a whole may also result in levels of fish consumption falling in poorer countries, due to demand being relatively income elastic. Restrictions on individuals’ movements are also modifying consumption patterns and purchasing modalities. Out-of-home consumption, which is very important for fish, has already declined sharply in several countries and demand for fresh fish dropped, as consumers no longer go to the markets, while demand for canned, smoked and frozen fish is increasing. The effects over the medium term and over the rest of next decade are more uncertain as these depend on how long the constraints are kept in place, on the duration of the economic slowdown and the impact on income growth, as well as on the macro and fisheries-specific policy responses and industry initiatives taken in reaction to the crisis.

The drop in oil prices initiated in early 2020 could lower energy costs, which are key constraints for capture fisheries. However, the effects of such drop will depend on its duration and magnitude, as well as, at least in the short term, on the above-mentioned impacts of COVID-19. Lower energy costs could boost profitability in the sector, but while this may benefit fishers in some markets, in others it could lead to overfishing, particularly where enforcement is weak and the risk of IUU is high, placing additional pressure on resources.

Weather variability due to climate change7 and changes in the frequency and extent of extreme weather events are anticipated to have a major impact on the availability and trade of fish and fish products, mainly through habitat destruction, changes in fish migration patterns, and natural productivity of fish stocks. However, for complexity reasons, climate change was not explicitly included in the modelling exercise of this Outlook, with the exception of the influence of El Niño events, which are explicitly accounted for in the modelling process (in 2021 and 2026) based on previous behaviour.

Notes

← 1. In this chapter and publication the term “fish” and “seafood” are used to indicate fish, crustaceans, molluscs and other aquatic animals, but exclude aquatic mammals, crocodiles, caimans, alligators and aquatic plants. All quantities are expressed in live weight equivalent, except those of fishmeal and fish oil.

← 2. Calculated in nominal terms, and covering fish and fish products.

← 3. The term “apparent” refers to the amount of food available for consumption, which is not equal to the edible average food intake. The amount is calculated as production + imports – exports - non-food uses, +/- stocks variations, all expressed in live-weight equivalent.

← 4. FAO, IFAD, UNICEF, WFP and WHO (2018), The State of Food Security and Nutrition in the World 2018. Building climate resilience for food security and nutrition, FAO Publications, Rome. Licence: CC BY-NC-SA 3.0 IGO.

← 5. It is important to note that a slowdown in growth rate does not indicate a decrease in production. Expressed in percentage terms, growth rates are usually higher when the calculation starts from a low base, and decline as the size of the base grows.

← 6. Assumed in the fish model for the years 2021 and 2026.

← 7. Barange, M., et al. (Eds.) (2018), “Impacts of Climate Change on fisheries and Aquaculture: Synthesis of Current Knowledge, Adaptation and Mitigation Options”, FAO Fisheries Technical Paper 627 http://www.fao.org/3/I9705EN/i9705en.pdf.